Marginal Costing – CA Inter Costing Question Bank is designed strictly as per the latest syllabus and exam pattern.

Marginal Costing – CA Inter Costing Question Bank

Question 1.

Indicate any five circumstances under which you will permit to fix a price, which is less than the marginal cost of the product. (May 1998, 4 marks)

Answer:

Circumstances under which a firm may fix a price less than the marginal cost of the product are as under:

- When goods are of perishable nature.

- When the concern had already purchased huge quantities of raw materials and the prices of these materials is falling considerably in the market.

- When competitors are to be eliminated from the market.

- When a new product is to be introduced in the market.

- To obviate shut-down costs.

Question 2.

Highlight the basic differences between Differential costing and Marginal Costing. (Nov 2000, 4 marks)

Answer:

Difference between Differential Costing and Marginal Costing:

The basic differences between differential costing and marginal costing are as below:

1. Differential cost analysis is possible in both absorption costing and marginal costing.

2. The technique of marginal costing requires a clear distinction between variable costs and fixed costs whereas no such distinction is made in the case of differential costing. In differential costing al total relevant costs irrespective of the fact whether they are fixed or variable are considered whereas in the case of marginal costing only variable costs are taken into account.

3. Marginal costs maý be incorporated in the accounting system whereas differential costs are worked out separately as analysis statements.

4. In marginal costing margin of contribution and contribution ratio are the main yardsticks for performance evaluation and for decision making. In differential costs analysis, differential costs are compared with the incremental or decremental revenues as the case may be, and then arrive at a decision.

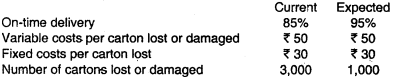

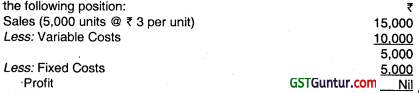

![]()

Question 3.

State three applications of direct costing. (May 2001, 3 marks)

Answer:

Three applications of direct costing are as follows:

- Stock valuation

- Minimum quantity to be produced to recover pattern or mould cost.

- Close down decision – like closing down of a department or shop.

Question 4.

Differentiate between MarginaI and Absorption Costing. (Nov 2020, 5 marks)

Question 5.

Distinguish between absorption costing and marginal costing. (Nov 2003, 4 marks)

Answer:

Difference between Absorption Costing and Marginal Costing

| Basis | Absorption Costing | Marginal Costing |

| 1. Calculation of Manufacturing Overhead rates | In this, absorption rate includes, both fixed and variable manufacturing overheads. | Marginal costing rate includes only variable manufacturing overhead. |

| 2. Valuation of Inventory | In Absorption costing, valuation is on Product cost i.e. Prime cost + applied fixed and variable manufacturing overheads. | Marginal costing will be at Prime cost + applied variable manufacturing overhead. |

| 3. Classification of Overhead | In Absorption costing, the overhead ‘ may be classified as factory, administrative, selling and distribution. | In marginal costing, overheads are classified as variable and fixed. |

| 4. Operating Profit | Under absorption costing Gross Profit = Net Sales – Manufacturing costs = Prime cost + Fixed and variable manufacturing overhead. | In Marginal costing, Marginal income or contribution = net sales – variable manufacturing cost of goods sold – variable administrative, selling and distribution overhead. |

| 5. Net Operating Profit | Under absorption costing, net operating profit = Gross profit – administrative selling and distribution overheads (Fixed and variable combined). | Under Marginal costing, Net Operating Profit = Marginal income or contribution Fixed manufacturing overhead – fixed administrative overhead – fixed selling and distribution overhead. |

| 6. Effect of Stock Valuation | The difference in the magnitude of opening and closing stock affects the unit cost of production due to the impact of the related fixed cost. | The difference in the magnitude of opening and closing stock does not affect the unit cost of production. |

| 7. Decision Making | It distorts decision making | It aids decision making. |

| 8. Profitability | Fixed costs are charged to the cost of production. Each product bears reasonable share of fixed costs’ and thus the profitability of a product is influenced by an apportionment of fixed asset. | Fixed costs are regarded as period costs. The profitability of different products are judged by their P/V. ratio. |

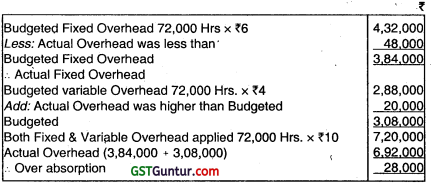

Question 6.

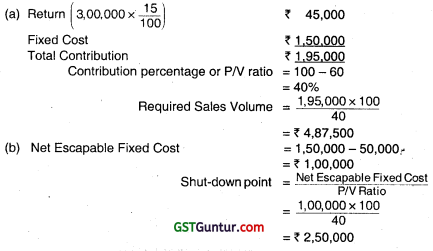

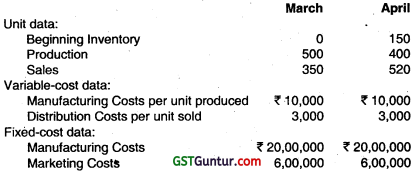

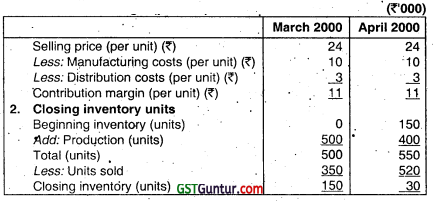

ABC Motors assembles and sells motor, vehicles. It uses an actual costing system, in which unit costs are calculated on a monthly basis. Data relating to March and April, 2000 are:

The selling price per motor vehicle is ₹ 24,000.

Required:

(i) Present income statements for ABC Motors in March and April of 2000 under (α) variable costing, and (β) absorption costing.

(ii) Explain the differences between (α) and (β) for March and April. (May 2000, 6 marks)

Answer:

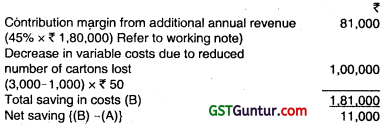

Income statement for ABC Motors

(Under Variable Coaling)

Working Notes:

1. Contribution margin (per unit)

(ii) Difference between operating income under variable costing and absorption costing is due to fixed cost. Under absorption costing the closing inventory has the component of fixed cost, due to which its profit increases under it.

March 2000: (₹ 000)

₹ 1,850 – ₹ 1,250 = ₹ 600 – ₹ 0

April 2000: (₹ 000)

₹ 2,670 – ₹ 3,120 = ₹ 150 – ₹ 600.

![]()

Question 7.

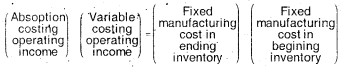

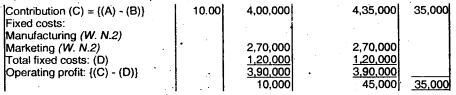

Jolly Fabrics manufactures quality napkins at its unit in Tirupur. The unit has a capacity of 60,000 napkins per month. Present monthly pròduction for April is 40,000 napkins. Costs incurred for production are as below:

The marketing costs per unit is ₹ 7(₹ is variable). Marketing costs include distribution costs and customer service costs. Present selling price is ₹ 22.50 per unit.

Due to a strike at its existing napkin supplier, a hotel group has offered to buy 10,000 napkins from Jolly Fabrics @ ₹ 11 per napkin for the month of June. No further sales to the hotel are anticipated. Fixed manufacturing

costs and marketing costs are tied to the 60,000 napkins. The acceptance of the special order is not expected to affect the selling price to regular customers.

No marketing costs involved in special order. Prepare:

(i) Budgeted income statement for June.

(ii) Actual income statement under absorption costing for April.

(iii) Should Jolly Fabrics accept the special order from the hotel or not? (Nov 2003, 16 marks)

Answer:

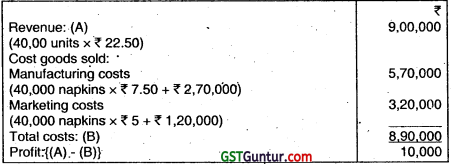

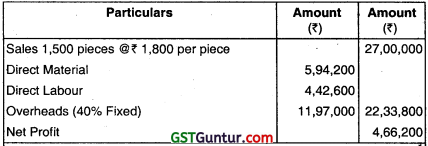

(i) Budgeted Income Statement for June of M/s. Jolly Fabrics

(ii) Actual Income Statement for April 200X (Under absorption costing)

(iii) Decision of M/s. Jolly about the acceptance of special Order of 10,000 napkins from the hotel:

M/s. Jolly Fabrics would earn an additional operating profit of ₹ 35,000 on accepting the special order. Hence this order must be accepted (Refer to (i) part of the answer).

Working Notes:

1. Variable and fixed cost components of manufacturing cost per unit:

2. Total fixed cost(tied up with 60,000 napkins)

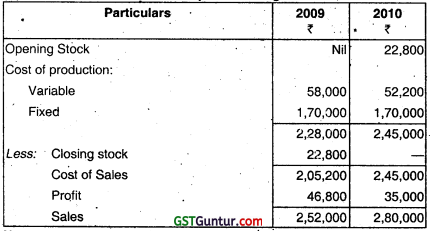

Question 8.

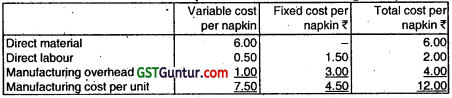

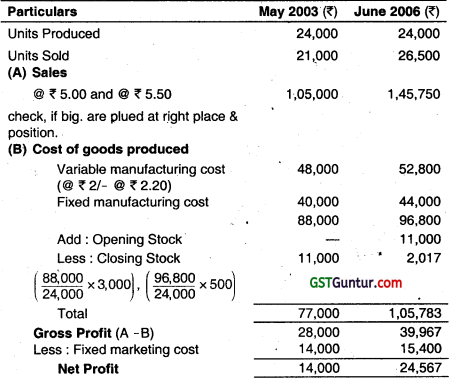

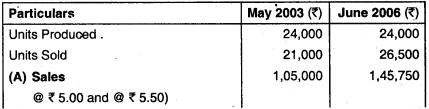

Jay Kay Limited is a single product manufacturing company. The following information relates to the months of May and June 2003:

(iii) There was no Stock of finished goods at the beginning of May 2003. There was no wastage or loss of finished goods during May or June 2003.

(iv) Actual costs incurred corresponded to those budgeted for each month. You are required to calculate the relative effects on the monthly operating profits of applying:

(a) Absorption costing and

(b) Marginal costing. (May 2006, 11 marks)

Answer:

Statement of cost under Absorption Costing Method

Statement of cost under Marginal Costing Method

Question 9.

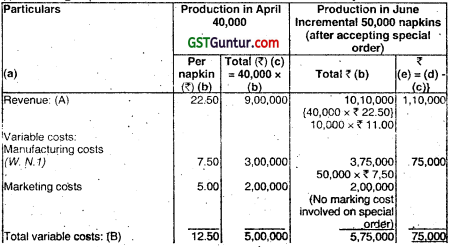

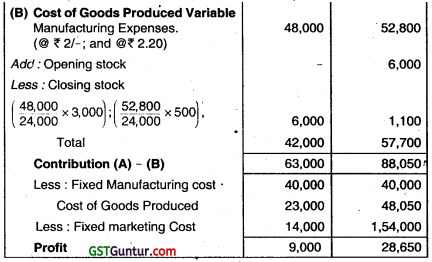

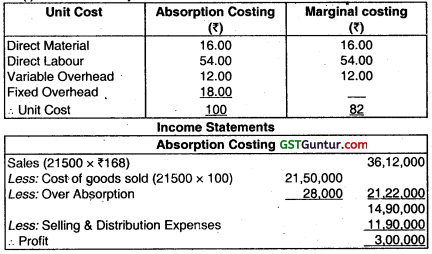

Mega Company has just completed its first year of operations. The unit costs on a normal costing basis are as under:

Selling and administrative costs:

Variable : ₹ 20 per unit

Fixed : ₹ 7,60,000

During the year the company has the following activity:

Units produced = 24,000

Units sold = 21,500

Unit selling price = 168

Direct labour hours worked = 72,000

Actual fixed overhead was ₹ 48,000 less than the budgeted fixed overhead. Budgeted variable overhead was ₹ 20,000 less than the actual variable overhead. The company used an expected actual activity level of 72,000 direct labour hours to compute the predetermine overhead rates.

Required:

(i) Compute the unit cost and total income under:

(a) Absorption costing

(b) Marginal costing.

(ii) Under or over absorption of overhead.

(iii) Reconcile the difference between the total income under absorption and marginal costing. (Nov 2009, 15 marks)

Answer:

(i) Computation of Unit and Total Income ‘

(ii) Under of over Absorption of overhead

(iii) Reconciliation of Profit

Difference in Profit: ₹ 3,00,000 – 2,55,000 = ₹ 45,000

Due to Fixed Factory Overhead being included in Closing Stock in Absorption Costing not in Marginal Costing.

Theréfore,

Difference in Profit = Fixed Overhead Rate (Production – Sale)

18 (24,000 – 21,500) = ₹ 45,000.

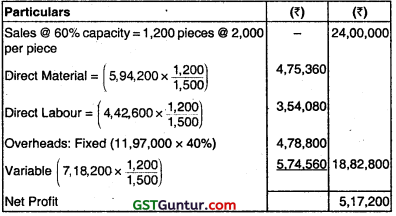

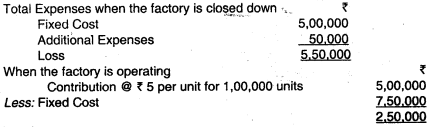

![]()

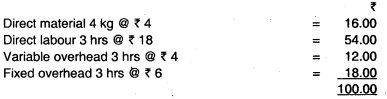

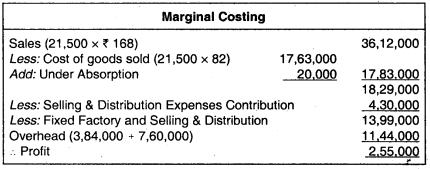

Question 10.

The following costs data relate to a factory run by M/s Rogen Bros.:

Work out profit under absorption costing and marginal costing for two year ₹ Assume FIFO bases for valuation of stocks.

Answer:

Note:

Closing stock has been valued @ ₹ 2.90 + \(\frac{1,70,000}{20,000}\) = 2.90 + 8.50 = ₹ 11.40 per unit.

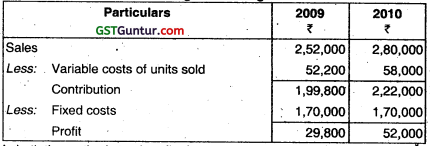

(B) Profit Determination – Marginal Costing:

In both the methods total profit of two years is ₹ 81,000. However, margiral costing shows profit of ₹ 29,800 in 2009 and ₹ 52,000 in 2010; whereas absorption costing shows profit of ₹ 46,800 in 2009 and ₹ 35,000 in 2010. The sales in 2010 is more in comparison to sales in 2009. Hence profit during 2010 is greater in comparison to 2009 under marginal costing but under absorption costing it is reverse. The reason is that under absorption costing more weightage is given to production than sales.

Question 11.

Enumerate the limitations of using the marginal costing technique. (May 2001, 5 marks)

Answer:

1. Marginal costing technique is not useful for valuaion of inventory.

2 Marginal costing cannot be successfully applied in cost plus contract unless a proper percentage over marginal cost is charged to cover the fixed cost and profit.

3. Marginal costing technique excludes fixed cost for decision making which some times leads to wrong conclusion. It may create difficulty in inter-firm comparison, higher demand of salaries, large tax payment etc.

4. Marginal costing assumes that all costs can be classified into fixed and variable. But it is not so, as there are costs which are neither fixed or variable. For example, various amenities provided to workers may have no relation either to volume of production or time factor.

5. Contribution of a product itself is not a guide for optimum profitability unless it is linked with the key factor.

6. Marginal Costing ignores time factor and investment. For example, the marginal cost of two jobs may be the same but the time taken for their completion and the cost of machines used may differ. The true cost of a job which takes longer time and uses costlier machine would be higher. This factor is not disclosed by marginal costing.

7. The overheads of fixed nature cannot altogether be excluded particularly in large contracts while valuing work-in-progress. In order to show the correct position, fixed overheads have to be included in work-inprogress.

8. In the long run, the selling prices should be based on total cost, i,e, inclusive of fixed cost also. In the short run or in special, situations when a product is sold below the total cost, customers may insist on the continuation of reduced prices forever which may not be possible in all cases. Further, sales staff may mistake marginal cost for total cost and sell at a price which will result in loss or low profit. Hence, sales staff should be cautioned while giving marginal cost.

9. The main assumptions regarding behaviour of costs are not true. The variable costs do not remain constant per unit of output. There may be changes in the prices of raw materials, wage rates, etc., after a certain level of output has been reached due to shortage of material, shortage of skilled labour, concessions of bulk purchases, etc. Similarly, the fixed costs does not remain static. They may change from one period to another. For example, salary bill may go up because of annual increments or due to change in pay rate etc.

Question 12.

what is contribution? How is it related to profit? (May 1998, 2 marks)

Answer.

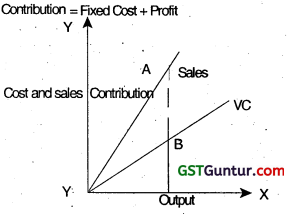

The excess of selling price over variable costs is known as contribution.

Contribution = Sales – Variable Cost.

Or

Contribution is also known as the gross margin. It indicates the amount of sales revenue which is available to cover fixed costs and profits. Once fixed costs have been fully received by the contribution, every rupee of additional sale is a net addition to profits. Entire marginal costing is based on this concept.

Contribution helps the management in solving the following problems:

- Fixation of selling price.

- Pricing in depression.

- Accepting a special offer from a new market.

- Level of activity planning.

- Evaluation of profitability of various products, departments etc.

- Selection of an optimum sales mix.

- Alternative methods of production.

- Operate or shut down decisions.

![]()

Question 13.

Explain, how Cost Volume Profit (CVP)-based sensitivity analysis can help managers cope with uncertainty. (Nov 2000, 4 marks)

Answer:

Sensitivity analysis focuses on how a result will be changed if the original estimates of the following assumptions has changed.

Cost Volume Profit (CVP)-based sensitivity analysis can help managers to provide answers to the following questions to cope up with uncertainty.

- What will be the profit if the sales mix changes from that originally predicted?

- What will be the profit if fixed costs increase by 10% and variable cost decline by 5%?

The use of spread sheet packages has enabled managers to develop CVP computerised models which can answer the above questions.

Managers can now consider alternative plans by keying the information into a computer, which can quickly show changes both graphically and numerically.

Therefore, managers can study various combinations of change in selling prices, fixed costs, variable costs and product mix, and can react quickly without waiting for formal reports from the accountant.

In such a way the use of CVP based sensitivity analysis can help managers to cope up with uncertainty.

Question 14.

What is Cost-Volume-profit analysis and what are its objectives. (May 2001, 3 marks)

Answer:

Cost-volume-profit analysis: It is the analysis of three variables, viz., cost, volume and profit, which explores the relationship existing amongst costs, revenue, activity levels and the resulting profit.

Profit, as a variable, is the reflection of a number of internal and external conditions which exert their influence on sales revenue and costs. Revenue depends upon selling prices, costs, volume of sales, demand, competition, etc. Although none of these can be singled out as the most important, the volume is considered to be a dominant factor. This is probably because changes in volume are more frequent, takes place rapidly and are outside the purview of management control. Further costs rarely vary in direct proportion to the volume and hence, a small change in the volume may have a more than proportionate effect on profits than the other factors outlined above. It is thus, the volume which is perhaps the largest single factor which influences costs. As such, an intimate relationship exists amongst costs, volume and profit.

The cost-volume-profit analysis is an extension of marginal costing. It makes use of the principles of marginal costing. It is an important tool of short term planning and is more relevant where the proposed changes in the level of activity are relatively small. It is useful in making short-run decisions.

Objectives of cost-volume-profit analysis : The main objectives of cost- volume-profit analysis are as below :

- It aims at-measuring variations in cost with volume.

- It enables business managers to fulfill the objective of profit planning.

- It facilitates in making short-run tactical decisions such as acceptance of special order, shift working; choice of sales mix etc.

Question 15.

Briefly discuss on curvilinear CVP analysis. (Nov 2001, 4 marks)

Answer:

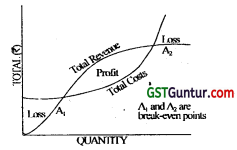

In CVP analysis, the usual assumption is that the total sales line and variable cost line will have linear relationship, that is, these lines will be straight lines. However, in actual practice it is unlikely to have a linear relationship for two reasons, which are:

1. After the saturation point of existing demand, the sales value may show a downward trend.

2. The average unit variable cost decline initially, reflecting the fact that, as output increases the firm will be able to obtain bulk discounts on the purchase of raw materials and can also benefit from division of labour. When the plant is operated at further higher levels of output, due to bottlenecks, and breakdowns, the variable cost per unit will tend to increase. Thus the law of increasing costs may operate and the variable cost per unit may increase after reaching a particular level of output.

In these cases, the contribution will not increase in linear proportion, i.e., based on the phenomenon of diminishing marginal productivity, the total cost line will not be straight as assumed but will be of curvilinear shape.

This situation-will give rise to two break-even points. The optimum profit is earned at the point where the distance between sales and total cost is the greatest.

Question 16.

State the assumptions of cost-volume-profit analysis. (May 2003, 4 marks)

OR

Discuss basic assumptions of Cost Volume Profit analysis. (May 2017, 4 marks)

Answer:

CVP Analysis: Assumptions

- Changes in the levels of revenues and costs arise only because of changes in the number of products (or service) units produced and sold.

- Total cost can be separated into two components: Fixed and variable

- Graphically, the behaviour of total revenues and total cost are linear in relation to output level within a relevant range.

- Selling price, variable cost per unit and total fixed costs are known and constant.

- All revenues and costs can be added, subtracted and compared without taking into account the time value of money.

- Only one product is considered for entire analysis.

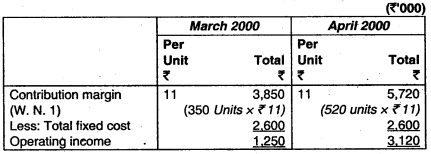

Question 17.

Answer the following :

Product Z has a profit-volume ratio of 28%. Fixed operating costs directly attributable to product Z during the quarter II of the financial year 2009-10, will be ₹ 2,80,000.

Calculate the sales revenue required to achieve a quarterly profit of ₹ 70,000. (May 009, 3 marks)

Answer:

Computation of Sales Revenue

P/V ratio = 28%

Quarterly fixed Cost = ₹ 2,80,000

Desired Profit. = ₹ 70,000

Sales revenue required to achieve desired profit

\(=\frac{\text { Fixed Cost }+ \text { Desired Profit }}{\text { P/V ratio }}\)

= \(\frac{2,80,000+70,000}{28 \%}\)

= \(\frac{3,50,000}{0.28}\) = ₹ 12,50,000

![]()

Question 18.

Answer of the following :

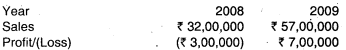

(i) Following informations are available for the year 2008 and 2009 of PIX Limited: .

![]()

Calculate—

(a) P/V ratio,

(b) Total fixed cost, and

(c) Sales required to earn a Profit of ₹ 12,00,000. (May 2010, 3 marks)

Answer:

(a) P/V Ratio \(=\frac{\text { Change in profit }}{\text { Change in sales }}\) × 100

= \(\frac{7,00,000+3,00,000}{(57,00,000-32,00,000}\) × 100

= \(\frac{10,00,000}{25,00,000}\) × 100

= 40%

(b) Total fixed coat = Total contribution – Profit

= (Sales × P/V ratio) – Profit

= (₹ 57,00,000 × \(\frac{40}{100}\)) – ₹ 7,00,000

= ₹ 22, 80,000 – ₹ 7,00,000 = ₹ 15,80,000

(c) Contribution required to earn a profit of ₹ 12,00,000 = Total fixed cost + Profit required

= ₹ 15,80,000 + 12,00,000 = ₹ 27,80,000

Required Sales \(=\frac{27,80,000}{\text { P/VRatio }}\) = \(\frac{27,80,000}{40 \%}\) = ₹ 69,50,000

Question 19.

Following information has been obtained from the records of a factory:

Profit : ₹ 25,000

Margin of Safety : ₹ 1,00,000

Find out the P/V Ratio.

Answer:

P/V Ratio \(=\frac{\text { Profit }}{\text { Margin of Safety }}\) × 100

= \(\frac{2,80,000+70,000}{28 \%}\)

= \(\frac{3,50,000}{0.28}\) = ₹ 12,50,000

Question 20.

Answer of the following:

(i) Following informations are available for the year 2008 and 2009 of PIX Limited:

Calculate—

(a) PN ratio,

(b) Total fixed cost, and

(c) Sales required to earn a Profit of ₹ 12,00,000. (May 2010, 3 marks)

Answer:

(a) PN Ratio \(=\frac{\text { Change in profit }}{\text { Change in sales }}\) × 100

= \(\frac{7,00,000+3,00,000}{(57,00,000-32,00,000}\) × 100

= 40%

(b) Total fixed cost = Total coñtribution – Profit

= (Sales × P/V ratio) – Profit

= (₹ 57,00,000 × \(\frac{40}{100}\)) – ₹ 7,00,000

= ₹ 22, 80,000 – ₹ 7,00,000 = ₹ 15,80,000

(c) Contribution required to earn a profit of ₹ 12,00,000 = Total fixed cost + Profit required

= ₹ 15,80,000 + 12,00,000 = ₹ 27,80,000

Required Sales = \(=\frac{27,80,000}{\text { P/VRatio }}\) = \(\frac{27,80,000}{40 \%}\) = ₹ 69,50,000

Question 21.

The following information has been obtained from the records of a factory:

Profit : ₹ 25,000

Margin of Safety : ₹ 1,00,000

Find out the P/V Ratio.

Answer:

P/V Profit \(=\frac{\text { Profit }}{\text { Margin of Safety }}\) × 100

= \(\frac{₹ 25,000}{₹ 1,00,000}\) × 100

= 25%

Question 22.

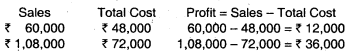

The relationship between Sales ánd Cost in a company is ãs follows:

Sales : Total Cost

₹ 60,000 : ₹ 48,300

₹ 1,08,000 : ₹ 72,000

Find out:

(1) Profit-Volume Ratio,

(2) Variable Cost at a Sale of ₹ 1,00,000,

(3) Fixed cost,

(4) Total Cost at a Sale of ₹ 80,000.

Answer:

Change in Profit = ₹ 36,000 – ₹ 12,000 = ₹ 24,000

Change in Sales = ₹ 1,08,000 – ₹ 60,000 = ₹ 48,000

(1) P/V Ratio \(=\frac{\text { Change in Profit }}{\text { Change in Sales }}\) × 100

= \(\frac{24,000}{48,000}\) × 100

= 50%

(2) Variable Cóst at a Sale of ₹ 1,00,000

= Sales × (100 – % of P/V Ratio)

= ₹ 1,00,000 × (100 – 50%)

= ₹ 1,00,000 × 50%

= ₹ 50,000

(3) Fixed Cost (F) = (Sales × P/V Ratio) — ProfIt

= (60,000 × 50%) – ₹ 12,000

= ₹ 30,000 – ₹ 12,000

= ₹ 18,000

(4) Total Costata Sale of ₹ 80,000

= Fixed Cost + Variable Cost at a Sale of ₹ 80,000

= ₹ 18,000 [ 80,000 × (100 – 50%)]

= ₹ 18,000 + ₹ 40,000

= ₹ 58,000.

![]()

Question 23.

List out the assumptions of break-even analysis. (Nov 1998, 4 marks)

Answer.

Assumptions of Break-even Analysis:

- All costs can be separated into fixed and variable.

- Variable costs vary ¡n proportion to output and fixed costs remain constant.

- Costs and revenues are linear over the range of activity under consideration.

- Costs and revenues are influenced only by volume.

- There will be no change in general price level.

- The state of technology, methods of production and efficiency remain unchanged.

- Stocks are valued at marginal cost.

- Both revenue and cost functions are linear over the range of activity under consideration.

- Productivity of the factors of production will remain the same.

- There will be no significant change in the levels of inventory.

- The company manufactures a single product.

- In the case of a multi-product company, the sales mix will remain unchanged.

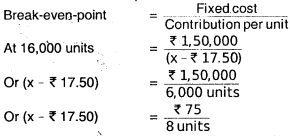

Question 24.

A Company manufactures a product, currently utilizing 80% capacity with a turnover of ₹ 8,00,000 at ₹ 25 per unit. The cost data are as under:

Material cost ₹ 7.50 per unit, Labour cost ₹ 6.25 per unit.

Semi-variable cost (Including variable cost of ₹ 3.75 per unit) ₹ 1,80,000.

Fixed cost ₹ 90,000 up to 80% level of output, beyond this an additional 20,000 will be incurred.

Calculate:

(i) Activity level at Break-Even-Point

(ii) Number of units to be sold to earn a net income of 8% of sales

(iii) Activity level needed to earn a profit of ₹ 95,000

(iv) Whãt should be the selling price per unit, if break-even-point is to be brought down to 40% activity level? (Nov 2000, 12 marks)

Answer:

Working notes:

1. (i) Number of units sold at 80% capacity

\(=\frac{\text { Turnover }}{\text { Selling price p.u. }}\) = \(\frac{₹ 8,00,000}{₹ 25}\) = 32,000 units

(ii) Number of units sold at 100% capacity

![]()

2. Component of fixed cost included in semi-variable cost of 32,000 units

Fixed cost = (Total semi-variable cost – Total variable cost)

= ₹ 1,80,000 – 32,000 units × ₹ 3.75

= ₹ 1,80,000 – ₹ 1,20,000

= ₹ 60,000

3. (i) Total fixed cost at 80% capacity

= Fixed cost + Component of fixed cost included in semi -variable cost

(Refer to working note 2)

= ₹ 90,000 + ₹ 60,000 = ₹ 1,50,000

(ii) Total fixed cost beyond 80% capacity

Total, fixed cost at 80% capacity + Additional fixed cost to be incurred

= ₹ 1,50,000 + ₹ 20,000 = ₹ 1,70,000

4. Variable cost and contribution per unit

Variable cost per unit = Material cost + Labour cost + Variable cost component in semi variable cost

= ₹ 7.50 + ₹ 6.25 + ₹ 3.75 = ₹ 17.50

Contribution per unit

= Selling price per unit -Variable cost per unit – Fixed cost

= ₹ 25 – ₹ 17.50 = ₹ 7.50

5. Profit at 80% capacity level

= Sales revenue – Variable cost – Fixed cost

= ₹ 8,00,000 – ₹ 5,60,000(32,000 units × ₹ 17.50) – ₹ 1,50,000

= ₹ 90,000

(i) Activity level at Break Even Point

Break-even point (units)

\(=\frac{\text { Fixed cost }}{\text { Contribution per unit }}\) = \(\frac{₹ 1,50,000}{₹ 7.50}\) = 20,000 units

(Refer to working notes 3 &4)

Activity level at Break-Even Point

![]()

(Refer to working note 1 (ii) = \(\frac{20,000 \text { units }}{40,000 \text { units }}\)‘ × 100 = 50%

(ii) Number of units to be sold to earn a net income of 8% of sales

Let x be the number of units sold to earn a net income of 8% of sales.

Mathematically, it means that:

(Sales revenue of x units) = Variable cost of x units + Fixed cost + Net income

or ₹ 25x = ₹ 17.5x + ₹ 1,50,000 + \(\frac{8}{100}\) × (₹ 25x)

or ₹ 25x = ₹ 17.5x + ₹ 1,50,000 + ₹ 2x

or x = (₹ 1,50,000/₹ 5.5) units

or x = 27,273 units.

(iii) Activity level needed to earn a profit of ₹ 95,000

The profit at 80% capacity level, is ₹ 90,000 which is less than the desired profit of ₹ 95,000, therelore the needed activity level would be more than 80%. Thus the fixed cost to be taken to determine the activity level needed should be ₹ 1,70,000 (Refer to Working note 3 (ii) Units to be sold to earn a profit of ₹ 95000

\(=\frac{\text { Fixed cost }+ \text { Desired profit }}{\text { Contribution per unit }}\)

\(\frac{₹ 1,70,000+₹ 95,000}{₹ 7.5}\)

= 35,333,33 units

Activity level needed to earn a profit of ₹ 95,000

\(\frac{35,333.33 \text { units }}{40,000 \text { units }}\) × 100

= 88.33%

(iv) Selling price per unit, if break-even Point is to be brought down to 40% (16,000 units) activity level

Let x be the šelling price per unit

Units at Break-even- point = 16,000 units

Or 8x – 8 × ₹ 17.50 = ₹ 75

Or 8x – ₹ 140 = ₹ 75

Or 8x = 215

Or x = ₹ 26.875

Hence, S.P. (per unit) = ₹ 26.875

![]()

Question 25.

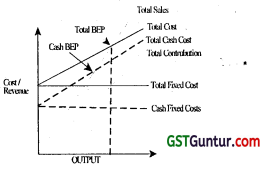

Explain and illustrate cash break even chart.

Answer:

A Cash Breakeven Chart records cash costs and revenues on the vertical axis and the level of activity on the horizontal axis. In this chart, variable costs are assumed to be payable in cash. Beside this, the fixed expenses are divided into two groups viz.

- Those expenses which involve cash outflow, e.g. rent, insurance, salaries etc. and

- Those expenses which do not involve cash outflow, e.g. depreciation, bad debts etc.

The making of the cash breakeven chart would require us to select appropriate axes. Subsequently, we will mark costs/revenues on the Y axis whereas the level of activity shall be traced on the X axis. Lines representing

- Cash Fixed costs,

- Total costs at maximum level of activity and

- Revenue at maximum level of activity (joined to the origin) shall be drawn next. The cash breakeven point is that point where the sales revenue line intersects the total cash cost line. Other measures like the margin of safety and profit can also be measured from the chart.

It is computed as under

ash BEP (units) \(=\frac{\text { Cash Fixed Cost }}{\text { Contribution Per Unit }}\)

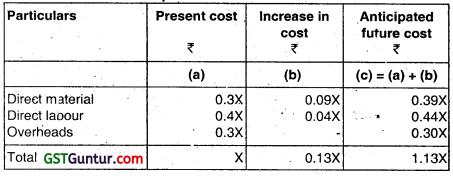

Question 26.

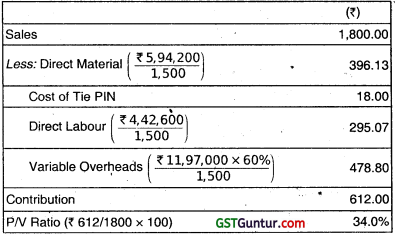

A company manufactures radios, which are sold at ₹ 1,600 per unit. The total cost is composed of 30% for direct materials, 40% ira direct wages and 30% and in wage rates by 10% is expected in the forth coming year, as a result of which the profit at current selling price may decrease by 40% of the present profit per unit. You are required to prepare a statement showing current and future profit at present Selling Price.

How much Selling Price should be increased to maintain the present rate of profit? (May 2001, 4 marks)

Answer:

Let X be the cost, Y be the profit and ₹ 1,600 selling price per unit of radio manufactured by a company.

Hence

X + Y = 1600 —– (i)

Statement of present and future cost of a radio

An increase in material price and wage rates resulted into a decrease in current profit by 40 percent at present selling price; therefore we have:

1.13X + 0.6Y = ………. (ii)

On solving (i) and (ii) we get:

X = ₹ 1,207.55

Y = ₹ 392.45

Current profit ₹ 392.45 or 32.5% of cost

Future profit ₹ 235.47

Statement of revised selling price to maintain the present rate of profit

Question 27.

Differentiate between ‘cost indifference point’ and ‘break-even pöint’. (May 2002, 4 marks)

Answer:

Cost indifference point: is the point at which total cost lines under the two alternatives intersect each other. Cost indifference point is calculated as under:

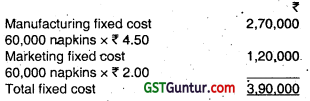

![]()

Whereas, Break-even point is the point where the total cost line and total revenue line for a particular alternative intersect each other.

Break- even point is calculated as under:

![]()

The following are the main points of distinction between cost indifference point and break-even point: –

- The cost indifference point is the activity level at which total cost two alternatives are equals, whereas break-even point is the activity level at which the total revenue from a product or product mix is equal to its cost.

- Cost Indifference point is used to choose between two alternative processes for achieving the same objective. The choice depends on the estimated activity level. Break-even point is used for profit planning.

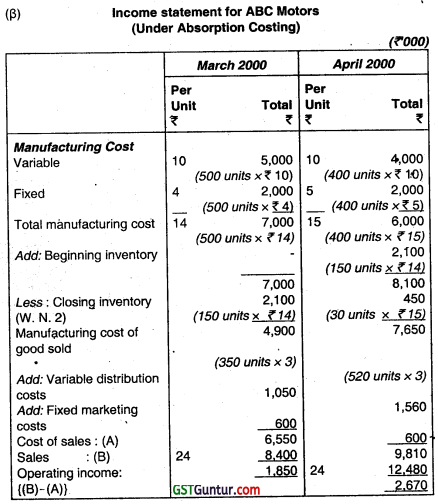

Question 28.

A Pharmaceutical company produces formulations having a shelf life of one year. The company has an opening stock of 30,000 boxes on 1st January, 2005 and expected to produce 1,30,000 boxes as was in the just ended year of 2004. Expected sale would be 1,50,000 boxes. Costing department has worked out escalation in cost by 25% on variable cost and 10% on fixed cost. Fixed cost for the year 2004 is ₹ 40 per unit. New price announced for 2005 is ₹ 100 per box. Variable cost on opening stock is ₹ 40 per box. You are required to compute Breakeven volume for the year 2005. (Nov 2005, 7 marks)

Answer:

Here, it is assumed that company is following FIFO method for valuing its inventory, Units available for rate are 30,000 units from opening stock and 1,20,000 units from current year production. Thus, making a total of 1,50,000 units. Now-

(1) Total contribution from opening stock No. of units of op. stock × (sale price – variable cost)

= 30,000(100 – 40) = ₹ 18,00,000/-

(2) New variable cost per unit = Ve + Escalation

= 40 + (25% of ₹ 40)

= 50 – per unit.

(3) Current years contribution per unit = sale price per unit – new variable cost per unit

= 100 – 50

= ₹ 50 – per unit.

(4) Fixed cost in current year = FC in previous year + Escalation

= (1,30,000 × 40) + 10% of ₹ 52,00,000 = 57,20,000.

(FC in previous year was 1,30,000 units × 40/- because Production in previous year was same as planned for this year)

BEP (in units) =

Units from opening stock (Total Fixed Cost – Total Contribution from op. stock

= 30,000 + \(\frac{57,20,000-18,00,000}{50}\) × 100 = ₹ 1,08,000/-

![]()

Question 29.

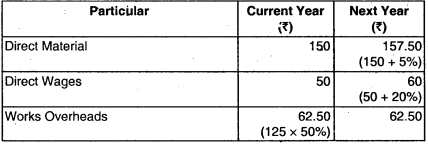

X Ltd. manufactures a semiconductor for which the cost and price structure is given below:

Selling price : ₹ 500

Direct material : ₹ 150

Direct labour : ₹ 100

Variable overhead : ₹ 50

Fixed cost = ₹ 2 lacs.

The product is manufactured by a machine, whose spare part costing ₹ 2,000 needs replacement after every 100 pieces of output. This is in additior to the above costs. Assume that no detectives are produced and that the spare part is readily available in the market at all times at ₹ 2,000.

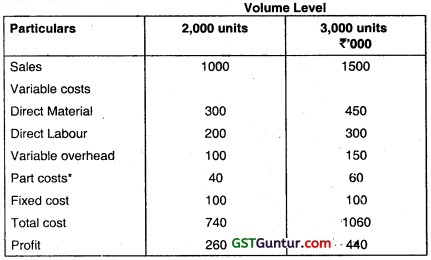

(i) Prepare the profitability statement for production levels of 2,000 units and 3,000 units, when fixed cost = ₹ 1 lacs. (Nov 2006, 4 marks)

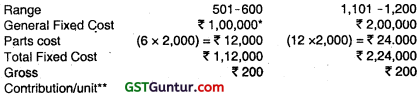

(ii) What is the break-even point (BEP) for the above data? (Nov 2006, 4 marks)

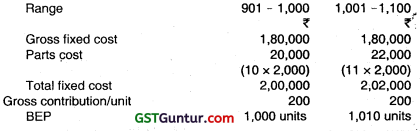

(iii) Comment on the BEP, If the fixed cost can be reduced to ₹ 1,80,000 from the existing level of 2 lacs. (Nov 2006, 6 marks)

Answer:

X Ltd. Profitability statement:

* Part cost: \(\frac{2,000}{100}\) × 2,000 – 4,000 \(\frac{3,000}{100}\) × 2,000 = ₹ 60,000

(ii) For computing the BEP : Parts cost although a step fixed cost can be considered as variable for the limited purpose of computing the range in which BEP occur. The variable parts cost per unit is ₹ 20 \(\left(\frac{2,000}{100}\right)\)

Range in which the BEP occur \(\frac{1,00,000}{(200-20)}\) – 555.55 \(\frac{2,00,000}{(200-20)}\) – 1,111.11

![]()

“Gross Contribution per unit

Sales – Direct Material – Direct Labour – Variable Overheads

………. ₹ 500 – ₹ 150 – ₹ 100 – ₹ 50 = ₹ 200

(iii) When fixed cost is ₹ 180,000. Range of BEP will be \(\frac{1,80,000}{180}\) = 1,000

(901 – 1,000)

Since the BEP of 1,000 falls on the upper most limits in the range 901 – 1,000 there will be one more BEP in the subsequent range in 1,001 – 1,100

Question 30.

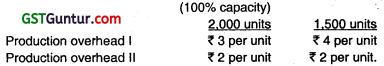

Answer the following:

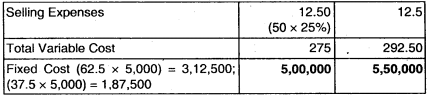

PO Ltd. reports the following cost structure at two capacity levels:

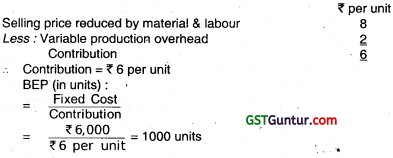

If the selling price, reduced by direct material and labour is ₹ 8 per unit, what would be its break-even point? (Nov 2008, 3 marks)

Answer:

Computation of BEP:

Production overhead l is fixed overhead.

In case of 2000 units 2000 × 3 = 6,000

In case of 1500 units – 1500 × 4 = 6,000

Hence, Fixed Production Overhead = ₹ 6,000

Variable Production Overhead = ₹ 2 per unit

Contribution:

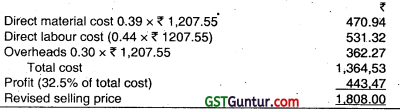

Question 31.

Answer the following:

A Company sells two products, J and K. The sales mix is 4 units of J and 3 units of K. The contribution margins per unit are ₹ 40 for J and ₹ 20 for K. Fixed costs are ₹ 6,16,000 per month. Compute the break-even point. (Nov 2009, 2 marks)

Answer:

Computation of BEP

Let 4x = No. of units of J

Then 3x = No. of units of K

BEP in x units \(=\left(\frac{\text { Fixed Cost }}{\text { Contribution }}\right)\) = \(\frac{₹ 6,16,000}{4(40)+3(20)}\)

Or \(\frac{6,16,000}{220}\) = 2800 units

Break even point of Product J = 4 × 2800 = 11200 units

Break even point of Product K = 3 × 2800 = 8400 units

![]()

Question 32.

MNP Ltd sold 2,75,000 units of its product at ₹ 37.50 per unit. Variable Costs are ₹ 17.50 per unit (manufacturing costs of ₹ 14 and selling cost of ₹ 3.50 per unit). Fixed costs are Incurred uniformly throughout the year-and

amount to ₹ 35,00,000 (including depreciation of ₹ 15,00,000). There are no beginning or ending inventories.

Required:

(i) Estimate breakeven sales level quantity and cash breakeven sales level quantity.

(ii) Estimate the P/V ratio.

(iii) Estimate the number of units that must be sold to earn an income (EBIT) of ₹ 2,50,000.

(iv) Estimate the sales level to ach4eve an after-tax income (PAT) of ₹ 2,50,000. Assume 40% corporate Income Tax rate. (Nov 2010, 8 marks)

Answer:

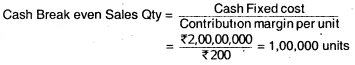

(i) Break even Sales \(=\frac{\text { Fixed Cost }}{\text { Contribution per unit }}\) = \(\frac{₹ 35,00,000}{₹ 20}\)

= ₹ 1,75,000 units

Cash Break even sales in \(=\frac{\text { Cash Fixed Cost }}{\text { Contribution per unit }}\)

= \(\frac{₹ 20,00,000}{₹ 20}\)

= 1,00,000 units

(ii) P/V ratio \(=\frac{\text { Contribution unit }}{\text { Selling Price/unit }}\) × 100 = \(\frac{20}{37.50}\) × 100 = 53.33%

(iii) Number of units that must be sold to earn an Income (EBIT) of ₹ 2,50,000

![]()

= 187500 units

(iv) After Tax Income (PAT) = ₹ 2,50,000

Tax rate = 40%

Desired level of Profit before tax

= \(\frac{₹ 2,50,000}{60}\) × 100 = ₹ 4,16,667/-

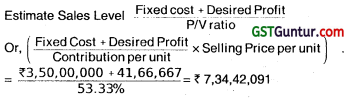

Estimated Sales level \(=\frac{\text { Fixed Cost }+ \text { Desired profit }}{\text { P/V ratio }}\)

= \(\frac{₹ 35,00,000+₹ 4,16,667}{53.33 \%}\) = ₹ 73,43,750/-

Question 33.

Answer the following:

(a) The P/V Ratio of Delta Ltd. is 50% and margin of safety is 40%. The company sold 500 units for ₹ 5,00,000. You are required to calculate:

(i) Break even point, and

(ii) Sales in unds to earn a profit of 10% on sales. (Nov 2011, 5 marks)

Answer:

(i) P/V Ratio : 50%

Margin of Safety : 40%

Sales Volume : 500 units

Sales Revenue : ₹ 5,00,000

∴ Sale / Unit : ₹ 1,000

Now: Màrgin of Safety \(=\frac{\text { Sales }- \text { BEP }}{\text { Sales }}\) × 100

or 40 = \(\frac{5,00,000-B E P}{5,00,000}\) × 100

or 2,00,000 = 5,00,000 – BEP

or BEP = 3,00,000

BEP(Units) \(=\frac{B E P(\text { Amount })}{\text { Sale/Unit }}\)

= \(\frac{3,00,000}{1,000}\) = 300

(ii) Profit at present level of sale

Margin of Safety \(=\frac{\text { Profit }}{\text { P/VRatio }}\)

∴ Profit = Margin of Safety × PN Ratio

= (40% × 5,00,000) × 50%

= 200,000 × 50%

= ₹ 1,00,000

Fixed Cost = (Sales × PN Ratio) – Profit

= (5,00,000 × 50%) – 1,00,000

= 2,50,000 – 1,00,000

= ₹ 1,50,000

Now

Desired Profit = 10% on Sale

Let the Sale be x

∴ Desired Profit = 10% of x

Again

Sales \(=\frac{\text { FC }+ \text { Profit }}{\text { P/V Ratio }}\)

or x = \(\frac{1,50,000+10 \% \text { of } x}{50 \%}\)

50% of x = 1,50,000 + 10% of x

or x = ₹ 3,75,000

∴ Sales = ₹ 3,75,000

Thus, sales in units to earn a profit of 10% on sales = \(\frac{3,75,000}{1,000}\) = 375 units

![]()

Question 34.

Answer the following:

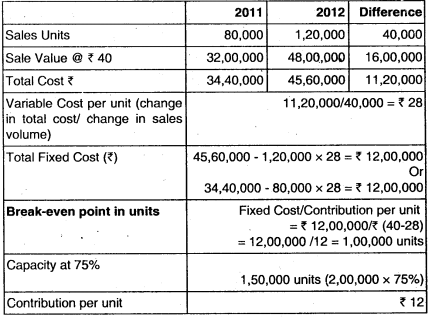

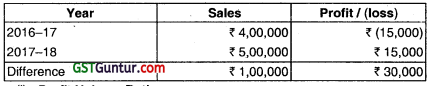

MFN Limited started its operation in 2011 with the total production capacity of 2,00,000 units. The following data for two years is made available to you:

![]()

There has been no change in the cost structure and selling price and it is expected to continue in 2013 as well. Selling price is ₹ 40 per unit.

You are required to calculate:

(i) Break-Even Point (in units)

(ii) Profit at 75% of the total capacity in 2013. (May 2013, 5 marks)

Answer:

Question 35.

Answer the following:

Zed Limited sells its product at ₹ 30 per unit. During the quarter ending on 31st March, 2014, it produced and sold 16000 units and suffered a loss of ₹ 1o per unit. If the volume of sales is raised to 40000 units, it can earn a profit of ₹ 8 per unit.

You are required to calculate:

(i) Break Even Point in Rupees.

(ii) Profit if the sale volume is 50000 units.

(iii) Minimum level of production where the company needs not to close the production if unavoidable fixed cost is ₹ 1,50,000. (Nov 2014, 5 marks)

Answer:

P/V Ratio \(=\frac{\text { Change in profit }}{\text { Change in sales value }}\) × 100

(i) Break Even Point \(=\frac{\text { Fixed Cost }}{\text { Contribution }}\)

= \(\frac{4,80,000}{20}\)

= 24,000 units

= 24,000 × 30

= ₹ 7,20,000

(ii) Profit when sales = 50,000 units

50,000 \(=\frac{\text { Fixed Cost }+ \text { Profit }}{\text { Contribution }}\)

50,000 = \(\frac{4,80,000+P}{20}\)

P = 10,00,000 – 4,80,000 = 5,20,000.

Note: 1

Suppose. Variable cost = x

Fixed cost = y

30 × 16,000 – 16,000x = y – 1,60,000 —- (1)

30 × 40,000 + 40,000x = y + 3,20,000 —— (2)

∴ 4,80,000 – 16,000x = 12,00,000 – 40,000x – 3,20,000 – 1,60,000

∴ 4,80,000 – 16,000x = 7,20,000 – 40,000x

∴ – 16,000 + 40,000x = 2,40,000

∴ x = \(\frac{2,40,000}{24,000}\)

∴ x = 10

∴ y = 4,80,000

Note: 2

Contribution = S – V

= 30 – 10

= 20

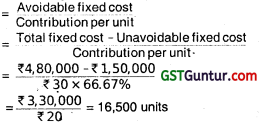

(iii) Minimum level of production where the company needs not to close the production, ¡f unavoidable fixed cost is ₹ 1,50,000:

At production level of ≥ 16,500 units, company needs not to close the production,

Question 36.

Answer the following:

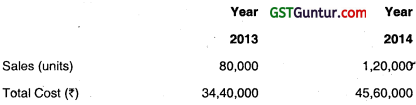

(a) ABC limited started its operations in the year 2013 with a total production capacity of 2,00,000 units. The following information, for two years, are made available to you:

There has been no change in the cost structure and selling price and it is anticipated that it will remain unchanged in the year 2015 also.

Selling price is ₹ 40 per unit.

Calculate:

(i) Variable cost per unit.

(ii) Profit Volume Ratio.

(iii) Break-Even Point (in Units)

(iv) Profit if the firm operates at 75% of the capacity. (May 2015, 5 marks)

Answer:

(i) Calculation for variable cost per unit

Fixed cost = 45,60,000 – 1,20,000 × 28

= ₹ 12,00,000

or

= 34,40,000 – 80,000 × 28

= ₹ 12,00,000

Variable cost per unit = ₹ 28

(ii) Calculation of PV Ratio:

PV Ratio \(=\frac{\text { Contribution }}{\text { Sales } .}\) × 100

Sales = 32,00,000

V.C. = (28 × 80,000)

= (22,40,000)

Contribution = 9,60,000

PV Ratio = \(\frac{9,60,000}{32,00,000}\) × 100

PV Ratio = 30%

(iii) Calculation for Break even points (in units):

Break even point (₹ in units) \(=\frac{\text { Fixed Cost }}{\text { Contribution per unit }}\)

Break even point = \(\frac{12,00,000}{₹(40-28)}\)

= \(\frac{12,00,000}{12}\)

Break even point = 1,00,000 units

(iv) Profit if the firm operates at 75% of the capacity:

Capacity at 75% = 2,00,000 × 75%

= 1,50,000 units

Contribution per unit = ₹ 12

Contribution (₹) 1,50,000 × ₹ 12

= ₹ 18,00,000

Fixed cost = ₹ 12,00,000

Profit = Contribution – Fixed Cost

= ₹ 18,00,000 – ₹ 12,00,000

= ₹ 6,00,000

![]()

Question 37.

Answer the following:

A company gives the following information:

Margin of Safety = ₹ 3,75,000

Total Cost = ₹ 3,87,500

Margin of Safety (Qty.) = 15000 units

Break Even Sates in Units = 5000 units

You are required to calculate:

(i) Selling price per unit

(ii) Profit

(iii) ProfitNolume Ratio

(iv) Break Even Sales (in Rupees)

(v) Fixed Cost ‘ (Nov 2015, 5 marks)

Answer:

(i) Selling Price per unit:

Selling Price per unit \(=\frac{\operatorname{MOS}(₹)}{\text { Margin of Safety (Qty) }}\)

= \(\frac{₹ 3,75,000}{15,000 \text { units }}\)

Selling Price per unit = ₹ 25/unit

(ii) Profit:

Profit = Sales – Total Cost

Sales = BES+MOS

= (25 × 5,000) + 3,75,000

= ₹ 5,00,000

Profit = 5,00,000 – 3,87,500

= ₹ 1,12,500

(iii) PV Ratio:

Margin of Safety \(=\frac{\text { Profit }}{\text { PVRatio }}\)

PV Ratio \(=\quad \frac{\text { Profit }}{\text { Margin of Safety }}\)

= \(\frac{1,12,500}{3,75,000}\) × 100

PV Ratio = 30%

(iv) Break Even Sales (In Rupees):

Break Even Sales = Break even quantity × Sales value

= 5,000 × 25

Break Even Sales = ₹ 1,25,000

(v) Fixed Cost:

Break Even Sales (₹) \(=\frac{\text { Fixed Cost }}{\text { PVRatio }}\)

Fixed Cost = Break even Sales × PV Ratio

= 1,25,000 × 30%

Fixed Cost = ₹ 37,500

Question 38.

Answer the following:

A dairy product company manufacturing baby food with a shell life of one year furnishes the following information:

(i) On 1st January, 2016, the company has an opening stock of 20,000 packets whose variable cost is ₹ 180 per packet.

(ii) In 2015, production was 1,20,000 packets and the expected production in 2016 is 1,50,000 packets. Expected sales for 2016 is 1,60,000 packets.

(iii) In 2015, fixed cost per unit was ₹ 60 and it is expected to increase by 10% in 2016. The variable cost is expected to increase by 25%. Selling price for 2016 has been fixed at ₹ 300 per packet You are required to calculate the Break-even volume in units for 2016. (May 2016, 5 marks)

Answer:

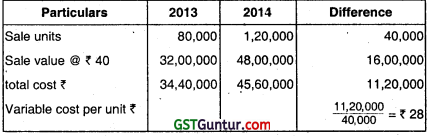

Computation of BEP

For the year 2016

At BEP Contribution = Fixed cost

Working Notes:

(i) Variable Cost in 2015 = 180 per packet

increase by 25% = 4

∴ in 2016 = 225 P.U.

(ii) Fixed cost in 2015 = 120.000 × ₹ 60 = 72,00,000

increase by 10% = 7,20,000

in 2016 = 79,20,000

Assume, that selling price in 2015 is same as in 2016 (i.e. ₹ 300)

Question 39.

A company, with 90% Capacity utilization, is manufacturing a product and makes a sale of ₹ 9,45,000 at ₹ 30 per unit. The cost data is as under:

Materials : ₹ 9.00 per unit

Labour : ₹ 7.00 per unit

semi variable cost

(including variable cost of ₹ 4.25 per unit) ₹ 2,10,000

Fixed cost is ₹ 94,500 upto 90% level of output (capacity). Beyond this, an additional amount of ₹ 15,000 will be incurred.

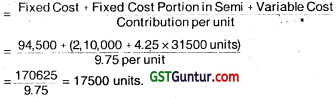

You are required to calculate:

(i) Level of output at break-even point

(ii) Number of units to be sold to earn a net income of 10% of sales

(iii) Level of output needed to earn a profit of ₹ 1,41,375. (Nov 2017, 8 marks)

Answer:

Selling Price = ₹ 30 per unit

Material Cost per unit = ₹ 9.00 per unit Labour.

Cost per unit = ₹ 7 per unit

Semi- variable cost per unit = ₹ 4.25 per unit

Total variable cost per unit = ₹ 20.25 per unit

Contribution per unit = ₹ 30 – ₹ 20.25

= ₹ 9.75 per unit

BEP = (units)

(ii) Profit = Sales – VG – FC

Let us assume × units sold to earn 10% profit.

Case-1: If we don’t consider additional cost ₹ 15,000, 30x – 20.25x – 170625

= 30x × 10% ₹ (units to be sold) = 25,278 units.

(It is valid since units are within level 31500 units)

Case – 2: II we consider additional cost ₹ 15,000, 30x – 20.25x – 170625 – 15000 = 30x × 10% × (units to be sold) = 27500 units

(It is invalid since 27,500 units are not beyond level of 31500 units)

(iii) Desired sales units \(=\frac{\text { Fixed Cost }+ \text { Desired Profit }}{\text { Contribution per unit }}\)

Case – 1: It we don’t consider additional cost ₹ 15,000.

Desired Sales units \(\frac{170625+141375}{9.75}\)

= 32,000 units.

(It is invalid since beyond 31500 units level)

Case – 2: 32000 units is beyond 90% activity level. In such case, the fixed cost will be increased by ₹ 15,000 to ₹ 3,27,000.

Then, S = \(=\frac{₹ 3,27,000}{₹ 9.75}\) = 33,538 units i.e., \(\frac{₹ 33,538}{₹ 35,000}\) × 100 = 95.82% activity level.

![]()

Question 40.

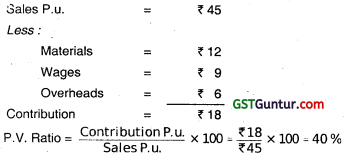

A manufacturing company is producing a product ‘A’ which is sold in the market at ₹ 45 per unit. The company has the capacity to produce 40000 units per year. The budget for the year 2018-19 projects a sale of 30000 units.

The costs of each unit are expected as under:

Materials : ₹ 12

Wages : ₹ 9

Overheads : ₹ 6

Margin of safety is : ₹ 4,12,500

You are required to:

(i) calculate fixed cost and break-even point.

(ii) calculate the volume of sales to earn profit of 20% on sales.

(iii) if management is willing to invest ₹ 10,00,000 with an expected return of 20%, calculate units to be sold to earn this profit.

(iv) Management expects additional sales if the selling price is reduced to ₹ 44. Calculate units to be sold to achieve the same profit as desired in above (iii). (Nov 2018, 10 marks)

Answer:

(i) Calculation for Fixed Cost and Break Even Point

Margin of Safety = ₹ 4,12,500

Profit = Margin of Safety × P. V. Ratio

= ₹ 4,12,500 × 40%

= ₹ 1,65,000

Sales – Variable Cost = Contribution

Also Contribution = Fixed Cost + Profit

So, Fixed Cost + Profit = Sales – Variable Cost

Fixed Cost = (Sales – Variable Cost) = Profit

= [(45 – 27) × 30,0001 – 1,65,000

Fixed Cost = ₹ 3,75,000

∴ BEP (Sales) \(=\frac{\text { Fixed Cost }}{\text { PVRatio }}\) = \(\frac{₹ 3,75,000}{40 \%}\)

Break Even Point (sales) = ₹ 9,37,500

Break Even Point (units) = 20833 units \(\left(\frac{9,37,500}{45}\right)\)

(ii) Let’s assume, Sales Volume = S unit so total sales value is 45 S and Contribution is 45 S – 27 S = 18 S

Now, Contribution = Fixed Cost + Desired Profit

18S = 3,75,000 + 9 S(20% of 45 S)

Or 9S = 3,75,000

So, S = \(\frac{3,75,000}{9}\) Units

Volume of sales \(=\frac{3,75,000 \times 45}{9}\)

= ₹ 18,75,000 OR 41666.67 Units

So, ₹ 18,75,000 sales are required to earn profit on 20% of sales.

(iii) Contribution = Fixed Cost + Desired Profit

18S = 3,75000 + Return on Investment

18S = 3,75,000 + 2,00,000

S = \(\frac{5,75,000}{18}\) Units = 31.945 Units (approx.)

So, 31,945 Units to be sold to earn a return of ₹ 2,00,000.

(iv) Revised Contribution = Fixed Cost + Desired Profit

17S = 3,75,000 + 2,00,000

S = \(\frac{5,75,000}{17}\)Units

S = 33,824 units (approx.)

∴ Additional Sales to be sold to achieve the same profit is 33,824 Units.

Question 41.

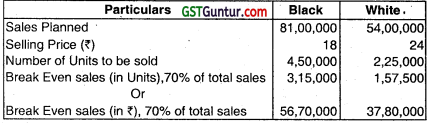

M/s. Gaurav Private Limited is manufacturing and selling two products:

BLACK’ and WHITE’ at selling price of ₹ 20 and ₹ 30 respectively. The following sales strategy has been outlined for the financial year 2019-20:

(i) Sales planned for the year will be ₹ 81,00,000 in the case of BLACK’ and ₹ 54,00,000 in the case of ‘WHITE’.

(ii) The selling price 0f ‘BLACK’ will be reduced by 10% and that of ‘WHITE’ by 20%.

(iii) Break-even is planned at 70% of the total sales of each. product.

(iv) Profit for the year to be maintained at ₹ 8,26,200 in the case of ‘BLACK’ and ₹ 7,45,200 in the case of WHITE’. This would be possible by reducing the present annual fixed cost of ₹ 42,00,000 allocated as ₹ 22,00,000 to ‘BLACK’ and ₹ 20,00,000 to ‘WHITE’.

You are required to calculate:

1. Number of units to be sold of ‘BLACK’ and ‘WHITE’ to Break even during the financial year 2019-20.

2. Amount of reduction in fixed cost product-wise to achieve desired profit mentioned at (iv) above. (May 2019, 5 marks)

Answer:

(i) Statement showing Break Even Sales

(ii) Statement showing Fixed Cost Reduction

Question 42.

When volume is 4000 units, average cost is ₹ 3.75 per unit. When volume is 5000 units, average cost is ₹ 3.50 per unit. The Break-Even point is 6000 units.

Calculate:-

(i) Variable Cost per unit

(ii) Fixed Cost and

(iii) Profit Volume Ratio. (Nov 2019, 5 marks)

Answer:

(i) When therè is 4000 units, total st = 4000 units × ₹ 3,75 per unit = ₹ 15,000

(ii) When there is 5000 units, total cost = 5000 units × 3.50 per unit

= ₹ 17,500

Variable cost \(=\frac{\text { Changeintotal cost }}{\text { ChangeinVolume }}\)

= \(\frac{(₹ 17,500-₹ 15,000)}{(5,000-4,000)}\) = \(\frac{₹ 2,500}{1,000}\)

Variable Cost = ₹ 2.5 per unit

(iii) When unit is 4000 units then Total Cost = ₹ 15,000

Variable Cost = (₹ 2.5 × 4,000) = ₹ 10,000

Fixed Cost = Total Cost – Variable Cost

= 15,000 – ₹ 10,000

Fixed Cost = ₹ 5,000

(iv) Break- Even point in value \(=\frac{\text { TotalFixed Cost }}{\text { PVRatio }}\)

(₹ 2.5 × 6,000) + ₹ 5,000 = \(\frac{₹ 5,000}{\text { PVRatio }}\)

₹ 20,000 = \(\frac{₹ 5,000}{\text { PVRatio }}\)

PV Ratio \(\frac{₹ 5,000}{₹ 20,000}\)

P V Ratio = 25%

Question 43.

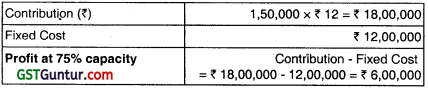

Answer the following:

During a particular period ABC Ltd. has furnished the following data:

Sales ₹ 10,00,000

Contribution to sales ratio 37% and

Margin of safety is 25% of sales.

A decrease in selling price and decrease in the fixed cost could change the “contribution to sales ratio to 30% and margin of safety to 40% of the revised sales. Calculate:

- Revised Fixed Cost.

- Revised Sales and

- New Break-Even Point. (Jan 2021, 5 marks)

![]()

Question 44.

The ratio of variable cost to sales is 60%. The break-even point occurs at 80% of the capacity sales.

(i) Find the capacity sales when fixed costs are ₹ 1,60,000

(ii) Compute profit at 80% of the capacity sales.

(iii) Find profit it sales is ₹ 5,70,000 and fixed cost remain same as above.

(iv) Find sales, if desired profit is ₹ 44,000, and fixed cost is ₹ 1,42,000.

Answer:

(i) Ratio of variable cost to sales = 60%

Hence, P/V ratio is 40%

Break-even point \(=\frac{\text { Fixed Cost }}{\text { P/VRatio }}\) = \(\frac{₹ 1,60,000}{40 \%}\) = ₹ 4,00,000

Break-even-point is 80% of sales at 100% capacity

Therefore, Sales at 100% Capacity = \(\frac{₹ 4,00,000}{80 \%}\) = ₹ 5,00,000

(ii) at 80% of capacity sales = 80% of ₹ 5,00,000 = ₹ 4,00,000

Profit at 80% sales capacity i.e. = (₹ 4,00,000 × P/V ratio) — Fixed Cost

= (₹ 4,00,000 × 40%) – ₹ 1,60,000

= Nil

(iii) When sales is ₹ 5,70,000 and fixed cost is ₹ 1,60,000

Contribution = ₹ 5,70,000 × 40% = ₹ 2,28,000

∴ Profit = Contribution — fixed cost

= ₹ 2,28,000 – ₹ 1,60,000 = ₹ 68,000

(iv) Required Contribution to earn profit of ₹ 44,000 when fixed cost is ₹ 1,42,000

= ₹ 44,000 + ₹ 1,42,000 = ₹ 1,86,000

Since, P/V ratio is 40%, therefore, Sales = ₹ 1,86,000/40%

= ₹ 4.65,000

Question 45.

MNP Ltd sold 2,75,000 units of its product at ₹ 375 per unit. Variable costs are ₹ 175 per unit (manufacturing costs of ₹ 140 and selling cost ₹ 35 per unit). Fixed costs are incurred Uniformly throughout the year and amount

to ₹ 3,50,00,000 (including depreciation of ₹ 1,50,00,000).

There are no beginning or ending inventories.

Required:

(i) COMPUTE breakeven sales level quantity and cash breakeven sales level quantity.

(ii) COMPUTE the PN ratio.

(iii) COMPUTE the number of units that must be sold to earn an income (EBIT) of ₹ 25,00,000.

(iv) COMPUTE the sales level achieve an after-tax income (PAT) of ₹ 25,00,000. Assume 40% corporate Income Tax rate.

Answer:

(i) Contribution = ₹ 375 – ₹ 175 = ₹ 200 per unit.

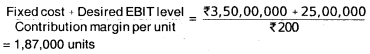

Break even Sales Quantity \(=\frac{\text { Fixed cost }}{\text { Contribution margin per unit }}\)

= \(\frac{₹ 3,50,00,000}{₹ 200}\) = 1,75,000

(ii) P/v ratio \(=\frac{\text { Contribution/unit }}{\text { SellingPrice/unit }}\) × 100 = \(\frac{₹ 200}{₹ 375}\) × 100 = 53.33%

(iii) No. of units that must be sold to earn an Income (EBIT) of ₹ 25,00,000

(iv) After Tax Income (PAT) = ₹ 25,00,000

Tax rate = 40%

Question 46.

What is margin of Safety? How can margin of safety be improved? (May 1999, 4 marks)

Answer:

Margin of Safely:

Margin of safety is the excess of sales over the break-even sales. it may also be considered as the excess of production over break-even point. It can be expressed in value as well as in percentage. The size of margin of safety shows the strength of the business. Small size of margin of safety indicates that the firm has large fixed expenses and is more vulnerable to changes in sales. In other words, if the margin of safety is large, a slight fall in sales may not affect the business very much but when it is small then a slight fall in sales may adversely affect the business. The margin of safety is calculated by using the following formula:

Margin of safety = Actual Sales – Break -even sales

Margin of safety \(=\frac{\text { Profit }}{\text { P/Vratio }}\)

Or \(=\frac{\text { Profit }}{\text { (Contribution } / \text { Sales })}\)

Margin of safety is also immensely useful for making Inter-firm comparison. This is being done by calculating their margin of safety ratio. This ratio can be calculated by using the following formula:

Margin of safety \(=\frac{\text { Margin of safety }}{\text { Sales }}\) × 100

or \(=\frac{\text { Actual Sales }- \text { Break even Sales }}{\text { Sales }}\) × 100

Measures for improving margin of safety : Margin of safety can be improved by taking the following measures:

- Increasing the selling price, provided the demand is inelastic so as to absorb the increased prices.

- Reduction fixed expenses.

- Reduction in variable expenses.

- Increasing the sales volume provided capacity is available.

- Substitution or introduction of a product mix such that more profitable lines are introduced.

![]()

Question 47.

Answer the following:

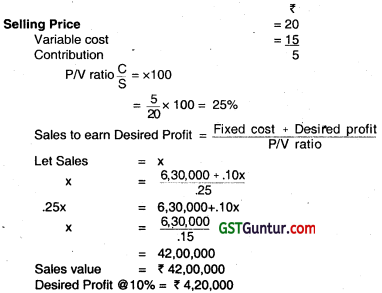

A company produces single product which sells for ₹ 20 per unit. Variable cost is ₹ 15 per unit and Fixed overhead for the year is ₹ 6,30,000.

Required:

(a) Calculate sales value needed to earn a profit of 10% on sales.

(b) Calculate sales price per unit to bring BEP down to 1,20,000 units.

(c) Calculate margin of safety sales if profit is ₹ 60,000. (Nov 2007, 3 marks)

Answer:

(a)

(b) Break- Even Point \(=\frac{\text { Fixed Cost }}{\text { Contribution/unit }}\)

\(\frac{6,30,000}{5}\)

= 1,26,000 Units

Sales Price / unit to bring BEP down to 1,20,000 units

= 1,20,000 = \(\frac{6,30,000}{C}\)

Contribution = \(\frac{6,30,000}{1,20,000}\)

= 5.25

Selling Price = Variable cost + Contribution

= 15 + 5.25

= ₹ 20.25

(c) Sales to earn ₹ 60,000 Profit

= \(\frac{6,30,000+60,000}{0.25}\)

Sales = ₹ 27,60,000

Sales at BEP = 1,26,000 units × ₹ 20

= ₹ 25,20,000

Margin of Safety Sales = Sales – Sales at BEP

= 27,60,000 – 25,20,000

= ₹ 2,40,000

Alternatively

Profit \(=\quad \frac{\text { Profit }}{\text { P/V ratio }}\)

∴ \(\frac{60,000}{\text { P/v ratio }}\) where P/v ratio = \(\frac{C}{S}\) × 100

= \(\frac{60,000}{25}\) × 100 = 2,40,000

Question 48.

Answer the following:

A company has fixed cost of ₹ 90,000, Sales ₹ 3,00,000 and Profit of ₹ 60,000.

Required:

(i) Sales volume if in the next period, the company suffered a loss of ₹ 30,000.

(ii) What is the margin of safety for a profit of ₹ 90,000? (May 2008, 3 marks)

Answer:

Fixed Cost (Given) = ₹ 90,000

Sales = ₹ 3,00,000

Profit = ₹ 60,000

Contribution = Fixed Cost + Profit = ₹ 1,50,000

P/V Ratio \(=\frac{\text { Contribution }}{\text { Sales }}\) × 100 = \(\frac{1,50,000}{3,00,000}\) × 100 = 50%

(i) Calculation of sales volume if there is loss of ₹ 30,000:

Sales \(=\frac{\text { Fixed cost }- \text { loss }}{\text { P/V Ratio }}\) × 100

= \(\frac{90,000-30,000}{50 \%}\) = \(\frac{90,000}{50 \%}\) = 1,80,000

(ii) Calculation of margin of safety for profit of ₹ 90,900:

Margin of Safety \(=\frac{\text { Profit }}{\text { P/VRatio }}\) = \(\frac{90,000}{50 \%}\) = ₹ 1,80,000

Question 49.

Answer the following:

What LS the meaning of Margin of Safety (MOS)? State the relationship between Operating Leverage and Margin of Safety Ratio. (Nov 2013, 4 marks)

Relationship between Operating Leverage and MOS:

Operating leverage is calculated as Contribution ÷ Operating profit and contribution margin plays an important role in It. If sales are expected to increase, higher operating leverage will result in higher profit. When sales

are expected to decrease, lower operating leverage will result in higher profit, Higher variable cost and lower fixed cost will result into higher MoS and risk will be lower and vice versa.

So like Operating leverage, MoS is a measure of risk as to what extent an organisation is exposed to change in sales volume.

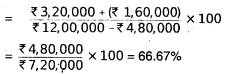

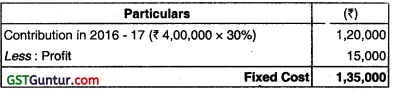

Question 50.

Answer the following:

SHA Limited provides the following trading results:

![]()

You are required to calculate:

(i) Fixed Cost

(ii) Break Even Point

(iii) Amount of profit, if sale is ₹ 30,00,000

(iv) Sale, when desired profit is ₹ 4,75,000

(v) Margin of Safety at a profit of ₹ 2,70,000 (May 2014, 5 marks)

Answer:

(i) Calculation of Fixed Cost:

P.V. Ratio \(=\frac{\text { Change in profit }}{\text { Change in sales }}\) × 100

= \(\frac{2,50,000-1,60,000}{25,00,000-20,00,000}\) × 100

= \(\frac{90,000}{5,00,000}\) × 100

= 18%

Calculation of Fixed Cost

∴ Sales × P.V. Ratio Fixed Cost = Profit

∴ 25,00,000 × 18% – Fixed Cost = 2,50,000

∴ 4,50,000 – Fixed Cost = 2,50,000

∴ Fixed Cost = 4,50,000 = 2,50,000

∴ Fixed Cost = ₹ 2,00,000

(ii) Calculation of Break-even point:

Break-even Sales \(=\frac{\text { Fixed Cost }}{\text { P/VRatio }}\)

= \(\frac{2,00,000}{18 \%}\)

= ₹ 11,11,111

(iii) Calculation of Amount of profit, if Sale is ₹ 30,00,000

Sales × P.V. Ratio – Fixed Cost Profit

30,00,000 × 18% – 2,00,000 = Profit

Profit = ₹ 3,40,000

(iv) Calculation of Sale when desired profit is ₹ 4,75,000

Sales × RV. Ratio Fixed Cost = Profit

∴ Sale × 18% – 2,00,000 = 4,75,000

∴ Sales = \(\frac{6,75,000}{18 \%}\)

Sales = ₹ 37,50,000

(v) Calculation of Margin of Safety at a profit ₹ 2,70,000

Sales at profit of ₹ 2,70,000 = \(\frac{4,70,000}{18 \%}\)

= ₹ 26,11,111

∴ Margin of Safety = Total Sales – Break-even Sales

= ₹ 26,11,111 — ₹ 11,11,111

= ₹ 15,00,000

Alternatively,

Margin safety \(=\frac{\text { Profit }}{\text { P/VRatio }}\)

= \(\frac{₹ 2,70,000}{18 \%}\) = ₹ 15,00,000

![]()

Question 51.

A company has introduced a new product and marketed 20,000 units. Variable cost of the product is ₹ 20 per unit and fixed overheads are ₹ 3,20,000.

You are required to:

(i) Calculate selling price per unit to earn a profit of 10% on sales value, BEP and Margin of Safety.

(ii) If the selling price is reduced by the company by 10%, demand is expected to increase by 5000 units, then what will be its impact on Profit, BEP and Margin of Safety?

(iii) Calculate Margin of Safety if profit is ₹ 64,000. (Nov 2016, 8 marks)

Answer:

(i) Calculation of selling price per unit to earn a profit of 10% on

sales value:

Let sales value per unit is x.

∴ Sales = Variable Cost + Fixed Cost + Profit

∴ 20,000 x = 4,00,000 + 3,20,000 + (10% of 20,000 x)

∴ 20,000x – 2,000x = 720,000

∴ x = \(\frac{7,20,000}{18,000}\)

x = 40

Hence, Sales price per unit is ₹ 40.

Calculation of BEP:

Calculation of Margin of Safety:

MOS = Total sales – Break even sales

= ₹ (20,000 × 40) – ₹ (16,000 × 40)

= ₹ 8,00,000 – ₹ 6,40,000

= ₹ 1,60,000

(ii) Calculation of New Profit, BEP & MOS:

Profit = Sales — V.C. — F.C.

= (25,000 × 36) – (25,000 × 20) – 3,20,000

= ₹ 9,00,000 — ₹ 5,00,000 — ₹ 3,20,000

= ₹ 80,000

Thus, there is no change in profit it selling price is reduced by 10%.

BEP \(=\frac{\text { F.C. }}{\text { Contribution p.u. }}\)

= \(\frac{₹ 3,20,000}{16}\) = 20,000 units

Thus, Break even point of sales is increase from 16,000 units to 20,000 units if S.P. reduced by 10%.

MOS = Total Sales – BEP

₹ (25,000 × 36) – ₹ (20,000 × 36)

= ₹ 9,00,000 – ₹ 7,20,000

= ₹ 1,80,000

Thus, MOS s also increase by ₹ 20,000 in case of reduction in S.P.

(iii) Calculation of MOS if profit is ₹ 64,000:

MOS = Total sales — Break-even sales

Or

MOS \(=\frac{\text { Profit }}{\text { P/V Ratio }}\)

∴ P/V \(=\frac{\text { Contribution }}{\text { Sales }}\) × 100

= \(\frac{₹ 4,00,000}{₹ 8,00,000}\) × 100 = 50%

Now, MOS \(=\frac{\text { Profit }}{\text { P/VRatio }}\)

= \(\frac{₹ 64,000}{50 \%}\)

= ₹ 1,28,000 or 3200 units

Question 52.

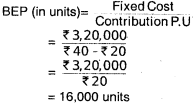

Following figures have been extracted from the books of M/s. RST Private Limited:

| Financial Year | Sales(₹) | Profit/ Loss (₹) |

| 2016-17 | 4,00,000 | 15,000 (loss) |

| 2017-18 | 5,00,000 | 15,300 (profit) |

You are required to calculate:

(i) Profit Volume Ratio

(ii) Fixed Costs

(iii) Break Even Point

(iv) Sales required to earn a profit of 45,000.

(v) Margin of Safety in Financial Year 2017-18. (May 2018, 5 marks)

Answer:

(i) Profit Volume Ratio :

PV Ratio \(=\frac{\text { Difference in Profit }}{\text { Difference in Sales }}\) × 100

= \(\frac{30,000}{1,00,000}\) × 100

(ii) Factory Costs:

(iii) Break Even Point:

Break Even Point \(=\frac{\text { Fixed Cost }}{\text { P/V Ratio }}\) = ₹ \(\frac{₹ 1,35,000}{30 \%}\) = ₹ 4,50,000

(iv) Sales required to earn a profit of ₹ 45,000

sales \(=\frac{\text { Fixed Cost }+ \text { Desired Profit }}{\text { P/V Ratio }}\)

= \(\frac{₹ 1,35,000+₹ 45,000}{30 \%}\)

= ₹ 6,00,000

(v) Margin of Safety in Financial Year 2017 – 18

Margin of Safety = Actual Sales — Break Even Sales

= ₹ 5,00,000 — ₹ 4,50,000

= ₹ 50,000

![]()

Question 53.

You are given the following data for the year 2015 of Rio Co. Ltd:

| Variable cost | 60,000 | 60% |

| Fixed cost | 30,000 | 30% |

| Net profit | 10,000 | 10% |

| Sales | 1,00,000 | 100% |

Find out

(a) Break-even point.

(b) PN ratio, and

(c) Margin of safety. Also draw a break-even chart showing contribution and profit.

Answer:

P/V Ratio = \(\frac{S-V}{S}\) = \(\frac{₹ 1,00,000-₹ 60,000}{₹ 1,00,000}\) × 100 = 40%

BE point = \(\frac{F}{\text { P/VRatio }}\) = \(\frac{30,000}{40 \%}\) = ₹ 75,000

Margin of safety = Actual Sales — BE point = 1,00,000 – 75,000 = 25,000

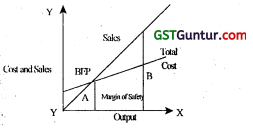

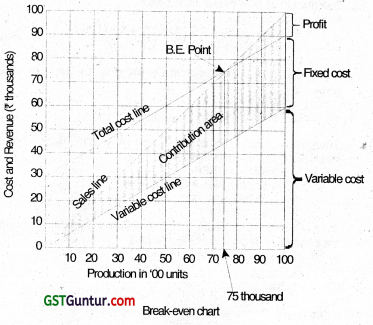

Break even chart showing contribution is shown below:

Question 54.

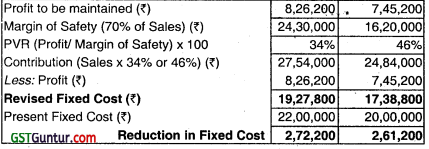

Discuss the relationship between Angla of Incidence, Break-even Level and Margin of Safely. (Nov 1999, 8 marks)

Answer:

1. If the break-even point is low and angle of incidence is large, the margin of safety is large and the business enjoys financial stability. A low break- even point indicates that the business could be run profitably even if there is a fall in sales, unless the sales are very low.

2. If the break- even point is low and angle of incidence is small, the conclusions are the same as in 1 above except that the rate of profit earning capacity is not so high as in 1.

3. If the break even point is high and the angle of incidence is small, the margin of safety is low. The business is very vulnerable, even a small reduction activity may result in a loss.

4. If the break-even point is large and the angle of incidence is large, this shows that the margin of safety is low. The business is likely to incur losses through a small reduction in activity. However after the break even point, the business makes the profit at a high rate.

![]()

Question 55.

Write short notes on the following: Angle of Incidence (May 2012, 2 marks)

Answer:

Angle of incidence

- Angle of incidence is formed by the intersection of sales line and total cost line at the break-even point.

- This angle shows the rate at which profits are being earned once the break-even point has been reached.

- The wider the angle the greater is the rate of earning profits. A large angle of incidence with a high margin of safety indicates extremely favourable position.

Question 56.

What are the important decision-making areas where marginal-costing technique is used? (May 2001, 5 marks)

Answer:

Marginal costing is a useful technique of decision making, used by the management of most of the manufacturing concerns. Some of the important decision making areas where marginal costing technique is used by these

concerns are:

1. Fixation of selling price.

- Under normal circumstances

- For special market (export market) or for a special customer

- During recession

- At marginal cost or below marginal cost.

2. Decision relating to the most profitable product mix

- Selection of optimal product mix

- Substitution of one product with another

- Discontinuing or dropping of a product line

3. Decision relating to make or buy

4. Shut down or continue of determination or output level in period of recession of depression.

5. Retaining or replacing a machine

6. Selling in the home or in the export market

7. Change vs. Status quo

8. Expanding or contracting

9. Decision relating to price-mix.

![]()

Question 57.

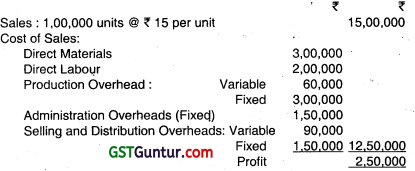

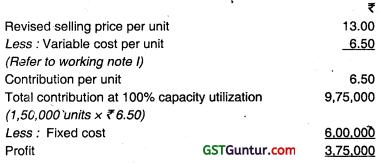

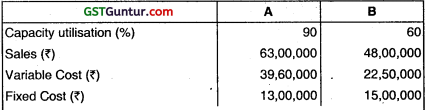

A company manufactures a single product with a capacity of 1,50,000 units per annum. The summarised profitability statement for the year is as under:

You are required to evaluate the following options:

(i) What will be the amount of sales required to earn a target profit of 25% on Sales, if the packing is improved at a cost of Re. 1 per unit? (May 2001, 3 marks)

(ii) There is an offer from a large retailer for purchasing 30,000 units per annum, subject to providing a packing with a different brand name at a cost of ₹ 2 per unit. However, in this case there will be no selling and distribution expenses. Also this will not, in any way, affect the company’s existing business. What will be the break-even price for this additional offer? (May 2001, 3 marks)

(iii) If an expenditure of ₹ 3,00,000 is made on advertising, the sales would Increase from the present level of 1,00,000 units to 1,20,000 units at a price of ₹ 18 per unit. Will that expenditure be justified? (May 2001, 3 marks)

(iv) If the selling price is reduced by ₹ 2 per unit, there will be 100% capacity utilization. Will the reduction in selling price be justified? (May 2001, 3 marks)

Answer:

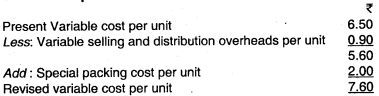

Working Note:

1.

2. Total fixed cost

Total fixed cost

(i) Amount of sales required to earn a target profit of 25% on sales after improving the packing.

Let x is the desired sales revenue to earn a target Profit of 25% on sales: then the desired contribution would be

Total fixed cost + 25% × x

Since P/V ratio = \(\frac{C}{S}\) × 100

\(=\frac{\text { Fixed cost }+ \text { Profit }}{x}\) × 100

Or x × 50% = ₹ 6,00,000 + 25% x

Or \(\left[\begin{array}{ll}

\frac{x}{2} & \frac{x}{4}

\end{array}\right]\) = 6,00,000

Or x = ₹ 24,00,000

Hence, the desired amount of sales required to earn a target Profit of 25% on sales is ₹ 24,00,000. ON the sale of ₹ 24,00,000 the desired contribution is 50% of sales i.e. ₹ 12,00,000 and profit is 25% of sales i.e. ₹ 6,00,000.

(ii) Evaluation of an offer of purchasing 30,000 per annum (subject to providing a packing with a different brand name at a cost of ₹ 2 per unit) from a large retailer. Determine also the break -even price for this additional offer.

The break-even price per unit for this additional offer of 30,000 units would be ₹ 7.60 per unit. In other words the break-even price for his additional offer here means the price per unit at which 30,000 units offer can be accepted without earning any profit on it.

Note : The existing business will bear the impact of fixed cost. Fixed costs will not affect this additional otter of 30,000 units.

Justification: The amount of profit on the sale of 1,00,000 units was ₹ 2,50,000 (Refer to the statement of the question). On increasing the sale of product units from 1,00,000 to 1,20,000 the profit of the concern increased from ₹ 2,50,000 to ₹ 4,80,000 therefore, the expenditure on advertisement is justifiable and the proposal under consideration is viable.

(iv) Justification of reduction in selling price to increase capacity utilization to 100%

![]()

Question 58.

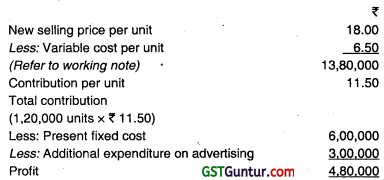

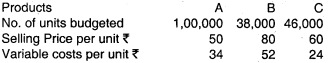

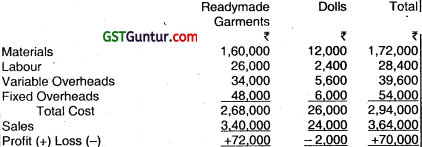

A company, which manufactures and sells three products, furnishes the following details for a month:

It has been proposed that an intensive advertisement campaign involving an expenditure of ₹ 1,20,000 per month and reduction of selling prices will increase the sales of product C as under:

(i) It the selling price is reduced to ₹ %5 per unit, the sales will increase to 59000 units per month.

(ii) If the selling price is reduced to ₹ 51. per unit, the sales will increase to ₹ 65,000 units per month.

The fixed of the company amount to ₹ 34,20,000 per month.

(i) Calculate the current monthly break-even sales value of the company.

(ii) Evaluate the two proposals and advise which of the proposals should be implemented.

(iii) Calculate the sales units required per month of product C to justify the expenditure on advertisement in respect of your decision I (ii) above. (May 2002, 12 marks)

Answer:

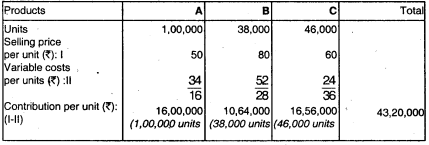

Working notes:

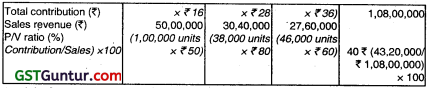

1. Statement of total contribution, sales revenue and P/V ratio

2. (a) Contribution per unit of product C under proposal (i)

Contribution per unit of product C will be ₹ 31, when its selling price and variable cost per unit are ₹ 55 and ₹ 24 respectively.

(b) Contribution per unit of Product C under proposal (ii)

Contribution per unit of product C will be ₹ 27, when its selling price and variable cost per unit are ₹ 51 and ₹ 24 respectively.

(i) Current monthly break-even Sales value of the company

(ii) Evaluation of proposal (i)

Decision: Proposal (i), to reduce selling price to ₹ 55 is better as it increases the net contribution by ₹ 74,000 (₹ 43,73,000 – ₹ 42,99,000)

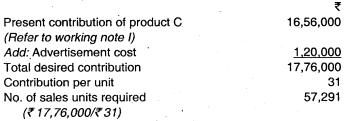

(iii) Computation of sales units required per month to Justify the expenditure on advertisement in respect of your decision in (ii) part of the question

![]()

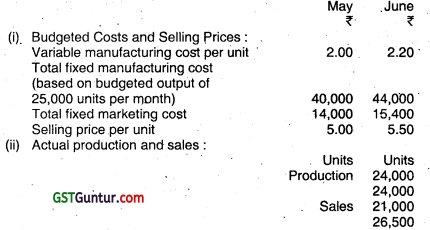

Question 59.

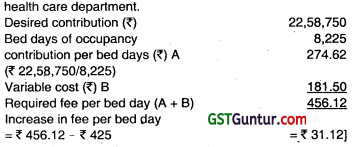

A hospital operates a 40 bed capacity special health care April 7, 2003 department. The said department levies a charge of ₹ 425 per bed day from the patient using its services. The data relating to fees collected and costs for the year 2001 are as under:

Fees collected during the year : ₹ 34,95,625

Variable costs based on patient days : ₹ 13,57,125

Departmental fixed costs : ₹ 6,22,500

Apportioned costs of the hospital administration charges : ₹ 10,00,000

Besides the above, nursing staff were employed as per the following scale at ₹ 48,000 per annum per nurse.

The projections for the year 2002 are as under:

- The costs other than apportioned overheads will go up by 10%.

- The apportioned overheads will increase by ₹ 2,50,000 per annum.

- The salary of the nursing staff will increase to ₹ 54,000 per annum per nurse.

The occupancy of the bed capacity is not likely to increase in 2002 and consequently the management is actively considering a proposal to close down the department. In that event, the departmental fixed costs can be avoided.

Required:

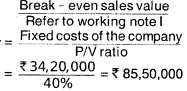

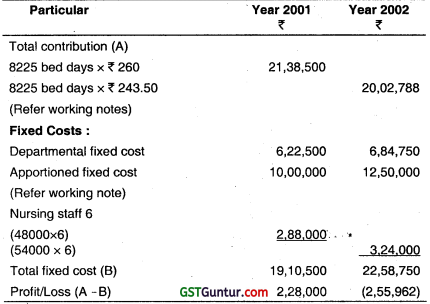

(i) Present statements to show the profitability of the department for the years 2001 and 2002.

(ii) Calculate the:

- break-even bed capacity for the year 2002

- increase in tee per bed day required to justify continuance of the department. (Nov 2002, 12 marks)

Answer:

Statement of Profitability of Special Health Care Department (for the year 2001 & 2002)

Working Notes:

(1) Number of bed \(=\frac{\text { Total fees collected }}{\text { Fees per bed days }}\)

= \(\frac{₹ 34,95,625}{₹ 425}\) = 8225 days

(2) Variable cost per bed day \(=\frac{\text { Total Variable cost }}{\text { No. of bed days occupancy }}\)

= \(\frac{13,57,125}{8.225}\)

= ₹ 165

Variable cost per bed day in year 2002

= 165 + 10% × ₹ 165 = ₹ 181.50

Contribution per bed day in year 2001

(₹ 425 – ₹ 265) = ₹ 260.0

Contribution per bed

days, in year 2002 = ₹ 243.0

(₹ 425 – ₹ 181.50)

(2) Computation of fixed cost

(a) Departmental fixed cost for the year 2001 = ₹ 6,22,500

for the year 2002

(₹ 6,22,500 + 10% × 6;22,500) = ₹ 6,84,750

(b) Apportioned fixed cost

for the year 2001 = ₹ 10,00,000

for the year 2002 = ₹ 12,50,000

(c) Salary of Nursing staff

for the year 2001 (6 × ₹ 48,000) = ₹ 2,88,000

for the year 2002 (6 × ₹ 54,000) = ₹ 3,24,000.

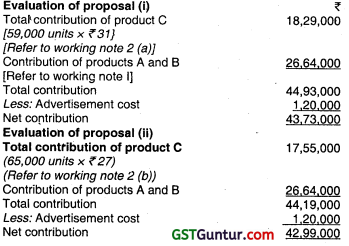

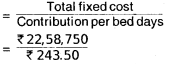

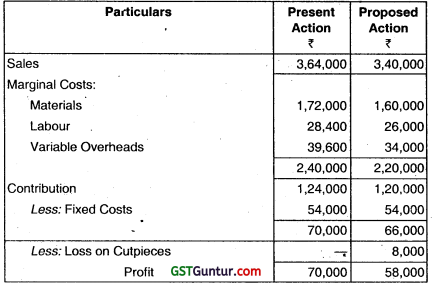

(3) Break even bed capacity for the year 2002

(This is not a valid answer because for 9,276 bed days, 8 nurses will be required)

![]()

Increase in fee per bed day required to justify continuance of the special health care department

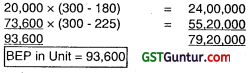

Question 60.