Budgetary Control – CA Final SCMPE Question Bank is designed strictly as per the latest syllabus and exam pattern.

Budgetary Control – CA Final SCMPE Question Bank

Question 1.

What are the various formulae used in calculating budget ratios? (May 2009, 4 marks)

Answer:

- Efficiency Ratio = (Standard hours ÷ Actual hours) × 100

- Activity Ratio = (Standard hours ÷ Budgeted hours) × 100

- Calendar Ratio = (Available working days ÷ budgeted working days) × 100

- Standard Capacity Usage Ratio = (Budgeted hours ÷ Max. possible hours in the budgeted period) × 100

- Actual Capacity Usage Ratio = (Actual hours worked ÷ Maximum possible working hours in a period) × 100

- Actual usage of Budgeted Capacity Ratio = (Actual working hours ÷ Budgeted hours) × 100.

![]()

Question 2.

What are the steps involved in Zero-base budgeting ? (Nov 2010, 5 marks)

Answer:

The process of Zero-Base Budgeting involves the following steps :

- Determination of a set of objectives is one of pre-requisites and essential step, in the direction of ZBB technique.

- Deciding about the extent to which the technique of ZBB is to be applied, whether in all areas of organisation’s activities or only in a few selected areas on trial basis.

- Identify those areas where decisions are required to be taken.

- Developing decision packages and ranking them in order of preference.

- Preparation of budget, that is translating decision packages into practicable units/items and allocating financial resources.

In real terms the Zero Base Budgeting is simply an extension of the cost, benefit, analysis method to the area of corporate planning and budgeting. It, however, provides a number of advantages to the organisational efficiency and effectiveness.

![]()

Question 3.

Define the following : (May 2012, 4 marks)

(i) maximum capacity (theoretical capacity)

(ii) practical capacity

(iii) normal capacity

(iv) principal budget factor

(The first three relate to a manufacturing plant)

Answer:

(i) Maximum Capacity = Maximum no. of days in a period × no. of workers or maximum no. of hours × no. of workers

or

The maximum no. of units that can be produced by a manufacturing facility in a certain period.

(ii) Practical Capacity = Maximum capacity (minus) Sundays, holidays, normal maintenance and idle time

(iii) Normal Capacity = Average of past 3 years, normal performance excluding abnormal data.

(iv) Principal Budget Factor = The factor that limits the activities of the functional budgets of the organization.

![]()

Question 4.

Discuss the characteristics of Zero Base Budgeting. (Nov 2012, 4 marks)

Answer:

Zero Base Budgeting:

Zero Base Budgeting (ZBB) is defined as method of budgeting which requires each cost element to be specifically justified, as though the activities to which the budget relates were being undertaken for the first time. ZBB is prepared and justified from scratch (zero). Without approval, the budget allowance is zero.

Characteristics of ZBB:

- Manager of a decision unit has to completely justify why there should be any budget allotment for his decision unit.

- Activities are identified in decision packages.

- Decision packages are ranked in order of priority.

- Packages are evaluated by systematic analysis.

- Decision packages are linked with corporate objectives, which are clearly laid down.

- Available resources are directed towards alternatives in order to prioritize to ensure optimal results.

![]()

Question 5.

Answer the following: (Nov 2013, 4 marks)

In each of the following independent situations, state with a brief reason whether ‘Zero Base Budgeting’ (ZBB) or ‘Traditional Budgeting’ (T8) would be more appropriate for year II.

(i) A company producing a certain product has done extensive ZBB exercise in year I. The activity level is expected to marginally increase in year II.

(ii) The sales manager of a company selling three products has the intuitive feeling that in year II, sales will increase for one product and decrease for the other two. His expectation cannot be substantiated with figures.

(iii) The top management would like to delegate responsibility to the functional managers for their results during year II.

(iv) Resources are heavily constrained and allocation for budget requirements is very strict.

Answer:

(i) The company has done extensive exercise in year-l that can be used as a basis for budgeting in year-ll by incorporating increase in costs / revenue at expected activity level. Hence, Traditional Budgeting would be more appropriate for the company in year-ll.

(ii) In Traditional Budgeting system budgets are prepared on the basis of previous year’s budget figures with expected change in activity level and corresponding adjustment in the cost and prices. But under Zero Base Budgeting (ZBB) the estimations or projections are converted into figures. Since, sales manager is unable to substantiate his expectations into figures so Traditional Budgeting would be preferred against Zero Base Budgeting.

(iii) Zero Base Budgeting would be appropriate as ZBB allows top-level strategic goals to be implemented into the budgeting process by tying them to specific functional areas of the organization, where costs can be first grouped, then measured against previous results and current expectations.

(iv) Zero Base Budgeting allocates resources based on order of priority up . to the spending cut-off level (maximum level upto which spending can be made). In an organisation where resources are constrained and budget is allocated on requirement basis, Zero Base Budgeting is more appropriate method of budgeting.

![]()

Question 6.

Answer the following:

What are the steps involved in Zero Based Budgeting? (Nov 2015, 4 marks)

Question 7.

Answer the following question: (May 2017, 4 marks)

(i) Is it necessary to start preparing a functional budget only after identifying the principal budget factor? Explain.

(ii) Is it practical to make a flexible production cost budget before the commencement of production activities of a certain production period? Why?

Answer:

(i) The principal budget factor is the factor that limits the activities of functional budgets of the organisation. The early identification of this factor is important in the budgetary planning process because it indicates which budget should be prepared first.

In general sales volume is the principal budget factor. So sales budget must be prepared first, based on the available sales forecasts. All other budgets should then be linked to this.

So from above we can say that it is necessary to start preparing a functional budget only after identifying the principal budget factor.

(ii) Production budget cannot be prepared directly from sales budget without a consideration of stakeholding policy. The production budget must be prepared first and all other budgets follow it. The production budget as prepared shows. the estimates about future production activities. Production budget provides the estimation of the production will be made for a certain time period from production activities.

So that yes, it is necessary to make a flexible production cost budget before the commencement of production activities of a certain production period.

![]()

Question 8.

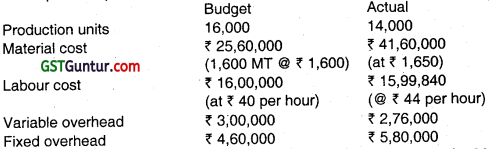

The budgeted and actual cost data of M Ltd. for 6 months from April to September, 2008 are as under: (Nov 2008, 6 marks)

In the first half of financial year 2009-10, production is budgeted for 30,000 units, material cost per tonne will increase from last year’s actual by ₹ 150, but it is proposed to maintain the consumption efficiency of 2008 as budgeted. Labour efficiency will be lower by 1% and labour rate will be ₹ 44 per hour. Variable and fixed overheads will go up by 20% over 2008 actuals. Prepare the Production Cost budget for the period April-September, 2009 giving all the workings.

Answer:

Assumption: Here, difference in actual and standard time is also considered for calculating the lower efficiency i.e. 3.74% + 1% = 4.74%.

Working Notes:

I. Material cost

Material consumption per units = \(\frac{1,600 \mathrm{MT}}{16,000}\) = 0.10 M

Consumption for 30,000 units = 3,000 MT.

Cost of 3,000 MT @ ₹ 1,300 per MT = ₹ 54,00,000.

II. Labour cost can be calculated as follows :

Time required for 30,000 units = 75,000 hours

Add: *(3.74% + 1%) = 4.74% for lower efficiency = 3.555 hours

= 78.555 hours

*3.74% = \(\frac{\text { Differencein actual and standardhours }}{\text { Actualhours }}\) × 100

= \(\frac{1,360 \text { hours }}{36,360 \text { hours }}\)

Labour cost = 78,555 hours × 44 per hour

= 34,56,420

![]()

III. Variable overhead

Actual rate = \(\frac{₹ 2,76,000}{14,000 \text { units }}\) = 19.71 per unit

Add : 20% = 3.94

New rate = 23.65

Total variable overhead = 30,000 × 23.65

= ₹ 7,09,500

IV. Fixed overhead

Actual = ₹ 5,80,000

Add : 20% = ₹ 1,16,000

= ₹ 6,96,000

![]()

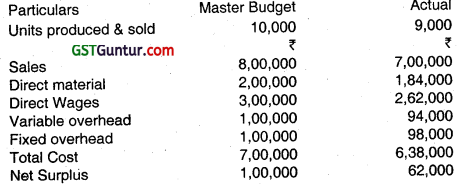

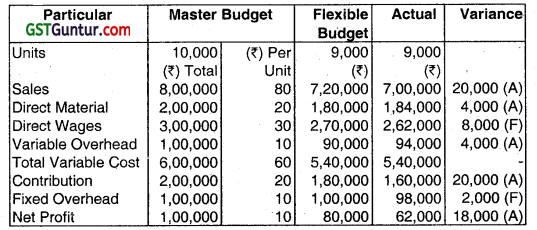

Question 9.

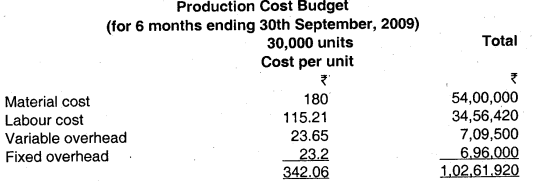

The CEO of your company has been given the following statement showing the results for a recent month: (May 2009)

The standard cost of the product is as follows :

Direct material (t kg @ ₹ 20/kg) – ₹ 20.00 per unit

Direct Wages (1 hour @ ₹ 30/hour) – ₹ 30.00 per unit

Variable overhead (1 hour @ ₹ 10/hour) – ₹ 10.00 per unit

Actual results for the month revealed that 9,800 kg. of material was used and 8,800 labour hours were recorded.

(i) Prepare a flexible budget for the month and compare with the actual results (6 marks)

(ii) Calculate material volume and variable overhead efficiency variances (2 marks)

Answer:

(i)

(ii) Calculation of Variances:

Material Volume Variance: SP (SQ – AQ) = 20 (9,000 – 9800)

= 16,000 (A)

Variable Overhead efficiency variance SR (SH – AH) = 10 (9,000 – 8,800)

= 2,000 (F).

![]()

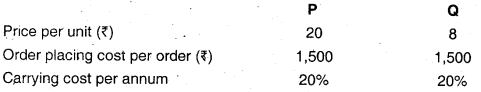

Question 10.

A Company is engaged in manufacturing two products A and B. Product A uses one unit of component X and two units of component Y. Product B uses two units of component X and one unit of component Y and two units of component Z. Component Z which is assembled In the factory uses one unit of component Y. (May 2010, 7 marks)

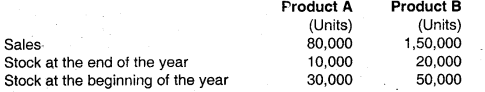

Components X and Y are purchased from the market. The company has prepared the following forecast of sales and inventory for the next year:

The production of both the products and the assembling of the component Z will be spread out uniformly throughout the year. The company at present orders its inventory of X and Y in quantities equivalent to 3 months production. The company has compiled the following data related to the two components:

Required:

(i) Prepare a budget for production and requirements of components for the next year.

(ii) Suggest the optimal order quantity of components X and Y.

Answer:

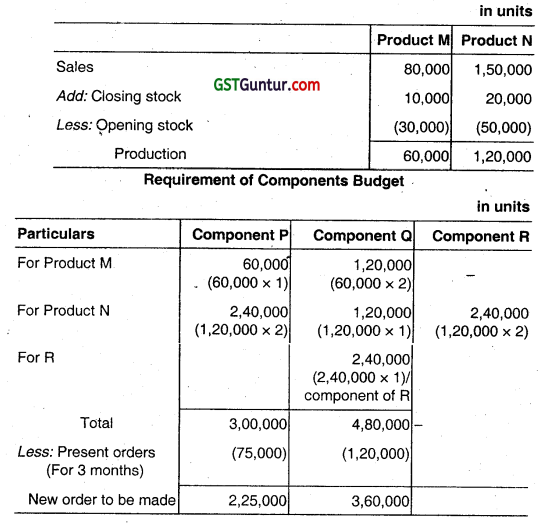

(i) Production Budget

| Product “A” | Product “B” | |

| Sales | 80,000 | 1,50,000 |

| Closing stock | 10,000 | 20,000 |

| Opening stock | 30,000 | 50,000 |

| Production Budget | 60,000 | 1,20,000 |

![]()

Budget of Component Requirements

| Components | X | Y | z |

| Product A : Production 60,000 units | 60,000 | 1,20,000 | |

| Product B : Production 1,20,000 units | 2,40,000 | 1,20,000 | 2,40,000 |

| Component Z : 2,40,000 units | 2,40,000 | ||

| Total | 3,00,000 | 4,80,000 | 2,40,000 |

(ii) Optimal order quantity of components X and Y

| Components | X | Y |

| Order placing costs ₹ | 1,500 | 1,500 |

| Price of the component ₹ | 20 | 8 |

| Carrying cost @ 20% ₹ | 4 | 1.60 |

EOQ = \(\sqrt{\left(\frac{2 \times 4,80,000 \times 1,500}{1.60}\right)}\)

= 30,000 components (for Y)

= \(\sqrt{\left(\frac{2 \times 3,00,000 \times 1,500}{4}\right)}\)

= 15,000 components (for X)

![]()

Question 11.

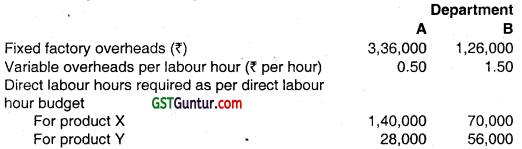

In a company, factory overheads are applied on the basis of direct labour hours. (May 2011, 4 marks)

The following information is given :

Prepare the product wise budget for fixed and variable overhead costs.

Answer:

| Particulars | Products | |

| X | Y | |

| Variable Overheads | 1,75,000 | 98,000 |

| Fixed Overheads | 3,50,000 | 1,12,000 |

| Total | 5,25,000 | 2,10,000 |

Working Note :

![]()

Question 12.

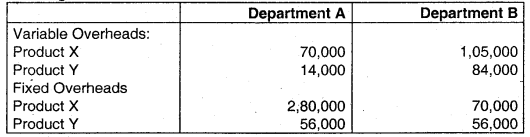

Alfa Mills prepared the following budget for its production department for 2010-11 for 12,000 units of production. (Nov 2011, 10 marks)

You are required to present the flexible budget classified under fixed and variable costs for

(i) Production of 10,000 units.

(ii) Production of 15,000 units, for which raw material price increases by 10% for the entire quantity and labour rate increases by 0.5 per hour for the full direct labour hours.

Answer:

| Flexible Budget | ||||

| Item of Cost | 10000 units | 15000 units | ||

| Working | ₹ | Working | ₹ | |

| Variable Costs | ||||

| Raw Material | 3 × 10000 | 30,000 | 3 × 15000 × 1.1 | 49,500 |

| Labour | 2 × 2.5 × 10000 | 50,000 | 2 × 3 × 15000 | 90,000 |

| Power | 3000/12000 × 10000 | 2,500 | 3000/12000 × 15000 | 3,750 |

| Repair | 1500/12000 × 10000 | 1,250 | 1500/12000 × 15000 | 1,875 |

| Indirect Labour – Variable | 2400 × 80%/12000 × 10000 | 1,600 | 2400 × 80%/12000 × 15000 | 2,400 |

| Other Mfg Cost – Variable | 600 × 50%/12000 × 10000 | 250 | 600 × 50%/12000 × 15000 | 375 |

| Sub-total variable costs | 85,600 | 1,47,900 | ||

| Fixed Costs | ||||

| Indirect Labour – Fixed | 2400 × 20% | 480 | 2400 × 20% | 480 |

| Other Mfg Cost – Fixed | 600 × 50% | 300 | 600 × 50% | 300 |

| Factory Rent | 3,600 | 3,600 | ||

| Factory Insurance | 1,800 | 1,800 | ||

| Sub-total fixed costs | 6,180 | 6,180 | ||

| Total Production Cost | 91,780 | 1,54,080 | ||

![]()

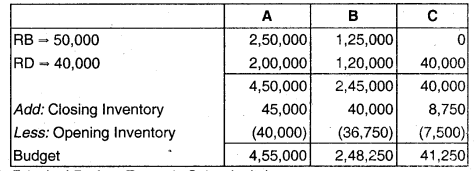

Question 13.

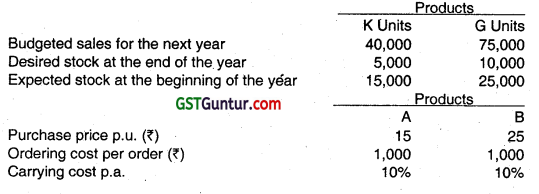

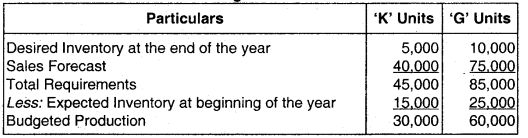

KG Ltd. is engaged in the production of two products K and G’. One unit of product K requires two units of material A and four units of material B. Each unit of product G needs four units of material A, two units of material B and four units of material C. Material C is locally produced in the factory of the company by using two units of material B for each unit of C. Materials A and B are purchased in the open market. Production of products K, G and C is carried out evenly throughout the year. At present the company has purchased its 3 months requirements of A and B in one purchase. That is four purchases per annum. The other particulars provided by the company are: (May 2013)

You are required to:

(i) Prepare a production budget and a material requirement budget for the next year.

(ii) Calculate the number of material purchases to be made, if the company wants to purchase materials in optimal quantity. (8 marks)

Answer:

Production Budget for Product K and G

![]()

Question 14.

The PLN Co. presents the following static budgets for units activity levels for October, 2013: (Nov 2013, 5 marks)

| 4000 units activity level | 6000 units activity level | |

| Overhead A ₹ 12/hr. × 2 hr. / unit | 96000 | 144000 |

| Overhead B – | 140000 | 190000 |

Overhead C was omitted to be listed out. It is a fixed plant overhead, estimated at ₹ 12.5/hr. at 4000 units activity level. This has to also feature in the flexible budget. The actual production was 5000 units and 9600 hours were needed for production.

You are required to present the flexible budget amount of each overhead to enable appropnate comparison with the actual figures.

Answer:

Statement Showing Flexible Budget for 5,000 units Activity Level

| Particulars | Amount (₹) |

| Overhead A (₹ 12.00 per hour × 2 hrs. per unit × 5,000 units) ‘ | 1,20,000 |

| Overhead B* (₹ 40,000 + ₹ 25 × 5,000 units) | 1,65,000 |

| Overhead C (₹ 12.50 per hour × 2 hrs. .per unit × 4,000 units) | 1,00,000 |

| Total | 3,85,000 |

Working Note (*)

Overhead B

Variable Cost (per unit) = \(\frac{\text { Change in Overhead Cost }}{\text { ChangeinProduction Units }}\)

= \(\frac{₹ 1,90,000-₹ 1,40,000}{6,000 \text { units }-4,000 \text { Units }}\)

= \(\frac{₹ 50,000}{2,000 \text { units }}\)

= ₹ 25

Fixed Cost = ₹ 1,40,000 – 4,000 units × ₹ 25

= ₹ 40,000

![]()

Question 15.

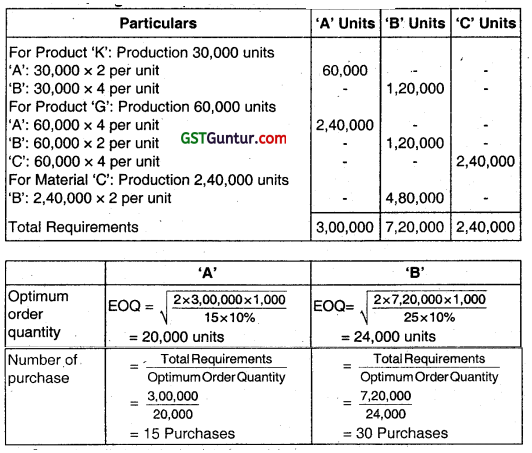

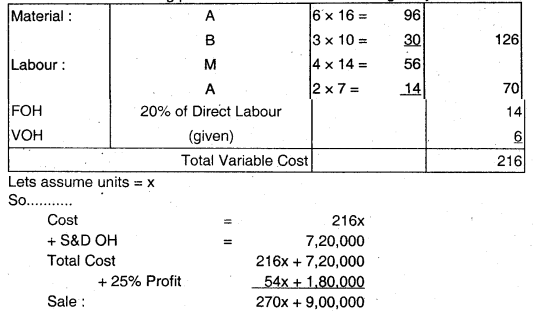

DEF Ltd. manufactures and sells a single product and has estimated sales revenue of ₹ 397.80 lacs during the year based on 20% profit on selling price. Each unit of product requires 6 kg of material A and 3 kg of material B and processing time of 4 hours in machine shop and 2 hours in assembly shop. Factory overheads are absorbed at a blanket rate of 20% of direct labour. Variable selling and distribution overheads are ₹ 6 per unit sold and fixed selling and distribution overheads are estimated to be ₹ 7,20,000. The other relevant details are as under: (May 2014, 7 marks)

You are required to calculate:

(i) Number of units of product proposed to be sold and selling price per unit.

(ii) Production budget in units.

(iii) Material purchase budget in units.

Answer:

1. Calculation of selling price and no. of units sold during the year:

270x + 9,00,000 = 3,97,80,000

∴ x = 388,80,000/270

= 1,44,000 units

![]()

Alternative Answer

(i) Workings:

Statement Showing Total Variable Cost for the year

| Particulars | Amount (₹) |

| Estimated Sales Revenue | 3,97,80,000 |

| Less: Desired Profit Margin on Sale @ 20% | 79,56,000 |

| Estimated Total Cost | 3,18,24,000 |

| Less: Fixed Selling and Distribution Overheads | 7,20,000 |

| Total Variable Cost | 3,11,04,000 |

Statement Showing Variable Cost per unit

| Particulars | Variable Cost p.u. (₹) |

| Direct Materials: | |

| A: 6 Kg. @ ₹ 16 per Kg. | 96 |

| B: 3 Kg. @ ₹ 10 per Kg. | 30 |

| Labour Cost: | |

| Machine Shop: 4 hrs. @ ₹ 14 per hour | 56 |

| Assembly Shop: 2 hrs. @ ₹ 7 per hour | 14 |

| Factory Overheads: 20% of (₹ 56 + ₹ 14) | 14 |

| Variable Selling & Distribution Expenses | 6 |

| Total Variable Cost per unit | 216 |

![]()

Number of Units Sold = Total Variable Cost / Variable Cost per unit

= ₹ 3,11,04,000/216

= 1,44,000 units

Selling Price per unit = Total Sales Value / Number of Units Sold

= ₹ 3,97,80,000 / 1,44,000 units

= ₹ 276.25

(ii) Production Budget

| Particulars | Units |

| Budgeted Sales | 1,44,000 |

| Add: Closing Stock | 30,000 |

| Total Requirements | 1,74,000 |

| Less: Opening Stock | 25,000 |

| Required Production | 1,49,000 |

(iii) Materials Purchase Budget (kg.)

| Particulars | Material A | Material B |

| Requirement for Production | 8,94,000 (1,49,000 units × 6 K.g.) | 4,47,000 (1,49,000 units × 3 K.g.) |

| Add: Desired Closing Stock | 80,000 | 55,000 |

| Total Requirements | 9,74,000 | 5,02,000 |

| Less: Opening Stock | 75,000 | 40,000 |

| Quantity to be purchased | 8,99,000 | 4,62,000 |

![]()

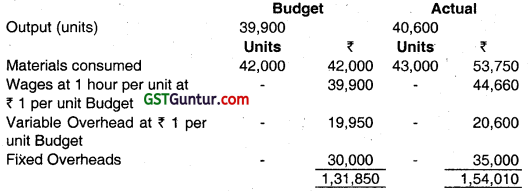

Question 16.

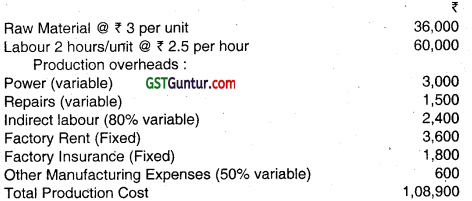

The following are the details regarding budgeted arid actual production costs for the year 2013 of an industrial concern. You are required to prepare a Production Cost Budget for the year 2014. (Nov 2014, 6 marks)

During the budget period:

(1) Production is expected to reach 50,000 units.

(2) Material price are expected to increase further by the same percentage as they had increased over the budget period.

(3) Labour rates are expected to increase by ₹ 0.20 per hour above the actual rates shown above; efficiency is expected to decline by 10%; upto 31st December, 2013, there has been no decline in efficiency.

(4) Variable overhead of previous year to be maintained.

(5) Fixed overheads are expected to rise by 10% per annum.

(6) Wastage of materials to be maintained at 2013 budget level.

Answer:

Production Cost Budget for 50,000 units for the year 2014

| Particulars | Cost Per Unit | Total Amount (₹) |

| Materials (W.N.-1) | 1.645 | 82,237.50 |

| Wages (W.N.-2) | 1.43 | 71,500.00 |

| Variable Overhead | 0.50 | 25,000.00 |

| Fixed Overhead (₹ 35,000 × 110%) | 0.77 | 38,500.00 |

| Total Cost | 4.345 (Approx.) | 2,17,237.50 |

Alternatively:

Fixed Overhead can also be compute on the basis of previous year’s budgeted figure.

Variable Overhead may also compute by taking ₹ 1 per unit.

This problem can also be solve by taking 50,000 hrs. as 90% of total hrs. required to produce the 50,000 units.

![]()

Working Notes

1. Material Cost:

(a) Increase in Material Price in the Year 2013:

= \(\frac{\text { Actual Cost per unitin2013-Budgeted Cost per unitin } 2013}{\text { Budgeted Costper unitin2013 }}\) × 100

= \(=\frac{\left(\frac{₹ 53,750}{43,000 \text { units }}\right)-₹ 1}{₹ 1}\) × 100 = 25%

(b) Material Required to Produce 50,000 units:

= \(\frac{42,000 \text { units }}{39,900 \text { units }}\) × 50,000 units

= 52,632 units (rounded)

(c) Increased Cost for 50,000 units in the Year 2014:

= \(\frac{₹ 53,750}{43,000 \text { units }}\) × 125% × 52,632 units

= ₹ 82,237.50

2. Wages:

(a) Rate per hour in 2014:

= \(\frac{\text { Wages Paidin the year } 2013}{\text { Actual Units Produced }}\) + ₹ 20

= \(\frac{₹ 44,660}{40,600 \text { units }}\) + ₹ 20

= ₹ 1.30

(b) Wages to be paid for 50,000 units i.e. for 50,000 hours (1 hour per unit). When the labour efficiency is 90%, then total Wages will be:

= (50,000hours × \(\frac{110}{100}\)) × ₹ 1.30 = ₹ 71,500

![]()

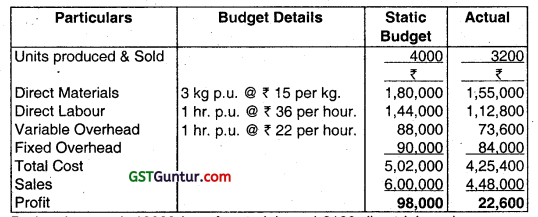

Question 17.

Tricon Co. has prepared the following statement for the month of April, 2015. (May 2015, 8 marks)

During the month 10000 kg. of materials and 3100 direct labour hours were utilized.

(i) Prepare a flexible budget for the month.

(ii) Determine the material usage variance and the direct labour rate variance for the actual Vs the flexible budget.

Answer:

(i) Flexible Budget

For Unit 3,200

(ii) Computation of Variances

Material Usage Variance = Standard Cost of Standard Quantity for Actual Production – Standard Cost of Actual Quantity

= (SQ × SP) – (AQ × SP)

Or

= (SQ – AQ) × SP

= [(3,200 units × 3 kg.) – 10,000 kg.] × ₹ 15,000

= ₹ 6,000(A)

Labour Rate Variance = Standard Cost of Actual Time – Actual Cost

= (SR × AH) – (AR × AH)

Or

= (SR – AR) × AH

= [(₹ 36 – \(\frac{₹ 1,12,800}{3,100 \mathrm{hrs} .}\)) × 3,100 hrs.]

= ₹ 1,200(A)

![]()

Question 18.

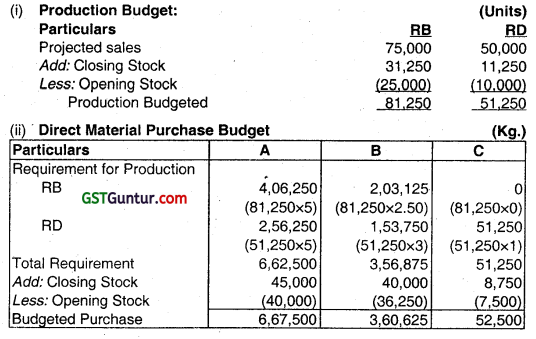

JCL Corporation manufactures and sells two products RB and RD. Three types of materials, A, B and C are required for producing these products. Projected information for 2015-16 is given below: (Nov 2015, 8 marks)

| Product | Projected sales for 2015-16 | Inventory (in units) | Direct Labour Requirement | |

| Units | on 1-4-2015 | on 31-3-2016 | Hours/Unit | |

| RB | 75,000 | 25,000 | 31,250 | 4 |

| RD | 50,000 | 10,000 | 11,250 | 6 |

Raw material stock and usage are as follows:

| Direct | Required | per unit | Inventory on 1-4-2015 | Inventory on 31-3-2016 |

| Material | RB | RD | ||

| A | 5 kg | 5.00 kg | 40000 kg | 45000 kg |

| B | 2.50 kg | 3 kg | 36250 kg | 40000 kg |

| C | 0 | 1kg | 7500 kg | 8750 kg |

You are required to prepare the following for 2015-16:

(i) Production budget (in units)

(ii) Direct material purchase budget in quantities for A, B and C.

(iii) After (i) and (ii), you are told that only 600,000 labour hours will be available for production. If there is no requirement to hold the stated level of finished goods closing inventory, what would be the principal budget factor? Substantiate your view with appropriate figures.

Answer:

(iii) Calculation of Principal Budgeted Factor :

⇒ Production and Labour Hours:

Means Labour Hours are not principal budget factor.

⇒ Raw material:

⇒ Principal Budget Factor is Sales (units)

![]()

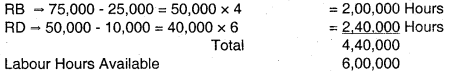

Question 19.

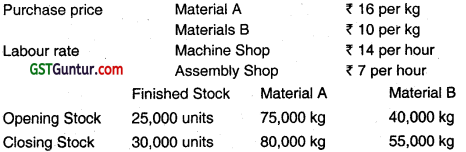

A company is engaged in manufacturing two products M and N. Product M uses one unit of component P and two units of component Q. Product N uses two units of components P, one unit of component Q and two units of component R. Component R which is assembled in the factory uses one unit of component Q. Components P and Q are purchased from the market. The company has prepared the following forecast of sales and inventory for the next year: (May 2016, 8 marks)

The production of both the products and the assembling of the component R will be spread out uniformly throughout the year. The company at present orders its inventory of P and Q in quantities equivalent to 3 months production.

The company has compiled the following data related to two components:

Required:

(i) Prepare a Budget of production and requirements of components for next year.

(ii) Suggeét the optimal order quantity of components P and Q.

Answer:

(i) Budget of Production and Requirement of Components:

Production Budget:

(ii) Optimal Order Quantity

EOQ = \(\sqrt{\frac{2 A O}{O}}\)

Component P = \(\sqrt{\frac{2 \times 3,00,000 \times 1,500}{[20 \% \times 20]}}\)

= 15,000 components

Component Q = \(\sqrt{\frac{2 \times 4,80,000 \times 1,500}{[80 \times 20 \%]}}\)

= 30,000 components

![]()

Question 20.

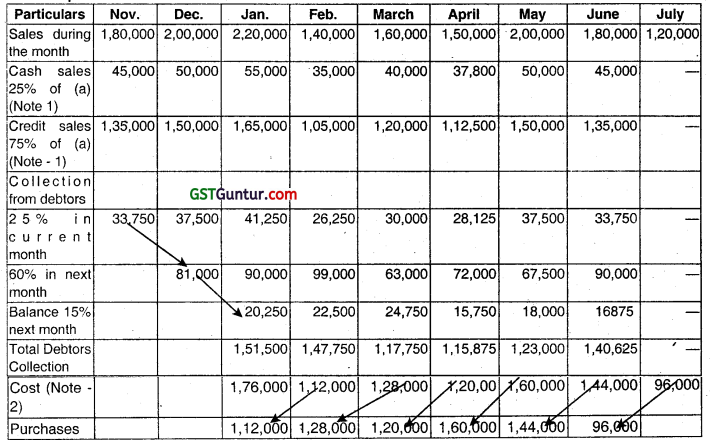

From the information given below, prepare a cash budget of the company for the first half of 2016, assuming that cost would remain unchanged. (Nov 2016, 8 marks)

(i) Sales are both on credit and for cash, the latter being one-third of the former.

(ii) Realisation from debtors are 25% in the month of sale, 60% in the following month and the balance in the month after that.

(iii) Company’s policy of selling price is 25% over cost.

(iv) Budgeted sales of each month are purchased and paid for in the preceding month.

(v) Rent payable is ₹ 2,000 per month.

(vi) Sales forecast for the different months are :

2015 – October ₹ 1,60,000; November ₹ 1,80,000; December ₹ 2,00,000.

2016 – January ₹ 2,20,000; February ₹ 1,40,000; March ₹ 1,60,000;

April ₹ 1,50,000; May ₹ 2,00,000; June ₹ 1,80,000 and July ₹ 1,20,000

(vii) The company has outstanding debentures of ₹ 2 Lakhs on 1st January carrying interest at 15% per annum payable on the last date of each quarter on calendar year basis. 20% debentures are due for redemption on 30 June, 2016.

(viii) The company has to pay advance tax of ₹ 54,000 in March.

(ix) Anticipated office costs for the six months are :

January ₹ 25,000, February ₹ 20,000, March ₹ 40,000, April ₹ 35,000, May ₹ 30,000, and June 45,000.

(x) Opening cash balance is t 10,000 on January 1, 2016.

Answer:

1. Computation of Sales and Purchases:

Note 1: Since cash sales = 1/3rd of credit sales, Ratio of Cash: credit sale is 1: 3 i.e. 25%: 75%

Note 2: Profit = 25% on cost = 1/4th on cost 1/5th on sales. So cost = 4/5th on sales.

![]()

2. Cash Budget for the first half of 2016

Note: His assumed that suitable arrangements will be made for handling forecast negative cash balances.

![]()

Question 21.

Answer the following question: (Nov 2016, 4 marks)

A company manufactures two products X and Y. Product X requires 5 hours to produce while Y requires 10 hours. In a month of 25 effective working days of 8 hours a day, 1,000 units of X and 600 units of Y were produced. The company employs 50 workers in the production department to produce X and Y. The budgeted hours are 1,02,000 for the year. Calculate capacity ratio, activity ratio and efficiency ratio. Also establish their inter-relationship.

Answer:

(i) Calculation of Capacity Ratio

= \(\frac{\mathrm{AH}}{\mathrm{BH}}\) × 100

= \(\frac{10,000}{8,500}\) × 100

= 117,65%

(ii) Calculation of Activity Ratio

= \(\frac{\mathrm{SH}}{\mathrm{BH}}\) × 100

= \(\frac{11,000}{8,500}\) × 100

= 129.42%

(iii) Calculation of Efficiency Ratio

= \(\frac{\mathrm{SH}}{\mathrm{AH}}\) × 100

= \(\frac{11,000}{10,000}\) × 100

= 110%

Working Note:

(i) Calculation of SH

= (1,000 units × 5 hrs.) + (600 units × 10 hrs.)

= 11,000 Hrs.

(ii) Calculation of AH

= 25 days × 8 hrs. × 50 Men.

= 10,000 Hrs.

(iii) Calculation of BH

= \(\frac{1,02,000}{12}\)

= 8,500 Hrs.

![]()

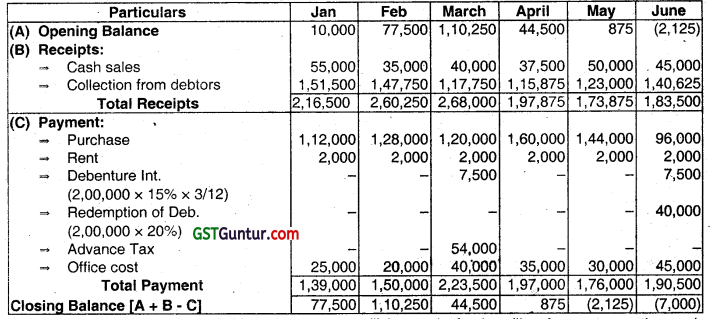

Question 22.

A Tea company manufactures two brands of tea namely Super and Normal by blending of four grades of tea leaves as raw material in the following proportion: (May 2017, 8 marks)

| Raw Material | Product Super | Product Normal |

| Grade A | 70% | |

| Grade B | 30% | |

| Grade C | 40% | |

| Grade D | 60% |

During the month of May. 2017, it is expected that 200 tons of brand Super and 80 tons of brand Normal will be sold. Actual and budgeted inventories for the month of May, 2017 are as follows:

| Actual inventories on 1st May, quantity in Tons | Budgeted inventories on 31st May, quantity in Tons | |

| Grade A | 40 | 50 |

| Grade B | 25 | 56 |

| Grade C | 150 | 250.5 |

| Grade D | 60 | 40.5 |

| Product Super | 40 | 20 |

| Product Normal | 20 | 15 |

Purchased tea leaves are seasoned and then held in stock or issued for production. During seasoning, they lose 15% of their initial weight. Calculate the following:

(i) The Production Budget for the month of May, 2017 (in quantity)

(ii) The Raw Material Purchase Budget for May, 2017 (in quantity)

Answer:

(i) The Production Budget for the month of May, 2017 (in quantity)

| Particulars | Product Super (in tons) | Product Normal (in tons) |

| Sale | 200 | 80 |

| (+) Closing Stock | 20 | 15 |

| (-) Opening Stock | (40) | (20) |

| Production | 180 | 75 |

![]()

(ii) Material Purchase Budget May ’17 (tons)

(*) Quantity to be purchased × 15% / 85%

Question 23.

(b) MH hotel has a capacity of 50 rooms, each of which can accommodate one or two guests. Guests staying in hotel are provided with free facilities like sports centre, kids zone, swimming pool etc, The details in the budget for the year ending 31-03-2018 are narrated below: (Nov 2017, 8 marks)

(i) Standard room rent of ₹ 3,500 per night during high season i.e. May, June, July, December and January and for the remaining months (low season) standard room rent of 1,800 per night will be charged.

(ii) Average room occupancy per night during high season is 80% and during low season is 50%.

(iii) The hotel is registered with number of internet based hotel providers. It is expected that subject to capacity available, an average of 15 rooms per night can be sold through them. These bookings will be in addition to the occupancy level stated in point (ii). The Internet service provider will pay 60% of the standard booking rate.

(iv) Variable cost per room night will be ₹ 1,075 per room night.

(v) Fixed cost will be ₹ 12,00,000 per month. However, when occupancy is 100%, fixed cost will increase by ₹ 9,000 per night.

Prepare budgeted profitability statement for the year ending 31-3-2018 showing the details of revenue, costs and profits.

Answer:

Working Note

| Particulars | High Season | Low Season |

| Nights | 154N (31 + 30 + 31 + 31 + 31) |

211N 28 + 31 + 30 + 31 + 30 + 31 + 30) |

| No. of Rooms | 50 | 50 |

| Occupancy | 80% | 50% |

| Room Nights (normal sale) | 6,160 [154N × 50 × 80%] |

5,275 [211N × 50 × 50%] |

| Un- Occupied Rooms per night | 10 [50 × 20%] |

25 [50 × 50%] |

| No. of Rooms (can be sold through Internet) | ’ 15 | 15 |

| No. of Rooms (sold through Internet) | 10 | 15 |

| Room Nights (internet sale) | 1,540 [154N × 10] |

3,165 [211N × 15] |

| Standard Room Rent | ₹ 3,500 | ₹ 1,800 |

| Less: Variable Cost per room night | ₹ 1,075 | ₹ 1,075 |

| Contribution (normal sale) | ₹ 2,425 | ₹ 725 |

| Room Rent- Internet Sale | ₹ 2,100 [3,500 × 60%] |

₹ 1,080 [1,800 × 60%] |

| Less: Variable Cost per room night | ₹ 1,075 | ₹ 1,075 |

| Contribution (internet sale) | ₹ 1,025 | ₹ 5 |

![]()

Budgeted Profitability Statement for the year ending 31st March, 2018

| Particulars | High Season (₹) | Low Season (₹) | Total (₹) |

| Revenue | |||

| Normal Sale | 2,15,60,000 [6,160 × ₹ 3,500] |

94,95,000 [5,275 × ₹ 1,800] |

3,10,55,000 |

| Internet Sale | 32,34,000 [1,540 × ₹ 2,100] |

34,18,200 [3,165 × ₹ 1,080] |

66,52,200 |

| Total Revenue …(A) | 2,47,94,000 | 1.29,13,200 | 3,77.07,200 |

| Costs | |||

| Variable Cost | 82,77,500 [(6,160 + 1,540) × ₹ 1,075] |

90,73,000 [(5,275 + 3,165) × ₹ 1,075 |

1,73,50,500 |

| Fixed Cost | 60,00,000 (5 × ₹ 12,00,000) |

84,00,000 (7 × ₹ 12,00,000) |

1,44,00,000 |

| Additional Fixed Cost | 13,86,000 (154N × ₹ 9,000) |

— | 13,86,000 |

| Total Costs …(B) | 1,56,63,500 | 1,74,73,000 | 3,31,36,500 |

| Profit …(A) – (B) | 91,30,500 | , (-)45,59,800 | 45,70,700 |

![]()

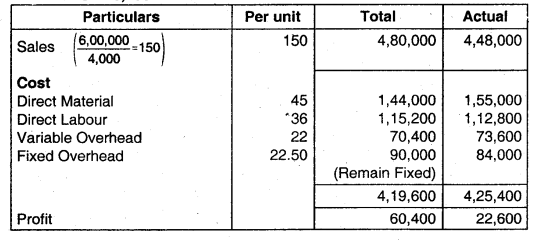

Question 24.

A company manufactures two products X and Y. The current pattern of sales of Product X and Product Y is in the ratio of 5 : 3. The budgeted data for the quarter ending 30-09-2017 is as under: (Nov 2017, 8 marks)

| Particulars | Product X | Product Y |

| Direct material cost per unit | ₹ 161 | ₹ 176 |

| Direct labour cost per unit | ₹ 75 | ₹ 90 |

| Variable overheads per unit | ₹ 30 | ₹ 50 |

| Commission on sales | 4% of selling price | 5% of selling price |

| PN ratio | 20% | 16% |

| Stock as on 1-7-2017 | 1,400 units | 1,050 units |

The annual fixed overheads amounts to ₹ 25,36,000 and it is assumed to be occurred evenly throughout the year. The Company desires profit of ₹ 4,50,000 per quarter. Closing stock is to be maintained at 20% of the budgeted sales.

Required:

(i) Calculate sales quantity to be sold during quarter ending 30-09-2017.

(ii) Prepare production budget in units for the quarter ending 30-09-2017.

Answer:

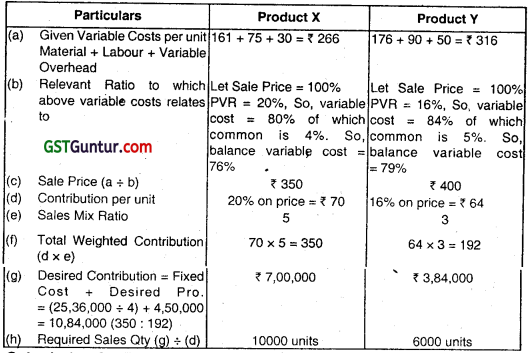

(i) Calculation for sales quantity to be sold during quarter ending 30.09.2017:

(ii) Calculation for Production Budget in units for the quarter ending on 30.09.2017:

| Particulars | Product – X | Product – Y |

| Budgeted Sales Qty. | 10,000 | 6,000 |

| Add: Closing Stock = 20% of

Budgeted Sales Qty |

2,000 | ‘ 1,200 |

| Sub – Total | 12,000 | 7,200 |

| Less: Opening Stock (given) | -1,400 | -1,050 |

| Budgeted Production | 10,600 | 6,150 |

![]()

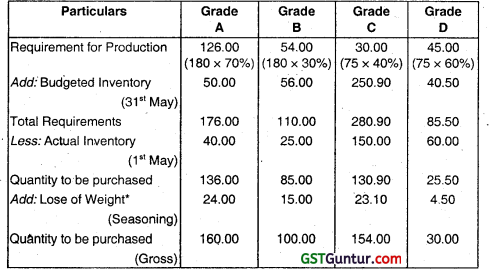

Question 25.

A company is planning to improve its profit level at least by 10% from the preliminary budget estimates of a profit of ₹ 32,80,000 for the coming year. It has worked out the following profit improvement plan: (May 2018, 10 marks)

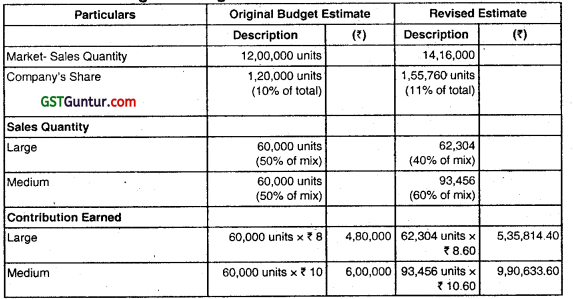

(i) In the year just concluded the sales of the company were 10% of the total market of 12,00,000 units. For the preparation of the original budget estimate, the same market demand and the same share of market for the company was envisaged. Now it has been estimated mat the total market demand will increase by 18% and the company’s market share will increase to 11% from the present level of 10%.

(ii) The products are sold in two sizes- large and medium. The sales mix of each size was 50:50 so far. Now it is planned that the sales will be 40% of large and 60% of medium. The medium packs and large packs have a contribution of ₹ 10 and ₹ 8 per pack respectively. The budget proposes to raise the price in such a manner that the contribution per pack will increase by ₹ 0.60 for each size.

(iii) There will be an additional expenditure on sales promotion worth ₹ 78,000.

(iv) The company proposes to save 9,000 by saving on interest cost in the coming year by better financial management. :

You are required to draw a profit improvement plan in financial terms and spelling out separately the effect of various factors on profit.

Answer:

Statement Showing Change in Profit

| Particulars | Large (₹) | Medium (₹) | Total (₹) |

| I. Effect of Product Mix Changes | |||

| Revised Estimated Sales Quantity (Ratio 40:60) | 62,304 | 93,456 | 1,55,760 |

| Revised Estimated Sales Quantity (Ratio 50:50) | 77,880 | 77,880 | 1,55,760 |

| Difference in Sales Quantity | (15,576) | 15,576 | NIL |

| Contribution Effect Thereon @ ₹ 8.60 and ₹ 10.60 | (1,33,953.60) | 1,65,105.60 | 31,152 |

| II Effect of Volume Change | |||

| Revised Estimate of Sales Quantity (50:50) | 77,880 | 77,880 | |

| Original Estimate of Sales Quantity (50:50) | 60,000 | 60,000 | |

| Difference in Sales Quantity | 17,880 | ‘ 17,880 | 35,760 |

| Contribution Effect Thereon @ ₹ 8 and ₹ 10 | 1,43,040 | 1,78,800 | 3,21,840 |

| III. Effect of Price Change | |||

| Revised Estimate of Sales Quantity (Ratio 40:60) | 62,304 | 93,456 | 1,55,760 |

| Difference in Price p.u. | 0.60 | 0.60 | 0.60 |

| Contribution Effect | 37,382.40 | 56,073.60 | 93,456 |

| IV. Effect of Expenses | |||

| Sales Promotion Expenses | (78,000) | ||

| Savings in Interest | 9,000 | ||

| Overall Increase in Profit | 3,77,448 |

Total Improvement in Profit ₹ 3,77,448 (11.51%)

![]()

Workings

Budaet for Oriciinal and Revised Contribution

| Particulars | Original Budget Estimate | Revised Estimate | ||

| Description | (₹) | Description | (₹) | |

| Effect of Expenses | ||||

| Sales Promotion | — | -78,000 | ||

| Interest | — | 9,000 | ||

| Revised Contribution | 10,80,000 | 14,57,448 | ||

![]()

Question 26.

The Board of Directors meeting of T.K., Motors Ltd., a car manufacturing company is to be scheduled to be held in another ten days. One of the items, as per agenda, to be discussed in the meeting is the present budgeting system of the company. Your organisation is at present, using budgets for control which are prepared mostly on traditional basis.

The CEO of your company wants to propose to the Board to use Beyond Budgeting instead of traditional budgeting in the company on experimental basis. Therefore, you, the Management Accountant has been asked by your CEO to explore the possibilities of introducing Beyond Budgeting (BB) system in the company. Specifically, you are required to prepare notes to your CEO to be used for his presentation at the meeting on : (Nov 2018, 10 marks)

(i) the major limitations of traditional budgets.

(ii) the advantages available in Beyond Budgeting.

(iii) the nature of Beyond Budgeting.

(iv) the benefits that can be enjoyed from Beyond Budgeting.

(v) The suitability of Beyond Budgeting to the company.

Answer:

(i) The major limitations of traditional budgets :

- Time consuming and costly to put together.

- Constrain responsiveness and flexibility.

- Often a barrier to change.

- Rarely strategically focused and are often contradictory.

- Add little value, especially given the time required to prepare.

- Concentrate on cost reduction and not on value creation.

- Developed and updated too infrequently, usually annually.

- Are based on unsupported assumptions and guesswork.

- Reinforce departmental barriers rather than encourage knowledge sharing.

- Make people feel undervalued.

(ii) Advantages of Beyond Budgeting :

- It is a more adaptive process than traditional budgeting.

- It is a decentralized process, unlike traditional budgeting where leaders plan and control organizations centrally.

(iii) The nature of Beyond Budgeting :

- The rolling budgets may incorporate KPIs. –

- Bench marking can be incorporated in budgets.

- Here, the focus of the managers shift to improving future results.

- Allow operational managers to react to the environment.

- Encourage a culture of innovation.

- More timely allocation of resource.

(iv) Benefits of Beyond Budgeting :

- Beyond Budgeting helps managers to work in coordination to beat the . competition. Internal rivalry between managers is reduced as target

shifts to competitors. - Helps in motivating individuals by defining clear responsibilities and challenges.

- It eliminates some behaviourial issues by making rewards team – based.

- Proper delegation of authority to operational managers who are close to the concerned action can react quickly.

- Operational managers do not restrict themselves to budget limits and focus on achieving key ratios.

- It establishes customer – oriented teams.

- It creates information systems which provide fast and open information throughout the organization.

(v) Suitability of Beyond Budgeting :

- industries where there is repaid change in the business environment:

Flexible targets will be responsive to change. - Industries using management methods such as TQM :

Continuous improvements will be the key. - Industries undergoing radical change, e.g. BPR :

Budgets may be hard to achieve in such circumstances.

![]()

Question 27.

Raju is Chief Financial Officer of Millets, corn, an internet company that enables customer to order for delivery of different millets by accessing its website. Raju is concerned with efficiency and effectiveness of the financial function. He collects the following information for three finance activities in 2018. (May 2019)

Rate per unit of Cost Driver

| Activity | Activity

level |

Cost Driver | Static Budget Amount | Actual Amount |

| ₹ | ₹ | |||

| Receivables | Output unit | Remittance | 6.39 | 7.50 |

| Payables | Batch | Invoices | 29.00 | 28.00 |

| Travel expenses | Batch | Travel claims | 76.00 | 74.00 |

The output measure is the number of deliveries which is the same as the number of remittances. The following additional information are also given:

| Budgeted | Actual | |

| Number of deliveries | 10,00,000 | 9,48,000 |

| Delivery Batch size | 5 | 4,468 |

| Travel expenses Batch size | 500 | 501.587 |

Required:

Calculate the flexible budget variances for 2018 to:

(i) Receivable Activities (2 marks)

(ii) Payable Activities (4 marks)

(iii) Travel expense Activities (4 marks)

(Ignore fractions in all calculations)

Answer:

Calculation for the Flexible Budget Variances:

(i) Receivable Activities:

Variance = Standard for Actual driver volume – Actual Cost

= (₹ 6.39 × 9,48,000) – ( ₹ 7.50 × 948,000)

= ₹ 60,57,720 – ₹ 71,10,000

= ₹ 10,52,280 (A)

![]()

(ii) Payable

Payables is a batch level activity.

| Static-Budget Amounts | Actual Amounts | |

| a. Number of deliveries | 10,00,000 | 9,48,000 |

| b. Batch size (units per batch) | 5 | 4,468 |

| c. Number of batches (a / b) | 2,00,000 | 2,12,175 |

| d. Cost per batch | ₹ 29 | ₹ 28 |

| e. Total payables activity cost (c × d) | ₹ 58,00,000 | ₹ 59,40,900 |

Step 1: The number of batches in which payables should have been processed

= 948,000 actual units /5 budgeted units per batch

= 189,600 batches

Step 2: The flexible-budget amount for payables

= 1,89,600 batches × ₹ 29 budgeted cost per batch

= ₹ 54,98,400

The flexible-budget variance can be computed as follows:

Flexible-Budget Variance

= Flexible-Budget Costs – Actual Costs

= 1,89,600 × ₹ 29 – 2,12,175 × ₹ 28

= ₹ 54,98,400 – ₹ 5940,900

= ₹ 4,42,500 (A)

![]()

(iii) Travel Expenses:

Travel expenses is a batch level activity.

| Static-Budget Amounts | Actual Amounts | |

| a. Number of deliveries | 10,00,000 | 9,48,000 |

| b. Batch size (units per batch) | 500 | 501.587 |

| c. Number of batches (a / b) | 2,000 | 1,890 |

| d. Cost per batch | ₹ 76 | ₹ 74 |

| e. Total travel expenses activity cost (c × d) | ₹ 1,52,000 | ₹ 1,39,860 |

Step 1: The number of batches in which the travel expense should have been processed

= 9,48,000 actual units/ 500 budgeted units per batch

= 1,896 batches

Step 2: The flexible-budget amount for travel expenses

= 1,896 batches × ₹ 76 budgeted cost per batch

= ₹ 1,44,096

The flexible budget variance can be calculated as follows:

Flexible Budget Variance

= Flexible-Budget Costs – Actual Costs

= 1,896 × ₹ 76 – 1,890 × ₹ 74

= ₹ 1,44,096 – ₹ 1,39,860

= ₹ 4.236(F)

![]()

Question 28.

SW & Co is a firm of Chartered Accountants having head office at Delhi and four branches in different parts of Northern region. They are providing wide range of services to their esteemed clients. Their core services include Taxation, Corporate Audits, Bank Audits, Management Audits and Project financing. The firm is preparing its budgets for the financial year 2019-2020. (Nov 2019, 10 marks)

The senior partners of the firm have stated that they would like to pay off the firm’s loan taken from a public sector bank two years back for the renovation of their office premises this year and to have’ a positive cash reserve of ₹ 2,00,000 by the end of the year.

While comparing the actual cost with the budgeted data of last year, it was revealed that travelling costs were much higher than the budgeted costs. Fees receivable from some clients were also pending for more than three years thus distorting the expectations of cash budget.

Discuss the differences between feedforward control and feedback control using the above information about the cash budget of SW & Co.

Answer:

In feed – forward control instead of actual results being compared against . desired results, forecasts are made of what results are expected to be at some future time. If these expectations differ from-what is desired, control actions are taken that will maximize these gaps.

In this Scenario, SW & Co. has following 2 expectations:

- the first is to pay off the firm’s loan taken from a public sector bank two years back

- the second is to have a positive cash reserve of ₹ 2,00,000 by the end of the year

Therefore, to achieve above expectations, a cash budget will be prepared based on various functional budgets showing cash inflows and outflows for each month so that the firm can identify its anticipated monthly cash balance. This can then be compared with the firm’s expectations to see if their cash balance objectives are being achieved. However, if the objectives are not met by these budgets, these budgets may need to be revised by changing the levels of activities. It is the process of feed forward control.

Feedback control involves monitoring results achieved against desired results and taking whatever corrective action is necessary if a deviation exists.

Thus, in the case of SW & Co., a comparison of the actual monthly cash balance can be made against the budgeted cash balance for that period. As with any budget and actual comparison there may be an adverse or favourable variance. If this is substantial, then further analysis may be needed to determine its reason. It may be that costs above budgets, cash receipts lower than expected or.receivables took less time to pay than expected, or payables were paid later than expected. This comparison process is feedback control.

Conclusion:

Feed forward control attempts to take corrective action before on event, whereas feedback control takes corrective action after the event.

![]()

Question 29.

“Correct balance must be established when budgeted performance is evaluated otherwise it may lead to a feeling that performance appraisal was unjust”. (Jan 2021)

In furtherance of the above object, three distinct styles, namely Budget Constrained Style, Profit Conscious Style and Non-Accounting Style have been observed for using budget and actual cost information in performance evaluation of a manufacturing division. Explain each of these styles. (3 marks)

Question 30.

In K Automotive Ltd., an automobile manufacturer, there is a sudden breakdown of one important machine which would delay the shipment of an important order and required to spend more than the repair budget allocation. Analyze the likely behavioural aspects of respective departmental heads in this situation under. (Jan 2021, 2 marks)

(A) Budget constrained Style

(B) Profit conscious style.

![]()

Question 31.

Summarize the effects of the given three styles of management in the below matrix in Table B by putting a suitably coined word given in Table A for each of the specified activity. (Jan 2021, 5 marks)

Table A

| High | Medium | Low | Extensive | Little | Good | Poor |

Table B

| Activity | Style of Evaluation | ||

| Budget Constrained | Profit Conscious | Non Accounting | |

| Involvement with Costs

Job related tension Manipulation of Accounting Information Relation with superiors Relation with Colleagues |

|||