Public Finance – CA Inter Economics Question Bank is designed strictly as per the latest syllabus and exam pattern.

Public Finance – CA Inter Economics Question Bank

Question 1.

Explain the role of Government in a Market economy as stated by Richard Musgrave. (May 2018, 3 marks)

Answer:

- Richard Musgrave, In his classic treatise ‘The Theory of Public Finance (1959), introduced the three-branch taxonomy of the role of government in a market economy.

- Musgrave believed that, for conceptual purposes, the functions of government are to be separated into three, namely, resource allocation, (efficiency), income redistribution (fairness) and macroeconomic functions, while stabilization is a macroeconomic function.

- The allocation function aims to correct the sources of inefficiency in the economic system while the distribution mode ensures that the distribution of wealth and income is fair.

- Monetary and fiscal policy, the problems of macroeconomy stability, maintenance of high levels of employment and price stability etc. fall under the stabilization function.

Question 2.

Why is there a need for the government to resort to resource allocation? (May 2019, 3 marks)

Answer:

- The Government’s Allocation is accomplished through the Revenue and Expenditure Activities of Budgeting. The Allocative Function in Budgeting determines who and what will be taxed for collecting revenue as well as how and on what the Government Revenue will be spent.

- The Allocation Function also involves the Re-Allocation of economy’s Resources from private use to public use.

The Objectives of Government intervention In allocation of resources:

1. Proper Resource Allocation:

Ensuring proper resource allocation to merit goods which are greatly beneficial to the economy.

2. Obtaining Optimum Mlx:

Ensuring that resources are divided among various uses judiciously so as to obtain an optimum mix of both public goods and merit goods.

3. Correct Market Failures:

Minimising resource mis allocation to correct market failures.

4. Maximising Social Welfare:

Implementing the needs and wants of the citizens thereby maximising social welfare.

Question 3.

Describe the allocation instruments available to the Government to influence resource allocation in an economy. (Jan 2021, 3 marks)

![]()

Question 4.

What do you mean by resource allocation? What are main problems associated with resource allocation?

Answer:

Resource Allocation

- It refers to the way in which available factors of production are allocated among the various uses in the economy.

- It is micro economic in nature.

- It aims to correct the sources of inefficiency in the economy.

Problems associated with resource allocation

1. Problem of what to Produce?

The problem of ‘what to produce’ is the basic problem related to resource allocation. Since resources are limited, economy cannot produce everything that it requires. Hence, economy faces the dilemma of:

- What goods and services are to be produced.

- How much quantity of each good or service is to be produced.

Scarcity is the fundamental cause of this problem. The need for allocation of resources arises only because resources are insufficient in quantity.

2. Problem of How to Produce?

This problem is related to the choice of production technique. Having decided about what to produce and how much to produce, another important decision that society has to make is to choose the production technique. A production technique implies application of a specific Input combination (i.e. labour & capital) to produce the desired goods.

There are two alternative production techniques available in the economy:

- Labour efficient technology (this requires more labour & less capital)

- Capital-efficient technology (this requires more capital and less labour).

Question 5.

What are the reasons behind market failure which hold back the efficient allocation of resources?

Answer:

Imperfect competition and presence of monopoly power in different degrees leading to under-production and higher prices than would exist under conditions of competition.

Failure to provide collective goods which are, consumed in common by all the sections of the society. Externalities which arise when the production and consumption of a good or service affects people. They cannot influence through markets the decision about how much of the good or service should be produced. Immobility of factors of production leading to unemployment and inefficiency. Imperfect information, about the market conditions. inequalities in the distribution of income and wealth.

Question 6.

What do you mean by redistribution Function? What are the main problems associated with redistribution function.

Answer:

Redistribution Function:

- It refers to the way in which income and wealth is distributed so as to ensure distributive justice namely equity and fairness.

- It is microeconomic in nature.

- It caters to the economic problem of ‘for whom to produce’.

- It is concerned about the way in which the effective demand over economic goods is divided among the various individual units.

Main problems associated with Redistribution Function:

The Problem of for whom to produce

The problem ‘for whom to produce’ is related to the distribution of national product among the members of the society.

The core of this problem is to determine who will get the output from the country’s economic activities and in what quantity. Eg: who will get the motorbikes and who will enjoy the cars; who will get the notebooks and who will enjoy the computers.

What goods & services should be consumed & by whom totally depends upon distribution of the national product (both functional as well as personal distribution).

As a basic market rule, goods are produced for those individuals who can afford their price. The purchasing ability originates from the share of the national income that individuals receive as rewards for their contribution to the national product. Thus, once we know who gets what quantity of income, we can easily decide for whom produce the goods and services.

![]()

Question 7.

What is the objective of Government Intervention in Re-distribution?

Answer:

Governments’ Redistribution Policies which interfere with Producer Choices or Consumer Choices are likely to have Efficiency Costs or Deadweight Losses, due to conflict between the objectives of “Efficiency” and “Equity”.

Objective of Government Intervention:

- Redistribution of Income: P + 1

- Equity in Income: P + 3

- Minimum standard of living: P + 5

- Well-being of the society: P + 2

- Security: P + 4

- Balancing between efficiency & equity: P + 6

1. To achieve Redistribution of Income for Equitable Distribution of Societal Output among Households.

2. To increase the well-being of Members of the Society who suffer from deprivations of different types.

3. To provide Equality in Income, Wealth and Opportunities

4. To provide Security for People who have hardships, and

5. To ensuring that everyone enjoys a certain Minimal Standard of Living.

6. Government Measures should be achieved with minimal efficiency costs, by balancing between Efficiency and Equity Objectives, by exercising a proper “trade-off”.

Question 8.

How the Government intervenes to ensure stability in price level? (Nov 2018, 2 marks)

Answer:

Government usually intervenes in many primary markets which are subject to extreme as well as unpredictable fluctuations in price. For example, in India, in the case of many crops, the government has initiated the Minimum Support Price (MSP) programme as well as procurement by government agencies at the set support prices. The objective is to guarantee, steady and assured income of farmers. In case, the market price falls below the MSP, then the guaranteed MSP will prevail.

Question 9.

Discuss the role of ‘Market Stabilization Scheme’ in our economy. (Jan 2021, 2 marks)

Question 10.

What do you mean by stabilisation function? What are the problems related to stabilization function.

Answer: .

