Material Cost – CA Inter Costing Question Bank is designed strictly as per the latest syllabus and exam pattern.

Material Cost – CA Inter Costing Question Bank

Question 1.

Write notes on: Bill of Material (May 1998, 4 marks)

Answer:

Answer:

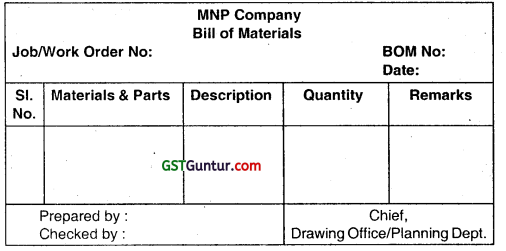

Bill of Material

- BOM is a schedule of standard quantities of materials required for any job or other units of production.

- It is also known as Material Specification list or just material list.

- It contains code, description and quantity of materials and other stores items required for carrying out a particular work or job order.

- It also acts as an authorization for issue of materials and stores items mentioned in it. Use of BOM saves paper work and also ensures requisition of the exact quantity of materials.

- It is prepared by Engineering/Planning deptt in a standard form, in quadruplicate to be used as follows:

- Stores Department: For verification against request for issue of materials.

- Cost Accounts Department: For accounting of standard cost.

- Production Control Department: For control purpose.

- Engineering/Planning Department: For record, reference and control purpose.

Bill of Materials

![]()

Question 2.

Distinguish between Bill of Material, Material Requisition note. (May 2012, 4 marks)

Answer:

Distinguish between Bill of Material, Material Requisition note

| Sl. No. | Basis | Bill of Material | Material Requisition Note |

| 1. | Preparation | It is document by the drawing office & Production planning department. | It is prepared by the foreman of the consuming department. |

| 2. | Scope | It is a complete schedule of component parts and raw materials required for a particular job or work order. | It is a document authorizing Store-Keeper to issue Material to the consuming department. |

| 3. | Purpose | It often serves fhe purpose of a Store Requisition as it shows the complete schedule of materials required for a particular job i.e. it can replace stores requisition. | It cannot replace a bill of material. |

| 4. | Usefulness | It can be used for the purpose of quotation. | It is useful in arriving at historical cost only. |

| 5. | Benefit | It helps in keeping a quantitative control on materials drawn through stores Requisition. | It shows the materials actually drawn from stores. |

![]()

Question 3.

Write treatment of items associated with purchase of material:

(i) Cash discount

(ii) Subsidy/Grant/Incentives

(iii) GST

(iv) Commission brokerage paid (May 2016, 4 marks)

Answer:

(i) Cash discount: It should be excluded from cost accounts because it is an item of purely financial nature. It is not deducted from purchase price.

(ii) Subsidy Grant/Incentive: It should be reduced from the material cost.

(iii) GST: It is excluded from purchase price if credit for same is available.

(iv) Commission or brokerage paid: Commission and Brokerage paid is added with cost of purchase.

![]()

Question 4.

Answer the following :

State how the following items are treated in arriving at the value of cost of material purchased :

(i) Detention Charges/Fines

(ii) Demurrage

(iii) Cost of Returnable containers

(iv) Central Goods and Service Tax (CGST)

(v) Shortage due to abnormal reasons. (Jan 2021, 5 marks)

Question 5.

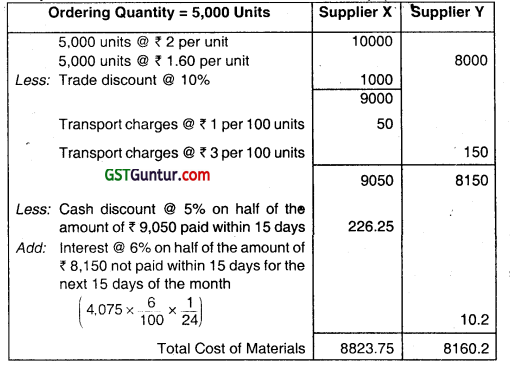

When tenders were invited for a store, quotations were received as under: (RTP)

Supplier X

(a) Rate ₹ 2 each; (b) Trade discount 10%; (c) Cash discount 5% if bills are paid within a fortnight after receipt; (d) Transport charges ₹ 1 per 100 units.

Supplier Y

(a) Rate ₹ 1.80 each (upto 1,000 units), ₹ 1.60 each (for orders above 1,000 units); (b) 6% interest per annum will be added if bills are not paid within a fortnight after receipt of the materials; (c) Transport charges ₹ 3 per 100 units.

Assuming that 5,000 units are required every month and that quality and other conditions of supply are the same, offer your comments as to whom purchase order can be issued. The factory pays 50% of its total monthly bills every fortnight.

Answer:

Comparative statement of cost of materials of two quotations:

The purchase order should be issued to Supplier Y because of the lower cost of material.

![]()

Question 6.

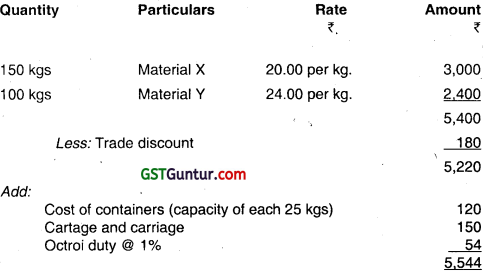

From the following invoice received from a supplier, calculate the material cost per unit:

Terms:

(i) 5% cash discount for payment within a week

(ii) Return value of containers ₹ 9 each

Answer:

Statement showing the Calculation of Material Cost

![]()

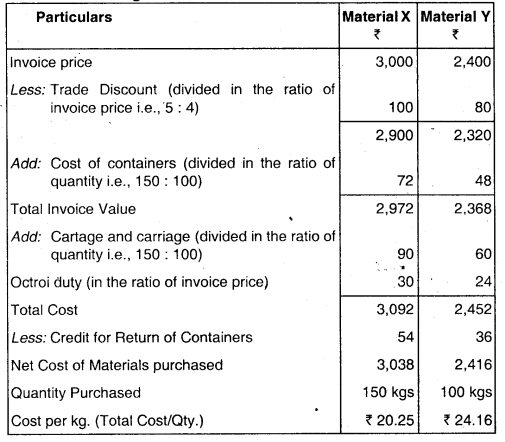

Question 6.

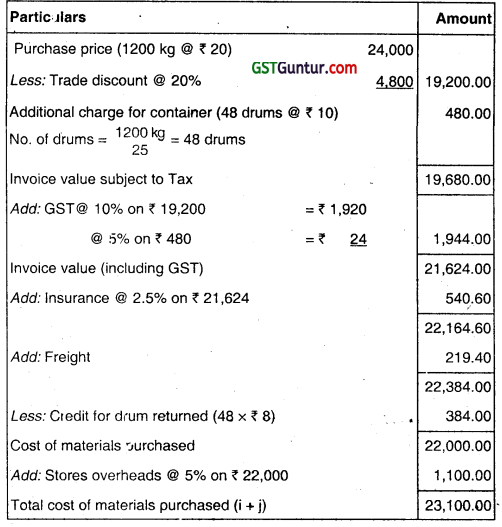

The particulars relating to 1200 kg of a certain raw material purchased by Krishna Sales Corporation Ltd. during March were as follows:

Lot prices quoted by supplier and accepted by the company for placing the purchase order:

Lot upto 1000 kgs @ 22 per kg

Between 1001 – 1500 kgs @ ₹ 20 per kg.

Between 1501 – 2000 kg @ ₹ 18 per kg.

Trade discount 20%

Additional charges for containers @ ₹ 10 per drum of 25 kg.

Credit allowed on return of containers @ ₹ 8 per drum.

GST at 10% on raw material and 5% on drums.

Total freight paid by the purchaser ₹ 219.40

Insurance at 2.5% (on Net Invoice Value) paid by the purchaser.

Stores overhead applied at 5% on total purchase cost of material (exclucfing stores overheads).

Normal Loss 5% and Abnormal Loss 140 kg.

Scrap value of loss ₹ 5 per kg. ,

Units issued to production 600 kgs.

The containers are returned in due course. Draw up suitable statements to show: .

(i) Total cost of material purchased

(ii) Unit cost of material issued to production

(iii) Total cost of material issued to production

(iv) Total cost of material in hand

(v) Total cost of abnormal loss.

Answer:

Statement showing the computation of Total Cost of Material Purchased

Statement showing the computation of Unit and Total Cost of materials issued to production etc.

![]()

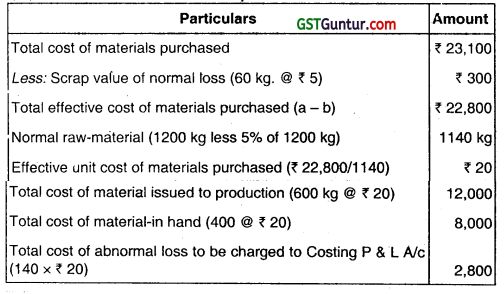

Question 7.

At what price per unit would Part No. A 32 be entered in the stores ledger, if the following invoice was received from a supplier?

Notes:

(i) A 2 per cent discount will be given for payment in 30 days.

(ii) Documents substantiating payment of GST is endosed for claiming Input credit.

Answer:

![]()

Question 8.

At the time of physical stock taking, it was found that actual stock level was different from the clerical or computer records. What can be possible reasons for such differences? How will you deal with such differences? (May 1999, 5 marks)

Answer:

When it was found that actual stock level was different from that of the clerical or computer records, possible reasons for difference arising may be as follows:

- Wrong entry might have been made in stores ledger account or bin card.

- The items of materials might have been placed in the wrong physical location in the store.

- Arithmetical errors might have been made while calculating the stores balances on the bin cards or stores ledger when a manual system is operated.

- Theft of stock.

When a discrepancy is found at the time of stock taking, the individual stores ledger account and the bin card must be adjusted so that they are in agreement with the actual stock. For example, if the actual stock is less than the clerical or computer record the quantity and value of the appropriate store ledger account and bin card (quantity only) must be reduced and the difference in cost be charged to a factory overhead account for store losses.

![]()

Question 9.

Distinguish clearly between Bin Cards and Stores Ledgers. (May 2000, May 2002, May 2003, Nov 2004, Nov 2017, RTP, 4, 4, 2, 2, 4 marks)

Answer:

Both Bin Cards and Stores Ledgers are perpetual inventory records. None of them is a substitute for the other. These two records can be distinguished on the basis of following view point:

| Sl. No. | Basis | Bin Cards | Stores Ledger |

| 1 | Maintained | Bin card is maintained by store keeper | Stores ledger is maintained by cost accounting department |

| 2 | Nature | It is the stores recording document | It is an accounting record |

| 3 | Information | It contains information as records to quantities i.e. their receipts, issue and balance. | It contains both quantitative and value information in respect of their receipts, issue and balance. |

| 4 | Time of recording | In bin card entries are made at the time when transaction takes place. | In stores ledger entries are made only’ after the transaction has taken place, |

| 5 | Recording | Bin cards records each transaction. | Stores ledger records the same information in a summarized form. |

| 6 | Inter department al transfer | Inter departmental transfers of materials does not appears. | Inter departmental transfers of materials appears here. |

![]()

Question 10.

Answer the following:

Define Inventory Control and given its objectives. List down the basis to be adopted for Inventory Control. (Nov 2019, 5 marks)

Answer:

Inventory Control

The Chartered Institute of Management Accountants (CIMA) defines Inventory Control as “The function of ensuring that sufficient goods are retained in stock to meet all requirements without carrying unnecessarily large stocks”.

The objective of inventory control is to make a balance between sufficient stock and over-stock.

The stock maintained should be sufficient to meet the production requirements so that uninterrupted production flow can. be. maintained. Insufficient stock not only pause the production but also cause a loss of revenue and goodwill.

On the other hand, Inventory requires some funds for purchase, storage, maintenance of materials with a risk of obsolescence, pilferage etc. A trade-off between stock-out and over-stocking is required. The management may employ various methods of Inventory control to have a balance. Management may adopt the following basis for Inventory Control:

- By Setting Quantitative Levels

- On the basis of Relative Classification

- Using Ratio Analysis

- Physical Control.

![]()

Question 11.

POR Tubes Ltd. are the manufacturers of picture tubes for T.V. The following are the details of their operations during 1999-2000:

Ordering cost – ₹ 100 per order

Inventory carrying cost – 20% p.a.

Cost of tubes – 500 per tube

Normal usage – 100 tubes per week

Minimum usage – 50 tubes per woek

Maximum usage – 200 tubes per week .

Lead time to supply – 6-8 weeks

Required:

(i) Economic order quantity. if (he supplier is willing to supply quarterly 1,500 units at a discount of 5%, is it worth accepting?

(ii) Re-order level

(iii) Maximum level of stock

(iv) Minimum level of stock. (May 2000, 4 marks)

Answer:

(i) Computatation of EOQ = Normal usage per week × 52 weeks

= 100 × 52

= 5,200 tubes

O = Ordering cost per order = ₹ 100

P = Cost per unit = ₹ 500 / tube

C = Srock holding rate p.a. = ₹ 20% p.a.

Q = Re-order quantity .

CS = Carrying cost per unit p.a. = 500 × 20% = ₹ 100

EOQ = \(\sqrt{\frac{240}{P C}}\)

= \(\sqrt{\frac{2 \times 5,200 \times 100}{100}}\) = 102 units (appx)

![]()

Evaluation of Price discount offer : The price discount offer can be decided upon only after comparing the total annual’inventory cost at EOQ & total annual inventory cost at 1500 units of order size.

Total annual inventory cost = Total purchase cost + Total ordering cost + Total carrying cost of average inventory.

= (U × C) + (\(\frac{U}{Q}\) × O) + \(\frac{1}{2}\) × Q × CS

At Q = 102 units (i.e. EOQ) = (5,200 × 500) + (\(\frac{5,200}{102}\) × 100) + (\(\frac{1}{2}\) × 102 × 100)

= 26,00,000 + 5098 + 5100

= ₹ 26,10,198 (appro.)

At Q = 1,500 units = [5200 × (500 – 5%)] + (\(\frac{5,200}{1,500}\) × 100) + [\(\frac{1}{2}\) × 1,500 × (500 5% × 20%)]

= 24,70,000 + 347 + 71,250

= ₹ 25,41,597 (App.)

Since, total annual inventory cost is lower, if the re-order quantity is fixed at 1,500 units, so the discount offer should be accepted.

(ii) Maximum stock level = Reorder level + Reorder Qty.- (Minimum usage × Minimum Lead Time)

= 1,600 (W. N. 1) + 102 (W. N. 2) – (50 tubes / week × 6 weeks)

= 1,402 tubes.

Minimum stock level = Reorder level – (Average / Normal usage × Avg. lead time)

= 1,600 – (100 × (\(\frac{6+8}{2}\)))

= 1,600 – 700

= 900 units.

Working Notes :

- Reorder level = Max. usage × Max lead time

= 200 tubes/week × 8 weeks = 1,600 units. - Since, there is no specification about reorder quantity, it has been assumed to be equal to EOQ units i.e. 102 tubes/order.

![]()

Question 12.

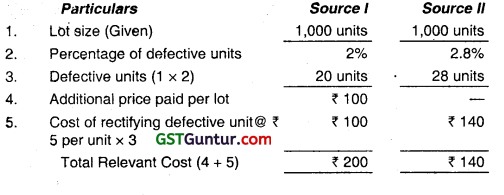

A Company has the option to procure a particular material from two sources:

Source I assures that detectives will not be more than 2% of supplied quantity.

Source II does not give any assurance, but on the basis of past experience of supplies received from it, it is observed that defective percentage is 2.8%.

The material is supplied in lots of 1,000 units. Source II supplies the lot at a price, which is lower by ₹ 100 as compared to Source I. The defective units of material can be rectified for use at a cost of ₹ 5 per unit.

You are required to find out which of the two sources is more economical. (May 2001, 8 marks)

Answer:

Statement of Cost of procurement of material for a lot size of 1,000 units

On comparing the total Relevant cost, we can say it is more economical to procure materials from Source II.

Alternatively (Using Incremental Method):

Hence, Source II is more economical than Source I.

![]()

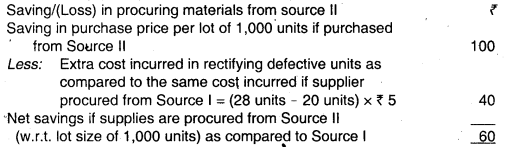

Question 13.

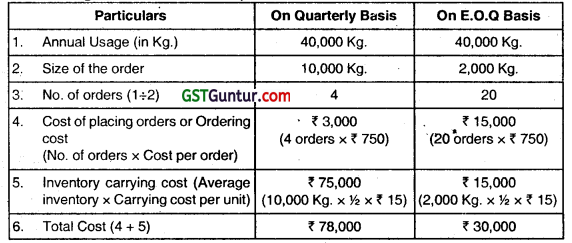

A company manufactures a product from a raw material, which is purchased at ₹ 60 per kg. The company incurs a handling cost of ₹ 360 plus freight of? 390 per order. The incremental carrying cost of inventory of raw material is Re. 0.50 per kg. per month. In addition, the cost of working capital finance on the investment in inventory of raw material is ₹ 9 per kg. per annum. The annual production of the product is 1,00,000 units and 2.5 units are obtained from one kg. of raw material.

Required:

(i) Calculate the economic order quantity of raw materials.

(ii) Advise, how frequently should orders for procurement be placed.

(iii) If the company proposes to rationalise placement of orders on quarterly basis, what percentage of discount in the price of raw materials should be negotiated? (Nov 2001, 10 marks)

Answer:

(i) EOQ:

U = Annual usage of Raw Material

= 1 unit of material gives 2.5 units of Finished Goods

For 1.00,000 units of finished goods, material required

= \(\frac{1,00,000}{2.5}\) = 40,000 kgs

O = Ordering cost per order = Handling cost + freight/order

= ₹ 360 + ₹ 390 = ₹ 750

P = Cost/kg of material = ₹ 60/kg.

PC = Carrying cost or Holding cost of Inventory per unit p.a.

Carrying cost pr unit p.a. + interest cost of investment in inventory per unit pa.

= (₹ 0.50 per unit/month × 12 months) + ₹ 9/kg. p.a.

= ₹ 6 + ₹ 9 = ₹ 15 per unit p.a.

Q = Reorder Qty.

= \(\sqrt{\frac{2 U O}{P C}}\)

= \(\sqrt{\frac{2 \times 40,000 \times 750}{15}}\) = \(\sqrt{40,00,000}\) = 2,000 kgs.

![]()

(ii) Frequency of placing orders/time Interval between orders:

(iii) % Discount to be negotiated for placing quartedy orders:

No. of orders if orders are placed quarterly

(i.e. at every three months) = \(\frac{12 \text { months }}{3 \text { months }}\) = 4 orders

∴ Order size per quarterly order = \(\frac{\text { Annual Requirement }}{\text { No. of orders }}\)

= \(\frac{40,000 \mathrm{kgs} .}{4 \text { Oiders }}\) = 10,000 kgs.

Total Annual Cot = Total annual Ordering Cost + Total Annual Carrying Cost

= (\(\frac{U}{Q}\) × O) + (\(\frac{Q}{2}\) × PC)

at Q = 2,000 kgs. (i.e. at EOQ)

=(\(\frac{40,000}{2,000}\) × 75o) +(\(\frac{2,000}{2}\) × 15)

= 15000 + 15000 = ₹ 30,000

at Q = 10,000 kgs. (i.e. at quantity orders)

= (\(\frac{40,000}{10,000}\) × 750) + (\(\frac{10,000}{2}\) × 15)

= 3,000 + 75,000 = ₹ 78,000

![]()

On analysis of the total annual ordering & carrying cost as above it can be said that if we place quarterly orders of 10,000 kgs. each then we would incur extra ordering & carrying cost of ₹ 48,000 (i.e. ₹ 78,000 – 30,000).

In order to avoid or compensate this increase in cost of ₹ 48,000 we will have to hegotiate 3 discount which will result in a total decrease in purchase cost by atleast ₹ 48,000.

Total discount required on annual requirement of 40,000 kgs.

= ₹ 48,000

∴ Required Discount per kg. of raw material

= \(\frac{48,000}{40,000 \mathrm{kgs}}\) = ₹ 1.2 per kg.

∴ Percentage of Discount to be negotiated

= \(\frac{\text { Discount } / \mathrm{kg}}{\text { Current Price } / \mathrm{kg}}\) × 100 = \(\frac{1.2}{60}\) × 100 = 2%

![]()

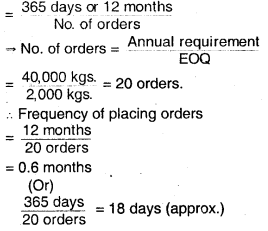

Question 14.

The quarterly production of a company’s product which has a steady market is 20,000 units. Each unit of a product requires 0.5 kg. of raw material. The cost of placing one order for raw material is ₹ 100 and the inventory carrying cost is ₹ 2 per annum. The lead time for procurement of raw material is 36 days and a safety stock of 1,000 kg. of raw materials is maintained by the company. The company has been able to negotiate the following discount structure with the raw material supplier:

Order Quantity – Discount

Kgs. – ₹

Upto 6,000 : Nil

6,000 – 8,000 : 400

8,000 – 16,000 : 2,000

16,000 – 30,000 : 3,200

30,000 – 45,000 : 4,000

You are required to :

(i) Calculate the re-order point taking 30 days in a month.

(ii) Prepare a statement showing the total cost of procurement and storage of raw materials after considering the discount If the company elects to place one, two, four or six orders in the year.

(iii) State the number of orders which the company should place to minimise the costs after taking EOQ also into consideration. (May 2002, 8 marks)

Answer:

(i) Reorder level or point = (Max. usage × Max. lead time) + Safety Stock

Quarterly (i.e. 3 months) production of finished goods

= 20,000 units

Raw material required per unit of finished goods.

= 0.5 kgs. of raw material

∴ Raw material required for 20,000 units of finished goods

= 20,000 × 0.5

= 10,000 units of raw material

∴ Daily requirement of raw material

= \(\frac{10,000 \text { units }}{3 \text { months } \times 30 \text { days }}\)

= 111.11 Units per day.

∴ Reorder Level = (111.11 units × 36 days) + 1000 units = 5000kgs.

![]()

(ii) Statement of total cost of procurement and storage of raw materials:

(iii) U = Annual requirement

= 10,000 units / Qtr. × 4 qtr.

= 40,000 units.

O = ordering cost/order

PC = Carrying cost/unit p.a.

= ₹ 2 unit p.a.

EOQ = \(=\frac{\sqrt{240}}{P C}\)

= \(\sqrt{\frac{2 \times 40,000 \times 100}{2}}=\) = 2,000 units

No. of order when order size is equal to EOQ.

= \(\frac{\text { Annual Demand }}{\text { EOQ }}\)

= \(\frac{40,000 \text { units }}{2,000}\) = 20 order p.a.

Total ordering and carrying cost is minimum at the order size of EQO. which is calculated as under:

Total ordering cost + Total carrying cost

= \(\left(\frac{U}{Q} \times 0\right)+\left(\frac{Q}{2} \times P\right)\)

= \(\left(\frac{40,000}{2,000} \times 100\right)+\left(\frac{1}{2} \times 2,000 \times 2\right)\) = 2,000 + 2,000 = ₹ 4,000

![]()

Question 15.

A company manufactures 5000 units of a product per month. The cost of placing an order is ₹ 100. The purchase price of the raw material is 10 per kg. The re-order period is 4108 weeks. The consumption of raw materials varies from 100 kg to 450 kg per week, the average consumption being 275 kg. The carrying cost of inventory is 20% per annum.

You are required to calculate:

(i) Re-order quantity

(ii) Re-order level

(iii) Maximum level

(iv) Minimum level

(v) Average stock level.. (Nov 2002, 6 marks)

Answer:

U = Annual Requirement

= Avg. consumption/week × 52 weeks

= 275 kg. week × 52 weeks

= 14,300 kgs.

O = Ordering cost / order = ₹ 100 per order

P = Price per unit = ₹ 10 per kg.

C = Stock Holding rate p.a. = 20%

PC = Carrying cost /unit p.a. = ₹ 10 × 20% = ₹ 2

(i) Re-order Quantity:

When price discount is not involved reader quantity should be such a quantity of ordering/order at which the total cost of ordering and carrying inventory p.a. is the least. This is so in case of EOQ.

Calculated as under:

EOQ = \(\sqrt{\frac{2 U O}{\mathrm{PC}}}\)

= \(\sqrt{\frac{2 \times 14,300 \times 100}{2}}\) = \(\sqrt{14,30,000}\)

= 1,196 kgs (approx)

![]()

(ii) Reorder Level = = Max. usage × Max. Lead time

= 450 kgs./week × 8 week

= 3,600 kgs.

(iii) Maximum Level = Reader Level + Reorder Qty – (Minimum usage × Minimum Lead time)

= 3,600 kg. + 1,196 kg. (100 kgs/week × 4 weeks)

= 4,796 kgs. – 400 kgs.

= 4,396 kgs.

(iv) Minimum Level = Reorder Level – (Average usage × Average lead time)

= 3.600 kgs. \(\left[\left(\frac{100+450}{2}\right)+\left(\begin{array}{c}

4+8 \\

2

\end{array}\right)\right]\)

= 3,600 – (275 × 6)

= 3,600 – 1,650

= 1,950 kgs.

= Max.Ievel÷Min.Level 3173kgs

(v) Average Stock Level = \(\frac{\text { Max. level }+ \text { Min. Level }}{2}\) = 3173 kgs.

Alternatively

Avg. stock level. Min. leve) + (\(\frac{1}{2}\) × reorder Qty.)

= 1,950 kgs. + (\(\frac{1196}{2}\) kg.)

= 1,950 + 598 kg. = 2,548 kgs.

![]()

Question 16.

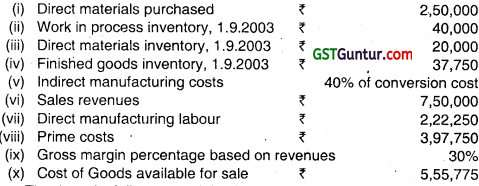

A lire occurred in the factory premises on October 31, 2003. The accounting records have been destroyed. Certain accounting records were kept in another building. They reveal the following for the period September 1, 2003 to October 31, 2003:

The loss is fully covered by insurance company. The insurance company wants to know the historical cost of the inventories as a basis for negotiating a settlement, although the settlement is actually to be based on replacement cost, not historical cost.

Required :

(i) Finished goods inventory, 31.10.2003 ‘

(ii) Work-in-process inventory, 31.10.2003

(iii) Direct materials inventory, 31.10.2003 . (Nov 2003, RTP, 3 + 3 + 2 = 8 marks)

Answer:

Working Notes :

1. Direct material inventory cost (used during the month) direct material, inventory cost.

= Prime cost – Direct manufacturing labour cost

= ₹ 3,97,750 – ₹ 2,22,250

= ₹ 1,75,500

![]()

2. Conversion & Indirect manufacturing cost:-

Conversion cost = Direct manufacturing cost + Indirect manufacturing cost

But Indirect manufacturing cost = 40% of conversion cost

or conversion cost = Direct manufacturing cost + 40% of conversion cost

or 0.60 conversion cost = Direct Manufacturing cost

or Conversion cost = \(\frac{\text { Direct Manufacturing Cost }}{0.60}\)

= \(\frac{₹ 2,22,250}{0.60}\)

= ₹ 3,70,417.

or Indirect manufacturing cost = 40% × ₹ 3,70,417

= ₹ 1,48,167

3. Cost of Goods Manufactured:

![]()

Question 17.

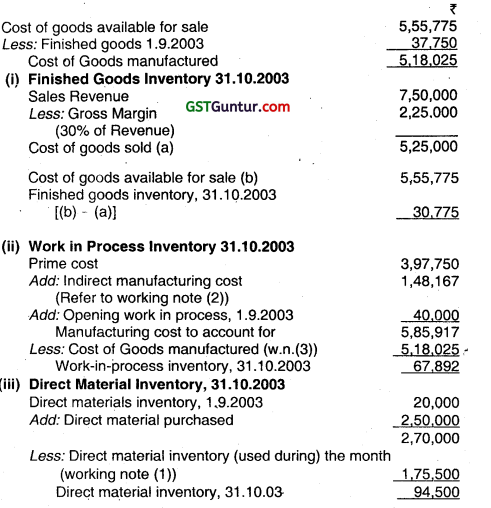

RST Limited has received an offer of quantity discount on its order of materials as under:

The annual requirement for the material is 500 tonnes. The ordering cost per order is ₹ 12,500 and the stock holding cost is estimated at 25% of the material cost per annum.

Required:

(i) Compute the most economical purchase level.

(ii) Compute EOQ it there are no quantity discounts and the price per tonne is 10,500. (Nov 2004, 4 + 2 = 6 marks)

Answer:

(i) Completion of most economical purchase level: When Annual usage is 500 tonnes

The computation shows that total cost of 500 tonnes including ordering and carrying cost is minimum i.e. ₹ 46,64,875.

Where the order size is 300 tonnes.

Therefore, the most economic purchase level is 300 units.

(ii) Computation of EOQ, when price portion is ₹ 10,500 and there is no quantity discount.

EOQ = \(\sqrt{\frac{2 U O}{\mathrm{PC}}}\)

= \(\sqrt{\frac{2 \times 500 \times ₹ 12,500}{₹ 10,500 \times 0.25}}\)

= 69 tones

![]()

Question 18.

SK Enterprise manufactures a special product ‘ZE’. The following particulars were collected for the year 2004:

Annual consumption – 12,000 units (360 days)

Cost per unit – ₹ 1

Ordering cost – ₹ 12 per order

Inventory carrying cost – 24%

Normal lead time – 15 days

Safety stock – 30 days consumption

Required:

(i) Re-order quantity

(ii) Re-order level

(iii) What should be the inventory level (ideally) immediately before the material order is received? (May 2005, 2 + 1 + 1 = 4 marks)

Answer:

(i) How much order should be place at time i.e. EOQ

EOQ = \(\sqrt{\frac{240}{P C}}\)

Where, u = Annual oonsumption

o = ordering cost per order

PC = carry,g cost per unit per annum

= \(\sqrt{\frac{2 \times 12000 \times 12}{1 \times(24 / 100)}}\)

= \(\sqrt{\frac{288.000}{0.24}}\) = \(\sqrt{1200,000}\) = 1095.4 untis

say 1,100 units

(i) When should the order be placed i.e. recording level

Reordering Level = Safety stock + Normal lead time consumption

Recording Level = \(\left[\frac{12,000}{360} \times 30\right]+\left[\frac{12,000}{360} \times 15\right]\)

= 1,000 + 500 = 1,500 units

(iii) What should be the inventory level (ideally) immediately before the material ordered is received i.e. safety stock

Safety stock = \(\left[\frac{12,000}{360} \times 30\right]\) = 1,000 units

![]()

Question 19.

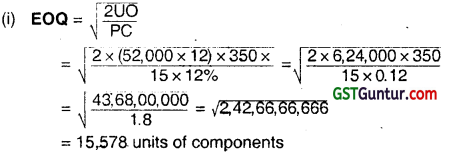

POR Limited produces a product which has a monthly demand of 52,000 units. The product requires a component X which is purchased at ₹ 15 per unit. For every finished product, 2 units of Component X are required. The Ordering cost is ₹ 350 per order and the Carrying cost is 12% p.a. (May 2006)

Required:

(i) Calculate the economic order quantity for Component X. (3 marks)

(ii) If the minimum lot size to be supplied is 52,000 units, what is the extra cost, the company has to incur? (3 marks)

(iii) What is the minimum carrying cost, the Company has to incur? (2 marks)

Answer:

(ii) Extra cost incurred by the company :

Total cost, when order size is 52,000 units.

Total cost – Total ordering cost + Total carrying cost

T.C.= A \(\frac{U}{Q}\) × O + \(\frac{Q}{2}\) × c × i

= \(\left(\frac{52,000 \times 12}{52,000}\right)\) × ₹ 350 + \(\left(\frac{52,000}{2}\right)\) × ₹ 15 × 12%

= ₹ 4,200 + ₹ 46,800 = ₹ 51,000

Total cost, when order size is 15,578 units

= \(\left(\frac{52,000 \times 12}{15,578}\right)\) × ₹ 350 + \(\left(\frac{15,578}{2}\right)\) × ₹ 15 × 12%

= ₹ 14,020 + ₹ 14,020 = ₹ 28,040

∴ Extra cost incurred = ₹ 51,000 – ₹ 28,040 = ₹ 22,960

(iii) Minimum carrying cost:

= \(\frac{\mathrm{Q}}{2}\) × c × i = \(\frac{15,578}{2}\) × ₹ 15 × 12%

= ₹ 14,020.

![]()

Alternatively :

(a) Assuming the annual demand of ‘X’ is 1,04,000 units (2 x 52,000 units) as per instruction that for every finished product, 2 units of component ‘X’ are required, the calculation of 2(a) (i), (ii) and (iii) will be as follows: 2AO

(i) EOQ = \(\frac{2 \mathrm{AO}}{\mathrm{C} \times \mathrm{i}}\)

= \(\sqrt{\frac{2 \times(2 \times 52,000 \times 12) \times 350}{15 \times 0.12}}\)

= 22,030 units of component ‘X’

(ii) Extra cost incurred by the company

Total cost (when order size is 52,000 units) = Total ordering cost + Total carrying cost

= \(\frac{A}{Q}\) × O + \(\frac{Q}{2}\) × C × i

= \(\left(\frac{2 \times 52,000 \times 12}{52,000} \times ₹ 350\right)+\frac{52,000}{2} \times 15 \times 12 \%\)

= ₹ 55,200

Total cost (when order size is 20,030 units)

= \(\left(\frac{2 \times 52,000 \times 12}{22,030} \times ₹ 350\right)+\frac{22,030}{2} \times 15 \times 12 \%\)

Total cost incurred = 19,828 + 19,827 = 39,655.

Extra cost incurred = 55,200 – ₹ 39655 = ₹ 15,545.

(iii) Minimum carrying cost, the company has to incur

= \(\frac{Q}{2}\) × C × i

= \(\frac{22,030}{2}\) × ₹ 15 × 12%

= ₹ 19,827.

![]()

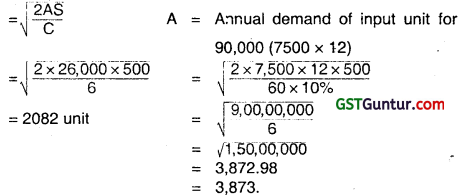

Question 20.

POR Ltd. manufactures a special product, which requires ‘ZED’. The following particulars were collected for the year 2005-06:

(i) Monthly demand of Zed : 7,500 units

(ii) Cost of placing an order : ₹ 500

(iii) Re-order period : 5 to 8 weeks

(iv) Cost per unit : ₹ 60

(y) Carrying cost % p.a. : 10%

(vi) Normal usage : 500 units per week

(vii) Minimum usage : 250 units per week

(viii) Maximum usage : 750 units per week

Required:

(i) Re-order quantity

(ii) Re-order level

(iii) Minimum stock level

(iv) Maximum stock level

(v) Average stock level. (Nov 2006, 2 × 5 = 10 marks)

Answer:

(i) Re-order quantity

(ii) Re-order level:

Maximum re-order period × Maximum usage

= Weeks × 750 units per weeks

6000 units

(iii) Minimum stock level:

= Re-order level – (Normal user × average re-order period).

=6000 – (500 × 6.5)

= 6000 – 3250

= 2750 units

(iv) Maximum stock level:

Re-order level ± Re-order quantity – (Minimum usage × Minimum re-order period)

= 6000 + 3,873 – (250 × 5)

= 6000 + 3,873 – 1250

= 8,623 units

(v) Averages stock level:

\(\frac{1}{2}\)(Minimum stock level + Maximum stock level)

= \(\frac{1}{2}\) (2750 + 8,623)

= 5,687 Units.

![]()

Question 21.

Answer the following:

The average annual consumption of a material is 18,250 units at a price ₹ 36.50 per unit. The storage cost is 20% on an average inventory and the cost of placing an order is ₹ 50. How much quantity is to be purchased a time? (May 2007, 2 marks)

Answer:

Quantity to be purchased at a time.

= \(\sqrt{\frac{2 \times 18,250 \times 50}{20 \% \text { of } 36.50}}=\sqrt{\frac{18,25,000}{7.3}}\)

= \(\sqrt{2,50,000}\) = 500 units

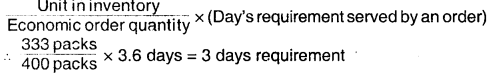

Question 22.

ZED Company supplies plastic crockery to fast food restaurants in metropolitan city. One of its products is a special bowl, disposable after initial use, for serving soups to its customers. Bowls are sold in pack 10 pieces at a price of ₹ 50 per pack.

The demand for plastic bowl has been forecasted at a fairly steady rate of 40,000 packs every year. The company purchases the bowl direct from manufacturer at ₹ 40 per pack within a three days lead time. The ordering and related cost is ₹ 8 per order. The storage cost is 10% per annum of average inventory investment.

Required:

(i) Calculate Economic Order Quantity.

(ii) Calculate number of orders needed every year.

(iii) Calcute the total cost of ordering and storage bowls for the year.

(iv) Determine when should the next order to be placed. (Assuming that the company does maintain a safety stock and that the present inventory level is 333 packs with a year of 360 working days. (May 2008, 2 + 1+ 2+3 =8 marks)

Answer:

(i) EOQ = \(\sqrt{\frac{2 \mathrm{UO}}{\mathrm{PC}}}\)

U = Annual Requirement = 40000

B = Buying Cost = 40 \(\sqrt{2,50,000}\)

O = Ordering cost = ₹ 8

PC = Carring cost permit × % cost of cost price

= ₹ 40 × 10% = 4

EQQ = \(\sqrt{\frac{2 \mathrm{UO}}{\mathrm{PC}}}\)

= \(\sqrt{\frac{2 \times 40,000 \times 8}{4}}\) = 400

Therefore, EOQ = 400 units

![]()

(ii) No. of orders needed = \(\frac{40,000}{400}\) = 100 orders

(iii) Total Cost of ordering

At EOQ level

Carrying cost = ordering cost

Ordering cost = 100 × 8 = 800

Carrying cost = 800

Total cost = 1600

Alternatively : Total Cost = \(\sqrt{2 U O P C}\)

= \(\sqrt{2 \times 40,000 \times 8 \times 4}\)

= 1,600

(iv) Timing of next order

(a) Day’s requirement served by each order.

Number of days requirements = \(\frac{\text { No. of working days }}{\text { No. of order in a year }}\) = \(\frac{360}{100}\) = 3.6 days supply

This implies that each order of 400 packs supplies for requirements of 3.6 days only.

(b) Days requirement covered by inventory

(c) Time interval for placing next order

Inventory left for day’s requirement – Lead time of delivery 3 days – 3 days = 0 days

This means that next order for the replenishment of supplies has to be placed immediately.

![]()

Question 23.

Answer the following:

The annual carrying cost of material X is ₹ 3.6 per unit and its total carrying cost is ₹ 9,000 per annum. What would be the Economic order quantity for material ‘X’, if there is no safety stock of material X? (Nov 2008, 2 marks)

Answer: a

Computation of Economic Order Quantity

Average Inventory = \(\frac{\text {Total Carrying Cost }}{\text { Carrying Cost per unit }}\)

= \(\frac{₹ 9,000}{₹ 3.60}\) = 2,500 Units

Econormc Order Quantity Average Inventory × 2 – 2,500 × 2 = 5,000 units.

Alternatively:

Total Carrying Cost = \(\frac{\text { Carrying Cost per Unit } \times \text { EO.Q }}{2}\)

or 9,000 = \(\frac{3.6 \times E O Q}{2}\)

or E.O.Q. = \(\frac{9,000 \times 2}{3.6}\) = 5,000 units

![]()

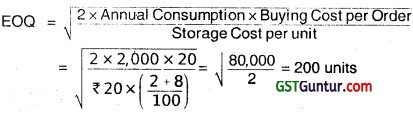

Question 24.

Answer the following:

The following information relating to a type of Raw material is available:

Annual demar’d – 2000 units

Unit price – ₹ 20.00

Ordering cost per order – ₹ 20.00

Storage cost – 2% p.a.

Interest rate – 8% p.a.

Lead time – Half-month

Calculate economic order quantity and total annual inventory cost of the raw material. (Nov 2009, 3 marks)

Answer:

Total Annual Inventory Cost

Cost of 2,000 Units @ ₹ 20 (2,000 × 20) = ₹ 40,000

No. of Order \(\frac{2,000}{200}\) = ₹ 10

Ordering Cost 10 × 20 = ₹ 200

Carrying cost of average inventory \(\frac{200}{2}\) × 20 × \(\frac{10}{100}\) = ₹ 200

= ₹ 40,400

![]()

Question 25.

Answer the following:

Re-order quantity of material ‘X’ is 5,000 kg.; Maximum level 8,000 kg.; Minimum usage 50 kg. per hour; minimum re-order period 4 days; daily working hours in the factory is 8 hours. You are required to calculate the re order level of material ‘X. (May 2010, 2 marks)

Answer:

Re-order Level = Maximum Level – [Re-order quantity – (Minimum usage per day × Minimum Re-order Period)

8000 kg. – (5000 kg. – (400 kg.* × 4)

= 8000 kg. – 3400 kg. = 4600 kg.

Hence, Re-order level is 4600 kg.

Minimum usage per day = 50 kg. × 8 = 400 kg.

![]()

Question 26.

Answer the following :

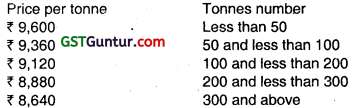

ABC Limited has received an otter of quantity discounts on its order of materials as under:

Price per tonne – Tonnes

₹ – Nos.

4,800 – Less than 50

4,680 – 50 and less than 100

4,560 – 100 and less than 200

4,440 – 200 and less than 300

4,320 – 300 and above

The annual requirement for the material is 500 tonnes. The ordering cost per order is ₹ 6,250 and the stock holding cost is estimated at 25% of the material cost per annum.

Required:

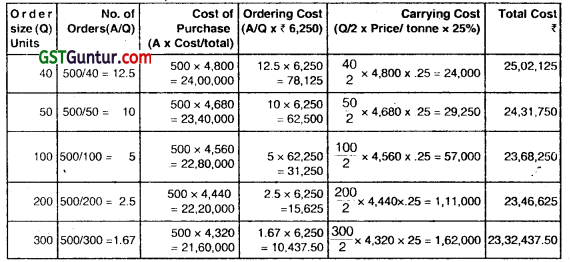

(i) Compute the most economical purchase level.

(ii) Compute E.O.Q. if there are no quantity discounts and the price per tonne is ₹ 5.250. (Nov 2010, 5 marks)

Answer:

(i) Calculation of most economical purchase level:

A = Annual requirement = 500 tonnes

Since the total cost of purchase, ordering cost and carrying cost of 500 tonnes is minimum ₹ 23,32,437.50 when the order size is 300 tonnes. Therefore most economical purchase level is 300 tonnes.

(ii) EOQ = \(\sqrt{\frac{2 \mathrm{AO}}{\mathrm{Cxi}}}=\sqrt{\frac{2 \times 500 \text { tonnes } \times ₹ 6,250 \text { per order }}{₹ 5,250 \times 0.25}}\) = 69 tonnes

A is the annual requirement for the material.

O is the ordering Cost per order

Ci is the carrying Cost per unit per annum.

![]()

Question 27.

KL Limited produces product ‘M’ which has a quarterly demand of 8,000 units. The product requires 3 kgs. quantity of material ‘X’ for every finished unit of product. The other information are follows:

Cost of material ‘X’ : ₹ 20 per kg.

Cost of placing an order : ₹ 1000 per order

Carrying Cost : 15% per annum of average inventory

You are required:

(i) Calculate the Economic Order Quantity for material ‘X’.

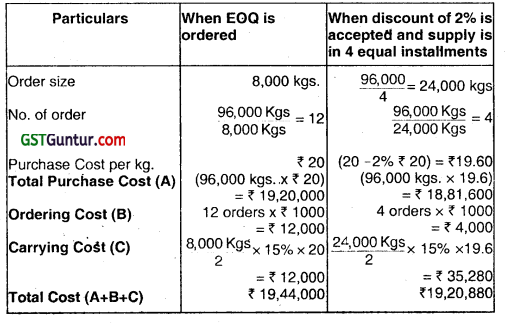

(ii) Should the company accept an offer of 2 percent discount by the supplier, if he wants to supply the annual requirement of material ‘X’ in 4 equal quarterly instalments? (Nov 2012, 5 marks)

Answer:

Annual demand of material ‘X’

= 8000 units (per quarter) × 4 (No. of Quarter in a year) × 3 kgs. (for every finished product) = 96,000 kgs.

(i) Calculation of Economic Order Quantity (EOQ) for material ‘X’

EQO = \(\sqrt{\frac{2 \times \text { Annual demand } \times \text { Ordering cost }}{\text { Carrying cost per unit per annum }}}\)

= \(\sqrt{\frac{2 \times 96,000 \times 1000}{20 \times 15 \%}}\)

= 8,000kg.

(ii) Analysis of Cost under different options of ‘order quantity’.

Advice: The total Cost is lower if Company accept an offer 01 2% discount by the supplier, when supply of the annual requirement of material ‘X’ is made in 4 equal instalments. Hence, the company should accept the offer of 2% discount.

![]()

Question 28.

Answer the following:

Primex Limited produces product ‘P’. It uses annually 60,000 units of a material Rex costing ₹ 10 per unit. Other relevant information are:

Cost of placing an order : ₹ 800 per order

Carrying cost : 15% per annum of average inventory

Re-order period : 10 days

Safetÿ stock : 600 units

The company operates 300 days in a year.

You are required to calculate:

(i) Economic Order Quantity for material ‘Rex’.

(ii) Re-order Level

(iii) Maximum Stock Level

(iv) Average Stock Level (Nov 2013, 5 marks)

Answer:

(i) Economic order quantity of material ‘Rex’.

EOQ = \(\sqrt{\frac{2 \times \text { Annual requirement of raw materials } \times \text { Buying cost per order }}{\text { Carrying Cost per unit per annum }}}\)

= \(\sqrt{\frac{2 \times 60,000 \times 800}{10 \times 15 \%}}\) = \(\sqrt{\frac{9,60,00,000}{₹ 1.5}}\)

= 8,000 units

![]()

(ii) Reorder level

Reorder level = Safety stock + Lead time consumption

Reorder level = 600 + (60000 × \(\frac{10}{300}\))

Reorder level = 600 + 2,000

Reorder level = 2,600 units

(iii) Maximum stock level

= Reorder level + Economic order quantity – (Min. usage × Min. Lead time)

= 2,600 + 8,000 – (60000 × \(\frac{10}{300}\)) lead time consumption

= 8,600 units

(iv) Avorage level

Average level = \(\frac{\text { Maximumlevel }+ \text { Minimumlevel }}{2}\)

= \(\frac{8,600+600}{2}\)

Average level = 4,600 units

![]()

Question 29.

A company manufactures a product from a raw material, which is purchased at ₹ 80 per kg. The company incurs a handling cost of ₹ 370 plus freight of ₹ 380 per order. The incremental carrying cost of inventory of raw material is ₹ 0.25 per kg per month. In addition, the cost of working capital finance on the investment in inventory of raw material is ₹ 12 per kg per annum. The annual production of the product is 1.00000 units and 2.5 units are obtained from one kg. of raw material.

Required:

(i) Calculate the economic order quantity of raw materials.

(ii) Advise, how frequently company should order for procurement be placed.

(iii) If the company proposes to rationalize placement of orders on quarterly basis, what percentage of discount in the price of raw materials should be negotiated? .

Assume 360 days in a year. (May 2014, 8 marks)

Answer:

(i) Economic Order Quantity:

EOQ = \(\sqrt{\frac{2 A C a}{C i}}\)

= \(\sqrt{\frac{2 \times 40,000^{\circ} \times 750^{\circ}}{15}}\)

= 2,000 Kg.

A = Annual units required

= \(\frac{1,00,000}{2.5}\)

= 40,000 kg.

** Ordering Cost = Ca = 370 + 380 = ₹ 750

*** Carrying Cost = Ci = 12 + 3 = 15

(∵ incremental carrying cost = 0.25 p.m. /per Kg.)

![]()

(ii) Computation of days of placing Next Order

for 43,000 units ⇒ 360 days

for 2,000 units ⇒ ? days

∴ Days required = \(\frac{2,000 \times 360}{40,000}\)

= 18 days.

Alternative Solution

Frequency of placing orders for procurement:

Annual consumption (A) = 40,000 Kg.

Qu’antity per order (E.O.Q) = 2,000 Kg.

No. of orders per annum (\(\frac{A}{E.O.Q}\)) = \(\frac{40,000 \mathrm{Kg}}{2,000 \mathrm{Kg}}\) = 20 orders

Frequency of placing orders (in days) = \(\frac{360 \text { days }}{20 \text { orders }}\) = 18 days.

(iii) Percentage of discount in the price of raw materials to be negotiated:

When order is placed on quarterly basis the ordering cost and carrying cost increased by ₹ 48000 (₹ 78,000 – ₹ 30,000).

So, discount required = ₹ 48,000

Total annual purchase = 40,000 Kg. × ₹ 80 = ₹ 32,00,000

Therefore, Percentage of discount to be negotiated

= \(\frac{₹ 48,000}{₹ 32,00,000}\) × 100 = 1.5 %

![]()

Question 30.

Following details are related to a manufacturing concern:

Re-order Level – 160000 units

Economic Order Quantity – 90000 units

Minimum Stock Level – 100000 units

Maximum Stock level – 190000 units

Average Lead time – 6 days

Difference between Minimum lead time and

Maximum lead time – 4 days

Calculate:

(i) Maximum consumption per day

(ii) Minimum consumption per day (Nov 2014, 5 marks)

Answer:

Difference between Minimum lead time and Maximum lead time =4 days

Max. lead time – Min. lead time = 4 days .

Or, Max. lead time = Min. lead time + 4 days ………………….. (i)

Average lead time is given as 6 days i.e.

\(\frac{\text { Min. lead time }+ \text { Min. lead time }}{2}\) = 6 days …………………. (ii)

Putting the value of (i) in (ii),

\(\frac{\text { Min. lead time }+4 \text { days }+ \text { Min. lead time }}{2}\) = 6 days

Or, Min. lead time + 4 days + Min. lead time = 12 days

Or, 2 Min. lead time = 8 days

Or, Minimum lead time = \(\frac{8 \text { days }}{2}\) = 4 days ,

Putting this Minimum lead time value in (i), we get

Maximum lead time = 4 days + 4 days = 8 days

![]()

(i) Maximum consumption per day:

Re-order level = Max. Re-order period × Maximum Consumption per day

1,60,000 units = 8 days × Maximum Consumption per day

Or, Maximum Consumption per day = \(\frac{1,60,000 \text { units }}{8 \text { days }}\) = 20,000 units

(ii) Minimum Consumption per day:

Maximum Stock level = Re-order level + Re-order Quantity – (Min. lead time × Min. Consumption per day)

Or. 1 ,90,000 units = 1,60,000 units + 90,000 units – (4 days × Min. Consumption per day)

Or, 4 days x Min. Consumption per day = 2,50,000 units – 1,90,000 units

Or, Minimum Consumption per day = \(\frac{60,000 \text { units }}{4 \text { days }}\) = 15,000 units

![]()

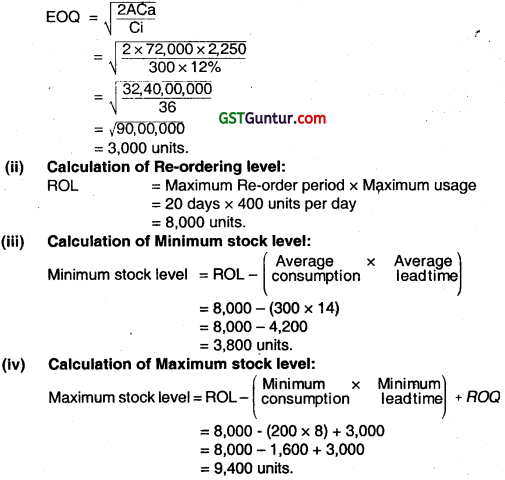

Question 31.

Answer the following:

Supreme Limited is a manufacturer of energy saving bulbs. To manufacture the finished product one unit of component ‘LED’ is required. Annual requirement of component ‘LED’ is 72,000 units, the cost being ₹ 300 per unît. Other relevant details for the year 2015-2016 are:

Cost of placing an order : ₹ 2,250

Carrying cost of inventory 12% per annum

Lead time –

Maximum : 20 days

Minimum : 8 days

Average : 14 days

Emergency purchase : 5 days

Consumption —

Maximum : 400 units per day

Minimum : 200units per day

Average : 300 units per day

You are required to calculate:

(i) Re-order quantity

(ii) Re-ordering level

(iii) Minimum stock level

(iv) Maximum stock level

(v) Danger level (Nov 2016, 5 marks)

Answer:

(i) Calculation of Re-order quantity:

(v) Calculation of Danger level:

Danger level = Minimum consumption × Emergency delivery time

= 200 units × 5 days

= 1,000 units.

![]()

Question 32.

Answer the following:

M/s. X Private Limited is manufacturing a special product which requires a component “SKY BLUE”. The following particulars are available for the year ended 31 March, 2018:

- Annual demand of “SKY BLUE” : 12000 units

- Cost of placing an order : ₹ 1,800

- Cost per unit of “SKY BLUE” : ₹ 640

- Carrying cost per annum : 18.75%

The company has been offered a quantity discount of 5% on the purchases of “SKY BLUE” provided the order sue is 3000 components at a time.

You are required to

(i) Compute the Economic Order Quantity.

(ii) Advise whether the quantity discount offer can be accepted. (May 2018, 5 marks)

Answer:

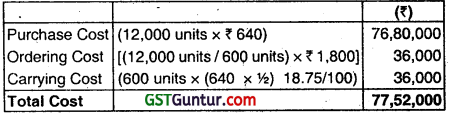

(i) Calculation of Economic Order Quantity:

EOQ = \(\sqrt{\frac{2 \mathrm{AO}}{\mathrm{C}}}=\sqrt{\frac{2 \times 12,000 \times 1,800}{640 \times 18.75 / 100}}\) = 600 units

![]()

(ii) Evaluation of Profitability of Different Option of Order Quantity:

(a) When EOQ is ordered:

(b) When Quantity Discount is accepted:

Advice: The total Cost ot inventory is lower if quantity discount is adopted. The company s advised not accept the EQO.

![]()

Question 33.

Answer the following

M/s. SJ Private Limited manufactures 20000 units of a product per month. The cost of placing an order is ₹ 1,500. The purchase price of the raw material is ₹ 100 per kg. The re-order period is 5 to 7 weeks. The consumption of raw materials varies from 200 kg to 300 kg per week, the average consumption being 250 kg. The carrying cost of inventory is 9.75% per annum.

You are required to calculate:

(i) Re-order quantity

(ii) Re-order level

(iii) Maximum level

(iv) Minimum level

(v) Aye rage stock level (Nov 2018, 5 marks)

Answer: .

(i) Re – Order Quantity (ROO):

Annual Consumption of raw material (A) = 13,000 Kg.

(250 Kg. × 52 weeks)

Cost of placing an order (O) = ₹ 1,500

Carrying Cost per Kg. Per annum (cxi) = ₹ 9.75

(₹ 100 × 9.75%)

Economic Order Quantity (EOQ) = \(\sqrt{\frac{2 {A O}}{\mathrm{Cxi}}}\)

= \(\sqrt{\frac{2 \times 13000 \mathrm{Kgs} \times ₹ 1,500}{₹ 9.75}}\)

= 2000 kg.

Economic Order Quantity / Re-order Quantity (ROQ) = 2000 Kg.

![]()

(ii) Re – order Level (ROL):

Re – order Level (ROL) = Maximum usage × Maximum re-order Period

= 300 Kg. × 7 weeks

= 2100 Kg.

(iii) Maximum Level :

Maximum Level = ROL + ROQ – (Min. Usage × Min. re-order Period)

= 2100 Kg. + 2000 Kg. ‘-‘(200 Kg. × 5 weeks)

= 3100 Kg.

(iv) Minimum Level :

Minimum Level = ROL – (Normal usage × Normal re – order period)

= 2100 Kg. – (250 Kg. × 6 weeks)

= 600 Kg.

(v) Average Stock Level :

Average Stock Level = 1/2 (Maximum Level + Minimum Level)

= 1/2(3100 Kg.+ 600 Kg.)

= 1850 Kg.

Or,

Minimum Level + 1/2 × ROQ

= 600 Kg. + 1/2 × 2000 Kg.

= 1600 Kg.

![]()

Question 34.

Answer the following:

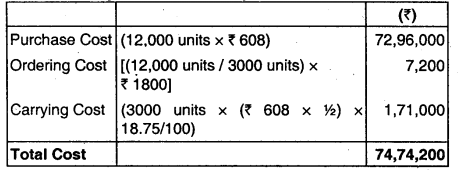

(a) Surekha Limited Produces 4000 Litres of paints on a quarterly basis. Each Litre requires 2 kg. of raw material. The cost of placing one order for raw material is ₹ 40 and the purchasing price of raw material is ₹ 50 per kg. The storage cost and interest cost is 2% and 6% per annum respectively. The lead time for procurement of raw material is 15 days. Calculate Economic Order Quantity and Total Annual Inventory Cost in respect of the above raw material. (Nov 2019, 5 marks)

Answer:

Working Notes:

Annual Demand of Raw Material

= 4000 litres (per quarter) × 4 × 2kg (Raw Material needed/ litre of paint)

= 32,000 kg.

Carrying Cost

Storage Cost + Interest Rate

= 2% + 6% = 8% p.a.

∴ Carrying Cost/unit p.a. = 8% of 50 = ₹ 4 p.a.

![]()

Question 35.

An automobile company purchases 27,000 spare parts for its annual requirements. The cost per order is ₹ 240 and the annual carrying cost of average inventory is 12.5%. Each spare part costs ₹ 50.

At present. the order size is 3.000 spare parts.

(Assume that number of days in a year = 360 days)

Find out:

(i) How much the company’s cost would be saved by opting EOQ model?

(ii) The Re-order point under EQO model if lead time is 12 days.

(iii) How frequently should orders for procurement be placed under EQO model? (Nov 2020, 10 marks)

Question 36.

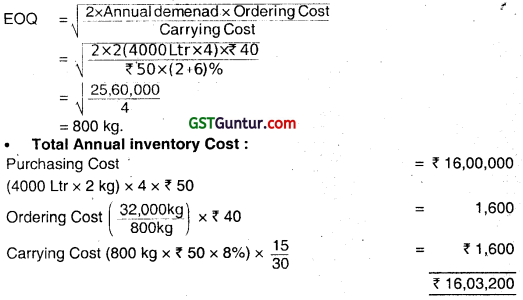

Ananya Ltd. produces a product SExe’ using a raw material Dee. To produce one unit of Exe. 2 kg. of Dee is required. As per the.sales forecast conducted by the company, it wIl able to sale 10,000 units of Exe in the coming year. The following is the information regarding the raw material Dee:

(i) The Re-order quantity is 200 kg. less than the Economic Order Quantiy (EOQ).

(ii) Maximum consumption per day is 20 kg. more than the average consumption per day.

(iii) There is an opening stock of 1,000 kg.

(iv) Time required to get the raw materials from the suppliers is 4 to 8 days.

(v) The purchase price is ₹ 125 per kg.

There is an opening stock of 900 units of the finished product Exe. The rate of interest charged by bank on Cash Credit facility is 13.76%.

![]()

To place an order company has to incur ₹ 720 on paper and documentation work. From the above information FIND OUT the followings in relation to raw material Dee:

(a) Re-order Quantity

(b) Maximum Stock level

(c) Minimum Stock level

(d) CALCULATE the impact on the profitability of the company by not ordering the EOQ. [Take 364 days for a year]

Answer:

Working Notes:

(i) Computation of Annual Consumption and Annual Demand for raw material ‘Dee’:

(iv) Minimum consumption per day of raw material ‘Dee’

Average Consumption per day = 50 kg.

Hence, Maximum Consumption per day = 50 kg. + 20 kg. = 70 kg.

So Minimum consumption per day will be

Average Consumption = \(\frac{\text { Min. consumption }+ \text { Max. consumption }}{2}\)

Or, 50 kg. = \(\frac{\text { Min. consumption }+70 \mathrm{~kg} \text {. }}{2}\)

Or, Min. consumption = 100 kg – 70 kg.= 30 kg.

(a) Re-order Quantity: = EOQ – 200 kg.= 1,200 kg. – 200 kg.

= 1,000 kg.

![]()

(b) Maximum Stock level:

= Re-order level + Re-order Quantity – (Min. consumption per day 1 × Min. lead time)

= 560 kg. + 1,000 kg. – (30 kg. × 4 days)

= 1,560 kg. – 120 kg. = 1,440. kg.

(c) Minimum Stock level:

= Re-order level -(Average consumption per day × Average lead time)

= 560 kg. – (50 kg. × 6 days) = 260 kg.

(d) Impact on the profitability of the company by not ordering the EOQ.

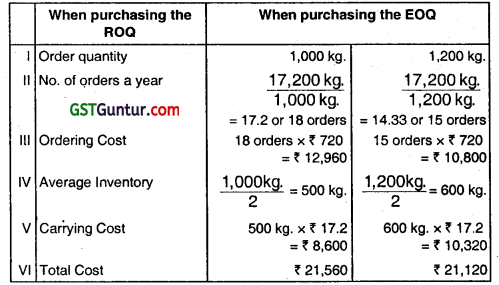

Extra Cost incurred due to not ordering EOQ = ₹ 21,560 – ₹ 21,120 = ₹ 440

![]()

Question 37.

IPL Limited uses a small casting in one of its finished products. The castings are purchased from a foundry. IPL Limited purchases 54,000 castings per year at a cost of ₹ 800 per casting.

The castings are used evenly throughout the year in the production process on a 360-day-per-year basis. The company estimates that it costs. ₹ 9,000 to place a single purchase order and about ₹ 300 to carry one casting in inventory for a year. The high carrying costs result from the need to keep the castings in carefully controlled temperature and humidity conditions, and from the high cost of insurance.

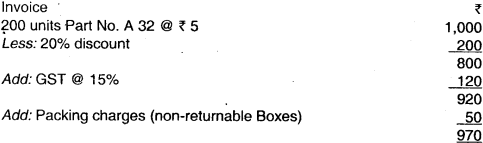

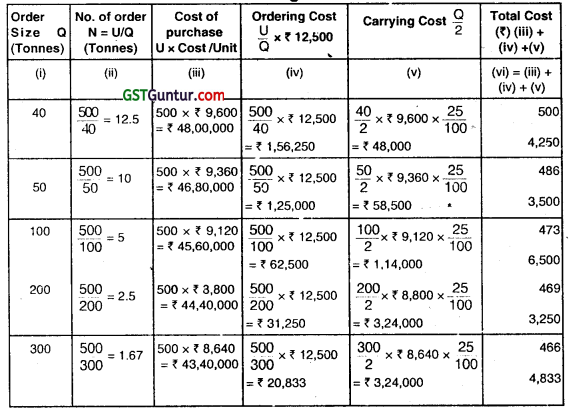

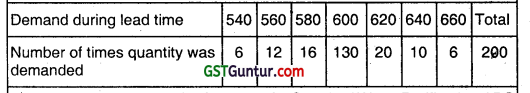

Delivery from the foundry generally takes 6 days, but it can take as much as 10 days. The days of delivery time and percentage of their occurrence are shown in the following tabulation :

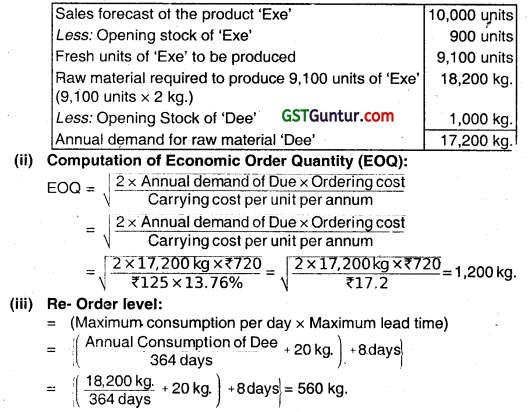

![]()

Required :

(i) Compute the economic order quantity (EOQ).

(ii) Assume the company is willing to assume a 15% risk of being out of stock. What would be the safety stock ? The re-order point ?

(iii) Assume the company is willing to assume a 5% risk of being out of stock. What would be the safety stock ? The re-order point ?

(iv) Assume 5% stock-out risk. What would be the total cost of ordering and carrying inventory for one year?

(v) Refer to the original data. Assume that using process re-engineering the company reduces its cost of placing a purchase order to only ₹ 600. In addition, company estimates that when the waste and inefficiency caused by inventories are considered, the true cost of carrying a unit in stock is ₹ 720 per year.

(a) Compute the new EOQ.

(b) How frequently would the company be placing an order, as compared to the old purchasing policy? (May 2004, 2+1+1+2+3=9 marks)

Answer:

(i) Computation of EOQ

U = Annual Usage = 54,000 castings

P = Cost per casting = ₹ 800

O = Ordering cost order = ₹ 9,000

PC = Carrying cost per unit p.a. = ₹ 300

EOQ = \(\sqrt{\frac{2 \times 54,000 \times 9,000}{300}}\) = \(\sqrt{32,40,000}\)

= 1,800 castings.

![]()

(ii) Safety Stock

(Assuming a risk of being out of stock)

Safety stock for/day = 54,000/360 days = 150 castings

Reorder Point = Minimum stock level + (Average lead time × Average usage)

= 150 + (6 × 150) = 1,050 casting.

(iii) Safety Stock

(assuming a 5% risk of being out of stock)

Safety stock for 3 days = 150 × 3 days = 450 cas.ting,

Re-order Point = 450 castings + 900 casting = 1,350 castings

(iv) Total cost of ordering = (54,000/1,800) × ₹ 9,000 = ₹ 2,70,000

Total cost of carrying = (450 + 1,800/2) × ₹ 300 = ₹ 4,05,000

(v) (a) Computation of new EOQ

Q = \(\sqrt{\frac{2 \times 54,000 \times 6,000}{720}}\) = 300 casting

(b) Total no. of orders to be placed in a year are 180. Each order is to be placed after 2 days (as year = 360 days.). Under old purchasing policy each order is placed after 12 days.

![]()

Question 38.

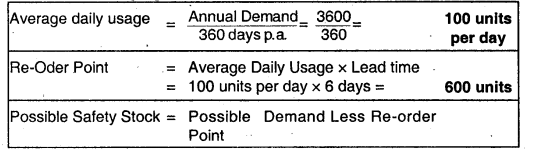

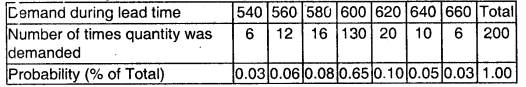

XYZ Ltd. distributes a wide range of Water Purifier Systems. One of its best selling items is a Standard Water Purifier. The management of XYZ Ltd. uses the EOQ decision model to determine optimal number of Standard Water Purifiers to order. Management now wants to determine how much safety stock to hold.

XYZ Ltd. estimates the annual demand (360 working days) to be 36,000 Standard Water Purifiers. Using the EOQ decision model the company orders 3,600 Standard Water Purifiers at a time. The lead-time for an order is 6 days. The annual Carrying cost of one Standard Water Purifier is ₹ 450.

Management has also estimated that the additional stock-out costs would be ₹ 900 for shortage of each Standard Water Purifier.

XYZ Ltd. has analyzed the demand during 200 past re-order periods.

The records Indicates the following patterns:

1. Determine the level of safety stock for Standard Water Purifier that ABC Ltd. should maintain in order to minimize expected stock-out costs and carrying costs. When computing carrying costs, assume that the safety stock is on hand at all times and that there is no over-stocking caused by decrease in expected demand (consider Safety Stock Levels of 0, 20, 40 and 60 units).

2. What would be XYZ’s new Re-Order Point?

3. What factors XYZ Ltd. should have considered in estimating stock-out costs?

Answer:

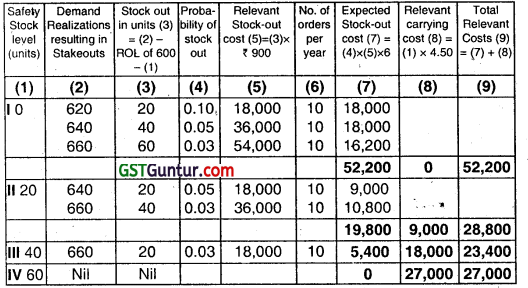

1. Determination of Safety Stock to minimize expected Stock-Out Costs & Carrying Costs

2. Probability of demand during lead time is asunder:

3. Cost Analysis: Relevant Costs under different Safety Stock situations are as under:

4. Decision: Safety Stock of 40 units would minimize ABC Ltd.’s total expected stock-out and carrying cost.

(a) New Re-order Point = ROL + Safety Stock = 600 units + 40 units

= 640 units.

(b) Factors to consider in estimating stock-out cost:

- Expediting an order from Supplier (additional Ordering Cost plus any associated Transportation Cost).

- Loss of sales due to stock-out (Opportunity cost in terms of contribution lost on the sales not made due to stock-out, plus any contribution lost on future sales due to that customer, that will be caused by the stock-out.)

![]()

Question 39.

Explain Just In Time’ (JIT) approach of inventory management. (May 2018, 5 marks)

Answer:

Just-In Time Purchasing:

JIT purchasing is the purchase of materials and supplies in such a manner^ that delivery immediately precedes the demand of use. This will ensure that stock are as low as possible or nearly cut to a minimum. Considerable saving in material handling expenses in made by requiring suppliers to inspect materials and guarantee their quality. This improved service is obtained by giving more business to fewer suppliers, who can provide high quality and reliable delivery. Encouragement is given to employees to render good service by placing with them long term purchasing order companies which implements JIT, purchasing substantially reduces their investments in raw materials and WIP stocks.

The features of JIT purchasing which plays important role are :

- Long term stable relationship with suppliers.

- Simple purchase agreements

- Small but frequents deliveries.

Advantages of JIT Purchasing: The advantages of JIT Purchasing are :

- It results in considerable savings in material handling expenses.

- It results in savings in factory space.

- Investment in raw materials and WIP is substantially reduced.

- Last quantity discounts can be obtain and paperwork is reduced because of using of blanket long term orders to fewer suppliers instead of purchase orders.

- JIT purchasing are now attempting to extend daily deliveries to as many areas as possible so that the goods spend less time in warehouse or on store shelf before they are exhausted.

![]()

Question 40.

What is ABC Analysis (May 2000, 3 marks)

OR

Discuss ABC Analysis as a system inventory control (Nov 2004, 4 marks)

OR

Discuss ABC Analysis as a technique of Inventory Control. (Nov 2005, May 2008, Nov 2011, May 2017, 3, 3, 4, 2 marks)

Answer:

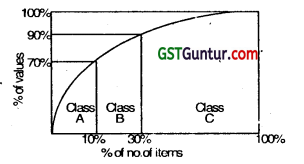

ABC Analysis: It is an important technique of inventory control on selective basis. Large manufacturing units have such a large number of items in their stores for which it is often not possible for the management to pay the same attention to each and every stock item.

A system is therefore required by which these items are classified according to their importance and then selective control is exercised. ABC analysis or ‘selective control’ is a technique whereby the measure of control over an item of inventory varies directly with ‘its usage value’. In other words, the high value items are controlled more closely than the items of low value.

ABC Analysis of Inventory

This figure shows ABC analysis of inventory. Class ‘A1 is made up of items which are either very expensive or used in massive quantities. Thus, these items though few in number contribute a high proportion of the value of inventories. Class ’B’ items are not so few in numbers but also they are not too many either, value wise also, they are neither very expensive nor very cheap.

Class ‘C’ contains a relatively large numbers of items, but they are either cheap items or used in very small quantities so that they do not constitute more than a negligible portion of the total inventory value.

![]()

This method is known as “Always Better Control or the Alphabetic Approach.” ABC concept of classifying goods in an inventory is very commonly used for exercising effective inventory control. Under this technique the items in inventory are classified according to the value of usage.

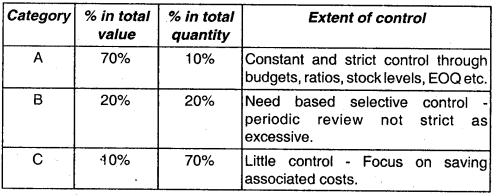

Analysis and Control: The three categories are classified & differential control is established as under:

Advantages of ABC: The advantages are :

1. Smooth Flow :

This method ensures that minimum investment will be made in inventories of stock of materials or stocks to be carried, without any danger of interruption of production for want of materials or stores requirement.

2. Cost Savings :

The cost of placing orders, receiving goods and maintaining stocks is minimized.

3. Control by exception :

Management’s time is saved since attention need be paid only to some of the Items rather than all the items.

4. Standardization of work :

With the introduction of ABC system, much of the work connected with purchase can be systematised on a routine basis.

Limitation of ABC

- In order to be fully cost effective, ABC analysis should be carried out with standardization and codification.

- The result of ABC analysis should be reviewed periodically and should be up dated.

![]()

Question 41.

How is slow moving and non-moving item of stores detected and what steps are necessary to reduce such stocks? (Nov 2001, 4 mark)

Answer:

Slow moving and non-moving items of stores can be detected in the following ways:

- By preparing & scanning periodic reports showing he status of different items of stores.

- By calculating the stock holding of various items in terms of numbers of days/months of consumption.

- By computing ratios periodically, relating to the issues as a percentage of average stock held.

- By implementing the use of a well designed information system.

Steps to reduce stock of slow moving and non-moving items of stores:

- Proper procedures and guidelines should be laid down for the disposal of non-moving items, before they further deteriorates in value.

- Diversity in production to use up such materials.

- Use these materials as substitute in place of other materials.

![]()

Question 42.

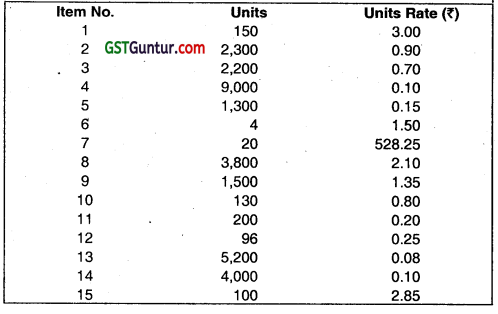

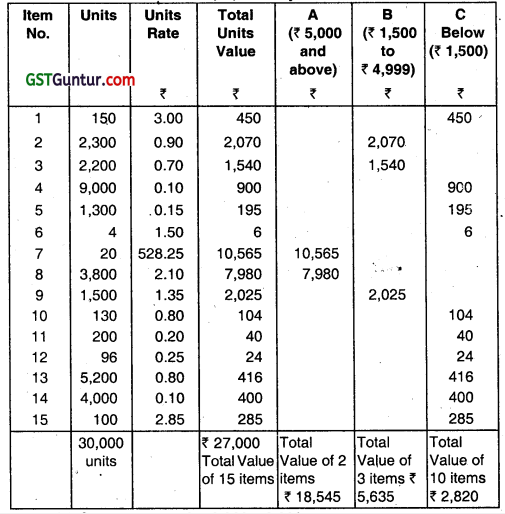

Analyse the following items into A, B and C categories on the basis of information given below:

Category A: ₹ 5.000 and above (total value)

Category B: ₹ 1.500 to ₹ 4,999 (total value)

Category C: Below ₹ 1,500.

Answer:

Statement of A, B, C Analysis of Material

Units of A Category = 20 + 3,800 = 3,820

Units of B Category = 2,300 + 2,200 + 1,500 = 6000

Units of C Category = 150 + 9,000 + 1,300 + 4 + 130 + 200 + 96 + 5,200 + 4,000 + 100 = 20,180

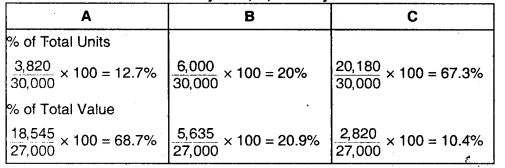

![]()

Summary of A, B, C Analysis

Material Turnover Ratio:

In material control, material turnover ratio plays an important role. Material turnover means the ratio of the quantity of material consumed in a certain period and the average quantity of material in the store. Through this ratio, it is known that for how many days, the material remains in the store. The formula to know the material turnover ratio is as follows:

Material Turnover Ratio = \(\frac{\text { Material Consumed }}{\text { Average Stock of Material }}\)

Where, Material Consumed = Opening stock of material + Purchase – Closing stock of material

Average stock = \(\frac{\text { Opening stock }+ \text { Closing stock }}{2}\)

![]()

Question 43.

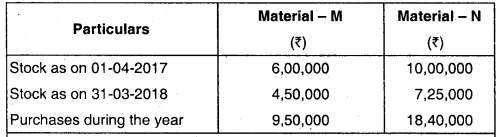

The following details are provided by M/s. SKU Enterprises for the year ended 31st March, 2018:

You are required to:

(i) Calculate Turnover Ratio of both the materials.

(ii) Advise which of the two materials is fast moving. (Assume 360 days in a year.) (May 2018, 5 marks)

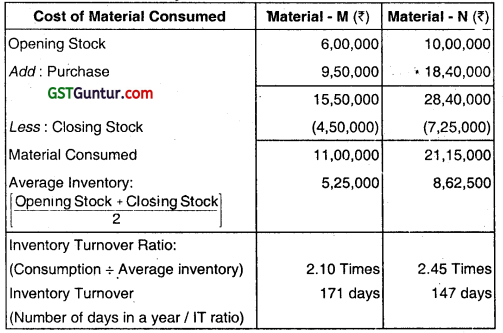

Answer:

First of all it is necessary to find out the material consumed:

![]()

Question 44.

From the following data for the year ended 31st Dec. 2016 calculate the inventory turnover ratio of two items and put forward your comments on them:

Answer:

Materials Consumed = Opening stock + Purchases – Closing Stock

Material A = 40,000 + 2,08,000 – 4,000 = ₹ 2.24,000

Material B = 36,000 + 1,08.000 – 48,000 = ₹ 96,000

Average Inventory = \(\frac{\text { Opening inventory }+ \text { Closing inventory }}{2}\)

Material A = \(\frac{40,000+24,000}{2}\) = ₹ 32,000

Material B = \(\frac{36,000+48,000}{2}\) = ₹ 42,000

Inventory Turnover Ratio = \(\frac{\text { Material consumed during the year }}{\text { Average inventory }}\)

Material A = 2,24,000 ÷ 32,000

= 7 times per annum

Material B = 96,000 ÷ 42,000

= 2.3 times per annum

If it is desired to express the inventory turnover in the number of days the average inventory is consumed, it is computed as follows:

= \(\frac{365 \text { (No. of days in a year) }}{\text { Inventory turnover ratio }}\)

Material A = \(\frac{365}{7}\) = 52 days (approx.)

Material B = \(\frac{365}{2.3}\) = 159 days (approx.)

Comments:

Material A is fast moving as compared to material B as it takes only 52 days to consume the average stock of A, whereas the consumption of average inventory of B takes 159 days. Considering the low turnover ratio of material B, its stock level may be refixed and if its rate of consumption does not change, its purchases may be reduced.

![]()

Question 45.

Describe perpetual inventory records and continuous stock verification. (May 2001, 3 marks)

Answer:

Perpetual Inventory Taking:

- Stock verification takes place.at the end of a financial period say a year.

- All items of stocks are covered in a single stretch of verification, say over 2-3 days.

- Regular stores procedures like material receipts, issues etc. may have to be stopped to facilitate stock taking.

- Discrepancies can be known only at the end of the period. Responsibility cannot be easily fixed.

- Inventory records may also be updated periodically, say weekly or monthly, in tact, at any time before physical verification.

- This does not facilitate or help the quick computation of interim or final financial results.

Continuous Stock Verification:

- Stocks are verified at regular intervals during the year, Since Stock taking takes place regularly, it is called continuous stock taking.

- In each verification, 2-3 items are covered. In the entire period, all items are covered on rotation basis.

- There is no interference with regular work flow.

- Discrepancies are ascertained immediately in-order to take corrective action and avoid re-occurrence.

- Due to surprise element involved, inventory records must be maintained upto date at all times. This is called perpetual Inventory Records.

- It provides stock figures on real-time basis. Hence, final accounts can be completed quickly, interim results can be prepared conveniently.

![]()

Question 46.

Discuss the use of perpetual inventory records and continuous stock verification, and its advantages. (Nov 2006, 4 marks)

Answer:

Use of Perpetual Inventory Records

Under this system, a continuous record of receipt and issue of materials is maintained by the stores, deptt. and the information about the stock of materials is always available. In this method stock records are maintained in suGh a way as to make an entry in the records, the physical movement of stock on receipts and issue of materials and to indicate the balance of each item of material in the stores at any point of time.

In this system, the entries are made in bin cards and stores ledger as arid when the receipts and issue of materials take place and the balance is ascertained after every receipt or issue of materials. The stocks as per dual records viz. bin cards and stores ledgers are reconciled on a continuous basis.

Advantages:

- This system facilitates production planning and inventory control.

- It helps in having a detailed and more reliable check on the stores.

- The stock records are more reliable and stock discrepancies are investigated and immediate actions are taken.

Use of Continuos Stock Taking:

Under this system, physical stock verification is made for each item of stock on continuous basis. It is physical checking of stock records with actual stock on continuous basis.

It is a method of verification of physical stock on a continuous basis instead of at the end of the accounting period. It is a verification conducted round the year, thus covering each item of stores twice or thrice. Valuable items are checked more frequently than the stocks with lesser value.

Advantages:

- Any discrepancies, irregularities or changes are detected at early stage and brought to the notice of management.

- It acts as a moral check On stores staff.

- It insists on upto date maintaining of stock records.

- The disruption in production caused by periodic stock taking is eliminated.

![]()

Question 47.

“Perpetual inventory system comprises Bin Card and Stores Ledger, but the efficacy of the system depends oñ continuous,stock taking.” Comment. (May 2013, 4 marks)

Answer:

- Perpetual Inventory system represents a system of records maintained by the stores department.

- Records comprise of (i) Bin Cards and (ii) Stores Ledger.

- Bin Card maintains a quantitative record of receipts, issues and closing balances of each item of stores. Like a bin card, the Stores Ledger is maintained to record all receipt and issue transactions in respect of materials. It is filled up with the help of goods received note and material requisitions.

- But a perpetual inventory system’s efficacy depends on the system of continuous stock taking. Continuous stock taking means the physical checking of the records i.e. Bin cards and store ledger with actual physical stock.

- Perpetual inventory is essentially necessary for material control. It incidentally helps continuous stock taking.

The main advantages of continuous stock taking are as follows:

- Quick compilation of Profit and Loss Accounts (for interim period) due to prompt availability of stock figures.

- Discrepancies are easily located and thus corrective action can be promptly taken to avoid their recurrence.

- Physical stocks can be counted and book balances adjusted as arid when desired without waiting for the entire stock-taking to be done.

- Fixation of the various levels and check of actual balances in hand with these levels assist the Storekeeper in maintaining stocks within limits and in initiating purchase requisitions for correct quantity at the proper time.

- A systematic review of the perpetual inventory reveals the existence of surplus, dormant, obsolete and slow-moving materials, so that remedial measures may be taken in time.

![]()

Question 48.

Answer the following :

Explain, why the Last in First out (LIFO) has an edge over First in First out (FIFO) or any other method of pricing material issues. (Nov 2007, 3 marks)

Answer:

Under LIFO method, production is charged with current market prices and hence pricing of the production is facilitated.

Whereas in case of FIFO method, production is charged with old price (i.e. .10w price under inflationary trend). In the same way, under weighed price method, the rise in prices is spread over a large number of units and therefore its effect is much reduced. The average price is always less than the current market price. However, determination of the average price requires a lot of clerical work.

Therefore we prefer to use LIFO method so the product cost is near to market price.

During inflationary period or period of rising prices, the use of LIFO would help to ensure that the cost of production determined on the above basis is approximately the current one. This method is also useful specially when there is a feeling that due to the use of FIFO or average methods, the profits shown and tax paid are too high.

![]()

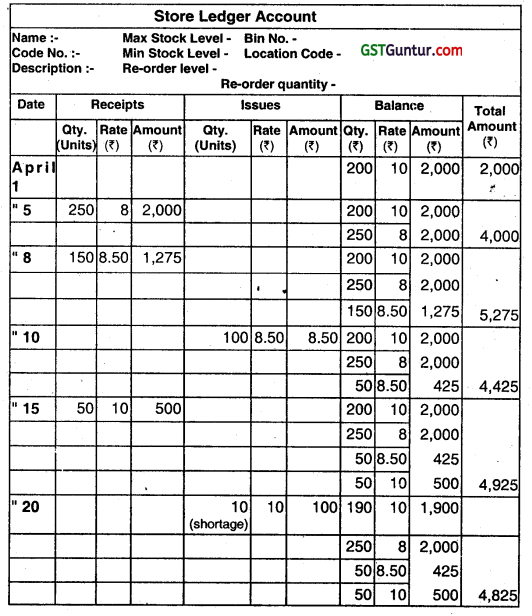

Question 49.

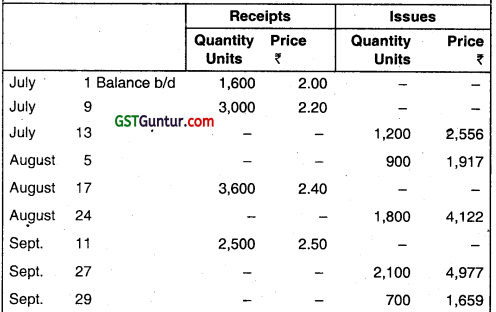

Prepare a Store Ledger Account from the following transactions of XV Company Ltd.:

April, 2011 :

1 Opening balance 200 units @ ₹ 10 per unit.

5 Receipt 250 units costing ₹ 2,000

8 Receipt 150 units costing ₹ 1,275

10 Issue 100 units

15 Receipt 50 units costing ₹ 500

20 Shortage 10 units .

21 Receipt 60 units costing ₹ 540

22 issue 400 units

The issues upto 10-4-11 will be priced at LIFO and from 11-4-11 issues will be priced at FIFO.

Shortage will be charged as overhead. (May 2011, 5 marks)

Answer:

![]()

Question 50.

Explain:

FIFO and LIFO method of stores issue. (May 2018, 2.5 marks)

Answer:

FIFO Method :

It is a method of pricing the issues of materials, in the order in which they are purchased. In other words, the materials are issued in the order in which they arrive in the store or the items longest in stock are issued first. Thus each issue of material only recovers the purchase price which does not reflect the current market price.

This method is considered suitable in times of falling price because the material cost charged to production will be high while the replacement cost of materials will be low. But, in the case of rising prices, if this method is adopted, the charge to production will be low as compared to the replacement cost of materials. Consequently, it would be difficult to purchase the same volume of material (as in the current period) in future without having, additional capital resources.

LIFO Method :

It is a method of pricing the issues of materials. This method is based on the assumption that the items of the last batch (lot) purchased are first to be issued. Therefore, under this method the prices of the last batch (lot) are used for pricing the issues, until it is exhausted, and so on. If however, the quantity of issue is more than the quantity of the latest lot than earlier (lot) and its price will also be taken into consideration.

During inflationary period or period of rising prices, the use of LIFO would help to ensure that the cost of production determined on the above basis is approximately the current one. This method is also useful specially when there is a feeling that due to the use of FIFO or average methods, the profits shown and tax paid are too high.

![]()

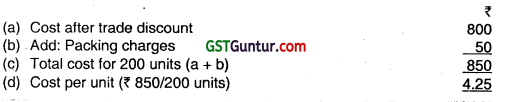

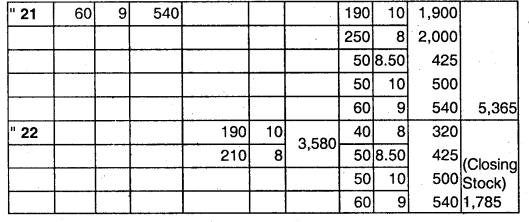

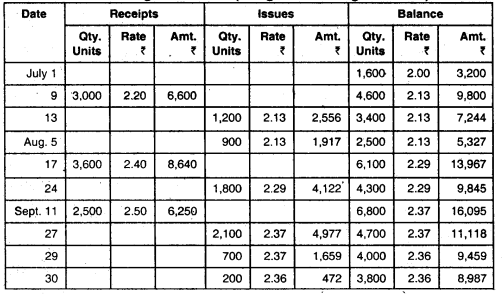

Question 51.

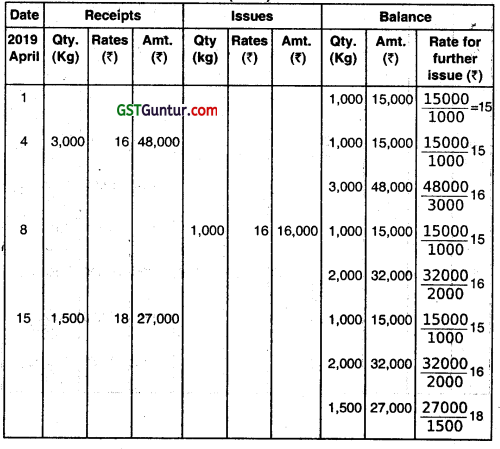

The following are the details of receipt and issue of material CXE’ in a manufacturing Co. during the month of April 2019: (May 2019)

On 30th April, 2019 it was found that 50 kg of material ‘CXE’ was fraudently misappropriated by the store assistant and never recovered by the Company.

Required:

(i) Prepare a store ledger account under each of the following method of pricing the issue:

(a) Weighted Average Method

(b) LIFO

(ii) What would be the value of material consumed and value of closing stock as on 30-04-2019 as per these two methods? (10 marks)

Answer:

(i) (a) Stores Ledger A/c

(Weighted Aug. Method)

(b) Store Ledger A/c (LIFO)

![]()

(ii) Value of Material consumed and value of closing stock as on 30/04/2019.

(a) Weighted Average Method:

Value of Material consumed = (15,750 + 19,800 + 16,350)

= ₹ 51,900

Value of closing stock as on 30/4/2019 = ₹ 41,200

(b) LIFO Method:

Value of Material consumed = (16,000 + 21,600 + 16,000)

= ₹ 53,600

Value of Closing stock as on 30/4/2019

= (15,000 + 16,000 + 7,650)

= ₹ 38,650

![]()

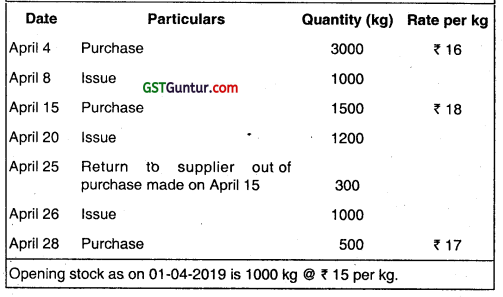

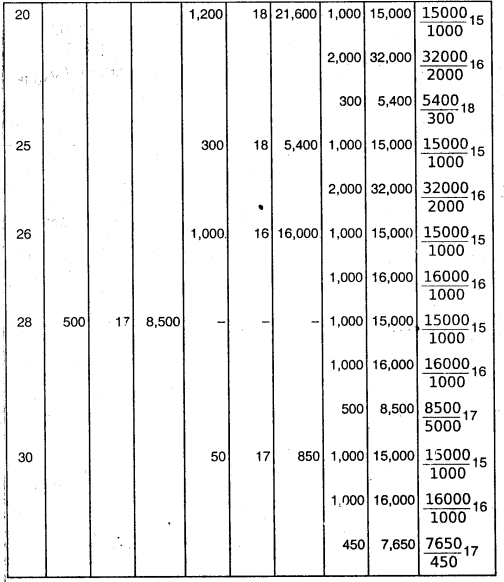

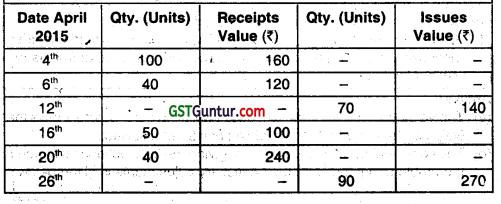

Question 52.

The stores ledger of a manufacturing company recorded for material item P-18 for Jan., 2018 the following information:

Answer:

(i) The First in first out (FIFO) has been employed in the stores ledger.

(ii) Stores Ledger (FIFO Method)

![]()

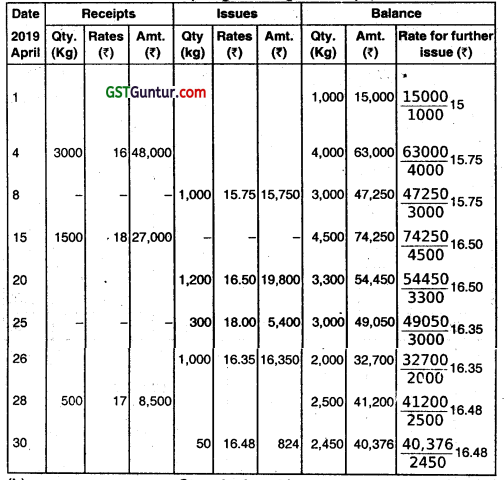

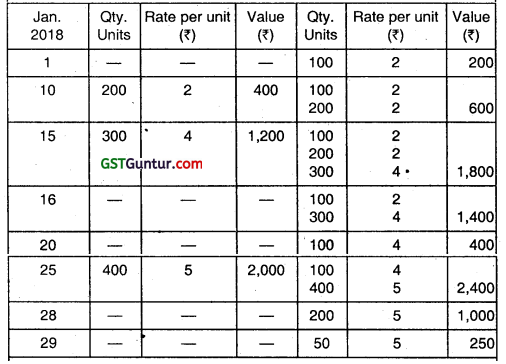

Question 53.

The stock ledgeraccount for material X in a manufacturing concern reveals the following data for the quarter ended Sept. 30, 2017.

Physical verification on Sept. 30 revealed an actual stock of 3M00 units.

You are required to:

(a) Indicate the method of pricing employed in the above.

(b) Complete the above account by making entries you would consider necessary including adjustments, if any, and giving explanations for such adjustments.

Answer:

(a) The verification of the value of issues applied in the problem shows that weighted average method of pricing has been followed.

(b) The complete stores ledger account giving the transactions as stated in the problem together with the necessary adjustments is given below:

Store Ledger Account (Weighted Average Method)

![]()

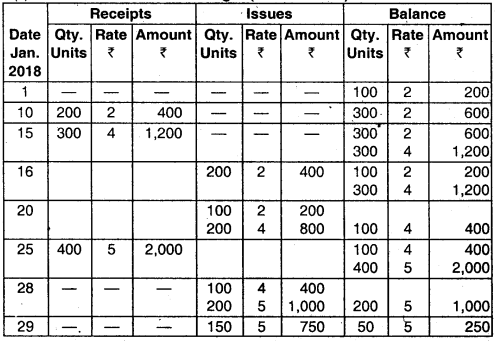

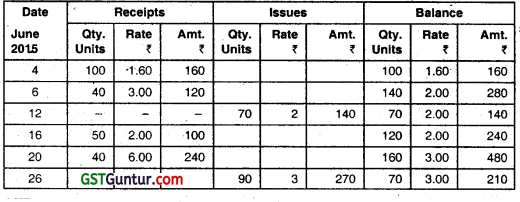

Question 54.

The Stores Ledger of a manufacturing company recorded for material for April 2015 the following information:

(a) State the method of pricing that was employed in the Stores Ledger, and

(b) Complete the Stores Ledger as per the method followed.

Answer:

(a) The Weighted Average Price Method” was employed in the stores ledger for issue of materials.

(b) The Stores Ledger as per this method can be l as follows:

Stores Ledger (Weighted Average Method)

Question 55.

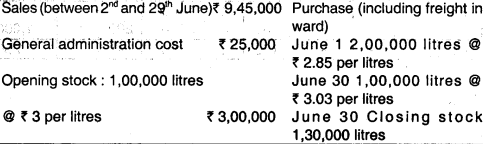

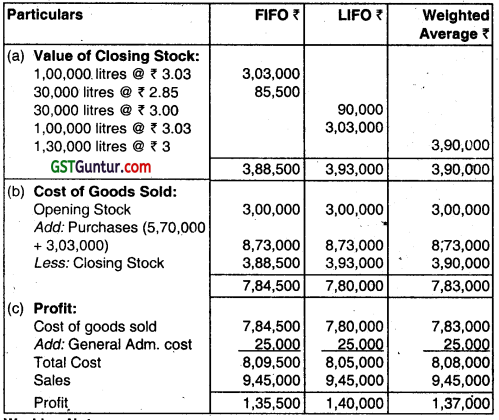

Oil India is a bulk distribution of high octane petrol. A periodic invertory of period on hand is taken when the books are closed at the end of each month. The following summary of information is available for the month.

Compute the following data by FIFO, LIFO and Weighted Average Method of inventory costing:

(a) Value of inventory on June 30 (b) Amount of the cost of goods sold for June (c) Profit or loss for June.

Answer:

Working Notes:

- Weighted Average Price on First Purchase

\(\frac{(1,00,000 \times ₹ 3)+(2,00,000 \times ₹ 2,85)}{1,00,000+2,00,000}=\frac{₹ 8,70,000}{3,00,000}\) = ₹ 2.90 per litres - Balance after issue = 1 00,000 + 2,00,000 – 2,70,000 = 30,000 litres

- Weighted Average Price on last purchase

\(\frac{(30,000 \times 2.90)+(1,00,000 \times 3.03)}{30,000+1,00,000}=\frac{₹ 3,90,000}{1,30,000}\) = ₹ 3 per litres

Note; No sale has taken place out of purchases on 30th June since sales are given between 2nd and 29th June.

![]()

Question 56.

Discus.s the accounting treatment of detectives in cost accounts. (May 2000, 4 marks)

OR