Budget and Budgetary Control – CA Inter Costing Question Bank is designed strictly as per the latest syllabus and exam pattern.

Budget and Budgetary Control – CA Inter Costing Question Bank

Question 1.

State four limitations of the budgetary control system. (Nov 1998, 2 marks)

Answer:

Limitations of Budgetary Control are :

- Budgetary control is not suitable in rapidly changing conditions because it requires frequent revision. Which is very costly and time taking process for organisation.

- Sometimes budget can serve as constraints on managerial effectiveness because every executive tries only to achieve budgeted target.

- The budgetary control system is expensive for small organisations.

- For application of budgetary control system, proper organisational structure should be followed which is not possible in all the firms.

Question 2.

Discuss the components of budgetary control system. (May 2009, 2 marks)

Answer:

Components of Budgetary Control System:

There are a number of bases for classifying the budgets into two or more categories. But the most important and widely used bases are functional classification and classification according to flexibility.

The policy of a business for a defined period is represented by the master budget the details of which are given in a number of individual budgets called functional budgets.

The functional budgets are broadly grouped under the following heads:

- Physical Budgets: This budget contains information in terms of physical units e.g. Sales Qty, Product Qty, Inventory, Manpower budget.

- Cost Budgets: Manufacturing Cost, Administration Cost, Sales and Distribution cost, R & D Cost.

- Profit Budget: A budget which enable in the ascertainment of profit, e.g. Sales Budget, Profit & Loss Budget etc. On the other hand, budgets may be classified into two categories oh the basis of flexibility as fixed budgets and flexibility budgets.

![]()

Question 3.

Essentials of budget (Nov 2011, 2 marks)

Answer:

Essential of Budget:

- Budget establishes the objective of the organisation and enables the management to conduct business in the most efficient manner.

- Budget is helpful in allocating scarce resources in most optimal way.

- Budget identifies the areas of in-efficiencies within the organisation.

- Budget is the most important tool of controlling because it provides a yardstick against which the performance of organisation can be evaluated.

- Budget is a basis for management by exception by comparing actual and budgeted results.

- Budget ensures effective utilisation of men, machine, material and money.

Question 4.

Describe the steps involved in the budgetary control technique. (Nov 2013, 4 marks)

Answer:

Steps involved in the Budgetary Control Technique

1. Definition of objectives

A budget being a plan for the achievement of certain operational objectives, it is desirable that the same are defined precisely. The objectives should be written out; the areas of control demarcated; and items of revenue and expenditure to be covered by the budget stated.

2. Location of the Key (or budget) Factor

There is usually one factor (sometimes there may be more than one) which sets a limit to the total activity. Such a factor is known as key factor. For proper budgeting, it must be located and estimated properly.

3 Appointment of Controller

Formulation of a budget usually requires whole time services of a senior executive known as budget controller; he must be assisted in this work by a Budget Committee, consisting of all the heads of department along with the Managing Director as the Chairman.

4 Budget Manual

Effective budgetary planning relies on the provision of adequate information which are contained in the budget manual. A budget manual is a collection of documents that contains key information for those involved in the planning process.

5 Budget Period

The period covered by a budget is known as budget period. The Budget Committee determines the length of the budget period suitable for the business. It may be months or quarters or such periods as coincide with period of trading activity.

6 Standard of Activity or Output

For preparing budgets for the future, past statistics cannot be completely relied upon, for the past usually represents a combination of good and bad factors. Therefore, though results of the past should be studied but these should only be applied when there is a likelihood of similar conditions repeating in the future.

Question 5.

Answer the following :

State the limitations of Budgetary Control System. (Jan 2021, 5 marks)

Preparation of Budget

Question 6.

Write a short note on “Key Factor”. (May 1998, 4 marks)

Answer:

Every businessman aims to produce and sell unlimited units of the product manufactured by him. But it is not possible due to some factor. There is always a factor which may limit the activity level of a firm such a factor is known as the key factor. In most of the cases ‘sales’ is the key factor. It determines the volume of output to be produced. Sometime sales may not be the key factor but some other factor such as labour; machine capacity, material, finance etc.

When may not be available in requisite quantity will be a key factor. In other words, key factor is a factor that limits the quantum of activity of a firm at a particular time or over a period of time. Key factor governs the decision “how much to produce” In case, sales being the key factor, the profitability of the product is measured by computing its profit volume ratio. When any other factor is the key-factor, the most profitable product will be that which would yield maximum contribution per unit of key factor.

![]()

Question 7.

Write a short note on “Budget Manual”. (Nov 2020, 2 marks)

Answer:

CIMA London defines budget manual as a document schedule or booklet which sets out. inter alla. responsibilities of the persons engaged in the routine of, and the forms and records required for budgetary control, Therefore budget manual should consist of responsibilities and duties of each executive, methods of preparation of various budget etc.

The budget manual should include following:

- Introduction, benefitš principles and objectives of budgetary control system.

- Organisation chart explaining the responsibilities of each executive.

- Budgeting programme including the time table for periodical reporting.

- Purpose, specimen form and number of copies to be used for each report.

- The method of accounting, the account code and classification used by the company.

- The budget period showing the date of completion-of each part of budget and submission of reports.

- The follow up procedure.

Preparation of Budget: Fixed and Flexible Budget

Question 8.

The Cost Sheet of a company based on a budgeted volume of Sales of 3,00,000 units per quarter is as under:

Particulars : per unit

Direct Materials : 5.00

Direct Wages : 2.00

Factory overheads (50% fixed) : 6.00

S/A dm. overheads (1/3 variable) : 3.00

Selling price : 18.00

When the budget was discussed it was felt that the company would be able to achieve only a volume of 2,50,000 units of production and sales per quarter. The company therefore decided that an aggressive sales promotion campaign should be launched to achieve the following improved operations:

Proposal I:

- Sell ₹ 4,00,000 units per quarter by spending ₹ 2,00,000 on special advertising.

- The factory fixed costs will Increase by ₹ 4,00,000 per quarter.

Proposal II:

- Sell 5,00,000 units per quarter subject to the following conditions.

- An overall price reduction of ₹ 2 per unit is allowed on all sales.

- Variable Selling and Administration Costs will increase by 5%.

- Direct Material Costs will be reduced by 1% due to purchase price discounts.

- The fixed factory Costs will Increase by ₹ 2,00,000 more.

You are required to prepare a Flexible Budget at 2,50,000, 4,00,000 and 5,00,000 units of output per quarter and calculate the Profit at each of the above levels of output. (May 2002, 9 marks)

Answer:

Statement of flexible budget and profit per quarter at 2,50,000; 4,00,000 and 5,00,000 units of output levels per quarter

| Units (to be sold) | 2,50,000 | 4,00,000 | 5,00,000 |

| ₹ | ₹ | ₹ | |

| Sales revenue: (A) | 45,00,000 | 72,00,000 | 80,00,000 |

| (2,50,000 units × ₹ 18) | (4,00,000 units × ₹ 18) | (5,00,000 × units × 16) | |

| Variable Cost

Direct materials |

12,50,000 (2,50,000 units × ₹ 5) | 20,00,000 (4,00,000 units × ₹ 5) | 24,75,000 (5,00,000 units × ₹ 4.95) |

| Direct labour @ 21- per unit | 5,00,000 | 8,00,000 | 10,00,000 |

| Factory overheads @ 3/per unit | 7,50,000 | 12,00,000 | 15,00,000 |

| Selling & Administration overheads | 2,50,000 | 4,00,000 | 5,25,000 |

| (2,50,000 units × ₹ 1) | (4,00,000 units × ₹ 1) | (5,00,000 × ₹ 1.05) | |

| Total variable Costs: (B) | 27,50,000 | 44,00,000 | 55,00,000 |

| Contribution : (C): {(A)-(B)} | 17,50,000 | 28,00,000 | 25,00,000 |

| Fixed Costs: Factory overhead | 9,00,000 | 9,00,000 | 9,00,000 |

| Selling & Administration overheads Increase in fixed costs Advertisement costs |

6,00,000 | 6,00,000 4,00,000 2,00,000 |

6,00,000 6,00,000 |

| Total fixed costs : (D) | 15,00,000 | 21,00,000 | 21,00,000 |

| Profit: {(C) – (D)} | 2,50,000 | 7,00,000 | 4,00,000 |

Under proposal II the factory costs were increased by ₹ 2,00,000 more over proposal I.

Question 9.

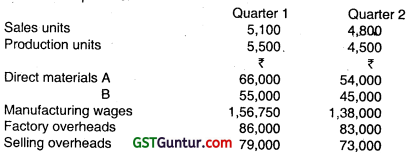

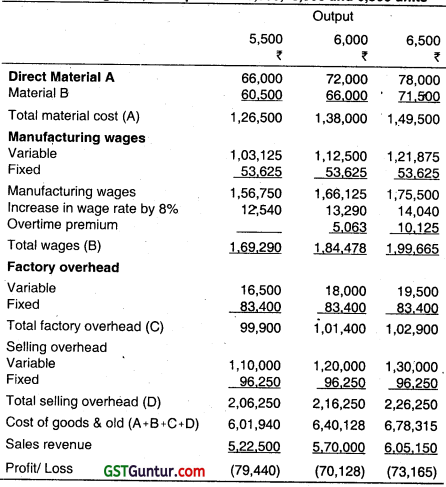

SV Ltd. manufactures a single product. The selling price of the product is ₹ 95 per unit. The following are the results obtained by the company during the last two quarters:

The company estimates its sales for the next quarter to range between 5,500 units and 6,500 units, the most likely volume being 6,000 units. The manufacturing programme will match with the sales quantity such that no increase in inventory of finished goods is contemplated in the next quarter.

The following price and cost changes will, however, apply to the next quarter:

- The price of direct material B will increase by 10%. There will be no change in the price of direct material A.

- The wage rates will go up by 8%. If the production volume increases beyond 5,500 units, overtime premium of 50% is payable on the increased volume due to overtime working to be done by the variable labour complement.

- The fixed factory and selling expenses will increase by 20% and 25% respectively.

- A discount in the selling price of 2% is allowed on all sales made at 6,500 units level of output. The selling price, however, will remain unaltered, if the volume of output is below 6,500 units.

While operating at a volume of output of 6,500 units in the next quarter, the company intends to quote for an additional volume of 2,000 units to be supplied to a Government department for its captive consumption. The working capital requirement of this order iš estimated at 80% of the sales value of the Government order. The company desires a return of 20% on the capital employed in respect of this order.

Required:

(i) Prepare a flexible budget for the next quarter at 5,500, 6,000 and 6,500 unit levels and determine the profit at the respective volumes.

(ii) Calculate the lowest price per unit to be quoted in respect of the Government order for 2,000 units. (May 2003, 12 marks)

Answer:

1. Working Notes:

Direct Material Cost of A & B Material Per unit

Material A \(=\frac{₹ 66,000}{55 \text { units }}\) = ₹ 12 per unit

Material B \(=\frac{₹ 55,000}{5,500 \text { units }}\) = ₹ 10 per unit + 10% increase = ₹ 11

2. (i) Variable manufacturing wages per unit:

\(\frac{₹ 1,56,750}{5,500 \text { unit }}\) – \(\frac{₹ 1,38,000}{4,500 \text { unit }}\) = \(\frac{₹ 18,750}{1,000 \text { units }}\) = ₹ 18.75

(ii) Fixed manufacturing wages

Total wages – variable manufacturing wages

₹ 1,56,750 – ₹ 1,03,125 = ₹ 53,625

3. Overtime premium

a. = 50%(500 units × ₹ 18.75+ 500 units × ₹ 1.50) – 6000 units

= 50% of ₹ 10,125 = ₹ 5,063

b. = 50%(1000 units × ₹ 18.75 + ₹ 1000 units × 1.50) – 6500 units

= ₹ 10,125

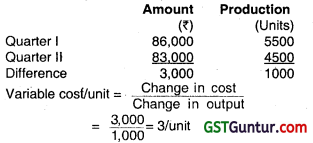

4. Variable factory overhead per unit

Fixed factory overhead = Total factory overhead – Variable factory overhead

= ₹ 86,000 – ₹ 16,500

= ₹ 69,500

Increase in fixed factory overhead by 20%

= ₹ 69,500 + ₹ 13,900 = ₹ 83,400

5. (i) Variable Selling Overhead per unit

(ii) Fixed selling overheads

Total selling overhead – variable selling overhead

= ₹ 1,79,000 – ₹ 1,02,000

= ₹ 77,000

Increase in fixed seHing overhead by 25%

= ₹ 77,000 + ₹ 19.250

= ₹ 96,250

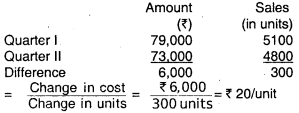

6. Manufacturing wages for 2,000 additIonal units

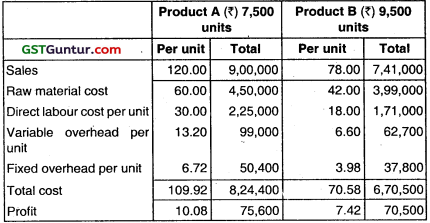

(i) Flexible budget for next quarter at 5,500, 6,000 and 6,500 units

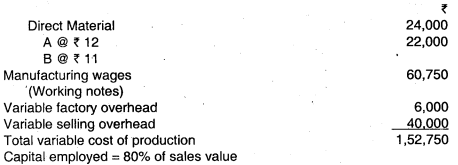

(ii) Computation of lowest price to be quoted for 2,000 units of Govt. order

Let sales value 100 x

Capital employed = 80% of 100x

= 80x

Desired return = 20% of 80x

= 16x

Sales value = Total variable cost + Desired return*

100x = ₹ 1,52,750 + 16x

100x – 16x = ₹ 1,52,750

84x = ₹ 1,52,750

x = \(\frac{1,52,750}{84}\)

= ₹ 1,818.45

Sales value = 100 x

= 100 × 1,818.45

= ₹ 1,81,845.23

Selling price/unit = \(\frac{₹ 1,81,845}{2,000}\)

= ₹ 90.92 or 91/ unit

Lowest price to be quoted for govt. order is ₹ 91/unit.

![]()

Question 10.

Explain briefly the concept of ‘flexible budget’. (Nov 2008, 2 marks)

OR

Explain the flexible Budget. (Nov 2007, 2 marks)

Answer:

Flexible Budget

Flexible Budgets show the expected results of a responsibility center unless for several activity levels. It is a budget which by recognising the difference between fixed, semi-variable and variable costs is designed to change in relation to level of activity attained, it is not rigid as it can be recasted on the basis of activity level to be achieved. It consists of services of static budgets for different levels of activity. Variance analysis through flexible budget provides useful information as each cost is analysed according to its behavior.

It facilitates the ascertainment of cost, fixation of selling price and submission of quotations. Flexible budgets provide a meaningful basis of comparison of the actual performance with the budgeted targets.

Such budgets are especially useful in estimating and controlling factory costs and operating expenses.

Flexible Budgeting may be resorted to In the following situations:

1. New Business:

In case of new business venture, due to its typical nature, it may be difficult to forecast the demand of a product accurately.

2. Uncertain Environment:

Where the business is dependent upon the vagary of nature.

3. Factor Market Conditions:

In the case of Labour intensive industry where the production of the concern is dependent upon the availability of labour.

Question 11.

Distinguish between “Fixed and flexible budget (Nov 2011, 4 marks)

OR

State the difference between Fixed Budget and Flexible Budget. (May 2016, 4 marks)

Answer:

Fixed Budgets: A budget prepared for a particular level of activity is called fixed budget. It presents the cost details for a specific level of activity, Consequently, budgeted costs for budgeted level of activity are compared with the actual costs for actual level of activity. Therefore, fixed budget is not going to highlight the cost variances due to the difference in the levels of activity.

Flexible Budgets: A budget prepared for a range of activities rather than a single level of activity is called flexible budget. It is capable of furnishing the budgeted cost at any level of activity. It recognises the behaviour of costs and classifies them into variable, fixed and semi-variable. On the basis of this, the budget is designed to change (i.e., flex) in relation to the level of activity attained. Therefore, it is able to compute and compare the budgeted costs for actual level of activity attained. In order to prepare the flexible budgets, tabular method is normally used.

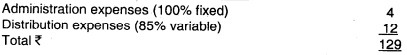

Question 12.

Pentax Limited has prepared its expense budget for 20,000 units in its factory for the year 2013 as detailed below:

Particulars : ₹ per unit

Direct Materials : 50

Direct Labour : 20

Variable Overhead : 15

Direct Expenses : 6

Selling Expenses (20% fixed) : 15

Factory Expenses (100% fixed) : 7

Prepare an expense budget for the production of 15,000 units and 18,000 units., (May 2013, 7 marks)

Answer:

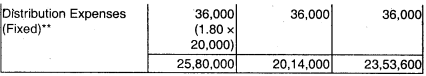

Expense Budget of M/s Pentax Ltd.

*Selling Expenses: Fixed cost per unit = ₹ 15 × 20% = ₹ 3

Fixed Cost = ₹ 3 × 20,000 units = ₹ 60,000

Variable Cost Per unit = ₹ 15 – ₹ 3 = ₹ 12

**Distribution Expenses: Fixed cost per unit = ₹ 12 × 15% = ₹ 1.80

Fixed Cost = ₹ 1.80 × 20,000 units = ₹ 36,000

Variable cost per unit = ₹ 12 – ₹ 1.80 = ₹ 10.20

Question 13.

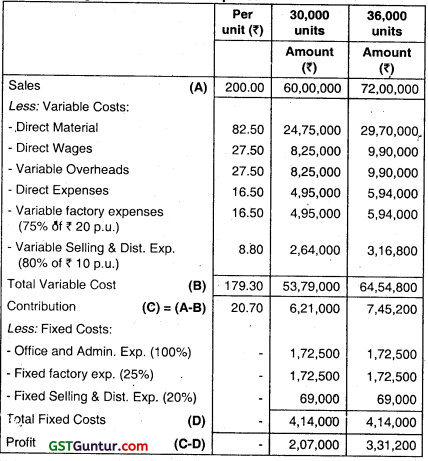

RST Limited is presently operating at 50% capacity and producing 30000 units. The entire output is sold at a price of ₹ 200 per unit. The cost structure at the 50% level of activity is as under:

Direct Material : ₹ 75 per unit

Direct Wages : ₹ 25 per unit

Variable Overheads : ₹ 25 per unit

Direct Expenses : ₹ 15 per unit

Factory Expenses (25% fixed) : ₹ 20 per unit

Selling and Distribution Exp. (80% variable) : ₹ 10 per unit

Office and Administrative Exp. (100% fixed) : ₹ 5 per unit

The company anticipates that the variable costs will go up by 10% and fixed costs will go up by 15%.

You are required to prepare an Expense budget, on the basis of marginal cost for the company at 50% and 60% level of activity and find out the profits at respective levels. (Nov 2014, 8 marks)

Answer:

Expense Budget of RST Ltd. to the period

Question 14.

You are given the following data of a manufacturing concern:

Variable Expenses (at 50% capacity):

Materials : ₹ 48,00,000

Labour : ₹ 51,20,000

Others : ₹ 7,60,000

Semi-variable expenses (at 50% capacity):

Maintenance and Repairs : ₹ 5,00,000

Indirect Labour : ₹ 19,80,000

Sales Dept. Salaries : ₹ 5,80,000

Sundry Administrative Expenses : ₹ 5,20,000

Fixed Expenses:

Wages & Salaries : ₹ 16,80,000

Rent, Rates and Taxes : ₹ 11,20,000

Depreciation : ₹ 14,00,000

Sundry Administrative Exp. : ₹ 17,80,000

The fixed expenses remain constant for all levels of production. Semi-variable expenses remain constant between 45% and 65% of capacity whereas it increases by 10% between 65% and 80% capacity and by 20% between 80% and 100% capacity.

Sales at various levels are as under

Capacity : Sales(₹)

75% : 2,40,00,000

100% : 3,20,00,000

Prepare flexible budget at 75% and 100% capacity. (May 2017, 8 marks)

Answer:

Flexible Budget

| Particulars | 75% (₹) | 100% (₹) |

| Sales | 2,40,00,000 | 3,20,00,000 |

| Variable Expenses | ||

| Materials | 72,00,000 | 96,00,000 |

| Labour | 76,80,000 | 1,02,40,000 |

| Others | 11,40,000 | 15,20,000 |

| Total Variable Expense (A) | 1,60,20,000 | 2,13,60,000 |

| Semi-Variable Expenses | ||

| Maintenance & repairs | 5,50,000 | 6,00,000 |

| indirect Labour | 21,78,000 | 23,76,000 |

| Sales Department Salaries | 6,38,000 | 6,96,000 |

| Sundry Administration expenses | 5,72,000 | 6,24,000 |

| Total Semi-Variable Expenses (B) | 39,38,000 | 42,96,000 |

| Fixed Expenses | ||

| Wages and Salaries | ‘16,80,000 | 16,80,000 |

| Rent, Rates, Taxes | 11,20,000 | 11,20,000 |

| Depreciation | 14,00,000 | 14,00,000 |

| Sundry Administration Expenses | 17,80,000 | 17,80,000 |

| Total Fixed Expenses (C) | 59,80,000 | 59,80,000 |

| Profit (Sales – A – B – C) | (19,38,000) | 3,64,000 |

![]()

Question 15.

What are the cases when a flexible budget is found suitable? (May 2019, 5 marks)

Answer:

Flexible Budgeting may be resorted to in the following situations:

1. New Business:

In case of new business venture, due to its typical nature, It may be difficult to forecast the demand of a product accurately.

2. Uncertain Environment:

Where the business is dependent upon the vagary of nature.

3. Factor Market Conditions:

In the case of Labour Intensive industry where the production of the concern is dependent upon the availability of labour.

Question 16.

G Ltd. manufactures a single product for which market demand exists for additional quantity. Present sales of ₹ 6,00,000 utilises only 60% capacity of the plant. The following data are available:

(1) Selling price : ₹ 100 per unit

(2) Variable cost : ₹ 30 per unit

(3) Semi-variable expenses : ₹ 60,000 fixed + ₹ 5 per unit

(4) Fixed expenses : ₹ 1,00,000 at present level, estimated to in crease by 25% at and above 80% capacity.

You are required to prepare a flexible budget so as to arrive at the operating profit at 60%. 80% and 100% levels. (Nov 2009, 5 marks)

Question 17.

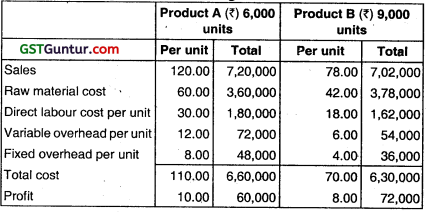

S Ltd. has prepared budget for the coming year for its two products A and B.

| Product A (₹) | Product B (₹) | |

| Production & Sales unit | 6,000 units | 9,000 units |

| Raw material cost per unit | 60.00 | 42.00 |

| Direct labour cost per unit | 30.00 | 18.00 |

| Variable overhead per unit | 12.00 | 6.00 |

| Fixed overhead per unit | 8.00 | 4.00 |

| Selling price per unit | 120.00 | 78.00 |

After some marketing efforts, the sales quantity of the Product A & B can be increased by 1,500 units and 500 units respectively but for this purpose the variable overhead and fixed overhoad will be increased by 10% and 5%

respectively for the both products.

You are required to PREPARE flexible budget for both the products:

(a) Before marketing efforts

(b) Alter marketing efforts.

Answer:

(a) Flexible Budget before marketing efforts:

(b) Flexible Budget after marketing efforts:

Preparation of Budget: Functional Budget(Comprehensive)

Question 18.

What is Sales Budget? How is it prepared? (Nov 1998, 4 marks)

Answer:

Sales budget: It is the foundation upon which the other functional budget are built. Sales forecast is the commencement of budgeting and as such, the sales budget is of primary importance.

In fact when sales forecast is presented in monetary value, it takes the form of a sales budget. It provides a basis for the production department to produce the required quantity of products.

The sales budget may be prepared according to products, sales territories, types of customers, salesmen etc. While preparing the sales budget, the following factors are to be taken into consideration:

- Past sales volume

- General economic and industry conditions

- Relative product profitability

- Market research studies

- Pricing policies

- Advertising and other sales promotion efforts

- Competition

- Production capacity

- Long term sales trends for various products

- Reports of salesmen.

Question 19.

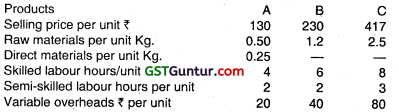

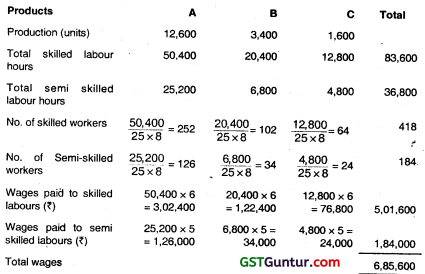

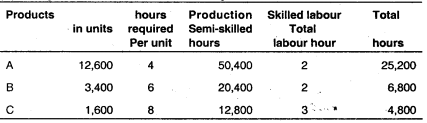

A company manufactures three products namely A, B and C. The current pattern of sales of A, B and C is in the ratio of 8 : 2 : 1 respectively. The relevant data are as under:

The prices of raw materials and direct materials respectively are ₹ 100 and ₹ 40 per kg. The wage rates of skilled and semi-skilled labour respectively are ₹ 6 and ₹ 5. Each operator works 8 hours a day for 25 days in a month. The position of inventories are as under:

The fixed overheads amount to ₹ 2,00,000 per month and the company desires a profit of ₹ 1,20,000 per month.

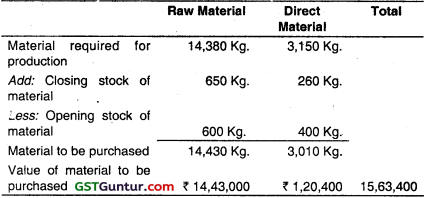

You are required to prepare the following for a month:

(i) Sales budget in quantity and value.

(ii) Production budget showing the quantity to be manufactured.

(iii) Purchase budget showing the quantity and value.

(iv) Direct labour budget showing the number of workers and wages. (May 2004, 12 marks)

Answer:

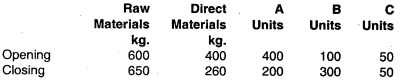

(i) Sales Budget (in quantity and value)

(ii) Production Budget

(iii) Purchase Budget

(iv) Direct Labour Budget

Working Notes:

(i) Material requirement for production of Product A, B and C

(ii) Computation of sales value

(iii) Computation of Labour hours required

(iv) Number of batches to be sold of product A, B, C in ratio of 8 : 2 : 1 to earn desired profit of ₹ 1,20,000

Number of batches to be sold = 1,600 batches.

Question 20.

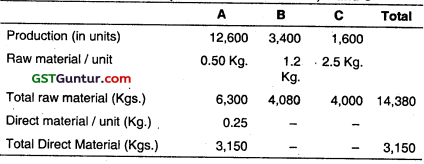

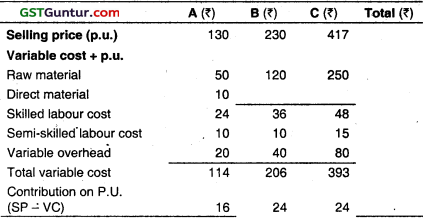

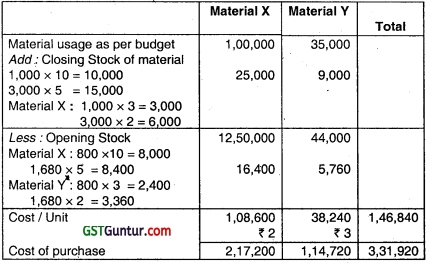

A Company manufactures two Products A and B by making use of two types of materials, viz., X and Y. Product A requires 10 units of X and 3 units of Y. Product B requires 5 units of X and 2 units of Y. The price of X is ₹ 2 per unit and that of Y is ₹ 3 per unit. Standard hours allowed per product are 4 and 3, respectively. Budgeted wages rate is ₹ 8 per hour. Overtime premium is 50% and is payable, if a worker works for more than 40 hours a week. There are 150 workers.

The Sales Manager has estimated the sales of Product A to be 5,000 units and Product B 10,000 units. The target productivity ratio (or efficiency ratio) for the productive hours worked by the direct worker in actually manufacturing the product is 80%, in addition, the non-productive downtime is budgeted at 20% of the productive hours worked. There are twelve 5-day weeks in the budget period and it is anticipated that sales and production will occur evenly throughout the whole period.

It is anticipated that stock at the beginning of the period will be :

Product A 800 units; Product B 1,680 units. The targeted closing stock expressed in terms of anticipated activity during the budget period are Product A 12 days sales; Product B 18 days sales. The opening and closing stock of raw material of X and Y will be maintained according to requirement of stock position for Product A and B.

You are required to prepare the following for the next period :

(i) Material usage and Material purchase budget in terms of quantities and values.

(ii) Prociuchon budget.

(iii) Wages budget for the direct workers. (Nov 2004, 8 marks)

Answer:

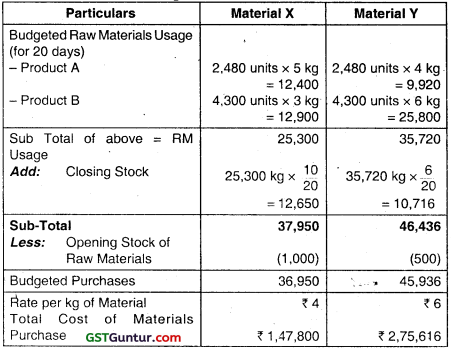

(i)

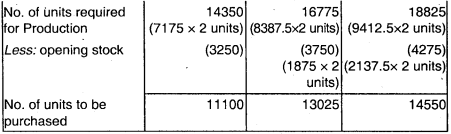

Material purchase Budget:

(ii)

![]()

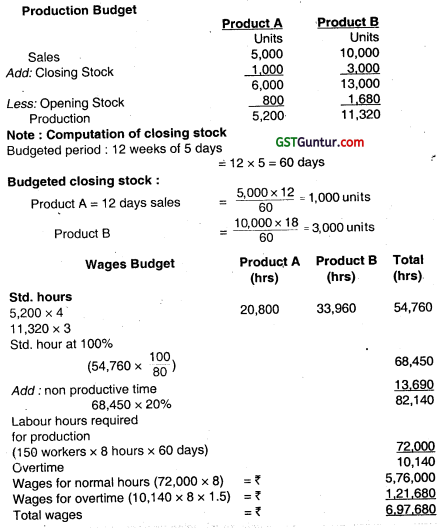

Question 21.

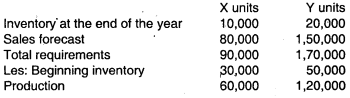

Company is engaged in manufacturing two products ‘X’ and ‘Y’. Product X uses one unit of component ‘P’ and two units of component ‘Q’. Product ‘Y’ uses two units of component ‘P’ one unit of component ‘Q’ and two units of component ‘R’. Component ‘R’ which is assembled in the factory uses one unit of component ‘Q’.

Components ‘P’ and ‘Q’ are purchased from the market. The company has prepared the following forecast of sales and inventory for the next year:

The production of both the products and the assembling of the component ‘R’ will be spread out uniformly throughout the year. The company at present orders its inventory of ‘P’ and ‘Q’ in quantities equivalent to 3 months production. The company has compiled the following data related to two components :

Required :

(a) Prepare a Budget of production and requirements of components during next year.

(b) Suggest the optimal order quantity of components ‘P’ and ‘Q’. (May 2006, 11 marks)

Answer:

Production Budget for products X and Y

Budgeted requirements of components P, Q and R

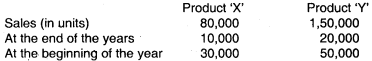

Question 22.

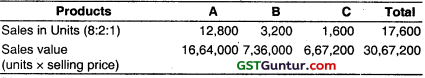

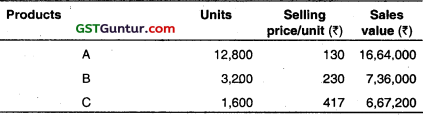

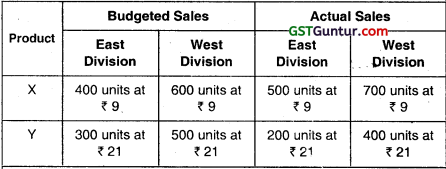

Following is the sales budget for the first six months of the year 2009 in respect of PQR Ltd:

![]()

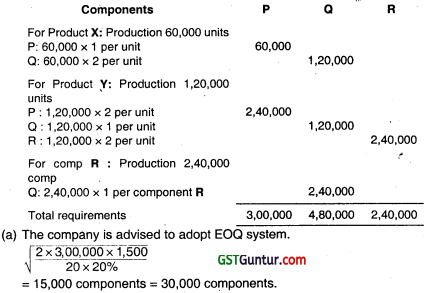

Finished goods inventory at the end of each month is expected to be 20% of budgeted sales quantity for the following month. Finished goods inventory was 2,700 units on January 1, 2009. There would be no work-in-

progress at the end of any month.

Each unit of finished product requires two types of materials as detailed below:

Material X : 4 kgs. @ ₹ 10/kg

Material Y : 6 kgs. @ ₹ 15/kg

Material on hand on January, 1, 2009 was 19,000 kgs. of material X and 29,000 kgs. of material Y. Monthly closing stock of material is budgeted to be equal to half of the requirements of next month’s production. Budgeted direct labour hour per unit of finished product is 3/4 hour. Budgeted direct labour cost for the first quarter of the year 2009 is ₹ 10,89,000.

Actual data for the quarter one, ended on March 31, 2009 is as under:

Actual production quantity : 40,000 units

Direct material cost

(Purchase cost based on materials actually issued to production)

Material X : 1,65,000 kgs. @ ₹ 10.20/kg

Material Y : 2,38,000 kgs. @ ₹ 15.10/kg

Actual direct labour hours worked: 32,000 hours

Actual direct labour cost: ₹ 13,12,000

Required:

(a) Prepare the following budgets:

(i) Monthly production quantity budget for the quarter one.

(ii) Monthly raw material consumption quantity budget from January, 2009 to April, 2009.

(iii) Materials purchase quantity budget for the quarter one.

(b) Compute the following variances:

(i) Material cost variance

(ii) Material price variance

(iii) Material usage variance

(iv) Direct labour cost variance

(v) Direct labour rate variance

(vi) Direct labour efficiency variance. (May 2009, 6 + 9 = 15 marks)

Answer:

(a) (i) Statement showing monthly production quantity budget: Production Budget for January, 2009 to March, 2009

Total Budgeted Output for the Quarter ended March 31, 2009

= (9,700 + 12,400 + 14,200)

= 36,300 units

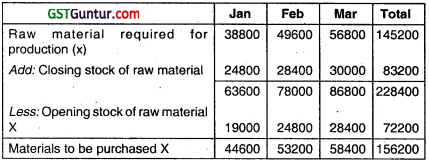

(ii) Monthly Raw Material consumption quantity budget from January 2009 to April 2009

Raw Material Consumption Budget (in quantity)

(iii) Material purchase quantity budget for the quarter Raw Materials Purchase Budget (in quantity) for the Quarter ended (March 31st, 2009) Material X

Raw Materials Purchase Budget (in quantity) for the Quarter ended (March 31st, 2009) Material Y

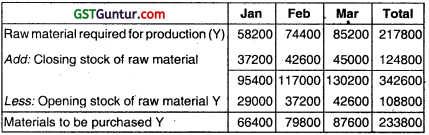

(b) Calculation of Material Cost Variance:

Material Variance

| (1) | (2) | (3) | (4) |

| SP X SQ | SP X SM | SP X AQ used | AP X AQ used |

| X 10 × 1,60,000 | 10 × 1,61,200 | 10 × 1,65,000 | 10.20 × 1,65,000 |

| Y 15 × 2,40,000 | 15 × 2,41,800 | 15 × 2,38,000 | 15.10 × 2,38,000 |

| 52,00,000 | 52,39,000 | 52,20,000 | 52,76,800 |

SM = Std. mix i.e. total actual quantity used in std. mix ratio

Total Actual quantity use = 1,65,000 + 2,38,000

= 4,03,000 kgs.

Std. mix ratio = 4 : 6 i.e. x : y

Std. mix for X = \(\frac{4}{10}\) × 4,03,000

= 1,61,200 kgs

Std. mix for Y = \(\frac{6}{10}\) × 4,03,000

= 2,41,800 kgs

Std. quantity i.e. std. qty for actual output.

Actual output = 40,000 kg.

∴ material x required = 40,000 × 4 = 1,60,000

material y required = 40,000 × 6 = 2,40,000

Here SP = Standard Price per kg of RM

SQ = Standard quantity for actual output.

SM = Standard mix i.e. Total actual quantity used in standard mix ratio

AQ used = Actual quantity used.

(i) Material cost variance = 1 – 4 = 76,800 (A)

(ii) Material Price variance = 3 – 4 = 56,800 (A)

(iii) Material uses variance = 1 – 3 = 20,000 (a)

Working Notes:

\(=\frac{\text { Budgeted labours cost }}{\text { Budgeted hours }}\)

\(\frac{10,89,000}{27,225}\) = ₹ 40

Let Actual time worked = Actual time paid

Here: SR = Standard rate of labour per hour

ST = Standard time for Actual output

SM = Standard mix i.e. total at worked in ltd. mix

ratio.

ATW = Actuat time worked

ATP = Actual time paid for

(iv) Direct Labour Cost Variance = 1 – 5 = 1,12,000 (A)

(v) Direct Labour rate variance =4 – 5= 32,000 (A)

(vi) Direct Labour efficiency variance = 1 – 2 80,000 (A)

Question 23.

List the eight functional budgets prepared by a business. (Nov 2009, 3 marks)

Answer:

A functional budget is prepared according to the various functions of the organization e.g.: Sales, Production, Administration Research & development etc.

Following are the most popular functional budgets:

- Sales budget

- Production budget

- Materials budget

- Labour budget

- Manufacturing overhead budget

- Administrative cost budget

- Plant utilisation budget

- Research and Development budget

- Capital expenditure budget

- Cash budget.

![]()

Question 24.

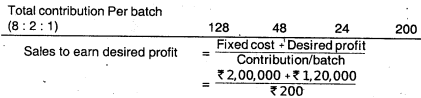

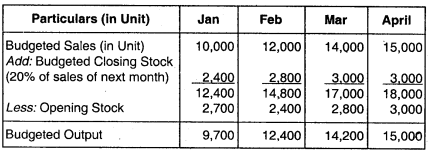

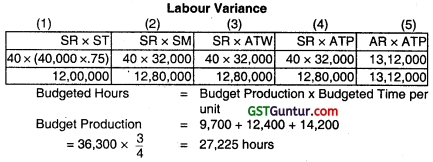

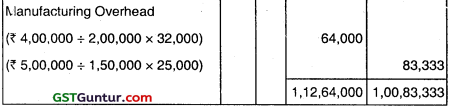

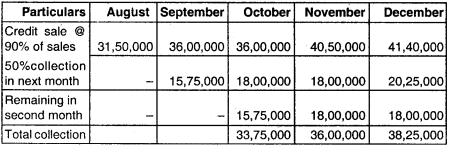

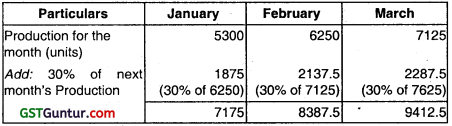

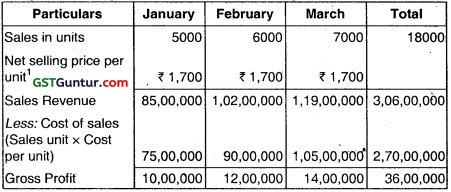

AK Limited produces and sells a single product. Sales budget for calendar year 2012 by quarters is as under:

![]()

The year is expected to open with an inventory of 6,000 units of finished products and close with inventory of 8,000 units. Production is customarily scheduled to provide for 70% of the current quarter’s sales demand plus 30% of the following quarter demand. The budgeted selling price per unit is ₹ 40. The standard cost details for one unit of the product are as follows: Variable Cost ₹ 34.50 per unit.

Fixed Overheads 2 hours 30 minutes @ ₹ 2 per hour based on a budgeted production volume of 1,10,000 direct labour hours for the year. Fixed overheads are evenly distributed through-out the year.

You are required to:

(i) Prepare Quarterly Production Budget for the year.

(ii) In which quarter of the year, company expected to achieve break-even point. (May 2012, 5 marks)

Answer:

(i) Production Budget for the year 2012

‘Balancing Figure

(ii) Break Even Point = Fixed Cost/PV Ratio

= 2,20,000/13.75% = 16,00,000 or 40,000 units.

PA/ Ratio = (40 – 34.50 = 5.50)/40 × 100 = 13.75%

(Or, Break Even Point = Fixed Cost/Contribution = 2,20,000/5.50 = 40,000 Units)

Total sales in the quarter II is 40,000 equal to BEP means BEP achieved in II quarter.

State the considerations on which capital expenditure budget is prepared.

Question 25.

State the considerations on which capital expenditure budget is prepared. (Nov 2012, 4 marks)

Answer:

The preparation of Capital Expenditure Budget is based on the following considerations:

- Overhead on production facilities of certain departments as indicated by the plant utilisation budget.

- Future development plans to increase output by expansion of plant facilities.

- Replacement requests from the concerned departments.

- Factors like sales potential to absorb the increased output, possibility of price reductions, increased costs of advertising and sales promotion to absorb increased output, etc.

![]()

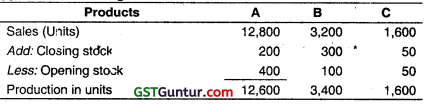

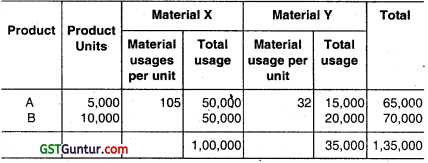

Question 26.

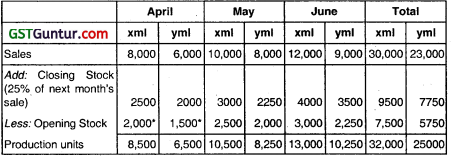

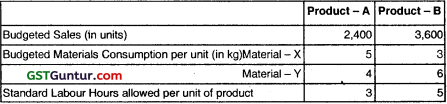

X Y Z Limited is drawing a production plan for its two products— Product ‘xml’ and Product ‘yml’ for the year 2015-16. The company’s policy is to maintain closing stock of finished goods at 25% of the anticipated volume of sales of the succeeding month.

The following are the estimated data for the two products:

![]()

The estimated units to be sold in the first four months of the year 2015-16 are as under:

| April | May | June | July | |

| xml | 8,000 | 10,000 | 12,000 | 16,000 |

| yml | 6,000 | 8,000 | 9,000 | 14,000 |

Prepare:

(i) Production Budget (Month wise)

(ii) Production cost Budget (for first quarter of the year) (May 2015, 5 marks)

Answer:

(i) Production Budget of Product ‘xml’ and ‘yml’ (month wise in units)

* Opening stock of April is the closing stock of March, which is as per company’s policy 25% of next month’s sale.

(ii) Production Cost Budget (for first quarter of the year)

Question 27.

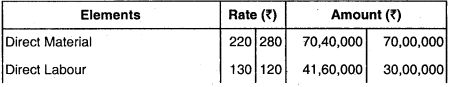

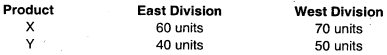

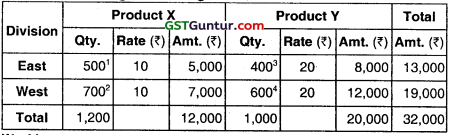

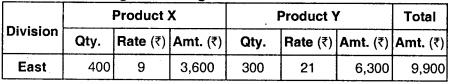

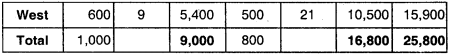

XY Co. Ltd. manufactures two products viz., X and Y and sells them through two divisions, East and West. For the purpose of Sales Budget to the Budget Committee, following information has been made available for the year 2014-15:

Adequate market studies reveal that product X is popular but under priced. It is expected that if the price of X is increased by ₹ 1, it will find a ready market. On the other hand, Y is overpriced and if the price of Y is reduced by ₹ 1, it will have more demand in the market. The company management has agreed for the aforesaid price changes. On the basis of these price changes and the reports of salesmen, following estimates have been prepared by the Divisional Managers:

Percentage increase in sales over budgeted sales

With the help of intensive advertisement campaign, following additional sales (over and above the above mentioned estimated sales by Divisional Managers) are possible:

You are required to prepare Sales Budget for 2015-16 after incorporating, above estimates and also show the Budgeted Sales and Actual Sales of 2014-15. (Nov 2015, 8 marks)

Answer:

Statement Showing Sales Budget for 2015-16

Workings:

- 400 × 110% + 60 = 500 units

- 600 × 105% + 70 = 700 units

- 300 × 120% + 40 = 400 units

- 500 × 110% + 50 = 600 units

Statement Showing Sales Budget

Statement Showing Actual Sales for 2014-15

Question 28.

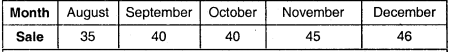

Following information relates to ABC company for the year 2016:

(i) Projected sales:

(₹ in lakhs)

(ii) Gross profit margin will be 20% on sale.

(iii) 10% of projected sale will be cash sale. Out of credit sale of each month, 50% will be collected in the next month and the balance will be collected during the second month following the month of sale.

(iv) Creditors will be paid in the first month following credit purchase. There will be credit purchase only.

(v) Wages and salaries will be paid on the first day of the next month. The amount will be ₹ 3 lakhs each month.

(vi) Interim dividend of ₹ 2 lakhs will be paid in December 2016,

(vii) Machinery costing ₹ 10 lakhs will be purchased in September 2016. Repayment by instalment of ₹ 50,000 p.m, will start from October 2016.

(viii) Administrative expenses of ₹ 1,00,000 per month will be paid in the month of their incurrence.

(ix) Assume no minimum cash balance is required. Opening cash balance as on 01-10-2016 is estimated at ₹ 10 lakhs.

You are required to prepare the monthly cash budget for the 3 month period (October 2016 to December 2016). (Nov 2016, 8 marks)

Answer:

Cash Budget

(from October, 2016 to December, 2016)

| Particulars | October | November | December |

| Opening Cash balance | 10,00,000 | 14,25,000 | 21,25,000 |

| Receipts: | |||

| Cash Sales | 4,00,000 | 4,50,000 | 4,60,000 |

| Collection from Debtors (W.N.1) | 33,75,000 | 36,00,000 | 38,25,000 |

| (A) | 47,75,000 | 54,75,000 | 64,10,000 |

| Payments | |||

| Payment to creditors (W.N. 2) | 29,00,000 | 29,00,000 | 33,00,000 |

| Wages & salaries | 3,00,000 | 3,00,000 | 3,00,000 |

| Interim dividend | – | – | 2,00,000 |

| Installment of Asset | 50,000 | 50,000 | 50,000 |

| Administration expenses | 1,00,000 | 1,00,000 | 1,00,000 |

| (B) | 33,50,000 | 33,50,000 | 39,50,000 |

| Closing Cash Bal. (A – B) | 14,25,000 | 21,25,000 | 24,60,000 |

Working Notes:

1. Calculation of collection from Debtors:

2. Calculation of purchase:

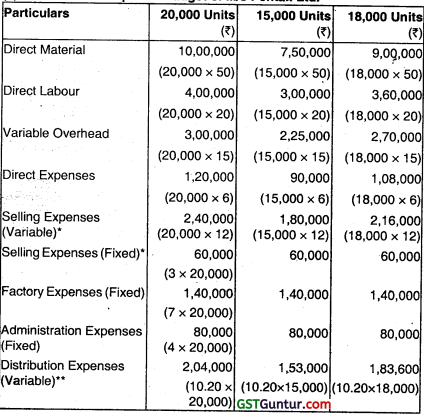

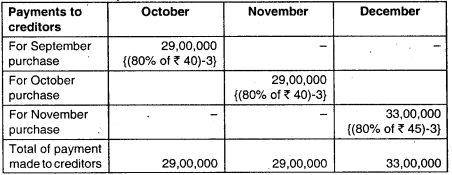

![]()

Question 29.

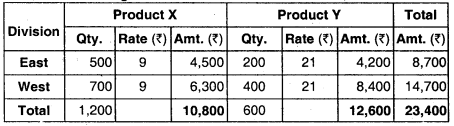

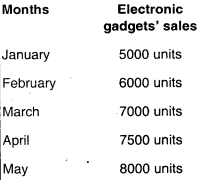

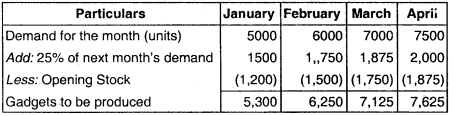

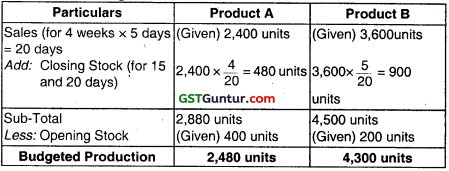

An electronic gadget manufacturer has prepared sales budget for the next few months. In this respect, following figures are available :

To manufacture an electronic gadget, a standard cost of ₹ 1,500 is incurred and it is sold through dealers at an uniform price of ₹ 2,000 per gadget to customers. Dealers are given a discount of 15% on selling price.

Apart from other materials, two units of batteries are required to manufacture a gadget. The company wants to hold stock of batteries at the end of each month to cover 30% of next month’s production and to hold stock of manufactured gadgets to cover 25% of the next month’s sale. 3250 units of batteries and 1200 units of manufactured gadgets were in stock on 1st January.

Required:

(i) Prepare production budget (in units) for the month of January, February, March and April.

(ii) Prepare purchase budget for batteries (in units) for the month of January, February and March and calculate profit for the quarter ending on March. (Nov 2018, 10 marks)

Answer:

(i) Preparation of Production Budget (in units)

(ii) Preparation of Purchase budget for batteries

Budgeted Gross profit for the Quarter January to March

Question 30.

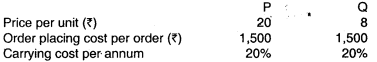

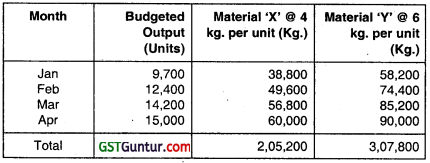

Concorde Ltd. manufactures two products using two types of materials and one grade of labour. Shown below is an extract from the Company’s working papers for the next month’s budget:

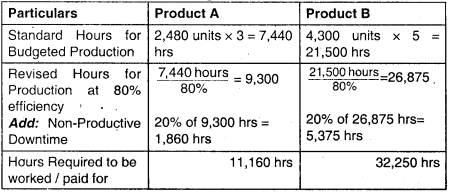

Question 31.

Material – X and Material – Y cost ₹ 4 and ₹ 6 per kg and Labourers are paid ₹ 25 per hour. Overtime Premium is 50% and is payable, if a Worker works for more than 40 hours a week. There are 180 Direct Workers.

The target Productivity (or Efficiency) Ratio for the productive hours worked by the Direct Workers in actually manufacturing the products is 80%. In addition, the Non- Productive Down – Time is budgeted at 20% of the Productive Hours worked.

There are four 5 – days weeks in the budgeted period and it is anticipated that Sales and Production will occur evenly throughout the whole period.

It is anticipated that stock at the beginning of the period will be:

| Product A | Product B | Material X | Material Y |

| 400 units | 200 units | 1,000 kgs | 500 kgs |

The anticipated Closing Stocks for the budget period are as below:

| Product A | Product B | Material X | Material Y |

| 4 days Sales | 5 days Sales | 10 days Consumption | 6 days Consumption |

Prepare material Purchase Budget and Wages Budget for Direct Workers, showing me quantities and values for the next month.

Answer:

1. Production Budget

2. Material Purchase Budget

3. Labour Hours and Cost Budget

Zero based Budgeting

Question 32.

State, how is Zero base Budgeting superior to Traditional Budgeting. (Nov 2002, 4 marks)

OR

Answer the following :

(c) Why is ‘Zero Base Budgeting’ Traditional Budgeting’? Explain. (ZBB) considered superior to (May 2018, 5 marks)

Answer:

ZBB is superior than traditional budgeting because :

- ZBB provides a systematic base for evaluation of different activities.

- ZBB gives an opportunity for management to allocate resources to various activities after a proper cost benefit analysis.

- ZBB assigns that the functions undertaken are critical for the achievement of the objectives.

- ZBB provides a base for a system of management by objectives.

- ZBB provides a base for a system of management by objectives.

- ZBB provides a close relationship between departmental budget and corporate objectives / budget.

- ZBB helps in identification of wastage and then their elimination.

![]()

Question 33.

What are the advantages and limitations of Zero base Budgeting? (Nov 2004, 4 marks)

Answer:

Advantages of ZBB:

- ZBB process identities inefficient operation and considers every time alternative ways of performing the same task.

- ZBB is used in identification of wastage and obsolescent items of expenditure.

- ZBB is very much useful for the staff and support areas of an organisation such as research & development, quality control, pollution control, legal and technical staff etc.

- The core resources will be allocated more efficiently according to the priority of programme.

- ZBB provides an opportunity to the management to allocate resources for various activities only after having a thorough cost-benefit analysis.

- Departmental budgets are closely linked with corporate objectives.

- ZBB ensures that the various functions undertaken by the organisation are critical for the achievement of its objectives and are being performed in the best way.

- The technique can also be used for the introduction of the system of management by objective (MBO).

Limitation of ZBB

- ZBB requires skilled and trained managerial staff.

- ZBB is time consuming as well as costly.

- ZBB faces various operational problems during the implementation of such technique.

- ZBB requires full support of top management.

Question 34.

Write short note on ‘Zero Base Budgeting as an approach towards productivity improvement.’ (Nov 2005, 4 marks)

Answer:

Zero Base Budgeting approach plays key role in productivity improvement. It is beneficial in this regard in the following manner:

- ZBB ensures that the various functions adopted by the organisation are important and critical for the achievement of its objectives and are being performed in the best possible way.

- ZBB gives an opportunity to the management to allocate resources for different activities only after proper cost benefit analysis.

- In this approach,chances of arbitrary cuts and enhancement are thus avoided.

- Department budgets are closely linked with corporate objectives.

- It provides a systematic approach for the evaluation of different activities and rank them in order of preference for the allocation of scarce resources.

- Wasteful expenditures can be easily identified and eliminated.

Question 35.

Define Zero Base Budgeting and mention its various stages. (Nov 2019, 5 marks)

Answer:

Zero-based Budgeting (ZBB) is defined as a method of budgeting which requires each cost element to be specifically justified, although the activities to which the budget relates are being taken for the first time without approval, the budget allowance is zero’.

ZBB involves the following stages:

(i) Identification and description of Decision packages

(ii) Evaluation of Decision packages

(iii) Ranking (Prioritisation) of the Decision Packages

(iv) Allocation of resources

(i) Identification and description of Decision packages:

Decision packages are the programmes or activities for which decision is required to be taken. The programmes or activities are described for technical specifications, financial impact in the form of cost benefit analysis and other issues like environmental, regulatory, social etc.

(ii) Evaluation of Decision packages:

Once Decision packages are identified and described, it is evaluated against factors like synchronisation with organisational objectives, availability of funds, regulatory requirements etc.

(iii) Ranking (prioritasation) of the Decision packages:

After evaluation of the decision packages, it is ranked on the basis priority of the activities. Because of this prioritisation feature ZBB is also known as Priority- based Budgeting.

(iv) Allocation of resources:

After ranking of the decision packages resources are allocated for decision packages. Budgets are prepared like it is done first time without taking reference to previous budgets.

Performance Budget

Question 36.

What are the important points an organization should consider if it wants to adopt Performance Budgeting? (Nov 2020, 5 marks)

Question 37.

Write short Note on;

Performance Budgeting.

Answer:

Meaning:

Performance Budgeting is a techinque of presenting budgets for costs and revenues, in terms of functions. So. programmes and activities are correlated with the physical and financial aspect of individual items comprising the budget.

It aims at a continuous growth of the Firm, and meet the dynamic needs of its growing clientele and customers. It enables the Firm to be sensitive and adaptive, preventing it from developing rigidities which may affect its growth and requires the preparation of periodic performance Reports, to compare budget and actuals to find out existing variances.

Focus:

Focus of Performance Budgeting is on functions, and not the cost of functions as such, The functions, programmes, activities and tasks, are reported, along with costs thereof.

Steps in Performance Budgeting

- Establishing a meaningful functional Programme and Activity Classification of operations,

- Bringing the system of Accounting and Financial Management, in accordance with the above Classification,

- Establishing suitable norms, yardsticks, work units of performance and unit costs, wherever possible, under each programme and activity, for their reporting and evaluation.

- Monitoring and evaluate performance on the basis of performance Reports.

Budget Ratios

Question 38.

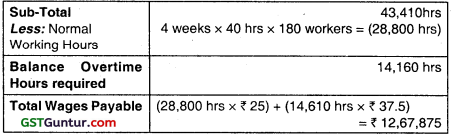

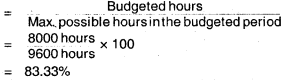

A company manufactures two products X and Y. Product X requires 8 hours to produce while Y requires 12 hours. In April, 2004, of 22 effective working days of 8 hours a day, 1,200 units of X and 800 units of Y were produced. The company employs 100 workers in production department to produce X and Y.

The budgeted hours are 1,86,000 for the year. Calculate Capacity, Activity and Efficiency ratio and establish their relationship. (Nov 2004, 6 marks)

Answer:

Calculation of Standard Hours

Relationship

Activity Ratio = Efficiency Ratio × Capacity Ratio

123.87 = \(\frac{109.09 \times 113.55}{100}\)

![]()

Question 39.

Answer the following:

Calculate Efficiency and Capacity ratio from the following figures:

Budgeted production : 80 units

Actual production : 60 units

Standard time per unit : 8 hours

Actual hours worked : 500(Nov 2007, 2 marks)

Answer:

Budgeted Production = 80 units

Actual Production = 60 units

Standard time per units = 8 hours

Total hours worked = 500

Standard hours for actual Production = 60 × 8

= 480 hours

Budgeted hours = 80 × 8

= 640 hours

Efficiency Ratio \(=\frac{\text { Standard hours for actual production }}{\text { Actual hours worked }}\) × 100

= \(\frac{480}{500}\) × 100

= 96%

Capacity Ratio \(=\frac{\text { Actual hours worked }}{\text { Budgeted hours }}\) × 100

= \(\frac{500}{640}\) × 100

= 78.125%

Question 40.

Answer the following:

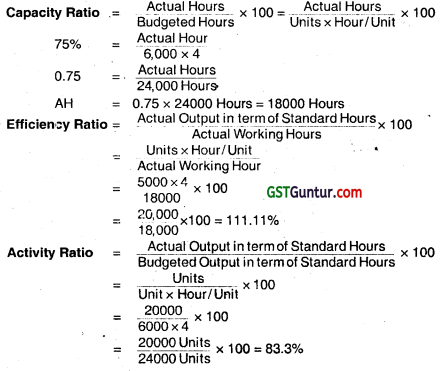

Calculate efficiency and activity ratio from the following data:

Capacity ratio = 75%

Budgeted output = 6000 units

Actual output = 5000 units

Standard Time per unit = 4 hours (Nov 20009, 2 marks)

Answer:

Question 41.

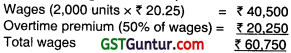

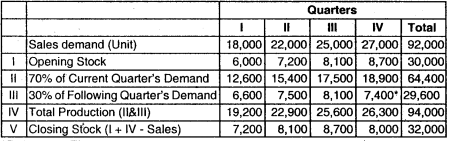

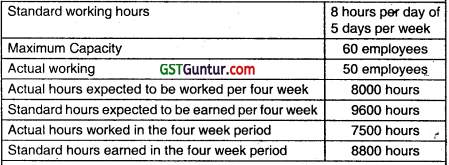

Following data is available for ABC Ltd.

The related period is of four weeks.

Calculate the following Ratios:

(i) Efficiency Ratio

(ii) Activity Ratio

(iii) Standard Capacity Usage Ratio

(iv) Actual Capacity Usage Ratio

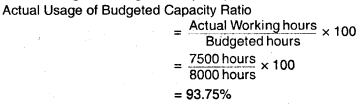

(v) Actual Usage of Budgeted Capacity Ratio (May 2019, 5 marks)

Answer:

Maximum capacity in a budgeted period

= 60 Employees × 8 hours × 5 days × 4 weeks

= 9600Hrs

Budgeted Hours

= 50 employees × 8 hours × 5 days × 4 Weeks = 8000 hours

Actual hours = 7500 hours (as given)

standard hours for Actual Output = 8800 hours

Budget No. of Days = 20 days = 20 days (4 weeks × 5 days)

(i) Efficiency Ratio:

Efficiency Ratio \(=\frac{\text { Standard hours }}{\text { Actual hours }}\) × 100

= \(=\frac{8800 \text { hours }}{7500 \text { hours }}\) × 100

= 117.33%

(ii) Activity Ratio :

Activity Ratio \(=\frac{\text { Standard hours }}{\text { Budgeted hours }}\) × 100

\(=\frac{8800 \text { hours }}{8000 \text { hours }}\) × 100

= 110%

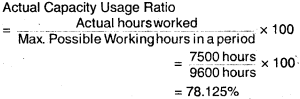

(iii) Standard Capacity Usage Ratio:

(iv) Actual Capacity Usage Ratio:

(v) Actual Usage of Budgeted Capacity Ratio:

![]()

Question 42.

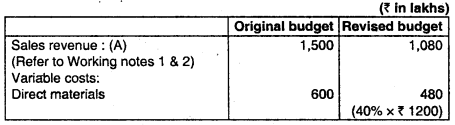

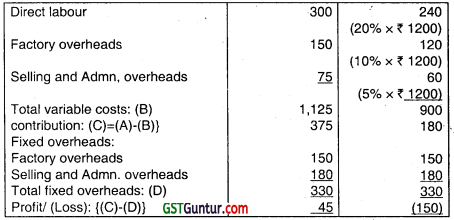

A company prepared the following budget for a year:

After evaluating the half-yearly performance, it was observed that the company would be able to achieve only 80% of the original budgeted sales. The revised budgeted sale as envisaged above was estimated at ₹ 1,080 lacs after taking into account a reduction in the selling price by 10%.

You are required to prepare a statement showing the break up of the original and revised budget for the year. (May 2000, 6 marks)

Answer:

Statement showing the break-up of the original and revised budget for a year:

Working notes:

1. Revised budgeted sales (after taking into account 10% reduction in selling price)

If revised budgeted S.P. is ₹ 90 The original budgeted S.P. is ₹ 100

If revised budgeted S.P. is ₹ 1 the original budgeted S.P. is \(\frac{₹ 100}{₹ 90}\)

If revised budgeted sales at revised S.P. is ₹ 1080 lacs then the revised budgeted sales at original S.P. will is \(\frac{₹ 100}{₹ 90}\) × ₹ 1080 lacs = ₹ 1,200 lacs

2. Original budgeted sales

If revised budgeted sales at original S.P. is ₹ 80 then the original budgeted sales at original selling price is ₹ 100

If revised budgeted sales at original S.P. is ₹ 1 then the original sales at original selling price is \(\frac{₹ 100}{₹ 80}\)

If revised budgeted sales at original S.P. is ₹ 1,200 lacs then the original budgeted sales at original selling price is \(\frac{₹ 100}{₹ 80}\) × ₹ 1,200 lacs

= ₹ 1,500 Lacs.