Cost Accounting System – CA Inter Costing Question Bank is designed strictly as per the latest syllabus and exam pattern.

Cost Accounting System – CA Inter Costing Question Bank

Question 1.

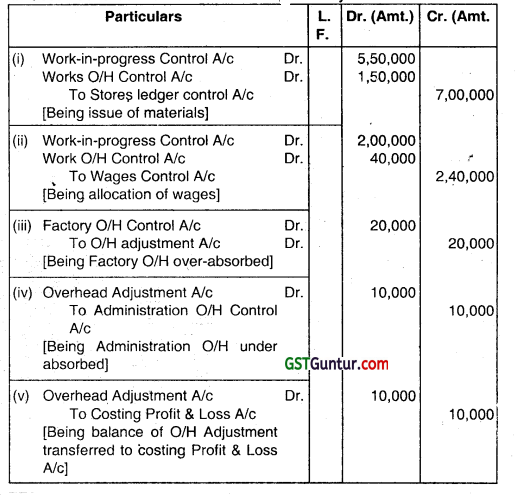

Pass journal entries in the cost books, maintained on non-integrated system, for the following:

(i) Issue of materials: Direct ₹ 5,50,000; Indirect ₹ 1,50,000.

(ii) Allocation of wages: Direct ₹ 2,00,000; Indirect ₹ 40,000.

(iii) Under/over absorbed Factory (over) ₹ 20,000;

overheads:

Administration (under) ₹ 10,000. (Nov 2000, 6 marks)

Answer:

In Cost Books Maintained on Non-Integrated System Journal Entries

![]()

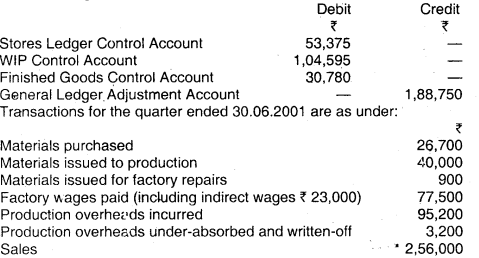

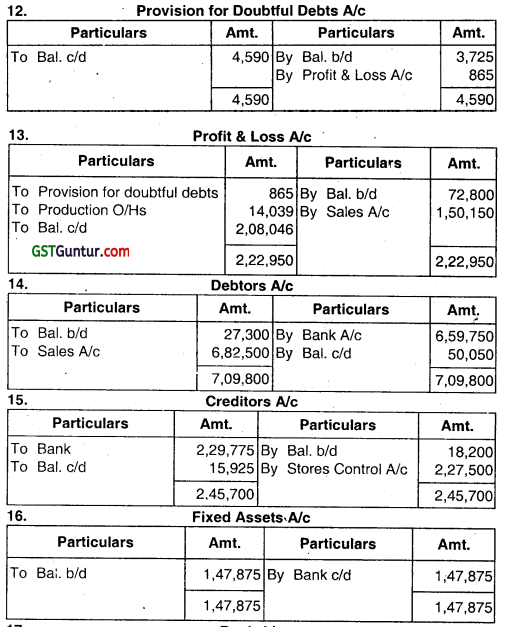

Question 2.

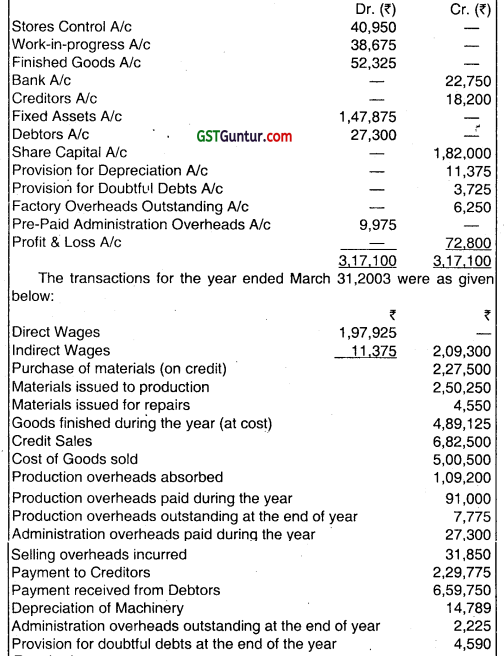

A company operates separate cost accounting and financial accounting systems. The following is the list of Opening balances as on 1.04.2001 in the Cost Ledger:

The Company’s gross profit is 25% on Factory Cost. At the end of the quarter, WIP stocks increased by ₹ 7,500.

Prepare the relevant Control Accounts, Costing Profit and Loss Account and General LeJger Adjustment Account to record the above transactions for the quarter ended 30.06.2001. (Nov 2001, 10 marks)

Answer:

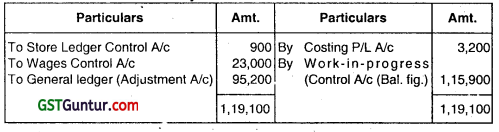

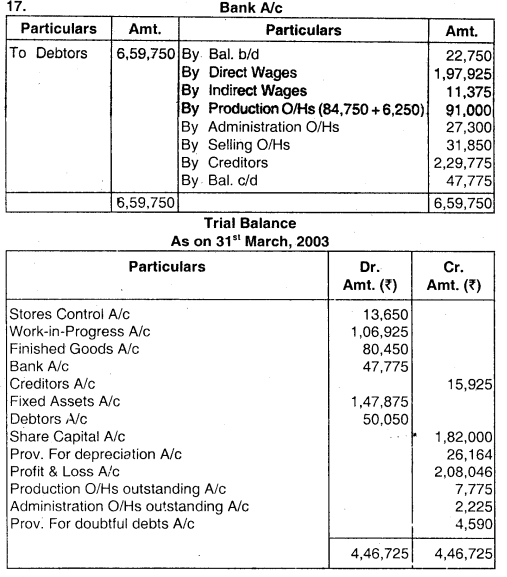

1. General Ledger Adjustment A/c

2. Stores Ledger Control A/c

![]()

5. Factory Overhead Control A/c

6. Wages Control A/c

Trial Balance As on 30-06-2001

![]()

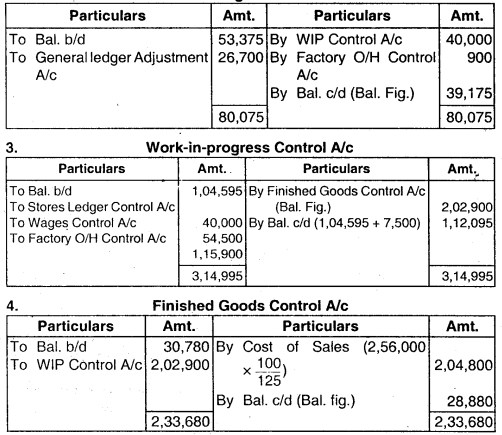

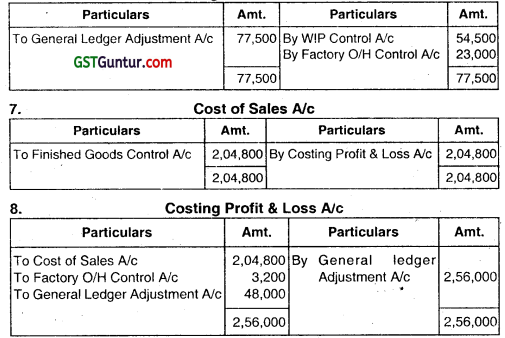

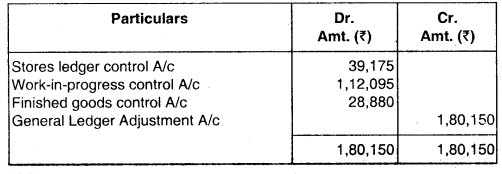

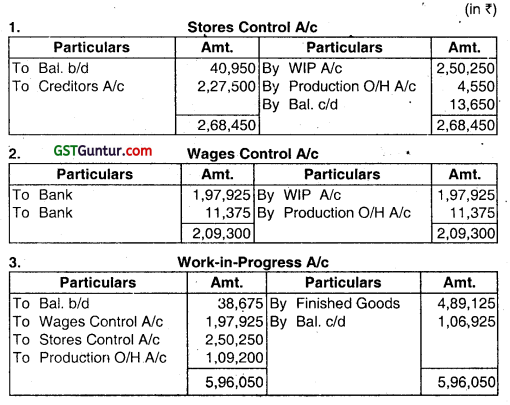

Question 3.

