Input Tax Credit – CA Final IDT Study Material is designed strictly as per the latest syllabus and exam pattern.

Input Tax Credit – CA Final IDT Study Material

Question 1.

A registered supplier of taxable goods supplied goods valued at ₹ 2,24,000 (inclusive of CGST ₹ 12,000 and SGST ₹ 12,000) to Mohan Ltd. under the forward charge on 15-08-2020 for which tax invoice was also issued on the same date. The inputs were received by Mohan Ltd. on 15-08-2020. Mohan Ltd. availed credit of ₹ 24,000 on 18-08-2020. But Mohan Ltd. did not make any payment towards such supply along with tax thereon to the supplier. Is Mohan Ltd. eligible to avail input tax credit on such supply? What are the consequences of such non-payment by Mohan Ltd.?

Discuss input tax credit provisions if Mohan Ltd. makes the payment of ₹ 2,24,000 to the supplier on 18-03-2021. [Nov. 2018, Old, 5 Marks]

Answer:

Statutory Provisions:

As per section 16 of the CGST Act, 2017, Mohan Ltd. is eligible to avail input tax credit (ITC) of the tax paid on inputs received by it on the basis of the invoice issued by the supplier provided other conditions for availing ITC are fulfilled.

Payment of value of the goods along with the tax to the supplier is not a pre-requisite at the time of availing credit, but Mohan Ltd. has to pay the said amount within 180 days from the date of issue of invoice.

In the given case:

(1) If Mohan Ltd. did not make any payment towards such supply along with tax thereon to the supplier, it has to report the fact of non-payment in the ITC return [GSTR – 2 (GSTR-2 is not operational, reporting is done in GSTR 3B.)] for the month immediately following the period of 180 days from the date of the issue of the invoice. When such report is made, ITC of ₹ 24,000 will be added to his output tax liability. Mohan Ltd will be required discharge this liability with interest @ 18% p.a. from the date of availing credit till the date when the amount added to the output tax liability [Second proviso to section 16(2) of the CGST Act, 2017 read with rule 37 of the CGST Rules, 2017],

(2) If Mohan Ltd. does not pay the supplier as mentioned above, subject to the provisions of section 126 of the CGST Act, 2017, a general penalty which may extend to ₹ 25,000 may also be levied for such contravention by Mohan Ltd. [under section 125 of the CGST Act, 2017]?

(3) If Mohan Ltd. makes the payment of ₹ 2,24,000 (Value + tax) to the supplier on 18.03.2021 i.e., after the expiry of 180 days from date of issue of invoice, Mohan Ltd. will have to report the default in the monthly report, add the amount of ITC to his output tax liability and when the payment is made to the supplier, take the credit of ₹ 24,000. The output tax liability added will have to be paid with interest @18% for the period from the date of availment of credit till the date of addition of the amount to the output tax liability.

Examiner’s Comment

A large number of examinees correctly wrote that in case of non-payment towards a supply along with tax thereon to the supplier, ITC will be added to its output tax liability. However, most of them did not mention that the fact of non-payment also needs to be reported in the ITC return for the month immediately following the period of 180 days from the date of the issue of the invoice.

![]()

Question 2.

ABC company Ltd. of Bengaluru is manufacturing and registered supplier of machine. It has provide the following details for the month of November 2020

Detail of GST paid on inward supplies during the months:

| Item | GST Paid (₹) |

| Health insurance of factory employees. | 20,000 |

| Raw material for which invoice has been received and GST has also been paid for full amount but only 50% of material has been received, remaining 50% will be received in next month | 18,000 |

| Work contractor’s services used for installation of plant and machinery | 12,000 |

| Purchase of manufacturing machine directly send to job worker’s premises under challan. | 50,000 |

| Purchase of car used by director for the business meeting only | 25,000 |

| Outdoor catering service availed for business meeting. | 8,000 |

ABC Company Ltd. provided service of hiring of machines along with man power for oper-ation. As per the trade practice machines are always hired out along with operators and also operators are supply only when machine are hired out.

Receipt on outward supplied (exclusive of GST) for the month of November 2020 are also followed:

| Items | Amounts |

| Hiring receipt for machine | 5,25,000 |

| Service charged for supply of man power operators | 2,35,000 |

Assumed all the transactions are inter-State and the rates of IGST to be as under:

i. Sales of machine 5%

ii. Services of hiring of machine 12%

iii. Supply of man power operator service 18%

Compute the amount of input tax credit available and also the net GST payable for the month of November 2020 by giving necessary explanations for treatment of variable items.

Note – Opening balance of input tax credit is nil. [MTP, May/Nov 2018, 10 Marks]

Answer:

Computation of net GST payable by ABC Company Ltd.

| Particulars | GST payable (₹) |

| Gross GST liability [Refer working note (2) below] | 91,200 |

| Less: Input tax credit [Refer working note (1) below] | 62,000 |

| Net GST liability | 29,200 |

Working Notes:

(1) Computation of Input Tax Credit (ITC) available with ABC Company Ltd. in the month of November 2020.

| Particulars | GST (₹) |

| Health insurance of factory employees (As per section 17(5)(6)(m) of the CGST Act, 2017 ITC of health insurance is blocked in the given case since said services are not notified by Government as obligatory for employer to provide to its employees under any law.) | Nil |

| Raw material received in factory (Where the goods against an invoice are received in lots/instalments, ITC is allowed upon receipt of the last lot/instalment vide first proviso to section 16(2) of the CGST Act, 2017. Therefore, ABC Company Ltd. will be entitled to ITC of raw materials on receipt of second instalment in December, 2017.) | Nil |

| Work’s contractor’s service used for installation of plant and machinery (As per Section 17(5)(c) of CGST Act, 2017 provides that ITC on works contract services is blocked when supplied for construction of immovable property (other than plant and machinery) except when the same is used for further supply of works contract service.

Though in this case, the works contract service is not used for supply of works contract service, ITC thereon will be allowed since such services are being used for installation of plant and machinery.) |

12,000 |

| Manufacturing machinery directly sent to job worker’s premises under challan (As per Section 19(5) of CGST Act, 2017 ITC on capital goods directly sent to job worker’s premises under challan is allowed) | 50,000 |

| Purchase of car used by director for business meetings only

1. (Section 17(5)(a) of CGST Act, 2017 ITC on motor vehicles is allowed only when the same are used:

(2) for transportation of goods. |

Nil |

| Outdoor catering service availed for business meetings (Section 17(5)(6)(z) of CGST Act, 2017 ITC on outdoor catering is blocked except where the same is used for making further supply of outdoor catering or an element of a taxable composite or mixed supply. Since ABC Company Ltd is a supplier of machine, ITC thereon will not be available.) |

Nil |

| Total ITC available | 62,000 |

(2) Computation of gross GST liability

| Value received (₹) | Rate of GST | GST payable (₹) | |

| Hiring receipts for machine | 5,25,000 | 12% | 63,000 |

| Service charges for supply of manpower operators | 2,35,000 | 12% | 28,200 |

| Gross GST liability | 91,200 |

Notes:

Since machine is always hired out along with operators and operators are supplied only when the machines are hired out, it is a case of composite supply, wherein the principal supply is the hiring out of machines [Section 2(30) of the CGST Act, 2017 read with section 2(90) of that Act], Therefore, service of supply of manpower operators will also be taxed at the rate applicable for hiring out of machines (principal supply), which is 12%, in terms of section 8(a) of the CGST Act, 2017.

In the above answer, the amounts given in the second table of the question have been taken as “Receipts on outward supply”. If the same are taken as GST paid, the gross GST liability will be ₹ 7,60,000 (5,25,000 + 2,35,000) and the same can be directly set off against input tax credit available. Thus, net GST liability will work out to ₹ 6,98,000 (7,60,000 – 62,000).

![]()

Question 3.

With reference to the provisions of section 17 of the CGST Act, 2017, examine the availability of input tax credit under the CGST Act, 2017 in the following independent cases:-

(i) MBF Ltd., an automobile company, has availed works contract service for construction of a foundation on which a machinery (to be used in the production process) is to be mounted permanently.

(ii) Shah & Constructions procured cement, paint, iron rods and services of architects and interior designers for construction of a commercial complex for one of its clients.

(iii) ABC Ltd. availed maintenance & repair services from “Jaggi Motors” for a truck used for transporting its finished goods. [Nov. 2018]

Answer:

| Statutory Provision | In the given case |

| (i) Section 17(5)(c) of the CGST Act, 2017 :- Input tax credit is blocked in respect of works contract services when supplied for construction of an immovable property (other than plant and machinery) except where it is an input service for further supply of works contract service.

Further, the term “plant and machinery” means apparatus, equipment and machinery fixed to earth by foundation or structural support that are used for making outward supply of goods and/or services and includes such foundation or structural support but excludes land, building or other civil structures, telecommunication towers, and pipelines laid outside the factory premises. |

ITC is available in respect of works contract service availed by MBF Ltd. as the same is used for construction of plant and machinery which is not blocked under section 17(5)(c) of the CGST Act, 2017. |

| (ii) Section 17(5)(d) of the CGST Act, 2017:- Input tax credit is blocked on goods and/or services received by a taxable person for construction of an immovable property (other than plant and machinery) on his own account even though such goods and/or services are used in the course or furtherance of business. | The taxable person has used the goods and services for construction of immovable property for some other person and not on its own account. Hence, ITC in this case will be allowed. |

| (iii) As per section 17(5) of the CGST Act, 2017 :- ITC is allowed on repair and maintenance services relating to motor vehicles, which are eligible for input tax credit. Further, as per section 17(5)(a) ITC is allowed on motor vehicles which are used for transportation of goods. | ITC on maintenance & repair services availed from “Jaggi Motors” for a truck used for transporting its finished goods is allowed to ABC Ltd. |

Question 4.

A company has entered to an agreement with a customer for the manufacture and supply of cement pipes for their exclusive use. A company manufactured the product but before receiving the inspection certificate, their customer rejected some quantity of goods on the grounds of quality.

As per agreement, the rejected quantity will be destroyed in front of the customer and shall not be sold. Examine the issue in the light of statutory provisions and suggest future course of action to the assessee as to whether any liability arises as per the provisions of GST law. [Nov 2018, Old, 4 Marks]

Answer:

Section 17 of the CGST Act, 2017 blocks ITC in respect of destroyed goods.

Accordingly, since in the given case the cement pipes have been destroyed, ITC attributable to such pipes will not be allowed [Section 17(5)(h) of the CGST Act, 2017].

Thus, in the given case, if the credit has already been availed, the same will need to be reversed.

Question 5.

PQR Company Ltd., a registered supplier of Bengaluru (Karnataka), is a manufacturer of goods. The company provides the following information pertaining to GST paid on input supplies during the month of April, 2020:

| Items | GST paid in (₹) |

| (i) Life Insurance premium paid by the company on the life of factory employees as per the policy of the company | 1,50,000 |

| (ii) Raw materials purchased for which invoice is missing but delivery challan is available. | 38,000 |

| (iii) Raw materials purchased which are used for zero rated outward supply. | 50,000 |

| (iv) Works contractor’s service used for repair of factory building which is debited in the profit and loss account of company. | 30,000 |

| (v) Company purchased the capital goods for ₹ 4,00,000 and claimed depreciation of ₹ 44,800 (@ 10%) on the full amount of ₹ 4,48,000 under Income Tax Act, 1961. | 48,000 |

Other Information:-

(i) In the month of September, 2019, PQR Company Ltd. availed input tax credit of ₹ 2,40,000 on purchase of raw material which was directly sent to job worker’s premises under a challan on 25-09-2019. The said raw material has not been received back from the Job worker up to 30-04-2020.

(ii) All the above input supplies except (ii) above have been used in the manufacture of taxable goods.

Compute the amount of net Input Tax Credit available for the month of April, 2020 with necessary explanations for your conclusion for each item. You may assume that all the other conditions necessary for availing the eligible input tax credits have been fulfilled. [Nov. 2018, 7 Marks]

Answer:

(a) Computation of Input Tax Credit (ITC) available with PQR Ltd. for the month of April, 2020

| Particulars | ₹ |

| Life Insurance premium paid by the company on the life of factory employees [Note 1] | Nil |

| Raw materials purchased [Note 2] | Nil |

| Raw materials used for zero rated outward supply [Note 3] | 50,000 |

| work contractor’s service[Note 4] | 30,000 |

| Capital goods purchased wherein the depreciation is claimed on the tax component [Note 5] | Nil |

| Total ITC available | 80,000 |

Notes:

(1) As per Section 17(5) of the CGST Act, 2017:- ITC on life insurance service is available only when the same is notified by the Government as being obligatory for an employer to provide to its employees under any law for the time being in force. In the absence of any information, it is assumed that such services have not been notified in the instant case and thus, the ITC thereon is blocked.

(2) As per Section 16 of the CGST Act, 2017:- ITC cannot be taken since invoice is missing and delivery challan is not a valid document to avail ITC.

(3) As per Section 16 of the IGST Act, 2017 :- ITC can be availed for making zero-rated supplies, notwithstanding that such supply ma be an exempt supply.

(4) As per Section 17(5) of the CGST Act, 2017:- ITC is blocked on works contract services for construction of an immovable property except when

- It is input service for further supply of works contract service

- Immovable property is plant and machinery

Construction includes reconstruction, renovation, additions or alterations or repairs, to the extent of capitalization, to the said immovable property.

ITC on expenses incurred on re-construction, renovation, additions or alterations and repairs would he allowed in case such expenses are charged to revenue and not capitalized.

(5) As per Section 16(3) of the CGST Act, 2017:- ITC is not available when depreciation has been claimed on the tax component of the cost of capital goods under the Income-tax Act.

(6) As per Section 19 of the CGSTAct, 2017:- The principal is entitled to take ITC of inputs sent for job work even if the said inputs are directly sent to job worker. However, where said inputs are not received back by the principal within a period of 1 year of the date of receipt of inputs by the job worker, it shall be deemed that such inputs had been supplied by the principal to the job worker on the day when the said inputs were received by the job worker.

Hence, the ITC taken by PQR Company Ltd. in September, 2019 is valid and since 1 year period has yet not lapsed in April, 2020, there will be no tax liability on such inputs.

Examiner’s Comment

Some examinees were unaware that the input tax credit in respect of raw materials used for zero rated outward supply can be availed in terms of section 16 of IGST Act, 2017. They also wrongly disallowed input tax credit in respect of work contractor’s service, which is allowed in the given case vide section 17(5) of CGST Act, 2017 as the repair of building is debited to P & L Account and not capitalized along with the immovable property.

![]()

Question 6.

Siddhi Ltd. is a registered manufacturer engaged in taxable supply of goods. Slddhi Ltd. purchased the following goods during the month of January, 2020. The following particulars are provided:

| Particulars | Input tax (₹) |

| 1. Capital goods purchased on which depreciation has been taken on full value including input tax thereon | 15,000 |

| 2. Goods purchased from Ravi Traders (Invoice of Ravi Traders is received in month of January, 2020, but goods were received in month of March, 2020) | 20,000 |

| 3. Car purchased for making further supply of such car. Such car is destroyed in accident while being used for test drive by potential customers | 30,000 |

| 4. Goods used for setting up telecommunication towers being immovable property | 50,000 |

| 5. Goods purchased from Pooja Ltd. (Full payment is made by Siddhi Ltd. to Pooja Ltd. against such supply, but tax has not been deposited by Pooja Ltd. | 10,000 |

| 6. Truck purchased for delivery of output goods | 80,000 |

Determine the amount of input tax credit (ITC) available by giving necessary explanations for treatment of various items as per the provisions of the CGST Act, 2017. You may assume that all the necessary conditions for availing the ITC have been complied with by SIddhi Ltd. [May 2019, Old, 5 Marks]

Answer:

Computation of ITC available with Siddhi Ltd.

| Particulars | Input tax (₹) |

| 1. Capital goods [Since depreciation has been claimed on the tax component of the value of the capital goods, ITC of such tax cannot be availed in terms of section 16 of the CGST Act, 2017.] | Nil |

| 2. Goods purchased from Ravi Traders [ITC in respect of goods not received cannot be availed (Section 16 of the CGST Act, 2017). Since the goods have been received in the month of March 2020, ITC thereon can be availed in March 2019 and not January 2020 even though the invoice for the same has been received in January 2020] | Nil |

| 3. Cars purchased for making further supply [Though ITC on motor vehicles used for further supply of such vehicles is not blocked, ITC on goods destroyed for whichever reason is blocked (Section 17(5) of the CGST Act, 2017).] | Nil |

| 4. Goods used for setting telecommunication towers [ITC on goods used by a taxable person for construction of immovable property on his own account is blocked even when such goods are used in the course or furtherance of business (Section 17 of the CGST Act, 2017).] | Nil |

| 5. Goods purchased from Pooja Ltd. [ITC can be claimed provisionally in January 2020 since all the conditions necessary for availing the same have been complied with (Section 16 of the CGST Act, 2017). | 10,000 |

| However, the claim will get confirmed only when the tax charged in respect of such supply has been actually paid to the Government.] | |

| 6. Trucks purchased for delivery of output goods [ITC on motor vehicles used for transportation of goods is not blocked (Section 17(5) of the CGST Act, 2017).] | 80,000 |

| Total ITC available with Siddhi Ltd. | 90,000 |

Note: The above answer is based on the assumption that the ITC available is to be computed for the month of January, 2020. However, since the question does not specify the period for which ITC available is to be computed, the question may also be answered without referring to any particular period.

![]()

Question 7.

Pari Ltd. of Jodhpur (Rajasthan) Is a registered manufacturer of cosmetic products. Pari Ltd.’ has furnished following details for the month of April, 2020:

| Particulars | ₹ |

| (A) Receipts (Details of Sales) | |

| (i) Sales in Rajasthan | 8,75,000 |

| (ii) Sales in States other than Rajasthan | 3,75,000 |

| (iii) Export under bond | 6,25,000 |

| (B) Payments | |

| (1) Raw materials | |

| (i) Purchased from registered suppliers located in Rajasthan | 1,06,250 |

| (ii) Purchased from unregistered suppliers located in Rajasthan | 37,500 |

| (iii) Purchased from Punjab from registered supplier | 1,00,000 |

| (iv) Integrated tax paid on Import from USA | 22,732 |

| (2) Consumables purchased from registered suppliers located in Rajasthan including high speed diesel (Excise and VAT paid) worth ₹ 31,250 for running the machinery in the factory | 1,56,250 |

| (3) Monthly rent for the factory building to the owner in Rajasthan | 1,00,000 |

| (4) Salary paid to employees on rolls | 6,25,000 |

| (5) Premium paid on life insurance policies taken for specified employees. Life insurance policies for specified employees have been taken by Pari Ltd. to fulfil a statutory obligation in this regard. The Government has notified such life insurance service under section 17(5)(b)(iii)(A). The life insurance service provider is registered in Rajasthan. | 2,00,000 |

All the above amounts are exclusive of all kinds of taxes, wherever applicable. However, the applicable taxes have also been paid by Pari Ltd.

The balance of Input Tax Credit (ITC) with Pari Ltd. as on 1st April, 2020 is

| CGST ₹ 20,000 |

| SGST ₹ 15,000 |

| IGST ₹ 15,000 |

Assume CGST, SGST and IGST rates to be 9%, 9% and 18% respectively, wherever applicable.

Assume that all the other necessary conditions to avail the eligible input tax credit have been compiled with by Pari Ltd., wherever applicable.

Compute eligible input tax credit and net GST payable (CGST and SGST or IGST as the case may be) by Pari Ltd. for the month of April, 2020. [Nov. 2018, 10 Marks]

Answer:

(a) Computation of eligible input tax credit available with Pari Ltd. in the month of April, 2020

| Particulars | Eligible input tax credit | ||

| CGST ₹ | SGST ₹ | IGST ₹ | |

| 1. Raw Material: | |||

| Purchased from local registered suppliers [Note 1(i)] (₹ 1,06,250 × 996) | 9,562.50 | 9,562.50 | |

| Purchased from local unregistered suppliers [Note 1(ii)] | Nil | Nil | |

| Purchased from Punjab from registered supplier [Note 1(i)] (₹ 1,00,000 × 18%) | 18,000 | ||

| Raw material imported from USA [Note 1(iii)] | 22,732 | ||

| 2. Consumables [Note 2] [(1,56,250-31,250) × 996] | 11,250 | 11,250 | |

| 3. Monthly rent for the factory building to the owner in Rajasthan [Note 3] | 9,000 | 9,000 | |

| 4. Salary paid to employees on rolls [Note 4] | Nil | Nil | Nil |

| 5. Premium paid on life insurance policies taken for specified employees [Note 5] (₹ 2,00,000 × 996) | 18,000 | 18,000 | – |

| Total | 47,812.50 | 47,812.50 | 40,732 |

| Add: Opening balance of ITC on 01.04.2020 | 20,000 | 15,000 | 15,000 |

| Eligible ITC [Note 7] | 67,812.50 | 62,812.50 | 55,732 |

Computation of net GST payable for the month of April, 2020

| Particulars | CGST ₹ | SGST ₹ | IGST ₹ |

| Intra-State sales | 78,750 | 78,750 | |

| Inter-State sales | 67,500 | ||

| Exports under bond [Note 6] | Nil | Nil | Nil |

| Total output tax liability | 78,750 | 78,750 | 67,500 |

| Less: Eligible ITC | 67,812.50 | 62,812.50 | 55,732 |

| Net GST payable | 10,937.50 | 15,937.50 | 11,768 |

Notes:

1.

(i) As per section 16 of the CGST ActCredit of GST paid on raw materials used in the course or furtherance of business is available.

(ii) All intra-State procurements made by a registered person from an unregistered supplier have been exempted from GST. Therefore, since no GST is paid on such raw material purchased, there does not arise any question of input tax credit (ITC) on such raw material.

(iii) As per section 16 of the CGSTAct: – IGST paid on imported goods qualifies as input tax in terms of section 2(62) of CGST Act, 2017. Therefore, credit of IGST paid on imported raw materials used in the course or furtherance of business is available.

2. ITC on consumables, being inputs used in the course or furtherance of business, is available. However, since levy of GST on high speed diesel has been deferred till a date to be notified by Government, there cannot be any ITC of the same.

3. ITC on monthly rent is available as the said service is used in the course or furtherance of business.

4. As per section 7 read with Schedule III to the CGST Act :- Services by employees to employer in the course of or in relation to his employment is not a supply. Therefore, since no GST is paid on such services, there cannot be any ITC on such services.

5. As per section 17(5) of the CGST Act, 2017ITC on life insurance service is available only when the same is notified by the Government as being obligatory for an employer to provide to its employees under any law for the time being in force.

6. As per section 16 of the IGST ActExport of goods is a zero rated supply. A zero rated supply under bond is made without payment of IGST, supplies includes zero rated supply.

7. Since export of goods is a zero rated supply, there will be no apportionment of ITC and full credit will be available.

Question 8.

State whether input tax credit is available in the following cases :

(i) Motor car purchased by driving school for imparting training to the customers. Whether your answer would be different if the motor car is purchased by a manufacturing company to be used by its Managing Director for official purposes (sitting capacity is 5 persons)?

(ii) Amount spent for construction of factory building.

(iii) Gift articles purchased on the occasion of Diwali to be distributed among the employees.

Answer:

(i) As per Section 17(5) of CGST Act, 2017:- Motor car purchased by driving school for imparting training to the customers is an exception to the blocked credit item. Hence, ITC is available.

Yes, motor car purchased by a manufacturing company to be used by its managing director is a blocked credit item as per Section 17(5)(a) of CGST Act, 2017. Hence, ITC is not available.

(ii) As per Section 17(5) of CGST Act, 2017 :- Amount spent for construction of factory building is an item for which input tax credit is not available.

(iii) As per Section 17(5) of CGST Act, 2017:- Input tax credit shall not be available for goods disposed of by way of gift or free samples.

![]()

Question 9.

V-Supply Pvt. Ltd. is a registered manufacturer of auto parts in Kolkata, West Bengal. The company has a manufacturing facility registered under Factories Act, 1948 in Kolkata. It pro-cures its inputs indigenously from both registered and unregistered suppliers located within as well as outside West Bengal as also imports some raw material from China.

The company reports the following details for the month of November, 20XX:

| Payments | ₹ (in lakh) | Receipts | ₹ (in lakh) |

| Raw material | 3.5 | Sales | 15 |

| Consumables | 1.25 | ||

| Transportation charges for bringing the raw material to factory | 0.70 | ||

| Salary paid to employees on rolls | 5.0 | ||

| Premium paid on life insurance policies taken for specified employees | 1.60 | ||

| Audit fee | 0.50 | ||

| Telephone expenses | 0.30 | ||

| Bank charges | 0.10 |

All the above amounts are exclusive of all kinds of taxes, wherever applicable. However, the applicable taxes have also been paid by the company.

Further, following additional details are furnished by the company in respect of the payments and receipts reported by it:

(i) Raw material amounting to ₹ 0.80 lakh is procured from Bihar and ₹ 1.5 lakh is imported from China. Basic customs duty of ₹ 0.15 lakh, education cesses of ₹ 0.0045 lakh and integrated tax of ₹ 0.29781 lakh are paid on the imported raw material. Remaining raw material is procured from suppliers located in West Bengal. Out of such raw material, raw’ material worth ₹ 0.30 lakh is procured from unregistered suppliers; the remaining raw material is procured from registered suppliers. Further, raw’ material worth ₹ 0.05 lakh purchased from registered supplier located in West Bengal has been destroyed due to see page problem in the factory and thus, could not be used in the manufacturing process.

(ii) Consumables are procured from registered suppliers located in Kolkata and include diesel worth ₹ 0.25 lakh for running the generator in the factory.

(iii) Transportation charges comprise of ₹ 0.60 lakh paid to Goods Transport Agency (GTA) in Kolkata and ₹ 0.10 lakh paid to horse pulled carts. GST applicable on the services of GTA is 5%.

(iv) Life insurance policies for specified employees have been taken by the company to fulfil a statutory obligation in this regard. The Government has notified such life insurance service under section 17(5)(b)(iii)(A). The life insurance service provider is registered in West Bengal.

(v) Audit fee is paid to M/s Goyal & Co., a firm of Chartered Accountants registered in West Bengal, for the statutory audit of the preceding financial year.

(vi) Telephone expenses pertain to bills for landline phone installed at the factory and mobile phones given to employees for official use. The telecom service provider is registered in West Bengal.

(vii) Bank charges are towards company’s current account maintained with a Private Sector Bank registered in West Bengal.

(viii) The break up of sales is as under:

Sales in West Bengal – ₹ 7 lakh

Sales in States other than West Bengal – ₹ 3 lakh

Export under bond – ₹ 5 lakh

The balance of input tax credit with the company as on 1.11.20XX is:

CGST – ₹ 0.15 lakh

SGST – ₹ 0.08 lakh

IGST – ₹ 0.10 lakh

Compute eligible input tax credit and net GST payable [CGST, SGST or IGST, as the case may be] by V-Supply Pvt. Ltd. for the month of November 20XX.

Note-

(i) CGST, SGST & IGST rates to be 9%, 9% and 18% respectively, wherever applicable.

(ii) The necessary conditions for availing input tax credit have been complied with by V-Supply Pvt. Ltd., wherever applicable.

You are required to make suitable assumptions, wherever necessary. [MTP, May 2018, 10 Marks]

Answer:

Computation of input tax credit available with V-Supply Pvt. Ltd. in the month of November 20XX

| Particulars | Eligible input tax credit | |||

| CGST*₹ | SGST*₹ | IGST*₹ | Total ₹ | |

| 1. Raw Material | ||||

| Raw material purchased from Bihar [Refer Note 1(i) | 14,400 | 14,400 | ||

| Raw material imported from China [Refer Note 1(ii)] | 29,781 | 29,781 | ||

| Raw material purchased from unregistered suppliers within West Bengal [Refer Note 1 (iv)] | Nil | Nil | Nil | |

| Raw material destroyed due to see page [Refer Note 1 (iv)] | Nil | Nil | Nil | |

| Remaining raw material purchased from West Bengal [Refer Note 1(f)] | 7,650 | 7,650 | 15,300 | |

| Total | 7,650 | 7,650 | 44,181 | 59,481 |

| 2. Consumables [Refer Note 2] | 9,000 | 9,000 | 18,000 | |

| 3. Transportation charges for bringing the raw material to factory [Refer Note 3] | 1,500 | 1,500 | 3,000 | |

| 4. Salary paid to employees on rolls [Refer Note 4] | Nil | Nil | Nil | Nil |

| 5. Premium paid on life insurance policies taken for specified employees [Refer Note 5] | 14,400 | 14,400 | – | 28,800 |

| 6. Audit fee [Refer Note 6] | 4,500 | 4,500 | – | 9,000 |

| 7. Telephone expenses [Refer Note 6] | 2,700 | 2,700 | 5,400 | |

| 8. Bank charges [Refer Note 6] | 900 | 900 | 1,800 | |

| 40,650 | 40,650 | 44,181 | 1,25,481 | |

Computation of net GST payable

| Particulars | CGST* ₹ | SGST* ₹ | IGST* ₹ | Total ₹ |

| On Intra-State sales in West Bengal | 63,000 | 63,000 | 1,26,000 | |

| On Inter-State sales other than West Bengal | 54,000 | 54,000 | ||

| On exports under bond [Note 7] | Nil | Nil | Nil | Nil |

| On inward supply of GTA services under reverse charge [Note 3] | 1,500 | 1,500 | 3,000 | |

| Total output tax liability | 64,500 | 64,500 | 54,000 | 1,83,000 |

| Less: Cash paid towards tax payable under reverse charge [Note 10] | (1,500) | (1,500) | (3,000) | |

| Less: Input tax credit [Note 8] | ||||

| Opening balance of input tax credit on 01.11.20XX | (15,000) | (8,000) | (10,000) | (33,000) |

| Input tax credit availed during the month | (40,650) | (40,650) | (44,181) | (1,25,481) |

| IGST Utilized for payment of CGST | 181 (IGST) |

|||

| Net GST payable | 7,169 | 14,350 | Nil | 21,519 |

Notes:

(1)

(i) As per section 16(1) of the CGST ActCredit of input tax (CGST & SGST/IGST) paid on raw materials used in the course or furtherance of business is available.

(ii) As per section 2(62)(a) of the CGST Act IGST paid on imported goods qualifies as input tax. Therefore, credit of IGST paid on imported raw materials used in the course or furtherance of business is available in terms of section 16(1) of the CGST Act.

(iii) No GST is paid on such raw material(because purchase from unregistered person), there does not arise any question of input tax credit on such raw material.

(iv) As per section 17(5)(h) of the CGST ActInput tax credit is not available on destroyed inputs.

(2) Consumables, being inputs used in the course or furtherance of business, input tax credit is available on the same in terms of section 16(1) of the CGST Act. However, levy of CGST on diesel has been deferred till such date as may be notified by the Government on recommendations of the GST Council [Section 9(2) of the CGST Act], Hence, there being no levy of GST on diesel, there cannot be any input tax credit of the same.

(3) In respect of intra-State road transportation of goods undertaken by a GTA, who has not paid CGST @ 6%, for any person registered under the GST law, CGST is payable under reverse charge by the recipient of service. Thus, V-Supply Pvt. Ltd. will pay GST under reverse charge on transportation service received from GTA.

Input tax paid under reverse charge on GTA service will be available as input tax credit in terms of section 16(1) of the CGST Act as the said service is used in course or furtherance of business.

Furthermore, intra-State services by way of transportation of goods by road except the services of a GTA and a courier agency are exempt from CGST vide Notification No. 12/2017. Therefore, since no GST is paid on such services, there cannot be any input tax credit on such services.

(4) As per Section 7 read with Para 1 of the Schedule III of CGST ActServices by employees to employer in the course of or in relation to his employment is not a supply.

(5) Input tax credit on supply of life insurance service is not blocked if the Government has made it obligatory for an employer to provide such service to its employees [Section 17(5) (b)(iii)(A) of the CGST Act], Therefore, GST paid on premium for life insurance policies will be available as input tax credit.

(6) Audit fee, telephone expenses and bank charges are all services used in the course or furtherance of business and thus, credit of input tax paid on such service will be available in terms of section 16(1) of the CGST Act.

(7) Export of goods is a zero rated supply in terms of section 16(1)(a) of the IGST Act. A zero rated supply under bond is made without payment of integrated tax [Section 16(3)(a) of the IGST Act].

(8) Since export of goods is a zero rated supply, there will be no apportionment of input tax credit and full credit will be available [Section 16 of the IGST Act read with section 17(2) of the CGST Act].

(9) As Per Rule 88A Manner of Utilisation of ITC is:

The rule 88A provides as under:

- ITC of IGST should first be utilized towards payment of IGST.

- Remaining ITC of IGST, if any, can be utilized towards the payment of CGST and SGST/UTGST in any order, i.e. ITC of IGST can be first utilized either against CGST or SGST.

- ITC of CGST, SGST/UTGST can be utilized towards payment of IGST, CGST, SGST/ UTGST only after the ITC of IGST has first been utilized fully.

(10) Section 49(4) of the CGST Act lays down that the amount available in the electronic credit ledger may be used for making payment towards output tax. However, tax payable under reverse charge is not an output tax in terms of section 2(82) of the CGST Act. Therefore, tax payable under reverse charge cannot be set off against the input tax credit and thus, will have to be paid in cash.

(11) CGST and SGST are chargeable on intra-State inward and outward supplies and IGST is chargeable on inter-State inward and outward supplies.

![]()

Question 10.

Flowchem Palanpur (Gujarat) has entered into a contract with R Refinery, Abu Road (Rajas-than) on 1st July, 2020 to supply 10 valves on FOR basis for its project, with following terms and conditions:

1. List price per valve is ₹ 1,00,000, exclusive of taxes.

2. The valves go through two stage third party inspection during manufacturing, as required by R Refinery. Cost of inspection of ₹ 15,000 is directly paid by R Refinery to testing agency. A special packing is to be done, as required by R Refinery. Cost of special packing is ₹ 10,000.

3. A special packing is to be done, as required by R Refinery. Cost of special packing is ₹ 10,000.

4. After making supply of valves, Flowchem has to arrange for erection and testing at the site for commissioning. Cost of erection etc. is of ₹ 15,000.

5. The goods were dispatched with tax invoice on 20th July, 2020 and they reached the destination at Abu-Road on 21st July, 2020. The lorry freight of ₹ 5,000 has been paid by R Refinery directly to lorry driver.

Assume the CGST and SGST rates to be 9% each and IGST rate to be 18%. Opening ITC of CGST is ₹ 20,000 and SGST is ₹ 20,000. All the given amounts are exclusive of GST, wherever applicable.

It has also undertaken following local transactions during the month of July, 2020 on which it has paid CGST and SGST as under:

Answer:

| Particulars | Amount paid CGST (₹) | Amount paid SGST (₹) |

| 1. It has acquired services of works contractor to erect foundation for fixing the machinery to earth in the factory. | 5,000 | 5,000 |

| 2. It has laid pipe line upto the gate of its factory to bring the water to the factory for the purpose of production facility. | 10,000 | 10,000 |

| 3. For the purpose of smooth and convenient communication in its factory, it has installed telecommunication tower of a mobile company (with due permission), the mobile phones of which have been provided to staff for factory work. | 5,000 | 5,000 |

| 4. It has entered into an agreement with a travel company to provide home travel facility to its employees when they are on leave. | 2,500 | 2,500 |

| 5. It has entered into an agreement with a fitness centre to provide wellness sendees to its employees after office hours | 2,000 | 2,000 |

Work out the GST liability [CGST & SGST or IGST, as the case may be] of Flowchem Palan-pur (Gujarat) for July, 2018 after making suitable assumptions, if any, [May 2019, 9 Marks]

Answer:

(a) Computation of GST liability of Flowchem, Palanpur (Gujarat) for July 2020

| Particulars | CGST @ 9% (₹) | SGST @ 9% (₹) | IGST @ 18% (₹) |

| Output tax liability [Working Note 1] | 1,88,100 | ||

| Less: ITC available for set off [Working Note 2] | 25,000 | 25,000 | |

| CGST | (25,000) | ||

| SGST | (25,000) | ||

| Net GST liability payable in cash | 1,38,100 |

Working Note 1 – Computation of output tax liability of Flowchem for July 2020

| Particulars | Amount (₹) |

| List price of 10 valves (₹ 1,00,000 × 10) (It has been assumed that the charges for inspection, special packing, erection and freight are in respect of 10 valves) | 10,00,000 |

| Add: Amount paid by R Refinery to testing agency [Note 1] | 15,000 |

| Add: Special packing [Note 2] | 10,000 |

| Add: Erection and testing at site [Note 2] | 15,000 |

| Add: Freight [Note 3] | 5,000 |

| Value of taxable supply | 10,45,000 |

| IGST @ 18% [Note 4] | 1,88,100 |

Notes:

(1) As per section 15(2) of the CGST Act, 2017, any amount that the supplier is liable to pay in relation to a supply but which has been incurred by the recipient of the supply and not included in the price actually paid or payable for the goods shall be included in the value of supply.

Assuming that in the given case, arranging inspection was the liability of the supplier, the same should be included in the value of supply charges for the same, however, have been paid directly to the third party service provider by the recipient.

(2) As per section 15(2) of the CGST Act, 2017, any amount charged for anything done by the supplier in respect of the supply of goods at the time of, or before delivery of goods shall be included in the value of supply.

(3) As per section 15(2) of the CGST Act, 2017, any amount that the supplier is liable to pay in relation to a supply but which has been incurred by the recipient of the supply and not included in the price actually paid or payable for the goods shall be included in the value of supply.

Since, in the given case, the supply contract is on FOR basis, payment of freight is the liability of supplier but the same has been paid by the recipient and thus, should be included in the value of supply.

(4) As per section 10( 1) of the IGST Act, 2017, where the supply involves movement of goods, the place of supply is the location of the goods at the time at which the movement of goods terminates for delivery to the recipient, i.e. Abu Road (Rajasthan) the location of the supplier (Gujarat). The supply is an inter-State supply liable to IGST.

![]()

Question 11.

M/s XYZ, a registered supplier, supplies the following goods and services for construction of buildings and complexes:

- excavators for required period at a per hour rate

- manpower for operation of the excavators at a per day rate

- soil-testing and seismic evaluation at a per sample rate.

The excavators are invariably hired out along with operators. Similarly, excavator operators are supplied only when the excavator is hired out.

M/s XYZ receives the following services:

- Annual maintenance services for excavators;

- Health insurance for operators of the excavators;

- Scientific and technical consultancy for soil testing and seismic evaluation. For a given month, the receipts (exclusive of GST) of M/s XYZ are as follows:

- Hire charges for excavators – ₹ 18,00,000

- Service charges for supply of manpower for operation of the excavator – ₹ 20,000

- Service charges for soil testing and seismic evaluation at three sites – ₹ 2,50,000. The GST paid during the said month on services received by M/s XYZ is as follows:

- Annual maintenance for excavators – ₹ 1,00,000

- Health insurance for excavator operators – ₹ 11,000

- Scientific and technical consultancy for soil testing and seismic evaluation – ₹ 1,00,000.

Compute the net GST payable by M/s XYZ for the given month.

Assume the rates of GST to be as under:

| Hiring out of excavators – 12% |

| Supply of manpower services and soil-testing and seismic evaluation services – 18% |

Note: – Opening balance of input tax credit of GST is nil. [MTP, May 2019, 10 Marks]

Answer:

(a) Computation of net GST payable by M/s XYZ

| Particulars | GST payable (₹) |

| Gross GST liability [Refer Working Note 1 below] | 2,63,400 |

| Less: Input tax credit [Refer Working Note 2 below] | 2,00,000 |

| Net GST liability | 63,400 |

Working Notes

(1) Computation of gross GST liability

| Particulars | Value received (₹) | Rate of GST | GST payable (₹) |

| Hiring charges for excavators | 18,00,000 | 12% | 2,16,000 |

| Service charges for supply of manpower for operation of excavators [the excavators are invariably hired out along with operators and excavator operators are supplied only when the excavator is hired out, it is a case of composite supply under section 2(30) of the CGST Act, 2017 wherein the principal supply is the hiring out of the excavator. Therefore, the supply of manpower for operation of the excavators will also be taxed at the rate applicable for hiring out of the excavator (principal supply), which is 12%.] | 20,000 | 12% | 2,400 |

| Service charges for soil testing and seismic evaluation [Soil testing and seismic evaluation services being independent of the hiring out of excavator the rate applicable to them, is 18%.] | 2,50,000 | 18% | 45,000 |

| Gross GST liability | 2,63,400 |

(2) Computation of input tax credit available for set off

| Particulars | GST paid (₹) | ITC available (₹) |

| Annual maintenance services for excavators [Refer Note] | 1,00,000 | 1,00,000 |

| Health insurance for excavator operators [It is Blocked as per section 17(5) of CGST Act, 2017] | 11,000 | – |

| Scientific and technical consultancy [Refer Note] | 1,00,000 | 1,00,000 |

| Total input tax credit available | 2,00,000 |

Note: The annual maintenance service for the excavators does not get covered by the bar under section 17 of the CGST Act, 2017 and the credit thereon will be available. The same applies for scientific & technical consultancy for construction projects because in this case also, the service is used for providing the outward taxable supply of soil testing and seismic evaluation service and not for construction of immovable property.

Question 12.

X, is a manufacturer of roofing sheets, and has total input tax credit of ₹ 1,60,000 as on 30-06-2020. He provides the following other information pertaining to June 2020:

(1) Input tax on for raw materials in June is ₹ 40,000.

(2) Input tax on account of Harvest caterers in connection with his Housewarming ₹ 10,000.

(3) Input tax on inputs contained in exempt supplies of ₹ 2 lakh in June is ₹ 20,000.

(4) GST paid on cosmetic and plastic surgery of CEO of the company is ₹ 30,000.

(5) Total turnover (inter-State, taxable @ 18%) for the month of June 2020 is ₹ 60 lakh. Compute the ITC available and his output tax liability for the month of June 2020. [May 2019, 10 Marks]

Answer:

Compute the ITC available and his output tax liability of X for June 2020

| Particulars | Amount (₹) |

| Output tax liability for June 2020 | |

| GST on taxable turnover for June 2020 | 10,80,000 |

| [Being inter-State supply, the same is leviable to IGST @ 18% = ₹ 60,00,000 × 1896] | |

| Add: Ineligible ITC [Refer working note below] [ITC out of common credit, attributable to exempt supplies shall be added to the output tax liability in terms of rule 42 of the CGST Rules, 2017] | 1,290 |

| Total output tax liability | 10,81,290 |

| Total ITC available as on 30.06.2020 | 1,60,000 |

Working Note:

Computation of ineligible ITC to be added to output tax liability

| Particulars | Amount (₹) |

| Input tax on raw materials [Note 1] | 40,000 |

| Input tax on catering for housewarming [Note 2] | Nil |

| Input tax on inputs contained in exempt supplies [Note 3] | Nil |

| Input tax on cosmetic and plastic surgery of CEO of company [Note 4] | Nil |

| Total ITC credited to the Electronic Credit Ledger in terms of rule 42 | 40,000 |

| Common credit [Note 5] | 40,000 |

| ITC attributable towards exempt supplies | 1,290 |

| [Common Credit x (Aggregate value of exempt supplies during the tax period/ Total turnover during the tax period) – Rule 42 of the CGST Rules, 2017 = ₹ 40,000 × ₹ 2,00,000/₹ 62,00,000 – (rounded off)] |

Note:

1. As per Section 16(1) of the CGST Act, 2017 Being used in the course or furtherance of business, input tax on raw materials is available as ITC

2. As per Section 17(5) of the CGST Act, 2017 ITC on outdoor catering is blocked if the same is not used for making an outward supply of outdoor catering or as an element of a taxable composite/mixed supply. Hence, ITC not allowed

3. As per Rule 42 of the CGST Rules, 2017 Input tax on inputs contained in exempt supplies, Not available as ITC and thus, not credited to the Electronic Credit Ledger

4. As per section 17(5) of the CGST Act, 2017 ITC on cosmetic and plastic surgery is blocked if the same are not used for making the same category of outward supply or as an element of a taxable composite/mixed supply.

5. As per Rule 42 of the CGST Rules, 2017 ITC credited to Electronic Credit Ledger (₹ 40,000) – ITC attributable to inputs and input services intended to be used exclusively for effecting taxable supplies (Nil).

It has been assumed that input tax on raw materials is attributable to both taxable and exempt activity

6. The information provided in the question leaves scope for multiple assumptions. The answer given above is based on one such assumption. Other assumptions can also be made to answer this question.

![]()

Question 13.

‘All-in-One Store’ is a chain of departmental store having presence in almost all metro cities across India. Both exempted as well as taxable goods are sold in such Stores. The Stores operate in rented properties. All-in-One Stores pay GST under regular scheme.

In Mumbai, the Store operates in a rented complex, a part of which is used by the owner of the Store for personal residential purpose.

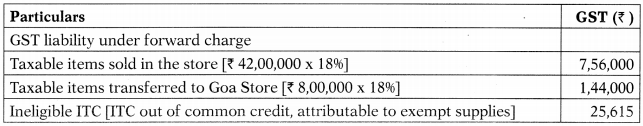

All-in-One Store, Mumbai furnishes following details for the month of October, 20XX:

(i) Aggregate value of various items sold in the Store:

Taxable items – ₹ 42,00,000

Items exempted vide a notification – ₹ 12,00,000

Items not leviable to GST – ₹ 3,00,000

(ii) Mumbai Store transfers to another All-in-One Store located in Goa certain taxable items for the purpose of distributing the same as free samples. The value declared in the invoice for such items is ₹ 5,00,000. Such items are sold in the Mumbai Skore at ₹ 8,00,000.

(iii) Aggregate value of various items procured for being sold in the Store:

Taxable items – ₹ 55,00,000

Items exempted vide a notification – ₹ 15,00,000

Items not leviable to GST – ₹ 5,00,000

(iv) Freight paid to goods transport agency (GTA) for inward transportation of taxable items – ₹ 1,00,000

(v) Freight paid to GTA for inward transportation of exempted items – ₹ 80,000

(vi) Freight paid to GTA for inward transportation of non-taxable items – ₹ 20,000

(vii) Monthly rent payable for the complex – ₹ 5,50,000 (one third of total space available is used for personal residential purpose).

(viii) Activity of packing the items and putting the label of the Store along with the sale price has been outsourced. Amount paid for packing of all the items – ₹ 2,50,000

(ix) Salary paid to the regular staff at the Store – ₹ 2,00,000

(x) GST paid on inputs used for personal purpose – ₹ 5,000

(xi) GST paid on rent a cab services availed for business purpose – ₹ 4,000.

(xii) GST paid on items given as free samples – ₹ 4,000

Given the above available facts, you are required to compute the following:

A. Input tax credit (ITC) credited to the Electronic Credit Ledger

B. Common Credit

C. ITC attributable towards exempt supplies out of common credit

D. Eligible ITC out of common credit

E. Net GST liability for the month of October, 20XX

Note:

- Wherever applicable, GST under reverse charge is payable @ 5% by All-in-One Stores. Rate of GST in all other cases is 18%.

- All the sales and purchases made by the Store are within Maharashtra. All the purchases are made from registered suppliers. All the other expenses incurred are also within the State.

- Wherever applicable, the amounts given are exclusive of taxes.

- All the necessary conditions for availing the ITC have been complied with.

Answer:

A. Computation of ITC credited to Electronic Credit Ledger

As per rule 42 of the CGST Rules, 2017, the ITC in respect of inputs or input services being partly used for the purposes of business and partly for other purposes, or partly used for effecting taxable supplies and partly for effecting exempt supplies, shall be attributed to the purposes of business or for effecting taxable supplies.

ITC credited to the electronic credit ledger of registered person [‘Cl’] is calculated as under C1 = T – (T1+T2+T3)

Where,

T = Total input tax involved on inputs and input services in a tax period.

T1 = Input tax attributable to inputs and input services intended to be used exclusively for non-business purposes

T2 = Input tax attributable to inputs and input services intended to be used exclusively for effecting exempt supplies

T3 = Input tax in respect of inputs and input services on which credit is blocked under section 17(5) of the CGST Act, 2017

Computation of total input tax involved [T]

| Particulars | (₹) |

| GST paid on taxable items [₹ 55,00,000 x 1896] | 9,90,000 |

| Items exempted vide a notification [Since exempted, no GST is paid] | Nil |

| Items not leviable to tax [Since non-taxable, no GST is paid] | Nil |

| GST paid under reverse charge on freight paid to GTA for inward transportation of taxable items – [₹ 1,00,000 x 5%] | 5,000 |

| GST paid under reverse charge on freight paid to GTA for inward transportation of exempted items – [₹ 80,000 x 5%] | 4,000 |

| GST paid under reverse charge on freight paid to GTA for inward transportation of non-taxable items – [₹ 20,000 x 5%] | 1,000 |

| GST paid on monthly rent – [₹ 5,50,000 x 18%] | 99,000 |

| GST paid on packing charges [₹ 2,50,000 x 18%] | 45,000 |

| Salary paid to staff at the Store | Nil |

| [Services by an employee to the employer in the course of or in relation to his employment is not a supply in terms of para 1 of the Schedule III to CGST Act, 2017 and hence, no GST is payable thereon]. | |

| GST paid on inputs used for personal purpose | 5,000 |

| GST paid on rent a cab services availed for business purpose | 4,000 |

| GST paid on items given as free samples | 4,000 |

| Total input tax involved in a tax period (October, 20XX) [T] | 11,57,000 |

Computation of T1, T2, T3

| Particulars | (₹) |

| GST paid on monthly rent attributable to personal purposes [1/3 of ₹ 99,000] | 33,000 |

| GST paid on inputs used for personal purpose | 5,000 |

| Input tax exclusively attributable to non-business purposes [Tl] | 38,000 |

| GST paid under reverse charge on freight paid to GTA for inward transportation of exempted items | 4,000 |

| [As per section 2(47) of the CGST Act, 2017, exempt supply means, inter alia, supply which may be wholly exempt from tax by way of a notification issued under section 11. Hence, input service of inward transportation of exempt items is exclusively used for effecting exempt supplies.] | |

| GST paid under reverse charge on freight paid to GTA for inward transportation of non-taxable items [Exempt supply includes non-taxable supply in terms of section 2(47) of the CGST Act, 2017. Hence, input service of inward transportation of non-taxable items is exclusively used for effecting exempt supplies.] | 1,000 |

| Input tax exclusively attributable to exempt supplies [T2] | 5,000 |

| GST paid on rent a cab services availed for business purpose | 4,000 |

| [ITC on rent a cab service is blocked under section 17(5)(b)(i) of the CGST Act, 2017 as the same is not used by All-in-One Store for providing the rent a cab service or as part of a taxable composite or mixed supply. It has been assumed that it is not obligatory for an employer to provide the same to its employees under any law for the time being in force. | |

| GST paid on items given as free samples | 4,000 |

| [ITC on goods inter alia, disposed of by way of free samples is blocked under section 17(5)(h) of the CGST Act, 2017], | |

| Input tax for which credit is blocked under section 17(5) of the CGST Act, 2017 [T3] ** | 8,000 |

**Since GST paid on inputs used for personal purposes has been considered while computing Tl, the same has not been considered again in computing T3.

ITC credited to the electronic credit ledger Cl = T – (T1+T2+T3)

= ₹ 11,57,000 – (₹ 38,000 + ₹ 5,000 + ₹ 8,000)

= ₹ 11,06,000

B. Computation of Common Credit

C2 = C1 – T4

where C2 = Common Credit

T4 = Input tax credit attributable to inputs and input services intended to be used exclusively for effecting taxable supplies

Computation of T4,

| Particulars | (₹) |

| GST paid on taxable items | 9,90,000 |

| GST paid under reverse charge on freight paid to GTA for inward transportation of taxable items | 5,000 |

| Input tax exclusively attributable to taxable supplies [T4] | 9,95,000 |

Common Credit C2 = C1 – T4 = ₹ 11,06,000 – ₹ 9,95,000 = ₹ 1,11,000

C. Computation of ITC attributable towards exempt supplies out of common credit

ITC attributable towards exempt supplies is denoted as ‘D1’ and calculated as – D1 = (E ÷ F) × C2

where,

‘E’ is the aggregate value of exempt supplies during the tax period, and ‘F’ is the total turnover in the State of the registered person during the tax period

Aggregate value of exempt supplies during October, 20XX

= ₹ 15,00,000 (₹ 12,00,000 + ₹ 3,00,000)

Total turnover in the State during the tax period

= ₹ 65,00,000 (₹ 42,00,000 + ₹ 12,00,000 + ₹ 3,00,000 + ₹ 8,00,000)

Note: Transfer of items to Store located in Goa is inter-State supply in terms of section 7 of the IGST Act, 2017 and hence includible in the total turnover. Such supply is to be valued as per rule 28 of the CGST Rules, 2017. However, the value declared in the invoice cannot be adopted as the value since the recipient Store at Goa is not entitled for full credit. Therefore, open market value of such goods, which is the value of such goods sold in Mumbai Store, is taken as the value of items transferred to Goa Store.

D1 = (15,00,000 ÷ 65,00,000) × 1,11,000

= ₹ 25,615 (rounded off)

D. Computation of Eligible ITC out of common credit

Eligible ITC attributed for effecting taxable supplies is denoted as ‘C3’, where,

C3 = C2 – D1

= ₹ 1,11,000 – ₹ 25,615

= ₹ 85,385

E. Computation of Net GST liability for the month of October, 20XX

![]()

Question 14.

Vansh Shoppe is a registered supplier of both taxable and exempted goods, registered under GST in the State of Rajasthan. Vansh Shoppe has furnished the following details for the month of April, 2020:

| ₹ | |

| (1) Details of sales: | |

| Sales of taxable goods | 50,00,000 |

| Sales of goods not leviable to GST | 10,00,000 |

| (2) Details of goods purchased for being sold in the shop: | |

| Taxable goods | 45,00,000 |

| Goods not leviable to GST | 4,00,000 |

| (3) Details of expenses: | |

| Monthly rent payable for the shop | 3,50,000 |

| Telephone expenses paid (₹ 30,000 for land line phone installed at the shop and ₹ 20,000 for mobile phone given to employees for official use) | 50,000 |

| Audit fees paid to a Chartered Accountant (₹ 35,000 for filing of income tax return & the statutory audit of preceding financial year and ₹ 25,000 for filing of GST return) | 60,000 |

| Premium paid on health insurance policies taken for specified employees of the shop. The Government has not notified such health insurance service under section 17(5)(b)(iii)(A) CGST Act, 2017 | 10,000 |

| Freight paid to goods transport agency (GTA) for inward transportation of non-taxable goods | 50,000 |

| Freight paid to goods transport agency (GTA) for inward transportation of taxable goods | 1,50,000 |

| GST paid on goods given as free samples | 5,000 |

All the above amounts are exclusive of all kinds of taxes, wherever applicable.

All the purchases and sales made by Vansh Shoppe are within Rajasthan. All the purchases are made from registered suppliers. All the other expenses incurred are also within Rajasthan.

Assume, wherever applicable, for purpose of reverse charge payable by Vansh Shoppe, the CGST, SGST and IGST rates as 2.5%, 2.5% and 5% respectively. CGST, SGST and IGST rates to be 6%, 6% and 12% respectively in all other cases.

There is no opening balance in the electronic cash ledger or electronic credit ledger.

Assume that all the necessary conditions for availing the ITC have been complied with. Ignore interest, if any.

You are required to compute the following:

(1) Input Tax Credit (ITC) credited to Electronic Credit Ledger

(2) Common credit

(3) ITC attributable towards exempt supplies out of common credit

(4) Net GST liability for the month of April, 2020 [May 2019, Old, 10 Marks]

Solution:

(1) Computation of ITC credited to Electronic Credit Ledger

ITC of input tax attributable to inputs and input services intended to be used for business purposes is credited to the electronic credit ledger. Input tax attributable to inputs and input services intended to be used exclusively for non-business purposes, for effecting exclusively exempt supplies and on which credit is blocked under section 17(5) of the CGST Act, 2017 is not credited to electronic credit ledger [Sections 16 and 17 of the CGST Act, 2017],

In the light of the aforementioned provisions, the ITC credited to electronic credit ledger of Vansh Shoppe is calculated as under:

| Particulars | Amount (₹) | CGST @ 6% (₹) | SGST @ 6% (₹) |

| GST paid on taxable goods | 45,00,000 | 2,70,000 | 2,70,000 |

| Goods not leviable to GST [Sine e non-taxable, no GST is paid] | 4,00,000 | Nil | Nil |

| GST paid on monthly rent for shop | 3,50,000 | 21,000 | 21,000 |

| GST paid on telephone expenses | 50,000 | 3,000 | 3,000 |

| GST paid on audit fees | 60,000 | 3,600 | 3,600 |

| GST paid on premium of health insurance policies | 10,000 | Nil | Nil |

| [ITC on life insurance service is blocked if the Government has not notified such services under section \l(5)(b){iii)(k) of the CGST Act], | 5,000 | Nil | Nil |

| GST paid on goods given as free samples | |||

| [ITC on goods disposed of by way of free samples is blocked under section 17(5) of the CGST Act, 2017] | |||

| Freight paid to GTA for inward transportation of non-taxable goods under reverse charge | 50,000 | Nil | Nil |

| [Since definition of exempt supply under section 2(47) of the CGST Act, 2017 specifically includes non-taxable supply, the input service of inward transportation of non-taxable goods is being exclusively used for effecting exempt supplies.] | 1,50,000 | 3,750 | 3,750 |

| Freight paid to GTA for inward transportation of taxable goods under reverse charge | |||

| ITC credited to the electronic ledger | 3,01,350 | 3,01,350 |

(2) Computation of common credit

Common Credit = ITC credited to Electronic Credit Ledger – ITC attributable to inputs and input services intended to be used exclusively for effecting taxable supplies [Section 17 of the CGST Act, 2017 read with rule 42 of the CGST Rules, 2017].

| Particulars | CGST (₹) | SGST (₹) |

| ITC credited to Electronic Credit Ledger | 3,01,350 | 3,01,350 |

| Less: ITC on taxable goods | 2,70,000 | 2,70,000 |

| Less: ITC on freight paid to GTA for inward transportation of taxable goods | 3,750 | 3,750 |

| Common credit | 27,600 | 27,600 |

(3) Computation of ITC attributable towards exempt supplies out of common credit

ITC attributable towards exempt supplies = Common credit × (Aggregate value of exempt supplies during the tax period/Total turnover during the tax period) [Section 17 of the CGST Act, 2017 read with rule 42 of the CGST Rules, 2017].

| Particulars | CGST (₹) | SGST (₹) |

| ITC attributable towards exempt supplies | 4,600 | 4,600 |

| [₹ 27,600 × (₹ 10,00,000/₹ 60,00,000)] |

(4) Computation of net GST liability for the month of April, 2020

| Particulars | CGST (₹) | SGST (₹) |

| GST liability under forward charge | ||

| Sale of taxable goods [₹ 50,00,000 × 6%] | 3,00,000 | 3,00,000 |

| Add: Ineligible ITC [ITC out of common credit, attributable to exempt supplies] | 4,600 | 4,600 |

| Total output tax liability under forward charge | 3,04,600 | 3,04,600 |

| Less: ITC credited to the electronic credit ledger | 3,01,350 | 3,01,350 |

| Net GST payable [A] | 3,250 | 3,250 |

| GST liability under reverse charge | ||

| Freight paid to GTA for inward transportation of taxable goods [₹ 1,50,000 × 2.596] | 3,750 | 3,750 |

| Freight paid to GTA for inward transportation of non-taxable goods | ||

| [₹ 50,000 × 2.5%] | 1,250 | 1,250 |

| Total output tax liability under reverse charge [B] | 5,000 | 5,000 |

| Net GST liability [A] + [B] | 8,250 | 8,250 |

| Note: Amount available in the electronic credit ledger may be used for making payment towards output tax [Section 49 of the CGST Act, 2017]. However, tax payable under reverse charge is not an output tax in terms of definition of output tax provided under section 2(82) of the CGST Act, 2017. Therefore, tax payable under reverse charge cannot be set off against the input tax credit and thus, will have to be paid in cash. |

![]()

Question 15.

Mr. Rajesh Surana has a proprietorship firm in the name of Surana & Sons in Jaipur. The firm, registered under GST in the State of Rajasthan, manufactures three taxable products ‘M’, ‘NT’ and ‘O’. Tax on ‘N’ is payable under reverse charge. The firm also provides taxable consultancy services.

The firm has provided the following details for the period April 2OXX – September 20XX:

| Particulars | (₹) |

| Turnover of ‘M’ | 14,00,000 |

| Turnover of ‘N’ | 6,00,000 |

| Turnover of ‘O’ | 10,00,000 |

| Export of ‘M’ with payment of IGST | 2,50,000 |

| Export of ‘O’ under letter of undertaking | 10,00,000 |

| Consultancy services provided to independent clients located in foreign countries under LUT. In all cases, the consideration has been received in convertible foreign exchange within 2-3 months from the date of the invoice | 20,00,000 |

| Sale of building (excluding stamp duty of ₹ 2.50 lakh, being 296 of value) | 1,20,00,000 |

| Interest received on investment in fixed deposits with a bank | 4,00,000 |

| Sale of shares (Purchase price ₹ 2,40,00,000/-) | 2,50,00,000 |

| Legal services received from an advocate in relation to product ‘M’ | 3,50,000 |

| Common inputs and input services used for supply of goods and services mentioned above [Inputs – ₹ 35,00,000; Input services – ₹ 15,00,000] | 50,00,000 |

With the help of the above-mentioned information, compute the net GST liability of Surana & Sons, payable from Electronic Credit Ledger and/or Electronic Cash Ledger, as the case may be, for the period April 20XX- September 20XX.

Note: Assume that all the domestic transactions of Surana & Sons are intra -State and that rate of GST on goods and services are 12% and 18% respectively. All the conditions necessary for availing the ITC have been compiled with. Turnover of Surana & Sons was ₹ 85,00,000 in the previous financial year. All the amounts given above are exclusive of GST, wherever applicable. [MTP, Nov 19, 9 Marks]

Solution:

Computation of net GST liability of Surana & Sons for the period April 20XX – September 20XX

| Particulars | (₹) |

| GST payable on outward supply [Refer Working Note 1] | 3,18,000 |

| GST payable on legal services under reverse charge [₹ 3,50,000 × 18%] [Tax on legal services provided by an advocate to a business entity, is payable under reverse charge by the business entity. Further, such services are not eligible for exemption provided under Notification No. 12/2017 CT (R) dated 28.06.2017 as the turnover of the business entity [Surana & Sons] in the preceding financial year exceeds ₹ 20 lakh.] |

63,000 |

| Common credit attributable to exempt supplies during the period April 20XX – September 20XX [Refer Working Note 2] | 4,74,820 |

| Total GST liability | 8,55,820 |

| Less: Input tax credit (ITC) [Refer Working Note 3] | 7,53,000 |

| Less: Tax paid in cash (₹ 63,000 + ₹ 39,820) | 1,02,820 |

| [Tax payable under reverse charge is not an output tax in terms of section 2(82) of the CGST Act, 2017. Therefore, tax payable under reverse charge cannot be set off against the input tax credit and thus, will have to be paid in cash.] |

Working Note 1

Computation of GST payable on outward supply

| Particulars | Value (₹) | GST (₹) |

| Turnover of ‘M’ [liable to GST @ 1296] | 14,00,000 | 1,68,000 |

| Turnover of ‘N’ [Tax on ‘N’ is payable under reverse charge by the recipient of such goods] | 6,00,000 | Nil |

| Turnover of ‘O’ [liable to GST @ 12%] | 10,00,000 | 1,20,000 |

| Export of ‘M’ with payment of IGST @ 12% | 2,50,000 | 30,000 |

| Export of ‘O’ under letter of undertaking (LUT) (Zero Rated Supply) | 10,00,000 | Nil |

| Consultancy services provided to independent clients located in foreign countries under LUT. | 20,00,000 | Nil |

| [The activity is an export of service in terms of section 2(6) of the IGST Act, 2017] | ||

| [Export of services is a zero rated supply] | ||

| Sale of building | 1,20,00,000 | Nil |

| [Sale of building is neither a supply of goods nor a supply of services in terms of para 5 of Schedule III to the CGST Act, 2017 and hence, is not liable to any tax] | ||

| Interest received on investment in fixed deposits with a bank [Exempt vide Notification No. 12/2017] | 4,00,000 | Nil |

| Sale of shares | 2,50,00,000 | Nil |

| [Shares are neither goods nor services in terms of section 2(55) and 2(102) of the CGST Act, 2017. Hence, it is not liable to any tax.] | ||

| Total GST payable on outward supply | 3,18,000 |

Working Note 2

Computation of common credit attributable to exempt supplies during the period April 20XX – September 20XX

| Particulars | (₹) |

| Common credit on inputs and input services -[Refer Working Note 3 below] | 6,90,000 |

| Common credit attributable to exempt supplies (rounded off) = Common credit on inputs and input services × (Exempt turnover during the period/Total turnover during the period] = ₹ 6,90,000 × ₹ 1,33,50,000/₹ 1,94,00,000 |

4,74,820 |

| Exempt turnover = ₹ 1,33,50,000 and total turnover = ₹ 1,94,00,000 [Refer note below] |

Note:

As per section 17(3) of the CGST Act, 2017, value of exempt supply includes supplies on which the recipient is liable to pay tax on reverse charge basis, transactions in securities, sale of land and, subject to clause (b) of paragraph 5 of Schedule II, sale of building. The value of exempt supply in respect of land and building is the value adopted for paying stamp duty and for security is 1% of the sale value of such security.

As per explanation to rule 42 of the CGST Rules, 2017:- The aggregate value of exempt supplies inter alla excludes the value of services by way of accepting deposits, extending loans or advances in so far as the consideration is represented by way of interest or discount, except in case of a banking company or a financial institution including a non-banking financial company, engaged in supplying services by way of accepting deposits, extending loans or advances.

Therefore, value of exempt supply will be the sum of value of output supply on which tax is payable under reverse charge (₹ 6,00,000), value of sale of building (₹ 2,50,000/2 × 100 = ₹ 1,25,00,000) and value of sale of shares (1% of 2,50,00,000 = 2,50,000), which comes out to be ₹ 1,33,50,000.

Total turnover = ₹ 1,94,00,000 (₹ 14,00,000 + ₹ 6,00,000 + ₹ 10,00,000 + ₹ 2,50,000 + ₹ 10,00,000 + ₹ 20,00,000 + ₹ 1,25,00,000 + ₹ 4,00,000 + ₹ 2,50,000)

Working Note 3

Computation of ITC available in the Electronic Credit Ledger of the Surana & Sons for the period April 20XX- September 20XX

| Particulars | (₹) |

| Common credit on inputs and input services | 6,90,000 |

| [Tax on inputs – ₹ 4,20,000 (₹ 35,00,000 × 12%) + Tax on input services – ₹ 2,70,000 (₹ 15,00,000 × 18%)] | |

| Legal services used in the manufacture of taxable product ‘M’ | 63,000 |

| ITC available in the Electronic Credit Ledger | 7,53,000 |

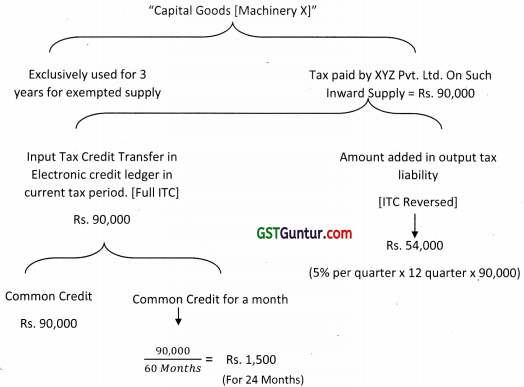

Question 16.

With the help of information given below in respect of a manufacturer for the month of September, 2020, calculate eligible input tax credit for the month and also calculate the amount of ITC to be reversed In September, 2020 and October, 2020. There is no carry forward credit or reversal requirement. Only the current month’s information is to be considered for calculation purposes.

| Particulars | Amount in ₹ |

| 1. Outward supply of taxable goods | 70,000 |

| 2. Outward supply of exempted goods | 40,000 |

| Total Turnover | 1,10,000 |

| 3. Inward supplies | GST paid (₹) |

| Capital goods purchased which are exclusively used for taxable outward supply | 2,000 |

| Capital goods purchased which are exclusively used for exempted outward supply | 1,800 |

| Capital goods purchased which are used for both taxable and exempted outward supply | 4,200 |

[Nov 2018, Old, 7 Marks]

Solution:

(a) Computation of eligible ITC and the ITC to be reversed

| Particulars | ₹ | ITC (₹) |

| Capital goods exclusively used for taxable outward supply [Full ITC is available under rule 43(1)(b) of the CGST Rules, 2017] – [A] | 2,000 | |

| Capital goods exclusively used for exempted outward supply | Nil | |

| [Since exclusively used for non-business purposes, ITC is not available under rule 43(1)(a) of the CGST Rules, 2017] | ‘ | |

| Capital goods used for both taxable and exempted outward supply -Common credit [B] | 4,200 | |

| [Commonly used for taxable and exempt supplies – Rule 43(1)(c) of the CGST Rules, 2017] | ||

| Common credit for the tax period (month here) = 4,200 4- 60 [Rule 43(1)(e) of the CGST Rules, 2017] | 70 | |

| Common credit attributable to exempt supplies in a month [C] (rounded off) = (40,000/1,10,000) × ₹ 70 [Rule 43(1)(g) of the CGST Rules, 2017 | 25.45 | |

| Eligible credit out of common credit for September, 2017 [B] -[C] (rounded off) | 4,174.55 | |

| Total eligible credit for September, 2020 | 6,174.55 | |

| Amount of ITC to be reversed in September, 2020 [B] | 25.45 | |

| Amount of ITC to be reversed in October, 2020 [B] | 25.45 |

Examiner’s Comment

Many examinees computed the total common credit correctly, but wrongly calculated the common credit for the tax period (month).

![]()

Question 17.

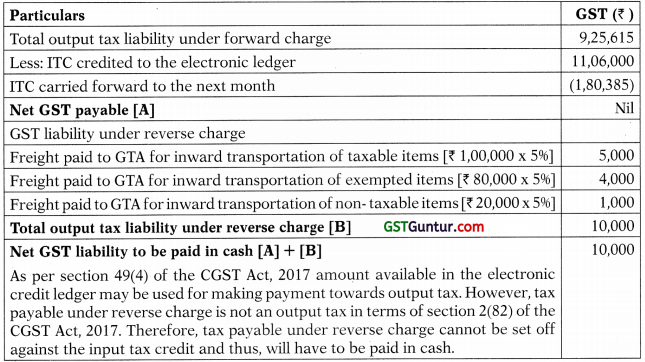

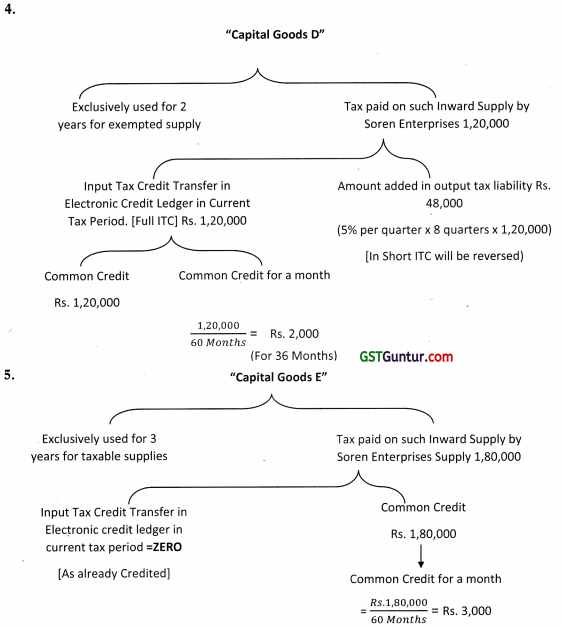

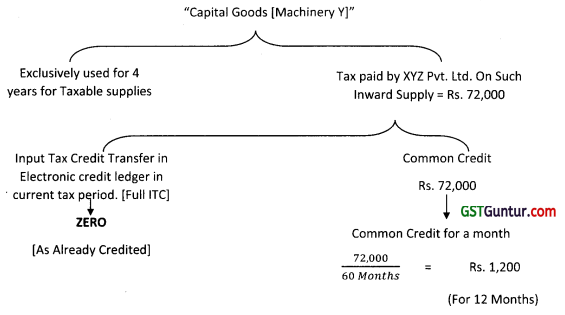

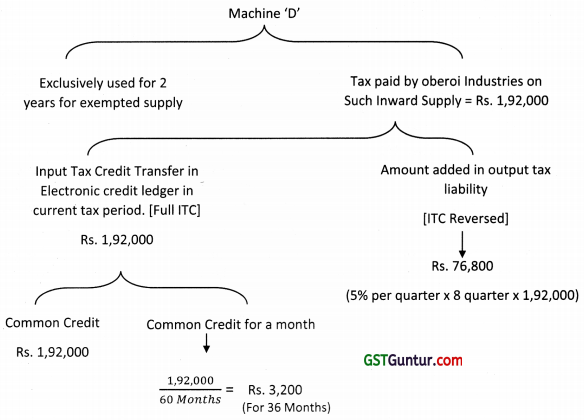

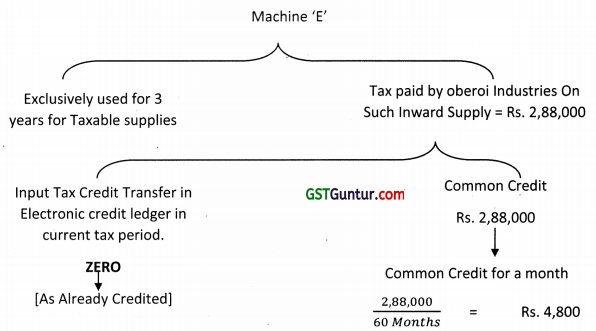

Soren Enterprises is in possession of certain capital goods and purchases more of them as per the following particulars:

| Particulars | Input tax on capita goods(₹) | Status of its use |

| Capital Goods A | 12,000 | Exclusively used for non- business purpose. |

| Capital Goods B | 24,000 | Exclusively used for zero- rated supplies. |

| Capital Goods C | 60,000 | Used both for taxable and exempt supplies. |

| Capital goods D (has been exclusively used for 2 years for exempted supplies) | 1,20,000 | Now there is change in use, both for taxable and exempt supplies. |

| Capital goods E (has been exclusively used for 3 years for taxable supplies) | 1,80,000 | Now there is change in use, both for taxable and exempt supplies. |

Useful life of all the above capital goods is considered as 5 years.

Apportion the input tax credit of capital goods, while being informed that aggregate value of exempt supplies during the tax period being ₹ 6,00,000 and total turnover during the tax period being ₹ 12,00,000. [May 2018, Old, 7 Marks]

Solution.

Apportionment of common credit pertaining to capital goods

| Particulars | ITC (₹) |

| Capital goods ‘A’ [WN 1] | Nil |

| Capital goods ‘B’ [WN 2] | – |

| Capital goods ‘C’ [WN 3] | 60,000 |

| Capital goods ‘D’ [WN 4] | 1,20,000 |

| Capital goods ‘E’ [WN 5] | 1,80,000 |

| Total common credit | 3,60,000 |

| Common credit for the tax period under rule 43(1)(e) of CGST Rules, 2017 = 3,60,000 ÷ 60m | 6,000 |

| Common credit attributable to exempt supplies in a tax period in terms of rule 43(1 )(g) of CGST Rules, 2017 | 3,000 |

| = (Turnover of exempt supplies/Total turnover) × Common credit |

Working Notes:-

1. Capital goods ‘A’ exclusively used for non-business purposes, ITC is not available under rule 43(1)(a) of CGST Rules, 2017

2. As per the rule 43(1)(b) of CGST Rules, 2017 For ITC purposes, taxable supplies include zero-rated supplies. Hence, full ITC of ₹ 24,000 is available

3. Capital goods ‘C’ Commonly used for taxable and exempt supplies

Examiner’s Comment

The question requires the examinees to apportion the input tax credit pertaining to capital goods. Most of the examinees were ignorant of the methodology of apportionment of credit of capital goods where nature of use of capital goods change from exclusive use for non-business purpose/exempt supplies to common use.

Consequently, apportionment of common credit in respect of capital goods D and E was wrongly calculated by most of the examinees.

Question 18.