Value of Supply – CA Inter Tax Question Bank is designed strictly as per the latest syllabus and exam pattern.

Value of Supply – CA Inter Tax Question Bank

Question 1.

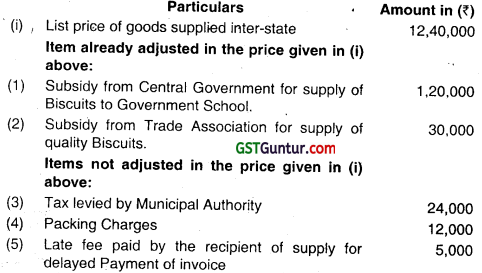

Candy Blue Ltd., Mumbai, a registered supplier, is manufacturing Chocolates and Biscuits. It provides the following details of taxable inter-state supply made by it for the month of October 2020:

Calculate the Value of taxable supply made by M/s Candy Blue Ltd. for the month of October 2020. (May 2018, 5 marks)

Answer:

Computation of Value of Taxable Supply made by M/s Candy Blue Ltd. for the month of October 2020:

Note: In the above solution, list price of the goods and late fee for delayed payment of invoice have been assumed to be exclusive of taxes.

![]()

Question 2.

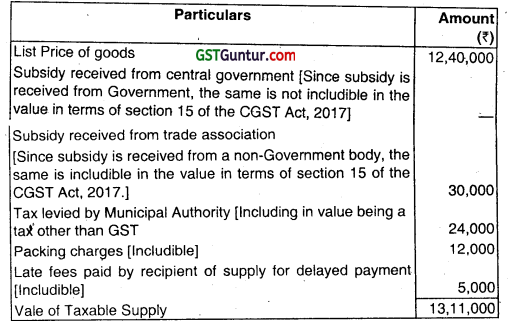

Ms. Achintya a registered supplier in Kochi (Kerala State) has provided the following details in respect of her supplies made within Intra-State for the month of March 2021 :

Compute the value of taxable supply and the gross GST liability of Ms. Achintya for the month of March 2021 assuming rate of CGST to be 9% and SGST to be 9%. All the amounts given above are exclusive of GST (Nov 2018, 5 marks)

Answer:

Computation of value of taxable supply and gross GST liabIlity of Ms. Achintya for the month of March, 2021

| Particulars | ₹ |

| List price of the goods | 3,30,000 |

| Add: Swachh Bharat Cess (SBC) levied on sale of goods [Note-1] | 12,500 |

| Add: Packing expenses [Note-2] | 10,800 |

| Less : Subsidy received from State Government [Note-3] | (5,000) |

| Less: Discount @ 1 % on list price [Note-4] | (3,300) |

| Value of taxable supply | 3,45,000 |

| CGST@ 9% | 31,050 |

| CGST @ 9% | 31,050 |

| Gross GST liability | 62,100 |

![]()

Notes:

As per section 15 of CGST Act, 2017,

- Any taxes, duties and cesses levied under any law other than CGST, SGST is includible in the value.

- Packing expenses being incidental expenses, are includible in the value.

- Since subsidy is received from State Government, the same is not includible in the value. It has been assumed that such subsidies are directly linked to the price of the goods. Further, since the same has not been adjusted in the list price, the same is to be excluded from the list price.

- Since discount is known at the time of supply, it is deductible from the value.

Note:

(i) In the above answer, the term “exclusive” mentioned in the question has been taken to be as “not adjusted in the list price”, i.e. the list price given in the question is before adjusting the amount of discount and subsidy. However, it is also possible to take a view that the list price “excludes” amount of discount and subsidy. Therefore, the same need not be deducted again from the list price to arrive at the taxable value.

(ii) Read SBC as other taxes.

![]()

Question 3.

M/s. Apna Bank Limited a Scheduled Commercial Bank has furnished the following details for the month of August. 2020:

| Particulars | Amount ₹ in Crores (Excluding GST) |

| Extended Housing Loan to its customers | 100 |

| Processing fees collected from its customers on sanction of loan | 20 |

| Commission collected from its customers on bank guarantee | 30 |

| Interest income on credit caFd issued by the bank | 40 |

| Interest received on housing loan extended by the bank | 25 |

| Minimum balance charges collected from current account and saving account holder | 01 |

![]()

Compute the Value of Taxable supply. Give reasons with suitable assumptions. (May 2019, 6 marks)

Answer:

Computation of value of taxable supply of M/s. Apna Bank Limited for the Month of August, 2020

| Particulars | Amount in crores (₹) |

| Housing loan extended to customers | Nil |

| [Since money does not constitute goods, extending housing loan is not a supply.] | |

| Processing fee collected on sanction of loan [Interest does not include processing fee on sanction of the loan. Hence, the same is taxable] | 20 |

| Commission collected on bank guarantee [Any commission collected over and above interest on loan, advance or deposit are not exempt.] | 30 |

| Interest income on credit card issued by the bank [Services by way of extending loans in so far as the consideration is represented by way of interest are exempt from tax. However, interest involved in credit card services is not exempt.] |

40 |

| Interest received on housing loan [Services by way of extending loans in so far as the consideration is represented by way of interest are exempt from tax.] |

Nil |

| Minimum balance charges collected from current account and saving account holder [Any charges collected over and above interest on loan, advance or deposit are not exempt.] |

01 |

| Value of taxable supply | 91 |

![]()

Question 4.

Following are the particulars, relating to one of the machine sold by M/s SQM Ltd. to M/s. ACD Ltd. in the month of February 2021 at List price of ₹ 9,50,000. (Exclusive of taxes and discount) Further, following additional amounts have been charged from M/s ACD Ltd:

| S. No. | Particulars | Amount (₹) |

| (i) | Municipal taxes chargeable on the machine | 45,000 |

| (ii) | Outward freight charges (Contract was to deliver machine at ACD Ltd.’s factory i.e. F.O.R. contract) | 65,000 |

Additional information:

(i) M/s SOM Ltd. normally gives an interest-free credit period of 30 days for payment. after that it charges interest @ 1% P.M. or part Thereof on list price.

ACD Ltd. paid for the supply after 45 days but, M/s SOM Ltd. waived the interest payable.

(ii) M/s SQM Ltd. received ₹ 50,000 as subsidy, from one non- government organization (NGO) on sale of such mchine. This subsidy was not linked to the price of machine and also not considered in list price of ₹ 9,50,000.

(iii) M/s ACD Ltd. deducted discount of ₹ 15,000 at the time of final payment, which was not as per agreement.

(iv) M/s ACD Ltd. collected of ₹ 9,500 as TCS (Tax Collected at Source) under the pr.visions of the Income Tax Act, 1961.

Compute the taxable Value of supply as per provision of GST laws, considering that the price is the sole consideration for the supply and both parties are unrelated to each other.

Note: Correct legal provision should form part of your answer. (Nov 2020, 6marks)

![]()

Question 5.

Green Agro Services, a registered person provides the following information relating to its activities during the month of February 2021:

| Gross Receipts from | (₹) |

| Services relating to rearing of sheeps | 6,00,000 |

| Services by way of artificial insemination of horses | 4,00,000 |

| Processing of Sugarcane into Jaggery | 8,00,000 |

| Milling of paddy into rice | 7,50,000 |

| Services by way of fumigation in a warehouse of Agricultural produce | 1,80,000 |

All the above receipts are exclusive of GST.

Compute the value of taxable supplies under GST laws for the month of February, 2021. (Jan 2021, 6 marks)

![]()

Question 6.

Mrs. Jaya purchases a Samsung television set costing ₹ 85,000 from Giriyas, in exchange of her existing TV set. After an hour of bargaining, the shop manager agrees to accept ₹ 78,000 instead of his quote of ₹ 81,000, as he would still be in a profitable position (the old TV can be sold for ₹ 8,000).

Answer:

Where the price is not the sole consideration for the supply, the ‘open market value’ would be the value of the supply. Therefore, ₹ 85,000 would be the value of the supply.

[Section 15(4) r/w Rule 1 (a) of Valuation Rules]

Question 7.

Mr. Mohan located in Manipal purchases 10,000 Hero ink pens worth ₹ 4,00,000 from Lekhana Wholesalers located in Bhopal. Mr. Mohan’s wife is an employee in Lekhana Wholesalers. The price of each Hero pen in the open market is ₹ 52. The supplier additionally charges ₹ 5,000 for delivering the goods to the recipient’s place of business.

Answer:

Mr. Mohan and Lekhana Wholesalers would not be treated as related persons merely because the spouse of the recipient is an employee of the supplier, although such spouse and the supplier would be treated as related persons. Therefore, the transaction value will be accepted as the value of the supply. The transaction value includes incidental expenses incurred by the supplier in respect of the supply up to the time of delivery of goods to the recipient. This means, the. transaction value will be: ₹ 4,05,000 (i.e., 4,000,000 + 5,000). [Section 15(1) r/w Section 15(2)]

![]()

Question 8.

Sri ram Textiles is a registered person in Hyderabad. A particular variety of clothing has been categorized as non-moving stock, costing ₹ 5,00,000. None of the customers were willing to buy these clothes in spite of giving big discounts units on them, for the reason that the design was too experimental. After months, Sriram Textiles was able to sell this stock on an online website to another retailer located in Meghalaya for ₹ 2,50,000, on the condition that the retailer would put up a poster of Sriram Textiles in all their retail outlets in the State.

Answer:

The supplier and recipient are not related persons. Although a condition is imposed on the recipient on effecting the sale, such a condition has no bearing on the contract price. This is a case of distress sale, and in such a case, it cannot be said that the supply is lacking ‘sole consideration’. Therefore, the price of ₹ 2,50,000 will be accepted as value of supply. [Section 15(4) r/w Rule 1 (d) r/w Rule 5 of Valuation Rules]

![]()

Question 9.

Rajguru Industries stock transfers 1,00,000 units (costing ₹ 10,00,000) requiring further processing before sale, from Bijapur in Karnataka to its Nagpur branch in Maharashtra. The Nagpur branch, apart from processing units of its own, engages in processing of similar units by other persons who supply the same variety of goods, and thereafter sells these processed goods to wholesalers. There are no other factories in the neighbouring area, which are engaged in the same business as that of its Nagpur unit. Goods of the same kind and quality are supplied in lots of 1,00,000 units each time, by another manufacturer located in Nagpur. The price of such goods is ₹ 9,70,000.

Answer:

In case of transfer of goods between two registered units of the same person (having the same PAN), the transaction will be treated as a supply even if the transfer is made without consideration, as such persons will be treated as ‘distinct persons’ under the GST law. The value of the supply would be the open market value of such apply.

If this value cannot be determined, the value shall be the value of supply of goods of like kind and quality. In this case, although goods of like kind and quality are available, the same may not be accepted as the ‘like goods’ in this case would be less expensive given that the transportation costs would be lower. Therefore, the value of the supply would be taken at 110% of the cost, i.e., ₹ 11,00,000 (i.e. 110% * 10,00,000).

[Section 15(4) r/w Rule 2(b) & (c) r/w Rule 4 of Valuation Rules]

![]()

Question 10.

M/s. Monalisa Painters owned by Vasudev is popularly known for painting the interiors of banquet halls. M/s. Starry Night Painters (also owned by Vasudev) is engaged in painting machinery equipment. A factory contracts M/s. Monalisa Painters for painting its machinery to keep it from corrosion, for a fee of ₹ 1,50,000. M/s. Monalisa Painters sub-contracts the work to M/s. Starry Night Painters for ₹ 1,00,000, and ensures supervision of the work performed by them. Generally, M/s Starry Night Painters charges a fixed sum of ₹ 1,000 per hour to its clients; it spends 120 hours on this project.

Answer:

Since M/s. Monalisa Painters and M/s. Starry Night Painters are controlled by Mr. Vasudev, the two businesses will be treated as related persons. Therefore, ₹ 1,00,000 being the sub-contract price will not accepted as transaction value. The value of the service would be the open market value being ₹ 1,20,000 (i.e., ₹ 1,000 per hour * 120 hours)*

Note: This view is based on the grounds that there are no comparable to this supply. [Section 15(4) t/w Rule 2(a) of Valuation Rules]

![]()

Multiple Choice Question

Question 1.

The value of supply of goods and services shall be the

(a) Transaction value

(b) MRP

(c) Market Value

(d) None of the above

Answer:

(a) Transaction value

Question 2.

The value of supply should include

(a) Any non-GST taxes, duties, cesses, fees charged by supplier separately

(b) Interest, late fee or penalty for delayed payment of any consideration for any supply

(c) Subsidies directly linked to the price except subsides provided by the Central and State Government.

(d) All of the above

Answer:

(a) Any non-GST taxes, duties, cesses, fees charged by supplier separately

![]()

Question 3.

Taxes paid on:

(a) Transaction Value

(b) Manufacturing Cost

(c) Both (a) and (b)

(d) None of the above

Answer:

(a) Transaction Value

Question 4.

When can the transaction value be rejected for computation of value of supply:

(a) When the buyer and seller are related and price is not the sole consideration

(b) When the buyer and seller are related or price is not the sole consideration

(c) it can never be rejected

(d) When the goods are sold at very low margins

Answer:

(b) When the buyer and seller are related or price is not the sole consideration

![]()

Question 5.

What deductions are allowed from the transaction value:

(a) Discounts offered to customers, subject to conditions

(b) Packing Charges, subject to conditions

(c) Amount paid by customer on behalf of the supplier, subject to conditions

(d) Freight charges incurred by the supplier for CIF terms of supply, subject to conditions

Answer:

(a) Discounts offered to customers, subject to conditions

Question 6.

If the goods are supplied to related persons then how should the taxable person ascertain the value of supplies?

(a) Seek the help of the GST officer

(b) Use the arm’s length price as required under the income Tax law

(c) Identify the prices at which goods are sold by the unrelated person to his customer,

(d) Refer the Rules which will be prescribed for this purpose

Answer:

(d) Refer the Rules which will be prescribed for this purpose

![]()

Question 7.

Rule 30 of the CGST Rules inter alia provides value of supply of goods or services or both based on cost shall be ……………… % of cost of production or manufacture or the cost of acquisition of such goods or the cost of provision of such services

(a) 100

(b) 10

(c) 110

(d) 120

Answer:

(c) 110

Question 8.

As per Rule 31 of the CGST Rules, residual method for determination of value of supply of goods or services or both will apply when:

(a) Value of supply cannot be determined under Rules 27 to 30

(b) Value of supply determined is more than the open market value of goods

(c) Value of supply determined is more than the Value of supply of like . kind and quality

(d) All of the above

Answer:

(a) Value of supply cannot be determined under Rules 27 to 30

![]()

Question 9.

In the case of supply of services, the supplier may opt for Rule 31 ignoring Rule 30 of the CGST Rules?

(a) True

(b) False

(c) Partly True/Partly False

(d) None of the above

Answer:

(a) True

Question 10.

In terms of Rule 32(7) of the CGST Rules, the value of taxable services provided by such class of service providers as may be notified by the Government, on the recommendations of the Council, as referred to in paragraph 2 of Schedule I of the CGST Act between distinct persons as referred to in section 25, where ITC is available, shall be deemed to be…

(a) ₹ 10,000/-

(b) Arm’s length price as required under the Income Tax law

(c) NIL

(d) As per the contract between the supplier and recipient

Answer:

(c) NIL

![]()

Value of Supply Notes

Inclusions in value u/s 15(2)

- Taxes other than GST

- Third party payments made by customer in relation to supply, which supplier was liable to pay and were not included in the price

- Incidental expenses including anything done by the supplier in respect of the supply till delivery of goods/ for supply of services, if charged to recipient

- Subsidies linked to price of supply other than the ones given by Central/State Governments

- Interest/late fee/penalty for delay in payment of consideration

TCS under Income Tax Act, 1961 not includible in the taxable value for the purpose of GST: The CBIC vide Circular No. 76/50/2018 GST dated 31.12.2018 (amended vide corrigendum .dated 7.03.2019) has clarified thait for the purpose of determination of value of supply under GST, tax collected at source (TCS) underthe provisions of the Income Tax Act, 1961 would not be includible as it is an interim levy not having the character of tax.

![]()

Exclusions from value u/s 15(2)

- Discounts given before or at the time of supply and recorded in the invoice

- Post supply discount/incentive, if known in advance and linked with invoices and proportionate input tax credit has been reversed by the recipient

Allowability of certain specific types of discounts offered by the supplier as clarified vide Circular No. 92/11/2019 GST date 07.03.2019

(i) Staggered discounts (‘Buy more, Save more’ offer): In case of staggered discounts, rate of discount increases with increase in purchase volume. For example – Get 10% discount for purchases above ₹ 5,000/-, 20% discount for purchases above ₹ 10,000/- and 30% discount for purchases above ₹ 20,000/-. Such discounts are shown on the invoice itself.

Such discounts are excluded to determine the value of supply.

Periodic/year , ending discounts/volume discounts: These discounts are offered by the suppliers to their stockists, etc. For example- Get additional discount of 1 % if you purchase 10,000 pieces in a year, get additional discount of 2% if you purchase 15,000 pieces in a year.

Such discounts are established in terms of an agreement entered into at or before the time of supply though not shown on the invoice as the actual quantum of such discounts gets determined after the supply has been effected and generally at the year end. In commercial parlance, such discounts are colloquially referred to as “volume discounts”. Such discounts are passed on by the supplier through credit notes.

Such discounts are excluded to determine the value of supply provided they satisfy the parameters laid down in sub-Section (3) of Sect.on 15 of the CGST Act, including the reversal of ITC by the recipient of the supply as is attributable to the discount on the basis of document (s) issued by the supplier.

![]()

(ii) Secondary discounts: These are the discounts which are not known at the time of supply or are offered after the supply is already over. For example, M/s A supplies 10,000 packets of biscuits to M/s B at ₹ 10/- per packet. Afterwards, M/s A re-values it at ₹ 9/- per packet. Subsequently, M/s A issues credit note to M/s B for ₹ 1/- per packet.

Such secondary discounts shall not be excluded while determining the value of supply as such discounts are not known at the time of supply and the conditions laid down in clause (b) of sub-Section (3) of Section 15 of the CGST Act, are not satisfied.

It may be noted that financial / commercial credit note(s) can be issued by the supplier even if the conditions mentioned in clause (b) of sub-Section (3) of Section 15 of the CGST Act, are not satisfied.

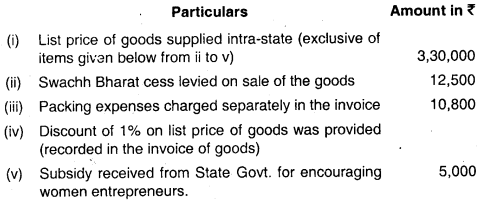

Determination of Value of Supply

1. Value of supply of goods or services is for a consideration not wholly in money

Where the supply of goods or services is for a consideration not wholly in money, the value of the supply shall,

(a) Be the open market value of such supply;

(b) If open market value is not available, be the sum total of consideration in money and any such further amount in money as is equivalent to the consideration not in money if such amount is known it the time of supply;

(c) If the value of supply is not determinable under clause (a) or clause (b), be the value of supply of goods or services or both of like kind and quality;

(d) If value is not determinable under clause (a) or clause (b) or clause (c), be the sum total of consideration in money and such further amount in money that is equivalent to consideration not in money as determined by application of rule 4 or rule 5 in that order.

![]()

Illustration 1:

(1) Where a new phone is supplied for ₹ 20,000 along with the exchange of an old phone and if the price of the new phone without exchange is ₹ 24,000. The value of supply of new phone is ₹ 24,000.

(2) Where a laptop is supplied for ₹ 40,000 along with a barter of printer that is manufactured by the recipient and the value of the printer known at the time of supply is ₹ 4,000 but the open market value of the laptop is not known, the value of the supply of laptop is ₹ 44,000.

2. Value of supply of goods or services or both between distinct or related persons, other than through an agent

The value of the supply of goods or services or both between distinct persons as specified in sub-section (4) and (5) of section 25 or where the supplier and recipient are related, other than where the supply is made through an agent, shall,-

(a) Be the open market value of such supply;

(b) If open market value is not available, be the value of supply of goods or services of like kind and quality;

(c) If value is not determinable under clause (a) or (b), be the value as determined by application of rule 4 or rule 5, in that order:

Provided where the recipient is eligible for full input tax credit, the value declared in the invoice shall be deemed to be the open market value of goods or services.

3. Value of supply of goods made or received through an agent

The value of supply of goods between the principal and his agent shall –

(a) Be the open market value of the goods being supplied, or at the option of the supplier, be 90% of the price charged for the supply of goods of like kind and quality by the recipient to his customer not being a related person, where the goods are intended for further supply by the said recipient;

(b) Where the value of a supply is not determinable under clause (a), the same shall be determined by application of rule 4 or rule 5 in that order.

![]()

Illustration 2:

Where a principal supplies groundnut to his agent and the agent is supplying groundnuts of like kind and quality in subsequent supplies at a price of ₹ 5,000 per quintal on the day of supply. Another independent supplier is supplying groundnuts of like kind and quality to the said agent at the price of ₹ 4,550 per quintal. The value of the supply made by the principal shall be ₹ 4,550 per quintal or where he exercise the option the value shall be 90% of the ₹ 5,000 i.e. is ₹ 4,500 per quintal.

4. Value of supply of goods or services or both based on cost

Where the value of a supply of goods or services or both is not determinable by any of the preceding rules, the value shall be 110% of the cost of production or manufacture or cost of acquisition of such goods or cost of provision of such services.

5. Residual method for determination of value of supply of goods or services or both

Where the value of supply of goods or services or both cannot be determined under rules 1 to 4, the same shall be determined using reasonable means consistent with the principles and general provisions of section 15 and these rules.

Provided that in case of supply of services, the supplier may opt for this rule, disregarding rule 4.

Clarification of issues pertaining to Del-credere agent (DCA):

A DCA is a selling agent who is engaged by a principal to assist in supply of goods or services by contacting potential buyers on behalf of the principal. The factor that differentiates a DCA from other agents is that the I DCA guarantees the payment to the supplier.

In such scenarios where the buyer fails to make payment to the principal ) by the due date, DCA makes the payment to the principal on behalf of the buyer (effectively providing an insurance against default by the buyer), and for this reason the commission paid to the DCA may be relatively higher than that paid to a normal agent.

In order to guarantee timely payment to the supplier, the DCA can resort to various methods including extending short-term transaction-based loans to the buyer or paying the supplier himself and recovering the amount from the buyer with some interest at a later date. This loan is to be repaid by the buyer along with an interest to the DCA at a rate mutually agreed between DCA and buyer.

![]()

Circular No. 73/47/2018 GST dated 05.11.2018 has clarified the following issues in this regard:

| Sl. No. | Issue | Clarification |

| i | Whether a DCA falls under the ambit of agent under Para 3 of Schedule I of the CGST Act? | As already clarified vide Circular No. 57/31/2018 GST (discussed above), whether or not the DCA will fall under the ambit of agent under Para 3 of Schedule I of the CGST Act depends on the following possible scenarios:

|

| 2 | Whether the temporary shortterm transaction based loan extended by the DCA to the recipient (buyer), for which interest is charged by the DCA, is to be included in the value of goods being supplied bythe supplier (principal) where DCA is not an agent under Para 3 of Schedule I of the *’ CGST Act? | In such a scenario, following activities are taking place:

It is clarified that in cases where the DCA is not an agent under Para 3 of Schedule I of the CGST Act, the temporary short-term transaction based loan being provided by DCA to the buyer is a supply of service by the DCA to the recipient on Principal to Principal basis and is an independent supply. Therefore, the interest being charged by the DCA would not form part of the value of supply of goods supplied (to the buyer) by the supplier. |

| 3 | Where DCA is an agent under Para 3 of Schedule I of the CGST Act and makes payment to the principal on behalf of the buyer arid charges interest to the buyer for delayed payment along with the value of goods being supplied, the interest will form a part of the value of supply of goods also or not? | In such a scenario following activities are taking place:

It is clarified that in cases where the DCA is an agent under Para 3 of Schedule I of the CGST Act, the temporary short-term transaction based credit being provided by DCA to the buyer no longer retains its character of an independent supply and is subsumed in the supply of the goods by the DCA to the recipient. It is emphasised that the activity of extension of credit by DCA to the recipient would not be considered as a separate supply as it is in the context of the supply of goods made by the DCA to the recipient. It is further clarified that the value of the interest charged for such credit would be required to be included in the value of supply of goods by DCA. |

![]()

Clarification on Sales promotion schemes:

A number of sales promotion schemes are commonly employed by the businesses to increase sales volume or to encourage the use or trial of a product or service so that new customers get attracted towards their products. For instance, certain sections of trade and industry, such as pharmaceutical companies often provide drug samples to their stockists, dealers, medical practitioners, etc., or sometimes, companies announce offers like ‘Buy One, Get One free’- buy one soap and get one soap free or get one tooth brush free along with,the purchase of toothpaste.

As we have already seen that as per Section 7(1 )(a), the goods or services which are supplied free of cost (without any consideration) shall not be treated as “supply” except in case of activities mentioned in Schedule I of the CGST Act. In view of the same, few sales promotion schemes have been examined as under:

Free samples and gifts: Samples which are supplied free of cost, without any consideration, do not qualify as “supply” under GST, except where the activity falls within the ambit of Schedule I of the CGST Act.

Buy one get one free offer: It may appear at first glance that in case of offers like “Buy One, Get One Free”, one item is being “supplied free of cost” without any consideration. In fact, it is not an individual supply of free goods, but a case of two or more individual supplies where a single price is being charged for the entire supply. It can at best be treated as supplying two goods for the price of one.

![]()

Taxability of such supply will be dependent upon as to whether the supply is a composite supply or a mixed supply and the rate of tax shall be determined accordingly

| S. No. | Description of Service | Supplier of service | Recipient of Service |

| 5A | Services supplied by Central Government, State Government, Union territory or local authority by way of renting of immovable property to a person registered under CGST Act, 2017 | Central Government, State Government, Union territory or local authority | Any person registered under the CGST Act, 2017 |

| 5B | Services supplied by any person by way of transfer of development rights (TDR) or Floor Space Index (FSI) (including additional FSI) for construction of a project by a promoter. | Any person | Any person |

| 5C | Long term lease of land (30 years or more) by any person against consideration in the form of upfront amount (called as premium, salami, cost, price, development charges or by any other name) and/or periodic rent for construction of a project by a promoter. | Any person | Any person |