Employee Cost and Direct Expenses – CA Inter Costing Question Bank is designed strictly as per the latest syllabus and exam pattern.

Employee Cost and Direct Expenses – CA Inter Costing Question Bank

Question 1.

Distinguish between “Direct and Indirect labour costs”. (Nov 2001, 2 marks)

Answer:

Direct and Indirect Labour cost:

Direct Labour Cost is the labour cost that is specifically incurred for or can be readily charged to a person identified with a specific job, contract, work order or any other unit of cost.

Indirect Labour Cost is the labour cost which cannot be readily identified with products or services but is generally incurred in carrying out production activity.

The importance of the distinction lies in the fact that whereas direct labour cost can be identified with and charged to the job, indirect labours costs cannot be so charged and is therefore, to be treated as part of the factory O/H and it is to be included in the cost of production.

![]()

Question 2.

What do you mean by time and motion study? Why is it so important to management? (May 1999, 6 marks)

Answer:

Time Study: Under this study, a standard time is assigned for the performance of a given job on the basis of the measurement of work required under a prescribed method. In this study proper allowance is provided for fatigue natural needs (for naturebs call) and unavoidable delay.

The main object of this study is to establish a standard time for a specific job, through a specific method under a normal working condition by the average workers. The main object of this study means to eliminate the wastage and minimise the labour cost.

Advantages:

- It is helpful for the fixation of an incentive plan.

- It is helpful for the calculation of production cost.

- It is helpful for establishing the process of production, budgeting, scheduling, etc.

- It is helpful for establishing standard cost under the standard costing system.

Motion Study: Every operation requires certain body of motion and every motion has it’s own time and own fatigue. So, by improving the operation we can eliminate unnecessary motion and as a result of which productivity will increase by which cost per unit will decrease.

Advantages:

- Faster and better working

- Planning of operation

- Better distribution of work.

- Better working condition

So, the ultimate result is high productivity at low cost.

![]()

Question 3.

Answer the following:

Enumerate the various methods of Time booking. (May 2007, 2 marks)

Answer:

The various methods of Time Booking are:

- Piece work card

- Daily time sheet

- Weekly time sheet

- Clock card

- Time ticket

- Job ticket

- Combined Time and Job ticket.

Question 4.

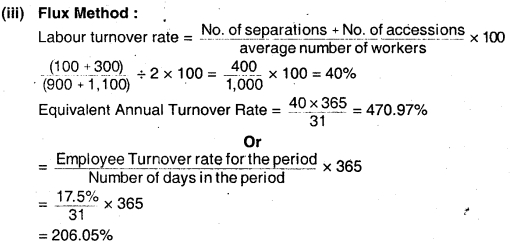

Discuss accounting treatment of idle capacity costs in cost accounting. (May 2009, 3 marks)

Answer:

Idle Capacity: It represents the difference between practical capacity and the capacity based on long term sales expectancy.

lithe actual capacity is different from the capacity based on sales expectancy, then the idie capacity is the difference between the practical capacity and the actual capacity.

∴ Idle capacity represents a part of practical capacity which has not been utilized due to regular interruptions and which may not be avoided. Idle capacity cost can be determined as

Idle Capacity Cost = \(\frac{\text { Total } \mathrm{OH} \text { related to plant }}{\text { Normal capacity }}\) × Idle capacity

It may be normal or abnormal.

![]()

The treatment can be done In the following ways:

Question 5.

Discuss any four objectives of ‘Time keeping’ in relation to attendance and payroll procedures. (Nov 2020, 4 marks)

Question 6.

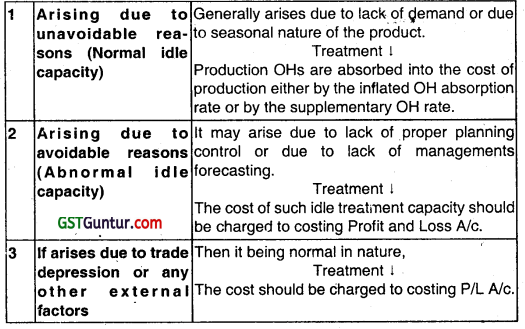

What is idle time? Explain the causes leading to idle time and its treatment in cost accounts. (May 2000, 3 marks)

Answer:

idle time represents a loss of time for which the enterprise pays wages to the employees but secures no benefit or work from such employees. It increases the labour cost without any increase in the output.

Idle time may arise due to some normal reasons which cannot be avoided or abnormal reasons which can be avoided if proper precautions are taken at proper time.

Treatment in cost accounts :

If idle time arises due to normal causes:

The labour cost of the normal idle time is to be borne by the cost of production. It can be further segregated in 2 parts: .

- If it is paid to direct labour :

Treated as part of direct labour cost by inflating the hourly rate. - If it is paid to indirect workers :

Becomes a part of production overhead expense.

If idle time arises due to abnormal causes :

It cannot be recovered from the cost of product. So such loss can be transferred to costing Profit & Loss A/c.

Another approach can be used under which entire labour cost of normal idle time can be charged to production OH. In such circumstances, it can be absorbed by the output or production. Therefore, proper control is required in order to minimise the idle time.

![]()

Question 6.

Discuss the accounting treatment of the following in cost-accounts: Idle time and Over-time wages (May 2003, 3 marks)

OR

Discuss the treatment of Idle time and Overtime premium in Cost Accounting. (May 2006, 4 marks)

Answer:

Over time:

Accounting treatment of overtime premium depends upon the circumstances of the work:

Case 1: If the overtime is worked on customer’s instruction In order to complete the work at the earliest-then it should be directly charged to the job as a part of direct wages.

Case 2 : If the overtime is worked due to shortage of the labour or any other reason – then it is treated as a part of the labour cost and such overtime premium is appointed on the basis of total hours work on different jobs.

Case 3 : If the overtime is worked to make-up the lost time due to unavoidable reason it means it is a cost incurred for normal time and it should be treated as part of the production OH and it can be recovered from the job completed during the accounting period.

Case 4 : If the overtime is worked to make-up the time lost due to avoidable reasons i.e. abnormal idle time – then it is charged to costing

Profit/Loss A/c.

Case 5 : If overtime is worked due to its management fault then it should be charged to that particular department.

![]()

Question 7.

Following data have been extracted from the books of M/s. ABC Private Limited:

(i) Salary (each employee, per month) – ₹ 30,000

(ii) Bonus – 25% of salary

(iii) Employer’s contribution to PF, ESI etc. – 15% of salary

(iv) Total cost at employees’ welfare activities – ₹ 6,61,500 per annum

(v) Total leave permitted during the year – 30 days

(vi) No. of employees – 175

(vii) Normal idle time – 70 hours per annum

(viii) Abnormal idle time (due to failure of power supply) – 50 hours

(ix) Working days per annum – 310 days of 8 hours

You are required to calculate:

(i) Annual cost of each employee

(ii) Employee cost per hour

(iii) Cost of abnormal idle time, per employee (Nov 2018, 5 marks)

Answer:

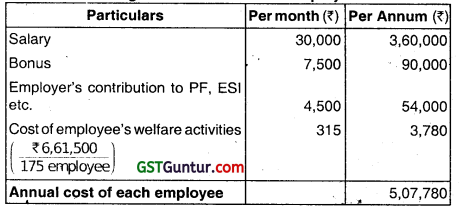

(i) Statement showing Annual Cost of each employee

Net Selling Price Per Unit = ₹ 2,000 – 15% discount on ₹ 2,000

= ₹ 1,700

(ii) Employee cost per hour:

(iii) Cost of abnormal Idle time, per employee = 50 hours × ₹ 234 = ₹ 11,700

![]()

Question 8.

Discuss the effect of overtime payment on productivity. (Nov 2001, 3 marks)

Answer:

Effect of overtime payment on productivity : Overtime work should be resorted to, only when it is extremely essential because It Involves extra cost.

The overtime payment increases the costal production In the following ways:

- The overtime premium paid is an extra payment in addition to the normal rate.

- The efficiency of operators during overtime work may fall and thus output may be less than normal output.

- In order to earn more, workers may not concentrate on work during normal idle time and thus the output during normal hours may also fall.

- Reduced output and increased premium of overtime will bring about an increase in costs of production.

- Gives rise to associated costs like lighting etc.

- Adversely affects the health of workers in long run.

- Increases the wear and tear of machinery.

- Promotes dissatisfaction among the workers who do not get the opportunity of overtime.

- Create difficulty in discontinuance of the practice of overtime work if it is once allowed.

- Promotes a tendency among the workers to keep the work pending so that overtime work is necessitated.

![]()

Question 9.

