International Trade – CA Inter Economics Question Bank is designed strictly as per the latest syllabus and exam pattern.

International Trade – CA Inter Economics Question Bank

Question 1.

How does international trade increase economic efficiency? Explain” (May 2019, 3 marks)

Answer:

(i) International trade is a powerful stimulus to economic efficiency and contributes to economic growth and rising economies.

Economic efficiency increases due to quantitative and qualitative benefits of extended division of labour, economies of large scale production, betterment of manufacturing capabilities, increased competitiveness and profitability by adoption of cost-reducing techrology and business practices and decrease in the like hood of domestic monopolies. Efficient deployment of productive resources natural, human, industrial and financial resources ensures productivity gains.

(ii) The gains from international trade are reinforced by the increased competition that domestic producers are confronted with on account of internationalisation of production and marketing. Competition from foreign goods compels manufacturers, especially in developing countries, to enhance competitiveness and profitability by adoption of cost-reducing technology and business practices.

Efficient deployment of productive resources to their best uses is a direct economic advantage of foreign trade. Greater efficiency in the use of natural, human, industrial and financial resources ensures productivity gains. Since international trade also tends to decrease the likelihood of domestic monopolies, it is always beneficial to the community.

Question 2.

Write short note on Dis advantages of International Trade.

Answer:

Disadvantages of International Trade

1. Adverse effect on wages: It is argued by the critics that international trade adversely affect wages, particularly when trade takes place between two countries in one of which wages are very low and in the other very high. For example, it is argued by the Americans that trade with India or China where wages are low will depress the wages of American workers. Frank William Taussig, a well-known American economist, exposed the fallacy of this argument when he stated that, “Perhaps the most familiar and most unfounded of all is the belief that complete freedom of trade would bring about an equalisation of money wages the world over. There is no such tendency to equalisation. The question of wages is at bottom one of productivity. The greater the productivity of industry at large, the higher will be the general level of wages.’

2. Dependence on other nations: It is argued that while international trade brings the blessings of a higher standard of living for a nation, it also implies dependence on foreign markets as sources of supply of raw materials and as outlets for domestic production. According to some people the national interests demand that this dependence should be reduced or entirely eradicated. In modem times, however, when the world has become a united whole, this nationalist argument is retrogressive.

3. Against national defence: It has been argued by some people that a nation which depends on foreign sources of supply lacks defence during war. The harrowing experience of England during the two world wars is cited as proof of this assertion.

4. Economic instability: International trade has been condemned as a source of economic instability. This argument gained currency in the 1939s when the great depression spread from one country to another by disrupting the international flow of goods, services and capital. Today this argument has been reinforced by government policies directed toward achieving full employment and economic growth. International trade has been regarded as positively harmful for a country’s planned economic development. According to nationalists, free trade is an anachronism and does not fit in with the requirements of a planned economy. Here, it may be pointed out that most nations are unable to achieve the objectives of full employment and growth except as members of an international trading system.

5. Lack of protection of domestic industry: Several arguments have been advanced to justify the protection of domestic industry against foreign competition. Though arguments against international trade and specialisation on the basis of national security, economic stability, full employment, planned economic development and protectionism have a powerful emotional appeal for the layman, international trade has a tremendous vitality for growth and the protectionists have not been able to dislodge it from its strong position. The advantages of international specialisation and trade made its alleged disadvantages pale into insignificance.

![]()

Question 3.

The table given below shows the number of labour hours required to produce Sugar and Rice in two countries X and Y:

| Commodity | Country X | Country Y |

| 1 unit of Sugar | 2 | 5 |

| 1 unit of Rice | 4 | 2.5 |

(i) Compute the Productivity of labour in both countries in respect of both commodities.

(ii) Which country has absolute advantage In production of Sugar?

(iii) Which country has absolute advantage in production of Rice? (Nov 2018, 3 marks)

Answer:

(i) Productivity of Labour in both Countries in respect of both Commodities

| Productivity of Labour | Country X | Country Y |

| Units of Sugar Per hour | 0.5 | 0.2 |

| Units of Rice Per hour | 0.25 | 0.4 |

(ii) Country X has absolute advantage in the production of Sugar because productivity of Sugar is higher in Country X, or conversely, the number of labour hours required to produce Sugar in Country X is less compared to Country Y

(iii) Country Y has absolute advantage in the production of Rice because productivity of Rice is higher in Country Y, or Conversely, the number of labour hours required to produce Rice in Country Y is less compared to Country X.

Question 4.

Explain the classical theory of Comparative Advantage as given by David Ricardo. (May 2019, 3 marks)

Answer:

David Ricardo developed the Classical Theory of Comparative advantage in his book ‘Principles of Political Economy and Taxation’ published in 1817.

The challenge to the absolute advantage theory was that some countries may be better at producing both goods and, therefore, have an advantage in many areas. In contrast, another country may not have any useful absolute advantages. To answer this challenge, David Ricardo, an English economist, introduced the theory of comparative advantage in 1817.

The law of comparative advantage states that even if one nation is less efficient than (has an absolute disadvantage with respect to) the other nation in the production of all commodities, there is still scope for mutually beneficial trade. The first nation should specialize in the production and export of the commodity in which its absolute disadvantage is smaller (this is the commodity of its comparative advantage) and import the commodity in which its absolute disadvantage is greater (this is the commodity of its comparative disadvantage).

Comparative advantage occurs when a country cannot produce a product more efficiently than the other country; however, it can produce that product better and more efficiently than it does other goods. The difference between these two theories is subtle. Comparative advantage focuses on the relative productivity differences, whereas absolute advantage looks at the absolute productivity.

Comparative advantage differences between nations are explained by exogenous factors which could be due to the differences in national characteristics. Labour differs in its productivity internationally and different goods have different labour requirements, so comparative labour productivity advantage was Ricardo’s predictor of trade.

Question 5.

Explain the key features of modern theory of international trade. (Nov 2019, 3 marks)

Answer:

The Heckscher-Ohlin theory of trade, also referred to as Factor-Endowment Theory of Trade or Modem Theory of Trade, emphasises the role of a country’s factor endowments in explaining the basis for its trade. ‘Factor endowment’ refers to the overall availability of usable resources including both natural and man-made means of production.

If two countries have different factor endowments under identical production function and identical preferences, then the difference in factor endowment results in two countries having different factor prices and different cost functions. In this model a country’s advantage in production arises solely from its relative factor abundance. Thus, comparative advantage in cost of production is explained exclusively by the differences in factor endowments of the nations.

According to this theory, international trade is but a special case of inter-regional trade. Different regions have different factor endowments, that is, some regions have abundance of labour, but scarcity of capital; whereas other regions have abundance of capital, but scarcity of labour. Thus, each region is suitable for the production of those goods for whose production it has relatively plentiful supply of the requisite factors. The theory states that a country’s exports depend on its resources endowment i.e. whether the country is capital-abundant or labour-abundant. A country which is capital-abundant will export capital-intensive goods.

Likewise, the country which is labour-abundant will export labour-intensive goods. The Heckscher-Ohlin Trade Theorem establishes that a country tends to specialize in the export of a commodity whose production requires intensive use of its abundant resources and imports a commodity whose production requires intensive use of its scarce resources.

The Factor-Price Equalization Theorem which is a corollary to the Heckscher-Ohlin trade theory states that in the absence of foreign trade, it is quite likely that factor prices are different in different countries. international trade equalizes the absolute and relative returns to homogenous factors of production and their prices. This implies that the wages and rents will converge across the countries with free trade, or in other words, trade in goods is a perfect substitute for trade-in factors. The Heckscher-Ohlin theorem thus postulates that foreign trade eliminates the factor price differentials.

Question 6.

‘The Heckscher Ohlin theory of Foreign Trade’ can be stated In the form of two theorems. Explain those briefly. (Nov 2020, 3 marks)

Question 7.

