Cost Sheet – CA Inter Costing Question Bank is designed strictly as per the latest syllabus and exam pattern.

Cost Sheet – CA Inter Costing Question Bank

Question 1.

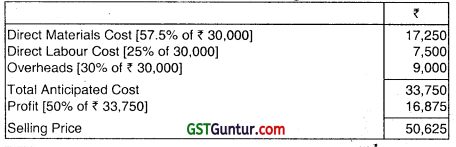

Popeye Company is a metal and wood cutting manufacturer, selling products to the home construction market. Consider the following data for the month of October, 2004:

Required:

(i) Prepare an income statement with a separate supporting schedule of cost of goods manufactured.

(ii) For all manufacturing items, indicate by V or F whether each is basically a variable cost or a fixed cost (where the cost object is a product unit.) (Nov 2004, 6 + 2 = 8 marks)

Answer:

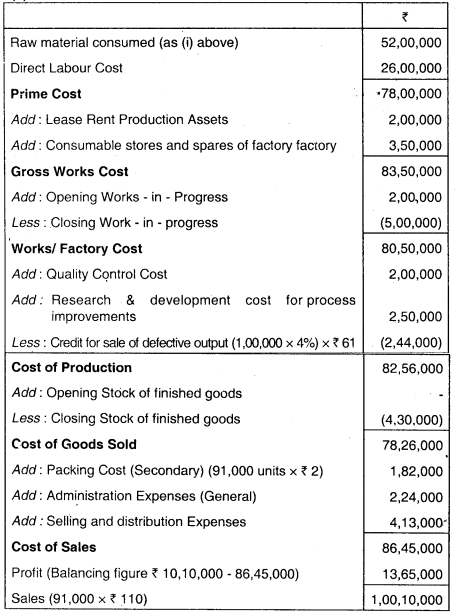

Computation of supporting schedule of cost of goods.

(i) Manufactured for the month ending Oct., 2004.

(ii) In the books of Popeye company:

Income Statement (For the month ending on 31 Oct. 2004)

![]()

Question 2.

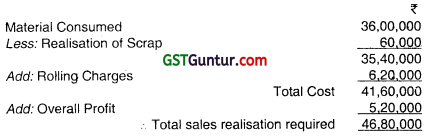

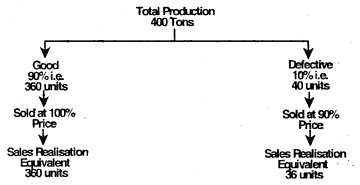

A Re-roher produced 400 metric tons of M.S. bars spending ₹ 36,00.000 towards materials and ₹ 6,20,000 towards rolling charges. Ter percent of the output was found to be detective, which had to be sold at 10% less than the price for good production. If the sales realization should give the firm an overall profit of 12.5% on cost, find the selling price per metric ton of both the categories of bars. The scrap arising during the Tolling process fetched a realization of ₹ 60,000. (Nov 2005, 6 marks)

Answer:

1.

2.

Thus, output (effective) = 360 + 36 = 396 units

i.e. 396 tons.

3. Sales Price of good units = \(\frac{46,80,000}{360 + 36}\) = 11,818.18

Sales price of defective units = 11.818.18 × 90% = 10.636.362

![]()

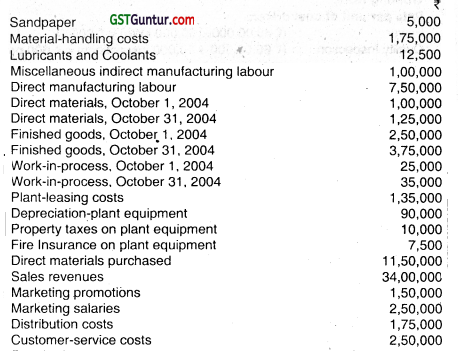

Question 3.

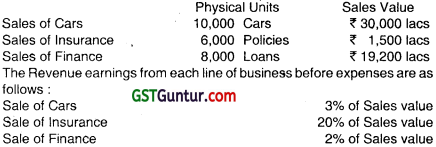

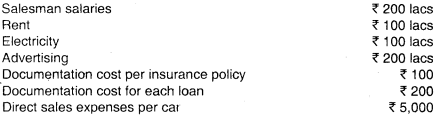

XYZ Auto Ltd. is in the business of selling cars. It also sells insurance and finance as part of its overall business strategy. The following information is available for the company: (May 2006)

The expenses of the company are as follows:

Indirect costs have to be allocated in the ratio of physical units sold.

Required:

(i) Make a cost sheet for each product allocating the direct and indirect costs and also showing the productwise profit and total profit. (6 marks)

(ii) Calculate the percentage of profit to revenue earned from each line of business. (2 marks)

Answer:

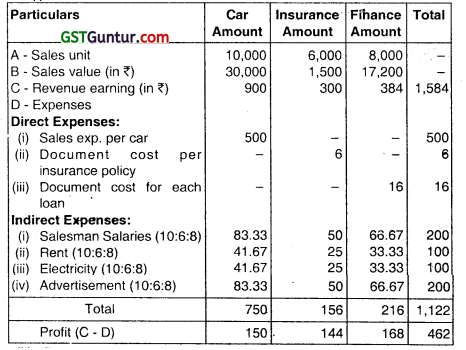

(i) Cost Sheet

(ii) Percentage of profit to revenue from each of business:

(a) Sale of car = \(\frac{150}{900}\) × 100 = 16.67%

(b) Sale of insurance = \(\frac{144}{300}\) × 100 = 48%

(c) Sale of finance = \(\frac{168}{384}\) × 100 = 43.75%

![]()

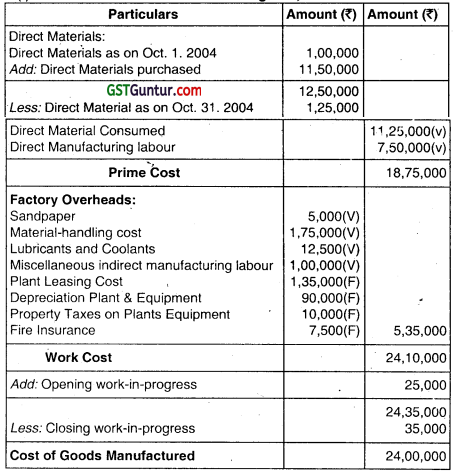

Question 4.

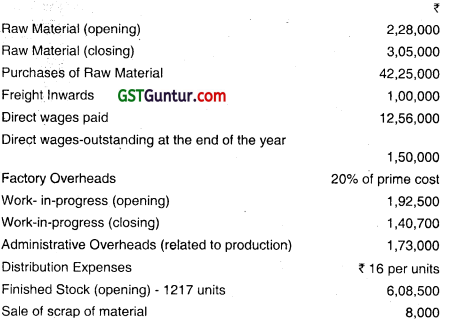

Following information relate to a manufacturing concern for the year ended 31st March, 2018:

The firm produced 14000 units of output during the year. The stock of finished goods at the end 01 the year is valued at cost of production. The firm sold 14153 units at a price of ₹ 618 per unit during the year.

Prepare cost sheet of the firm. (May 2018, 10 marks)

Answer:

Cost Sheet for the year ended 31st March, 2018.

Units produced – 14,000 units

Units sold – 14,153 units

![]()

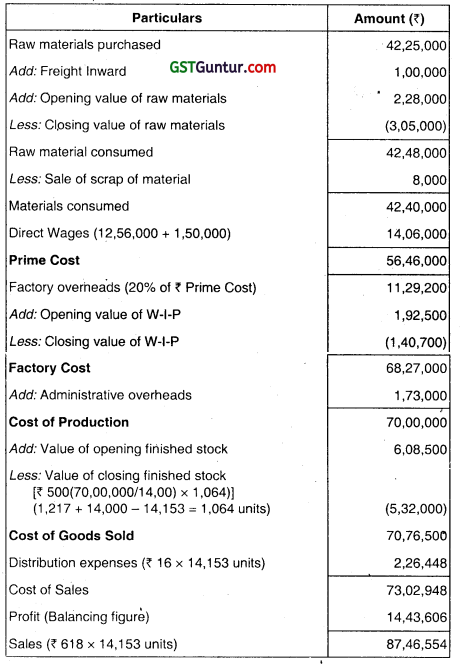

Question 5.

