Browsing through CA Foundation BCK Notes Chapter 1 Business and Commercial Knowledge: An Introduction helps students to revise the complete subject quickly.

Business and Commercial Knowledge: An Introduction – BCK CA Foundation Notes Chapter 1

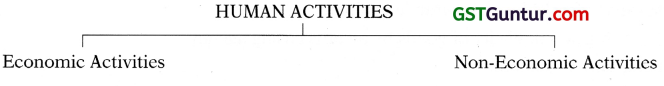

Every human being is busy in some activity or the other throughout the day. Every person gets up from bed in the morning, brushes his/her teeth, takes bath and eats breakfast. Then a child goes to School or College to study. An adult goes to work on the job and a housewife works at home. In the evening a person comes back home, watches television, eats dinner and goes to bed at night. All these activities in which a person engages from morning to evening are known as ‘human activities’.

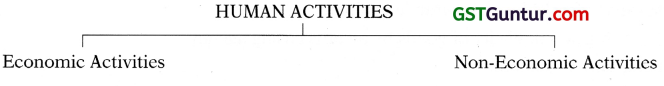

1.1 Economic and Non-Economic Activities:

All human activities may broadly be classified into two categories:

- Economic activities

- Non-economic activities

Economic activities are undertaken with the object of earning money and acquiring wealth. These activities result in the production of economic goods and services. Business is an economic activity but it differs from other economic activities such as those of an employee, and self employed persons like doctors, lawyers, chartered accountants, etc.

Non-economic activities are inspired by sentiments and emotions such as love for the family, desire to help the poor and love for the country. These activities are not undertaken for monetary gain but for one’s satisfaction and happiness.

1.1.1 Economic Activities:

Economic activities refer to all those human activities which are undertaken to earn a living and thereby satisfy human wants. The main object of these activities is to earn income and create wealth. The money earned through work is used to satisfy wants.

For example, a teacher teaches in a school or college, a doctor attends to patients in his clinic and a shopkeeper sells goods to his customers. Economic activities are concerned with the production, distribution and exchange of goods and services. These activities create utilities and result in the production of wealth. Economic activities are also called occupations.

The main characteristics of economic activities are as follows:

(i) Economic motive – Economic activities are undertaken to earn money and acquire wealth The main motive behind these activities is to make an economic gain. These activities are performed by human beings for earning livelihood.

(ii) Productive – Economic activities involve production, distribution and exchange of goods and services for satisfying human wants. These activities are directly related to creation of wealth.

(iii) Economic resources – Economic activities make use of economic resources such as land, labour, capital, etc.

(iv) Rational use – Economic activities require proper allocation of scarce resources so as to obtain maximum output from them. These activities involve optimum utilisation of land, labour, capital and other factors of production. Welfare of society can be maximised when best possible use of resources is made.

(v) Economic growth – Economic activities determine the level of economic development of a country and the standard of living of its citizens.

(vi) Legally valid – Human activities performed for economic gain are called economic activities only when they are lawful. Unlawful activities such as gambling, black marketing, theft, dacoity, smuggling etc., are opposed to public interest. Therefore, these activities cannot be called economic activities.

(vii) Socially desirable – Economic activities are desirable for society. They must be in accordance with the expectations and norms of society.

Examples of economic activities:

- Production of goods by a manufacturer in a factory.

- Distribution of goods by a wholesaler to retailers.

- Selling of goods by a retailer to customers.

- Transportation of goods and passengers by railways/roadways/airlines/ships.

- Storage of goods by a warehouse keeper.

- Acceptance of deposits and lending of money by a banker.

- Insurance of risks by an insurance company.

- Advertising and publicity of goods by an advertising agency.

- A clinic run by a doctor.

- Legal services provided by a lawyer in a court.

- Audit services provided by a chartered accountant in his office.

- Working of a Government officer.

- Services of a teacher in a school/college.

- Working of a farmer in his fields to self his produce.

- Working of a nurse in a hospital.

Economic Activities at a Glance:

Characteristics –

- Economic motive

- Productive

- Rational use

- Economic resources

- Economic growth

- Legally valid

- Socially desirable

Examples:

- Manufacturing goods in a factory.

- Selling goods in a shop.

- A doctor treating patients in his clinic.

- A lawyer providing legal advice in his own office.

- A professor teaching in a university.

- A clerk working in a Government office.

1.1.2 Non-Economic Activities:

Activities which are undertaken to satisfy social, religious, cultural and sentimental requirements are called non-economic activities. The object of these activities is not to earn monetary gain or reward. People engage in non-economic activities for reasons of love, sympathy, religion, patriotism, etc.

For example, a mother looks after her children, a student donates blood, an old man goes to temple daily, a rich man donates money to Prime Minister Relief Fund, a young man helps a blind girl to cross the road, etc.

It is the object of any activity that distinguishes between economic and non-economic activities. The primary objective of economic activities is to earn livelihood and create wealth. On the other hand, the main objective of non-economic activities is to get some sort of social, cultural, religious or recreational satisfaction.

The output of economic activities can be measured in terms of money example the salary of a teacher, the fee of a doctor and the profits of a businessman. But the result of non-economic activities cannot be measured in terms of money.

The same activity may be economic as well as non-economic. For example, a nurse attending a patient in a hospital is an economic activity as the nurse works for a salary. But when the same nurse attends to her sick mother at home it is a non-economic activity because the object is not to earn money.

Thus, the activity of the same person may be economic at one-time or place and non-economic at another time or place. The dividing line is not the activity or the person who is doing it but the objective for which it is undertaken.

Thus, non-economic activities are undertaken due to the following considerations :

- Love and affection – for example taking dinner with the family, cooking food for family.

- Personal satisfaction – for example meditating in a park.

- Physical needs – for example morning walk by a person.

- Religious obligation – for example praying in a temple.

- Social obligations – for example helping victims of an accident, flood or earthquake.

- Patriotism – donating blood for injured army men.

Distinction Between Economic and Non-Economic Activities:

| Point of Distinction |

Economic Activities |

Mon-Economic Activities |

| 1. Objective |

Economic objective – To earn a living and acquire wealth |

Sentimental and emotional objectives – To obtain some sort of personal satisfaction. |

| 2. Expectation |

Money income is expected from these activities |

Money income is not expected from these activities |

| 3. Relationship |

Directly related to income and wealth |

Not related to income and wealth. |

| 4. Measurement of outcome |

Result can be measured in terms of money |

Result cannot be measured in terms of money |

| 5. Logic |

Guided by rational considerations of cost and benefit |

Guided by sentiments and emotions without regard to gain or sacrifice |

| 6. Resources |

Involve proper allocation and optimum use of resources |

Optimum allocation and use of resources not essential |

| 7. Types of examples |

Business, Profession and employment |

Family-oriented, religious, social, cultural and national. |

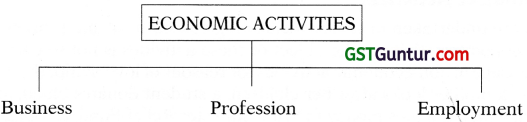

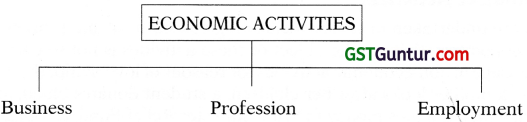

Economic activities are also known as ‘occupations’. Economic activities or occupations may be classified into three broad categories as follows:

1.2 Nature of Business, Profession and Employment:

1.2.1 Meaning and Nature of Business:

Business is an activity, in which different persons exchange something of value, whether goods or services, for mutual gain or profit. It is an organised or systematic activity involving the satisfaction of human wants. Business involves regular or recurring purchase and sale of goods and services with the purpose of earning profits through the satisfaction of human needs.

Repeated dealings rather than a single isolated transaction constitute business. Business may be distinguished from other activities by the fact that goods and services created or purchased are meant for sale and not for personal consumption.

Various experts have defined business in different ways. Some of the popular definitions of business are given below:

→ L.H. Haney : “Business may be defined as human activity directed towards producing or acquiring wealth through buying and selling of goods”.

→ B.O. Wheeler – “Business is an institution organised and operated to provide goods and services to society under the incentive of private gain.”

→ L.R. Dicksee – “Business is a form of activity pursued primarily with the objective of earning profits for the benefit of those on whose behalf the activity is conducted.”

→ James Stephenson – “Economic activities performed for earning profits are termed as Business”.

→ Keith and Carlo – “Business is a sum of all activities involved in the production and distribution of goods and services for private profits”.

→ Urwick and Hunt – “Business is any enterprise which makes, distributes or provides any article or service which the other members of the community need and are able and willing to pay for.”

→ R.N. Owens – “Business is any enterprise engaged in the production and distribution of goods for sale in market or rendering services for a price.”

The salient features of business are given below:

1. Creation of utilities – Business makes goods more useful to satisfy human wants. It adds time, place, form and possession utilities to various types of goods. In the words of Roger, “a business exists to create and deliver value satisfaction to customers at a profit”.

Business enables people to satisfy their wants more effectively and economically. It carries goods from place of surplus to the place of scarcity (place utility). It makes goods available for use in future through storage (time utility).

2. Dealings in goods and services – Every business enterprise produces and/or buys goods and services for selling them to others. Goods may be consumer goods or producer goods. Consumer goods are meant for direct use by the ultimate consumers, e.g., bread, tea, shoes, etc.

Producer goods are used for the production of consumer or capital goods like raw materials, machinery, etc. Services like transport, warehousing, banking, insurance, etc. may be considered as intangible and invisible goods. Services facilitate buying and selling of goods by overcoming various hindrances in trade.

3. Continuity in dealings – Dealings in goods and services become business only if undertaken on a regular basis. According to Peterson and Plowman, “a single isolated transaction of purchase and sale will not constitute business.

Recurring or repeated transaction of purchase and sale alone mean business.” For instance, if a person sells his old scooter or car it is not business though the seller gets money in exchange. But if he opens a shop and sells scooters or cars regularly, it will become business. Therefore, regularity of dealings is an essential feature of business.

4. Sale, transfer or exchange – All business activities involve transfer or exchange of goods and services for some consideration. The consideration called price is usually expressed in terms of money. Business delivers goods and services to those who need them and are able and willing to pay for them.

For example, if a person cooks and serves food to his family, it is not business. But when he cooks food and sells it to others for a price, it becomes business. According to Peter Drucker “any organisation that fulfils itself through marketing a product or service is a business”.

5. Profit motive – The primary aim of business is to earn profits. Profits are essential for the survival as well as growth of business. Profits must, however, be earned through legal and fair means. Business should never exploit society to make money.

6. Element of risk – Profit is the reward for assuming risk. Risk implies the uncertainty of profit or the possibility of loss. Risk is a part and parcel of business. Business enterprises function in uncertain and uncontrollable environment.

Changes in customers’ tastes and fashions, demand, competition, Government policies, etc. create risk. Food, fire, earthquake, strike by employees, theft, etc. also cause loss. A businessman can reduce risks through correct forecasting and insurance. But all risks cannot be eliminated.

7. Economic activity – Business is primarily an economic activity as it involves production and distribution of goods and services for earning money. However, business is also a social institution because it helps to improve the living standards of people through effective utilisation of scarce resources of the society. Only economic activities are included in business. Non-economic activities do not form a part of business.

8. Art as well as science – Business is an art because it requires personal skills and experience. It is also a science because it is based on certain principles and laws.

1.2.2 Meaning and Nature of Profession:

The term profession means an occupation which involves application of specialised knowledge and skills to earn a living. The persons who are engaged in profession are called professionals. They render personal services of a specialised nature to their clients.

The service is based on professional education, training and experience. Professionals receive fee for their services. Chartered Accountancy, medicine, law, tax consultancy are examples of professions.

The main features of a profession are as follows :

(i) Specialised body of knowledge – Every profession has a specialised and systematised body of knowledge. Members of the profession are required to learn this knowledge.

(ii) Restricted entry – Entry to a profession is allowed only to those who have completed the prescribed education and have passed the specified examination.

(iii) Formal training – A profession provides facilities for formal education and training to those who want to acquire professional qualification.

(iv) Professional association – Every profession has its own association. A professional association is a statutory body and its membership is essential. The association regulates entry in the profession, grants certificate of practice, formulates and enforces code of conduct. For example, The Institute of Chartered Accountants of India (ICAI) regulates the accountancy profession in India.

Names of various Professions and their Respective Associations are given below:

| Professions |

Professional |

Professional associations |

| 1. Medical Profession |

Doctors |

Medical Council of India |

| 2. Law Profession |

Lawyers |

Bar Council of India |

| 3. Accounting Profession |

Chartered Accountants |

The Institute of Chartered Accountants of India (ICAI) |

| 4. Company Secretary Profession |

Company Secretaries |

The Institute of Company Secretaries of India (ICSI) |

| 5. Cost Accounting Profession |

Cost Accountants |

The Institute of Cost and Works Accountants of India (ICWAI) |

| 6. Engineering Profession |

Engineers |

The Institution of Engineers (India) |

(v) Service motive – Professionals are expected to emphasise services to their clients rather than economic gain.

(vi) Code of conduct – The activities of a professional are regulated by a formal code of conduct. The code is prescribed by the professional association of which he is a member.

1.2.3 Meaning and Nature of Employment:

Employment means an economic activity, where people work for others in exchange for some remuneration. The persons who work for others are called ’employees’. The persons or organisations which engage others to work for them are called ‘employers’.

The remuneration by an employer to his employee is known as wages or salary. The employee performs the work assigned to him by his employer as per the terms and conditions of employment. There is an oral or written agreement between the employer and the employee.

The employee acts under the guidance and control of his employer. The employer may be a Government (department) undertaking or a private firm. Employment thus includes all types of jobs in Government offices and private enterprises. When a professionally qualihed person works as an employee he is also said to be in employment. For example, a doctor may be employed in a hospital, a chartered accountant may be working as an accountant in a company and a lawyer may serve as a law officer in a bank.

The main features of employment are as follows:

- In employment, a person works for others called employer.

- An employee provides personal service.

- There is a service agreement or contract between the employee and the employer. It contains the terms and conditions of employment.

- The employee has to obey the order of the employer.

- No capital investment is made by the employee.

- The employee gets wage or salary for his/her service.

Various examples of employment are as follows:

- A teacher teaching in a school or college.

- An engineer employed in Municipal Corporation of Delhi.

- An accountant working in the accounts department of a company.

- A person working as the plant manager of a factory.

- A nurse or doctor working in a hospital.

1.2.4 Distinction between Business, Profession and Employment:

1. Mode of establishment – A business enterprise is established when an entrepreneur takes a decision to carry on some business activity. In a profession, on the other hand, the membership or enrolment of a recognised professional association or institution is essential. In order to take up employment, a person has to enter into a contract of service.

2. Nature of work – A business exists to provide goods and services to satisfy human wants. On the other hand, a professional renders personalised service of a specialised nature to his clients. An employee performs the work assigned by the employer under the contract of service.

3. Qualifications – No formal education is compulsory in order to carry on a business. But for a profession, specialised knowledge and training are essential. Minimum educational qualifications are prescribed for every profession. In case of employment, the qualifications required depend upon the nature of the job.

4. Main objective – In business, the basic motive is to earn profits. A professional, on the other hand, is expected to emphasise the service motive and sense of mission. That is why, a rigorous code of ethical behaviour is laid down in every profession. In case of service, the motive of an employee is to earn salary and receive other benefits.

5. Investment – Every business requires capital depending upon the nature and scale of operations. A professional also has to invest some capital to establish an office for rendering services. There is no need for capital in case of employment.

6. Risk – There is an inherent element of risk in business and profession but practically no risk is involved in case of employment. There can be loss in business but in profession and employment return is never negative.

7. Reward – Profit is the reward of a businessman while professional fee is the reward of a professional. The reward in case of employment is wage or salary. Wage/salary and fee are more regular and fixed than profits.

8. Transfer of interest – It is possible to transfer ownership interest in business. But no such transfer is possible in case of profession and employment.

9. Public advertisement – The success of a business depends upon public advertisements. But professionals are prohibited from giving public advertisements. There is no need for public advertisements in case of service.

In spite of the above differences, there is a closed inter-relationship between business, profession and service. A large business enterprise employs a large number of persons in order to achieve its objectives. It also requires the services of professional experts such as chartered accountants, lawyers, architects, cost accountants, etc.

Modern business has become very complex. Trained and experienced managers and other experts are required for efficient business operations. Professionals and other employees provide the necessary manpower for efficient running of business concerns. Thus, business, profession and employment are complementary to one another.

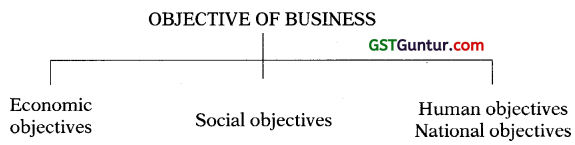

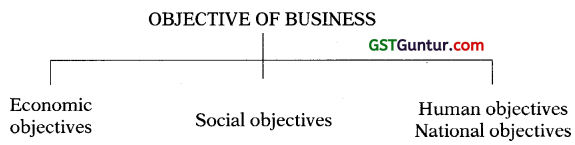

1.3 Objectives of Business:

Every business enterprise has certain objectives which regulate and generate its activities. Objectives are needed in every area where performance and results directly affect survival and prosperity of a business. Various objectives of business may be classified into four broad categories as follows:

1.3.1. Economic Objectives:

Business is basically an economic activity. Therefore, its primary objectives are economic in nature.

The main economic objectives of business are as follows:

(i) Earning profits – A business enterprise is established for earning some income. It is the hope of earning profits that inspires people to start business. Profit is essential for the survival of every business unit. Just as a person cannot live without food, a business firm cannot survive without profit.

Profits enable a businessman to stay in business by maintaining intact the wealth producing capacity of its resources. Profit is also necessary for the expansion and growth of business. Profits ensure continuous flow of capital for the modernisation and extension of business operations in future. Profit also serves as the barometer of stability, efficiency and progress of a business enterprise.

(ii) Creating customers – Profits are not created by God or by the force of nature. They arise from the businessman’s efforts to satisfy the needs and wants of customers. A businessman can earn profits only when there are enough customers to buy and pay for his goods and services. In the words of Drucker, “There is only one valid definition of business purpose; to create a customer.

The customer is the foundation of business and keeps it in existence. It is to supply the customer that society entrusts wealth-producing resources to a business enterprise”. No business can succeed without providing customers value for their money.

Business exists to satisfy the wants, tastes and preferences of customers. In order to earn profit, business must supply better, quality goods and services at reasonable prices. Therefore, creation and satisfaction of customers is an important economic objective of business. Business creates customers through advertising and salesmanship. It satisfies the needs of customers by producing the required goods and services and by creating utilities.

(iii) Innovations – Business is an organ of dynamism and change. In these days of competition a business can be successful only when it creates new designs, better machines, improved techniques, new varieties, etc. Modern science and technology have created a great scope for innovation in the business world. Innovation is not confined to the invention of a new machine.

It comprises all efforts made in perfecting the product, minimising the costs and maximising benefits to customers. It involves improvements in management, production, selling servicing, methods of personnel and accounting, etc.

Business firms invest money, time and efforts in Research and Development (R&D) to introduce innovations. They develop new technology, introduce new designs and new tools and processes to minimise costs and to satisfy ever increasing wants of customers. In order to create customers business has to explore new markets and attract more customers. It has also to retain old customers by providing better services to them.

1.3.2. Social Objectives:

Business does not exist in a vacuum. It is a part of society. It cannot survive and grow without the support of society. Business must therefore discharge social responsibilities in addition to earning profits. According to Henry Ford, “the primary aim of business should be service and subsidiary aim should be earning of profit”.

The social objectives of business are as follows:

(i) Supplying desired goods at reasonable prices – Business is expected to supply the goods and services required by the society. Goods and services should be of good quality and these should be supplied at reasonable prices. It is also the social obligation of business to avoid malpractices like hoarding, black marketing and misleading advertising.

(ii) Fair Remuneration to employees – Employees must be given fair compensation for their work. In addition to wages and salary a reasonable part of profits should be distributed among employees in recognition of their contributions. Such sharing of profits will help to increase the motivation and efficiency of employees.

It is the obligation of business to provide healthy and safe work environment for employees. Good working conditions are beneficial to the organisation because these help to improve the productivity of employees and thereby the profits of business. Employees work day and night to ensure smooth functioning of business. It is, therefore, the duty of employers to provide hygienic working and living conditions for workers.

(iii) Employment Generation – Business should provide opportunities for gainful employment to members of the society. In a country like India unemployment has become a serious problem and the Government is unable to offer jobs to all. Therefore, provision of adequate and full employment opportunities is a significant service to society. If unemployment problem increases, the socio-economic environment cannot be congenial for the growth of business activities.

(iv) Fair return to investor – Business is expected to pay fair return to shareholders and creditors in the form of dividend and interest. Investors also expect safety and appreciation of their investment. They should be kept informed about the financial health and future prospects of business.

(v) Social welfare – Business should provide support to social, cultural and religious organisations. Business enterprises can build schools, colleges, libraries, dharamshalas, hospitals, sports bodies and research institutions. They can help non-government organisations (NGOs) like CRY, Help Age, and others which render services to weaker sections of society.

(vi) Payment of Government Dues – Every business enterprise should pay tax dues (income tax, GST, excise duty, customs duty, etc.) to the Government honestly and at the right time. These direct and indirect taxes provide revenue to the Government for spending on public welfare. Business should also abide faithfully by the laws of the country.

Thus, businessmen should pursue those policies and take those actions which are desirable in terms of the objectives and values of our society.\

1.3.3 Human Objectives:

Business is run by people and for people. Labour is a valuable human element in business. Human objectives of business are concerned with the well-being of labour. These obj ectives help in achieving economic and social objectives of business. Human objectives of business are given below:

(i) Labour welfare – Business must recognise the dignity of labour and human factor should be given due recognition. Proper opportunities should be provided for utilising individual talents and satisfying aspirations of workers. Adequate provisions should be made for their health, safely and social security. Business should ensure job satisfaction and sense of belonging to workers.

(ii) Developing human resources – Employees must be provided the opportunities for developing new skills and attitudes. Human resources are the most valuable asset of business and their development will help in the growth of business. Business can facilitate self-development of workers by encouraging creativity and innovation among them. Development of skilled manpower is necessary for the economic development of the country.

(iii) Participative management – Employees should be allowed to take part in decision making process of business. This will help in the development of employees. Such participation will also provide valuable information to management for improving the quality of decisions. Workers’ participation in management will usher in industrial democracy.

(iv) Labour management cooperation – Business should strive for creating and maintaining cor¬dial employer-employee relations so as to ensure peace and progress in industry. Employees should be treated as honourable individuals and should be kept informed.

1.3.4 National Objectives:

National objectives of business are as follows:

(i) Optimum utilisation of resources – Business should use the nation’s resources in the best possible manner. Judicious allocation and optimum utilisation of scarce resources is essential for rapid and balanced economic growth of the country. Business should produce goods in accordance with national priorities and interests. It should minimise the wastage of scarce natural resources.

(ii) National self-reliance – It is the duty of business to help the Government in increasing exports and in reducing dependence on imports. This will help a country to achieve economic inde-pendence. This requires development of new technology and its application in industry.

(iii) Development of small scale industries – Big business firms are expected to encourage growth of small scale industries which are necessary for generating employment. Small scale firms can be developed as ancillaries which provide inputs to large scale industries.

(iv) Development of backward areas – Business is expected to give preference to the industriali-sation of backward regions of the country. Balanced regional development is necessary for peace and progress in the country. It will also help to raise standard of living in backward areas. Government offers specific incentives to the businessmen who set up factories in no¬tified backward areas.

(v) Control over pollution – Rapid industrialisation has resulted in air, water and noise pollution. Business is responsible for reducing the adverse effect of business on the quality of life. It must make proper arrangements for the disposal of smoke, effluents, wastes, etc. to protect the health and life of people, animals and birds.

Business Objectives At A Glance:

| Economic Objectives |

Social objectives |

Human Objectives |

National Objectives |

1. Earning Profit

2. Creating customers

3. Innovations |

1. Quality goods at fair prices

2. Fair remuneration to employees

3. Generating employment

4. Fair return to investors

5. Social welfare

6. Payments of taxes |

1. Labour welfare

2. Developing Human Resources

3. Participative management

4. Labour management Cooperation. |

1. Optimum utilisation of resources

2. National self-reliance

3. Development of small scale units

4. Development of backward areas

5. Pollution control |

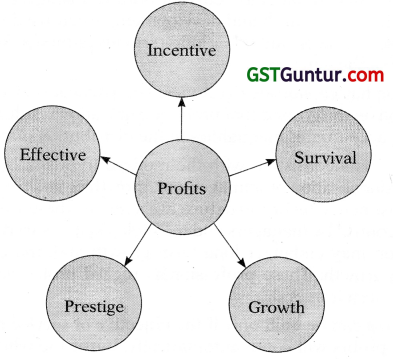

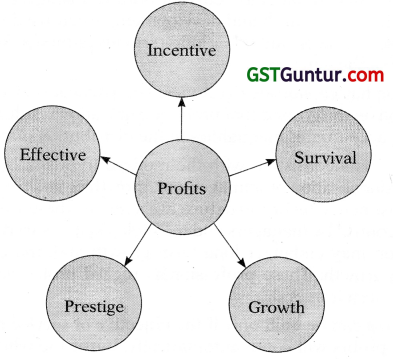

1.3.5 Role of Profit in Business:

Profit earning is essential in business due to the following reasons:

1. Incentive – Profit is the driving force behind every business. It inspires people to start an enterprise and to work hard for making it successful. Profit is the reward for, undertaking the risk of business.

2. Survival – Profit is essential for the survival of business and it ensures the continuity of an enterprise. In the absence of profits, an enterprise will eat up its own capital and ultimately close down. With the help of profits business can replace obsolete machinery and equipment and thereby maintain its capacity to create wealth.

According to Drucker, “profit is the risk premium that covers the costs of staying in business”. Profits help business to face trade cycles and other shocks. Profits are also required to reward various factors of production.

3. Growth – Profits is the biggest source of capital for expansion and growth of business. It serves as a means of self-financing. In addition, profits enable business to attract capital from outside. Nobody likes to invest money in a loss making enterprise.

4. Measure of efficiency – Profit is considered to be the index of success in business. People judge the performance of an enterprise on the basis of profits earned by it.

5. Prestige and recognition – A loss making business enjoys no goodwill. Profits provide economic power and status to businessmen. Higher profits increase the bargaining strength and credit worthiness of business. Moreover, only a profit making business can provide service to society.

Thus, profit earning is an essential and desirable objective of every business. But mere money chasing is not business. According to Drucker, “the problem of any business is not the maximisation of profit but the achievement of sufficient profits to cover the risks of economic activity, and thus, to avoid loss. The businessmen who keep their customers, employees, investors and the society satisfied, will definitely earn good profits”.

Urwick has very aptly summed up the relevance of profit motive in business as “earning of profits cannot be the objective of a business any more than eating is the objective of living”. A business cannot survive without profit just as a person cannot live without food.

But profits cannot be the sole purpose of business just as eating is not the aim of life. However, profits must be earned by satisfying the wants of customers and after paying workers their dues. In the words of Arvind Mafatlal, “no business or industry is run philanthropically. It has to make a profit for further growth. But this profit cannot be at the expense of labour and the community at large”.

Economic and social objectives of business are not contradictory. They go hand in hand in the long run. No business can earn profits without satisfying customers and other sections of society.

Similarly, business cannot render service without earning profits. Thus, the real objective of business is to earn profit by serving the interests of consumers, employees, investors, Government and the society as a whole.

1.3.6 Objections against Profit Maximisation:

Despite their indispensable role in business, profits cannot be the be-all and end-all of business. The profit maximisation objective is undesirable on account of the following reasons:

1. Profit maximisation overstresses the end result and overlooks the means employed to achieve the profits. It considers profit as the ultimate goals of business rather than a means to the real end. The ultimate aim of business should be social welfare. If profit maximisation is considered as the ultimate aim of business, businessmen might try to maximise profits by socially undesirable means such as profiteering, black-marketing, hoarding, exploitation of workers and consumers, etc.

2. Profit maximisation overstresses the reward for owners and ignores the interests of other stakeholders. Profit is the reward for capital and profit maximisation gives the impression that a business concern is the domain only of owners. In reality, no business can succeed without the fullest co-operation of labour, consumers, Government and the community at large. Profit maximisation objective overlooks the stake of these groups in business.

3. Profit maximisation misguides managers to the point where they may endanger the survival of the business. In order to maximise current profits, managers may undermine the firm’s future. They may ignore research and development, executive development, pushing of the most easily saleable products, and other long-term investments. Such activities threaten the long-term success of the enterprise.

4. Profit maximisation has capitalistic overtones. The advocates of socialism decry the goal of profit maximisation on the ground that profit maximisation results in the exploitation of poor by the rich. It also accentuates inequalities in the distribution of income and wealth.

5. Profit maximisation is inconsistent with the modern trends in business. Diffusion of share ownership, professionalisation of management, growth of institutional shareholding and the emergency of a distinctive technostructure are some of these trends.

The main goal of the technostructure (control by managers and technologists), is survival and growth of business. Profit maximisation may endanger long term growth and, therefore, the technostructure prefers long-term growth. These professionals regard profit maximisation as unrealistic, inappropriate and even immoral.

A truly successful business can be built only if the objective of service to the society is constantly followed. If this is done profits will come automatically, but if the whole emphasis is on making money business may not survive and succeed for a long period. The guiding principle of business should be profit through service. Every business should provide a proper balance between profit motive and social service.

1.4 Forms of Business Organizations:

The main forms of ownership in private sector are as follows:

- Sole Proprietorship

- Joint Hindu Family Business

- Partnership

- Joint Stock Company

- Cooperative Society

1.4.1 Sole Proprietorship:

Sole trader is a person who carries on business exclusively for himself He alone establishes the business, arranges its finances, manages its affairs and bears all its risk. He acts both as the owner and manager of his business. He alone, is responsible for the profits and losses of his business. He may borrow funds and employ people to help him but the ultimate authority and responsibility lie in his hands. Sole trader business is thus a one-man show.

Some popular definitions of sole trader are given below:

The individual proprietorship is the form of business organisation at the head of which stands an individual as one who is responsible, who directs its operations and who alone runs the risk of failure.

A sole proprietor is a person who carries on business exclusively by and for himself. He is not only the owner of the capital of the undertaking, but is usually the organiser and manager and takes all the profits or responsibility for losses.

A sole trader business is a type of business unit where one person is solely responsible for providing the capital, for bearing the risk of the enterprise and for the management of business.

Under the sole proprietorship form of ownership, a single individual organises and operates the business in his own name. He is not only responsible for its management but also for its risks. Sole proprietorship is a form of business where the individual proprietorship is the supreme judge of all matters pertaining to his business. Sole proprietorship is an informal type of business owned by one person.

The sole proprietorship is that form of business ownership which is owned and controlled by a single individual. He receives all the profits and risks all of his property in the success or failure of the enterprise.

The distinguishing characteristics of sole proprietorship are as follows:

1. Single ownership – A sole proprietorship is wholly owned by one individual. The individual supplies the total capital from his own wealth or from borrowed funds.

2. One-man control – The proprietor alone takes all the decisions pertaining to the business. He is not required to consult anybody. Ownership and management are vested in the same person. Some persons may be employed to help the owner but ultimate control lies with him.

3. No legal entity – A sole proprietorship has no legal identity separate from that of its owner. The law makes no distinction between the proprietor and his business. The business and the owner exist together. If the owner dies or becomes insolvent the business is dissolved. Business and the proprietor are one and the same.

4. Unlimited liability – The proprietor is personally liable for all the debts of the business. In case the assets are insufficient to meet its debts, the personal property of the proprietor can be attached.

5. No profit-sharing – The sole proprietor alone is entitled to all the profits and losses of business. He bears the complete risk and there is nobody to share the profits or losses.

6. Small size – The scale of operations carried on by a sole proprietorship is generally small. A sole trader can arrange limited funds and managerial ability. Therefore, the area of operations is limited.

7. No legal formalities – No legal formalities are required to start, manage and close.

| Advantages |

Disadvantages |

| 1. Ease of formation |

1. Limited capital |

| 2. Incentive to work |

2. Lack of specialisation |

| 3. Independence in control |

3. Lack of stability |

| 4. Prompt decisions |

4. Unlimited liability |

| 5. Business secrecy |

5. No scope for expansion and growth. |

| 6. Personal touch |

|

| 7. Flexibility of operations |

|

| 8. Inexpensive management |

|

| 9. Minimum Government regulations |

|

| 10. Easy dissolution |

|

| 11. Social advantage. |

|

Suitability:

Thus, sole proprietorship has several advantages and disadvantages. According to William R. Basset, “the one man control is the best in the world if that man is big enough to manage everything.” But, one man can rarely manage and control everything. Therefore, sole proprietorship is a suitable form of organisation in the following cases:

- Where the market is local, example – small-scale retailers

- Where personal attention to the needs and preferences of customers is essential, example – tailoring, beauty parlours, etc.

- Where fashions change very frequently, example – artistic jewellery.

- Where small amount of capital is required but personal skills are more important, example – health clinic.

- Where quick decision and prompt action are necessary, example – stock brokers.

- Where risk involved is negligible, example – doctors, lawyers, chartered accountants.

1.4.2 Joint Hindu Family Business:

The joint Hindu family business refers to a business which is owned and managed by the members of a joint Hindu family. It is also known as Hindu Undivided Family Business: It is governed by the Hindu Succession Act. This form of business is created by the law of succession. The joint Hindu family form of business is one in which the family possesses some inherited property.

The share of ancestral property is inherited by a male member from his father grandfather and great grandfather. Thus, three successive generations can simultaneously inherit the ancestral property. All the male members having a share in family property are known as coparceners and the oldest male member is called the karta.

Features : The main characteristics of Joint Hindu Family Business are as follows:

1. Membership – A person becomes a member in the family business by virtue of his birth in the family. No formal agreement is necessary between the family members. The membership is restricted to three successive generations. Only male members can be coparceners. A female relative of a deceased male coparcener will have a share after the death of the coparceners. Minors are also full-fledged members of the family business. There is no limit on the number of members.

2. Management – The management of joint Hindu family business is rested in the karta. The karta may, however, associate other members to assist him in the management of family business.

3. Liability – The liability of the karta is unlimited. The liability of other members is limited to the extent of their share in the property of the family business.

4. Right to Accounts – Coparceners are not entitled to inspect the accounts of the business. However, a coparcener who is leaving the family business can demand accounts from the karta.

5. Dissolution – Joint Hindu family business is not dissolved on the death of a coparcener. It comes to an end when all the members notify that they are not members of the joint Hindu family.

Joint Hindu Family Business at a Glance:

| Merits |

Demerits |

| 1. Ease of formation |

1. Limited financial resources |

| 2. Freedom of action |

2. Limited managerial ability |

| 3. Personal contact |

3. Unlimited liability of karta |

| 4. Utmost secrecy |

4. Hasty decisions |

| 5. Limited liability |

5. Source of Conflicts |

| 6. Stability |

6. Misuse of authority by Kartans |

| 7. Incentive to work hard |

|

| 8. Quick decisions |

|

| 9. Economy of operations |

|

| 10. Flexibility of operation |

|

| 11. Social advantage. |

|

1.4.3 Partnership:

The partnership form of business organisation grew out from the limitations of sole proprietorship. When the business expands, one man is unable to arrange the financial resources and bear the risks. He cannot supervise and manage all the functions of business personally. Therefore two or more persons join hands and combine their capital and skill to start and run a business. Partnership is thus an extension of sole proprietorship.

A partnership is a voluntary association of two or more persons who agree to carry on some business jointly and share its profits and losses. They combine their funds and skills to carry on business together. Some popular definitions of partnership are as follows:

L.H. HANNEY: Partnership is the relations existing between persons competent to make contact, who agree to carry on lawful business in connection with a new to private gain.

The Partnership Act : “Partnership is the relation between persons who have agreed to share profits of a business carried on by all or any one of them acting for all”. A Partnership is a form of business organisation in which two or more persons upto a maximum twenty join together to undertake some form of business activity.

Two or more individuals may form a partnership by making a written or oral agreement that they will jointly assume full responsibility for the conduct of business.

The persons who enter into partnership with the one another are individually called ‘partners’ and collectively a ‘firm’. The name under which they carry on business is called the ‘firm name’.

The essential characteristics of partnership are as follows :

1. Two or more persons – There must be at least two persons to form a partnership. A person cannot enter into partnership with himself. The maximum number of persons in a partnership should not exceed 50. If the number of partners exceeds the prescribed maximum, it would become an illegal association of persons. A firm cannot become a partner of another firm though its partners can join any other firm as partners.

2. Agreement – Partnership is the outcome of an agreement between persons. The relation of partnership arises from the formation of a contract and not from status or birth. If a proprietor gives a share in profits to his employee it will not be called a partnership unless there is an agreement of partnership between the two. The agreement may be oral or in writing but it must satisfy all the essentials of a valid contract.

3. Lawful business – A partnership can be formed only for the purpose of carrying on a business. An association of persons who jointly own a house without carrying on a business is not partnership. Moreover, the business carried on by the partners must be lawful. Illegal acts such as theft, dacoity, smuggling, etc., cannot be called partnership.

4. Sharing of profits – The agreement between the partners must be to share the profits of business. There can be no partnership without the intention of mutual gain. The profits must be distributed among the partners in an agreed ratio. Similarly, losses should be shared among the partners. However, sharing of profits is not a conclusive proof of partnership. For example, a manager may be given a share in profits of the firm.

5. Mutual agency – Partnership business can be carried on by all the partners or by any of them acting on behalf of the others. In other words, every partner is an implied agent of the other partners and of the firm. Each partner is liable for acts performed by other partners on behalf of the firm.

The above mentioned features are the real tests of partnership. In addition, partnership has the following characteristics:

6. Utmost good faith – The relations between partners are based upon mutual trust and confidence. Every partner is expected to act in the best interests of other partners and of the firm as a whole. He must observe utmost good faith in all the dealings with his co-partners. He must render true accounts and make no secret profits from the business.

7. Unlimited liability – Every partner is jointly and severally liable to an unlimited extent for the debts of the partnership firm. In case the assets of the firm are insufficient to pay the debts in full, the personal property of each partner can be attached to pay the creditors of the firm.

8. Restriction on transfer of interest – No partner can transfer his share in the partnership without the prior consent of all other partners.

9. Joint ownership and control – A partnership is owned and controlled jointly by all the partners.

Distinction Between Proprietorship and Partnership:

| Point of Distinction |

Sole Proprietorship |

Partnership |

| 1. Members |

One-man show |

Minimum: 2 Maximum: 50 |

| 2. Agreement |

Not required |

Essential |

| 3. Capital |

Contributed by the owner |

Contributed by the partners |

| 4. Registration |

No provision for registration |

Desirable |

| 5. Management |

Lies with the owner |

Lies with the partners |

| 6. Secrecy |

Easy to maintain |

Difficult to maintain |

| 7. Risk |

Borne entirely by the owner |

Shared by the partners |

| 8. Continuity |

Depends on the life of the owner |

Depends on mutual trust and unity among the partners |

| 9. Scale of Operations |

Small scale |

Medium scale |

Merits and Demerits of Partnership:

| Merits |

Demerits |

| 1. Ease of formation |

1. Limited resources |

| 2. Larger financial resources |

2. Unlimited liability |

| 3. Combined judgment |

3. Uncertain life |

| 4. Direct motivation |

4. Conflicts |

| 5. Close supervision |

5. Risk of implied agency |

| 6. Flexibility of operations |

6. Restriction on transfer of interest |

| 7. Secrecy |

7. Lesser Public confidence |

| 8. Protection of minority interest |

|

| 9. Mutual Cooperation |

|

| 10. Scope for expansion |

|

Limited Liability Partnership (LLP) – Limited partnership is now allowed in India under the Limited

Liability Partnership Act, 2008. The chief characteristics of a limited liability partnership are as follows:

- A limited liability partnership must be registered under the Act with a minimum of two partners. There is no limit on the maximum number of partners.

- An LLP is a body corporate having a separate legal entity and perpetual succession.

- In an LLP the liability of partners is limited to their agreed contributions to the LLP. No partner would be liable on account of any unauthorised or independent actions of other partners.

- An LLP must maintain annual accounts reflecting the true and fair view of its state of affairs.

- The liability of partners and the firm would become unlimited in case the firm or its partners carry out any act with the intention to defraud the creditors or any other person or for any fraudulent purpose.

- Thus, LLP is a hybrid form of business organisation combining features of both partnership firm and joint stock company.

Advantages: Limited liability partnership offers the following benefits:

- An LLP is a separate legal entity independent of the partners. It is capable of owning and holding property in its own name.

- It is much more stable than a general partnership because it is not dissolved by the retirement, insolvency, death, etc. of a partner. It enjoys perpetual existence.

- The Liability of partners in LLP is limited, they have not to take unlimited risk.

- As there is no limit on the number of partners, an LLP can raise huge funds for expansion and growth of business.

Disadvantages: An LLP suffers from the following disadvantages:

- It has to be registered under the Act. It has to spend time and money in the documents and formalities of incorporation.

- There is less secrecy of business affairs as it has to fulfil legal requirements.

- Credit standing of an LLP is reduced due to the limited liability of partners.

Distinction Between Company and Partnership:

| Basis of Distinction |

Company |

Partnership |

| 1. Formation |

By incorporation-legal formalities |

By agreement- No legal formalities |

| 2. Registration |

Compulsory |

Optional |

| 3. Legal Status |

Separate from members |

No separate entity |

| 4. Number of members |

Minimum 2 in private company and 7 in public company. Maximum 200 in private company and no limit in public company |

Minimum 2, maximum 50 |

| 5. Liability |

Limited |

Unlimited |

| 6. Transferability of interest |

Freely transferable except in case of private company |

Transferable with the consent of all partners |

| 7. Implied agency |

Members not agents of the company |

Partners are agents of the firm |

| 8. Management |

By elected representatives of members |

By partners themselves |

| 9. Statutory control |

Legal formalities concerning accounts audit, directors, etc. |

No legal formalities |

| 10. Durability |

Life independent of members |

Life dependent on members |

| 11. Dissolution |

Through legal process of winding up |

By agreement between partners |

| 12. Audit |

Compulsory in all cases |

Not always compulsory |

| 13. Scale of operations |

Large scale |

Medium size |

1.4.4 Joint Stock Company:

The company form of business organization came into existence to overcome the limitations of sole proprietorship and partnership.

According to James Stephenson, “a company is an association of many persons who contribute money or money’s worth to a common stock and employ it in some trade business, and who share the profit and loss arising therefrom”.

Under the Companies Act a company having share capital may be is defined as “a company limited by shares having a permanent paid up or nominal capital of fixed amount divided into shares, also of fixed amount held and transferable as stock and formed on the principles of having its members only the holders of those shares or stock and no other persons”.

According to Prof. Haney, “Joint stock company is a voluntary association of individuals for profit, having a capital divided into transferable shares, the ownership of which is the condition of membership”.

In the words of Justice Lindley, “By a company is meant an association of many persons who contribute money or money’s worth to a common stock and employ it for a common purpose. The common stock so contributed is denoted in money, and is the capital of the company. The persons who contribute it are its members”.

The distinctive features of the company form of organisation are as follows:

1. Separate legal existence – A company has a distinct legal entity independent of its members. It can own property, make contracts and file suits in its own name. Shareholders are not the joint owners of the company’s property.

A shareholder cannot be held liable for the acts of the company. Similarly, members of the company are not its agents. There can be contracts between a company and its members. A creditor of the company is not a creditor of its members.

2. Perpetual succession – Perpetual succession means continued existence. A company is a creation of the law and only the law can bring an end to its existence. Its life does not depend on the life of its members.

The death, insolvency or lunacy of members does not affect the life of a company. It continues to exits even if all its members die. Members may come and go but the company goes on until it is wound up.

3. Limited liability – As a company has a separate legal entity, its members cannot be held liable for the debts of the company. The liability of every member is limited to the nominal value of the shares bought by him or to the amount of guarantee given by him.

For instance, if a member has 50 shares of ₹ 10 each, his liability is limited to Rs 500. Even if the assets of the company are insufficient to satisfy fully the claims of the creditors, no member can be called to pay anything more than what is due from him. However, if the members of the company so desire, they may form a company with unlimited liability.

4. Transferability of shares – The capital of a company is divided into parts. Each part is called a share. These shares are generally transferable. A shareholder is free to withdraw his membership from the company by transferring his shares. However, in actual practice some restrictions are placed on the transfer of shares.

5. Common seal – Being an artificial entity, a company cannot act and sign itself. Therefore, it acts through human beings. All the acts of the company are authorised by its common seal. The name of the company is engraved on its common seal.

The common seal is affixed on all important documents as a token of the Company’s approval. The common seal is the official signature of the company. Any document which does not bear the common seal of the company is not binding on the company.

6. Separation of ownership and control – Members have no right to participate directly in the day- to-day management of a company. They elect their representatives, called directors, who manage the company’s affairs on behalf of the members. Thus, the ownership of a company is distributed among the shareholders while management is vested in the board of directors. The management of a company is delegated and centralised.

7. Voluntary association – A joint stock company is a voluntary association of certain persons formed to carry out a particular purpose in common. Members of a company can join it and leave it at their own freewill.

8. Artificial legal person – A company is an artificial person created by law. It exists only in contemplation of law. It is competent to enter into contracts and to own property in its own name. But it docs not take birth like a natural person and it has no physical body of a natural human being.

9. Corporate finance – The share capital of a company is generally divided into a large number of shares of small value. These shares are purchased by a large number of people from different walks of life.

10. Statutory regulation and control – Government exercises control through company law over the management of joint stock companies. A company is required to comply with several legal formalities and to file several documents with the Registrar of Companies.

Joint Stock Company At A Glance:

| Advantages |

Disadvantages |

| 1. Large capital resources |

1. Legal formalities |

| 2. Limited liability |

2. Lack of motivation |

| 3. Stability |

3. Delay in decisions |

| 4. Efficient management |

4. Economic oligarchy |

| 5. Transferability of shares |

5. Corrupt management |

| 6. Economies of scale |

6. Excessive Government control |

| 7. Democratic management |

7. Unhealthy speculation |

| 8. Public goodwill |

8. Conflict of interests |

| 9. Social utility |

9. Social evils |

Private Company – It means a company which has a minimum paid-up capital of one lakh rupees or such higher paid-up capital as may be prescribed, and which by its Articles of Association:

- restricts the right of its members to transfer shares, if any;

- except in case of one person company limits the number of its members to 200, excluding members who are or were in the employment of the company;

- prohibits any invitation to the public to subscribe for any securities of, the company;

- prohibits any invitation or acceptance of deposits from persons other than its members directors or their relatives.

The minimum number of members required to form a private company is two. Such a company must use the word ‘private’ in its name. A private company enjoys special privileges and exemptions under the Companies Act. It is generally a family affair. A private company enjoys several privileges under the Companies Act, 2013.

The main privileges available to a private company are as follows –

1. A private company can be started with just two members whereas a public company ‘requires at least seven members.

2. A private company can start its business immediately after incorporation. Unlike a public company, it is not required to obtain the certificate of commencement of business.

3. A private company is not required to issue or file a prospectus or statement in lieu of prospectus with the Registrar of Companies.

4. A private company is neither required to hold statutory meeting nor to file statutory report with the Registrar of Companies.

5. A private company can directly allot shares. There is no restriction of minimum subscription.

6. It can have only two directors whereas a public company must have at least three directors.

7. It is not required to offer new issue of shares to the existing shareholders on a pro rata basis. It can issue shares with disproportionate voting rights.

8. Its directors need not retire by rotation. Consent to act as directors or to take up the qualification shares need not be filed with the Registrar. A private company need not take the consent of the Government to grant loans to its directors. Its directors can vote on a contract in which they are interested. Persons can be appointed to office of profit.

9. A private company is exempted from restrictions concerning remuneration to managerial personnel, appointment of persons to office of profit, inter company investments and publication of accounts.

10. Two persons personally present is sufficient quorum for general meeting of a private company unless the Articles of Association provide otherwise.

11. A private company is exempted from preparing an index to its register of members.

Public Company – It means a company which –

- is not a private company;

- has a minimum paid-up capital of five lakh rupees or such higher paid-up capital, as may be prescribed;

- is a private company which is a subsidiary of a company which is not a private company.

Thus, a public company is one which:

- does not restrict the transfer of its shares

- does not limit the number of members

- can invite the general public to subscribe to its share; and debentures, and

- can invite or accept deposits from the public.

At least seven persons are required to form a public company.

One Person Company (OPC) – The Companies Act, 2013 allows the formation of one person company. As the name suggests, a one person company has only one member. The company’s name will carry a suffix ‘OPC’. The process of setting upon OPC is the same as that for a private limited company.

Since the company is owned by a single person, he must nominate someone to take charge of it in case of his death or disability. The nominee must give his consent in writing which has to be filed with the Registrar of companies.

An OPC is exempt from certain procedural formalities, such as conducting annual general meetings, general meetings and extraordinary general meetings. No provisions have been prescribed on holding board meetings if there is only one director, but two meetings need to be organised every year if there is more than one director.

Any resolution passed by the sole member must be communicated to the company and entered in the minutes book. There is, however, no relief from the provisions on audits, financial statements and accounts, which are applicable to private companies.

Benefits & drawbacks of an OPC – The biggest advantage of a one person company is that its identity is distinct from that of its owner. Therefore, if the firm is embroiled in a legal controversy, the owner will not be sued, only the company will. Another advantage is limited liability. Since the company is distinct from that of its owner, the personal assets of the shareholders and directors remain protected in case of a credit default.

On the other hand, an OPC is not easy to set up. It requires a lot of paperwork and is a time-consuming and costly process. Despite the advantages that a one person company offers, it may not be a viable option for everyone. In contrast to a company, a proprietorship is easy to set up. The paperwork involved is minimal. Of course, the risk in a proprietorship is higher as the owner is personally responsible for the business.

Comparison Between Proprietorship and Opc:

| Basis of Comparison |

Proprietorship |

OPC |

| 1. Legal status |

The firm and the owner are one |

It is a separate legal entity |

| 2. Registration |

Registration is not compulsory |

It must be registered |

| 3. Liability of the owner |

Liability of the owner is unlimited |

Liability of the owner is limited |

| 4. Setting up |

It is easy to set up, minimum paper is involved |

It is difficult to set up, involves more paperwork. It is a time consuming process |

| 5. Formalities |

No legal formalities involved |

Formalities concerning board meetings, audit etc. make it difficult to run. |

Distinction Between Partnership and Private Company:

| Basis of Distinction |

Partnership |

Private Company |

| 1. Number of members |

Maximum: 2

Maximum: 50 |

Minimum: 2

Maximum: 200 |

| 2. Registration |

Operational |

Compulsory |

| 3. Legal status |

No separate legal entity |

Separate legal entity |

| 4. Minimum paid up capital |

Not prescribed |

One lakh |

| 5. S. Liability of members |

Unlimited |

Limited |

| 6. Directors |

Not required |

Minimum two |

| 7. None |

Not required |

Must be “Private Limited” after its name |

| 8. Regulating show |

The Partnership Act, 1932 |

The Companies Act, 2013 |

Distinction Between Private and Public Companies:

| Point of Distinction |

Private Company |

Public Company |

| 1. Number of Members |

Minimum-2, Maximum-200 |

Minimum-7, Maximum- No limit |

| 2. Name |

The name must include the words “Private Limited”. |

The name must include the word “Limited”. |

| 3. Prospectus |

Need not issue and file prospectus |

Must issue and file a prospectus or a statement in lieu of prospectus. |

| 4. Allotment of shares |

No restrictions on allotment of shares. No binding on further issue of shares |

Cannot allot shares without raising minimum subscription and without complying with other legal formalities. Further issues of shares must in the first instance, be offered to the existing members. |

| 5. Share Warrants |

Cannot issue share warrants |

Can issue share warrants per bearer |

| 6. Minimum Capita |

One lakh |

Five lakh |

| 7. Listing on stock exchange |

Cannot be listed |

Can be listed |

| 8. Managerial Remuneration |

No restrictions on director’s remuneration |

Total annual remuneration must not exceed 11 per cent of the net profits. In case of insufficiency of profits the maximum limit is ₹ 50,000 per annum |

| 9. Filing |

Need not send the list of Directors and their consent to the Registrar |

Must sent list of directors, their consent to the Registrar |

| 10. Quorum at annual general meeting |

Two members personally present |

At least five members personally present |

1.4.5 Cooperative Society:

Cooperative organisation developed as a means of protecting the interests of the weaker sections of society against exploitation and oppression by the economically strong and powerful sections. It is a form of organisation wherein persons associate together voluntarily and on equal basis to further their common interests.

For example, consumers may join hands to provide goods at cheaper rates by establishing direct contacts with manufacturers and thereby eliminating the profits of middlemen. Similarly, people belonging to the working class may form a cooperative society to provide houses at low costs to the members. A cooperative society is based on the principles of self help and mutual help and its primary motive is to render service to the members.

Some popular definitions of cooperative organisation are given below :

Cooperative organisation is “a society which has its objectives for the promotion of economic interests of its members in accordance with cooperative principles”. A cooperative society is “a form of organisation wherein persons voluntarily associate together as human beings on the basis of equality for the promotion of the economic interests of themselves”.

Cooperative is a joint enterprise of those who are not financially strong and, therefore, come together not with a view to get profits but to overcome disability arising out of the want of adequate financial resource. Cooperative is an association of individuals to secure a common economic goal by honest means.

The distinctive features of cooperative organisation are as follows :

1. Voluntary association – A cooperative society is essentially a voluntary association of persons desirous of improving their economic status through joint action. Everyone having a common interest is free to join a cooperative society. He can also leave the society after giving proper notice. He can withdraw his capital but cannot transfer his share to another person. No body is forced to become a member or to continue as a member.

2. Religious and political neutrality – The membership of a cooperative society is open to all irrespective of caste, creed, religion or political affiliation. New members are always welcome to join the society. Cooperative societies represent universal brotherhood.

3. Separate legal entity – After registration a cooperative society becomes a distinct body independent of its members. It can own property and make contracts in its own name. It becomes an autonomous and self-governing organisation.

4. One-man one vote – Every member has one vote irrespective of the number of shares held by him. Rich persons holding more shares cannot dictate terms. The organisation of a cooperative society is democratic and all members have an equal voice in its management.

5. Service motive – The primary aim of a cooperative society is to provide service to its members. Its motto is ‘each for all and all for each’. However, a cooperative society

may earn some profits for the benefit of its members.

6. Disposal of surplus – The surplus of a cooperative society is not distributed among members in proportion to their capital. According to law, at least one fourth of the profits must be transferred to general reserve. A portion of the profits, not exceeding ten per cent, may be utilised for the welfare of the locality in which the society is functioning. Thus, profits of a cooperative society are utilised for the benefit of its members and the local community.

7. Limited return on capital – A dividend not exceeding 10 per cent can be paid to members on the capital. The members of a cooperative society are thus assured of a fixed return on their investment.

8. Cash Trading – Cooperative societies sell goods on cash basis. Cash trading provides protection against bad debts and maintains working capital. However, an exception, may be made in the case of members.

9. Perpetual existence – Once registered a cooperative society enjoys perpetual existence. It is created by law and law alone can dissolve it.

10. State control – Every cooperative society must be registered under the Cooperative Societies Act, 1912 or respective State cooperative laws. It is required to observe the prescribed rules and regulations. Government exercises supervision and control over cooperative societies to ensure their proper functioning.

Cooperative Organisation At a Glance:

| Advantages |

Disadvantages |

| 1. Easy to form |

1. Limited finance |

| 2. Open membership |

2. Lack of expertise |

| 3. Limited liability |

3. Lack of incentive |

| 4. Continuity |

4. Non-transferability of interest |

| 5. Democratic control |

5. Lack of secrecy |

| 6. Low operating costs |

6. Legal formalities |

| 7. State patronage |

7. Disputes among members |

| 8. Internal financing |

|

| 9. Cheaper and better supplies |

|

| 10. Social utility |

|

Distinction Between Company And Cooperative:

| Point of Difference |

Company |

Cooperative |

| 1. Formation |

Many legal formalities |

Few legal formalities |

| 2. Governing Law |

Under the Companies Act |

Under the Cooperative Societies Act |

| 3. Number of members |

Minimum two in private company and seven in public company. Maximum 200 in private company and no limit in public company. Membership open to all. |

Minimum ten, maximum no limit. Membership restricted to a particular locality or group |

| 4. Management |

By Board of Directors |

By Managing Committee |

| 5. Basic Object |

Earning profits |

Service to members |

| 6. Voting rights |

One share one vote |

One member one vote |

| 7. Transferability of shares |

Freely transferable |

Not transferable, but returnable to the society |

| 8. Capital Subscription |

No limit on individual holding of shares. New shares first offered to existing members. Subscription list closed. |

Individual subscription to capital may be limited. New shares issued to admit new members. Membership open. |

| 9. Distribution of profits |

Dividend in proportion to share in capital. |

Limited dividend, rest on equitable basis. |

| 10. Privileges |

No special exemptions |

Special exemptions relating to stamp duty, income tax, etc. |

| 11. Return of capital |

No member can demand back his capital except at the time of winding up |

A member can demand his capital during life time of the society. |

| 12. Scale of operations |

Large scale |

Small scale |

![]()

![]()

![]()

![]()

![]()