Scope and Objectives of Financial Management – CA Inter FM Question Bank is designed strictly as per the latest syllabus and exam pattern.

Scope and Objectives of Financial Management – CA Inter FM Question Bank

Question 1.

Explain the two basic functions of Financial Management. (Nov 2002, Nov 2009, 3 marks)

Answer:

The two basic functions of F.M. are

1. Procurement of funds

2. Effective use of these funds

1. Procurement of fund

Procurement of funds includes:

- Identification of sources of finance

- Determination of finance mix

- Raising of funds

- Division of profit

- Retention of profit

There are various sources of procurement of funds such as:

Share capital, debentures, bank, financial institution, ADR, GDR, FDI, Fil etc. Every source has an element of risk, cost and control attached with it. Whatever be the source, the cost of the fund should be at the minimum, balancing the risk and the control function.

2. Effective use of fund

- The funds once procured cannot be left to remain idle.

- The funds are to be invested in such a way that the business yields maximum return along with maintaining its solvency.

- Thus the effective use of the funds would require that adequate funds should be maintained to meet the working capital requirement and avoiding the blockage of funds in inventories, book debts, cash etc.

Aspects of Funds Utilisation

- Utilisation for Property Plant and Equipment

- Utilisation for working capital

Question 2.

Discuss the changing scenario of Financial Management in India. (May 2006, 6 marks)

Answer:

Modern financial management has come a long way from traditional corporate finance. As the economy is opening up and global resources are being tapped, the opportunities available to a finance manager have no limits. Financial management is passing through an era of experimentation and excitement as a large part of finance activities are carried out today. A few instances of these are mentioned as below:

- Interest rate freed from regulation treasury operation therefore have to be more sophisticated as interest rates are fluctuating.

- The rupee has become fully convertible.

- Optimum debt-equity mix is possible.

- Maintaining share prices is crucial. The dividend policies and bonus policies formed by finance managers have a direct bearing on the share prices.

- Share buy backs and reverse book building.

- Raising resources globally through ADRs./GDRs.

- Risk Management due to introduction of option and future trading.

- Free pricing and book building for iPOs, seasoned equity offering.

- Treasury management.

Question 3.

Explain Finance Funàtlon’. (Nov 2017, 4 marks)

Answer:

Finance Function:

The finance function is most important for all business enterprises. It starts with the setting up of an enterprise and is concerned with raising of funds, deciding the cheapest source of finance, utilization of funds raised, making provision for refund when money is not required in the business, deciding the most profitable investment, managing the funds raised and paying returns to the providers of funds in proportion to the risks undertaken by them. Therefore, it is at acquiring sufficient funds, utilizing them property, increase the profitability of the organisation and maximizing the value of the organisation and ultimately the shareholder’s wealth.

The basic finance function includes:

1. Investment decision.

2. Financing decision.

3. Dividend decision.

1. Investment Decision: The funds once procured have to be allocated to the various projects. This requires proper investment decision. The investment decisions are taken after careful analysis of various projects through capital budgeting and risk analysis. Only those proposals are accepted which yields a reasonable return on the capital employed.

2. Financing Decision: There are various sources of funds. A finance manager has to select the best source of finance from a large number of options available. The financing decision regarding selection of source and internal financing depends upon the need, purpose, object and the cost involved. The finance manager has also to maintain a proper balance between

long-term and short-term loan. He has also to ensure a proper mix of loan funds and owners funds which will yield maximum return to the shareholders.

3. Dividend Decision: A finance manager has also to decide whether or not to declare dividend, If dividends are to be declared then what portion is to be paid to the shareholder and what portion is to be retained in the business.

![]()

Question 4.

What are the two main aspects of the Finance Function? (May 2018, 2 marks)

Answer:

Two main aspects of the Finance Function

1. Long-term Finance Function Decisions

- Investment decisions (I)

- Financing decisions (F)

- Dividend decisions (D).

2. Short-term Finance Function Decision

Working Capital Management (WCM)

Question 5.

Briefly explain the three finance function decisions. (Nov 2019, 3 marks)

Answer:

The three finance Function decisions:

(a) Investment decisions (I):

These decisions relate to the selection of assets in which funds will be invested by a firm. Funds procured from different sources have to be invested in various kinds of assets. Long-term funds are used in a project for various fixed assets and also for current assets. The investment of funds in a project has to be made after careful assessment of the various projects through capital budgeting. A part of long-term funds is also to be kept for financing tt working capital requirements.

Asset management policies are to be paid down regarding various items of current assets. The inventory policy would be determined by the production manager and the finance manager keeping in view the requirement of the production and the future price estimates of raw materials and availability of funds.

(b) Financing decisions(F):

These decisions relate to acquiring the optimum finance to meet financial objectives and seeing that fixed and working capital are effectively managed. The financial manager needs to possess a good knowledge of the sources of availability of funds and their respective costs and needs to ensure that the company has a sound capital structure, i.e. a proper balance between equity capital and debt such managers also need to have a very clear understanding as to the difference between profit and cash flow, bearing in mind that profit is of little avail unless the organization is adequately supported by cash to pay for assets and sustain the working capital style.

Financing decisions also call for a good knowledge of evaluation of risks, eg. excessive debt carried high risk for an organization’s equity because of the priority rights of the lenders. A major area for risk-related decisions is in overseas trading, where on organisation is vulnerable to currency fluctuations, and the manager must be well aware of the various protective procedures, such as heding (it is a strategy designed to minimize, reduce or cancel out the risks in another investment) available to him. For example, someone who has a shop takes care of the risk of the goods being destroyed by fire by hedging it via a fire insurance contract.

(c) Dividend decisions (D):

These decisions relate to the determination as to how much and how frequently cash paid out of the profits of an organisation as income for its owners/shareholders. The owner of any profit-making organization looks for reward for his investment in two ways, the growth of the capital invested and the cash paid out as income; for a sole trader, this income would be termed as drawings and for a limited liability company the term is dividends.

The dividend decision thus has two elements – the amount to be paid out and the amount to be retained to support the growth of the organisation, the latter being also a financing decision; the level and regular growth of dividends represent a significant factor in determining a profit-making company’s market value, i.e. the value placed on its shares by the stock market.

Question 6.

State tour tasks involved to demonstrate the Importance of good Financial Management. (Jan 2021, 4 marks)

Question 7.

Discuss the ‘Profit maximisation and ‘Wealth maximisation’ objectives of a firm. (Nov 2003, 6 marks)

Answer:

Financial management is basically concerned with procurement and use of funds. in the light of these the main objectives of financial management are:

1. Profit Maximisation.

2. Wealth Maximisation.

1. Profit Maximisation:

Profit Maximisation is the main objective of business because:

- Profit acts as a measure of efficiency and

- It serves as a protection against risk.

Agreements in favour of profit maximisation:

- When profit earning is the main aim of business the ultimate objective should be profit maximisation.

- Future is uncertain. A firm should earn more and more profit to meet the future contingencies.

- The main source of finance for growth of a business is profit. Hence, profits maximisation is required.

- Profit maximisation is justified on the grounds of rationality as profits act as a measure of efficiency and economic prosperity.

Arguments against profit maximisation:

- it leads to exploitation of workers and consumers.

- It ignores the risk factor associated with profit.

- Profit in itself is a vague concept and means differently to different people.

- It is a narrow concept at the cost of social and moral obligations. Thus, profit maximisation as an objective of financial management has been considered inadequate.

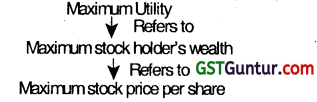

2. Wealth Maximisation: Wealth maximisation is considered as the appropriate objective of an enterprise. When the firms maximises the stockholder’s wealth, the individual stockholder can use this wealth to maximise his individual utility. Wealth maximisation is the single substitute for a stockholder’s utility.

A stockholder’s wealth is shown by:

Stockholder’s wealth = No. of share owned × Current stock price per share

Higher the stock price per shares, the çreater will be the stockholder’s wealth, the greater will be the stock price per share.

Arguments in favour of wealth maximisation:

(i) Due to wealth maximisation, the short-term money lenders get their payments in time.

(ii) The long-time lenders too get a fixed rate of interest on their investments.

(iii) The employee’s share in the wealth gets increased.

(iv) The various resources are put to economical and efficient use.

Argument against wealth maximisation:

- It is socially undesirable.

- It is not a descriptive idea.

- Only stock holder’s wealth maximisation does not lead to firm’s wealth maximisation.

- The objective of wealth maximisation is endangered when ownership and management are separated.

- In spite of the arguments against wealth maximisation, it Is the most appropriative objective of a firm.

Question 8.

Explain the limitations of profit maximization objective of Financial Management. (Nov 2007, 3 marks)

OR

Answer the following:

The profit maximization is not an operationally feasible criterion. Comment on it. (May 2012, 4 marks)

Answer:

| Arguments against Profit Maximisation | 1. It leads to exploitation of workers and consumers 2. It ignores the risk factor associated with profit. 3. Profit in itself is a vague concept and means differently to different people. 4. It is a narrow concept at the cost of social and moral obligations. |

| Limitation of Profit Maximization objectives | 1. It ignores the risk facto as well as timing of returns. 2. The concept of profit maximisation is vague and narrow. 3. It emphasizes the short-run profitability and short-term projects. 4. It may cause decrease in share price. 5. It fails to consider the social responsibility of business. 6. It may allow decisions to be taken at the cost of long run stability and profitability of the concern. 7. The profit is only one of the many objectives of a modem firm. 8. It ignores the time and risk factors |

Question 9.

Write two main objectives of Financial Management. (Nov 2018, 2 marks)

Answer:

Financial management is basically concerned with procurement and use of funds. In the light of these the main objectives of financial management are:

1. Profit Maximisation.

2. Wealth Maximisation.

1. ProfIt Maximisation:

Profit Maximisation is the main objective of business because:

(i) Profit acts as a measure of efficiency and

(ii) It serves as a protection against risk.

2. Wealth Maximisation: Wealth maximisation is considered as the appropriate objective of an enterprise. When the firms maximises the stockholder’s wealth, the individual stockholder can use this wealth to maximise his individual utility. Wealth maximisation is the single substitute for a stockholder’s utility.

![]()

Question 10.

Answer the following:

Discuss conflict in profit versus wealth maximisation objective. (Nov 2006,Nov 2009, 4 marks)

OR

Distinguish between Profit maximisation vs Wealth maximisation objective” of the firm. (Nov 2010, May 2017, 4 marks)

OR

Answer the following;

Discuss the conflicts in Profit versus Wealth maximization principle of the firm. (Nov 2012, May 2015, 4 marks)

Answer: .

1. Profit Maximisation:

Profit Maximisation is the main objective of business because profit acts as a measure of efficiency and it serves as a protection against risk.

Arguments in favour of Profit Maximisation:

- When profit earning is the main aim of business the ultimate objective should be profit maximisation.

- Future is uncertain. A firm should earn more and more profit to meet the future contingencies.

- The main source ot finance for growth of a business is profit. Hence, profits maximisation is required.

- Profit maximisation is justified on the grounds of rationality as profits act as a measure of efficiency and economic prosperity.

Arguments against Profit Maximisation:

- it leads to exploitation of workers and consumers

- it ignores the risk factors associated with profit.

- Profit in itself is a vague concept and means differently to different people.

- It is a narrow concept at the cost of social and moral obligations. Thus, profit maximisation as an objective of financial management has been considered inadequate.

2. Wealth Maximisation:

Wealth maximisation is considered as the appropriate objective of an enterprise. When the firms maximises the stockholder’s wealth, the individual stockholder can use this wealth to maximise his individual utility.

Wealth maximisation is the single substitute for a stockholder utility Arguments In favour of Wealth Maximisation:

- Due to wealth maximisation, the short-term money lenders get their payments in time.

- The long-time lenders too get a fixed rate of interest on their investments.

- The share of employees in the wealth gets increased.

- The various resources are put to economical and efficient use.

Arguments against Wealth Maximisation:

(i) It is socially undesirable.

(ii) It is not a descriptive idea.

(iii) Only stockholder’s wealth maximisation does not lead to firm’s wealth maximisation.

(iv) The objective of wealth maximisation is endangered when ownership and management are separated.

Question 11.

“The information age has given a fresh perspective on the role of finance management and finance managers. With the shift in paradigm, it is imperative that the role of Chief Financial Officer (CFO) changes from a controller to a facilitator.” Can you describe the emergent role which is described by the speaker/author? (Nov 2000, 6 marks)

Answer:

It is true that the information age has given a fresh perspective on the role of financial management and finance managers. The job of the financial manager in India today has become more important, complex, and demanding due to:

Global competition

- Technological development

- Volatile financial prices

- Economic uncertainty

- Tax law changes etc.

The key challenges before a financial manager is following areas:

- Investment Planning

- Corporate governance

- Risk management

- Financial Structure

- Working capital management

- Performance management

- Mergers

- Acquisitions

- Restructuring

- Investors relations etc.

Question 12.

Discuss the functions of a Chief Financial Officer. (May 2004, 3 marks)

OR

Answer the following:

What are the main responsibilities of a Chief Financial Officer of an organisation? (May 2007, 3 marks)

OR

Answer the following:

(ii) State the role of a Chief Financial Officer. (May 2010, 3 marks)

OR

Answer the following:

(a) Elucidate the responsibilities of Chief Financial Officer. (Nov 2011, 4 marks)

OR

What are the roles of Finance Executive in Modern World? (May 2018, 2 marks)

OR

List out the role of Chief Financial Officer in todays World. (Nov 2020, 4 marks)

Answer:

The finance manager occupies an important position in the organisational structure. Earlier his role was just confined to raising of funds from a number of sources. Today his functions are multidimensional.

The functions performed by today’s finance managers are as below:

1. Forecasting the financial requirement

A financial manager has to make an estimate and forecast accordingly the financial requirements of the firm.

2. Planning

A finance manager has to plan out how the funds will be procured and how the acquired funds will be allocated.

3. Procurement of fund

A finance manager has to select the best source of finance from a large number of options available. The finance manager’s decisions regarding the selection of source is influenced by the need, purpose object and the cost involved.

4. Investment Allocation of fund

A finance manager has also to invest or allocate funds in best possible ways. In doing so a finance manager cannot but ignore the principles of safety profitability and liquidity.

5. Maintaining proper liquidity

A finance manager plays an important role In maintaining proper liquidity. He determines the need for liquid assets and then arranges them in such a way that there is no scarcity of funds.

6. Cash management

A finance manager has also to manage the cash in an efficient way. Cash is to be managed in such a way that neither there is scarcity of it nor does it remains idle earning no return on It.

7. Dividend decision

A finance manager has also to decide whether or not to declare a dividend. If dividends are to be declared, then what amount is to be paid to the shareholders and what amount is to be retained In the business.

8. Evaluation of financial performance

A finance manager has to implement a system of financial control to evaluate the financial performance of various units and then take corrective measures wherever needed.

9. Financial negotiations

In order to procure and invest funds a finance manager has to negotiate with the vanous financial institutions, banks, public depositors in a meticulous way.

10. To ensure proper use of surplus

A finance manager has to see to the proper use of surplus fund. This is necessary for expansion and diversification plans and also for protecting the interest of shareholders.

![]()

Question 13.

Discuss emerging issues affecting the future role of Chief Financial Officer (CFO). (May 2014, 4 marks)

OR

List the emerging issues (any four) affecting the future role of CFO. (Nov 2016, 4 marks)

Answer:

Emerging issues affecting the future role of Chief Financial Officer (CFO)

1. Regulation Regulation requirements are increasing and CFOs have an increasing persona stake in regulatory adherence.

2. Globalisation

The challenges of globalisation are creating a need for finance leaders to develop a finance function that works effectively on the global stage and that embraces diversity.

3. Technology

Technology is evolving very quickly, providing the potential for CFOs to reconfigure finance processes and drive business insight through big data and analysis.

4. Risk

The nature of the risk that organisations face is changing, requiring more effective risk management approaches and increasingly CFOs have a role to play in ensuring an appropriate corporate ethos.

5. Transformation

There will be more pressure on CFOs to transform their finance functions to drive a better service to the business at zero cost impact.

6. Stakeholder Management

Stakeholder management and relationships will become important as increasingly CFOs become the face of the corporate brand.

7. Strategy

There will be a greater role to play in strategy validation and execution, because the environment is more complex and quick changing, calling on the analytical skills CFOs can bring.

8. Reporting

Reporting requirements will broaden and continue to be burdensome for CFOs.

9. Talent and capability

A brighter spotlight will shine on talent, capability and behaviour in the top finance role.

Question 14.

Differentiate between Financial Management and Financial Accounting. (Nov 2009, 2 marks)

Answer:

Difference between Financial Management and Financial Accounting

| Basis of Difference | Financial Management | Financial Accounting |

| 1. Decision making | Financial Management’s primary responsibility relates to financial planning, controlling and decision | The chief focus of Financial Accounting is to collect data and present the data. |

| 2. Treatment of funds making. | In financial management it is based on cash flows. The revenues are recognised only when cash is actually received (i.e. cash inflow) and expenses are recognised on actual payment (i.e. cash outflow). | In Finaicial Accounting, the measurement of funds is based on the accrual principle of funds. |