The price index for exports of Bangladesh in the year 2018-19 (based on 2010-11) was 233.73 and the price index for imports of it was 220.50 (based on 2010-11).

(i) What do these figures mean?

(ii) Calculate the index of terms of trade for Bangladesh.

(iii) How would you interpret the index of terms of trade for Bangladesh? (Nov 2019, 5 marks)

Answer:

(i) Price index for exports of Bangladesh in the year 2018-19 (based on 2010-1 1), was 233.73 means that compared to year 2010-11, its export prices were 133.73% above the 2010-11 base year prices. The price index for Bangladesh’s import is 220.50 (based on 2010-11), means that compared to year 2010-11, its import prices were 120.50% above the 2010-11 base year prices.

(ii) The index of the terms of trade for Bangladesh in 2018-19 would be calculated as follows:

Terms of Trade = \(\frac{\text { Price of a country’s exports }}{\text { Price index of its imports }} \times 100\)

= \(\frac{233.73}{220.50} \times 100\)

= 106%

(iii) Terms of trade is ratio of the price of a country’s export commodity to the price of its import commodity. It is the relative price of a country’s exports in terms of its imports and can be interpreted as the amount of import goods an economy can purchase per unit of export goods.

If the export prices increase more than the import prices, a country has positive terms of trade, because for the same amount of exports, it can purchase more imports. The figure 106% means that each unit of Bangladesh’s exports in 2018-19 exchanged for 6% (6 = 106-100) more unit of imports than in the base year.

![]()

Question 8.

Write short note on Mercantilism.

Answer:

Mercantilism

Developed in the sixteen century, mercantilism was one of the earliest efforts to develop an economic theory

This theory stated that a country’s wealth was determined by the amount of its gold and silver holdings.

In it’s simplest sense, mercantilists believed that a country should increase its holdings of gold and silver by promoting exports and discouraging imports.

In other words, if people in other countries buy more from you (exports) than they sell to you (imports), then they have to pay you the difference in gold and silver.

The objective of each country was to have a trade surplus, or a situation where the value of exports are greater than the valve of imports, and to avoid a trade deficit, or a situation where the value of imports is greater than the value or exports.

A closer look at world history from the 1500s to the late 1800s helps explain why mercantilism flourished. The 1500s marked the rise of new nation-states, whose rulers wanted to strengthen their nations by building larger armies and national institutions.

By increasing exports and trade, these rules were able to amass more gold and wealth for their countries. One way that many of these new nations promoted exports was to impose restrictions on imports. This strategy is called protectionism and is still used today.

Question 9.

Explain In brief on theory of Absolute Advantage.

Answer:

Theory of Absolute Advantage

In 1776. Adam Smith questioned the leading mercantile theory of the time in The Wealth of Nations Adam Smith, An Inquiry into the Nature and Causes of the Wealth of Nations.

Adam Smith offered a new trade theory called absolute advantage, which focused on the ability of a country to produce a good more efficiently than another nation.

Adam Smith reasoned that trade between countries shouldn’t be regulated or restricted by government policy or intervention. He stated that trade should flow naturally according to market forces. In a hypothetical two-country world, if Country A could produce a good cheaper or faster (or both) than Country B, then Country A had the advantage and could focus on specializing on producing that good.

Similarly, if Country B was better at producing another good, it could focus on specialization as well. By specialization, countries would generate efficiencies, because their labor force would become more skilled by doing the same tasks. Production would also become more efficient because there would be an incentive to create faster and better production methods to increase the specialization.

Question 10.

Elucidate the theory of Comparative Advantage.

Answer: ‘

Theory of Comparative Advantage

The challenge to the absolute advantage theory was that some countries may be better at producing both goods and, therefore, have an advantage in many areas. In contrast, another country may not have any useful absolute advantages. To answer this challenge, David Ricardo, an English economist, introduced the theory of comparative advantage in 1817. Ricardo reasoned that even if Country A had the absolute advantage in the production of both products, specialization and trade could still occur between two countries.

Comparative advantage occurs when a country cannot produce a product more efficiently than the other country; however, ¡t can produce that product better and more efficiently than ¡t does other goods. The difference between these two theories is subtle. Comparative advantage focuses on the relative productivity differences, whereas absolute advantage looks at the absolute productivity.

Question 11.

Trade theory emphasises differences in comparative costs to explain trade patterns. What other factors need to be taken into account if actual patterns are to be fully explained? Explain with reference to Adam Smith’s Theory.

Answer:

Adam Smiths Theory

Interregional or international trade takes place when the domestic price ratios are different. In international trade, a country exports that commodity which is cheaper at home than abroad and vice versa. Thus, differences in the relative prices of goods between different countries is the basis of international trade. The cheapness of one commodity and dearness of another relatively at home than abroad may be due to differences either In the supply conditions or in the demand conditions in the two countries. The classical theory of comparative cost advantage ignored the phenomenon of demand reversal because it focused attention only the supply side.

Absolute Cost Advantage:

Adam Smith argued for free trade on the basis of advantages of division of labour. Free trade makes possible a greater degree of specialisation of labour. It augments the gains from territorial division of labour. Each country specialises in the production of those commodities in which it has a comparative advantage over others. According to Adam Smith the principle governing the international exchange of goods is basically the same that underlines the domestic exchange.

Adam Smith developed the theory of international trade on absolute difference in costs. If one country has an absolute cost advantage in the production of one commodity and dis advantage in the production of the other, each country will export that commodity in the production of which it commands an absolute cost advantage and import that commodity in which it has an absolute cost disadvantage. In order to export a commodity Its price in the country should be low relatively to its price in the other country. It is possible only if the country possesses comparative cost advantage in the production of the commodity. For this purpose the country must have an absolute cost advantage.

Question 12.

Write Short Note on Criticisms of Adam Smith’s Theory.

Answer:

Criticism of Adam Smith’s Theory

Adam Smith explained the basis of trade between tropical zone countries and temperate zone countries or between industrial countries and agricultural countries on the principle of comparative cost advantage emerging from absolute difference in costs. However as P.T. Ellsworth and J. Clark Leith, point out it is assumed without argument that international trade required a producer of exports to have an absolute advantage; that is, an exporting country must be able to produce, with a given amount of capital and labour, a large output than any rival.

But what if a country had no line of production in which ¡t was clearly superior? Suppose a relatively backward country whose and industry In the broadest sense (compared with Its more advanced neighbours) were inefficient, capable of production less In all lines of production, not too hypothetical case. Would it be forced to insulate itself against more efficient outside competition or see all its industry and agriculture subjected to ruinous competition? Adam Smith’s analysis was too narrow. It was left to Robert Torrens and David Ricardo to attack the problem and to elaborate Adam Smith’s statement to fit In a more general framework by formulating a more general theory of international trade.

![]()

Question 13.

Explain the Ricardian theory of Comparative Cost.

Answer:

David Ricardo’s Pure Theory

In his magnum opus entitles. The principles of Political Economy and Taxation, first published in 1817, David Ricardo formulated the pure theory of international trade. At the centre of the theory was the so-called principle of comparative advantage”. The idea was that nations would gain by specialising in the production of those goods in which they possess special advantages. David Ricardo said, “It is important to the happiness of mankind that our enjoyments should be increased by the better distribution of labour, by each country producing those commodities for which by its situation, its climate and its other natural or artificial advantages, it is adapted, and by their exchanging them for the commodities of other countries.”

Labour Theory of Value:

The doctrine of comparative cost advantage was developed by David Ricardo out of his celebrated labour theory of value. According to this theory, the value of any commodity is determined by its labour cost of production. To quote Ricardo’s words, “It is the comparative quantity of commodities which labour will produce that determines their present or past relative values.” This theory breaks down as a determinant of value-in-exchange in international trade.

