Redemption of Preference Shares – CA Inter Accounts Question Bank is designed strictly as per the latest syllabus and exam pattern.

Redemption of Preference Shares – CA Inter Accounts Question Bank

Question .1

What are the conditions which must be fulfilled for redemption of preference shares? (June 2011, 6 marks)

Answer:

As per Sec. 55 of the Companies Act, 2013 the condtions which must be fulfilled for redemption of preference shares are as follows:

1. Such shares must be fully paid up.

2. Such shares shall be redeemed only out of profits or out of the proceeds of a fresh Issue of shares made for the purpose of redemption.

3. ln case the company proposes redemption of shares out of the profits of the company, there shall, out of such profits, be transferred, a sum equal to the nominal amount of the shares to be redeemed, to a reserve, to be called the Capital Redemption Reserve Account, and the provisions of this Act relating to reduction of share capital of a company shall, except as provided in this section, apply as if the Capital Redemption Reserve Account were paid-up share capital of the company. The capital redemption reserve account may be applied by the company, in paying up unissued shares of the company to be issued to members of the company as fully paid bonus shares.

4. Certain class of companies as may be prescribed and whose financial statements comply with the accounting standards prescribed under Section 133, for such class of companies, the premium if any, payable on redemption shall b provided for out of the profits of the company. before the shares are! redeemed. For other companies the premium if any, payable on redemption shall be provided for out of the profits of the company or out of the company’s securities premium account, before such shares are redeemed.

5. No company limited by shares shall after the commencement of the companies issue any preference shares which is irredeemable or is redeemable after the expiry of a period of twenty years from the date of issue.

Question 2.

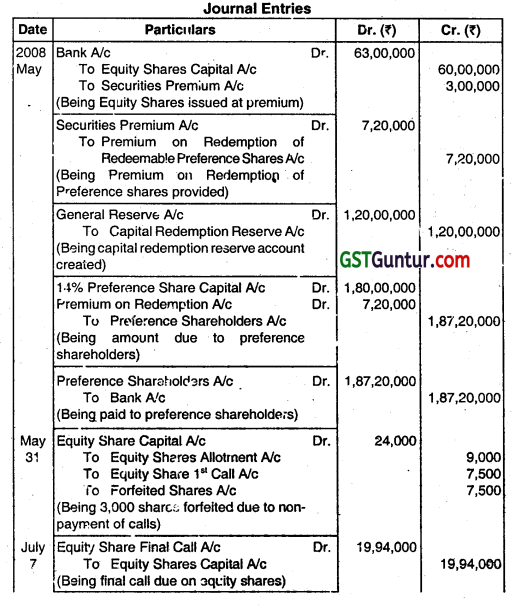

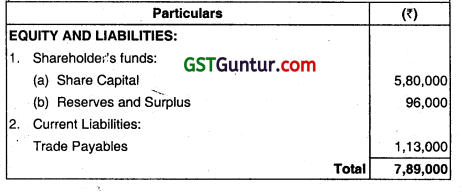

Jolly Ltd. has the following balance sheet as on 31st March 2008: (June 2009, 6 marks)

The preference shares are to be redeemed at 10% premium. Fresh issue of equity shares is to be made to the extent it is required under the Companies Act, 2013 for the purpose of this redemption. The shortfall in funds for the purpose of the redemption after utilising the proceeds of the fresh issue are to be met by taking a bank loan. Show journal entries.

Answer:

![]()

Question 3.

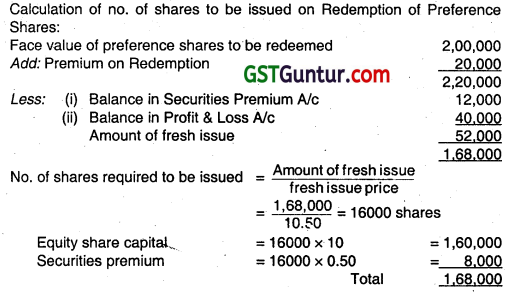

Extract of ledger balances of Kalpana Ltd. as on 31st March 2015 includes the following:

2,000, 12% Preference shares of 100 each, fully paid ₹ 2,00,000

Surplus ₹40,000

Securities premium ₹12,000

Under the terms of issue, the preference shares are redeemable on 31st March 2015 at a premium of 10%. The directors desire to make a minimum fresh issue of equity shares of 10 each at a premium of 5% for redemption purpose. You are required to ascertain the amount of fresh issues to be made and pass necessary journal entries in the books of the company. (June 2016, 5 marks)

Answer:

Question 4.