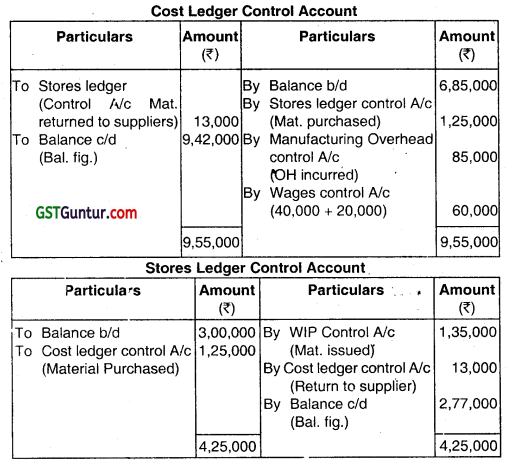

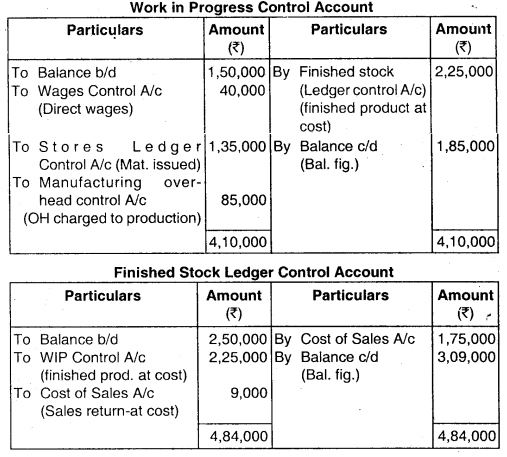

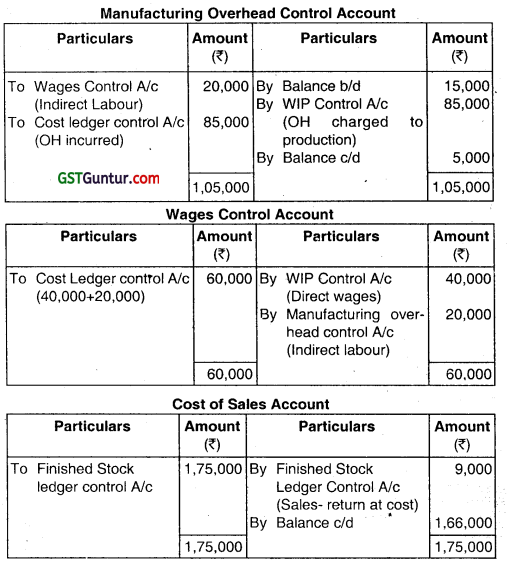

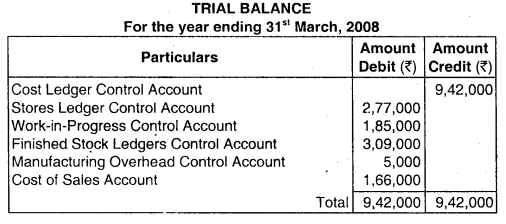

As of 31st March, 2008, the following balances existed in a firms cost ledger, which is maintained separately on a double entry basis:

You are required to prepare the Cost Ledger Control A/c, Stores Ledger ControlA/c, Work-in-progress Control A/c, Finished Stock Ledger Control A/c, Manufacturing Overhead Control A/c, Wages Control A/c, Cost of Sales A/c and the Trial Balance at the end of the quarter. (Nov 2008, 15 marks)

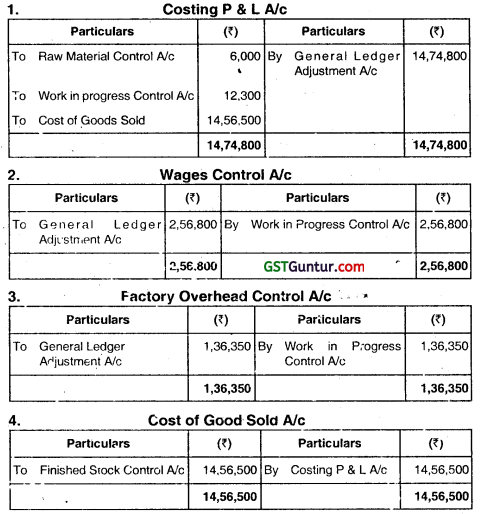

Answer:

![]()

![]()

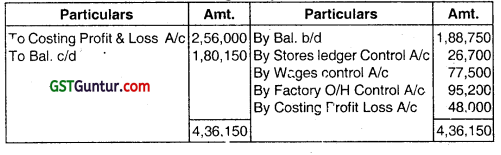

Question 4.

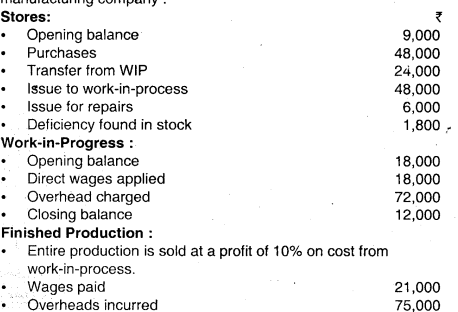

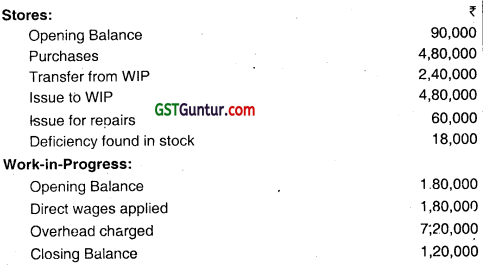

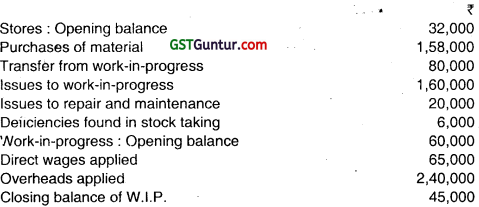

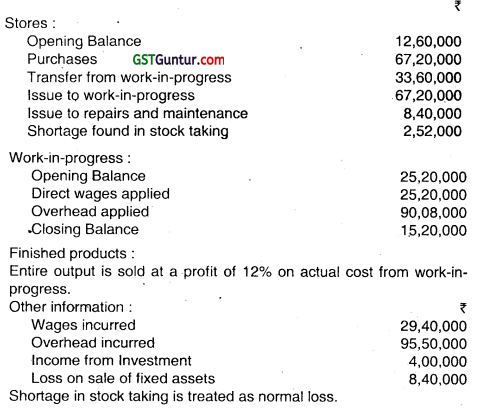

The following information have been extracted from the cost records of a manufacturing company:

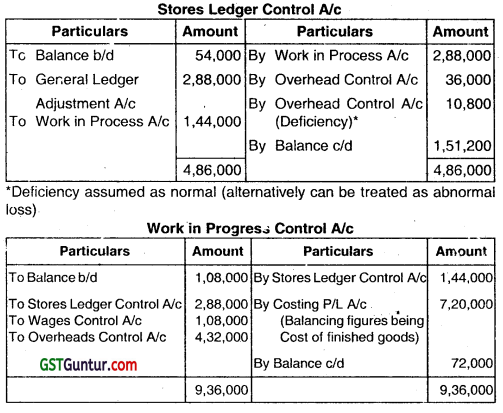

Draw the Stores Ledger Control A/c, Work-in-Progress Control A/c, Overheads Control A/c and Costing Profit and Loss A/c. (Nov 2011, 8 marks)

Answer:

Stores Ledger Control A/c

Note: 1. Deficeincy is assumed to be normal.

![]()

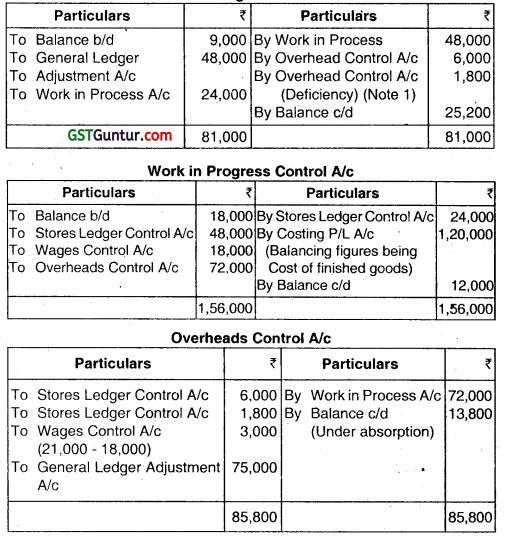

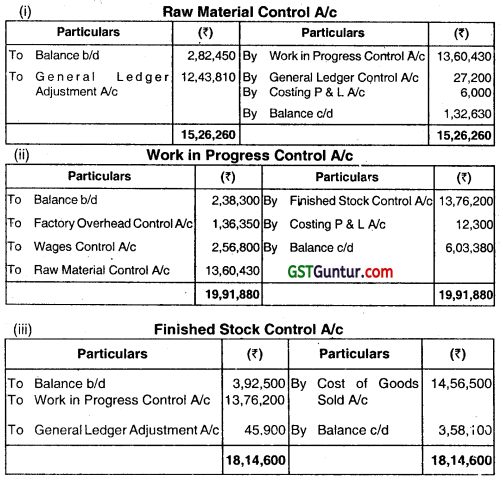

Question 5.

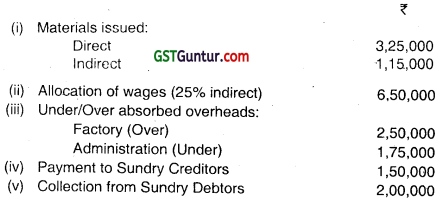

Following information have been extracted from the cost records of XYZ Pvt. Ltd.:

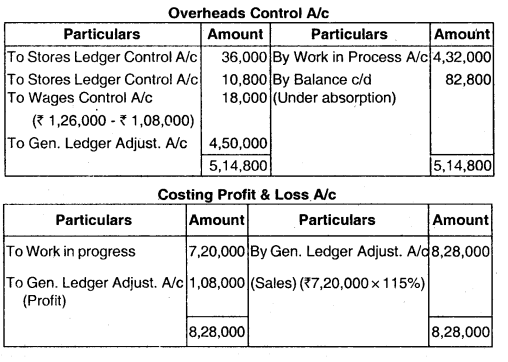

Draw the Stores Ledger Control Account, Work-in-Progress Control Account, Overheads Control Account and Costing Profit and Loss Account. (Nov 2014, 8 marks)

Answer:

![]()

Question 6.

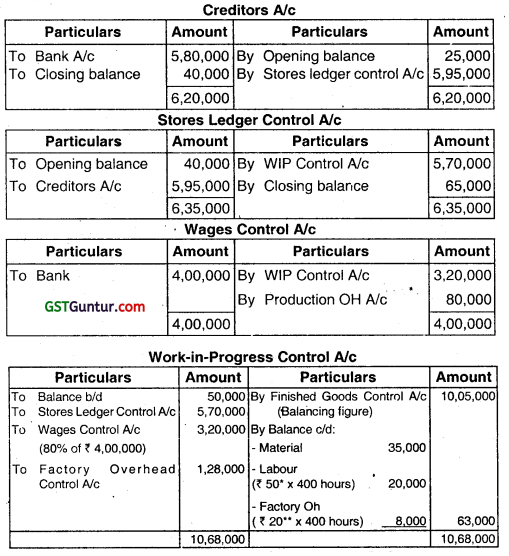

The following information is available from a company’s records for March, 2016:

(a) Opening Balance of Creditors Account – ₹ 2,5,000

(b) Closing Balance of Creditors Account – ₹ 40,000

(c) Payment made to Creditors – ₹ 5,80,000

(d) Opening Balance of Stores Ledger Control Account – ₹ 40,000

(e) Closing Balance of Stores Ledger Control Account – ₹ 65,000

(f) Wages paid (for 8000 hours) 20% relate to indirect worker – ₹ 4,00,000

(g) Various indirect expenses incurred – ₹ 60,000

(h) Opening balance of WIP control account – ₹ 50,000

(i) Inventory of WIP at the end of the month includes materia1 worth ₹ 35,000 on which 400 labour hours have been booked.

(j) Factory overhead is charged to production at budgeted rate based on direct labour hours.

(k) Budgeted overhead cost is 20,80,000 for budgeted direct labour hours of 1,04,000.

You are required to prepare Creditors A/c, Stores Ledger Control A/c, WIP Control A/c. Wages Control A/c and Factory Overhead Control A/c. (May 2016, 8 marks)

Answer:

Ledgers Accounts:

* Direct Labour Hour Rate = ₹ 3,20,000/6,400 hours = ₹ 50

** Factory Overhead Rate = ₹ 20,80,000/1,04,000 = ₹ 20

![]()

Question 7.

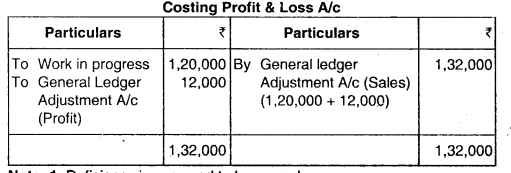

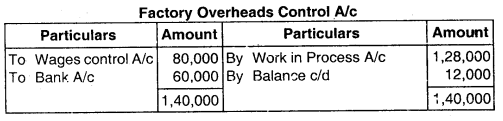

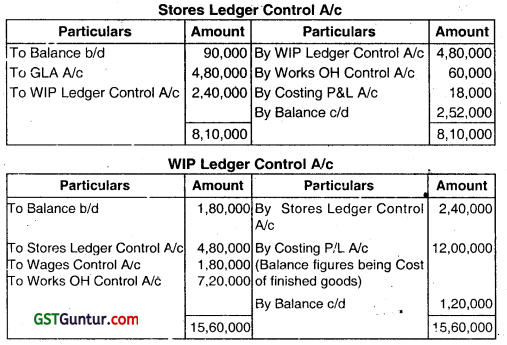

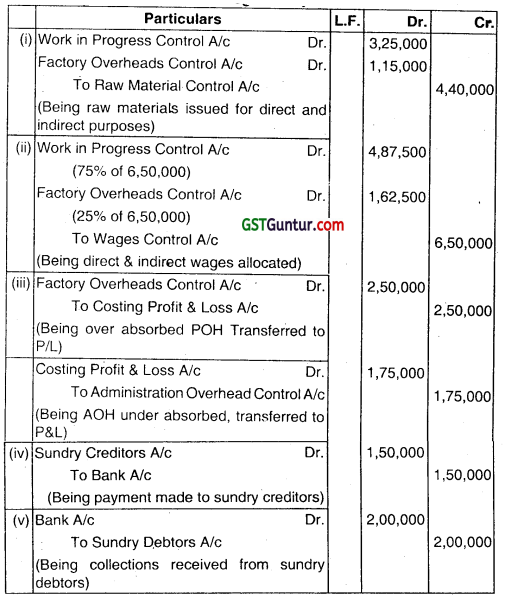

The following information have been extracted from the cost records of JKL Manufacturing Company LW:

Finished Production:

Entire production is sold at a profit of 10% on —-

cost from work-in-progress

Wages Paid 2,10,000

Overhead Incurred 7,50,000

Prepare Stores Ledger Control A/c., Work-in-Progress Control A/c.,

Overheads Control A/c and Costing Profit & Loss A/c. (May 2017, 8 marks)

Answer:

![]()

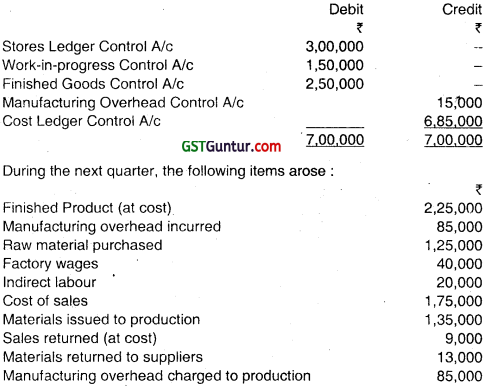

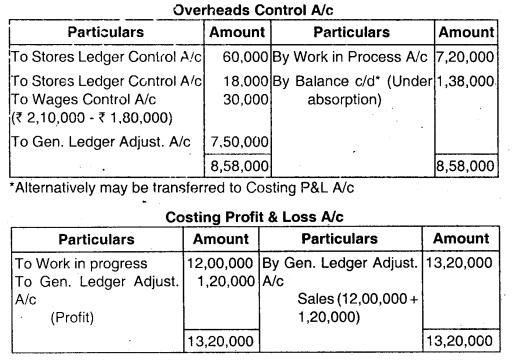

Question 8.

The following balances were extracted from a Company’s ledger as on 30th June 2018:

| Particulars | Debit (₹) | Credit (₹) |

| Raw material control a/c | 2,82,450 | |

| Work-in-progress control a/c | 2,38,300 | |

| Finished stock control a/c | 3,92,500 | |

| General ledger adjustment a/c | 9,13,250 | |

| Total | 9, 13,250 | 1,13,250 |

The following transactions took place during the quarter ended 30th September, 2018:

| ₹ | |

| (i) Factory overheads – allocated to work-in-progress | 1,36,350 |

| (ii) Goods finished – at cost | 13,76,200 |

| (iii) Raw materials purchased | 12,43,810 |

| (iv) Direct wages – allocated to work-in-progress | 2,56,800 |

| (v) Cost of goods sold | 14,56,500 |

| (vi) Raw materials – issued to production | 13,60,430 |

| (vii) Raw materials – credited by suppliers | 27,200 |

| (viii) Raw materials losses – inventory audit | 6,000 |

| (ix) Work-in-progress rejected (with no scrap value) | 12,300 |

| (x) Customer’s returns (at cost) of finished goods | 45,900 |

![]()

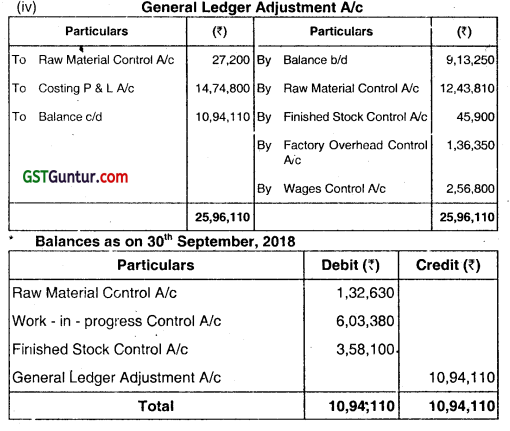

You are required to prepare:

(i) Raw material control a/c

(ii) WorI-in-progress control a/c

(iii) Finished stock control a/c

(iv) General ledger adjustment a/c (Nov 2018, 10 marks)

Answer:

Working Notes:

![]()

Question 9.

Answer the following:

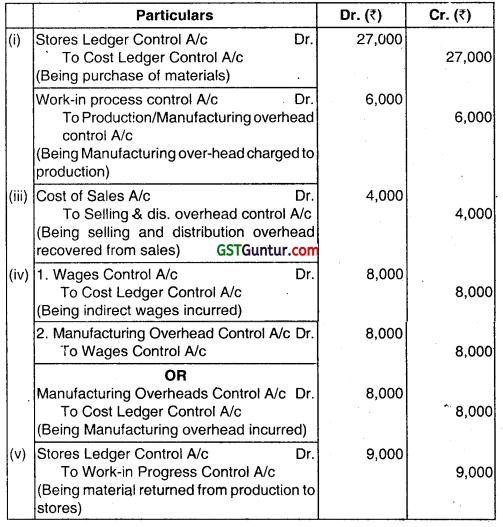

Jourrialise the following transactions in cost books under Non Integrated system of Accounting.

(i) Credit Purchase of Material ₹ 27,000

(ii) Manufacturing overhead charged to Production ₹ 6,000

(iii) Selling and Distribution overheads recovered from Sales ₹ 4000

(iv) Indirect wages incurred ₹ 8,000

(v) Material returned from production to stores ₹ 9000 (Nov 2019, 5 marks)

Answer:

Journal Entries

*Cost Ledger Control A/c is also known as General Ledger Control A/c

![]()

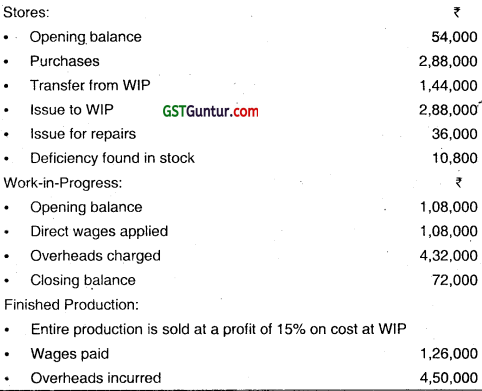

Question 10.

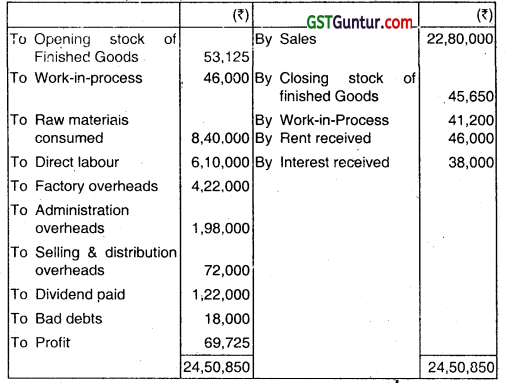

The financial books of a company reveal the following data for the year ended 31st March, 2018:

| Opening Stock: | (₹) |

| Finished goods 625 units | 53,125 |

| Work-in-process | 46,000 |

| 01.04.2017 to 31.03.2018 | |

| Raw materials consumed | 8,40,000 |

| Direct Labour | 6,10,000 |

| Factory overheads | 4,22,000 |

| Administration overheads (Production related) | 1,98,000 |

| Dividend paid | 1,22,000 |

| Bad Debts | 18,000 |

| Selling and Distribution Overheads | 72,000 |

| Interest received | 38,000 |

| Rent received ‘ | 46,000 |

| Sales 12,615 units | 22,80,000 |

| Closing Stock: Finished goods 415 units. | 45,650 |

| Work-in-process | 41,200 |

![]()

The cost records provide as under:

- Factory overheads are absorbed at 70% of direct wages.

