Chapter 2 Supply – CS Professional Advance Tax Law Notes is designed strictly as per the latest syllabus and exam pattern.

Supply – CS Professional Advance Tax Law Study Material

Question 1.

State with reasons, whether the following statements are true or false under GST law:

(ii) Supply of newspaper in trains shall be taxed at ‘nil’ rate of GST. (Dec 2019, 1 mark)

Answer:

True. Supply of newspaper invoiced separately shall be taxed at ‘nil’ rate of GST. (Notification dated 28th June, 2017).

Question 2.

State with brief reasons whether the following are true or false; as per GST law:

(v) Rendering service by way of fumigation in a warehouse of agricultural produce is exempted service. (Dec 2019, 1 mark)

Answer:

True. As the services by way of fumigation in a warehouse of agricultural produce is an exempted service by Notification No.12 of 2017.

Question 3.

State with reasons whether the following statement is true or false under GST Law:

(v) Malaysia was the first country to have Anti-profiteering provisions. (Aug 2021, 1 mark)

Answer:

False Australia was the first country to have anti-profiteering provision (Australian Competition & Consumer Commission) in 2000.

Question 4.

Write short notes:

(ii) Deemed Export (Dec 2017, 1 mark)

Answer:

“Deemed Exports” means such supplies of goods as may be notified under Section 147. [Section 2(39)]

Question 5.

Write the difference between zero rated supply and exempted supply under the GST Law. (June 2022, 5 marks)

Answer:

The difference between Exempted Supplies and Zero rated Supplies is tabulated as below:

| S. No. |

Basis of Difference |

Exempted Supplies |

Zero Rated Supplies |

| 1. |

Meaning |

As per Section 2(47) of the Central Goods and Services Tax Act, “Exempt supply” – means supply of any goods or services or both which attracts nil rate or tax or which may be wholly exempt from tax under section 11 of Central Goods and Services Tax Act, 2017 or under section 6 of IGST Act, 2017 and includes non – taxable supply. |

As per Section 16 of Integrated Goods and Services Tax Act, 2017, “Zero-rated supply” – means export of goods or services or both or supply of goods or services or both to a SEZ developer or a SEZ unit. |

| 2. |

Tax Treatment |

No tax on the outward exempted supplies, however the input supplies used for making exempt supplies are not exempt automatically. |

No tax on the outward supplies; input supplies also to be tax free by way of refund. |

| 3. |

Input tax credit |

No ITC on the exempted supplies. Therefore, Credit of Input tax needs to be reversed, if taken. |

Credit of Input tax may be availed for making zero-rated supplies, even if such supply is an exempt supply. ITC if taken, allowed on zero-rated supplies by way of set off or refund. |

| 4. |

Registration requirement |

Any person engaged exclusively in the business of supplying goods or services or both that are not liable to tax or wholly exempt from tax under the Central Goods and Services Tax or Integrated Goods and Services Tax Act, 2017, shall not be liable to registration. |

A person exclusively making zero rated supplies may have to register as refund of utilized to register as refund of utilized ITC or integrated tax paid shall have to be claimed. |

| 5. |

Tax invoice/bill of supply |

A Registered person supplying exempted goods or service or both shall issue, instead of a tax invoice, a bill of supply. |

Normal Tax invoice shall be issued with declaration – Supply meant for Export/Supply to SEZ unit or Developers. |

Question 6.

Explain in the context of CGST Act, 2017 the following:

(i) The liability on composite and mixed supplies (Dec 2017, 2 marks)

Answer:

The tax liability on a composite or a mixed supply shall be determined in the following manner;

(a) a composite supply Comprising two or more supplies, one of which is a principal supply, shall be treated as a supply of such principal supply.

Hence, in case of composite supply, tax rate as applicable to principal supply would apply to entire supply; and

(b) A mixed supply comprising two or more supplies shall be treated as a supply of that particular supply which attracts the highest rate of tax.

Hence, in case of mixed supply, highest tax rate as applicable to any single supply would apply to all supplies forming part of mixed supply.

Question 7.

Explain the procedure of furnishing details of outward supplies and of revision for rectification of errors and omissions as per CGST Act, 2017. (Dec 2017, 5 marks)

Answer:

Furnishing Details of Outward Supplies [Section 37]

Every Registered taxable person [other than an Input Service Distributor, a non-resident taxable person and a person paying tax under Section 10 (composition scheme) or section 51 (TDS) or section 52 (TCS by e- commerce operator)] shall furnish electronically in such form and manner as may be prescribed details of outward supplies of goods or services or both effected during the tax period by 10th of the month succeeding the tax period.

Details of outward supplies will include invoices relating to zero rated supplies, inter-state supplies, intra state supplies, Goods/Services returned, Exports, supplementary invoices, debit notes and credit notes.

Once return is filed/uploaded it cannot be revised. The mechanism of filing revised returns for any correction of errors/ omissions has been done away with. The rectification of errors/ omissions is allowed in the subsequent returns.

Question 8.

Decide the following transactions in the context of GST law:

(a) When would a discount be excluded from the value of supply? Will secondary discount issued for goods supplied be reduced in determining the value of supply?

(b) Determination of value of supply when TCS under Income-tax Act, 1961 is charged separately in the invoice. (Dec 2019, 5 marks)

Answer:

(a) Determination of the value of supply:

The value of supply shall not include any discount which is given before or at the time of supply if such discount has been duly recorded in the invoice issued in respect of such supply [Section 15(3)(a)].

The value of supply shall also not include any discount issued after the supply if such discount is established in terms of an agreement entered into at or before the time of supply and specifically linked to relevant invoice and input tax credit as is attributable to the discount on the basis of document issued by the supplier has been reversed by the recipient of supply. [Section 15(3) (b)].

As such GST law does not distinguish between secondary discount and primary discount. In the present case, if the secondary discount is issued after the supply is completed and does not fulfil the conditions laid down under Section 15(3)(b), it shall not be excluded while determining the value of supply. In other words, the value of supply shall not include any discount by way of issuance of credit notes except where it is covered by section 15(3)(b).

(b) Vide C.B.I. & C. Corrigendum F.No. 20/16/04/2018-GST, dated 7-3-2019, this aspect has been clarified as under;

Section 15(2) of the CGST Act says that the value of supply shall include ‘any taxes, duties, cesses, fees and charges levied under any law for time being in force other than under CGST, SGST and UTGST, if charged separately by the supplier.

For the purpose of determination of value under GST, Tax collection at source under the provisions of the Income-tax Act is deductible as it is an interim relief not having the character of tax.

Hence TCS charged under Income Tax Act is not includible in determination of the value of supply.

Question 9.

State which of the following is composite supply or mixed supply under the GST law:

(i) Sale of car with warranty coverage.

(ii) Gift pack with chocolates and books.

(iii) Sale of Refrigerator with power stabilizer.

(iv) Hotel accommodation with complimentary breakfast.

(v) Doctor providing consultancy and dispensing medicines. (Dec 2019, 5 marks)

Answer:

Composite Supply or Mixed Supply:

(i) Composite Supply : Sale of car with warranty coverage is a composite supply as both supplies are naturally bundled and sale of car is a principal supply.

(ii) Mixed Supply : Gift pack with chocolates and books are not bundled due to natural necessities and hence they are mixed supply.

(iii) Mixed Supply: Refrigerator and power stabilizer are not inseparable and are not bundled due to natural necessities. They are mixed supply.

(iv) Composite Supply : Hotel accommodation with complimentary breakfast is a composite supply as the principal supply is supply of service i.e. accommodation.

(v) Composite Supply : Doctor providing consultancy and dispensing medicine is a composite supply as the principal supply of service is medical service.

Question 10.

What do you mean by zero rated supply? List the essential features of zero rated supply. Explain the procedure for claiming refund for zero rated supply. (Aug 2021, 5 marks)

Answer:

Zero rated Supply – Section 16 of the Integrated Goods and Services Act, 2017

Zero rated Supply – Section 16 of the Integrated Goods and Services Act, 2017

“Zero rated supply” means any of the following supplies of goods or services or both, namely: –

(a) export of goods or services or both; or

(b) supply of goods or services or both for authorized operations to a Special Economic Zone developer or a Special Economic Zone unit.

Essential Features of Zero rated supply:

- Zero rated supply connotes the situation where output as well as input tax effectively remains Nil.

- The exporter has been given an option to either pay Integrated Goods and Services Tax (IGST) on exports and claim refund or opts to export without payment of IGST under Letter of Undertaking (LUT) or bond.

- The inward supplies to the exporter are charged to normal tax but the exporter is entitled to avail input tax credit of such tax and can use it for other tax liabilities and the credit remaining utilized can be claimed as refund.

Procedure to claim refund:

Procedure to claim refund: Rule 96 & 96A of CGST Rules

The exporters of goods and services can claim refund of Input Tax paid by them on Zero rated goods or services as follows:

i. According to Rule S6A of CGST Rules an exporter may export the goods /services under a letter of undertaking without payment of GST and claim refund of unutilized Input Tax Credit.