David Ricardo admitted. “The same rule which regulates the value of commodities in one country does not regulate the relative values of the commodities exchanged between two or more countries. The quantity of wine which Portugal shall give in exchange for the cloth of England is not determined by the respective quantities of labour devoted to the production of each, as it would be if both commodities were manufactured in England, or both in Portugal.”

The labour (cost) theory of value, can not explain the exchange values in international trade due to the immobility of labour as factor of production between different countnes which prohibits the application of this theory to trade taking place between countries. Commodities would exchange in the ratio of the quantities of labour embodied in them if labour were perfectly mobile between countries.

Any divergence between their exchange ratio and their cost ratio would be eliminated by the market forces of demand and supply. If the product of an industry can be sold at more than the value of labour it contains, additional labour will be transferred to that industry from other occupations. The supply of the commodity will expand until the price falls to become equal to the value of labour embodied in it. Conversely, if the commodity sells for less than the value of its labour contents, labour will move away from that industry into other lines of production. Thus, the supply of the commodity will decrease and its price wilt rise until the price equals the labour cost of production of the commodity.

The labour cost principle implies that in different branches of production, there is a tendency of wages towards equality within a country so that prices of goods will be equal to the returns to labour in all lines of production and regions within the country. However, this equilibrating mechanism does not operate between two countries due to the assumption of immobility of labour between the countries. Thus trade will emerge if the exchange ratio between the two commodities is different in two countries.

Values of Goods In International Exchange:

David Ricardo explains it by the doctrine of comparative cost advantage. According to this doctrine, a country will specialise in the production of that commodity for which its labour cost is comparatively lowest. The doctrine emphasises the principle that competence should specialise where competence counts most and incompetence must specialise where incompetence counts least. A country would export that commodity in the production of which It has comparative cost advantage or superiority over others and import that commodity in which its cost advantage is least or in which it suffers from comparative cost disadvantage.

Support of Free Trade:

The principle of comparative cost advantage supports free trade. Each country in the long run tends to specialise in the production of and export of those goods In which it enjoys a comparative advantage in terms of real costs. It tends to import those goods in the production of which it has comparative disadvantage in terms of real costs. This specialisation is to the mutual advantage of both the countries participating in trade.

David Racardo’s classic example of two men of differing efficiencies both of whom could make shoes and hats, illustrated the point. Though simple and powerful, Adam Smith’s demonstration of the benefits of free trade was not very deep and subtle. He did not tackle the more difficult case in which one country enjoys absolute advantage over the other country in the production of both the goods. It was David Ricardo who saw the problem and answered in the affirmative. So long as country A is not equally more productive in both the lines of production, both the countries will benefit by trading.

Question 14.

What were the assumptions underlying the Ricardian Theory of Comparative cost.

Answer:

Assumptions of Comparative Cost Advantage Theory:

- Labour is the only factor of production. Consequently, the theory is based on the labour (cost) theory of value.

- All units of labour are homogeneous.

- Labour is perfectly mobile within the country and perfectly immobile between different countries.

- Production functions are linearly homogeneous i.e., production of goods obeys the law of constant returns of scale. In other words, the unit cost ratio of the two goods are constant regardless of the scale of production. Thus, the theory abstracts from considering the economies and diseconomies of scale of production.

- The theory assumes trade taking place between only two countries and in only two goods produced by single factor of production (labour). In other words, the theory Is a 2 x 2 x I trade model.

- Transport costs are absent.

- Process of goods are determined by their real (labour) cost of production.

- Product and factor markets are perfectly competitive.

Improvement by Others:

The problem of determination of the actual terms of trade was not tackled by David Ricardo. It was left for John Stuart Mill, Alfred Marshall and Francis Ysidro Edgeworth to introduce the demand condition in international trade in order to explain the process of the determination of terms of trade. Thus, Ricardo’s explanation of the comparative cost advantage theory was incomplete as it focused attention only on the supply side and took the demand side for granted.

John Stuart Mill examined the problem of determination of the real terms of trade (exchange ratio) at which the countries exchange commodities. Mill’s doctrine was, The actual exchange ratio at which goods are traded will depend on the strength and elasticity of each country’s demand for the other country’s product or on the reciprocal demand. The exchange ratio will be stable when the value of each country’s exports is just enough to pay for its imports.”

Mill’s analysis of reciprocal demands was further translated into graphical terms by the noted Cambridge Economists Alfred Marshall and Francis Ysidro Edgeworth. They developed and used the technique of otter curves to explain effectively the operation of Mill’s reciprocal demand.

![]()

Question 15.

Examine the Opportunity Cost Doctrine of International Trade as propounded by Haberler

Answer:

Meaning of Opportunity Cost Approach

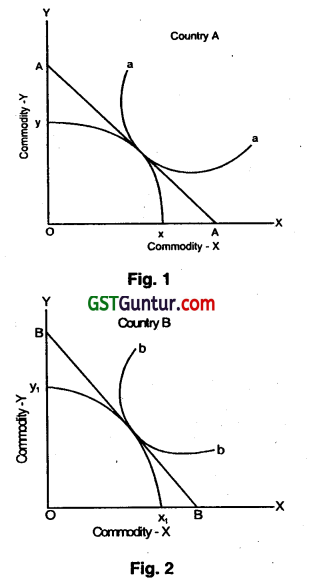

In offering his opportunity cost doctrine, Haberler emphasised the role of differing factor endowments of the trading countries but assumed for simplicity that the factors available to a country are fixed in supply. These factors can be used in several ways; some of the output of one commodity can be sacrificed to increase the output of another so that each country can exhibit a set of production possibilities. From this, it follows that the cost of production of a commodity is equal to the value of commodities whose production is given up in order to produce it.

This analysis in which the costs of substituting one commodity for another take the place of labour costs is valid, no matter if the factors, leaving the production of one commodity, are all suited to the production of the other commodity. Haberler gave detailed consideration to the degree to which factors of production are specific to one industry and of no use to another.

Even if the factors are specific, Haberler showed that the exchange ratio is given by the ‘marginal rate of substitution’ defined as the number of units of one commodity given up to obtain one extra unit of the other. Thus, Haberler followed the Austrian school that measured costs not by the absolute amount of labour required but by the alternative foregone. To quote Haberler, “The marginal cost of a given quantity ‘x’ of commodity ‘A’ must be regarded as that quantity of commodity ‘B’ which must be foregone in order that ‘x’, instead of (x-1) units of ‘A’ can be produced. The exchange ratio on the market between A and B must equal their costs in this sense of the terms.

Assumptions of the Theory:

Haberler sought to derive a country’s opportunity cost curve under the following assumptions:

1. Perfect competition exists in factor and commodity markets.

2. The price of every product equals its marginal cost of production.

3. The units of any factor of production, have the same price in all employment provided that they are mobile or substitutable for one another.

4. The factors are fully employed, and the uniform price of each factor is equal to its marginal productivity in each use.

A specialises completely in the production of Y and B in that of X. In equilibrium, the slopes of the new price lines A1A1 and B1B1 countries A and B respectively equal. If specialisation is in complete in one country because of the unequal size of the two countries, the equihbrium price line will be tangent to the production indifference curve in the larger (partially specialised) country.

If the production is subject to the law of increasing costs in country A and to that to constant costs in country B, country B will specialise completely if its size is smaller than or equivalent to that of country A. If country B is larger in size, neither of the two countries might specialise completely.

It production is subject to the law of decreasing costs in A and to that of constant costs in B, both the countries will specialise completely if they are not unequal in size. If the size of the two countries is unequal, the smaller will specialise completely and the larger partially.

When the rate at which the costs are decreasing in A, is precisely the same at which the cost are decreasing ¡n B, there will be no differences in comparative costs. The scope for trade will exist only if the demand conditions favour it. If the consumption indifference curves are identical in the two countries, therë will be no difference in comparative costs and hence no scope for trade. If the consumption indifference curves are dissimilar, there will arise scope for profitable trade. The decreasing costs country will specialise more completely than the increasing costs country.

Question 16.

On what assumptions is the Heckscher-Ohlin theory of international trade based? Explain the relative factor abundance and relative factor intensity.

Answer:

Assumptions of Heckscher-Ohlin Theory

The phenomenon of international trade is exceedingly complex, in the real world. It includes under its cover a multi-commodity, a multi-country and a multi-factor world. In order to avoid total confusion, abstraction from such a complex world of reality is needed. No theory of trade worth the name can be a perfect approximation to the real trading world, as every theory abstracts from complexities of real-world trade by making several assumptions. The Heckscher-Ohlin theory of international trade is no exception to this rule. The following are its self imposed assumptions:

1. Trade takes place between only two countries and in only two commodities which are produced by only two factors of production, namely labour and capital. In other words, the Heckscher-Ohlin theory may be described as a two-country, two commodity and two factor trade model i.e., a 2 x 2 x 2 trade model.

2. Production of both the goods involves the use of both factors and is subject to constant returns to scale. In other words, the production functions of both the commodities are linearly homogeneous.

3. The linearly homogeneous production functions are different for the two goods but are identical for each goods in the two countries.

4. There is perfect competition in the goods and factor markets and resources are fully employed.

5. Transport costs, tariff and other artificial barriers to trade are absent.

6. The relative factor endowments are different in the two countries.

7. Consumer tastes are fixed and identical in the two countries.

8. Production functions are such that the relative factor intensities are the same at all factor prices which are same in both the industries, i.e., the labour-intensive goods remain labour-intensive at all the prices of labour. In other words, the theory is based on the assumption of strong factor intensity.

9. Factor supply (endowments) in each country is fixed, unchanging over time, homogeneous and qualitatively identical. In short, the theory abstracts from consideration of the effect on trade of differences in the qualities of factors of production in different regions.

10. International transactions are confined to only commodity trade. In other words, these ignore transactions arising from capital movements, remittances of interest or dividends, and other invisible items in the balance of payments.

11. Factors are mobile within each country but are immobile between the countries. At any rate, it is assumed that the factor mobility within the country is considerably greater than international factor mobility.

12. Technology is fixed and information is costless and ubiquitous.

Question 17.

Criticise the Heckscher-Ohiin theory of international trade. I

Answer:

Criticisms of Heckscher-OhIlfl Theory

1. OversimplifIed explanatioñ of trade: This theory explains trade between only two countries, in two commodities produced by only two inputs. Thus, it is a 2 x 2 x 2 trade model. In practice, however, trade takes place between many countries and in many commodities which are produced by several inputs. Consequently, the theory cannot explain the actual complex trade pattern. It is an oversimplified explanation of trade.

2. Trade between countries of similar endowments: According to this theory, a country will produce and export that commodity in whose production relatively large amount of its abundant factor is used. Thus, trade occurs due to differences in factor proportions between nations. Trade will not occur between regions or countries endowed with similar relative factory endowments. For example, if the ‘two countries are identical in capital and labour abundance they would not trade. This claim is false as a substantial part of world trade takes place between countries with similar factor endowments.

3. Neglect of cost-influencing factors: In fact, international trade takes place due to differences in the relative prices of commodities between different regions which may be due to cost differences. Differences in costs of different products between different regions arise from many factors including transport costs, economies of scale and external economies. Ohiin was mistaken to make the simplifying assumption that regional differences in factor proportions uniquely determined specialisation and trade. His theory is faulty as an explanation of specialisation and trade because it ignores several other factors like transport costs, economies of scale external economies, etc., which account for the differences in costs and consequently in the prices of products between different regions.

4. Neglect of the role of product differentiation: If there is product differentiation, trade may take place even if the two countries are similarly endowed with the productive agents.

5. Prices of commodities are not determined by the lactar costs of Production: H.W.J. Wijanholds criticised the Heckscher-Ohlin theory on the ground that the prices of commodities are not determined by the factor costs of production. He maintained that the relation is quite the reverse. The prices of commodities are determined by their utility to the consumers. The prices of raw materials and labour ultimately depend on the prices of final goods.

6. No mention of by-products: Heckscher-Ohlin theory does not mention anything about the by-products. In influencing the structure and direction of international trade sometimes the by-products are more important than the main final products.

7. Static-equilibrium analysis: This theory rests on the static assumptions of fixed quantities of factors of production, given consumer incomes and tastes, given production functions, etc. The conclusions drawn from the static equilibrium analysis cannot be applied to a dynamic economy characterised by changes in tastes, technical knowledge and relative factor endowments over time. This theory neglects the problems of long-run historical developments and their impact on the nature and pattern of international trade. The assumptions of fixed factor endowments and unchanging technology cannot be defended.

8. Neglect of the influence of technological progress on trade: The assumption of identical production functions in two countries is plausible only in a static world in which the technical conditions of production remain constant. Any production function is available for exploitation by any potential user barring exceptional cases of very few well-guarded industrial secrets and patented production processes which their owners will not license. There are no industrial secrets, in the long run. Even the patents and copyrights expire after a certain time lapse.

![]()

Question 18.

What do you mean by anti-dumping duties? (May 2018, 2 marks)

Answer:

Anti-Dumping Duties:

Dumping occurs when manufacturers sell goods in a foreign country below the sales price in their domestic market or below their full average cost of the product. Dumping is an international price discrimination favouring buyers of exports, but ¡n tact, the exporters deliberately forego money in order to harm the domestic producers of the importing country. This is unfair and constitutes a threat to domestic producers and therefore when dumping is found, anti-dumping measures which are tariffs to offset the effects of dumping may be initiated as a safeguard instrument by imposition of additional import duties so as to offset the foreign firm’s unfair price advantage.

Question 19.

How do import tariffs affect International Trade? (May 2018, 2 marks)

Answer:

Import tariffs affect International Trade in following manner

1. Tariff barriers create obstacles to trade, decrease the volume of imports and exports and therefore of international trade. The prospect of market access of the exporting country is worsened when an importing country imposes a tariff.

2. By making imported goods more expensive tariffs discourage domestic consumers from consuming imported foreign goods. Domestic consumers suffer a loss in consumer surplus because they must how now pay a higher price for the good and also because compared to free trade quantity they now consume lesser quantity of the good.

3. Tariffs encourage consumption and production of the domestically produced import substitutes and thus protest domestic Industries.

4. Producers in the importing country experience an increase in well-being as a result of imposition of tariff. The price increase of their product in the domestic market increases producer surplus in the industry. They can also charge higher prices than would be possible in the case of free trade because foreign competition has reduced.

5. The price increase also induces an increase in the output of the existing firms and possibly addition of new firms due to entry into the industry to take advantage of the new high profits and consequently an increase in employment in the industry.

6. Tariffs create trade distortions by disregarding comparative advantage and prevent countries from enjoying gains from trade arising from comparative advantage. Thus, tariffs discourage efficient production in the rest of the world and encourage inefficient production in the home country.

7. Tariffs increase government revenues of the importing country by the value of the total tariff it charges.

Question 20.

Explain with example how Ad Valorem Tariffes levied. (Nov 2018, 3 marks)

Answer:

An ad valorem tariff is levied as a constant percentage of the monetary value of one unit of the imported good. For example, a 20% ad valorem tariff on any bicycle generates a ₹ 1,000/- payment on each imported bicycle priced at ₹ 5,000/- in the world market and if the price raises to ₹ 10,000, it generates a payment of ₹ 2,000/-. While ad valorem tariff preserves the protective value of tariff on home producers, it gives incentives to deliberately undervalue the good’s price on invoices and bills of loading to reduce the tax burden. Nevertheless, ad valorem tariffs are widely used the world over.

Question 21.

What is meany by 4 Mixed tariffs’? (May 2019, 2 marks)

Answer:

Mixed tariffs:

Mixed tariffs is a combination of an ad valorem and a specific tariff. That is, the tariff is calculated on the basis of both the value of the imported goods (an ad valorem duty) and a unit of measure of the imported goods (a specific duty).

Question 22.

What is meant by ‘Bound tariff’? (Nov 2019, 2 marks)

Answer:

Bound Tariff:

A bound tariff is a tariff through which a WTO member binds itself with a legal commitment not to raise it above a certain level. By binding a tariff, often during negotiations, the members agree to limit their right to set tariff levels beyond a certain level. The bound rates are specific to individual products and represent the maximum level of import duty that can be levied on a product imported by that member. A member is always free to impose a tariff that is lower than the bound level. Once bound, a tariff rate becomes permanent and a member can only increase its level after negotiating with its trading partners and compensating them for possible losses of trade. A bound tariff ensures transparency and predictability.

Question 23.

What is meant by ‘Countervailing Duties’? (Nov 2020, 2 marks)

Question 24.

Describe the purposes of Trade Barriers in international trade. (Jan 2021, 2 marks)

Question 25.

You are given the following information:

| Good M (Mobile Phones) | India (in $) | Japan (In $) | China (In $) |

| Average Cost | 70.5 | 69.4 | 70.9 |

| Price per unit for domestic sales | 71.2 | 71.10 | 70.9 |

| Price charged in Dubai | 71.9 | 70.6 | 70.6 |

(A) Which of the three exporters are engaged in anti-competitive act in the international market while pricing its export of mobile phones to Dubai?

(B) What would be the effect of such pricing on domestic producers of mobile phones? (Jan 2021, 3 marks)

Question 26.

Describe and classify non tariff measures.

Answer:

Non -Tariff Measures:

Non-tariff barriers to trade or “Non-Tariff Measures (NTMs)” are trade barriers that restrict imports or exports of goods or services through mechanisms other than the simple imposition of tariffs. A Non-Tariff Barrier is any obstacle to international trade that is not an import or export duty. They may take the form of import quotas, subsidies, customs delays, technical barriers, or other systems preventing or impeding trade.

According to the World Trade Organisation, non-tariff barriers to trade Include import licensing, rules for valuation of goods at customs, pro-shipment inspections, rules of origin (‘made in’), and trade-prepared investment measures.

classification:

Sanitary and Phytosanitary Measures:

- Measures that are applied to protect human or animal lite from risks arising from: additives, contaminants, toxins or disease-causing organisms in food.

- Geographical restrictions on eligibility: Imports of dairy products from countries.

Technical Barriers to Trade:

- Measures referring to technical regulations, and procedures for assessment of conformity with technical regulations and standards.

- Labelling requirements: Refrigerators need to carry a label indicating their size, weight and electricity consumption level.

Contingent Trade-protective Measures:

Measures implemented to counteract particular adverse effects of imports in the market of the importing country contingent upon the fulfilment of certain procedural and substantive requirements.

Anti-dumping duty: An anti-dumping duty of between 8.5 per cent and 36 per cent has been imposed on imports of bio-diesel products from country A.

Question 27.

Defi ne Tariff. Why is it imposed?

Answer:

Tariff:

A tariff is a tax imposed by a governing authority on goods or services entering or leaving the country and is typically focused on a specified industry or product. It is meant to atter the balance of trade between the tariff-imposing country and its international trading partners.

For example, when a government imposes an import tariff, it adds to the cost of importing the specified goods or services. The additional marginal cost added by the tariff discourages imports, thus affecting the balance of trade.

Why are tariffs Imposed?

There are various reasons a government may choose to impose a tariff. The most common examples of rationale used to justify tariffs are protection for nascent industries, national defence purposes, supporting domestic employment, combating aggressive trade policies and environmental reasons.

Infant Industries

Tariffs are commonly used to protect an early-stage domestic industry from international competition. The tariff acts as an incubator that, in theory, should allow the domestic industry ample time to develop and grow into a competitive position on an international landscape.

National Defense

If a particular segment of the economy provides critical products with respect to national defence, a government may impose tariffs on international competition to support and secure domestic production in the event of a conflict.

Domestic Employment

It is common for government economic policies to focus on creating an environment where constituents have robust employment opportunities. If a domestic segment or industry is struggling to complete against international competitors, the government may use tariffs to discourage consumption of imports and encourage consumption of domestic goods in hopes of supporting associated job growth. (For related reading, see: Do Cheap Imported Goods Cost Americans Jobs?)

Aggressive Trade Practices

International competitors may employ aggressive trade tactics such as flooding the market in an attempt to gain market share and put domestic producers out of business. Governments may use tariffs to mitigate the effects of foreign entities employing what may be considered unfair tactics.

Environmental Concerns

Governments may use tariffs to diminish consumption of international goods that do not adhere to certain environmental standards.

Question 28.

Distinguish between ‘non-tariff measures’ and ‘non-tariff barriers’.

Answer:

Non-tariff measures are policy measures other than ordinary customs tariffs that can potentially have an economic effect on international trade in goods, changing quantities traded, or prices or both (UNCTAD, 2010). They form a constellation of different types of policies which alter the conditions of international trade. They are more difficult to quantify or compare than tariffs. NTMs can be instituted for a range of public policy reasons and have been negotiated within the General Agreement on Tariffs and Trade and at the World Trade Organization NTMs are allowed under the WTO’s regulations

and are meant to allow governments to pursue legitimate policy goals even if this can lead to increased trade costs. For example, NTMs like sanitary and phytosanitary measures and licensing could be legitimately used by members to ensure consumer health and to protect plant and animal life and environment.

Depending on their scope and design NTMs are categorized as:

(i) Technical Measures: Technical measures refer to product-specific properties such as characteristics of the product, technical specifications and production processes. These measures are intended for ensuring product quality, food safety, environmental protection, national security and protection of animal and plant health.

(ii) Non-technical Measures: Non-technical measures relate to trade requirements; for example; shipping requirements, custom formalities, trade rules, taxation policies, etc.

These are further distinguished as:

a. Hard measures (e.g. Price and quantity control measures),

b. Threat measures (e.g. Anti-dumping and safeguards) and

c. Other measures such as trade-related finance and investment measures. Furthermore, the categorization also distinguishes between:

- Import-related measures which relate to measures imposed by the importing country, and

- Export-related measures which relate to measures imposed by the exporting country itself.

NTMs are not the same as non-tariff barriers (NTBs). NTMs are sometimes used as means to circumvent free-trade rules and favour domestic industries at the expense of foreign competition. In this case, they are called non-tariff barriers (NTBs). NTBs are a subset of NTMs that have a ‘protectionist or discriminatory intent’ and implies a negative impact on trade. NTMs only become NTBs when they are more trade-restrictive than necessary. Some examples of NTBs are compulsory standards, often not based on international norms or genuine science; stringent technical regulations requiring alterations in production processes, testing regimes which require complex procedures and product approvals requiring inspection of individual premises.

In addition, to these, there are procedural obstacles (PO) which are practical problems in administration, transportation, delays in testing, certification etc. that may make it difficult for businesses to adhere to a given regulation.

![]()

Question 29.

Describe the objectives of World Trade Organization (WTO). (May 2018, 3 marks)

Answer:

The objectives of World Trade Organization (WTO) include

- Raising standards of living,

- Ensuring full employment and a large and steadily growing volume of real income and effective demand.

- Expanding the production of and trade in goods and services.

- The principal objective of the WTO is to facilitate the flow of international trade, smoothly, freely, fairly and predictably.

Question 30.

Examine why General Agreement in Tariff & Trade (GATT) lost its relevance. (May 2018, 2 marks)

Answer:

General Agreement in Tariff and Trade (GATT) lost its relevance because,

- It was obsolete to the fast-evolving contemporary complex world trade scenario characterized by emerging globalisation.

- International investments had expanded substantially.

- Intellectual property rights and trade-in services were not covered by GATT.

- World merchandise trade increased by leaps and bounds and was beyond its scope.

- The ambiguities in the multilateral system could be heavily exploited.

- Efforts at liberalizing agricultural trade were not successful.

- There were inadequacies in institutional structure and dispute settlement system.

- It was not a treaty and therefore terms of GATT were binding only insofar as they are not incoherent with a nation’s domestic rules.

Question 31.

“World Trade Organisation (WTO) has a three-tier system of decision making.” Explain. (Nov 2018, 2 marks)

Answer:

The WTO has a three-tier system of decision-making as follows:

1. The WTO’s top-level decision-making body is the Ministerial conference which can take decisions on all matters under any of the multilateral trade agreements. The ministerial conference meets at least once every two years.

2. The next levels general council which meets several times a year at the Geneva headquarters. The General Council also meets as the Trade Policy Review Body and the Dispute Settlement Body.

3. At the next level, the Goods Council, Services Council and Intellectual Property (TRIPS) Council report to the General Council.

Question 32.

How does the WTO agreement ensure market access? (Nov 2019, 2 marks)

Answer:

The WTO aims to increase world trade by enhancing market access by converting all non-tariff barriers into tariffs which are subject to country-specific limits. Further, in major multilateral agreements like the Agreement on Agriculture (AOA). Specific targets have been specified for ensuring market access.

Question 33.

Discuss the guiding principle of WTO in relation to trade without discrimination. (Nov 2020, 2 marks)

Question 34.

Define ‘dumping’?

Answer:

Dumping

Dumping occurs when manufacturers sell goods in a foreign country below the sales prices in their domestic market or below their full average cost of the product. Dumping maybe persistent, seasonal, or cyclical. Dumping may also be resorted to as a predatory pricing practice to drive out established domestic producers troth the market and to establish monopoly position.

Dumping is international price discrimination favouring buyers of exports, but in fact, the exporters deliberately forego money in order to harm the domestic producers of the importing country and to gain market share. This is an unfair trade practice and constitutes a threat to domestic producers.

Question 35.

How does the WTO address the special needs of developing and the least developed countries?

Answer:

The WTO addresses the special needs and problems of developing and the least developed countries in the following ways.

- Special and Differential Treatment (S&DT) for these countries is incorporated in the WTO laws and rules.

- Developing and the least developed countries are generally given longer implementation time to conform to their obligations for promotion of freer trade.

- They are also given more flexibility in matters of compliance with the WTO and special privileges and permission to phase out the transition period.

- These countries are granted transition periods to make adjustments to the not-so-familiar and intricate WTO provisions

- Members may violate the principle of MEN to give special market access to developing countries.

Question 36.

What’s meant by free trade area?

Answer:

Free Trade Area

Free trade policy is based on the principle of non-interference by government in foreign trade. The distinction between domestic trade and international trade disappears and goods and services are freely imported from and exported to the rest of the world. Buyers and sellers from separate economies voluntarily trade without the domestic government helping or hindering movements of goods and services between countries by applying tariffs, quotas, subsidies or prohibitions on their goods and services.

The theoretical case for free trade is based on Adam Smith’s argument that the division of labour among countries leads to specialization, greater efficiency, and higher aggregate production.

Question 37.

What are the objectives of the Agreement on Agriculture (AOA)?

Answer:

Objectives of the AOA

The Agreement on Agriculture (AoA) is an international treaty of the World Trade Organization negotiated during the Uruguay Round. It contains provisions in three broad areas of agriculture and trade policy: market access, domestic support and export subsidies.

The Agreement aims to:

1. establish fair and market-oriented agricultural trading system, and

2. provide for substantial and progressive reduction in agricultural support and export subsidies with a view to removing distortion in the world market. These are to be achieved through enhancement of market access, reduction of domestic support and elimination of export subsidies.

Question 38.

List the point of difference between fixed exchange rate and floating exchange rate. (May 2018, 2 marks)

Answer:

Difference between Fixed and Floating Exchange Rates Is Concerned.

1. The exchaige rate which the government sets and maintains at the same level is called fixed exchange rate. The exchange rate that variates with the variation in market forces is called floating exchange rate.

2. The fixed exchange rate is determined by government or the central bank of the country. On the other hand, the floating exchange rate is fixed by demand and supply forces.

3. In fixed exchange rate regime, a reduction in the par value of the currency is termed as devaluation and a rise as the revaluation. On the other hand, in the flexible exchange rate system, the decrease in currency price is regarded as depreciation and increase as appreciation.

4. Speculation is common in the floating exchange rate. Conversely, in the case of fixed exchange rate speculation takes place when there is a rumour about change in government policy.

5. In fixed exchange rate, the self-adjusting mechanism operates through variations in the supply of money, domestic interest rate and price. As opposed to the floating exchange rate that operates to remove external instability by the change in forex rate.

Question 39.

Explain ‘depreciation’ and ‘appreciation’ of home currency under floating exchange rate. (May 2019, 2 marks)

Answer:

Under flexible exchange system, the exchange value of currency frequently appreciates or depreciates depending upon the change in the demand for and supply of currency.

Depreciation of a currency is tall in value of domestic currency in terms of foreign currency. Thus, currency depreciation takes place when there is an increase in the domestic currency price of the foreign currency. For instance, if the value of rupee in terms of US dollar fails, say from ₹ 50 to ₹ 51 to a dollar, it will be a case of depreciation of Indian rupee because more rupees are required now to buy one US dollar. In short, higher exchange rate like $1 = ₹ 51 instead of ₹ 50 means depreciation of Indian currency.

Appreciation vs. Depreciation of currency

Appreciation of a currency is the increase in its value in terms of another foreign currency. Thus, currency appreciation takes place when there is a decrease in the domestic currency price of foreign currency. For Instance, if the value of a rupee in terms of US dollar increases, say from ₹ 50 to ₹ 49 to a dollar, it will be called appreciation of Indian currency (i.e., rupee) because less rupees are required to buy one US dollar. This shows strengthening of the Indian rupee. By contrast when Indian rupee in dollar terms appreciates, the dollar would depreciate. In short lower exchange rate like $1 = ₹ 49

instead of ₹ 50 means appreciation of Indian currency.

Question 40.

Using suitable diagram, explain, how the nominal exchange rate between two countries is determined? (May 2019, 3 marks)

Answer:

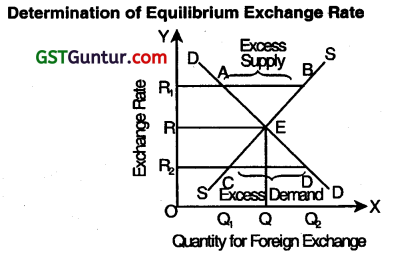

Determination of Exchange Rate

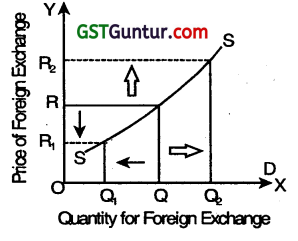

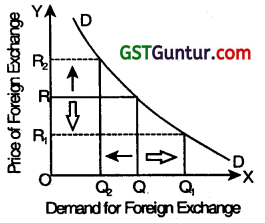

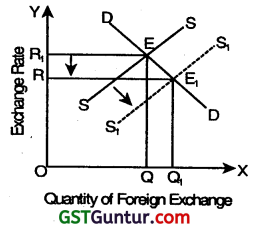

Flexible Exchange Rate is determined by market forces of Demand for and Supply of Foreign Currency change in flexible exchange rate occur on account of change in market demand and supply.

Demand for Foreign Exchange –

Demand for foreign exchange arises mainly due to import of goods, investing in foreign countries and giving loans to other nations. Demand for foreign exchange signifies the functional relationship between exchange rate and demanded quantity of foreign exchange. There is an inverse relationship between price of foreign exchange (i.e., rate of exchange) and demand for foreign exchange, e.g., more foreign exchange is demanded at lower exchange rate and Wee-versa. That is why demand curve for foreign exchange slopes downward from left to right.

Supply of Foreign Exchange

Supply of foreign exchange represents the functional relationship between foreign exchange rate and supply of foreign exchange. There is a direct positive relationship between foreign exchange rate and supply of foreign exchange, e.g., with rise of foreign exchange rate, supply of foreign exchange increases and vice-versa.

Equilibrium exchange rate is determined at the point where demand and supply curves of foreign exchange (DO and SS respectively) cut each other. In Figure, equilibrium exchange rate is determined at the point E, where both demand and supply of foreign exchange are equal to OQ. Thus, OR is the equilibrium market rate of exchange where the demand for and supply of foreign exchange are equal.

![]()

Question 41.

Explain the term ‘real exchange rate’. (Nov 2019, 2 marks)

Answer:

The ‘real exchange rate’ incorporates changes in prices and describes how many’ of a good or service in one country can be traded for ‘one’ of that good or service in a foreign country.

Real exchange rate = Nominal exchange rate × \(\frac{\text { Domestic Price Index }}{\text { Foreign Price index }}\)

Question 42.

Explain the concept of soft peg and hard peg exchange rate policies. (Nov 2020, 2 marks)

Question 43.

Distinguish between ‘direct quote’ and ‘indirect quote’ with reference to express nominal exchange rate between two currencies. (Jan 2021, 2 marks)

Question 44.

Describe the advantages of Floating Exchange Rate. (Jan 2021, 3 marks)

Question 45.

The Nominal Exchange rate of India is ₹ 56/1 $, Price Index in India is 116 and Price Index in USA is 112. What will be the Real Exchange Rate of India? (Nov 2018, 2 marks)

Answer:

Real Exchange Rate = Nominal exchange rate × \(\frac{\text { Domestic Price Index }}{\text { Foreign Price index }}\)

= ₹ 56 × \(\frac{116}{112}\)

Real Exchange Rate = ₹ 58

Question 46.

Following exchange rate quotations are available for different periods:

(1) The spot exchange rate changes from ₹ 65 por $ to ₹ 68 per $.

(2) The spot exchange rate changes from $ 0.0125 per rupee to $0.01 625 per rupee.

Please Answer the following –

(A) Identify the nature of rate quotations in (1) and (2) above.

(B) Identify the base currency and counter currency in (1) and (2) above.

(C) What are possible consequences on exports and imports of (1) and (2) above. (Nov 2020, 3 marks)

Question 47.

Explain the nature of changes in exchange rates and their impact on real economy

Answer:

Changes In exchange rate takes place in form of:

- Appreciation of Domestic Currency

- Depreciation of Domestic Currency

Appreciation of Domestic Currency

When the value of domestic currency increases in terms of foreign currency, it is appreciation of domestic currency.

In other words, when there is decrease in the exchange rate of foreign currency (say dollar) in terms of domestic currency (say rupee), it is appreciation of domestic currency (say rupee).

Effects of Appreciation of Domestic Currency

In the situation of appreciation of domestic currency, the imports for domestic country become cheaper, hence, it may lead to increase in imports. On the other hand, exports from domestic country become dearer for foreign country, hence, it may lead to decrease in exports. As a result, it may create the situation of trade deficit in the domestic country.

Depreciation of Domestic Currency

When the value of domestic currency decreases in terms of foreign currency, it is depreciation of domestic currency.

In other words, when there ¡s an increase in the exchange rate of foreign currency (say dollar) in terms of domestic currency (say rupee), it is depreciation of domestic currency (say rupee).

Effects of Depreciation of Domestic Currency

In the situation of depreciation of domestic currency, the imports for domestic country become dearer, hence, it may lead to decrease in imports. On the other hand, exports from domestic country become cheaper for foreign country, hence, it may lead to increase In exports. As a result, it may create the situation of trade surplus in the domestic country.

Question 48.

Explain the effect of currency devaluation? Do you think a weak currency is advantageous to a country?

Answer:

Devaluation is a deliberate downward adjustment in the value of a country’s currency relative to another currency, group of currencies or standard, It is a policy tool used by countries that have a fixed exchange rate or nearly fixed exchange rate regime and involves a discrete official reduction in the otherwise fixed par value of a currency. The ‘monetary authority formally sets a new fixed rate with respect to a foreign reference currency or currency basket.

Devaluation is primarily an expenditure-switching policy. Ceteris paribus, the weakening of currency can have positive effects on an economy’s trade balance. Devaluation increases the price of foreign goods relative to goods produced in the home country and diverts spending from foreign goods to domestic goods. Devaluation implies that foreigners pay less for the devalued currency and that the residents of the devaluing country pay more for foreign currencies. By lowering export prices, devaluation helps increase the international competitiveness of domestic industries and increases the volume of exports.

Devaluation lowers the relative price of a country’s exports, raises the relative price of its imports, increases demand both for domestic import-competing goods and for exports, leads to output expansion, encourages economic activity, increases the international competitiveness of domestic industries, increases the volume of exports and promotes trade balance.

Question 49.

Write short note on Alternative Systems of Exchange Rate.

Answer:

Alternative Systems of Exchange Rate

1. Wider Bands

Wider Bands is a system that allows wider adjustment in the fixed exchange rate system. It allows adjustment upto 10 per cent around the ‘parity’ between any two currencies in the international money market.

Example: If one US dollar is fixed as equal to fifty Indian rupees, 10 per cent revision (upward or downward) is to be allowed in this exchange rate of 1: 50. Exchange rate may be revised as

1 :50 + 10% = 1 :55

Or

1: 50- 10% = 1:45

This is to help the member countries to correct their B0P (balance of payments) status. In the event of deficit BoP, India, for example, may depreciate its currency (upto 10 per cent). So that, purchasing power of other currencies in India increases by 10 percent (from 50 to 55 rupees a dollar). This is expected to increase demand for India’s products. Export earnings are expected to rise. Accordingly, BoP status is expected to improve.

2. Crawling Peg

Crawling Peg allows ‘small’ but regular adjustments in the exchange rate for different currencies. Not more than (±) 1 per cent adjustment is allowed at a time. Indeed it is a small adjustment. But it can crawl: it can be repeated at regular intervals.

Question 50.

Write short note on Effective Exchange Rate.

Answer:

Effective Exchange Rate

Effective Exchange Rate (EER) is a measure of strength of one currency in relation to other currencies in the international money market. EER in India would mean how strong is Indian rupee (on an average) in relation to currencies of our trading partners in the international market.

EER is of two types:

- NEER (Nominal Effective Exchange Rate), and

- REER (Real Effective Exchange Rate).

1. Nominal Effective Exchange Rate (NEER): It is that type of EER which does not account for changes in the price level while measuring average strength of one currency in relation to the others. It is estimated as under:

NEER = \(\sum_{i=1}^n\left(R^i \text { index }\right)\left(W_i\right) \)

Here,

NEER = Nominal effective exchange rate.

Σ = Sum total of all values.

i = Ah trading partner (say for India).

R’ = Exchange rate with the Ah partner. It refers to ₹‘:

£ for India-UK and ₹ : $ for India-USA.

R’ index = Index of exchange rate with Ah partner with reference to exchange rate ¡n the base year.

Wi = Rate of trade volume with Ah trading partner to India’s total trade.

n = Number of trading partners.

2. Real Effective Exchange Rate (REER): It is that type of Effective Exchange Rate which accounts for changes in the price level across different countries of the world. It is based on constant prices or real

exchange ra1e and is estimated as under:

PEER = \(\sum_{i=1}^n\left(R E R^i \text { index }\right)\left(W_i\right)\)

Note the difference between NEER and REER:

In NEER we have R index.

In REER we have RER index.

R index refers to index of ‘simple’ exchange rate between (say)

India and its the trading partner.

RER index refers to index of ‘real’ exchange rate between India and its the trading partner.

Real Exchange Rate (RER): It accounts for the change in price level in different countries, It is an exchange rate that is based upon constant prices.

![]()

Question 51.

Write short note on Purchasing Power Parity.

Answer:

Purchasing Power Parity (PPP):

One of the measure of spot rate of exchange is Purchasing Power Parity (PPP). Purchasing power parity refers to the ratio of purchasing power of the currencies of trading partners. It simply implies the ratio of price levels in different countries. Thus, exchange rate between the two countries is simply equal to the ratio of the price levels in the two countries. Symbolically,

R = \(\frac{P_A}{P_B}\)

Here, R = Rate of exchange.

PA = Price level in country ‘A’.

PB = Price level in country ‘B’.

For example, if the price level of one kilogram apples in India is 50 rupees and in USA is 1 dollar then the purchasing power of 50 rupees is equal to the purchasing power of 1 dollar. The exchange rate will be: ₹ 50=$ 1

Some economists believe that exchange rate between two countries in the long run tends to be equal to PPP between the countries.

Absolute Purchasing Power Parity and Relative Purchasing Power Parity

Absolute purchasing power parity simply refers to the ratio between the price levels in the two countries. It does not account for the rate of inflation in the countries. Relative purchasing power parity, on the other hand, is that ratio between the price levels of the two countries which accounts for the difference in the rate of inflation in the two countries.

Question 52.

Write short note on merits and demerits of Flexible Exchange Rate.

Answer:

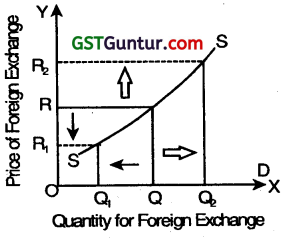

Merits of Flexible Exchange System:

1. Simple system: It is a simple system in its operation where exchange rate is determined at a point where the demand and supply forces of exchange rate become equal. Hence, it does not need any outside intervention.

2. Continuous adjustments: There is always a possibility of adjustment in flexible exchange rate and hence, adverse effects of long-term disequilibrium can be avoided.

3. Improvement In BOP: Adjustments in balance of payments in flexible exchange rate are smoother as compared with the fixed exchange rate adjustments.

4. Optimum use of resources: Flexible exchange rate ensures optimum use of resources which consequently increases the level of efficiency in the economy.

Demerits of Flexible Exchange Rate:

The main demerits of flexible exchange rate are as follows:

1. Bad effects of less elasticity: Less elasticity in exchange rate makes foreign exchange market unstable and consequently BOP situation becomes worse as a result of depreciation in scarce money.

2. Uncertainty: A flexible exchange rate generates uncertainty and frequent changes in exchange rate discourages international trade and capital movements.

3. Instability in International trade: Instability in international money market generates instability In international trade. Consequently, formulation of long-run policies related to import and export becomes difficult.

![]()

Question 53.

Write short note on arguments against and in favour of Fixed Exchange Rate.

Answer:

Arguments against Fixed Exchange Rate

1. Ignores national interest: Fixed exchange rate ignores national interests for gaining international benefits because national elements like national income, price level and other national interests are placed at secondary level for maintaining fixed exchange rate with other countries.

2. Controls in various sectors: For maintaining fixed exchange rate various types of controls have to be applied on industrial sector, banking section and foreign trade. These controls lead to corruption and immoral activities in the economy.

Arguments In favour of Fixed Exchange Rate

1. Increase In international trade: When all the nations adopt fixed exchange rate, international trade increased because this type of exchange rate contains an element of certainty.

2. Incentives to foreign capital: This exchange rate ensures a regular flow of long-term foreign capital as there is no fear of currency appreciation or depreciation.

3. Acceleration in capital formation: Fixed exchange rate ensures internal price stability which promotes capital formation.

4. Economic Planning Possible: In fixed exchange rate expenditures on public projects do not variate which makes economic planning possible and easy.

5. Helps in maintaining favourable BOP: Fixed exchange rates attract foreign capital which ensures more industriation, employment generation and more production. All these results in favourable balance of payments.

Question 54.

Differentiate between Spot Market and Forward Market in foreign exchange.

Answer:

Foreign exchange markets are sometimes classified in two categories spot market and forward market on the basis of the period of transaction carried out.

It is explained below:

Spot Market

Spot market for foreign exchange is that market which handles only spot transactions or current transactions. Such market does not deal with future transactions and it contains the nature of daily market. It is also called ‘Effective Exchange Rate’.

In terms of ‘period of transactions’, spot market is of ‘daily nature It does not trade in future deliveries. The rate of exchange which is determined in the spot market is known as spot rate of exchange. The spot rate of exchange or current rate of exchange is that rate which happens to prevail at the time when transactions are incurred.

Forward Market

Forward market for foreign exchange is that market which handles such transactions of foreign exchange as are meant future delivery. Such transactions are signed today but are to materialise (or are to be honoured) on some future date.

In this market, foreign exchange is made available in future. So forward exchange rate is that one at which transactions are made on some future date.

It only caters to forward transactions; ¡t does not deal with spot transactions in foreign exchange.

It defines (or determines) forward exchange rate-the exchange rate at which forward transactions are to be honoured.

Question 55.

What is the difference between Appreciation of Currency and Revaluation of Currency?

Answer:

Appreciation vs. Revaluation

When a country raises the value of its currency in terms of foreign currency under a fixed rate regime, it is called revaluation. The effect of revaluation is the same as that of appreciation. Although both appreciation and revaluation convey the same thing, i.e., a rise in the value of domestic currency in terms of foreign currency but they take place in different regimes. Revaluation takes place by government order in Fixed Exchange Rate regime whereas appreciation occurs in Flexible Exchange Rate regime in a free exchange market depending upon forces of demand and supply of currency.

Question 56.

What is the difference between Depreciation of Currency and Devaluation of Currency?

Answer:

Depreciation vs. Devaluation

Devaluation means decrease in price of domestic currency with respect to gold or any other currency by the government. When a country brings down the value of its currency in terms of foreign currency by a government order, it is called devaluation. The effect of depreciation is the same as that of devaluation. Although both depreciation and devaluation mean the same thing, i.e., a tall in the value of domestic currency in terms of foreign currency yet the notable difference between the two is that devaluation takes place in Fixed Exchange Rate regime whereas depreciation occurs in Flexible Exchange Rate regime in a free exchange market.

Question 57.

Give the difference between Nominal Exchange Rate and Real Exchange Rate.

Answer:

Nominal Exchange Rate: Ills price of foreign currency in terms of domestic currency. When cost (price) of purchasing one unit of foreign currency (say, dollar) is quoted in terms of domestic currency (say, rupees), it is called nominal exchange rate because exchange rate es quoted ¡n money terms i.e. so many rupees per dollar. For instance, if 1 American dollar can be obtained (exchanged) for 50 Indian rupees i.e. if it cost rupees 50 to buy 1 dollar, it will be called nominal exchange rate. Generally exchange rate is expressed in the form of nominal exchange rate, i.e. so many units of home currency are to be paid to get one unit of foreign currency.

Real Exchange Rate: It is relative price of foreign goods in terms of domestic goods. When õost of purchasing one unit of domestic currency (say, rupees) is quoted in terms of foreign currency (say, dollar), it is called real exchange rate. For instance in the above case it costs 2 cents (1 dollar = 100 cents) to buy 1 rupee. People who plan to visit America need to know how expensive American goods are relative to goods at home. Real exchange rate is equal to Nominal exchange rate multiplied, by foreign price level and divided by domestic price level.

Symbolically:

Real exchange rate = \(\frac{\text { Nominal exchange rate } \times \text { Foreign price level }}{\text { Domestic price level }} \)

Question 58.