Discuss the treatment of overtime premium in Cost Accounting. (Nov 2004, May 2008, 3, 2 marks)

Answer:

Over time:

Accounting treatment of overtime premium depends upon the circumstances of the work :

Case 1: If the overtime is worked on customer’s instruction in order to complete the work at the earliest- then it should be directly charged to the job as a part of direct wages.

Case 2: If the overtime is worked due to shortage of the labour or any other reason-then it is treated as a part of the labour cost and such overtime premium is appointed on the basis of total hours work on different jobs.

Case 3: If the overtime is worked to make-up the lost time due to unavoidable reason it means it is a cost incurred for normal time and it should be treated as part of the production OH and it can be recovered from the job completed during the accounting period.

Case 4: If the overtime is worked to make-up the time lost due to avoidable reasons i.e. abnormal idle time -then it is charged to costing Profit/Loss A/c.

Case 5: If overtime is worked due to its management fault then it should be charged to that particular department.

![]()

Question 10.

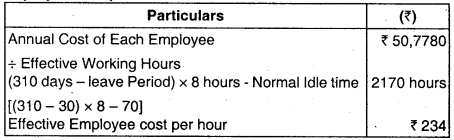

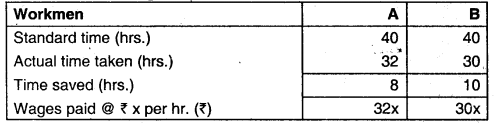

Following are the particulars of two workers ‘R’ and ‘S’ for a month :

The normal working hours for the month are 200 hrs. Overtime is paid at double the total of normal wages and dearness allowance. Employer’s contribution to State Insurance and Provident Fund are at equal rates with employees’ contributions.

Both workers were employed on jobs A, B and C in the following proportions:

| Jobs | A | B | C |

| R | 75% | 10% | 15% |

| S | 40% | 20% | 40% |

Overtime was done on job ‘A’.

You are required to:

(i) Calculate ordinary wage rate per hour of ‘R’ and ‘S’.

(ii) Allocate the worker’s cost to each job ‘A’, ‘B’ and ‘C’. (Nov 2020, 6 marks)

![]()

Question 11.

State the circumstances in which time rate system of wage payment can be preferred in a factory. (Nov 2001, 3 marks)

Answer:

Circumstances in which time rate system of wage payment can be preferred is as follows:

- Persons whose services cannot be directly or tangibly measured. e.g. general helpers, supervisory and clerical staff etc.

- Workers engaged on highly skilled jobs on sending skilled services, e.g. tool making, inspection and testing.

- Where the pace of output is independent of the operation e.g., automatic chemical plants.

Question 12.

Describe briefly, how wages may be calculated under the following systems:

(i) Rowan system

(ii) Halsey system. (Nov 2008, 9 marks)

Answer:

(i) Rowan System :

In it essence, the plan is similar to the Halsey Plan wages at the ordinary rate for actual time put in by a worker are guaranteed and a bonus given, if the worker saves time out of the standard time, set for him. According to this plan, the bonus is that proportion of wages of actual time taken which time saved bears to the standard time.

Formula for calculating wages under Rowan system:

\(\frac{\text { Time saved }}{\text { Time allowed }} \) × time taken × Rate per hour

(ii) Halsey System :

Under this method, standard time for doing a job is determined and workers are encouraged to do the job in less than the standard time. A standard is fixed for each job or process. If there is no saving on this standard time allowance, the worker is paid only his day rate.

He gets his time rate even if he exceeds the standard time limit, since his day rate is guaranteed. If, however, he does the job in less than the standard time, he gets a bonus equal to 50 percent of wages of time saved; the employer benefits by the other 50 percent. The scheme also is sometimes referred to as the Halsey fifty percent plan.

Formula for calculating wages under Halsey system :

= Time taken × Time Rate + 50% of time saved × Time Rate

The Halsey-Weir system is the same as the Halsey system except that the bonus paid to workers is 30% of time saved. This system is useful for capital intensive industry.

![]()

Question 13.

Answer the following:

Which is better plan out of Halsey 50 percent bonus scheme and Rowan bonus scheme for an efficient worker? In which situation the worker get same bonus in both schemes? (May 2010, 3 marks)

Answer:

- Rowan Bonus Scheme pays more bonus if the time saved is below the 50 percent of time allowed and if the time saved is more than 50 percent of time allowed then Halsey bonus scheme pays more bonus.

- Normally, time saved by a worker is not more than 50 percent of time allowed.

- Therefore, the Rowan bonus scheme is better for an efficient worker. When the time saved is equal to 50 percent of time allowed then both plans pay same bonus to a worker.

Bonus under Halsey Plan

= Standard wage rate × 50/100 × Time saved ……………… (i)

Bonus under Rowan Plan

= Standard wage rate × \(\frac{\text { Time taken }}{\text { Time allowed }}\) × TimeSaved ……………….. (ii)

Bonus under Halsey Plan will be equal to the

Bonus under Rowan Plan when the following condition holds good

= Standard wage rate × 50/100 × Time saved

= Standard wage rate × \(\frac{\text { Time taken }}{\text { Time allowed }}\) × Time saved

or \(\frac{1}{2}\) = \(\frac{\text { Time taken }}{\text { Time allowed }}\)

or Time taken = \(\frac{1}{2}\) of time allowed.

Hence, when the time taken is 50% of the time allowed, the bonus under Halsey and Rowan Plans is equal.

![]()

Question 14.

The finishing shop of a company employs 60 direct workers. Each worker is paid ₹ 400 as wages per week of 40 hours. When necessary, overtime is worked upto a maximum of 15 hours per week per worker at time rate plus one-halt as premium. The current output on an average is 6 units per man hour which may be regarded as standard output. If bonus scheme is introduced, it is expected that the output will increase to 8 units per man hour. The workers will, if necessary, continue to work Overtir9e upto the specified limit although no premium on incentives will be paid.

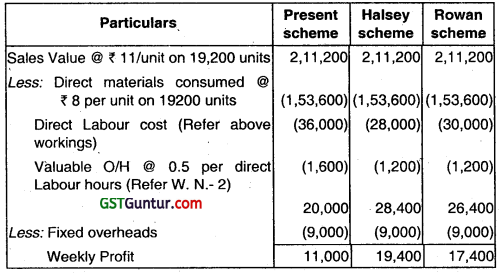

The company is considering introduction of either Halsey Scheme or Rowan Scheme of Wage Incentive system. The budgeted weekly output is 19,200 units. T selling price is ₹ 11 per unit and the direct Material Cost is ₹ 8 per unit. The variable overheads amount to ₹ 0.50 per direct labour hour and the fixed overhead is ₹ 9,000 per week.

Prepare a Statement to show the effect on the Company’s weekly Profit of the proposal to introduce (a) Halsey Scheme, and (b) Rowan Scheme. (May 2002, 8 marks)

Answer:

Calculation of total wages under the present scheme

Wage rate per hour per workers = \(\frac{₹ 400}{40 \mathrm{hrs}}\) = ₹ 10/hours..

∴ Overtime Rate hrs/workers = Normal rate/hr + 50%

= ₹ 10 + 50%

= ₹ 15/per hour

Average current output/hour = 6 units

∴ Hours to be worked for budgeted weekly output of 19,200 units

= \(\frac{19,200 \text { units }}{6 \text { units }}\) = 3 200 hours per man hour 6 units

Total normal hours available in a week

= No. of workers × Hours per week

= 60 workers × 40 hours

= 2,400 hours

![]()

Overtime hour required to be worked:

= Total hours to be worked – Total normal hrs. available •

= 3,200 hrs. – 2,400 hrs. = 800 hrs.

Total wages under the proposed scheme:

Time allowed : For 6 units = 1 hours

∴ For 19,200 units = \(\frac{19,200}{6 \text { Units }}\) = 3,200 hrs.

6 Units

Time taken : 8 units need 1 hour

∴ 19,200 units need = \(\frac{19,200}{8}\) = 2 400 hours

∴ Time saved = Time allowed – Time taken

= 3,200 – 2,400

= 800 hrs.

Under Halsey Normal wages + Bonus:

Total wages = (Time taken × Time rate ) + (50% × time saved × Time Rate)

= (2,400 × 10) + (50% × 800 × 10)

= 24,000 + 4,000 = ₹ 28,000/-

Under Rowan: ‘

Total wages = Normal wages + Bonus

= (Time taken × Time Rate) + (Time Saved × \( \frac{\text { Time taken }}{\text { Time allowed }}\) × Time rate)

= (2,400 × 10) + (800 × \(\frac{2,400}{3,200}\) × 1o)

= 24,000 + 6,000 = ₹ 30,000

![]()

Statement of Profit

Working Notes : .

