Activity Based Costing – CA Inter Costing Question Bank is designed strictly as per the latest syllabus and exam pattern.

Activity Based Costing – CA Inter Costing Question Bank

Question 1.

What is the fundamental difference between Activity Based Costing System (ABC) and Traditional Costing System? Why more and more organisations in both the manufacturing and non-manufacturing industries are adopting ABC? (Nov 2007, 10 marks)

Answer:

Fundamental difference between ABC and Traditional costing system are as follows:

| Particulars | Activity Based Costing | Traditional Absorption Costing | |

| 1 | Cost Identification | OH are related to activities (work performed) or grouped into Cost Pools. | OHs are related to places/ cost centres/departments. |

| 2 | Activity and Cost Ascertainment | All four levels of activities and related costs, viz. (a) Unit Level, (b) Batch Level, (c) Product Level, and (d) Facility Level, are identified. | Only-(a) Unit Level Activities (Variable), and (b) Facility Level Activities (Fixed) may be identified. [Sometimes, SemiVariable Costs are also ascertained.] |

| 3 | Cost Assignment | Costs are assigned to Cost Objects, e.g. customers, customer segments, services, distribution channels, products, departments, etc. | Cost are assigned to Cost Units, i.e. to products, or jobs or hours. . |

| 4 | Cost Drivers | Activity-wise Cost Drivers are identified. Time may also be a (but not the only) Cost Driver. | Time (Hours) is assumed as the only “causal factor” governing cost in all departments. |

| 5 | Single vs. Multiple Cost Drivers | Multiple Cost Drivers may be identified for each activity. However, for fixing ABC rate, the most relevant/ dominant Cost Driver will be considered. | Only one Cost Driver (either Labour Hours or Machine Hours) is identified for each Department. |

| 6 | Recovery Rates | Specific activity-wise recovery rates are used. There is no concept of “single” or “overall” ABC Rate. | Either Multiple Rates (for each department) or Single Rate (also called Blanket or Overall or Factory Rate may be used. |

| 7 | Cost Control | Essential activities can be simplified and unnecessary activities can be eliminated. The corresponding costs are also reduced/ minimized. Hence ABC aids cost control. | Places/Cost Centres cannot be eliminated. Hence, not suitable for cost control. |

| 8 | Method used | Under conventional or traditiona1 costing system, OH are first allocated and apportioned to cost centres and then absorbed to cost objects. | Under ABC, OH are first assigned to activity pools and then assigned to cost objects. |

![]()

Question 2.

Describe the various levels of activities under ‘ABC methodology. (Nov 2020, 4 marks)

Question 3.

Answer the following:

Explain ‘Activity Based Budgeting’, (Nov 2018, 5 marks)

Answer:

Activity Based Budgeting (ABB): .

Activity Based Budgeting analyse the resource input or cost for each activity. It provides a framework for estimating the amount of resources required in accordance with budgeted level of activity. Actual results can be compared with budgeted results to highlight both in financial and non-financial terms those activities with major discrepancies from budget for potential reduction in supply of resources.

It is a planning and control system which seeks to support the objectives of continuous improvement, It means planning and controlling the expected activities of the organisation to derive a cost effective budget that meet forecast workload and agreed strategic goals. ABB is the reversing of the ABC process to produce financial plans and budgets.

![]()

Question 4.

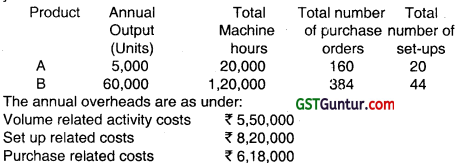

A company manufacturing two products furnishes the following data for a year:

You are required to calculate the cost per unit of each Product A and B based on:

(a) Traditional method of charging overheads

(b) Activity based costing method. (Nov 2002, 9 marks)

Answer:

(i) Statement showing overhead cost per unit (based on traditional method of charging overheads)

| Products | Annual Output (units) | Total Machine hours | Overhead Cost Component (Refer to W. Note 1) (₹) | Overhead Cost per Unit (₹) |

| A | 5,000 | 20,000 | 2,84,000 (20,000 hrs × ₹ 14.20) |

56.80 (₹ 2,84,000/ 5,000 units) |

| B | 60,000 | 1,20,000 | 17,04,000 (1,20,000 h₹ × ₹ 14.20) |

28.40 (₹ 17,04,000/ 60,000 units) |

(ii) Statement showing overhead cost per unit (based on activity based costing method)

Working Notes:

1. Machine hour rate = \(\frac{\text { Total annual overheads }}{\text { Total machine hours }}\)

= \(\frac{₹ 19,88,000}{1,40,000 \text { hours }}\) = ₹ 14.20 per hour

2. Machine hour rate

= \(\frac{\text { Total annual overhead cost for valume related activities }}{\text { Total machine hours }}\)

= \(\frac{₹ 5, 50,000}{1,40,000 \text { hours }}\)

= ₹ 3.93 (approx.)

3. Cost of one set-up = \(\frac{\text { Total costs related to set-ups }}{\text { Total number of set }- \text { ups }}\)

= \(\frac{₹ 8,20,000}{64 \text { set-ups }}\) = ₹ 12,812.50

4. Cost of purchase order = \(\frac{\text { Total costs related to purchases }}{\text { Total number of purchase order }}\)

= \(\frac{₹ 6,18,000}{544 \text { orders }}\)

= ₹ 1,136.03

![]()

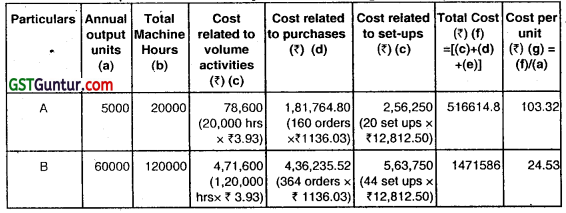

Question 5.

Family Store wants information about the profitability of individual product lines : Soft drinks, Fresh produce.and Packaged food, Family store provides the following data for the year 2002-03 for each product line:

| Soft drinks | Fresh produce | Packaged

food |

|

| Revenues

Cost of goods sold Cost of bottles returned Number of purchase orders placed Number of deliveries received Hours of shelf-stocking time Itehns sold |

₹ 7,93,500

₹ 6,00,000 ₹ 12,000 360 300 540 1,26,000 |

₹ 21,00,600

₹ 15,00,000 ₹ 0 840 2,190 5,400 11,04,000 |

₹ 12,09,900

₹ 9,00,000 ₹ 0 360 660 2,700 3,06,000 |

![]()

Family Store also provides the following information for the year 2002-03:

| Activity | Description of Activity | Total Cost | Cost-allocation Base |

| Bottles returns

Ordering Delivery Shelf stocking

Customer Support |

Returning of empty bottles to store

Placing of orders for purchases Physical delivery and receipt kf goods Stocking of goods on store shelves and on-going restocking Assistance provided to customers including check-out |

₹ 12,000

₹ 1,56,000 ₹ 2,52,000 ₹ 1,72,800 ₹ 3,07,200 |

Direct tracing to soft-drink line

1,560 purchase orders 3,150 deliveries 15,36,000 items sold |

Required:

(i) Family Store currently allocates support cost (all costs other than cost of goods sold) to product lines on the basis of cost of goods sold of each product line. Calculate the operating income and operating income as a % of revenues for each product line.

(ii) If Family Store allocates support costs (all costs other than cost of goods sold) to product lines using an activity-based costing system, calculate the operating income and operating income as a of revenues for each product line.

(iii) Comment on your answers in requirements (i) and (ii). (May 2003, 3 + 7 + 2 = 12 marks)

Answer:

(i) Statement of operating income and operating income as a % of revenues for each product line:

![]()

2. Percentage of Support Cost to Cost of Goods Sold (COGS):

= \(\frac{\text { Total Support Cost }}{\text { Total Cost of Goods Sold }}\) × 100

= \(\frac{9,00,000}{30,00,000}\) × 100 = 30%

3. Cost for Each Activity Cost Driver:

| Activity (1) | Total Cost (2) | Cost allocation base (3) | Cost driver Rate 4 = 2 ÷ 3 |

| Ordering

Delivery Shelf-stocking Customer Support |

1,56,000

2,52,000 1,72,800 3,07,200 |

1,560 Purchase order

3,150 deliveries 8,640 Hours 15,36,00u items sold |

100 per purchase order

80 per delivery 20 per stocking hour 0.20 per item sold. |

(ii) Statement of operating income and operating income as a % of Revenues for each product line. (When support costs are allocated to product lines using an activity-based costing system).

(iii) Comment: Managers believe that ABC system is more credible than the traditional costing system. The ABC system distinguishes with different type of activities at family store more precisely. It also tracks more precisely how individual product lines use resources.

Soft drinks consume less resources than either fresh produce or packaged food. Soft drinks have (ever deliveries and require less shelf stocking time.

Family store managers can use ABC information to guide their decisions as to how to allocate a planned increase in floor space. Pricing decisior can also be made in a more informed may with ABC information.

![]()

Question 6.

RST Limited specializes in the distribution of pharmaceutical products. It buys from the pharmaceutical companies and resells to each of the three different markets:

(i) General Supermarket Chains

(ii) Drugstore Chains

(iii) Chemist Shops

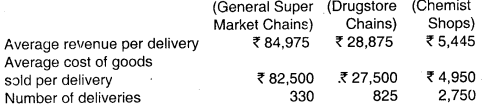

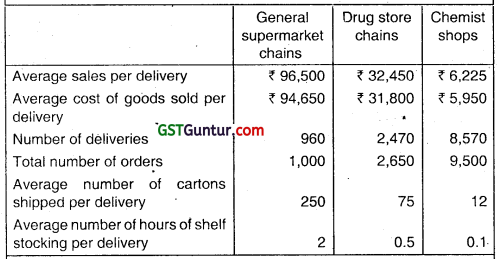

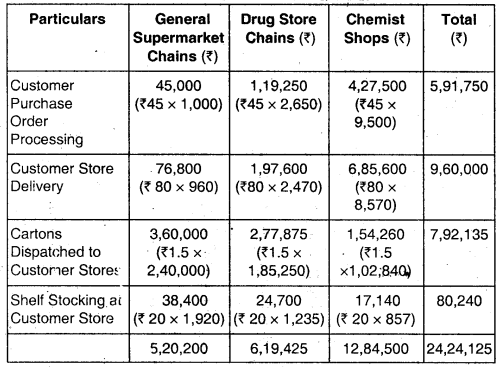

The following data for the month of April, 2004 in respect of RST Limited has been reported:

In the past, RST Limited has used gross margin percentage to evaluate the relative profitability of its distribution channels.

The company plans to use activity-based costing for analysing the profitability of its distribution channels.

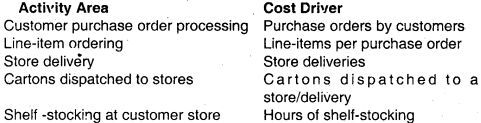

The activity analysis of RST Limited is as under:

The April, 2004operatingcosts (other than cost of goods sold) of RST Limited are ₹ 8,27,970. These operating costs are assigned to five activity areas. The cost in each area and the quantity of the cost allocation basis used in that area for April. 2004 are as follows:

Required:

(i) Compute for April, 2004 gross-margin percentage for each of its three distribution channels and compute RST Limited’s operating income.

(ii) Compute the April, 2004 rate per unit of the cost-allocation base for each of the five activity areas.

(iii) Compute the operating income of each distribution channel in April, 2004 using the activity-based costing information. Comment on the results. What new insights are available with the activity-based cost information?

(iv) Describe four challenges one would face in assigning the total ‘April, 2004 operating costs of 8,27,970 to five activity areas. . (May 2004, 12 marks)

Answer:

RST Ltd.

(i) Statement of operating Income and gross margin % for each of its 3 distribution channel:

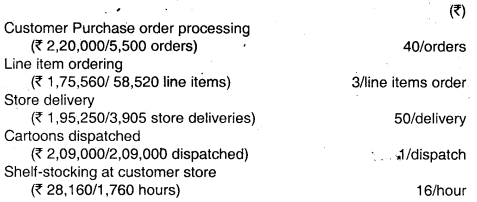

(ii) Computation of rate per unit of the cost allocation base for each of the 5 activity areas for April 2004:

![]()

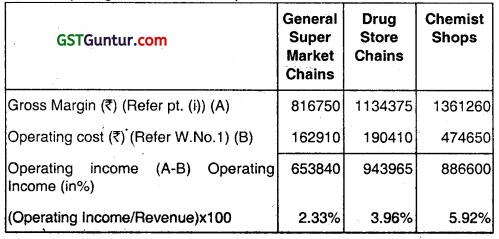

(iii) Operating Income Statement of each distribution channel in April, 2004 (using ABC information):

Comments and new Insights:

The ABC information highlights, how the Chemist Shops uses a larger amount of RST Ltd’s resources per revenue than do the other 2 distribution channels. Ratio of operating costs to revenues, across these markets is:

General Super market chains

(iv) Challenges faced in assigning total operating cost of ₹ 827970:

- Choosing an appropriate cost driver for activity area.

- Developing a reliable data base for the chosen cost driver

- Deciding how to handle costs that may be common across several activities.

- Choice of the item period to compute cost rates per cost driver.

- Behavioural factors.

![]()

Question 7.

MST Limited has collected the following data for its two activities. It calculates activity cost rates based on cost driver capacity.

| Activity Power | Cost Driver Kilowatt hours | Capacity 50,000 kilowatt hours | Cost

₹ 2,00,000 |

| Quality | Number of | 10000 | ₹ 3,00,000 |

| inspections | Inspections | Inspections |

The company makes three products. M. S and T. For the year ended March 31, 2004, the following consumption of cost drivers was reported:

| Product | Kilowatt Hours | Quality Inspections |

| M | 10000 | 3500 |

| S | 20000 | 2500 |

| T | 15000 | 3000 |

![]()

Required:

(i) Compute the costs allocated to each product from each activity.

(ii) Calculate the cost of unused capacity for each activity.

(iii) Discuss the factors the management considers in choosing a

capacity level to compute the budgeted fixed overhead cost rate. (May 2004, 6 marks)

Answer:

(i) Statement of cost allocation to each product from each activity

| Product | ||||

| M | S | T | Total | |

| Power (Refer W.N.) | 40,000 (10,000 kwh × ₹ 4) | 80,000 (20,000 kwh × ₹ 4) | 60,000 (15,000 kvvh × ₹ 4) | 180000 |

| Quality Inspection (Refer W.N.) | 1,05,000 (3,500 inspection × ₹ 30) | 75,000 (2,500 inspection × ₹ 30) | 90,000 (3,000 inspection × ₹ 30) | 270000 |

Working Notes:

Power ₹ 2,00.000/ 50,000 kwh = ₹ 4/kwh.

Quality Inspection: ₹ 3,00,000/10.000 lnsp. = ₹ 30/ Inspection

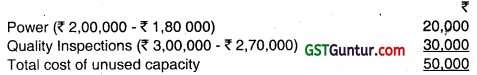

(ii) Computation of cost of unused capacity for each activity:

(iii) Factors management should consider in choosing a capacity level to compute the budgeted fixed overhead cost rate:

- Effect on product costing and capacity management.

- Effect on pricing decisions

- Effect on performance

- Effect on financial statements.

- Regulatory requirements

- Difficulties in forecasting chosen capacity level concepts.

![]()

Question 8.

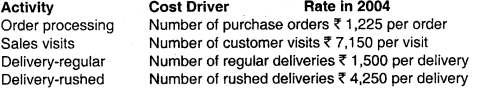

MNP suits is a ready-to-wear suit manufacturer. It has tour customer: two wholesale-channel customers and two retail-channel customers. MNP suits has developed the following activity-based costing system:

List selling price per suit is 1.000 and average cost per suit is ₹ 550.

The CEO of MNP suits wants to evaluate the profitability of each of the four customers in 2003 to explore opportunities for increasing profitability of his company in 2004. The following data are available for 2003:

Required:

(i) Calculate the customer-level operating income in 2003.

(ii) What do you recommend to CEO of MNP suits to do to increase the Company’s operating income in 2004?

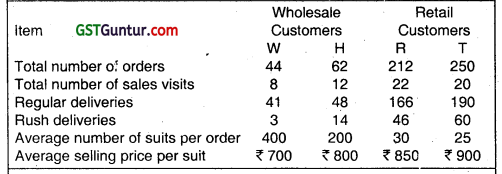

(iii) Assume MN2 suits’ distribution channel costs are ₹ 17,50,000 for its wholesale cdstomers and 10,50.000 for tne retail customers. Also, assume that its Corporate sustaining costs are ₹ 12,50.000. Prepare

Income statement of MNP suits for 2003. (Nov 2004, 6 + 2 + 2 10 marks)

Answer:

(i) Computation of Customer level operating Income in 2003:

![]()

(ii) Before giving our opinion to CEO of MNP suits for Increasing the company’s operating Income In 2004, we first see the key challenges faced by the CEO:

- Reduce level of price discounting, especially by the wholesale customer ‘W’.

- Reduce level of ‘Customer level costs’, especially by retail customers R&T.

ABC analysis highlights some to problem areas regarding the customers R&T. Such as:

- High number of customer visits.

- High number of orders.

- High number of rushed deliveries.

So Our opinion is – CEO should reduce such high level of activities without reducing customer revenues.

(iii) Income Statement of MNP suits for 2003:

![]()

Question 9.

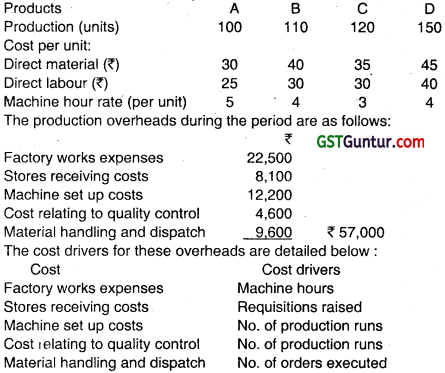

A B C D Co. Ltd. produces and sells tour products A, B, C and D. These products are similar and usually produced in production runs of 10 units and sold in a batch of 5 units. The production details of these, products are as follows:

The number ni requisitions raised on the Stores was 25 for each product and number of orders executed was 96, each order was in a batch of 05 units.

Required:

(i) Total cost of each product assuming the absorption of overhead on machine hour basis;

(ii) Total cost of each product assuming the absorption of overhead by using activity base costing; and

(iii) Show the differences between (i) and (ii) and comments. (May 2005, 12 marks)

Answer:

Statement showing total cost of each product assuming absorption of overheads on Machine Hour Rate Basis (MHR):

Statement showing total cost of each product assuming activity based costing (ABC): as the base:

- The above analysis shows that, A consumes comparatively more of Machine hours.

- On the use of activity based costing gives different product costs than what were arrived at by utilising traditional costing.

- Product costs are more precise by using ABC because in this method of absorption overheads have been identitied with specific activities.

![]()

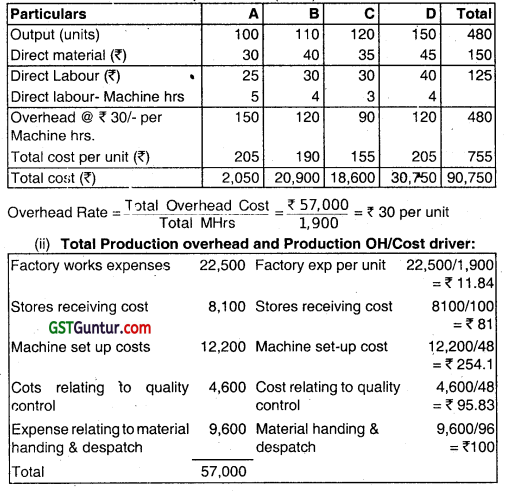

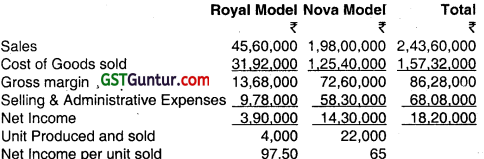

Question 10.

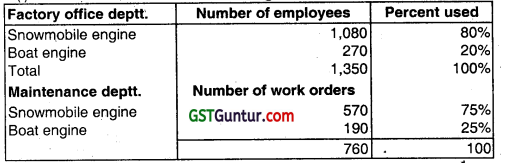

An engine manufacturing company has two production departments:

(i) Snow mobile engine and (ii) Boat engine and two service departments:

(i) Maintenance and (ii) Factory off ice Budgeted cost data and relevant cost drivers are as follows:

Required:

(i) Compute the cost driver allocation percentage and then use these percentage to allocate the service department costs by using direct method.

(ii) Compute the cost driver allocation percentage and then use these

percentage to allocate the service department costs by using non -reciprocal method! step method. (May 2005, 2 + 3 = 5 marks)

Answer:

(i) Cost Driver Allocation Percentage:

Service Department Allocation:

| Factory office deptt. | Maintenance deptt. | Snowmobile engine | Boat engine | |

| Departmental Cost | ₹ 3,00,000 | ₹ 2,40,000 | ₹ 6,00,000 | ₹ 17,00,000 |

Allocated Costs (₹):

| Factory office Deptt. | 3,00,000 | 2,40,000 | 60,000 | |

| Maintenance Deptt. | 2,40,000 | 1,80,000 | 60,000 | |

| Total | 0 | 0 | 10,20,000 | 18,20,000 |

(ii) Cost Driver Allocation Percentage

![]()

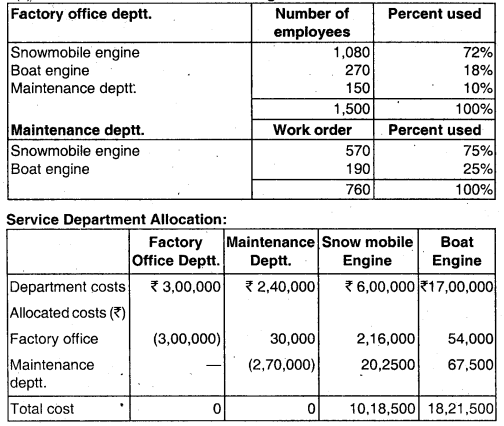

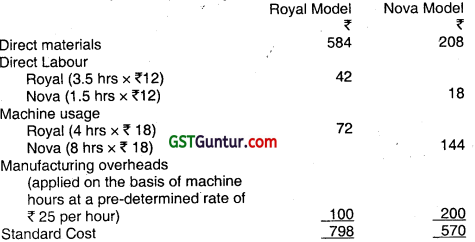

Question 11.

ABC Limited manufactures two radio models, the Nova which has beer) produced for five years and sells for 900, and the Royal, a new model introduced in early 2004, which sells for ₹ 1,140. Based on the following Income statement for the year 2004-05, a decision has been made to concentrate ABC Limited’s marketing resources on the Royal model and to begin to phase out the Nova model.

ABC Limited Income statement for the year ending March 31, 2005

The standard unit costs for the Royal and Nova models are as follows:

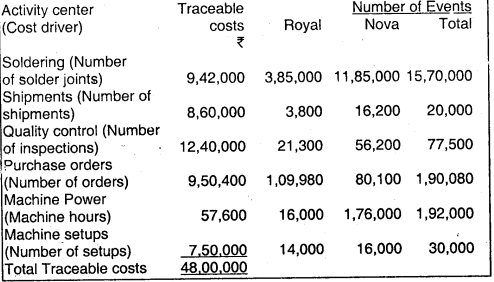

ABC Ltd.s Controller is advocating the use 01 activity-based costing and activity-based cost management and has gathered the following information about the company’s manufacturing overheads cost for the year ending March 31, 2005.

Required:

(i) Prepare a statement showing allocation of manufacturing overheads using the principles of activity-based costing.

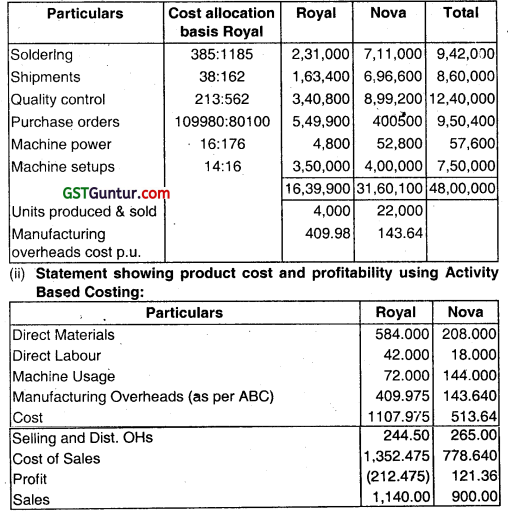

(ii) Prepare a statement showing product cost and profitability using activity-based costing.

(iii) Should ABC Ltd. continue to emphasize the Royal model and phase out the Nova model? Discuss. (Nov 2005, 10 marks)

Answer:

(i) Statement showing allocation of manufacturing overheads using the principles of Activity Based Costing:

![]()

(ii) Statement showing Net Income

| Royal | Nova | Total | |

| Gross margin/unit | 32.02 | 386.36 | |

| Gross Margin | 1,28,080 | 84,99,920 | 86,28,000 |

| Selling Adm. Expenses | 9,78,000 | 58,30,000 | 68,08,600 |

| Net Income | (8,49,920) | 26,69,920 | 18,20,000 |

(iii) Company should not emphasise the royal model and should emphasise more on Nova Model and phase out the Royal Model gradually. Rather, the pricing of Royal Model is required to, be corrected.

![]()

Question 12.

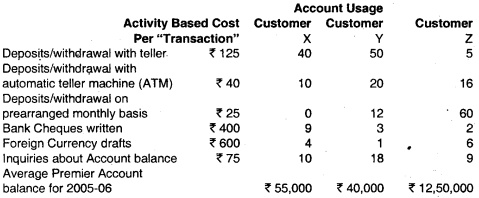

ABC Bank is examining the profitability of its Premier Account, a combined Savings & Cheque account. Depositors receive a 7% annual interest of their average deposit. ABC Bank earns an interest rate spread of 3% (the difference between the rate at which it lends money and rate it pays to depositors) by lending money for home loan purpose at 10%

The Premier Account allows depositors unlimited use of services such as deposits, with&awals, cheque facility, and foreign currency drafts. Depositors with Premier Account balances of ₹ 50,000 or more receive unlimited free use of services. Depositors with minimum balance of less than ₹ 50,000 pay ₹ 1 ,000-a-month service fee for their Premier Account. ABC Bank recently conducted an activity-based costing study of its services. The use of these services in 2005-06 by three customers is as follows: (May 2006)

Assume Customer X and Z always maintain a balance above ₹ 50,000, whereas Customer Y always has a balance below ₹ 50,000.

Required:

(i) Compute the 2005-06 profitability of the customers X, Y and Z Premier Account at ABC Bank (6 marks)

(ii) What evidence is there of cross-subsidization among the three Premier Accounts? Why might ABC bank worry about this Cross-subsidization, if the Premier Account product offering is profitable as a whole? (3 marks)

(iii) What changes would you recommend for ABC Bank’s Premier Account? (2 marks)

Answer:

Use of Service Cost of ABC Bank to each type of Customer

| Cost Driver | Activity Based cost per transaction | Customer | ||

| X | Y | Z | ||

| Deposit/Withdrawal with teller | ₹ 125 | 5,000 (Refer working notes) | 6,250 | 625 |

| Deposits/Withdrawal with ATM | ₹ 40 | 400 | 800 | 640 |

| Deposits Withdrawal as per arranged monthly basis | ₹ 25 | 0 | 300 | 1,500 |

| Bank Cheques Written | ₹ 400 | 3,600 | 1,200 | 800 |

| Foreign Currency drafts | ₹ 600 | 2,400 | 600 | 3,600 |

| Inquiries about Account balance | ₹ 75 | 750 | 1,350 | 675 |

| Total Cost | 12,150 | 10,500 | 7,840 | |

![]()

1. Profitability Statement of 2005 – 06 of ABC Bank:

Working Notes:

(i) Computation of Activity Based Cost of each Customers:

| X | Y | Z | |

| Deposite/Withdrawal with teller | 125 × 40 = 5,000 | 125 × 50 = 6,250 | 125 × 5 = 625 |

| Deposits/ Withdrawal with automatic teller machine (ATM) | 40 ×x 10 = 400 | 40 × 20 = 800 | 40 × 16 = 640 |

| Deposits/Withdrawal on prearranged monthly basis | 25 × 0 = 0 | 25 × 12 = 300 | 25 × 60 = 1,500 |

| Bank Cheques Written | 400 × 9 = 3,600 | 400 × 3 = 1,200 | 400 × 2 = 800 |

| Foreign Currency Drafts | 600 × 4 = 2,400 | 600 × 1 =600 | 600 × 6 = 3,600 |

| Inquiries about Account balance | 75 × 10 = 750 | 75 × 18= 1,350 | 75 × 9 = 675 |

| 12,150 | 10,500 | 7,840 |

(ii) Above computation shows that cross-subsidisation among the three Premier Accounts to beneficial when the Average Premier Account balance is high otherwise it is not beneficial for the bank as in case of Customer ‘X’.

Custom ‘X’ whose Average Premier Account balance is low, reduces the overall profitability of the Bank.

(iii) As per our view, ABC Bank should enhance their minimum average of balance Premier Account to ₹ 1,00.000 in place of ₹ 50,000 or impose restriction on number of transactions for the said facilities.

![]()

Question 13.

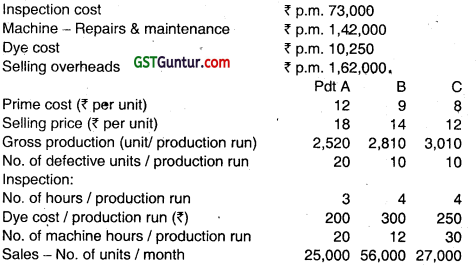

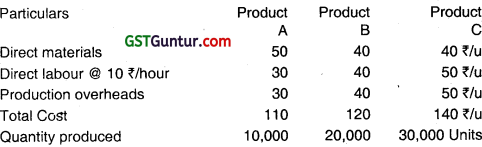

Biscuit Ltd. manufactures 3 types of biscuits, A, B and C, in a fully mechanised factory. The company has been following conventional method of costing and wishes to shift to Activity Based Costing System and therefore wishes to have the following data presented under both the system for the month:

The following.additional information is given:

(i) No accumulation of inventory is considered. All good units produced are sold.

(ii) All manufacturing and selling overheads are conventionally allocated on the basis of units sold.

(iii) Product A needs no advertisement. Due to its nutritive value, it is readily consumed by diabetic patients of a hospital. Advertisement costs included in the total selling overhead is ₹ 83,000.

(iv) Product B needs to be specially packed before being sold, so that it meets competition. ₹ 54,000 was the amount spent for the month in specially packing B, and this has been included in the total selling overhead cost given.

You are required to present product wise profitability of statements under the conventional system and the ABC system and accordingly rank the products. (May 2008, 11 marks) (CA Final -II]

Answer:

![]()

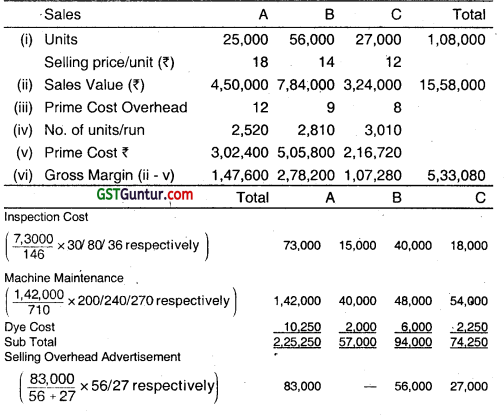

Conventional Accounting System

![]()

Question 14.

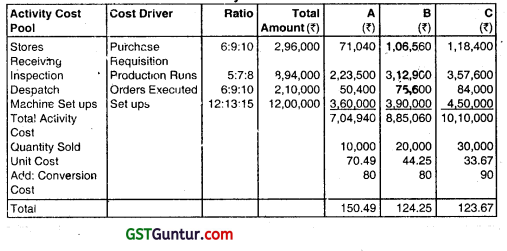

Traditional Ltd. is a manufacturer of a range of goods. The cost structure of its different products is as follows:

Traditional Ltd. was absorbing overheads on the basis of direct labour hours A newly appointed management accountant has suggested that the company should introduce ABC system and has identified cost drivers and cost pools as follows:

You are required to calculate activity based production cost of all the three products. (May 2009, 5 marks) [CIA Final -II]

Answer:

The total production overheads are ₹ 26.00,000.

Product A: 10,000 × ₹ 30 = ₹ 3,00,000

Product 6: 20,000 × ₹ 40 = ₹ 8,00,000

Product C: 30,000 × ₹ 50 = ₹ 15,00,000

On the basis of ABC analysis this amount will be apportior1d as follows:.

Statement of Activity Based Production Cost

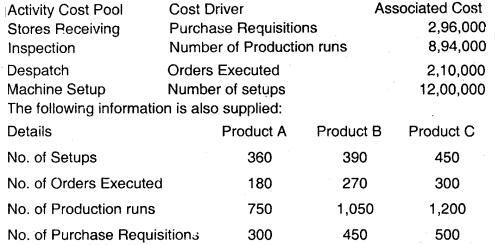

Question 15.

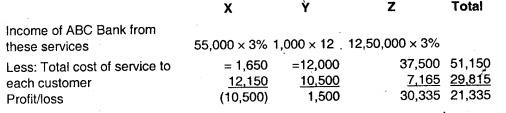

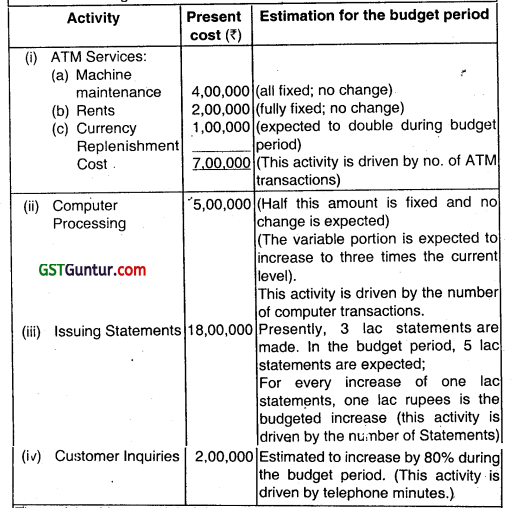

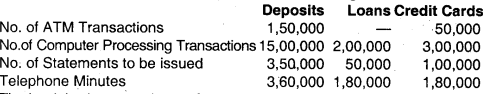

A bank offers three products, viz., deposits, Loans and Credit Cards. The bank has selected 4 activities for a detailed budgeting exercise, following activity based costing methods.

The bank wants to know The product wise total cost per unit for the selected activities, so that prices may be fixed accordingly.

The following information is made available to formulate the budget:

![]()

The activity drivers and their budgeted quantities are given below:

The bank budgets a volume of 58,600 deposit accounts, 13,000 loan accounts, and 14,000 Credit Card accounts.

You are required to:

(i) CalcuLate the budgeted rate for each activity.

(ii) Prepare the budgeted cost statement activity wise.

(iii) Find the budgeted product cost per account for each product using (i) and (ii) above. (Nov 2009, 12 marks) (CA Final – II)

Answer:

Budget Cost Statement

Working Notes:

![]()

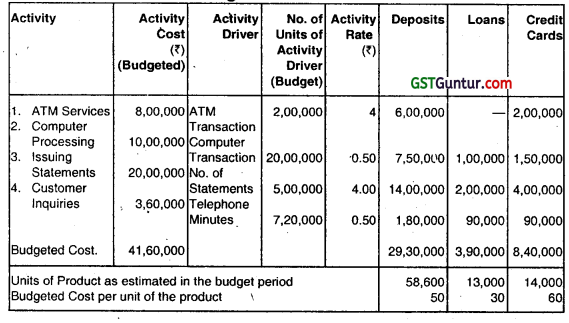

Question 16.

AML Ltd. is engaged in production of three types of ice-cream products:

Coco, Strawberry and Vanilla. The company presently sells 50,000 units of Coco @ ₹ 25 per unit, Strawberry 20000 @ ₹ 20 per unit and Vanilla 60,000 units @ ₹ 15 per unit. The demand is sensitive to selling price and it has been observed that every reduction of 1 per unit in selling price, increases the demand for each product by 10% to the previous level. The company has the production capacity of 60.500 units of Coco, 24,200 units of Strawberry and 72,600 units of Vanilla. The company marks up 25% on cost of the product.

The Company management decides to apply ABC analysis. For this purpose it identifies four activities and the rates as follows:

Under the traditional costing system, store support costs are charged @ 30% of prime cost. In ABC these costs are coming under customer support and assistance.

Required:

(i) Calculate target cost for each product after a reduction of selling price required to achieve the sales equal to the production capacity.

(ii) Calculate the total cost and unit cost of each product at the maximum level using traditional costing.

(iii) Calculate the total cost and unit cost of each product at the maximum level using activity based costing.

(iv) Compare and the cost of each product calculated in (i) and (ii) with (iii) and comment on it. (May 2010, 12 marks) [CA Final – II]

Answer:

(i) Cost of products under target costing Demanded unit and selling price

| Coco | Strawberry | Vanilla | |||

| Selling Price | Demand | Selling Price | Demand | Selling Price | Demand |

| 25 | 50,000 | 20 | 20,000 | 15 | 60,000 |

| 24 | 55,000 | 19 | 22,000 | 14 | 66,000 |

| 23 | 60,500 | 18 | 24,200 | 13 | 72,600 |

![]()

Target cost of each product after reduction in selling price

| Coco | Strawberry | Vanilla | |

| Selling price after reduction | 23.00 | 18.00 | 13.00 |

| Profit marks up 25% on cost i.e. 20% on selling price | 4.60 | 3.60 | 2.60 |

| Target cost of production (per unit) | 18.40 | 14.40 | 10.40 |

(ii) Cost of product under traditional costing

| Coco | Strawberry | Vanilla | |

| (₹) | (₹) | (₹) | |

| Units | 60,500 | 24,200 | 72,600 |

| Material cost (8,6,5, per unit) | 8 | 6 | 5 |

| Labour cost (5,4,3 per unit) | 5 | 4 | 3 |

| Prime cost | 13 | 10 | 8 |

| Store support costs (30% of prime) | 3.90 | 3 | 2.40 |

| Cost per unit | 16.90 | 13.00 | 10.40 |

(iii) Cost of product under activity based costing

| Coco | Strawberry | Vanilla | |

| (₹) | (₹) | (₹) | |

| Units | 60,500 | 24,200 | 72,600 |

| Material cost (8, 6, 5, per unit) | 4,84,000 | 1,45,200 | 3,63,000 |

| Labour cost (5, 4, 3 per unit) | 3,02,500 | 96,800 | 2,17,800 |

| Prime cost | 7,86,500 | 2,42,000 | 5,80,800 |

| Ordering cost @ ₹ 800 (35, 30, 15) | 28,000 | 24,000 | ‘ 12,000 |

| Delivery cost @ ₹ 700 (112, 66, 48) | 78,400 | 46,200 | 33,600 |

| Shelf stocking @ ₹ 199, (130,150,160) | 25,870 | 29,850 | 31,840 |

| Customer Support ₹ 1.10 | 66,550 | 26,620 | 79,860 |

| Cost Per unit | 16.29 | 15.23 | 10.17 |

![]()

(iv) Comparative Analysis of cost of production (₹)

| Coco | Strawberry’ | Vanilla | |

| (₹) | (₹) | (₹) | |

| (a) As per Target Costing | 18.40 | 14.40 | 10.40 |

| (b) As per traditional Costing | 16.90 | 13.00 | 10.40 |

| (c) As per Activity Based Costing | 16.29 | 15.23 | 10.17 |

| (a) – (c) | 2.11 | -0.83 | 0.23 |

| (b) – (c) | 0.61 | -2.23 | 0.23 |

Note: (a) The cost of product of strawberry is higher in ABC method in comparison to target costing and traditional methods. It indicated that actual profit under target Costing is less than targeted. For remaining two products, ABC is most suitable.

![]()

Question 17.

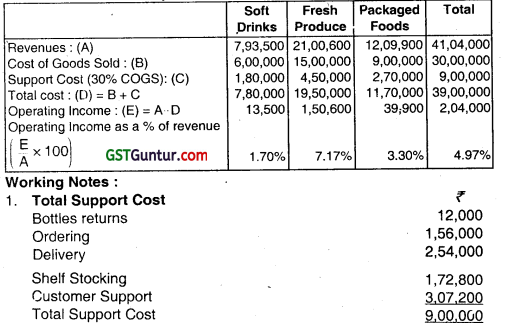

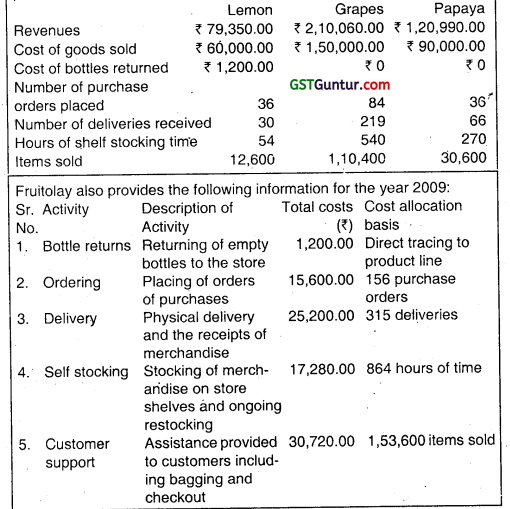

Fruitolay has decided to increase the size of the store. It wants the information about the probability of the individual product lines: Lemon, grapes and papaya. It provides the following data for the 2009 for each product line.

Required:

(i) Fruitolay currently allocates store support costs (all costs other than the cost of goods sold) to the product line on the basis of the cost of goods sold of each product line. Calculate the operating income and operating income as the percentage of revenue of each product line.

(ii) If Fruitolay allocates store support costs (all costs other than the cost of goods sold) to the product lines on the basis of ABC system, calculate the operating income and operating income as the percentage of revenue of each product line.

(iii) Compare both the systems. (Nov 2010, 11 marks)[CA Final Gr. II]

Answer:

(i) Traditional Costing System

| Particulars | Lemon | Grapes | Papaya | Total |

| Revenue | 79,350 | 2,10,060 | 1,20,990 | 4,10,400 |

| Less: Cost of goods sold (COGS) | 60,000 | 1,50,000 | 90,000 | 3,00,000 |

| Less: Store Support Cost | 18,000 | 45,000 | 27,000 | 90,000 |

| Operating income | 1,350 | 15,060 | 3,990 | 20,400 |

| Operating Income % | 1.70% | 7.17% | 3.30% | 4.97% |

![]()

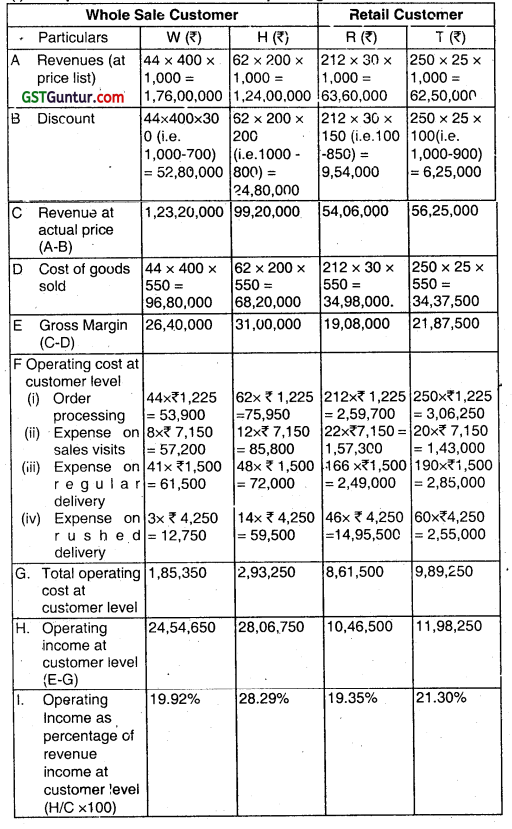

(ii) ABC System Overhead Allocation Rate

| Activity | Cost Heirarchy Level | Total Costs (₹) | Quantity of Cost Allocation Base | Overhead Allocation Rate |

| Ordering | Batch | 15600 | 156 Purchase orders | ₹ 100 |

| Delivery self. | Batch | 25200 | 315 delivering orders | ₹ 80 |

| Stocking | Output unit | 17280 | 864 self stocking hours | ₹ 20 |

| Customer Support | Output unit | 30720 | 153600 items sold | ₹ 0.20 |

Store Support Cost

| Particulars | Cost Driver | Lemon | Grapes | Papaya | Total |

| Bottle Returns | Direct | 1200 | 0 | 0 | 1200 |

| Ordering | Purchase orders | 3600 | 8400 | 3600 | 15600 |

| Delivery | Deliveries | 2400 | 17520 | 5280 | 25200 |

| Self Stocking | Hours of time | 1080 | 10800 | 5400 | 17280 |

| Customer Support | Items Sold | 2520 | 22080 | 6120 | 30720 |

| Grand Total | 10800 | 58800 | 20400 | 90000 |

![]()

Operating Income

| Particulars | Lemon | Grapes | Papaya | Tqtal |

| Revenue | 79350 | 210060 | 120990 | 410400 |

| Less: Cost of goods sold | 60000 | 150000 | 90000 | 300000 |

| Less: Store Support Cost | 10800 | 58800 | 20400 | 90000 |

| Operating income | 8550 | 1260 | 10590 | 20400 |

| Operating income % | 10.78% | 0.60% | 8.75% | 4.97% |

Summary / Comparison

| Particulars | Lemon | Grapes | Papaya | Total |

| Under Traditional Costing System | 1.70% | 7.17% | 3.30% | 4.97% |

| Under ABC System | 10.78% | 0.60% | 8.75% | 4.97% |

The grapes line drops sizeably when ABC is used. Although it constitutes 50% COGS, it uses a higher percentage of total resources in each activity area, especially the high cost of customer support area. In contrast, lemon line draws a much lower percentage of total resources used in each activity area than its percentage of total COGS. Hence under ABC, Lemon is most profitable. Fruitolay can explore ways to increase sales of lemons and also explore price increases on grapes.

Operating income Ranking is highest for Grapes under Traditional System because other products bear its overhead cost, whereas under ABC a more accurate picture shows Grapes as the lowest ranking product.

![]()

Question 18.

PQ Ltd. makes two products P and Q, which are similar products with slight difference in dimensions, but use the same manufacturing processes and facilities. Production may be made interchangeably after altering machine setup. Production time is the same for both products. The cost structure is as follows:

Fixed cost per unit has beer calculated based on the total practical capacity of 20,000 units per annum (which is either P or Q or both put together). Market demand is expected Lo be the deciding factor regarding the product mix for the next 2 years. The company does not stock inventory of finished goods. The company wishes to know either ABC system is to be set up at a cost of ₹ 10,000 per month for the purpose of tracking and recording the fixed overhead costs for allocation to products. Support your advice with appropriate reasons.

Independent of the above, if you are told to assume that fixed costs stated above, consist of a non-cash component of depreciation to plant at ₹ 90,000 for the year, will your advice change? Explain. (Nov 2011, 8 marks)[CA Final – II]

Answer:

| Data | Reasoning | Decision | |

| (i) | Similar Products, Similar Production Resources | OH Cost based on production units is appropriate. ABC will also yield identical results | No need for ABC System |

| (ii) | Present OH CoSt = ₹ 10/u. Proposed Increase due to ABC system: 120000 / 20000 = ₹ 6/u | Current OH cost of ₹ 10/u will increase by ₹ 6 per unit due to installing ABC system (60% increase) | For allocation purpose, ABC not justified |

| (iii) | Both have positive contribution/u. Market demand determines the mix | OH allocation has no role in decision making | No need for ABC System |

| (iv) | For the purpose of OH allocation, ABC need not be installed. However, if the fixed overheads of ₹ 2,00,000 are analysed by activity and thereby a saving of at least ₹ 1.,20,000 be expected (which is the cost of installing ABC system), then, ABC system may be installed | ||

| (v) | For the non cash component of depn. = ₹ 90,000, FC that can be saved is a maximum of ₹ 1,10,000 (₹ 2,00,000 – ₹ 90,000).

Hence, this is clearly less than ABC cost installation. Hence do not install ABC System |

||

![]()

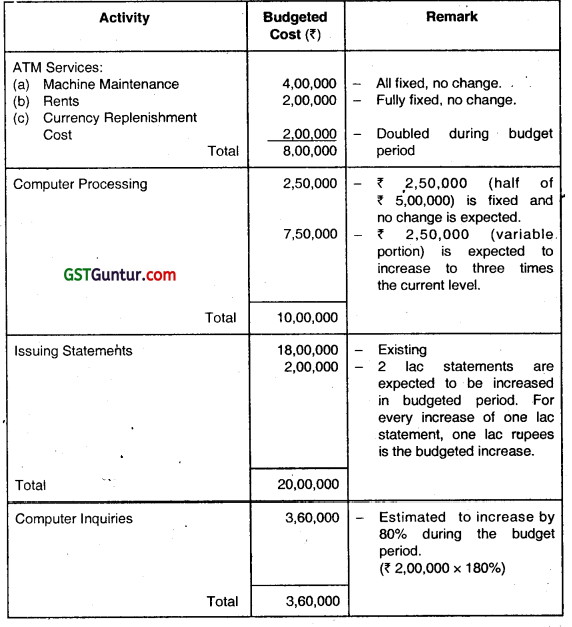

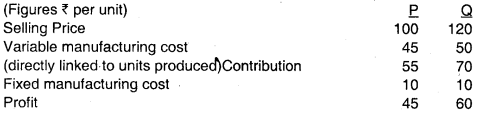

Question 19.

DEF Bank operated for years under the assumption that profitability can be increased by increasing Rupee volumes. But that has not been the case. Cost Analysis has revealed the following:

| Activity | Activity Cost (₹) | Activity Driver | Activity Capacity |

| Providing ATM service | 1,00,000 | No. of transactions | 2,00,000 |

| Computer processing | 10,00,000 | No. of transactions | 25,00,000 |

| Issuing Statements | 8,00,000 | No. of statements | 5,00,000 |

| Customer inquiries | 3,60,000 | Telephone minutes | 6,00,000 |

The following annual information on three products was also made available:

| Checking Accounts | Personal Loans | Gold Visa | |

| Units of product | 30,000 | 5,000 | 10,000 |

| ATM transactions | 1,80,000 | 0 | 20,000 |

| Computer transactions | 20,00,000 | 2,00,000 | 3,00,000 |

| Number of statements | 3,00,000 | 50,000 | 1,50,000 |

| Telephone minutes | 3,50,000 | 90,000 | 1,60,000 |

![]()

Required:

(i) Calculate rates for each activity.

(ii) Using the rates computed in requirement (i), calculate the cost of each product. (May 2013, 8 marks) [CA Final -II]

Answer:

Computation showing Rates for each Activity

![]()

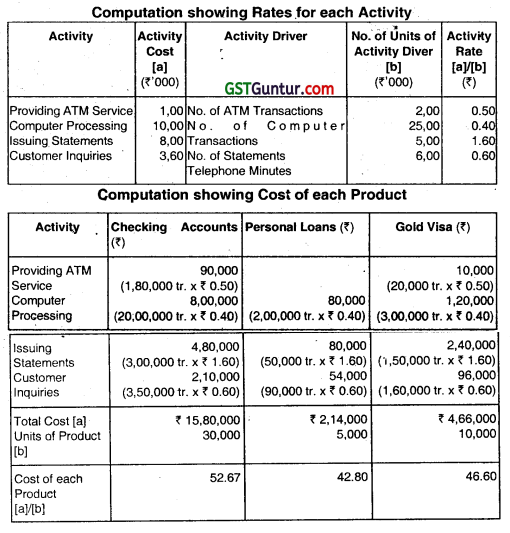

Question 20.

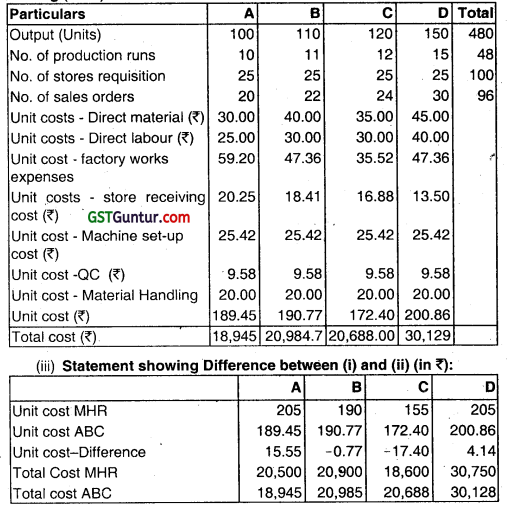

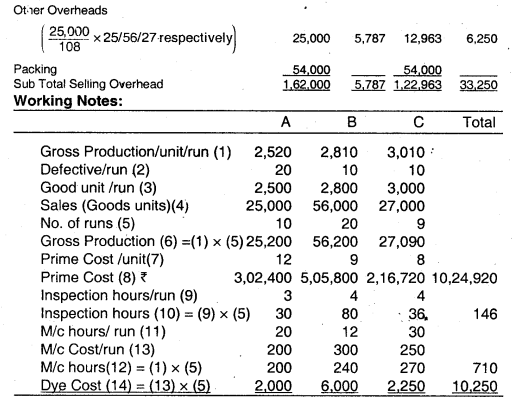

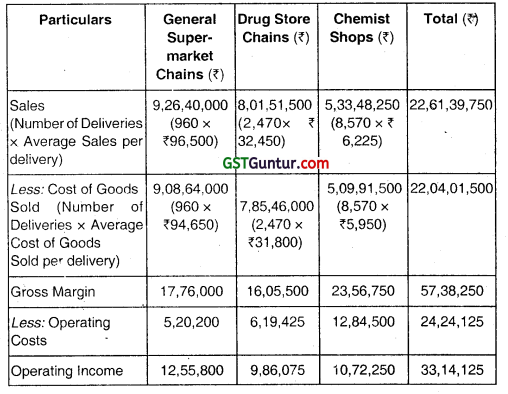

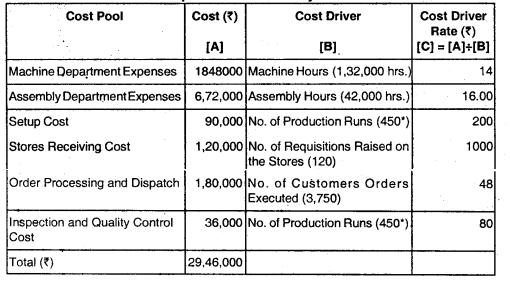

MK Ltd. manufactures four products, namely A, B, C and D using the same plant and process. The following information relates to a production period:

![]()

The four products are similar and are usually produced in production runs of 24 units and sold in batches of 12 units. The total overheads incurred by the company for the period are as follows:

It is also determwied that:

- Machine operation and maintenance cost should be apportioned between setup cost, store receiving and inspection activity in the ratio 4 : 3 : 2.

- Number of requisition raised on store is 50 for each product and the no. of orders executed is 192, each order being for a batch of 12 units of a product.

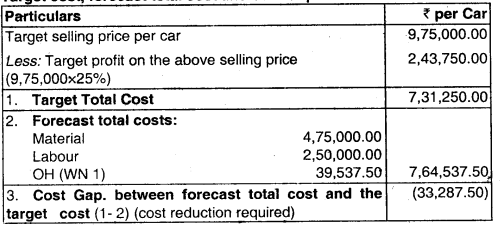

Calculate the total overhead cost per unit of each product using activity based costing after finding activity wise overheads allocated to each product. (Nov 2013, 8 marks) [CA Final – II)

Answer:

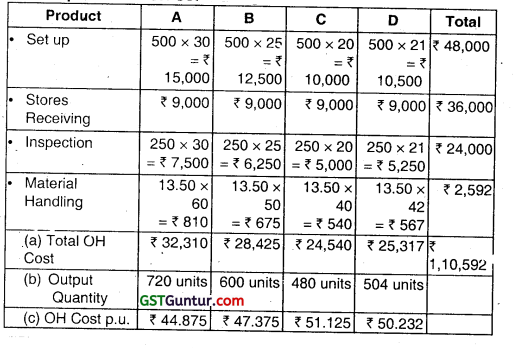

1. Computation of ABC Recovery Rates

| Activity | Activity Cost Pool | Cost Driver | Quantity | ABC Rate |

| Set Up | 20,000 + 28,000 = ₹ 48,000 | No. of Production Runs | 96 | ₹ 500 per Run |

| Stores Receiving | 15,000 + 21,000 = ₹ 36,000 | Requisitions raised | 50 x 4 = 200 | ₹ 180 per Reqn. |

| Inspection | 10,000+ 14,000 = ₹ 24,000 | No. of Production Runs | 96 | ₹ 250 per Run |

| Material Handling | Given = ₹ 2,592 | Orders executed | 192 | ₹ 13.5 per Batch |

![]()

Note:

- Machine Operation and Maintenance Cost of ₹ 63,000 is apportioned to the first three activities in the ratio 4:3:2, i.e. 28,000, ₹ 21,000 and 14,000

- Number of Production Runs and Number of Batches are computed as under:

| Product | A | B | C | D | Total |

| (a) Output Quantity | 720 units | 600 units | 480 units | 504 units | |

| (b) Quantity per Production Run | 24 units | 24 units | 24 units | 24 units | |

| (c) Number of Production Runs (a ÷ b) | 30 runs | 25 runs | 20 runs | 21 runs | 96 runs |

| (d) Quantity per Batch Order | 12 units | 12 units | 12 units | 12 units | |

| (e) Number of Batches (a ÷ b) | 60 batches | 50 batches | 40 batches | 42 batches | 192 batches |

![]()

2. Computation of OH Costs using ABC System

Question 21.

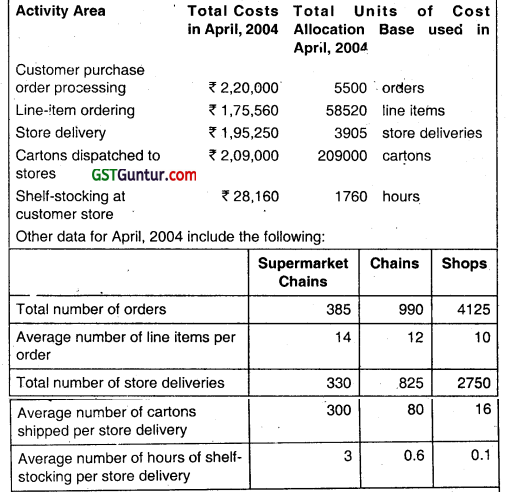

POR Ltd. specializes in the distribution of pharmaceutical products. It buys from pharmaceutical companies and resells to each of the three different markets:

(i) General Supermarket chains

(ii) Drug Store chains

(iii) Chemist shops

The company plans to use activity based costing for analyzing the profitability of its distribution channels. The following data for the quarter ending March 2014 is given:

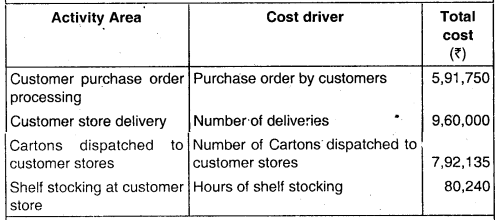

The following information is available in respect of operating costs (other than cost 01 goods sold) or the quarter ending March 2014:

Compute the operating income of each distribution channel for the quarter ending March 2014 using activity based costing. (May 2014, 8 marks) [CA Final – II]

Answer:

Statement showing operating Income of Distribution Channels of POR Ltd.

Workings Notes:

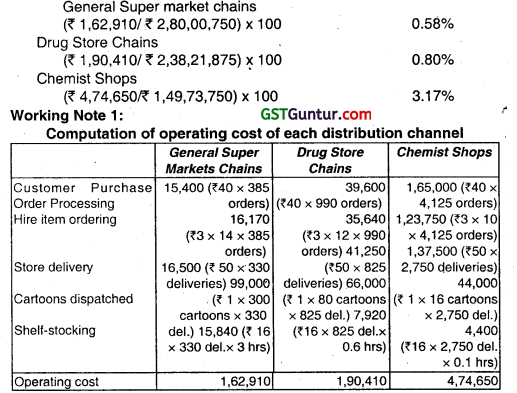

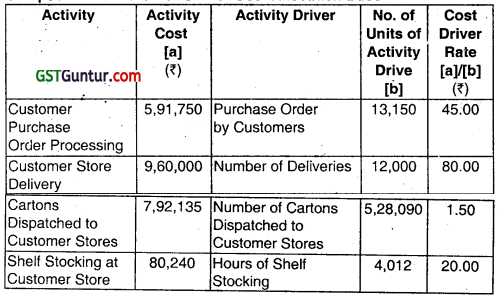

Statement Showing Operating Cost of Distribution Channels of PQR Ltd.

![]()

Computation of Rate Per Unit of Cost Allocation Base

No. of Units of Activity Driver:

Purchase Order by Customers = 1,000 + 2,650 + 9,500

= 13,150

Number of Deliveries = 960 + 2,470 + 8,570

= 12,000

Number of Cartons Dispatched to Customer Stores = Number of Deliveries × Average Number of Cartons Shipped per delivery

= (960 × 250) + (2,470 × 75) + (8,570 × 12)

= 2,40000 + 1,85,250 + 1,02,840

= 5,28,090

Hours of Shelf Stocking Number of Deliveries × Average Number of Hours of Shelf Stocking per delivery

= (960 × 2.0) + (2,470 × 0.5) + (8,570 × 0.1)

= 1,920 + 1,235 + 857

= 4,012

![]()

Question 22.

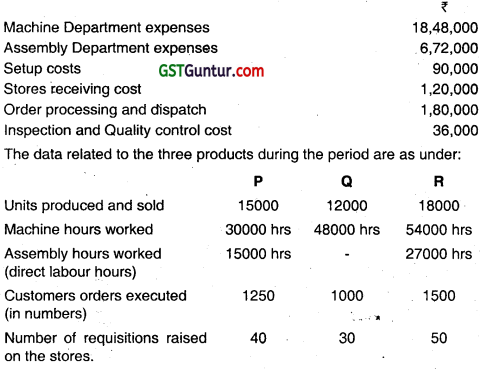

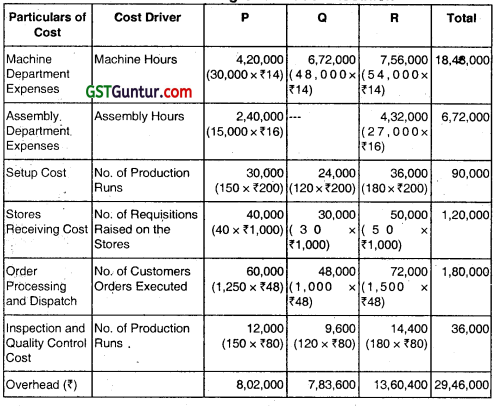

Linex Limited manufactures three products P, Q and R which are similar in nature and are usual’y produced in production runs of 100 units. Product P and R require both machine hours and assembly hours, whereas product Q requires only machine hours. The overheads incurred by the company during the first quarter are as under:

Prepare a statement showing details of overhead costs allocated to each j product type using activity based costing. (May 2015, 8 marks) (CA Final – II]

Answer:

Computation of Activity Rate

![]()

* Number of Production Run is 450 (150 + 120 + 180)

Statement Showing Overheads Allocation

![]()

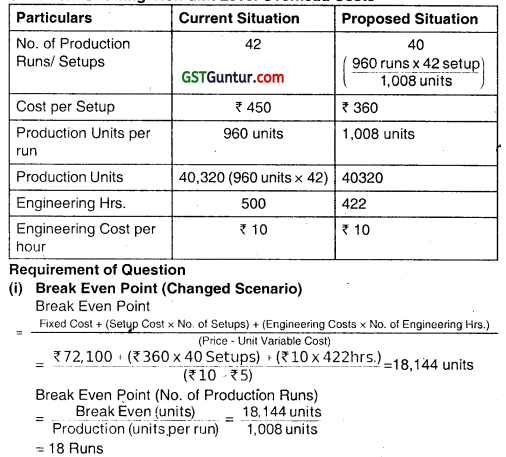

Question 23.

X Ltd. makes a single product with the following details:

| Description | Current Situation | Proposed Change |

| Selling Price (₹/ unit) | 10 | |

| Direct Costs (₹/ unit) | 5 | |

| Present number of setups per production period, (before each production run, setup is done) | 42 | |

| Cost per set up (₹) | 450 | Decrease by ₹ 90 |

| Production units per run | 960 | 1008 |

| Engineering hours for production period | 500 | 422 |

| Cost per engineering hour (₹) | 10 |

The company has begun Activity Based Costing of fixed costs and has presently identified two cost drivers, viz, production runs and engineering hours. Of the total fixed costs presently at ₹ 96,000, after the above, ₹ 72,100 remains to be analysed. There are changes as proposed above for the next production period for the same volume of output.

(i) How many units and in how many production runs should X Ltd. produce in the changed scenario in order to break – even?

(ii) Should X Ltd. continue to break up the remaining fixed costs into activity based costs? Why? (Nov 2015, 8 marks) [CA Final – II]

Answer:

(a) Workings

Statement Showing ‘Non-unit Level Overhead Costs’

![]()

(ii) A company should adopt Activity Based Costing (ABC) system for accurate product costing, as traditional volume based costing system does not take into account the Non-unit Level Overhead Costs such as Setup Cost, Inspection Cost, and Material Handling Cost etc.

Cost Analysis under ABC system showed that while these costs are largely fixed with respect to sales volume, but they are not fixed to other appropriate Cost drivers. If break up of the remaining ₹ 72,100 fixed costs consist of only a small portion of these costs, ABC need not be applied.

However, it may also be noted that the primary study has resulted in cost savings. If the savings in cost are expected to exceed the cost of study and implementing ABC, it may be justified. Further it is pertinent to mention that ABC offers no increase in product-costing accuracy for single-product setting.

![]()

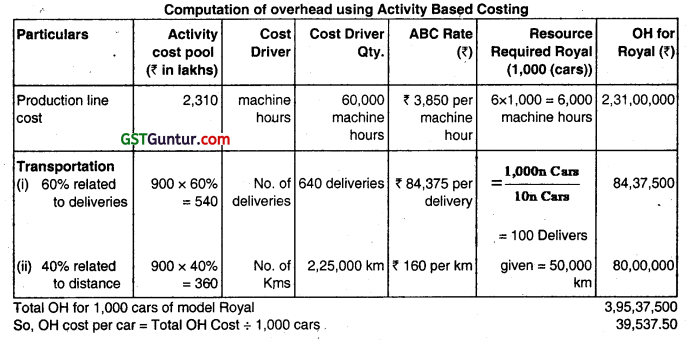

Question 24.

Speedo Limited is a specialist car manufacturer that produces various models of cars. The organization is due to celebrate its 100th anniversary next year. To mark the occasion, Speedo Limited intends to produce a sports car; the Model Royal. As this will be a special edition, production will be limited to 1,000 numbers of Model Royal Cars.

Speodo Limited is considering using a target costing approach and has conducted market research to determine the features that consumers require in a sports car. Based on this market research and knowledge of competitor’s products, company has decided to price the Model Royal at ₹ 9.75 Lacs. Company requires an operating profit margin of 25% of the selling price of the car. Details for the forthcoming year are as follows:

Forecast of direct costs for a Model Royal Car

Labour – ₹ 2,50,000

Material – ₹ 4,75,000 .

Forecast of annual overhead costs

| ₹ in lacs | Cost driver | |

| Production line cost | 2,310 | See note 1 |

| Transportation costs | 900 | See note 2 |

![]()

Note 1:

The production line that would be used for Model Royal has a capacity of 60000 machine hours per year. The production line time required for Model Royal is 6 machine hours per car. This production line will also be used to make other cars and will be working at full capacity.

Note 2:

Some models of cars are delivered to showrooms using car transporters. 60% of the transportation costs are related to the number of deliveries made. 40% of the transportation costs are related to the distance travelled. The car transporters have forecast to make a total of 640 deliveries in the year and carry 10 cars each time. The car transporter will always carry its maximum capacity of 10 cars.

The total annual distance travelled by car transporters is expected to be 2.25,000 kms. 50,000 kms of this is for the delivery of Model Royal cars only. All 1.000 Model Royal cars that will be produced will be delivered in the year using the car transporters.

Required:

(i) Calculate the forecast total cost of producing and delivering a Model Royal car using Activity Based Costing principles to assign the overhead costs.

(ii) Calculate the cost gap that currently exists between the forecast total cost and the target total cost of a Model Royal car. (Nov 2016, 10 marks) [CA Final – II]

Answer:

Target cost, forecast total cost and cost Gap

![]()

Question 25.

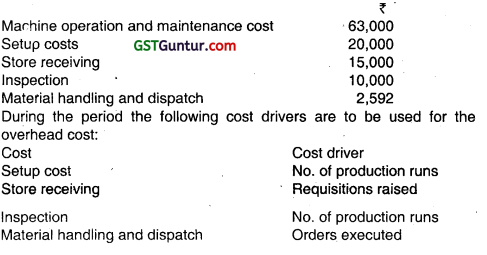

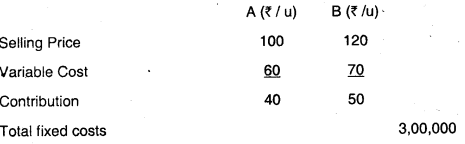

A company can make any or both of products A and B in a production period not exceeding a total of 10,000 units due to non-availability of the required material and labour. Until now, the company had been taking decisions on the product mix, based on the following marginal cost analysis.

Since the decisions based on the above approach did not yield the required results, the fixed costs were analysed as follows for 10,000 units of only A or 10,000 units of only B.

Further, the Management ensured availability of raw material and labour to support a production of 15000 units of either A or B or both together. There was no change to the step costs or contribution. However, the total unanalysed fixed cost increased to ₹ 32,000.

(i) Based on the principles of Activity Based Costing, prepare a statement showing the contribution and item wise analysed overheads for each product, arrive at the profitability of A and B and then the final profits if 15000 units of only A or 15000 units of only B are manufactured.

(ii) Find the minimum break-even point in units if only product A is manufactured after the cost reduction. (May 2017, 12 marks) [CA Final – II]

Answer:

(i)

(ii) BEP = \(\frac{\text { Fixed Cost }}{\text { Contribution per unit }}\) = \(\frac{32,000}{40}\)

= 800 units

Setup Cost (fixed for 2,000 units); 1 Production Run; ₹ 4,000/-

Step Cost (fixed for 2,000 units); ₹ 4,000/-

Distribution Cost will have to be recovered on the basis of 30 units.

Let BEP (unit) – ‘K’

40 × K = ₹ 32,000 + ₹ 8,000 + \(\left(\frac{\mathrm{K}}{30 \text { units }}\right)\) Boxes × ₹ 120

K = 1,111.11 units

Refining, 1,11 1.11 will have 37.03 boxes or say 38 boxes. The last box will cost ₹ 120 which is equivalent to contribution from 3 units. Hence, BEP is 1,114 units.

![]()

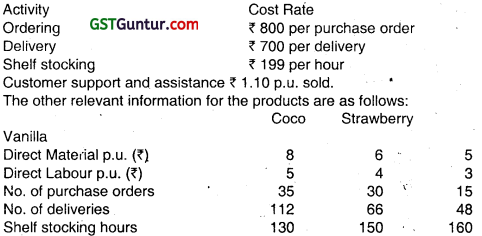

Question 26.

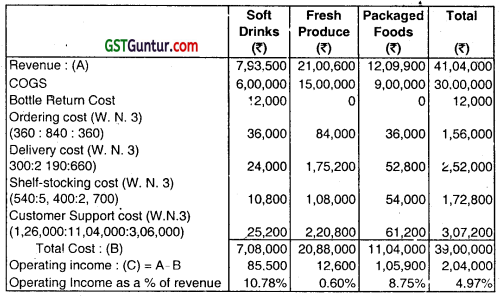

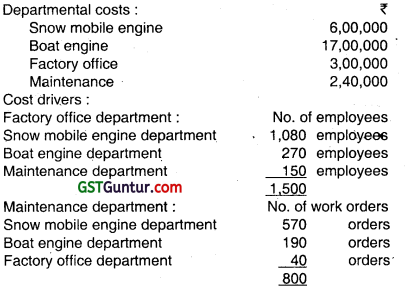

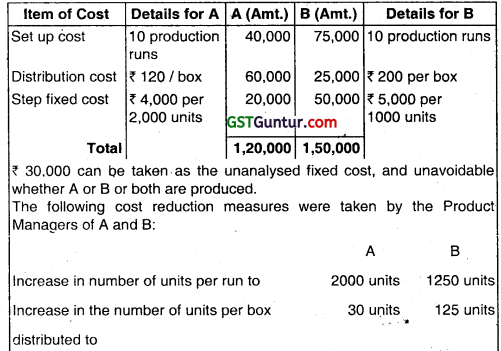

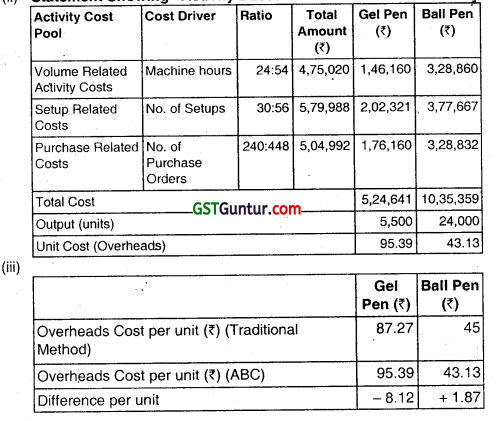

POR Pens Ltd. manufactures two products – ‘Gel Pen’ and ‘Ball Pen’. It furnishes the following data for the year 2017:

| Product | Annual Output (Units) | Total Machine Hours | Total number of purchase orders | Total number of set-ups |

| Gel Pen | 5,500 | 24,000 | 240 | 30 |

| Ball Pen | 24,000 | 54,000 | 448 | 56 |

The annual overheads are as under:

| Particulars | ₹ |

| Volume related activity costs | 4,75,020 |

| Set up related costs | 5,79,988 |

| Purchase related costs | 5,04,992 |

![]()

Calculate the overhead cost per unit of each Product – Gel Pen and Ball

Pen on the basis of:

(i) Traditional method of charging overheads

(ii) Activity based costing method and

(iii) Find out the difference in cost per unit between both the methods. (May 2018, 10 marks)

Answer:

(i) Calculation of the overhead cost per unit of each Product on the basis of Traditional Method of charging overheads.

Calculation of Overhead Recovery Rate:

Recovery Rate = \(\frac{\text { Total Overhead Cost }}{\text { Total Machine Hours }}\)

= \(\frac{4,75,020+5,79,988+5,04,992}{24,000+54,000}\)

= \(\frac{15,60,000}{78,000}\)

= ₹ 20 Per hour

In this case, it is assumed that the POR Pens Ltd. is absorbing the overheads by using machine hours as per Traditional Method.

![]()

(ii) Statement Showing “Activity Based Overhead Cost”

(Volume related activity cost, set up related costs and purchase related cost can also be calculated under Activity Base Costing using Cost driver rate. However, there will be no changes in the final answer.)

![]()

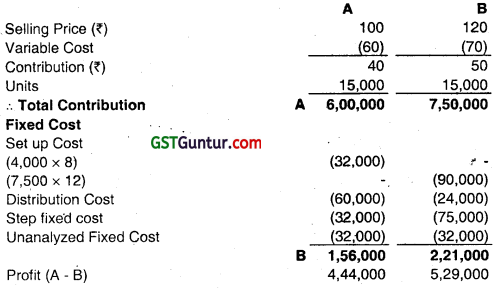

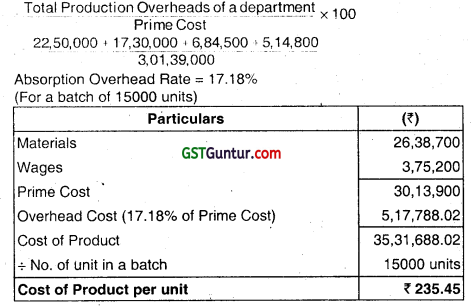

Question 27.

M/s. HMB Limited is producing a product in 10 batches each of 15000 units in a year and incurring following overheads their on:

The prime costs for the year amounted to ₹ 3.01 39,000:

The company is using currently the method of absorbing overheads on the basis of prime cost. Now it wants to shift to activity based costing. Information relevant to Activity drivers for a year are as under:

The company has produced a batch of 15000 units and has incurred ₹ 26,38.700 and ₹ 3,75,200 on materials and wages respectively.

The usage of activities of the said batch are as follows:

Material orders – 48 orders

Maintenance hours – 810 hours

No. of set-ups – 40

No. of inspections – 25

![]()

You are required to:

(i) find out cost of product per unit on absorption costing basis for the said batch.

(ii) determine cost driver rate, total cost and cost per unit of output of the said batch on the basis of activity based costing. (Nov 2018, 10 marks)

Answer:

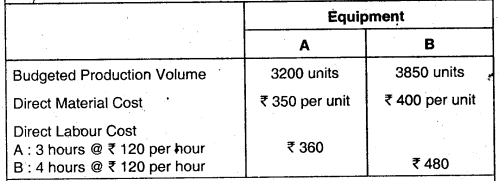

(i) Calculation of Cost of product per unit on the basis of absorption costing method.

Absorption of overhead on the basis of Prime Cost

Absorption Overhead Cost Rate

(ii) Statement Showing Cost Driver Rate

![]()

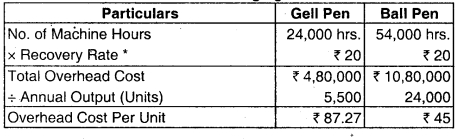

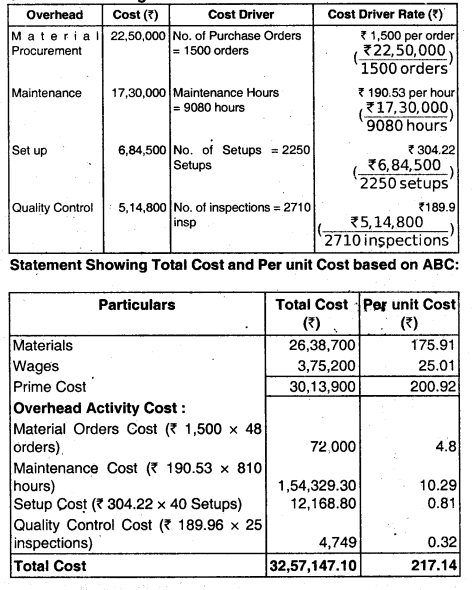

Question 28.

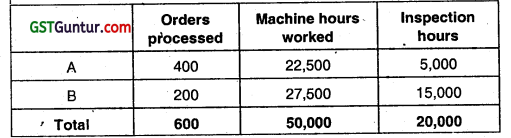

MNO Ltd. manufactures two types of equipment A and B and absorbs overheads on the basis of direct tabour hours. The budgeted overheads and direct labour hours for the month of March 2019 are ₹ 15,00,000 and ₹ 25,000 hours respectively. The information about the company’s products is as follows:

Overheads of ₹ 15,00,000 can be identified with the following three major activities:

Order processrig: ₹ 3,00,000

Machine processing: ₹ 10,00,000

Product Inspection: ₹ 2,00,000

These activities are driven by the number of orders processed, machine hours worked and inspection hours respectively. The data relevant to these activities is as follows:

Required:

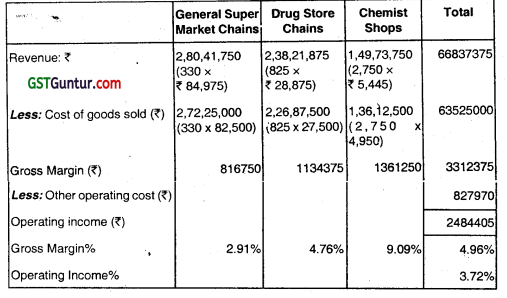

(i) Prepare a statement showing the manufacturing cost per unit of each product using the absorption costing method assuming the budgeted manufacturing volume is attained.

(ii) Determine cast driver rates and prepare a statement showing the manufacturing cost per unit of each product using activity based costing, assuming the budgeted manufacturing volume is attained.

(iii) MNO Ltd.’s selling prices are based heavily on cost. By using direct labour hours as an application base, calculate the amount of cost distortion (under costed or over costed) for each equipment. (May 2019, 10 marks)

Answer: ,

(i) Overheads Application Base: Direct Labour hours

(iii) Calculation of Cost Distortion

Low volume product A is under-costed and high volume product B is over costed using direct labour hours for overhead absorption.

![]()

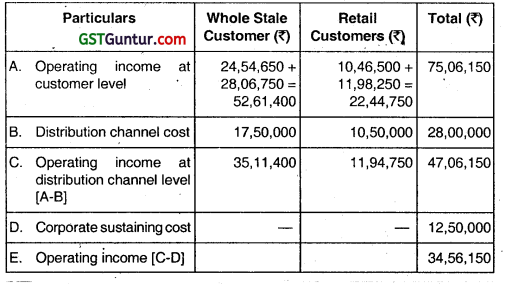

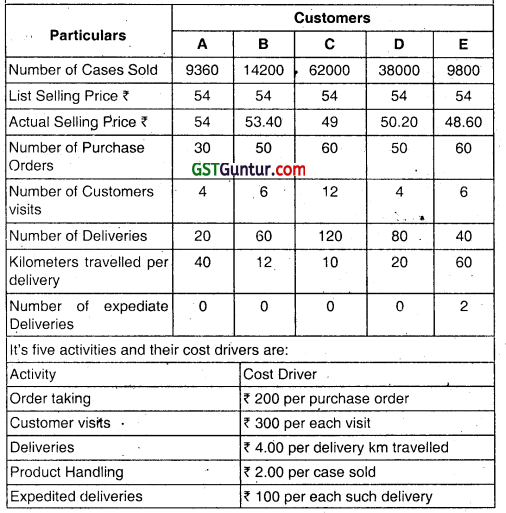

Question 29.

POR Ltd has decided to analyse the profitability of it’s five new customers. It buys soft drink bottles in cases at ₹ 45 per case and sells them to retail customers at a list price of ₹ 54 per case. The data pertaining to five customers are given below:

You are required to:

(i) Compute the customer level operating income of each of five retail customers by using the Cost Driver rates.

(ii) Examine the results to give your comments on Customer ‘D’ In comparison with Customer ‘C’ and on Cutomer ‘E’ in comparison with Customer ‘A’. (Nov 2019, 10 marks)

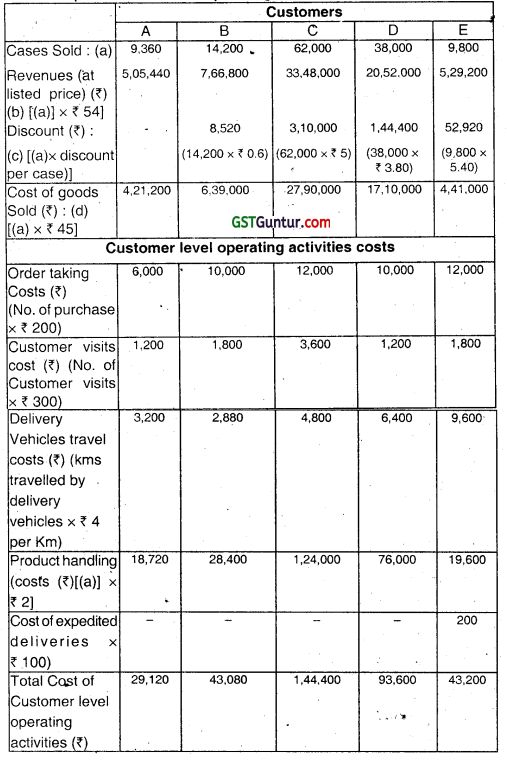

Answer:

Working Note:

1. Computation of revenues (at listed price), discount, cost of goods sold and customer level operating activities costs:

![]()

Computation of Customer level operating Income

(ii) Comments on the results:

Customer D is the most profitable customer, despite having only 61.29% of the unit volume of Customer C.

The main reason is that C receives a ₹ 5 per case discount while Customer D receives only a ₹ 3.8 discount per case.

Customer E is in loss, in comparision with the small customer A being profitable. Customer E received a discount of ₹ 5.4 per case. makes more frequent orders, requires more customer visits and requires more delivery kms. in comparision with Customer A.

![]()

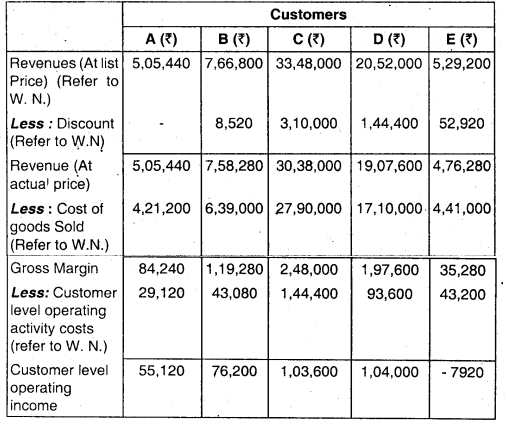

Question 30.

ABC Ltd. is engaged in production of three types of Fruit Juices: Apple, Orange and Mixed Fruit.

The following cost data for the month of March 2020 are as under:

Required:

(i) Calculate cost driver’s rate.

(ii) Calculate total cost of each product using Activity Based Costing. (Nov 2020, 6 marks)

Question 31.

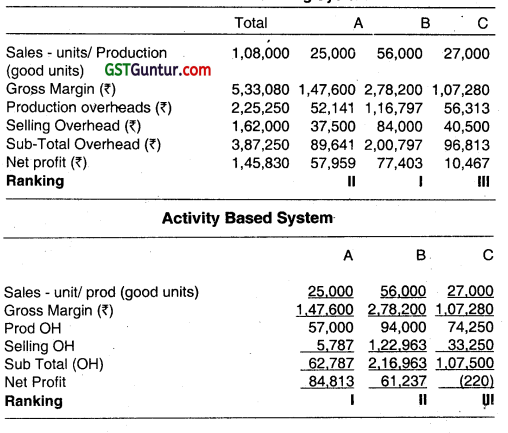

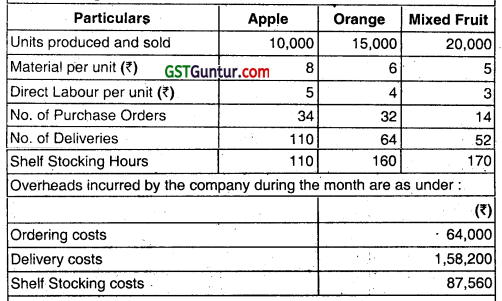

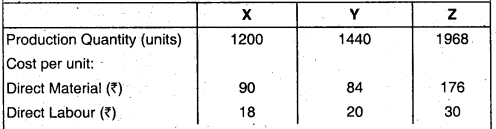

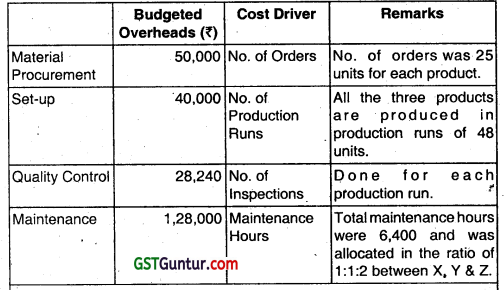

ABC Ltd. manufactures three products X, Y and Z using the same plant and resources. It has given the following information for the year ended on 31st March, 2020:

Budgeted direct labour rate was ₹ 4 per hour and the production overheads, shown in table below, were absorbed to products using direct labour hour: rate. Company followed Absorption Costing Method. However, the company is now considering adopting Activity Based Costing Method.

Required:

- Calculate the total cost per unit of each product using the Absorption Costing Method.

- Calculate the total cost per unit of each product using the Activity Based Costing Method. (Jan 2021, 10 marks)

![]()

Question 32.

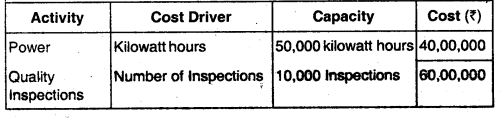

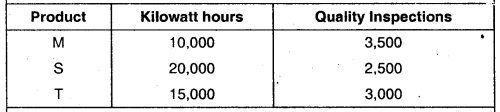

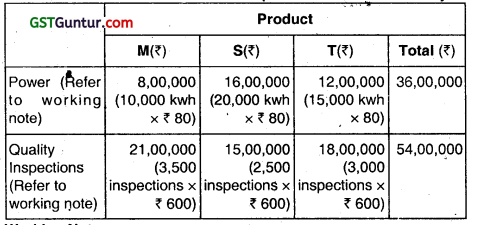

MST Limited has collected the following data for its two activities. It calculates activity cost rates based on cost driver capacity.

The company makes three products M S and T. For the year ended March 31, 20X 9. the following consumption of cost drivers was reported.

Required:

(i) PREPARE a statement showing cost allocation to each product from each activity.

(ii) CALCULATE the cost of unused capacity for each activity.

(iii) STATE the factors the management considers in choosing a capacity level to compute the budgeted fixed overhead cost rate.

Answer:

(i) Statement of cost allocation to each product from each activity

Working Note:

Rate per unit of cost driver

Power : (₹ 40,00,000 ÷ 50,000 kWh) = 80/kWh

Quality Inspechon : (₹ 60.00,000 ÷ 1,000 inspections) = ₹ 600 per inspection

![]()

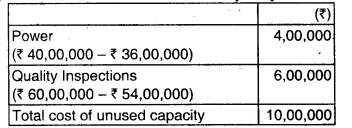

(ii) Calculation of cost of unused capacity for each activity:

(iii) Factors management consider in choosing a capacity level to compute the budgeted fixed overhead cost rate:

- Effect on product costing and capacity management

- Effect on pricing decisions.

- Effect on performance evaluation

- Effect on financial statements

- Regulatory requirements.

- Difficulties in forecasting for any capacity level.