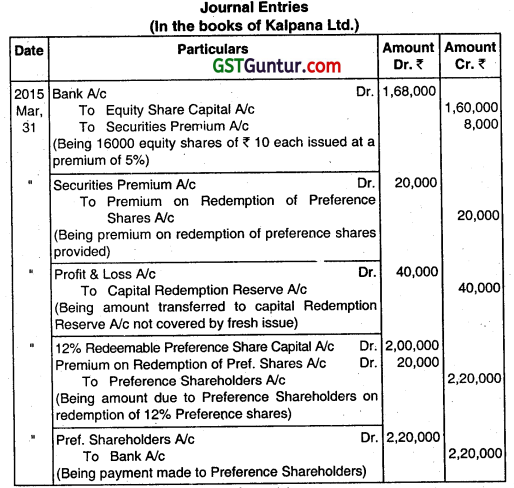

Dheeraj Limited had 5,000 10% Redeemable Preference Shares of ₹ 100 each, fully paid up. The company had to redeem these shares at a premium of 10%.

It was decided by the company to issue the following:

(i) 40.000 Equity Shares of ₹10 each at par

(ii) 2,000 12% Debentures of ₹ 100 each.

The issue was fully subscribed and all accounts were received in full. The payment was duly made. The company had sufficient profits. Show journal entries in the books of the company. (May 2018, 10 marks)

Answer:

Working Note:

1. Amount to be transferred to Capital Redemption Reserve Account

Question 5.

Answer of the following:

Explain the conditions when a company should issue new equity shares for redemption of the preference shares. Also, discuss the advantages and disadvantages of redemption of preference shares by issue of equity shares. (Nov 2018, 5 marks)

Answer:

A company may prefer Issue of new equity shares on the basis of following conditions:

- When the company realises that the capital is needed permanently and it makes more sense to issue equity shares in place of Redeemable Preference Shares which carry a fixed rate of dividend.

- When the balance of profit, which would otherwise be available for dividend, is insufficient.

- When the liquidity position of the company Is not good enough.

Advantages of redemption of preference shares by issue of fresh equity shares:

- No cash outflow of money is required now or later.

- New equity shares may be valued at a premium

- Shareholders retain their equity interest.

Disadvantages of redemption of preference shares by issue of tresh equity shares:

- There will be dilution on future earnings:

- Share-holding In the company is changed.

![]()

Question 6.

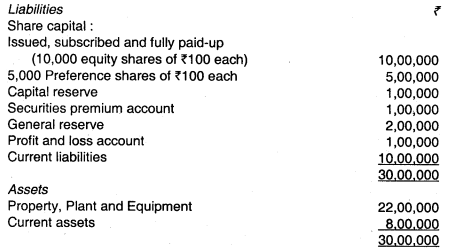

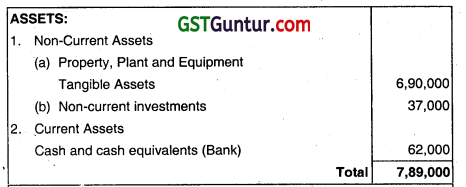

The Summarized Balance Sheet of Clean Ltd. as on 31 March 2019 is as follows:

The Share Capital of the company consists of ₹ 50 each Equity shares of ₹ 4,50,000 and ₹ 100 each 8% Redeemable Preterence Shares of ₹ 1.30,000 (issued on 1.4.2017)

Reserves and Surplus comprise statements of profit and loss only. In order to facilitate the redemption of preference shares at a premium of 10%, the Company decided:

(a) to sell all the investments for ₹ 30,000.

(b) to finance part of redemption from company funds, subject to, leaving a Bank balance of ₹ 24,000.

(C) to issue minimum equity share of ₹ 50 each at a premium of ₹ 10 per share to raise the balance of funds required.