In this respect the exporter has to:

- Ensure that No GST is charged in the export – import.

- Submit proof of export and satisfy all other conditions prescribed.

- Claim Input Tax credit relates to the outward export supply.

- File form GST RFD-01 for claiming refund.

- The exporter may supply goods or services or both after payment of GST charged on tax invoice in INR meant only for GST purpose and their claim refund thereof.

ii. In this respect the Exporter has to file the Shipping Bill in respect of exports of goods / services and such application of refund is deemed to have been filed when:

- The person in charge of the conveyance crossing the exported goods file an export manifest or export report giving the number and date of shipping bills or bills of export; and

- The applicant furnishes a valid return in FORM GSTR-3 or FORM GSTR- 3B, as the case may be.

iii. The details of the relevant export invoices in FORM GSTR-1 shall be electronically transmitted by the common portal to the designated system of customs where in return shall confirm that the goods covers by this proposed invoices have been exported out of India.

Question 11.

Explain in brief the meaning of the following terms in the context of the provisions contained under the CGST Act, 2017 :

(i) Goods

(ii) Services. (Dec 2021, 4 marks)

Answer:

(i) Goods as per Section 2(52) of Central Goods and Services Tax Act, 2017 means every kind of movable property other than money and securities but includes; actionable claim, Growing crops, grass and things attached to or forming part of the land which are agreed to be served before supply of under a contract of supply.

(ii) Services as per Section 2(102) of Central Goods and Services Tax Act, 2017 means anything other than, goods, money and securities but includes activities relating to;

(a) the use of money, or

(b) its conversion by cash or by any other mode, from one form, currency or denomination, to another form, currency or denomination for which a separate consideration is charged.

Question 12.

Decide as per provisions contained under the CGST Act, 2017 whether the following activities constitute supply or not:

(i) Services received from Government against taxes paid.

(ii) Buying a new car in exchange of old car. (Dec 2021, 4 marks)

Answer:

(i) Not a Supply. Tax payer pays different types of taxes to the government treasury and government performs welfare activities out of such taxes. There should be a direct link and a not any casual link between activity and consideration. Therefore, such activities do not constitute service as there is no direct link between such services and taxes; hence, such activities would not qualify as supply.

(ii) Supply. As per Section 7(1)(a) of Central Goods and Services Tax Act, 2017, supply includes exchange of goods for a consideration by a person in the course or furtherance of business. Thus, buying a new car in exchange of old car will constitute supply and dealer of car will be liable to pay GST.

Question 13.

What is the Provision of applicability of GST on supply of food in Anganwadi’s and Schools ? Define the latest Clarification in this regard as per 43rd GST council meeting. (June 2022, 4 marks)

Answer:

Clarification regarding applicability of GST on supply of food in Anganwadis and School:

Circular No. 149/05/2021-GST, dated June 17, 2021:

1. Clarification on applicability of GST on the issues as to whether serving of food in schools under Mid- Day Meals Scheme would be exempt if such supplies are funded by government grants and/or corporate donations. The issue was examined by GST Council in its 43rd meeting held on 28th May, 2021.

2. Entry 66 clause (b)(ii) of notification No. 12/2017-Central Tax (Rate) dated 28th June, 2017, exempts Services provided to an educational institution, by way of catering, including any mid-day meals scheme sponsored by the Central Government, State Government or Union territory. This entry applies to pre-school and schools.

3. Accordingly, as per said entry 66, any catering service provided to an educational institution is exempt from GST. The entry further mentions that such exempt service includes mid-day meal service as specified in the entry. The scope of this entry is thus wide enough to cover any serving of any food to a school, including pre-school. Further, an Anganvadi interalia provides pre-school nonformal education. Hence, Anganwadi is covered by the definition of educational institution (as pre-school).

4. As per recommendation of the GST Council, it is clarified that services provided to an educational institution by way of serving of food (catering including midday meals) is exempt from levy of GST irrespective of its funding from government grants or corporate donations [under said entry 66 (b)(ii)]. Educational institutions as defined in the notification include anganwadi. Hence, serving of food to anganwadi shall also be covered by said exemption, whether sponsored by government or through donation from corporates.

Question 14.

Harivallabh, a registered supplier, rendered taxable service for ₹ 2 lakhs on 1 -11 -2021. The tax invoice was raised on 9-12-2021. Payment was received the next day. Ascertain the time of supply for GST purposes. (June 2018, 3 marks)

Answer:

Tax Invoice should have been issued by Mr. Harivallabh within 30 days from the date of providing of service on 01.11.2021.

Tax invoice issued / raised on 09.12.2021, this has been issued beyond the stipulated time limit.

The time of supply as per Section 13 of CGST Act, 2017 would be 01.11.2021 i.e. earliest of the following :

(a) Date of provision of service (01.11.2021)

(b) Date of receipt of payment (10.12.2021)

Question 15.

M/s Basu & Co., an Audit Firm based in Kolkata undertake an Audit assignment of a Mumbai based client. The contract with the client includes ₹ 5,00,000 as audit fee and arrangement of taxi for movement of auditors amounting to ₹ 15,000 actually spent by the auditors and reimbursed by the client. Find out the transaction value in the hands of M/s Basu & Co. (Dec 2018, 2 marks)

Answer:

As per Section 15(2)(b) the value of supply shall include any amount that the supplier is liable to pay in relation to such supply but which has been incurred by the recipient of the supply and not included in the price actually paid or payable for the goods or services or both.

Therefore, transaction value in the hands of M/s Basu and Co. is ₹ 5,15,000.

Question 16.

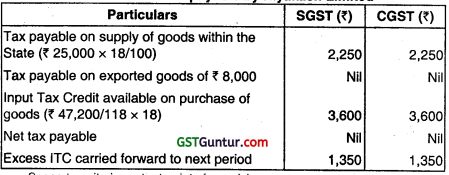

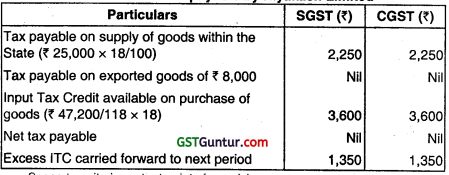

Hiyakash Ltd. is a producer of certain products. The tax rate applicable on the supply of goods by them is 18 %. (SGST 9% and CGST 9%). The company purchased goods worth ₹ 47,200 (Inclusive of Tax 18%) which is fully utilized in the manufacture of final products. The company sold the goods for ₹ 25,000 within the State and also exported the goods worth ₹ 8,000. The invoices are properly uploaded and matched in GSTN Portal. Calculate the tax payable by the company assuming there was no opening or closing stock of inputs or final products. (Dec 2018, 5 marks)

Answer:

Question 17.

Mudit Enterprises, registered in the State of Maharashtra (Mumbai) is engaged in supply of various goods and services exclusively to persons notified under Section 51 of the CGST Act, 2017.

Calculate the amount of TDS to be deducted by the recipient if any, from the details given below of three independent contracts for thé Month of November, 2021:

| Particulars |

Contracts |

|

I |

II |

III |

| Place of supply |

Mumbai |

Mumbai |

Mumbai |

| Registered place of recipient |

Mumbai |

Mumbai |

Delhi |

| Total contract value (inclusive of GST) (₹) |

2,75,000 |

3,10,000 |

4,50,000 |

| Payment due in November, 2021 (exclusive of GST) (₹) |

55,000 |

60,000 |

1,20,000 |

Note: Take the rate of CGST, SGST and IGST as 6%, 6% and 12% respectively. (June 2019, 5 marks)

Answer:

The tax at source (TDS) would be deducted @ 1 % under CGST Act and 1 % under SGST/UTGST Act or 2% under IGST Act as the case may be, of the payment made to the supplier where the total value of such supply, under a contract, exceeds ₹ 2,50,000 (excluding the amount of GST indicated in the invoice). Thus, individual supplies may be less than ₹ 2,50,000 but if the value of supply under a contract is more than ₹ 2,50,000, TDS will have to be deducted as per rates prescribed.

Case I: Given contract value is inclusive of GST, therefore to calculate contract value for TDS purpose the same is calculated exclusive of GST (CGST and SGST)

2,75,000 × 100/112

= 2,45,535.71 or ₹ 2,45,536 (rounded off)

Since the total value of supply under the contract does not exceed ₹ 2,50,000, tax is not required to be deducted on amount of ₹ 55,000.

Case II: The contract value exclusive of GST shall be:

3,10,000 × 100/112

= 2,76,785.71 or ₹ 2,76,786 (rounded off)

Since the total value of supply under the contract exceed ₹ 2,50,000, tax is required to be deducted on ₹ 60,000 @ 1% under CGST Act and 1% under SGST Act because this is an intra-state transaction (i.e. place of supply and location of supplier is in the same State).

Hence, TOS would be 1% of 60,000 = ₹ 600 (CGST) and ₹ 600 (SGST)

Case III: The proviso to Section 51(1) of CGST Act. 2017 lays down that when the location of the supplier and the place of supply is In a State which is different from the State/ Union territory of registration of the recipient, there will be no TDS.

Since the location of the supplier and the place of supply is Mumbai and the State of registration of the recipient is Delhi, no tax is liable to be deducted in the given case on amount of ₹ 1,20,000.

Question 18.

Ramakrishna Trivedi, a registered supplier of Bengaluru has received the following amounts from the various activities undertaken by him during the month ended on 31 October, 2021:

| Particulars |

Amount (₹) |

| (i) Services related to funeral including transportation of dead bodies |

30,000 |

| (ii) Commission received as an insurance agent, from insurance company |

95,000 |

| (iii) Business assets (old computer) given to friends free of cost, the market value of all the computers was ₹ 2,00,000. No input tax credit has been availed on such computers when used for business |

No amount received as given free |

| (iv) Amount received from PQR Ltd. for performance of classical dance in one program |

1,99,000 |

| (v) Service provided to recognized sport body as Coach, for participation in a sporting event organized by a recognized sports body. |

75,000 |

Note: All the amount stated above are exclusive of GST, wherever applicable. You are required to calculate gross value of taxable supply on which GST is required to be paid by Ramakrishna Trivedi for the Month of October, 2021.

Legal provision explained in brief should form part of the answer. (June 2019, 5 marks)

Answer:

| S. No. |

Particulars |

Amount (₹) |

| (i) |

Services related to funeral including transportation of dead bodies of ₹ 30,000

Note: As per Section 7(2)(a read with Schedule III of CGST Act, 2017 this is neither be treated as supply of goods nor supply of services. |

Not a supply |

| (ii) |

Commission received as an insurance agent, from insurance company of ₹ 95,000

Note: Above service is covered under reverse charge mechanism (RCM) where tax is payable by the recipient i.e. insurance company [Notification No. 13/2017-Central Tax (Rate) dated 28-06.2017] |

Taxable

under RCM |

| (iii) |

Business assets (old computer) given to friends free of cost.

Note: As per Schedule I any kind of disposal or transfer of business assets made by an entity on permanent basis even though without consideration qualifies as supply. However, this provision would apply only where the input tax credit (PTC) has been availed on such assets.

Since no ITC is claimed when such computers used for business, it is not a supply. |

Not a supply |

| (iv) |

Amount received from PQR Ltd. for performance of classical dance in one program of ₹ 1,99,000 Note: This service is exempt only if the consideration charged for such performance is not more than ₹ 1,50,000. Here, it is more than ₹ 1,50,000, hence taxable in total |

1,99,000 |

| (v) |

Service provided to recognized sports body as Coach of ₹ 75,000

Note: This service is exempt from GST under Notification No. 12/2017-Central Tax (Rate) dated 28.06.2017Total Taxable turnover |

Exempt

1,99,000 |

Question 19.

Mrs. Bharghavi is a registered supplier under GST law in Coimbatore, Tamil Nadu, running a factory for manufacture of electric motors. For giving training to her employees, she has utilized the services of Vibrant Trainers Pvt. Ltd., a registered supplier in Trissur, Kerala. The training programs are to be held at Trissur.

(i) What will be the place of supply of services provided by Vibrant Trainers Pvt. Ltd. to Mrs. Bharghavi? (June 2019, 2 marks)

(ii) Will your answer be different, if Mrs. Bharghavi is not a registered supplier? (June 2019, 2 marks)

(iii) In the situation given in the problem, if the training is to be provided at Singapore, what will be the place of supply? (June 2019, 1 mark)

Answer:

(i) When service in relation to training/organization of an event (like training) is provided to a registered person, place of supply is the location of recipient [Section 12 of the IGST Act, 2017].

Therefore, if Mrs. Bhargavi is a registered person, the place of supply will be the location of recipient, i.e., Coimbatore, Tamil Nadu.

(ii) When service in relation to training/organization of an event (like training) is provided to an unregistered person, the place of supply is the location where the services are actually performed or the event is actually held [Section 12 of the IGST Act, 2017].

Therefore, in this case, place of supply will be Trissur, Kerala.

(iii) When the training takes place outside India (Singapore), the place of supply will be the location of recipient i.e. Coimbatore, Tamil Nadu whether Mrs, Bharghavi is registered or unregistered.

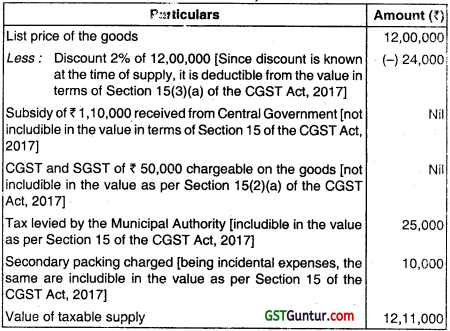

Question 20.

Jitendra Ltd., of Delhi, a registered supplier, is manufacturing taxable goods. It provides the following details of taxable supply made by it for the month of March, 2023:

| Particulars |

Amount (₹) |

| • List price of goods supplied (exclusive of taxes and discount) |

12,00,000 |

| • Subsidy received from Central Government for supply of taxable goods to Government School. Directly linked to price |

1,10,000 |

| • CGST and SGST chargeable on the goods |

50,000 |

| • Tax levied by Municipal Authority |

25,000 |

| • Secondary packing charged |

10,000 |

Note:

(i) Jitendra Ltd. offers 2% discount on the list price of the goods which is recorded in the invoice for the goods.

(ii) The list price of the goods is after considering the subsidy received from Central Government. However, the other charges/taxes/fee are charged to the customers over and above the list price.

Calculate the value of taxable supply made by Jitendra Ltd. for the month of March, 2023. (June 2019, 5 marks)

Answer:

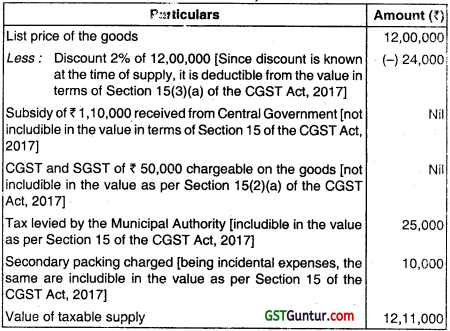

Computation of value of taxable supply made by Jitendra Ltd. for the month of March, 2023

Question 21.

Amit Ltd.. a registered supplier, is engaged in manufacturing activity. It also gives job work to other units. It purchased raw materials on 5th June, 2021 for ₹ 2 lakhs (+ GST @ 12%). It dispatched 50% of the raw material to job worker on 10th July, 2021. How much can the company claim as input tax credit in respect of those goods?

What is the time limit for receiving the goods after completion of job work by the job worker? What would be your answer In case 50% of the raw material is directly sent to job worker by the original seller of goods? Will your answer be different in case it is capital good, instead of raw material? (Dec 2019, 5 marks)

Answer:

ITC on raw materials/capital goods sent to job worker:

Amit Ltd paid GST @ 12% on the goods which works out to ₹ 24,000. As per Section 19(1) of the CGST Act, 2017, it can claim input tax credit in entirety regardless of the fact that it has wholly or partially sent such goods to a job worker. It dispatched 50% of the raw materials on 10.07.2021 to the job worker.

The time limit is that the job worker must return the raw material as such or as processed goods within 1 year from the date of dispatch by Amit Ltd. In the case of delay, the raw material so sent to job worker would be treated as supply from the date when the goods where originally sent out Amit Ltd would be required to pay tax along with interest.

Where the raw material is dispatched directly to the job worker i.e. on 05.06.2020, the time limit of one year would be counted from that date of receipt of raw material by the job worker. Thus, in case 50% of the raw material is directly sent to the job worker, the time limit for return of such raw material as such or as processed goods would be one year from the date of receipt of such raw material by the job worker. In the case of capital goods, the time limit for return is 3 years instead of 1 year. If the goods are not returned by the job worker within 3 years then such capital goods would be deemed to have been supplied to the job worker on the date when the same were originally sent and therefore Amit Limit would be required to pay tax on such capital goods along with interest.

Question 22.

Amit Ltd., a registered supplier, is engaged in manufacturing activity. It also gives job work to other units. It purchased raw materials on 5th June, 2021 for ₹ 2 lakhs (+ GST @ 12%). It dispatched 50% of the raw material to job worker on 10th July, 2021. How much can the company claim as input tax credit in respect of those goods?

What is the time limit for receiving the goods after completion of job work by the job worker? What would be your answer in case 50% of the raw material is directly sent to job worker by the original seller of goods? Will your answer be different in case it is capital good, instead of raw material? (Dec 2019, 5 marks)

Answer:

ÌTC on raw materials/capital goods sent to bob worker:

Amit Ltd paid GST @ 12% on the goods which orPs out to 24,000. As per Section 19(1) of the COST Act, 2017, it can claim input tax credit in entirely regardless of the fact that it has wholly or partially sent such goods to a job

worker. It dispatched 50% of the raw materials on 10.07.2021 to the job worker.

The time limit is that the job worker must return the raw material as such or as processed goods within 1 year from the date of dispatch by Amit Ltd. In the case of delay, the raw material so sent to job worker would be treated as supply from the date when the goods where originally sent out Amit Ltd would be required to pay tax along with interest.

Where the raw material is dispatched directly to the job worker i.e. on 05.06.2020, the time limit of one year would be counted from that date of receipt of raw material by the job worker. Thus, in case 50% of the raw material is directly sent to the job worker, the time limit for return of such raw material as such or as processed goods would be one year from the date of receipt of such raw material by the job worker.

In the case of capital goods, the time limit for return is 3 years instead of 1 year. If the goods are not returned by the jòb worker within 3 years then such capital goods would be deemed to have been supplied to the job worker on the date when the same were originally sent and therefore Amit Limit would be required to pay tax on such capital goods along with interest.

Question 23.

Determine (with brief reason) the time of supply of goods in the following cases, where the supply involves movement of goods (in one lot):

| Case No. |

Date of removal of goods |

Date of Invoice |

Date of Payment |

| 1. |

10-06-2021 |

12-06-2021 |

20-05-2021 |

| 2. |

10-11-2021 |

20-10-2021 |

29-11-2021 |

| 3. |

07-09-2021 |

02-10-2021 |

06-12-2021 |

| 4. |

10-12-2021 |

20-11-2021 |

Bank credit 22-09-2021/ in the books of account 24-09-2021 |

| 5. |

27-12-2021 |

29-12-2021 |

Bank credit 24-12-2021 / in the books of account 22-12-2021 |

(Dec 2019, 5 Marks)

Answer:

Time of supply:

As per Section 12(1) of CGST Act,2017, the time of supply of goods shall be the earlier of the following dates, namely:

(a) the date of issue of invoice by the supplier or the last date on which he is required to issue invoice under section 31; or

(b) the date on which the supplier receives the payment with respect to the supply.

However, advance received in respect of supply of goods is not liable to be taxed at the time of receipt vide Notification No. 66/2017 CT dated 15.11.2017. Therefore, the date of payment in respect of supply of goods shall not be relevant for determining the time of supply.

Further, Section 31 of the CGST Act provides that a registered person supplying taxable goods shall issue a tax invoice, before or at the time of, —

(a) removal of goods for supply to the recipient, where the supply involves movement of goods; or

(b) delivery of goods or making available thereof to the recipient, in any other case.

In view of the above stated legai position, the time of supply of goods in each of the independent cases shall be as tabulated below.

Case 1: In this the earliest date is the date of removal of goods [as date of payment is not relevant] Hence, the time of supply is 10.6.2021.

Case 2: In this case, the earliest is the date of invoice and whereas the removal of goods is much later. The time of supply hence is 20.10.2021.

Case 3: In this case, the date of removal of goods is much before date Of invoice and therefore the time of supply is 07.09.2021.

Case 4 : Since the date of payment is not relevant for supply of goods and the date of invoice is earlier than the date of removal, the time of supply is 20.11.2021.

Case 5 : Date of payment is not relevant for supply of goofs & date of removal of goods much before the date of invoice i.e. 27.12.2021.

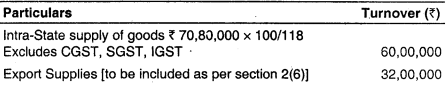

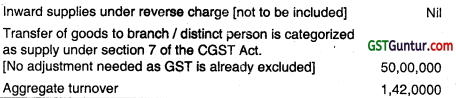

Question 24.

Gopal Das & Co., Kolkata is a manufacturer and is a registered supplier (under regular scheme). It tumishes the following details for the tax period ended on 31st March, 2023:

(i) Intra-State supply of goods (includes GST @ 18%) : ₹ 70,80,000

(ii) Goods exported (GST Nil) : ₹ 32,00,000

(iii) Inward supplies liable for reverse charge : ₹ 6,00,000

(iv) Transfer of goods to Branch at Delhi (without GST) : ₹ 50,00,000

Complete the ‘aggregate turnover’ under section 2 (6) of the CGST Act, 2017. (Dec 2019, 5 marks)

Answer:

Section 2(6) of the CGST Act, 2017 defines the term “aggregate turnover” so as to mean the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both and inter-State supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes central tax, State tax, Union territory tax, integrated tax and cess.

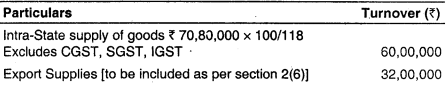

In the light of the above definition, the computation of aggregate turnover in the instant case is as below:

Question 25.

State whether the following are supply of goods/services, as per GST law, with brief reasons:

(i) Mr. X availed the architectural services of his son living in France (free of cost) for designing his residential building and factory layout.

(ii) Scrap of machinery destroyed by fire handed over to insurance company for settlement of claim.

(iii) Lease of land for two wheeler parking stand.

(iv) Permitting use of registered patent for annual fee.

(v) Transfer of tenancy right by executing and registering a document. (Dec 2019, 5 marks)

Answer:

Issues on supply of service:

(i) In terms of Section 7 of the CGST Act, 2017, import of service for a consideration whether or not in the course of or furtherance of business is a supply.

Here, the services received by Mr X is without consideration, thus not a supply. It is not subject to GST.

(ii) As per Clause 2 of Schedule i of the CGST Act, Permanent transfer or disposal of business assets where input tax credit has been availed on such assets is considered as supply.

When the machinery destroyed by fire is handed over to insurance company in return for insurance compensation, it is a supply of goods.

(iii) As per Clause 2(a) of Schedule II of the CGST Act, any lease, tenancy, easement, licence to occupy land is a supply of services. Thus, lease of land for two wheeler parking is a supply of service.

(iv) As per Clause 5(c) of Schedule II of the CGST Act provides that Temporary transfer or permitting the use or enjoyment of any intellectual property right is supply of service.

Hence, permitting use of registered patent/trade mark shall amount to supply of service.

(v) The activity of transfer of tenancy rights is squarely covered under the scope of supply of service in terms of Section 7.

However, renting of residential dwelling unit for use as a residence is exempt.

Question 26.

Tex Mark Inc. of USA, established a liaison office in Mumbai for the purpose of liaisoning with the suppliers for purchase of raw materials. The purchase orders or contracts were entered into with the suppliers directly by the head office. Liaison office did not enter into any contract with any of the suppliers. Payments were also made by the head office directly to the suppliers. The expenses incurred by the liaison office are reimbursed by the HO. There is no amount excessively charged by the liaison office to the HO. Is the amount received by the liaison office liable for GST as supply of service ? Is the liaison office required to get registered under GST law? (Dec 2019, 5 marks)

Answer:

Liaison office : Whether liable for registration:

The liaison office does not undertake any activity of trading, commercial or industrial nature. It does not enter into any business contracts. It does not charge any commission, fee or remuneration for the liaison activities/ services rendered by it either from the suppliers or from the head office.

The head office merely reimburses the expenses incurred by the liaison office on actual expenditure basis without any mark up. There is no source of income for the liaison office and it is solely dependent on the head office for all expenses incurred by it and therefore the head office and liaison office cannot be treated as separate persons.

The liaison office does not render any consultancy services directly or indirectly with or without consideration and does not have significant commitment powers. The amount received by liaison office hence cannot be treated as amount received towards supply of service.

Since it is not in furtherance of business of the liaison office, it is not required to get registered under GST.

Case law reference : Habufo Meubelan B.V. 2018(14) G.S.T.L 596 (A.A.R- GST).

Question 27.

With brief reasons, state whether the following will attract GST levy :

(i) Lodging accommodation with room tariff @ ₹ 900 per day.

(ii) SKT & Co. transporting textile goods thro ESSEM Transport Agency by paying ₹ 700 per bundle and sending 10 bundles on 31st March, 2023.

(iii) Kaziranga National Park collecting ₹ 200 per person as entrance fee.

(iv) Muthu Lab is a pathological lab owned by Muthu. He is a post-graduate in Microbiology. He collects fees for services rendered.

(v) Samy Transports carried agricultural produce i.e. turmeric from villages to town (markets) by charging ₹ 2,000 per day per person. (Dec 2019, 5 marks)

Answer:

Exemption for certain services:

Service exemption is to be considered in the light of Notification No. 12/2017-C.T (Rate) dated 28.6.2017

(i) Lodging accommodation with tariff below ₹ 1,000 is not liable for GST.

(ii) Services provided by the goods transport agency where the consideration for the transportation of goods for a single consignee does not exceed ₹ 750 is not liable for GST. However, in the present case, the consideration for 10 bundles [being single consignment] is ₹ 7000. Hence, GST is attracted.

(iii) As per S.No. 79 of Notification No. 12/2017-C.T (Rate) dated 28.6.2017, Entrance/ admission fee received by national park from visitors is not liable for GST.

(iv) Services by way of health care including paramedical service are not liable for GST.

(v) As per S.No. 20 of the referred notification, Transportation of agricultural produce by rail or vessel from one place in India to another place is not liable for GST.

Question 28.

Examine by giving reasons in brief in the context of provisions contained under the CGST Act, 2017 as to taxability or otherwise of the following independent supply of services :

(i) Tejas & Co of Delhi a tour operator provided services to Robert, a foreign tourist resident of UK for his tour conducted in Rajasthan and Agra for a sum of ₹ 2,50,000 and of Jammu Kashmir for a sum of ₹ 1,00,000 and received the total amount of ₹ 3,50,000.

(ii) Ms. Purnima acts as a Team Manager for Indian Sports League (ISL) a recognized sports body. She was contracted by a MuLi Brand Retail Company to act as Manager for a Tennis tournament organized by them and was paid an amount of ₹ 5,00,000. (Dec 2020, 4 marks)

Answer:

(i) Services provided by a tour operator to a foreign tourist in relation to a tour conducted wholly outside India are exempt vide Entry 54 of Notification No. 2/ 2017-IT (Rate). In this case tour is conducted in Rajasthan, Agra and Jammu Kashmir. IGST Act applies to whole of India including Jammu & Kashmir, hence exemption will not operate and Tejas and Co. of Delhi will be liable to pay GST and tax be payable on the entire amount of ₹ 3,50,000.

(ii) Services provided to a recognized sports body by an individual as a player, referee, umpire, coach or team manager for participation in a sporting event organized by a recognized sports body are exempt vide Entry 68 of Notification No. 2/2017-IT (Rate). Since Multi Brand Retail Company is not a recognized sports body hence exemption will not be available. Thus, the services provided by Ms. Purnima will be liable to GST and tax be payable on amount of ₹ 5,00,000.

Question 29.

Determine the time of supply (TOS) by giving reason in brief in each of the following cases in accordance with the provisions in CGST Act, 2017:

| No. |

Date of completion of service |

Date of Invoice |

Date of receipt of payments |

| 1. |

16.07.2021 |

21.07.2021 |

26.08.2021 |

| 2. |

16.08.2021 |

11.09.2021 |

01.09.2021 |

| 3. |

16.09.2021 |

11.10.2021 |

Part payment on 01.10.2021

Remaining payment on 26.10.2021 |

| 4. |

16.10.2021 |

11.11.2021 |

Part payment on 12.11.2021

Remaining payment on 15.11.2021 |

(Dec 2020, 4 marks)

Answer:

The time of supply (TOS) in each of the following cases shall be on the principle of date of invoice or the date of payment whichever is earlier.

| No. |

Date of completion of service |

Date of invoice |

Date on which payment of received |

Time of supply (TOS) |

| 1 |

16.07.2021 |

21.07.2021 |

26.08.2021 |

21.07.2021, since invoice issued within 30 days of completion of service and the payment received was later then the invoice. |

| 2 |

16.08.2021 |

11.09.2021 |

01.09.2021 |

01.09.2021 since invoice issued within 30 days of completion of service and the payment received was earlier then the invoice. |

| 3 |

16.09.2021 |

11.10.2021 |

Part payment on 01.10.2021 and remaining payment on 26.10.2021 |

As invoice is issued within 30 days from the date of completion of service, time of supply shall be 01.10.2021 for the part payment and 11.10.2021 for the remaining payment being the date of invoice. |

| 4 |

16.10.2021 |

11.11.2021 |

Part payment on 12.11.2021 and remaining payment on 15.11.2021 |

11.11.2021 for both payments. The invoice issued within 30 days of completion of service and the payments received after the date of invoice. |

Question 30.

Ram Avtar resident of Nagpur has entered into a roll over contract approached NDMC Bank Ltd. on 12-01-2022 for selling US $ 4.50,000 at the rate of ₹ 75 per USD. RBI reference rate on 12-01-2022 was ₹ 76 and the rate of exchange declared by CBEC for the day was ₹ 76.50 per USD.

Calculate the value of taxable supply by explaining in brief the provisions of CGST Act, 2017 and rules framed thereunder. (Dec 2020, 4 marks)

Answer:

Rule 32(2)(a) of CGST Rules, 2017 provides the manner of determination of the value of taxable supply so far as it pertains to purchase or sale of foreign currency including money changing.

The value of service for currency, when exchanged from, or to, Indian Rupees (INR), shall be equal to the difference in the buying rate or the selling rate, as the case may be and the Reserve Bank of India (RBI) reference rate for that currency at that time, multiplied by the total units of currency. Central Board of Excise and Customs (CBEC) rate has no relevance for determining the value of taxable supply of service.

Hence the value of taxable supply = RBI reference rate of USD × Total units of currency = ₹ (76 – 75 ) × 4,50,000 = ₹ 4,50,000.

The taxable value of supply shall be ₹ 4,50,000.

Question 31.

Determine the time of supply in the following transactions:

(i) Grocery supplier company issues a voucher of ₹ 3,500 for purchase of any item from its stores against bulk purchase.

(ii) Grocery supplier company issues a voucher only to buy an Electric Fan for ₹ 3,500, on 15th September, 2020.

(iii) Ram purchases goods worth ₹ 10,000 on 10.01.2022 and later on paid ₹ 10,600 with interest on 10.03.2022. Mention the time of supply for the interest payment of ₹ 600.

(iv) Saroj consultancy services received advance of ₹ 50,000 from clients on 31.12.2021 for services to be rendered in the month of March, 2022. (Aug 2021, 4 marks)

Answer:

(i) Since as per Section 12(4) of Central Goods and Services Tax Act, 2017 the voucher of ₹ 3,500 is an unidentifiable voucher the date of redemption of the voucher would be the time of supply.

(ii) In this case it is an identifiable voucher and hence the date of voucher shall be the time of supply i.e. 15th September, 2020.

(iii) Time of Supply to the extent it relates to an addition in the value of supply by way of interest, late fee or penalty for delayed payment of any consideration shall be the date on which such supplier receives such additions in value. Hence, in this case the time of supply for ₹ 10,000 shall be 10.1.2022 and the time of supply for interest i.e. ₹ 600 shall be 10.03.2022.

(iv) As per Section 13(2) of Central Goods and Services Tax Act, 2017 advances received are taxable at the time when such advances are received. Accordingly 31.12.2021 shall be the time of supply for advance payment of ₹ 50,000 received by Saroj Consultancy services.

Question 32.

UDB Builders Ltd. had undertaken a project to construct residential tower in Jaipur having 100 apartments/flats. The builder has entered into an agreement to sell a flat of carpet area of 1800 sq. ft out of 100 flats to a customer Shiv Charan. The breakup of the cost and charges of the flat as per agreement are as follows :

(i) Price of flat including apportioned value of cost of land : ₹ 84,00,000

(ii) Prime Location Charges (PLC) (extra charges for getting garden and swimming pool view) : ₹ 4,00,000

(iii) Club membership fee (Club to be formed after completion of construction of the tower) : ₹ 5,00,000

(iv) Stamp duty for executing sale deed on actual basis : ₹ 6,00,000

(v) Documentation charges : ₹ 2,00,000

(vi) Maintenance charges to maintain building till the residential complex is handed over to Housing Society of members : ₹ 4,00,000

The builder had received payment of ₹ 25,00,000 on agreement and balance amount of the value of flat to be received after obtaining completion certificate from the Corporation. The value of land is 1/3rd of the total consideration for the supply of flat.

Compute the value of taxable supply in respect of the flat so sold by the builder to the customer Shiv Charan for the purpose of GST. (Dec 2021, 5 marks)

Answer:

Computation of Value of taxable supply under GST of the Flat

| Particulars |

Amount(₹) |

| 1. Price of flat including apportioned value of cost of land |

84,00,000 |

| 2. Prime Location Charges (PLC) (extra charge for getting garden and swimming pool view). (Charges are part of construction service of flat being naturally bundled) |

4,00,000

|

| 3. Club membership fee (Club to be formed after construction is complete). Not part of construction service of flat being neither part of composite supply nor naturally bundled |

Nil

|

| 4. Stamp duty for executing sale deed on actual basis. (Stamp duty does not form part of value of service. It is only reimbursement of expenses incurred on behalf of the customer) |

Nil

|

| 5. Documentation Charges (These charges are part of construction service of flat) |

2,00,000 |

| 6. Maintenance charges to maintain building till the residential tower is handed over to Housing Society of Members. (Not part of construction service being neither of composite supply nor naturally bundled). |

Nil

|

| Total Consideration for the supply of flat |

90,00,000 |

| Less: Value of land or undivided share of land being 1/3rd of the total amount charged |

(30,00,000) |

| Taxable Value of Supply |

60,00,000 |

Question 33.

“ Diligent Force” a professional training institute gets its training material of “Aptitute Quotient” printed from “Durga Printing House” a printing press. The content of the material is provided by the “Diligent Force” who owns the usage rights of the same while the physical inputs including paper used for printing belong to the “Durga Printing House”. Justify, in the context of provisions of CGST Act, 2017 whether supply of training material by “ Durga Printing House” constitutes supply of goods or supply of services. (Dec 2021, 5 marks)

Answer:

Circular No. 11/11/2017-GST dated 20.10.2017 has clarified that supply of books printed with contents supplied by the recipient of such printed goods is composite supply and the question, whether such supplies constitute supply of goods or services would be determined on the basis of what constitutes the principal supply.

Principal supply has been defined in Section 2(90) of the Central Goods and Services Tax Act, 2017 as supply of goods or services which constitutes the predominant element of a composite supply and to which any other supply forming part of that composite supply is ancillary.

In the case of printing of books where content is supplied by the publisher or the person who owns the usage rights to the intangible inputs while the physical inputs including paper used for printing belong to the printer.

Supply of printing of the content supplied by the recipient of supply is the principal supply and therefore, such supplies would constitute supply of service and not supply of goods.

Thus, in view of the above mentioned provisions, the supply of training material by Durga Printing House would constitute supply of services.

Question 34.

Jagatguru Textiles Ltd. transfers from Bellary in Karnataka stocks of 15,000 meters of cloth having cost of ₹ 15,00,000 requiring further processing before sale to its Bhilwara branch located in Rajasthan* from where it is being sold. The Bhilwara branch, apart from processing its own goods is also engaged in processing of the similar nature goods for other persons located in Rajasthan.

There are no other factories in the neighboring area of Bellary in Karnataka who are engaged in the same business work of processing as being done by the Bhilwara, Rajasthan unit of Jagatguru Textiles Ltd. Other persons located in Rajasthan supply the same variety of goods in lots of 15,000 meters each time and thereafter make sells of such processed goods to whole sellers. The price of such lot of goods in the market is ₹ 14,75,000. Determine the value of supply in the aforesaid case by explaining in brief the provisions of CGST Act, 2017. (Dec 2021, 5 marks)

Answer:

As per Section 25(4) of the Central Goods and Services Tax Act, 2017 a person who has obtained more than one registration, whether in one State or Union territory or more than one State or Union territory shall, in respect of each such registration be treated as distinct person for the purposes of this Act.

As per provisions of section 7 read with Para- 2 of Schedule -1, transfer of goods between two registered units of the same person (having the same PAN) will be treated as supply even if the transfer is made without consideration, as such persons will be treated as ‘distinct persons’ under the GST law.

The value of the supply would be the open market value of such supply, if open market value cannot be determined, the value shall be the value of supply of goods of like kind and quality prevailing in the market. If value cannot be determined any of the above modes, then the value shall be determined as per Rule 30 or Rule 31 of the CGST Rules in that order.

In this case, although goods of like kind and quality are available, the same may not be accepted as the ‘like goods’ since they are supplied by another manufacturers located in Rajasthan whereas supplier in the case of Jagatguru Textiles is located at Bellary in Karnataka. Transportation cost in respect of manufacturers of Rajasthan are lower and thus less expensive in comparison to goods under consideration which were supplied from Karnataka.

Therefore, the value of the supply would be taken as per Rule 30 of the Central Goods and Services Tax Rules at 110% of the cost (110% × 15,00,000) = ₹ 16,50,000 for charge of GST.

Question 35.

XYZ Ltd. of Delhi, engaged in various activities has provided the following services in the month of March 2023, of which values are being listed against each.

(i) Service of interior decoration in respect of immovable property located in Jammu ₹ 5 lakhs.

(ii) Architectural services to an Indian Hotel Chain which has business establishment in Mumbai for its newly acquired property- in Sydney which is a fixed establishment of the Indian Hotel Chain for ₹ 15Lakhs.

(iii) Freight-forwarding services: ₹ 12 lakhs profit earned on buying and selling cargo space on airlines for export of goods. In some other cases, commission of ₹ 3 lakhs earned from airlines on acting as intermediary in arranging cargo space on airlines for export of goods.

(iv) Online information and database access and retrieval services provided to clients in UK: ₹ 5 lakhs.

All the values given here in above are exclusive of taxes, cess & GST. You are required to compute the value of taxable supplies for the purpose of GST liabilities by giving the reason in brief in the context of provision of CGST Act, 2017. (Dec 2021, 5 marks)

Answer:

XYZ Ltd.

The value of taxable supply for the month of March, 2023

| Particulars |

Amount(₹) |

| 1. Service of interior decoration in respect of immovable property located in Jammu: As per section 12(3) of Central Goods and Services Tax Act, 2017 in respect of services provided directly in relation to immovable property, the place of supply shall be the location of immovable property.

Therefore, in the given case, the place of supply of service shall be in Jammu. |

5,00,000 |

| 2. Architectural services to an Indian Hotel Chain which has business establishment in Mumbai for its newly acquired property in Sydney which is not fixed establishment

As per proviso to section 12(3) of the IGST Act if the Exempt location of the immovable property is outside India, the place of supply shall be the location of recipient

As per Sec 2(14)(b) Defines location of the Recipient as follows

Where a supply is received at a place other than the place of business for which registration has been obtained (a fixed establishment elsewhere), the location of such fixed establishment.

Therefore location of service recipient would be Sydney i.e., non taxable territory & GST will be exempt. |

Exempt

Nil |

| 3. Freight Forwarding:

According to section 12(8). where the transportation of goods is to a place outside India, the place of supply shall be description of such goods. The said services if provided by an aircraft from customs station of clearance in India to a place outside India have been exempt vide Entry 19A of Notification No. 1212017 initially for the period till 30.09.2018, however extended from time to time and currently the exemption is valid until 30.9.2023.

As per section 12(2), the place of supply of intermediary services shall be the location of registered person, assuming that services are provided to registered person. Hence it shall be taxable. |

3,00,000 |

| 4. Online information database access and retrieval services:

As per provisions of Section 13(12), the place of supply of service shall be the location of the recipient of services i.e., UK. Since it is outside taxable territory, hence it shall not be taxable. |

Nil |

| Total value of taxable supply |

8,00,000 |

Question 36.

Determine the place of supply of services as well as their taxability in each of the following independent cases in the context of provisions contained in the CGST Act, 2017:

(a) Ajay the owner of an immovable property located in New Delhi gives on rent the said property to Basant of U.P. for use in commercial purposes.

(b) Rahul, a Delhi based Interior Decorator provides his professional services to Rama Enterprises of Agra in respect of property which is intended to be located in Punjab.

(c) A USA based company possessing specialization in mineral exploration has been awarded a contract by Singhal Sons Mines of Jaipur (Rajasthan) for mineral exploration in respect of specific sites located in Canada.

(d) Rohit, a consulting Engineer provides his professional consultancy services to a UK based company in respect of its three properties located in UK, USA and Dubai.

(e) A Delhi based builder provides construction services to Punjab based company in respect of construction of its new building in Bangladesh. (Dec 2021, 5 marks)

Answer:

(i) As per Section 12(3) of Integrated Goods and Services Tax Act, 2017 in respect of services provided directly in relation to immovable property, the place of supply shall be place where immovable property is located or intended to be located. Therefore, in the given case, the place of supply of service shall be New Delhi which falls within the ambit of taxable territory and shall be liable to GST.

(ii) As per Section 12(3) of Integrated Goods and Services Tax Act, 2017 in respect of services provided directly in relation to immovable property, the place of supply shall be place where immovable property is located or intended to be located. The place of supply of services shall be Punjab as the concerned property is intended to be located in Punjab which falls within the ambit of Taxable Territory and thus this service shall be liable to GST.

(iii) As per Section 13(4) of Integrated Goods and Services Tax Act, 2017 in respect of services provided directly in relation to immovable property, the place of supply shall be place where immovable property is located or intended to be located. In tnis case, since specific sites in respect of which mineral exploration is to be carried out are located in Canada, the place of supply of service shali be Canada which does not fali within the ambit of taxable territory and resultantly, this service will not be liable to GST.

(iv) As per Section 13(4) of integrated Goods and Services Tax Act, 2017 in respect of services provided directly in relation to immovable property, the place of supply shall be place where immovable property is located or intended to be located. Since, In this case, consulting engineer’s services provided by Mr. Rohit are in respect of property which falls within non-taxable territory, hence no GST is payable by Mr. Rohit. ,

(v) As per Section 12(3) of Integrated Goods and Services Tax Act, 2017 in respect of services provided directly in relation to immovable property, the place of supply shall be place where immovable property is located or intended to be located. If the immovable property is located or intended to be located outside india, the place of supply shall be location of the recipient.

In this case services provided in relation to immovable property located in Bangladesh, the place of supply shall be location of the recipient i.e., Punjab which falls within the ambit of Taxable Territory and thus this service shall be liable to GST.

Question 37.

Xavier started profession of Architect w.e.f. 01.04.2022. His value of intra-state taxable supply upto 30.09.2022 was ₹ 20 lakh. He applied for registration on 01.10.2022 and opted for Presumptive Scheme for service suppliers in registration application and was granted registration as per provisions of GST law. He made intra-state taxable supplies of 135 lakh for the quarter ending 31.12.2022.

You are required to determine the Presumptive tax liability of Xavier under Notification No. 2/2019-CT(R) for the period 01.04.2022 to 31.12.2022. (Dec 2021, 4 marks)

Answer:

As per Notification No. 02/2019-CT(R) dated 07.03.2019, if registered person is eligible to take the benefit of this notification, he shall pay GST at the rate of 6% (3% CGST and 3% SGST/UTGST) on his aggregate turnover i.e., “First supplies of goods or services or both” upto ₹ 50 lakhs.

Explanation to Notification No. 02/2019-CT(R) dated 07.03.2019 provide that the expression “first supplies of goods or services or both” shall, for the purposes of determining eligibility of a person to pay tax under this notification, include the supplies from the first day of April of a financial year to the date from which he becomes liable for registration under the said Act but for the purpose of determination of tax payable under this notification shali not include the supplies from the first day of April of a financial year to the date from which he becomes liable for registration under the Act.

At the same time, for determining its eligibility to the scheme, the supplies made from 1 st day of April till it becomes eligible for scheme shall be taken into account.

Thus, where supplier has taken the GST registration for the first time, the presumptive tax at the rate of 6% shall be payable on the supplies made by him only after the date of registration.

In the instant case, Xavier was eligible to opt for composition scheme as on 1.10.2021 as his aggregate turnover till such date was ₹ 20 lakhs [less than ₹ 50 lakhs].

Since for the purpose of eligibility, the turnover from the first day of April needs to be considered, the turnover of ₹ 20 lakhs made during 1.4.2022 and 30.9.2022 also shall be included, the turnover of Xavier breached the limit of ₹ 50 lakhs during the period 1.10.2022 and 31.12.2022 as he made supplies for ₹ 35 lakhs during such period.

Thus, the amount of composition tax liability of Xavier under notification No. 2/2019- CT(R) will be ₹ 30,00,000 × 6% = ₹ 1,80,000.

Xavier shall be liable to pay tax under normal scheme on turnover of ₹ 5,00,000.

Question 38.

ABC Ltd. Co. registered as Company having under the GST, its head office in Mumbai. It has also obtained registration for its branch situated in Jaipur, Rajasthan. ABC Ltd. had transferred 1000 units of finished goods from Mumbai to Jaipur branch without consideration, as stock transfer. You are required to state in the context of provision of GST whether such transaction qualifies as supply. (Dec 2021, 4 marks)

Answer:

Yes, As per section 7(1)(C) read with Schedule 1 of Central Goods and Services Tax Act, 2017, when a person who has obtained or is required to obtain registration in a State or Union Territory in respect of an establishment in another State or Union Territory, then such establishments shall be treated as establishments of distinct persons.

Transactions between different establishments with separate GST registration, of same legal entity (e.g. Stock transfers or Branch transfers) will quality as ‘supply’ under GST.

Accordingly, in view of section 7(1)© the stock transfer between Mumbai & Jaipur branch shall be treated as supply under GST.

Question 39.

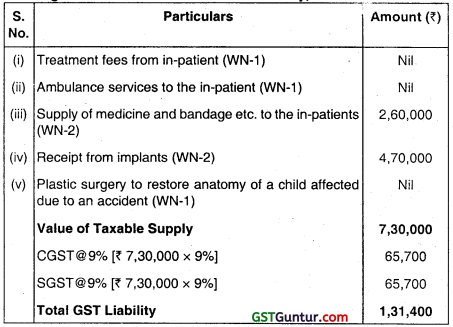

SK Health and diagnostic centre situated in Noida, registered under GST furnishes the following figures of their collection from various medical services provided to the patients for the month of January, 2023.

| S. No |

Particulars |

Amount (₹) |

| (i) |

Treatment fees from in-patient |

22,50,000 |

| (ii) |

Ambulance services to In-patient |

3,80,000 |

| (iii) |

Supply of medicine and bandage etc. to the in-patients |

2,60,000 |

| (iv) |

Receipts-from implants |

4,70,000 |

| (v) |

Plastic surgery to restore anatomy of a child affected due to an accident |

3,00,000 |

Compute the taxable value of supply and GST payable for the month of January, 2023. (rate of GST may be taken as 18%) (June 2022, 5 marks)

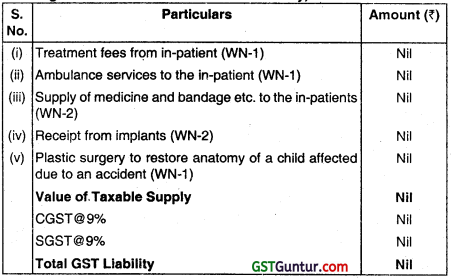

Answer:

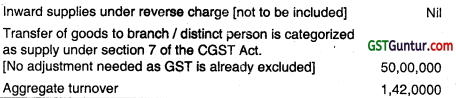

Computation of Taxable Velue of Supply and GST payable GK Health and diagnostic centre for the month of January, 2023:

Working Notes:

1. Entry 74 of the Notification no. 12/2017 Central Tax (Rate) dated June 28, 2017 exempts Health care services by a clinical establishment, an authorized medical practitioner or paramedics from GST.

Health care services means any service by way of diagnosis or treatment or care for illness, injury, deformity, abnormality or pregnancy in any recognized system of medicines in India and includes services by way of transportation of the patient to and from a clinical establishment, but does not include hair transplant or cosmetic or plastic surgery, except when undertaken to restore or to reconstruct anatomy or functions of body affected due to congenital defects, developmental abnormalities, injury or trauma.

2 Further, it is held in various advance rulings that the supply of implants and medicines as a part of health care services constitute a composite service and such supplies shall also be considered as health care service and accordingly exempted.

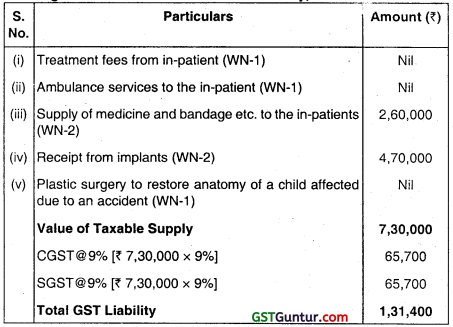

Alternate Answer:

Computation of Taxable Value of Supply and GST payable of SK Health and diagnostic centre for the month of January, 2023:

Working Notes:

1. Entry 74 of the Notification no. 12/2017 Central Tax (Rate) dated June 28, 2017 exempts Health care services by a clinical establishment, an authorized medical practitioner or paramedics from GST.

Health care services means any service by way of diagnosis or treatment or care for illness, injury, deformity, abnormality or pregnancy in any recognized system of medicines in India and includes services by way of transportation of the patient to and from a clinical establishment, but does not include hair transplant or cosmetic or plastic surgery, except when undertaken to restore or to reconstruct anatomy or functions of body affected due to congenital defects, developmental abnormalities, injury or trauma.

2. Exemption Notification No. 12/2017 does not include: –

- Supply of medicine and bandage through pharmacy.

- Implants.

Question 40.

Determine the time of supply (TOS) by giving reason in brief in each of the following cases in accordance with the provisions of CGST Act, 2017 :

(i) Sunshine Pvt. Ltd. engaged in supply of services. It receives advance of ₹ 2,35,000 from clients on 14th May, 2022 for the service to be rendered in the month of June, 2022.

(ii) Deep Ltd. provided management consultancy services to M/s. PBS & Co. on 14th August, 2022 and billed it for ₹ 1,60,000 on 19th September, 2022. It received the payment for the same on 23rd September, 2022.

(iii) A provided the professional services to B Ltd. on 16th July, 2022 and date of raising invoice was 11th August, 2022 he received part payment 50% on 1st August, 2022 and Remaining 50% payment on 26th August, 2022.

(iv) Ankit Kumar purchased some goods covered under reverse charge mechanism. The goods received on 19m June, 2022. Date of invoice is 14th May, 2022 and the payment is made on 22nd June, 2022.

(v) TPS Ltd. is an Indian Company. It has received taxable supply of services from its associated enterprises Alfa Ltd. an US based company on 1st January, 2023. Alfa Ltd. raised an invoice of $ 80,000 on 10th February, 2023. TPS Ltd. debited its books of account on 25th February, 2023 and made the payment on 25th, March, 2023. (June 2022, 5 marks)

Answer:

| Case |

Time of Supply (TOS) |

Reason |

| (i) |

14th May, 2022 |

As per Section 13(2) of the Central Goods and Services Tax Act, 2017.

The time of supply of services shall be the earliest of the following dates, namely:-

(a) the date of issue of invoice by the supplier, if the invoice is issued within the period prescribed under section 31 or the date of receipt of payment, whichever is earlier; or

(b) the date of provision of service, if the invoice is not issued within the period prescribed under section 31 or the date of receipt of payment, whichever is earlier.

In both the cases, advance payment is the Time of Supply. |

| (ii) |

14m August, 2022 |

As per Section 13(2) of Central Goods and Services Tax Act, 2017 read with section 31(2) of Central Goods and Services Tax Act, 2017 and rule thereof, in case invoice has not been issued within 30 days of completion of service, time of supply of service is date of completion of service or date of. receipt of payment, whichever is earlier. Thus, Time of supply of service is 14th August, 2022. |

| (iii) |

1st August, 2022 for first 50% payment and 11th August, 2022 for remaining 50% amount. |

As invoice is issued within 30 days from the date of completion of service, time of supply shall be date of invoice date of receipt of payment, whichever is earlier.

For first 50% payment time of supply is 1st August, 2022 and for the remaining 50% payment time of supply is 11th August, 2022. |

| (iv) |

14th June, 2022 |

As per Section 12(3) In case of supply of reverse charge on goods time of supply is

(a) date of receipt of goods; or

(b) date of payment; or

(c) date immediately following 30 days from the issue of invoice, whichever is earlier.

Thus, Time of supply of goods under reverse charge is 14th June, 2022. |

| (v) |

25th February, 2023 |

As per Section 13(3) of Central Goods and Services Tax Act, 2017, In case of associated enterprises where the person providing the service is located outside India, the Time of supply of service shall be

(a) the date of debit in the books of account of the person receiving the service; or

(b) date of making the payment, whichever is earlier.

Thus, Time of supply of goods under reverse charge is 25th February, 2023. |

Question 41.

XYZ Pvt. Ltd., Nagpur, provide housekeeping services. The company supplies its services exclusively through an E-commerce website owned and managed by Elixir Technology Pvt. Ltd., Nagpur. The turnover of XYZ Pvt. Ltd. In the current financial year is ₹ 19 lakh. Advice suitably to the company XYZ Pvt. Ltd. as to whether it is required to obtain GST registration as per provisions contained under the CGST Act, 2017. Will your answer would be different it XYZ Pvt. Ltd. sells readymade garments exclusively through an E-commerce website owned and managed by Elixir Technology Pvt. Ltd.? (June 2022, 5 marks)

Answer:

As per Section 22 of Central Goods and Services Tax Act, 2017, every supplier of goods or services or both is required to obtain registration in the State or Union Territory from where he makes a taxable supply if his aggregate turnover exceeds the threshold limit in a financial year.

However, Section 24 of Central Goods and Services Tax Act, 2017 enlists certain categories of persons who are mandatorily required to obtain registration, irrespective of their turnover. Persons who supply goods or services or both through such Electronic Commerce Operator (ECO), who is required to collect tax at source under section 52, is one such person specified under clause (ix) of Section 24. However, where the ECO is liable to pay tax on behalf of the suppliers of services under a notification issued under Section 9(5), the suppliers of such services are entitled for threshold exemption.

Section 2(45) defines ECO as any persons who owns, operates or manages digital or electronic facility or platform for electronic commerce. Electronic commerce is defined under section 2(44) to mean the supply of goods or services or both, including digital products over digital or electronic network. Since Elixir Technology Pvt. Ltd. owns and manages a website for e commerce where both goods and services are supplied, it will be classified as an ECO under Section 2(45).

Notification No. 17/2017 Central Tax (Rate) dated 28.06.2017 issued under section 9(5) specifies services by way of housekeeping, except where the person supplying such service through ECO is liable for registration under section 22(1), as one such service where the ECO is liable to pay tax on behalf of the suppliers.

In the given case, XYZ Pvt. Ltd. provides housekeeping services through an ECO. It is presumed that Elixir Technology Pvt. Ltd. is an ECO which is required to collect tax at source under section 52. However, housekeeping services provided by XYZ Pvt. Ltd., which is not liable for registration under section 22(1), as its turnover is less than ₹ 20 lakh, is a service notified under section 9(5). Thus, XYZ Pvt. Ltd. will be entitled for threshold exemption for registration and will not be required to obtain compulsory registration even though it supplies services through ECO.

In the second case, XYZ Pvt. Ltd. sells readymade garments through ECO. Such supply cannot be notified under section 9(5) as only supplies, of services are notified under that section. Therefore, in the second case, XYZ Pvt. Ltd. will not be entitled for threshold exemption and will have to compulsory obtain registration in terms of section 24(ix).

Question 42.

Secure Meter Ltd., registered in Gurgaon, Haryana, is engaged in manufacturing heavy steel machinery. It enters into an agreement with Rajveer Associates, registered in Delhi, for imparting motivational training to the top level management of Secure Meter Ltd. in a 10 day residential motivational training program at an agreed consideration of ₹ 21,00,000.

Rajveer Associates books the conference hall along with the rooms of Hotel Shourya residency in Ajmer (registered in Rajasthan) for the training program, for a lump sum consideration of ₹ 14,00,000.

You are required to determine the place of supply in respect of the supply(ies) involved in the given scenario in the context of CGST Act, 2017. (June 2022, 5 marks)

Answer:

In the given situation, two supplies are involved:

- Services provided by Rajveer Associates to Secure Meter Ltd. by way of providing motivational training to its top management.

- Services provided by Hotel Shourya Residency to Rajveer Associates by way of accommodation in said hotel for organizing the training program.

The place of supply in respect of each of the above supplies is determined as under:

1. As per the provisions of Section 12(5)(a) of the Integrated Goods and Services Tax Act, 2017, the place of supply of services provided in relation to training and performance appraisal to a registered person, shall be the location of such person.

Therefore, the place of supply of services supplied by Rajveer Associates to the registered recipient – Secure Meter Ltd. by way of providing motivational training to its top management is the location of Secure Meter Ltd., i.e. Gurgaon, Haryana.

2. As per the provisions of Section 12(3)(c) of the Integrated Goods and Services Tax Act, 2017, the place of supply of services, by way of accommodation in any immovable property for organizing, inter alia, any official/business function including services provided in relation to such function at such property, shall be the location at which the immovable property is located.

Therefore, the place of supply of services supplied by Hotel Shourya Residency to Rajveer Associates by way of accommodation of conference hall along with the rooms is location of Hotel Shourya Residency i.e. Ajmer, Rajasthan.

Question 43.

RP Manufacturers Ltd., registered in Mumbai (Maharashtra), is a manufacturer of footwear. It imports a footwear making machine from USA. RP Manufacturers Ltd. enters into a contract with Kartik Logistics, a licensed customs broker with its office at Ahmedabad (Gujarat), to meet all the legal formalities in getting the said machine cleared from the customs station.

Apart from this, RP Manufacturers Ltd. authorises Kartik Logistics to incur, on its behalf, the expenses in relation to clearance of the imported machine from the customs station and bringing the same to the warehouse of RP Manufacturers Ltd. expenses shall be reimbursed on the actual basis in addition to agency charges.

Kartik Logistics provided following details in the invoice issued by it to RP Manufacturers Ltd.:

| Particulars |

Amount (₹) |

| (i) Agency Charges |

4,00,000 |

| (ii) Unloading of machine at Kandla port, Gujarat |

45,000 |

| (iii) Charges for transportation of machine from Kandla port, Gujarat to Kartik Logistics’ godown in Ahmedabad, Gujarat |

25,000 |

| (iv) Charges for transportation of machine from Kartik Logistics’ Ahmedabad godown to the warehouse of RP manufacturers Ltd. in Mumbai, Maharashtra |

31,000 |

| (v) Dock dues paid |

60,000 |

| (vi) Port charges paid |

30,000 |

| (vii) Prepared and submitted Bill of Entry and paid customs duty |

6,00,000 |

| (viii) Hotel expenses |

47,000 |

| (ix) Travelling expenses |

48,000 |

According to GST law, compute the value of supply made by Kartik Logistics with the help of given information.

Note : All amounts are exclusive of GST. (Dec 2022, 5 marks)

Question 44.

Virat rents out a commercial building owned by him to Rohit for the month of October 2022, for which he charges a rent of ₹ 20,00,000. Virat paid the maintenance charges of ₹ 1,00,000 (for October 2022) as charged by the local society. The charges have been reimbursed to him by Rohit.