Stabilisation Function

It refers to the way In which the macroeconomic fluctuations due to sub-optimal resource allocation is eliminated through the fiscal and monetary policy.

It is macroeconomic in nature.

Problems related to stabilization Function.

1. Problems of how to Utilise Resources Fully:

The price mechanism also helps in the full utilization of the resources of an economy. Full utilisation of resources implies their full employment. This requires increase in income through large investments, and ultimately to the equality of saving and investment.

In a growing economy equality between saving and investment is brought about by reductions in interest rates. When the economy is nearing the level of full employment by an efficient use of resources, income grows at a rapid rate and so do savings. But investment lags behind which can be raised to the level of savings by interest-rate reductions. Thus the rate of interest acts as an equilibrating mechanism.

However, the rate of Interest cannot be relied upon exclusively for this purpose in an economy nearing full employment. Therefore, monetary and fiscal measures and physical controls are also required to influence the decisions of consumers and producers regarding saving and investment.

2. Problem of how to provide an Incentive to Growth:

Prices are an important factor in providing for economic growth. The impetus for improvement, innovation and development comes through the price mechanism. Higher prices and profits encourage large industrial concerns to spend huge sums on research and experimentation to improve and develop better techniques.

The adaptation of the economic system to changes in wants, resources, and technologies takes place through prices. If consumers want more of one commodity In preference to the other the price of the former rises. Resources move to that industry Profits also increase.

Larger profits lead to the adoption of superior technology which lowers costs. Larger profits and low coast attract new producers who provide new capital. All this leads to capital formation. No doubt economic growth depends upon a number of other factors, yet prices play an important role in providing for economic growth with stability.

Question 11.

Describe features of public goods. (May 2018, 2 marks)

Answer:

Public goods refer to goods provided by the government such as national defence, public administration, street lighting, roads, etc. the following features separate public goods from private goods:

Collective Consumption: Public goods are collectively consumed.

Non-rivalrous: Goods are non-rivalrous if the use of the goods by one person does not limit the amount available for consumption by others.

Non-excludability: Non-excludability means that it is not possible to exclude non-payers from enjoying the benefits of these services as they are common property.

All these characteristics make it difficult to collect fees for the use of these goods and private enterprises will, in general, not provide these goods i.e. such goods can’t be effectively provided by market mechanism. Hence, these goods are provided by the government and financed through taxes and related sources.

![]()

Question 12.

Define the market failure. Why do markets fail? (Nov 2018, 3 marks)

OR

Define the concept of Market Failure. Describe the different sources of Market Failure.

Answer:

Market Failure:

Concept

Market failure is a situation in which the free market fails to allocate resources efficiently in the sense that there is either overproduction or underproduction of particular goods and services leading to less-than-optimal market outcomes. The reason for market failure lies in the fact that though perfectly competitive markets work efficiently, most often the prerequisites of competition are unlikely to be present in an economy.

Market failure exists when the competitive outcome of markets is not satisfactory from the point of view of society. What is satisfactory nearly always involves value judgments. However, it can be said that it leads to the misallocation of scarce resources in the economy resulting in either overproduction or underproduction.

Aspects

There are two aspects of market failures namely, demand-side market failures and supply-side market failures. Demand-side market failures are said to occur when the demand curves do not take into account the full willingness of consumers to pay for a product. Supply-side market failures happen when supply curves do not Incorporate the full cost of producing the product.

Types of Market Failure

Complete and partial market failure

- Complete market failure occurs when the market simply does not supply products at all – we see TMmissing markets”.

- Partial market failure occurs when the market does actually function but it produces either the wrong quantity of a product or at the wrong price.

Different sources of Market Failures

There are four basic reasons of market failure

1. Market power or monopoly power

2. Externalities such as

- Negative Production Externalities

- Positive Production Externalities

- Positive Consumption Externalities

- Negative Consumption Externalities

3. Public goods or collective consumption goods or social goods

4. Incomplete information about the market.

Question 13.

Explain the concept of Social Costs. (Nov 2018, 2 marks)

Answer:

Social Costs:

Social Cost refers to the total cost to the society on account of a production or consumption activity. It includes the private costs borne by the individuals directly together with external costs borne by third party not directly involved.

Thus Social Cost = Private Cost + External Cost.

Example:

1. Example of the social cost of smoking

If one smokes the private cost is payment for a packet of cigarettes. But, there are also external costs to society.

- Air pollution and risks of passive smoking

- Litter from discarded cigarette butts

- Health costs

The social costs of smoking include the total of all private and external costs.

2. Example of social cost of building airport Private costs of airport

- Cost of constructing an airport.

- Cost of paying workers to run airport.

External costs of airport

- Noise and air pollution to those living nearby.

- Risk of an accident to those living nearby.

- Loss of landscape.

Question 14.

Define ‘Market power’.

What is its disadvantage? (May 2019, 2 marks)

Answer:

Market power or monopoly power is the ability of a firm to profitably raise the market price of a goods or service over its marginal cost.

Disadvantage:

- Market power lead to market failure. Market failure occurs when the free market outcomes do not maximize net benefits of an economic activity and therefore there is deadweight losses and inefficient allocation of resources.

- Excess market power causes a single producer or a small number of producers to strategically reduce their supply and charge higher prices compared to competitive market.

- Market power can cause markets to be inefficient because it keeps price and output away from the equilibrium of supply and demand.

- Market power thus results in sub-optimal outcomes such as deadweight loss, underproduction of goods and services, higher prices and loss of consumer surplus.

Question 15.

‘Lemons Problem’ is an important source of market failure. How? (Nov 2020, 2 marks)

Question 16.

Explain the various types of externalities. (Nov 2020, 3 marks)

Question 17.

Explain the concept of ‘private cost’. (Jan 2021, 2 marks)

Question 18.

Explain in details the different sources of Market Failure.

Answer:

1. Money Power or Monopoly Power

Excess market power or monopoly power causes the single producer or small number of producers to produce and sell less output than would be produced in a competitive market and to charge higher prices that give them positive economic profits.

2. ExternalIties.

Externalities, also referred to as ‘spillover effects’, ‘neighborhood effects’ ‘third-party effects’ or ‘side-effects’, occur when the actions of either consumers or producers result in costs or benefits that do not reflect as part of the market price. Externalities cause market inefficiencies because they hinder the ability of market prices to convey accurate information about how much to produce and how much to buy.

3. Public Goods

Public goods (also referred to as a collective consumption good or a social good) are indivisible goods which all individuals enjoy in common and are non-excludable and non rival in consumption. Each individual’s consumption of a such a good leads to no subtraction from any other individual’s consumption and consumers cannot (at least at less than prohibitive cost) be excluded from consumption benefits of that good. Public goods do not conform to the settings of market exchange and left to the market, they will not be produced at all or will be underproduced.

4. Incomplete Information

The assumption of complete information which is a feature of competitive markets is not fully satisfied in real markets due to highly complex nature of products and services, inability of consumers to quickly/cheaply find sufficient information, inaccurate or incomplete data, ignorance, lack of alertness and uncertainty about true costs and benefits. Misallocation of scarce resources occurs due to information failure and equilibrium price and quantity is not established through price mechanism.

![]()

Question 19.

identify the market outcomes for each of the following situations

(i) A few youngsters play loud music at night. Neighbors may not be able to sleep.

(ii) Ram buys a large SUV which is very heavy.

(iii) X smokes in a public place.

(iv) Rural school students are given vaccination against measles.

(v) Traffic congestion marking travel very uncomfortable.

Answer:

The market outcomes of different situations are given below;

(i) Negative consumption externality; social cost not accounted for; market failure; overproduction

(ii) Negative consumption externality; environmental externality; wear and tear of roads; increased fuel consumption; added insecurity imposed on others; social cost not accounted for; overproduction.

(iii) Negative consumption externality; overproduction.

(iv) Public good, merit good; positive consumption externality; under production: scope for government intervention.

(v) Negative externality; social cost not accounted for; over production.

Question 20.

What is social cost? What is its importance?

Answer:

Social Cost:

Social Cost refers to the total cost to the society on account of a production or consumption activity. It includes the private costs borne by the individuals directly together with external costs borne by third party not directly involved.

Thus Social Cost = Private Cost + External Cost

Example:

1. Example of social cost of smoking

If one smokes the private cost is payment for a packet of cigarettes. But, there are also external costs to society.

- Air pollution and risks of passive smoking

- Litter from discarded cigarette butts

- Health costs

The social costs of smoking include the total of all private and external costs.

2. Example of social cost of building airport

Private costs of airport

- Cost of constructing an airport.

- Cost of paying workers to run airport.

External costs of airport

- Noise and air pollution to those living nearby.

- Risk of an accident to those living nearby.

- Loss of landscape.

Importance of Social Cost

Rational choice theory suggests individuals will only consider their private costs. For example, if deciding how to travel, we will consider the cost of petrol and time taken to drive. However, we won’t take into consideration the impact on the environment or congestion levels for other members in society. Therefore, if social costs significantly vary from private costs then we may get a socially inefficient outcome in a free market.

Question 21.

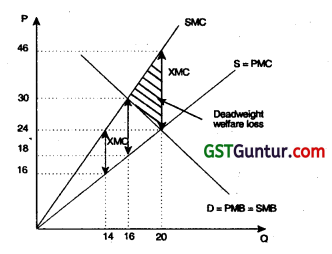

Explain with the help of a diagram the Marginal Social Cost.

Answer:

Marginal social cost (MSC)

The marginal social cost is the cost to society of producing/consuming one extra unit of output.

Example of Marginal Social Cost

| Price | Quantity | PMC | XMC | SMC |

| 24 | 20 | 24 | 22 | 46 |

| 18 | 16 | 18 | 12 | 30 |

| 16 | 14 | 16 | 8 | 24 |

| 13 | 12 | 13 | 6 | 19 |

| 10 | 11 | 10 | 4 | 14 |

| 5 | 4 | 5 | 2 | 7 |

PMC = Pnvate Marginal Cost

XMC = External Marginal Cost

SMC = Social Marginal Cost

Question 22.

You see that your family farmhouse s well-maintained while a public park has poor maintenance. Provide an economic explanation for this fact.

Answer:

Family farmhouse is a private good white public park is public good.

Public goods have the characteristic of non-excludability Le. non-payers can’t be excluded from enjoying the benefits of such goods. As majority of the people enjoy the benefits of public parks but fewer pay for them, there is tack of adequate resources for their proper maintenance.

![]()

Question 23.

What s meant by quasi-public goods? (May 2019, 2 marks)

Answer:

The quasi-public goods or services, also called a near-public good (for e.g. education, health services) possess nearly afl of the qualities of the private goods and some of the benefits of public good. It is easy to keep people away from them by charging a price or fee. However, it is undesirable to keep people away from such goods because the society would be better off if more people consume them. The particular characteristic namely, the combination of virtually infinite benefits and the ability to charge a price results in some quasi-public goods being sold through markets and others being provided by government. As such, people argue that these should not be left to the market alone.

Markets for the quasi-public goods are considered to be incomplete markets and their lack of provision by free markets would be considered as inefficiency and market failure.

Question 24.

What do you mean by ‘Global Public goods’? Explain in brief. (Nov 2019, 2 marks)

Answer:

There are several public goods benefits of which accrue to everywhere and everyone in the world. These goods have a widespread impact on different countries and regions, population groups, and generations. These are goods whose impacts are indivisibly spread throughout the entire globe. These goods are known as Global Public Goods. The WHO delineates two categories of global public goods namely.

Final public goods which are ‘outcomes’ (eg. the eradication of polio) and Intermediate public goods, which contribute to the provision of final public goods. (eg. international Health regulations aimed at stopping the cross-border movement of communicable diseases and thus reducing cross broader movement of communicable diseases and thus reducing cross border health risks).

World Bank identifies five areas of global public goods which it seeks to address: namely, the environmental commons (Including the prevention of climate change and biodiversity), communicable diseases (including HIV/AIDS, tuberculosis, malaria, and avian influenza), international trade, international financial architecture, and global knowledge for development.

Question 25.

Distinguish between positive and negative externalities. (Nov 2019, 2 marks)

Answer:

An externality is defined as the uncompensated impact of one person’s production and/or consumption actions on the well-being of another who is not involved in the activity and such effects are not reflected directly in market prices. If the impact on the third parties is adverse, It is called a negative externality. If it is beneficial it is called a positive externality.

When negative externalities are present, the social cost of production or consumption is greater than the private cost. The benefit of a negative externality goes to the agent producing it, while the costs are invariably borne by the society at large.

When a positive externality exists, the benefit to the individual or firm is less than the benefit to the society i.e. the social value of the good exceeds the private value. In both cases, the outcome is market failure and inefficient allocation of resources.

Question 26.

Describe the characteristics of ‘Public Goods’. (Nov 2020, 2 marks)

Question 27.

Which types of Government interventions are applied for correcting information failure. (May 2018, 2 marks)

Answer:

Government intervention for Correcting Information Failure:

For combating the problem of market failure due to information problems and considering the importance of information in making rational choices, the following interventions are resorted to:

Government makes it mandatory to have accurate labelling and content disclosures by producers.

For example:

- SEBI requires that accurate information be provided to prospective buyers of new stocks.

- Public dissemination of information to improve knowledge and subsidizing of initiatives in that direction.

- Regulation of advertising and setting of advertising standards to make advertising more responsible, informative and less persuasive.

Question 28.

How do Governments correct market failure resulting from demerit Goods? (Nov 2018, 3 marks)

Answer:

Governments corrects market failure resulting from demerit goods Government may enforce complete ban on a demerit goods. i.e. intoxicating drugs. ln such cases, the possession, trading or consumption of the good is made illegal.

Through persuasion which is mainly intended to be achieved by negative advertising campaigns Which emphasize the dangers associated with consumption of demerit goods.

Through legislations that prohibits the advertising or promotion of demerit goods in whatsoever manner. Strict regulations of the market for the good may be put In place so as to limit access to the good, especially by vulnerable groups such as children and adolescents.

Regulatory controls In the form of spatial restrictions e.g. smoking in public places, sale of tobacco to be away from school, and time restrictions under which sale at particular times during the day is banned.

![]()

Question 29.

Describe the problems in administering an efficient pollution tax. (Nov 2019, 3 marks)

Answer:

Problems in administering an efficient pollution tax:

Pollution taxes are difficult to determine and administer because it is difficult to discover the right level of taxation that would ensure that the private cost plus taxes will exactly enquate with the social cost. if the demand for the good is inelastic, the tax may only have an insignificant effect in reducing demand.

The method of taxing the polluters has many limitations because it involves the use of complex and costly administrative procedures for monitoring the polluters.

This method does not provide any genuine solutions to the problem. It only establishes an incentive system for use of methods which are less polluting.

In the case of goods which have inelastic demand procedures will be able to easily shift the tax burden in the form of higher product prices. This will have an inflationary effect and may reduce consumer welfare.

Pollution taxes also have potential negative consequences on employment and investments because high pollution taxes in one country may encourage producers to shift their production facilities to those countries with lower taxes.

Question 30.

Explain the market outcome of price ceiling through diagram. (Nov 2020, 2 marks)

Question 31.

Write short note on Government interventions to correct market failure.

Answer:

Government Interventions to correct Market Failure

1. Government intervention to minimise market power through

- Enactment of Competition Act, 2002

- Price regulations in form of setting maximum prices

- Rate of return regulation etc.

2. Government Intervention to correct externalities through

- Direct controls

- Market-based policies.

3. Government intervention In case of socially desirable and undesirable goods.

4. Government Intervention to correct information failure through

- Mandatory labelling and content disclosures on products

- Public dissemination of information

- Regulation of Advertisement

5. Government Intervention for equitable distribution through

- Progressive income tax

- Targeted budgetary allocation

- Unemployment compensation.

Question 32.

What are the price-based regulations to minimise market power?

Answer:

Price-based Regulations Include the following:

- Setting Maximum Prices that Firms can charge, (e.g. Essential Drugs and similar items),

- Rate of Return Regulation, in which a Regulatory Authority determines an acceptable price for an item, based on its Costs + Fair Rate of Return (e.g. for Natural Monopolies like Electricity, Gas, Water),

- Price-Caps based on a Firm’s Variable Costs, Past Prices, possible inflation and productivity growth, etc.

Question 33.

What is the difference between Control Price and Minimum Support Price?

Answer:

Different Between Control Price and Minimum Support Price:

| Basis | Control Price | MSP |

| 1. Meaning | It is the maximum price for a product that a producer can legally charge in the market. | It is the minimum price guaranteed by the government to the producers at which they can sell their products to the government. |

| 2. Determination | It is generally fixed below the equilibrium price. | It is generally fixed above the equilibrium price. |

| 3. Objective | This policy protects the interests of the buyers i.e. the government fixes a ceiling on price to help the consumers. | This policy protects the interests of Producers (especially the farmers) to stabilize their income. |

| 4. Economic consequences | A policy of control price may lead to malpractices on the part of sellers such as hoardings i.e. creating artificial scarcity or black marketing. | Policy of support price may require the government to maintain buffer stocks of some basic goods like food grains, sugar, etc. |

Question 34.

How does Government intervene to fix limits of price?

Answer:

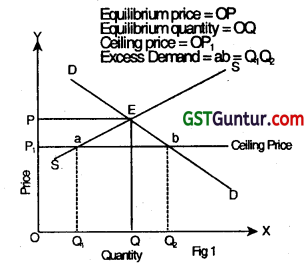

Government intervenes to fix limits of prices through

1. Price Ceiling

2. Price Floor

1. Price Ceiling Limit: This price ceiling limit signifies that price which a seller can charge at the maximum due to government intervention. In Fig. 1, this price ceiling is shown at price OP1. if the prevailing market price OP seems to be higher to the government, it may fix the price ceiling of OP1 price to provide a relief to the poor people. To solve the problem of excess demand (i.e., scarce supply) this price takes help of rationing and fixes a limited constant consumption quota for every income group people.

2. Price Floor Limit: Price floor limit signifies that minimum price which government fixes at the minimum to support the producers. For agricultural products this price is known as minimum support price. Fig. 2 shows that in case of excess supply, government fixes price floor limit at OP2, so as to prevent any price fall tendency appearing due to excess supply cd. Such price floor limit saves the producers from losses.

![]()

Question 35.

Explain the economic consequences/effects of control price/price ceiling.

Answer:

The effects of a ‘Price ceiling’ on the market of a good are as follows:

| 1. Shortage | When the government fixes price ceiling on a product, market demand of it increases while market supply shrinks. The overall effect of this demand of it increases while market supply shrinks. The overall effect of this can be seen in terms of excess demand or shortage of the commodity in the market. |

| 2. Need for a well-designed rationing system | Since a large portion of consumer’s demand remains unsatisfied because of shortage of the commodity, thus, a problem now arises about the distribution of the limited supply among a large number of consumers. This problem can be solved by developing a good rationing system by the centrally administered system. |

| 3. Black Marketing | Policy of control price may lead to malpractices on part of sellers such as hoardings i.e. creating artificial scarcity or black marketing. |

Question 36.

Explain the economic consequences of price support policy.

Answer:

Economic Consequences of Price Support Policy:

| 1. Excess Supply | In order to safeguard the interest of farmers, the government announces the floor price (i.e. MSP). This policy ensures the producers that the price would not fall below a certain level and they will get a minimum guaranteed price. This results in expansion in market supply and contraction in the market demand due to increase in price. Therefore, a surplus arises which is known as excess supply. |

| 2. Maintaining buffer stocks: | One of the pre-requisite of the success of minimum support price programme is that government is required to maintain the buffer stock. Butter stock refers to government stocks where in order to stabilise the market price of agricultural products, the government plays an active role in buying the excess supply when production is plentiful and it clears stocks in case of deficient production. |

| 3. Burden of Huge food subsidiary | Government is responsible of providing food securing to the masses (i.e. the poor people). It purchases food grains at MSP. |

Question 37.

Describe the meaning and mechanism of ‘crowding out’ effect of public expenditure. (May 2018,3 marks)

OR

Crowding Out Effect is a monetarist criticism of expansionary fiscal policy. In light of the above statement discuss the impact of crowding out effect.

Answer:

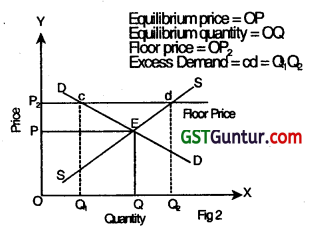

Impact of The Crowding Out Effect

- Crowding out effect is the negative effect of fiscal policy where by money from private sector is crowding out to the public sector.

- The Government spending replaces private spending.

- Fiscal policy becomes ineffective as decline in private spending offsets the expansion in demand resulting from an increase in Govt. Expenditure.

The Crowding Out Effect is a monetarist criticism of expansionary fiscal policy. As seen in the multiplier effect, government spending will shift Aggregate Demand (AD) further than expected when an expansionary fiscal policy is implemented. However, Monetarists believe that because of this expansionary fiscal policy, the government will need to borrow money by selling government bonds. This leads to a rise in interest rates, i.e. from R1 to R3 as in figure 1. The increased borrowing crowds out’ private investing.

A rise in interest rates would discourage private investors from investing and private consumption may also decrease as many large purchases are made on credit. So the result could be a rise from AD1 to AD2, instead of AD1 to AD3 as shown in figure 2.

Question 38.

Explain the objectives of Fiscal Policy. (May 2018, 3 marks)

Answer:

The objectives of fiscal policy may vary from country to country. However, the most common objectives of fiscal policy are:

- Achievement and maintenance of full employment

- Maintenance of price stability.

- Acceleration of the rate of economic development, and

- Equitable distribution of income and wealth.

Question 39.

Define the Contractionary Fiscal Policy. What measures under this policy are to be adopted to eliminate the inflationary gap? (Nov 2018, 3 marks)

Answer:

Contractionary Fiscal Policy:

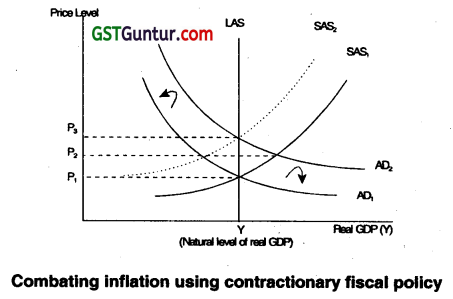

Contractionary fiscal policy is defined as a decrease in government expenditures and/or an increase In taxes that causes the government’s budget defiit to decrease or its budget surplus to increase. Contractionary fiscal policy refers to the deliberate policy of government applied to curtail aggregate demand and consequently the level of economic activity. In the other words, it is fiscal policy aimed at eliminating an inflationary gap. Eliminating an inflationary gap can be achieved by adopting policy measures that would result in the aggregate demand curve (AD) shifting the to the left so the equilibrium may be established at the full employment level of real GDP.

This can be achieved either by:

- Decrease in government spending.

- Increase in personal income taxes and/or business taxes.

- A combination of decrease in government spending, and increase in personal income taxes and/or business taxes.

Combating inflation using contractionary fiscal policy. Keynesians also argue that fiscal policy can be used to combat expected increases in the rate of inflation. Suppose that the economy is already at the natural level of real GDP and that aggregate demand is projected to increase further, which will cause the AD curve in Figure to shift from AD1 to AD2.

As real GDP rises above its natural level, prices also rise, prompting an increase in wages and other resource prices and causing the SAS curve to shift from SAS1 to SAS2. The end result is inflation of the price level from P1 to P3, with no change from real GDP.

The government can head off this inflation by engaging in a contractionary fiscal policy designed to reduce aggregate demand by enough to prevent the AD curve from shifting out to AD2. Again, the government needs only to decrease expenditures or Increase taxes by a small amount because of the multiplier effects that such actions will have.

Question 40.

What is allocation function of Fiscal Policy? (Nov 2018, 2 marks)

Answer:

The allocation function of fiscal policy determines who and what will be taxed as well as how and on what the government revenue will be spent. It is concerned with the provision of public goods and the process by which the total resources of the economy are divided among various uses and an optimum mix of various social goods (both public goods and merit goods). The allocation function also involves the reallocation of society’s resources from private use to public use.

Question 41.

Describe the limitation so fiscal policy. (May 2019, 3 marks)

Answer:

Limitations of Fiscal Policy:

1. One of the biggest problems with using discretionary fiscal policy to counteract fluctuations is the different types of lags involved in fiscal policy action. There are significant lags are:

| Recognition lag | The economy is a complex phenomenon and the state of the macroeconomic variables is usually not easily comprehensible. Just as in the case of any other policy, the government must first recognize the need for a policy change. |

| Decision lag | Once the need for intervention is recognized government has to evaluate the alternative policies. Delays are likely to decide on the most appropriate policy. |

| Implementation lag | When appropriate policy measures are decided on, there are possible delays in bringing in legislation and Implementing them. |

| Impact lag | Impact lag occurs when the outcomes of a policy are not visible for some time. |

2. Fiscal policy changes may at times be badly timed due to the various lags so that it is highly possible that an expansionary policy is initiated when the economy is already on a path of recovery and vice versa.

3. There are difficulties in instantaneously changing governments spending and taxation policies.

4. It is practically difficult to reduce government spending on various items such as defence and social security as well as huge capital projects which are already midway.

5. Public works cannot be adjusted easily along with movements of the trade cycle because many huge projects such as highways and dams have long gestation period. Besides, some urgent public projects cannot be postponed for reasons of expenditure cut to correct fluctuations caused by business cycles.

6. Due to uncertainties, there are difficulties of forecasting when a period of inflation or deflation may set in and also promptly determining the accurate policy to be undertaken.

7. There are possible conflicts between different objectives of fiscal policy such that a policy designed to achieve one goal may adversely affect another. For example, an expansionary fiscal policy may worsen inflation in an economy.

8. Supply-side economics are of the opinion that certain fiscal measures will cause disincentives. For example, increase in profits tax may adversely affect the incentives of firm to invest and an increase in social security benefits m&j adversely affect incentives to work and save.

![]()

Question 42.

What is meant by expansionary fiscal policy? Under what circumstances do government pursue expansionary policy? (May 2019, 2 marks)

Answer:

Expansionary fiscal policy is defined as an increase in government expenditures and/or a decrease in taxes that causes the government’s budget deficit to increase or its budget surplus to decrease. Expansionary fiscal policy is designed to stimulate the economy-aim to increase aggregate expenditures and aggregate demand increase in government spending and/or a decrease in taxes.

The government pursued the expansionary policy in the following circumstances:

A recession is said to occur when overall economic activity declines, or in other words when the economy ‘contracts’. A recession sets in with a period of declining real income, as measured by real GDP simultaneously with a situation of rising unemployment.

If an economy experiences a fall In aggregate demand during a recession, it is said to be in a demand falls and therefore, lesser quantity of goods and services will be produced. In such case government pursue the expansionary policy.

When the aggregate demand falls short of aggregate supply, it results in unemployment of resources, especially labour. In this case government pursued expansionary policy.

Question 43.

Distinguish between ‘pump priming’ and ‘compensatory spending’. (Nov 2019 2 marks)

Answer:

Pump priming involves a one-shot injection of government expenditure into a depressed economy with the aim of boosting business confidence and encouraging larger private investment, It is a temporary fiscal stimulus in order to set off the multiplier process. The argument is that with a temporary injection of purchasing power into the economy through a rise in government spending financed by borrowing rather than taxes, it is possible for government to bring about permanent recovery from a slump.

Compensatory spending is said to be resorted to when the government spending is deliberately carried out with the obvious intention to compensate for the deficiency in private investment. Thus, Pump priming is certain volumes of public spending to revive the economy. compensatory spending is government spending to compensate for the deficiency in private investment.

Question 44.

How does a discretionary fiscal policy help in correcting instabilities in the economy? (Nov 2019, 3 marks)

Answer:

Discretionary fiscal policy for stabilization refers to deliberate policy actions on the part of government to change the levels of expenditure, taxes to influence the level of national output, employment and prices. Governments influence the economy by changing the level and types of taxes, the extent and composition of spending, and the quantity and form of borrowing.

During inflation, or during the expansionary phase of the business cycle when there is excessive aggregate spending and excessive level of utilization of resources, contractionary fiscal policy is adopted to close the inflationary gap.

This measure involves:

- decrease in government spending,

- increase in personal and business taxes, and introduction of new taxes.

- a combination of decrease in government spending and increase in personal income- taxes and/or business taxes.

- a smaller government budget deficit or a larger budget surplus.

- a reduction in transfer payments.

- increase in government debt from the domestic economy.

During deflation or during a recessionary/contractionary phase of the business cycle, with sluggish economic activity when the rate of utilization of resources is less, expansionary fiscal policy aims to compensate the deficiency in effective demand by boosting aggregate demand. The recessionary gap is set right by:

- increased government spending,

- decrease in personal and business taxes,

- a combination of increase in government spending and decrease in personal income taxes and/or business taxes.

- a larger government budget deficit or a lower budget surplus.

- an increase in transfer payments.

- repayment of public debt to people.

Question 45.

What is ‘Recessionary Gap’? (Nov 2019, 2 marks)

Answer:

A recessionary gap, also known as a contractionary gap, is said to exist if the existing levels of aggregate production is less than what would be produced with full employment of resources. It is a measure of output that is lost when actual national income falls short of potential income and represents the difference between the actual aggregate demand and the aggregate demand which is required to establish the equilibrium at full employment level of income. This gap occurs during the contractionary phase of business cycle and results in higher rates of unemployment. In other words, a recessionary gap occurs when the aggregate demand is not sufficient to create conditions of full employment.

![]()

Question 46.

Discuss the “Fiscal Policy Measures” which are useful for reduction in inequalities of income and wealth. (Nov 2020, 3 marks)

Question 47.

What do you mean by crowding Out” in relation to fiscal policy? (Jan 2021, 2 marks)

Question 48.

Explain the significance of public debt as an instrument of fiscal policy. (Jan 2021, 2 marks)

Question 49.

Calculate the Fiscal Deficit and Primary Deficit from the data given below:

| (₹ In Crores) | |

| Total Expenditure on Revenue Account and Capital Account | 547.62 |

| Revenue Receipts | 226.82 |

| Non-debt Capital Receipts | 103.00 |

| Interest Payments | 8400 |

(Jan 2021, 3 marks)

Question 50.

Expansionary fiscal policy leads to crowding out and contractionary fiscal policy leads to crowding in. Explain how.

Answer:

Classical economists point out that the Keynesian view of the effectiveness of fiscal policy tends to ignore the secondary effects that fiscal policy can have on credit market conditions. When the government pursues an expansionary fiscal policy, it finances its deficit spending by borrowing funds from the nation’s credit market. Assuming that the money supply remains constant, the government’s borrowing of funds in the credit market tends to reduce the amount of funds available and thereby drives up interest rates.

Higher interest rates, in turn, tend to reduce or crowd out” aggregate investment expenditures and consumer expenditures that are sensitive to interest rates. Hence, the effectiveness of expansionary fiscal policy in stimulating aggregate demand will be mitigated to some degree by this crowding-out effect.’

The same holds true for contractionary fiscal policies designed to combat expected inflation. If the government reduces its expenditures and thereby reduces its borrowing, the supply of available funds in the credit market increases, causing the interest rate to fall. Aggregate demand increases as the private sector increases its investment and interest-sensitive consumption expenditures. Hence, contractionary fiscal policy leads to a crowding-in effect on the part of the private sector. This crowding- in effect mitigates the effectiveness of the contractionary fiscal policy in counteracting rising aggregate demand and inflationary pressures.

Question 51.

What is Expansionary fiscal policy? Throw light on classical and Keynesian views of fiscal policy.

Answer: .

Expansionary fiscal policy is defined as an increase in government expenditures and/or a decrease in taxes that causes the government’s budget deficit to increase or its budget surplus to decrease. Classical and Keynesian views of fiscal policy.

The belief that expansionary and contractionary fiscal policies can be used to influence macroeconomic performance is most closely associated with Keynes and his followers. The classical view of expansionary or contractionary fiscal policies is that such policies are necessary because there are market mechanisms – for example, the flexible adjustment of prices and wages – which serve to keep the economy at or near the natural level of real GDP at all times. Accordingly, classical economists believe that the government should run a balanced budget each and every year.

Question 52.

How is Expansionary fiscal policy used to combat recession?

Answer:

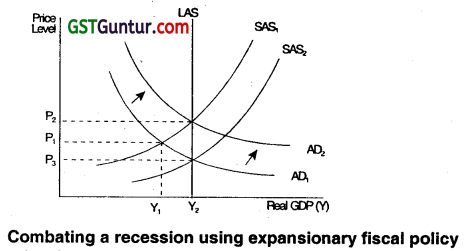

Combating a recession using expansionary fiscal policy. Keynesian theories of output and employment were developed in the midst of the Great Depression of the 1930s, when unemployment rates in the US and Europe exceeded 25% and the growth rate of real GDP declined steadily for most of the decade. Keynes and his followers believed that the way to combat the prevailing recessionary climate was not to wait for prices and wages to adjust but to engage in expansionary fiscal policy instead. The Keynesians’ argument in favour of expansionary fiscal policy is illustrated in Figure.

Assume that the economy is initially in a recession. The equilibrium level of real GDP, Y1, lies below the natural level, ‘Y2’ implying that there is less than full employment of the economy’s resources. Classical economists believe that the presence of unemployed resources causes wages to fall, reducing costs to suppliers and causing the SAS curve to shift from SAS1 to SAS2, thereby restoring the economy to full employment. Keynesians, however, argue that wages are sticky downward and will not adjust quickly enough to reflect the reality of unemployed resources.

Consequently, the recessionary climate may persist for a long time. The way out of this difficulty, according to the Keynesians, is to run a budget deficit by increasing government expenditures in excess of current tax receipts. The increase in government expenditures should be sufficient to cause the aggregate demand curve to shift to the right from AD1 to AD2, restoring the economy to the natural level of real GDP. This increase in government expenditures need not, of course, be equal to the difference between Y1 and Y2.

Recall that any increase in autonomous aggregate expenditures, including government expenditures, has a multiplier effect on aggregate demand, Hence, the government needs only to increase its expenditures by a small amount to cause aggregate demand to increase by the amount necessary to achieve the natural level of real GDP.

Keynesians argue that expansionary fiscal policy provides a quick way out of a recession and is to be preferred to waiting for wages and prices to adjust, which can take a long time. As Keynes once said, “In the long run, we are all dead.”

![]()

Question 53.

Define Government Budget, Explain in brief the Objectives of government budget.

Answer:

Government Budget

Government Budget is an annual statement representing item-wise estimates of government’s proposed revenues and expenditures for the coming fiscal year.

Components of Government Budget

- Revenue Budget

- Capital Budget

Objectives of Government Budget:

| 1. Reallocation of Resources | An important objective of government budget is to reallocate the resources in the best interest of the economy. Goods and Services provided by the government i.e. public goods and services such as national defence, public administration, Street lighting, roads etc. can’t be effectively provided by market mechanism. Therefore, when market forces are not able to allocate the resources efficiently, the government undertakes this responsibility. Through public sector undertakings and their administration, the government diverts the resources from productive to more productive uses. |

| 2. Redistributive Objective | Another objective of government budget is to reduce income inequalities to achieve the goal of social equity and regional equalities. Inequalities in the distribution of income and wealth are widespread in a developing country like India. Because government budgets aims to remove these disparities, it makes use of the policy of progressive taxation and also gives subsidies and social security payment to weaker sections of the society. |

| 3. Economic Growth with Stability | In this dynamic world, a fluctuation in the general business activity is a normal phenomenon. Sometimes, these fluctuations of business cycle (such as recession) hinder the pace of economic growth. The aim of government budget is to control fluctuation of trade cycle so as to maintain a healthy growth rate. The government uses fiscals policy instruments such as taxes, public spending, etc. to control the general price level and to achieve the desired rate of employment. |

| 4. Management of Public Sector Undertakings | Public sector enterprises are in the form of basic, heavy, and capital-intensive industries and are distinct from private sector industries which are predominantly consumer goods industries. A natural monopoly element also exists in public industries which refers to those enterprises in which economies of large-scale production are so high that no other firm can stand in its competition. Being a government-owned enterprise, the choice of investment, location, pricing, employment, and other important policies are centrally decided. Thus, for their efficient management and financing, the government makes provisions in its annual budget. |

Question 54.

Define revenue deficit. What is its implication?

Answer:

Revenue Deficit

The excess of total revenue expenditure over total revenue receipts is called revenue deficit. In other words, it is the balance of a revenue budget in which expenditure exceeds the receipts.

Revenue Deficit = Revenue Expenditure – Revenue Receipts

Implications of Revenue Deficit:

| 1. Extent of Deficiency In Revenue Account | Revenue deficit indicates that the government has proposed to spend more than what it will earn i.e. it indicates dissaving or negative savings of the government body; it signifies that the government does not have sufficient amount of resources to meet the routine expenses. |

| 2. Debt Burden | High revenue deficit leads to large-scale public borrowings and increases debt burden due to repayment liability and interest payment. This may lead to larger revenue deficit in future. |

| 3. Disinvestment | Revenue deficit is met by drawing money from capital receipts. This may compel the government to dispose of its assets (by disinvestment). |

| 4. Inflation | Since revenue expenditure is incurred on routine functioning of the government, a large demand for goods and services by the government may lead to an inflationary situation in the economy with all its concerns. |

Question 55.

Define fiscal deficit. What are its implications?

Answer:

Fiscal Deficit

Fiscal deficit is defined as excess of total expenditure over total receipts (excluding borrowings) during a fiscal year.

Fiscal Deficit = Total Expenditure – Revenue Receipts – Capital Receipts (excluding borrowings)

Or

Fiscal Deficit = Total Expenditure – Revenue Receipts – (Capital Receipts – Borrowings)

Or

Fiscal Deficit = Borrowings

Implications of Fiscal Deficit

| 1. Creates vicious cycle of debt | Fiscal deficit indicates borrowing requirements of the government. Larger fiscal deficit means large borrowing requirement. Larger borrowing increases the burden of interest payments, leading to larger revenue deficit in future and hence, in next fiscal year, more borrowings will be needed. This creates a vicious cycle of debt that perpetuates for a long time. And generally, it becomes extremely difficult to come out of this cycle. |

| 2. Inflation | When fiscal deficit is met through borrowings from the RBI i.e. via deficit financing, it may fuel inflation as money supply increases in the economy. |

| 3. Extravagancy of government body | High fiscal deficit generally leads to wasteful and unnecessary expenditure by the government. |

| 4. Retards economic growth and is an obstacle to sustainable development | Most of the times, a major part of borrowings is used to meet the interest commitment and not for productive purposes, especially in a developing country like India. This retards the growth of the economy. Increasing debt due to fiscal deficit puts greater burden on future generations. Hence, it is an obstacle to sustainable development. |

| 5. Foreign dependence and their intervention home country’s affairs | The government also borrows from the rest of the rest of the world which raises its dependence on other countries’ domestic affairs and policy In making. |

Question 56.

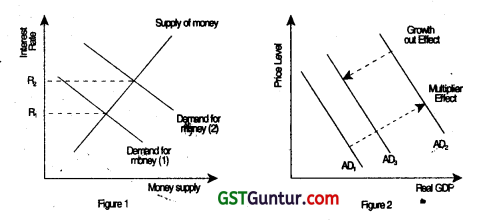

Define deficient demand. Show deflationary gap with the help of a diagram and explain monetary and fiscal measures to correct it.

Answer:

Deficient Demand

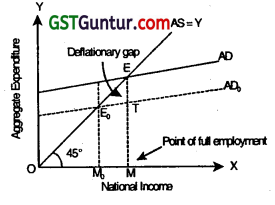

The amount by which actual aggregate demand falls short of the aggregate demand required to establish full-employment equilibrium is called deficient demand. Deficiency in aggregate demand creates deflationary pressure in the economy which means that general price level shows downward trend. Therefore, deficient demand is measured in terms of deflationary gap.

Deflationary gap: It is the gap showing deficiency of aggregate demand with respect to aggregate supply corresponding to the point of full employment. It is the measure of deficient demand in the economy.

- Point E, lying on the 45° line, is the full-employment equilibrium point.

- It is an ideal situation for the economy as aggregate demand represented by Em is equal to full employment aggregate output OM. Suppose that actual aggregate demand is measured along AD0 curve.

- E0 point is the underemployment equilibrium point.

- Actual aggregate demand at full employment is TM which is less than full-employment aggregate output (OM = EM).

![]()

Question 57.

Why should the government reduce fiscal deficit when it can financed through borrowings and printing of new currency?

Answer:

Fiscal deficit is the excess of proposed total expenditure over proposed non-debt total receipts, It is the amount of borrowings that the government has to make so as to meet its expenses.

- Thus, the entire amount of fiscal deficit is met through borrowings. Fiscal deficit creates a problem of payment of interest and repayment burden of loans. Thus, it leads the economy into a vicious cycle of debt.

- Printing of new currency (in the form of government borrowings from the central bank) increases money supply that leads to inflationary pressure. That is why the government always tries to reduce its fiscal deficit.

Question 58.

Define excess demand. Show inflationary gap with the help of a diagram and explain the monetary and fiscal measures to correct it.

Answer:

Excess demand:

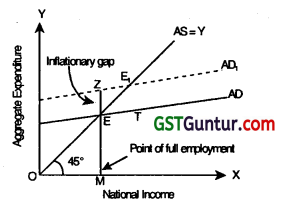

The amount by which actual aggregate demand exceeds the aggregate demand required to establish full employment equilibrium is called excess demand. Excess demand creates inflationary pressure in the economy which means that general price level shows an upward trend. Therefore, excess demand is measured in terms of inflationary gap.

Causes of excess demand

- Increase in propensity to consume.

- Rise in firm’s investment outlays.

- Increase in government spending

- increase in population

- increase in the money supply

- Rise in exports

Inflationary gap: it is the gap showing excess of aggregate demand over aggregate supply/aggregate output corresponding to the point of full employment.

- In the diagram, income/output/employment is shown on the X-axis whereas as the Y-axis measures aggregate expenditure.

- Point E located on the 45° line is full employment equilibrium point where aggregate demand represented by EM is equal to aggregate output represented by OM. This is an ideal situation for the economy.

- Suppose that actual aggregate demand curve is AD which intersects the 45° line at point E.

- Now, actual aggregate demand corresponding to the point of full employment is ZM which exceeds full employment aggregate supply OM = EM.

- Therefore difference between ZM and EM (EZ) is the inflationary gap which is the measure of excess demand in economy.

Question 59.

What are the fiscal measures to correct excess demand and deficient demand.

Answer:

| Measures | In case of Excess Demand | In case of Deficient Demand |

| 1. Expenditure Policy | When there is excess demand in the economy, the government curtails its expenditure so that the level of aggregate demand falls. |

There is a direct relationship between public expenditure and aggregate demand. When there is deficient demand in the economy, the government increases its expenditure so that the level of aggregate demand increases. |

| 2. Revenue Policy | In a situation of excess demand, the government levies additional taxes and also increases the existing rates of taxes. By doing this, the government cuts down disposable income and purchasing power of the people which helps to control the excess aggregate demand. | In a situation of deficient demand, the government gives tax relaxation. By doing this, the government increases the disposable income and purchasing power of people which helps combat recession /deficient demand. |

| 3. Policy of Public Debt and Deficit Financing | To absorb the surplus purchasing power of the public, the government may resort to large-scale’ public borrowing. However, deficit financing should be avoided as it fuels inflation. | In a situation like deficient demand, the government redeems its debts so as to pump additional purchasing power into the economy. The government may also resort to deficit financing by choosing a deficit budget. |