1. Overtime Premium rate = Overtime rate – Normal rate

= ₹ 15 – ₹ 10

= ₹ 5/-

2. Variable overheads are given as absorption rates which are absorbed on the basis of Direct Labours Hours worked.

Hence, Under Present Scheme – Direct Labour Hours worked were 3,200 Hrs. (including overtime)

∴ Overheads = 3,200 hours × 0.5 = ₹ 1,600/-

Under Halsey & Rowan Scheme – Direct Labour hours worked were 2,400 hrs. (& rest 800 hrs. were saved & not worked). So for 2,400 hrs’worked = 2,400 × 0.5 = ₹ 1,200.

![]()

Question 15.

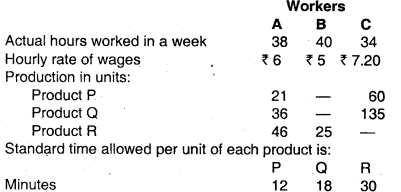

A Company is undecided as to what kind of wage scheme should be introduced. The following particulars have been compiled in respect of three systems, which are under consideration of the management:

For the purpose of piece rate, each minute is valued at ₹ 0.10.

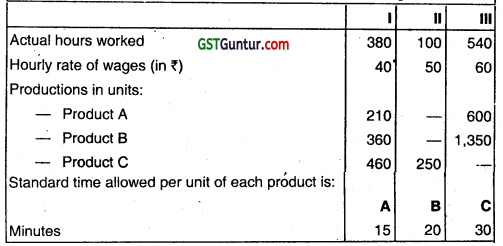

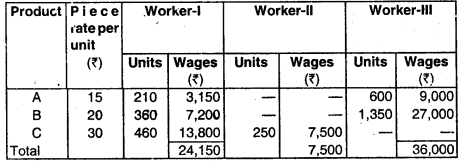

You are required to calculate the wages of each worker under:

(i) Guaranteed hourly rates basis

(ii) Piece work earnings basis, but guaranteed at 75% of basic pay (guaranteed hourly rate) if his earnings are less than 50% of basic pay.

(iii) Premium bonus basis where the worker receives bonus based on Rowan scheme. (Nov 2002, 9 marks)

Answer:

(i) Computation of wages under Guaranteed Hourly Rate basis

(ii) Computation of wages of each worker under piece work earnings basis:

Since, each workers has been guaranteed at 75% at basic pay, if his earnings are less than 50% of basic pay, therefore, workers A & C will be paid the wages as computed viz. ₹ 228 & 315 respectively. The computed wages of worker B is ₹ 75 which is less than 50% of his basic pay viz ₹ 100, therefore he would be paid 75% × 200 = ₹ 150/-

Working Notes :

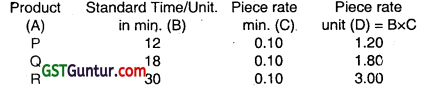

1. Piece rate per unit:

2. Time allowed to each worker:

Worker A = 21 units × 12 min. + 36 units × 18 min. + 46 units × 30 min.

= 2,280 min. = 38 hrs

Worker B = 25 units × 30 min.

= 750 min. = 12.5 hrs

Worker C = 60 units × 12 min. + 135 units × 18 min.

= 720 min. + 2430 min.

= 31,50 min. = 52.50 hrs.

(iii) Computation of wages of each worker under Premium Bonus basis (where each workers receives bonus based on Rowan Plan)

![]()

Question 16.

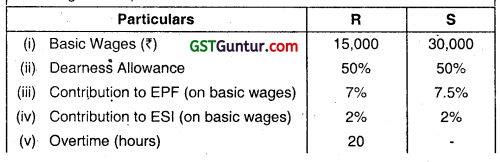

ZED Limited is working by employing 50 skilled workers. It is considered the introduction of incentive scheme-either Halsey scheme (with 50% bonus) or Rowan scheme of wage payment for increasing the labour productivity to cope up the increasing demand for the product by 40%. It is believed that proposed incentive scheme could bring about an average 20% increase over the present earnings of the workers; if could act as sufficient incentive for them to produce more.

Because of assurance, the increase in productivity has been observed as revealed by the figures for the month of April, 2004.

Hourly rate of wages (guaranteed) – ₹ 30

Average time for producing one unit by one worker at the previous performance (This maV be taken as time allowed) – 1.975 hours

Number of working days in the month – 24

Number of working hours per day of each worker – 8

Actual production during the month – 6,120 units

Required:

(i) Calculate the effective rate of earnings under the Halsey scheme and the Rowan scheme.

(ii) Calculate the savings to the ZED Limited in terms of direct labour cost per piece.

(iii) Advise ZED Limited about the selection of the scheme to fulfil his assurance. (May 2004, 4 + 2 + 2 = 8 marks)

Answer:

Working Notes :

1. Computation of time saved (in hours) per month:

= Standard production time of 6,120 units – actual time taken by the workers

= (6,120 units × 1.975 hrs. – 24 days × 8 hrs./day × 50 skilled workers)

= 12,087 hrs. – 9,600 hrs.

= 2,487 hours

![]()

2. Computation of bonus for time saved (in hours ) under Halsey & Rowan Plan:

Time saved hours = 2487 hrs

(Refer W.N.-1) .

Wage rate per hour = ₹ 30

Bonus under Halsey Scheme = 1/2 × 2,487 hrs × ₹ 30/-

= ₹ 37,305/-

Bonus under Rowan scheme = Time Saved × \( × Rate per hour

= [latex]\frac{2,487 \mathrm{hrs} .}{12,087 \mathrm{hrs}}\) × 9,600 hrs × ₹ 30

= ₹ 59,258.38

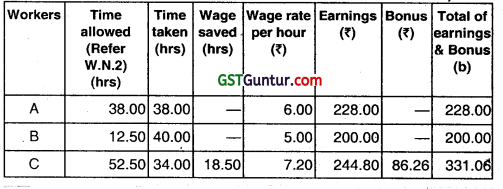

(i) Computation of effective rate of earning under the Halsey & Rowan scheme

Total parning (under Halsey) = Time wages + Bonus

(W.N.-2) = 24 days × 8 hrs × 50 skilled worker × ₹ 30+ 37,305

= ₹ 2,88,000 + ₹ 37,305

= ₹ 3,25,305.

Total earning (under Rowan scheme) = Time wages + Bonus

(W.N.- 2) = ₹ 2,88,000 + ₹ 59,258.38

= ₹ 3,47,258.38

Effective rate earnings/hour (Under Halsey plan)

(₹ 3,47,258.38/9,600 hrs,) – ₹ 33.89

Effective rate of earning/hour (Under Rowan plan)

(₹ 3,47,258.38/9,600 hrs.) – ₹ 36.17

![]()

(ii) Saving to the ZED Ltd. in terms of direct labours cost/unit

(iii) Advised to ZED Ltd:

(Regarding selection of the scheme to fulfill assurance)

Halsey scheme brings more saving to the management of ZED Ltd., Over the present earning of ₹ 2,88,000, but the other scheme i.e. Rowan fulfill the promise of 20% increase over the present earnings of ₹ 2,88,000 by paying 20.58% in the form of Bonus. Hence, Rowan Plan should be adopted.

![]()

Question 17.

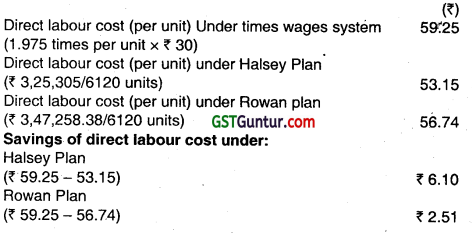

The existing Incentive system of Alpha Limited is as under:

Normal working week – 5 days of 8 hours each plus 3 late shifts of 3 hours each

Rate of Payment – Day work : ₹ 160 per hour

Late shift: ₹ 225 per hour

Average output per operator for 49-hours week i.e. including 3 late shifts. – 120 articles

In order to Increase output and eliminate Overtime, it was decided to switch on to a system of payment by results. The following Information is obtained:

Time-rate (as usual) : ₹ 160 per hour

Basic time allowed for 15 articles : 5 hours

Piece-work rate : Add 20% to basic piece-rate

Premium Bonus : Add 50% to time

Required:

(i) Prepare a Statement showing hours worked, weekly earnings, number of articles produced and labour cost per article for one operator under the following systems:

(a) Existing time-rate

(b) Straight piece-work

(c) Rowan system

(d) Halsey premium system.

