Treasury & Cash Management – CA Inter FM Question Bank is designed strictly as per the latest syllabus and exam pattern.

Treasury & Cash Management – CA Inter FM Question Bank

Question 1.

Enumerate the activities which are covered by Treasury Management. (Nov 2002, 3 marks)

OR

Answer the following:

Explain briefly the functions of Treasury Department. (May 2008, 3 marks)

OR

Answer the following:

Write a short note on functions of Treasury Department. (May 2009, 2 marks)

OR

Answer the following:

Explain briefly the functions of Treasury Department. (Nov 2016, 4 marks)

Answer:

Functions of Treasury Department can be as follows:

1. Cash

Planning or forecasting future cash Management requirements through Cash Budgets, Efficient collection of Receivables, and payment of liabilities/claims through Float Management. Monitoring of funds position at various divisions/branches and identifying surplus or idle funds to transfer them to other divisions. Investment Planning or parking of surplus funds in marketable securities to optimise return.

2. Funding Management

Planning of long-term, medium-term, and short-term cash needs. Participation in decisions concerning capital structure, dividend payout, etc. Obtaining the fund requirements from sources like Bank Loans, Public Issues, etc.

3. Currency Management

Managing foreign currency risk exposure through hedging/forwards! futures. Timely settling or setting off of intra-group indebtedness, between divisions in various countries. Matching transactions of receipts and payments in the same currency to save transaction costs. Decision on currency to be used while invoicing Export Sales.

4. Corporate Finance

Advising on various issues such as buy-back, mergers, acquisitions, and divestments, and planning the financial needs thereof Investor Relationships. Capital Market Intelligence-obtaining information on market trends, timing of public issues, etc.

5. Banking

Maintaining cordial and good relationships with Bankers and Financing Institutions. Coordinating, liaising, and negotiating with the Lenders during the course of obtaining finance.

![]()

Question 2.

Answer the following:

Evaluate the role of cash budget in effective cash management system. (Nov 2015, 4 marks)

Answer:

Cash Budget

A cash budget is a forecast of estimates showing the amount of cash which will be available for future period taking into account all the sources of cash received and channel in which payments are made. In cash budget no accrual concept is taken under consideration.

Role of Cash

- This Budget helps to determine, whether the cash Budget being collected is sufficient to own the business.

- It helps to preserve liquidity in the business.

- It helps to determine, when & how the funds will be utilized and where also.

- It is known by cash budget the availability of cash discounts and control of quantum of cash.

Question 3.

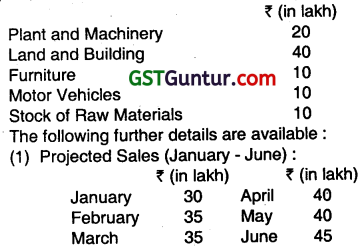

A new manufacturing company ¡sto be incorporated from January 1, 2000. Its authorized capital will be ₹ 2 crores divided into 20 Iakh equity shares of ₹ 10 each. It intends to raise capital by issuing equity shares of ₹ 1 crore (fully paid) on 1st January. Besides a loan of ₹ 13 lakh @ 12% per annum will be obtained from a financial institution on 1st January and further borrowings will be made at the same rate of interest on the first day of the month in which borrowing is required. All borrowings will be repaid along with interest on the expiry of one year. The company will make payment for the following assets in January:

(2) Gross profit margin will be 25% on sales.

(3) The company will make credit sales only and these will be collected in the second month following sales.

(4) Creditors will be paid in the first month following credit purchases. There will be credit purchases only.

(5) The company will keep minimum stock of raw materials of ₹ 10 lakh.

(6) Depreciation will be charged @ 10% per annum on cost on all Property Plant and Equipment.

(7) Payment of preliminary expenses of ₹ 1 lakh will be made in January.

(8) Wages and salaries will be ₹ 2 lahks each month and will be paid on the first day of the next month.

(9) Administrative expenses of ₹ 1 lakh per month will be paid in the month of their incurrence.

Assume no minimum required cash balance.

You are required to prepare the monthly cash budget (January-June), the projected Income Statement for the 6-month period, and the projected Balance Sheet as on 30th June, 2000. (May 2000, 20 marks)

Answer:

Note: In February 2000 there is a shortage of cash of by ₹ 2.5 Lakhs, so it will be met by borrowing at the beginning of the said month.

2. Computation of Payment to the Creditors:

Purchase = Cost of goods sold – Wages and salaries

Purchases for January = (75% of 35 lakhs) – ₹ 2 = ₹ 20.50 lakhs

Since Creditors are paid in the first month following purchases.

Therefore, payment in February is the purchase of January i.e. ₹ 20.50 lakhs.

Same procedure will be followed for other months.

Total Purchases = ₹ 125 lakhs (for Jan.- May) + ₹ 31.75 lakhs (for June) + ₹ 10 lakhs (stock)

= ₹ 166.75 lakhs

3. Amount of depreciation for six months:

Dep. = ₹ 80,00,000 × 10% × 6/12) = ₹ 4,00,000

Question 4.