You are required to

1. Pass Journal Entries to record the above train stations.

2. Prepare Balance Sheet upon completion of the above transactions. (May 2019, 10 marks)

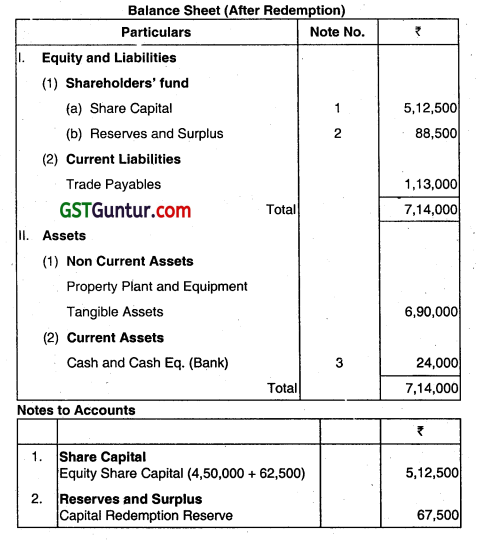

Answer:

Working Note:

1. Calculation of Number of Shares:

Question 6.

The Books of Arpit Ltd. shows the following Balances as on 31 December 2019:

| Amount (₹) | |

| 600,000 Equity shares of ₹ 10 each fully paid up | 60,00,000 |

| 30,000, 10% Preference shares of ₹ 100 each, ₹ 80 paid tip | 24,00,000 |

| Securities Premium | 6,00,000 |

| Capital Redemption Reserve | 18,00,000 |

| General Reserve | 35,00,000 |

Under the terms of issue, the Preference Shares are redeemable on 31 March 2020 at a premium of 10%. In order to finance the redemption, the Board of Directors decided to make a fresh issue of 1,50,000 Equity shares of ₹ 10 each at a premium of 20%. ₹ 2 being payable on application, ₹ 7 (Including premium) on allotment and the balance on 1 January 2021. The issue was fully subscribed and allotment made on March 2020. The money due on allotment was received by 20th March 2020.

The preference shares were redeemed after fulfilling the necessary conditions of Section 55 of the Companies Act, 2013. You are required to pass the necessary Journal Entries and also show how the relevant items will appear in the Balance Sheet of the company after the redemption carried out on 31st March 2020. (Nov 2020, 12 marks)

Question 7.

The Capital structure of a company BK Ltd. consists of 30,000 Equity Shares of ₹10 each fully paid up and 2,000 9% Redeemable Preference Shares of ₹ 100 each fully paid up as on 31.03.2020. The other particulars as at 31.03.2020 are as follows:

| Amount (₹) | |

| General Reserve | 1,20,000 |

| Profit & Loss Account | 60,000 |

| Investment Allowance Reserve (not free for- distribution as dividend) | 15,000 |

| Cash at bank | 1,95,000 |

Preference Shares are to b redeemed at a premium of 10%. For the purpose of redemption. the directors are empowered to make fresh issue of Equity Shares at par after utilizing the undistributed reserve & surplus. subject to the conditions that a sum of 40,000 shall be retained in General Reserve and which should not be utilized.

Company also sold investment of 4500 Equity Shares In G Ltd., costing ₹ 45,000 at 9 per share. Pass Journal entries to give effect to the above arrangements and also show how the relevant items will appear In the Balance Sheet as at 31.03.2020 of BK Ltd., after the redemption carried out. (Jan 2021, 12 marks)

Question 8.

