Job and Contract Costing – CA Inter Costing Question Bank is designed strictly as per the latest syllabus and exam pattern.

Job and Contract Costing – CA Inter Costing Question Bank

Question 1.

What is meant by Job Costing? Give examples of (any four) industries where it is used. (May 2001, Nov 2016, 4 marks)

Answer:

Job Costing:

Meaning: It is a method of costing which is used when the work is undertaken as per the customer’s special requirement. When an inquiry is received from the customer costs expected to be incurred on the job are estimated and on the basis of this estimate a price is quoted to the customer. Actual cost of materials, labour and overhead are accumulated and on the completion of job, these actual costs are compared with the quoted price and thus the profit or loss on it is determined.

Job Costing is applicable in printing press, hardware foundry, ship building, heavy machinery, general engineering works, machine tools, interior decoration, repairs and other similar work.

![]()

Question 2.

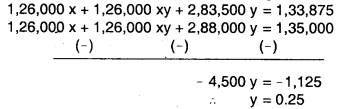

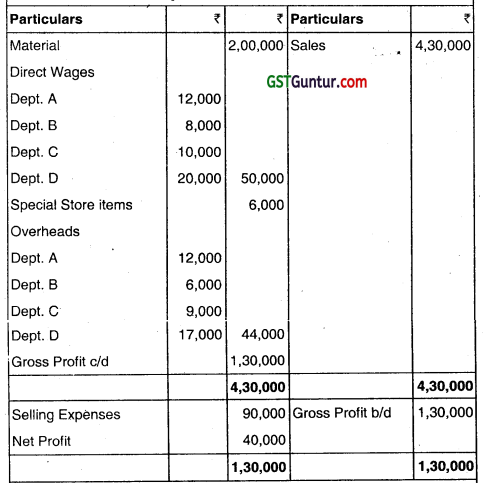

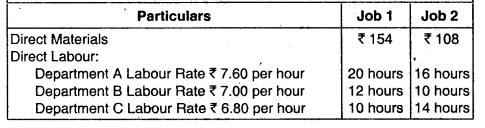

In the current quarter, a company has undertaken two jobs. The data relating to these jobs are as under:

It is the policy of. the company to charge Factory overheads as percentage on direct wages and Selling and Administration overheads as percentage on Factory cost.

The company has received a new order for manufacturing of a similar job. The estimate of direct materials and direct wages relating to the new order are ₹ 64,000 and ₹ 50,000 respectively. A profit of 20% on sales is required.

You are required to compute:

(i) The rates of Factory overheads and Selling and Administration overheads to be charged;

(ii) The Selling price of the new order. (Nov 2002, 9 marks)

Answer:

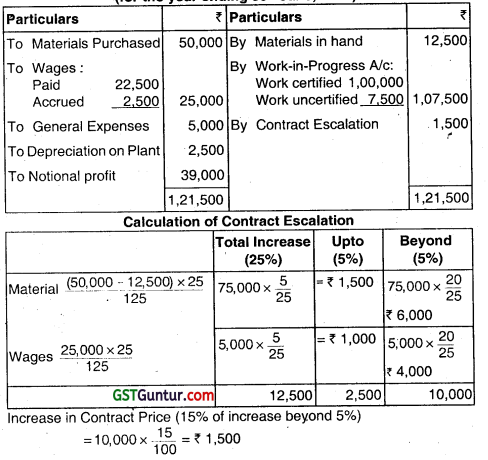

(i) Computation of factory OH Rates & Selling & Distribution OH Rates:

Let the factory OH Recovery Rate be ‘x’ &. Selling & Admin. OH Recovery Rate be ‘y.

Jobs Cost Sheet

Computation of Total Cost of Job No. 1102 & 1108

Job No. 1102:

Total cost when Profit is 8% on cost = \(\frac{1,07,325}{108}\) × 100

= ₹ 99375

Job No. 1108:

Total cost when Profit is 12% on cost = \(\frac{1,57,920}{112}\) × 100

= ₹ 1,41,000

Job No. 1102:

67.500 + 30,000 x + 67.500 y + 30,000 xy = 99,375

or, 30,000x + 30.000 xy + 67,500 y = 31,875 …………….. (1)

![]()

Job No. 1108:

96000 + 42,000 x + 96,000 y + 42,000 xy = 1,41,000

or, 42,000 x + 96,000 y + 42,000 xy = 45,000 ………………. (2)

Multiplying e.g. (1) by 4.2 & e.g. (2) by 3 we get,

Putting the value of ‘y’ in e.g. (1), we get,

30,000 x + 30,000 x x 0.25 + 67,500 × 0.25 = 31,875

or, 30,000 x + 75,00x + 16,875 = 31,875

37,500x = 15,000

∴ x = 0.4

Hence, Factory OH Recovery Rate on Direct Wages = 40%, &, Selling & Admin. OH Recovery Rate on Factory Cost = 25%.

(iii) Computation of Selling Price of New Order:

![]()

Question 3.

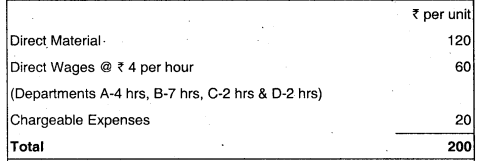

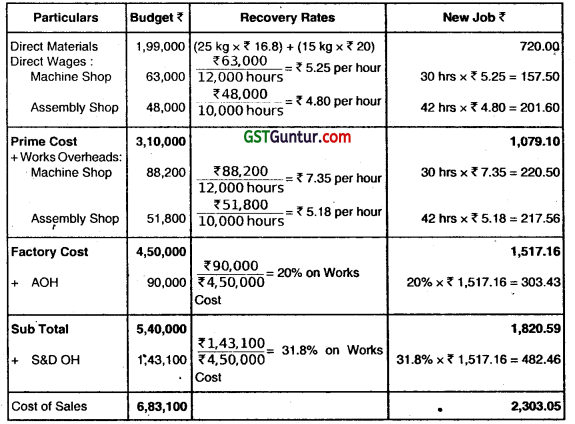

The following data presented by the supervisor of a factory for a Job.

Analysis of the Profit and Loss Account for the year ended 31st March, 2019

It is also to be noted that average hourly raies for all the four departments are similar.

Required:

(i) Prepare a Job Cost Sheet.

(ii) Calculate the entire revised cost using the above figures as the base.

(iii) Add 20% profit on selling price to determine the selling price. (Nov 2019, 5 marks)

Answer:

Job Cost Sheet

Customer details ______________

Date of Commencement __________

Job No.______________

Date of Completion ______________

![]()

Question 4.

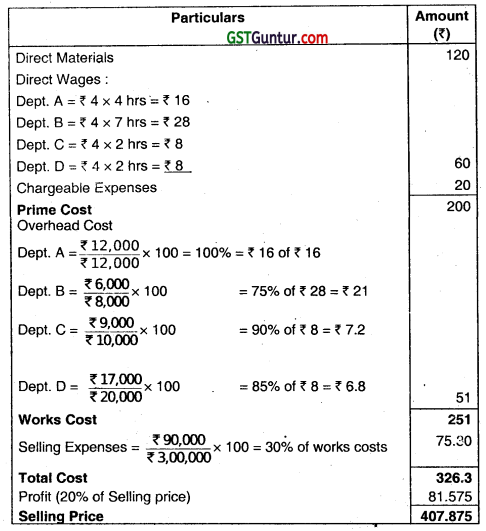

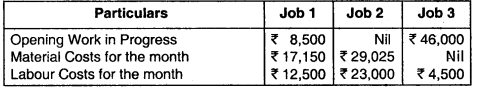

A Firm uses Job Costing System and recovers OH based on Direct Labour. Three jobs were worked on during a month and their details are as follows:

OH for the period were exactly as bugeted ₹ 1,40,000. Jobs 1 and 2 are incomplete at the end of the month. You are required to calculate the value of Closing WIP.

Answer:

1. Computation of OH Recovery Rate

- Total Labour Cost for the month = ₹ 12,500 + ₹ 23,000 + ₹ 4,500. = ₹ 40,000

- So, OH Absorption Rate = \(\frac{₹ 1,40,000}{₹ 40,000}\) = 350% of Direct Labour Cost

2. Valuation of Closing Work-in-Progress (only for job 1 and 2, which are incomplete at the month end)

| Particulars | Job 1 | Job 2 | Total |

| Opening Work in Progress Value

Material Costs for the month Labour Costs for the month OH absorbed at 350% of Direct Labour Cost |

₹ 8,500

₹ 17,150 ₹ 12,500 ₹ 43,750 |

Nil

₹ 29,025 ₹ 23,000 ₹ 80,500 |

₹ 8,500

₹ 46,175 ₹ 35,500 ₹ 1,24,250 |

| Total | ₹ 81,900 | ₹ 1,32,525 | ₹ 2,14,425 |

![]()

Question 5.

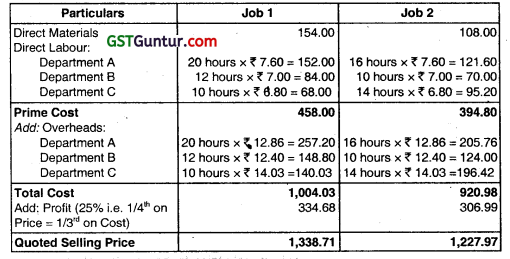

A Furniture making business manufactures quality furniture to customers’ order. It has three Production Departments (A, B and C) which have OH Absorption Rates (per Direct Labour Hour) of ₹ 12.86, ₹ 12.40 and ₹ 14.03 respectively.

Two pieces of furniture are to be manufactured for customers. Direct Costs are as follows:

The Firm quotes prices to customers that reflect a required profit of 25% on Selling Price calculate the total cost and selling price of each job.

Answer:

Job Cost Sheet

![]()

Question 6.

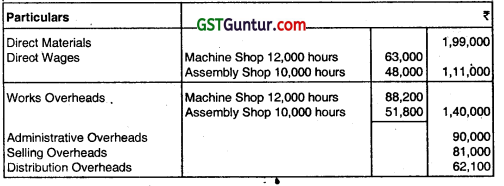

From the records of a manufacturing Company, the following budgeted details are available.

The Company follows Absorption Costing method. You are required to prepare-

- Schedule of 01-4 Rates from the data available stating the basis of OH Recovery Rates used under the given circumstances.

- A cost estimate for the following job based on the overhead rates so computed.

(a) Direct Materials 25 kg at ₹ 16.80 per kg and 15 kg at ₹ 20.00 per kg

(b) Direct Labour Machine Shop 30 houes, Assembly Shop 42 hours.

Answer:

![]()

Question 7.

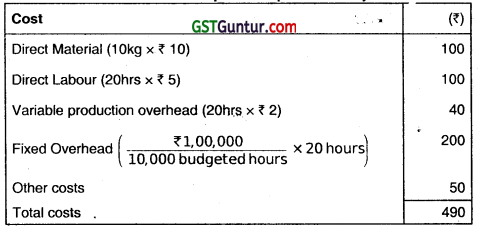

A company has been asked to quote for a job. The company aims to make a net profit of 30% on sales. The estimated cost for the job is as follows: Direct materials 10 kg @ ₹ 10 per kg

Direct labour 20 hours @ ₹ 5 per hour

Variable production overheads are recovered at the rate of ₹ 2 per labour hour.

Fixed production overheads for the company are budgeted to be ₹ 1,00,000 each year and are recovered on the basis of labour hours, ‘ i There are 10,000 budgeted labour hours each year. Other costs in relation to selling, distribution and administration are recovered at the rate of ₹ 50 per job.

DETERMINE quote for the job by the Company.

Answer:

Determination of quotation price for the job

Net profit is 30% of sales, therefore total costs represent 70% (₹ 490 × 100) ÷ 70 = ₹ 700 price to quote for job.

To check answer is correct; profit achieved will be ₹ 210 (₹ 700 – ₹ 490) = ₹ 210 ÷ ₹ 700 = 30%

![]()

Question 8.

Discuss briefly the principles to be followed while taking credit for profit on incomplete contracts. (Nov 2006, May 2017, 6 marks each)

OR

Discuss the process of estimating profit/loss on incomplete contracts. (Nov 2003, May 20114 marks each)

Answer

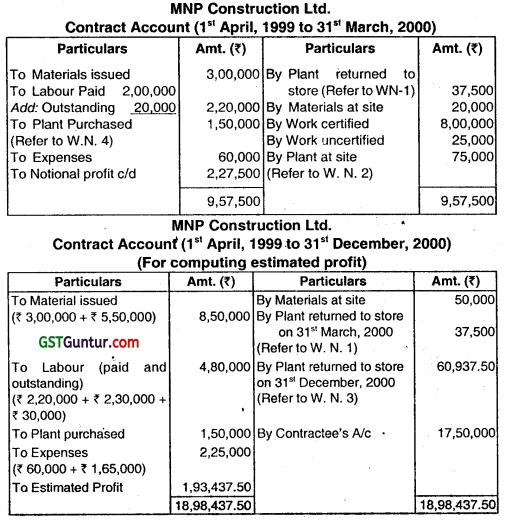

Principles to be Followed While Taking Credit for Profit on Incomplete Contract:

There are no hard and fast rules as to how much portion of profit on incomplete contract should be credited to Profit & Loss Account. However, the following principles may be followed:

- The costs incurred upto date should be clearly identified.

- The stage of contract performance completed should be reasonably estimated.

- The costs to complete the contract should be reasonably estimated.

- The total contract revenues to be received should be reliable estimated.

- The work certified should be valued in terms of contract price and its value should be treated as contract revenue for the accounting period.

- The uncertified work should be valued at cost and should be treated like closing inventory at the end of accounting period.

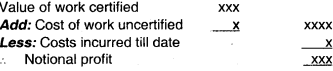

- The notional profit on incomplete contract should be estimated as under:

Notional profit = Value of work certified + cost of uncertified work – costs incurred to date. - The amount of profit to be credited to profit and loss account can be calculated as under:

![]()

| 1. | Stage of contract- Initial (just began) | Percentage of work done – Less than 25%

Profit – Nil [as it is impossible to foresee clearly the future position] |

| 2. | Stage of contract – In course (but not substantial) | Percentage of work done – upto or more than 25% but less than 50%

Profit = \(\frac{1}{3}\) × Notional Profit × \(\frac{\text { Cash Received }}{\text { Work Certified }}\) |

| 3. | Stage of contract – Substantially complete | Percentage of work done – upto or more than 50% but less than 90%

Profit = \(\frac{2}{3}\) × Notional Profit × \(\frac{\text { Cash Received }}{\text { Work Certified }}\) |

| 4. | Stage of contract – Almost complete | Percentage of work done – upto or more than 90% but less than 100%

Profit: Profit to be transferred to P&L.A/C here is the proportion of the estimated profit. The estimated profit is arrived at by deducting from the contract price the aggregate of estimated cost and the expenditure incurred. The proportion of estimated profit in computed by adopting any of the following formula. (i) Estimated Profit × \(\frac{\text { Work Certified }}{\text { Contract Price }}\) (ii) Estimated Profit × \( \frac{\text { Work Certified }}{\text { Contract Price }}\) × \(\frac{\text { Cash Received }}{\text { Work Certified }}\) (iii) Estimated Profit × \(\frac{\text { Cost of work to date }}{\text { Estimated total cost }}\) (iv) Estimated Profit × \(\frac{\text { Cost of work to date }}{\text { Estimated total cost }}\) × \(\frac{\text { Cash Received }}{\text { Work Certified }}\) |

Note: If Notional profit < estimated profit then only the notional profit is transferred to Profit and Loss A/c.

![]()

Question 9.

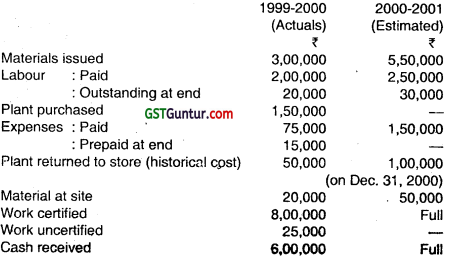

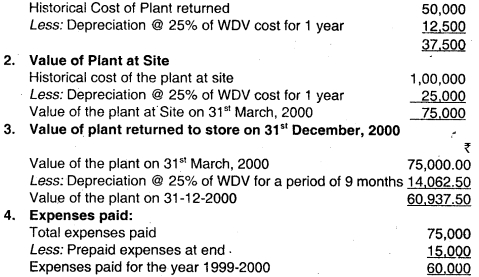

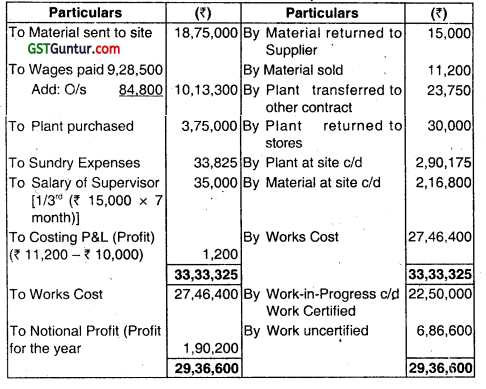

MNP Construction Ltd. commenced a contract on April 1, 1999. The total contract was for ₹ 17,50,000. It was decided to estimate the total profit and to take to the credit of P/I A/c the proportion of estimated profit on cash basis, which work completed bore to the total contract. Actual expenditure in 1999-2000 and estimated expenditure in 2000-2001 are given below:

The plant is subject to annual depreciation @ 25% of WDV Cost. The contract is likely to be completed on Dec. 31,2000. Prepare the Contract A/c. Determine notional profit and estimated profit. (May 2000, 10 marks)

Answer:

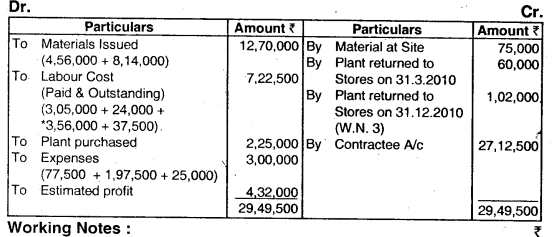

Working Notes :

1. Value of Plant returned to Stores on 31st March, 2000

![]()

Question 10.

A construction company undertook a contract at an estimated price of ₹ 108 lacs, which includes a budgeted profit of ₹ 18 lacs. The relevant data for the year ended 31.3.2002 are as under: (₹ 000’s)

Materials issued to site – 5,000

Direct wages paid – 3,800

Plant hired – 700

Site office costs – 270

Materials returned from site – 100

Direct expenses – 500

Work certified – 10,000

Progress payments received – 7,200

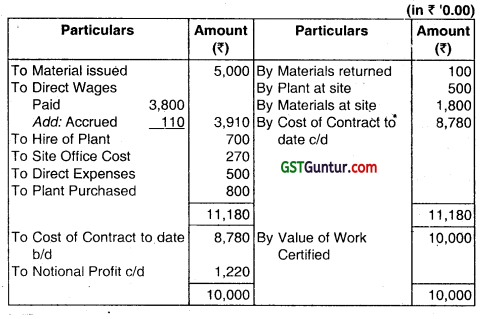

A special plant was purchased specifically for this contract at ₹ 8,00,000 and after use on this contract till the end of 31 .3.2002, it was valued at ₹ 5,00,000. The cost of materials at site at the end of the year was estimated at ₹ 18,00,000. Direct wages accrued as on 31.3.2002 was ₹ 1,10,000.

Required:

Prepare the Contract Account for the year ended 31st March, 2002 and compute the notional profit. (Nov 2002, 6 marks)

Answer:

Contract Account (for the year ended on 31.03.2002)

![]()

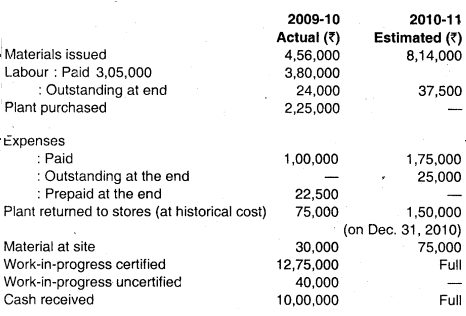

Question 11.

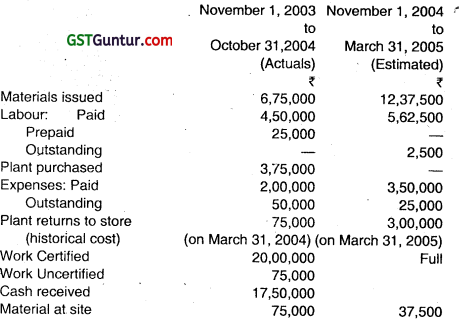

Brock Construction Ltd. Commenced a contract on November 1,2003. The total contract was for ₹ 39,37,500. It was decided to estimate the total profit on the contract and to take to the credit of P/L A/c that proportion of estimated profit on cash basis, which work completed bore to the total contract. Actual expenditure for the period November 1,2003 to October 31, 2004 and estimated expenditure for November 1,2004 to March 31,2005 are given below:

The plant is subject to annual depreciation @33% on written down value method. The contract is likely to be completed on March 31,2005 Required:

(i) Prepare the contract A/c.

(ii) Determine notional profit and estimated profit. (Nov 2004, 8 marks)

Answer:

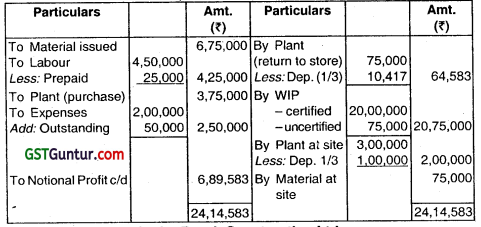

In the books of Brock Construction Ltd. Contract Account (From 1st Nov. 2003 to 31st Oct. 2004)

In the Brock Construction Ltd. Contract Account (From 1st Nov., 2003 to 31st March, 2005)

![]()

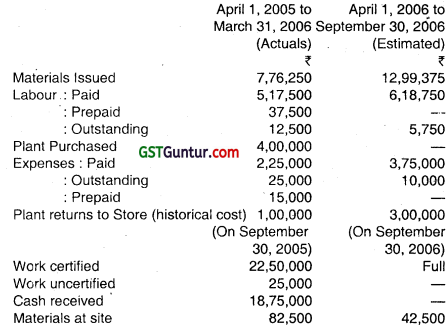

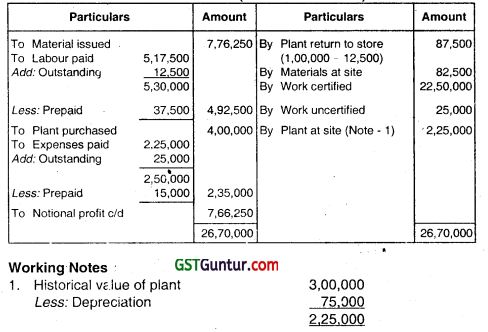

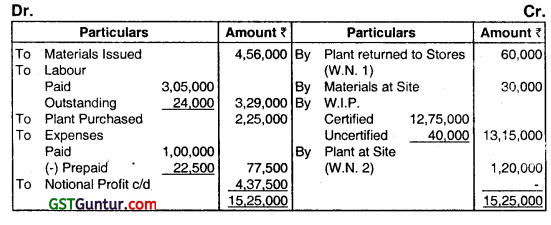

Question 12.

RST Construction Ltd. commenced a contract on April 1, 2005. The total contract was for ₹ 49,21,875. It was decided to estimate the total Profit on the contract and to take to the Credit of PIL A/c that proportion of estimated profit on cash basis, which work completed bore to total Contract. Actual expenditure for the period April 1, 2005 to March 31, 2006 and estimated expenditure for April 1, 2006 to September 30, 2006 are given below:

The plant is subject to annual depreciation @ 25% on written down value method. The contract ¡s likely to be completed on September 30, 2006.

Required:

(i) Prepare the contract A/c.

(ii) Determine notional profit & estimated profit. (May 2006, 10 marks)

Answer:

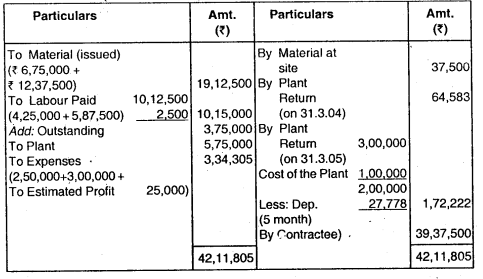

RST Construction Ltd. Contract Account (1-4-05 to 31-03-06)

Contract Account )From 1st April, 2005 to 30th September, 2006)

![]()

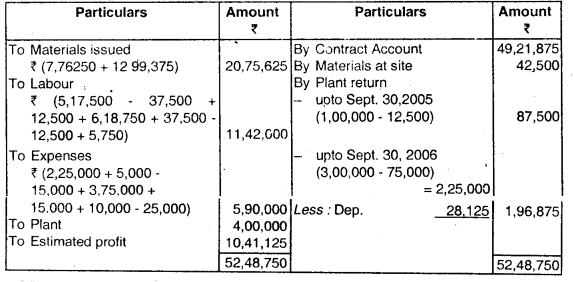

Question 13.

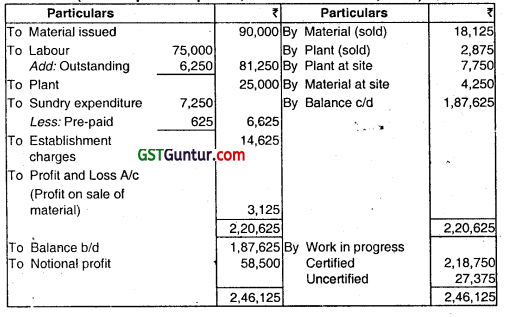

AKP Builders Ltd. commenced a contract on April 1st, 2005. The total contract was for ₹ 5,00,000. Actual expenditure for the period April 1st, 2005 to March 31st, 2006 and estimated expenditure for April 1st, 2006 to December 31st. 2006 are given below:

A part of the material was unsuitable and was sold for ₹ 18,125 (Cost being ₹ 15000) and a part of plant was scrapped and disposed of for ₹ 2,875. The value of plant at site on 31st March, 2006 was ₹ 7,750 and the value of material at site was ₹ 4,250. Cash received on account to date was ₹ 1,75,000, representing 80% of the work certified. The cost of work uncertified was valued at ₹ 27,375.The contractor estimated further expenditure that would be incurred in completion of the contract:

- The contract would be completed by 31st December, 2006.

- A further sum of ₹ 31,250 would have to be spent on the plant and the residual value of the pant on the completion of the contract would be ₹ 3,750.

- Establishment charges would cost the same amount per month as in the previous year.

- ₹ 10,800 would be sufficient to provide for contingencies.

Required :

Prepare Contract account and calculate estimated total profit on this contract. (May 2007, 8 marks)

Answer:

AKP Builders Ltd.

Contract Account

(For the period April 1st, 2005 to March 31st, 2006)

Working Note:

1. Memorandum Contract Account (9 Months)

![]()

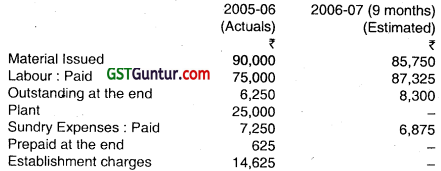

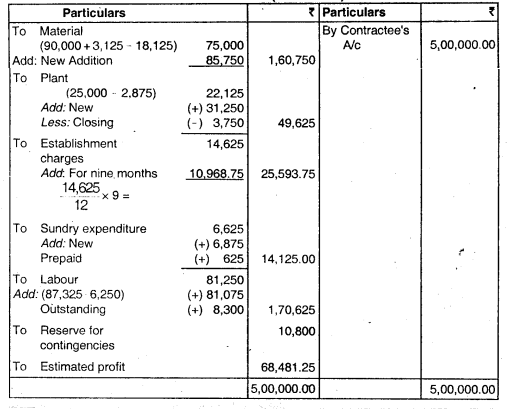

Question 14.

POR Construction Ltd. commenced a contract on April 1, 2009. The total contract was for ₹ 27,12,500. Actual expenditure in 2009-10 and estimated expenditure in 201 0-11 are given below:

The plant is subject to annual depreciation @ 20% of WDV cost. The contract is likely to be completed on December 31, 2010.

Required:

(i) Prepare the Contract A/c for the year 2009-10.

(ii) Calculate estimated profit on the contract. (Nov 2010, 8 marks)

Answer:

POR Construction Ltd.

Contract A/c

(1st April, 2009 to 31st March, 2010)

Computation of estimated profit POR Construction Ltd. Contract A/c (From 1st April, 2009 to 31st December, 2010)

Note : Labour paid in 2010 – 11 . 3,80,000

![]()

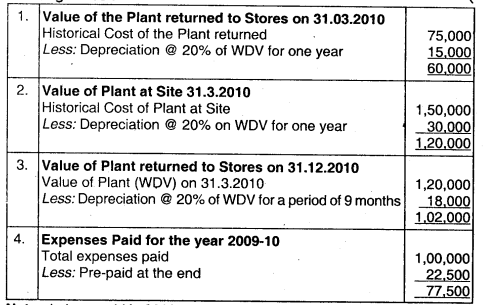

Question 15.

A contractor commenced a contract on 1-7-2011. The costing records concerning the said contract reveal the following Information as on 31-3- 2012:

Plant used for the contract has an estimated lite of 7 years with residual value at the end of lite ₹ 50,000. Some of material costing ₹ 13,500 was found unsuitable and sold for ₹ 10,000. Contract price was ₹ 45,00,000. On 31 -3-2012 two third of the contract was completed. The architect issued certificate covering 50% of the contract price and contractor has been paid 20,00,000 on account. Depreciation on plant is charged on straight line basis. Prepare Contract Account. (May 2012, 8 marks)

Answer:

Contract Account

(For the period 1.7.11 to 31.3.12)

Working Note:

1. Calculation of depreciation on Plant

Estimated life 7 Years

Depreciation per annum 1,03,000

Depreciation for 9 months

= \(\frac{1,03,000}{12}\) × 9 = 77,250

2. Cost of work uncertified = Cost incurred to date minus 50% of the total

cost of contract

= ₹ 26,39,600 (figure already shown in the contract Nc) – ₹ 19,79,700

= ₹ 6,59,900

![]()

Question 16.

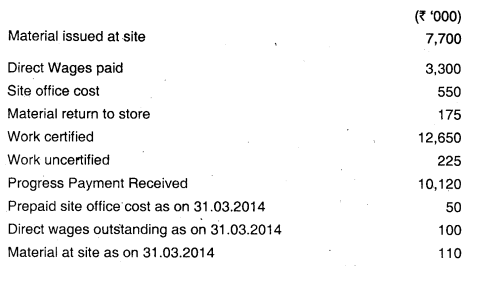

M/s ABID Constructions undertook a contract at a price of ₹ 171.00 lacs. The relevant data for the year ended 31st March, 2014 are as under:

Additional Information:

(a) A plant was purchased for the contract at ₹ 8,00,000 on 01.12.2013.

(b) Depreciation @ 15% per annum is to be charged.

(c) Material which cost ₹ 1,30,000 was destroyed by fire.

Prepare:

(i) Contract Account for the year ended 31st March, 2014 and compute the profit to be taken to the Profit & Loss Account.

(ii) Account of Contractee.

(iii) Profit & Loss Account showing the relevant items.

(iv) Balance Sheet showing the relevant items. (May 2014, 8 marks)

Answer:

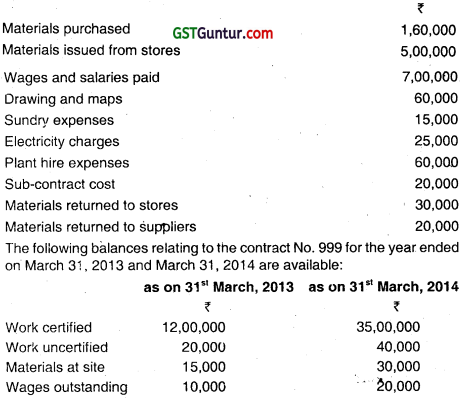

(i) M/s ABID Construction Contract Account

![]()

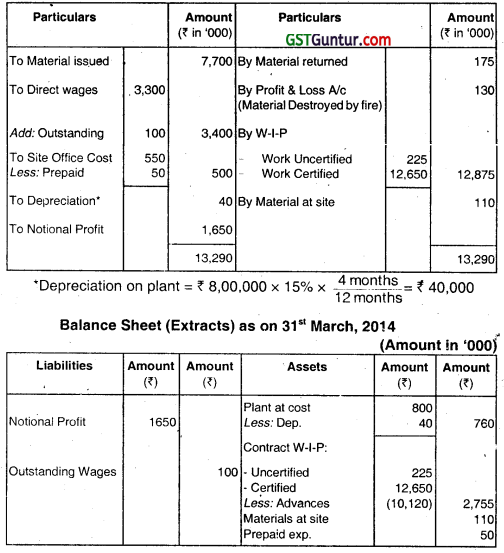

Question 17.

Z Limited obtained a contract No. 999 for ₹ 50 lacs. The following details are available in respect of this contract for the year ended March 31,2014:

The contractor receives 75% of work certified in cash.

Prepare Contract Account and Contractee’s Account. (Nov 2014, 8 marks)

Answer:

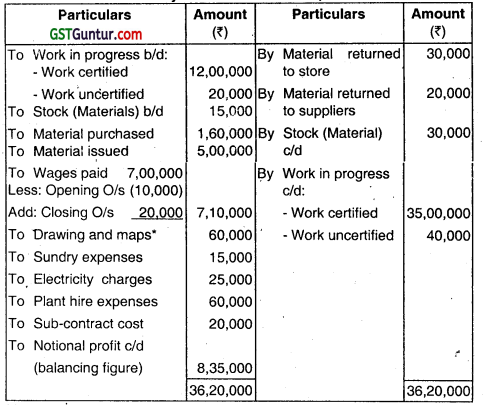

Contract No. 999 Account For the year ended 31st March, 2014

*Assumed that expenses incurred for drawing and maps are used exclusively for this contract only.

![]()

Question 18.

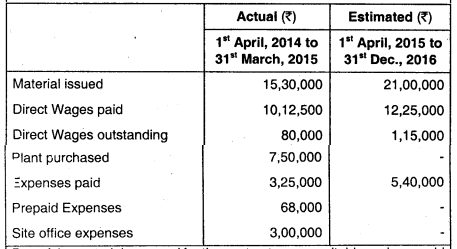

PVK Constructions commenced a contract on 1 April, 2014. Total contract value was ₹ 100 lakhs. The contract is expected to be completed by 31 December, 2016. Actual expenditure during the period 1st April, 2014 to 31st March, 2015 and estimated expenditure for the period 1st April, 2015 to 31st December, 2016 are as follows:

Part of the material procured for the contract was unsuitable and was sold for ₹ 2,40,000 (cost being ₹ 2,55,000) and a part of plant was scrapped and disposed of for ₹ 80,000. The value of plant at site on 31st March, 2015 was ₹ 2,50,000 and the value of material at site was ₹ 73,000. Cash received on account to date was ₹ 36,00,000, representing 80% of the work certified. The cost of work uncertified was valued at ₹ 5,40,000. Estimated further expenditure foncompletion of contract is as follows:

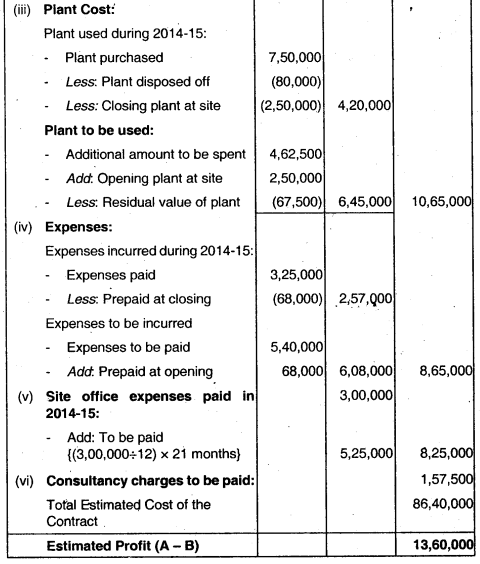

- An additional amount of ₹ 4,62,500 would have to be spent on the plant and the residual value of the plant on the completion of the contract would be ₹ 67,500.

- Site office expenses would be the same amount per month as charged in the previous year.

- An amount of ₹ 1,57,500 would have to be incurred towards consultancy charges.

Required:

Prepare Contract Account and calculate estimated total profit on this contract. (Nov 2015, 8 marks)

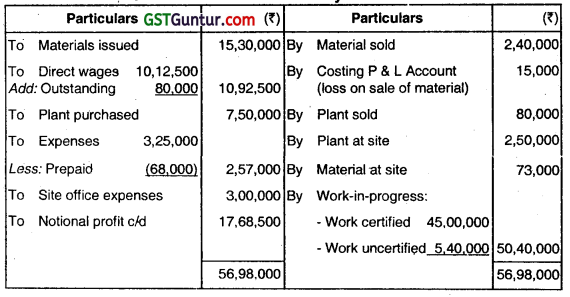

Answer:

PVK Constructions – Contract Account for the year 2014-15

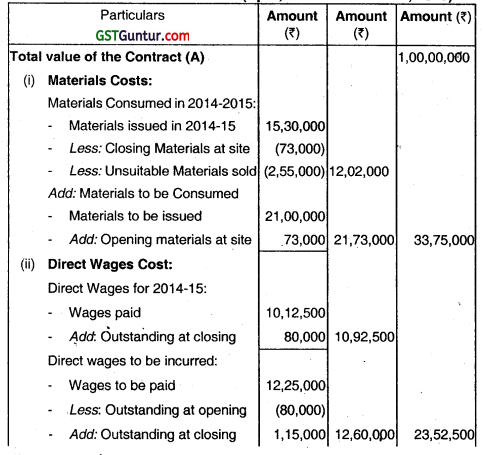

Calculation of Estimated Profit (April, 2014 to December, 2016)

![]()

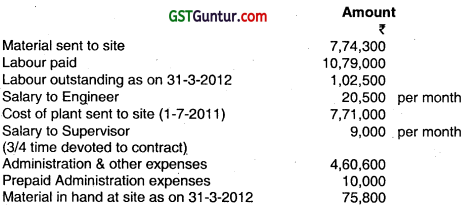

Question 19.

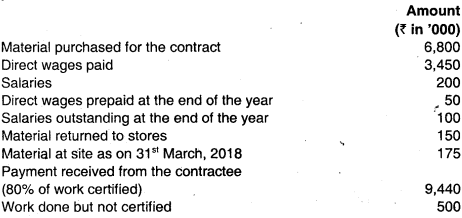

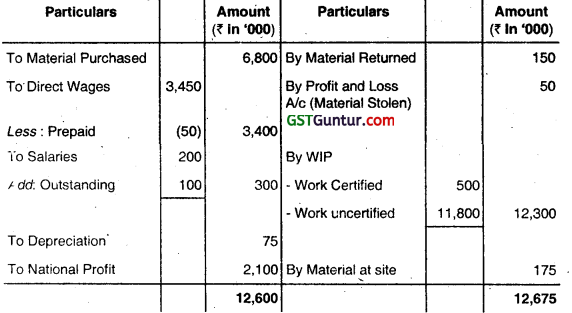

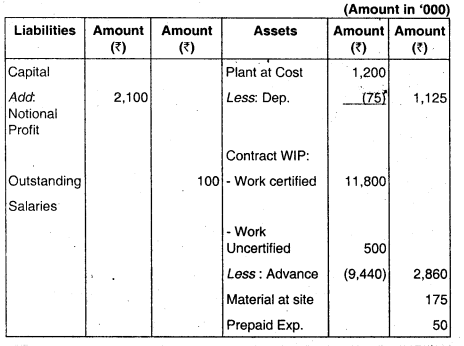

XYZ Construction Company took a contract for construction of a stadium on 1st April, 2017 at a price of ₹ 160 lakhs. The relevant information for the year ended 31st March, 2018 are as under:

A plant was purchased for ₹ 12,00,000 on 1st November, 2017 and was in use at the site upto 31st March, 2018. Depreciation is to be charged on plant @ 15% per annum on straight line basis. Material costing ₹ 50,000 was stolen from the site.

You are required to:

(i) Prepare contract account for the year ended 3l’ March, 2018.

(ii) Prepare Balance Sheet showing the relevant items. (May 2018, 10 marks)

Answer:

(i) Contract Account

* Depreciation on Plant = ₹ 1200,000 × 15% × \(\frac{5 \text { months }}{12 \text { months }}\)

= ₹ 75,000

(ii) Balance sheet (Extracts) as on 31st March, 2018

![]()

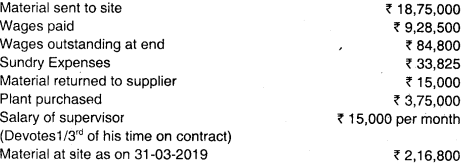

Question 20.

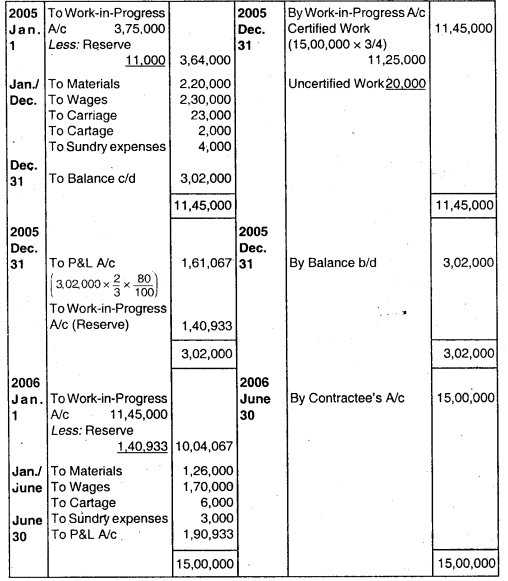

A contractor prepares his accounts for the year ending 31st March each year. He commenced a contract on 1st September, 2018. The following information relates to contract as on 31st March, 2019:

Some of material costing ₹ 10,000 was found unsuitable and was sold for ₹ 11,200. On 31-12-2018 plant which costs ₹ 25,000 was transferred to some other contract and on 31-01-2019 plant which costs ₹ 32,000 was returned to stores. The plant is subject to annual depreciation @ 15% on written down value method.

The contract price is ₹ 45,00,000. On 31st March, 2019 two-third of the contract was completed. The architect issued certificate covering 50% of the contract price.

Prepare Contract A/c. and show the notional profit or loss as on 31st March, 2019. (May 2019, 10 marks)

Answer:

Contract Account as on 31st March 2019)

Working Note:

1. Value of plant transferred to other contract:

₹ 25,000 less Depreciation for 4 months

= ₹ 25,000 – (₹ 25,000 × 15% × \(\frac{4}{12}\)) = ₹ 23,750

2. Value of plant returned to stores:

₹ 32,000 less Depreciation for 5 months

= ₹ 32,000 – (₹ 32.000 × 15% × \(\frac{5}{12}\) ) = ₹ 30,000

3. Value for Work Uncertified:

The cost of 2/3rd of the contract is ₹ 27,46,400

:. Cost of 100% of the contract is \(\frac{₹ 27,46,400}{2}\) × 3 = ₹ 41,19,600

.. Cost of 50% of the contract which has been certified by the architect is ₹ 41,19,600/2 = ₹ 20,59,800. Also, the cost of 1/3rd of the contract, which has been completed but not certified by the architect is ₹ (27,46.400 – 20,59,800) = ₹ 6,86,600.

![]()

Question 21.

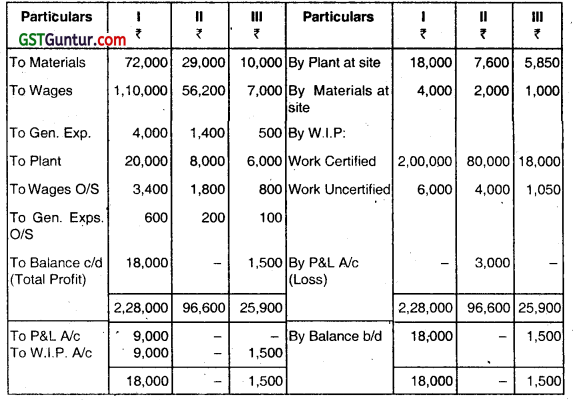

A firm of Contractors undertook three contracts on 1st April, 2005, 1st October, 2005 and 1st January, 2006. On 31st March, 2006 when their accounts were made up the position was as follows:

| I ₹ | II ₹ | III ₹ | |

| Contract price | 4,00,000 | 1,35,000 | 1,50,000 |

| Materials | 72,000 | 29,000 | 10,000 |

| Wages | 1,10,000 | 56,200 | 7,000 |

| General Expenses | 4,000 | 1,400 | 500 |

| Plant | 20,000 | 8,000 | 6,000 |

| Materials on hand | 4,000 | 2,000 | 1,000 |

| Wages outstanding | 3,400 | 1,800 | 800 |

| Work Certified | 2,00,000 | 80,000 | 18,000 |

| Cash Received | 1,50,000 | 60,000 | 13,500 |

| Work Uncertified | 6,000 | 4,000 | 1,050 |

| General Expenses (Outstanding) | 600 | 200 | 100 |

![]()

The plant were installed on the respective dates of the contract and depreciation is taken at 10% p.a. Prepare contract account.

Answer:

Working Notes:

- Calculation of depreciation are as follows:

Contract I = 20,000 × \(\frac{10}{100}\) = ₹ 2,000

Contract II = 8,000 × \(\frac{10}{100}\) × \(\frac{6}{12}\) = ₹ 400

Contract III = 6,000 × \(\frac{10}{100}\) × \(\frac{3}{12}\) = ₹ 150 - Certified work of Contract III is less than 1/4th of contract price.

Therefore, total profit on this contract has been kept in reserve. - There is loss on Contract Il which has been transferred to P&L A/c.

- Certified work of Contract I is equal to 14 of contract price. Therefore, 2/3rd of the profit received has been transferred to P&L Ac.

![]()

Question 22.

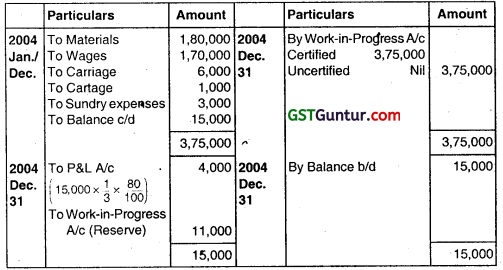

Bhagwandas undertook a contract for ₹ 15,00,000 on an arrangement that 80% of the work certified will be paid to them immediately and the remaining 20% will be paid on completion of the work.

In 2004, the amounts expended were: Materials ₹ 1.80,000; Wages ₹ 1,70,000; Carriage ₹ 6,000; Cartage ₹ 1,000; Sundry expenses ₹ 3,000. The work was certified for ₹ 3,75,000 and 80% of this was paid.

In 2005, the amounts were expended as: Materials ₹ 2,20,000; Wages ₹ 2,30,000; Carriage ₹ 23.000; Cartage ₹ 2,000; Sundry expenses ₹ 4,000; 3/4 of the contract was certified as done by 3151 December, 2005 and 80 percent of this was received in cash. The value of work uncertified till that day was ₹ 20,000.

In 2006, the amounts expended were : Materials ₹ 1,26,000; Wages ₹ 1,70,000: Çarriage ₹ 6,000; Sundry expenses ₹ 3,000. On 30th June, 2006, the work was completed and the balance of contract price was received in cash.

Prepare the Contract Account and the Contractee’s Account for three years.

Answer:

In the Books of Bhagwandas Contract Account

![]()

Question 23.

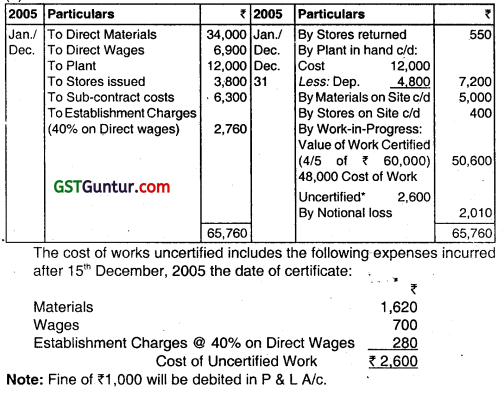

The following ¡s the summary of expenditure on a contract upto 31st December, 2005:

You are given the following informations:

(a) The contract was started on 1st January, 2005 and contract price is ₹ 60,000.

(b) The architects had certified that 4/5 of the contract had been completed on 15th December, 2005.

(c) Depreciation on plant upto 15.12.2005 was ₹ 4,800.

(d) The summary set out above includes items relating to the period since 15th Dec., 2005 as follows:

Wages ₹ 700 and Materials used ₹ 1,620.

(e) Materials at site on 31st December, 2005 had cost ₹ 5,000 and stores at site had cost ₹ 400.

(f) Establishment charges are 40% on direct wages.

(g) A fine of ₹ 1,000 is likely to be imposed for late completion.

You are required:

(a) to prepare Contract Account,

(b) show what profit or loss has arisen on work certified,

(c) suggest what figures should be taken to the Profit & Loss Account for the year ended 31st Dec., 2005,

(d) show how the balance would be shown in the Contract A/c as on 1st Jan., 2006

Answer:

Contract Account

![]()

Question 24.

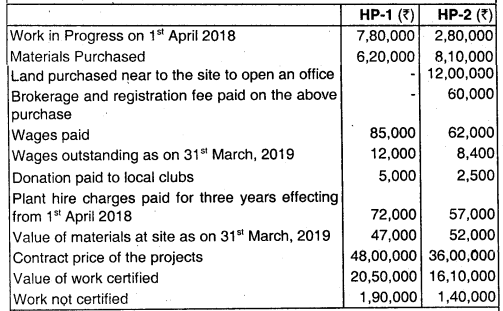

Dream house (P) Ltd. is engaged in building two residential housing projects in the city. Particulars related to two housing projects are as below:

A concrete mixture machine was bought on 1st April 2018 for ₹ 8,20,000 and used for 180 days in HP-1 and for 100 days in HP-2. Depreciation is provided @ 15% p.a. (this machine can be used for any other projects) PREPARE contract account for the two housing projects showing the notional profit or loss on each project for the year ended 31st March. 2019.

Answer:

Contract Account for the year ended 31st March, 2019

* Assuming donation paid to local club was exclusively for the above projects, hence included in the contract account.

** Depreciation on concrete mixture machine is charged on the basis of number of days used for the projects, as it is clearly mentioned in the question that this machine can be used for other projects also.

(Land purchased and brokerage and registration fee paid for this purpose cannot be charged to contract account, hence not included in the contract account)

![]()

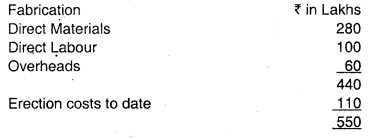

Question 25.

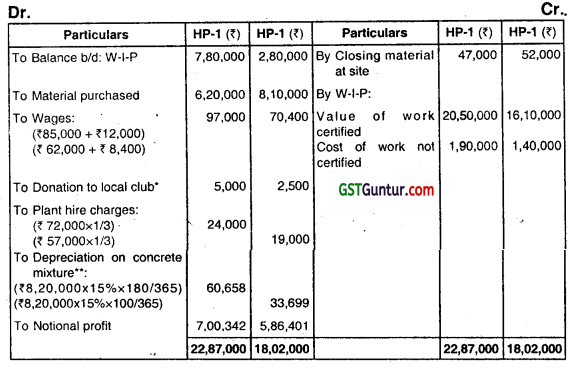

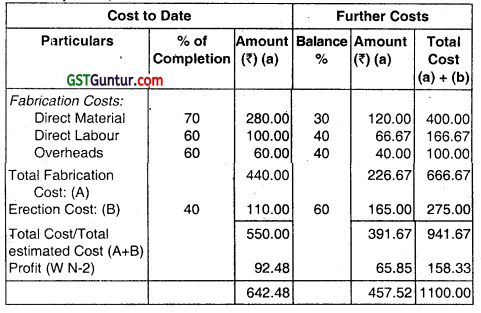

Paramount Engineers are engaged in construction and erection of a bridge under a long-term contract. The cost incurred upto 31.03.2001 was as under:

The contract price is ₹ 11 crores and the cash received on account till 31.03.2.001 was ₹ 6 crores.

A technical estimate of the contract indicates the following degree of completion of work:

Fabrication—Direct Material—70%, Direct Labour and Overheads 60%, Erection—40%.

You are required to estimate the profit that could be taken to Profit and Loss Account against this partly completed contract as at 31.03.2001. (May 2001, 10 marks)

Answer:

Estimation of Profit to be taken to Profit & Loss A/c against Partly Completed Contract – as on 31.03.2001

Profit to be taken to P/L Account = Notional Profit × \(\frac{2}{3}\) × \(\frac{\text { Cash Received }}{\text { Work Certified }}\)

= ₹ 92.48 Lacs × \(\frac{2}{3}\) × \(\frac{₹ 600 \text { Lacs }}{₹ 642.48 \text { Lacs }}\)

= ₹ 57.576 Lacs

![]()

Working Notes :

1. Statement Showing Cost of Contract to date, Further Cost of Completion, Notional Profit and Estimated Profit

2. Computation of Notional Profit and Future Profit

Notional Profit = Total Estimated Profit × \(\frac{\text { Cost to date }}{\text { Total Estimated Cost }}\)

= 158.33 × \(\frac{550}{941.67}\)

= ₹ 92.48 Lacs

Future Profit = Total Estimated Profit – Notional Profit

= ₹ 158.33 – ₹ 92.48

= ₹ 65.85

3. Computation of Work Certified

Work Certified = Cost of Contract to date + Notional Profit

= ₹ 550 Lacs + ₹ 92.48 Lacs

= ₹ 642.48 Lacs

4. Percentage of Completion of Contract

= \(\frac{\text { Value of Work Certified }}{\text { Contract Price }}\) × 100

= \(\frac{₹ 642.48 \text { Lacs }}{₹ 1100 \text { Lacs }}\) × 100

= 58.40%

2/3rd of the Notional Profit in the ratio of Work Certified to contract Price should be transferred to Profit & Loss A/c.

![]()

Question 26.

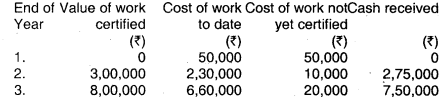

A contract expected to be completed in year 4, exhibits the following information:

The contract price is ₹ 10,00,000 and the estimated profit is 20%. You are required to calculate, how much profit should have been credited to the Profit and Loss A/c by the end of years 1, 2, and 3. (Nov 2008, 3 marks)

Answer:

At the end of Year – 1

Since percentage completion of contract is 0, therefore, no profit will be recognised in the Profit and Loss Account.

At the end of Year-2

Notional Profit

= Value of work certified – (cost of work to date – cost of work not yet certified)

= ₹ 3,00,000 – (₹ 2,30,000 – ₹ 10,000)

= ₹ 80000

Percentage completion = \(\frac{\text { Value of Work Certified }}{\text { Contract Price }}\) × 100

= ₹ \(\frac{3,00,000}{10,00,000}\) × 100 = 30%

Since, percentage completion ranges between 25% to 50%. therefore, estimated profit to be transferred to Profit and Loss A/c (at the end of year 2)

= \(\frac{1}{3}\) × Notional Profit × \(\frac{\text { Cash received }}{\text { Work certified }}\)

= \(\frac{1}{3}\) × 80000 × \(\frac{2,75,000}{3,00,000}\)

= ₹ 24,444.44

![]()

At the end of year-3

Notional Profit:

= Value of work certified – (cost of work to date- cost of work not yet certified)

= ₹ 8,00.000 – (₹ 6,60000 – ₹ 20,000)

= ₹ 1,60,000

Percentage completion = \(\frac{\text { Value of Work Certified }}{\text { Contract Price }}\) × 100

= \(\frac{₹ 8,00,000}{10,00,000}\) × 100 = 80%

Since, percentage completion is in the range 50% to 90%, therefore, estimated profit to be transferred to Profit and Loss A/c (at the end of year 3)

= \(\frac{2}{3}\) × Notional Profit × \(\frac{\text { Cash received }}{\text { Work certified }}\)

= \(\frac{2}{3}\) × 1,60,000 × \(\frac{7,50,000}{8,00,000}\)

= ₹ 1,00,000

![]()

Question 27.

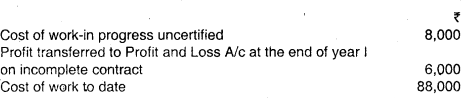

A contract is estimated to be 80% complete in its first year of construction as certified. The contractee pays 75% of value of work certified, as and when certified and makes the final payment on the completion of contract. Following information is available for the first year:

Calculate the value of work-in-progress certified and amount of contract price. (May 2009, 3 marks)

Answer:

As the contract is 80% complete, so 2/3rd of the notional profit on cash basis has been transferred to Profit & Loss A/c in the first year of contract.

∴ Amount transferred to Profit & Loss A/c

= \(\frac{2}{3}\) × Notional Profit × 9/ of cost received or, 60000

= \(\frac{2}{3}\) × Notional Profit × \(\frac{75}{100}\)

or, Notional Profit = \(\frac{60,000 \times 3 \times 100}{2 \times 75}\) = ₹ 1,20,000

Computation of Value of Work Certified:

![]()

Question 28.

Answer the following:

Explain the terms notional profit and retention money in contract costing. (Nov 2011, 4 marks)

Answer:

NotIonal Profit :

Notional Profit is the excess of income till date over expenditure till date on a contract. Since actual profit can be computed only after the contract is complete, notional profit is used to recognise profit during the course of contract.

The notional profit is computed as follows:

Retention Money :

The contractor gets money on the basis of work completed as certified by the certificate of work done. Sometimes the customer does not pay the whole value of work done. As per the agreement, a certain percentage of the value of work done is retained by the customer. This is called Retention Money.

The objective behind Retention Money s to place the customer in a favourable position as against the contractor. It safeguards the interest of the customer as against failure of the contractor to fulfill any of the clause of the agreement or against the defective work found later on.

![]()

Question 29.

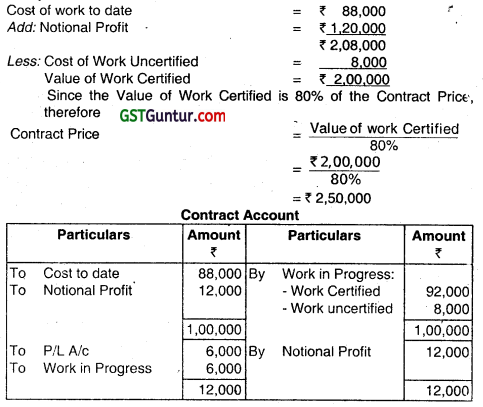

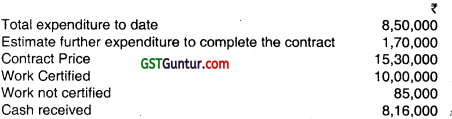

From the following particulars compute a conservation estimate of profit by4 methods on a contract which has 80 percent complete: (Nov 2012, 4 marks)

Answer:

Working Notes:

1. Calculation of Notional Profit

= (Work certified + work not certified) – Total expenditure to date

= ₹ (10,00,000 + 85,000) – ₹ 8,50000

= ₹ 2,35,000

2. Calculation of Estimated Profit

= Contract Price (Expenditure to date + Further expenditure to be incurred)

= ₹ 15,30,000 – ₹ (8,50,000 + 1,70,000)

= ₹ 5,10,000

Computation of Conservative Estimate of Profit by following methods:

Most conservative Profit is ₹ 1,25333, therefore profit to be transferred to Profit and Loss a/c is ₹ 1,25,333.

![]()

Question 30.

Premier Construction Company undertook a contract for ₹ 5,00,000 on 1st August, 2016. on 31st March, 2017 when the accounts were closed, the following information was available:

Cost of work uncertified – ₹ 1,20,000

Cash received – ₹ 2,50,000 (80 of work certified)

Profit transferred to costing Profit and

Loss account at the end of the year on ₹ 80,000

Incomplete contract

Calculate:

(i) The value of work ¡n progress certified

(ii) Degree of completion of contract

(iii) Notional Profit and

(iv) Cost of contract as on 31 -03-2017 (Nov 2017, 5 marks)

Answer:

(i) Cash Received (80% of work certified) = ₹ 2,50,000

Value of work certified = \(\frac{2,50,000}{80 \%}\) = ₹ 3,12,500

(ii) Degree of completion

= \(\frac{\text { Value of work certified }}{\text { Contract Price }}\) × 100 = \(\frac{3,12,500}{5,00,000}\) × 100 = 62.5%

(iii) Since contract is 62.5% than profit to be transferred to costing P&L A/c.

2/3 × notional profit × \(\frac{2,50,000}{3,12,500}\) = ₹ 80,000

∴ Notional profit = ₹ 1,50,000

(iv) Cost of contract = Cost of work certified + Cost of work uncertified

= 1,20,000 + 1,62,500 (Working Note 1)

= ₹ 2,82,500

Working Note: 1

Notional Profit = Value of work certified – Cost of work certified

1,50,000 = 3,12,500 – Cost of work certified

Cost of work certified = ₹ 1,62,500

![]()

Question 31.

Answer the following:

Explain ‘Retention Money and ‘Progress payment in contract. (Nov 2017, 4 marks)

Answer:

Retention Money in Contract Costing:

A contractor does not receive the full payment of the work certified by the surveyor. Contractee retains some amount to be paid after some time, when it is ensured that there is no default in the work done by the contractor. If any deficiency or defect is noticed, it is to be rectified by the contractor before the release of the retention money. Thus, the retention money provides a safeguard against the default risk in the contracts.

Progress Payment:

Contractors receive payments based on the certificate issued by the architect.

PP = Value of Work Certified – Retention Money.

![]()

Question 32.

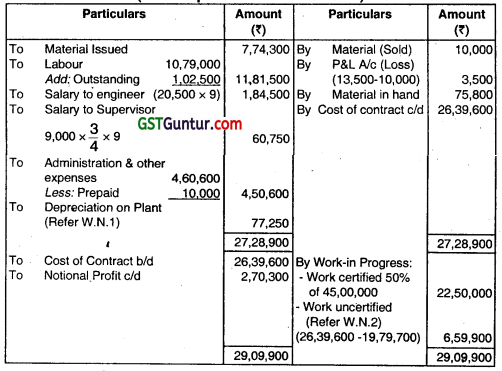

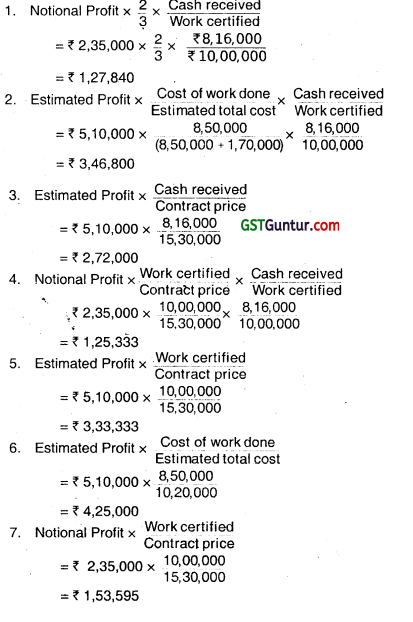

M/s. SD Private Limited commenced a contract on 1st July 2017 and the company closes its .account for the year on 31st March every year. The following information relates to the contract as on 31st March 2018.

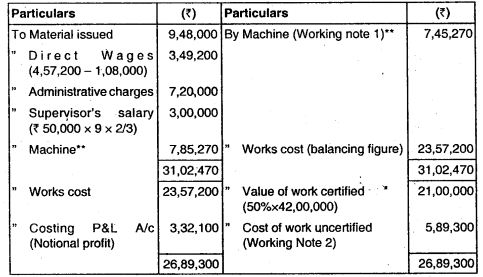

(i) Material issued – ₹ 9,48,000

(ii) Direct wages – ₹ 4,57,200

(iii) Prepaid direct wages as on 31.3.2018 – ₹ 1,08,000

(iv) Administration charges – ₹ 7,20,000

(v) A supervisor, who is paid ₹ 50,000 per month, has devoted two-third of his time to this contract.

(vi) A plant, costing ₹ 7,85,270 has been on the site for 185 days, its working life is estimated at 9 years and its scrap value is ₹ 75,000.

The contract price is ₹ 42 lakhs. On 31st March 2018 two-third of the contract was completed. The Architect issued certificate covering 50% of the contract price and the contractor had been paid ₹ 15.75 lakhs on account.

Assuming 365 clays in a year, you are required to:

(i) Prepare a Contract Account showing worl cost

(ii) Calculate Notional Profit or Loss as on 31M March.2018. (Nov 2018, 5 marks)

Answer:

∴ Cost of 50% of the contract which has been certified by the architect is ₹ 22,96,852.50

Also the Cost of 1/3rd of the contract, which has been completed but not certified by the architect is ₹ 7,65,617.5.

![]()

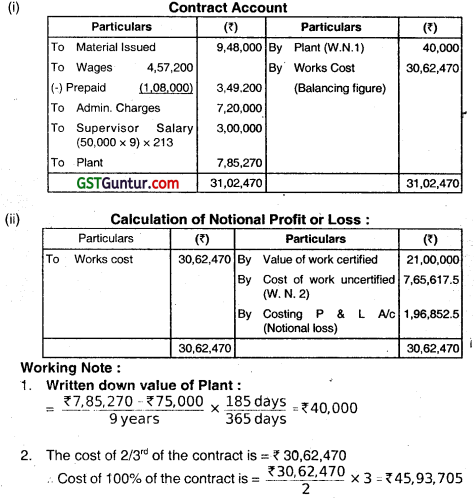

Alternate Solution:

Contract Account

** Alternatively Depreciation on machine can be shown debit side of Contract Account.

Working Note :

1. Written down value of Machine:

Depreciation = \(\frac{₹ 7,85,270-₹ 75,000}{9 \text { years }} \times \frac{185 \text { days }}{365 \text { days }}\) = ₹ 40,000

Hence the value of machine after the period of 185 days = ₹ 7,85,270 – ₹ 40,000 = ₹ 7,45,270

2. The cost of 2/3rd of the contract is ₹ 23.57,200

∴ Cost of 100% of the contract is \(\frac{₹ 23,57,200}{2}\) × 3 = ₹ 35,35,800

∴ Cost of 50% of the contract which has been certified by the architect

is ₹ 17,67,900. Also, the cost of 1/3rd of the contract, which has been completed but not certified by the architect is ₹ 5,89,300.

![]()

Question 33.

Cost plus contract (Nov 2000, 2 marks)

OR

What are the main advantages of cost plus contract? (May 2008, 2 marks)

OR

Mention the main advantage of cost plus contracts. (Nov 2009, 2 marks)

OR

What is cost plus contract? What are its advantages? (May 2016, 4 marks)

Answer:

Cost Plus Contract:

A cost plus contract is one in which the contract price is ascertained by adding a percentage of profit to the total cost of contract. In such a contract the, contract gets reimbursement from the contractee, of all allowable or specifically defined costs incurred, plus a percentage of these expenses or a fixed amount as profit.

Main features of Cost-Plus Contract:

- The cost-plus-contract is adopted in those contracts where the probable cost of contract can not be estimated with reasonable accuracy.

- It is adopted in those contracts which may take a long duration to complete.

- It is preferred in case of those contracts whose cost of material and labour cost is unsteady and is likely to change in future.

- Such a contract is beneficial for both contractor as well as customer. On one hand, it offers a fair price to the customer, and a reasonable profit to the contractor on the other hand.

- The contract price is ascertained by adding a fixed and predetermined percentage of profit to the total cost of contract.

- The different costs to be included in the contract are pre-decided so that no dispute arises in future.

- The customer is allowed to scrutinize the concerned books, documents and accounts of the contractor.

![]()

Advantage of Cost Plus Contract:

- In contacts where the probable cost of contract cannot be estimated with reasonable accuracy, cost plus contract method helps in ascertaining the contract cost by adding a percentage of profit to the total cost of contract.

- It is preferable in those contracts whose cost of material and labour is unsteady and is likely to change in future.

- It is beneficial for both.contractor as well as customer. It offers a fair price to the customer and a reasonable profit to the contractor.

- The different costs to be included in the contract are pre-decided so that no dispute arise in future.

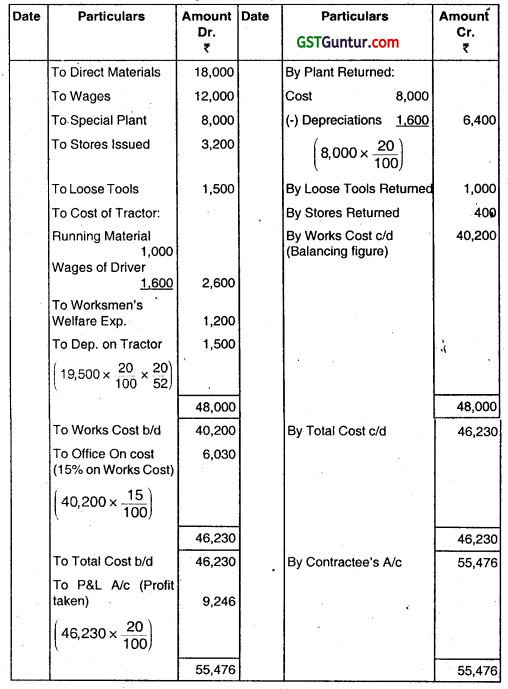

Question 34.

Write up a Contract Account from the following particulars:

The contract was completed in 20 weeks at the end of which period plant was returned subject to a depreciation of 20% on the original cost. The value of loose tools and stores returned were ₹ 1,000 and ₹ 400 respectively. The value of the Tractor was ₹ 19,500 and depreciation was to be charged to this contract at the rate of 20% per annum. You are required to provide Office on cost at the rate of 15% on Works cost. The contract was executed at a profit of 20% on total cost.

Answer:

In the Books of Contractor Contract Account

![]()

Question 35.

Write note on ‘Escalation Clause’. (Nov 2000, May 2015, 4 marks)

OR

Explain the importance of an Escalation Clause in contract cost. (Nov 2007, 2 marks)

OR

State the escalation clause in contract costing. (Nov 2013, 2 marks)

Answer:

Escalation Clause

Meaning :

Is a stipulation in the contract that the contract price will be increased by an agreed amount or percentage if the price of raw material, ges etc. rises beyond a certain limit. The object of this clause is to safeguard the interest of both sides against untavourable change in price. By this clause, the contractor’s interests are safeguarded as his percentage of profit is not reduced, The customer’s interest is safeguard as quality is ensured because due to the escalation clause the contractor does not use materials of low quality.

Accounting Treatment :

Step I : The increased contract price is determined with reference to the escalation dause.

Step II : The amount due from the customer is recorded in contract A/c by passing the following journal entry.

Customer’s A/c

Dr. ‘

To Contract A/c

![]()

Question 36.

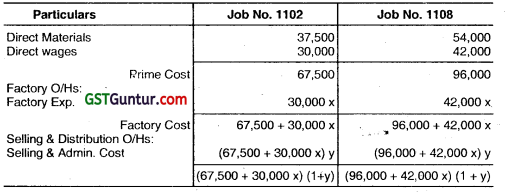

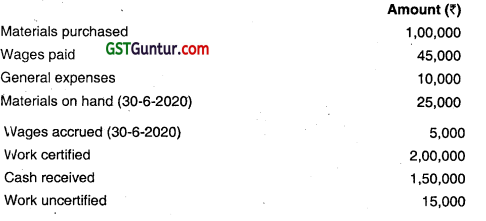

W Limited undertook a contract for ₹ 5,00,000 on 1st July, 2019. On 30th June, 2020 when the accounts were closed, the following details about the contract were gathered:

The above contract contained “Escalation clause” which read as follows:

“In the event of increase in the prices of materials and rates of wages by more than 5%, the contract price would be increased accordingly by 25% of the rise in the cost of materials añd wages beyond 5% in each case.” It was found that since the date of signing the agreement, the prices of materials and wage rates increased by 25%. The value of the work certified does not take into account the effect of the above clause. Calculate the ‘value of work certified’ after taking the effect of ‘Escalation Clause’ as on 30th June, 2020. (Nov 2020, 5 marks)

![]()

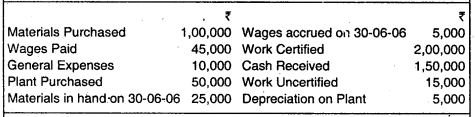

Question 37.

Deluxe Limited undertook a Contract for ₹ 5,00,000 on 1st July, 2005. On 30th June, 2006. when the accounts were dosed, the following details about the contract were gathered:

The above contract contained an escalation clause which read as follows:

“In the event of prices of materials and rates of wages increase by more than 5%, the contract price would be increased accordingly by 25% of the the cost of materials and wages beyond 5% in each case.”

It was found that since the date of signing the agreement, the prices of materials and wages rates increased by 25%. The value of work certified does not take into account the effect of the above clause.

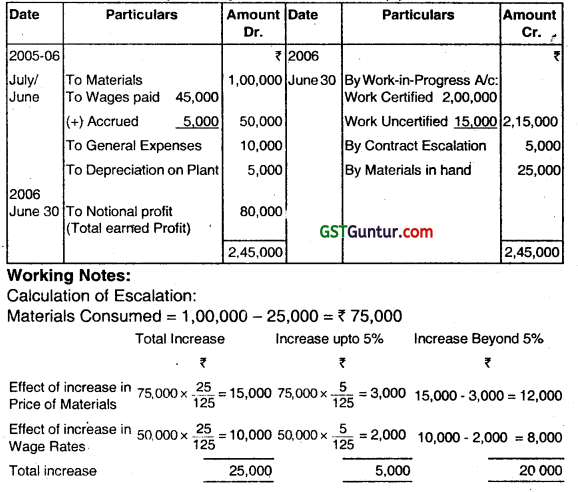

Prepare the Contract Account.

Answer:

In the Books of Deluxe Limited Contract Account (for the year ended 30-6-2006)

Increase in Contract Price 20,000 × \(\frac{25}{100}\) = ₹ 5,000

(25% of Increase beyond 5%)

![]()

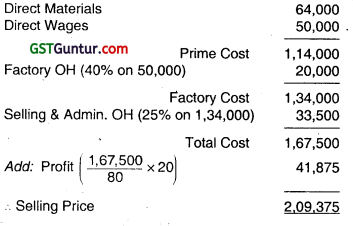

Question 38.

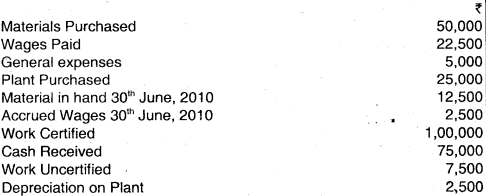

Asita Ltd. undertook a contract for ₹ 2,50,000 on 1st July, 2009. On 30th June, 2010 when the accounts were closed, the following details about the contract Were gathered:

The above contract contained an escalation clause whLch reads as follows:

“In the event of prices of materials and rates of wages increase by more than 5%, the contract price would be increased accordingly by 15% of the rise in the cost of materials and wages beyond 5% in each case.” It was found that since the date of signing the agreement, the prices of material and wages rates increased by 25%. The value of work certified does not take into account the effect of the above clause. Prepare Contract Account and find the amount of increase in contract price.

Answer:

Contract Account (for the year ending 30th June, 2010)