ICAI CA Final Indirect Tax Laws Study Material for May 2023: Students who are preparing for their CA Final Examinations 2023 should keep their hands on the valid study resources such as CA Final IDT Study Material Question Bank, CA Final Indirect Tax IDT Notes for May Nov 2023, CA Final IDT Practice Manual, CA Final IDT Books Chapter Wise Important Questions and Answers.

These exam sources will definitely make your score the top grades in the CA Final 2023 Exam. For a better understanding of the marks for individual chapters, we have also provided the last year’s CA Final IDT Chapterwise Weightage. Do check that along with the latest revised syllabus of chartered accountancy final indirect tax law.

- CA Final IDT Study Material

- CA Final IDT Marks Weightage

- ICAI CA Final IDT Practice Manual Books

- CA Final Indirect Tax Syllabus

- How Can I Get CA Final Study Material For Indirect Tax Laws?

- FAQs On IDT CA Final Handwritten Notes PDF

CA Final IDT Study Material – CA Final Indirect Tax Study Material Notes

CA Final Study Materials for Indirect Tax Laws Paper will cover the complete knowledge about the concepts involved in the new syllabus. Each and every concept of IDT is explained in a comprehensive manner with important questions and answers, exercises, Multiple type questions with answers, etc. So, we suggest you all study and complete your exam preparation with ICAI CA Final Indirect Tax Laws Study Notes PDF from the below links.

Part I: Goods and Services Tax

- GST in India – An Introduction

- Supply under GST

- Charge of GST

- Exemptions from GST

- Place of Supply

- Time of Supply

- Value of Supply

- Input Tax Credit

- Registration

- Tax Invoice, Credit and Debit Notes

- Accounts and Records; E-way Bill

- Payment of Tax

- Returns

- Refunds

- Job Work

- Electronic Commerce

- Assessment and Audit

- Inspection, Search, Seizure and Arrest

- Demands and Recovery

- Liability to Pay Tax in Certain Cases

- Offences and Penalties

- Appeals and Revision

- Advance Ruling

- Miscellaneous Provisions

Part II: Customs & FTP

- Levy of and Exemptions from Customs Duty

- Types of Duty

- Classification of Imported and Export Goods

- Valuation under the Customs Act, 1962

- Importation, Exportation and Transportation of Goods

- Duty Drawback

- Refund

- Foreign Trade Policy

- CA Final IDT Question Paper Nov 2020

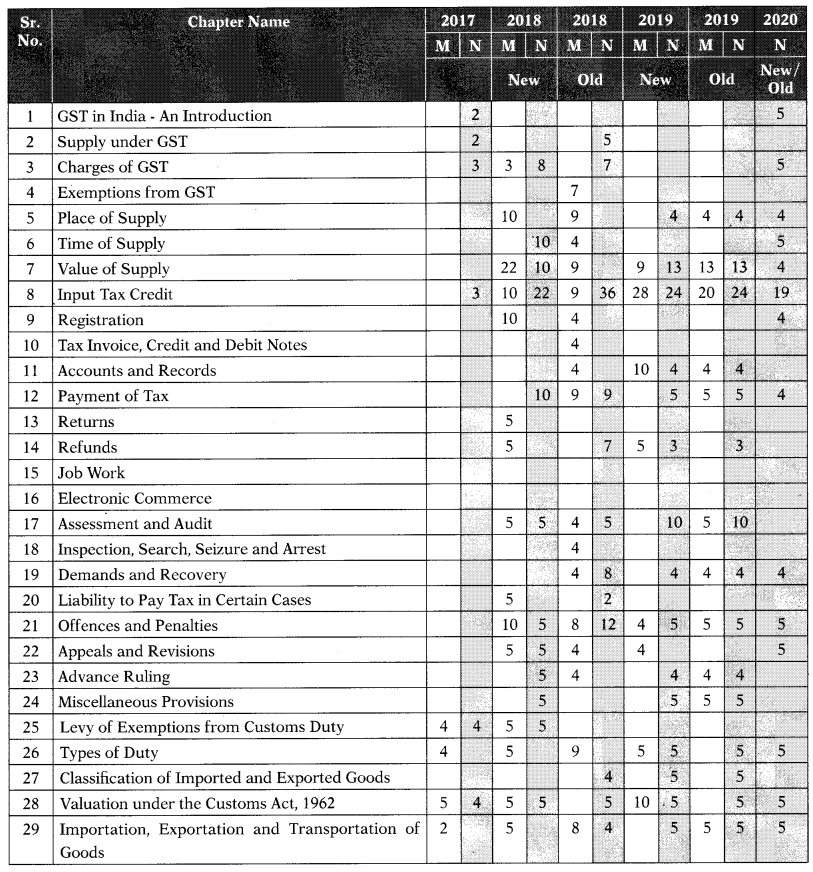

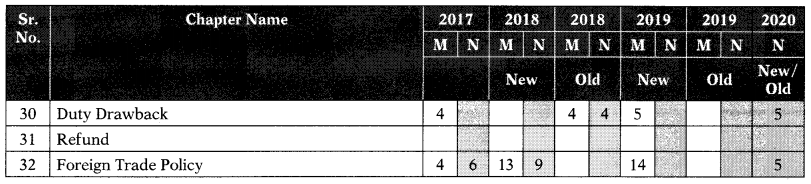

CA Final IDT Marks Weightage

All chapters’ weightage marks for CA Final IDT Paper shown here in the below image. With the help of CA Final IDT Marks Weightage information, you can choose the important topics for preparation and score better grades in the upcoming exams. Do check the provided marks distribution of CA Final Indirect Tax below without fail.

CA Final Indirect Tax Marks Distribution

ICAI CA Final IDT Practice Manual Books

Practicing each and every topic of IDT makes you feel confident to attend the exams of CA Final 2023. So, we have linked the chapterwise indirect tax laws CA final practice manual books below for free of charge. GSTGuntur.com suggests every applicant of Chartered Accountant practice with these CA Final IDT Practice Manual Summary Charts and bridge the knowledge gap.

CA Final Indirect Tax Practice Manual Books

Part I: Direct Tax Laws

Module 1

- Initial Pages

- Chapter 1: Basic Concepts

- Chapter 2: Residence and Scope of Total Income

- Chapter 3: Incomes which do not form part of Total Income

- Chapter 4: Salaries

- Chapter 5: Income from House Property

- Chapter 6: Profits and Gains of Business or Profession

- Chapter 7: Capital Gains

- Chapter 8: Income from Other Sources

- Annexure

Module 2

- Initial Pages

- Chapter 9: Income of Other Persons included in assessee’s Total Income

- Chapter 10: Aggregation of Income, Set-Off and Carry Forward of Losses

- Chapter 11: Deductions from Gross Total Income

- Chapter 12: Assessment of Various Entities

- Chapter 13: Charitable or Religious Trusts and Institutions, Political Parties and Electoral Trusts

- Chapter 14: Tax Planning, Tax Avoidance & Tax Evasion

Module 3

- Initial Pages

- Chapter 15: Deduction, Collection and Recovery of Tax

- Chapter 16: Income-tax Authorities

- Chapter 17: Assessment Procedure

- Chapter 18: Appeals and Revision

- Chapter 19: Dispute Resolution

- Chapter 20: Penalties

- Chapter 21: Offences and Prosecution

- Chapter 22: Liability in Special Cases

- Chapter 23: Miscellaneous Provisions

Part II: International Taxation

Module 4

- Initial Pages

- Chapter 1: Transfer Pricing and Other Provisions to check Avoidance of Tax

- Chapter 2: Non Resident Taxation

- Chapter 3: Double Taxation Relief

- Chapter 4: Advance Rulings

- Chapter 5: Equalisation Levy

- Chapter 6: Application and Interpretation of Tax Treaties

- Chapter 7: Fundamentals of Base Erosion and Profit Shifting

- Chapter 8: Overview of Model Tax Conventions

- Annexure

- Hindi Medium

- Study Material

- Study Guidelines for May 2023 examination

- Statutory Update for November, 2022 examination

- Statutory Update for May, 2022 examination

- MCQs and Case Scenarios Booklet

- MCQs and Case Scenarios Booklet – Hindi Medium

- Revisions in BoS Publications

- Revision Test Papers

- Suggested Answers

- Mock Test Papers

- Question Papers

- Referencer for Quick Revision

CA Final IDT Syllabus – CA Final Indirect Tax Syllabus

Latest Chartered Accountant Final Indirect Tax Laws Paper 8 Syllabus is mentioned here explicitly in two parts. Part 1 is Goods and Services Tax and Part 2 is Customs & FTP so check the concepts and its sub-topics from the following CA Final IDT New Syllabus 2023.

Paper 8: Indirect Tax Laws

(One Paper – Three hours – 100 Marks)

Part I: Goods and Services Tax (75 Marks)

Objectives:

To acquire the ability to analyze and interpret the provisions of the goods and services tax law and recommend solutions to practical problems.

Contents:

Goods and Services Tax (GST) Law as contained in the Central Goods and Services Tax (CGST) Act, 2017 and Integrated Goods and Services Tax (IGST) Act, 2017 including:

(i) Introduction to GST in India including Constitutional aspects (ii) Levy and collection of CGST and IGST – Application of CGST/IGST law; Concept of supply including composite and mixed supplies, inter-State supply, intra-State supply, supplies in territorial waters; Charge of tax including reverse charge; Exemption from tax; Composition levy (iii) Place of supply (iv) Time and Value of Supply (v) Input tax credit (vi) Computation of GST liability (vii) Procedures under GST including registration, tax invoice, credit and debit notes, electronic way bill, accounts and records, returns, payment of tax including tax deduction at source and tax collection at source, refund, job work (viii) Liability to pay in certain cases (ix) Administration of GST; Assessment and Audit (x) Inspection, Search, Seizure, and Arrest (xi) Demand and Recovery (xii) Offences and Penalties (xiii) Advance Ruling (xiv) Appeals and Revision (xv) Other Provisions.

The entire CGST and IGST laws are included in the syllabus at the Final level. Any residuary provision under the CGST Act, 2017 and IGST Act, 2017, not covered under any of the above specific provisions, would be covered under “Other provisions”. Further, if any new Chapter is included in the CGST Act, 2017 and IGST Act, 2017, the syllabus will accordingly include the provisions relating thereto.

Part II: Customs & FTP (25 Marks)

Objectives:

(a) To develop an understanding of the customs laws and acquire the ability to analyze and interpret the provisions of such laws.

(b) To develop an understanding of the basic concepts of foreign trade policy to the extent relevant to indirect tax laws, and acquire the ability to analyse such concepts.

Contents:

1. Customs Law as contained in the Customs Act, 1962, and the Customs Tariff Act, 1975

(i) Introduction to customs law including Constitutional aspects (ii) Levy of and exemptions from customs duties – All provisions including the application of customs law, taxable event, a charge of customs duty, exceptions to levy of customs duty, exemption from custom duty (iii) Types of customs duties (iv) Classification and valuation of imported and exported goods (v) Officers of Customs; Appointment of customs ports, airports, etc.* (vi) Import and Export Procedures including special procedures relating to baggage, goods imported or exported by post, stores (vii) Provisions relating to coastal goods and vessels carrying coastal goods* (viii) Warehousing* (ix) Drawback (x) Demand and Recovery*; Refund (xi) Provisions relating to prohibited goods, notified goods, specified goods, illegal importation/exportation of goods* (xii) Searches, seizure and arrest; Offences; Penalties; Confiscation and Prosecution* (xiii) Appeals and Revision; Advance Rulings; Settlement Commission* (xiv) Other provisions.

The entire customs law is included in the syllabus at the Final level. Any residuary provision under the Customs Act, 1962 or Customs Tariff Act, 1975, not covered under any of the above specific provisions, would be covered under “Other Provisions”. Further, if any new Chapter is included in the Customs Act, 1962 or Customs Tariff Act, 1975, the syllabus will accordingly include the provisions relating thereto.

2. Foreign Trade Policy to the extent relevant to the indirect tax laws

(i) Introduction to FTP – legislation governing FTP, salient features of an FTP, administration of FTP, contents of FTP, and other related provisions (ii) Basic concepts relating to import and export (iii) Basic concepts relating to export promotion schemes provided under FTP.

Note: If any new legislation(s) is enacted in place of existing legislation(s), the syllabus will accordingly include the corresponding provisions of such new legislation(s) in place of the existing legislation(s) with effect from the date to be notified by the Institute. Similarly, if any existing legislation ceases to have an effect, the syllabus will accordingly exclude such legislation with effect from the date to be notified by the Institute. Students shall not be examined with reference to any particular State GST Law.

Further, the specific inclusions/exclusions in any topic covered in the syllabus will be effected every year by way of Study Guidelines, if required.

* The main topics marked with an asterisk have been excluded from the syllabus by way of Study Guidelines.

In addition to the main topics, various sub-topics within the scope of the main topics given above also have been excluded from the syllabus by way of Study Guidelines. Therefore, Study Guidelines need to be referred to for the complete list of exclusions from the syllabus.

CA Final Study Material

How Can I Get CA Final Study Material For Indirect Tax Laws?

You can get and download CA Final Study Material for IDT from the official site of the Institute of Chartered Accountants of India (ICAI) or from the links provided on our page. Check the below steps for downloading ICAI CA Final IDT Study Materials:

- Open the ICAI official site by this link ie., www.icai.org

- For CA Final Study Material for Indirect Tax Laws May 2023, tap on the available link ie., www.icai.org/post.html?post_id=14121

- Now, you will be redirected to the direct Paper-8: Indirect Tax Laws page.

- Check the list and press the study material option.

- On the next page, you can find all chapter’s study materials along with a supplementary study paper for May 2023 exams.

- Download CA Final IDT Chapter Wise Study Materials PDF from the ICAI site freely and start preparing efficiently for the upcoming exams.

FAQs On IDT CA Final Handwritten Notes PDF New Syallbus

1. What is the full form of IDT in tax?

The full form of IDT in tax is Indirect Tax.

2. How to study CA final indirect tax?

To study CA final indirect tax concepts thoroughly, one should definitely download the study materials and MCQs and other practice books from the official portal of ICAI and start learning the chapters one by one following with the preparation of study notes on our own for revision at the last moment.

3. Who is the best teacher for CA final indirect tax?

CA Manoj Batra is the best teacher for CA Final Indirect Tax Paper as he wrote and published the CA Final Indirect Tax Regular Course By CA Manoj Batra For May 2021 and Nov. 2021 for the students to study well for their upcoming CA Final Exams 2023.

Key Takeaways

Remember each and every point mentioned here about CA Final IDT Study Material for a long time as it saves you in any of the tough situations. So follow the preparation tips and study every concept of Indirect tax laws before the exams and be prepared for the tests. To read and practice other CA Final Papers like CA Final DT Study Material or CA Final Law Study Material, etc. click on the available links or else stay in touch with us regularly.