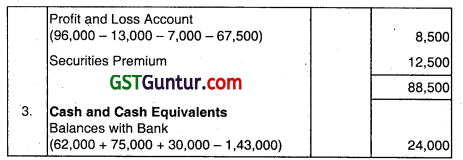

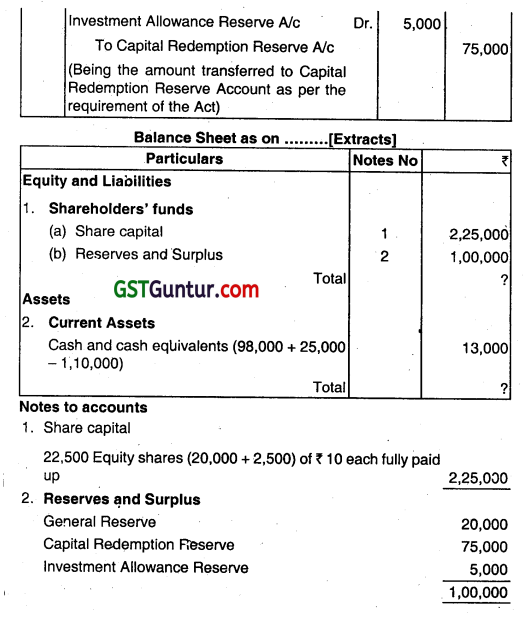

The capital structure of a AP Ltd. consists of 20.000 Equity Shares of 10 each fully paid up and 1.000 8% Redeemable Preference Shares of loo each fully paid up (issued On 1.4.2011). Undistributed reserve and surplus stood as: General Reserve 80,000; Profit and Loss Account 20,000; Investment Allowance Reserve out of which 5,000, (not free for distribution as dividend) 10,000; Cash at bank amounted to ₹ 98,000.

Preference shares are to be redeemed at a Premium of 10% and for the purpose of redemption, the directors are empowered to make fresh issue of Equity Shares at par after utilising the undistributed reserve and surplus, subject to the conditions that a sum of ₹ 20,000 shall be retained In general reserve and which should not be

utilised.

Pass Journal Entries to give effect to the above arrangements and also show how the relevant items will appear In the Balance Sheet of the company after the redemption carried out.

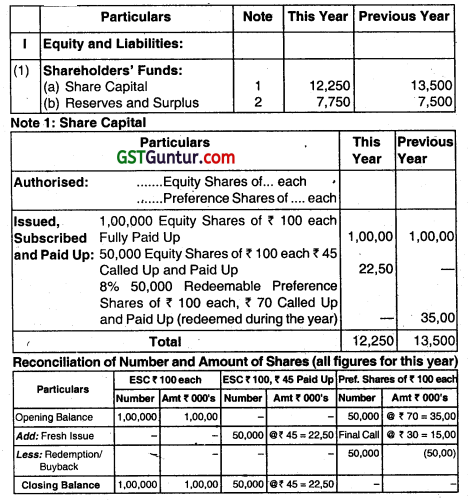

Answer:

Working Note:

No of Shares to be issued for redemption of Preference Shares:

Face value of shares redeemed ₹ 1,00,000

Less Profit available for distribution as dividend:

General Reserve: (80,000-20,000) ₹ 60,000

Profit and Loss (20,000 – 10,000 set aside for adjusting premium payable on redemption of preference shares) ₹ 10,000![]()

Therefore, no. of shares to be issued =25,000/₹ 10 = 2,500 shares.

![]()

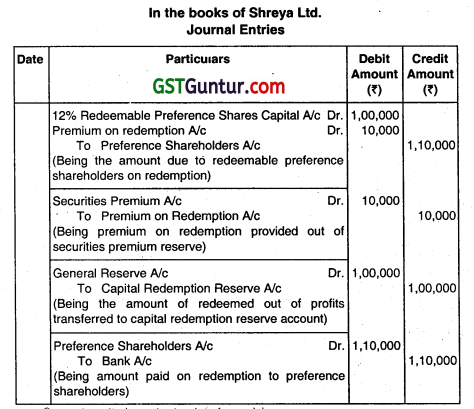

Question 9.

Shreya Ltd. had an issue of 1,000, 12% redeemable preference shares of ₹100 each, repayable at a premium of 10%. These shares are to be redeemed now Out 0f the accumulated reserves, which are more than the necessary sum required for redemption. Show the necessary entries in the books of the company, assuming that the premium on redemption of shares has to be written out against the company’s securities premium reserve account. (June 2013, 6 marks)

Answer:

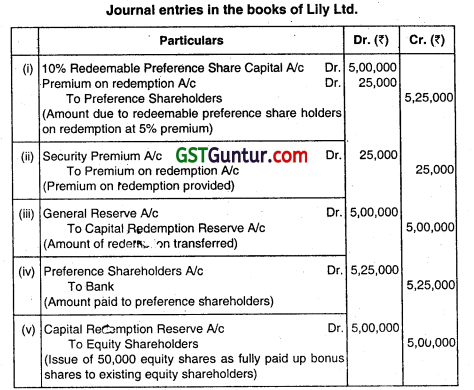

Question 10.