Alcobex Metal Company (AMC) does business in three products P1, P2, and P3. Products P1 and P2 are manufactured in the company, while product P3 is procured from outside and resold as a combination with either product P1 or P2. The sales volume budgeted for the three products for the year 2000- 2001 (April-March) are as under:

Based on the budgeted Sales value, the cash flow forecast for the company is prepared based on the following assumptions:

1. Sales realization is considered at:

50% Current month

25% Second month

25% Third month

2. Production Programme for each month is based on the sales value of the next month.

3. Raw Material consumption of the company is kept at 59% of the month’s production.

4. 81 % of the raw materials consumed are components.

5. Raw materials and components to the extent, at 25% are procured through import.

6. The Purchases budget is as follows:

(i) Indigenous raw materials are purchased two months before the actual consumption.

(ii) Components are procured in the month of consumption.

(iii) Imported raw materials and components are bought three months prior to the month of consumption.

7. The company avails of the following credit terms from suppliers:

(i) Raw materials are paid for in the month of purchases;

(ii) Company gets one month’s credit for its components,

(iii) For imported raw materials and components payments are made one month prior to the dates of purchases.

8. Currently the company has a cash credit facility of ₹ 140.88 lakhs.

9. Expenses are given below and are expected to be constant throughout the year:

Wages and Salaries ₹ 312 lakhs

Administrative Expenses ₹ 322 lakhs

Selling and Distribution Exp. ₹ 53 Iakhs.

10. Dividend of ₹ 58.03 lakhs is to be paid in October.

11. Tax of ₹ 23.92 lakhs will be paid in equal instalments in four quarters: i.e., January, April, July, and October.

12. The term loan of ₹ 237.32 lakhs is repayable in two equal instalments half-yearly. i.e., June-December.

13. Capital expenditure of ₹ 292.44 lakhs for the year is expected to be spread equally during the 12-month period.

You are required to prepare a Cash Flow Statement (Cash Budget) for the period of June – November 2000. (May 2001, 20 marks)

Answer:

Assumptions: The said problem can be solved on the basis of some assumptions:

- Since opening cash balance is not given, ¡t is assumed that credit facility received by the company (i.e. ₹ 140.88 lakhs) is its opening balance.

- For the complete information some working flotes are calculated from December otherwise they have no relevance. .

- Said problem does not provide information regarding purchase price and payment terms to the creditors of product ‘P3’ which is procured from outside and sold out as a combined product with P1 or P2. So, it is assumed that the product P3 is manufactured within the company and production costs is same as to the other product P1 or P2.

![]()

Question 5.

The following details are forecasted by a company for the purpose of effective utilization and management of cash:

(i) Estimated sales and manufacturing costs:

| Year and month 2010 | Sales ₹ | Materials ₹ | Wages ₹ | Overheads ₹ |

| April | 4,20,000 | 2,00,000 | 1,60,000 | 45,000 |

| May | 4,50,000 | 2,10,000 | 1,60,000 | 40,000 |

| June | 5,00,000 | 2,60,000 | 1,65,000 | 38,000 |

| July | 4,90,000 | 2,82,000 | 1,65,000 | 37,500 |

| August | 5,40,000 | 2,80,000 | 1,65,000 | 60,800 |

| September | 6,10,000 | 3,10,000 | 1,70,000 | 52,000 |

(ii) Credit terms:

Sales 20 percent sales are on cash, 50 percent of the credit sales are collected next month, and the balance in the following month. Credit allowed by suppliers is 2 months. Delay in payment of wages is ½ (one-half) month and of overheads is 1 (one) month.

(iii) Interest on 12 percent debentures of ₹ 5,00,000 is to be paid half yearly in June and December.

(iv) Dividends on investments amounting to ₹ 25,000 are expected to be received in June, 010.

(v) A new machinery will be installed in June. 2010 at a cost of ₹ 4,00,000 which is payable in 20 monthly instalments from July 2010 onwards.

(vi) Advance income tax to be paid in August 2010 is ₹ 15,000.

(vii) Cash balance on 1st June 2010 is expected to be ₹ 45,000 and the company wants to keep it at the end of every month around this figure, the excess cash (in multiple of thousand rupees) being put in fixed deposit. You are required to prepare monthly Cash budget on the basis of above information for four months beginning from June, 2010. (May 2010, 7 marks)

Answer:

(2) Payment of Wages

June = 80,000 + 82,500 = 1,62,500;

July = 82,500 + 82,500 = 1,65,000;

Aug. = 82,500 + 82,500 = 1,65,000; and

Sept. = 82,500 + 85,000 = 1,67,500

(Notes: Its has been assumed that the company wants to keep minimum cash balance of 45,000 at the end of every month.)

Question 6.

