Introduction to Working Capital Management – CA Inter FM Question Bank is designed strictly as per the latest syllabus and exam pattern.

Introduction to Working Capital Management – CA Inter FM Question Bank

Question 1.

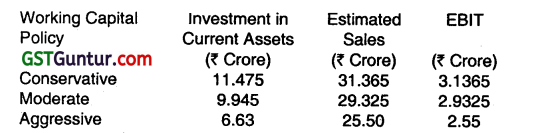

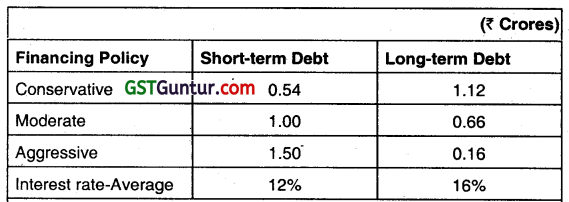

An engineering company is considering its working capital investment for the year 2003-04. The estimated Property Plant and Equipment and current liabilities for the next year are ₹ 6.63 crore and ₹ 5.967 crore respectively. The sales, and earnings before interest and taxes (EBIT) depend on investment in its current assets – particularly inventory and receivables. The company is examining the following alternative working capital policies:

Your are required to calculate the following for each policy:

(i) Rate of return on total assets.

(ii) Net working capital position.

(iii) Current assets to Property Plant and Equipment ratio.

(iv) Discuss the risk-return trade-off of each working capital policy. (May 2003, 1+1+1 +3=6 marks)

Answer:

(iv) Risk return trade-off:

The Net working capital or current ratio is a measure of risk. Rate of Return total assets is a measure of return. The expected risk and return are minimum in the case of conservative investment policy and maximum in case of aggressive investment policy. The firm can improve profitability by reducing investment in working capital.

Question 2.

Discuss the liquidity vs. profitability issue in management of working capital. (Nov 2010, 4 marks)

Answer: .

Liquidity Vs Profitability Issue in Management of Working Capital:

Working capital management monitors & controls all the components of working capital i.e. cash, marketable securities, debtors, creditors etc. Finance manager has to pay particular attention to the levels of current ‘assets and their financing.

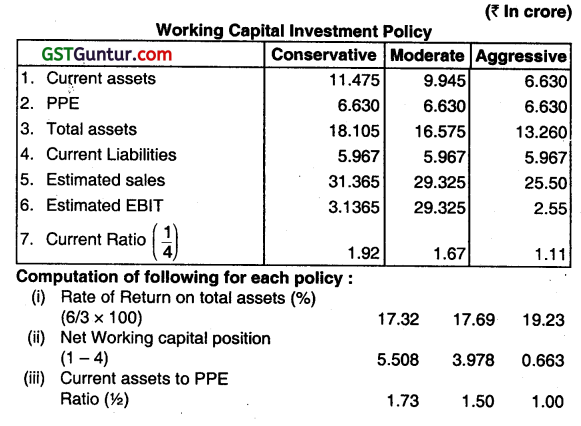

In order to decide the level of financing of current assets, the risk-return trade-off must be taken into account. The level of current assets can be measured by creating a relationship between current assets and Property Plant and Equipment. A firm may follow a conservative, aggressive or moderate policy.

A conservative policy means lower return arid risk whe an aggressive policy produces higher return and risk. The two important aims of the working capital management are profitability and solvency. A liquid firm has less risk of insolvency i.e. it will hardly experience a cash shortage or a stock out situation. Whereas, there is a cost associated with maintaining a sound liquidity position. Hence, to have a higher profitability the firm may have to sacrifice solvency and maintain a relatively low level of current assets.

Question 3.

Answer the following:

Discuss the risk-return considerations in financing current assets. (Nov 2015, 4 marks)

Answer:

The financing of Current Assets involves a trade-off between risk and return. A firm can choose from short or long-term sources of finance. Short-term financing less expensive than long-term financing, but at the same time, short-term financing involves greater risk than long-term finance. Depending upon the mix of short-term and long-term financing the approach followed by a company may be referred as matching approach, conservative approach and aggressive approach.

1. Matching Approach:

In matching approach, long term finance is used to finance Property Plant and Equipment and permanent current assets and short-term financing to finance temporary or variable current assets.

2. Conservative Approach

Under the conservative plan, the firm finances its permanent assets and also a part of temporary current assets with long-term financing and hence less risk of facing the problem of shortage of funds.

3. Aggressive Approach

An aggressive approach is said to be followed by the firm when it uses more short-term financing than warranted by the matching plan and finances a part of its permanent current assets with short-term financing.

![]()

Question 4.

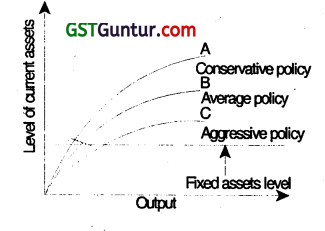

A company is considering its working capital investment and financial policies for the next year. Estimated PPE and current liabilities for the next year are ₹ 2.60 crores and ₹ 2.34 crores respectively. Estimated Sales and EBIT depend on current assets investment, particularly inventories and book debts. The financial controller of the company is examining the following alternative Working Capital Policies:

After evaluating the working capital policy, the Financial Controller has advised the adoption of the moderate working capital policy. The Company is not examining the use of long-term borrowings for financing its assets. The company will use ₹ 2.50 crores of the equity funds. The corporate tax rate is 34%. The company is considering the following debt alternatives.

You are required to CALCULATE the following:

(i) Working Capital Investment for each policy:

(a) Net Working Capital position.

(b) Rate of Return.

(c) Current ratio.

(ii) Financing for each policy:

(a) Net Working Capital position.

(b) Rate of Return on Shareholders’ equity.

(c) Current ratio.

Answer:

Question 5.

The following annual figures relate to MNP Limited:

Sales (at three months credit) ₹ 90,00,000

Materials consumed (suppliers extend one and half months’ credit ₹ 22,50,000

Wages paid (one month in arrear) ₹ 18,00,000

Manufacturing expenses outstanding at the end of the year (cash expenses are paid one month in arrear) ₹ 2,00,000

Total Administrative expenses for the year (cash expenses are paid one month in arrear) ₹ 6,00,000

Sales Promotion expenses for the year (paid quarterly in advance) ₹ 12,00,000

The company sells its products on gross profit of 25% assuming depreciation as a part of cost of production. It keeps two month’s stock of finished goods and one month’s stock of raw materials as inventory. It keeps cash balance of ₹ 2,50,000. Assume a 5% safety margin, work out the working capital requirements of the company on cash cost basis. Ignore work-in-progress. (May 2004, 6 marks)

Answer:

Question 6.

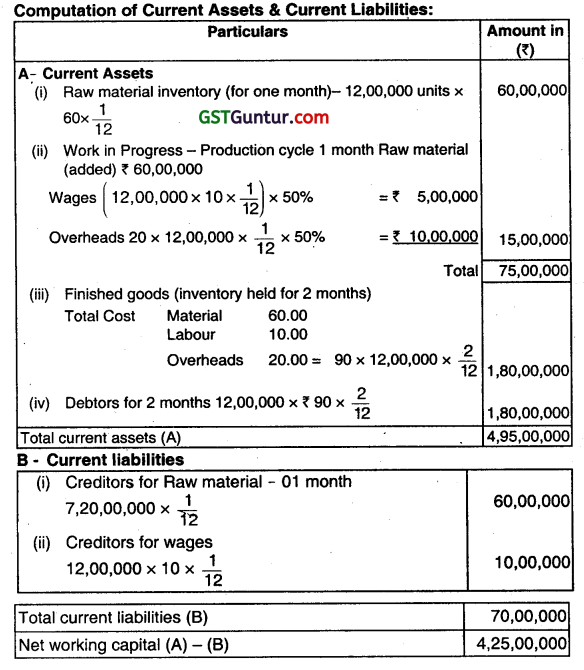

XYZ Co. Ltd. is a pipe manufacturing company. Its production cycle indicates that materials are introduced in the beginning of the production cycle; wages and overhead accrue evenly throughout the period of the cycle. Wages are paid in the next month following the month of accrual. Work in process includes full units of raw materials used in the beginning of the production process and 50% of wages and overheads are supposed to be conversion costs. Details of production process and the components of working capital are as follows:

Production of pipes 12,00,000 units

Duration of the production cycle One month

Raw materials inventory held One month of consumption

Finished goods inventory held for Two months

Credit allowed by creditors One months

Credit given to debtors Two month

Cost price of raw materials ₹ 60 per unit

Direct wages ₹ 10 per unit

Qver heads ₹ 20 per unit

Selling price of finished pipes ₹ 100 per unit

Required to calculate:

The amount of working capital required for the company. (May 2005, 5 + 5= 10 marks)

Answer:

Question 7.

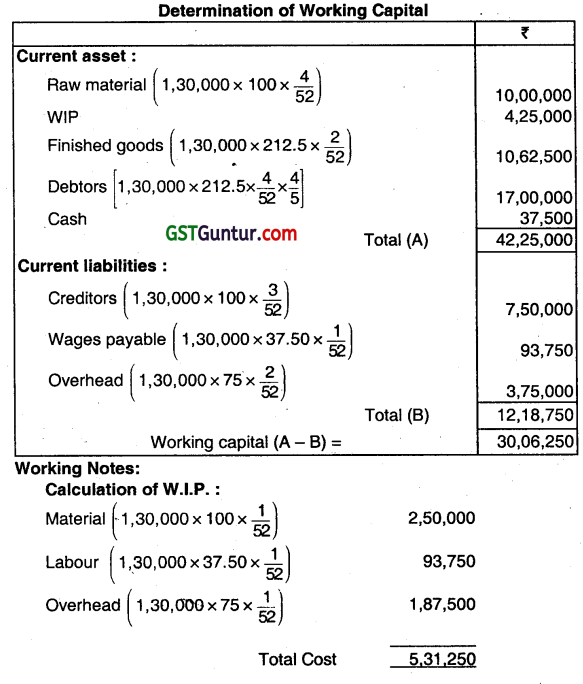

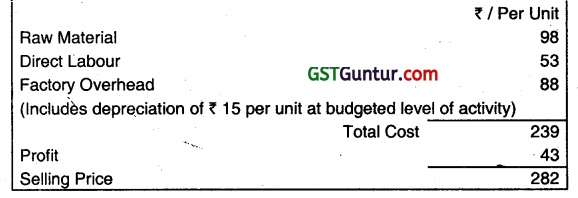

A proforma cost sheet of a Company provides the following particulars:

| Amount per unit (₹) | |

| Raw materials cost | 100 |

| Direct labour cost | 37.50 |

| Overheads cost | 75 |

| Total cost | 212.50 |

| Profit | 37.50 |

| Selling Price | 250 |

The Company keeps raw materials in stock, on an average for one month; work-in-progress, on an average for one week; and finished goods in stock, on an average for two weeks. The Credit allowed by suppliers is three weeks and company allows four weeks credit to its debtors. The lag in payment of wages is one week and lag in payment of overhead expenses is two weeks.

The Company sells one-fifth of the output against cash and maintains Cash-in-hand and at bank put together at ₹ 37,500.

Required:

Prepare a statement showing estimate of Working Capital needed to finance an activity level of 1,30,000 units of production. Assume that production is camed on evenly throughout the year, and wages and overheads accrue similarly work-in-progress stock is 80% complete in all respects. (Nov 2006, 12 marks)

Answer:

WIP =5,31,250 × 80%

= 4,25,000.

For calculation purposes, 4 weeks has been taken as equivalent to a month.

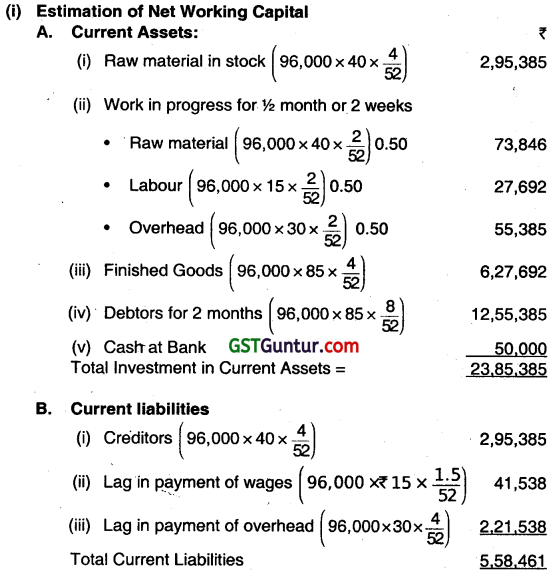

Question 8.

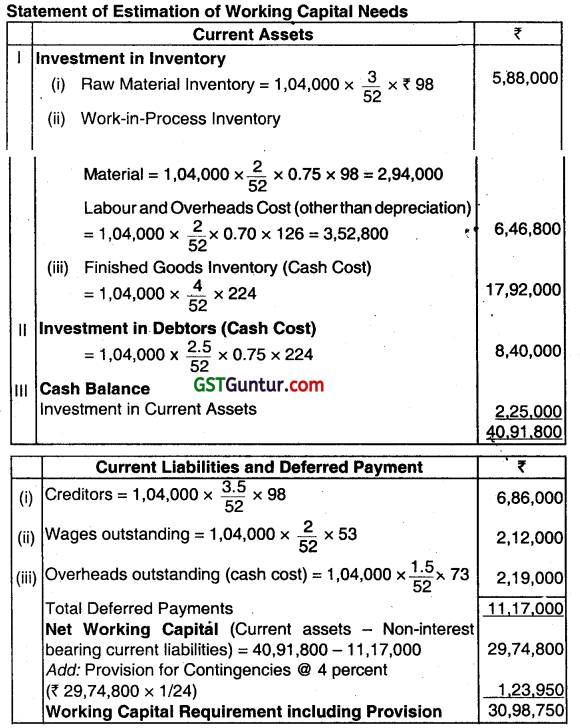

A newly formed company has applied to the Commercial Bank for the first time for Financing its working capital requirements. The following information is available about the projections for the current year:

Other information:

Raw material in stock: average 4 weeks consumption, Work in progress (completion stage, 50 percent), on an average half a month. Finished goods in stock: on an average, one month.

Credit allowed by suppliers is one month.

Credit allowed to debtors is two months.

Average time lag in payment of wages is 11/2 weeks and 4 weeks in overhead expenses.

Cash in hand and at bank is desired to be maintained at ₹ 50,000.

All Sales are on credit basis only.

Required:

(i) Prepare a statement showing estimate of working capital needed to finance an activity level of 96,000 units of production. Assume that production is carried on evenly throughout the year, and wages and overhead accrue similarly. For the calculation purpose, 4 weeks may be taken as equivalent to a month and 52 weeks in a year.

(ii) From the above information calculate the maximum permissible bank finance by all the three methods for working capital as per Tondon Committee norms; assume the core current assets constitute 25% of the current assets. (Nov 2007, 5 + 3 = 8 marks)

Answer:

Networking Capital = Current Assets – Current Uabilities

= 23,85,385 – 5,58,461

= 18,26,924

Answer:

(ii) Maximum Permissible Bank Finance

1. Method I.75 (CA- CL)

75 (18,26,924)

= ₹ 13,70,193

2. Method II:-

75 CA – CL

75 × 23,85,385 – 5,58,461

= 17,89,038.75 -5,58,461

= ₹ 12,30,577.75

3. Method III

75 (CA- CCA) – CL

[75 (23,85,385- 5,96,346) – 5,58,461]

= 13,41,779 – 5,58,461

= ₹ 7,83,318

![]()

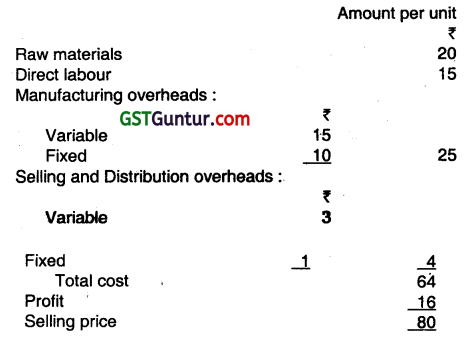

Question 9.

MN Ltd. is commencing a new project for manufacture of electric toys. The following cost information has been ascertained for annual production of 60,000’units at fruit capacity:

In the first year of operations expected production and sales are 40,000 units and 35,000 units respectivety. To assess the need of Working capital, the following additional information is available:

(i) Stock of Raw materials …………………… 3 months consumption.

(ii) Credit allowable for debtors ……………………. 1\(\frac{1}{2}\) months.

(iii) Credit allowable by creditors …………………….. 4 months.

(iv) Lag in payment of wages ……………….. 1 month.

(v) Lag in payment of overheads …………………………. \(\frac{1}{2}\) month.

Cash in hand and Bank is expected to ₹ 60,000.

Provision for contingencies is required @ 10% of Working capital requirement including that provision. You are required to prepare a projected statement of Working capital requirement for the first year of operations. Debtors are taken at cost. (Nov 2008, 9 marks)

Answer:

Question 10.

Answer the following:

Discuss the estimation of working capital need based on operating cycle process. (Nov 2010, 4 marks)

Answer: .

Estimation of Working Capital Need based on Operating Cycle Working capital is that part of the firm’s capital which is required for financing short-term assets or current assets such as cash, marketable securities inventories etc.

Forecasting working capital requirements is based on the concept of operating cycle. The determination of operating capital cycle helps in the forecast, control and management of working capital.

The length of operating cycle is the indicator of performance of management. The net operating cycle represents the time interval for which the firm has to negotiate for Working Capital from its Banker. It enables to determine accurately the amount of working capital needed for the continuous operation of business activities.

The duration of working capital cycle may vary depending on the nature of the business. In the form of an equation, the operating cycle process can be expressed as follows:

Operating Cycle = R+W+F+D-C

Where,

R = Raw material storage period.

W = Work-in-progress holding period.

F = Finished goods storage period.

D = Debtors collection period.

C = Credit period availed.

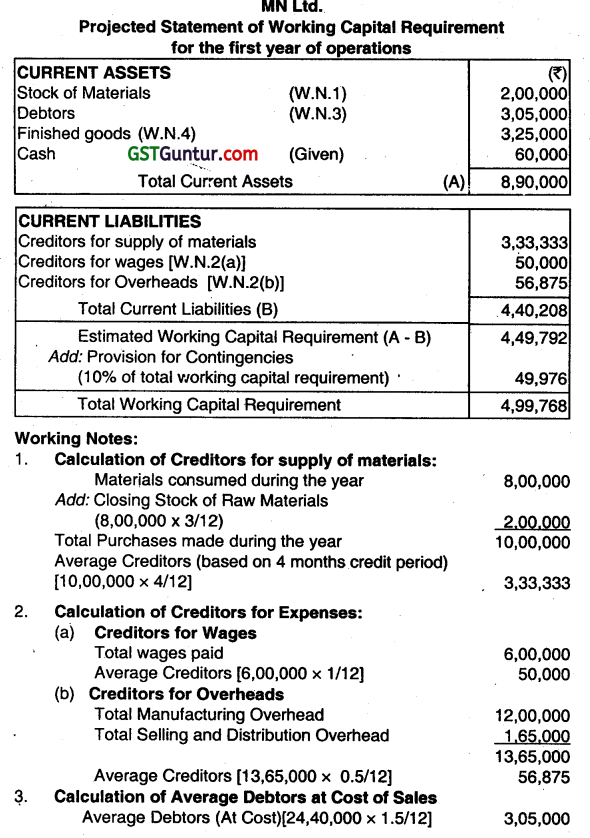

Question 11.

The management of MNP Company Ltd. is planning to expand its business and consult you to prepare an estimated working capital statement. The records of the company reveals the following annual information:

Sales – Domestic at one month’s credit ₹ 24,00,000

Export at three month’s credit (sales price 10% below domestic price) ₹ 10,80,000

Materials used (suppliers extend two months credit) ₹ 9,00,000

Lag in payment of wages -1/2 month ₹ 7,20,000

Lag in payment of manufacturing expenses (cash) -1 month 10,80,000

Lag in payment of Adm. expenses – 1 month 2,40,000

Sales promotion expenses payable quarterly in advance 1,50,000

Income tax payable in four instalments of which one falls in the next financial year 2,25,000

Rate of gross profit is 20%.

Ignore work-in-progress and depreciation.

The company keeps one month’s stock of raw materials and finished goods (each) ãnd believes in keeping ₹ 2,50,000 available to it including the overdraft limit of ₹ 75,000 not yet utilized by the company. The management is also of the opinion to make 12% margin for contingencies on computed figure. You are required to prepare the estimated working capital statement for the next year. (May 2011, 16 marks)

Answer:

Question 12.

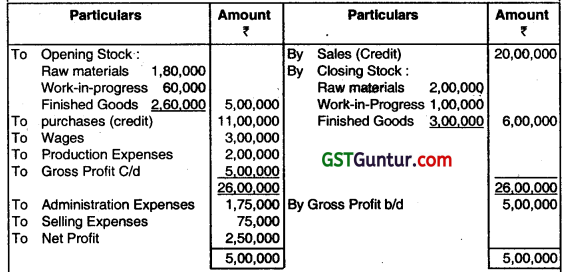

The Trading and Profit and Loss Account of Beta Ltd. for the year ended 31st March, 2011 is given below:

The opening and closing balances of debtors were ₹ 1,50,000 and ₹ 2,00,000 respectively whereas opening and closing creditors were ₹ 2,00,000 and ₹ 2,40,000 respectively. You are required to ascertain the working capital requirement by operating cycle method. (Nov 2011, 8 marks)

Answer:

Computation of Operating Cycle

1. Raw Material Storage period (R)

= \(\frac{\text { Average Stock of Raw Material }}{\text { Daily Average Consumption of RawMaterial }}\)

= \(\frac{(1,80,000+2,00,000) / 2}{10,80,000 / 360} \)

= 63.33 days

Raw Material Consumed = Opening Stock + Purchases – Closing Stock

= 1,80,000 + 11,00,000-2,00,000= ₹ 10,80,000

2. Conversion/Work-In-Process Period (W)

Conversion/Processing Period = \(\frac{\text { Average Stock of WIP }}{\text { Daily Average Production Cost }}\)

= \(\frac{(60,000+1,00,000) / 2}{15,40,000 / 360}\) = 18.7 Days

3. Finished Goods Storage Period (F)

Finished Goods Storage period = \(=\frac{\text { Average Stock of Finished Goods }}{\text { Daily Average Cost of Good Sold }} \)

= \(\frac{(2,60,000+3,00,000) / 2}{15,00,000 / 360} \)

= 67.19 days

4. Debtors Colledilon Period (D)

Debtors Collection Period = \(\frac{\text { Average Debtors }}{\text { Daily Average Sales }}\)

= \(\frac{(1,50,000+2,00,000) / 2}{20,00,000 / 360} \)

= 31.5 days

5. Creditors Payment Period (C)

Creditors Payment Period = \( \frac{\text { AverageCreditors }}{\text { DailyAveragePurchase }}\)

= \(\frac{(2,00,000+2,40,000) / 2}{11,00,000 / 360}\) = 72 days

6. Duration of Operating Cycle (O)

O = R + W + F+D – C

= 63.33+18.7+67.19+31.5-72

= 108.72 days

Computation of Working Capital

(i) Number of Operation Cycles per Year

= 360/Duration Operating Cycle = 360/108.72 = 3.311

(iii) Working Capital Required

Working Capital Required = \(\frac{\text { Total Operating Expenses }}{\text { Numberd OperatingCyclesperyear }} \)

= \(\frac{17,50,000}{3.311}\) = ₹ 5,28,541

Assumption: No. of days in a year = 360 days.

Question 13.

STN Ltd. is a ready-made garment manufacturing company. Its production cycle indicates that materials are introduced in the beginning of the production phase; wages and overhead accrue evenly throughout the period of cycle. The following figures for the 12 months ending 31st

December 2011 are given.

Production of shirts 54,000 units

Selling price per unit ₹ 200

Duration of the production cycle 1 month

Raw material inventory held 2 month’s consumption

Finished goods stock held for 1 month

Credit allowed to debtors is 1.5 months and credit allowed by creditors is 1 month.

Wages are paid in the next month following the month of accrual.

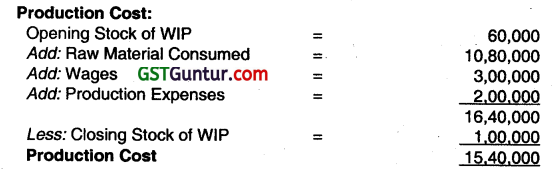

In the work-in-progress 50% of wage and overheads are supposed to be conversion costs. The ratios of cost to sales price are – raw materials 60%, direct wages 10%, and overheads 20%. Cash ¡s to be held to the extent of 40% of current liabilities and safety margin of 15% will be maintained. Calculate amount of working capital required for the company on a cash-cost basis. (May 2012, 8 marks)

Answer:

Computation of Amount of Working Capital required on a cash-cost basis

Working Notes:

1. Raw material Inventory:

The cost of materials for the whole year is 60% of the Sales value.

Hence, it is 54,000 units x ₹ 200 × \(\frac{60}{100}\) = ₹ 64,80,000. The monthly

consumption of raw materials would be ₹ 5,40,000. Raw material requirements would be for two months; hence raw materials in stock would be ₹ 10,80,000.

2. Debtors: Total Cash Cost of Sales = 97,20,000 × \(\frac{1.5}{12}\) = ₹ 12,15,000.

3. Work-in-process: (Each unit of production is expected to be in process for one month).

5. CredItors: Suppliers allow a one-month’s credit period. Hence, the average amount of creditors would be ₹ 5,40,000 being one month’s purchase of raw materials.

6. Direct Wages payable: The direct wages for the whole year is 54,000 units × ₹ 200 × 10% = 10,80,000. The monthly direct wages would be 90,000 (10,80,000 ÷ 12). Hence, wages payable would be ₹ 90,000.

Question 14.

The following information is provided by the DPS Limited for the year ending 31st March, 2013.

Raw material storage period 55 days

Work-in-progress conversion period 18 days

Finished Goods storage period 22 days

Debt collection period 45 days

Creditors payment period 60 days

Annual Operating cost ₹ 21,00,000

(including depreciation of ₹ 2,10,000)

[1 year = 360 days]

You are required to calculate:

(i) Operating Cycle period.

(ii) Number of Operating Cycle in a year.

(iii) Amount of working capital required for the company on a cash cost basis.

(iv) The company is a market leader in its product, there is virtually no competitor in the market. Based on a market research it is planning to discontinue sales on credit and deliver products based on pre payments. Thereby, it can reduce its working capital requirement substantially. What would be the reduction in working capital requirement due to such decision? (May 2013, 8 marks)

Answer:

(i) Computation of Operating Cycle Period

Operating Cycle Period = R + W + F + D – C

=55 + 18 + 22 + 45 – 60

= 80 days

(ii) Number of Operating Cycles in a Year

= \(\frac{360}{\text { OperatingCyclePeriod }} \)

= \(\frac{360}{80}\) = 4.5

(iii) Amount of Working Capital Required

= \(\frac{\text { Annual OperatingCost }}{\text { Number of Operating Cycle }}\)

= \(\frac{18,90,000}{4.5}\) = 4,20,000

(iv) Reduction in Working Capital

Operating Cycle Period = R + W + F -C

= 55 + 18 + 22 – 60 = 35

Amount of Working Capital Required = \(\frac{18,90,000 \times 35}{360}\) = 1,83,750

Reduction in Working Capital = 4,20,000 – 1,83,750 = 2,36,250

Question 15.

Black Limited has furnished the following cost sheet

Additional Information:

(i) Average raw material in stock 3 weeks

(ii) Average work-in-progress 2 weeks

(% of completion with respect to Material – 75%

Labour & Overhead – 70%)

(iii) Finished goods in stock 4 weeks

(iv) Credit allowed to debtors 2\(\frac{1}{2}\) weeks

(v) Credit allowed by creditors 3\(\frac{1}{2}\) weeks

(vi) Time lag in payments of labour 2 weeks

(vii) Time lag ¡n payments of factory overheads weeks 1 \(\frac{1}{2}\)

(viii) Company sells, 25% of the output against cash.

(ix) Cash in hand and bank is desired to be maintained ₹ 2,25,000.

(x) Provision for contingencies is required @ 4% of working capital requirement including that provision.

You may assume that production is carried on evenly throughout the year and labour and factory overheads accrue similarly. You are required to prepare a statement showing estimate of working capital needed to finance a budgeted activity level of ₹ 1,04,000 units of production. Finished stock, debtors, and overhead are taken at cash cost. (May 2014, 8 marks)

Answer:

(Note: For calculation purpose, 4 weeks may be taken as equivalent to month and 52 weeks in a year.)

Question 16.

The following information is provided by the DVP Ltd. for the year ending 31st March 2015.

Raw Material storage period 50 days

Work in progress conversion period 18 days

Finished Goods storage period 22 days

Debt Collection period 45 days

Creditors’ payment period 55 days

Annual Operating Cost ₹ 21 Lacs

(Including depreciation of ₹ 2,10,000)

(1 year = 360 days)

You are required to calculate:

(i) Operating Cycle period.

(ii) Number of Operating Cycles in a year.

(iii) Amount of working capital required for the company on a cash cost basis.

(iv) The company is a market leader in its product, there is virtually no competitor in the market. Based on a market research, it is planning to discontinue sales on credit and deliver products based on pre-payments. Thereby, it can reduce its working capital requirement substantially. What would be the reduction in working capital requirement due to such decision? (May 2015, 8 marks)

Answer:

(i) Computation for Operating Cycle Period:

Operating Cycle = RM Period + WIP Period + FG Period + Debtor

Collection Period – Creditor Payment period

= 50 days + 18 days + 22 days + 45 days – 55 days

Operating Cycle =80 days.

(ii) No of Operating Cycle in a year:

One operating cycle is for 80 days. So

\(\frac{360}{80}\) = 4.5

No. of Operating Cycle in a year = 4.5 times.

(iii) Computation for Amount of working capital required for company on cash cost basis: –

Annual operating cost =21 lakhs

depreciation = ₹ 2,10,000

Cash operating cost = Annual Cost – Depreciation

= ₹ 21 Lakhs -2,10,000

Cash operating cost =18,90,000

= 18,90,000 × \(\frac{80}{360}\)

= 4,20,000

Working Capital Required = ₹ 4,20,000

(iv) Reduction In working capital:

Operating Cycle Period = R + W + F – C

=50+18+22-55 = 35 days

Amount of Working Capital Required = \(\frac{18,90,000}{360}\) × 35= 1,83,750

Reduction in Working Capital = 4,20,000 – 1,83,750 = 236,250

![]()

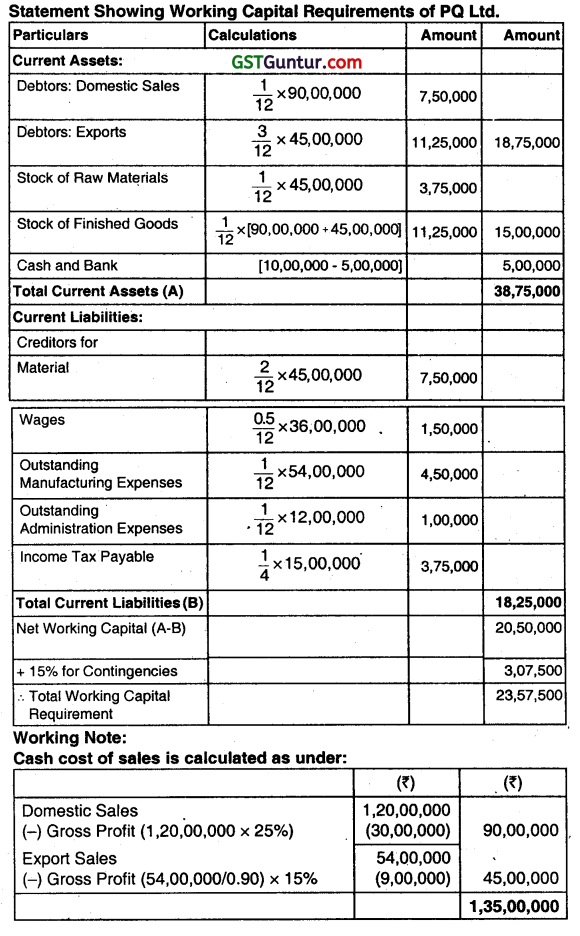

Question 17.

PQ Limited wants to expand its business and has applied for a loan from a commercial bank for its growing financial requirements. The records of the company reveals that the company sells goods in the domestic market at a gross profit of 25% not counting depreciation as part of the cost of goods sold.

The following additional information is also available for you:

Sales-Home at one month’s credit ₹ 1,20,00,000

Sales-Export at three months’ credit (sale price 10% below home price) ₹ 54,00,000

Material used (suppliers extends two months’ credit) ₹ 45,00,000

Wages paid ½ month in arrear ₹ 36,00,000

Manufacturing Expenses (Cash) paid (one month in arrear) ₹ 54,00,000

Adm. Expenses paid one month in arrear ₹ 12,00,000

Income tax payable in four installments of which one falls in the next financial year ₹ 15,00,000

The company keeps one month’s stock of each of raw materials and finished goods and believes in keeping ₹ 10,00,000 available to it including the overdraft limit of ₹ 5,00,000 not yet utilized by the company. Assume a 15% margin for contingencies. Ignore the work-in-progress. You are required to ascertain the requirement of the working capital of the company. (May 2017, 8 marks)

Answer:

Question 18.

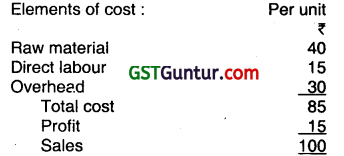

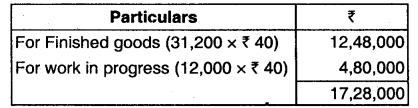

Day Ltd., a newly formed company has applied to the Private Bank for the first time for financing it’s Working Capital Requirements. The following informations are available about the projections for the current year:

Estimated Level of Activity

Completed Units of Production 31200 plus Units of Work In Progress 12000

Raw Material Cost ₹40 per unit

Direct Wages Cost ₹ 15 per unit

Overhead ₹ 40 per unit (inclusive of Depreciation ₹ 10 per unit)

Selling Price ₹ 130 per unit

Raw Material in Stock Average 30 days consumption

Work in Progress Stock Material 100% and Conversion Cost 50%

Finished Goods Stock 24000 Units

Credit Allowed by the Suppliers 30 days

Credit Allowed to Purchasers 60 days

Direct Wages (Lag in payment) 15 days

Expected Cash Balance ₹ 2,00,000

Assume that production is carried on evenly throughout the year (360 days) and wages and overheads accrue similarly. All sales are on the credit basis. You are required to calculate the Net Working Capital Requirement on a cash-cost basis. (May 2018, 10 marks)

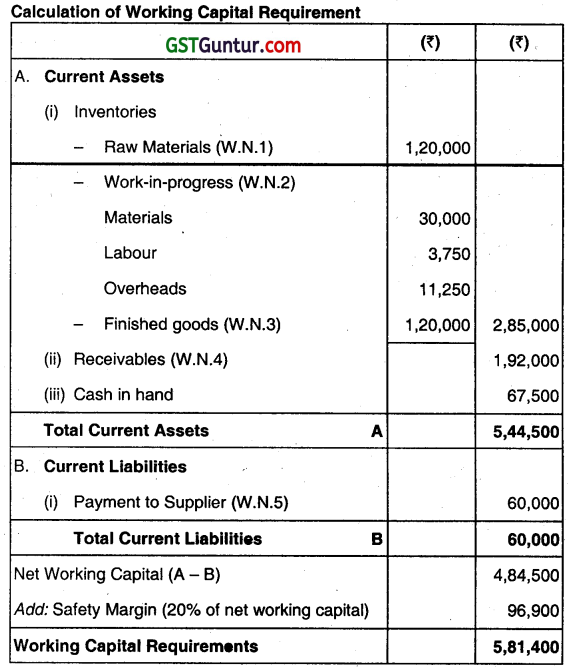

Answer:

3. Raw Material Stock

It is given that raw material in stock is average 30 days consumption. Since, the company is newly formed, the raw material requirement for production and work in progress will be issued and consumed during the year. Hence, the raw material consumption for the year (360 days) is as follows:

Raw material stock = \(\frac{₹ 17,28,000}{360 \text { days }}\) × 30 days

= ₹ 1,44,000

4. FInished goods stock = 24,000 units @ 85 per unit

=₹ 20,40,000

5. Debtors for sale=6,12000 x \(\frac{60}{360}\)

= ₹1,02,000

6. CredItors for raw material:

Credit allowed by Suppliers = \(\frac{₹ 18,72,000}{360 \text { days }}\) × 30 days

= ₹ 1,56,000

7. Creditors for Wages:

Outstanding wage payment = \(\frac{₹ 5,58,000}{360 \text { days }} \times 15 \text { days } \) = ₹ 23,250

![]()

Question 19.

Bita Limited manufactures used in the steel industry. The following information regarding the company is given for your consideration:

(i) Expected level of production 9000 units per annum.

(ii) Raw materials are expected to remain in store for an average of two months before issued to production.

(iii) Work-in-progress (50 percent complete as to conversion cost) will approximate to 1/2 month’s production.

(iv) Finished goods remain in warehouse on an average for one month.

(v) Credit allowed by suppliers ¡s one month.

(vi) Two months credit is normally allowed to debtors.

(vii) A minimum cash balance of ₹ 67,500 is expected to be maintained.

(viii) Cash sales are 75 percent less than the credit sales.

(ix) Safety margin of 20 percent to cover unforeseen contingencies.

(x) The production pattern is assumed to be even during the year.

(xi) The cost structure for Bita Limited’s product is as follows:

| ₹ | |

| Raw Materials | 80 per unit |

| Direct Labour | 20 per unit |

| Overheads (including depreciation ₹ 20) | 80 per unit |

| Total Cost | 180 per unit |

| Profit | 20 per unit |

| Selling Price | 200 per unit |

You are required to estimate the working capital requirement of Bita Limited. (May 2019, 10 marks)

Answer:

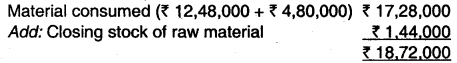

Working Notes:

1. Raw materials = (9,000 units × ₹ 80 × 2/12) = ₹ 1,20,000

2. Work in Progress:

Raw Materials = (9,000 units × ₹ 80 × 0.5/12) = ₹ 30,000

Labour = (9,000 units ×₹ 20 × 0.5/12) × 50% = ₹ 3,750

Overheads (excluding depreciation)

= (9,000 units × ₹ 60 × 0.5/12) × 50% = ₹ 11,250

3. Finished Goods (excluding depreciation)

= (9,000 units × ₹ 160 × 1/12) = ₹ 120,000

4. Receivables = (9,000 units × ₹ 160 × 2/12) × 80% = ₹ 1,92,000

Credit Sales = 80%

i.e. Cash Sales are 75% less than credit sales

So, if credit sales = ₹ 100

Less=75%= ₹ 75

Cash Sales = ₹ 25

So, total Sales = 100 + 25 = 125

Credit Sales = \(\frac{100}{125}\) × 100 = 80%

5. Payment to Supplier = (9,000 units × ₹ 80 × 1/12) = ₹ 60,000

Question 20.

PK Ltd., a manufacturing company, provides the following information:

| (₹) | |

| Sales | 1,08,00,000 |

| Raw Material Consumed | 27,00,000 |

| Labour Paid | 21,60,000 |

| Manufacturing Overhead (Including Depreciation for the year 3,60,000) | 32,40,000 |

| Administrative & Selling Overhead | 10,80,000 |

Additional Information:

(a) Receivables are allowed 3 months’ credit.

(b) Raw Material Supplier extends 3 months’ credit.

(c) Lag in payment of Labour is 1 month.

(d) Manufacturing Overhead are paid one month in arrear.

(e) Administrative & Selling Overhead is paid 1 month advance.

(f) Inventory holding period of Raw Materials & Finished Goods are of 3 months.

(g) Work-in-Progress is Nil.

(h) PK Ltd. sells goods at Cost plus 33\(\frac{1}{3}\) %

(i) Cash Balance 3,00,000.

(j) Safety Margin 10%.

You are required to compute the Working Capital Requirements of PK Ltd. on Cash Cost basis. (Nov 2020, 10 marks)

Question 21.

The following information is provided by MNP Ltd. for the year ending 31st March 2020:

Raw Material Storage period 45 days

Work-in-Progress conversion period 20 days

Finished Goods storage period 25 days

Debt Collection period 30 days

Creditors’ payment period 60 days

Annual Operating Cost ₹ 25,00,000

(Including Depreciation of ₹ 2,50,000)

Assume 360 days in a year.

You are required to calculate:

(i) Operating Cycle period

(ii) Number of Operating Cycle in a year.

(iii) Amount of working capital required for the company on a cost basis.

(iv) The company is a market leader in its product and it has no competitor in the market. Based on a market survey ills planning to discontinue sales on credit and deliver products based on pre-payments in order to reduce its working capital requirement substantiaty. You are required to compute the reduction in working capital requirement in such a scenario. (Jan 2021, 5 marks)

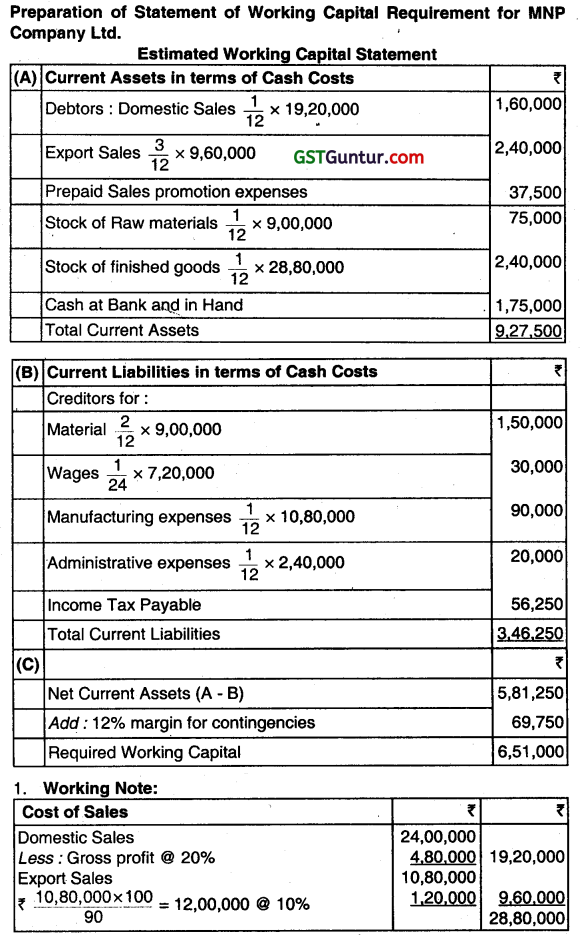

Question 22.

Following information is forecasted by the Puja Limited for the year ending 31st March 2018:

You may take one year as equal to 365 days.

Required:

CALCULATE

(i) Net operating cycle period.

(ii) Number of operating cycles in the year.

(iii) Amount of working capital requirement using operating cycles.

Answer:

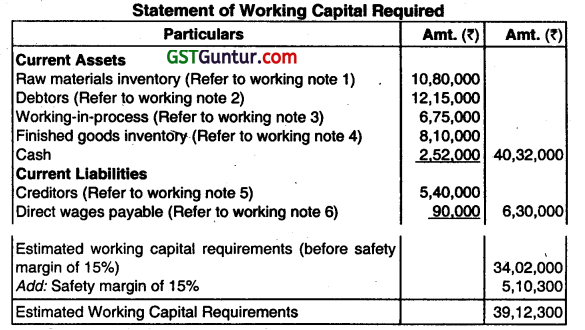

(i) Operating Cycle-Period

=R+W+F+D-C

=53+21 +26+41 —55

=86 days

(ii) Number of Operating Cycles in the Year

= \(\frac{365}{\text { OperatingCyclePeriod }}=\frac{365}{86} \) = 4.244

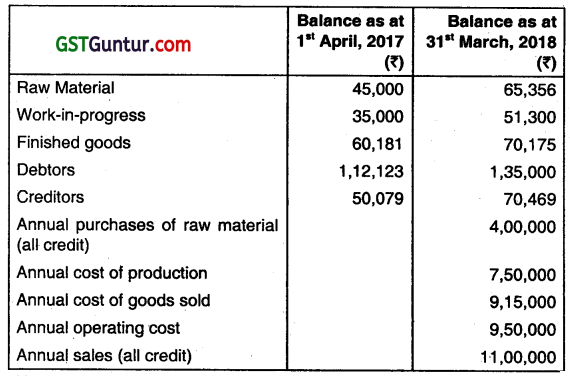

Working Notes:

1. Raw Material Storage Period (R)

= \(\frac{\text { Average Stock of Raw Material }}{\text { Annual Consumption of RawMaterial }} \times 365 \)

= \(\frac{\frac{₹ 45,000+₹ 65,356}{2}}{₹ 3,79,644} \times 365\)

= 53 days.

Annual Consumption of Raw Material Opening Stock + Purchases – Closing Sock

=₹ 45,000 + ₹ 4,00,000 – ₹ 65,356 = ₹ 3,79,644

2. Work-in-Progress (WIP) Conversion Period (W)

WIP Conversion Period = \(\frac{\text { Average Stock of WIP }}{\text { Annual Cost of Production }} \times 365\)

= \(\frac{\frac{₹ 35,000+₹ 51,300}{2}}{₹ 7,50,000} \times 365\)

=21 days.

3. Finished Stock Storage Period (F)

= \(\frac{\text { Average Stock of Finished Goods }}{\text { Cost of Goods Sold }} \times 365 \)

= \(\frac{₹ 65,178}{₹ 9,15,000} \times 365 \)

= 26 days.

![]()

Average Stock = \(\frac{₹ 60,181+₹ 70,175}{2} \) = ₹ 65,178.

4. Debtors Collection Period (D)

= \(\frac{\text { Average Debtors }}{\text { Annual Credit Sales }} \times 365 \)

= \(\frac{₹ 1,23,561.50}{₹ 11,00,000} \times 365 \)

= 41 days.

Average debtors = \(\frac{₹ 1,12,123+₹ 1,35,000}{2} \)

= ₹ 1,23,561.50

5. Creditors Payment Period (C)

= \(\frac{\text { Average Creditors }}{\text { Annual Net Credit Purchases }} \times 365 \)

= \(\frac{\left(\frac{(₹ 50,079+₹ 70,469}{2}\right)}{₹ 4,00,000} \times 365 \)

= 55 days.