Following details are provided by MIs. ZIA Private Limited for the quarter ending 30 September, 2018:

(i) Direct expenses – ₹ 1,80,000

(ii) Direct wages being 175% of factory overheads – ₹ 2,57,250

(iii) Cost of goods sold – ₹ 18,75,000

(iv) Selling & distribution overheads – ₹ 60,000

(v) Sales – ₹ 22,10,000

(vi) Administration overheads are 10% of factory overheads

Stock details as per Stock Register :

| 30.06.2018 | 30.09.2018 | |

| Particulars | ₹ | ₹ |

| Raw material | 2,45,600 | 2,08,000 |

| Work-in-progress | 1,70,800 | 1,90,000 |

| Finished goods | 3,10,000 | 2,75,000 |

![]()

You are required to prepare a cost sheet showing:

(i) Raw material consumed

(ii) Prime cost

(iii) Factory cost

(iv) Cost of goods sold

(v) Cost of sales and profit (Nov 2018, 10 marks)

Answer:

Cost Sheet (for the quarter ending 30th September, 2018)

*(18,75,000 + 2,75,000 – 3,10,000 – (1,47,000 × 10%) + 1,90,000 -1,70,800 – (2,57,250 × 100/175%) – 1,80,000 – 2,57,250 + 2,08,000 – 2,45,600) = 12,22,650

Working Notes:

Purchase of raw materials = Raw material consumed + Closing stock – Opening stock of raw material

Raw material consumed = Prime cost – Direct wages – Direct expenses

Factory Overheads = 2,57,250 × 100/175

Prime cost = Factory cost + Closing WIP – Opening WIP – Factory overheads

Factory Cost = Cost of Production goods sold + Closing stock of Finished goods – Opening stock of Finished goods – Administrative overheads

Net Profit = Sales – Cost of sales

![]()

Question 6.

M/s. Areeba Private Limited has a normal production capacity of 36000 units of toys per annum. The estimated costs of production are as under:

(i) Direct Material – ₹ 40 per unit

(ii) Direct Labour – ₹ 30 per unit (subject to a minimum of ₹ 48,000 p.m.)

(iii) Factory Overheads

(a) Fixed – ₹ 3,60,000 per annum

(b) Variable – ₹ 10 per unit

(c) Semi-Variable – ₹ 1,08,000 per annum up to 50% capacity and additional ₹ 46,800 for every 20% increase in capacity or any part thereof.

(iv) Administrative Overheads – ₹ 5,18,400 per annum (fixed)

(v) Selling overheads are incurred at ₹ 8 per unit.

(vi) Each unit of raw material yields scrap which is sold at the rate of ₹ 5 per unit.

(vii) In year 2019, the factory worked at 50% capacity for the first three months but it was expected that it would work at 80% capacity for the remaining nine months.

(viii) During the first three months, the selling price per unit was ₹ 145.

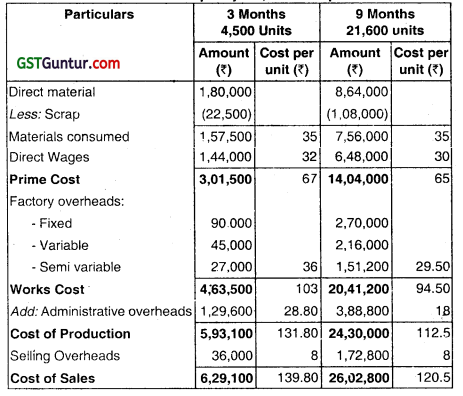

![]()

You are required to:

(i) Prepare a cost sheet showing Prime Cost, Works Cost, Cost of Production and Cost of Sales.

(ii) Calculate the selling price per unit for remaining nine months to achieve the total annual profit of ₹ 8,76,600. (May 2019, 10 marks)

Answer:

(i) Cost Sheet of MIs Areeba Pvt. Ltd. for the year 2019.

Normal Capacity: 36,000 units p.a.