Lily Ltd.. having sufficient balance to the credit of general reserve and 1,00,000 balance in securities premium account, decides to:

Redeem 5,000, 10% redeemable preference shares of ₹ 100 each fully paid-up at a premium of 5%; and – Capital redemption reserve arising as a result of redemption be utilised in allotting the un-issued shares of the company as fully paid equity shares of 10 each by way of bonus to its members. Show journal entries for redemption of preference shares and issue of bonus shares (Dec 2016, 5 marks)

Answer:

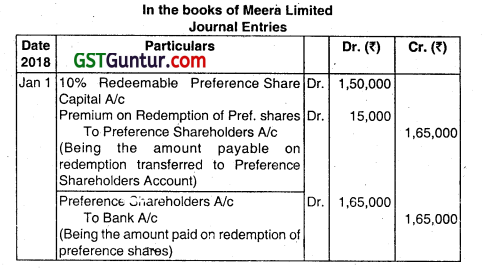

Question 11.

The following are the extracts from the Balance Sheet of Meera Ltd. as on 31st December 2017. Share capital: 60,000 Equity shares of ₹ 10 each fully paid – ₹ 6,00,000; 1,500 10% Redeemable preference shares of ₹ 100 each fully paid – ₹ 1,50,000.

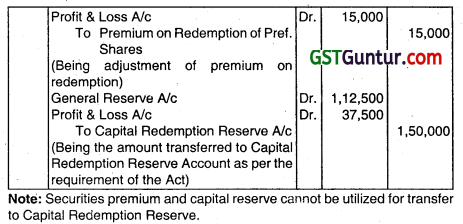

Reserve & Surplus: Capital reserve – 75,000; Securities premium – ₹ 75,000; General reserve – ₹ 1,12,500; Profit and Loss Account – ₹ 62,500 On 1st January 2018, the Board of Directors decided to redeem the preference shares at premium of 10% by utilisation of reserve. You are required to prepare necessary Journal Entries including cash transactions in the books of the company.

Answer:

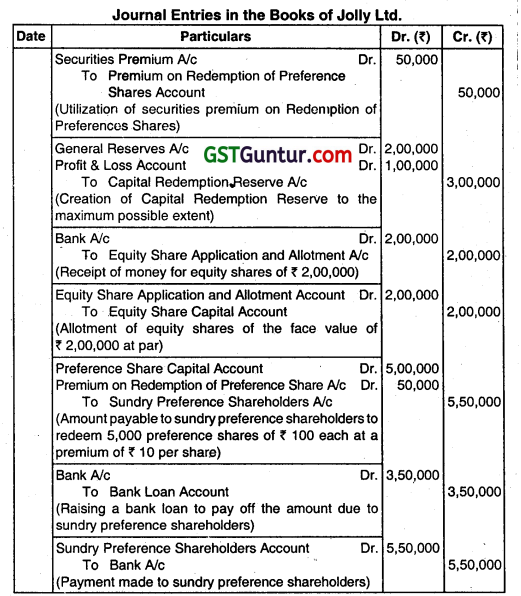

Question 11.

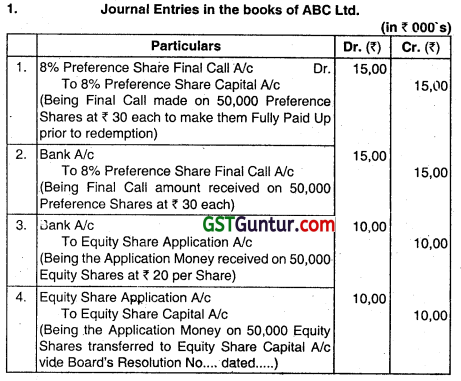

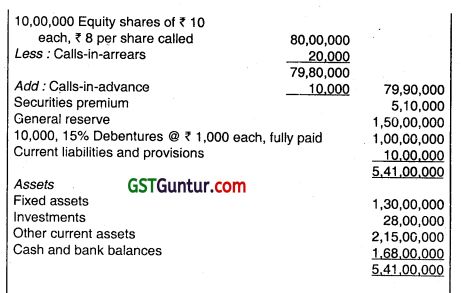

The Balance Sheet of ABC Ltd. as at the beginning of a financial year, inter alla, includes the following: (₹)

50,000 8% Preference Shares of ₹ 100 each ₹ 70 paid up ₹ 35,00,000

100,000 Equity Shares of ₹ 100 each fully paid up ₹ 1,00,00,000

Securities Premium ₹ 5,00,000

Capital Redemption Reserve ₹ 20,00,000

Genera! Reserve ₹ 50,00,000

Under the terms of their issue, the Preference Shares are redeemable at the end of the year at a Premium of 5%. In order to finance the redemption, the Company ms.s a Rights Issue of 50,000 Equity Shares of ₹ 100 each at ₹ 110 per Share, 20 being payable on Application, ₹ 35 (including Premium) on Allotment, and the balance to be called in the next financial year. The issue was fully subscribed and allotment made on December. The Moneys due on allotment were promptly received by the end of the year.

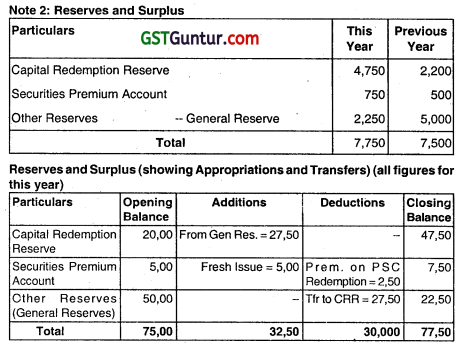

The Preference Shares were redeemed after fulfilling the necessary conditions of the Companies Act. The Company deelded to make the minimum utilisation of General Reserve. Assume that Securities Premium A/c is usable for providing the Premium on redemption of Preference Shares. You are asked to pass the necessary Journal Entries and show the relevant extracts from the Balance Sheet as at the end of the year with the corresponding figures for the previous year.

Answer:

![]()

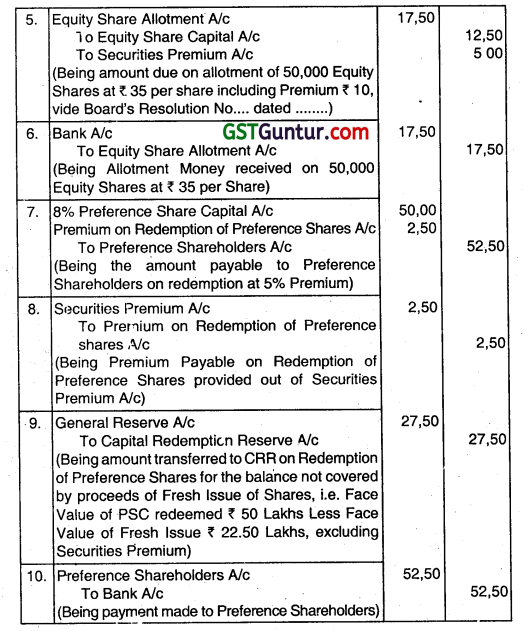

Question 12.

Extract nf Balance Sheet of ABC Ltd. as at …………………. (after redemption of Preference Shares) (₹ 000’s)

Answer:

Question 13.

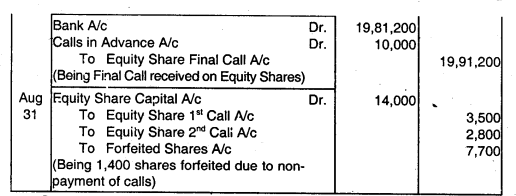

Following is the balance sheet of Anupam Ltd. as on 31st March 2008:

On 1st April 2008, the Board of directors decided that –

(i) The fully paid preference shares are to be redeemed at a premium of 4% on 1st May 2008 and for that purpose 6 lakh equity shares of 10 each are to be issued at a premium of 5%.

(ii) 3,000 Equity shares owned by Mohan, an existing shareholder, who has failed to pay the allotment money and the first call money @ ₹ 3 and ₹ 2.50 per share respectively, equity shares are to be forfeited on 31st May 2008.

(iii) The final call of ₹2 per share is to be made on July, 2008 on equity shares. All the above are duly complied with according to schedule. The amount due on the issue of fresh issue and on final call are also duly received except from Sohan who had failed to pay the first call for his 1,400 equity shares, has again failed to pay the final call also. These shares of Sohan are to be forfeited on 31 August 2008. Show the necessary journal entries. (Dec 2008, 9 marks)

Answer: