Management of Receivables and Payables – CA Inter FM Question Bank is designed strictly as per the latest syllabus and exam pattern.

Management of Receivables and Payables – CA Inter FM Question Bank

Question 1.

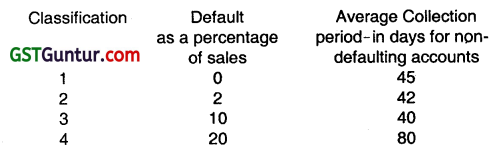

The credit manager of XYZ Ltd. is reappraising the company’s credit policy. The company sells its products on terms of net 30. Cost of goods sold is 85% of sales and fixed costs are further 5% of sales. XYZ classifies its customers on a scale of 1 to 4. During the past five years, the experience was as under:

The average rate of interest is 15%. What conclusions do you draw about the Company’s Credit policy? What other factors should be taken into account before changing the present policy? Discuss. (May 2001, 6 marks)

Answer:

Assumptions: In the said question, amount of revenue generated from customer is not given, So, we consider ₹ 100 as the amount of revenue generated for each type of customers and entire reappraisal of credit policy shall be made on the basis of ₹ 100.

Working Notes:

(1) Calculation of Interest cost:

Formula used:

Interest = \(=\frac{\text { Cost of goods sold } \times \text { Rate of interest } \times \text { Average collection period in days }}{365 \text { days }} \)

(i) Conclusions: Above reappraisal of credit policy shows that company may either follow a simplified credit policy or it is inefficient in collection of debts. Category 1, 2, & 3 shows favourable impact whereas category 4 shows unfavourable impact of company’s position. In case of category 4, if the company can reduce the bad debt percentage at least by 7.8%, the company can allow the credit period of 80 days. By this way company can increase the market share.

(ii) Other factors should be taken before changing the present policy:

- Analyze the past performance of the customers.

- Feasibility of credit performance.

- Enhancing the credit recovery.

Question 2.

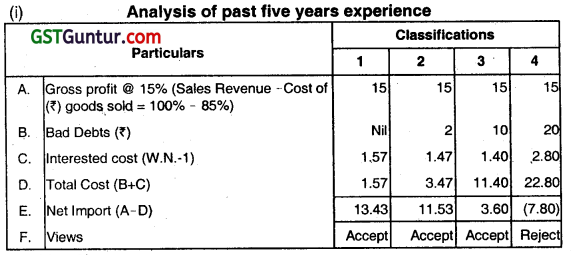

A company has prepared the following projections for a year:

Sales 21,000 units

Selling Price per unit ₹ 40

Variable Costs per unit ₹ 25

Total Costs per unit ₹ 35

Credit period allowed One month

The Company proposes to increase the credit period allowed to its customers from one month to two months. It is envisaged that the change in the policy as above will increase the sales by 8%. The company desires a return of 25% on its investment. You are required to examine and advise whether the proposed Credit Policy should be implemented or not. (Nov 2002, 4 marks)

Answer:

Calculation of contribution and excess fund blockage if credit period is extended to two months from one month:

∴ Return due to change in credit policy

= \(\frac{\text { Contribution on extra sales }}{\text { Blockage of Extra funds }} \times 100 \)

= \(\frac{₹ 25,200}{₹ 68,250} \times 100\) = 36.92%

Advice: Proposed credit policy should be adopted because it gives more return (36.92%) as comparison to existing policy (25%)

![]()

Question 3.

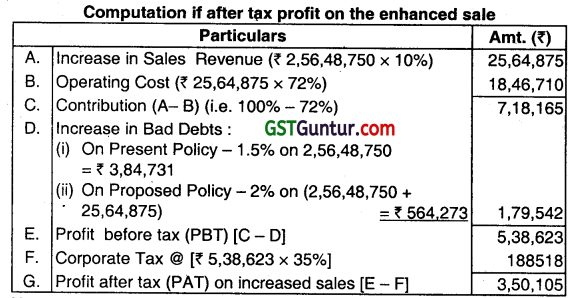

A firm has a current sales of ₹ 2,56,48,750. The firm has unutilized capacity. In order to boost its sales, it is considering the relaxation in its credit policy. The proposed terms of credit will be 60 days credit against the present policy of 45 days. As a result, the bad debts will increase from 1.5% to 2% of sales. The firm’s sales are expected to increase by 10%. The variable operating costs are 72% of the sales. The firm’s Corporate tax rate is 35%, and it requires an after-tax return of 15% on its investment. Should the firm change its credit period? (Nov 2003, 6 marks)

Answer:

Now, Increase in receivable Investment:

Investment proposed receivable investment

\(\frac{₹ 2,56,48,750+₹ 25,64,875}{360 \text { days }} \times 60 \text { days }\) = ₹ 47,02,271

Therefore, Expected rate of return

\(\frac{\text { Increase in PAT }}{\text { Increase in receivable investment }}=\frac{₹ 3,50,105}{₹ 14,96,177} \times 100\) = 23.40%

Advice: Firm should adopt the proposal because the expected rate of return is 23.40% where as the required rate of return is 15%.

Question 4.

A firm is considering offering 30-day credit to its customers. The firm like to charge them an annualized rate of 24%. The firm wants to structure the credit in terms of a cash discount for immediate payment. How much would the discount rate have to be? (Nov 2004, 4 marks)

Answer:

30 days credit cost (interest) at annualized rate 24%

\(\frac{24}{100} \times \frac{30 \text { days }}{365 \text { days }} \) =0.019726 i.e 1.9726%

i.e. Present value of ₹ 1 after 30 days

Therefore, the present value of ₹ 1 on zero date is \(\frac{1}{1.09726}\) = 0.980656

∴ The discount which can be offered to receivable as on zero date is (1- 0.980656) = 0.019344 i.e. = 1.93%

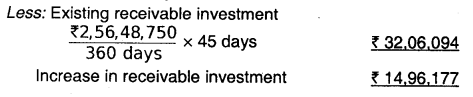

Question 5.

Answer the following:

The Sales Manager of AB Limited suggests that if credit period is given for 1.5 months then sales may likely to increase by ₹ 1,20,000 per annum. Cost of sales amounted to 90% of sales. The risk of non-payment ¡s 5%. Income tax rate is 30%. The expected return on investment is ₹ 3,375 (after tax). Should the company accept the suggestion of Sales Manager? (May 2008, 3 marks)

Answer:

Conclusion:

Since the net Profit is ₹ 4,200 and expected return is 3,375, therefore as PAT is positive hence, the suggestion of the sales manager may be accepted.

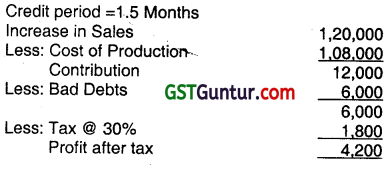

Question 6.

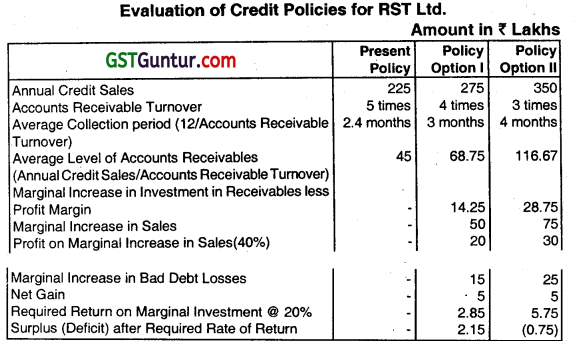

RST Limited is considering relaxing its present credit policy and is in the process of evaluating two proposed policies. Currently, the firm has annual credit sales of ₹ 225 lakhs and accounts receivable turnover ratio of 5 times a year. The current level of loss due to bad debts is ₹ 7,50,000. The firm is required to give a return of 20% on the investment in new accounts receivables. The company’s variable costs are 60% of the selling price. Given the following information, which is better option?

(Nov 2010,8 Marks)

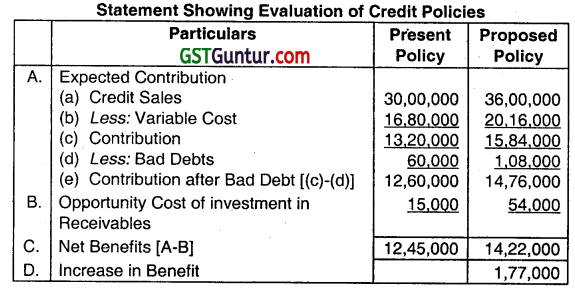

Answer:

Advise: On the basis of above analysis the Policy Option I has a surplus of ₹ 2.15 lakhs whereas Option II shows a deficit of ₹ 0.75 lakhs on the basis of 20% return. Therefore, Policy Option I is better.

Question 7.

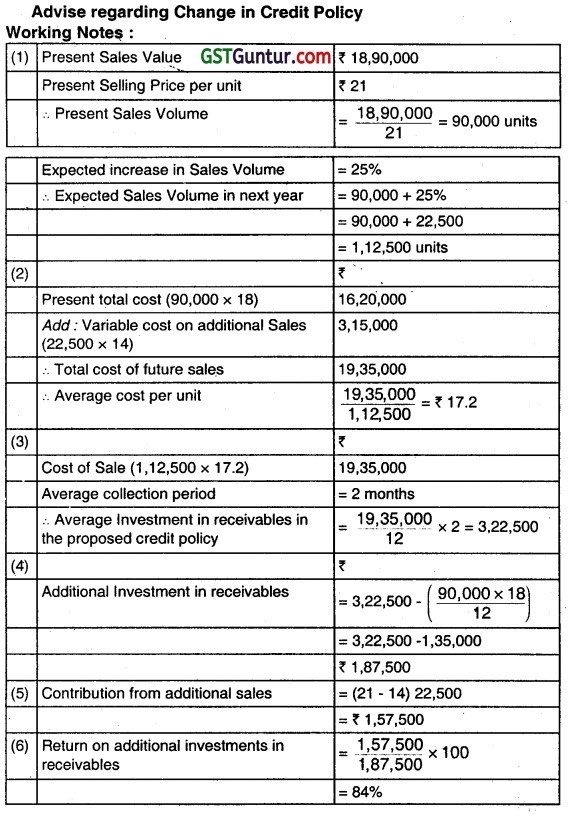

The Marketing Manager of XY Ltd. is giving a proposal to the Board of Directors of the company that an increase in credit period allowed to customers from the present one month to two months will bring a 25% increase in sales volume in the next year.

The following operational data of the company for the current year are taken from the records of the company:

| ₹ | |

| Selling price | 21 p.u. |

| Variable cost | 14 p.u. |

| Total cost | 18 p.u. |

| Sales value | 18,90,000 |

The Board, by forwarding the above proposal and data requests you to give your expert opinion on the adoption of the new credit policy in next year subject to a condition that the company’s required rate of return on investments is 40%. (May 2011, 8 marks)

Answer:

Advise: The expected rate of return on additional investment in receivables (84%) is more than the required rate of return (40%), therefore the proposed increase in credit period from one month to two months should be accepted and implemented in the next year.

![]()

Question 8.

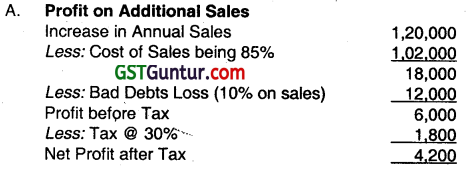

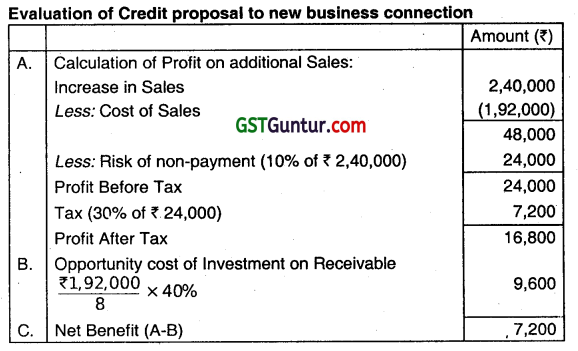

Answer the following:

A new customer with 10% risk of non-payment desires to establish business connections with you. He would require 1.5 month of credit and is likely to increase your sales by ₹ 1,20,000 p.a. Cost of sales amounted to 85% of sales. The tax rate is 30% Should you accept the offer if the required rate of return is 40% (after tax)? (Nov 2011, 5 marks)

Answer:

Working Notes:

(i) Receivable Turnover = \(\frac{12}{1.5}\) = 8 Times

(ii) Average Investment in Receivables

=\(\frac{\text { Cost of Sales }}{\text { Receivables Turnover }}=\frac{1,02,000}{8} \) = ₹ 12,750

(iii) Opportunity Cost of Funds Blocked = 12,750 x 40/100 = 5,100

Evaluation of Credit to New Customer

B. Opportunity Cost of Investment

in Receivables (12,750 x 40) 5,100

C. Net Benefit/Loss (A – B) (900)

Decision: The offer should not be accepted since ₹ 4,200 the estimated profit after tax on additional sales is less than the required return on additional investment of ₹ 5,100 in receivables.

Question 9.

A company is presently having credit sales of ₹ 12 lakhs. The existing credit terms are 1/10, net 45 days and average collection period is 30 days. The current bad debts loss is 1.5%. In order to accelerate the collection process further as also to increase sales, the company is contemplating liberalisation of its existing credit terms to 2/10, net 45 days.

It is expected that sales are likely to increase 1/3 of existing sales, bad debts increase to 2% of sales, and average collection period to decline to 20 days. The contribution to sales ratio of the company is 22% and opportunity cost of investment in receivables is 15% percent (pre-tax). 50 percent and 80 percent of customers in term of sales revenue are expected to avail cash discount under existing and liberalization scheme respectively. The tax rate is 30%. Should the company change its credit terms? (Assume 360 days in a year). (May 2012, 5 marks)

Answer: .

Evaluation of Credit Policy

Working Notes:

(i) Computation of Cash Discount

Cash Discount = Total credit sales × % of customers who take up discount × Rate

Present Policy = \(\frac{12,00,000 \times 50 \times 01}{100}\) = ₹ 6,000

Proposed Policy = 16,00,000 × 0.80 × 0.02 = ₹ 25,600

(ii) Opportunity Cost of Investment in Receivables

Present Policy = 9,36,000 × (30/360) × (70% of 15)/1oo = 78,000 × 10.5/100 = ₹ 8,190

Proposed Policy = 12,48,000 × (20/360) × 10.50/1 00 = ₹ 7,280

Statement showing Evaluation of Credit Policies

| Particulars | Present Policy | Proposed Policy |

| Credit Sales | 12,00,000 | 16,00,000 |

| Variable Cost @ 78% of sales | 9,36,000 | 12,48,000 |

| Bad Debts @ 1.5% and 2% | 18,000 | 32,000 |

| Cash Discount | 6,000 | 25,600 |

| Profit before tax | 2,43,000 | 2,94,400 |

| Tax @ 30% | 72,000 | 88,320 |

| Profit after tax | 1,68,000 | 2,06,080 |

| Opportunity Cost of Investment in Receivables | 8,190 | 7,280 |

| Net Profit | 1,59,810 | 1,98,800 |

Advise: Proposed policy should be adopted increased by (₹ 1,98,800 – ₹ 1,59,810) = ₹ 38,990.

[Note: Opportunity cost of investment in receivables can be computed alternatively taking contribution @ 22 percent into consideration. The net benefit then would change accordingly to ₹ 1,95,137.]

Question 10.

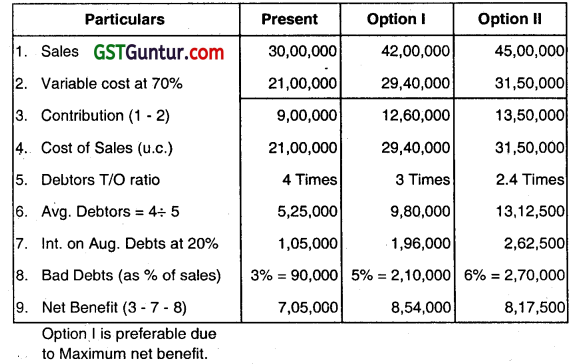

PTX Limited is considering a change in its present credit policy. Currently, it is evaluating two policies. The company is required to give a return of 20% on the investment in new accounts receivables. The company’s variable costs are 70% of the selling price. Information regarding present and proposed policies are as follows:

| Present Policy | Policy Option 1 | Policy Option 2 | |

| Annual Credit Sales (₹) | 30,00,000 | 42,00,000 | 45,00,000 |

| Debtors turnover ratio | 4 times | 3 times | 2.4 times |

| Loss due to bad debts | 3% of sales | 5% of sales | 6% of sales |

Note: Return on investment in new accounts receivable is based on cost of investment in debtors. Which option would you recommend? (Nov 2013, 8 marks)

Answer:

Question 11.

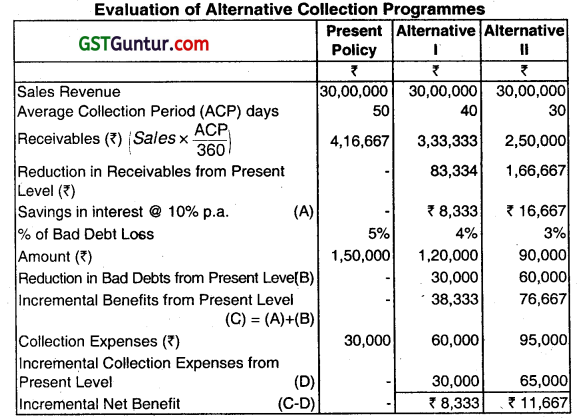

PQR Ltd. having an annual sales of ₹ 30 lakhs, is re-considering its present collection policy. 1t present, the average collection period is 50 days and the bad debt losses are 5% of sales. The company is incurring an expenditure of ₹ 30,000 on account of collection of receivables.

The alternative policies are as under:

| Alternative I | Alternative II | |

| Average Collection Period | 40 days | 30 days |

| Bad Debt Losses | 4% of sales | 3% of sales |

| Collection Expenses | ₹ 60,000 | ₹ 95,000 |

Evaluate the alternatives on the basis of incremental approach and state which alternative is more beneficial. (2014-Nov 8 marks)

Answer:

Conclusion: From the analysis, it is apparent that Alternative I has a benefit of 8,333 and Alternative II has a benefit of ₹ 11,667 over present level. Alternative II has a benefit of 3,334 more than Alternative. I. Hence Alternative II is more viable.

(Note: In absence of Cost of Sales, sales has been taken for purpose of calculating investment in receivables. Cost of Funds has been assumed to be 10% 1 year = 360 days)

![]()

Question 12.

Answer the following:

A new customer has approached a firm to establish new business connection. The customer requires 1.5 months of credit. If the proposal is accepted, the sales of the firm will go up by ₹ 2,40,000 per annum. The new customer is being considered as a member of 10% risk of non-payment group. The cost of sales amounts to 80% of sales. The tax rate is 30% and the desired rate of return is 40% (after tax). Should the firm accept the offer? Give your opinion on the basis of calculations. (May 2015, 5 marks)

Answer:

Receivable Turnover = \(\frac{12 \text { months }}{1.5 \text { months }}\) = 8 times

Since estimated PAT on additional sales (i.e. ₹ 16,800) is more than the opportunity cost of investment on receivable (i.e. ₹ 9,600), the firm should accept the offer.

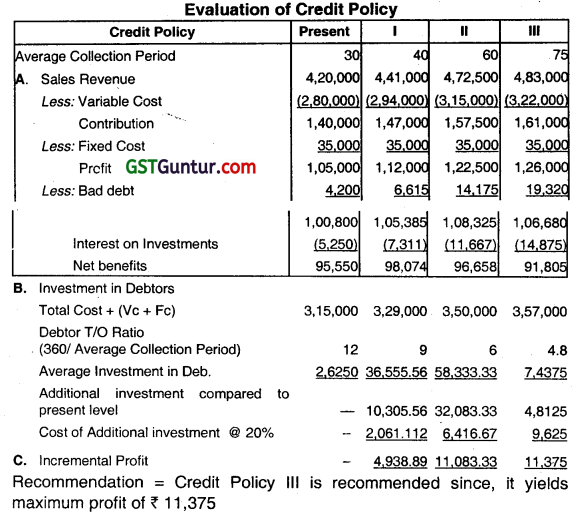

Question 13.

A trader whose current sales are ₹ 4,20,000 per annum and an average collection period of 30 days, wants to pursue a more liberal policy to improve sales. A study made by a management consultant reveals the following information:

| Credit Policy | Increase in Collection Period | Increase in Sales | Present default anticipated |

| I | 10 days | ₹ 21,000 | 1.5% |

| II | 30 days | ₹ 52,500 | 3% |

| III | 45 days | ₹ 63,000 | 4% |

The selling price per unit is ₹ 3. Average cost per unit is ₹ 2.25 and variable cost per unit is ₹ 2. The current bad-debts loss in 1%. Required return on additional investment is 20%. Assume a 360-day year. Which of the above policies would you recommend for adoption? (May 2016, 8 marks)

Answer:

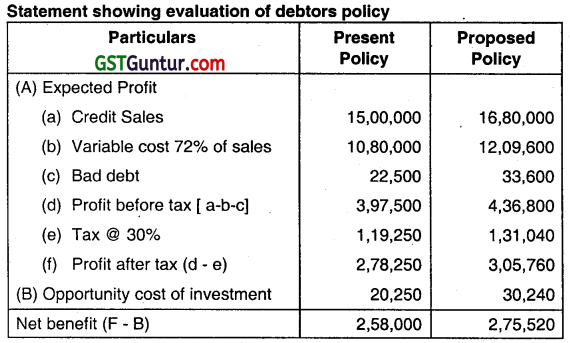

Question 13.

The current credit sales of a firm is ₹ 15 lakhs and the firm still has an unutilized capacity. In order to boost its sales, the firm is willing to relax its credit policy. The firm proposes a new credit policy of 2/10 net 60 days as against the present policy of 1/10 net 45 days. The firm expects an increase in the sales by 12%. However, it is also expected that bad debts will go upto 2% of sales from 1.5%. The contribution to sales ratio of the firm is 28%. The firm’s tax rate is 30% and firm requires an after tax return of 15% on its investment. Should the firm change the credit policy? (Nov 2017, 8 marks)

Answer:

Recommendation: Proposed policy should be implemented since net benefit under this policy are higher than present policy.

Workings Note:

Opportunity cost of average investment.

= Total cost × \(\frac{\text { Collection period }}{360 \text { days }}\) × Rate of Return

Present Policy =10,80,000 × \(\frac{45}{360} \times \frac{15}{100}\) = 20,250.

Proposed Policy =12,09,600 × \(\frac{60}{360} \times \frac{15}{100}\) = 30,240.

Question 14.

MN Ltd. has a current turnover of ₹ 30,00,000 p.a. Cost of Sale is 80% of turnover and Bad Debts are 2% of turnover, Cost of Sales includes 70% variable cost and 30% Fixed Cost, while company’s required rate of return is 15%. MN Ltd. currently allows 15 days credit to its customer, but it is considering increase this to 45 days credit in order to increase turnover. It has been estimated that this change in policy will increase turnover by 20%, while Bad Debts will increase by 1%. It is not expected that the policy change will result in an increase in fixed cost and creditors and stock will be unchanged. Should MN Ltd. introduce the proposed policy? (Assume a 360 days year) (Nov 2018, 10 marks)

Answer:

Recommendation: Proposed Policy i.e. credit from 15 days to 45 days should be implemented by NM Ltd. since the net benefit under this policy are higher than those under present policy

Working Note:

1.

| Present Policy (₹) | Propose Policy (₹) | |

| Sales | 30,00,000 | 36,00,000 |

| Cost of Sales (80% of sales) | 24,00,000 | 28,80,000 |

| Variable Cost (70% of cost of sales) | 16,80,000 | 20,16,000 |

2. Opportunity Costs of Average Investments

= Variable Cost × \(\frac{\text { Collection Period }}{360}\) × Rate of Interest

Present Policy = ₹ 24,00,000 × 15 × 15% = ₹ 15,000

Proposed Policy = ₹ 28,80,000 x \(\frac{15}{360} \) × 15% = ₹ 54,000

Question 15.

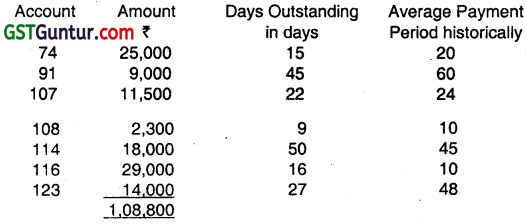

A Bank is analysing the receivables of Jackson Company in order to identify acceptable collateral for a short-term loan. The company’s credit policy is 2/10 net 30. The bank lends 80 per cent on accounts where customers are not currently overdue and where the average payment period does not exceed 10 days past the net period. A schedule of Jackson’s receivables has been prepared. How much will the bank lend on a pledge of receivables, if the bank uses a 10 per cent allowance for cash discount and returns?

(Nov 2000, 6 Marks)

Answer:

For identification of acceptable collateral for a short-term to loan, Bank analyses the receivables of Jackson company:

(i) Credit policy of the company ¡s 2/10 net 30.

It means bank lends 80% on A/c where customers are not currently overdue.

Average payment period does not exceed 10 days past the period of 30 days.

on the basis of this, schedule of Jackson’s

– Account No. 91 & Account no. 114] – are currently overdue.

– Account No 123 – payment period exceeds 40 days.

So, these accounts are eliminated.

Therefore, Account Nos. 74, 107, 108 and 116 are selected for lending decision.

(ii) Calculation of the amount lend by the banks on a pledge of receivables (if bank allows 10% allowance for cash discount and returns)

Question 16.

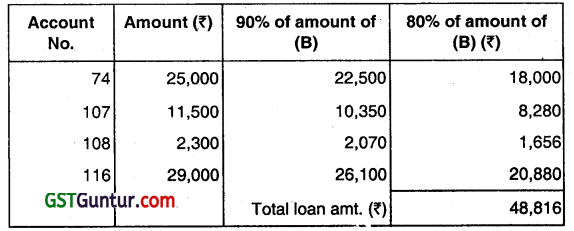

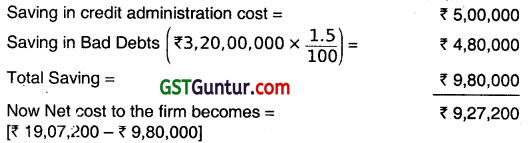

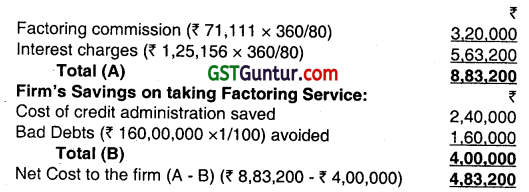

A Ltd. has a total sales of ₹ 3.2 crores and its average collection period is 90 days. The past experience indicates that bad-debt losses are 1.5% on Sales. The expenditure incurred by the firm in administering its receivable collection efforts are ₹ 5,00,000. A factor is prepared to buy the firm’s receivables by charging 2% commissions. The factor will pay advance on receivables to the firm at an interest rate of 18% p.a. after withholding 10% as reserve. Calculate the effective cost of factoring to the Firm. (May 2002, 6 marks)

Answer:

Assumption: Assuming 360 days in a year.

A. Average receivables = \(\frac{₹ 3,20,00,000}{360 \text { days }}\) × 90 days = ₹ 80,00,000

B. Factoring commission = ₹ 80,00,000 × 2% = ₹ 1,60,000

&

C. Factoring reserve = ₹ 80,00,000 × 10% = ₹ 8,00,000

D. ∴ Amount available for advances [A- (B + C)] = ₹ 70,40,00

Average receivable – (Factoring commission + Factoring reserve)

E. Factoring interest @ 18%

[latex]₹ 70,40,000 \times \frac{18}{100} \times \frac{90 \text { days }}{360 \text { days }}[/latex] = ₹ 3,16,800

F. Therefore, advance to be paid = [₹ 70,40,000 – ₹ 3,61,800] = ₹ 67,23,200

G. Computation of cost of factoring to the firm:

H. Computation of saving when factoring service is taken:

∴ The effective rate of interest = \(\frac{₹ 9.27,200}{₹ 67,23,200}\) × 100 = 13.79%

![]()

Question 17.

Write short notes on the following:

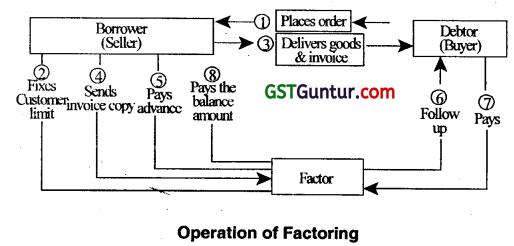

Factoring. (Nov 2003, 5 marks)

Answer:

Factoring: Faloring is an arrangement between a firm and a financial institution unde which the firm called the borrower receives advances against its receivables from the financial institution called the factor. In factoring, receivables are generally sold to the factor who charges commission and bears the credit risk associated with the receivables.

It is not just a single service but involves provisions of specialized services relating to:

- Credit investigation.

- Sales ledger management.

- Purchase of debts.

- Collection of debts.

- Credit protection.

- Provision of finance against receivables and risk bearing. etc.

The borrower selects various combinations of these functions and makes arrangements with the factor accordingly.

The operation of factoring is very simple and operates in the following way:

- The borrower enters into an agreement with the factor on suitable terms and conditions.

- The factor then selects the account of the customer that would be handled by it.

- The borrower sells his account receivable to the factor.

- The factor provide advance against the account receivables after deducting its commission and fees.

- The borrower forwards collection from the customers to the ‘actor and settles the advances received along with interest on advances.

- If provided in the agreement, the factor provides for the following allied services.

- Credit investigation.

- Collection of debt.

- Sales ledger management.

- Credit protection.

- Provision of finance against receivables.

Note: The operation of factoring in India is with recourse i.e. in case of default by the customer the risk is borne by borrower and not the factor

The benefits of factoring are as follows:

- The receivables gets easily converted into cash.

- It ensures a definite pattern of cash inflows from credit sales.

- It eliminates the need for the credit and collection department and in this way reduces the cost.

- It provides flexibility to the borrower as he is ensured of the debt return.

- Unlike an unsecured loan, compensating balances are not required in this case.

The drawbacks of factoring are as follows:

- Factoring may be considered as a sign of financial weakness.

- The cost of factoring sometimes tends to be higher than the cost of other forms of short-term borrowing.

- While evaluating the creditworthiness of a customer by a factor, it may overlook the sales growth aspect.

Question 18.

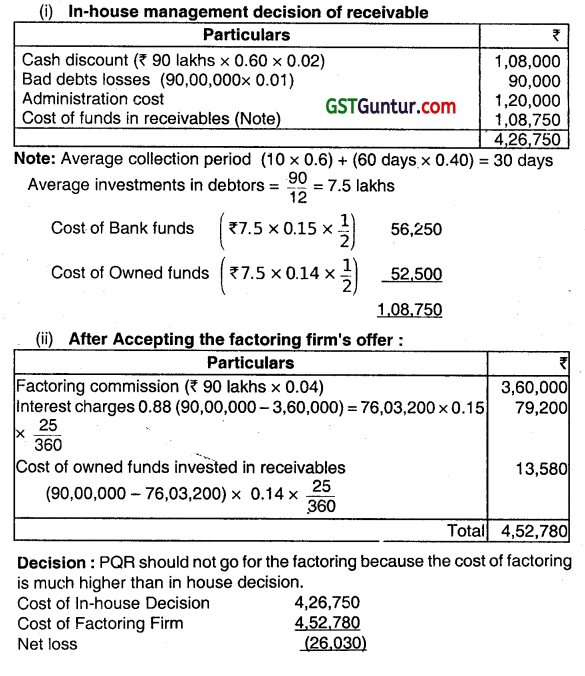

The turnover of PQR Ltd. is ₹ 120 lakhs of which 75 per cent is on credit. The variable cost ratio is 80 percent. The credit terms are 2/10, net 30. On the current level of sales, the bad debts are 1 percent. The company spends ₹ 1,20,000 per annum on administering its credit sales. The cost includes salaries of staff who handle credit checking, collection etc. These are avoidable costs. The past experience indicates that 60 percent of the Customers avail of the cash discount, the remaining customers pay on an average 60 days after the date of sale.

The Book debts (receivable) of the company are presently being financed in the ratio of 1: 1 by a mix of bank borrowings and owned funds which cost per annum 15 per cent and 14 per cent respectively. A factoring firm has offered to buy the firm’s receivables. The main elements of such deal structured by the factor are:

(i) Factor reserve, 12 percent

(ii) Guaranteed payment, 25 days

(iii) Interest charges, 15 percent, and

(iv) Commission 4 percent of the value of receivables.

Assume 360 days in a year.

What advise would you give to PQR Ltd. – whether to continue with the in-house management of receivables or accept the factoring firm’s offer? (May 2007, 8 marks)

Answer:

Question 19.

Answer the following:

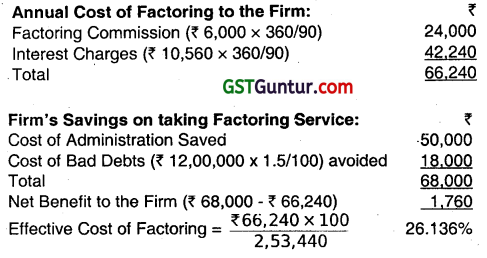

A firm has a total sales of ₹ 12,00,000 and its average collection period is 90 days. The past experience indicates that bad debt losses are 1.5% on sales. The expenditure incurred by the firm in administering receivable collection efforts are ₹ 50,000. A factor ¡s prepared to buy the firm’s receivables by charging 2% commission. The factor will pay advance on receivables to the firm at an interest rate of 16% pa. after withholding 10% as reserve. Calculate effective cost of factoring to the firm. Assume 360 days in a year. (May 2009,3 marks)

Answer:

Computation of Effective Cost of Factoring

Average level of Receivables = 12,00,000 × 90/360 3,00,000

Factoring Commission = 3,00,000 × 2/100 6,000

Factoring Reserve = 3,00,000 × 10/1 00 30,000

Amount Available for Advance = 3,00,000 – (6,000+30,000) 2,64,000

Factor will deduct his interest @ 16%:

Interest = \(\frac{₹ 2,64,000 \times 16 \times 90}{360 \times 100} \) = ₹ 10,560

Advance to be paid = ₹ 2,64,000 – ₹ 10,560 = ₹ 2,53,440

Effective Cost of Factoring = 26.136%

Note: In the same manner we can also calculate effective rate of cost saving to the firm.

= \(\frac{₹ 66,240 \times 100}{2,53,440}\) = 0.694%

Question 20.

What is factoring? Enumerate the main advantages of factoring. (May 2011, 5 marks)

OR

Explain the meaning and advantages of Factoring. (May 2017, 4 marks)

Answer:

Factoring: Factoring is an arrangement between a firm and a financial institution under which the firm called the borrower receives advances against its receivables from the financial institution called the factor. In factoring, receivables are generally sold to the factor who charges commission and bears the credit risk associated with the receivables. It is not just a single service but involves provisions of specialised services relating to:

1. Credit investigation.

2. Sales ledger management.

3. Purchase of debts.

4. Collection of debts.

5. credit protection.

6. Provision of finance against receivables and risk bearing. etc.

The borrower selects various combinations of these functions and makes arrangement with the factor accordingly.

The benefits of factoring are as follows:

1. The receivables get easily converted into cash.

2. It ensures a definite pattern of cash inflows from credit sales.

3. It eliminates the need for the credit and collection department and in this way reduces the cost.

4. It provides flexibility to the borrower as he is ensured of the debt return.

5. Unlike an unsecured loan, compensating balances are not required in this case.

Question 21.

A firm has a total sales of ₹ 200 lakhs of which 80% is on credit It is offering credit terms of 2/40, net 120. 01 the total, 50% of customers avail of discount and the balance pay in 120 days. Past experience indicates that bad debt losses are around 1 % of credit sales. The firm spends about ₹ 2,40,000 per annum to administer its credit sales. These are avoidable as a factor is prepared to buy the firm’s receivables. He will charge 2% commission. He will pay advance against receivables to the firm at an interest rate of 18% after withholding 10% as reserve.

(i) What is the effective cost of factoring? Consider year as 360 days.

(ii) If bank finance for working capital is available at 14% interest, should the firm avail of factoring service? (Nov 2015, 8 marks)

Answer:

Total Sales = ₹ 200 lakhs

Credit Sales (80%) = ₹ 160 lakhs

Receivables for 40 days =₹ 80 lakhs

Receivables for 120 days =₹ 80 lakhs

Average collection period[(40 x 0.5) + (120 x 0.5)] = 80 days

Average level of Receivables ( 1,60,00,000 x 80/360) = ₹ 35,55,556

Factoring Commission ( 35,55,556 x 2/100) = ₹ 71,111

Factoring Reserve ( 35,55,556 x 10/100) = ₹ 3,55,556

Amount available for advance (₹ 35,55,556 – (3,55,556 + 71,111)) = ₹ 31,28,889

Factor will deduct his interest @ 18%:

Interest = \(\frac{₹ 31,28,889 \times 18 \times 80}{100 \times 360} \) = ₹ 1,25,156

Advance to be paid (₹ 31,28,889 – ₹ 1,25,156) = ₹ 30,03,733

(i) Calculation of Effective Cost of Factoring

Annual Cost of Factoring to the Firm:

If cost of factoring is calculated on the basis of total amount available for advance, then, it will be:

= \(=\frac{₹ 4,83,200}{₹ 31,28,889} \times 100 \) = 15.44%

(ii) If Bank finance for working capital ¡s available at 14%, firm will not avail factoring service as 14% is less than 16.08% (or 15.44%).

![]()

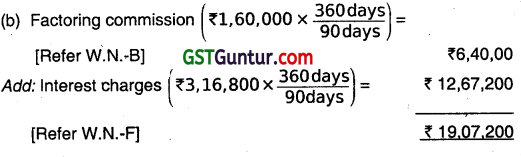

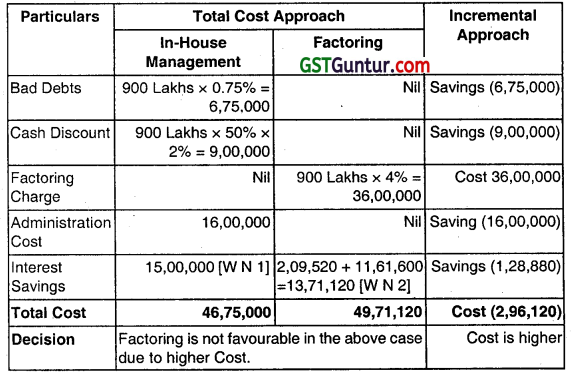

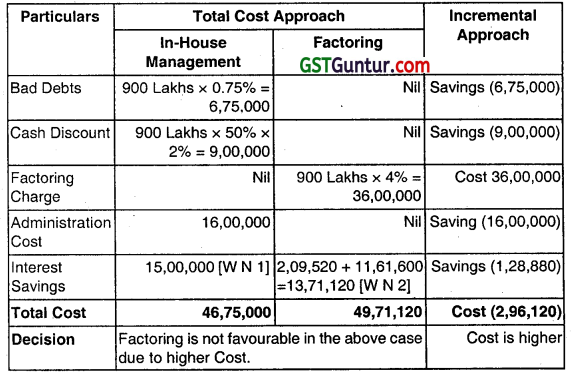

Question 22.

Ramana Ltd. sells on credit terms 2/10 net 30. It has an annual credit sales of ₹ 900 Lakhs, with a Variable Cost of 80% and Bad Debts of 0.75%. Past experience shows that 50% of the customers avail cash discount and the remaining customers pay 50 days after the date of sale. Presently the Company’s investment in receivables are financed in the ratio of 2: 1 by a mix of Bank Borrowings and Own Funds, which cost 24% and 27% p.a. respectively. The Company also incurs 16 Lakhs on Credit

Collection Costs.

The Company is considering a “Non-Recourse Factoring” arrangement with T-Factors Ltd. on the following terms – (a) 15% Factor Reserve, (b) Guaranteed Payment date 24 days after the date of purchase, (c) 22% Interest/Discount, (d) 4% Factoring Commission. Evaluate whether the factoring proposal is worthwhile, with suitable assumptions, wherever applicable.

Answer:

Working Note: 1

Interest Cost under In-House Management

Weighted Average Collection Period = (50% × 10 days) + (50% × 50 days) = 30 days.

Weighted Average Cost of Capital for present system = (24% × 2/3rd) + (27% × 1/3rd) = 16% + 9% 25%

It is assumed that 1 year = 360 days.

Interest Cost under In-House Management = (₹ 900 Lakhs × 80%) × 25% × \(\frac{30}{360} \) = ₹ 15,00,000

Working Note: 2

Interest under Factoring

Total Sales = ₹ 900 Lakhs

Own Funds (B/f) [Note 1]

(Total Sales – Amount lent by Factor) × Variable Cost Ratio%

(9,00,00,000 – 7,60,32,000) × 80% = ₹ 1,11,74,400

₹ 1,11,74,400 × 27% × \(\frac{25}{360}\) = ₹ 2,09,520

Amount Lent by Factor after retaining 12% Reserve i.e. 88%

(Total Sales – Factoring Commission) × Advance % [Note 2]

= (₹ 900 Lakhs – ₹ 36 Lakhs) × 88% = ₹ 7,60,32,000

₹ 7,60,32,000 × 22% × \(\frac{25}{360}\) = ₹ 11,61,600

![]()

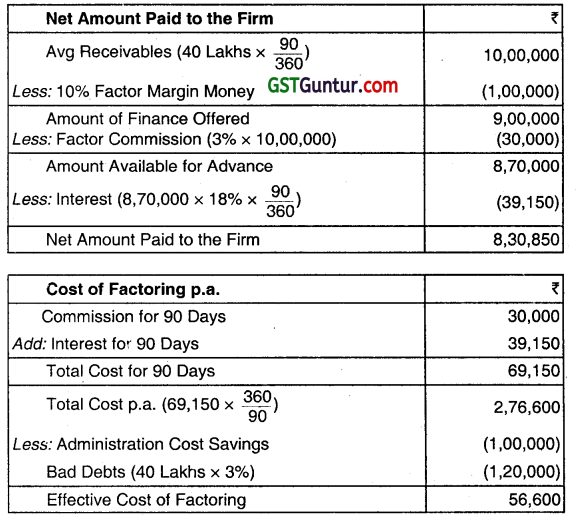

Question 23.

Jaidev Ltd. has total credit sales of ₹ 40 Lakhs p.a. and its average collection period is 90 days. The past experience indicates that the Bad Debt losses are around 3% of credit sales. Jaidev spends about ₹ 1,00,000 per annum on administrating its credit sales. It is considering availing the services of a Factoring Firm. It has received offer from Uday Ltd., which agrees to buy the receivables of Company. Uday will charge Commission of 3% and also agrees to pay advance against receivables at an interest Rate of 18% p.a. after withholding 10% as Reserve. Should Jaidev accept Uday’s offer the former’s ROI is 15%? Assume 360 days in a year.

Answer:

Effective Rate of Factoring Cost = \(\frac{56,600}{8,30,850} \) × 1oo = 6.81 %

Decision: Since the Company’s ROI of 15% is higher than the Cost of Factoring, the Factoring Proposal is worthwhile.

Question 24.

Briefly explain the meaning and importance of ‘Credit-rating. (May 2002,4 marks)

Answer:

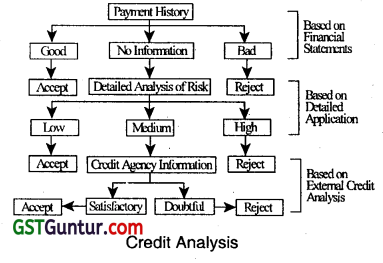

After drawing up the credit policy, a firm has to evaluate the creditworthiness of the individual customer and also the possibility of bad debt. Credit analysis determines the degree of risk associated with the capacity of the customer to borrow and his ability and willingness to pay. For this, firm has to ascertain the credit rating of prospective customers.

Credit Rating: Credit rating is to rate the various debtors who seek credit facility. Credit rating implies taking decisions regarding individual debtors so as to ascertain the quantum of credit and the credit period.

This would further involve:

1. Collection of information about the debtor.

2. Decision Tree analysis of credit granting.

Collection of information about the debtor:

The various sources of information are:

- Past Records: Past records of existing customers prove to be a valuable source of information to find out the credit risk involved.

- Salesman’s Report: Very often the firms depend and decide the creditworthiness of a customer on the basis of the salesman’s report. The salesman ascertains the potential of the customers and reports accordingly.

- Bank References: Sometimes the banks provide the required information about the customer and decision is taken after analysing such information.

- Trade References: Information about the customer also collected from the persons referred by the customer himself. Such persons giving relevant information about the customer are the trade references.

- Credit Bureau Reports: Useful and authentic credit information is also provided by credit bureaus of specific industries.

- Published Financial Reports: The financials reports;i.e. balance sheet, profit & loss A/c, and others when examined can give valuable information about credit worthiness of a customer.

- List of Government Suppliers: If a customer’s name appears in the list of government-approved suppliers in agencies like DGS & D or any other reputed agency, it proves the creditworthiness of the customer.

- Decision tree analysis of credit granting: Once all the credit information about the customer (both existing and prospective) is gathered, it has to be thoroughly analysed to arrive at a decision relating to:

(a) Whether or not to grant credit.

(b) If credit is to be granted, then oh what terms and conditions.

The five ‘C’s of credit which provide a framework for evaluating a customer are:

(A) Character.

(B) Capacity.

(C) Capital.

(D) Collateral.

(E) Condition.

These characteristics throw light on credit worthiness of a customer. Step-by-step analysis of information may be done as under:

When a customer’s credit standing is favourable or unfavorable it is easy to accept or reject the customer. Problem arises when customers are marginally credit-worthy. In such a situation attempt is made to balance the potential profitability against the potential loss from default. If the relative chances of recovering the dues can be decided it can form a probability distribution of payment or default.

Question 25.

Explain the ‘Ageing Schedule’ in the context of monitoring of receivables. (Nov 2004, 3 marks)

Answer:

Aging Schedule: The ageing schedule classifies the outstanding receivables at a given point of time into different age groups together with percentages of total receivables that fall in each group. For e.g., the receivables of a firm having a normal credit period of 20 days may be classified as follows:

| Age Group (Number of Days) | % of Total Outstanding Receivables |

| Less than 20 days | 60% |

| 21-35 days | 20% |

| 36-50days | 10% |

| 50 days and above | 10% |

The age group represents the number of days or weeks the receivable become outstanding. The quality of a receivable can be judged by looking at the age of receivable. The older the receivable the lower the quality and higher the chances of default.

Benefits of Ageing Schedule:

1. It provides a kind of an early warning proclaiming:

- deterioration of quality of receivables.

- where to apply the corrective action.

2. It helps in analysing the collection policy, procedure etc. by comparing the present period ageing schedule with past period ageing schedule.

3. it directly points out those customers which require special attention. It helps to recognise increase & slumps in sales.

Question 26.

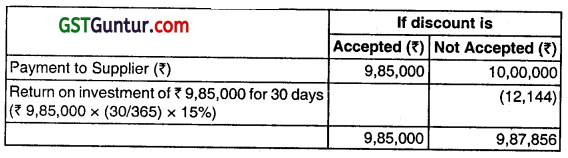

A Ltd. is in the manufacturing business and it acquires raw material from X Ltd. on a regular basis. As per the terms of agreement the payment must be made within 40 days of purchase. However, A Ltd. has a choice of paying ₹ 98.50 per ₹ 100 it owes to X Ltd. on or before 10th day of purchase.

Required:

EXAMINE whether A Ltd. should accept the offer of discount assuming average billing of A Ltd. with X Ltd. is ₹ 10,00,000 and an alternative investment yields a return of 15% and company pays the invoice. Thus, from above table it can be seen that it is cheaper to accept the discount.

Answer:

Annual Benefit of accepting the Discount

\(\frac{₹ 1.5}{₹ 100-₹ 1.50} \times \frac{365 \text { days }}{40-10 \text { days }}=\) = ₹ 18.53%

Annual Cost = Opportunity Cost of foregoing interest on investment = 15%

If average invoice amount is ₹ 10,00,000

Thus, from above table, it can be seen that it is cheaper to accept the discount.