Assume that 135 articles are produced in a 40-hour week under straight piece work, Rowan Premium system, and Halsey premium system above and worker earns half the time saved under Halsey premium system (Nov 2005, 2 × 4 = 8 marks)

Answer:

Statement showing hours worked, weekly earnings, number of articles produced and labour cost per article under various wage systems:

| Particular (Scheme) | Hours Worked | Weekly Earning (₹) | No. of Articles Produced | Labour Cost per Article (₹) |

| (a) Existing time rate | 49 | 8,425 (W. N. – 1) | 120 | 70.21 |

| (b) Straight piece-work | 40 | 8,640 (W. N. – 2) | 135 | 64.00 |

| (c) Rowan system | 40 | 9,007.41 (W. N. – 3) | 135 | 66.72 |

| (d) Halsey system | 40 | 8,600 (W. N. – 4) | 135 | 63.70 |

![]()

Working Notes :

∴ Rate/article = 960 ÷ 15 =64

& Earnings for the week = 135 × 64 = 8,640

Rowan premium system : Basic time = 5 hrs. for 15 articles

Add: 50% to time (i.e.) 2.5 hours for 15 articles

∴ Total time = 7.5 hrs. for 15 articles

or 30 mins / article

∴ Time allowed for 135 articles = 67.5 hrs.

& Actual time taken for 135 articles =40 hrs.

Earnings = (HW × RH) + [\(\frac{\mathrm{TA}-\mathrm{HW}}{\mathrm{TA}}\) × HW × RH]

= (40 hrs. × ₹ 160) + [\(\frac{67.5 – 40}{67.5}\) × 40 × 160]

= ₹ 9,007.41

Halsey premium system : Earnings

=HW × RH + \(\frac{50}{100}\)(TA – HW) × RH

=40 × ₹ 160 + \(\frac{1}{2}\) (675 – 40) × ₹ 160

= ₹ 8,600.

![]()

Question 18.

Answer the following:

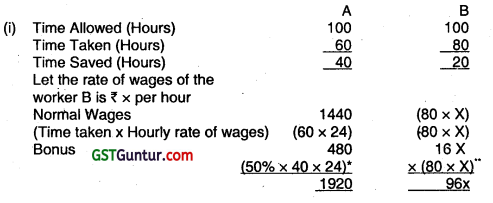

Two workmen. A and B, produce the same product using the same material. A is paid bonus according to Halsey plan, while B is paid bonus according to Rowan plan. The time allowed to manufacture the product is 100 hours. A has taken 60 hours and B has taken 80 hours to complete the product. The normal hourly rate of wages of workman A is ₹ 24 per hour. The total earnings of both the workers are same. Calculate normal hourly rate of wages of workman B. (May 2009, 2 marks)

Answer:

According to the problem,

Total earnings of A = Total earnings of B

1920 = 96 X × \(\left(\frac{20}{100}\right)\)

X = \(\frac{1920}{96}\) = ₹ 20

Therefore, hourly rate of wages of the worker is ₹ 20 per hour.

* Bonus = Time Saved × 50% × Wage Rate

** Bonus = \(\frac{\text { Time taken }}{\text { Time Allowed }}\) × Time Saved × Wage Rate

![]()

Question 19.

Answer the following: .

Standard Time for a job is 90 hours. The hourly rate of Guaranteed wages is ₹ 50. Because of the saving in time a worker A gets an effective hourly rate of wages of ₹ 60 under Rowan premium bonus system. For the same saving in time, calculate the hourly rate of wages a worker B will get under Halsey premium bonus system assuring 40% to worker. (Nov 2009, 3 marks)

Answer:

(i) Increase in Hourly Rate of Wages (Rowan Plan) is (₹ 60 – ₹ 50) = ₹ 10

This is equivalent to

\(\frac{\text { Time Saved }}{\text { Standard Time }}\) × Hourly rate

Or 10 = \(\frac{\text { Time Saved }}{\text { Standard Time }}\) × 50

Or, \(\frac{\text { Time Saved }}{90}\) × 50 = 10

Time Saved = \(\frac{900}{50}\) = 18 Hours

Actual Time Taken = (90 – 18) = 72 Hours

Effective Hourly Rate under Halsey System Time saved = 18 Hours

Bonus @ 40%= 18 × 40 % × 50 = ₹ 360

Total Wages = (50 × 72 + 360) = 3,960

Effective Hourly Rate = 3,960 ÷ 72 Hours = ₹ 55

![]()

Question 20.

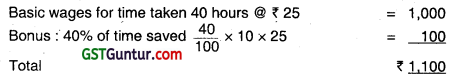

You are given the following information of a worker:

(i) Name of worker : ‘X’

(ii) Ticket No. : 002

(iii) Work started : 1-4-11 at 8 a.m.

(iv) Work finished : 5-4-11 at 12 noon

(y) Work allotted : Production of 2,160 units

(vi) Work done and approved : 2,000 units

(vii) Time and units allowed : 40 units per hour

(viii) Wage rate : ₹ 25 per hour

(ix) Bonus : 40% oT time saved

(x) Worker X worked : 9 hours a day

You are required to calculate the remuneration of the worker on the following basis:

(i) Halsey plan and

(ii) Rowan plan (May 2011, 5 marks)

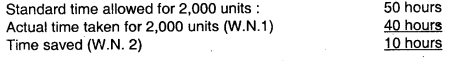

Answer:

No. of units produced and approved = 2,000

Standard time = 40 units per hour

Hourly Wage Rate = ₹ 25

Time allowed Rate = 40 units per hour

Time allowed for 2,000 units \(\frac{2,000}{40}\) = 50 hours

(i) Calculation of Remuneration under Halsey Plan :

(ii) Calculation of Remuneration Under Rowan Plan:

Wages for time taken 40 hours @ ₹ 25 = ₹ 1,000

Bonus = \(\frac{\text { Time saved }}{\text { Time allowed }}\) × (Time Taken × Hourly Rate)

= \(\frac{40 \times 10 \times 25}{50}\) = ₹ 200

Total = ₹ 1,200

Working Notes :

![]()

Question 21.

A skilled worker is paid a guaranteed wage rate of 120 per hour. The standard time allowed for a job is 6 hours. He took 5 hours to complete the job.

He is paid wages under Rowan Incentive Plan.

(i) Calculate his effective hourly rate of earnings under Rowan Incentive Plan.

(ii) If the worker is placed under Halsey Incentive Scheme (50%) and he wants to maintain the same effective hourly rate of earnings, calculate the time in which he should complete the job. (May 2013, 6 marks)

Answer:

(i) Effective hourly rate of earnings under Rowan Incentive Plan:

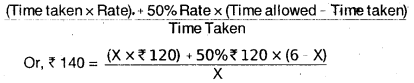

Earnings under Rowan Incentive plan =

(Actual time taken × wage rate) + \(\frac{\text { Time Saved }}{\text { Time Allowed }}\) × Time taken × Wage rate

= (5 hours × 120)+ (\(\frac{1 \text { hour }}{6 \text { hour }}\) × 5 hours × ₹ 120)

= ₹ 600 + ₹ 100 = ₹ 700

Effective hourly rate = ₹ 700/5 hours = ₹ 140/hour

(ii) Effective hourly rate = \(\frac{\text { Earnings under Halsey Rate }}{\text { Time Taken }}\)

Let time taken = X

Or, Effective hourly rate under Rowan Incentive plan =

Or, 140X = 120 X+ 360 – 60X

Or 80X = 360

Or,

X = \(\frac{360}{80}\) = 4.5 hours

Therefore, to earn effective hourly rate of ₹ 140 under Halsey Incentive Scheme worker has to complete the work in 4.5 hours.

![]()

Question 22.

A skilled worker is paid a guaranteed wage rate of ₹ 150.00 per hour. The standard time allowed for a job is 50 hours. He gets an effective hourly rate of wages of ₹ 180.00 under Rowari Incentive Plan due to saving in time. For the same saving in time, calculate the hourly rate of wages he will get, if he is ptaced under Halsey Premium Scheme (50%). (Nov 2017, 5 marks)

Answer:

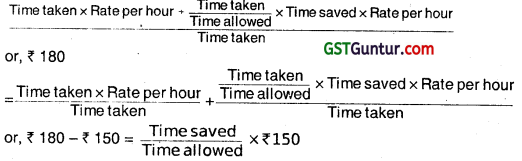

Increase in hourly rate of wages under

Rowan Plan is ₹ 30, i.e., (₹ 180 – ₹ 150)

This is equal to \(\frac{\text { Time saved }}{\text { Time allowed }}\) × Rate per hour

or \(\frac{\text { Time saved }}{\text { Time allowed }}\) × ₹ 150

or \(\frac{\text { Time saved }}{50 \text { hours }}\) × ₹ 150 = ₹ 30

Therefore, Time saved = 10 hours and time taken is 40 hours i.e. (50 hours – 10 hours)

Effective Hourly Rate under Halsey System:

Time saved = 10 hours

Bonus @ 50% = 10 hours × 50% × ₹ 150 = ₹ 750

Total wages = (₹ 150 × 40 hours + ₹ 750) = ₹ 6,750

Effective hourly rate = ₹ 6,750 ÷ 40 hours

= ₹ 168.75

Working Note:

Effective Hourly Rate =

![]()

Question 23.

Answer the following:

A worker takes 15 hours to complete a piece of work for which time allowed is 20 hours. His wage rate is 5 per hour. Following additional information are also available:

Material cost of work – ₹ 50

Factory overheads – 100% of wages

Calculate the factory cost of work under the following methods of wage an payments:

(i) Rowan Plan

(ii) Halsey Plan (May 2018, 5 marks)

Answer:

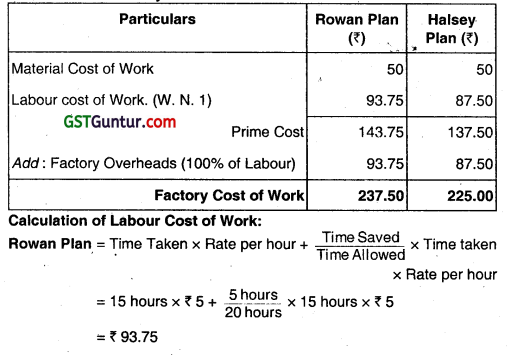

Calculation of Factory Cost of Work:

Halsey Plan = Time Taken × Time Rate + 50% of Time Saved × Time Rate

= 15 hours × ₹ 5 + (50% of 5 hours) × ₹ 5

= ₹ 87.50

![]()

Question 24.

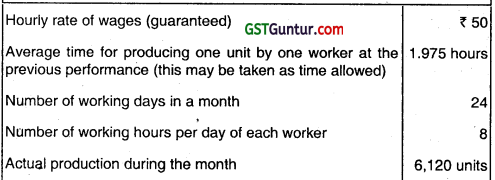

Zico Ltd. has its factory at two locations viz Nasik and Satara. Rowan plan is used at Nasik factory and Halsey plan at Satara factory. Standard time and basic rate of wages are same for a job which is similar and is carried out on similar machinery. Normal working houis is 8 hours per day in a 5 day week.

Job in Nasik factory is completed in 32 hours while at Satara factory it has taken 30 hours. Conversion costs at Nasik and Satara are ₹ 5408 and ₹ 4950 Overheads account for ₹ 25 per hour.

Required:

(i) To find out the normal wage: and

(ii) To compare the respective conversion costs. (Nov 2019, 10 marks)

Answer:

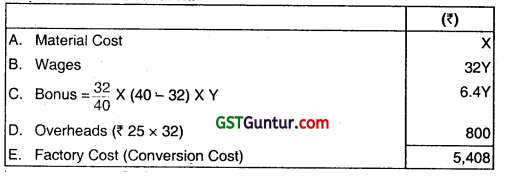

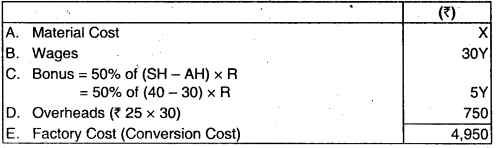

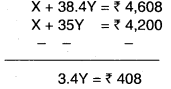

Step 1: Let X be the cost of material and Y be the normal rate of wages per hour.

Step 2 : Factory Cost of Nasik Factory:

X + 32Y + 6.4Y + ₹ 800 = ₹ 5,408

X + 38.4Y = ₹ 4,608 ………………………. Equation (i)

Step 3: Factory Cost of Satara Factory:

![]()

X + 30Y + 5Y + ₹ 750 = ₹ 4,950

X + 35Y = ₹ 4,200 …………………………. Equation (ii)

Step 4 : Subtract equatFon (i) from equation (ii)

Y = ₹ 120

New, X + 38.4Y =₹ 4,608

X + 38.4(120) = ₹ 4,608

X = 0

Normal Wage: Nasik factory = (₹ 120 × 32) = ₹ 3,840

Satara factory = (₹ 120 × 30) = ₹ 3,600

(ii) Comparative Statement of respective conversion costs

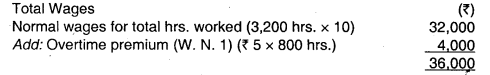

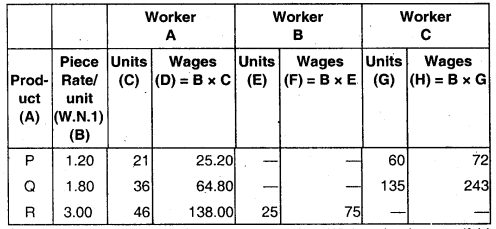

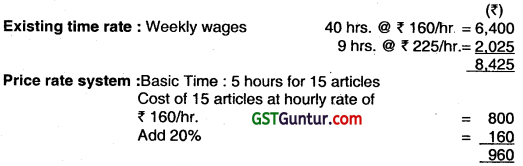

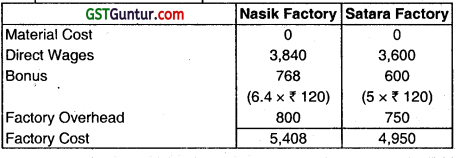

Question 25.

Z Ltd. Is working by employing 50 skilled workers. It is considering the introduction of an incentive scheme – either Halsey Scheme (with 50% Bonus) or Rowan Scheme – of wage payment for increasing the labour productivity to adjust with the increasing demand for its products by 40%. The company feels that if the proposed incentive scheme could bring about an average 20% increase over the present earnings of the workers, it could act as sufficient incentive for them to produce more and the company has accordingly given assurance to the workers.

Because of this assurance, an increase in productivity has been observed as revealed by the figures for the month of April, 2020:

Required :

(i) Calculate the effective increase in earnings of workers in percentage terms under Halsey and Rowan scheme.

(ii) Calculate the savings to Z Ltd. in terms of direct labour cost per unit under both the schemes.

(iii) Advise Z Ltd. about the selection of the scheme that would fulfil its assurance of incentivising workers and also to adjust with the increase in demand. (Jan 2021, 10 marks)

![]()

Question 26.

A job can be executed either through workman A or B. A takes 32 hours to complete the job while B finishes it in 30 hours. The standard time to finish the job is 40 hours.

The hourly wage rate s same for both the workers. In addition workman A is entitled to receive bonus according to Halsey plan (50%) sharing while B is paid bonus as per Rowan plan. The works overheads are absorbed on the job at ₹ 7.50 per labour hour worked. The factory cost of the job comes to ₹ 2.600 irrespective of the workman engaged.

INTERPRET the hourly wage rate and cost of raw materials input. Also show cost against each element of c included in factory cost.

Answer:

Calculation of:

1. Time saved and wages:

2. Bonus Plan:

| Halsey | Rowan | |

| Time saved (hrs.) | 8 | 10 |

| Time saved (hrs.) | 4x \(\left\lfloor\frac{8 \mathrm{hrs} \times ₹ \mathrm{x}}{2}\right\rfloor\) |

7.5x \(\left|\frac{10 \mathrm{hrs}}{40 \mathrm{hrs}} \times 30 \mathrm{hrs} \times ₹ \times\right|\) |

![]()

3. Total wages :

Workman A: = 32x + 4x = ₹ 36x

Workmna B: = 30x + 7.5x = ₹ 37.5 x

Statement of factory cost of the job

| Workmen | A (₹) | B (₹) |

| Material cost (assumed) | y | y |

| Wages (shown above) | 36x | 37.5X |

| Works overhead | 240 | 225 |

| Factory cost (given) | 2,600 | 2600 |

The above relations can be written as follows:

36x + y + 240 = 2,600 ……….. (i)

37.5x + y + 225 = 2,600 ………….. (ii)

Subtracting (i) from (ii) we get .

1.5x – 15 = 0

Or, 1.5x = 15

Or, x = ₹ 10 per hour

On substituting the value of x in (i) we get y = ₹ 2,000

Hence the wage rate per hour is ₹ 10 and the cost of raw material is ₹ 2,000 on the job.

![]()

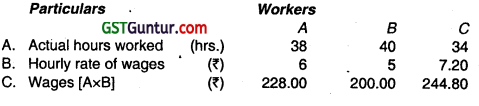

Question 27.

A Company is undecided as to what kind of wage scheme should be introduced. The following particulars have been compiled in respect of three workers. Which are under consideration of the management.

For the purpose of .piece rate, each minute is valued at ₹ 1/-

You are required to CALCULATE the wages of each worker under:

(i) Guaranteed hourly rate basis

(ii) Piece work earning basis, but guaranteed at 75% of basic pay (Guaranteed hourly rate if his earnings are less than 50% of basic pay.)

(iii) Premium bonus basis where the worker received bonus based on Rowan scheme.

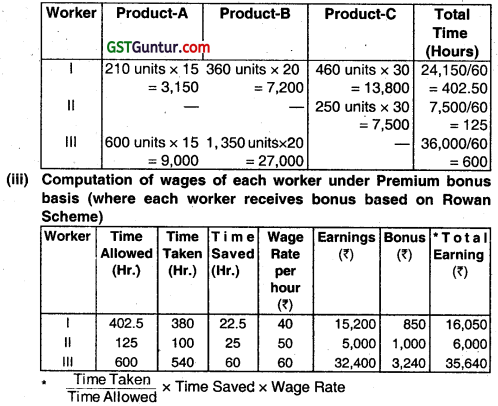

Answer:

(i) Computation of wages of each worker under guaranteed hourly rate basis

| Worker | Actual hours worked (Hours) | Hourly wage rate (₹) | Wages (₹) |

| I | 380 | 40 | 15,200 |

| II | 100 | 50 | 5,000 |

| III | 540 | 60 | 32,400 |

![]()

(ii) Computation of Wages of each worker under piece work earning basis

Since -each worker’s earnings are more than 50% of basic pay.

Therefore, worker-I, II and III will be paid the wages as computed i.e. ₹ 24,150, ₹ 7,500 and ₹ 36,000 respectively.

Working Notes:

1. Piece rate per unit

| Product | Standard time per unit in minute | Piece rate each minute (₹) | Piece rate per unit (₹) |

| A | 15 | 1 | 15 |

| B | 20 | 1 | 20 |

| C | 30 | 1 | 30 |

2. Time allowed to each worker

Worker – I = \(\frac{380}{402.5}\) × 22.5 × 40 = 850

Worker – II = \(\frac{100}{125}\) × 25 × 50 = 1,000

Worker – III = \(\frac{540}{600}\) × 60 × 60 = 3,240

![]()

Question 28.

Answer the following:

X executes a piece of work in 120 hours as against 150 hours allowed to him. His hourly rate is ₹ 10 and he gets a dearness allowance @ ₹ 30 per day of 8 hours worked in addition to his wages. You are required to calculate total wages received by X under the following incentive scheme: Rowan Premium Plan , [Modified] (Nov 2011, 5 marks)

Answer:

Standard Time = 150 hours

Actual Time = 120 hours i.e. 15 days

Time Saved = 30 hours

Hourly Wage Rate = ₹ 10

DA = ₹ 30/day

= 30 × 15 = 450

Rowan Premium Plan

(Actual Time × Time Rate) + (Time Saved × \(\frac{\text { Time Taken }}{\text { Time Allowed }}\) × Time Rate)

= (120 × 10 + DA) + (30 × \(\frac{120}{150}\) × 10)

= (120 × 10 + 450) + (240)

= 1,200 + 450 + 240

= ₹ 1,890

![]()

Question 29.

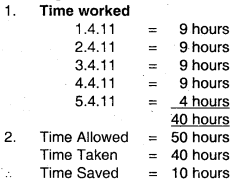

The management of a company wants to formulate an incentive plan for the workers with a view to increase productivity. The following particulars have been extracted from the books of company.

Piece Wage rate – ₹ 10

Weekly working hours – ₹ 40

Hourly wages rate – ₹ 40 (guaranteed)

Standard/normal time taken per unit 15 minutes.

Actual output for a week:

Worker A – 176 pieces

Worker B – 140 pieces

Differential piece rate: 80% of piece rate when output below normal and 120% of piece rate when output above normal.

Under Halsey scheme, worker gets a bonus equal to 50% of Wages of time saved.

Calculate:

Earning of workers under Halseys and Rowans premium scheme. [Modified] (May 2012, 8 marks)

Answer:

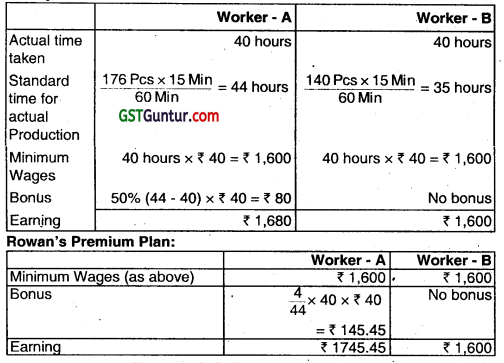

Calculation of earnings for workers under different incentive plans:

Halsey’s Premium Plan:

![]()

Question 30.

M/s. Zeba Private Limited allotted a standard time of 40 hours for a job and the rate por hour is ₹ 75. The actual time taken.by a worker is 30 hours.

You are required to calculate the total earnings under the following plans:

(i) Halsey Premium Plan (Rate 50%) .

(ii) Rowan Plan

(iii) Time Wage System

(iv) Piece Rate System [Modified] (May 2019, 5 marks)

Answer:

(i) Halsey Premium Plan:

Halsey Premium Plan (Wages)

= (Time taken × Time Rate) + (50% of time saved × time rate)

= (30 hours × ₹ 75) + (40 hours – 30 hrs) × 50% × ₹ 75

= ₹ 2,625

(ii) Rowan Plan

Rowan Plan (Earnings) = (Time Taken × Rate Per hour) + \(\frac{\text { Time Saved }}{\text { Time Allowed }}\) × Time Taken × Rate per hour

= (30 hours × ₹ 75) + [\(\frac{10 \mathrm{hrs}}{40 \mathrm{hrs}}\) × 30hrs × ₹ 75)

= ₹ 2,250 + 562.50 .

= ₹ 2,812.50

(iii) Time Wage System:

Time Wage System (Earnings) = Hours Works × Rate Per hour

= 30 hours × ₹ 75

= ₹ 2,250

(iv) Piece Rate System:

Std. Time × Rate per hour

= 40 × ₹ 75

= ₹ 3,000.

![]()

Question 31.

Calculate the Employee hour rate of a worker A from the following data:

Basic pay – 10,000 pm

D.A. – 36,000

Fringe benefits – 12,000

Number of working days in a year 320.20 days are availed off as holidays on full pay in a year. Assume a day of 8 hours.

Answer:

(i) Effective working days in a year – 320

Less: Leave days on full pay – 20

Effective working days – 300 days

Total effective working hours (300 days × 8 hours) = 2400

(ii)

(iii) Hourly rate : ₹ 1,68,000/2400 hours = ₹ 70.00

![]()

Question 32.

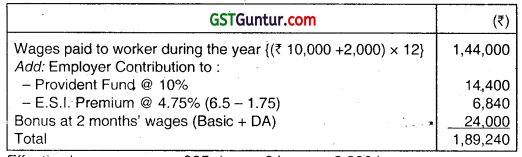

A worker is paid 10,000 per month and a dearness allowance of ₹ 2,000 p.m. Worker contribution to provident fund is @ 10% and employer also contributes the same amount as the employee. The Employees State Insurance Corporation premium is 6.5% of wages of which 1.75% is paid by the employees. It is the firm’s practice to pay 2 months’ wages as bonus each year.

The number of working days in a year are 300 of 8 hours each. Out of these the worker is entitled to 15 days leave on full pay. Calculate the wage rate per hour for costing purposes.

Answer:

Effective hours per year: 285 days × 8 hours = 2,280 hours

Wages rate per hour (for costing purpose): ₹ 1,89,240/ 2,280 hours = ₹ 83

![]()

Question 33.

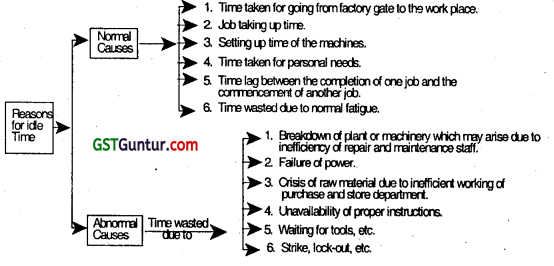

What do you understand by labour turnover? How is it measured? (May 2003, 1 + 4 = 5 marks)

OR

Define Labour Turnover’. How is it measured? Explain. (Nov 2014, 4 marks)

Answer:

Meaning :

Labour turnover refers to “the rate of change in the composition of labour force during a particular period measured against suitable index “. It arises because an organisation is a dynamic entity and not a static one. Definition : Prof. B Banerjee has therefore defined labour turnover as “The rate of change in the labour force of an organisation during a specified period.”

Measurement of Labour Turnover:

Three important methods are available to measure labour turnover. The company may use any one of these methods for the purpose of measuring the rate of labour turnover. But for the purposes of facilitating both the trend analysis (e.g. company’s labour turnover rate during the year just ended with the preceeding years) and the inter firm comparison (e.g. comparing the rate of labour turnover of a company with that of others), it is necessary to use the method selected consistently year after year.

Since, each method lays emphasis on a particular aspect and therefore, no useful and meaningful comparison can be made if there is a change or difference in the method of measuring labour turnover. The three methods are :

- Separation method

- Replacement method

- Flux method

![]()

1. Separation Method; Underthis method, labourturnover is measured by dividing the total number of separations during a period by the average no. of employees on the pay roll. The result is to be multiplied by 100 to express it in the form of percentage.

Therefore,

LTO = \(\frac{\text { No. of separations during a period }}{\text { Avg. no. of employees during the period }}\) × 100

Where,

Avg. no. of employees = \(\frac{[\text { No. of employees at the beginning of the period }]+[\text { No. of employees at the end of the period }]}{2}\)

2. Replacement Method: Under this method labour turnover is measured by dividing the number of replacements made, irrespective of number of separations, during a period by the average number of employees on the payroll. The important point to be noted is that only the replacements made to fill the vacancies caused by the separations are to be considered for measuring labour turnover under this method. Therefore,

LTO = \(\frac{\text { No. of separations made during a period }}{\text { Avg. no. of employees during the period }}\) × 100

3. Flux Method: Under this method, both the number of separations and replacements are considered. Hence, labour turnover is computed by dividing the aggregate of no. of separations & replacements during a period by the average number of employeeS. Therefore,

[No. of separations during a period]+(No. of replacements during a period]

LTO = \(\frac{[\text { No. of separations during a period }]+[\text { No. of replacements during a period }]}{\text { Average no. of employees during the period }}\)

![]()

Question 34.

Discuss the two types of cost associated with labour turnover. (Nov 2003, 3 marks)

Answer:

The two types of costs associated with labour turnover are:

1. Preventive costs: These are costs incurred to keep the labour turnover at a low level, e. g. cost of medical services, welfare schemes and pension schemes. If the firm incurs high preventive costs, its rate of labour turnover is usually low.

2. Replacement costs: These are costs arising due to high labour turnover and represents the amount spent on new workers. Some examples are cost of employment, training and induction, abnormal breakage and scrap, extra wages and overheads due to inefficiency of new workers. The company will incurs high replacement costs if its rate of labour turnover is high.

Hence every company must work out an optimum level of labour turnover keeping in view its personnel policies and behaviour of replacement and preventive costs at various levels of labour turnover rates.

![]()

Question 35.

Discuss the three methods of Calculating labour turnover. (Nov 2004, Nov 2010, 3, 4 marks)

Answer:

Meaning :

Labour turnover refers to “the rate of change in the composition of labour force during a particular period measured against suitable index”. It arises because an organisation is a dynamic entity and not a static one.

Definition :

Prof. B Banerjee has therefore defined labour turnover as wThe rate of change in the labour force of an organization during a specified period.”

Measurement of Labour Turnover :

Three important methods are available to measure labour turnover. The company may use any one of these methods for the purpose of measunrig the rate of labour turnover. But for the purposes of facilitating both the trend analysis (e.g. company’s labour turnover rate during the year just ended with the preceding years) and the inter firm comparison (e.g. comparing the rte of labour turnover of a company with that of others), it is necessary to use the method selected consistently year after year.

Since each method lays emphasis on a particular aspect and therefore, no useful and meaningful comparison can be made if there is a change or difference in the method of measuring labour turnover. The three methods are:

- Separation method

- Replacement method

- Flux method

![]()

1. Separation Method: Under, this method, labour turnover is measured by dividing the total number of separations during a period by the average no. of employees on the pay roll. The result is to be multiplied by 100 to express it in the form of percentage. Therefore,

LTO = \(\frac{\text { No. of separations during a period }}{\text { Avg. no. of employees during the period }}\) × 100

Where,

Avg. no. of employees = \(\frac{[\text { No. of employees at the beginning of the period }]+[\text { No. of employees at the end of the period }]}{2}\)

2. Replacement Method: Under this method labour turnover is measured by dividing the number of replacements made, irrespective of number of separations, during a period by the average number of employees on the payroll. The important point to be noted s that only the replacements made to fill the vacancies caused by the separations are to be considered for measuring labour turnover under this method. Therefore,

LTO = \(\frac{\text { No. of replacements made during a period }}{\text { Avg no of employees during the period }}\) × 100

3. Flux Method: Under this method, both the number of separations & replacements are considered. Hence, labour turnover is computed by dividing the aggregate of no. of separations & replacements during a period by the average number of employees.

Therefore,

LTO = \(\frac{[\text { No. of separations during a period }]+[\text { No. of replacements during a period }]}{\text { Average no. of employees during the period }}\)

![]()

Question 36.

Enumerate the remedial steps to be taken to minimise the labour turnover. (Nov 2007, 3 marks)

Answer :

The following remedial steps may be adopted to minimise labour turnover:

- Exit interview with each outgoing employee to ascertain the reasons for his leaving the organisation.

- Job analysis and evaluation carried out even before recruitment to ascertain the requirement of each job.

- Scientific system of recruitment, placement and promotion, by fitting the right person in the right job.

- Use of committee, comprising of members from management and workers to handle issue concerning workers grievance, requirements etc.

- Enlightened attitude of management — Mental revolution on the part of management by taking workers into confidence and acting a healthy working atmosphere, with measures such as:

- Training service rules after discussion between management and workers union.

- Provision of facilities for education, training and development of workers.

- Introduction of procedures for settlement of workers grievances.

![]()

Question 37.

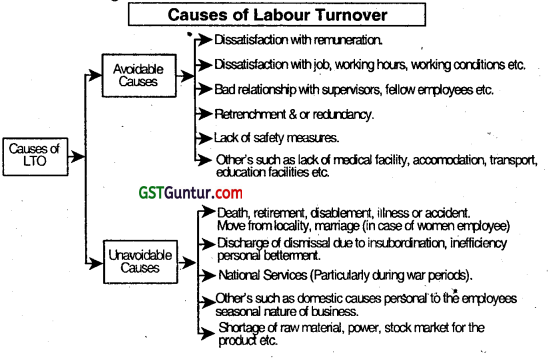

Enumerate the cause labour turnover. (May 2011, 4 marks)

Answer:

In order to keep the labour turnover rate at the minimum level, it is necessary to understand the various reasons as to why the people leave the organisation. Though it is a very strenuous task to list all the reasons for or causes of LTO, an attempt has been made in the following paragraph to identify some of the important & usual causes which can be classified into two broad categories:

![]()

Question 38.

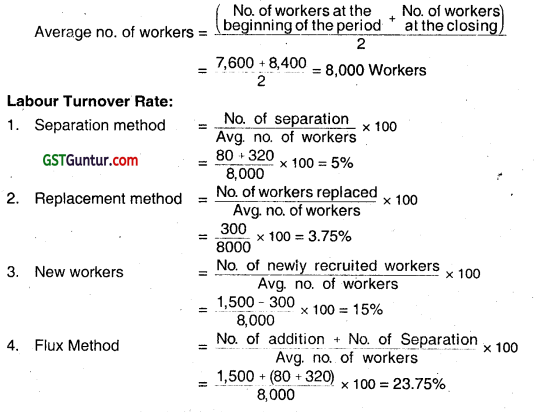

From the following information, calculate Labour turnover rate and Labour flux rate :

No. of workers as on 01.01.2000 = 7,600

No. of workers as on 31 .12.2000 = 8,400

During the year, 80 workers left while 320 workers were discharged. 1,500 workers were recruited during the year of these, 300 workers were recruited because of exits and the rest were recruited in accordance with expansion plans. (May 2001, 4 marks)

Answer:

![]()

Question 39.

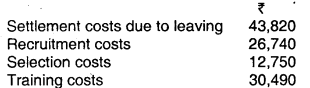

The management of a company are worried about their increasing labour turnover in the factory and before analysing the causes and taking remedial steps, they want to have an idea of the profit foregone as a result of labour turnover in the last year.

Last year sales amounted to ₹ 83,03,300 and the profit-volume ratio was 20 per cent. The total number of actual hours worked by the Direct Labour Force was 4.45 lakhs. As a result of the delays by the Personnel Department in filling vacancies due to labour turnover, 1 ,00,000 potentially productive hours were lost. The actual direct labour hours included 30,000 hours attributable to training new recruits, out of which half of the hours were unproductive.

The costs incurred consequent on labour turnover revealed on analysis the following:

Assuming that the potential production lost as a consequence of labour turnover could have been sold at prevailing prices, find the profit foregone last year on account of labour turnover. (Nov 2001, 8 marks)

Answer:

Actual Production Hours:

![]()

Question 40.

Accountant of your company had computed labour turnover rates for the quarter ended 30th September, 2012 as 14%, 8% and 6% under Flux method, Replacement method and Separation method respectively. If the number of workers replaced during 2 quarter of the financial year 2012-13 is 36, find the following:

(i) The number.of workers recruited and joined; and

(ii) The number of workers left and discharged. (Nov 2012, 5 marks)

Answer:

Labour Turnover Rate (Replacement method)

= \(\frac{\text { No. of workers replaced }}{\text { Average No. of workers }}\)

or, \(\frac{8}{100}\) = \(\frac{36}{\text { Average No. of workers }}\)

∴ Average No. of workers = 450

Labour Turnover Rate (Separation method) = \(\frac{\text { No. of workers seperated }}{\text { Average No. of workers }}\)

or \(\frac{6}{100}\) = \(\frac{\text { No. of workers replaced }}{450}\)

∴ No. of workers separated = 27

Labour Turnover Rate (Flux Method)

= \(\frac{\text { No. of Separations }+ \text { No. of accession (Joinings) }}{\text { Average No. of workers }}\)

or \(\frac{14}{100}\) = \(\frac{27+\text { No. of accession (Joinings) }}{450}\)

or, 100 (27 + No. of Accessions) = 6,300

∴ No. of Accessions = 36

(i) The No. of workers recruited and Joined = 36

(ii) The No. of workers left and discharged = 27

![]()

Question 41.

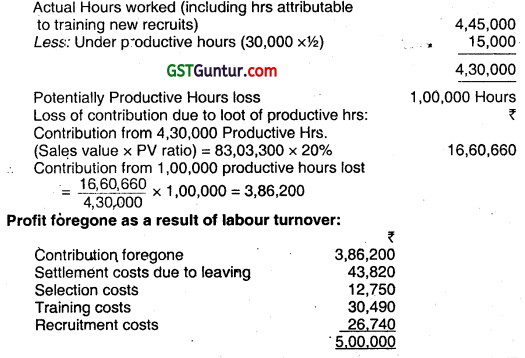

The rate of change of labour force in a company during the year ending 31st March, 2013 was calculated as 13%, 8% and 5% respectively under ‘Flux Method’, ‘Replacement method’ and ‘Separation method’. The number of workers separated during the year is 40.

You are required to calculate:

(i) Average number of workers on roll.

(ii) Number of workers replaced during the year.

(iii) Number of new accessions i.e. new recruitment.

(iv) Number of workers at the beginning of the year. (Nov 2013, 8 marks)

Answer: .

(i) Labour Turnover Rate (Separation method)

= \(\frac{\text { No. of workers separated }}{\text { Average no. of workers on roll }}\)

Or, \(\frac{5}{100}\) = \(\frac{40}{\text { Average no. of workers on roll }}\)

Or, Average no. of workers on roll = 800

(ii) Labour Turnover Rate (Replacement method)

= \(\frac{\text { No. of workers replaced }}{\text { Average no. of workers on roll }}\)

Or, \(\frac{8}{100}\) = \(\frac{\text { No. of workers replaced }}{800}\)

Or, No. of workers replaced = 64

![]()

(iii) Labour Turnover Rate (Flux Method)

= \(\frac{\text { No. of Separations }+ \text { No. of accession (new recruitments) }}{\text { Average no. of workers on roll }}\)

Or \(\frac{13}{100}\) = \(\frac{40+\text { No. of Accessions (New recruitments) }}{800}\)

Or, 100 (40 + No. of Accessions) = 10,400

Or, No. of new accessions = 64

(iv) No. of workers at the beginning of the year

Let workers at the beginning of the year were ‘X

Average no. of workers on roll

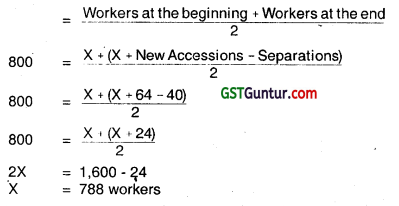

Question 42.

Human Resources Department of A Ltd. computed labour turnover by replacement method at 3% for the quarter ended June 2015. During the quarter, fresh recruitment of 40 workers was made. The number of workers at the beginning and end of the quarter was 990 and 1010 respectively.

You are required to calculate the labour turnover rate by Separation Method and Flux Method. (Nov 2015, 5 marks)

Answer:

Calculation of labour turnover by Separation Method:

Separation Method = \(\frac{\text { No. of workers separated }}{\text { Average no. of Workers }}\) × 100

= \(\frac{50}{1000}\) × 100

= 5%

Calculation of labour Turnover by Flux Method:

![]()

Question 43.

RST Company Ltd. has computed labour turnover rates for the quarter ended 31st March, 2017 as 20%, 10% and 5% under flux method, replacement method and separation method respectively. If the number of workers replaced during that quarter is 50, find out (i) Workers recruited and joined (ii) Workers left and discharged and (iii) Average number of workers on roll. (May 2017, 5 marks)

Answer:

1. Average Number of workers on roll during the year:

Labour turnover rate under Replacement method

= \(\frac{\text { No. of workers replaced }}{\text { Avg. No. of workers on roll }}\) × 100

Or 10% = \(\frac{50}{\text { Avg. No. of workers on roll }}\) × 100

∴ Average Number of workers on roll = 500

2. Number of workers left and discharged:

Labour turnover rate under Separation method

= \(\frac{\text { No. of Separations }}{\text { Ava No of workers on roll }}\) × 100

0r5% = \(\frac{\text { No. of Separations }}{500}\) × 100

∴ Number of Separations = 25

3. Number of workers recruited and joined:

Labour turnover rate under Flux Method

= \(\frac{\text { No. of Sep. }+ \text { Accession }}{\text { Avg. No. of workers on roll }}\) × 100

0r 20% = \(\frac{25+\text { Accession }}{500}\) × 100

∴ Number of the Accession = 75

![]()

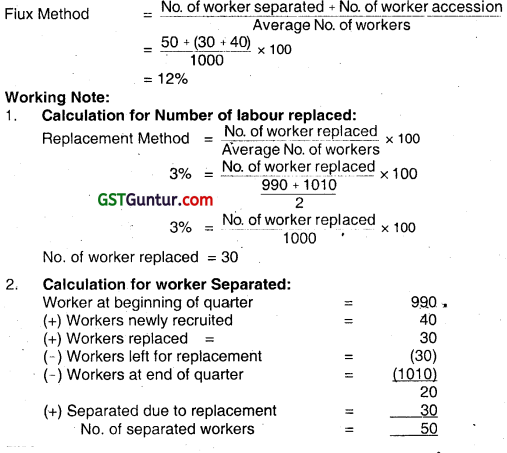

Question 44.

The information regarding number of employees on roll in a shopping mall [or the month ot December, 2017 are given below:

Number of employees as on 01-12-2017 : 900

Number of empoyees as on 31 -12-2017 : 1100

During December, 2017, 40 employees resigned and 60 employees were discharged. 300 employees were recruited during the month. Out of these 300 employees, 225 employees were recruited for an expansion project of the mall and rest were recruited due to exit of employees.

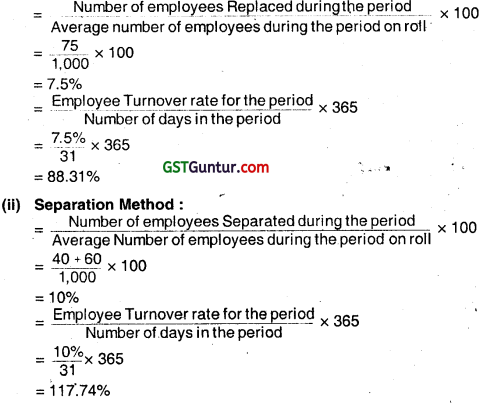

Assuming 365 days in a year, calculate Employee Turnover Rate and Equivalent Annual Employee Turnover Rate by applying the following:

(i) Replacement Method

(ii) Separation Method

(iii) Flux Method (May 2018, 10 marks)

Answer:

Calculation for Employee Turnover Rate :

(i) Replacement Method: