Redemption of Debentures – CA Inter Accounts Question Bank is designed strictly as per the latest syllabus and exam pattern.

Redemption of Debentures – CA Inter Accounts Question Bank

Question 1.

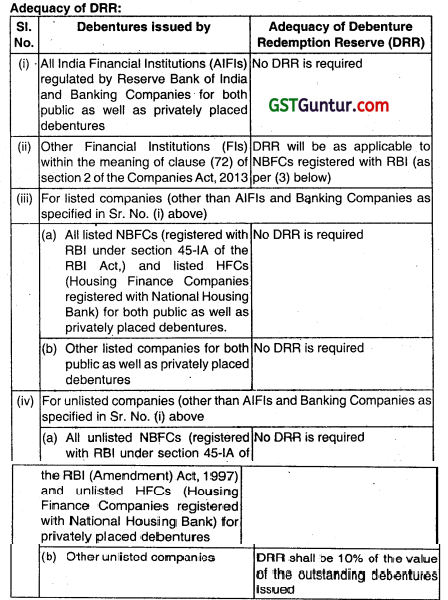

Comment on adequacy of Debenture Redemption Reserve (DRR) w.r.t. following:

Debentures issued by

(i) All India Financial Institutions regulated by Reserve Bank of India and Banking companies.

(ii) For other Financial Institutions within the meaning given in the Companies Act.

(iii) For debentures issued by NBFCs registered with the RBI.

(iv) For debentures issued by other companies including manufacturing and infrastructure companies. (May 2015, 4 marks)

Answer:

Question 2.

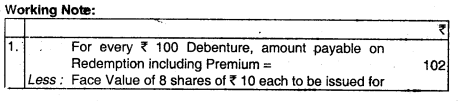

ABC Ltd. has Authorized Capital of 8,00,000 Equity Shares of ₹ 10 each. But out of these 2,40,000 shares have been issued as fully paid. The Company has an outstanding 14% Debentures Loan of ₹ 24,00,000 redeemable at 102% and interest has been paid up to date. The Directors resolved to redeem the Debentures on 1st January and the Holders are given an option to receive payment either wholly in cash or wholly in fully Paid Equity Shares @ 8 Shares for every ₹ 100 of Debentures.

On that date, the balance of the Debenture Redemption Reserve Account is 20.00,000 and corresponding Investment Account ₹ 20,00,000 (at cost) of which the Market Value is ₹ 18,00,000. 75% of the Holders decided to exercise the option for taking Shares in repayment and cash for the rest is procured by realizing an adequate amount of Investment at the prevailing Market Value. Draw up Journal Entries (including Cash Book Entries) to give effect to the above transactions.

Answer:

![]()

Question 3.

Mention the ways by which Redeemable Debentures may be redeemed under Companies Act, 2013. (May 2016,4 marks)

Answer:

The following are the ways by which Redeemable Debentures may be redeemed:

| 1. By Payment in Lumpsum | In this method, the payment of entire debt is made one lot at the expiry of a specified period (i.e. at maturity) or even before expiry of the specified period after passing necessary resolution at the meeting of the debenture holders. |

| 2. By Payment In Instalments | In this method, the payment of specified portion of debentures debt s made in instalments at specified rates for e.g., a debentures of ₹ 100 may be discharged as 20% or ₹ 20 on 1/1/2011,20% or ₹ 20 on 1/1/2013, 30% or ₹ 30 on 1/1/2015, 30% or ₹ 30 on 1/1/2017 or etc. |

| 3. Redemption by Purchase in the open market | When a company purchases its own debentures in the open market for the purpose of cancellation, such an act of purchasing and cancelling the debentures constitutes redemption by purchase in the open market. |

Question 4.

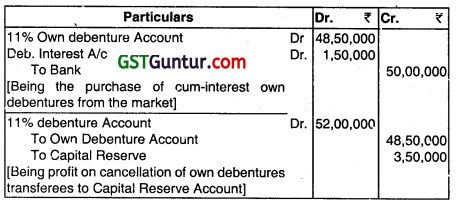

A Company purchased its own 11% debentures In the open market for ₹ 50,00.000 (Cum-interest). The interest amount included in the purchase price is ₹ 1,50,000. The face value of the debentures purchased is ₹ 52,00,000. The Company cancelled the debentures so purchased. Pass Journal Entries in the books of the Company or purchase and immediate cancellation of debentures.(Nov 2007, 4 marks)

Answer:

Question 5.

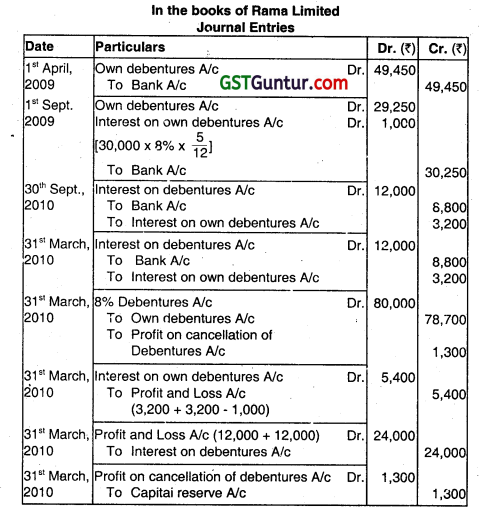

Rama Limited issued 8% Debentures of ₹ 300,000 in earlier year on which interest is payable half yearly on 31st March and 30th September. The company has power to purchase its own debentures in the open market for cancellation thereof. The following purchases were made during the financial year 2009-10 and cancellation made on 31st March 2010:

(a) On 1st April 50,000 nominal value purchased for ₹ 49,450, ex-interest.

(b) On 1st September 30,000 nominal value purchased for ₹ 30,250 cum interest.

Show the Journal Entries (without narrations) for the transactions held in the year 2009-10. (Nov 2010, 5 marks)

Answer:

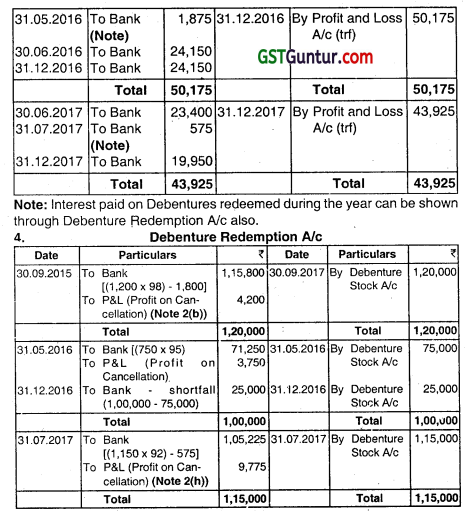

Question 6.

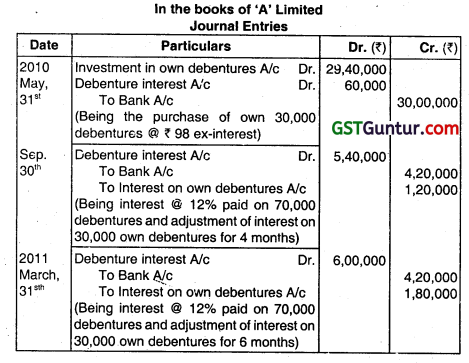

On 1st April 2010, A Ltd had outstanding In its books 1,00,000 Debentures of ₹ 100 each, interest @ 12% per annum. The interest on debentures was paid half-yearly on 30th September and 31st March of every year. On 31st May 2010, the company purchased 30,000 Debentures of its own @ ₹ 98 (ex-interest) per debenture. The company cancelled the debentures so purchased on 31st March 2011. Pass the necessary Journal Entries to record the above transactions for the year ended 31st March 2011. (Nov 2011, 5 marks)

Answer:

![]()

Question 7.

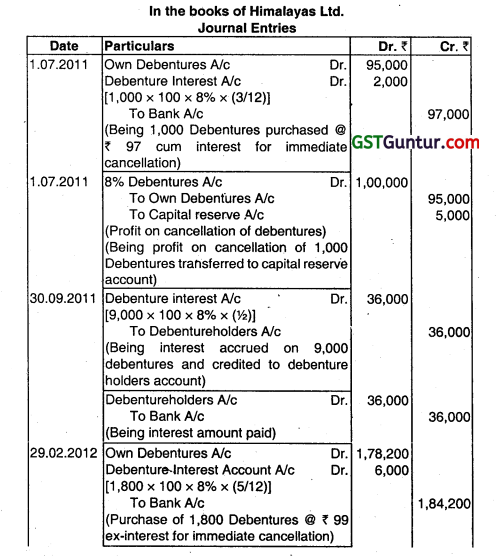

Himalayas Ltd. had 10,00,000/-8% Debentures of ₹ 100 each as on 31st March, 2011. The company purchased in the open market following debentures for immediate cancellation:

On 01-07-2011 – 1000 debentures @ ₹ 97/(cum interest)

On 29-02-2012- 1800 debentures @ ₹ 99/(ex interest)

Debenture interest due date is 30th September and 31st March. Give Journal Entries in the books of the company for the year ended 31st March, 2012. (Nov 2012, 8 marks)

Answer:

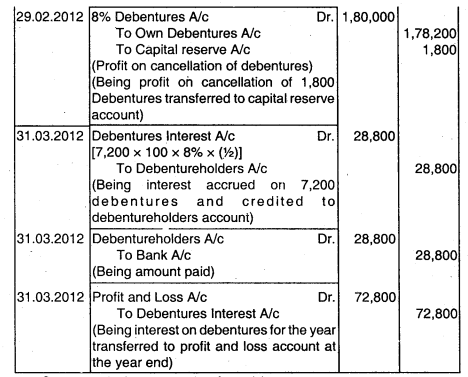

Question 8.

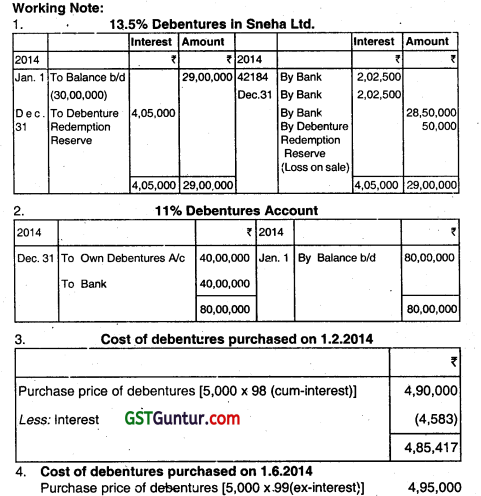

M/s. Piyush Ltd. had the following among their ledger opening balances on January 1, 2014:

11% Debenture A/c (2002 issue) ₹ 80,00000

Debenture Redemption Reserve A/c ₹ 70,00,000

13.5% Debenture in Sneha Ltd. A/c (Face Value ₹ 30,00,000) ₹ 29,00,000

Own Debentures A/c (Face Value ₹ 30,00,000) 27,00,000

As 31st December 2014 was the date of redemption of the 2002 debentures, the company started buying own debentures and made the following purchases in the open market:

1 -2-2014 – 5000 debentures at ₹ 98 cum-interest

1-6-2014 – 5000 debentures at ₹ 99 ex-interest.

Half-yearly interest is due on the debentures on 30th June and 31st December in the case of both the companies.

On 31st December 2014, the debentures in Sneha Ltd. were sold for ₹ 95 each ex-interest. On that date, the outstanding debentures of M/s. Piyush Ltd. were redeemed by payment and by cancellation. Show the entries in the following ledger accounts of M/s. Piyush Ltd. during 2014:

(i) Debenture Redemption Reserve Account.

(ii) Own Debenture Account.

The face value of a debenture was ₹ 100. (May 2015, 12 marks)

Answer:

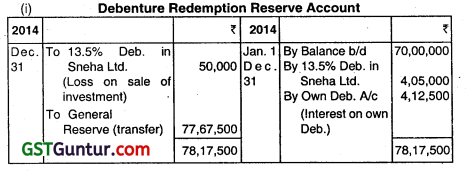

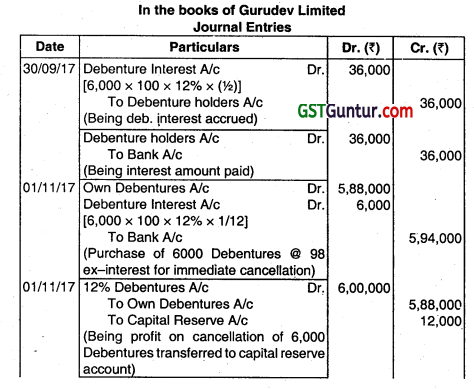

Question 9.

Answer the following:

Gurudev Limited purchases for immediate cancellation 6,000 of its own 12% debentures of ₹ 100 each on 1st November, 2017. The dates of interest being 31st March and 30th September. Pass necessary journal

entries relating to the cancellation if:

(i) Debentures are purchased at ₹ 98 ex-interest.

(ii) Debentures are purchased at ₹ 98 cum-interest. (May 2018, 5 marks)

Answer:

![]()

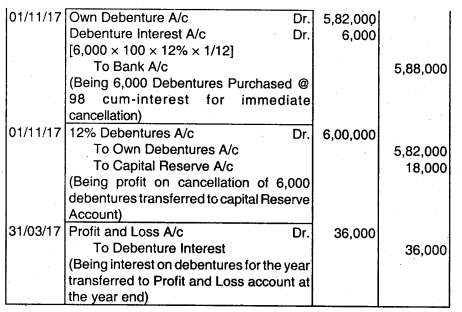

Question 10.

A Company had issued 1,000 12% debentures of ₹ 100 each redeemable at the company’s option at the end of 10 years at par or prior to that by purchase in open market or at ₹ 102 after giving 6 months notice. On 31st December, 2016, the accounts of the company showed the following balances:

On debenture redemption fund ₹ 53,500 represented by 10% Govt. Loan of a nominal value of ₹ 42,800 purchased at an average price of ₹ 101 and ₹ 10,272 uninvested cash in hand.

On 1st January 2017, the company purchased ₹ 11,000 of its own debentures at a cost of ₹ 10,272. On 30 June 2017, the company gave a six months notice to the holders of ₹ 40,000 debentures and on 31st December, 2017 carried out the redemption by sale of ₹ 40,800 worth of Govt. Loan at par and also cancelled the own debentures held by it. Prepare ledger account of Debenture Redemption Fund Account and Debenture Redemption Fund Investment Account for the year ended 31.12.2017, assuming that, interest on company debentures & Govt. loan was payable on 31st December every year. (Nov 2018,8 marks)

Answer:

Question 11.

Sumit Ltd. (an unlisted company other than AIFI, Banking company, NBFC and HFC) had 8,000, 9% debentures of 100 each outstanding as on 1st April, 2019, redeemable on 31st March, 2020.

On 1st April, 2019, the following balances appeared in the books of accounts:

Investment in 1,000, 7% secured Govt. bonds of ₹ 100 each, ₹ 1,00,000.

Debenture Redemption Reserve is ₹ 50,000.

Interest on investments ¡s received yearly at the end of financial year. 1,000 own debentures were purchased on 30th March 2020 at an average price of ₹ 96.50 and cancelled on the same date.

On 31st March 2020, the investments were realized at par and the debentures were 1edeemed. You are required to write up the following accounts for the year ended 31st March 2020:

(1) 12% Debentures Account.

(2) Debenture Redemption Reserve Account.

(3) DRR Investment Account.

(4) Own Debentures Account. (Nov 2020,10 marks)

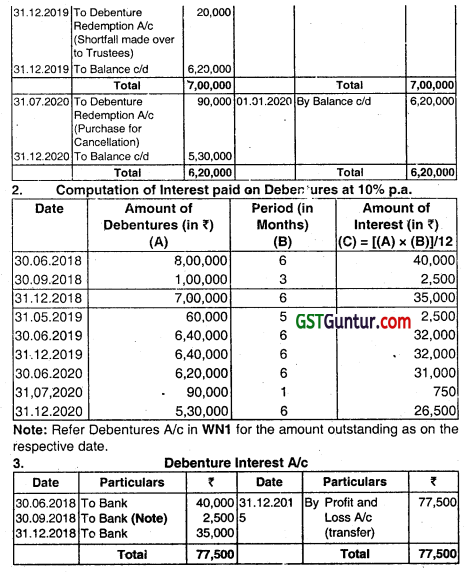

Question 12.

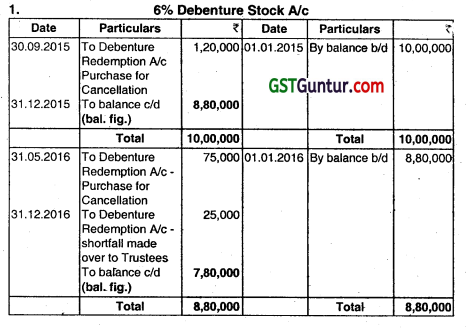

ABC Ltd. issued ₹ 10,00,000, 6% Debenture Stock at par on 21.01.2014. Interest was payable on 30th June and 31st December, in each year. Under the terms of the, Debenture Trust Deed the stock is redeemable at par. The Trust Deed obliges the Company to pay to the Trustees on 31.12.2015, and annually thereafter the sum of ₹ 1,00,000 to be utilised for the redemption and cancellation of an Equivalent Amount of Stock, which is to be selected by drawing lots.

Alternatively, the Company is empowered as from 01.01.2015, to purchase its Own Debentures on the Open Market. These Debentures must be surrendered to the Trustees for cancellation and any adjustments for Accrued Interest recorded in the Books of Account. If any year, the Nominal Amount of the stock surrendered under this alternative does not amount to ₹ 1,00,000, then the shortfall is to be paid by the company to the Trustees in cash on 31 December. The following Purchases of Stock were made by the Company.

| Date | Nominal Value of Stock Purchased (₹) | Purchase Price per ₹ 100 of stock (₹) |

| 30.09.2015 | 1,20,000 | 98(Cum Interest) |

| 31.05.2016 | 75,000 | 95(Ex-Interest) |

| 31 .07.2017 | 1,15,000 | 92(Cum Interest) |

Assuming that the Company fulfilled all its obligations under the Trust Deed, prepare the following Ledger Accounts – (a) Debenture Stock A/c, (b) Debenture Redemption A/c, and (c) Debenture Interest A/c. Ignore costs of transaction and taxation.

Answer:

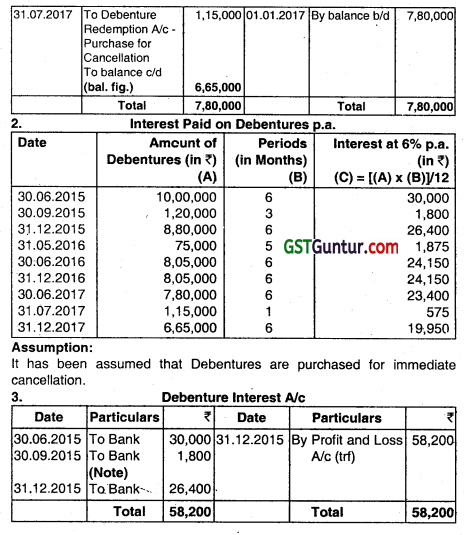

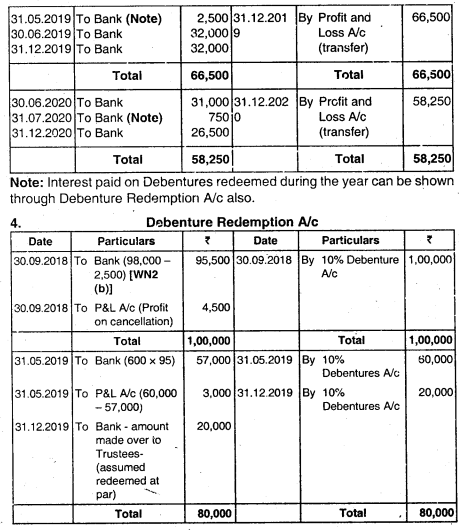

Question 13.

ABC Limited ssued 10% Debentures at par for ₹ 8 Lakhs. Interest was payable half yearly on 30th June and 31st December every year. Under the terms of the Trust Deed, the Debentures are redeemable at par (three years after issue) by the Company purchasing them in the Open Market and cancelling, them with a minimum redemption of ₹ 80,000 every year.

In case, there is a shortfall in redemption by the Company by Open Market Operations, the shortfall would be made good by the Company by payment on the last day of the accounting year to the Trustees, who would then draw lots and redeem the balance Debentures.

The Company purchased its Own Debentures for cancellation as under:

30.09.2018 ₹ 1.00,000 at ₹ 98 cum-interest.

31.05.2019 ₹ 60,000 at ₹ 95 ex-interest.

31.07.2020 ₹ 90,000 at ₹ 96 cum-interest.

The Company carned out its obligations under the Trust Deed. Prepare the following Ledger Accounts In the books of the Company, for Calendar Years 2018, 2019 and 2020 – (a) Debenture A/c, (b) Debenture Redemption A/c, and (c) Debenture Interest A/c. Ignore Taxation.

Answer:

![]()

Question 14.

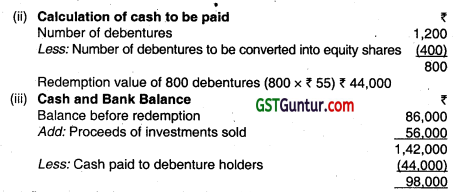

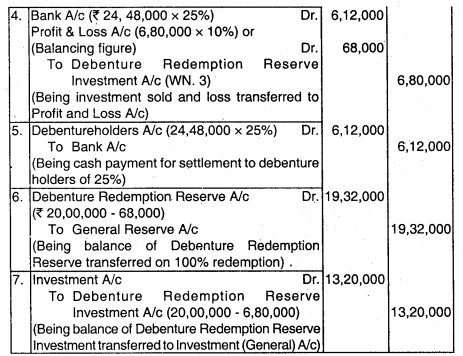

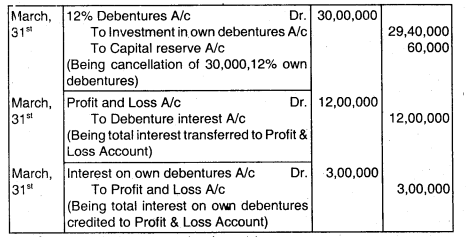

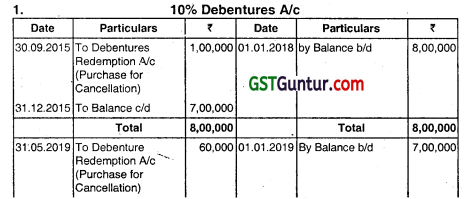

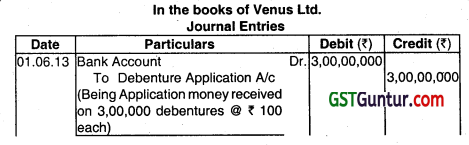

Conversion of debt into equity is a non-cash transaction.” Comment. (Nov 2009, 2 marks)

Answer:

Under certain cases, debenture holders are offered an option to convert their debts into equity by issuing equity share capital. in such circumstances, debentures are redeemed by issuing fresh share capital.

Journal Entry will be as follows:

![]()

In such entry, no cash account is opened. Therefore, one can conclude that the conversion of debt to equity is a non-cash transaction.

Question 15.

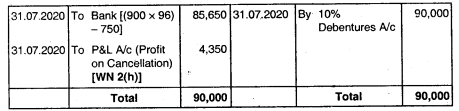

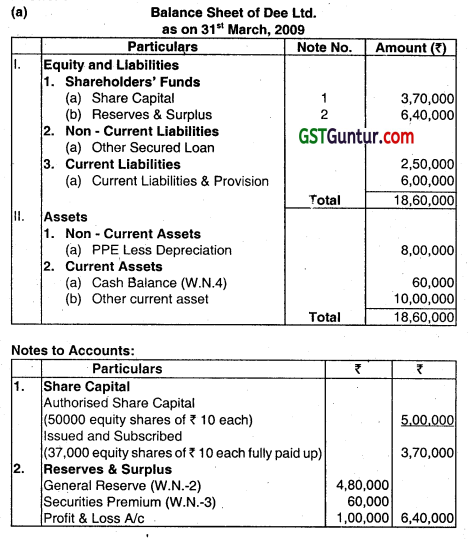

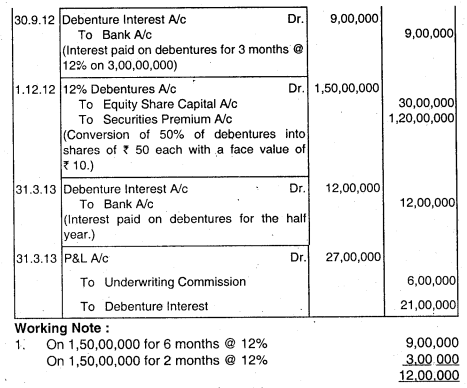

The Balance Sheet of Dee Limited on 31st March. 2009 was as follows:

At the General meeting, it was resolved to:

1. Pay proposed dividend of 10% in cash.

2. Give existing shareholders the option to purchase one share of ₹ 10 each at ₹ 15 for every five shares held. This option was taken up by all the shareholders.

3. Redeem the debentures at a premium of 5% and also confer option to the debenture holders to convert 50% of their holding into equity shares at a predetermined price of ₹ 15 per share and balance payment to be made in cash.

Holders of 3,000 debentures opted to get their debentures redeemed in cash only while the rest opted for getting the same converted into equity shares as per the terms of issue. Debenture redemption fund investments realised ₹ 1,80,000 on” Sales.

You are required to redraft the Balance Sheet after giving effects of the tight issue and redemption of debentures. Also, show the calculations in respect of number of equity shares issued and cash payment. (2009- Nov, 16 marks)

Answer:

Working Notes:

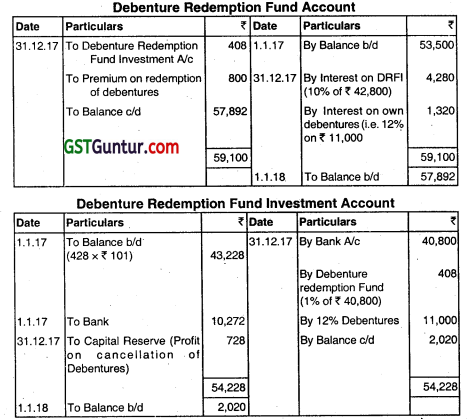

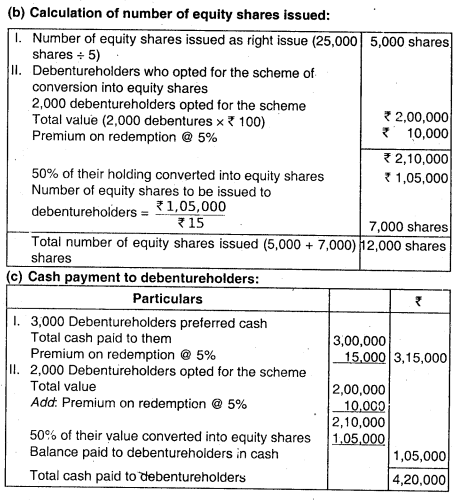

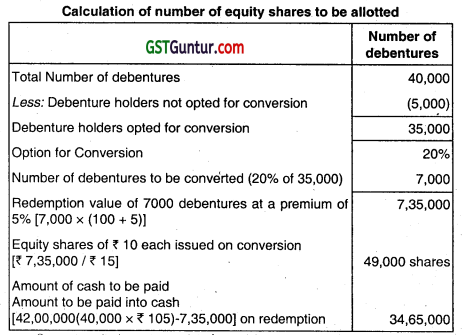

Question 16.

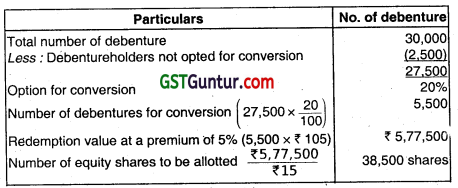

A Company had issued 20,000, 13% Convertible debentures of ₹ 100 each on 1st April 2007. The debentures are due for redemption on 1st July 2009. The terms of issue of debentures provided that they were redeemable at a premium of 5% and also conferred option to the debenture holders to convert 20% of their holding into equity shares (Nominal value ₹ 10) at a price of ₹ 15 per share.

Debenture holders holding 2,500 debentures did not exercise the option. Calculate the number of equity shares to be allotted to the Debenture holders exercising the option to the maximum. (May 2010, 2 marks)

Answer:

Redemption value of 3,500 debentures at a premium of 5% [3,500 x (100 + 5)] ₹ 3,67,500

Equity shares of 10 each issued on conversion [ ₹ 3,67,500/₹ 15] 24,500 shares

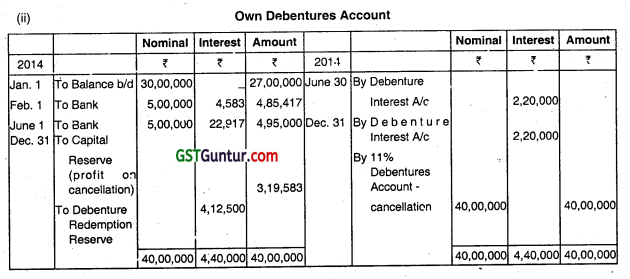

Question 17.

XYZ Ltd. had issued 30,000, 15% convertible debenture of ₹ 100 each on 1st April 2008. The debentures are due for redemption on 1st March, 2011. The terms of issue of debentures provided that they were redeemable at a premium of 5% and also conferred option to the debenture holders to convert 20% of their holding into equity shares (Nominal Value ₹ 10) at a price of ₹ 15 per share. Debenture holders holding 2500 debentures did not exercise the option. Calculate the number of equity shares to be allotted to the Debenture holders exercising the option to the maximum. (May 2011, 4 marks)

Answer:

Computation of number of equity shares allotted to be debenture holders

![]()

Question 18.

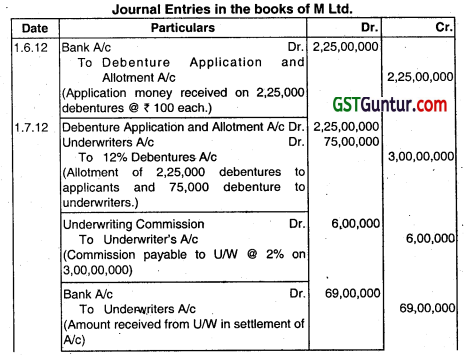

M Limited recently made a public issue of debentures. The following information is available in respect of the issue:

(i) 3,00,000 partly convertible debentures of face value and issue price of ₹ 100 per debenture were issued; .

(ii) Conversion of 50% of each debenture is to be done on expiry of 6 months from date of close of issue;

(iii) Date of closure of subscription list is 1st June 2012. Date of allotment is 1st July 2012.

(iv) Interest on debenture at the rate of 12% is payable from date of allotment;

(v) Equity share of ₹ 10 each are issued at ₹ 50 per share for the purpose of conversion;

(vi) Underwriting commission is 2%;

(vii) 2,25,000 debentures were applied for;

(viii) Interest on debentures is payable halt yearly on 30th September and 31st March.

Give Journal entries for all transactions relating to the above, including cash and bank entries or the year ended 31st March, 2013. (Nov 2013,8 marks)

Answer:

Question 19.

The summarized Balance Sheet of Spices Ltd. as On 31st March 2013 read as under:

The debentures are due for redemption on 1st April, 2013. The terms of issue of debentures provided that they were redeemable at a premium 5% and also conferred option to the debenture holders to convert 25% of their holding into equity shares at a predetermined price of ₹ 11.90 per share and the balance payment in cash.

Assuming that:

(i) Except for debenture holders holding 12,000 debentures in aggregate, rest of them exercised the option for maximum conversion,

(ii) The investments realized ₹ 32,00,00 on sale,

(iii) All the transactions were taken place on 1st April 2013 with out any lag,

(iv) Premium on redemption of debentures is to be adjusted against General Reserve.

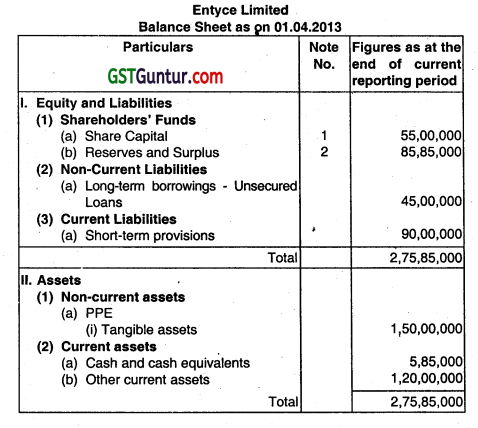

Redraft the Balance Sheet of Entyce Ltd. as on 01.04.2013 after giving effect to the redemption. Show your calculations in respect of the number of equity shares to be allotted and the cash payment necessary.

Answer:

Question 20.

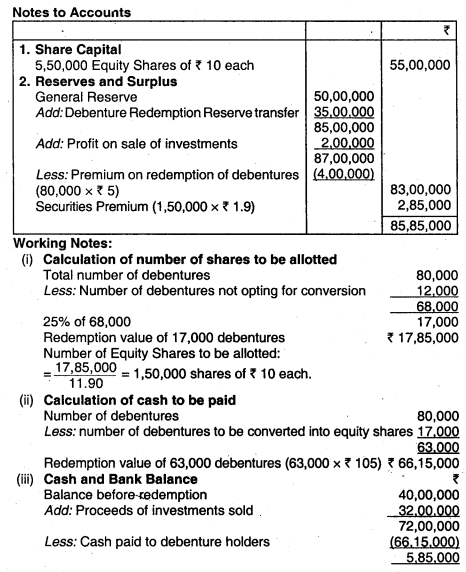

Venus Limited recently made a public issue in respect of which the following information is available:

(i) No. of partly convertible debentures issued 4,00,000; face value and issue price of ₹ 100 per debenture.

(ii) Convertible portion per debenture – 80%, date of conversion – on expiry of 7 months from the date of closing of issue.

(iii) Date of closure of subscription list – 01.06.2013, date of allotment – 01.07.2013, Rate of interest on debentures – 10% pa. payable from the date of allotment. Value of equity share for the purpose of conversion – 40 (Face value ₹ 10)

(iv) Underwriting commission – 3%

(v) No. of debentures applied for 3,00,000

(vi) Interest payable on debentures – halt yearly on 30th September and 31st March.

Write relevant journal entries for all transactions arising out of the above during the year ended on 31st March 2014 (including cash and bank entries). (Nov 2014, 8 marks)

Answer:

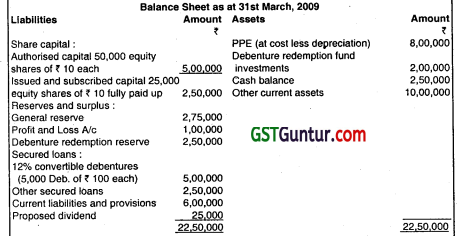

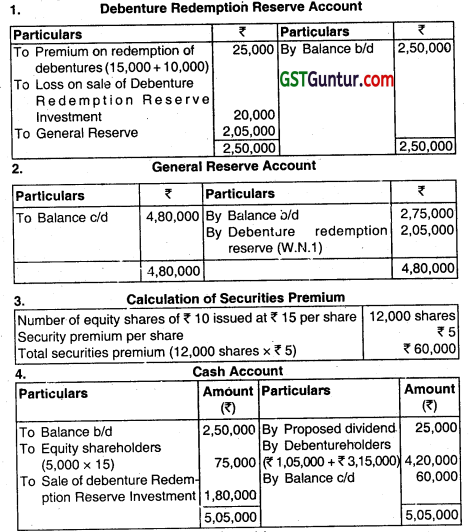

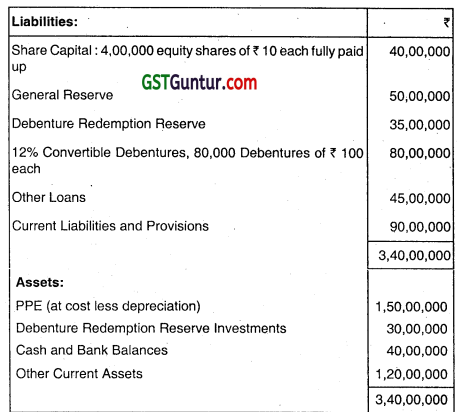

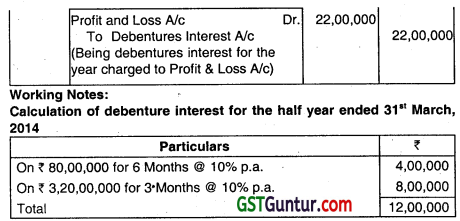

Question 21.

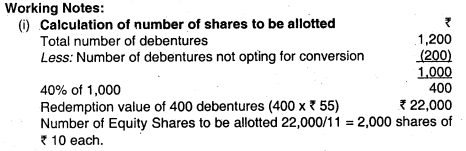

Answer the following:

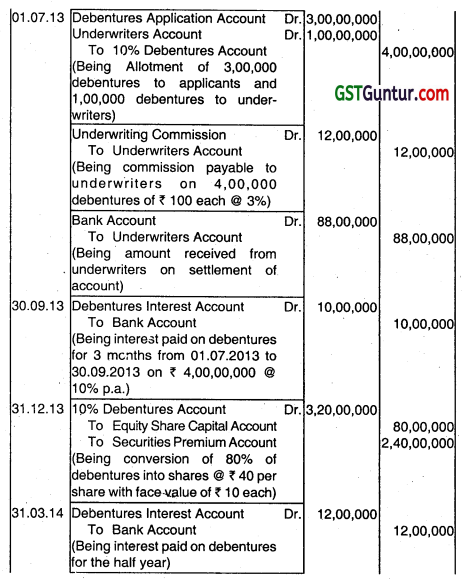

A company had issued 40,000, 12% debentures of ₹ 100 each On 1st April 2015. The debentures are due for redemption on 1st March 2019. The terms of issue of debentures provided that they were redeemable at a premium of 5% and also conferred option to the debenture holders to convert 20% of their holding into equity shares (nominal value ₹ 10) at a predetermined price of ₹ 15 per share and the payment in cash, 50 debentures holders holding totally 5,000 debentures did not exercise the option. Calculate the number of equity shares to be allotted to the debenture holders and the amount to be paid in cash on redemption. (Nov 2019, 5 marks)

Answer:

![]()

Question 22.

During the year 2019-20, A Limited (a listed company) made a public issue in respect of which the following information is available:

(i) No. of partly convertible debentures issued – 1,00,000; face value and issue price ₹ 100 per debenture. (Whole issue was underwritten by X Ltd.)

(ii) Convertible portion per debenture- 60%, date of conversion- on expiry of 6 months from the date of closing of issue.

(iii) Date of closure of subscription lists- 1st May 2019, date of allotment- 1st June 2019, rate of interest on debenture -15% p.a. payable from the date of allotment, value of equity share for the purpose of conversion – ₹60 (face value ₹ 10)

(iv) Underwriting Commission -2%

(v) No. of debentures applied for by public – 80,000

(vi) Interest is payable on debentures half yearly on 30th September and 31st March each year. Pass relevant journal entries for all transactions arising out of the above

during the year ended 31st March 2020. (including cash and bank entries) (Jan 2021, 8 marks)

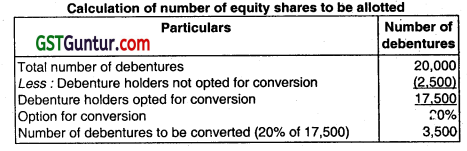

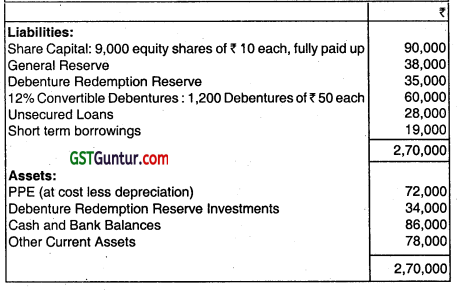

Question 23.

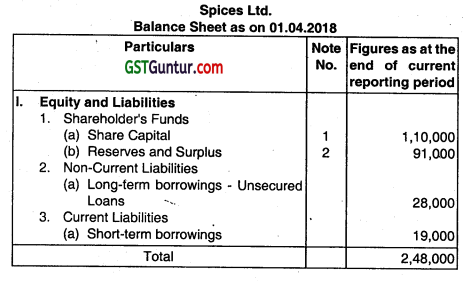

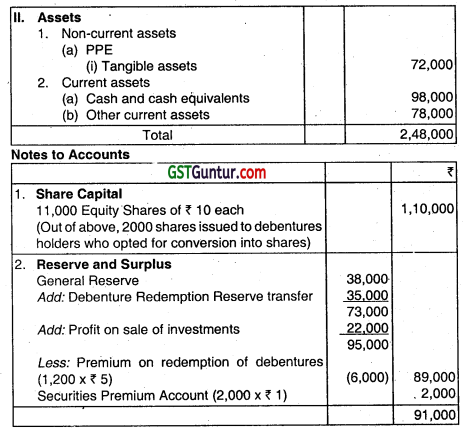

The summarized Balance Sheet of Spices Ltd. as on 31st March 2018 read as under:

The debentures are due for redemption on 1st April 2018. The terms of issue of debentures provided that they were redeemable at a premium 10% and also conferred option to the debenture holders to convert 40% of their holding into equity shares at a predetermined price of ₹ 11 pe share and the balance payment in cash.

Assuming that:

(i) Except for debenture holders holding 200 debentures In aggregate, rest of them exercised the option for maximum conversion,

(ii) The investments realized ₹ 56,000 on sale,

(iii) All the transactions were taken place on 1st April, 2018

(iv) Premium on redemption of debentures is to be adjusted against General Reserve.

You are required to

(a) Redraft the Balance Sheet of Spices Ltd. as on 01.04.2018 after giving effect to the redemption.

(b) Show your calculations in respect of the number of equity shares to be allotted and the cash payment necessary.

Answer: