CA Final DT Paper Nov 2020 (New Syllabus) – CA Final DT Question Bank is designed strictly as per the latest syllabus and exam pattern.

CA Final Direct Tax Question Paper Nov 2020 (New Syllabus)

Question 1.

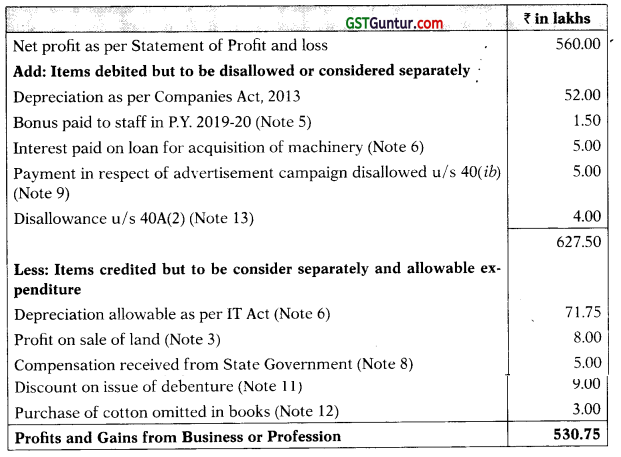

MP Ltd. is engaged in the manufacture of textile since 01.05.2011. Its Statement of Profit and Loss for the financial year ended 31 st March, 2021 shows a profit of ₹ 560 lakhs after debiting or crediting the followings items:

(a) Depreciation charged on the basis of useful life of assets as per Companies Act is ₹ 52 lakhs.

(b) Industrial power tariff concession of ₹ 5.40 lakhs, received from Madhya Pradesh Government was credited to Statement of Profit and Loss.

(c) Contribution of ₹ 2.50 lakhs to a scientific laboratory functioning at the national level with a specific direction for use of the amount for scientific research programme approved by the prescribed authority.

(d) Profit of ₹ 8 lakhs on sale of a plot of land to AVM Limited a domestic company, the entire shares of which are held by the assessee company. The plot was acquired by MP Ltd. on 30th June, 2019.

(e) Payment of ₹ 3.50 lakhs towards transportation of various materials procured by one of its units to M/s Bansal Transport, a partnership firm, without deduction of tax at source. The firm opts for presumptive taxation u/s 44AE and has furnished a declaration to this effect. It also furnished its Permanent Account Number in the tender, document.

(f) Bonus paid to staff includes an amount of ₹ 1.50 lakhs which was pro-vided for in the books on 31.03.2020 but has been paid in August 2020.

(g) Interest of 15 lakhs paid on loans taken specifically for purchase of plant and machinery. Out of this, ₹ 5 lakhs is for upto the period till such machinery was commissioned.

(h) A debtor who owed the company an amount ₹ 20 lakhs was declared insolvent and hence, was written off by debiting the Statement of Profit and Loss.

(i) ₹ 5 lakhs, being the additional compensation received from the State Government pursuant to an interim order of Court in respect of land acquired by the State Government in the previous year 2015-16.

(j) In order to expand its overseas business the company planned online advertisement campaign for which it engaged Fastex Inc., a London based company not having any PE in India and paid ₹ 5 lakhs for services availed. No tax/TDS was deducted by the company.

(k) ₹ 2 lakhs paid to consultant for expert opinion on new business set-up.

![]()

Additional Information:

(i) Normal depreciation computed as per Income-tax Rules on the book assets is ₹ 71 lakhs.

(ii) Debenture of face value of 1,500 lakhs having 5 years tenure were issued at a discount of 3% and were subscribed in full.

(iii) The company received a bill for ₹ 3 lakhs on 31st March, 2021 from a supplier of cotton for supply made in March, 2021. The bill was omitted to be recorded in the books in March, 2021. Payment against the bill was made in April, 2021 and necessary entry was made in the books then. The same has been considered in closing inventory valuation during physical verification conducted on 31.03.2021.

(iv) The company has purchased 1,000 bales of cotton at ₹ 5,000 per bale from Enpee LLP, a firm in which majority of the directors are partners. The normal selling price in the market for the same material is ₹ 4,600 per bale.

Compute total business income of the company for A.Y. 2021-22 giving a brief explanation to each item of addition or deletion. Ignore MAT provisions and the provisions of section 115BAA.

Solution:

Computation of Total Income of MP Ltd. for the A.Y. 2021-22

![]()

Notes:

1. As per sec. 2(24)(xviii), income shall include assistance received in the form of a subsidy or grant or cash incentive or duty drawback or waiver or concession or reimbursement (by whatever name called) from the Central Government or a State Government or any authority or body or agency in cash or in kind to the assessee other than the subsidy or grant or reimbursement which is taken into account for determination of the actual cost of the asset in accordance with the provisions of Explanation 10 to sec. 43(1).

Therefore, the Industrial Power Tariff Concession received by MP Ltd. from the Madhya Pradesh Government shall be taxable and to be included in the Income Statement. Since, it has been already credited to statement of profit and loss account, no adjustment is required.

2. As per Sec. 35(1), contribution to a scientific laboratory functioning at the national level for scientific research shall be allowed as deduction only for 100% w.e.f. A.Y. 2021-22. Since 100% of contribution has already been debited to profit and loss account, no further adjustment is required.

3. As per sec. 47(iv), any transfer of a capital asset by a holding company to its wholly owned subsidiary company, being an Indian company, is exempt in the hands of holding company. In this case, MP Ltd. had sold plot of land to AVM Ltd. which is 100% subsidiary company of MP Ltd. and also an Indian company. Therefore, the capital gain from such transfer is exempt in the hands of MP Ltd. As the profit was already credited to statement of profit and loss, it shall be reduced.

4. As per section 40(a)(ia), 30% of the sum payable to a resident shall not be allowed as a deduction to the assessee, if he has not deducted tax from such payment which is deductible under Chapter XVII-B or after deducting such tax, has not deposited it to the account of the Central Government on or before the due date u/s 139(1).

In this case, MP Ltd. has made payment to the contractor on which TDS is deductible u/s 194C of Chapter XVII-B, but no tax was deducted by MP Ltd. and therefore, 30% of the amount paid to transporter shall be disallowed. However, as per section 194C, no tax shall be deducted in case of assessee, opted for Sec. 44AE and furnishes a declaration to that effect along with his PAN. Therefore, in this case, no disallowance shall be made from payment made to M/s Bansal Transport.

![]()

5. As per section 43B, any sum payable as bonus or commission to the employees shall be allowed as a deduction to the employer only if it is paid on or before the due date for furnishing the ROI u/s 139(1). Since, MP Ltd. has paid bonus to staff for the year ended 31.03.2020 before the due date of furnishing for that year and therefore, it has already been allowed as deduction in the P.Y. 2020-21. Hence, it shall be added back to the statement of profit and loss of the P.Y. 2021-22.

6. As per Sec. 36(1)(iii), interest on capital borrowed for acquisition of an asset (whether capitalized in the books of account or not) for the period till the asset was first put to use, shall not be allowed as deduction.

Further, as per ICDSIX Borrowing Cost, borrowing cost directly attributable to acquisition of qualifying asset shall form part of cost of asset.

Therefore, interest paid of ₹ 5 lakhs upto the period till the machinery was commissioned shall be disallowed and it shall be capitalized in the actual cost of machinery.

Assuming that normal depreciation of ₹ 71 lakhs does not include depreciation in respect of ₹ 5 lakhs that became part of cost of machinery, the depreciation will be calculated as below:

| ₹ in lakhs | |

| Depreciatiori as per normal provision

Depreciation on ₹ 5 lakhs (15%) (Assuming to be used for more than 180 days) |

71.00

0.75 |

| 71.75 |

7. Bad debts write off in the books of account is allowable as deduction u/s 36(1)(vii). Since the same has already been debited to statement of profit and loss, no further adjustment is required.

8. As per the proviso to Sec. 45(5), where any amount.of compensation received in pursuance of an interim order of a court,’Tribunal or other authority shall be deemed to be income chargeable under the head ‘Capital gains’ of the previous year in which the final order was passed. Since ₹ 5 lakhs has been credited in the statement of profit & loss, the same has to be reduced while calculating business income.

9. As per Sec. 40(ib), any consideration paid or payable to a non-resident for a specified service on which equalization levy is deductible shall not be allowed as deduction on which levy has not been deducted or after deduction has not been paid on or before the due date specified u/s 139(1). In this case, since the payment for advertisement campaign is made to non-resident who do not have any PE in India and also the amount exceeds ₹ 1 lakh, equalization levy shall be deducted. Since, the payment has been made without deduction of equalisation levy, the same shall be disallowed u/s 40(a)(ib).

![]()

10. As per Sec. 37(1), any expenditure incurred wholly and exclusively for the purpose of business and profession shall be allowed as deduction. Therefore, ₹ 2 lakhs paid to consultant for expert opinion on new business set-up shall be allowed as deduction. Since, the same has already been debited in the statement of profit & loss, no further adjustment is required.

11. Supreme Court in Madras Industrial Investments Corporation Ltd. v. CIT [1997], held that when a company issues debentures at a discount, it incurs a liability to pay a larger amount than the amount it has borrowed and this liability is to be spread over the period of the debentures. Such discount is essentially in the nature of business expenditure. A proportionate amount of discount is deductible every year over the period of the debentures.

In view of the above judgment, out of the total discount of ₹ 45,00,000 (i.e., ₹ 1,500 lakhs × 3%) a proportionate amount of discount of ₹ 9,00,000 (i.e. ₹ 45 lakhs/5) is deductible every year over the period of 5 years tenure of debentures.

12. Since, the omission of recording of bill of cotton has results into increasing in profits of the company, the same shall be deducted while calculating the profits.

13. As per sec. 40A(2), where in case an assessee being a company, incurs any expenditure for which the payment has been made or is to be made to a specified person ie. in this case, to an LLP in which majority of the directors are partners, and such expenditure in the opinion of A.O. is excessive and unreasonable having regard to the fair market value of the goods, then such expenditure shall be disallowed to the extent considered as excessive or unreasonable by the A.O.

Therefore, in this case, ₹ 4 lakhs [1000 bales × (₹ 5,000 – ₹ 4,600 per bale)] shall be disallowed.

![]()

Question 2.

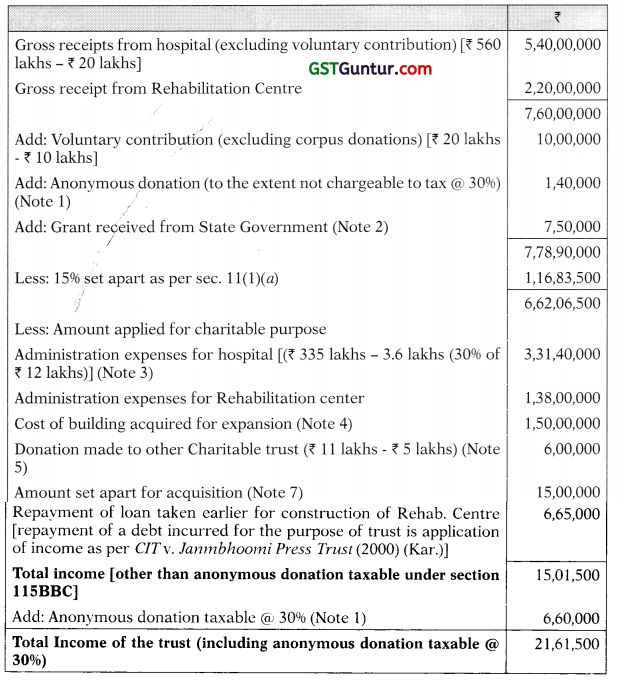

(a) Asma Rani Public Charitable Trust runs a hospital cum Rehabilitation Centre to treat patients suffering from leprosy. The trust is registered u/s 12AA and following cash system of accounting, furnishes the following information:

- Gross Receipts from Hospital : ₹ 560 Lakhs

- Gross Receipts from Rehabilitation Centre : ₹ 220 Lakhs

- Fees not realized from patients as at 31/3/2021 : ₹ 36 Lakhs

- Administration Expenses paid for hospital : ₹ 335 Lakhs

- Administration Expenses paid for Rehab Centre : ₹ 138 Lakhs

- Acquired a building for ₹ 150 lakhs on 1 /5/2020 for expansion of Rehab. Centre (Cost of land included there in ₹ 85 lakhs). Stamp duty value of Land & Building on the date of registration was ₹ 185 lakhs.

- Grant received from State Govt. – ₹ 7.50 lakhs.

- Administration expense includes payments of ₹ 12 lakhs to resident doctors & contractors on which TDS is required to be deducted u/s 192 & 194C but such TDS has not been deducted.

- Voluntary contributions (including Corpus Donations for ₹ 10 lakhs) is + ₹ 20 Lakhs. These contributions are included in Gross Receipts of hospital.

- Anonymous donations received – ₹ 8 Lakhs.

- Amount donated to Jan Kalvan Trust registered u/s 1 2AA running similar hospital in Bihar (includes Corpus donation of ₹ 5 Lakhs from hospital receipts) – ₹ 11 Lakhs

- Repayment of loan taken earlier for construction of Rehab. Centre – ₹ 6.65 Lakhs.

- The trust set apart ₹ 25 lakhs for acquiring another table & equipment for OT but the amount was spent in Oct. 2021. Form 10 was filed and A.O. was duly informed as required u/s 11(2). Investment made in the units of UTI (mode prescribed u/s 11(5)) of ₹ 15 lakhs upto 31/03/2021.

Compute the Total Income of the trust and its I.T. Liability for the A.Y. 2021-22.

Solution:

Computation of Total Income of Asma Rani Public Charitable Trust for the A.Y. 2021-22

![]()

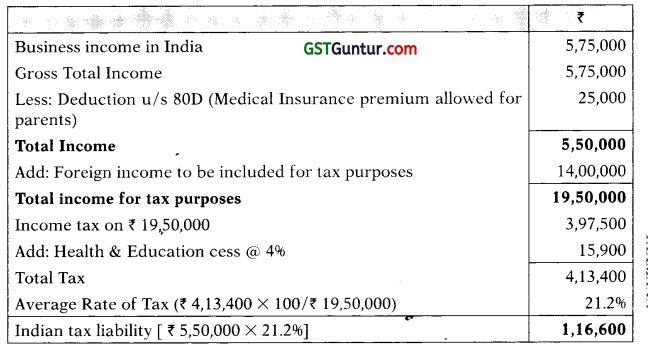

Computation of Income Tax Liability of Asma Rani Public Charitable Trust for the AY. 202 1-22

Notes:

(1) Only the anonymous donations in excess of the limit specified below would be subject to tax @ 30% u/s 115BBC. The limit is the higher of the following:

- 5% of the total donations received by the assessee(5% × ₹ 28,00,000) = ₹ 1,40,000 or

- 1 lakh.

Therefore, Anonymous donation taxable @ 30% shall be ₹ 8,00,000 – ₹ 1,40,000 = ₹ 6,60,000.

[Here, a view is taken that the amount of anonymous donations exempt from the applicability of 30% tax /₹ 1,40,000 in this solution] is eligible for retention/accumulation to the extent of 15% as per sec. 11(1) without conditions in the same line as with other income and the voluntary contributions. A contrary view may also be taken that such anonymous donations chargeable to tax at normal rates are not eligible for retention/ accumulation to the extent of 15%. If this view is taken, ₹ 1,16,62,500, being 15% of ₹ 7,77,50,000 has to be set apart (instead of ₹ 1,16,83,500, being 15% of ₹ 7,78,90,000)]

![]()

(2) As per Sec. 2(24)(xviii), assistance received in the form of subsidy from the Central or State Government or any authority or body or agency shall be taxable.

(3) As per Explanation 3 to Sec. 11(1), for the purpose of determining the amount of application, the provisions of Sec. 40(a)(ia), shall, mutatis mutandis, apply as they apply in computing the income chargeable under the head Profit and Gains of Business or Profession. Therefore, administration expense of ₹ 12 lakhs paid to resident doctors and contractors on which tax is required to be deducted shall be disallowed u/s 40(ia) to the extent of 30% of 12 lakhs i.e. ₹ 3,60,000.

(4) The land and building acquired for the purpose of expansion of Rehabilitation Centre would be treated as application of income. The difference of ₹ 35 lakhs between the stamp duty value and cost of acquisition of land and building would not be taxable in the hands of Asma Rani Public Charitable Trust by invoking the provisions of sec. 56(2)(x), since sec. 56(2)(x) is not applicable when any sum of money or property is received by a trust registered u/s 12AA or 12AB. Therefore, ₹ 150 lakhs would be considered as application of income.

(5) As per Explanation 2 to sec. 11(1), any corpus donation made to any trust registered u/s 12AA or 12AB shall not be treated as application of income. Therefore, out of ₹ 11 lakhs donated to Jan Kalvan Trust registered u/s 12AA, ₹ 5 lakhs in respect of corpus donations shall not be treated as application of income.

(6) Since the trust follows cash system of accounting, fees not realised from patients would not form part of gross receipts. Therefore, Explanation 1 to sec. 11(1) shall not applicable.

(7) As per section 11(2), income accumulated or Set apart can be treated as application of income provided the prescribed conditions are fulfilled. One such condition is that the money so accumulated or set apart shall be invested or deposited in forms or modes specified u/s 11(5). In this case, out of ₹ 25 lakhs accumulated by the trust for the purpose of acquiring table and equipment for OT, only ₹ 15 lakhs has been invested in the prescribed modes u/s 11(5). Therefore, the balance ₹ 10 lakhs shall not be treated as application of income.

![]()

(b) Answer any one out of the following two questions:

(i) M/s Kashdash (R) Ltd. an Indian company in the business of event management throughout India withdraws ₹ 10 lakhs in cash on 7th day of each month during the financial year 2019-20 from its current account with Union Bank, for local payments and for payment of wages and incentives to temporary employees engaged by it for different events. It did not made any single payment of ₹ 10,000 or more to any person in a day. Examine the liability for tax deduction at source in the present case.

(ii) M/s TQ Inc. a foreign company seconded some employees to its collaborator M/s Tekwel Ltd., an Indian company, for working on a turnkey project for setting up a pharmaceutical factory. These employees worked with M/s Tekwel Ltd., throughout the P.Y. 2019-20. The employees were in receipt of salary from M/s Tekwel Ltd. They were also in receipt of special allowance directly from M/ s TQ Inc. in foreign currency outside India. M/s Tekwel Ltd., deducted tax under section 192, on the component of salary paid by it without taking into account the special allowance paid abroad by M/s TQ Inc. in foreign currency to these employees.

For this reason, the Revenue authorities treated M/s Tekwel Ltd. as an ‘assessee-in-default’ under section 201 for non-deduction of tax at source on the “special allowance” component of salary paid by M/s TQ Inc. under section 192. Is such treatment by the Revenue Authorities and the consequent levy of interest and penalty justified?

Solution:

(i) As per Sec. 194N, every person being a banking company or cooperative bank or post office who is responsible for paying any sum or aggregate of sums in cash exceeding ? 1 crore during the previous year to any person from one or more accounts maintained by the recipient shall, at the time of payment of sum, deduct tax @ 2% of such sum.

In the given case, M/s Kashdash (R) Ltd. an Indian Company has with-drawn ₹ 10 lakhs in cash in each month from his current account with Union Bank. Thus, total amount withdrawn in the previous year by M/s Kashdash (R) Ltd. is ₹ 1,20,00,000 which exceeds ₹ 1 crore and therefore, Union Bank is liable to deduct tax at source @ 2% on ₹ 1,20,00,000 i.e. ₹ 2,40,000.

![]()

(ii) As per Sec. 9(1)(ii), any income which falls under, the head ‘salaries’ is deemed to accrue or arise in India, if it is earned in India and the income payable for services rendered in India shall be regarded as income earned in India.

Sec. 192 requires the person responsible for paying any income chargeable under the head ‘salaries’ to deduct tax, at the time of payment, at the average rate of income tax computed on the basis of rates in force for the financial year on the amount payable.

The facts of the given case are similar to the facts in the case of CITv. Eli Lilly & Co. (India) P. Ltd where the Supreme Court held that salary and special allowances paid by a non-resident employer, even if paid outside India but, for service rendered in India shall be deemed to accrue or arise in India in the hands of recipient. Therefore, it would attract TDS liability in the hands of the non-resident payer, since u/s 192 even the non-resident employers are liable for tax deduction if such salary is taxable in the hands of the recipient in India.

Therefore, in this case, non-deduction of tax at source by M/s Tekwel Ltd. on special allowances paid by foreign collaborator M/s TQ Inc. to employees is incorrect. Thus, the action of the Revenue authorities to treat M/s Tekwel Ltd. as an ‘assessee in default’ and consequent levy of interest and penalty is justified.

However, as per sec. 273B, no penalty u/s 271C would be attracted, if M/s Tekwel Ltd. was under the genuine and bona fide belief that it was not under any obligation to deduct tax at source from the special allowance paid by the foreign company.

![]()

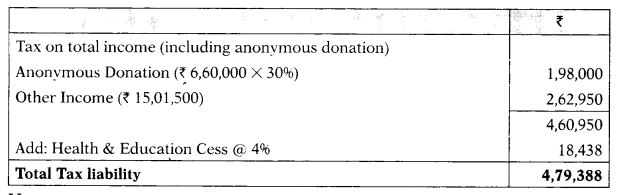

Question 3.

(a) The net result of the business carried on by a branch of a foreign company in India for the financial year ended 31.03.2021 was a profit of ₹ 20 lakhs after charge of the following expenses :

- Depreciation for the current financial year of ₹ 15 lakhs.

- Unabsorbed depreciation for previous financial year of ₹ 17 lakhs.

- Capital Expenditure incurred for promoting family planning amongst its employees of ₹ 7 lakhs. 7 Lakhs is one fifth of the total expenditure incurred on promoting family planning.

- Expenditure incurred for Scientific research ₹ 11 lakhs.

- Business loss brought forward for A.Y. 2020-21 of ₹ 25 lakhs.

- Deductions under chapter VI-A of ₹ 20 lakhs.

- Head Office expenses of ₹ 125 lakhs allocated to the branch.

Compute income to, be declared by the branch in its return for the Assessment Year 2021-22.

Solution:

As per Sec. 44C, the income of branches of foreign companies in India shall be computed as per the provisions contained in Sec. <28 to Sec. 44D.

However, the head office expenditure shall be allowed as deduction only to the following extent:

- 5% of ADJUSTED TOTAL INCOME; OR

- So much of the Head office expenditure attributable to the business or profession of the assessee in India;

whichever is less.

ADJUSTED TOTAL INCOME’ means the total income computed in accordance with the Income Tax Act, without giving effect to:

- Unabsorbed depreciation referred u/s 32(2), or

- Unabsorbed family planning expenditure referred u/s 36(1)(ix), or

- Brought forward losses u/s 72(1), 73(2), 74, 74A(3), or

- Deductions under chapter VI-A.

![]()

Calculation of Adjusted Total Income

| ₹ | |

| Net profit

Add: Head office Expenses deducted (to be added back) Unabsorbed depreciation B/f business loss Deduction under chapter VI-A |

20,00,000

1,25,00,000 17,00,000 25,00,000 20,00,000 |

| Adjusted Total Income | 2,07,00,000 |

Note: The capital expenditure incurred on family planning is of current year and not unabsorbed capital expenditure incurred on family planning. So it is not added back while calculating adjusted total income.

Calculation of Income to be declared by Foreign Branch for the A.Y. 2021-22

Note: Since, the profit figure in the question has been given after deducting depreciation, capital expenditure and scientific research, no adjustments in respect of the same shall be made.

![]()

(b) Explain in brief whether the transaction – Interest of ₹ 5,00,000 paid on money borrowed by Mr. Smith (a Non-Resident) for the purpose of doing business of garments at Mumbai to Mr. John (who is also a Non-Resident) attracts income tax in India in the hands of recipient in the Assessment Year 2021-22.

Solution:

As per sec. 9(1)(v), interest payable by a non-resident in respect of any debt incurred, or any moneys borrowed and used, for the purpose of business or profession carried on by him in India shall be deemed to accrue or arise in India. In this case, Mr. Smith, a non-resident, has paid interest on money bor-rowed for the purpose of doing business of garments in Mumbai, India and therefore, it shall be deemed to accrue or arise in India and shall be taxable in the hands of Mr. John in India as per Sec. 9(1)(v).

![]()

(c) KVS Ltd., the assessee, has sold goods on 12.01.2021 to L Ltd., located in notified jurisdictional area (NJA), for ₹ 10.50 crores. During the current financial year KVS Ltd. charged ₹ 11.50 crores from AJ of New York and ₹ 12 crores from KP of London for sale of identical goods and both of which are neither associated enterprise of KVS Ltd. nor they are situated in any NJA.

While sales to AJ and KP were on CIF basis, the sale to L Ltd., was on FOB basis, which paid ocean freight and insurance amounting to ? 20 lakhs on purchases from KVS Ltd.

India has a Double Taxation Avoidance Agreement with the U.S.A. and U.K.

The assessee has a policy of providing after sales support service to the tune of ₹ 14 lakhs to all customers except L Ltd. which procured the same locally at a cost of ₹ 18 lakhs.

Compute the ALP for the sales made to L Ltd., and the amount of consequent increase, if any, in the profit of the assessee company.

Solution:

If an assessee enters into a transaction, where one of the parties to the trans-action is a person located in a notified jurisdictional area, the transaction shall be deemed to be an international transaction and accordingly, transfer pricing regulations shall apply to such transactions.

Also, the transaction of sale to L Ltd., located in a NJA, is an international transaction as per section 92B since it has a bearing on income or assets of the assessee. The ALP has to be computed as per the most appropriate method.

In the given case, the facts suggest that the most appropriate method of com-puting ALP would be Comparable Uncontrolled Price (CUP) method.

Assuming that CUP method is the most appropriate method, the ALP would be computed as under:

(₹ in crores)

| AS | KP | |

| Sale price of identical goods to unfamiliar customer | 11.50 | 12.00 |

| Less: Difference for CIF & FOB | (0.20) | (0.20) |

| Less: Cost of after sales support | (0.14) | (0.14) |

| Arm’s length price (ALP) | 11.16 | 11.66 |

As more than one price is determined by CUP method, the ALP would be arithmetical mean of such prices. Therefore, ALP shall be ₹ 11.41 [(₹ 11.16 crores + ₹ 11.66 crores)/2]

Increase in Profits = Arm’s length price – Actual Transfer Price to L Ltd.

= ₹ 11.41 crores – ₹ 10.50 crores

= ₹ 0.91 crores

Thus as per the CUP method, the ALP would be ₹ 11.41 crores and the increase in profits of KVS Ltd. would be ₹ 91 lakhs.

![]()

Question 4.

(a) Mahadev & Sons Ltd. is a Public Company whose account have been prepared in accordance with provisions of Schedule III of the Company’s Act. Its P&L for the year ended 31st March, 2021 shows a Net Profit of ₹ 27 Lakhs. The Company informs the following debit/credits have been made in the P&L a/c before arriving at the above stated Net Profit.

| Credits to the P&L A/c | Debits to the P&L A/c |

| 1. Net Agricultural income in India ₹ 11 Lakhs | 1. Expenses relating to Sec. 10AA undertaking ₹ 16 Lakhs |

| 2. Profits of Industrial undertaking Covered & qualified for deduction u/s 10AA – ₹ 30 Lakhs | 2. Depreciation relating to P.Y. 2019-20 b/f ₹ 13 Lakhs |

| 3. Amount withdrawn from reserve created in P.Y. 2019-20 (Book profit was not increased by the amount transferred to the reserve in the year 2019-20) – ₹ 4 Lakhs | 3. Business Loss relating to P.Y. 2019-20 b/f ₹ 10 Lakhs |

| 4. LTCG on sale of equity shares on which STT paid – ₹ 3.50 Lakhs | 4. Current Year Depreciation ₹ 12 Lakhs |

| 5. Amount withdrawn from Revaluation Reserve ₹ 10 lakhs | 5. Interest to bank not paid upto filing of ROI ₹ 5 Lakhs |

| 6. Provision for unascertained liability ₹ 3 Lakhs | |

| 7. Income Tax ₹ 6 Lakhs | |

| 8. Penalty for infraction of Law ₹ 2 Lakhs |

Further Information: Depreciation for current year includes ₹ 5 Lakhs towards revaluation of assets.

Compute the book profit of the Company for the year ended 31.03.2021 liable to tax under MAT.

Solution:

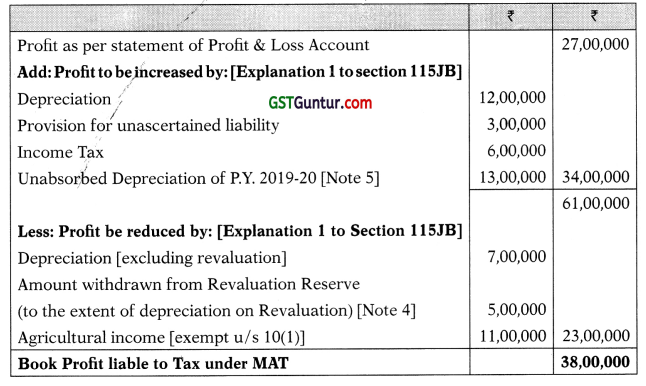

Computation of Book Profit of Mahadev & Sons Ltd. u/s 11 5JB for year ended 31.03.2021

![]()

Notes:

1. As per proviso to section 115JB(6), the profits from unit established in Sec. 10AA cannot be excluded while computing book profit, and hence, such income would be liable for MAT. Similarly, expenses relating to unit established in Sec. 10AA shall also not be added back.

2. Items which are not specifically mentioned under Explanation 1 to section 115 JB cannot be adjusted from the profit for computing book profit for levy of MAT and therefore, the following items since not specifically mentioned thereunder cannot be adjusted for computing book profit:

- Interest to bank (unpaid before filing of return) and

- Penalty for infraction of law

- LTCG on sale of Equity shares on which STT paid.

3. Amount withdrawn from reserves and credited to Statement of Profit and loss is to be reduced while computing Book Profit only if the Book profit (of any year in which MAT was applicable) has been increased by those reserves (out of which said amount was withdrawn). Since, Book profit of year 2019-20 was not increased by amount transferred to reserve, such withdrawal of ₹ 4 lakhs shall not be reduced while computing Book Profits.

4. As per clause (iib) of Explanation 1 to Sec. 115 JB, the amount withdrawn from Revaluation Reserve and credited to statement of profit and loss shall be reduced while computing book profit to the extent it does not exceed the amount of depreciation on account of Revalued Assets. Therefore, upto ₹ 5,00,000 (to the extent of depreciation on Revalued Assets) withdrawn from Revaluation reserve shall be reduced from Book profits.

5. As per section 115 JB, the amount of brought forward loss of unabsorbed depreciation as per books, whichever is less, has to be reduced from profit. In the present question, unabsorbed depreciation is ₹ 13,00,000 and brought forward loss is ₹ 10,00,000 and therefore, ₹ 10,00,000 shall be deducted. Since, both are already debited, unabsorbed depreciation of ₹ 13,00,000 shall be added back.

![]()

(b) Explain the expression “Round Trip Financing” in relation to Impermissible Avoidance Agreement (IAA).

Solution:

One of the conditions of an Impermissible Avoidance Arrangement is that the arrangement lacks commercial substance or is deemed to lack commercial substance in whole or in part. An arrangement shall be deemed to lack commercial substance if it involves or includes Round Trip Financing.

As defined u/s 97(2), ‘Round Trip Financing’ includes any arrangement in which, through a series of transactions:

(a) funds are transferred among the parties to the arrangement; and

(b) such transactions do not have any substantial commercial purpose other than obtaining the tax benefit without having regard to:

(A) whether or not the funds involved in the round trip financing can be traced to any funds transferred to, or received by, any party in connection with the arrangement;

(B) the time, or sequence, in which the funds involved in the round trip financing are transferred or received; or

(C) the means by, or manner in, or mode through, which funds in-volved in the round trip financing are transferred or received.

![]()

(c) M/s Manish & Co., a proprietary concern of Mr. Manish failed to furnish its Return of Income (Rol) for A.Y. 2019-20 within the due date u/s 139(1). The A.O. in turn lodged a complaint against the proprietor u/s 276CC. The tax payable on assessed income as reduced by the tax deducted at source and advance tax paid was ₹ 1,65,000. Mr. Manish filed an appeal before CIT(A) against the order of assessment and got part relief. Accordingly, A.O. passed an order giving effect to the order of CIT(A). The tax payable as per said order of A.O. was ₹ 8500. The A.O. accepted the order of CIT(A) and did not prefer an appeal against it to ITAT M/s Manish & Co. seek your advice on the maintainability of proceedings u/s 276CC.

Also, briefly mention would your answer be different if Manish and Co. is a private limited company.

Solution:

Section 276CC provides for prosecution for wilful failure to furnish a return of income within prescribed time, in a case where tax would have been evaded had the failure not been discovered.

Since, the amount of tax which would have been evaded doesn’t exceed ₹ 25 lakh, imprisonment would be for a term of 3 months to 2 years. In addition, line would also be attracted.

However, in a case where the return of income is not filed within the due date, prosecution proceedings will not be attracted if the tax payable by the assessee (not being a company) on the total income determined on regular assessment, as reduced by the Advance Tax or Self Assessment Tax, if any, paid and any tax deducted or collected at source, does not exceed ₹ 10,000.

In this case, even though the tax liability of assessee as per original order of assessment exceeded ₹ 10,000, however, as a result of order of Commissioner (Appeals), it got reduced to ₹ 8,500, which is less than ₹ 10,000.

Therefore, since the tax liability of the assessee on final assessment .was determined at ₹ 8,500, the prosecution proceedings are not maintainable.

However, if Manish & Co. were a private limited company then, yes the answer would be different, Because the relief given under the Proviso to Sec. 276CC which provides for no procecution in case of tax liability being less than ₹ 10,000 is not available to a company assessee. Thus, in such a case, the proceeding u/s 276CC would be considered as valid.

![]()

Question 5.

(a) Mr. Lai Singh created Lai Singh Welfare Trust in June 2020 by duly executing in writing a trust deed. He appointed Ms. Vinita as the trustee. The trust was created to take care of his old parents and his 2 uncles (both being older brothers of his father) where all are dependent on Mr. Lai Singh and continue to live together in their native village in Rajasthan. The income arising out of assets of the trust is to be allocated amongst the beneficiaries each year as per the sole discretion of Ms. Vinita. The beneficiaries to the trust have no income. The income of the trust during RY. 2020-21 was ₹ 10 lakhs. Calculate the tax liability of the trust for A.Y. 2021-22. Would your answer differ if father of Mr. Lai Singh was receiving a monthly pension of ₹ 25,000 apart from the trust?

Solution:

Private trust means any trust created for the benefit of ascertained individuals or families.

As per Sec. 164(1), where the shares of beneficiaries are indeterminate or unknown and the income of the trust does not include any income under the head PGBP, then the income of the trust shall be taxable in hand of trustee at rates applicable to AOP, provided that none of the beneficiaries income exceed the maximum amount not chargeable to tax.

In the given case of Lal Singh Welfare Trust, the income of Trust is ₹ 10,00,000 and the beneficiaries do not have any other source of income. So ₹ 10,00,000 shall be taxed as per tax rates applicable to AOP.

In case, where father of Mr. Lai Singh receives monthly pension of ₹ 25,000 then his income would be ₹ 3,00,000 for the year which is within the maximum amount not changeable to tax as Mr. Lai Singh’s father is a senior citizen. So, the answer will remain the same and the tax treatment shall not change. [As Mr. Lai Singh’s father is a pensioner he would be above 60 years and stays in India so a senior citizen],

![]()

(b) During the Previous Year 2020-21. Ms. Sujata, a citizen of India is a resident of both India and a foreign country with which India has a Double Taxation Avoidance Agreement (DTAA), which provides that the “income would be taxable in country where it is earned and not in other country, but would be included for computation of tax rate in such other country”.

Her income is ₹ 5,75,000 from business in India and ₹ 14,00,000 from business in foreign country. In foreign country the rate of tax is 20%.

During the year she paid a premium of ₹ 35,000 to insure the health of her mother, also a non-resident, aged 83 years, through her credit card. You are required to compute the tax payable by Ms. Sujata in India for the A.Y. 202122. Also, show the tax payable by Ms. Sujata in India, had there been no DTAA with such foreign country.

Solution:

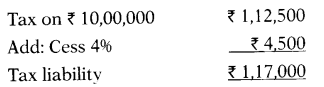

Tax payable by Ms. Sujata in India for A.Y. 2021-22, where there is DTAA with the foreign country

Note: Deduction under section 80D shall be available for only ₹ 25,000 as the premium paid by Ms. Sujata is on the health of her mother who will not be considered as Senior Citizen, being a non-resident.

Tax payable by Ms. Sujata for A.Y. 2021-22, where there is no DTAA with the foreign country

Note: Relief u/s 91 is allowed on doubly taxed income at lower of the following:

Average rate of tax in foreign Country:

\(\frac{\text { Foreign Income Tax }}{\text { Foreign Total Income }}\) × 100 = ₹ \(\frac{1,20,000}{6,00,000}\) × 100 = 20%

Average rate of tax in India:

\(\frac{\text { Tax payable in India }}{\text { Total Income }}\) × 100 = ₹ \(\frac{4,13,400}{19,50,000}\) × 100 = 21.2%

![]()

(c) An assessee received a notice u/s 148 stating reasons for reassessment. The assessing officer completed reassessment based on fresh grounds that were different from original reasons which prompted the reassessment.

Stating legal provisions briefly discuss whether the reassessment based on fresh grounds would be valid when the original reason which prompted the reassessment, does not survive.

Solution:

As per Sec. 149, where A.O. has reasons to believe that any income changeable to tax has escaped assessment for any A.Y. then A.O. may assess, reassess such income & also any other income which comes to his notice subsequently during the course of proceeding under this section.

In the case of Ranbaxy laboratories Ltd. v. CIT, the Delhi High Court held that if the income, the escapement of which was the basis of reasons to believe is not assessed or reassessed, it would not be open to A.O. to independently assess only that income which comes to his notice subsequently during the course of the proceedings.

However, in the case of CITv. Mehak Finvest P. Ltd., the Punjab and Haryana High Court gave a contradictory judgment and held that once the reasons to believe are found to be sufficient, then the A.O. may do reassessment in respect of any other item of income which may have escaped assessment, even through the original reason.for issue of notice u/s 148 does not survive.

![]()

Question 6.

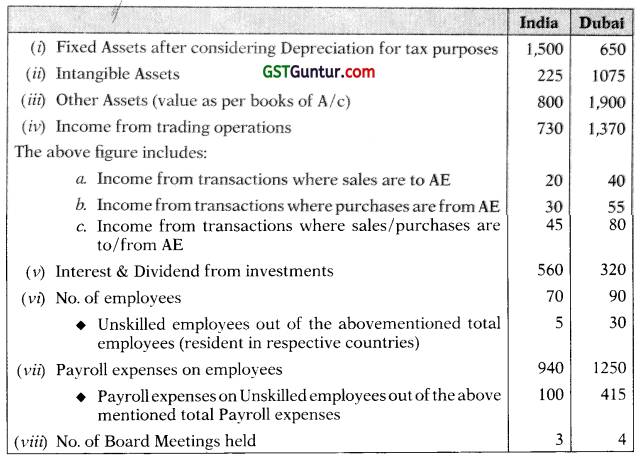

(a) Simran (P) Ltd. holds 55% of shares in Al Kuber Ltd, Company incorporated in Dubai. Al Kuber Ltd. has its offices in India also. Details relating to Al Kuber Ltd. for year ended March 2021 are as stated below:

(₹ in crores)

Determine the Residential Status of Al Kuber Ltd. for A.Y. 2021-22.

Solution:

As per Sec. 6(3), a company is said to be resident in India in any previous year, if:

(a) It is an Indian Company, or

(b) Its place of effective management (POEM) in that year, is in India.

Explanation to Sec. 6(3), defines POEM as a place where key management and commercial decisions that are necessary for conduct of business of an entity as a whole, are in substance made.

POEM is determined based on the fact as to whether or not the company is engaged in “active business outside India”.

![]()

The company shall be said to be engaged in ‘active business outside India’, only if the following conditions are simultaneously satisfied: –

- Passive income is not more than 50% of its total income; and

- less than 50% of its total assets are situated in India; and

- less than 50% of total number of employees are situated in India or are resident in India; and

- the payroll expenses incurred on such employees is less than 50% of its total payroll expenditure.

Passive income means an income which is aggregate of:

- income from the transactions where both the purchase and sale of goods is from /to its associated enterprises; and

- income by way of royalty, dividend, capital gains, interest or rental income.

Calculation of Passive Income of A1 Kuber Ltd.

| ₹ in crores | |

| Income where both purchase & sale are made to/from associated enterprises (₹ 45 + ₹ 80) | 125 |

| Interest and Dividend from investments (₹ 560 + ₹ 320) | 880 |

| Total Passive Income | 1,005 |

Determination of whether A1 Kuber Ltd. is has engaged in “Active Business outside India”

| India | Total | % of India out of Total | |

| Value of Assets (Cr.) | 2525 | 6150 | 47.86 % |

| No. of employees | 70 | 160 | 43.75 % |

| Payroll expenses (Cr.) | 940 | 2,190 | 42.92 % |

| Passive Income/Total Income (1005/2100) | 47.86 % |

Since, all the conditions are fulfilled, it can be said that A1 Kuber Ltd. is engaged in Active Business outside India.

Now, POEM of a company, engaged in active business outside India shall be presumed to be outside India, if the majority of board meetings are held outside India.

During F.Y. 2020-21, out of total 7 board meetings of A1 Kuber Ltd., are held outside India and thus, POEM of Al Kuber Ltd. is said to be Outside India.

Thus, Al Kuber Ltd. is a Non-Resident Company in India as its POEM is outside India for A.Y. 2021-22.

![]()

(b) Mr. Anand, a resident of Bangalore has 2 house properties, one situated in Bangalore and the other in Jaipur. The house property at Jaipur was purchased in April 1998 and the Bangalore house was purchased during May 2008. Mr. Anand transferred his house property at Jaipur in the name of his son, Prateek on his 10th birthday in July 2003.

In Sept. 2020, TRO has served a notice on Mr. Anand for recovering outstanding tax arrears of ₹ 150 lakhs relating to A.Y. 2016-17 in respect of his proprietorship business’. TRO simultaneously attached both houses for recovering the tax arrears along with interest.

Mr. Prateek has been staying in the house property at Jaipur with his wife for last 4 years after he got separated from his father. The current value of house at Jaipur is ₹ 45 lakhs and Bangalore is ₹ 90 Lakhs.

Mr. Prateek seeks your advice on the validity of action taken by TRO in attaching the Jaipur property.

Solution:

As per Sec. 222, when an assessee is in default or is deemed to be in default in making a payment of tax, the Tax Recovery Officer (TRO) shall proceed to recover the amount of arrears from assessee, inter alia, by attaching the assessee’s movable and immovable property.

Here, the assessee’s movable or immovable property shall include any property which has been transferred, directly or indirectly on or after the 1st day of June, 1973, by the assessee to his spouse or minor child or son’s wife or son’s minor child, otherwise than for adequate consideration, and which is held by, or stands in the name of, any of such persons and so far as the movable and immovable property so transferred to his minor child or his son’s minor child is concerned, it shall, even after the date of attainment of majority by such minor child or son’s minor child, continue to be included in the assessee’s movable or immovable property for recovering any arrears due from the assessee in respect of any period prior to such date.

In this case, arrears are related to A.Y. 2016-17 when Mr. Prateek is already a major and therefore, the TRO cannot recover the arrears pertaining to A.Y. 2016-17 amounting to ₹ 150 lakhs by attaching Jaipur Property transferred in name of Prateek who has attained majority on or before the period of which arrears are due.

Hence, the action of the TRO in attaching the Jaipur property is not valid and not tenable in law.

![]()

(c) ND Ltd., an Indian Company has borrowed ₹ 90 crores on 01-04-2020 from M/s. TM Inc. a company incorporated in London, at an interest rate of 10% p.a. The said loan is repayable over a period of 5 years. Further, this loan is guaranteed by M/s TY Inc. incorporated in UK. M/s. TD Inc. a non-resident, holds shares carrying 40% of voting power both in M/s ND Ltd-and M/s TY Inc.’

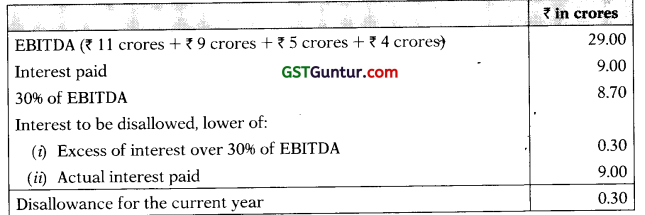

Net profit of M/s. ND Ltd. for P.Y. 2020-21 was ₹ 11 crores after debiting the above interest, depreciation of ₹ 5 crores and income-tax of ₹ 4 crores.

Calculate the amount of interest to be allowed to be claimed under the head “Profits and gains of business or profession” in the computation of M/s ND Ltd. giving appropriate reasons. Also explain allowability of such disallowed interest, if any.

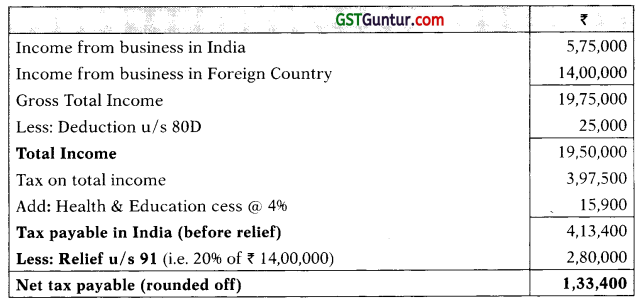

Solution:

As per Sec. 94B, where an Indian company or a PE of a foreign company in India, being the borrower, incurs any expenditure by way of interest or of similar nature exceeding ₹ 1 crore which is deductible under the head PGBP in respect of any debt issued by a non-resident, being an associated enterprise of such borrower, the interest shall not be deductible in computation of income under the said head to the extent that it arises from excess interest:

Provided that where the debt is issued by a lender which is not associated but an associated enterprise either provides an implicit or explicit guarantee to such lender or deposits a corresponding and matching amount of funds with the lender, such debt shall be deemed to have been issued by an associated enterprise.

In this case, ND Ltd., a resident Indian Company, has borrowed ₹ 90 crores from M/s. TM Inc. a company incorporated in London at an interest rate of 10% p.a. The loan is guaranteed by M/s TY Inc. incorporated in UK. M/s. TD Inc. a non-resident holds shares carrying 40% of voting power both in M/s ND Ltd. and M/s TY Inc. Since, M/s. TD Inc. holds more than 26% shares in M/s ND Ltd. and M/s. TY Inc. M/s ND Ltd. and M/s. TY Inc. shall be deemed to be an associated enterprises as per Sec. 92A(2).

![]()

Therefore, the provisions of Sec. 94B shall be applicable, since the amount borrowed by M/s. ND Ltd. is guaranteed by its associated enterprise M/s. TY Inc. and also the amount of interest exceeds ₹ 1 crore.

As per sec. 94B, the amount of excess interest shall be disallowed. Excess interest shall mean an amount of:

- total interest paid or payable in excess of 30% of earnings before interest, taxes, depreciation and amortization (EBITDA) of the borrower in the previous year, or

- interest paid or payable to associated enterprises for that previous year, g whichever is less.

Computation of disallowance of interest u/s 94B for the current year

Therefore, ₹ 30,00,000 shall be disallowed for the current year in computing the income under the head “Profits and Gains from Business or Profession” of M/s. ND Ltd. Such interest disallowed shall be carried forward to the following assessment years and allowed as a deduction against the profits and gains of any business or profession carried on by it and assessable for that assessment year to the extent of maximum allowable interest as per this section.

![]()

Such interest expenditure shall be carried forward for not more than 8 assessment years immediately succeding the assessment year for which the excess interest expenditure was first computed.