Accounting for Bonus Issue and Right Issue – CA Inter Accounts Question Bank is designed strictly as per the latest syllabus and exam pattern.

Accounting for Bonus Issue and Right Issue – CA Inter Accounts Question Bank

Question 1.

Write a note on ‘Bonus share?

Answer:

Bonus Shares: Bonus Shares are shares issued to existing Shareholders free of Cost by Capitalizing Free Reserves. But Company can issue Bonus Shares when Articles of Association authorize the same. In case the Company issuing bonus shares is a Listed Company, the Guidelines issued by SEBI must be complied with. Only existing Shareholders are entitled to receive Bonus Shares. Bonus Shares are be issued to only those Shareholders who hold fully paid up Shares. An issuer, announcing a bonus issue after the approval of its BOD, and not requiring shareholders approval for capitalisation of profits or reserves for making the bonus issue, shall implement the bonus issue within fifteen days from the date of approval of the issue by its BOD.

![]()

Question 2.

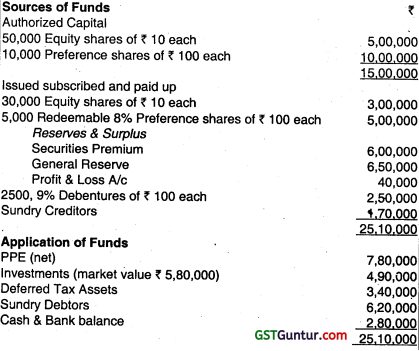

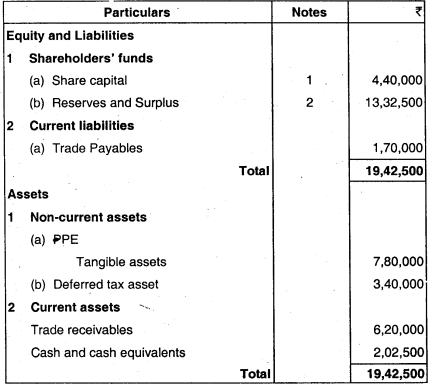

The following is the Balance Sheet of Bumbum Limited as at 31st March, 2009:

Sources of Funds ₹

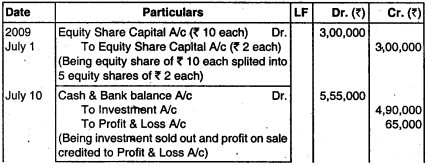

In Annual General Meeting held on 20th June, 2009 the company passed the following resolutions:

(i) To split equity share of ₹ 10 each into 5 equity shares of ₹ 2 each from 1st July, 09.

(ii) To redeem 8% preference shares at a premium of 5%.

(iii) To redeem 9% Debentures by making offer to debenture holders to convert their holdings into equity shares at ₹ 10 per share or accept cash on redemption.

(iv) To issue fully paid bonus shares in the ratio of one equity share for every 3 shares held on record date.

On 10th July, 2009 investments were sold for ₹ 5,55,000 and preference shares were redeemed.

40% of Debentureholders exercised their option to accept cash and their claims were settled on 1st August, 2009.

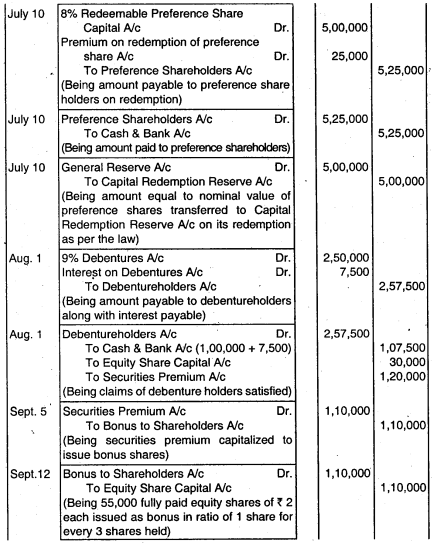

The company fixed 5th September, 2009 as record date and bonus issue was concluded by 12th September, 2009.

You are requested to journalize the above transactions including cash transactions and prepare Balance Sheet as at 30th September, 2009. All working notes should form part of your answer. (Nov 2010, 12 marks)

Answer:

Bumbum Limited Journal Entries

Balance Sheet as at 30th September, 2009

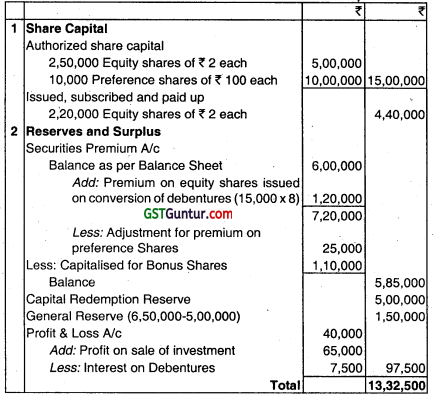

Notes to Accounts

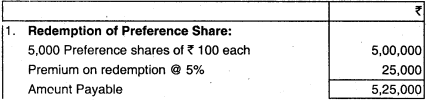

Working Notes:

![]()

Question 3.

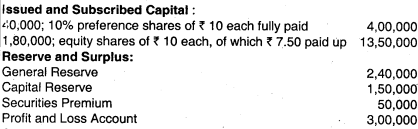

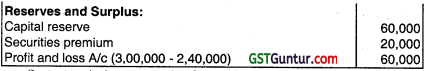

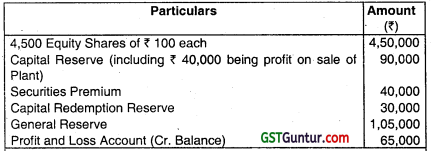

Following is the extract from the Balance Sheet of M/s. Yahoo Ltd. as at 31st March, 2011:

On 1st April, 2011, the company has made a final call @ ₹ 2.50 each on 1,80,000 equity shares. The call money was received by 30th April, 2011. There after the company decided to capitalize its reserves by issuing bonus shares at the rate of one share for every three shares held. Securities premium of ₹ 50,000 includes a premium of ₹ 20,000 for shares issued to vendor for purchase of a special machinery. Capital reserve includes ₹ 60,000 being profit on exchange of plant and machinery.

Show necessary Journal Entries in the books of the company and prepare the extract of the Balance Sheet after bonus issue. Necessary assumption, if any should form part of your answer. (Nov 2011, 8 marks)

Answer:

Assumptions:

1. According to SEBI Guideline, only Capital Reserve and Securities Premium collected in cash can be utilized for the purpose of issue of bonus shares. It is assumed that balance of capital reserve and securities premium is collected in cash only.

2. It is also assumed that necessary resolutions have been passed and requisite legal requirements related to the issue of bonus shares have been complied with before issue of bonus shares.

Working Note:

On the basis of the above assumptions, the Authorised Capital should be increased as under:

Total authorised capital after bonus issue (₹ 20,00,000 + ₹ 4,00,000) = ₹ 24,00,000

In the books of M/s. Yahoo Ltd. Journal Entries

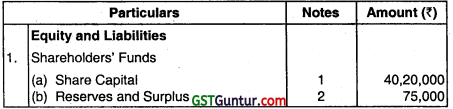

Extract of Balance Sheet (After bonus issue)

Question 4.

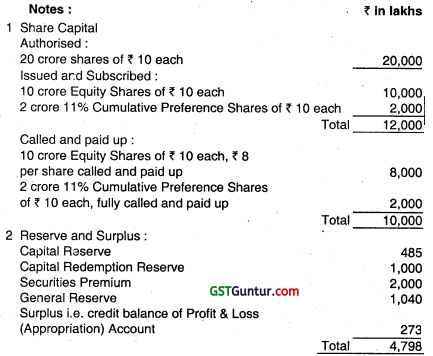

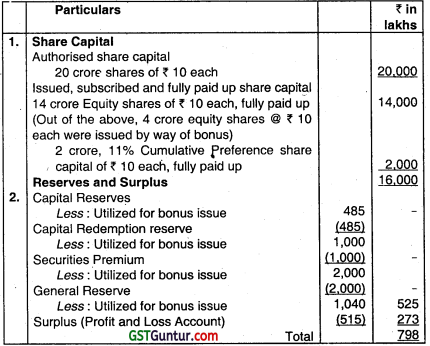

The following notes pertain to Brite Ltd.’s Balance Sheet as on 31st March, 2012:

Notes :

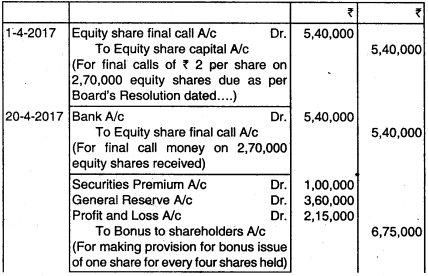

On 2nd April, 2012 the company made the final call on equity shares @ ₹ 2 per share. The entire money was received in the month of April, 2012.

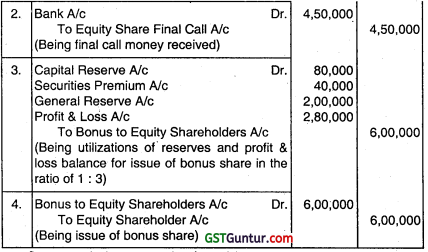

On 1st June, 2012 the company decided to issue to equity shareholders bonus shares at the rate of 2 shares for every 5 shares held and for this purpose, it decided to utilize the capital reserves to the maximum possible extent.

Pass journal entries for all the above mentioned transactions. Also prepare the notes on Share Capital and Reserves and Surplus relevant to the Balance Sheet of the company immediately after the issue of bonus

shares. (Nov 2012, 8 marks)

Answer:

In the books of Brite Ltd.

Journal Entries

Notes on Share Capital and Reserves & Surplus

Notes : As per SEBI Guidelines, Capital reserve and Securities premium have been assumed as realized in cash and hence car be used for issue of fully paid bonus shares.

Question 5.

Answer the following:

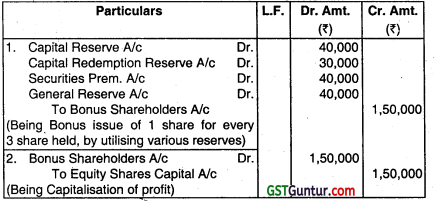

Following items appear in the Trial Balance of Saral Ltd. as on 31st March, 2014:

The company decided to issue to equity shareholders bonus shares at the rate of 1 share for every 3 shares held. Company decided that there should be the minimum reduction in free reserves. Pass necessary Journal Entries in the books Saral Ltd. (May 2014, 4 marks)

Answer:

In the books of Saral Ltd.

Journal Entry

Question 6.

Following is the extract of balance sheet of Sunrise Ltd. as on 31st March, 2015:

Issued and subscribed capital:

40,000, 10% Preference shares of ₹ 10 each fully paid : ₹ 4,00,000

1,80,000 Equity shares of ₹ 10 each, ₹ 7.50 paid-up : ₹ 13,50,000

Reserves and surplus:

Capital reserve : ₹ 1,60,000

General reserve : ₹ 2,00,000

Securities premium : ₹ 40,000

Surplus : ₹ 3,20,000

The company made the final call of ₹ 2.50 per share from equity shareholders and duly received it. Thereafter, it was decided to capitalise its reserves by issuing bonus shares at the rate of 1 share for every 3 shares held. Capital reserve includes ₹ 80,000 being profit on exchange of machinery.

Pass journal entries with necessary assumptions. (June 2016, 5 marks) [CS Exe -1]

Answer:

Journal Entries in the Books of Sunrise Ltd.

![]()

Question 7.

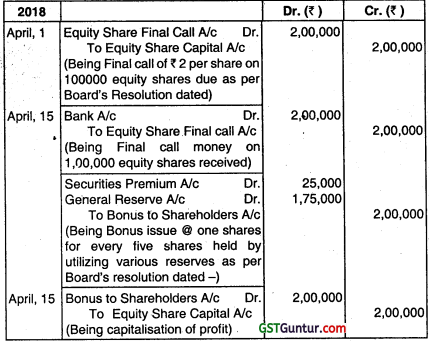

Following are the balances appear in the trial balance of Arya Ltd. as at 31st March, 2018.

Issued and Subscribed Capital: ₹

10,000; 10% Preference Shares of ₹ 10 each fully paid. : ₹ 1,00,000

1,00,000 Equity Shares of ₹ 10 each, ₹ 8 paid up : ₹ 8,00,000

Reserves and Surplus:

General Reserve : ₹ 2,40,000

Securities Premium (collected in cash) : ₹ 25,000

Profit and Loss Account : ₹ 1,20,000

On 1st April, 2018 the company has made final call @ ₹ 2 each on 1,00,000 Equity Shares. The call money was received by 15th April, 2018. Thereafter the company decided to issue bonus shares to equity shareholders at the rate of 1 share for every 5 shares held and for this purpose, it decided that there should be minimum reduction in free reserves. Pass Journal entries. (May 2018, 5 marks)

Answer:

In the books of Arya Ltd. Journal Entries

Question 8.

Answer the following:

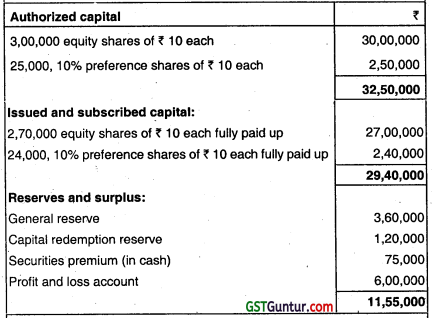

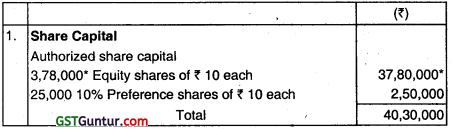

Following is the extract of Balance Sheet of Prem Ltd. as at 31st March, 2018:

On 1st April, 2018, the company decided to capitalize its reserves by way of bonus at the rate of two shares for every five shares held.

Show necessary journal entries in the books of the company and prepare the extract of the balance sheet after bonus issue. (Nov 2019, 5 marks)

Answer:

Journal Entries in the books of Prem Ltd.

Balance Sheet (Extract) as on 1st April, 20 18 (after bonus issue)

Notes to Accounts:

Note: Authorized capital has been increased by the minimum required amount i.e. ₹ 7,80,000 (37,80,000 — 30,00,000) in the above solution.

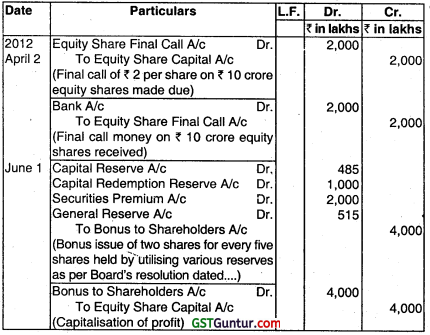

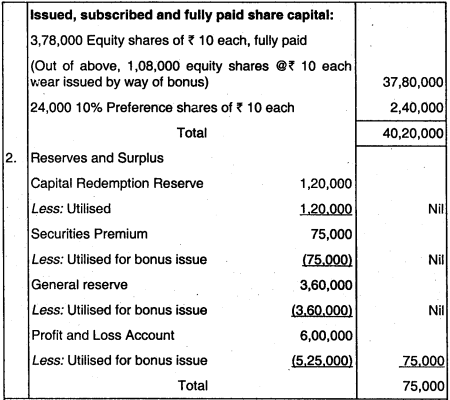

Question 9.