- Administration overheads are recovered at 15% of factory cost.

- Selling and distribution overheads are charged at ₹ 3 per unit sold.

- Opening Stock of finished goods is valued ₹ 120 per unit.

- The company e work-in-process at factory cost for both Financial and Cost Profit Reporting.

Required:

(i) PREPARE a statements for the year ended 31st March, 2018. Show

- the profit as per financial records

- the profit as per costing records.

(ii) PREPARE a statement reconciling the profit as per costing records with the profit a per Financial Records.

Answer:

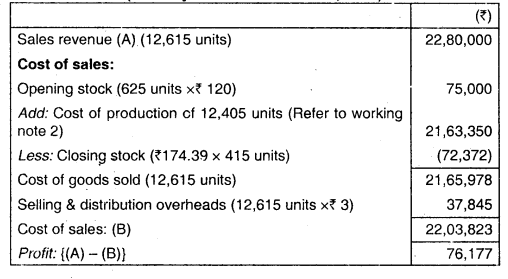

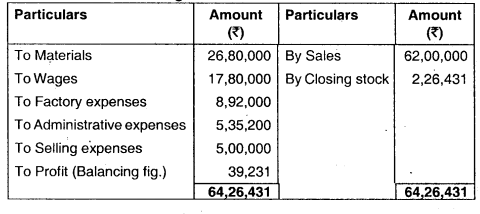

(i) Statement of Profit as per Financial records (for the year ended 31st March, 2018)

Statement of Profit as per Costing records (for the year ended 31st March, 2018)

![]()

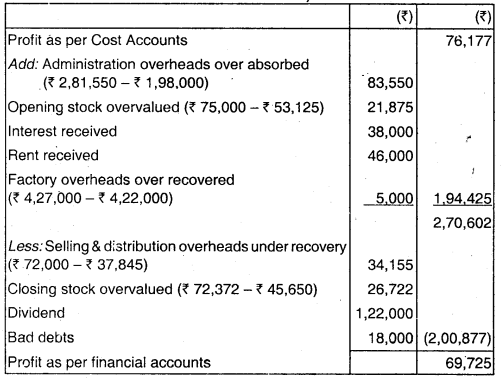

(ii) Statement of Reconciliation

(Reconciling the profit as per costing records with the profit as per financial records)

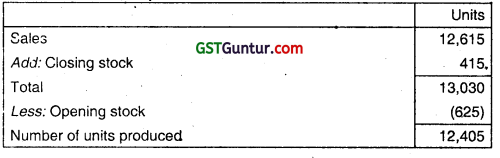

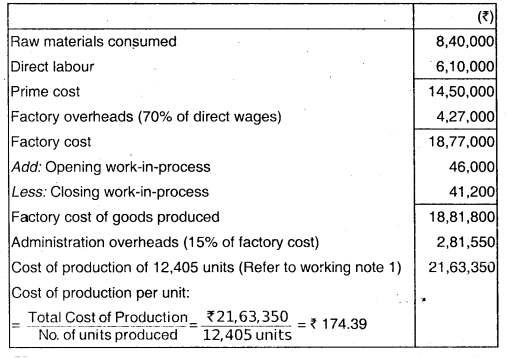

Working Notes:

1. Number of units produced

2. Cost Sheet

![]()

Question 11.

State the essential pre-requisites of Integrated Accouning System. (Nov 2001, Nov 2007, 6, 3 marks)

Answer:

The success of an integrated system of accounting dependi’ upon certain pre-requisities which should be ensured before the system is introduced.

These are:

- Deciding the extent of integration of the two sets of books. Some companies find it useful to integrate upto the stage of primary cost or factory cost while others prefer an integration of the entire accounting records.

- A suitable coding system must be developed to serve the purpose of both financial and cost accounts.

- To lay down the procedure for the treatment of provision for accruals prepaid expenses, other adjustments necessary preparing interim accounts.

- Perfect coordination should exist between the staff responsible for financial aspects and cost aspects of the accounts. An efficient processing of accounting documents is to be ensured.

- Under this system there is no need for a separate cost ledger of cause, there will be a number of subsidiary ledgers; in addition to the useful customers ledgers and the bought Ledgers, there will be:

(a) Stores ledger

(b) Stock iedger and,

(c) Job ledger.

![]()

Question 12.

What are the advantages of integrated accounting? (May 2002, May 2010, 4, 2 marKs)

OR

Answer the following;

State benefits of Integrated Accounting. (May 2015, 4 marks)

OR

Explain integrated accounting system and stat2 its advantages. (May 2019, 5 marks)

Answer:

CIMA defines that “Integrated accounting system refers to the interlocking of the Financial & Cost Accounting system to ensure all relevant expenditure is absorbed into the Cost accounts. Under this system transactions are classified both according to their production and nature.”

Under integrated accounting system, both financial and cost accounting records are maintained in one set of books to meet the requirements of financial accounting and cost accounting purposes. In other words, it can be said that cost accounting is integrated into the financial accounting system. Advantages: The main advantages of Integrated Accounts are as follows:

- Economical process: It is economical also as it is based on the concept of “Centralisation of Accounting function.”

- Less Time consuming: No delay is caused in obtaining information as it is provided from books of original entry.

- No need for Reconciliation: The question of reconciling costing profit and financial profit does not arise, as there is one figure of profit only.

- Less efforts: Due to use of one set of books, there is a significant extent of saving in efforts made. Efforts in duplicate recording erf entries and to maintain separate set of books are saved. Thus, there is saving of time and labour.

- Complete details available: Complete details of all receipts and payments in cash and complete details of all assets and liabilities are kept and this system does not use notional account to represent impersonal accounts.

- No delay: Costing data are available from books of original entry and hence, no delay is caused in obtaining information.

- Complete analysis: Complete analysis of cost and sales is kept. Since financial books are subject to a rigorous accuracy, checking integrated accounts ensures similar checks for cost account.

![]()

Question 13.

Explain what are the pre-requisites of integrated accounting. (Nov 2020, 5 marks)

Question 14.

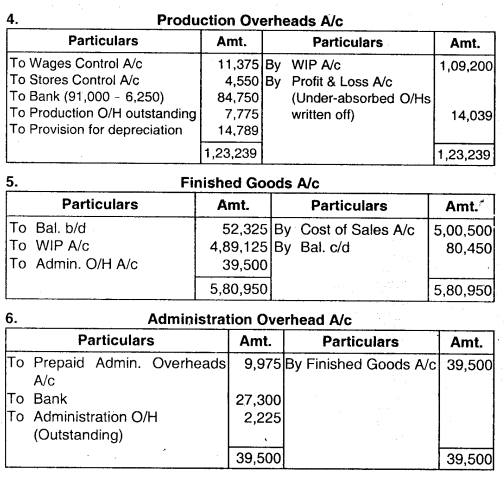

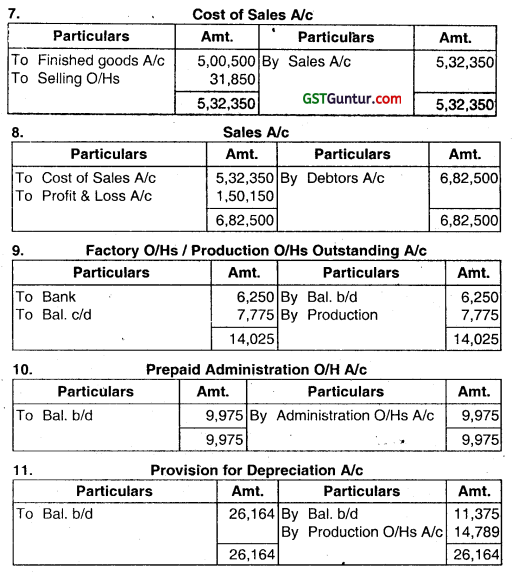

BPR Limited keeps books on integrated accounting system. The following balances appear in the books as on April 1, 2002:

Required:

Write up accounts in the integrated ledger of BPR Limited and prepare a Trial Balance. (Nov 2003, 10 marks)

Answer:

![]()

![]()

![]()

Question 15.

Journalise the following transactions assuming cost and financial accounts are integrated: (Nov 2013, 5 marks)

Answer:

Journal Entries under Integrated System of Accounting

![]()

Question 16.

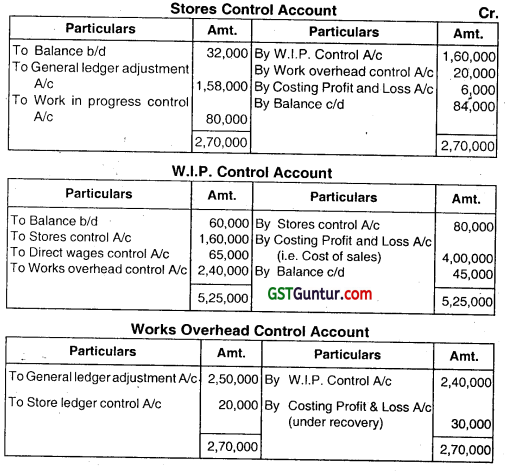

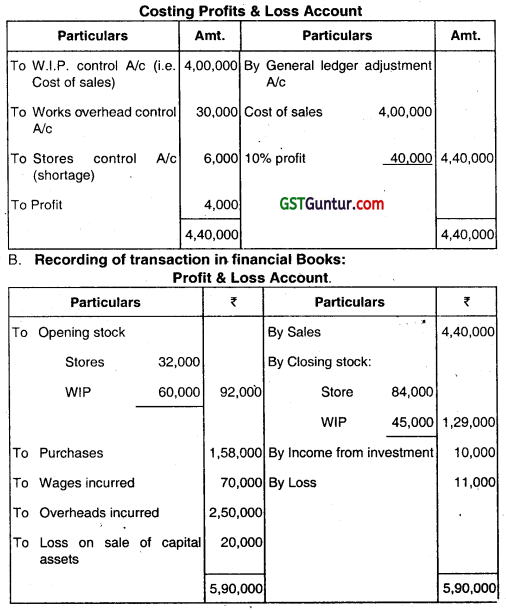

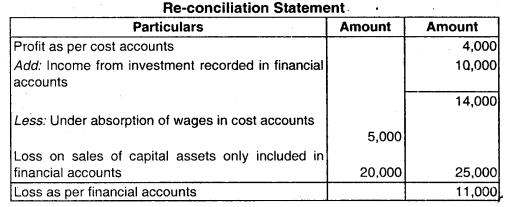

The following figures have been extracted from the cost records of a manufacturing unit:

Finish products: Entire output ¡s sold at a profit of 10% on actual cost from work-in-progress. Wages incurred ₹ 70,000, overhead incurred ₹ 2,50,000.

Items not included ¡n cost records: Income from investment ₹ 10,000, Loss on sale of capital assets ₹ 20,000.

Draw up Store Control account, Work-in-progress Control account, Costing Profit and Loss account, Prof it and Loss account and Reconciliation statement. (May 2005, 2+2+1+1+2=8 marks)

Answer:

A. Recording of transactions in costing books:

![]()

Question 17.

Discuss the reconciliation of Profits as per Cost Accounts and Financial Accounts. (May 2006, 6 marks)

OR

Enumerate the factors which cause difference in profits as shown in Financial Accounts and Cost Accounts. (May 2007, 3 marks)

Answer:

Problem of reconciliation arises where cost and financial accounts are maintained independent of each other. Reconciliation between the results of the two sets of books is necessary due to following reasons:

- To find out the reasons for the difference in the profit or loss in cost and financial accounts.

- To contribute to the standardisation of policies regarding stock valuation depreciation and overheads.

- To facilitate co-ordination and promote better co-operation between the activities of financial and cost sections of accounting department.

- To place management in better position to acquaint itself with the reasons for the variation of profit.

Reason for disagreement in profit : Following are the reasons of disagreement of profit between two sets of books:

- Item shown only in financial accounts.

- Purely financial charge.

- Appropriation of profit.

- Writing of intangible and fictitious assets.

- Purely financial income.

- Item shown only in cost accounts.

- Over or under absorption of overheads.

- Different basis of stock valuation.

- Different method of changing depreciation.

![]()

Question 18.

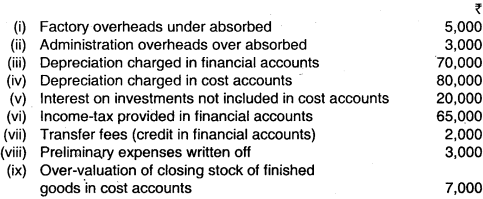

A manufacturing company has disclosed a net loss of ₹ 2,13,000 as per their cost accounting records for the year ended March 31, 2009. However, their financial accounting records disclosed a net loss of ₹ 2.58,000 for the same period. A scrutiny of data of both the sets of books of accounts revealed the following information:

Prepare a Memorandum Reconciliation Account. (May 2009, 7 marks)

Answer:

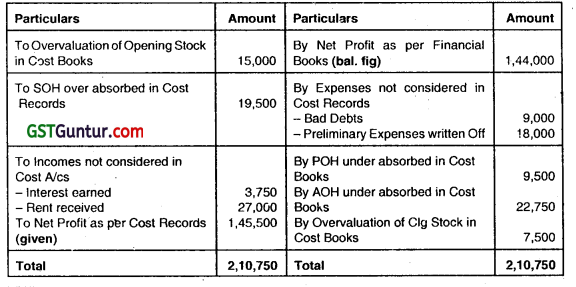

![]()

Question 19.

List the Financial expenses which are not included in cost. (Nov 2009, 2 marks)

Answer:

Financial expenses which are not Included ¡n cost accounting are as follows

- Preliminary expenses

- Underwriting Commission;

- Discount on issue of Share

- Income Tax

- Interest on debentures and deposit

- Bonus of Employee

- Pension

- Gratuity

![]()

Question 20.

When is the reconciliation statement of Cost and Financial accounts not required? (Nov 2009, 2 marks)

Answer:

Circumstances where reconciliation statement can be avoided is as follows:

When the Cost and Financial Accounts are integrated – there is no need to have a separate reconciliation statement between the two sets of accounts. Integration means that the same set of accounts fulfill the requirement of both i.e., Cost and Financial Accounts.

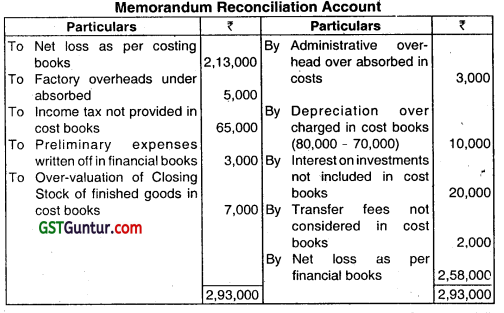

Question 21.

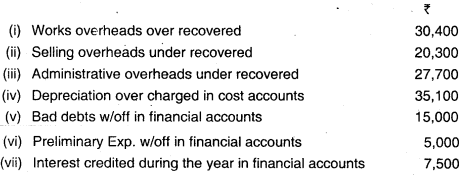

A manufacturing company has disclosed a net loss of ₹ 8.75,000 as per their cost accounting records for the year ended March 31,2010. However, their financial accounting records disclosed a net loss of ₹ 7,91,250 for the same period. A srutiny of the data of both the sets of books of accounts revealed the following information:

Required:

Prepare a Memorandum Reconciliation A/c. (Nov 2010, 8 marks)

Answer:

Memorandum Reconciliation Account

![]()

Question 22.

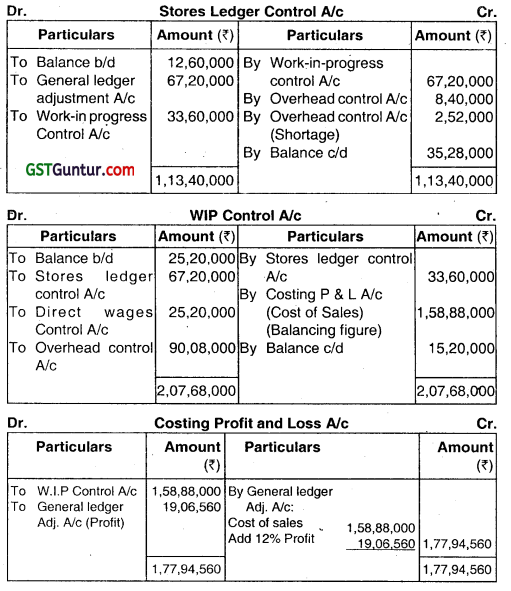

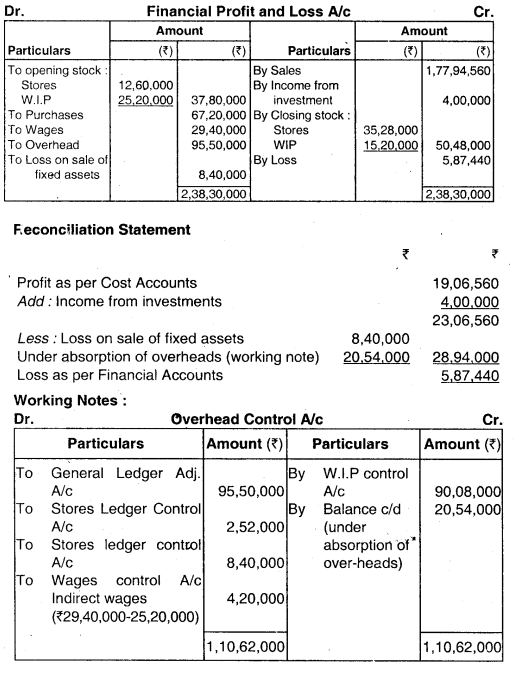

You are given the following information of the cost department of a manufacturing company:

You are required to prepare:

(i) Stores control account;

(ii) Work-in-progress control account;

(iii) Costing Profit and Loss account;

(iv) Profit and Loss account and

(v) Reconciliation statement (May 2011, 12 marks)

Answer:

![]()

![]()

Question 23.

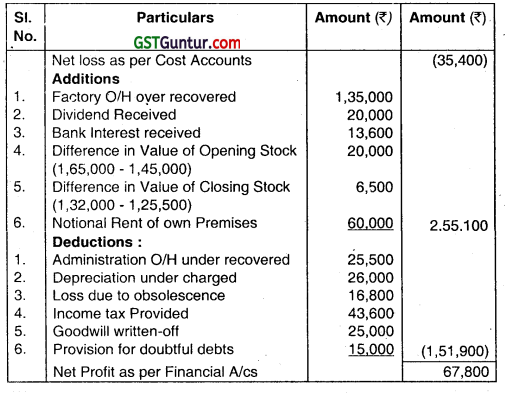

R Limited showed a net loss of ₹ 35,400 as per their cost accounts for the year ended 31st March, 2012. However, the financial accounts disclosed a net profit of ₹ 67,800 for the same period. The following information were revealed as a result of scrutiny of the figures of cost accounts and financial accounts:

Prepare a reconciliation statement by taking costing net loss as base. (Nov 2012, 8 marks)

Answer:

Statement of Reconciliation

![]()

Question 24.

Answer the following:

“Is reconciliation of cost accounts and financial accounts necessary in case of integrated accounting system?” (May 2013, 4 marks)

Answer:

Under integrated accounting system cost and financial accounts are kept in the same set of books. Such a system will hive to afford full information required for Costing as well as for Financial Accounts.

In other way we can say, information and data should be recorded in such a way so as to enable the firm to ascertain the cost (together with the necessary analysis) of each product, job, process, operation or any other identifiable activity. It also ensures the ascertainment of marginal cost, variances, abnormal losses and gains. In fact all information that management requires from a system of Costing for doing its work properly is made available.

The integrated accounts give full information in such a manner so that the profit and loss account and the balance sheet can be prepared according to the requirements of law and the management maintains full control over the liabilities and assets of its business.

Since, only one set of books is kept for both cost accounting and financial accounting purpose so there is no necessity of reconciliation of cost and financial accounts.

![]()

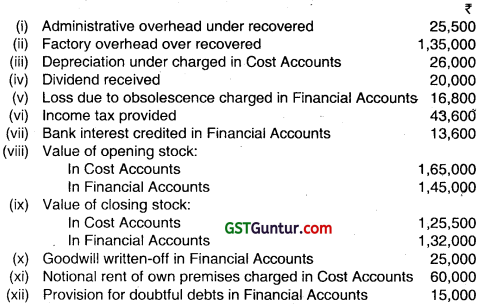

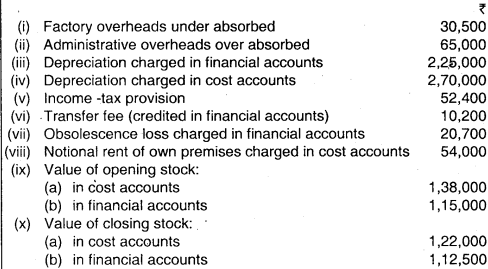

Question 25.

A manufacturing company has disclosed net loss of ₹ 48,700 as per their cost accounting records for the year ended 31st March, 2014. However their financial accounting records disclosed net profit of ₹ 35,400 for the same period. A scrutiny of data of both the sets of books of accounts revealed the following informations:

Prepare a Memorandum Reconciliation Account by taking costing loss as base. (May 2014, 5 marks)

Answer:

Memorandum Reconciliation Account

* Overvaluation of Opening Stock as per Cost Accounts

= Value in Cost Accounts – Value in Financial Accounts

= ₹ 1,38,000 – ₹ 1,15,000 = ₹ 23,000.

**Overvaluation of Closing Stock as per Cost Accounts

Value in Cost Accounts – Value in Financial Accounts

= ₹ 1,22000 – ₹ 1,12,500 = ₹ 9,500.

![]()

Question 26.

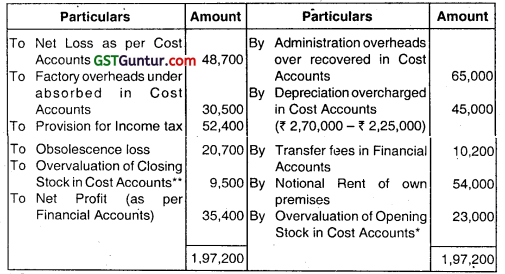

The Trading and Profit and Loss Account of a company for the year ended 31-03-2016 is as under:

Trading and Profit and Loss Account

In the Cost Accounts:

(i) Factory expenses have been allocated to production at 20% of Prime Cost.

(ii) Administrative expenses absorbed at 10% of factory cost.

(iii) Selling expenses charged at 10 per unit sold.

Prepare the Costing Profit and Loss Account of the company and reconcile the Profit/Loss with the profit as shown in the Financial Accounts. (Nov 2016, 8 marks)

Answer:

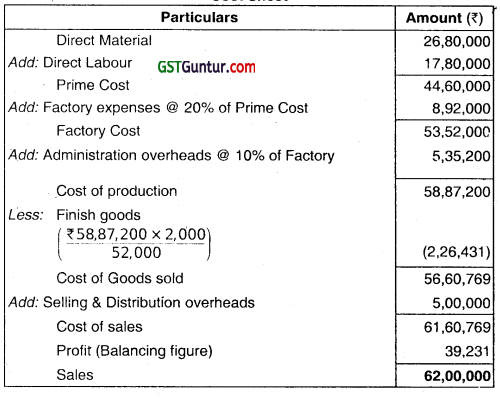

Cost Sheet

![]()

Statement of Reconciliation of Profit/Loss

Costing Profit and Loss Account

![]()

Question 27.

What are the motivational factors for adopting a reconciliation process? Explain. (Nov 2017, 4 marks)

Answer:

When the cost and financial accounts are kept separately, it is imperative that these should be reconciled, otherwise the cost accounts would not be reliable. The reconciliaton of two set of accounts can be made, if both the sets contain sufficient de:ail as would enable the causes of differences to be located. It is therefore, important that in the financial accounts, the expenses should be analysed In the same way as in cost accounts.

Motivation for reconciliation is:

- To ensure reliability of cost data

- To ensure ascertainment of correct product cost

- To ensure correct decision making by the management based on Cost and Financial data.

![]()

Question 28.

Answer the following:

GK Ltd. showed net loss of ₹ 2,43,300 as per their financial accounts for the year ended 31st March, 2018. However, cost accounts disclosed net loss of ₹ 2,48,300 for the same period. On scrutinizing both the set of books of accounts, the following information were revealed:

Prepare a reconciliation statement reconciling losses shown by financial and cost accounts by taking costing net loss as base. (May 2018, 5 marks)

Answer:

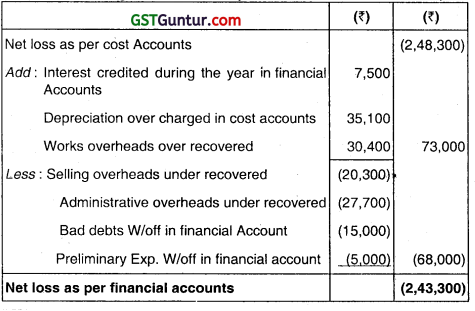

Reconciliation Statement

(Reconciliating losses shown by financial and Cost Accounts)

![]()

Question 29.

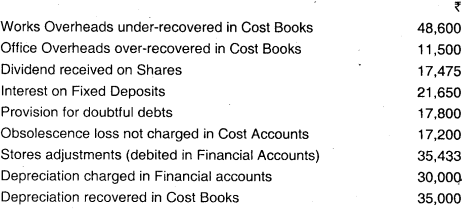

M/s. Abid Private Limited disclosed a net profit of ₹ 48,408 as per cost books for the year ending 31st March 2019. However, financial accounts disclosed net loss of ₹ 15,000 for the same period, On scrutinizing both the set of books of accounts, the following information was revealed:

Prepare a Memorandum Reconciliation Account. (May 2019, 5 marks)

Answer:

Memorandum Reconciliation Accounts

![]()

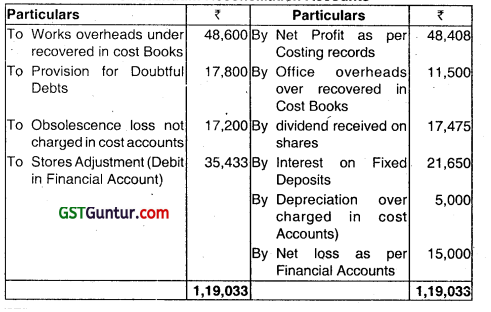

Question 30.

Answer:

Memorandum Reconciliation Accounts

![]()

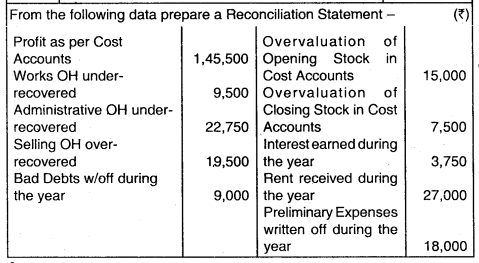

Question 31.

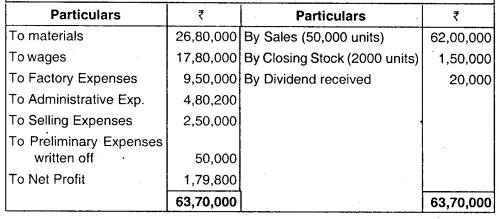

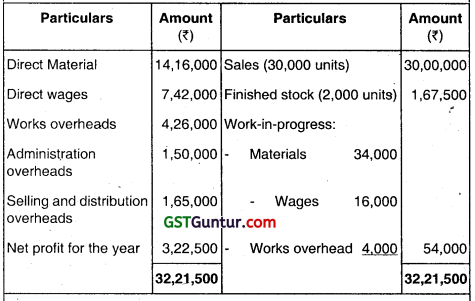

The following is the summarised Trading and Profit and Loss Account of XYZ Ltd. for the year ended 31st March. 2019:

The company’s cost records show that in course of manufacturing a standard unit (i) works overheads have been charged @ 20% on prime cost, (ii) administration overheads are related with production activities and are recovered at ₹ 5 per finished unit, and (iii) selling and distribution overheads are recovered at ₹ 6 per unit sold.

You are required to PREPARE:

(i) Costing Profit and Loss Account Indicating the not profits,

(ii) A Statement showing reconciliation between profit as disclosed by the Cost Accounts and Financial Accounts.

Answer:

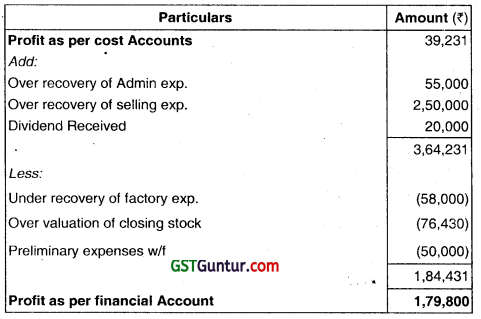

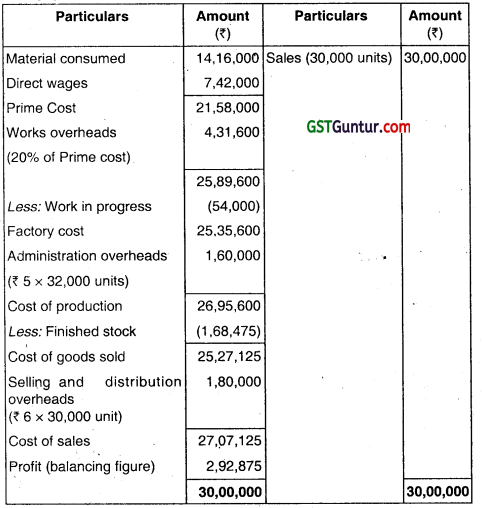

(i) Costing Profit and Loss Account for the year ended 31st March 2019:

![]()

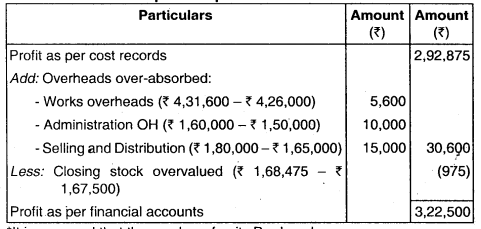

(ii) Statement reconciling the profit as per costing profit account with the profit as per financial accounts

* It is assumed that the number of units Produced

= Number of units sold + Finished stock

= 30,000 + 2,000 = 32,000 units.