CA Final DT Paper Nov 2020 (Old Syllabus) – CA Final DT Question Bank is designed strictly as per the latest syllabus and exam pattern.

CA Final Direct Tax Question Paper Nov 2020 (Old Syllabus)

Question 1.

Tulsi Ltd., engaged in manufacturing activity shows a net profit of ₹ 2,47,00,000 for the financial year ended on 31st March, 2021 after the debit credit of following items:

(i) ₹ 45 lakhs paid to X Ltd. towards feasibility study conducted for examining proposals for technological advancement relating to the existing business, where the project was abandoned without creating a new asset.

(ii) Depreciation charged during the year amounted to ₹ 72 lakhs.

(iii) It incurred ₹ 3 lakhs as expenditure for public issue of shares. The public issue could not materialize due to non-clearance by SEBI.

(iv) Profit of ₹ 10 lakhs on sale of plot of land to S Ltd., a domestic company, the entire shares of which are held by the assessee company. The plot was acquired by Tulsi Ltd. on 30.09.2019.

(v) Loss of ₹ 3 lakhs incurred by way of trading in futures and options (derivatives) in stocks in a recognized stock exchange.

(vi) Provision for gratuity based on actuarial valuation was ₹ 130 lakhs. Actual gratuity paid was so ₹ 80 lakhs.

(vii) ₹ 8.50 lakhs, being the additional compensation from the State Government pursuant to an interim order of the Court in respect of land acquired by the State Government in the the previous year 2015-16.

(viii) One time license fee of ₹ 80 lakhs paid to a foreign company for obtaining franchise on 01.10.2020.

(ix) Payment of ₹ 15 lakhs towards purchase of software from a non-resident meant for subsequent resale in the Indian market (no tax deducted at source), was ultimately sold at a profit during financial year 2020-21.

![]()

Additional Information:

(1) Asa corporate debt restructuring, the bank has converted unpaid interest of ₹ 10 lakhs upto 31st March, 2020 into a new loan account repayable in five equal annual instalments. The first instalment of ₹ 2 lakhs was paid in March, 2021 by debiting new loan account.

(2) Depreciation allowable as per Income-tax Act, 1961 is ₹ 75 lakhs.

(3) The company has installed a new plant and machinery worth ₹ 300 lakhs on 01.06.2020 in the notified backward area in the state of Telangana. Further, it invested ₹ 250 lakhs in the plant and machinery on 01.11.2020 out of which machinery worth ₹ 50 lakhs was second hand. Additional depreciation and Investment allowance on this machinery was not considered while calculating depreciation as per Income-tax Act.

Compute the total income of M/s. Tulsi Ltd. for the A.Y. 2021-22 by analyzing, integrating and applying the relevant provisions of Income-tax Act, 1961 (ignoring MAT and the provisions of section 115BAA). Explain in brief, the reasons for the treatment of each item.

Solution:

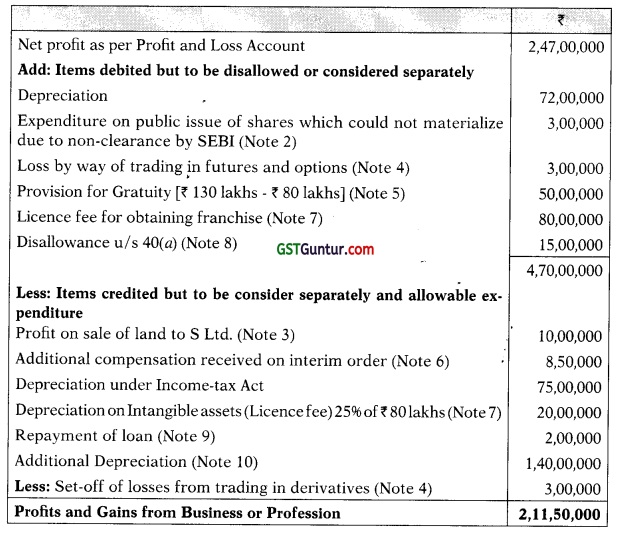

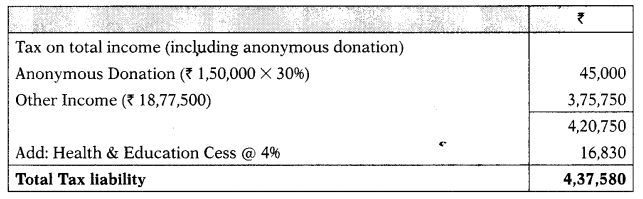

Computation of Total Income of Tulsi Ltd. for the A.Y. 2021-22

Notes:

(1) As per Delhi High Court in case of Priya Village Roadshows Ltd. it was held that if there is no creation of a new asset, then the expenditure incurred on feasibility study for the technological advancement of the project which was abandoned without creating a new asset, would be of revenue nature.

As the expenditure is already debited to profit and loss account, no further treatment is required.

![]()

(2) Share issue expenses constitute a capital expenditure, even though the company could not go in for the public issue on account of non-clear-ance by SEBI. Though the efforts were aborted, the fact remains that the expenditure incurred was only for the purpose of expansion of the capital base. The capital nature of the expenditure would not be lost on account of the abortive efforts [Mascon Technical Services Ltd. v. CIT (2013) (Mad.)]. Since the expenditure has been charged to profit and loss, the same has to be added back.

(3) As per sec. 47(iv), any transfer of a capital asset by a holding company to its wholly owned subsidiary company, being an Indian company, is exempt in the hands of holding company. In this case, Tulsi Ltd. had sold plot of land to S Ltd. which is 100% subsidiary company of Tulsi Ltd. and also an Indian company. Therefore, the capital gain from such transfer is exempt in the hands of Tulsi Ltd. As the profit was already credited to P & L account, it shall be reduced from the profit.

(4) As per section 43(5), an eligible transaction of trading in derivatives in stocks in a recognized stock exchange is not a speculative transaction. In this case, the company is engaged in the business of manufacturing and hence, the loss on account of trading in derivatives is not incurred wholly and exclusively in relation to such business and hence, has to be disallowed while computing profits from the business of manufacturing.

Trading in derivatives in stocks is also not incidental to the business of manufacturing. Therefore, it has to be assumed that the company is also carrying on the business of trading in derivatives in stocks in addition to its manufacturing business.

In this case, the loss has to be disallowed at the first instance while computing income from the business of manufacturing since it is not wholly and exclusively incurred for the said business and thereafter, loss from trading in derivatives has to be set-off against the profits from manufacturing business applying the provisions of section 70(1) permitting inter-source set-off of losses.

(5) As per sec. 40A(7), provision for Gratuity shall be available to the assessee only if it is made for payment to Approved Gratuity Fund or made for Gratuity which has become due and payable during the current previous year. Therefore, in this case, only the actual gratuity paid by Tulsi Ltd. shall be eligible for deduction and provision of ₹ 50 lakhs [₹ 130 lakhs – ₹ 80 lakhs] shall be disallowed.

(6) As per the proviso to Sec. 45(5), where any amount of compensation received in pursuance of an interim order of a court, Tribunal or other authority shall be deemed to be income chargeable under the head “Capital gains” of the previous year in which the final order of such court, Tribunal or other authority is made. Hence, the additional compensation received on interim order shall not be treated income as Final order is still not passed.

![]()

(7) Franchise is an intangible asset eligible for depreciation @ 25%. Since one-time licence fees of ₹ 80 lakhs paid to a foreign company for obtaining franchise has been debited to profit and loss account, the same has to be added back. Depreciation @ 25% has to be provided in respect of the intangible asset since it has been used for more than 180 days during the year.

(8) Notification No.21/2012 provides that no deduction shall be made u/s 194J on payment by a person for acquisition of software from resident transferor where the software is acquired in a subsequent transfer and the transferor has transferred the software without any modification and tax has been deducted on it earlier. However, in this case, Tulsi Ltd. has purchased software from non-resident and therefore, tax shall be deducted at source.

Since, no tax has been deducted at source on payment of ₹ 15 lakhs made to non-resident for purchase of software, the same shall be disallowed u/s 40(a).

(9) Conversion of unpaid interest into a new loan shall not be deemed as actual paymdnt of interest for the purpose of deduction u/s 43B. Consequently such converted interest will not be deductible, but on repayment of such loan, it shall be allowed as deduction in the year of payment. [Kalpana Lamps and components Ltd. (2002) (Mad.)]

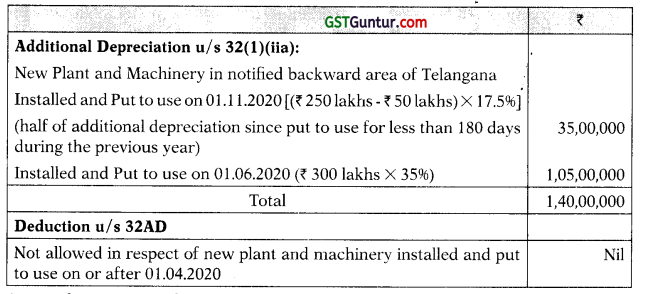

(10) Calculation of Additional Depreciation and Deduction u/s 32AD:

Since, the company has installed a new plant and machinery in the notified backward area in the State of Telangana, it shall be eligible for additional depreciation @ 35% of actual cost of eligible asset. However, in respect of plant and machinery acquired on 01.11.2020, only half of additional depreciation ie. 17.5% (50% of 35%) shall be allowed since it has been put to use for less than 180 days during the previous year.

Additional depreciation shall not be available in respect of second hand machinery.

Deduction u/s 32AD is allowed only if the new plant and machinery acquired and installed between 01.04.2015 to 31.03.2020. In this case, the new plant and machinery were acquired and installed after 31.03.2020 and therefore, no deduction u/s 32AD shall be allowed to Tulsi Ltd.

![]()

Question 2.

(a)

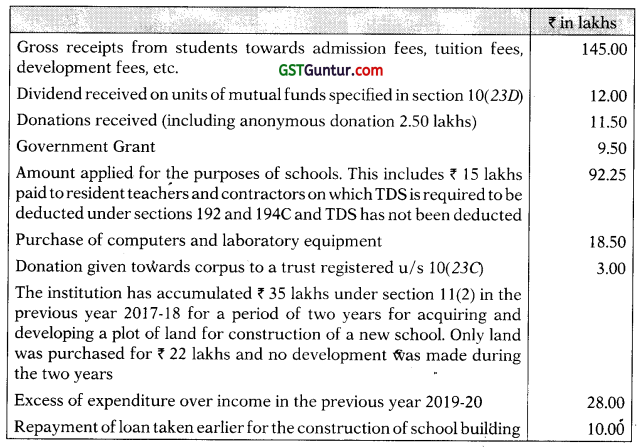

Compute total income of the trust and tax payable by it for the Assessment year 2021-22.

Solution:

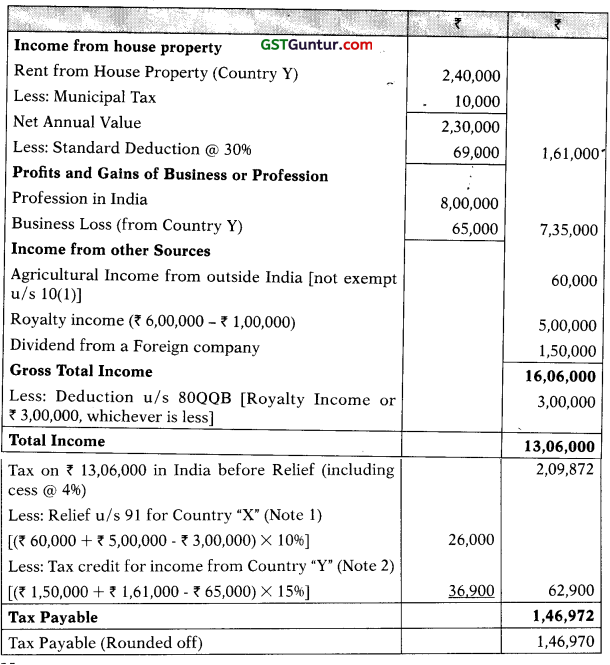

Computation of Taxable Income of Trust for A.Y. 2021-22

Computation of Income Tax Liability of Trust for the A.Y. 2021-22

![]()

Notes:

(1) Only the anonymous donations in excess of the limit specified below would be subject to tax @ 30% under section 115BBC. The limit is the higher of the following:

- 5% of the total donations received by the assessee (5% × ₹ 11,50,000) = ₹ 57,500 or

- 1 lakh.

Therefore, Anonymous donation taxable 30% shall be ₹ 2,50,000 – ₹ 1,00,000 = ₹ 1,50,000.

Now, total donation is ₹ 11,50,000 of which taxable Anonymous donation is ₹ 1,50,000.

Thus, Donations (other than taxable anonymous donations) taxable at normal rate = ₹ 11,50,000 – ₹ 1,50,000 = ₹ 10,00,000.

Here, a view is taken that the amount of anonymous donations exempt from the applicability of 30% tax [₹ 1,00,000 in this solution] is eligible for retention/accumulation to the extent of 15% as per sec. 11(1) with out conditions in the same line as with other income and the voluntary contributions. A contrary view may also be taken that such anonymous donations chargeable to tax at normal rates are not eligible for retention/ accumulation to the extent of 15%. If this view is taken, ₹ 26,47,500, being 15% of 1,76,50,000, has to be set apart (instead of ₹ 26,32,500, being 15% of ₹ 1,75,50,000)

(2) As per Sec. 2(24)(xviii), assistance in the form of a subsidy received from the Central or State Government or any authority or body or agency shall be taxable.

(3) As per Explanation 3 to Sec. 11(1), for the purpose of determining the amount of application, the provisions of Sec. 40(a)(ia), shall, mutatis mutandis, apply as they apply in computing the income chargeable under the head Profit and Gains of Business or Profession. Therefore, administration expense of ₹ 15 lakhs paid to resident teachers and contractors on which tax is required to be deducted shall be disallowed u/s 40(ia) to the extent of 30% of 15 lakhs i.e. ₹ 4,50,000.

(4) As per Explanation 2 to Sec. 11(1), any amount credited or paid out of income to any trust registered u/s 10(23C) as a contribution with a specific direction that it shall form part of the corpus of the trust shall not be treated as application of income for charitable or religious purposes.

(5) ₹ 35 lakhs, being excess of expenditure over income in the preceding financial year 2019-20 can be treated as application of income of the current year as held by Delhi High Court in Raghuvanshi Charitable Trust and others (2011).

(6) As per section 11(3) where the income accumulated for the specified purpose by the trust is not utilized for the said purpose within the period (not exceeding 5 years) for which it was accumulated, or in the year immediately following the expiry thereof, then the unutilized amount is deemed to be the income of the charitable institution for the year immediately following the expiry of the period of accumulation.

In the given question, the institution accumulated ₹ 35,00,000 in the previous year 2017-18 for acquiring and developing a plot of land for construction of a new school for a period of 2 years. Period of accumulation thus expired on 31.3.2020. The assessee has spent ₹ 22,00,000 [out of accumulated sum of 135,00,000] in the P.Y. 2020-21. Hence, the unutilized amount of ₹ 13,00,000 is deemed to be income of the previous year 2020-21.

![]()

(b) Mr. Suresh, an individual resident in India aged 60 years, furnishes you the following particulars of income earned in India, Country “X” and Country “Y” for the previous year 2020-21. India has not entered into double taxation avoidance agreement with Country X and has a double taxation avoidance agreement with country Y.

| ₹ | |

| Income from profession carried on in India | 8,00,000 |

| Agricultural income in Country “X” (gross) | 60,000 |

| Dividend received from a company incorporated in Country “Y” (gross) | 1,50,000 |

| Royalty income from a literary book from Country “X” (gross) | 6,00,000 |

| Expenses incurred for earning royalty | 1,00,000 |

| Business loss in Country “Y” (Proprietary business) | 65,000 |

| Rent from a house situated in Country “Y” (gross) | 2,40,000 |

| Municipal tax paid for above house in Country “Y” (not allowed as deduction in country “Y”) | 10,000 |

Note: Business loss in Country “Y” not eligible for set off against other incomes as per law of that country. Royalty income brought in India in May, 2021. The rates of tax in Country “X” and Country “Y” are 10% and 15%, respectively. Compute total income and tax payable Suresh in India for Assessment Year 2021-22. Ignore Sec. 115BAC.

Solution:

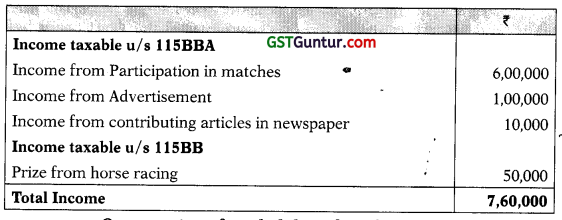

Computation of Total Income and Tax liability of Mr. Suresh for the A.Y. 2021-22

![]()

Note:

1. Relief u/s 91 in respect of Country X is allowed on doubly taxed Income at lower of the following:

Average rate of tax in India:

\(\frac{\text { Tax payable in India }}{\text { Total Income }}\) × 100 = \(\frac{2,09,872}{13,06,000}\) × 100 = 16.07%

Average Rate.of Tax in Country “X” is already given as 10%.

2. Tax credit in respect of income from Country “Y”:

It is assumed that DTAA provides that tax paid in other country will be allowed as credit while computing Indian tax liability.

Question 3.

(a) Examine the liability for tax deduction at source in the following cases, which have taken place during the year ended 31st March, 2021:

(i) Sartaj Hotels Ltd. paid tips to his employees, received from its customers (who made payments through credit card). Examine whether tips distributed to the employees would fall within the meaning of “Salaries” to attract tax deduction at source under section 192?

(ii) Skyhigh Airlines Ltd. has paid amount of X 22 lakhs during the year ended 31.3.2021 to Airports Authority of India towards landing and parking charges.

(iii) Paras Hospitals Pvt. Ltd. has recently accorded recognition by several insurance companies to admit and treat patients on cashless hospitalization basis. Payment to the assessee hospital will be made by Third Party Administrators (TPA) who will process the claims of the patients admitted and make payments to the various hospitals including the assessee, All TPAs are corporate entities. The assessee wants to know whether the TPAs are bound to deduct tax at source under section 194J or under section 194C.

(iv) Beta Ltd., an event management company, organized a concert of international artists in India. In this connection, it engaged the services of an overseas agent Mr. Mike from UK to bring artists to India. He contacted the artists and negotiated with them for performance in India in terms of the authority given by the company. He did not take part in event organized in India. The company made a payment of commission equivalent to ₹ 2 lakhs to the overseas agent.

Solution:

(i) The facts of the case are similar to the facts in ITC Ltd. v. CIT (2016), where the Supreme Court observed that the person who is responsible for paying the employee (i.e. tips) is not the employer at all, but a third party, namely, the customer. Thus, income from tips would be chargeable in the hands of employees as “Income from Other Sources” and therefore, section 192 would not get attracted.

Also, the Supreme Court observed that the tips paid by the employer to the employees had no reference to the contract of employment at all as they were received by the employer in a fiduciary capacity as trustee for payments which is later on disbursed to the employees for service rendered to the customer. The Supreme Court, therefore, held that there is no liability on the assessee company to deduct tax at source u/s 192 from the amount of tips collected and distributed to its employees.

Thus, in this case, tips distributed by Sartaj Hotels Ltd. to his employees will not attract tax deduction at source u/s 192.

![]()

(ii) The Supreme Court in the case of Japan Airlines Co. Ltd. v. CIT and CIT v. Singapore Airlines Ltd. (2015) observed that the landing and parking charges which are fixed by the Airports Authority of India are not merely for the ‘use of the land’. These charges are also for services and facilities offered in connection with the aircraft operation at the airport which include providing of air traffic services, ground safety services, aeronautical communication facilities, installation and maintenance of navigational aids and meteorological services at the airport.

Thus, tax is not deductible u/s 194-1 which provides deduction of tax for payment in the nature of rent. Hence, tax is deductible @ 2% u/s 194C by the airline company, Skyhigh Airlines Ltd., on payment of ₹ 22 lakhs made towards landing and parking charges to the Airports Authority of India for P.Y. 2020-21.

(iii) As per Circular No. 8/2009, Third Party Administrators (TPAs) who are making payment on behalf of insurance companies to hospital for settlement of medical/insurance claims, etc., under various schemes including cashless schemes, are liable to deduct tax at source u/s 194J @ 10%. Therefore, TPAs are bound to deduct tax at source u/s 194J in respect of payments made to various hospitals including Paras Hospitals Pvt. Ltd.

(iv) An overseas agent of an Indian company operates in his own country and no part of his income accrues or arises in India. His commission is usually remitted directly to him and is, therefore, not received by him or on his behalf in India. The commission paid to the non-resident agent for services rendered outside India is, thus, not chargeable to tax in India [DIT (International Taxation) v. Wizcraft International Entertainment (P.) Ltd. (2014) (Bom.)].

Since commission income for contacting and negotiating with artists by Mr. Mike, a non-resident, who remains outside India is not subject to tax in India, consequently, there is no liability for TDS. It is assumed that the commission of ₹ 2 lakhs was remitted to Mr. Mike outside India.

![]()

(b) Michael, a foreign national and a cricketer came to India as a member of Australian cricket team in the year ended 31st March, 2021. He received ₹ 6 lakhs for participation in matches in India. He also received ₹ 1 lakh for an advertisement of a product on TV. He contributed articles in newspaper for which he received ₹ 10,000/ -. When he stayed in India, he also won a prize of ₹ 50,000/- from horse racing in Mumbai. He has no other income in India during the year.

(i) Compute tax liability of Michael for Assessment Year 2021-22.

(ii) Are the income-specified above subject to deduction of tax at source?

(iii) Is he liable to file his return on income for Assessment Year 2021-22?

Solution:

(i) Computation of Total Income of Michael

Computation of tax liability of Michael

| ₹ | |

| Tax u/s 115BBA [(₹ 6,00,000 + 1,00,000 + ₹ 10,000) × 20%] | 1,42,000 |

| Tax u/s 115BB [₹ 50,000 × 30%] | 15,000 |

| Total tax | 1,57,000 |

| Add: Health & Education cess @ 4% | 6,280 |

| Total tax liability | 1,63,280 |

![]()

(ii) As per Sec. 194E, where any income referred to in Sec. 1T5BBA is payable to a non-resident sportsman which is not a citizen of India, the person responsible for making the payment shall, at the time of credit or payment, whichever is earlier, deduct tax from such income @ 20%. Therefore, the income from participation in matches, income from advertisement and income from contributing articles in newspaper shall be liable for deduction at source @ 20%.

As per Sec. 194BB, any person being the holder of license for the horse racing, who is responsible for paying any income by way of winnings from any horse race in an amount exceeding ₹ 10,000 shall, at the time of payment, deduct tax thereon at the rates in force.

Therefore, the prize of ₹ 50,000 from horse racing shall be subject to deduction of tax @ 30%.

Since, Michael is a non-resident, the amount of tax deducted at the prescribed rates would be increased by health & education cess @ 4%.

(iii) As per Sec. 115BBA, it shall not be necessary for the assessee to furnish the return of income u/s 139(1) if his total income consists of income referred to in Sec. 115BBA only and tax has been deducted at source from it. However, in this case, the total income of Michael also includes income from winnings from horse race and therefore, Michael is required to file the returnof income u/s 139(1).

![]()

Question 4.

(a) Answer any two out of the following three:

(i) Mr. Rakesh received the draft order from the assessing officer as per section 144C of the Income-tax Act, 1961 due to variations determined by the Transfer pricing officer in the arm’s length price. But Mr. Rakesh did not prefer to file the objection against the draft order before the Dispute Resolution penal, instead, he prefer to do appeal before the CIT appeals u/s 246A against the final order reoeived from the Assessing officer.

You are required to advise Mr. Rakesh, whether his contentions are tenable? Discuss the issue with reference to provisions of section 144C – of the Income-tax Act, 1961.

(ii) During search conducted on premises of assessee, some gold bars were seized by the department from lockers of assessee. Assessee voluntarily disclosed some income during course of search. Assessee moved an application before assessing officer, for adjustment of tax liability on income surrendered during search by sale of seized gold bars. However said application was turned down by assessing officer. Explain whether action of the AO is justified, in light of relevant case laws?

(iii) In the case of Mr. Vinod, a summary assessment was made under section 143(1) for assessment year 2016-17 without calling him. Thereafter, Mr. Vinod has received a notice under section 148 on 6th April, 2019 for reopening of assessment. Can Mr. Vinod challenge the legality of the notice on the ground of change of opinion?

Solution:

(i) As per Sec. 144C, on receipt of the draft order from the A.O., the eligible assessee shall, within 30 days of the receipt by him of the draft order:

(a) File his acceptance of the variations with the A.O.; or

(b) File his objections, if any, to such variation with,—

- the Dispute Resolution Panel and

- the A.O.

The A.O. shall complete the assessment on the basis of the draft order, if:

(a) The assessee intimates to the A.O. the acceptance of the variation; or

(b) No objections are received within the period of 30 days specified above.

![]()

However, it is not mandatory for the eligible assessee to file objections with the Dispute Resolution Panel against the draft assessment order of A.O. He may choose to file a appeal before the CIT(A) against the final assessment order instead of filing the objections with the Dispute Resolution Panel against the draft assessment order of the A.O.

Therefore, in this case, Mr. Rakesh may, instead of filing objections against the draft order before the Dispute Resolution Panel, prefer to file appeal before the CIT(A) u/s 246A against the final order received from the A.O.

(ii) The issue under consideration is that whether the assessee’s application, for adjustment of tax liability on income surrendered during search by sale of seized gold bars, can be entertained, where assessment has not been completed.

The facts of the case are similar to the facts in the case of Hemant Kumar Sindhi&Anotherv. CIT{2014), where the Allahabad High Court observed that section 132B(l)(z) uses the expression ‘the amount of any existing liability’ which postulates a liability that is crystallized by adjudication. It further uses the expression ‘the amount of the liability determined’ which happens only on completion of the assessment.

Thus, until the assessment is complete it cannot be postulated that a liability has been crystallized. Therefore, the High Court held that the Assessing Officer was justified in his conclusion that it is only when the liability is determined on the completion of assessment that it would stand crystallized and in pursuance of which a demand can be raised and recovery can be initiated.

On applying the above rationale in the present case, the turning down of assessee’s application for adjusting tax liability on income surrendered during search by sale of seized gold bars is justified.

(iii) As per section 143(1), while processing return of income, only the adjust-ments relating to any arithmetical error in the return, incorrect claim which is apparent from any information in the return, disallowance of loss claimed if return of loss furnished after the due date u/s 139(1), disallowance of expenditure not considered for computing total income in return but indicated in audit report, disallowance of deduction under specified sections if return is furnished after due date u/s 139(1).

Thus, while making the adjustments u/s 143(1), the Assessing Officer has no power to go beyond the information given in the return and make any allowance or disallowance except as specified in that section. Therefore, the intimation given u/s 143(1) cannot be treated as an order of assessment. Applying the above rationale, the SC in the case of ACIT v. Rajesh Jhaveri Stock Brokers P. Ltd. (2007) held that intimation u/s 143(1) is not an assessment order. Hence, the question of change of opinion does not arise at all since no assessment has been done u/s 143(1).

Therefore, Mr. Vinod cannot challenge the legality of the notice issued under section 148, for reopening the assessment, on the ground of change of opinion in the given case.

![]()

(b) Examine, with reasons, whether the following transactions attract income tax in India, in the hands of recipients under section 9 of Income-tax Act, 1961:

(i) A firm of solicitors in New Delhi engaged a barrister in UK for arguing a case before Hon’ble Supreme court of India. A payment of 5000 pounds was made as per terms of professional engagement.

(ii) A non-resident German company, which did not have a permanent establishment in India, entered into an agreement for execution of electrical work in India. Separate payments were made to the German Company towards drawing & designs, which were described as “Engineering Fee”. The assessee contended that such business profit should be taxable in Germany as there is no business connection within the meaning of section 9(1)(i) of the Income-tax Act, 1961.

(iii) Ekta Engineering, a non-resident foreign company entered into a collaboration agreement on 25/06/2019, with an Indian company and was in receipt of interest on 896 debentures of ₹ 10 lakhs, issued by Indian company, in consideration of providing technical know-how utilised in its business in Mumbai during previous year 2020-21.

Solution:

(i) As per section 9(1)(i), all income accruing or arising, whether directly or indirectly, through or from any business connection in India is deemed to accrue or arise in India.

In the given case, there exists a professional connection between the firm of solicitors in New Delhi and the barrister in UK. Further, the expression “business” includes not only trade and manufacture; but also “profession”. Thus, such professional connection would amount to “business connection” under section 9(1)(i) as per Supreme Court judgment in Barendra Prasad Roy v. ITO (1981).

Hence, the amount of 5,000 pounds paid to the barrister in UK would be deemed to accrue or arise in India under section 9(l)(z) and it will be liable to tax in India.

(ii) In the given case, separate payments have been made towards drawings and designs which is described as “engineering fee” but are actually in the nature of fee for technical services. Therefore, it is taxable in India by virtue of section 9(1)(vii) – AEG Aktiengesellschaftv. CIT(2004) (Kar.).

As per Explanation to section 9, where income is deemed to accrue or arise in India under section 9(1)(vii), such income shall be included in the total income of the non-resident, irrespective of whether it has a residence or place of business or business connection in India. Thus, it will be taxable in the hands of the German Company even though it does not have a permanent establishment in India.

(iii) Debentures of ₹ 10 lakhs issued by the Indian Company as consideration for providing technical know-how is in the nature of fee for technical services and herice as per Sec. 9(1)(vii) it will be deemed to accrue or arise in India. Thus, it will be liable to tax in India.

As per section 9(1)(v), income by way of interest payable by a person who is a resident of India is deemed to accrue or arise in India. So, interest income from these debentures of an Indian company will also be deemed to accrue or arise in India in the hands of Ekta Engineering. Therefore, interest income will also be taxable.

Note: The provisions of double taxation avoidance agreement, if any, applicable in the above cases, have not been taken into consideration since the question specifically requires to examine the taxability of the above transactions under section 9.

![]()

Question 5.

(a)

(i) Cash of ₹ 50 lakhs was seized on 12.9.2020 in a search conducted as per section 132 of the Act. The assessee moved an application on 27.10.2020 to release such cash after explaining the sources thereof, which was turned down by the department. The assessee seeks your opinion on the following issues:

- Can the department withhold the explained money?

- If yes, then to what extent and up to what period?

(ii) The assessing officer has initiated the penalty proceedings under section 270A for under reporting of income and launched prosecution proceedings under section 276C for wilful evasion of tax at the time of completion of Re-assessment of Mr. Pradeep under section 147 of Income-tax Act, 1961.

Mr. Pradeep filed an application for the immunity from imposition of penalty and prosecution before the assessing officer. Is he entitled to file application for immunity from penalty and prosecution under sections 270A and 276C respectively before the Assessing Officer?

Solution:

(i) As per First Proviso to Sec. 132B(l)(z), if the person whose assets have been seized u/s 132 makes an application to the A.O. for release of asset within 30 days from the end of the month in which the asset was seized, and the nature and source of acquisition of any such asset is explained to the satisfaction of the A.O., then the amount of any existing liability may be recovered out of such asset and the remaining portion, if any, of the asset may be released, with the prior approval of the PCCIT or CCIT or PCIT or CIT, to the person from whose custody the assets were seized. Such asset is to be released within 120 days from the date on which the search was completed.

In this case, the application for release of asset was made within 30 days from the end of the month in which the asset was seized and therefore, the amount of any existing liability may be recovered from cash of ₹ 50 seized and the balance, may be released within 120 days from the date on which the last of the authorizations for search u/s 132 was executed.

However, in this case, it has been given that the assessee’s application for release of the asset, explaining the sources thereof, was turned down by the Department. It is possible to take a view that the application was turned down due to the reason that the A.O. was not satisfied with the explanation given by the assessee as to the nature and source of acquisition of the asset. In such a case, the cash cannot be released.

![]()

(ii) As per Sec. 270AA, in order to avail immunity from imposition of penalty u/s 270A and initiation of prosecution proceedings u/s 276C, an assessee may make an application to the A.O., within one month from the end of the month in which the order u/s 147 has been received, in such form and verified in such manner as may be prescribed, by fulfilling the following conditions:

(a) the tax and interest payable as per the order of assessment or reassessment u/s 143(3) or 147 has been paid within the period specified in such notice of demand; and

(b) no appeal has been filed against such order.

However, if the proceedings for penalty u/s 270A have been initiated under the circumstances of misreporting of income, immunity u/s 270AA shall not be granted.

Since, in this case, the proceedings for penalty u/s 270A has been initiated in respect of under reporting of income, Mr. Pradeep can file an application u/s 270AA for immunity from imposition of penalty u/s 270A and prosecution u/s 276C provides he satisfies the above conditions.

![]()

(b) ABC Ltd., an Indian company Declared income of ₹ 150 crores computed in accordance with Chapter IV-D before making any adjustments in respect of the following transaction for the year ended on 31.03.2021:

Unisea Ltd., a Swedish company advanced a loan of Euro 500 crores carrying interest @ 8% per annum during the FY 2020-21 to ABC Ltd. The total Book value of assets of ABC Ltd. on 31 /03/2021 was ₹ 70,000 crores. The said Swedish Co. also advanced a loan of similar nature & amount to another Indian Co. @ 6% per annum during the EY. 2020-21. The total interest paid for the year was 40 crore Euros,

(i) You are required to make primary adjustments, if any, to the above in come keeping in mind transfer pricing provisions contained in Section 92 of IT Act, 1961 for filing return of income for the AY 2021-22.

(ii) You have to elaborate on secondary adjustments required to be made if any, under said provisions of IT Act, 1961.

(iii) If ABC Ltd. opts for additional tax instead of repatriation of excess money by Unisea Ltd. calculate additional tax liability required to be made.

Value for 1 Euro was ₹ 85, throughout the year.

Solution:

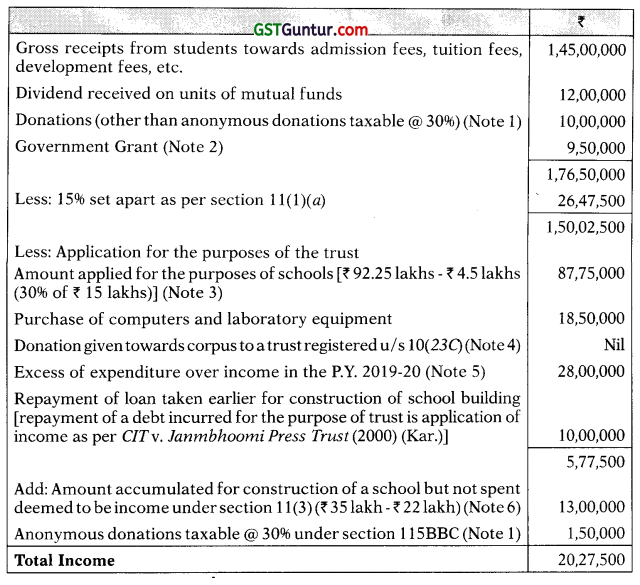

(i) As per section 92A two enterprises are deemed to be associated enterprises if, at any time during the previous year, a loan advanced by one to other constitutes 51% or more of book value of total assets of other. In this case, Unisea Ltd., a Swedish Company, has advanced a loan of ₹ 42,500 crores (Euro 500 crores × ₹ 85 per Euro) to ABC Ltd. which constitutes 60.71 % of the total book value of assets of ABC Ltd. Therefore, Unisea Ltd., a Swedish Company and ABC Ltd., a domestic company are deemed to be associated enterprises.

![]()

In this case, Unisea Ltd. has advanced loan to ABC Ltd. @ 8% per annum. Unisea Ltd. also had advanced loan of similar nature and amount to Indian company @ 6% per annum during the EY. 2020-21. Therefore, it is necessary to determine Arm’s Length Price (ALP) in accordance with the provisions of transfer pricing.

Primary adjustment required to be made:

| ₹ in crores | |

| Interest paid by ABC Ltd. to Unisea Ltd. (Euro 500 crores × ₹ 85 × 8%) | 3,400 |

| Interest as per Arm’s Length Price (Euro 500 crores × ₹ 85 × 6%) | 2,550 |

| Increase in Total Income of ABC Ltd, (₹ 3,400 crores – ₹ 2,550 crores) | 850 |

(ii) As per Sec. 92CE, where a primary adjustment to transfer price has been made suo motuby the assessee in his return of income, the assessee shall make a secondary adjustment. Therefore, on account of the primary adjustment of ₹ 850 crores, the total income of ABC Ltd. for A.Y. 2021-22 would increase by ₹ 850 crores.

Where as a result of primary adjustment to the transfer price, there is an increase in the total income of the assessee, the excess money which is available with its associated enterprise, if not repatriated to India within 90 days from the due date of filing ROI u/s 139(1), shall be deemed to be an advance made by the assessee to such associated enterprise and the interest on such advance, shall be computed in such manner as may be prescribed and will be treated as the income of the assessee.

Accordingly, the excess money (i.e., ₹ 850 crores) available with the associated enterprise (Le., Unisea Ltd.), if not repatriated to India within 90 days from the due date of filing ROI u/s 139(1) would be deemed as an advance made by the ABC Ltd. to Unisea Ltd. Interest would be calculated on such advance at the rate of six month LIBOR as on 30th September + 3%, since the international transaction is denominated in foreign currency. Such interest, if any, would be added to the total income of ABC Ltd.

(iii) As per section 92CE, where the excess money has not been repatriated within the prescribed time, the assessee may, at his option, pay additional income tax @18% plus surcharge @12% plus cess @ 4% on such excess money.

Therefore, in this case, if ABC Ltd. opts for additional tax liability instead of repatriation of excess money, then it has to pay additional income tax @18% (plus surcharge and cess) on excess money of ₹ 850 crores and the additional tax liability will comes to ₹ 178.2144 crores.

![]()

Question 6.

(a) Describe procedures to be followed by Authority of Advance ruling ” on receipt of application under section 245R and the circumstances in which it should not allow it.

Solution:

As per Sec. 245R, on receipt of application:

(i) The Authority will forward a copy of the application to Principal Commissioner or Commissioner and call upon him to furnish relevant records, if necessary. Such records will be returned to the Principal Commissioner or Commissioner as soon as possible.

(ii) After examining the application and the relevant records, the Authority may either allow or reject the application. Before rejection of application, an opportunity of being heard will be given.

(iii) The order of rejection will contain reasons for such rejection:

(iv) Order of rejection is final and NO appeal against such order can be made.

(v) Where an application is allowed, the Authority shall, after examining such further material as may be placed before it by the applicant or obtained by the Authority, pronounce its advance ruling on the question specified in the application.

(vi) On request of applicant, the Authority shall, before pronouncing its advance ruling, provide an opportunity to the applicant of being heard, either in person or through a duly authorised representative.

(vii) The Authority shall pronounce its advance ruling in writing within 6 months of the receipt of application.

(viii) After pronouncement of advance ruling, the authority shall send a certified copy to the applicant and to the Principal Commissioner or Commissioner, as soon as may be, after such pronouncement.

Circumstances in which the Authority shall not allow the application:

The Authority shall not allow the application where the question raised in the application:

(a) is already pending before any income tax authority, ITAT, or

(b) is already pending before any court, or

(c) involves determination of fair market value of any property, or

(d) relates to a transaction or issue, which is designed prima facie for avoidance of income tax.

Exception: However, restriction under clause (a) or£d) above is not applicable if an application for advance ruling is filed by notified residents being public sector companies.

The restriction under clause (d) is also not applicable in case of resident or non-resident applicant referred to in sub-clause (iv) of Sec. 245N(a).

![]()

(b) Specify with reasons, whether the following acts can be considered as (i) Tax planning; or (ii) Tax evasion; or (iii) Tax management?

(1) PQR Ltd. established a manufacturing unit in Karimnagar in the State of Telangana, a notified backward area, so as to claim additional depreciation u/s 32AD?

(2) A company installed a refrigerator costing ₹ 75,000 at the residence of a director as per terms of his appointment but treats it as fitted in quality control section in the factory. This is with the objective to treat it as plant for the purpose of computing depreciation.

(3) RR Ltd. fictitiously gave salary of ₹ 2,40,000 to Mr. X. The purpose is to build income of Mr. X, who is unemployed otherwise and reduce the income of RR Ltd. by ₹ 2,40,000. ‘

(4) A company remitted provident fund contribution of both its own contribution and employees’ contribution on monthly basis before due date.

Solution:

(1) Tax planning: Establishing a manufacturing unit in the notified back-ward area of Telangana to claim depreciation u/s 32AD is as per the provisions of law.

(2) Tax evasion: Air conditioner fitted at the residence of a director as per the terms of his appointment would be a furniture eligible for depreciation @ 10%, whereas an air-conditioner fitted in a factory would be a plant eligible for higher depreciation @ 15%. This false treatment unjustifiably increases depreciation and consequently, reduces profit and evades tax.

(3) Tax evasion: The given fictitious transaction is a method of reducing the tax liability of the company. The company is liable to tax at a flat rate of 25% where total turnover of P.Y. 2018-19 does not exceed ₹ 400 crores or 30% in any other case, whereas Mr. X is not liable to pay tax since his income is within the basic exemption limit of ₹ 2,50,000 (salary is his only income, since he is unemployed otherwise). Reducing tax liability by recording a fictitious transaction would be a tax evasion.

(4) Tax management: Remitting of own contribution to provident fund and employees contribution to provident fund on a monthly basis before due date is proper compliance of the statutory obligations.

![]()

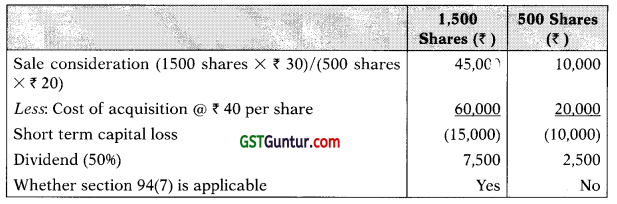

(c) Mr. Piyush, an individual resident in India bought 2,000 equity shares of ₹ 10 each of Delta Ltd. at ₹ 40 per share on May 30, 2020. He sold 1,500 equity shares at ₹ 30 per share on September 30th, 2020 and the remaining 500 shares at ₹ 20 per share on December 20th 2020. Delta Ltd. declared a dividend of 50%, the record date being August 10th, 2020. Piyush sold on February 1st 2021 a house from which he derived a long term capital gain of ₹ 80,000.

Discuss the provision involved and compute the amount of capital gain arising to Piyush for the A.Y. 2021-22.

Solution:

Till A.Y. 2020-21, the domestic company was liable to pay DDT on dividends distributed by it and such dividends income were exempt in the hands of shareholders. However, as per the amendment made by the Finance Act, 2020, the dividends are now taxable in the hands of shareholders and therefore, the provisions of dividend stripping u/s 94(7) shall not be applicable from A.Y. 2021 -22. As a result, the solution of the above question will not be as it was asked in the examination because of the change in the scheme of taxing dividend income.

The below solution has been given considering the facts as it should be before 31.03.2020:

![]()

Computation of income:

| ₹ | |

| Long term capital gain on sale of House | 80,000 |

| Less: Short term capital loss on sale of 1,500 shares [₹ 15,000 – ₹ 7,500] | (7,500) |

| Short term capital loss on sale of 500 shares | (10,000) |

| Long term capital gain | 62,500 |