CS Professional Governance Risk Management Compliances and Ethics Notes Study Material Important Questions

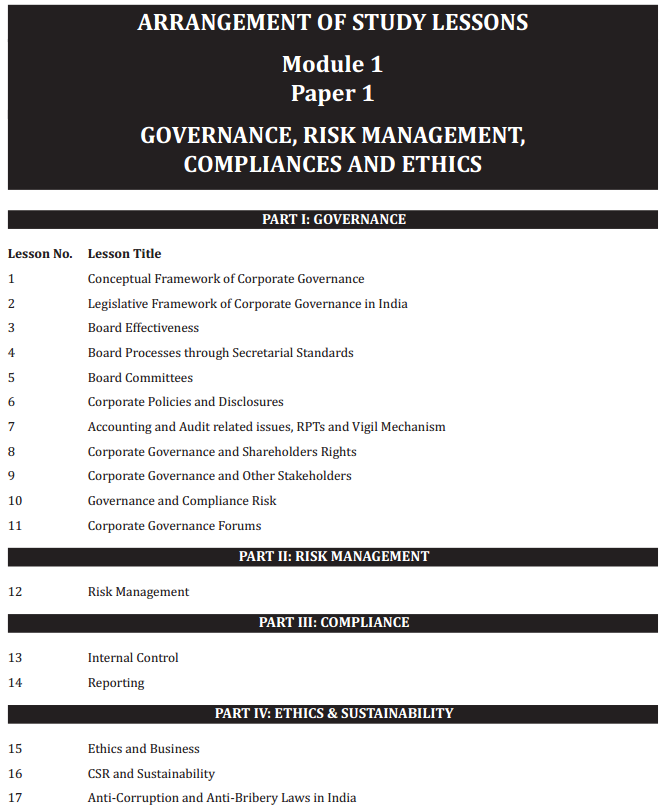

- Chapter 1 Conceptual Framework of Corporate Governance

- Chapter 2 Legislative Framework of Corporate Governance in India

- Chapter 3 Board Effectiveness

- Chapter 4 Board Processes through Secretarial Standards

- Chapter 5 Board Committees

- Chapter 6 Corporate Policies and Disclosures

- Chapter 7 Accounting and Audit Related Issues, RPTs and Vigil Mechanism

- Chapter 8 Corporate Governance and Shareholders Rights

- Chapter 9 Corporate Governance and Other Stakeholders

- Chapter 10 Governance and Compliance Risk

- Chapter 11 Corporate Governance Forums

- Chapter 12 Risk Management

- Chapter 13 Internal Control

- Chapter 14 Reporting

- Chapter 15 Ethics and Business

- Chapter 16 CSR and Sustainability

- Chapter 17 Anti-Corruption and Anti-Bribery Laws in India

CS Professional Governance, Risk Management, Compliances and Ethics Syllabus

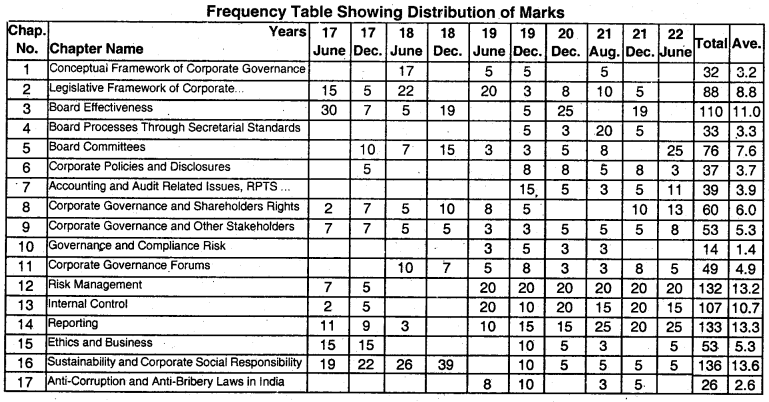

CS Professional Governance Risk Management Compliances and Ethics Chapter Wise Weightage

PROFESSIONAL PROGRAMME Module 1 – Paper 1

GOVERNANCE, RISK MANAGEMENT, COMPLIANCES AND ETHICS (100 Marks)

SYLLABUS

Objective:

Part-I: To develop skills of high order so as to provide thorough knowledge and insight into the corporate governance framework, best governance practices.

Part–II: To develop skills of high order so as to provide thorough knowledge and insight into the spectrum of risks faced by businesses.

Part-III: To develop the ability to devise and implement adequate and effective systems to ensure compliance of all applicable laws.

Part-IV: To acquire knowledge of ethics in business and framework for corporate sustainability reporting.

Detailed Contents

Part I: Governance (50 Marks)

1. Conceptual Framework of Corporate Governance: Introduction, Need and Scope, Evolution of Corporate Governance, Management vs. Ownership, Majority vs Minority, Corporate Governance codes in major jurisdictions, Sarbanes Oxley Act, US Securities and Exchange Commission; OECD Principles of Corporate Governance; Developments in India, Corporate Governance in Indian Ethos, Corporate Governance –Contemporary Developments.

2. Legislative Framework of Corporate Governance in India: Listed Companies, Unlisted Companies, PSUs, Banks and Insurance Companies.

3. Board Effectiveness: Composition and Structure, Duties and Liabilities, Evolution of Jurisprudence, Diversity in Board Room, Women Director, Nominee Directors; Selection and Appointment Process, Independent Directors: expectations, liabilities and their role, code of conduct, responsibilities and effectiveness.

4. Board Processes through Secretarial Standards.

5. Board Committees: Composition & Terms of Reference, Roles and Responsibilities.

6. Corporate Policies & Disclosures: Various policies and disclosures to be made as per regulatory requirements / voluntarily made as part of good governance.

7. Directors’ Training, Development and familiarisation.

8. Performance Evaluation of Board and Management: Evaluation of the performance of the Board as a whole, individual director (including independent directors and Chairperson), various Committees of the Board and of the management.

9. Role of promoter/controlling shareholder, redressal against Oppression and Mismanagement.

10. Monitoring of group entities and subsidiaries.

11. Accounting and Audit related issues.

12. Related Party Transactions.

13. Vigil Mechanism/Whistle blower.

14. Corporate Governance and Shareholders’ Rights.

15. Corporate Governance and other Stakeholders: Employees, Customers, Lenders, Vendors, Government and Regulators, Society, etc.

16. Governance and Compliance Risk: Governance/Compliance failure and their impact on business, reputation and fund raising.

17. Corporate Governance Forums.

18. Parameters of Better Governed Companies: ICSI National Award for Excellence in Corporate Governance.

19. Dealing with Investor Associations, Proxy Services Firms and Institutional Investors.

20. Family Enterprise and Corporate Governance.

Case Laws, Case Studies & Practical Aspects.

Part II: Risk Management (20 Marks)

21. Risk Identification, Mitigation and Audit: Risk Identification, Risk Analysis, Risk Measurement, Risk Mitigation, Risk Elimination, Risk Management Committee, Clarification and Investigation, Role of Internal Audit, Risk Audit, Risk Related Disclosures.

Case Studies & Practical Aspects.

Part III: Compliances (20 Marks)

22. Compliance Management: Essentials of successful compliance program, Significance of Compliance, devising proper systems to ensure compliance, ensuring adequacy and effectiveness of compliance system, internal compliance reporting mechanisms, use of technology for compliance management.

23. Internal Control: Nature, Scope and Elements, Techniques of Internal Control System, Steps for Internal Control, Efficacy of internal controls and its review.

24. Reporting: Integrated Reporting, Non-financial Reporting, Corporate Sustainability Reporting, Board Reporting, Annual Report, Other Reports under LODR, PIT, SAST Regulations.

25. Website Management: Meeting through Video Conferencing.

Case Studies & Practical Aspects

Part IV: Ethics & Sustainability (10 Marks)

26. Ethics & Business: Ethics, Business Ethics, Organization Structure and Ethics, Addressing Ethical Dilemmas, Code of Ethics, Indian Ethos, Designing Code of Conduct, Policies, Fair practices and frameworks.

27. Sustainability: Corporate Social Responsibility, Corporate Sustainability Reporting Framework, Legal Framework, Conventions, Treaties on Environmental and Social Aspects, Triple Bottom Line, Principle of Absolute Liability – Case Studies, Contemporary Developments, Indian Ethos.

28. Models / Approaches to measure Business Sustainability: Altman Z-Score Model, Risk Adjusted Return on Capital, Economic Value Added (EVA), Market Value Added (MVA), Sustainable Value Added Approach.

29. Indian and contemporary Laws relating to Anti-bribery: Prevention of corruption Act,1988, Central Vigilance Commission Act, 2003, Lokpal & Lokayukta Act, 2013, Foreign Corrupt Practices Act, 1977, Unlawful Activities (Prevention) Act, 1967 & Delhi Special Police Establishment Act, 1946; ICSI Anti Bribery Code.

Case Studies & Practical Aspects