Answer the following:

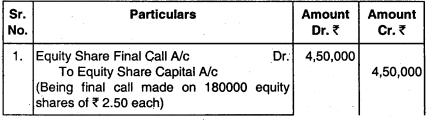

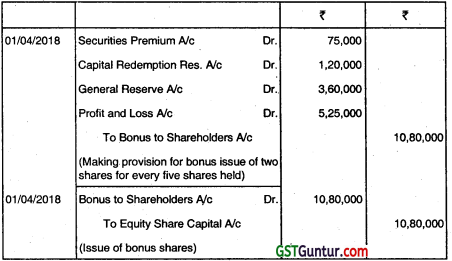

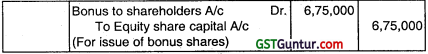

Following items appear in the Trial Balance of Star Ltd. as on 31st March, 2019:

On 1st April, 2019, the Company has made final call on Equity shares @ ₹ 2 per share. The entire money was received in the month of April, 2019.

On 1st June, 2019, the Company decided to issue to Equity shareholders bonus shares at the rate of 2 shares for every 5 shares held and for this purpose, it decided that there should be minimum reduction in free reserves.

Pass necessary journal entries in the Books of Star Ltd. (Jan 2021, 5 marks)

![]()

Question 10.

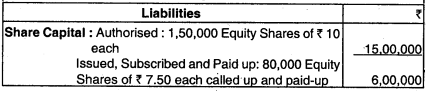

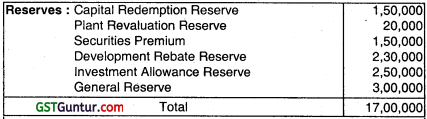

The Balance Sheet of ABC Ltd. as at 31st March, having Net Assets ₹ 17,00,000 contained the following:

The Company wanted to issue Bonus Shares to its Shareholders at the rate of One Share for every Two Shares held. Necessary resolutions were passed, requisite legal requirements were complied with.

Requires:

(a) Give effect to the proposal by passing Journal Entries in the books of the Company,

(b) Show the amended Balance Sheet.

Answer:

Journal Entries in the Books of the ABC Ltd.

Working Note:

1. Reserves not available for Bonus Issue: Plant Revaluation Reserve, Development Rebate Reserve and Investment Allowance Reserve, cannot be used for any type of Bonus Issue.

2. Types of Bonus Issue: There are two types of Bonus Issue in the above case:

(a) Converting ₹ 7.50 Paid up Shares into ₹ 10 Paid Up: Securities Premium and Capital Redemption Reserve cannot be used for this purpose. So, the Company can utilize General Reserve and P& L A/c only for this purpose.

(b) Issuing Additional Shares to Holders of Fully Paid Shares:

Securities Premium and Capital Redemption Reserve can be fully utilized for this purpose. For balance requirement, General Reserve and P&L A/c may be used.

Question 11.

The Paid up Capital of ABC Ltd. is ₹ 10,00,000 consisting of 60,000 Equity Shares of ₹ 10 eacti fully paid up and 50,000 Equity Shares of ₹ 10 each, ₹ 8 per share paid up. It has ₹ 40,000 in Securities Premium Account, ₹ 2,00,000 in Profit and Loss A/c (Cr.) ₹ 3,00,000 in General Reserve and ₹ 60,000 in Capital Redemption Reserve Account.

By way of Bonus Dividend, the Partly Paid up Shares are converted into Fully Paid Up Shares, and the holders of Fully Paid up Shares are also allotted Fully Paid Up Bonus Shares in the same ratio.

Pass Journal Entries showing separately the two types of Bonus Issues stated above. It is desired that there should be minimum reduction in Free Reserves.

Answer:

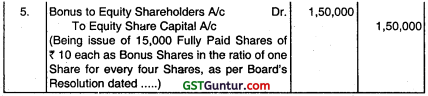

Journal Entries in the Books of the ABC Ltd.

Note:

1. Additional Shares issued: Ratio of Bonus declared on partly paid shares is ₹ 2 for every ₹ 8 Paid -up Capital. So, Bonus Shares are issued at the rate of 1 for every 4 Shares held. Hence, the amount of Bonus payable to the holders of Fully Paid Shares is (1 Bonus Share ÷ 4 Shares Held) × 60,000 Scares × ₹ 10 Issue Price = ₹ 1,50,000.

2. Bonus issue can be done by:

(a) Converting 50,000 ₹ 8 Paid Up Shares into ₹ 10 Paid Up: Securities Premium and Capital Redemption Reserve cannot be used for this purpose. Hence, the Company can utilize General Reserve and P&L Account only for this purpose.

(b) Issuing Additional Shares to the holders of fully paid shares: Securities Premium and Capital Redemption Reserve can be fully utilized for this purpose. For the balance requirements, General Reserve and Profit and Loss Account may be used.

Question 12.

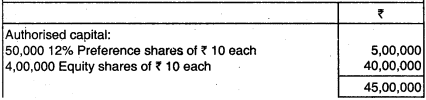

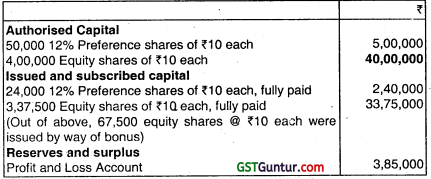

Following is the extract of the Balance Sheet of Xeta Ltd. as at 31st March, 2017:

On 1st April, 2017, the Company has made final call @ ₹ 2 each on 2,70,000 equity shares. The call money was received by 20th April, 2017. Thereafter, the company decided to capitalize its reserves by way of bonus at the rate of one share for every four shares held.

You are required to give necessary journal entries in the books of the company and prepare the extract of the balance sheet as on 30th April, 2017 after bonus issue.

Answer:

Journal Entries In the books of Xets Ltd.

Extract of Balance Sheet as at 30th April, 2017 (after bonus issue)

Question 13.

Distinguish between the following :

‘Bonus shares’ and ‘rights shares’. (June 2011, 3 marks) [CS Exe -1]

Answer:

Following are the main points of distinction between bonus shares & right shares:

| Basic | Bonus Shares | Right Shares |

| 1. Meaning | Bonus shares are shares issued by a company free of cost to its existing shareholders on a pro rata basis out of free reserve. | When company issues further shares to existing shareholder in ratio of their holding Such issue is known as right issue. |

| 2. Cash flow | In case of bonus issue there is no cash flow. | In case of right issue there is cash inflow to the company. |

| 3. Consideration | Company does not receive any consideration in case of bonus issue. | Company receives consideration as shares are issued against cash. |

| 4. Authorization | Bonus issue is made on the recommendation of the Board and authorization from general meeting of the company. | In case of right issue authorization from members through ordinary or special resolution is necessary. |

| 5. Market value | Issue of bonus shares does not affect the market value of the company. | Right issue of shares affects the market value of the company. |

| 6. Section | It is governed by Sec. 63 of the Companies Act, 2013. | It is governed by Sec. 62 of the Companies Act, 2013. |

Question 14.

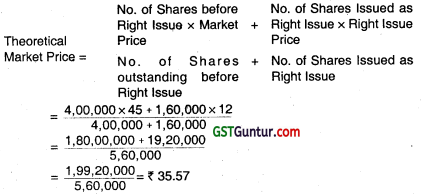

Fitness Ltd. is planning to raise funds by making rights issue of equity shares to part finance its expansion. The existing equity share capital of the company is ₹ 40 lakh and the market value is ₹ 45 per share. The company offered to its shareholders the right to buy 2 shares at ₹ 12 each for every 5 shares held. You are required to calculate –

(i) Theoretical market price per share after the rights issue;

(ii) The value of rights; and

(iii) Percentage increase in share capital. (Dec 2015, 5 marks) [CS Exe -1]

Answer:

(i) Calculation of Theoretical Market Price per Share after the Right Issue:

(ii) The Value of Rights = Market Price – Theoretical Market Price

= 45 – 35.57 = 9.43

(iii) Percentage increase in Share Capital:

\(=\frac{\text { No. of fresh Shares Issued }}{\text { Total no. of Shares before Right Issue }}\) × 100

= \(\frac{1,60,000}{4,00,000}\) × 100 = 40%

Working Notes:

1. No. of Shares Outstanding at Beginning

= \(\frac{40,00,000}{10}\) = 4,00,000 Shares

2. No. of Shares Issued as Right Issue

= 4,00,000 × \(\frac{2}{5}\) = 1,60,000 Shares.

![]()

Question 15.

The Share of ABC Ltd of a Face Value of ₹ 10 is being quoted at ₹ 24. The Company has a plan to make a Rights Issue of one Equity Share for every four shares currently held at a Premium of 40% per Share. You are required to –

1. Determine the Minimum Price that can be expected of Share after the issue.

2. Calculate the Theoretical Value of the Rights alone.

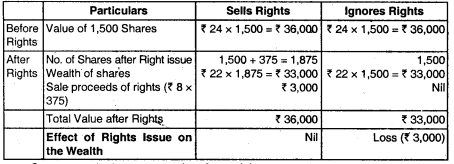

3. Show the effect of the Right Issue on the wealth of a Shareholder who has 1,500 Shares, if

(a) He sells the entire rights, and

(b) He ignores the rights.

Answer:

Theoritical value of Right:

Ratio 1 : 4

Ex-Rights Price per share = \(\frac{(₹ 24 \times 4)+(₹ 14 \times 1)}{5}\) = ₹ 22

∴ Issue Price = 10 + 40% = ₹ 14

Rights Value = ₹ 8

∴ Value of Right = \(\frac{₹ 8}{4 \text { shares }}\) = ₹ 2

2. Effect on the Wealth of a shareholder

Question 16.

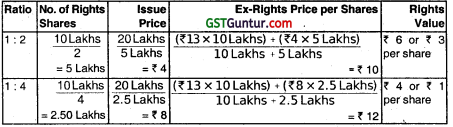

ABC Limited’s shares are currently selling at ₹ 13 per share. There are 10,00,000 shares outstanding. The Company is planning to raise ₹ 20

Lakhs to finance a new project. Required:

What is the Ex-Right Price of Shares and the Value of a right, if

(a) The Firm offers one right share for every two Shares held.

(b) The Firm offers one right share for every four Shares held.

Answer:

Computation of Ex-Rights Price and Value of a right

Question 17.

Zeta Ltd. has decided to increase its existing share capital by making rights issue to its existing shareholders. Zeta Ltd. is offering one new share for every two shares held by the shareholder. The market value (cum-right) of

the share is ₹ 360 and the company is offering one right share of ₹ 180 each to its existing shareholders. You are required to calculate the value of a right. What should be the ex-right value of a share?

Answer:

Ex-right value of the shares = (Cum-right value of the existing shares + Rights shares × Issue Price) /(Existing Number of shares + Number of Right shares)

= (₹ 360 × 2 Shares + ₹ 180 × 1 Share)/(2 + 1) Shares

= ₹900/3 shares = ₹ 300 per share.

Value of right = Cum-right value of the share – Ex-right value of the share

= ₹ 360 – 300 = ₹ 60 per share.

Hence, any one desirous of having a confirmed allotment of one share from the company at ₹ 180 will have to pay ₹ 120 (2 shares × ₹ 60) to an existing shareholder holding 2 shares and willing to renounce his right of buying one

share in favour of that person.

Question 18.

Right Issue

A company offers new shares of 100 each at 25% premium to existing shareholders on one for four basis. The cum-right market price of a share is ₹ 150. Calculate the value of a right

Answer:

Ex-right value of the shares = (Cum-right value of the existing shares + Rights shares Issue Price) / (Existing Number of shares + Rights Number of shares)

= (₹ 150 × 4 Shares + ₹ 125 × 1 Share) / (4 + 1) Shares = ₹ 725 / 5 shares = ₹ 145 per share.

Value of right = Cum-right value of the share – Ex-right value of the share

= ₹ 150 – ₹ 145 = ₹ 5 per share.