Working Notes:

1. Calculation of Costs

| Particulars | 4,500 units | 21,600 units |

| Amount (₹) | Amount (₹) | |

| Material | 1,80,000 (₹ 40 × 4.500 units) | 8,64,000 (₹ 40. × 21,600 units) |

| Wages | 1,44,000 (Max. of ₹ 30 × 4,500 units = ₹ 1,35,000 and ₹ 48,000 × 3 months = ₹ 1,44,000) | 6,48,000 (21600 Units × 30) |

| Variable Cost | 45,000 (₹ 10 × 4,500 units) | 2,16,000 (₹ 10 × 21,600 units) |

| Semi-variable Cost | 27,000 (\(\frac{₹ 1,08,000}{12 \text { months }}\) 3 months) | 1,51,200 ( \(\frac{₹ 1,08,000}{12 \text { months }}\) × 9 months) |

| + 46,800 (for 20 % increase) + 23,400 (for 10% increase) |

||

| Selling Overhead | 36,000 (₹ 8 × 4,500 units) | 1,72,800 (₹ 8 × 21,600 units) |

Notes:

- Alternatively scrap of raw material can also be reduced from Work Cost.

- Administrative overhead may be treated alternatively as a part of general overhead. In that case. Works Cost as well as Cost of Production will be same i.e.₹ 4,63,500 and Cost of Sales will remain same as ₹ 6,29,100.

![]()

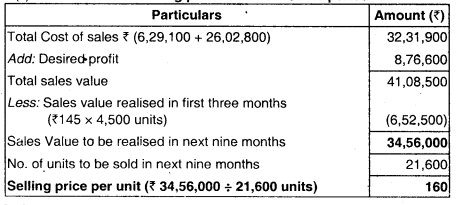

(ii) Calculation of Selling price for nine months period

![]()

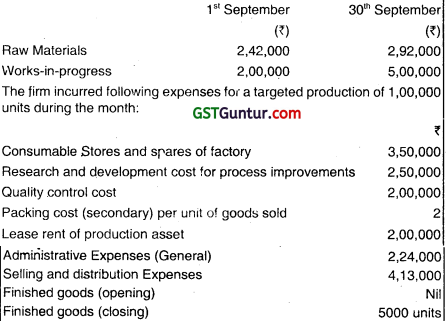

Question 7.

XYZ a manufacturing firm, has revealed following information for September, 2019:

Defective output which is 4% of targeted production, realizes ₹ 61 per unit. Closing stock is valued at cost of production (excluding administrative expenses)

Cost of goods sold, excluding administrative expenses amounts to ₹ 78,26,000.

Direct employees cost is 1/2 of the cost of material consumed.

Seliing price of the output is ₹ 110 per unit.

You are required to:

(i) Calculate the Value of material purchased

(ii) Prepare cost sheet showing the profit earned by the firm. (Nov 2019, 10 marks)

Answer:

(i) Computation of Value of Material Purchased

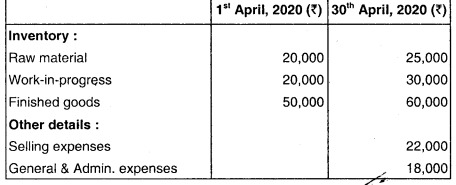

(ii) Cost Sheet

![]()

Question 8.

X Ltd. manufactures two types of pens ‘Super Pen’ and ‘Normal Pen’. The cost data for the year ended 30th September, 2019 is as follows:

| (₹) | |

| Direct Materials | 8,00,000 |

| Direct Wages | 4,48,000 |

| Production Overhead | 1,92,000 |

| Total | 14,40,000 |

It is further ascertained that:

(1) Direct materials cost in Super Pen was twice as much of direct material in Normal Pen.

(2) Direct wages for Normal Pen were 60% 01 those for Super Pen.

(3) Production overhead per unit was at same rate for both the types.

(4) Administration overhead was 200% of direct labour for each.

(5) Selling cost was ₹ 1 per Super pen.

(6) Production and sales during the year were as follow:

| Production | Sales | ||

| No. of units | No. of units | ||

| Super Pen | 40,000 | Super Pen | 36,000 |

| Normal Pen | 1,20,000 | ||

(7) Selling price was ₹ 30 per unit for Super Pen.

– Prepare a Cost Sheet for ‘Super Pen’ showing:

- Cost per unit and Total Cost

- profit per unit and Total Profit (Nov 2020, 10 marks)

![]()

Question 9.

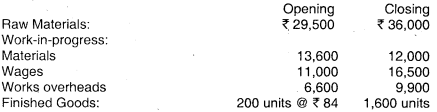

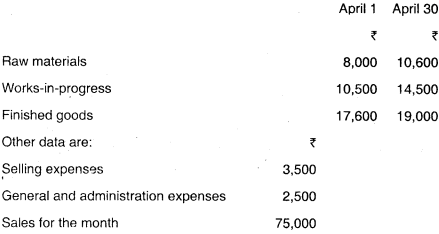

The following data are available from the books and records of Q Ltd. for the month of April 2020:

Direct Labour Cost ₹ 1,20.000 (120% of Factory Overheads)

Cost of Sales = ₹ 4,00,000

Sales = ₹ 5,00,000

Accounts show the following figures:

You are required to prepare a cost sheet for the month of April 2020 showing:

(i) Prime Cost

(ii) Works Cost

(iii) Cost of Production

(iv) Cost of Goods sold

(v) Cost of Sales and Profit earned. (Jan 2021, 10 marks)

![]()

Question 10.

From the following information, prepare a Cost Sheet showing the cost and profit.

Purchases of raw material ₹ 1,90,000, Carriage on purchases ₹ 1,500,

Sale of scrap of Raw materials ₹ 5,000

Wages ₹ 2,97.000

Works overheads are absorbed @ 60% of direct labour cost.

Administration overheads are absorbed @ ₹ 12 per unit produced.

Selling and distribution overheads are absorbed @ 20% of selling price.

Sales – 7600 units @ at a profit of 10% on sales price.

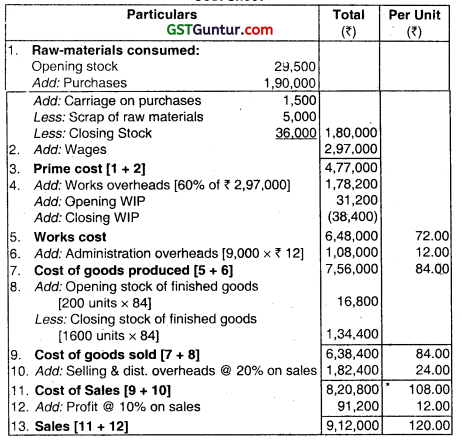

Answer:

Cost Sheet

Working Notes:

(i) Units produced = Closing Stock + Sales – Opening Stock

= 1,600 + 7,600 – 200

= 9,000

(ii) Let Sales be X, then. X = 6,38,400 + 20% of X + 10% of X

7X = 6,38,400

X = 6,38,400/7

= ₹ 9,12,000

![]()

Question 11.

The books of Subhash Manufacturing Company present the following data for the month of April 2017:

Direct labor cost ₹ 17,500 being 175% of works overheads.

Cost of goods sold excluding administrative expenses ₹ 55,000

Inventory accounts showed the following opening and dosing balance:

Compute the value of materials purchased and Prepare a cost statement showing the various elements of cost and also the profit earned.

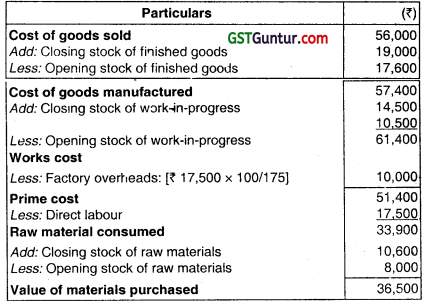

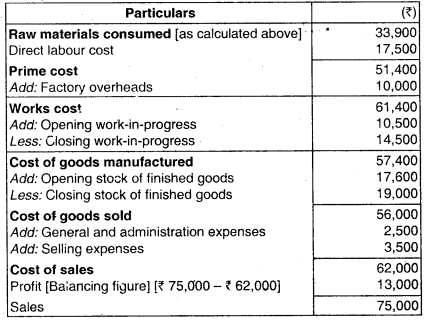

Answer:

(i) Statement Showing the Computation of the Value of Materials Purchased

(ii) Cost Statement Showing the Various Elements of Cost and Profit Earned

![]()

Question 12.

From the following data of Arnav Metallic Ltd. CALCULATE Cost production:

| Amount (₹) | ||

| (i) | Repair & maintenance paid for plant & machinery | 9,80,500 |

| (ii) | Insurance premium paid for inventories | 26,000 |

| (iii) | Insurance premium paid for plant & machinery | 96,000 |

| (iv) | Raw materials purchased | 64,00,000 |

| (v) | Opening stock of raw materials | 2,88,000 |

| (Vi) | Closing stock of raw materials | 4,46,000 |

| (vii) | Wages paid | 23,20,000 |

| (viii) | Value of opening Work-in-process | 4,06,000 |

| (ix) | Value of closing Work-in-process | 6,02,100 |

| (x) | Quality control cost for the products in manufacturing process | 86,000 |

| (xi) | Research and development cost for improvement in production process | 92,600 |

| (xii) | Administrative cost for: | |

| – Factory and production | 9,00,000 | |

| – Others | 11,60,000 | |

| (xiii) | Amount realised by selling scrap generated during the manufacturing process | 9,200 |

| (xiv) | Packing cost necessary to preserve the goods for further processing | 10,200 |

| (xv) | Salary paid to Director (Technical) | 8,90,000 |

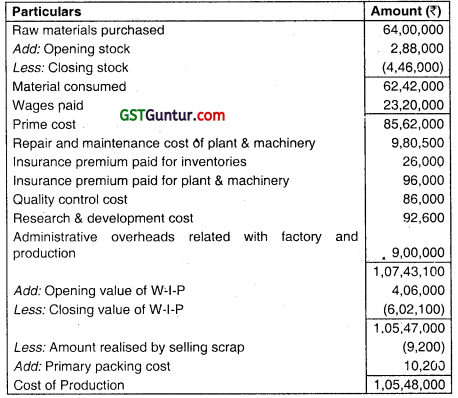

Answer:

Calculation of Cost of Production of Arnav Metallic for the period…..

Notes:

- Other administrative overhead does not form part of cost of production.

- Salary paid to Director (Technical) is an administrative cost.

![]()

Question 13.

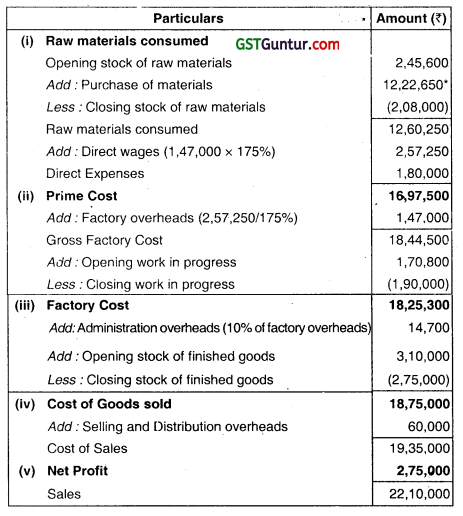

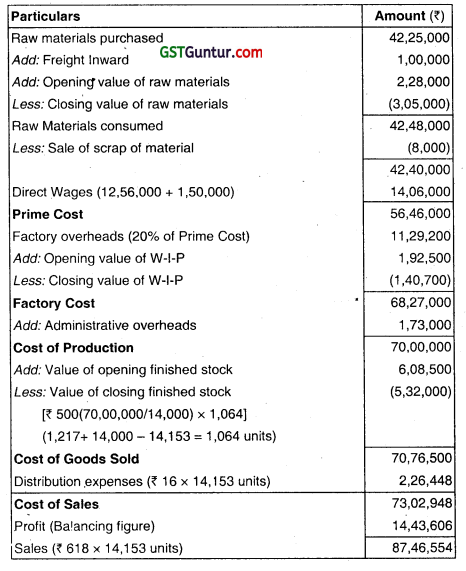

Following information relate to a manufacturing concern for the year ended 31st March, 2019:

| Raw Material (opening) | 2,28,000 |

| Raw Material (closing) | 3,05,000 |

| Purchases of Raw Material | 42,25,000 |

| Freight Inwards | 1,00,000 |

| Direct wages paid | 12,56,000 |

| Direct wages-outstanding at the end of the year | 1,50,000 |

| Factory Overheads | 20% of prime cost |

| Work-in-progress (opening) | 1,92,500 |

| Work-in-progress (closing) | 1,40,700 |

| Administrative Overheads (related to production) | 1,73,000 |

| Distribution Expenses | ₹ 16 per unit |

| Finished Stock (opening)-1,217 Units | 6,08,500 |

| Sale of scrap of material | 8,000 |

The firm produced 14.000 units of output during the year. The stock of finished goods at the end of tho year is valued at cost of production. The firm sold 14.153 units at a price of ₹ 618 per unit during the year.

PREPARE cost sheet of the firm.

Answer:

Cost sh6et foi the year ended 31st March, 2019.

Units produced – 14,000 units

Units sold – 14.153 units

![]()

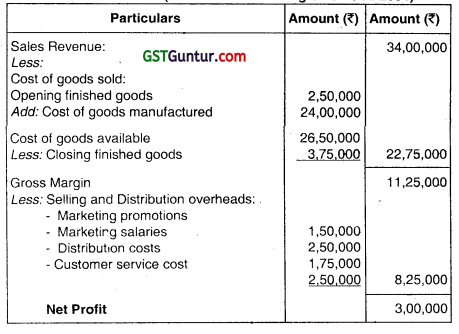

Question 14.

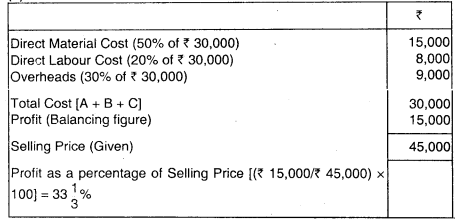

The cost structure of an article the selling price of which is ₹ 45,000, is as follows:

Direct Materials 50%, Direct Labour 20%, Overheads 30%

An increase of 15% in the case of materials and 25% in the cost of labour is anticipated. These increased-costs in relation to the present selling price would cause a 25% decrease in the amount of profit per article.

Prepare a statement of profit per article at present, and the revised selling price to produce the same percentage of profit to sales as before.

Answer:

Let‘x’ be the Total Present Cost

Statement Showing Present and Anticipated Cost per article

| Item (A) | Present Cost ₹ (B) | Increase % (C) | Increase ₹ (D) | Anticipated Cost ₹ (E) = (B) + (D) |

| Direct Material Cost | 0.5 x | 15 | 0.075 x | 0.575 x |

| Direct Labour | 0.2 x | 25 | 0.050 x | 0.250 x |

| Overheads | 0.3 x | – | – | 0.300 x |

| Total | x | – | 0.125 x | 1.125 x |

Present Profit = 45,000 – X,

Anticipated Profit at same selling price = ₹ 45,000 – 1.125 x

₹ 45,000 – 1.125 x = 75% of (45,000 – x)

45,000 – 1.125 x = 33,750 – .75 x

.375 × 11,250x

= 11,250/.375 = ₹ 30,000

![]()

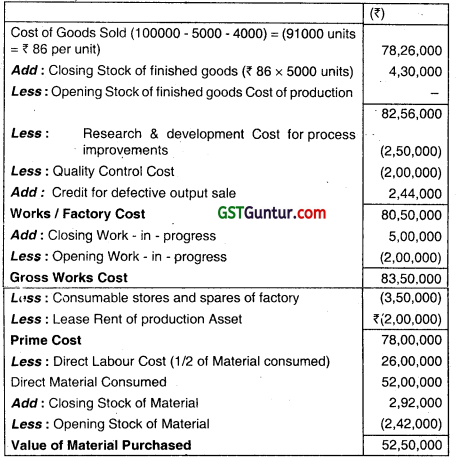

(a) Present Statement of Profit Per Article

(b) Statement of Revised Selling Price