Determination of National Income – CA Inter Economics Question Bank is designed strictly as per the latest syllabus and exam pattern.

Financing of Working Capital – CA Inter Economics Question Bank

Question 1.

What is National Income? How is it defined?

Answer:

Meaning of National Income:

The gross money value of final goods and domestic territory of the country is called gross domestic product or income. If depreciation is subtracted from gross domestic income, we get net domestic income. Besides, domestic income there is net factor income earned from abroad. If net factor income earned from abroad is added to domestic income, we get national income.

National income may be defined as follows:

National income is the net money value of all final goods and services that are produced in a country in a year plus net factor income received from abroad. This national income is also distributed as factor income (wages, salary, rent, interest, profit, etc.) among the factors of production. Therefore, national income may also be estimated by adding up all the factors of income. Factors of production spend their factor incomes on final goods and services. In this way, national income can also be obtained by adding up all the final expenditures.

Therefore, in short, national income is either the net value of all final goods and services.

Or the sum total of all factor incomes.

Or the sum total of final expenditures.

Thus, there are 3 ways of expressing National Income

1. NI = ΣPG

Where ΣPG = sum total of market value of the final goods and services produced.

2. NI = ΣFY

Where ΣFY = sum total of factor income.

3. NI = C+1

Where C + 1 = sum total of expenditure on the final goods and services produced.

Question 2.

Write a short note on:

National Income as an indicator of economic welfare.

Answer:

National Income as an Indicator of Economic Welfare The increase in National Income does not necessarily mean an increase in welfare of the people.

The reasons are as follows:

1. Unequal distribution of Gross National Product (GNP): Although there may be rise in GNP but if the distribution is not equal or even, this rise in GNP will not help in raising welfare of people.

2. Composition of growth: If the composition of growth consist of defence equipment and socially under arable product like smack, brown sugar etc. it will not help in raising the welfare of the people.

3. Growth rate of population: If the rate of growth of population is more than the rate of growth of GNP then the growth of GNP will not rise the welfare of the people.

4. Inflation: If the GNP rises due to rise in general price level without any increase in actual production of goods and services, it will not raise the welfare of the people.

5. Industrialisation: If National Income of a country rises due to fast industrialisation, the welfare of the common people falls as industrialisation gives rise to pollution, the greatest every of welfare.

Question 3.

Explain the Concept of Gross National Product at market price (GNPMP). (Nov 2018, 2 marks)

Answer:

Gross National Product (GNP) is a measure of the market value of all final economic goods and services, gross of depreciation, produced within the domestic territory of a country, by normal residents during an accounting year including net factor incomes from abroad. Gross National Product (GNP) is evaluated at market prices and therefore ills in fact Gross National Product at market prices (GNPMP).

GNPMP = GDPMP + Net factor income from Abroad.

NFIA is the difference between factor income Earned by our residents from the rest of the world and factor income earned by our residents within our country.

Thus, NFIA = Factor Income earned by our resident from abroad – Factor income earned by non-residents within our country.

Question 4.

Distinguish between Personal Income and Disposable Personal Income. (Nov 2018, 3 marks)

Answer:

Difference between Personal Income and Personal Disposable Income

| Personal Income | Disposable Income |

| 1. Personal income is a measure of actual current income receipts of persons from all sources which may or may not be earned from productive activities during a given period of time. In other words, it is the income actually paid out to the household sector but not necessarily earned. | Disposable personal income is a measure of amount of the money in the hands of the individuals that is available for their consumption or savings. Disposable personal income is derived from personal income by subtracting the direct taxes paid by individuals and other compulsory payments made to the government. DI = Pl – Personal Income Taxes |

| 2. It is a broader concept as it Includes direct taxes and fines and fees of Govt administration. | It is a narrow concept and does not include both direct taxes and miscellaneous Govt. receipts. |

| 3. Whole of this income cannot be disposed of upon consumption and savings. | It can be disposed of upon consumption expenditure and savings. |

| 4. It includes direct taxes, income tax, wealth tax, etc. | It does not include such taxes. |

Question 5.

Which method is used in India for measurement of National Income? Also, state the method which is considered the most suitable for measurement of National Income of the developed economies. (Nov 2020, 2 marks)

![]()

Question 6.

Compute the amount of subsidies from the following data:

GDP at market price (₹ in crores) 7,79,567

Indirect Taxes (₹ in crores) 4,54,367

GDP at factor cost (₹ in crores) 3,60,815 (Nov 2019, 3 marks)

Answer:

Gross Domestic Product at Factor cost (GDP)

= Gross Domestic Product at Market Price (GDPMP) – Indirect Taxes + Subsidies.

₹ 3,60,815 Cr. = ₹ 7,79,567 Cr. – ₹ 454,367 + subsidies

₹ 3,60,815 Cr. = ₹ 3,25200 Cr. + subsidies

∴ Subsidies = ₹ 35,615 Cr.

Question 7.

Compute the amount of depreciation from the following data:

(₹ In Crores)

GDP at Market Price (GDPMP) 8,76,532

Net factor income from abroad (-) 232

Aggregate amount of Indirect Taxes 564

Subsidies 30

National Income (NNPFC) 8,46,576 (Nov 2020, 3 marks)

Question 8.

Compute GOP at market price and Mixed Income of Self-Employed from the data given below:

| (₹ In Crores) | |

| Compensation of Employees | 810 |

| Depreciation | 26 |

| Rent, Interest, and Profit | 453 |

| NDP at factor cost | 1450 |

| Subsidies | 18 |

| Net factor Income from Abroad (-) | 17 |

| Indirect taxes | 57 |

(Jan 2021, 3 Marks)

Question 9.

You are given the following data on an economy in millions:

Consumer Expenditure (inclusive of indirect taxes) 110 m

Investment 20 m

Government Expenditure (inclusive of transfer payments) 70 m

Export 20m

Imports 50m

Net Property Income from abroad 10 m

Transfer payments 20 m

indirect taxes 30m

Population 0.5 m

(i) Calculate the Gross Domestic Product at market prices.

(ii) Calculate the Gross National Income at market prices.

(iii) Calculate the Gross Domestic Product at factor cost.

(iv) Calculate the per capita Gross National Income at factor cost.

Answer:

(i) GDPMP = C+I+G+(X-Z) = 110+20 + (70-20) + (20-50) = 150 million

(ii) GNPMP = GDP at market prices + net property income from abroad = 150 + 10 = 160 million

(iii) GDPat factor cost = GDP market prices – indirect taxes = 150 – 30 = 120 million

(iv) Per Capita Income = \(\frac{\text { GNP at Factor Cost }}{\text { Population }}\) = (160 m-30 m)/0.5 million = 130/0.5=260

Question 10.

Write short flotes on the following: a

1. Private Income

2. Personal Income

3. Personal Disposable Income

Answer:

1. Private Income

Private Income relates to income and other payments relating to private sector. It includes at payments, which are earned by private sector within the country and abroad, plus all current transfer payments.

Private Income can be obtained from the National Income as well as from the Domestic Income.

Private Income = NI – Income from domestic product accruing to Government sector + current transfer payments also

Private Income = NDPFC accruing to Private sector + NFIA + Interest on national debt + current transfer from government + current transfer from rest of the world.

2. Personal Income

Personal income is the total of all current income received by households from all sources. All income which accrues to the factors i.e. earned by the factors are not received by them (corporate saying, corporate tax) and on the other hand, there are certain payments which they receive but are not earned by them (pension, interest on national debt, etc). Therefore personal income is the total of all such payments and income received whether or not they have earned, it. Thus, Personal Income = Private income – Corporate Tax – Undistributed profit corporate saving.

3. Personal Disposable Income (PDI)

PDI is that part of personal income, which the individual can spend the way they like. It is the income remaining with individual after deduction of all taxes levied against their income and property by the Government.

Thus, PDI = Personal Income Direct Personal taxes – Miscellaneous fees and fines paid by the householders to the Government.

![]()

Question 11.

Differentiate between:

National Income at Current Price and National Income at Constant Price.

Answer:

Difference Between NI at Current Price and NI at Constant Price

| Basis of Difference | NI at Current Price | NI at Constant Price |

| 1. Meaning | When goods and services produced by normal residents within and outside the country in a year is valued at current year’s price is called NI at current prices. | When goods and services produced by normal residents within and outside the country in a year is valued at constant price i.e. base year’s price is NI at constant price. |

| 2. Formula | Y = Q x P Where: Y = NI at current price Q = quantity of goods and services produced during an accounting year P = Prices of goods and services prevailing during the current accounting year. |

Y1 = Q x P1 Where: Y1 = NI at constant price Q = Quantity of goods and services produced during an accounting year. P1 = Prices of goods and services prevailing during the base year. |

| 3. Also known as | Nominal National Income. | Real National income. |

Question 12.

What is the difference between Real GOP and Nominal GOP?

Answer:

Difference between Real GDP and Nominal GDP

| Basis of Difference | Real GDP | Nominal GDP |

| 1. Meaning | Goods and services produced by all producing units within the domestic territory of a country during an accounting year valued at current year’s price. | Goods and services produced by all producing units within the domestic territory of a country during an accounting year valued at base years’s price or constant price. |

| 2. Influenced by | Influenced by change in physical output and not by change in price. | Influenced by change in both physical output an price level. |

| 3. As an Indicator of economic development | It is considered as a true indicator of economic development. | It is not a true indicator of economic development. |

Question 13.

How do you differentiate between:

Private Income and Personal Income

Answer:

Difference between Private income and Personal Income

| Basis | Private Income | Personal Income |

| 1. Meaning | It is the total income of both private enterprises and households. | It is the actual income received by households and individuals. |

| 2. Broad Vs Narrow | It is a broader concept than personal income because it includes corporate tax and corporate savings. | it is a narrow concept than private income as it does not include corporate tax and corporate savings. |

| 3. Comprises of | Private Income = Domestic Income accrued to Private Sector + NFIA + All Transfer Payments + Interest on National Debts. |

Personal Income = Private Income – Corporate Tax – Corporate Savings. |

Question 14.

What are the related concepts or aggregates of National Income?

Answer:

The related concepts or Aggregates of National Income are as follows:

1. Gross Domestic Product at Market price (GDPMP)

GDPMP is the market value of the final goods and services produced during a year within the domestic territory of a country.

Note: Gross indicates that the value of domestic product is inclusive of depreciation, i.e. consumption of fixed capital. Within the domestic territory means within the boundaries of the country including the production by domestic companies and by foreign companies as well.

2. Gross National Product at Market price (GDPMP)

When net factor income from abroad (NFIA) is added to GDPMP we get GNPMP

Thus GNPMP = NFIA + GDPMP

NFIA is the difference between factor income Earned by our residents from the rest of the world and factor income earned by our residents within our country.

Thus, NFIA = Factor Income earned by our resident from abroad – Factor income earned by non-residents within our country.

3. Net National Product at Market price (NNPMP)

When Depreciation is subtracted from GNPMP, we get NNPMP

Thus, NNPMP = GNPMP – Depreciation.

In other words, NNPMP – is the market value of final goods and services produced within the domestic territory of a country along with net factor income from abroad during a year.

What is depreciation?

Depreciation, also called consumption of fixed capital refers to the loss of value of fixed asset on account of:

- Normal wear and tear

- Normal obsolescence

- Accidental damage of machinery.

4. Net Domestic Product at Market Price (NNPMP)

When Depreciation is subtracted from GNPMP we get NNPMP

Thus, NNPMP = GNPMP – Depreciation

In other words, NNPMP is the market value of final goods and services produced within the domestic territory of a country during a year, exclusive of depreciation.

5. Gross Domestic Product at Factor Cost GDPFC

GDPFC is the sum total of factor incomes (Rent + Interest + Wages + Profit) generated within the domestic territory of a country along with consumption of fixed capital i.e. depreciation. during a year.

6. Gross National Product at Factor cost GNPFC

When net factor income from abroad (NFIA) is added to GDPFC we get GNPFC

Thus, GNPFC = GDPFC + NFIA

7. Net Domestic Product at Factor Cost NDPFC

When depreciation is subtracted from GDPFC we get NDPFC

Thus, NDPFC = GDPFC – Depreciation.

In other words, NDPFC is the value of final goods and services produced within the domestic territory of a country at factor cost, exclusive of depreciation. It is the sum total of factor incomes generated within the domestic territory and is also known as Domestic income.

8. Net National Product at Factor cost NNPFC

When NFIA is added to NDPFC we get NNPFC

Thus, NNPFC = NDPFC + NFIA.

In other words, NNPFC is the sum total of factor incomes generated within the domestic territory of a country, along with net factor income from abroad during a year. It is this NNPFC which is known as National Income.

9. National Disposable Income (NDI)

NDI is the income from all sources (earned income as well as transfer payments from abroad) available to residents of a country for consumption expenditure or for saving during a year.

Thus, NDI = National Income + Net Indirect taxes + Net current transfer from the rest of the world.

In other words, NDI refers to the net income at market price available to a country for disposal.

10. Factor Income from Net Domestic Product Accruing to Private sector.

Factor income from NDP accruing to private sector is the income earned by the private sector. It is that part of NDPFC which accrues to the private sector and excludes:

- Property and entrepreneurial income of the departmental and

- Saving of the non-departmental enterprises of the Government.

Thus Factor income from Net Domestic product Accruing to Private sector = NDPFC – Income from Property and entrepreneurship accruing to Government department enterprises-saving of non-departmental enterprises.

Question 15.

Private Income

Answer:

Private Income

Private Income relates to income and other payment relating to private sector. It includes at payments, which are earned by private sector within the country and abroad, plus all current transfer payments.

Private Income can be obtained from the National Income as well as from the Domestic Income.

Private Income = NI – Income from domestic product accruing to Government sector + current transfer payments also

Private Income = NDPFC accruing to Private sector + NFIA + Interest on national debt + current transfer from government + current transfer from rest of the world.

Question 16.

Personal Income

Answer:

Personal Income

Personal income is the total of all current income received by households from all sources. All income which accrue to the factors i.e. earned by the factors are not received by them (corporate saying, corporate tax) and on the other hand, there are certain payments which they receive but are not earned by them (pension, interest on national debt, etc). Therefore personal income is the total of all such payments and income received whether or not they have earned, it.

Thus, Personal Income = Private income – Corporate Tax – Undistributed profit corporate saving.

Question 17.

Personal Disposable Income (PDI)

Answer:

Personal Disposable Income (PDI):

PDI is that part of personal income, which the individual can spend the way they like. It is the income remaining with individual after deduction of all taxes levied against their income and property by the Government.

Thus, PDI = Personal Income – Direct Personal taxes – Miscellaneous fees and tines paid by the householders to the Government.

Question 18.

Why ‘Indirect Taxes’ are deducted and ‘Subsidy’ is added in NDP, for calculating NDPFC?

Answer:

Deduction of Indirect Taxes:

In the calculation of Net Domestic Product, the value goods and services at market prices are taken into consideration which includes indirect taxes. Hence, the entire market price is not received by factors of production. So indirect taxes are deducted from market price for calculating the value of factor cost.

Addition of Subsidy:

Generally, government provides subsidy (i.e., economic assistance) to the producer or distributor, so that the commodity may be sold at lower prices. In this case, market price becomes lower to what factors of production actually get. Hence, for calculating the actual factor income, subsidy amount is added in market price.

Question 19.

From the following data, calculate the GDP, GNP, NDP and NNP at both factor cost and market prices.

| (₹ Lakhs) | |

| Gross investment | 120 |

| Net exports | 15 |

| Net indirect taxes | 5 |

| Depreciation | 20 |

| Net factor income from abroad | 10 |

| Personal consumption expenditure | 450 |

| Government purchases of goods and services | 150 |

Answer:

Question 20.

Given:

| ₹ (Lakhs) | |

| NDPFC | 10,000 |

| Net factor Income from Abroad | 200 |

| Depreciation | 300 |

| Net Indirect Taxes | 250 |

Calculate:

(a) NNPFC

(b) GNPFC

(c) GNPMP

(d) NNPMP

(e) NDPMP

(f) GDPMP

(g) GDPFC.

Answer:

(a) NNPFC = NDP + Net Factor Income from Abroad

=10,000+200

= ₹ 10,200 Lakhs

(b) GNPFG = NNPFC + Depreciation

= 10,200 + 300

= ₹ 10,500 crores.

(c) GNPMP = GNPMP+ Net indirect taxes

=10,500+250

= ₹ 10,750 Lakhs

(d) NNPMP = GNPMP – DepreciatIon

= 10,750 – 300

= ₹ 10,450 crores.

(e) NDPMP = NNPMP – Net Factor Income from Abroad

= 10,450 – 200

= ₹ 10,250 Lakhs

(f) GDPMP = NDPMP + Depreciation

= 10,250 + 300

= ₹ 10,550 Lakhs

(g) GDPFC = NDPFC + Depreciation

= 10,000 + 300

= ₹ 10,300 Lakhs

Question 21.

Calculate the aggregate value of depreciation.

Answer:

GNPMP = GDPMP + Net Factor Income from Abroad = 1100+ 100= 1200

GNPFC = GNPMP – Net Indirect Taxes = 1200- 150= 1050

Deprecation = GNPFC – NNPFC

= 1050 – 850

= ₹ 200 Lakhs.

Question 22.

From the following data, calculate Personal Income (Pl) and Personal Disposable Income (PDI):

| (₹ Lakhs) | |

| NDPFC | 10,000 |

| Net Factor Income from Abroad | 500 |

| Undistributed Profit | 1,500 |

Answer:

PI = NDPFC + NFIA – Undistributed Profit – Corporate Tax – (Interest paid by households – Interest received by households) + Transfer Income

= 10,000+ 500 – 1,500 – 800 – (1,600 – 1,800) + 400

= 10,000+ 500 – 200+ 400 – (1,500) + 800)

= ₹ 8,800 Lakhs

PDI = Personal Income – Personal Tax

= 8,800 – 600

= ₹ 8,200 Lakhs.

Question 23.

From the following data, estimate:

(a) GDPMP

(b) Private Income and

(c) Personal Income

| ₹ (Lakhs) | |

| GNPFC | 14,500 |

| Depreciation | 1,300 |

| Net Factor Income from Abroad (-) | 350 |

| income from the property to government administrative department | 1,500 |

| National Debt Interest | 400 |

| Current transfers from ROW | 250 |

| Corporate Tax | 280 |

| Savings of private corporate sector | 700 |

| Indirect Taxes | 800 |

| Subsidies | 250 |

Answer:

(a) GDPMP

= GNPFC – Net Factor income from abroad + Indirect Tax – Subsidies

= 14,500-(-350)+800-250 = ₹ 15,400 Lakhs

(b) Private Income

= GNPFC – Depreciation – Income from property to government administrative department + Current transfers from ROW + National Debt Interest

= 14,500 – 1,300 – 1500 + 250 + 400

= ₹ 12,350 Lakhs

(c) Personal Income

= Private Incbnie – Corporation Tax – Saving of private corporate sector

= 12,350 – 280 – 700

= ₹ 11,370 Lakhs.

![]()

Question 24.

Given:

| ₹ (Lakhs) | |

| GDPFC | 4,000 |

| Depreciation | 100 |

| Net Indirect Taxes | 300 |

| NNPMP | 4,500 |

Calculate the Net Factor Income from Abroad

Answer:

NDPFC = GDPFC Depreciation

= 4,000 – 100

= 3,900

NDPMP = NDPFC + Net lndrect Taxes

= 3,900+300

= 4,200

NFIA = NNPMP – NDPMP

= 4500 – 4200

= ₹ 300 Lakhs

Question 25.

Given:

GNPMP 7,000

Net Factor Income from Abroad 200

Depreciation 150

NDPFC 6,200

Calculate the Net Indirect Tax.

Answer:

GDPMP = GNPMP – Net Factor Income from Abroad

= 7,000 – 200

= ₹ 6,800 Lakhs

NDPMP = GDPMP – Depreciation

= 6,800 – 150

= ₹ 6,650 Lakhs

NIT = NDPMP – NDPFC

= 6,650 – 6,200

= ₹ 460 Lakhs.

Question 26.

Calculate Gross National Disposable income from the following data:

| ₹ (Lakhs) | |

| National income (or NNPFC) | 2,000 |

| Net Current Transfers from Rest of the World | 200 |

| Depreciation | 100 |

| Net Factor Income from Abroad (-) | 50 |

| Net Indirect Taxes | 250 |

Answer:

GNDI = NI + Net current transfers of the rest of the world + Depreciation + Net Indirect Taxes

= 2,000+200+100+250

= ₹ 2,550 Lakhs.

Question 27.

From the following data calculate Income accruing to the private sector from domestic product:

| ₹ (Lakhs) | |

| NNPMP | 15000 |

| Net Factor Income from Abroad | 250 |

| Indirect Tax | 200 |

| Subsidies | 150 |

| Income accruing to the public sector from domestic product | 300 |

Answer:

NDPFC = NNPMP – Net Factor Income from Abroad – Indirect Tax +

Subsidies

= 15000 – 250 – 200 + 150

= ₹ 14,700 crores.

Income accruing to the private sector from domestic product = NDPFC – Income accruing to the public sector.

∴ Income accruing to the private sector from domestic product =14,700 – 300 = ₹ 14,400 Lakhs.

Question 28.

From the following data calculate Personal Income:

| ₹ (Lakhs) | |

| Private Income | 12,000 |

| Saving of Private Corporate Sector (or undistributed corporate profits) | 200 |

| Corporate Tax | 70 |

Answer:

Personal Income

= Private Income – Saving of Private Corporate Sector – Corporate Tax

= 12,000 – 200 – 70

= ₹ 11,730 Lakhs.

Question 29.

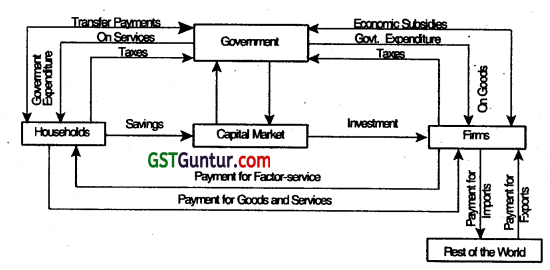

Explain the circular flow of income in an economy. (Nov 2019, 3 marks)

Answer:

Production is the result of collective efforts of various factors of production. Factors engaged in production process get their award – land, labour, capital, and entrepreneurship get rent, wage, interest, and profit respectively.

Commercial firms make use of these factors for producing goods and services. These factors of production are not only suppliers of factors to the producer, but they are consumers also. These factors earn their income on consumption. Commercial firms sell their product, earn income, and again spend on completing production activity. Thus, flow of income circulates.

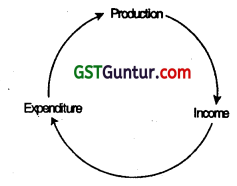

Production gives birth to Income, income to consumption, consumption to expenditure, and again expenditure to income and production. Thus, circular flow of income-earning economic activities takes places in the economy.

Hence, the circular flow of income refers to flow of money income or the flow of goods and services across different sectors of the economy in a circular form. It is a continuous flow of production income and expenditure.

Definition:

According to Lipsey, “The circular flow of income is the flow of payment and receipts between domestic firms and domestic households.”

![]()

Question 30.

What are the Principles of Circular Flow of Income? Explain.

Answer:

Principles or Reasons of Circular Flow of Income:

Circular flow of income depends on two principles (or reasons):

1. In the process of exchange, seller of the producer gets that money which is spent by buyer or consumer, i.e., income earned by the producer equals the income spent by the consumer.

2. Goods and services flow from sellers to buyers in one direction but the money payment for these goods and services flow in opposite direction i.e., it flows from buyers to sellers.

Question 31.

State the relationship between leakages and injections in various economies

Answer:

Relationship between Leakage and Injection:

For the equiftbrium in economy, leakages should be equal to injections.

Or Injections = Leakages

Various sources of Injections and Leakages:

Two Sector Economy:

Leakages = Savings (S)

Injections = Investment (I)

Three Sector Economy:

Leakages = Savings + Tax = S + T

Injections = Investment + Government Expenditure = I + G

Four Sector Economy:

Leakages = Savings + Tax + Import = S + T + M

Injections = lnvestment+Govemment Expenditure + Export = I + G + X

Question 32.

Elucidate the importance of Circular Income Flows.

Answer:

Importance of Circular Income Flows:

In economic analysis circular income flow has a vital role to play. Salient points showing the importance of circular flow of income are as follows:

- It helps in estimation of national income.

- It gives the knowledge of working of the economy.

- Equality between savings and investment becomes an important basis for monetary policy in the economy.

- Its study also helps in fiscal policy from the economic point of view.

- Its study helps in analysing the reasons of imbalance in the economy and making solutions to them.

- Keynesian Theory of Income and Employment takes important note of elements associated with flow of money.

- It also helps in studying the effects on imports and exports in the economy.

- This circular flow explains that Production = Income = Expenditure

This identity becomes basis for the methods of calculating national income.

Question 33.

From the following data, compute the Gro€s National Product at Market Price (GNPMP) using value-added method.

| (₹ in crores) | |

| Value of Output in Secondary Sector | 1,000 |

| Intermediate Consumption in Primary Sector | 300 |

| Value of Output in Tertiary Sector | 3,000 |

| Intermediate consumption in Secondary Sector | 400 |

| Net factor income from abroad (-) | 100 |

| Value of Output in Primary Sector | 800 |

| Intermediate Consumption in Tertiary Sector | 900 |

(May 2018, 3 marks)

Answer:

| (₹ In cr.) | |

| Value of output in primary sector | 800 |

| – Intermediate consumption of primary sector | (300) |

| + Value of output in secondary sector | 1,000 |

| – Intermediate consumption of secondary sector | (400) |

| + Value of output in tertiary sector | 3,000 |

| – Intermediate consumption of tertiary sector | (900) |

| GDPMP | 3,200 Cr. |

GDPMP + NFIA = GNPMP

∴ GNPMP = 32,000 + (-100) = 3100

Ans: GNPMP = ₹ 3,100 Cr.

Question 34.

Calculate GNP at market price from the following data using Value Added Method.

| (₹ in Crores) | |

| Government Transfer Payments | 1800 |

| Value of Output in Primary Sector | 1500 |

| Value of Output in Secondary Sector | 2700 |

| Value of Output in Tertiary Sector | 2100 |

| Net factor income from Abroad (-) | 60 |

| Intermediate Consumption in Primary Sector | 750 |

| Intermediate Consumption in Secondary Sector | 1200 |

| Intermediate Consumption in Tertiary Sector | 900 |

(Jan 2021, 5 marks)

Question 35.

Write short note on:

Precautions to be taken while measuring National income by Product Method.

Answer:

Precautions to be taken while measuring National Income by Product Method:

- The value of only final goods and services should be included to avoid double counting.

- Sale and purchase of 2 hand goods should not be counted.

- Services of housewife should not be counted.

- Production for self-consumption should also be included

- Inputed rental value of the self-occupied house should be included.

![]()

Question 36.

How is NI measured by Value Added Method? Explain.

Answer:

Product Method or Value added method is that method which measures the national income by estimating the contribution of each producing enterprise to production in the domestic territory of the country in an accounting year.

The steps involved are:

1st Step:

First of ah the various producing enterprise in a country are classified into primary sector, secondary sector and tertiary sector.

2nd Step:

Estimating net value added.

Net value added = Value of output – [Value of non-factor inputs (also called intermediate consumption) + depreciation + net indirect tax]

Value of Output = Sales + Change in stock

Change in stock = Closing Stock – Opening stock

3rd Step:

The NVA of all the sectors of a country is added to obtain NDP at factor cost.

4th Step:

Estimating NFIA and adding the same to NDP to obtain net national product or National Income.

Thus, ΣNVA (of all the sectors) = NDPFC

NDPFC + NFIA = NNPFC

NNPFC = NI.

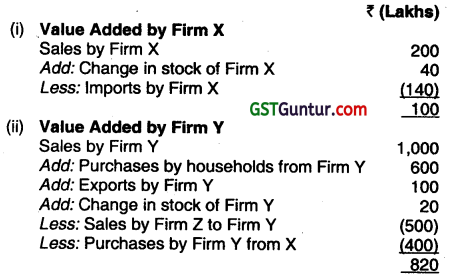

Question 37.

Calculate value added by Firm X and Firm Y from the following data:

| ₹ (Lakhs) | |

| Sales by Firm X | 200 |

| Sales by Firm Y | 1000 |

| Purchases by households from Firm Y | 600 |

| Exports by Firm Y | 100 |

| Change in stock of Firm X | 40 |

| Change in stock of Firm Y | 20 |

| Imports by Firm X | 140 |

| Sales by Firm Z to Firm Y | 500 |

| Purchases by Firm Y From X | 400 |

Answer:

Question 38.

Calculate the net value added at factor cost a producing unit from the following data:

| ₹ (Lakhs) | |

| Total Sales | 4,000 |

| Closing stock | 700 |

| Opening stock | 500 |

| Indirect Taxes | 200 |

| Subsidies | 150 |

| Depreciation | 300 |

| Purchase of raw materials from other firms | 1,000 |

Answer:

Value of output

= Total sales + Change in stock

(Clo. stock – Op. stock)

= 4,000+(700-500)

= ₹ 4,200Lakhs.

GVAMP

= Value of output – Purchase of material from other firms

= ₹ 4,200 – 1,000 = 3,200 Lakhs.

Net Value Added at factor cost

= GVAMP – Depreciation – (Indirect taxes – Subsidies)

= ₹ 3,200 – 300 -(200 – 150)

= ₹ 2,850 Lakhs.

Question 39.

Given:

Value of gross output at market prices ₹ 10,000

Intermediate consumption ₹ 3,000

Net Indirect taxes ₹ 700

Consumption of fixed capital ₹ 140

Calculate:

(a) Gross Value Added at market price.

(b) Gross Value Added at factor price.

(c) Net value added at factor cost.

Answer:

(a) Gross Value Added at market price.

= Value of Gross OutputMP – Intermediate consumption

= ₹ 10,000 – ₹ 3,000 = ₹ 7,000

(b) Gross Value Added at factor cost

= GVAMP – Net Indirect Taxes

= ₹ 7,000 – 700 = ₹ 6,300

(c) Net Value Added at factor cost

= GVAFC – Consumption of fixed capital

= ₹ 6,300 – 140 = ₹ 6,160

Question 40.

From the following data, find out.

Value of output at market prices;

Gross value added at market prices;

Net value added at market prices;

Net value added at factor cost.

| ₹ (Lakhs) | |

| Opening stock | 400 |

| Closing stock | 200 |

| Purchase of raw material | 300 |

| Sales | 1600 |

| Consumption of fixed capital | 200 |

| Indirect taxes | 150 |

| Subsidies | 50 |

Answer:

(a) Value of output at market prices

= Sales + Closing stock – Opening stock

= (1,600+200 – 400)

= ₹ 1,400 Lakhs

(b) Gross value added at market prices

= Value of output – Purchase of raw materials

= (1,400-300)

= ₹ 1,100 Lakhs

(c) Net value added at market prices

= Gross value added – Consumption of fixed capital

= (1,100-200)

= ₹ 900 Lakhs

(d) Net value added at factor cost

= NVA at market prices – Indirect taxes + Subsidies

= (900-150+50)

= ₹ 800 Lakhs.

![]()

Question 41.

Using the information given in the following table calculate,

(i) Value added by firm A and firm B

(ii) Gross Domestic Product at Market Price

(iii) Net Domestic Product at Factor Cost.

| Particulars | ₹ crore |

| (i) Sales by firm B to general government | 300 |

| (ii) Sales by firm A | 1500 |

| (iii) Sales by firm B to households | 1350 |

| (iv) Change in stock of firm A | 200 |

| (v) Closing stock of firm B | 140 |

| (vi) Opening stock of firm B | 130 |

| (vii) Purchases by firm A | 270 |

| (viii) Indirect taxes paid by both the firms | 375 |

| (ix) Consumption of fixed capital | 720 |

| (x) Sales by firm A to B | 300 |

Answer:

(i) Value added by Firm A and Firm B

Gross Value Added (GVAMP) of Firm A

= Gross value of output (GVOMP) of Firm A :

Intermediate consumption of firm A

= (Sales by firm A + Change in stock of firm A) – (Purchases by firm A)

= ((ii) + (iv)] – (vii) = (1500+ 200) -270 = 1430 Crores

Gross Value Added (GVAMP) of Firm B = Gross value of output

(GVOMP) of firm B -Intermediate consumption of firm B

= [Sales by firm B to general government + Sales by firm B to households + (Closing stock of firm B – Opening stock of firm B)] – Purchases by firm B

= [(300+1350)+(140-130)]-300

= 1650+10-300 = ₹ 1360 Crores

(ii) Gross Domestic Product at Market Price:

= Value added by firm A + Value added by firm B

= 1430 + 1360 = ₹ 2790 Crores

(iii) Net Domestic Price at Factor Cost:

NDPFC = Gross Domestic Product at market price – Consumption of fixed capital – Indirect taxes paid by both the firms

= 2790 – (ix) – (viii) = 2790 -720 – (375 -0) = ₹ 1695 Crores

Question 42.

Compute NNP at factor cost or national income from the following data using income method:

| (₹ In crores) | |

| Compensation of employees | 3,000 |

| Mixed-income of self-employed | 1,050 |

| Indirect taxes | 480 |

| Subsidies | 630 |

| Depreciation | 428 |

| Rent | 1,020 |

| Interest | 2,010 |

| Profit | 980 |

| Net factor income from abroad | 370 |

(Nov 2019, 3 marks)

Answer:

(i) NNP et factor cost or National lnocme =

Compensation of employees + operating Surplus (rent + interest + profit) + Mixed Income of Self – employed + Net factor Income from Abroad.

= 3000 Cr. + (₹ 1020 Cr. + 2010 Cr. + 980 Cr.)+ 1050 Cr. + 370 Cr. = ₹ 8430Cr.

Question 43.

Discuss the Income Method of measuring National Income.

Answer:

Income Method of Measuring National Income:

Income method is that method which measures NI from the payment point of view where payment is made in form of wages, rent, interest and profit to the primary factors of production i.e. labour, land, capital, and enterprise respectively for their productive seces in an accounting year.

The steps involved are:

1st Step:

First of all the various producing enterprises in a country are classified into

(a) Primary sector

(b) Secondary sector

(c) Tertiary sector.

2nd Step:

All the factor payments are classified as follows:

(i) Income from work – wages and salary

(ii) Income from property – Rent and Interest

(iii) Income from profit – Dividend, Undistributed Profit and Corporate taxes

(iv) Mixed Income – income of self-emploÿed like doctor, advocate etc.

3rd Step:

Domestic factor Income is estimated by adding all the factor payments of all the enterprises of all the sector.

4th Step:

Net Income earned from abroad is estimated and added to domestic Income to arrive at national product, which ¡s the national Income.

Thus,

Wage

+ Salary

+ Profit

+ Rent

+ Interest

+ Mixed Income

= NDPFC = Domestic Income + NFIA

= NNPFC = National Income.

Question 44.

Write short note on:

Precautions to be taken while measuring National income by income Method

Answer:

Precautions to be taken while measuring National Income by Income Method

1. Windfall gains like income from lottery are not included.

2. Wealth tax capital gain tax are not to be included.

3. Production br self-consumption should also be included.

4. imputed rental value of self-occupied house should also be included.

5. Sale and purchase of 2nd hand goods should not be counted.

6. Income of gamblers, smugglers, thieves etc. should not be included.

7. Financial transaction such as sale of shares is not included.

Question 45.

State the various components of:

Domestic Income

Answer:

Components of Domestic Income

1. CompensatIon of employees

(i) Wages and salaries

(ii) Employer’s contribution to social security schemes.

2. Operating surplus

(i) Rent

(ii) interest

(iii) Profit

3. Mixed Income for self-employed persons.

![]()

Question 46.

Suppose in an economy:

Consumption Function : C = 150+0.75 d

Investment spending: I = 100

Government spending: G = 115

Tax : Tx = 20 + 0.20Y

Transfer Payments: Tr =40

Exports: X=35

Imports : M=15 + 0.1 Y

Where, Y and Yd are National Income and Personal Disposable Income respectively. All figures are in rupees.

Find:

The equilibrium level of National Income

Consumption at equilibrium level

Net Exports at equilibrium level (May 2018, 5 marks)

OR

You are given the following information of an economy:

Consumption Function : C = 200 + 0.60 Yd

Government Spending: G = 150

Investment Spending: I = 240

Tax: Tx=10 + 0.20 Y

Transfer Payment: Tr =50

Exports: X=30 + 0.2Y

Imports: M= 400

Where Y and Yd are National Income and Personal Disposable Income respectively. All figures are in ₹.

Find:

(i) The equilibrium level of National Income.

(ii) Net Exports at equilibrium level.

(iii) Consumption at equilibrium level. (Nov 2020, 5 marks)

Answer:

The consumption function is

C = 150 + 0.75Yd

Level of Disposable income Yd is given by

Yd = V-Tax + TransforPayments, Where, Transfer Payment = Tr =40

=Y-(20 + 0.20Y) + 40 = Y-20-0.20Y+40

=Y- 0.2Y – 20 + 40

Yd = 20 + 0.8V and C = 150 + 0.75 Yd

C = 150+ 75 (20 +0.8 Y) where Yd = (20+0.8V)

C= 150 +1 5+ 0.6Y

C = 165 + 0.6Y

(i) The equilibrium level of national Income

Y =C+I+G+(X-M)

Y =165 + 0.6Y + 100 + 115 + [35- (15+0.1Y)]

= 165+0.6Y +100+115+ [35 -15-0.1Y)

= 165+0.6Y +215+35-15-0.1V

Y =400+0.5V

Y-0.5Y = 400; 0.5 Y = 400

Y =400/0.5

= 800

The equilibrium level of national income is ₹ 800

(ii) Consumption at equilibrium level of national income of ₹ 800

C=165+0.6Y

C = 165 + 0.6(800)

C=165+480=645

Consumption at equilibrium level = ₹ 645

(iii) Net Exports at equilibrium level of national Income 800

Net exports = Value total exports – Value of total imports

Given, exports X = 35; and imports M = 15+0.1V

Net exports = [35- (1 5+0.1 Y)I

=35 -15-0.1V

= 35-15 – (0.1 X 800) = 35-15-80 = -60

Net exports = ₹ (-)60

There is an adverse balance of trade

Question 47.

Compute GNP at factor cost and NDP at market price using expenditure method from the following data:

| (₹ In Crores) | |

| Personal Consumption expenditure | 2900 |

| Imports | 300 |

| Gross public Investment | 500 |

| Consumption of fixed capital | 60 |

| Exports | 200 |

| inventory Investment | 170 |

| Government purchases of goods & services | 1100 |

| Gross Residential construction Investment | 450 |

| Net factor Income from abroad (-) | 30 |

| Gross business fixed Investment | 410 |

| Subsidies | 80 |

(May 2019, 5 marks)

Answer:

GDPMP = Personal consumption expenditure + Gross Investment (Gross fixed investment + inventory investment) + Gross residential construction investment + Gross Public investment + Government purchases of goods and services + Net Exports (Exports – Imports)

GNPMP = GDPMP + Net factor income from abroad

GNPFC = GNPMP – Indirect Taxes

So, GDPMP Is:

| ₹ In cr. | |

| Personal consumption expenditure | 2900 |

| Gross business fixed Investment | 410 |

| Inventory Investment | 170 |

| Gross Residential construction investment | 450 |

| Gross public investment | 500 |

| Government purchases of goods & services | 1100 |

| Net Exports (Exports – Imports) (₹ 200 – ₹ 300) | -100 |

| GDPMP | 5430 |

GNPMP = 5,430 Cr. + (-30 Cr.) = ₹ 5,400 Cr.

Here, there is no indirect taxes, so GNPMP = GNPFC

So, GNPFC = ₹ 5,400 Cr.

NDPMP = GDPMP – Consumption of fixed capital

= ₹ 5,430 Cr. – ₹ 60 Cr.

NDPMP = ₹ 5,370 Cr.

Question 48.

How is National Income measured by Expenditure Method?

Answer:

Expenditure Method of Measuring National Income:

Expenditure method is the method, which measures the final expenditure on GDP at market price during an accounting year.

The steps involved are:

1st Step:

The private final consumption expenditure is estimated.

This expenditure is the expenditure by consumer households and non profit making institutions on:

(a) Durable consumer goods-fan, TV etc.

(b) Single-use consumer goods-milk, fruit

(c) Services such as education, medical facilities etc.

2nd Step:

The Government’s final consumption expenditure is estimated. This is the expenditure incurred by Govt. for the general well being of the citizen’s like education, health and medical care, electricity and water supply etc.

3rd Step:

The gross domestic capital formation is estimated. Gross domestic capital formation is the sum of change in stock and gross fixed domestic capital formation.

4th Step:

The net export of goods and services is estimated. Net export is the difference between export and import of a country.

5th Step:

All the items from 1st to 4th step is added. The sum Is the expenditure on domestic product. It is also known as NDP at market price.

6th Step:

The NFIA is estimated and added to the NDPMP to get NNPMP Which is the National income at Market price. To obtain NI at factor cost, net indirect taxes have to be subtracted.

![]()

Question 49.

Write short note on:

Precautions to be taken while measuring National Income by Expenditure Method.

Answer:

Precautions to be taken while measuring National Income by Expenditures Method: ,

- Expenditure on 2’ hand good should not be included.

- Expenditure on financial transaction like purchase of shares should not be included.

- Government expenditure on transfer payments should not be included.

- To avoid double counting only expenditures on final goods and services is to be included.

Question 50.

State the various components of:

Final Expenditure

Answer:

Components of Final Expenditure

1. Final consumption expenditure

- Private final consumption expenditure.

- Government final consumption expenditure.

2. Gross Domestic Capital Formation

- Gross domestic fixed capital formation.

- Change in stock

3. Net export (X – M)

- Export (X)

- Import (M)

Question 51.

What are the conceptual difficulties in the measurement of national income? (May 2019, 2 marks)

Answer:

The conceptual difficulties in the measurement of national income are as follows:

- Lack of an agreed definition of national income

- Accurate distinction between final goods and intermediate goods

- Issue of transfer payments

- Services of durable goods

- Difficulty of incorporating distribution of income

- Valuation of a new good at constant prices, and

- Valuation of government services.

Question 52.

Write short note on: .

Problems in estimation of National Income.

Answer:

Problems In Estimation of National Income:

- Presence of non-monetized sector: Sometimes, a part of production escapes valuation (due to self-consumption) Thus, NI is underestimated is that extent.

- Ignorance of Indian producer: Many a time the producers are ignorant about the exact value and quantity of their produce.

- Lack of differentiation of economic functions: When a person is engaged in many occupation simultaneously it is difficult to make proper valuation of his total economic efforts.

- Non-availability of reliable data: There is lack of adequate data and reliability in it is ¿0w. The estimates of costs are generally absent in primary and subsidiary occupation.

- Avoidance of financial burden: To avoid the tax liability, people do not furnish exact data about their income and expenditure.

Question 53.

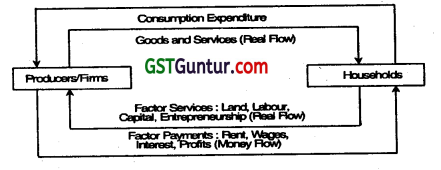

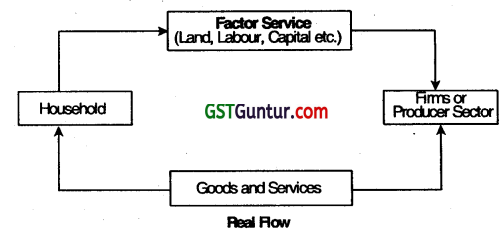

Explain briefly the Two Sector Model of Circular Flow of Income.

Answer:

Two-Sector Model of Circular Flow of income:

The structure of macro economy is given by circular flows of income and output. In a two-sector model of circular flow of Income, there are only two sectors.

- Household sector.

- Producer sector (Firms)

A two-sector model of circular flow of income thus deals with circular flow (Money flow as well as real flow) between these two sectors.

Assumptions:

1. The economy consists of two sectors:

(a) Household Sector:

This sector providas its services to producer sector and consumes the goods and services finally produced by producer sector

(b) Producer Sector:

It produces final goods and services and makes use of the services of various factors like land, labour, capital, etc.

2. Economic policies are not influenced by the government.

3. Economy is ‘closed economy’, i.e., producer sector makes neither exports nor imports and household sector is fully dependent on domestic production.

4. Household sector spends Its entire income and saves nothing.

Explanation:

Under these presumptions, the firm sector hires factor services from households, who are owners of factors of production (land, labour, capital, and enterprise), for producing goods and services and pays them remuneration (or compensation) In the form of money for rendering the productive services.

For the factors of production, these are factor incomes known as rent, wages, interest and profit WhiCh have been generated in the production process.

Thus, money income flows from firm sector to the households. With this money the households purchase from the firms, manufactured goods and service to satisfy their wants with the result, the same money flows back from households to the firm sector. Thus, entire income of economy comes back to firms In the form of sales revenue. Clearly one man’s (or sectors) expenditure Is other man’s (or sector’s) Income.

Structure of Two Sector Model:

Question 54.

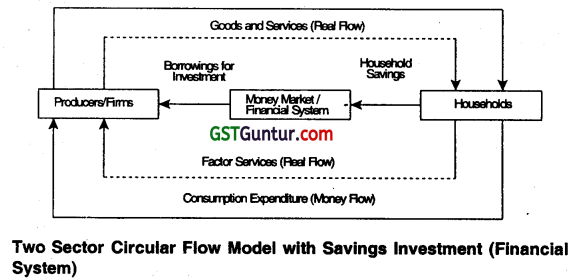

Explain briefly the Two Sector Model of Circular Flow with Saving Investment within a Capital Market or Financial Systems.

Answer:

Two-Sector Model with Saving-Investment within a Capital Market or Financial Systems:

In real life both household sector, (i.e., family) and producer sector (i.e., firm) save a part of their income. This saying is withdrawn from money flow and consequently, money flow squeezes. This is called leakage.

Thus, saving is a leakage from money flow which becomes available in capital market for loaning purposes. This becomes an injection in the circular how. Commercial firms borrow from capital market for investment. Investment has the opposite effect than that of saving. If the saving made by households returns back to money circulation through investment of commercial firms, money circulation remains stable. Hence, in a two sector model, the equlhbdum condition or the stability condition is:

Savings = Investment

S = I

Factor Payments (Money Flow)

Capital market consisting of financial institutions plays an important role. Financial institutions are primary intermediaries between savers and investors or lenders and borrowers.

Question 55.

Write short note on:

The Various Sectors of Two Sector Economy.

Answer:

Household Sector:

- Household sector is the owner of factors of production.

- This sector receives income in the form of wages, rent, interest, and profits. They also get certain transfer payments from the government.

- This sector spends money on the purchase of goods and services produced by the producing sector (or business sector) and also pays taxes to the government.

- This sector saves a part of its income which goes to the financial market.

Producing Sector (Firm):

- Producing sector (firms) produces goods and services which are consumed by the households and government. The firms in turn receive revenue from the sale of their goods and services. This sector also earns export income.

- This sector hires factor services and makes them payments. It also makes payment to other countries for goods/services imported.

- This sector also has to pay taxes to the government on sale and production of their goods. Certain firms receive subsidies from the government.

- This sector also saves a part of its income.

![]()

Question 56.

Distinguish between:

Real Flows and Money Flows in a Two Sector Economy.

Answer:

Real Flows:

Real flows refer to flows of goods and services. These are called real flows because they consist of actual goods and services. In the context of national accounting, real flow implies flow of factor services from household sector to the firm (or producing) sector and the corresponding flow of goods and services from firm sector to the household sector. Thus, flows of goods and services between firm sector and household sector are real flows. Such flows are continuous and thereis no beginning or end point in these flows.

Money Flows:

These refer to flows of money in the form of factor payments and consumption expenditure. The monetary flows occur because it is through money that varibus transactions are conducted bringing flows of money from one sector to another.

When factor incomes (rent, wages, interest, and profit) flow from firm sector to the households as reward for their factor services, these are called monetary flows. Similarly, when households spend their incomes on, purchase of goods and services produced by the firm sector, money flows back to the firm sector, household expenditure. These also indicates monetary flows. In short, flows of money between firm sector and household sector are monetary flows.

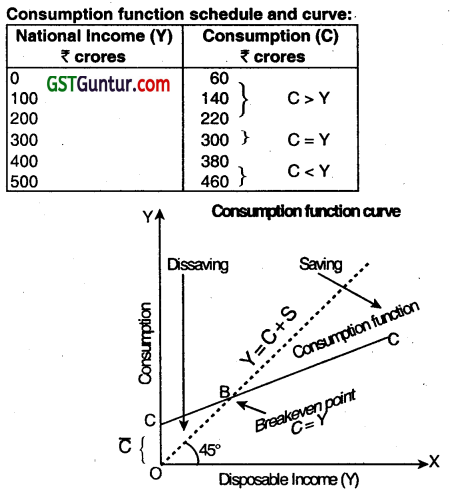

Question 57.

Explain the consumption function using a suitable table and diagram. (Nov 2019, 3 marks)

Answer:

Propensity to Consume or Consumption Function

Meaning:

The relationship between consumption and income is called consumption function (or propensity to consume). In other words, propensity to consume means proportion of income spent on consumption. Consumption being a part of income directly depends upon income itself. Thus consumption (C) is a function (f) of income (Y).

Symbolically C = f(Y).

Consumption may be divided in two parts:

(i) First part relates to consumption when income is zero, i.e., when minimum level of consumption has to be maintained for survival. This is called autonomous consumption (denoted by C).

(ii) Second part of consumption is when income increases, consumption also increases but by a lesser amount i.e. additional consumption (ΔC) is less than additional income (ΔY) or ΔC/ΔY is less than 1 . This may be represented, by b (i.e., marginal propensity to consume). Thus, Consumption function (linear consumption function) may be represented In the following equation.

C= C+bY

Here C is consumption, C is autonomous consumption, b is marginal propensity to consume or MPC and Y is level of income.

Comments:

1. Consumption can never be zero even if income is zero because survival needs some minimum consumption (called Autonomous Consumption). That is why consumption curve starts from positive point C on Y-axis. In Fig. OC is the minimum level of consumption.

2. Slope of consumption curve is constant making it a straight line because for convenience’s sake we have assumed marginal propensity to consume to be constant. (e.g., MPC, i.e., ΔC/ΔY is 0.8 throughout in the schedule).

3. Point B is the breakeven point indicating consumption = Income – Before it consumption > income showing dissaving but after point B consumption

4. 45° dotted line Y = C + S is the line of equality where each point indicates consumption is equal to income.

Question 58.

Clarify the concept of ‘Average Propensity to Save’ with the help of formula and example. (Nov 2020, 2 marks)

Question 59.

Calculate the Marginal Propensity to Consume (MPC) and Marginal Propensity to Save (MPS) from the following data:

Income (Y) Consumption (C) Level

₹ 8,000 ₹ 6,000 Initial level

₹ 12,000 ₹ 9,000 Changed level

(May 2018, 2 marks)

Answer:

(i) Change in consumption (ΔC) = 9,000 – 6,000 = ₹ 3,000

Change ¡n Income (ΔY) = 12,000 – 8,000 = ₹ 4,000

Marginal Propensity to Consume (MPC) = \(\frac{\Delta c}{\Delta y} \)

= \(\frac{3,000}{4,000} \)

= 0.75

(ii) MPC+MPS=1

0.75 + MPS = 1

MPS = 0.25

Marginal Propensity to Save (MPS) = 0.25

Question 60.

Calculate the Average Propensity to Consume (APC) and Average Propensity to Save (APS) from the following data:

income Consumption

₹ 4,000 ₹ 3,000

(Nov 2018, 2 marks)

Answer:

(ii) Average Propensity to Consume (APC):

APC = \(\frac{\text { Total Consumption }}{\text { Total Income }}=\frac{C}{\mathrm{Y}} \)

= \(\frac{₹ 3,000}{₹ 4,000} \)

APC = 0.75

Average Propensity to Save (APS):

APS = \(\frac{\text { Total Saving }}{\text { Total Income }}=\frac{S}{Y}\)

= \(\frac{₹ 1,000}{₹ 4,000} \)

APS = 0.25

Question 61.

Can value of APC be greater than one? Comment.

Answer:

Average propensity to consume (APC):

The ratio of total consumption expenditure to total Income is called APC. It is the percentage (or ratio) of income which s spent on consumption. It is worked out by dividing total consumption expenditure (C) with total income (Y).

Symbolically:

APC = C/V

For instance, if the aggregate income of an economy is Z 5,000 crores and aggregate consumption is Z’ 4,500 crores, then:

APC= \(\frac{C}{Y}=\frac{4,500}{5,000}\)= 0.90 or 90%

It indicates that 90% of income is spent by way of consumption expenditure. But if aggregate income is very low, say Z 1,000 crores, and aggregate

consumption is ₹ 1200 crores, the APC = 1,200/1,000 = 1.2.

Thus, the value of APC may be greater than 1 when at very low level of income, consumption exceeds Income to meet the very basic necessities. Then saving becomes negative.

![]()

Question 62.

Income and Consumption expenditure are directly related to each other. Do you agree. Give reasons in support of your answer.

Answer:

Relationship between income and consumption expenditure:

1. According to Keynes, as income increases, consumption expenditure also increases but by less than the increase In income. In other words, when income increases, consumption expenditure does not increase at the same rate as income. This is called Keynesian psychological law of consumption.

There is tendency of people not to spend on consumption the whole of incremental income. i.e., additional consumption is less than additional income. In other words, MPG is less than 1 (MPC < 1).

For example,

If income increases by ₹ 100; the tendency is to spend a part, say ₹ 75, on consumption and save the remaining part (i.e., ₹ 25). This is known as induced consumption.

It should be kept in mind that when income is zero, consumption is positive (+) because a person has to spend a minimum amount to keep his body and soul together. This is called autonomous consumption.

2. When income is very low, consumption expenditure is higher than income:

Its reason is that some minimum level of consumption has to be maintained irrespective of low level of income. In such a situation, value of APC (i.e., C/Y) becomes higher than 1.

Question 63.

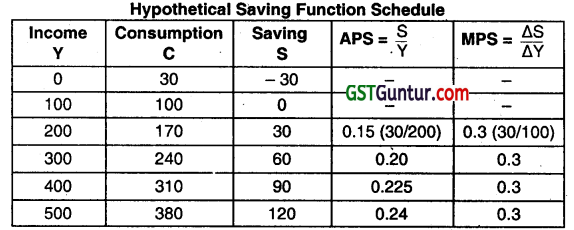

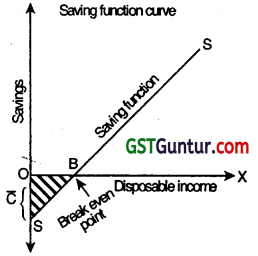

What is meant by propensity to save (or saving function)? Explain saving function and State relationship between income and saving.

Answer:

Saving Function:

A person spends a part of his income on consumption and saves the rest. Keynes called the proportion which is consumed as ‘Propensity to consume’ and proportion which is saved as ‘Propensity to save’. Meaning of ‘Saving’ Function: The functional relationship between saving and income is called saving function (or propensity to save). In other words, it is proportion of income Which is saved. Thus, saving (S) is a function (f) of income (Y).

Algebraically:

S = f(Y)

It shows direct relation between saving and level of income. In other words as the level of income increases, saving also increases. Thus, saving function is corollary or reciprocal of consumption function.

The table shows that in the beginning saving ¡s negative since consumption is never zero. But as income increase, consumption increases less than proportionally. Consequently saving becomes positive and increases at a faster rate than the increase in income.

The above Fig. reflects saving function which relates the level of saving to the level of income. A diagrammatic representation of the relationship between income and saving gives the saving curve. Line SS represents saving function. The saving function line SS crosses the income line at point B which is called breakeven point because at this point savings are zero (or consumption is equal to income). To the left of breakeven point, savings are negative indicating consumption being more than income whereas to the right of breakeven point, savings are positive indicating consumption expenditure being less than income. The shaded area reflects dissavings which is equal to equal to the area of autonomous consumption shown as – C in the fig.

Relationship between income end Saving:

1. As income increases, saving also increases but the rate of increase in saving is more than the rate of increase in income after a particular level of income. This means that as income increases, the proportion of income saved increases (and the proportion of income consumed decreases).

2. At lower level of incomes, savings is negative. In the stages when there is no income or very low level of income, consumption expenditure is more than income leading to negative saving (i.e., dissaving). For instance, if income is, say ₹ 5,000, and consumption expenditure is, say ₹ 6,000, then saving will ₹ 1,000 (=5,000-6,000), i.e., there is dissaving.

Here average propensity to save is negative. APS = – 1,000/5,000 =-0.2.

Question 64.

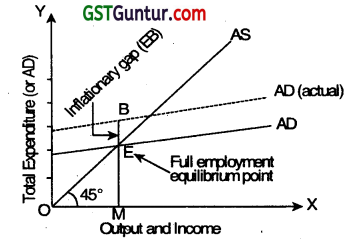

What is Excess Demand? How does it give rise to an Inflationary gap.

Answer:

Meaning of Excess Demand:

When in an economy, aggregate demand is for a level of output that is more than the full employment level of output, the demand is said to be an excess demand and the gap is called inflationary gap. In other words, excess demand refers to the excess of aggregate demand over the available output at full employment. The gap is called inflationary because it causes inflation (continuous rise in prices) in the economy. According to Keynes, equilibrium level of income, output and employment is determined solely by level of aggregate demand during short period.

Inflationary Gap.

When aggregate demand is more than level of output at full employment’ then the excess or gap is called inflationary gap. Alternatively, it is the amount by which actual aggregate demand exceeds the level of aggregate demand required to establish full-employment equilibrium. This inflationary gap is a measure of amount of the excess of aggregate demand. It indicates that the buyers intend to buy more than the maximum physical output the producers can produce by employing all the available resources. In such a situation an increase in demand means only an increase in money expenditure without any corresponding increase in output and employment because all the resources have already been fully employed. A simple example will further clarify it.

Here, point E lying on 45° line is the full employment equilibrium point. This is an ideal situation because aggregate demand represented by EM is equal to full employment level of output (aggregate supply) represented by OM. Suppose the actual aggregate demand is for a level of output BM which is greater than full employment level of output EM (OM). Thus, the difference between the two is EB (BM – EM) which is measure of Inflationary gap or excess demand.

In short inflationary gap is the amount by which aggregate demand exceeds the aggregate demand required to establish the full employment equilibrium. Impact of Excess Demand. Since there is already full capacity production, excess demand does not cause any rise in output and employment but it leads to rise in prices. In such a situation when resources have been fully employed, increase in demand implies pressure on existing supplies of goods causing rise in prices and a situation of inflation. Clearly, this is demand-pull inflation, i.e., demand-induced increase in price level. A persisting rise in general level of prices after full employment is called inflation.

Inflation creates inequalities of distribution of wealth, loss to creditors and salaried people, social unrest and revolt, loss of faith in government and morality. Remember, in such a situation real income (i.e., in ternis of physical output) cannot rise but money income (i.e., in terms of money value of physical output) will rise.

Question 65.

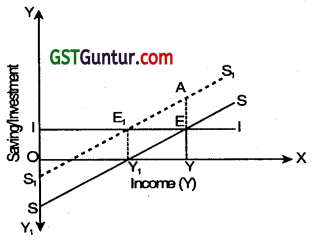

As people become more thrifty, they end up saving less or same as before. Explain Paradox of Thrift in light of the above statement.

Answer:

Paradox of Thrift:

Since start of human civilization it was considered a virtue to keep consumption level at the minimum but the lasting effects and chain reactions of keeping consumption in check were not realised. People were taught that thrift or savings are good because a penny saved today will bring increased income. In this connection, Keynes pointed out paradox of thrift’ and showed that as people become more thrifty, they end up saving less or same as before. According to Keynes if all the people of an economy increased the proportion of income which is saved (Le., MPS), the value of savings in the economy will not increase, rather it will decline or remain unchanged. Let us understand this statement with the help of the diagram given below.

In Figure initial saving curve is SS and investment curve is I. Economy attains equilibrium (saving = investment) at E and equilibrium level of income is OY. Now suppose the society decides to become thrifty and increases saving by, say, AE. As a result saving curve shifts upward to S1S1 intersecting investment curve II at E1. Unplanned inventories will increase and firms will cut down production and employment and move to new equilibrium E1.

The Figure shows that in the end, planned saving has fallen from AY to E1Y1. At the new equilibrium point E1, the investment level and saving remain same ie., E1Y1 but level of income has fallen from OY to OY1. This decline in the equilibrium level of income shows the paradox of thrift as the reverse process of the multiplier has worked on reducing consumption expenditure. In fact, increased saving is virtually a withdrawal from circular flow of income.

![]()

Question 66.

What Is Keynes’ Psychological Law of Consumption?

Answer:

Keynes Psychological Law of Consumption:

Keynes’ Psychological Law of Consumption states that consumption is a direct function of disposable income. According to this law, “Society has a tendency to increase its consumption spending whenever income increases but not in that proportion in which income increases.”

The law has three basic propositions:

- When income increases, consumption also increases but by somewhat smaller amount.

- Net increase in income will be divided between consumption and savings in some ratio.

- It is unlikely that an increase in income would lead to either fall in consumption or decline in savings.

Question 67.

Define saving function. If consumption function is C = C + bY, find out the corresponding saving function.

Answer:

Saving function is a functional relationship between savings and income. i.e. it shows that the level of savings depends upon the level of income. it is expressed as:

S = f (Y)

S = savings

f = function

Y = income

Derivation of saving function:

C= C+bY

S = Y-C

S = Y(C+bY)

= Y-C-bY

= -C + Y- bY

S = -C + Y (1-b)

Question 68.

Given that consumption function C = 100 + 075V, find out:

1. Corresponding saving function

2. Level of income at which savings will be zero.

3. If the level of income ¡s ₹ 800, find out the value of consumption and savings.

Answer:

1. C = 100 + 0.75Y ………………………. (i)

C = C+ bY …………………………. (ii)

From (i) and (ii)

C = 1oo

b = 0.75

S =-C + Y (1 – b)

S=- 100 + Y(1 – 0.75)

= – 100 + 0.25V

2. lf s=0

Then 0 =- 100+0.25V

\(\frac{100}{0.25} \) = Y

When income will be ₹ 400, savings will be zero.

3. WhenY=800

C = C + bY

Question 69.

Write short note on the concept of Aggregate Demand.

Answer:

Aggregate Demand:

Aggregate 1emand broadly refers to the total demand for goods and services in the economy. Since it is measured by total expenditure of the community on goods and services, therefore, aggregate demand is also defined as “the total amount of money which all sections (households, firms, government) are ready to spend on purchase of goods and services produced in an economy during a given period.” Alternatively AD is the total expenditure which the community intends to incur on

purchase of goods and services. Thus, aggregate demand is synonyms with aggregate expenditure in the economy.

If the total intended (i.e., ex-ante) expenditure on buying all the output is larger than before, this shows a higher aggregate demand. On the contrary, if the community decides to spend less on the available output, it shows a fall in the aggregate demand.

In simple words, Aggregate Demand is the total expenditure on consumption and investment. Determination of output and employment in Keynesian framework depends mainly on level of aggregate demand.

Aggregate Demand Function: Two Sector Model

AD = C + I

Aggregate Demand Function: Three Sector Model

AD = C + I + G

Aggregate Demand Function: Four Sector Model

AD = C + I + G + (X-M)

Where,

C = Private (household) consumption demand

I = Private investment demand

G = Government demand for goods and services

(X-M) = Net export demand.

Question 70.

Define consumption function? Examine what would happen if aggregate expenditure were to exceed the economy’s production capacity.

Answer:

Consumption Function:

Consumption function is the functional relationship between aggregate consumption expenditure and aggregate disposable income, expressed as C = f (Y); shows the level of consumption (C) corresponding to each level of disposable income (Y)

Aggregate expenditures in excess of output lead to a higher price level once the economy reaches full employment. Nominal output will increase, but it merely reflects higher prices, rather than additional real output.

Question 71.

In a two-sector model Economy, the business sector produces 7500 units at an average price of 7.

(i) What is the money value of output?

(ii) What is the money income of Households?

(iii) If households spend 75% of their income, what is the total consumer expenditure?

(iv) What ¡s the total money revenue received by the business sector?

(v) What should happen to the level of output? (Nov 2018, 5 marks)

Answer: .

(i) The money value of output equals total output times the average price per unit. The money value of output is (7,500 × ₹ 7) = ₹ 52,500

(ii) In a two-sector economy, households receive an amount equal to the money value of output. Therefore, the money income of households is the same as the money value of output i.e. ₹ 52,500.

(iii) Total spending by households (₹ 52,500 x 0.75) i.e. ₹ 39,375.

(iv) The total money revenues received by the business sector is equal to aggregate spending by households i.e. ₹ 39,375.

(v) The business sector makes payments of ₹ 52,500 to produce output, whereas the households purchase only worth ₹ 39,375 of what is produced. Therefore, the business sector has unsold inventories valued at ₹ 13125. They should be expected to decrease output.

![]()

Question 72.

Given the following equations:

C = 200 + 0.8V

I = 1200

Calculate equilibrium level of National Income and the Consumption Expenditure at equilibrium level of National Income. (Jan 2021, 3 marks)

Question 73.

When Investment in an economy increases from ₹ 10,000 crores to ₹14,000 crores and as a result of this national income rises from ₹ 80,000 crores to ₹ 92,000 crores, compute Investment multiplier. (May 2019, 2 marks)

Answer:

Investment Multiplies (K) = \(\frac{\Delta y}{\Delta l}\)

Increase In investment = (₹ 14,000 – ₹ 10,000) Cr.

\(\Delta\) I = ₹ 4,000 Cr.

Increase in national income (ΔY) = ₹ (92000-80,000) Cr.

\(\Delta Y \) = ₹ 12,000 Cr.

Investment Multiplier (k) = \(\frac{\Delta y}{\Delta l} \)

∴ K = \(\frac{₹ 12,000 \mathrm{Cr}}{₹ 4,000 \mathrm{Cr}}\)

Investment Multiplier (K) = 3

Question 74.

Due to Recession in an economy, Government expenditure increased by 6 billion. If Marginal Propensity to Consume (MPG) in the economy is 0.8, compute the increase in GDP. (Jan 2021, 2 marks)

Question 75.

What is the concept of Investment Multiplier

Answer:

Investment Multiplier:

The concept of ‘Investment Multipliers is an important contribution of Prof. J.M. Keynes. Keynes believed that an initial increment in investment increases the final income by many times. Multiplier expresses the relationship between an initial increment in investment and the resulting increase in aggregate income.

In practice, it is observed that when investment is increased by a certain amount, then the change in income is not restricted to the extent of the initial investment, but it changes several times the change in investment. In other words, change in income is a multiple of the change in investment. Multiplier explains how many times he income increases as a result of an increase in the investment. Multiplier (k) is the ratio of increase in national income (\(\Delta Y \)) due to an increase in investment (\(\Delta l \)).

K = \(\frac{\Delta Y}{\Delta l} \)

Suppose an additional investment (\(\Delta l \)) of ₹ 4,000 crores in an economy generates an additional income (\frac{\Delta Y}{\Delta l}) of ₹ 16,000 crores. The value of multiplier (K), in this case will be:

k = \(\frac{16,000}{4,000}\) = 4

Question 76.

Explain the relationship between Multiplier and MPG.

Answer:

Multiplier and MPC

There exists a direct relationship between MPG and the value of multiplier. Higher the MPC, more will be the value of multiplier, and vice-versa. The concept of multiplier is based on the fact that one person’s expenditure is another person’s income. When investment is increased, it also increases the income of the people. People spend a part of this increased income on consumption. However, the amount of increased income spent on consumption depends on the value of MPG.

In case of higher MPC, people will spend a large proportion of their increased income on consumption. In such case, value of multiplier will be more.

In case of law MPG, people will spend lesser proportion of their increased income consumption. In such case, value of multiplier will be comparatively less. Thus, the value of multiplier depends upon the MPC.

Question 77.

What is the maximum and minimum value of multiplier.

Answer:

Maximum Value of Multiplier

The maximum value of multiplier is infinity when the value of MPG is 1.

MPG = 1 indicates that the economy decides to consume the whole of its additional income. Here, not even a bit of the additional income is saved. It will lead to a continuous increase in the consumption expenditure and value of multiplier will be infinity.

Proof:

We know;k = \(\frac{1}{1-\mathrm{MPC}}\)

When MPC = 1, then:

k = \(\frac{1}{1-1}=\frac{1}{0} \) = ∞ (as any number, when dividend by 0, gives infinity)

Minimum Value of Multiplier

The minimum value of multiplier is one when the value of MPC is zero. MPC = 0 indicates that the economy decides to save the whole of its additional income and nothing is spent as consumption expenditure. So, there will be no further increase in income. As a result, the total increase in income (\(\Delta Y \)) will be equal to the increase in investment (\(\Delta l \)), i.e., \(\Delta Y \) = \(\Delta l \). Here, the value of multiplier is equal to 1.

Prof: We know; k = \(\frac{1}{1-M P C} \)

When MPC =0, then:

k = \(\frac{1}{1-0}=\frac{1}{1} \) = 1

Question 78.

Explain the Three Sector Model of Circular Flow of Income.

Answer:

Three-Sector Model of Circular Flow of Income:

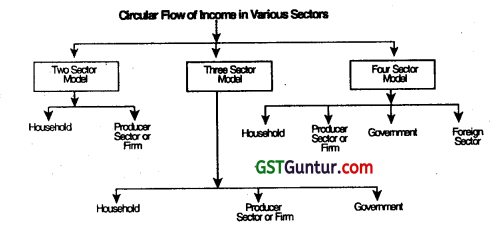

The structure of Macro Economy is given by circular flows of income and output. A three-sector model of circular flow of income is characterized by the presence of three sectors namely

- Household sector

- Producer sector (Firms)

- Government

Question 79.

Explain the Leakages and Injections in circular flow of Income. (May 2018, 2 marks)

Answer:

Leakages: A leakage is an outflow or withdrawal of income from the circular flow. Leakages are money leaving the circular flow and therefore, not available for spending on currently produced goods and services. Leakages reduce the flow of income.

Injections: An injection is a non-consumption expenditure. It is an expenditure on goods and services produced within the domestic terntory but not used by the domestic household for consumption purposes. Injections are exogenous additions to the circular flow and add to the total volume of the basic circular flow.

In the two-sector model with households and firms, household saving is the only leakage and investment is the only injection. In the three-sector model which includes the government, saving and taxes are the two leakages, and investment and government purchases are the two injections. In the four-sector model which includes foreign sector also, savings, taxes, and imports are the three leakages; investment, government purchases, and exports are the three injections.