Service Costing – CA Inter Costing Question Bank is designed strictly as per the latest syllabus and exam pattern.

Service Costing – CA Inter Costing Question Bank

Question 1.

Explain Operating Costing. (May 2002, 2 marks)

Answer:

- Operating costing is one of the methods of costing used to ascertain the cost of generating and rendering services such as transport, hospitals, canteens, electricity etc.

- It is undertaken in industries which provides services such as canteens, hospitals, electricity, transport etc.

- Operating Costing aims at ascertaining the operating costs.

- The cost incurred to generate and render services such as hospital, canteen, electricity, transport etc. is called operating cost.

Question 2.

State the unit of cost for the following industries:

(a) Transport

(b) Power

(c) Hotel

(d) Hospital (Nov 2008, 2 marks)

Answer:

The unit of cost for various industries are as follows:

Industry : Unit of Cost

(a) Transport :

- Goods – Per ton km. or per tonne km.

- Passengers – per passenger km.

(b) power : Per kilo-watt hour (Kwh) or Horse Power (HP)

(c) Hotel : Per Room-day or Per Service day

(d) Hospital : Per Patient-day or Per Bed-day or per Operation

![]()

Question 3.

Explain briefly, what do you understand by Operating Costing. How are composite units computed? (Nov 2009, 2 marks)

OR

What do you understand by Operating Costing? How are composite units computed. (Nov 2009, 4 marks)

Answer:

Operating costing is one of the methods of costing used to ascertain the cost of generating and rendering services such as transport, hospitals, canteens, electricity etc.

Job costing is undertaken in industries which provide services such as canteens, hospitals, electricity, transport etc.

Operating Costing aims at ascertaining the operating costs.

The cost incurred to generate and render services such as hospital, canteen, electricity, transport etc. is called operating cost.

Operating costs (in transport costing) are classified into three broad categories:

1. Operating and running cost

2. Standing cost

3. Maintenance cost

1. Operating and Running Costs: These are the costs which are incurred for operating and running the vehicle. For e.g. – cost of diesel, petrol etc. These costs are variable in nature and vary with operations in more or less same proportions.

2. Standing Costs: Standing costs are the costs which are incurred irrespective of operation. For e.g. – rent of garage, salary of drivers, insurance premium etc. It is fixed in nature and thus the cost goes on accumulating as the time passes.

3. Maintenance Costs: Maintenance costs are the costs which are incurred to keep the vehicle in good or running condition. For e.g. – Cost of repair, painting, overhauling etc. It is semi-variable in nature and is influenced by both time and volume of operation.

4. Absolute and Commercial Tonne – Kilometres

Composite units like Tonne – Kilometres, Quintal – kilometres etc. may be computed in two ways-

5. Absolute (Weighted Average) Tonne – Kilometres: This is the sum total of Tonne- Kilometres, arrived at by multiplying various distances by respective load quantities carried. Numerically, Absolute tonne- kilometres = Σ(Distance covered between two stations load carried)

6. Commercial (Simple Average) Tonnes – Kilometres: It is derived by multiplying total distance (i.e. kilometres), by average load quantity (Tonnes). Numerically, Commercial tonne- Km. = Avg. Load × Distance covered.

Answer:

Composite Cost Unit

Many a times two measurement units are combined together to know the cost of service or operation. These are called composite cost -units. Examples of Composite Cost units are Ton-Km., Quintal km., Passenger km., Patient day etc.

Composite unit may be computed in two ways:

(1) Absolute or Weighted Average Basis:

It is summation of the products of qualitative and quantitative factors. For example, to calculate absolute Ton-km. for a goods transport is calculated as follows:

In both the example, variable cost is dependent of distance and is a quantative factor. Since, the weight carried does not affect the variable cost hence and is a qualitative factor.

Σ(Weight Carried × Distance)1 + (Weight Gamed × Dietance)2 + ……… + (Weight Carried × Distance)n

Similarly, in case of cinema theatres, price for various classes of seats are fixed differently. For e.g., First class seat may be provided with higher quality service and hence charged at a higher rate, whereas second class seat may be priced less. In this case, appropriate weight to be given effect for First class seat and Second Class Seat -to ensure proper cost per composite unit.

(2) Commercial or Simple Average Basis:

It is product of average qualitative and total quantitative factors. For example, in case of goods transport, Commercial Ton-km. is arrived at by multiplying total distance km., by average load quantity.

Σ(Distance1 + Distance2……. + Distance n) × \(\left(\frac{W_1+W_2 \cdots \cdots \cdots W_n}{n}\right)\)

In both the example, variable cost is dependent of distance and is a quantative factor. Since, the weight carried does not affect the variable cost hence and is a quantitative factor.

Question 4.

“The more kilometers you travel with your own vehicle, the cheaper it becomes. Comment briefly on this statement. (Nov 1995, 2 marks)

Answer:

The cost per kilometre is arrived at by dividing the total cost incurred by the total kilometres travelled. Since the majority of cost for running and maintaining vehicles are fixed in nature, the fixed cost per kilometre decreases with increase in kilometre. Thus as more kilometres is travelled it becomes cheaper.

![]()

Question 5.

A Mineral is transported from two mines—A’ and ‘B’ and unloaded at plots a Railway Station. Mine A is at a distance of 10 kms. arid B is at a distance of 15 kms. from railhead plots. A fleet of lorries of 5 tonne carrying capacity is used for the transport of mineral from the mines.

Records reveal that the lorries average a speed of 30 kms. per hour, when running and regularly take 10 minutes to unload at the railhead. At mine ‘A’ loading time averages 30 minutes per load while at mine ‘B’ loading

time averages 20 minutes per load. Drivers’ wages, depreciation, insurance arid taxes are found to cost ₹ 9 per hour operated. Fuel, oil, tyres, repairs and maintenance cost ₹ 1.20 per km.

Draw up a statement, showing the cost per tonne-kilometer of carrying mineral from each mine. (Nov 2000, 8 marks)

Answer

Working Notes:

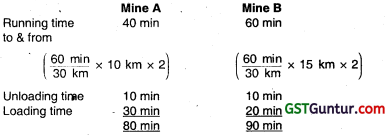

(1) Total operated time 1 trip:

(2) Effective tonnes km generated per trip:

![]()

Statement showing cost per tonne km of carrying mineral from each time:

Question 6.

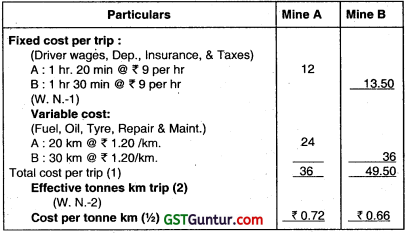

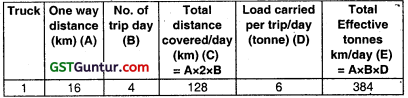

A transport company has a fleet of three trucks of 10 tonnes, capacity each plying in different directions for transport of customers goods. The trucks run loaded with goods and return empty. The distance travelled, number of trips made and the load carried per day by each truck are as under:

The analysis of maintenance cost and the total distance travelled during the last two years is as under:

The following are the details of expenses for the year under review:

Diesel : ₹ 10 per litre. Each litre gives 4 km. per litre of diesel on an average.

Drivers salary : ₹ 2,000 per month.

License and taxes : ₹ 5,000 per annum per truck.

Insurance : ₹ 5,000 per annum for all the three vehicles.

Purchase price per truck : ₹ 3,00,000. Life 10 years. Scrap value at the end of life is ₹ 10,000.

Oil and sundries : ₹ 25 per 100 km. run.

General Overhead : ₹ 11,084 per annum.

The vehicles operate 24 days per month on an average.

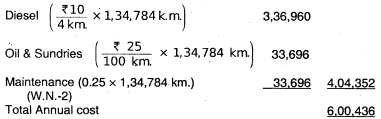

(i) Prepare an Annual Cost Statement covering the fleet of three vehicles.

(ii) Calculate the cost per km. run.

(iii) Determine the freight rate per tonne km. to yield a profit of 10% on freight. (Nov 2001, 10 marks)

Answer:

Working Notes:

(1) Total km travelled and effective tonnes km of load carried generated by 3 trucks annually:

Total kms. travelled by 3 trucks annually:

468 km. × 24 days × 12 months = 1,34,784 krns.

Total effective tonne km of load carried by 3 trucks annually

1,824 tonnes km. × 24 days × 12 months = 5,25,312 tonnes kms.

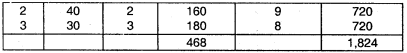

(2) Segregation of fixed & variable component of maintenance cost ⇒ Variable Maintenance cost

Fixed Maintenance Cost = Total Maint, cost – VarIable Maint, cost

= ₹ 46,050 – (1,60,200 km. × 0.25}

= ₹ 6,000/-

(i) Annual Cost Statement of 3 vehicles:

Fixed cost:

Variable cost :

(ii) Calculations of cost/km. Run:

Question 7.

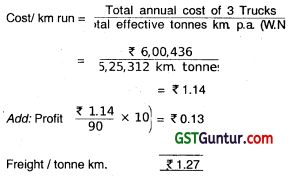

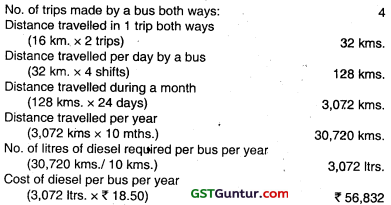

EPS is a Public School having 25 buses each plying in different directions for the transport of its school students. In view of large number of students availing of the bus service, the buses work two shifts daily both in the morning and in the afternoon. The buses are garaged in the school. The workload of the students has been so arranged that in the morning, the first trip picks up senior students and the second trip plying an hour later picks up junior students. Similarly, in the afternoon, the first trip takes the junior students and an hour later the second trip takes the senior students home.

The distance travelled by each bus, one way is 16 kms. The school works 24 days a month and remains closed for vacation in May and June. The bus fee, however, is payable by the students for all the 12 months in a year.

The details of expenses for the year 2003-2004 are as under:

Drivers salary-payable for all the 12 months : ₹ 5,000 per month per driver

Cleaner’s salary payable for all 12 month(one Cleaner has been employed for every five buses) : ₹ 3,000 per month per cleaner

Licence Fees, Taxes etc. : ₹ 2,300 per bus per cleaner

Insurance Premium : ₹ 15,600 per bus month per cleaner

Repairs and Maintenance : ₹ 16,400 per bus per annum

Purchase price of the bus : ₹ 16,50,000 each

Life of the bus : ₹ 16 years

Scrap value : ₹ 1,50,000

Diesel Cost : ₹ 18.50 per litre

Each bus gives an average of 10 kms per litre of diese4. The seating capacity of each bus is 60 students. The seating capacity is fully occupied during the whole year.

The school follows differential bus fees based on distance travelled as

Ignore interest. Since the bus fees has to be based on average cost, you are required to:

(i) Prepare a statement showing the expenses of operating a single bus and the fleet of 25 buses for a year.

(ii) Work out average cost per student per month in respect of:

(a) Students coming from a distance of upto 4 kms from the School;

(b) Students coming from a distance of upto 8 kms from the School; and

(c) Students coming from a distance of upto 16 kms from the School. (May 2004, 7 + 3 = 10 marks)

Answer:

EPS Public School

(i) Statement showing the expenses of operating a single bus & the fleet of 25 buses a year:

(ii) Average cost /students/month in respect of students coming from a distance of:

Working Notes :

(1) Total km travelled and effective tonnes km of load carried generated by

(2) Calculation of no. of students per bus:

120 × 15% = 18

120 × 4/1 × fare = 240 × 30% = 72

120 × 4/1 × 100% fare = 480 × 55% students = 264 students

Question 8.

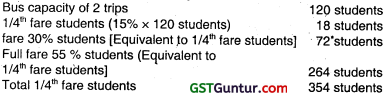

In order to develop tourism, ABCL airline has been given permit to operate three flights in a week between X and Y cities (both side). The airline operates a single aircraft of 160 seats capacity. The normal occupancy is estimated at 60% through out the year of 52 weeks. The one way fare is ₹ 7,200. The cost of operation of flights are:

Fuel cost (variable) : ₹ 96,000 per flight

Food served on board on non-chargeable basis : ₹ 125 per passenger

Commission : 5% of fare applicable for all booking

Fixed cost:

Aircraft lease : ₹ 3,50,000 per flight

Landing charges : ₹ 72,000 per flight

Required:

(i) Calculate the net operating income per flight.

(ii) The airline expects that its occupancy will increase to 108 passengers per flight if the fare is reduced to ₹ 6,720. Advise whether this proposal should be implemented or not. (May 2005, 3+2=5 marks)

Answer:

Number of passengers 160 × \(\frac{60}{100}\) = 96

There is an increase ¡n contribution by ₹ 31,332. Hence, the proposal is acceptable.

![]()

Question 9.

Distinguish between the Absolute ton-kms and Commercial ton-kms. (Nov 2006, 2 marks)

Answer:

When goods are transported, the cost unit is tonne kilometres or quintal

kilometres which are computed as:

1. Absolute (weighted average) tonne-kilometres

2. Commercial (simple average) tonne-kilometres

Absolute (weighted average) tonne- kilometres: It is the sum total of tonnes-kilometre which is determined by multiplying various distances by respective load quantity carried.

or

Numerically, Absolute tonne-kilometres = Σ(Distance covered between two stations local carried)

Commercial (simple average) tonne-kilometres: It is the sum total of tonnes-kilometre which is determined by multiplying total distance by average load quantity carried.

or, Numerically, Commercial tonne Km = Avg. Load × Distance covered.

Question 10.

Calculate total passenger kilometres from the following information: Number of buses 6, number of days operating in a month 25, trips made by each bus per day 8, distance covered 20 kilometres (one side), capacity of bus 40 passengers, normally 80% of capacity utilization. (Nov 2007, 2 marks)

Answer:

Total Passengers km. = No. of buses × Distance in one trip × seating capacity in each bus × No. of days in a month × No. of trips

= 6 × 20 × 40 × 25 × 8 × 2

= 1,92,00,000 Passengers km

Effective Passengers km. = Total passengers km. × capacity utilised

= 1,92,00,000 × 80%

= 15,36,000 Passengers kms.

Question 11.

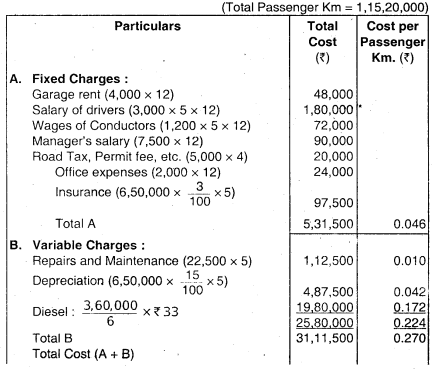

A transport company has been given a 40 kilometre long route to run 5 buses. The cost of each bus is ₹ 6,50,000. The buses will make 3 round trips per day carrying on an average 80 percent passengers of their seating capacity. The seating capacity of each bus is 40 passengers. The buses will run on an average 25 days in a month. The other information for the year 2010.11 are given below:

Garage rent : ₹ 4,000 per month

Annual repairs and maintenance : ₹ 22,500 each bus

Salaries of 5 drivers : ₹ 3,000 each per month

Wages of 5 conductors : ₹ 1,200 each per month

Manager’s salary : ₹ 7,500 per month

Road tax, permit fee, etc. : ₹ 5,000 for a quarter

Office expenses : ₹ 2,000 per month

Cost of diesel per litre : ₹ 33

Kilometre run per litre for each bus : 6 kilometres

Annual depreciation : 15% of cost

Annual Insurance : 3% of cost

You are required to calculate the bus fare to be charged from each passenger per kilometre. if the company wants to earn a profits of 331/3 percent on taking (total receipts from passengers). (May 2010, 8 marks)

Answer:

Operating Cost Sheet for the year 2010-11

Working Notes:

1. Total Kilometres to be run during the year 2010-11

= 40 × 2 × 3 × 25 × 12 × 5 = 3,60,000 Kilometres

2. Total passenger Kilometres

= 3,60,000 × 40 × \(\frac{80}{100}\) = 1,15,20,000 Passenger km.

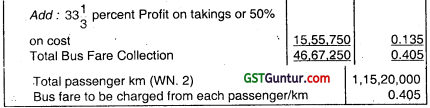

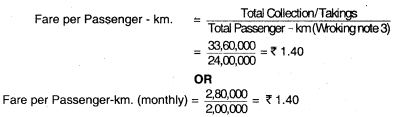

Question 12.

The following information relates to a bus operator:

Cost of the bus : ₹ 18,00,000

Insurance charges 3% p.a.

Manager-cum accountant’s salary : ₹ 8.000 p.m.

Annual Tax : ₹ 50,000

Garage Rent : ₹ 2,500 p.m.

Annual repair & maintenance : ₹ 1,50,000

Expected life of the bus : 15 years

Scrap value at the end of 15 years : ₹ 1,20,000

Drivers salary : ₹ 15,000 p.m.

Conductor’s salary : ₹ 12,000 p.m.

Stationery : ₹ 500 p.m.

Engine oil, lubricants (for 1200 kms.) : ₹ 2,500

Diesel and oil (for 10 kms.) : ₹ 52

Commission to driver and conductor (shared equally) : 10% of collections

Route distance : 20 km long

The bus will make 3 round trips for carrying on the average 40 passengers in each trip. Assume 15% profit on collections. The bus will work on the average 25 days in a month. Calculate fare for passenger-km. (Nov 2013, 8 marks)

Answer:

Statement of Operating Costs & Revenues per month

Working Note:

No. of passengers = 40 (given)

No. of km. permonth = 1 Bus × 3 Trips × 2 ways × 2o km. × 25 days

= 3,000 km. p.m.

Passenger km. p.m. = 40 × 3,000 = 1,20,000.

It is given that profit = 15% of takings &

Commission = 10% of takings.

Hence,

Total Operating Costs 100% – 15% – 10% = 75% of total taking.

Total Takings = \(\frac{90,350}{75 \%}\) = 1,20,467.

Now, Commission & Profits are taken at 10% & 15% respectively on total takings.

Fare per Passenger Km. = \(\frac{1,20,467}{1,20,000}\) = ₹ 1.00

![]()

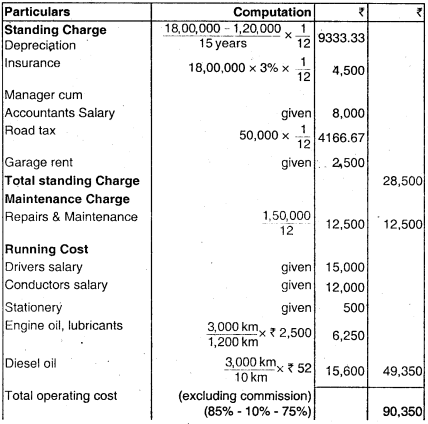

Question 13.

A mini-bus, having a capacity of 32 passengers, operates between two places – ‘A’ and ‘B’. The distance between the place A’ and place B’ is 30 km. The bus makes 10 round trips in a day for 25 days in a month. On an average, the occupancy ratio is 70% and is expected throughout the year.

The details of other expenses are as under:

Particulars : Amount (₹)

Insurance : 15,600 Per annum

Garage Rent ₹ 2,400 Per quarter

Road Tax ₹ 5,000 Per annum

Repairs : 4,800 Per quarter

Salary of operating staff : 7,200 Per month

Tyres and Tubes : 3,600 Per quarter

Diesel: (one litre is consumed for every 5 km) : 13 Per litre

Oil and Sundries : 22 Per 100 km run

Depreciation : 68,000 Per annum

Passengers or tax @ 22% on total taking is to be levied and bus operator requires a profit of 25% on total taking.

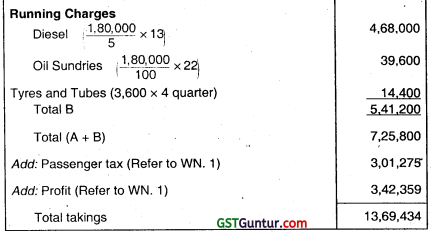

Prepare operating cost statement on the annual basis and find out the cost per passenger kilometer and one way fare per passenger. (May 2015, 8 marks)

Answer:

Calculation for Onerating Cost Per Annum:

Caculation for Cost Per Passenger Kilometer and one way fare per passenger:

Working Notes:

1. Let total taking be X then Passenger tax and profit will be as follows:

X = ₹ 7,25,800 + 022 X + 0.25X

X – 0.47 X = ₹ 7,25,800

X = \(\frac{₹ 7,25,800}{0.53}\)

= ₹ 13,69,434

Passenger tax = ₹ 13,69,434 × 0.22

= 3,01,275

Profit = ₹ 1369.434 × 0.25

= ₹ 3,42,359

2. Total Kilometres to be run during the year

= 30 km. × 2 sides × 10 trips × 25 days × 12 months

= 1,80,000 Kilometres

3. Total passenger Kometres

= 1,80,000 km. × 3 passengers × 70%

= 40,32,000 Passenger km.

Question 14.

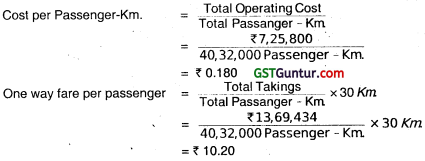

Royal transport company has been given a 50 kilometre long route to run 6 buses. The Cost of each bus is ₹ 7,50,000. The buses will make 3 round trips per day carrying on an average 75 percent passengers of their seating capacity. The seating capacity of each bus is 48 passengers. The buses will run on an average 25 days in a month. The other information for the year 2016-17 is given below:

| Garage Rent | ₹ 6,000 per month |

| Annual Repairs & Maintenance | ₹ 24,000 each bus |

| Salaries of 6 drivers | ₹ 4,000 each per month |

| Wages of 6 conductors | ₹ 1,600 each per month |

| Wages of 6 cleaners | ₹ 1,000 each per month |

| Manager’s salary | ₹ 10,000 per month |

| Road Tax, Permit fee, etc. | ₹ 6,000 for a quarter |

| Office expenses | ₹ 2,500 per month |

| Cost of diesel per litre | ₹ 66 |

| Kilometre run per litre for each bus | 6 kilometres |

| Annual Depreciation | 20% of cost |

| Annual Insurance | 4% of cost |

| Engine oils & lubricants (for 1000 kilometres) | ₹ 2,000 |

You are required to calculate the bus fare to be charged from each passenger per kilometre (upto four decimal points), if the company wants to earn profit of 33 1/3 percent on taking (total receipts from passengers). (Nov 2016, 8 marks)

Answer:

Working Notes:

1 Total kilometers to be run during the year 2016 – 17

= 50 km × 2 sides × 3 trips × 25 days × 12 months × 6 buses

= 5,40,000 kilometres

2. Total passenger kilometres

= 5,40,000 km × 48 passengers × 75%

= 1,94,40,000 passenger- km.

Operating Cost Sheet for the year 2016 – 17

Operating cost sheet can also be calculated for

- six buses per month,

- per bus per annum and

- per bus per month. However, the final answer will remain same.

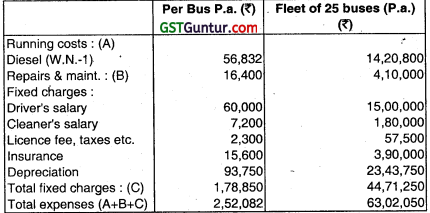

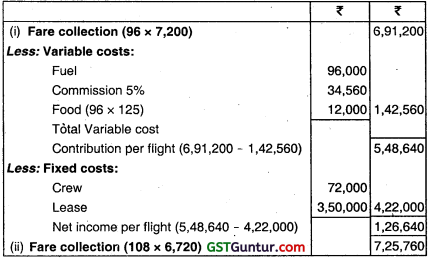

Question 15.

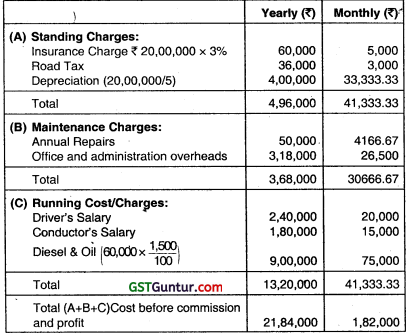

M/s XV Travels has been given a 25 km. long route to run an air conditioned MiniBus. The cost of bus is ₹ 20,00,000. It has been insured @ 3% premium per annum while annual road tax amounts to 36,000. Annual repairs will be ₹ 50,000 and the bus is likely to last for 5 years. The drivers salary will be ₹ 2,40,000 per annum and the conductor’s salary will be ₹ 1,80,000 per annum in addition to 10% of the takings as commission (to be shared by the driver and the conductor equally). Office and administration overheads will be ₹ 3,18,000 per annum. Diesel and oil will be ₹ 1,500 per 100 km. The bus Will make 4 round trips carrying on an average 40 passengers on each trip.

Assuming 25% profit on takings and considering that the bus will run on an average 25 days in a month, you are required to:

(i) prepare operating cost sheet (for the month).

(ii) calculate fare to be charged per passenger km. (Nov 2018, 10 marks)

Answer:

(i) Statement showing the Operating Cost per Passenger-km.

(ii)

Working note:

- Cost before commission (10%) and profit (25%) is 21,84,000 which is 65% of total takings. So total takings is (21,84,000 ÷ 65) × 1oo = ₹ 33,60,000.

- Commission is 10% of ₹ 33,60,000 = ₹ 3,36,000 and Profit is 25% of ₹ 33,60,000 = ₹ 8,40,000.

- Total km is 4 Round Trips × Days in a month x Month = (4 × 2 × 25 × 25 × 12)

= 60,000 km

Passenger km is 60,000 km × 40 passenger = 24,00,000.

![]()

Question 16.

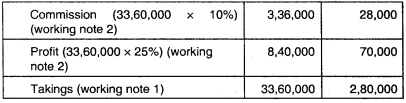

X Ltd. distributes its goods to a regional dealer using single lorry. The dealer premises are 40 kms away by road. The capacity of the lorry is 10 tonnes. The lorry makes the journey twice a day fully loaded on the outward journey and empty on return journey. The following information is available:

Diesel consumption : 8 km per litre

Diesel cost : ₹ 60 per litre

Engine Oil : ₹ 200 per week

Driver’s Wages (fixed) : ₹ 2,500 per week

Repairs : ₹ 600 per week

Garage Rent : ₹ 800 per week

Cost of Lorry (excluding cost of tyres) : ₹ 9,50,000

Life of Lorry : 1,60,000 kms

Insurance : ₹ 18,200 per annum

Cost of Tyres : ₹ 52,500

Life of Tyres : 25,000 kms

Estimated sale value of the lorry at end of its lite is : ₹ 1,50,000.

Vehicle License cost : ₹ 7,800 per annum

Other overhead cost : ₹ 41,600 per annum

The lorry operates on a 5 day week.

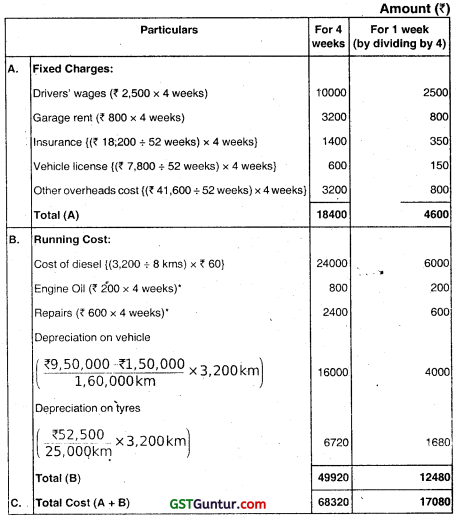

Required:

(i) A statement to show the total cost of operating the vehicle for the four week period analysed into Running cost and Fixed cost.

(ii) Calculate the vehicle operating cost per km and per tonne km. (Assume 52 weeks in a year.) (May 2019, 10 marks)

Answer:

Working Note:

(i) Statement showing Operating Cost

*Cost of engine oil & repairs may also be treated as fixed cost, as the question relates these with time i.e. in weeks instead of running of vehicle.

(ii) Calculation of vehicle operating cost:

Question 17.

SEZ Ltd. built a 120 km. long highway and now operates a toll road to collect tolls. The company has invested ₹ 900 crore to build the road and. has estimated that a total of 120 crore vehicles will be using the highway

during the 10 years toll collection tenure. The other costs for the month of “June 2020’ are as follows:

(i) Salary:

- Collection personnel (3 shifts and 5 persons per shift) – 200 per day per person.

- Supervisor (3 shifts and 2 persons per shift) – 350 per day per person.

- Security personnel (2 shifts and 2 persons per shift) – 200 per day per person.

- Toll Booth Manager (3 shifts and 1 person per shift) – 500 per day per person.

(ii) Electricity – ₹ 1,50,000

(iii) Telephone – ₹ 1,00,000

(iv) Maintenance cost – ₹ 50 lakhs

(v) The company needs 30% profit over total cost.

Required:

- Calculate cost per kilometre.

- Calculate the toll rate per vehicle. (Nov 2020, 10 marks)

Question 18.

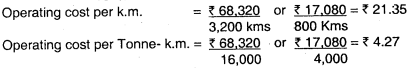

A hotel is being run in a Hill station with 200 single rooms. The hotel offers concessional rates during six off-season months in a year. During this period, half of the full room rent LS charged. The management’s profit margin is targeted at 20% of the room rent. The following are the cost estimates and other details for the year ending 31st March, 2019:

(i) Occupancy during the season is 80% while in the off-season it is 40%.

(ii) Total investment in the hotel is ₹ 300 lakhs of which 80% relates to Buildings and the balance to Furniture and other Equipment.

(iii) Room attendants are paid ₹ 15 per room per day on the basis of occupancy of rooms in a month.

(iv) Expenses:

- Staff salary (excluding that of room attendants) : ₹ 8,00,000

- Repairs to Buildings : ₹ 3,00,000

- Laundry Charges : ₹ 1,40,000

- Interior Charges : ₹ 2,50,000

- Miscellaneous Expenses : ₹ 2,00,200

(v) Annual Depreciation s to be provided on Buildings @ 5% and 15% on Furniture and other Equipments on straight line method.

(vi) Monthly lighting charges are ₹ 110, except in four months in winter when it is ₹ 30 per room and this cost is on the basis of full occupancy for a month.

You are required to workout the room rent chargeable per day both during the season and the ott-season months using the foregoing information. (Assume a month to bé of 30 days and winter season to be considered as

part of off-season). (Nov 2019, 10 marks)

Answer:

Working Notes:

1. Total Room days in a year:

| Season | Occupancy (Room days) | Equivalent Full Room charge days |

| Season – 80 % occupancy | 200 Rooms × 80% × 6 months × 30 days in a month = 28,800 Room Days | 28,800 Room Days × 100% = 28,800 |

| Off-Season – 40% Occupancy | 200 Rooms × 40% 6 months × 30 days in a month = 14,400 Room days | 14,400 Room Days × 50% = 7,200 |

| Total Room Days | 28,800+ 14,400 = 43,200 Room Days | 36,000 Full Room Days |

2. Lighting Charges:

It is given in the question that lighting charges for 8 months is ₹ 110 per month and during winter season of 4 months it is ₹ 30 per month. Further it is also given that peak season is 6 months and oft season is 6 months.

It should be noted that – being Hill station winter season is to be considered as part of off season. Hence, the non-winter season of 8 months Including – Peak season of 6 months and off season of 2 months.

Accordingly the lighting charges are calcúlated as follows:

| Season | Occupancy (Room – days) |

| Season & Non – winter – 80% occupancy | 200 Rooms × 80% × 6 months × ₹ 110 per month = ₹ 1,05,600 |

| Off – Season & Non – winter – 40% Occupancy (8 – 6 months) | 200 Rooms × 40% × 2 months × ₹ 110 per month = 17,600 |

| Off – Season & winter – 40% occupancy (4 months) | 200 Rooms × 40% × 4 months × – ₹ 30 per month = ₹ 9,600 |

| Total Lighting charges | ₹ 1,05,600 + ₹ 17,600 + ₹ 9,600 = ₹ 1,32,800 |

* Statement of total Cost

Calculation of Room Rent per day:

Total Cost Equivalent full Room day s = \(\frac{₹ 57,13,750}{36,000}\)

= ₹ 158.72

Room Rent during Season = ₹ 158.72

Room Rent during off season = ₹ 158.72 × 50%

= ₹ 79.36

Question 19.

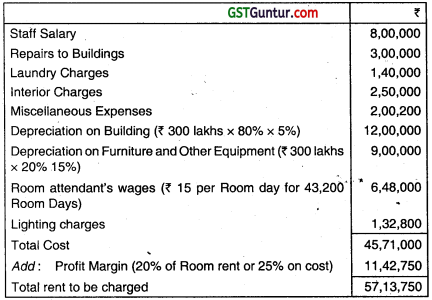

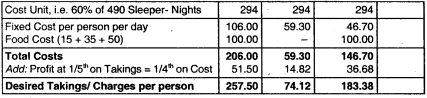

A Hotel has 40 bed – rooms with a maximum occupancy of 490 sleeper nights per week. Average occupancy is 60% throughout the year. The average food cost per person per day is Breakfast ₹ 15, Lunch ₹ 35 and Dinner ₹ 50. Direct wages and staff meals per week are as under-

- House Keeping : ₹ 3,904

- Restaurant and Kitchen : ₹ 6,860

- General and Service : ₹ 3,520

Direct Expenses per annum are ₹ 1,04,000 for House Keeping and ₹ 91,520 for the Restaurant. Indirect Expenses are ₹ 6,82,240 which should be apportioned on the basis of Floor Area. The Floor Area are; Bedrooms 3,600 sqm, Restaurant 1, 200 sqm and Service area 600 sqm. A Net Profit of 20% each must be made on the Restaurant Takings and Accommodation Takings.

You are required to calculate what inclusive terms per person should be charged per day. Show the split between Meals and Accommodation Charges. Indirect Expenses are apportioned on the basis of Floor Area and General and Service Expenses in the ratio of total of House- Keeping and Restaurant before apportioning such expenses.

Answer:

Statement of Operating Cost and Revenue per week

Question 20.

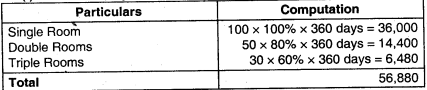

A company runs a holiday home. For this purpose, it has hired a building at a rent of ₹ 10,000 per month along with 5% of total taking. It has three types of suites for its customers, viz., single room, double rooms and triple

rooms. Following information is given:

| Type of suite | ‘ Number | Occupancy Percentage |

| Single room | 100 | 100% |

| Double rooms | 50 | 80% |

| Triple rooms | 30 | 60% |

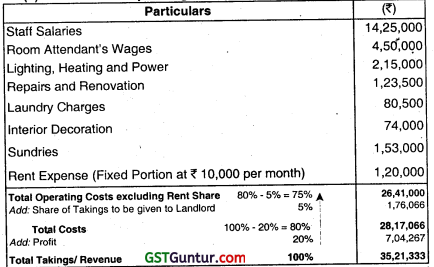

The rent of double rooms suite is to be fixed at 2.5 times of the single room suite and that of triple rooms suite as twice of the double rooms suite. The other expenses for the year 2018 are as follows:

| (₹) | |||

| Staff salaries Room attendants’ wages Lighting, heating and power |

14,25,000 4,50,000 2.15.000 |

Repairs and renovation Laundry charges Interior decoration Sundries |

1,23,500 80,500 74,000 1,53,000 |

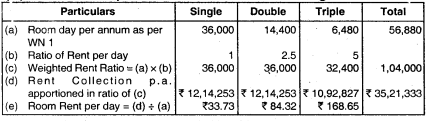

Provide profit @ 20% on total taking and assume 360 days in a year.

Answer:

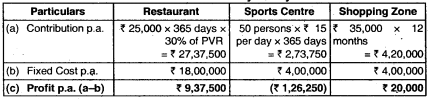

(i) Computation of Room days per annum

(ii) Statement of Operating Cost per annum:

It is given that Profit = 20% of Takings and Share to Landlord = 5% of Takings. Hence, Total Operating Cost = 100% – 20%- 5% = 75% of Total Takingš, which equals ₹ 26,41,000. Hence, Total Takings = \(\frac{₹ 26,41,000}{75 \%}\) = ₹ 35,21,333. Now, Profits and Share to Landlord are calculated at 20% and 5% respectively, on Total Takings.

(iii) Computation of Room Rent to be charged

![]()

Question 21.

ABC Company operates a Hotel. It is spread over six floors of a building excluding the Ground Floor, with a Restaurant in the Sixth Floor. On the Ground Floor, the Hotel operates a Sports Centre including a Swimming Pool and a Shopping Zone.

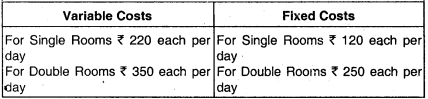

The Hotel has a capacity of 100 Single Rooms and 20 Double Rooms. The average occupancy or both Single and Double Rooms is expected to be 80% throughout the year of 365 days. The rent for a Double Room has been fixed at 125% of the rent of a Single Room. The costs are as under

The Income and Costs relating to the service centres are as under:

Restaurant

- Estimated Average Sales per day ₹ 25,000

- Fixed Costs ₹ 18,00,000 per annum.

- Contribution 30% of Sales.

Sports Centre

- Average Number of personš expected to use the Centre per day is 50.

- Average Contribution per day per person is ₹ 15

- Fixed Costs ₹ 4,00,000 per annum.

Shopping zone

- Average Contribution per month ₹ 35,000

- Fixed Costs ₹ 4,00,000 per annum.

Note: Contribution = Revenue less Variable Costs.

Required:

1. Calculate the rent chargeable for Single and Double Rooms per day in such a way, that the Hotel earns a profit of ₹ 139.43 Lakhs from the hire of rooms.

2. Evaluate the profitability of the three Service Centres and work out the Total Profit of the Hotel per annum based on the rent recommended by you in (1) above.

Answer:

1. Computation of Room — Days per annum

2. Computation of Room Rent p.a. and Rent per day

3. Divisional Profitability Analysis

Question 22.

A company runs a holiday home. For this purpose it has hired a building at a rent of ₹ 10,00,000 per month along with 5% of total taking. It has three types of suites for its customers, viz., single room, doublè rooms and triple

rooms.

Following information is given:

| Type of suite | Number | Occupancy Percentage |

| Single room | 100 | 100% |

| Double rooms | 50 | 80% |

| Triple rooms | 30 | 60% |

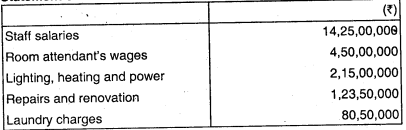

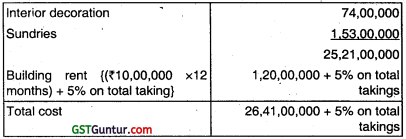

The rent of double rooms suite is to be fixed at 2.5 times of the single room suite and that of triple rooms suite as twice of the double rooms suite. The other expenses for the year 2019 are as follows:

Staff salaries : ₹ 14,25,00,000

Room attendants’ wages : ₹ 4,50,00,000

Lighting, heating and power : ₹ 2,15,00,000

Repairs and renovation : ₹ 1,23,50,000

Laundry charges : ₹ 80,50,000

Interior decoration : ₹ 74,00,000

Sundries : ₹ 1,53,00,000

Answer:

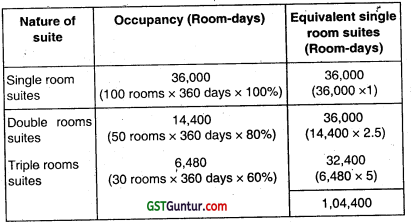

(i) Total equivalent single room suites

(ii) Statement of Total cost:

Profit is 20% of total takings

Total takings = ₹ 26,41,00,000 + 25% (5% +20%) of total takings

Let x be rent for single room suite

Then 1,04,400 x = 26,41.00,000 + 0.25 × 1,04,400 x

Or, 1,04,400 z = 26,41,00,000 + 26,100 x

Or, 78,300 z = 26,41,00,000

Or, z = 3373

(iii) Rent to be charged for single room suite = ₹ 3,373

Rent for double rooms suites ₹ 3,373 × 2.5 = ₹ 8,432.5

Rent for triple rooms suites ₹ 3,373 × 5 = ₹ 16,865

Question 23.

A group of ‘Health Care Services’ has decided to establish a Critical Care Unit in a metro city with an investment of ₹ 85 lakhs in hospital equipments, The unit’s capacity shall be of 50 beds and 10 more beds, it required, can be added.

Other information for a year are as under:

Building Rent : ₹ 2,25,000 per month

Manager’s Salary : ₹ 50,000 per month to each one

(Number of Managers – 03)

Nurses’ Salary : ₹ 18,000 per month to each Nurse

(Number of Nurses —24)

Word boy’s Salary : ₹ 9000 per month per person

(Number of word boys -24)

Doctor’s Payment : ₹ 5,50,000 per month

(Paid on the basis of number of patients attended and time spent by them)

Food and laundry services (variable) : ₹ 39,53,000 per year

Medicines to patients (variable) : ₹ 22,75,000 per year

Administrative Overheads : ₹ 28,00,000 per year

Depreciation on equipments : 15% per annum on original cost

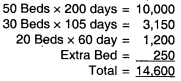

It was reported that for 200 days in a year 50 beds were occupied, for 105 days 30 beds were occupied and for 60 days 20 beds were occupied. The hospital hired 250 beds at a charge of ₹ 950 per bed to accommodate the flow of patients. However, this never exceeded the normal capacity of 50 beds on any day.

Find Out:

(i) Profit per patient day, if hospital charges on an average ₹ 2,500 per day from each patient.

(ii) Break even point per patient day (Make calculation on annual basis) (May 2018, 10 marks)

Answer:

(i) Calculation of Contribution Per Patient day

Total Contribution = ₹ 2,34,34,500

Total Patient days = 14,600

Contribution per Patient day = ₹ 2,34.34,500/ 14,600

= ₹ 1,605.103

(ii) Break even point

Break oven point = Fixed Cost / Contribution per patient day

= ₹ 1,63,51,000/₹ 1,605.103

= ₹ 10,187 patient days

Working Notes:

1. Calculation of number of patient days:

Statement of Profitability

Question 24.

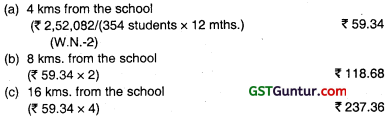

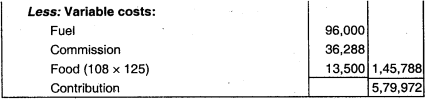

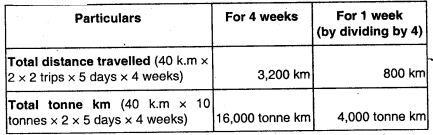

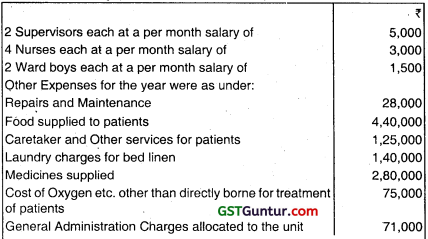

ABC Health care runs an Intensive Medical Care Unit. For this purpose, it has hired a building at a rent of ₹ 50,000 per month with the agreement to bear the repairs and maintenance charges also.

The unit consists of 100 beds and 5 more beds can comfortably be accommodated when the situation demands. Though the unit is open for patients all the 365 days in a year, scrutiny of accounts for the year 2020 reveals that only for 120 days n the year, the unit had the full capacity of 100 patients per day and for another 80 days, it had, on an average only 40 beds occupied per day. But, there were occasions when the beds were full, extra beds were hired at a charge of ₹ 50 per bed per day. This did not come to more than 5 beds above the normal capacity on any one day. The total hire charges for the extra beds incurred for the whole year amounted to ₹ 20,000.

The unit engaged expert doctors from outside to attend on the patients and the fees were paid on the basis of the number of patients attended and time spent by them which on an average worked out to 30,000 per month in the year 2020.

The permanent staff expenses and other expenses of the unit were as follows:

Required:

(i) What is the profit per patient day made by the unit in the year 2020. if the unit recovered an overall amount of ₹ 200 per day on an average from each patient.

(ii) The unit wants to work on a budget for the year 2021, but the number of patients requiring medical care is a very uncertain factor. Assuming that same revenue and expenses prevail in the year 2021 in the first instance, work out the number of patient-days required by the unit to break even. (Jan 2021, 10 marks)

![]()

Question 25.

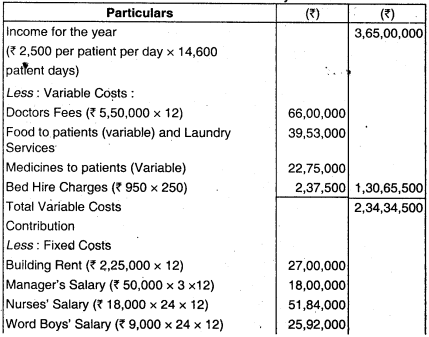

The administration of a Nursing Home has sought your assistance in preparing the budget for next year. The Nursing Home obtains its revenues through two types of charges —

(a) Charges for using a hospital room and

(b) Charges for using the operating room. The use of hospital room depends upon whether the patient undergoes surgery during the stay in the nursing home. The following estimated data is provided for your requirements.

The Hospital Room charges are ₹ 100, ₹ 60 and ₹ 20 for Private, Semi-Private and General Ward respectively.

Charges for using the Operating Room are a function of the length of operation and the number of persons involved in the operation. The charges are ₹ 5 per man-minute. Based on past experience following is the break

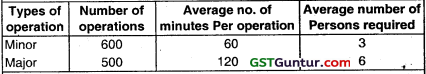

down of the types of operations to be performed:

Required:

1. Prepare a Budgeted Revenue Statement of Room Charges by the type of patients and type of rooms.

2. Prepare a Budgeted Revenue Statement of Operating Room Charges by the types of operation.

Answer:

1. Budgeted Revenue Statement of Room Charges

2. Budgeted Revenue Statement of Operating Room Charges

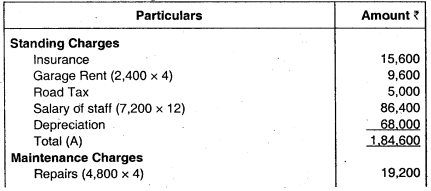

Question 26.

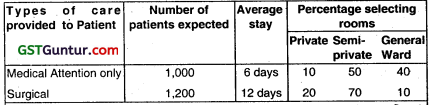

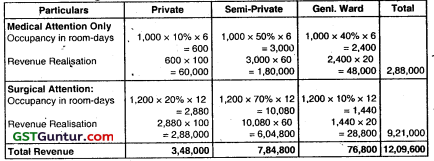

Thomas&Cook hire a building to run a Nursing Home. The building has 4,000 square feet of area consisting of 20 rooms of 120 square feet each. The rest is General Area. The monthly rent has been agreed at ₹ 10 per square foot. Lighting and Heating expenses are ₹ 40,000 per month.

The Staff would consist of —

(a) Two Doctors at ₹ 30,000 per month each,

(b) Six Nurses at ₹ 9,000 per month each, and

(c) Four General Helpers at ₹ 6,000 per month each.

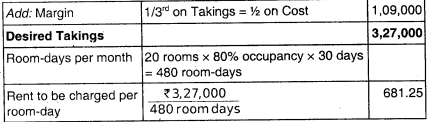

It is expected that 80% of the rooms will always remain occupied. If a Margin of 1/3rd on Takings is desired to cover other expenses ascertain the Rent to be charged assuming a month of 30 days.

Answer:

![]()

Question 27.

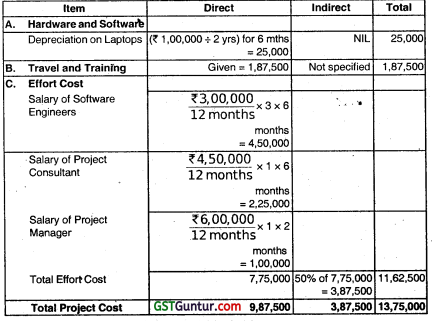

Prepare Project Cost Sheet for Entity XYZ Ltd. in the ITES Sector, for a particular project whose duration was 6 months.

Salary of 5 Software Engineers : ₹ 3,00,000 each p.a.

Salary of 2 Project Consultants : ₹ 4,50,000 each p.a.

Salary of Project Manager : ₹ 6,00,000 p.a.

Administration and Service overhead per annum representing Cost of Employee Benefits, Salary of Support Staff, etc is ₹ 15,00,000 p.a.

Additional Details for the project under consideration are—

- 1 Projéct Consultant and 3 Software Engineers were involved for the entire duration of the project, whereas the Project Manager spends 2 month’s efforts. during the execution of the Project.

- Travel Expenses specifically incurred for the project — ₹ 1,87,500

- 2 Laptops were purchased at ₹ 50,000 each, for use in the project and the life of the same is estimated to be 2 years.

Answer:

1. Computation of Effort Costs Absorption Rate (based on Annual Costs)

Cost of Direct Manpower p.a. = (₹ 3,00000 × 5) + (₹ 4,50,000 × 2) + (₹ 6,00,000 × 1) = ₹ 30,00,000.

Indirect Effort Cost Absorption Rate \(=\frac{\text { Service OH }}{\text { Direct Manpower Cost }}\)

= \(\frac{15,00,000}{30,00,000}\)

= 50% of Direct Manpower

2. Project cost sheet

Question 28.

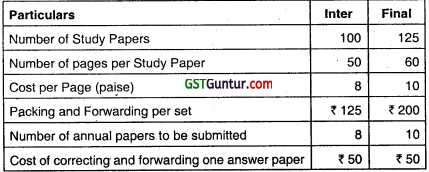

A Professional Institute has organized a correspondence course for the benefit of its students who have to undergo two levels of education — Inter and Final, the latter being open only to those who pass the former. The number of students involved is 12,500 and 5,000 for Inter and Final Levels respectively. The Fixed Expenses for the two curses taken together are:

Salaries

-Academic – ₹ 13,44,000

– General – ₹ 3,15,000

Rent, Lighting. etc. – ₹ 2,45,000

Postage, Telephone, etc. – ₹ 1,75,000

Stationery – ₹ 1,96,000

The following further details are available

Ascertain the cost of imparting tuition per student for the two courses.

(Note: Apportion all Fixêd Costs on the basis of number of students.)

Answer:

Average Fixed Cost per student

\(=\frac{\text { Salaries }+ \text { Rent, Lighting }+ \text { Postage }+ \text { Stationery }}{\text { Total no. of students }}\)

= \(\frac{₹(13,44,000+3,15,000+1,75,000+2,45,000+1,96,000)}{(12,000+5,000)}\) = ₹ 130

Statement of Operating Cost per student

Question 29.

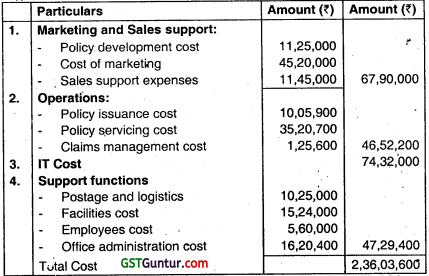

Sanziet Lifecare Ltd. operates in life insurance business. Last year it has launched a new term insurance policy for practicing professionals ‘Professionals Protection Plus’. The company has incurred the following expenditures during the last year for the policy:

Policy development cost : ₹ 1,25,000

Cost of marketing of the policy : 45,20,000

Sales support expenses : ₹ 1,45,000

Policy issuance cost : 10,05,900

Policy servicing cost : ₹ 35,20,700

Claims management cost ₹ 1,25,600

IT cost : ₹ 74,32,000

Postage and logistics : 10,25,000

Facilities cost : ₹ 15,24,000

Employees cost : ₹ 5,60,000

Office administration cost : ₹ 16,20,400

Number of policy sold 528

Total insured value of policies- ₹ 1,320 crore

Required:

(i) CALCULATE total cost for Professionals Protection Plus’ policy segregating the costs into four main activities namely

(a) Marketing and Sales support,

(b) Operations,

(c) IT and

(d) Support functions.

(ii) CALCULATE cost per policy.

(iii) CACULATE cost per rupee of insured value

Answer:

(i) Calculation of Total Cost for ‘Professionals Protect Plus’ policy

(ii) Calculation of cost per policy \(=\frac{\text { Total cost }}{\text { No. of policies }}\) = \(\frac{₹ 2,36,03,600}{528}\)

= ₹ 44,703.79

(iii) Cost per rupee of insured value \(=\frac{\text { Total cost }}{\text { Total insured value }}\)

= \(\frac{₹ 2.36 \text { crore }}{₹ 1,320 \text { crore }}\) = ₹ 0.0018