Slide Ltd. is preparing a cash flow forecast for the three-month period from January to the end of March. The following sales volumes have been forecasted;

| December | January | February | March | April | |

| Sales (units) | 1800 | 1875 | 1950 | 2100 | 2250 |

Selling price per unit is ₹ 600. Sales are all on one month’s credit. Production of goods for sale takes place one month before sales. Each unit produced requires two units of raw materials costing ₹ 150 per unit. No raw material inventory is held. Raw materials purchases are on one-month credit. Variable overheads and wages equal to ₹ 100 per unit are incurred during production and paid In the month of production. The opening cash balance on 1st ‚ January is expected to be ₹ 35,000. A long-term loan of ₹ 2,00,000 is expected to be received in the month of March. A machine costing ₹ 3,00,000 will be purchased in March.

(a) Prepare a cash budget for the months of January, February, and March and calculate the cash balance at the end of each month in the three-month period.

(b) Calculate the forecast current ratio at the end of the three-month period. (Nov 2019, 10 marks)

Answer:

Question 7.

Explain the following:

(i) Concentration Banking

(ii) Lock Box System (May 2014, Nov 2017, 2 marks each)

Answer:

(i) Concentration Banking:

In concentration Banking the Company establishes a number of strategic collection centers in different regions instead of a single collection center at the head office. This system reduces the period between the time a customer mails In his remittances and the time when they become spendable funds with the company, payment received by different collection centres are deposited with their local Bank which in turn transfers all surplus funds to the concentration bank of head office.

The concentration bank with which the company has its major bank account is generally located at the headquarters. Concentration banking is one important and popular way of reducing the size of the float.

(ii) Lock Box System:

Another means to accelerate the flow of funds in lock box system. While concentration banking remittances are received by a collection centre and deposited in the bank after processing. The purpose of lock box system is t0 eliminate the time between the receipts of remittances by the company and deposited at bank. A lockbox arrangement usually is on regional basis which a company chooses according to its billing patterns.

Question 8.

Explain four kinds of float with reference to management of cash. (Nov 2014, 4 marks)

Answer:

Different kinds of float with reference to cash management are as under:

| 1. Billing float | This is the time formal document that a seller prepares and sends to the purchaser as the payment request for goods sold or services provided. |

| 2. Mail float | This is the time when a cheque is being processed by post office, messenger service, or other means of delivery. |

| 3. Cheque processing float | This is the time for the seller to sort, record & deposit the cheque after it has been received by the company. |

| 4. Bank processing float | This is the time from the deposit of the cheque to the crediting of funds in the seller’s A/c. |

Question 9.

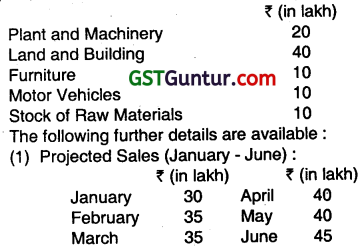

Given below is summary of the 2007 Accounts of Universal Ltd.:

The company deals In a single product. The following estimates of Trading have been made for the year 2008:

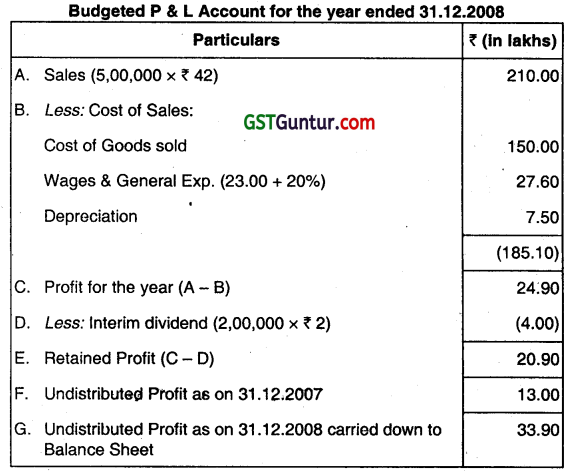

(a) Sales will be 5,00,000 units at a price of ₹ 42 per unit. Sales in Nov. and Dec. will be 50,000 units per month, balance being equally spread for the rest of the year.

(b) The amount of wages and general expenses will be 20 percent higher than in 2007.

(c) ₹ 10 lakhs will be spent on new shop fitting in June 2008. The depreciation charges will be ₹ 7.50 lakhs.

(d) All sales and purchases will, as in the past, be made on credit for settlement two months after sale or purchase. Wages and general expenses will be paid immediately.

(e) Purchase will be 43,000 units por month at a price of ₹ 30 per unit.

(f) An interim dividend of ₹ 2 per share will be paid in Now. 2008.

Required: Prepare the Budgeted Profit and Loss Account, monthly Cash Budget for the year and Balance Sheet as at end of the year 2008.

Answer:

Working Notes:

(i) The Closing Balance of Debtors as on 31.12.2006 ( ₹ 26 lakhs)

represents the sales for two months-Nov. 2007 & Dec. 2007. Taking this balance equally spread over these months, sales for Nov. 2007 ₹ 13.00 lakhs & for Dec. 2007 ₹ 13.00 lakhs.

(iii) The Closing Balance of Creditors as on 31.12.2007 (₹ 20 lakhs) represents the purchases for two months-Nov. 2007 & Dec. 2007. Taking this balance equally spread over these months, purchases for Nov. 2007 ₹ 10 lakhs & for Dec. 2007 ₹ 10 lakhs.

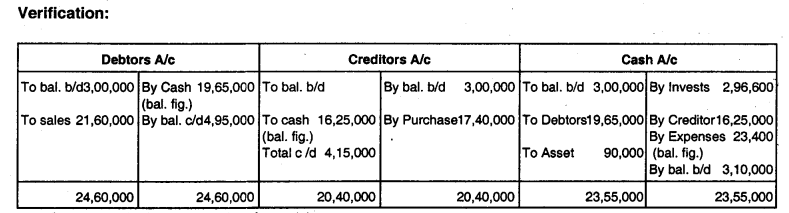

Question 10.

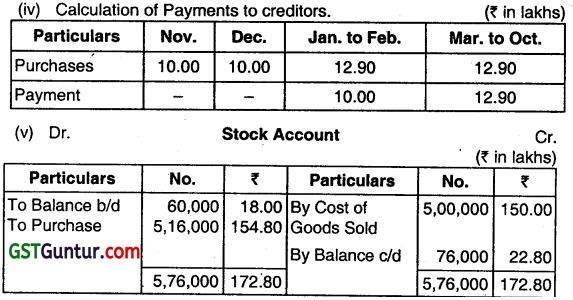

X & Y agree to start a Ltd. Company and to take over partly an existing business of Z. They agreed to contribute ₹ 25,000 each in the form of equity shares and also agree that Z will provide any additional amount required to finance the company in 1 six months and they would not recourse to any bank overdraft. Z will provide funds in the form of 8% debentures, to the nearest ₹ 1,000 above the amount required. The debentures will be secured by freehold premises. The company will purchase freehold premises for ₹ 25,000, Stock for ₹ 8,000, and plant for ₹ 6,000 Settlement is to be made in the month of in corporation.

(b) Gross Profit on sales to be @ 20%. .

(c) Purchase: to be sufficient to secure Stock at the end of each month adequate to supply the sales of the following month.

(d) Creditors: To be paid at the end of month following the month of purchase.

(e) Debtors: To settle their accounts net by the aid of the second month after the month of sales.

(f) Expenses:

(i) Preliminary Expenses ₹ 800 to be paid in Feb.

(ii) General Exp. ₹ 600 per month.

(iii) Salaries and Wages ₹ 800 per month from Jan. to April and ₹ 900 thereafter.

(iv) Rates ₹ 400 per annum payable in June and Dec. to be paid in the month following in which it is due.

(d) Assume shares and debentures are issued on 1st January.

Required: Draw up a Cash budget and Budgeted final account and Balance Sheet to 30th June.

Answer:

![]()

Question 11.

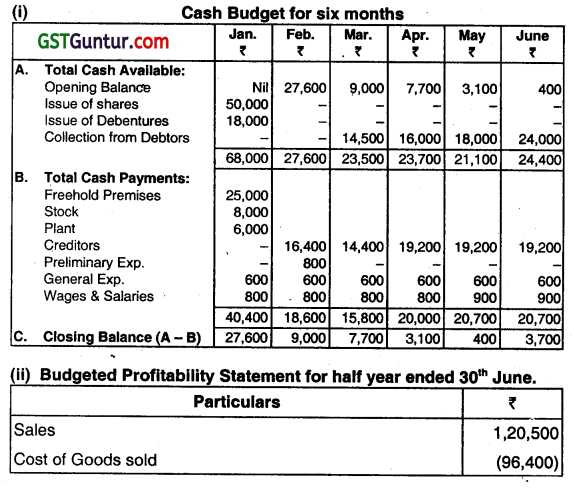

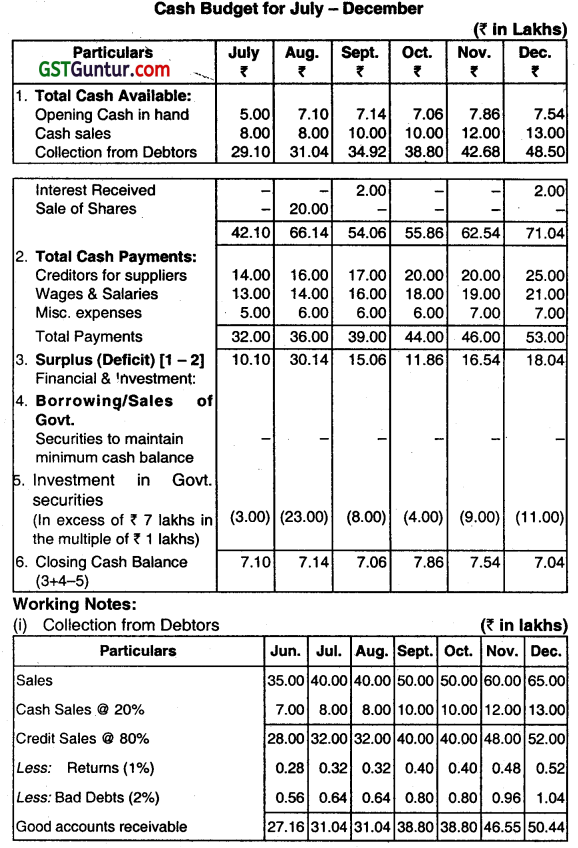

Prepare Cash Budget for July-December from the following information:

(a) The estimated sales, expenses, etc. are as follows:

(b) 20% of the sales are on cash and the balance on credit.

(c) 1 % of the credit sales are returned by the customers. 2% of the Gross accounts receivable constitute bad debt losses. 50% of the good accounts receivables are collected in the month of the sales, and the rest in the next month.

(d) The time lag in the payment of misc. expenses and purchases is one month. Wages and salaries are paid fortnightly with a time lag of 15 days.

(e) The company keeps a minimum cash balance of ₹ 5 lakhs. Cash in excess of ₹ 7 Lakhs is invested in Govt. securities In the multiple of ₹ 1 lakh. Shortfalls in the minimum cash balance are made good by borrowing from banks. Ignore interest received and paid.

Answer:

The wordings used ¡n the question may also be interpreted to mean that bad debts at 2% is to be worked out from net credit sales figures after returns.

(ii) Payment of Wages & Salaries (Fortnightly with a lag of 15 days)

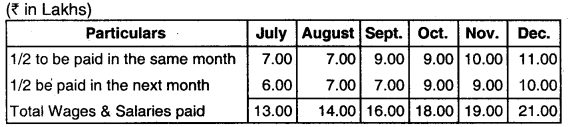

Question 12.

From the information given below, prepare a Cash Budget of M/s. Ram Ltd. for the first half year of 2009, assuming that cost would remain unchanged:

(a) Sales are both on credit and for cash the latter being one-third of the former;

(b) Realisations from debtors are 25% in the month of sale, 60% in month following that, and the balance in the month after that;

(c) The company adopts uniform pricing policy of the selling price being 25% over cost;

(d) Budgeted sales of each month are purchase1 and paid for in the preceding month;

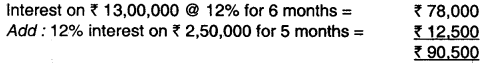

(e) The company has outstanding debentures of ₹ 2 lakhs on 1st Jan. which carry interest at 15% per annum payable on the last date of each quarter on calendar years basis. 20% of the debentures are due for redemption on 30th June 2009;

(f) The company has to pay the last instalment of advance tax, for assessment year 2008-2009, amounting to ₹ 54,000;

(g) Anticipated office costs for the six-month period are; Jan. ₹ 25,000 Feb. ₹ 20,000 Mar. ₹ 40,000 Apr. ₹ 35,000 May ₹ 30,000 and June ₹ 45,000;

(h) The operating cash balance of ₹ 10,000 is the minimum cash balance to be maintained Deficits have to be met by borrowers in multiples of ₹ 10,000 on which interest on monthly basis has to be paid on the first date of the subsequent month at 12% p.a. Interest is payable for a minimum period of a month.

(i) Rent payable is ₹ 2,000 per month.

(j) Sales forecast for the different months are:

Oct. 2008 ₹ 1,60,000, Nov. ₹ 1,80,000, Dec. ₹ 2,00,000, Jan. 2009 ₹ 2,20,000, Feb. ₹ 1,40,000 Mar. ₹ 1,60,000, Apr. ₹1,50,000, May ₹ 2,00,000, June ₹ 1,80,000 and July ₹ 1,20,000.

Answer:

Question 13.

JPL has two dates when It receives its cash mf lows. i.e., Feb. 15, and Aug. 15. On each of these dates, it expects to receive ₹ 15 crore. Cash expenditure are expected to be steady throughout the subsequent 6 month period. Presently, the ROI in marketable securities is 8% per annum, and the cost of transfer from securities to cash is ₹ 125 each time a transfer occurs.

(i) What s the optimal transfer size using the EOQ model? what is the average cash balance?

(ii) What would be your answer to part (i), if the ROI were 12% per annum and the transfer costs were 75? Why do they differ from those in part (i)? (May 2001, 10 marks)

Answer:

(I) Computation of optimal transfer size by using EOQ model and the average cash balance:

C = \(\sqrt{\frac{2 F A T}{1}}\)

Where C = Cash required each time to maintain a minimum cash balance.

F = Total annual cash required.

T = Transaction cost of one transfer between cash and securities.

I = Interest rate on securities.

Here, F = 30,00,00,000 I =8% p.a., T = ₹ 125/Transaction

C = \(\sqrt{\frac{2 \times ₹ 30,00,00,000 \times 125}{0.08}} \) = ₹ 9,68,245

∴ Average cash balance = C/2 = \(\frac{₹ 6,12,372}{2}\) = ₹ 4,84,123

(ii) Optimum transfer size if ROI is 12% and T is ₹ 75/Transaction:

C = \(\sqrt{\frac{2 \times ₹ 30,00,00,000 \times ₹ 75}{0.12}}\) = ₹ 6,12,372

Average cash balance = C/2 = \(\frac{₹ 6,12,372}{2}\) = ₹ 3,06,186

Causes of difference In figure (II) from the figure of part (I)

(a) Transaction cost is lower as comparison to part (i)

(b) Higher opportunity cost of holding (ROI =12%) as comparison to part (i).

Question 14.

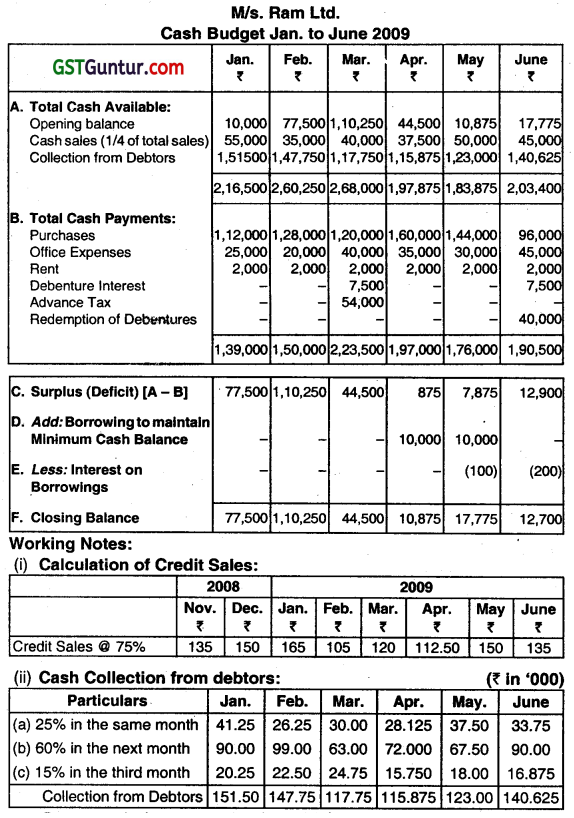

Write short notes on the following:

(d) William J Baumal vs. Miller-Orr Cash Management Model (May 2004, May 2011, 3 marks)

Answer:

William J Baumal vs. MIlIer-Orr Cash Management Model

| Particulars | Baumal’s Model | Miller-Orr Model |

| 1. Aim of the Model | This model tries to balance the income foregone on cash held by the firm against the transaction cost of converting cash into marketable securities or vice-versa. | The Miller Orr model attempts to answer the following two questions about the cash management. 1. When should transfer be effected between cash and marketable securities. 2. How much cash is to be converted into marketable securities and vice-versa. |

| 2. The Model | The optimum cash level is that level of cash where the carrying cost and the transaction cost are the minimum. Where; Carrying cost denotes cost of holding cash i.e. the interest foregone on marketable securities.Transaction cost denotes cost involved in converting marketable securities into cash. |

This model operates under uncertainties and random i.e. irregular cash flows. According to the model, control limits for cash transaction is set which when reached trigger off a transaction. There are 2 control limits, the upper control limit and the lower control limit. Within these control limits, the cash balance fluctuates.The optimum cash balance according to this model is the point where the holding cost and transaction cost are equal. When it hits the upper or the lower limit, action should be taken to restore the cash balance to its normal level within the control points. |

The Miller-On Model is More realistic:

- The limitation of Baumal Model is that it does not allow cash flows to fluctuate terms do not use their cash balance uniformly nor are they able to predict daily cash inflows and outflows.

- The miller or model overcomes this. This shortcoming and allows for daily cash flow variation within the lower and upper limit set.

- If the firms cash flows fluctuate randomly and hit the upper limit, then it buys sufficient marketable securities to come back to a normal level of cash balance and vice versa.

Question 15.

Discuss Miller-Orr Cash Management model. (Nov 2005, 3 marks)

OR

Explain ‘Miller-Orr Cash Management model’. (May 2015, 4 marks)

Answer:

Miller – Orr Cash Management Model

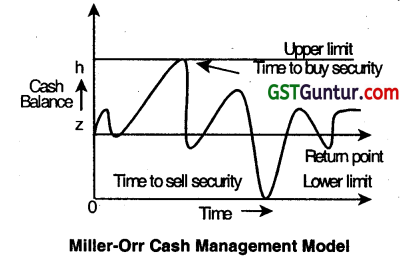

This stochastic model of cash management was presented by Miller and Orr in 1966. It is an expansion of Baumol’s EOQ model for optimum cash balance.

Aim of the Model: The Miller Orr model attempt to answer the following two questions about the cash management.

- When should transfer be effected between cash and marketable securities.

- How much cash is to be converted into marketable securities and vice-versa.

The Model: This model operates under uncertainties and random i.e. irregular cash flows.

According to the model, control limits for cash transaction is set which when reached trigger off a transaction. There are 2 control limits, the upper control limit and the lower control limit.

Within these control limits, the cash balance fluctuates. When it hits the upper or the lower limit, action should be taken to restore the cash balance to its normal level within the control points.

Explanation of the Model: The control limits are fixed on the basis of:

- Fixed cost associated with the securities transacted.

- The opportunity cost of holding cash.

- The degree of fluctuations in cash balances.

The upper limit is denoted by h, the lower limit by zero and the return point is denoted by Z. When the cash balance! reaches the upper limit, cash which is equal to (h-z) is invested in the marketable securities. When the cash balance reaches the lower limit, the cash is generated by selling the marketable securities. When the cash balance remains between the higher and lower levels, no transaction between the marketable securities and cash takes place.

Formula:

Z = \(3 \sqrt{\frac{3 T \sigma^2}{R I}} \)

Where;

R = Return point.

T = Transaction cost.

σ = Variance of daily cash balance.

l = Interest rate ie. carrying cost per rupee of cash.

Assumptions:

- Out of cash and marketable securities, marketable securities has a marginal yield.

- The buying and selling of marketable securities takes place without any delay.

Limitations:

- It assumes a constant variability of cash flows.

- It cannot cope up with large transactions such as payment of dividends.

![]()

Question 16.

Answer the following:

(i) A firm maintains a separate account for cash disbursement. Total disbursements are ₹ 2,62,500 per month. The administrative and transaction cost of transferring cash to disbursement account is ₹ 25 per transfer. Marketable securities yield is 7.5% per annum. Determine the optimum cash balance according to William J. Baurmol’s model. (May 2009, 3 marks)

Answer:

Determination of Optimal Cash Balance according to William J. Baumol Model

Optimum Cash Balance = \(\sqrt{\frac{2 \mathrm{AB}}{\mathrm{C}}}\)

Where,

A = Annual disbursement

B Administrative and transaction cost

C = Marketable securities yield.

C = \(\sqrt{\frac{2 \times 2,62,500 \times 12 \times 25}{0.075}}\)

= \(\sqrt{\frac{15,75,00,000}{0.075}}\)

= \(\sqrt{2,10,00,00,000} \)

Optimum cash Balance, C = ₹ 45,826

Question 17.

Answer the following:

VK Co. Ltd. has total cash disbursement amounting ₹ 22,50,000 in the year 2017 and maintains a separate account for cash disbursements. Company has an administrative and transaction cost on transferring cash to disbursement account ₹ 15 per transfer. The yield rate on marketable securities is 12% per annum. You are required to determine optimum cash balance according to the William J. Baumol Model. (May 2017, 5 marks)

Answer:

Optimum Cash Balance = \(\sqrt{\frac{2 \times A T \times T}{H}}\)

Where,

A = Annual Cash disbursements

T = Transaction Cost (fixed cost) per transaction

H = Opportunity Cost one rupee per annum (Holding Cost)

Optimum Cash Balance = \(\sqrt{\frac{2 \times 22,50,000 \times 15}{0.12}}=\sqrt{56,25,00,000}\)

Optimum Cash Balance = ₹ 23,717

Thus, Optimum Cash Balance according to William J. Boumol Model is ₹ 23,717.

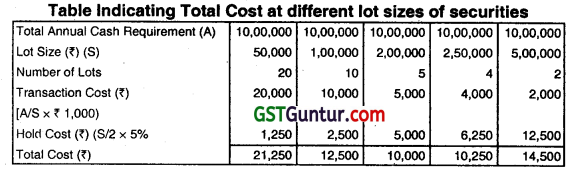

Question 18.

The annual cash requirement of X Ltd. is ₹ 10 lakhs. The company has marketable secucities in lot size8 of ₹’ 50,000, ₹ 1,00000, ₹’ 2,00,000 ₹ 2,50,000 and ₹’ 5,00,000. Cost of conversion of marketable securities per lot is ₹ 1,000. The company can earn 5% annual yield on its securities. You required to prepare a table indicating which lot size will have to be sold by the company. Also show that the economic lot size can be obtained by the Baumal Model.

Answer:

Economic lot size is ₹ 2,00,000 at which total costs are minimum.

Economic Lot Size = \(\sqrt{\frac{2 \times A \times T}{H}}\)

Where; A = Annual Cash requirement = ₹ 10,00,000

T = Transaction Cost per lot = ₹ 1,000

H = Holding Cost interest earned on marketable securities per annum =5%

Economic Lot Size = \(\sqrt{\frac{2 \times 10,00,000 \times 1,000}{0.05}}\) = ₹ 2,00,000

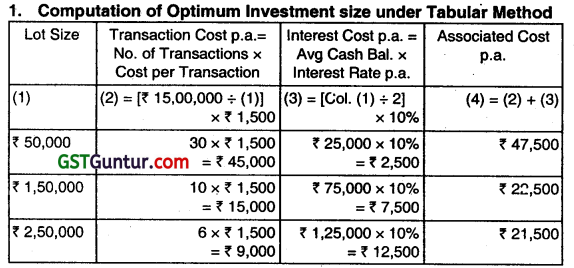

Question 19.

The annual cash requirement of X Ltd. is ₹ 15 Lakhs. The Company has Marketable Securities in Lot Sizes of ₹ 50,000, ₹ 1,50,000 and ₹ 2,50,000. Cost of conversion of Marketable Securities per lot is ₹ 1,500. The Company can earn 10% annual yield on its securities. Prepare a table indicating which Lot Size will have to be sold by the Company. Also show the Economic Lot Size, which can be obtained by the Baumol’s model.

Answer:

Conclusion: From the above table, the Economic Lot Size is ₹ 2,50,000, since Associated Cost is the least at that level.

2. Optimum Investment Size = \(\sqrt{\frac{2 A T}{1}}\)

Where;

A = Annual Cash Requirement = ₹ 15,00,000

T = Transaction Cost per purchase/sate = 1,500

I = Interest Rate per rupee per annum = 10%

On substitution, Optimum Investment Size = ₹ 2,12,132

Question 20.

X Ltd. requires a minimum cash balance of ₹ 6,000 and the variance of daily cash flows is estimated to be ₹ 22,50000. The interest rate is 0.025% per day and the transaction cost for each sale or purchase of securities is ₹ 20. Calculate the spread, the upper limit, and the return point.

Answer:

(i) Spread = \(3 \times \sqrt[3]{\frac{3}{4} \times \frac{T+\sigma^2}{1}}\)

= \(3 \times \sqrt{\frac{3}{4} \times \frac{20+(22,50,000)^2}{0.025 \%}} \)

= 15,390

(ii) Return Point = Lower Limit +\(\frac{1}{3}\) rd of Spread

= 6,000 + \(\frac{1}{3} \times 15,390\)

= 11,130

(iii) Upper Limit = Lower Limit + Spread

= 6,000 + 15,390

= 21,390

(iv) Average Cash Balance = Lower Limit +\(\frac{4}{9}\) of Spread

= 6,000 + \(\frac{4}{9} \times 15,390 \)

= 12,840

![]()

Question 21.

Answer the following:

State the advantages of Electronic Cash Management System. (May 2013, 4 marks)

Answer:

Advantages of Electronic Cash Management System

- Significant saving in time.

- Greater accounting accuracy.

- More control over time and funds:

- Decrease in interest costs.

- Less paperwork.

- Speedy conversion of various instruments into cash.

- Faster transfer of funds from one location to another, where required.

- Supports electronic payments.

- Reduction in the amount of ‘idle float’ to the maximum possible extent.

- Ensures no idle funds are placed at any place in the organization.

- It makes inter-bank balancing of funds much easier.

- Making available funds wherever required, whenever required.

- Produces faster electronic reconciliation.

- It is a true form of centralised ‘Cash Management’.

- Allows for detection of book-keeping errors.

- Earns interest income or reduces interest expense.

- Reduces the number of cheques issued.

Question 22.

What is Virtual Banlcing? State its advantages. (Nov 2013, 4 marks)

Answer:

Virtual Banking

| Concept | It refers to the provisions of Banking and related services through the use of Information Technology (IT) without direct interaction between Bank employees and customers. |

| Origin | The origin of virtual banking in the developed countries can be traced back to the seventies with the installation of Automated Teller Machine (ATMS). Subsequently, driven by the competitive market environment as well as various technological and customer pressures, other types of virtual banking services have grown in prominence throughout the world. |

Service Offered:

- Computerized settlement of clearing transactions.

- Use of Magnetic Ink Character Recognition (MICR) technology.

- Provision of inter-city clearing facilities and high-value clearing facilities.

- Electronic Clearing Service Scheme (ECSS).

- Electronic Funds Transfer (EFT) scheme.

- Delivery vs. Payment (DVP) for Government securities transactions.

- Setting up of Indian Financial Network(INFINET) etc.

Advantages:

- Lower cost of handing a transaction.

- Virtual banking allows the possibility of improved and a range of services being made available to the customer rapidly, accurately and at his convenience.

- High speed Leads to prompt services with perfect accuracy

- Cost Efficiency by lower cost of handling a transaction.

Question 23.

Explain Electronic Cash Management System. (Jan 2021, 4 marks)

Question 24.

Answer the following:

‘Management of marketable securities is an integral part of investment of cash.’ Comment. (Nov 2013, 4 marks)

OR

Describe the three principles relating to selection of marketable securities. (May 2016, 4 marks)

Answer:

Management of marketable securities serves the purpose of liquidity and cash provided choice of investment is done accurately. The selection of securities should be guided by 3 principles:

- Safety

- Maturity

- Marketability

Safety

Returns and risks are directly related to each other. Higher the default risk, higher the return from securities and lower the default risk, lower the return from securities. The default risk means the possibility of default in payment of interest or/and principal on time. To minimize default risk, the access cash should be invested in safe securities.

Maturity

Maturity refers to the time period cover which interest and principal are to be paid. Matching of maturity forecasting cash need is essential. Prices of long-term securities fluctuate more with changes in interest rates therefore, more risky. To avoid the fluctuation in prices of securities the excess cash should be invested in short-term securities.

![]()

Marketability

It refers to the convenience, speed, and cost at which a security can be converted into cash. If the security can be sold quickly without loss of time and price it is highly liquid or marketable. Thus, in situations when working capital needs are fluctuating, investment of excess funds should be done in short-term securities, so as to maintain the liquidity.