Money Market – CA Inter Economics Question Bank is designed strictly as per the latest syllabus and exam pattern.

Money Market – CA Inter Economics Question Bank

Question 1.

Define Money

Answer:

Functional Definition of Money

According to Crowther

Money can be defined as anything that is generally acceptable as a means of exchange (i.e. as a means of setting debts) and that at the same time acts as a measure and as a store of value.

Legal Recognition Definition of Money

According to Knapp: Anything which is declared as money by the state, that becomes money.

General AcceptabilIty Definition:

According to Kent: Money is anything which is commonly used and generally accepted as a medium of exchange or as a standard of value.

Question 2.

Mention the general characteristics of Money. (Nov 2018, 2 marks)

Answer:

Following are some general characteristics that money should possess are:

- Generally acceptable

- Durable or long-lasting

- Effortlessly recognizable

- Difficult to counterfeit i.e. not easily reproducible by people

- Relatively scarce, but has elasticity of supply

- Portable or easily transported

- Possessing uniformity; and

- Divisible into smaller parts in usable quantities or fractions without losing value.

Question 3.

“Money has four functions: a medium, a measure, a standard, and a store.” Elucidate. (May 2019, 3 marks)

Answer:

Primary Functions of Money

Money performs two primary functions, as under:

1. Medium of Exchange:

Money acts as a medium for the sale and purchase of goods and services. In the absence of money, goods were exchanged for goods. This required double coincidence of wants. Implying that exchange was difficult, and therefore limited. Introduction of money has separated the acts of sale and purchase double coincidence of wants is no longer a limitation.

2. Measure of Value or Unit of Value:

Money serves as a measure of value. in other words, it serves as a unit of account. Unit of account means that the value of each good or service is measured in the monetary unit. Measurement of value was very difficult in the barter system: one good was valued in terms of the other. There was no common unit of value. introduction of money has removed this difficulty.

Now, each good is valued in terms of money. It is because of the existence of money as a common unit of value that we are now able to construct consumer price index and wholesale price index. Consumer price index reflects cost of living of the people. Wholesale price index shows the rate of inflation in the country.

Secondary or Subsidiary Functions

Following three functions are secondary or subsidiary functions of money:

1. Standard of Deferred Payments:

Deferred payments refer to those payments which are made sometimes in the future. Money has made deferred payments much easier than before. When we borrow money from somebody, we have to return both the principal as well as Interest amount, sometime in the future. Money is a convenient mode of these payments. It is difficult to make such payments in terms of goods and services. Imagine that you have taken a loan from somebody in terms of wheat. How difficult it is to return this loan in terms of wheat of the same quality?

2. Store of Value: Store of value implies store of wealth. Storing wealth has become considerably easy with the introduction of money. Wealth can be stored just in terms of paper titles like FOR (Fixed Deposit Receipt). It was not convenient to store value in the barter system of exchange. Because goods tend to wear out or perish.

3. Transfer of Value: Money serves as a convenient mode of transfer of value (wealth). Wealth can be conveniently transferred (or can be transferred) to any part of the world, It is the transfer of value, which has led to the emergence of MNCs (Multinational Corporations). Accordingly, the concept of global economy has come into existence.

![]()

Question 4.

“Money performs many functions n an economy.” Explain those functions briefly. (Nov 2020, 3 marks)

Question 5.

Do you think money is a unique store of value?

Answer:

The effectiveness of an asset as a store of value depends on the degree and certainty with which the asset maintains its value over time. Money is undeniably a good store of value; but it is not unique as a store of value.

Financial assets other than money are also performing the function of store of value just as money has the financial assets have fixed nominal value over time and represent generalised purchasing power. Any asset, such as equities, bonds, land, buildings, precious metals, antiques and works of art can all act as store of value.

Question 6.

Explain the concept of demand for money. What are the approaches to demand for money.

Answer: .

Demand for money can be defined as the quantity of money demanded for different purposes by the people at any particular time and in any particular economy.

Approaches to Demand for Money

1. Classical Approach

- Fisher’s Approach

- Cambridge Approach

2. Modern Approach

- Keynesian Approach

- Post Keynesian Approach.

Question 7.

Explain the following modified equation of exchange as given by Irving Fisher:

MV + M’V’ = PT (May 2018, 3 marks)

Answer:

Fisher’s version, also termed as ‘equation of exchange’ or ‘transaction approach’ is formally stated as follows:

MV= PT

Where M = the total amount of money in circulation can an average) in an economy.

V = transactions velocity of circulation i.e. the average number of times across all transactions a unit of money (say Rupee) is spent in purchasing goods and services

P = average price level CP = MV/T)

T = the total number of transactions.

Later, Fisher extended the equation of exchange to include demand (bank) deposits (M’) and their velocity (V’) in the total supply of money. Thus, the expanded form of the equation of exchange becomes.

(MV + M’V’=PT)

Where, M’ = the total quantity of credit money

V’ = velocity of circulation of credit money.

The equation broadly indicates that the price level (P) is directly related to total quantity of money (original money and bank money) multiplied by its velocity. It, is, however, inversely related to T. He has established in his equation the basic proposition that the price level and the value of money is a function of money supply provided other things remain constant. These other things are M’V, V, and T and if they remain constant, price level will change directly and proportionately with the change in money supply. Price level affects the value of money inversely and thus change In money supply

influences the value of money inversely.

Question 8.

Explain why people hold money according to Liquidity Preference Theory. (May 2018, 3 marks)

Answer:

According to Liquidity Preference Theory as given by Keynes people hold money in cash for three motives:

1. The Transactions Motive

The transactions motive for holding cash relates to the need for cash for current transactions for personal and business exchange. The need for holding money arises because there is lack of synchronization between receipts and expenditures

2. The Precautionary Motive

Many unforeseen and unpredictable contingencies involving money payments occur in our day-to-day life. Individuals as well as businesses keep a portion of their income to finance such unanticipated expenditures.

The amount of money demanded under the precautionary motive depends on the size of income, prevailing economic as well as political conditions, and personal characteristics of the individual such as optimism/pessimism, farsightedness etc. Keynes regarded the precautionary balances just as balances under transactions motive as income elastic and by itself not very sensitive to rate of interest.

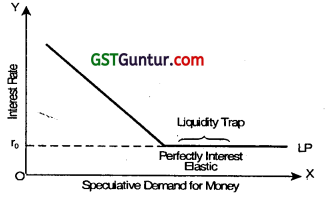

3. The speculative Demand for Money:

The speculative motive reflects people’s desire to hold cash in order to be equipped to exploit any attractive investment opportunity requiring cash expenditure.

According to Keynes, people demand to hold money balances to take advantage of the future changes in the rate of interest, which is the same as future changes in bond prices.

![]()

Question 9.

Explain the transaction motive for holding cash. (Jan 2021, 2 marks)

Question 10

Explain the neo-classical approach to demand for money. (Nov 2019, 3 marks)

Answer:

The Neoclassical Approach or the cash balance approach put forth by Cambridge economists holds that money increases utility in the following two ways:

1. for transaction motive, i.e. for enabling the possibility of split-up of sale and purchase to two different points of time rather than being simultaneous.

2. as a temporary store of wealth i.e. for a hedge against uncertainty. Demand for money involves a precautionary motive in Cambridge approach.

Since money gives utility in its store of wealth and precautionary modes, one can say that money is demanded for itself. Now question is how much money will be demanded. The answer is it depends partly on income and partly on other factors of which important ones are wealth and interest rates. The former determinant of demand i.e. income point to transactions demand such that higher the income, the greater the quantity of purchases and as a consequence greater will be the need for money as a temporary abode of value to overcome transactions costs.

The Cambridge equation is stated as:

Md=KPY

Where,

Md = is the demand for money

Y = real national income

P = Average price level of currently produced goods and services

PY = Nominal income

K = Proportion of nominal income (PY) that people want to hold as cash balances.

The term ‘K’ in the above equation is called ‘Cambridge K’. The equation above explains that the demand for money (M) equals K proportion of the total money income.

Thus the neoclassical theory changed the focus of the quantity theory of money to money demand and hypothesized that demand for money is a function of only money income. This version is concerned with money as a means for transactions or exchange and therefore, they represent models of the transaction demand for money.

Question 11.

Explain how speculative motive for holding cash is related to market interest rate.

Answer:

According to Keynes’ theory of Liquidity Preference, speculative motive for holding cash is related to market Interest. The market value of bonds and the market rate of interest are inversely related. A rise in the market rate of interest leads to a decrease in the market value of the bond, and vice versa, Investors have a relatively fixed conception of the ‘normal’ or ‘critical’ interest rate and compare the current rate of interest with such ‘normal’ or ‘critical’ rate of interest.

If wealth-holders consider that the current rate of interest is high compared to the normal or critical rate of interest, they expect a fall in the interest rate (rise in bond prices). At the high current rate of interest, they will convert their cash balances into bonds because:

- they can earn high rate of return on bonds

- they expect capital gains resulting from a rise in bond prices consequent upon an expected fall in the market rate of interest in future.

Conversely, if the wealth-holders consider the current interest rate as low, compared to the ‘normal or critical rate of interest’, i.e., if they expect the rate of interest to rise in future (fall in bond prices), they would have an incentive to hold their wealth in the form of liquid cash rather than bonds because:

- the loss suffered by way of interest income forgone is small,

- they can avoid the capital losses that would result from the anticipated increase in interest rates, and

- the return on money balances will be greater than the return on alternative assets.

- If the interest rate does increase in future, the bond prices will fail and the idle cash balances held can be used to buy bonds at lower prices and can thereby make a capital gain.

Summing up, so long as the current rate of interest is higher than the critical rate of interest, a typical wealth-holder would hold in his asset portfolio only government bonds while if the current rate of interest is lower than the critical rate of interest, his asset portfolio would consist wholly of cash. When the current rate of interest is equal to the critical rate of interest, a wealth-holder is indifferent to holding either cash or bonds. The inference from the above is that the speculative demand for money and interest are inversely related.

Question 12.

Compare and contrast Fisher’s Version with the Cambridge version of the Quantity Theory of Money.

Answer:

Fisher’s Version Vs Cambridge’s Version of Quantity Theory of Money:

Similarities between the two Approaches

- Both the theories lead to the same conclusion that it is the quantity of money that determines the value of money and the price level.

- MV + M’V’ in Fisher’s equation, M in Robertson’s as well as Pigou’s equations and in Keynes equation refer to the same things i.e. the total quantity of money.

The points are worth nothing here:

(i) In Fisher’s equation credit money has been represented separately by M’ but in Cambridge equations, credit money has not been separately shown because the total quantity of money implies credit money also in this dynamic world of today.

(ii) In Fisher’s equation velocity of Legal tender money and credit money have been represented separately by V and V’ whereas in Cambridge equations, there is no mention velocity of circulation of money.

3. The cash balance equation of Robertson, namely, P = \(\frac{M}{K T}\) and Fisher’s equation namely P = \(\frac{M V}{T} \) resembles with one another. The symbols used in the two equations are almost the same. The only difference relates to V and K. But even V and K are reciprocal to each other. In Fisher’s equation V = \(\frac{P T}{M}\) which in Robertson’s equation K = \(\frac{\mathrm{M}}{\mathrm{PT}} \) Thus, K is reciprocal of V. In other words K = \(\frac{1}{V}\) or V = \(\frac{1}{\mathrm{~K}} \) There is no fundamental difference in the two equations. Rather they represent different aspects of the same phenomenon.

4. Fisher’s equation and Cambridge’s equations, according to Robertson, are not basically different from each other. Rather they explain the same thing with two different angles. Fisher’s equation stresses money as a flow while Cambridge’s version emphasises money as stock.

Dissimilarities Between the Two Approaches

The two approaches differ from each other on the following grounds:

1. The two versions make use of different concepts of demand for money. In transactional approach, the demand for money is to exchange goods and services and thus it stresses medium of exchange function of money. Whereas, in cash balance approach, the demand for money is to store and thus here it emphasises the ‘store of value’ function of money.

2. The two approaches have different nations of money. In Fisher’s approach, emphasis is laid on velocity of circulation of money (V) while the cash balance approach, the stress is on the idle cash balance that is a fractional part of the national income (K). It should be noted that V is exactly opposite of K.

3. Fisher’s equation explain the value of money over a period of time while the Cambridge equations explain the value of money at a point of time. When we consider a period of time, velocity becomes important because money during that period is expected to perform a variety of functions. At a given point of point money simply represents some goods and services. Here K plays an important role. it is for this reason that V is emphasised in Fisher’s equation and K in Cambridge equation.

4. Symbol P in two types of equations is not identical In meaning. P in Fisher’s equation represents general price level whereas P in the Cambridge equations refers to only the prices of consumption goods.

![]()

Question 13.

Out of fisher’s verison and cambridge version of the quantity theory of money, which one do you consider superior and why?

Answer:

Cambridge Version i.e. Cash Balance approach Is Superior

The study of the two version of the Quantity Theory of money-cash transaction and cash balance – their similarities and dissimilarities, establishes the superiority of the Cambridge version i.e. cash balance approach.

The points in support are:

1. Fisher’s version is mechanical whereas Cambridge version is realistic. Fisher’s version is mechanical in the sense that it treats price level as the exclusive function of the quantity of money in circulation. It accords no place to human motives. The Cambridge version, on the other hand, make consideration of human motives by emphasising K in determining the price level. The size of K is more or less determined by human motives i.e., store of money.

2. Fisher’s version considers only the quantity of money (i.e, supply of money) as the sole determinant of the value of money. Whereas the Cambridge equations considers, on the other hand, both the demand and supply aspects of money in determining the value of money. The Cambridge version is thus more comprehensive than Fisher’s version. Fisher’s version, thus, may be considered as incomplete.

3. The Cambridge version is wider and more comprehensive from another point of view also. Fisher’s version does not consider the income level as a determinant of price level. The price level, according to this version, is determined by the quantity of supply (supply of money) and the total number of transactions whereas in Cambridge version, price level is influenced by the income level and the changes in it.

4. Fisher’s equation explains that price level changes only when there is a change in the supply (total quantity) of money in circulation. But the Cambridge version explains that price level may change even without any change ¡n the quantity of money, if K undergoes a change. If people prefer holding more cash balances (if K changes), the price level will also undergo a change without any change in the quantity of money. Thus, K is more important determinant than M.

5. The Cambridge version stresses subjective factors as the main determinants of the demand for money. Fisher’s approach, takes into account only objective factors while discussing the demand for money. On the above ground, the Cambridge version enjoys a superiority over Fisher’s approach to the Quantity Theory of Money.

Question 14.

What are the assumptions of Fisher’s Quantity Theory of Money.

Answer:

The Quantity Theory of money was first expounded by an Italian economist Mr. Davanzatti but the theory was popularised by the American economist, Irving Fisher who gave ¡t a quantitative form and explained by an equation known as Equation of Exchange.

Assumptions of Fisher’s Equation

The Fisher’s equation of exchange is based on the following assumptions:

1. Price level (or P) is a passive factor.

P in the equation (Price level) is inactive or passive in the equation. P ¡s affected by other factors in the equation Le. T,M, M’ V or V’ but it does not influence other factors in any way. P is thus a resultant and not a cause.

2. T and V are constant.

The theory assumes that T in the short period remains constant because T depends upon the volume of production and the production and its techniques do not change in the short period. Similarly. V depends upon the size of population, state of economic development, money habits of the people, which remain unaffected during the short period. Hence, T and V have been assumed constant in the theory.

3. T and V are Independent Factors.

Fisher assumes that total volume of trade (T) and velocity of money (V) are independent variables in the equation and are not affected by the change in any other factor. The volume of trade however, is determined by certain outside factors. V (velocity of circulation of money) is also independent and was not affected by change in M or P. V. is also affected by money other external factors.

4. The Ratio of Credit Money to Legal Tender Money Remains Constant.

The theory assumes that the ratio of credit money to legal tender money also remains constant. If it is not constant, the quantitative relation between money and prices as visualized in the theory does not hold good.

Thus, four variables in the equation of exchange i.e., M’ V, V’, and T are assumed to be constant during the short period. P is a passive factor, therefore, the change in the quantity of money (M) directly affects the price level (P).

![]()

Question 15.

Briefly explain the Quantity Theory of Money.

Answer:

The Quantity Theory of Money – The Transaction Approach As we know, the value of money implies what a unit of money can buy in terms of commodities and services. The price of commodities or the general price level does not remain constant hence the value of money also fluctuates. The two have inverse relationship. If general price level increases, the value of money decreases or the value of money increases with the decrease in general price level.

The quantity theory of money indicates that the value of money In a given period depends upon the quantity of money in circulation in the economy. The quantity of money supply determines the general price level and the value of money. Any change in the money supply will change the general price level directly and the value of money inversely in the same proportion. For example, if the quantity of money in circulation is doubled other things being equal, the general price level will be doubled and the value of money is halved. Similarly, if the quantity of money is halved, the price level will be halved and the value of money will be doubled. Prof. F.W.

Taussig has stated the tendency of this theory thus:

“Double the quantity of money, and other things being equal, prices will be twice as high as before; and the value of money as one-half. Halve the quantity of money, and other things being equal, prices will be one half of what they were before, and the value of money double.” In the words of J.S. Mill, “The value of money, other things being the same, varies inversely as its quantity; increase of quantity lowers the value and every diminution raising it in a ratio exactly equivalent.”

Equation of Exchange

The transaction version of the quantity theory of money was presented by Irving Fisher in the form of an equation known as equation of exchange as given below:

MV = PT

Where M Quantity of money in circulation.

V = Velocity of circulation of money. It denotes average number of times a unit of money changes hands.

P = Price level

T = Total volume of transactions of goods and services during a given period of time.

The above equation has two sides i.e. MV an PT. MV represents total supply of money in the economy. M represents the total money supply in circulation but a unit of money does not purchase goods and services. In a given period of time, only once. It changes hands by a number of times. Hence, total money supply is represented by the quantity of money multiplied by its velocity which is represented by MV in the equation. PT, on the other side of the equation represents total demand for money or the money value of all the goods and services brought during a given period of time. Hence, total volume of transactions (T) multiplied by the price level (P) denotes the total demand of money. Thus, MV = PT or total supply of money (MV) is equal to total demand of money to purchase the total transactions at a given price (PT). The equation is referred to as the cash transaction equation. It could also be expressed as follows:

P = \(\frac{M V}{T}\)

Thus, price level is determined by the total quantity of money divided by the total transactions. Thus, the total quantity of money determines the price level provided P and T are constant. The above equation was criticised by some of the monetary experts on the ground that the theory ignores completely the credit money and its velocity both of which are important in the modern-day economy.

Irving Fisher, later extended his original equation, considering the credit money and its velocity represented by M’ and V’ respectively and put the extended equation as follows:

MV+ M’V’ = PT

or P = \(\frac{M V+M V’}{T} \)

The equation broadly indicates that the price level (P) is directly related to total quantity of money (original money and bank money) multiplied by its velocity. It, is, however, inversely related to T. He has established in his equation the basic proposition that the price level and the value of money is a function of money supply provided other things remain constant. These other things are M’V, V and T and it they remain constant, price level will change directly and proportionately with the change in money supply. Price level affects the value of money inversely and thus change in money supply influences the value of money inversely.

Question 16.

Give the critical Appraisal of Quantity Theory of Money.

Answer:

Critical Appraisal of the Quantity Theory:

The transaction approach of the quantity theory of money (or Fisher’s equation of exchange) has been subjected to the following criticism.

1. The theory Is based upon unreal assumptions. According to Fisher. P is a passive factor, T is independent, M’ V and V’ are constant in the short period. He covered up all these assumptions under ‘other things remaining the same’. But according to critics, these other things do not remain constant in the actual working of the economy hence they are unrealistic and misleading.

For example:

- the velocity of circulation of money automatically changes with the change in the quantity of legal tender money.

- there is no well-defined relationship between legal tender money (M) and bank money (M’).

- any change in legal tender money will also influence the velocity of credit money (V’).

- the assumption that T is an independent factor and does not change with the change in M.

Which is not correct because T cannot remain constant consequent upon the change in M. If M increases, P will also increase, resulting in higher profits which naturally affect the production. Impliedly, P cannot be assumed as a passive factor. It certainly influence T.

(v) Price level is not an outcome of changes in money supply, P also effectively influence the money supply. Thus, P also determines M and M determines P. Both are inter-related. Thus, according to critics, the assumption are not real because other things do not remain constant.

2. A Long-Term Analysis of Money. The theory offers a long-term analysis of value of money and therefore, ignores the changes in short period. However, there are certain violent and far-reaching changes in the short run in the value of money which the theory ignores.

3. How money supply influences the price level is not Explained. The theory simply presents that the quantity of money affects the price level but it does not explain the process how it is possible. MV = PT is simply a mathematical equation and explains only that total supply of money is equal to total transaction value. It throws no light on cause and effect relationship of money and price.

4. No Direct and Proportional Relationship between Quantity of Money and the Price Level. The theory states that every change in the money supply brings proportional and direct change in the price level. But in actual life, no such relationship exists because there are other external factors which disturb this relationship.

5. Assumption of Full Employment is Wrong. Keynes has raised an objection against, the theory that the assumption of full employment is a rare phenomenon in a economy and the theory is not real. The relationship between M and P does not hold good if we assume unemployment in the economy.

6. The Theory is not Comprehensive. According to Keynes, total legal tender money and credit money do not constitute the total supply of money, because whole of it is not used for the purchase of commodities and services. A part of the total legal tender money is hoarded by the people which is not used for the exchange of goods and services. So, the hoarded money should not be considered.

7. Money Supply is not the only factor influencing price level. The change in price level is not influenced merely by the change in money supply. There are other factors such as change in national income, national expenditure, savings, and investments. According to Prof. Crowther ‘the value of money, in fact, is a consequence of the total of incomes rather than of the quantity of money. It Is the causes of fluctuations in the total of incomes of which we must go in search.’

8. The Theory Neglects Velocity of Commodities. The theory considers velocity of money but ignores velocity of circulation of commodities which is a serious drawback of the theory.

![]()

Question 17.

Examine the Cash Balance Approach to the Quantity Theory of Money.

Answer:

According to Cash Balance Approach, the value of money is determined on the basis of its demand and the its supply. When the demand for money is equal to its supply, the value of money, like other things is settled. The changes in the value of money are thus caused by changes either in its demand or in its supply or in both. In this way the approach is based on the general theory of value and is applicable to the problem of money. The approach considers the demand for and supply of money at a particular point of time, rather than over a period of time enunciated by the transaction approach.

According to Cash Balance Approach, the supply of money is its stock at a particular time not its flow over a period of time and comprises alt the cash and bank deposits subject to withdrawals by cheques. Demand for money, according to this approach, has been interpreted in a different manner.

According to Fisher the demand for money is not for its own sake. It is made only to purchase the commodities and services. In other words, money is demanded because, it serves as a medium of exchange. But this theory emphasises that the demand for money is made for meeting their day-to-day requirements by individuals, firms and governments. Thus, the demand for money refers to that quantity of money which the individuals, commercial firms and the government hold to meet its day-to-day requirements. Thus the supply of money set against the community’s aggregate demand (or cash

balances) determines the level of prices or the value of money in the economy. If demand is constant, only change in the supply of money will directly affect the price level and inversely the money value.

On the other hand, if supply is constant, the price level will change inversely and money value directly with any change in the demand for money. An increase in the demand for money (for store purposes) will lower down the demand for goods and services because people can now have a larger cash balance only by cutting their expenditure on goods and services. Consequently the price level will fall and the money value will go up. Converse will be the case with the fall in demand for money.

Question 18.

Elucidate the equations of Cash Balance Approach.

Some Equations of Cash Balance Approach

We shall now examine some of the equations of cash balance approach.

Marshall’s Equation:

Marshall’s cash balance equation is

M=KY.

where M represents total supply of money.

K is that portion of income which we want to hold in the form of money.

Y is the aggregate real national income

K, in other words, is the reciprocal of velocity.

Since the total money income Y equals the total real output (O) time the price level (P), the abovQ equation can be presented as:

M = KPO

or P = \(\frac{\mathrm{M}}{\mathrm{KO}} \)

This approach emphasises that a shift in the magnitude of K significantly influence the price level even though the supply of money (M) remains constant. Thus, it is K and not M that influences the money value.

Pigou’s Equation:

Prof. Pigou has developed the equation as:

P = \(\frac{K R}{M}\)

where P represents the value of money, K stand for the proportion of total real income to be held in cash, R represents total real income and M is total quantity of money. The equation later enlarged considering the fact that all people do not hold cash strictly in the form of legal tender money. Some of them have cash in the form of bank deposits also. The enlarged equation is:

P = \(\frac{\mathrm{KR}}{\mathrm{M}} \) [c + h(1-c)]

M = \(\frac{\mathrm{KR}}{\mathrm{P}} \) [c+h(1- c)]

Where c represents cash in legal tender money, h represents the proportion of cash reserves to deposits held by the bank. (1- c) stands for the proportion of legal tender money which is kept in the form of bank deposits. For explaining the changes in the value of money, Pigou emphasised on K rather than on M.

Keynes Equation

J.M. Keynes, a noted Cambridge economist has presented his own equation known as ‘The Real Balance Quantity equation.’ His equation is:

n=PK

or P = \(\frac{n}{K}\)

where, n = total supply of money in circulation.

P = Prices of consumption goods.

K = Total quantity of consumption units which the people went to hold in cash. Keynes refers to K as the real balance.

Keynes further enlarged his equation taking bank deposits into account. The enlarged equation is: .

n = P (K + rK)

or P = \(\frac{n}{K+r K} \)

where, r =proportion of bank reserves to their deposits

K’ =number of consumption units which the public keeps in the form of bank deposits. Other symbols carry the same meaning as given above.

Assuming K; K’ and constant nand P have direct and proportional relations. The proportion between K and K’ is determined by the banking arrangements of the public and their absolute value is determined by the habits of the people The value of r is determined by the practice of banks to hold cash reserves. So long as these values remain constant n and P have direct relation.

Question 19.

What were the criticisms against the Cash Balance Approach to Quantity Theory of Money.

Answer:

Criticism of the Cash Balance Approach

The Cambridge version of the quantity theory of money or the cash-balance approach has the following shortcomings:

1. The theory assumes that the elasticity of demand for money is unity which is not possible in the dynamic society of today.

2. The cash-balance approach does not consider all the determents of the demand for money. For example, it ignores the speculative motive of holding money which causes a violent change in the demand for money.

3. The serious defect in the Cambridge equations is that they seek to explain the value of money in terms of consumption goods only. It is wrong and illogical. The equations completely ignores the reference of capital goods.

4. According to theory, the real income only determines the value of k (i.e. cash to be held by people). Whereas there are other determinants of k in the real life than real income, such as, the price level, monetary and business habits and political conditions of the country etc.

5. According to the Approach, cash holdings by the people (K) determines the purchasing power of money or the price level. It is also not correct. Critics pointed out that K not only influences P but is also influenced by it. At a time of rising prices, K falls because the people want to buy today rather than wait for tomorrow. The K (cash holding) would rise in case of a fall in prices. Thus, K is also influenced by the change in the price level (P).

6. It is difficult to visualise in terms of cash balance approach the extent to which prices and output will change, consequent upon a given change in the supply of money. The theory thus lack quantitative exactness.

7. The Cambridge equations also assume K and T as constant. It is thus, open, to the same criticism as the Fisher’s equation.

8. The cash-balance approach ignores those bank deposits which come into existence consequent upon the lending operations of the banks. Thus, the approach considers only primay and not the derivative bank deposits. Derivative bank deposits are not the less important than the primary deposits.

Question 20.

Write short note on how Interest rate affect the transaction demand for money.

Answer:

Interest Rate and Transaction Demand of Money

Keynes has assumed rate of interest ineffective to transaction demand for money as a determinant of transaction demand for money. But he has also pointed that Demand of money is the function of interest rate. Even then, he and his followers have not emphasized much on this i.e. interest rate as a determinant of transaction demand for money and they have ignored this factor.

Some of the post-Keynesian economists like J. Baumol and J. Tobin etc. have assumed interest rate as a very important determinant of ‘Transaction Demand for Money’.

They said this also that there is no linear and proportionate relationship between transaction demand for money and income rather as a result of change in income, change in transaction demand for money is proportionately small.

According to these economists, transaction demand for money is the function of both income and rate of interest i.e. Lt = f (Y, r)

Question 21.

Question Short Notes on liquidity Trap

Answer:

Liquidity Trap:

Liquidity Trap is a situation in which speculative demand for money becomes perfectly elastic. it is a situation of absolute liquidity preference. This term was coined by Prof. J. M. Keynes. A liquidity trap appears at a very low rate of interest in which people prefer to hold cash rather than invest in bonds. The fear of loss due to minimum rate of interest may induce the public to refrain fram further secunty purchases; the alternative is simply to hold the additional cash as an idle asset.

Question 22.

Write short note on superiority of the saving-investment theory of money over Quantity Theory of Money.

Answer:

The saving-investment theory or income theory is superior to the traditional theory of the value of money. Following are the points, explaining merits of the theory over the Quantity Theory of Money.

1. The Saving-Investment theory has a good combination of the two theories i.e., the general theory of value (the theory of individual price) and the theory of money (the theory of general prices). It, therefore, presents a more comprehensive view of the price fluctuations than the classical theory of the value of money (i.e. the quantity theory of money).

2. The older quantity theory of money established that any change in the quantity (or supply) of money will affect the price level directly and proportionately if other things remaining constant. Thus, it presents a very simple explanation to money-price relationship. The saving-investment theory is rather complicated as it describes a series of event that lead to the changes in price level.

Changes in the supply of money lead to changes in the rates of interest, bringing about a change in the relationship between saving and investment. This change in relationship, in their turn, influences the level of income, employment, and output which ultimately brings about a change in price level. If investment exceeds saving, prices will rise or if saving exceeds investment, the price will fall. This establishes a better relationship between money and prices.

3. The Saving-Investment theory, provides a tool for analysing the cyclical fluctuation ¡n prices, employment and output. According to this theory, business cycle is nothing but an altering expansion and contraction of national income. It is, therefore, a distinct improvement over the quantity theory of money.

4. The quantity theory of money has assumed the situation of full employment which is not a realistic assumption because the situation of full employment does not exist in any economy. The Saving-Investment theory, on the other hand, does not assume full employment as the basis of theory.

5. The quantity theory of money does not explain why the velocity of money changes or the factors that change the velocity of money. The Saving Investment theory, on the other hand, throws light on changes in the velocity of circulation of money from time to time. Thus, the theory is better than the quantity theory of money.

![]()

Question 23.

In Keynesian analysis of speculative demand for money, how will demand for money be affected it people feel that the level of interest is very high? What is the rationale behind their choice?

Answer:

If wealth-holders consider that the current rate of interest is high compared to the ‘normal or critical rate of interest’, they expect a fall in the interest rate (rise in bond prices). At the high current rate of interest, people are discouraged from holding money and hence they will convert their cash balances into bonds because there is high opportunity cost ot holding cash in terms of interest forgone; as they can earn high rate of return on bonds.

Also, there is less chance of interest rates to rise further resulting in a fall in prices of bonds and consequent capital losses. They expect fall in the market rate of interest in future and capital gains resulting from a rise in bond prices.

Anticipating such capital gains from rising bond prices, people will convert their cash into bonds. The inference from the above is that the speculative demand for money and interest are inversely related. At higher rates of interest, the speculative demand for money would be less. The individual would then hold as little money as possible, only for covering the transactions and precautionary motives.

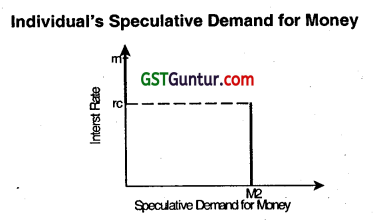

The individual’s demand fpr money, as a function of the interest rate, would then be a step function, depicting a discontinuous portfoio decision as shown in figure below;

When the current rate of interest in is higher than the critical rate of interest rc, the entire wealth is held by the individual wealth-holder in the form of bonds. If the rate of interest falls below the critical rate of interest rc, the individual will hold his entire wealth in the form of speculative cash balances.

Question 24.

Describe the determinants of demand for money as identified by Milton Friedman in his re-statement of Quantity Theory of demand for money. (May 2019, 3 marks)

Answer:

Modern Quantity Theory of Money by Milton Friedman

According to Milton Friedman, Quantity Theory of Money is mainly ‘Theory of Demand of Money’ and there are four elements or factors which determine the Demand of Money of the society as following:

| 1. General Price level | According to Milton Friedman, General Price Level and Demand of Money change directly and proportionately. Other things remaining the same. Demand of Money will increase exactly by 10% as a result of 10% increase in the price level i.e. Demand of Money is unitary elastic. |

| 2. Change in Quantity of Goods and Services or Real Income | Milton Friedman told that Change in Real Income and Quantity of goods and services affect Demand of Money. Change in Real Income and Change in Demand of Money are directly related, though not proportionately. As a result of increase in Real Income or quantity of goods and services, Demand of Money will increase certainly but not proportionately. Here, Demand of Money will not be unitary elastic. Often ¡t is more than unitary elastic. |

| 3. Change In Rate of Interest | So far as there is question of interest, if money is held in the form of cash, it will not earn any interest i.e. income. If it is advanced as loan or it is deposited into Bank, it will earn some income as interest. Therefore, interest is the cost of holding cash. Increase in rate of interest increases the cost of holding money in the form of cash. At high rate of interest people would like to hold lesser amount of cash and demand of money will be reduced. Likewise, at low rate of interest, cost of holding money would be reduced and demand of money will be increased. There is inverse relationship between Rate of Interest and Demand of Money. There is no question of proportionate change. |

| 4. Change in Rate of Increase in General Price Level | Rate of increase in general price level also affects demand of money. If price level is increasing at a high rate, cost of or loss on holding cash will be increased due to rapid reduction in the purchasing power of money. Therefore, people would likes or prefer to hold lesser amount of money as cash whereby reduction in demand of money will be seen. Contrary to it. If rate of increase in price level is very slow, the cost of holding cash or loss due to reduction in purchasing power would be lesser. Therefore, people would like to hold more cash than before whereby increase in demand of money will be seen. |

Question 25.

Describe the treatment of transaction demand for money as per Baumol and Tobin’s model.

Answer:

Baumol (1952) and Tobin (1956) developed a deterministic theory of transaction demand for money, known as Inventory Theoretic Approach, in which money was essentially viewed as an inventory held for transaction purposes.

Inventory models assume that there are two media for storing value: money and an interest-bearing alternative asset. Baurriol’s propositions in his theory of transaction demand for money hold that receipt of income, say Y takes place once per unit of time but expenditure is spread at a constant rate over the entire period of time.

There is an opportunity cost of holding money: the interest forgone on an interest-bearing asset such as a bond. In order to maximize interest earnings, a person would like to hold as much of his wealth as possible in the form of bonds, while still being able to finance the flow of monetary expenditures. If there is no cost to doing so, he would keep all of his wealth in the form of “bond and hold zero money balances.

However, making these transfers generally incurs some kind of cost, either explicitly through a transaction fee or implicitly through the time and inconvenience of making the transfer. The level of inventory holding depends upon the carrying cost, which is the interest forgone by holding money and not bonds, net of the cost to the individual of making a transfer between money and bonds, say for example brokerage fee. 1f an individual, say X, decided to invest in bonds. If r is the return on bond holding; c is the cost of each transaction in the bond market; (i.e. for converting it to Hquid cash) and n is the number of bond transactions, then the net profit for the individual would be R- (n c) where R is the interest earning on the average bond holding which is equal to r times average bond holdings and nc the transaction costs which equal the cost of each transaction multiplied by the number of bond transactions.

Therefore, for a given income, the choice of the split of total money into money and bond holdings is determined by the choice of n. The individual will choose n in such a way that the net profits from bond transactions are maximized. The Baumol-Tobin model derives the optimal frequency of bond-money transactions that minimizes the sum of the two components of cost: the forgone interest cost (which rises as average money balances increase) and the transaction cost (which falls as fewer transactions are made or more money is held).

The individual will apply the marginalist principle and will increase the number of transactions in the bond market until the point at which the marginal interest earnings from one additional transaction just equals the constant margin cost, which will be equal to the brokerage fee etc. Beyond this point, the marginal gain in interest earned from increasing the number of bond market transactions is not sufficient to cover the brokerage cost of the transaction. To surmise, the choice of n determines the spilt of money and bond holdings for a given income.

The optimal average money holding is:

- a positive function of income Y,

- a positive function of the price level P,

- a positive function of transactions costs c, and

- a negative function of the nominal interest rate i.

Question 26.

Analyse the drawbacks of Friedman’s Quantity theory of money.

Answer:

Friedman’s Approach of Modern Quantity Theory of Money has been mainly criticised on the basis of the following:

1. Rate of Interest: Rate of interest has not been attributed so much importance as it should have been attributed. Rate of Interest plays very important role in influencing or affecting the demand of cash balance. Undoubtedly, cost of holding cash balance is increased due to increase in rate of interest and demand of money is reduced. And contrary to it, increase in fixed deposits of Bank is started, because people like to take advantage of the increased rate of interest. In the last decades of the twentieth-century an extraordinary increase in these deposits was recorded due to the increase in rate of interest on fixed deposits.

2. Supply of Money: It was assumed by Milton Friedman that supp’y of money in society is not affected by change in income and price level. Conversely, supply of money determines price level and income of the society. Experiences prove that supply of money is not an independent variable and this is always affected by the change in price level and income.

Question 27.

Critically examine the post-Keynesian theories of demand for money?

Answer:

Post Keynesian Theories of Demand for Money

The post-Keynesian economists developed a number of models to provide alternative explanations to confirm the formulation relating real money balances with real income and interest rates. Most post-Keynesian theories of demand for money emphasize the store-of-value or the asset function of money.

Inventory Approach to Transaction Balances

Baumol (1952) and Tobin (1956) developed a deterministic theory of transaction demand for money, known as Inventory Theoretic Approach, in which money or ‘real cash balance’ was essentially viewed as an inventory held for transaction purposes. People hold an optimum combination of bonds and cash balance, i.e., an amount that minimizes the opportunity cost. The optimal average money holding is: a positive function of income Y, a positive function of the price level P, a positive function of transactions costs c, and a negative function of the nominal interest rate i.

Friedman’s Restatement of the Quantity Theory

Milton Friedman (1956) extending Keynes’ speculative money demand within the framework of asset price theory holds that demand for money is affected by the same factors as demand for any other asset, namely, permanent income and relative returns on assets. The nominal demand for money is positively related to the price level, P; rises if bonds and stock returns, rb and re, respectively decline and vice versa; is influenced by inflation; and is a function of total wealth. The Demand for Money as Behaviour toward as ‘aversion to risk’ propounded by Tobin states that money is a safe asset but an investor will be willing to exercise a trade-off and sacrifice to some extent the higher return from bonds for a reduction in risk.

The Demand for Money as Behaviour towards Risk

According to Tobin, rational behaviour explained induces individuals to hold an optimally structured wealth portfolio which is comprised of both bonds and money and the demand for money as a store of wealth depends negatively on the interest rate. These theories establish a positive relation of demand for money to real income and an inverse relation to the rate of return on earning assets, i.e. the interest rate.

Question 28.

Write short note on Rationale of Measuring Money Supply.

Answer:

Rationale of Measuring Money Supply

Supply of money is a stock concept. It refers to total stock of money (of all types) held by the people of a country at a point of time.

It is important to note that the supply of money does not include:

- stock of money held by the government, and

- stock of money held by the banking system of a country. Because, government and the banking system of a country are suppliers of money, and the stock of money held by the suppliers of money is never treated as a part of the supply of money in the country.

Rationale:

- Measurement of money supply helps in analysis of monetary developments in order to provide a deeper understanding of the causes of money growth.

- It also facilitates in evaluating whether the stock of money in the economy is consistent with the standards and to understand the nature of deviations from this standard.

- The success of monetary policy depends on the contra/ability of money supply hence, the requirement of measurement of money supply.

- The Central Banks measure money supply to stabilise price and GDP growth.

Question 29.

What do you mean by ‘Reserve Money’? (Jan 2021, 2 marks)

Question 30.

The RBI Published the following data as on 31st March, 2018. You are required to compute M4:

| (₹ in crores) | |

| Currency with the public | 1,12,206.6 |

| Demand Deposits with Banks | 1,93,300.4 |

| Net Time Deposits with Banks | 2,67,310.2 |

| Other Deposits of RBI | 614.8 |

| Post Office Savings Deposits | 277.5 |

| Post Office National Savings Certificates (NSCs) | 110.5 |

(Nov 2018, 3 marks)

Answer:

Calculation of M4 : (₹ in crores)

M4 = M3 + total deposits with the post office savings organisation

(excluding National Saving Certificates).

= ₹ 5,73,432 + ₹ 277.5

M4</sub = ₹ 5,73,709.5

Working Note:

1. Calculation of M1 : (₹ In crores)

M1 = Currency notes and coins with the people + demand deposits of banks (Current and Saving deposit accounts) + other deposits of the RBI.

= ₹ 1,12,06.6 + ₹ 1,93,300.4 + ₹ 614.8

= ₹ 3,06,121.8

2. CalculatIon of M3 (₹ in crores)

M3 = M1 + Net time deposits with the banking system

= ₹ 3,06,121.8 + ₹ 2,67,31 0.2

= ₹ 5,73,432

![]()

Question 31.

Compute M1 supply of money from the data given below:

| Currency with public | 2,13,279.8 Crores |

| Time deposits with bank | 3,45,000.7 Crores |

| Demand deposits with bank | 1,62,374.5 Crores |

| Post office savings deposit | 382.9 Crores |

| Other deposits of RBI | 765.1 Crores |

(May 2019, 3 marks)

Answer:

Calculation of M1, Supply of Money

M1 = Currency flotes and coins with the people + demand deposits of banks (current and saving deposit accounts) + other deposits with the RBI

= ₹ 213279.8 Cr. + ₹ 162374.5 + ₹ 765.1 Cr.

M1 = ₹ 376419.4Cr.

Question 32.

Compute reserve money from the following data published by RBI:

| (₹ In crores) | |

| Net RBI credit to the government | 8,51,651 |

| RBI Credit to the commercial sector | 2,62,115 |

| RBI’s claim on Banks | 4,10,315 |

| Government’s Currency liabilities to the public | 1,85,060 |

| RBI’s net foreign assets | 72,133 |

| RBI’s net non-monetary liabilities | 68,032 |

(Nov 2019, 3 marks)

Answer:

Reserve Money = Net RBI credit to the Government + RBI credit to the Commercial sector + RBI’s Claims on banks + RBI’s net Foreign Assets + Government’s Currency liabilities to the public – RBI’s net non-monetary liabilities.

= ₹ 8,51,651 Cr. + ₹ 2,62.115 Cr. + ₹ 4,10,315 Cr. + ₹ 72,133 Cr. + ₹ 1,85,060 Cr. – ₹ 68,032Cr.

Reserve Money = ₹ 17,13,242 Cr.

Question 33.

Compute M3 from the following data:

| Component | ₹ In Crores |

| Currency with the public | 2,25,432.6 |

| Demand Deposits with Banks | 3,40,242.4 |

| Time Deposits with Banks | 2,80,736.8 |

| Post Office Savings Deposits (Excluding National Saving Certificates) | 446.7 |

| Other Deposits with RBI (Including Government Deposits) | 392.7 |

| Post Office National Saving Certificates | 83.7 |

| Government Deposits with RBI | 102.5 |

(Nov 2020, 3 marks)

Question 34.

Compute M2 supply of money from the following RBI data:

| (₹ In Crores) | |

| Currency with public | 435656.6 |

| ‘Other’ deposits with RBI | 1234. 2 |

| Saving deposits with post office saving banks | 647.7 |

| Net time deposits with the banking system | 514834.3 |

| Demand deposits with banks | 274254.9 |

(Jan 2021, 3 marks)

Question 35.

Write short note on Measures of Money Supply.

Answer:

Measures of Money Supply

M1 Measurement

According to M1, measurement, money supply includes the following components:

M1 = C + DD + OD

Where,

C = Currency held by the public. It includes coins as well as paper notes.

DD = Demand deposits of the people with the commercial banks. These are chequeable deposits which can be withdrawn or transferred on demand.

OD = Other deposits which include:

- Demand deposits with RBI of public financial institutions like NABARD (National Bank for Agriculture and Rural Development).

- Demand deposits with RBI of foreign central banks and of the foreign governments.

- Demand deposits of international financial institutions like IMF and World Bank.

Specifically, OD does not include:

(j) deposits of the government of the country with RBI.

(ii) deposits of the country’s banking system with RBI.

M2 Measurement

M2 is a broader concept of money supply compared to M1. Besides all the

components of M1 it also includes savings of the people with the post offices.

Thus.

M2 = M1 + Deposits with Post Office Savings Bank Account

M3 Measurement

M3 is also a broader concept of money supply compared to M1. Besides all

the components of M1 it also includes (net) time deposits (or fixed deposits/terms deposits) of the people with the commercial banks. Thus,

M3 = M1 + Net Time Deposits with the Commercial Banks

M4 Measurement

M4 concept of money supply is still broader, it is broader than even M3.

Besides all the components of M3, it also includes total deposits with the post offices (other than in the form of National Saving Certificate).

M4 = M3 + Total Deposits with post office (Other than NSC)

Question 36.

Write short note on the omponents of New Monetary Aggregates and Liquidity Aggregates.

Answer:

Monetary Aggregates:

Reserve Money = Currency in circulation + Bankers’ deposits with the RBI + Other deposits with the RBI

= Net RBI credit to the Government + RBI credit to the Commercial sector + RBl’s Claims on banks + RBl’s net Foreign assets + Government’s Currency liabilities to the public – RBI’s net non – monetary Liabilities

NM1 = NM1 Currency with the public + Demand deposits with the banking system + ‘Others deposits with the RBI.

NM2 = NM2 + Short-term time deposits of residents (including and up to contractual maturity of one year.)

NM3 = NM3 + Long-term time deposits of residents + Call/Term funding from financial institutions.

Liquidity Aggregates:

L1 = NM3 + All deposits with the post office savings banks (excluding

National Savings Certificates).

L2 = L1 + Term deposits with term lending institutions and refinancing

institutions (Fls) + Term borrowing by Fls + Certificates of deposit issued by FIs.

L3 = L2 + Public deposits of non-banking financial companies.

Question 37.

Explain the concept of ‘Money Multiplier’. (Jan 2021, 2 marks)

Question 38.

Describe the different determinations of money supply in a country.

Answer:

The money supply is defined as .

M=mXMB

Where M is the money supply, m is money multiplier an MB is the monetary base or high powered money. Money Multiplier m is defined as a ratio that relates the change in the money supply to a given change in the monetary base. It denotes by how much the money supply will change for given change in high-powered money. The multiplier indicates what multiple of the monetary base is transformed into money supply.

Money Multiplier m = \(\frac{\text { Money Supply }}{\text { Monetary Base }} \)

There are two alternate theories in respect of determination of money supply.

1. Money supply is determined exogenously by the central bank

2. Money supply is determined endogenously by changes in the economic activities which affect people’s desire to hold currency relative to deposits, rate of interest, etc. The current practice is to explain the determinants of money supply based on ‘money multiplier approach’ which focuses on the relation between the money stock and money supply in terms of the monetary base or high-powered money. This approach holds that total supply of nominal money in the economy is determined by the joint behavior of the central bank, the commercial banks and the public.

![]()

Question 39.

Explain the money multiplier approach to money supply.

Answer:

Money Multiplier Approach to Money Supply:

The money multiplier approach to money supply propounded by Milton Friedman and Anna Schwartz, (1963) considers three factors s immediate determinants of money supply, namely:

1. The stock of high-powered money (H)

2. The ratio of deposit to reserve, e = {ER/D} and

3. The ratio of deposit to currency, c = {C/D}

These three represent the behaviour of the central bank, behaviour of the commercial banks and the behaviour of the general public respectively.

The Behaviour of the Central Bank:

The behaviour of the central bank which controls the issue of currency is reflected in the supply of the nominal high-powered money. Money stock is determined by the money multiplier and the monetary base is controlled by the monetary authority. Given the behaviour of the public and the commercial banks, the total supply of nominal money in the economy will vary directly with the supply of the nominal high-powered money issued by the central bank.

The Behaviour of Commercial Banks:

By creating credit, the commercial banks determine the total amount of nominal demand deposits. The behaviour of the commercial banks in the economy is reflected in the ratio of their cash reserves to deposits known as the ‘reserve ratio’. If the required reserve ratio on demand deposits increases while all the other variables remain the same, more reserves would be needed.

This implies that banks must contract their loans, causing a decline in deposits and hence in the money supply. If the required reserve ratio falls, there will be greater multiple expansions of demand deposits because the same level of reserves can now support more demand deposits and the money supply will increase. The additional units of high-powered money that goes into ‘excess reserves’ of the commercial banks do not lead to any additional loans, and therefore, these excess reserves do not lead to the creation of deposits.

When the required reserve ratio falls, there will be greater multiple expansions for demand deposits. Excess reserves ratio e is negatively related to the market interest rate i. If interest rate increases, the opportunity cost of holding excess reserves rises, and the desired ratio’of excess reserves to deposits falls.

The Behaviour of the Public:

The public, by their decisions in respect of the amount of nominal currency in hand (how much money they wish to hold s cash) is in a position to influence the amount of the nominal demand deposits of the commercial banks. The behaviour of the public influences bank credit through the decision on ratio of currency to the money supply designated as the ‘currency ratio’.

The time deposit-demand deposit ratio i.e. how much money is kept as time deposits compared to demand deposits, also has an important implication for the money multiplier and hence for the money stock in the economy. An increase in TD/DD ratio means that greater availability of free reserves and consequent enlargement of volume of multiple deposit expansion and monetary expansion.

Thus, the money multiplier approach, the size of the money multiplier is determined by the required reserve ratio (r) at the central bank, the excess reserve ratio (e) of commercial banks and the currency ratio (c) of the public.

The lower these ratios are, the larger the money multiplier is. In other words, the money supply is determined by high powered money (H) and the money multiplier (m) and varies directly with changes in the monetary base, and inversely with the currency and reserve ratios. Although these three variables do not completely explain changes in the nominal money supply, never the less they serve as useful devices for analysing such changes. Consequently, these variables are designated as the ‘proximate determinants’ of the nominal money supply in the economy.

Question 40.

What would be the impact of each of the following on credit multiplier and money supply?

(i) If Commercial Banks keep 100 percent reserves.

(ii) If Commercial Banks do not keep reserves.

(iii) If Commercial Banks keep excess reserves. (May 2018, 3 marks)

Answer:

(i) If Commercial Banks decides to keep 100% reserves, then the Money multiplier 1/ required reservo ratio = 1/100% = 1. No additional money supply as there is no credit creation.

(ii) If Commercial Banks do not keep reserves, then money multiplier is infinite and there will be unlimited money creation. There will be chaos with spiraling prices as money supply is too much arid real output cannot increase.

(iii) Excess reserves are those reserves that the commercial banks hold with the central bank in addition to the mandatory reserve requirements. Excess reserves result in an increase in reserve deposit ratio of banks; less money for lending reduces money multiplier; money supply declines.

Question 41.

What is the in pact of the following on credit multiplier and money supply, if Commercia Banks keep:

(1) Less Reserve?

(2) Excess Reserve? (Nov 2020, 2 marks)

Question 42.

Explain how each of the following may affect money multiplier and money supply?

(i) Fearing shortage of money in ATM’s, people decide to hoard money?

(ii) During festival season, people decide to withdraw money through ATMs very often

Answer:

(i) The public by their decisions in respect of the size of the nominal currency in hand (designated as the currency ratio) is in a position to influence the amount of the nominal demand deposits of the commercial banks. When people decide to hoard to money fearing shortage of money in ATM’s, there is an increase in currency in hand because depositors are converting some of their demand deposits into currency. Demand deposits undergo multiple expansions while currency does not. Hence, when demand deposits are being converted into currency, there ¡s a switch from a component of the money supply that undergoes multiple expansions to one that does not. The overall level of multiple expansion declines, and therefore, money multiplier also falls.

(ii) Demand deposits held by poople are highly liquid as they can be easily withdrawn and converted to cash. If people, for any reason, withdraw money from ATMs with greater frequency, then banks will have to keep more cash reserves to meet the obligations. This will raise the reserve ratio, and tower the money multiplier. As a result money supply will decline.

![]()

Question 43.

“The deposit multiplier and the money multiplier though closely related are not identical”. Explain briefly. (Nov 2020, 2 marks)

Question 44.

What will be the total credit created by the commercial banking system for an initial deposit of ₹ 3000 at a Required Reserve Ratio (ARR) of 0.05 and 0.08 respectively? Also compute credit multiplier. (May 2019, 3 marks)

Answer:

The credit multiplier is the reciprocal of the required reserve ratio.

Credit Multiplier = \(\frac{1}{\text { Required Reserve Ratio }} \)

For RRR = 0.05 Credit Multiplier = 1/0.05 =20

For RRR = 0.08 Credit Multiplier = 1/0.08 = 12.5

Credit Creation = Initial Deposit x 1/RRR

For RRR = 0.05, Credit creation will be 3,000 x 1/0.05 = 60,000/

For RRR = 0.08, Credit creation will be 3,000 x 1/0.08 = 37,500/

Question 45.

Compute credit multiplier if the Required Reserve Ratio is 10% and 12.5% for every ₹ 1,00,000 deposited in the banking system. What will be the total credit money created by the banking system in each case? (Nov 2019, 2 marks)

Answer:

Credit Multiplier = 1/ Required Reserve Ratio

(a) 10% 1,00,000 × 1/0.10 = ₹ 10,00,000

(b) 12.5% ₹ 1,00,000 × 1/0.125 = ₹ 8,00,000.

Question 46.

Write short note on Monetary Policy.

Answer:

Monetary Policy

Concept:

Policy related with the control on supply of money in circulation and quantity or volume of credit with the object of achieving the goal of planned economic development of any nation is called Monetary Policy.

Definitions

“Monetary Policy includes all those monetary decisions and methods which aim to affect monetary system. – Paul Einzing

“Monetary Policy is the name given to the principle whereby the Government and the Central Bank of a country fulfill the general objectives of the country’s economic policy. – Prof. D. Hazra

Broadly speaking, monetary policy refers to the policy of the central bank which it pursues with a view to administer and control the country’s money supply including the currency and demand deposits and managing the foreign exchange rates. The central bank coordinates the money supply, credit supply, government expenditure, and the rates of interest through its monetary policy in such a way so that the monetary system may be benefitted to the maximum extent. Through its monetary policy, the central bank try to achieve the national objectives.

Question 47.

Briefly explain the features of Monetary Policy.

Answer:

1. It is a part of Economic Policy

The object of the economic policy is to enhance the prosperity and income of the nation. Various plans are designed for it. Monetary policy helps in controlling, the supply of money and volume of credit. It also helps in achieving the rate if economic development as predetermined. Hence, Monetary P’Tìcy is considered as an important part of the economic policy.

2. Control On Supply of Money

Merely Monetary Policy can determine the supply of money of any nation. Government has to maintain the supply of money according to the size of the population and plans of the economic development. Government attempts to establish control over the supply of money in circulation in accordance with the Monetary Policy of the country by direct control or control by other methods through Central Bank like change in bank rates open market operations, deficit budget and surplus budget etc. in accordance with the Monetary Policy of the country.

3. Control On Volume of Credit

Credit Creation and control on the volume of the credit is a part of the Monetary Policy, Modern Banks mainly Commercial Banks play very important role in creating credit as well as increasing credit volume Monetary Policy plays important role in determining the liquidity ratio of the banks also. Volume of credit can be controlled by increasing or decreasing the liquidity ratio also.

4. Determining the Direction of Economic Development

Inflation and deflation, both are quite capable of turning or changing the economic development of any country in the adverse direction. Hence, inflation and deflation must be controlled promptly and strictly. Equilibrium between demand and supply can be maintained by adopting appropriate Monetary Policy. Neither inflation is suitable for any economy nor deflation. Maintaining equilibrium between supply and demand of money in circulation is in the interest of the whole nation as well as in the nation’s economic development.

5. Controlling the Speed of Economic Development

For the economic development of any country more capital, high rate of capital formation and high rate of credit creation is necessary, and for this purpose determination and adoption of an appropriate Monetary Policy is necessary.

Question 48.

Explain the difference between Liquidity Adjustment Facility (LAF) and Marginal Standing Facility (MSF). (May 2018, 3 marks)

Answer:

Difference between LAF and MSF

| LAF | MSF |

| 1. Minimum bidding amount is ₹ 5 cr. | Minimum bidding amount is ₹ 1 Cr. |

| 2. All clients of RBI are eligible to bid | Only scheduled commercial banks can bid |

| 3. Bank cannot sell government security to RBI that is part of bank’s SLR quota | Bank can sell the government security from its SLR quota to RBI |

| 4. LAF lending rate is always Repo rate | MSP lending rate is always repo rate + 3% |

Question 49.

How do changes in Cash Reserve Ratio (CRR) impact the economy? (May 2018, 2 marks)

Answer:

Higher the CRR withjhe RBI, lower will be the liquidity in the system and vise-versa. During the slowdown in the economy, the RBI reduces the CRR in order to enable the banks to expand credit and increases the supply of money available in the economy. In order to contain credit expansion during period ‘of high inflation, the RBI increases the CRR.

Question 50.

(i) Explain the different mechanism of monetary policy which influences the price – level and national income. (Nov 2018, 3 marks)

(ii) Explain the Monetary Policy Framework Agreement. (Nov 2018, 2 marks)

Answer:

(i) There are mainly four different mechanisms through monetary policy influences the price level and national income.

These are:

- the interest rate channel,

- the exchange rate channel,

- the quantum channel (e.g., relating to money supply and (credit), and

- the asset price channel ie. via equity and real estate prices.

(ii) The Monetary Policy Framework Agreement:

The Reserve Bank of India (RBI) Act, 1934 was amended on June 27, 2016 for giving a statutory backing to the Monetary Policy Framework Agreement and for setting up a Monetary Policy Committee (MPG). The Monetary Policy Framework Agreement is an agreement reached between the Government of India and the Reserve Bank of India (RBI) on the maximum tolerable inflation rate that the RBI should target to achieve price stability.

![]()

Question 51.

Why is the central bank reffered to as a “banker’s bank”? (May 2019, 2 marks)

Answer:

A cental bank is a ‘banker’s bank’. It provides liquidity to banks when the latter face shortages of liquidity. This facility is provided by the Central bank through its discount window. The scheduled commercial banks can borrow from the discount window against the collateral of securities like commercial bills, government securities, treasury bills, or other eligible papers. This type of support earlier took.

The form of refinancing of loans given by commercial banks to various sectors (e.g. Exports, agriculture etc.). By varying the terms and conditions of refinance, the RBI could employ the sector-specific refinance facilities as an instrument of credit policy to encourage/discourage lending to particular sectors. In line with the financial sector reforms, the system of sector-specific refinance schemes (except export credit refinance scheme) was withdrawn. From June, 2,000, the RBI has introduced Liquidity Adjustment Facility (LAF).

The Liquidity Adjustment Facility (LAF) is a facility extended by the Reserve bank of India to the scheduled commercial banks (excluding RRBs) and primary dealers to avail of liquidity in case of requirement (or park excess funds with the RBI in case of excess liquidity) on an overnight basis against the collateral of government securities including state government securities.

Question 52.

Explain the open market operations conducted by RBI. (Nov 2019,2 marks)

Answer:

Open Market Operations

1. Open Market Operations (OMO) refers to market operations conducted by the Reserve Bank of India by way of sale/purchase of Government securities to/from the market with an objective to adjust the rupee liquidity conditions in the market on a durable basis.

2. When the RBI feels there is excess liquidity in the market, it resorts to sale of securities thereby sucking out the rupee liquidity.

3. When the liquidity conditions are tight, the RBI will buy securities from the market, thereby releasing liquity into the market.

Question 53.

Explain ‘Reverse Repo Rate’. (Nov 2019, 2 marks)

Answer:

Reverse Repo Rate

‘Reverse Repo’ is defined as an instrument for lending funds by purchasing securities with as agreement to resell the securities on a mutually agreed future date at an agreed price which includes interest for the funds lent. Reverse repo operation takes place when RBI borrows money from banks by giving them securities. The Securities transacted here can be either government securities or corporate securities or any other securities which the RBI permits for transaction. The interest rate paid by RBI for such transactions is called the ‘reverse repo rate’. Reverse Repo Rate of October 2020 4%.

Question 54.

What is the meant by ‘Statutory Liquidity Ratio’? In which forms this ratio is maintained? (Nov 2020, 3 marks)

Question 55.

Distinguish between Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR). (Jan 2021, 3 marks)

Question 56.

Examine what would be the effect on money multiplier if bank loads excess reserves?

Answer: