Input Tax Credit – CA Inter Tax Question Bank is designed strictly as per the latest syllabus and exam pattern.

Input Tax Credit – CA Inter Tax Question Bank

Question 1.

Ms. Jimmy wants to adjust input tax credit for payment of interest, penalty and payment of tax under reverse charge. Explain whether she can do so. (Nov 2018, 3 marks)

Answer:

The input tax credit as self-assessed in the return of a registered person shall be credited to his electronic credit ledger which may be used for making any payment towards output tax.

“Output tax” inter alla excludes tax payable on reverse charge basis.

Thus, Ms. Jimmy cannot adjust input tax credit for payment of interest, penalty as also for payment of tax under reverse charge.

Question 2.

Who can impose restrictions on utilization of input tax credit (ITC) available in the electronic credit ledger and under what circumstances can restrictions be imposed under the CGST Rules 2017? (Nov 2020, 5 marks)

![]()

Question 3.

Mr. Ajay, a registered supplier of goods, pays GST under regular scheme and provides the following information for the month of August 2020:

Particulars – (₹)

(i) Inter-state taxable supply of goods – 10,00,000

(ii) Intra state taxable supply of goods – 2,00,000

(iii) Intra state purchase of taxable goods – 5,00.000

He has the following Input tax credit at the beginning of August 2020:

Nature – ITC Amount in (₹)

CGST – 20,000

SGST – 30,000

IGST – 25,000

Rate of CGST, SGST and IGST are 9%, 9% and 18% respectively. Both inward and outward supplies are exclusive of taxes wherever applicable. All the conditions necessary for availing the ITC have beenfulfilled. Compute the net GST payable by Mr. Ajay for the month of August 2020. (May 2018, 6 marks)

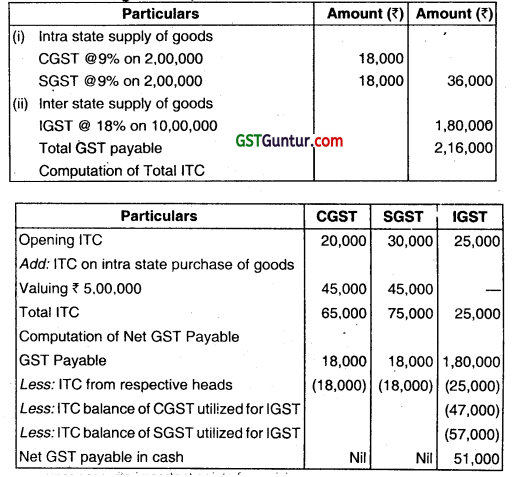

Answer:

Computation of Net GST payable by Mr. Ajay on outward supplies for the month of August 2020;

![]()

Question 4.

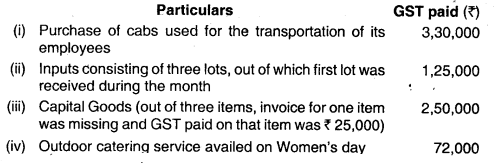

Fun Pharma Private Limited, a registered supplier is engaged in the manufacture of taxable goods. The company provides the following information of GST paid on the purchases made/input services availed by it during the month of September 2020:

Determine the amount of Input Tax Credit available with M/s Fun Pharma Private Limited for the month of September 2020 by giving necessary explanations for treatment of various items. All the conditions necessary for availing the input tax credit have been fulfilled. (May 2018, 4 marks)

Answer:

Determination of ITC available with M/s Fun Pharma Private Limited for the month of September

Particulars ITC allowed or not

(i) Purchase of cabs used for the transportation of its employees ITC not allowed as the ITC on motor vehicles has been specifically disallowed u/s 17(5)(a). However ITC on motor Vehicles used for transportation of goods is not allowed.

(ii) Inputs received in lots ITC not allowed as in case of inputs received in installments ITC can be availed only on receipt of last installments.

(iii) ITC paid on capital goods cannot be availed if depreciation has been claimed on such tax component. In the given case it is assumed that depreciation is not claimed on tax component. ITC cannot be taken on missing invoice. To claim ITC, registered person should have invoice in its possession. Hence GST paid of ₹ 25,000 on missing invoice is not allowed. On the balance 2,25,000 ITC is allowed.

(iv) Outdoor Catering Services ITC on food or beverages is specifically disallowed unless the same is used for making outward taxable supply of the same category or as an element of the taxable composite or mixed supply- Section 17(5)(b)(i). The fact it is availed on womens day does not alter the position of law.

![]()

Question 5.

Mr. Thiraj, a registered supplier of service in Bangalore (Karnataka State) has provided the following information for the month of February 2021:

Particulars – Amount in ₹

(i) Intra-state taxable supply of service – 5,20,000

(ii) Legal fee paid to a Lawyer located within the state – 20,000

(iii) Rent paid to the State Govt, for his office building – 30,000

(iv) Received for services towards conduct of exams to Love all University, Pune (recognized by law), being an inter-state transaction – 16,000

Compute the net GST liability (CGST, SGST or IGST) of Mr. Thiraj for the month of February 2021.

Rate of CGST, SGST and IGST are 9%, 9% and 18% respectively. All the amounts given above are exclusive of taxes. (Nov 2018, 6 marks)

Answer:

![]()

Computation of net GST liability by Mr. Thiraj for the month of February, 2021

| S.N. | Particulars | Value of supply (₹) | CGST @ 9% (₹) | SGST @ 9% (₹) | IGST @18% (₹) |

| Output supply | |||||

| (i) | Intra-State taxable supply of services | 5,20,000 | 46,800 | 46,800 | |

| (iv) | Services towards conduct Of exams in Love all University, Pune [Note-1] | 16,000 | Exempt | ||

| Inward supply | |||||

| (ii) | Legal fee paid to lawyer located within State [Note-2] | 20,000 | 1,800 | 1,800 | |

| (iii) | Rent paid to State Government for Office Building [Note-3] | 30,000 | 2,700 | 2,700 | |

| Total tax liability | 51,300 | 51,300 | |||

| Less: Cash paid towards tax payable under reverse charge [A] [Note-4] | (4,500) | (4,500) | |||

| Output tax payable against which ITC can be set off | 46,800 | 46,800 | |||

| Less : ITC of tax paid on legal fees and rent | (4,500) | (4,500) | |||

| Output tax payable after Set off of ITC [B] | 42,300 | 42,300 | |||

| Net GST liability [A] + [B] | 46,800 | 46,800 | |||

Notes :

- Since Love all University provides education recognized by law,1 it is an educational institution and services provided to an educational institution, by way of conduct of examination by such institution are exempt from GST.

- In case of legal services provided by an advocate to any business entity GST is payable under reverse charge by the recipient of service.

- In case of services supplied by, inter alia, State Goverpment by way of renting of immovable property to a person registered under the CGST Act, GST is payable under reverse charge by the recipient of service

- The amount available in the electronic credit ledger may be used for making payment towards output tax.

However, tax payable under reverse charge is not an output tax. Therefore, tax payable under reverse charge cannot be Set off against the input tax credit and thus, will have to be paid in cash.

![]()

Question 6.

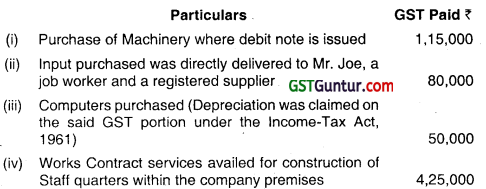

CANWIN Ltd., a registered supplier, is engaged in the manufacture of Tanks. The company provides the following information pertaining to GST paid on the purchases made/input services availed by it during the month of January 2021:

It has been logically assumed that the education provided by the Loveall University is recognised by Indian law

Determine the amount of ITC available to M/s. CANWIN Ltd. for the month of January 2021 by giving brief explanations for treatment of various items. Subject to the information given above, all the conditions necessary for availing the ITC have been fulfilled. (Nov 2018, 4 marks)

Answer:

Computation of input tax credit (ITC) available with CAN WIN Ltd. for the month of January 2021

| Particulars | GST (₹) |

| Purchase of machinery where debit note is issued [Note-1] | 1,15,000 |

| Inputs directly delivered to a job worker supported by a valid document | 80,000 |

| Computers [Note-2] | Nil |

| Works contract services availed for construction of staff quarters within the company premises [Note-3] | Nil |

| Total ITC | 1,95,000 |

Notes :

- Input tax credit on goods purchased on the basis of debit note which is a valid document is allowed.

- Where depreciation has been claimed on the tax component of the cost of capital goods and plant and machinery under the provisions of the Income-tax Act, 1961, the input tax credit on the said tax component is not allowed.

- Input tax credit on works contract services supplied for construction of an immovable property is specifically disallowed except where it is an input service for further supply of works contract service.

![]()

Question 7.

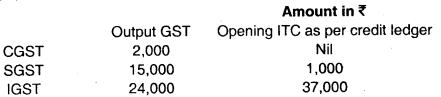

From the following information, compute the Net GST payable for the month of March 2021 : (Nov 2018, 4 marks)

Answer:

Computation of net GST payable for the month of March, 2021

| Particulars | CGST (₹) | SGST (₹) | IGST (₹) |

| Output tax payable | 2,000 | 15,000 | 24,000 |

| Less: IGST set off first | (2,000)-IGST | (11,000)-IGST | |

| Less: Opening ITC as per credit ledger | NIL | 1,000 (SGST) | (24,000)-IGST |

| Net GST payable | Nil | 3,000 | Nil |

Note: Input tax credit of IGST has been used to pay IGST, CGST and SGST in any order.

![]()

Question 8.

Mr. Himanshu, a registered supplier of chemicals, pays GST under regular scheme. He is not eligible for any threshold exemption. He has made the following outward taxable supplies for the month of September 2020:

Intra-State supply of goods – ₹ 25,00,000

Inter-State supply of goods – ₹ 5,00,000

He has also made the following inward supply:

Intra-State purchase of goods from Registered Dealer – ₹ 14,00,000

Intra-State purchase of goods from Unregistered Dealer – ₹ 2,00,000

Inter-State purchase of goods from Registered Dealer – ₹ 4,00,000

Balance of ITC at the beginning of September 2020:

CGST – ₹ 95,000

SGST – ₹ 60,000

IGST – ₹ 50,000

![]()

Additional Information:

- He purchased a car (Intra-State supply) used for business purpose at a price of ₹ 6,72,000/- (including CGST of ₹ 36,000 & SGST of ₹ 36,000) on September 15, 2020. He capitalized the full value including GST in the books on the same date to claim depreciation.

- Out of Inter-State purchase from registered deafer, goods worth ₹ 1,00,000 were received on October 3, 2020 due to road traffic jams.

Note:

- Rate of CGST, SGST and IGST to be 9%, 9% and 18% respectively.

- Both inward and outward supplies given above are exclusive of taxes, wherever applicable.

- All the conditions necessary for availing the ITC have been fulfilled except mentioned above.

Compute the net CGST, SGST and IGST payable in cash by Mr. Himanshu for the month of September 2020. (May 2019, 8 marks)

Answer:

Computation of Net GST Payable in cash of Mr. Himanshu for September, 2020

| Particulars | Value (₹) | CGST (₹) | SGST (₹) | IGST (₹) |

| Total tax liability | ||||

| Intra-State outward supplies of goods | 25,00,000 | 2,25,000 | 2,25,000 | |

| Infer-State outward supplies of goods. | 5,00,000 | 90,000 | ||

| Total Tax Liability (A) | 2,25,000 | 2,25,000 | 90,000 | |

| Input Tax Credit (ITC) | ||||

| Brought forward ITC | 95,000 | 60,000 | 50,000 | |

| Intra-State purchase of goods from registered dealer [Note-1] | 14,00,000 | 1,26,000 | 1,26,000 | |

| Inter-State purchase of goods from registered dealer [Note-1 and Note 4] | 3,00,000 | – | – | 54,000 |

| Intra-State purchase of goods from unregistered dealer [Note-2]’ | 2,00,000 | – | – | – |

| Purchase of car used for business purpose [Note-3] | – | – | “ | – |

| Total ITC (B) | – | 2,21,000 | 1,86,000 | 1,04,000 |

| Less: Set off from IGST credit first | 14,000 | 14000 | ||

| Less: Set off from CGST/SGST Credit | 2,11,000 | 1,86,000 | ||

| C/F Balance | 11,000 | 39,000 | NIL |

![]()

Notes:

- Every registered person is entitled to take credit of input tax charged on any inward supply of goods used/intended to be used in the course/furtherance of his business.

- Intra-State supplies received by a registered person from any unregistered supplier, are exempt from the whole of the tax leviable thereon under reverse charge till 30.09.2020. Since no tax has been paid, so no credit is available.

- Input tax paid on capital goods cannot be availed as ITC If depreciation has been claimed on such tax component. Moreover, ITC on motor vehicle (car) is blocked under section 17(5) of CGST Act, 2017.

- A registered person is entitled to avail input tax in respect of any supply of goods to him only if he has actually received the said goods. Since goods worth ₹ 1,00,000 have not been received by Mr. Himanshu in the month of September 2020, credit n respect of same cannot be claimed in the said month.

- Input tax credit of IGST has been used to pay IGST. CGST and SGST in that order.

![]()

Question 9.

M/s. Grey, a registered taxable person under regular scheme provides following information in respect of supplies made by it during the month of April 2020:

| (All amount in rupees) | |

| (i) Inter-state supply of goods | 1,00,000 |

| (ii) Intra-state supply of 500 packets of detergent @ ₹ 400 each alongwith a plastic bucket worth ₹? 100 each with each packet, being a mixed supply. (Rate of GST on detergent is 18% and on plastic bucket is 28%) | |

| (iii) Supply of online educational journals to M/s. Pinnacle, a private coaching centre providing tuitions to students of Class X-XII, being intra-state supply. | 50,000 |

M/s, Grey has also received the following inward supplies:

| (iv) Inter-state supply of goods (out of which invoice for goods worth ₹ 20,000 is missing and no other tax paying document is available) | 70,000 |

| (v) Repairing of bus with seating capacity of 20 passengers used to transport its employees from their residence, being intra-state supply. | 50,000 |

![]()

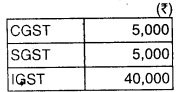

Details of opening balances of ITC as on 1-4-2020 are as follows:

Following additional information is provided:

(a) Rate of GST in respect of all inward and outward supplies except item

(ii) above is 18% i.e. CGST and SGST @ 9% and IGST @ 18%.

(b) All figures mentioned above are exclusive of taxes.

(c) All the conditions for availing the ITC have been fulfilled except specifically given and M/s. Grey is not eligible for any threshold exemption.

Compute the minimum net GST payable in cash by M/s. Grey for the month of April 2020. (Nov 2019, 8 marks)

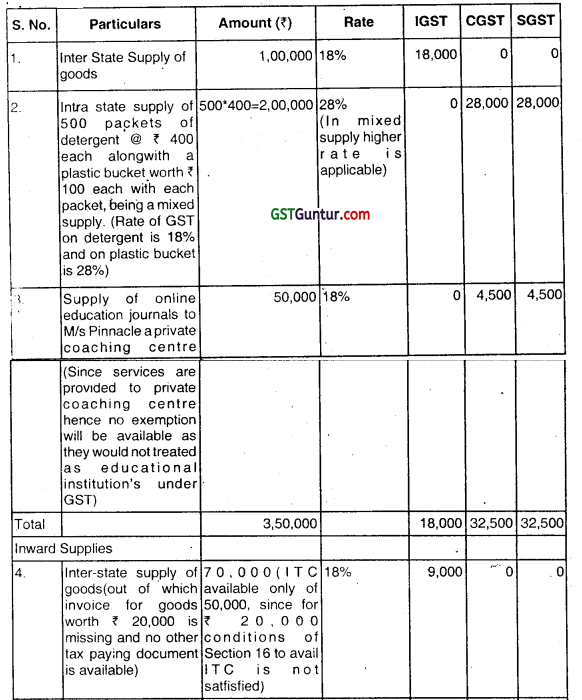

Answer:

Calculation of Net GST payable in cash by M/s Grey for the month of April, 2020

![]()

Question 10.

KNK Ltd., a registered supplier of Mumbai is a manufacturer of heavy machines, Its outward supplies (exclusive of GST) for the month of January, 2021 are as follows:

| S. No. | Particulars | Amount (₹) |

| (i) | Inter-state | 85,00,000 |

| (ii) | Intra-state | 15,00,000 |

Applicable rate of CGST, SGST and IGST on outward supply are 9%, 9% and 18% respectively. Details of GST paid on inward supplies during the month of January, 2021 are as follows:

| S. No. | Particulars | CGST paid (₹) | SGST paid (₹) |

| (i) | Raw materials A (of which 70% of inputs procured wpre used and 30% were in stock at the end of the January, 2020) |

60,000 | 60,000 |

| (ii) | Raw materials B (of which 90% material received in factory and remaining material.completely damaged due to a road accident on the way to factory. There was no negligence on the part of the KNK Ltd.) |

50,000 | 50,000 |

| (iii) | Construction of pipelines laid outside the factory premises | 30,000 | 30,000 |

| (iv) | Insurance Charges paid for trucks used for transportation of goods. | 55,000 | 55,000 |

![]()

Additional Information :

(i) There is no opening balance of any Input Tax Credit and all the conditions necessary for availing the Input Tax Credit (ITC) have been fulfilled.

(ii) Details of GST paid on inward supplies are available in GSTR-2A except for Item (i) i.e. Raw Material A, for which supplier has not filed its GSTR-1 for the month of January 2020, hence corresponding Input Tax Credit (ITC) is not reflecting in GSTR-2A of KNK Ltd. in January, 2021.

Compute the following :

(i) Amount of eligible Input Tax Credit (ITC) available for the month of January, 2021.

(ii) Net minimum GST payable in Cash, for the month of January, 2020 after using available Input Tax Credit.

Working notes should form part of your answer. (Nov 2020, 8 marks)

![]()

Question 11.

Star Ltd. a registered supplier in Karnataka has provided the following details for supply of one machine.

| Particulars | Amount in (₹) | |

| (1) | List price of Machine supplied [Exclusive of items given below from (2) to (4)] | 80,000 |

| (2) | Tax levied by Local Authority on sale of such machine | 6,000 |

| (3) | Discount of 2% on the list price of machine was provided (recorded in the invoice of Machine) | |

| (4) | Packing expenses for safe transportation charged separately in the invoice | 4,000 |

Star Ltd. received ₹ 5,000 as subsidy from a NGO on sale of each such machine. The Price of ₹ 80,000 of the machine is after considering such subsidy.

During the month of February, 2021, Star Ltd. supplied three machines to Intra-state customers and one machine to Inter-state customer.

![]()

Star Ltd. purchased inputs (intra-state) for ₹ 1,20,000 exclusive of GST for supplying the above four machines during the month.

The Balance of ITC at the beginning of February, 2021 was :

| CGST | SGST | IGST |

| ₹ 18,000 | ₹ 4,000 | ₹ 26,000 |

Note:

(i) Rate of CGST, SGST and IGST to be 9%, 9% and 18% respectively for both inward and outward supplies.

(ii) All the amounts given above are exclusive of GST.

(iii) All the conditions necessary for availing the ITC have been fulfilled.

Compute the minimum net GST payable in cash by Star Ltd. for the month of February, 2021. (Jan 2021, 8 marks)

![]()

Question 12.

Satya Sai Residents Welfare Association, a registered person under GST has 30 members each paying ₹ 8,000 as maintenance charges per month for sourcing of goods and services from third persons for common use of its members.

The Association purchased a water pump for ₹ 59,000 (inclusive of GST of ₹ 9,000) and availed input services for ₹ 23,600 (inclusive of GST of 3,600) for common use of its members during February 2021.

Compute the total GST payable, if any, by Satya Sai Residents Welfare Association, for February 2021.

GST rate is 18%. All transactions are intra-state.

There is no opening ITC and all conditions for ITC are fulfilled. (Jan 2021, 4 marks)

![]()

Question 13.

What are the conditions to be fulfilled for entitlement of input tax credit?

Answer:

A registered person will be entitled to claim input tax credit only upon fulfillment of the following conditions:

- He is in possession of tax invoice/debit note issued by a registered supplier or any other tax paying documents;

- He has received the goods and /or services or both;

- The tax charged on such supply is paid to the Government

- (by way of cash or by utilizing input tax credit)

- He has furnished a valid return.

Question 14.

Whether Input tax credit on Inputs and Capital Goods is allowed in one installment?

Answer:

Yes. Input tax credit will be available in full with respect to inputs and capital goods, subject to fulfillment of the prescribed conditions under Section 16(2) of the CGST Act. Even in the case of supply of goods in lots/ instalments, the credit would be available in full on the receipt of the last lot/ installment.

The existing concept of partial credit on purchase of capital goods under the CENVAT Credit Rules, 2004 (i.e. 50% in the year of receipt and 50% in subsequent years) has been done away with.

![]()

Question 15.

One of the conditions to claim credit is that the receiver has received the goods. Is there any provision for deemed receipt of goods in case of transfer of document of title before or during the movement of goods?

Answer:

Yes. Explanation to Section 16(2)(b) of the CGST Act provides for deemed receipt of goods where the goods are delivered by the supplier to the recipient or any other person on the direction of the recipient, whether acting as agent or otherwise, before or during movement of goods.

Question 16.

If certain goods/ services are used partly for business and partly for non-buSiness purposes, will the credits be allowed in full or proportionately?

Answer:

The credit on goods/ services used partly for business, and partly for non-business purposes will be allowed proportionately to the extent it is attributable for business purposes. The manner of calculation of such credit is provided in Rule 7(1) of the Input Tax Credit Rules, 2017.

![]()

Question 17.

Credit attributable to exempt supplies is not available to a registered person. What are the supplies that are included in exempt supplies?

Answer:

‘Exempt Supplies’ for this purposes means all supplies other than taxable and zero rated supplies and specifically include the following:

- Supplies.liable to tax under reverse charge mechanism;

- Transactions in securities;

- Sale of land;

- Sale of building.

Question 18.

Whether input tax credit will be available on taxable goods which are given by way of gift or free samples under the sales promotion?

Answer:

No. Section 17(5)(h) specifically restricts input tax credit on goods disposed of by way of gift or free samples.

![]()

Question 19.

Whether input tax credit is allowed on inputs which become waste and is sold as scrap?

Answer:

Section 17(5)(h) specifically restricts input tax credit on goods lost, stolen, destroyed, written off or disposed by way of gift or free samples. Therefore, if the goods have been destroyed in full, input tax credit will not be available. However, if in the process of manufacture some inputs become waste and are sold as scrap, credit shall not be denied. Further, output tax shall be payable on sale of such waste/scrap.

Question 20.

Whether Input tax credit is available in respect of input tax paid on use of mobile phones/ laptops given to employees?

Answer:

Yes. The mobile phones/ laptops would be covered under the definition of ‘inputs’ as they are used in the course/ furtherance of business and hence, the input tax paid on such goods will be available as input tax credit.

![]()

Question 21.

Whether benefit of input tax credit would be available if the company procures health insurance Services for benefit of its employees. Procurement of such services is mandatory under Factories Act.

Answer:

Yes. Section 17(5)(d)(i) food and beverages, outdoor catering, beauty treatment, health services, cosmetic and plastic surgery, leasing, renting or hiring of motor vehicles, vessels or aircraft referred to in clause (a) or clause (aa) except when used for the purposes specified therein, life insurance and health insurance will be eligible as input tax credit where the Government notifies that such services are obligatory for an employer to provide to its employees under any law for the time being in force.

Question 22.

Whether input tax credit can be availed on input services and capital goods (lying in stock) when there is application for new registration or during voluntary registration under section 18?

Answer:

No. In case of new registrations and voluntary registrations, input tax credit can be availed only on the stock held (inputs, semi-finished goods or finished goods) preceding the day when he is liable to pay tax or preceding to the date of grant of voluntary registration. Input service and capital goods lying in stock are not eligible for ITC.

![]()

Question 23.

In case of change of scheme from composition scheme to Regular scheme whether input tax credit on capital goods is eligible.

Answer:

Yes. In such a scenario, the registered person will be entitled to claim input tax credit on the stock held (inputs, semi-finished goods or finished goods) and on the capital goods preceding the day when he is liable to pay tax under the regular scheme. The credit of capital goods shall stand reduced by five percentage points for every quarter.

Question 24.

Whether the principal is entitled to take input tax credit even when the principal has not received the goods and directly sent to job worker by the vendor?

Answer:

Yes. Section 19(2) and 19 (5) allows the principal to take input tax credit of goods not received by him, if the goods are sent directly to the job workers premises by the vendor.

![]()

Multiple Choice Question

Question 1.

Whether definition of inputs includes capital goods

(a) Yes

(b) No

(c) Certain capital goods only

(d) None of the above

Answer:

(a) Yes

Question 2.

Is it mandatory to capitalize the capital goods in books of Accounts?

(a) Yes

(b) No

(c) Optional

(d) None of the above

Answer:

(a) Yes

![]()

Question 3.

Whether credit on capital goods can be taken immediately on receipt of the goods?

(a) Yes

(b) No

(c) After usage of such capital goods

(d) After capitalizing in books of Accounts

Answer:

(a) Yes

Question 4.

Whether it, is necessary to capitalize the capital goods in the books of account

(a) Yes

(b) No

(c) Only use of goods is recognized

(d) Accounting is not relevant

Answer:

(a) Yes

![]()

Question 5.

The term “used in the course or furtherance of business”means?

(a) It should be directly co-related to output supply

(b) It is planned to use in the course of business

(c) It is used in the course of business

(d) It is used in the course of business for making outward supply

Answer:

(c) It is used in the course of business

Question 6.

Under Section 16(2) of CGST Act how many conditions are to be fulfilled for the entitlement of credit?

(a) All the conditions

(b) Any two conditions

(c) Conditions not specified

(d) None of the above

Answer:

(a) All the conditions

![]()

Question 7.

Whether credit on inputs should be availed based on receipt of documents or receipt of goods

(a) Receipt of goods

(b) Receipt of Documents

(c) Both

(d) Either receipt of documents or Receipt of goods

Answer:

(c) Both

Question 8.

In case supplier has deposited the taxes but the receiver has not received the documents, is receiver entitled to avail credit?

(a) Yes it will be upto populated in recipient monthly returns

(b) No as one of the conditions of 16(2) is not fulfilled

(c) Yes it the receiver can prove later that documents are received subsequently

(d) None of the above

Answer:

(b) No as one of the conditions of 16(2) is not fulfilled

![]()

Question 9.

Input tax credit on capital goods and inputs can be availed in one instalment or in multiple instalments?

(a) In thirty six instalments

(b) In twelve instalments

(c) In one instalment

(d) In six instalments

Answer:

(d) In six instalments

Question 10.

The tax paying documents in Section 16(2) is

(a) Bill of entry, Invoice raised on RCM supplies, etc.

(b) Acknowledged copy of tax paid to department

(c) Supply invoice by the recipient

(d) Any, of the above

Answer:

(a) Bill of entry, Invoice raised on RCM supplies, etc.

![]()

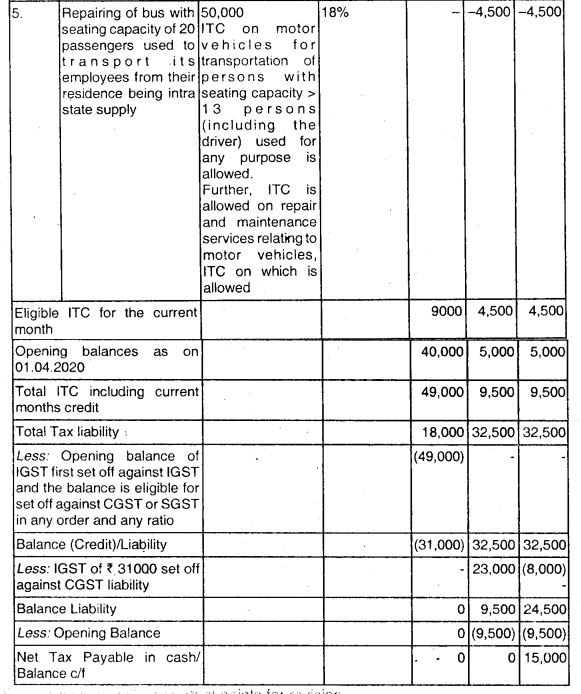

Input Tax Credit Notes

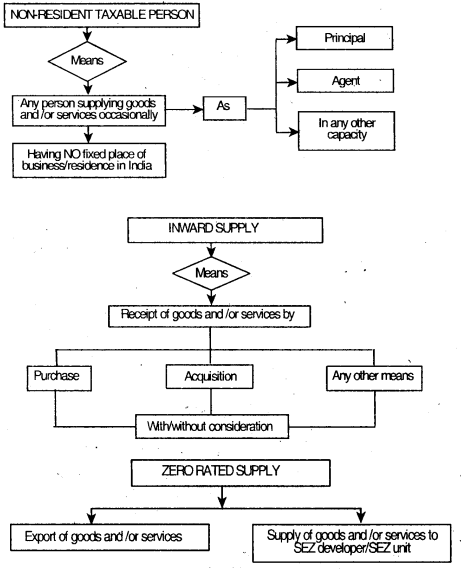

I. Definitions of certain key terms have been summarized by way of diagrams as under:

Includes

- Any trade/commerce, manufacture, profession, vocation etc. even if there is no monetary benefit

- Any activity incidental? ancillary to it

- Any activity of same nature even if no volume/continuity/frequency

- Supply/acquisition of goods including capital goods and services

- in connection with commencement/closure of bušiness

- Provision of facilities by club/association/society etc.

- to its members for consideration

- Admission to any premises

- for a consideration

- Services as holder of an office

- accepted in course/furtherance of trade, profession/vocation

- Services by race club by way of

- totalisator or a license to book maker in such club

- Any activity by Government/local authority as public authorities

- Government includes both Central and State Governments

![]()

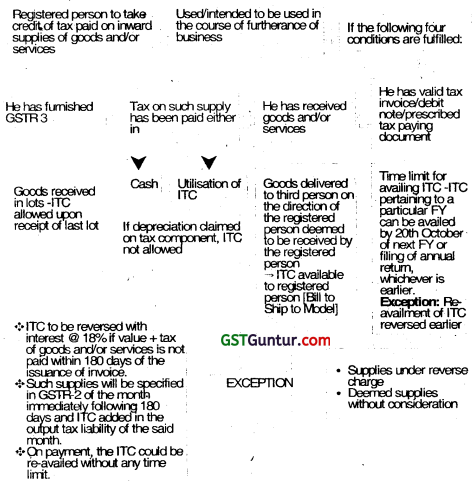

II. Provisions of Section 16 relatIng to eligibility and conditions for taking ITC read with relevant rules are summarized below:

Input tax credit to be availed by a registered person in respect of invoices or debit notes, the details of which have not been uploaded by the suppliers under sub-section (1) of section 37, shall not exceed 10 per cent of the eligible credit available in respect of invoices or debit notes the details of which have been uploaded by the suppliers under sub-section (1) of section 37.

![]()

Restricted ITC on invoices/debit notes not uploaded by supplier in his GSTR-15 [Rule 36(4) read with Circular No. 123/42/2019 GST*, dated f 1.11.2019]: It is observed that some taxpayers take inflated or bogus ITG, even if proper tax invoices or debit notes in respect of inputs or input services are not available. To exercise control over the malpractice of availing bogus ITC by the taxpayers, certain restrictions have been placed on availment of ITC.

ITC on all invoices/debit notes which are uploaded by the suppliers in their GSTR-1s can be availed in full. The recipient gets details of tax invoices and debit notes uploaded by the suppliers in their GSTR-1s, in his (recipient’s) GSTR-2A and GSTR-2B.

However, in respect of invoices/debit notes the details of which are not uploaded by the suppliers in their GSTR-1 s (and hence cannot be seen in GSTR-2A and GSTR-2B of the recipient), ITC can be availed only upto 10% of the eligible credit available in respect of invoices/debit notes the details of which have been uploaded by the suppliers in their GSTR-1 s under section 37(1).

In other words, the ITC claimed should not exceed 110% of ITC reflecting in GSTR-2A on the due date of filing of GSTR-1 of the suppliers for the said tax period. The taxpayer has to avail the ITC on self-assessment basis as the restriction is not imposed through the common portal.

The balance ITC may be claimed by the taxpayer in any of the succeeding months provided details of requisite invoices are uploaded by the suppliers. He can claim proportionate ITC as and when details of some invoices are uploaded by the suppliers provided that ITC on invoices, the details of which are not uploaded in GSTR-1 remains under 10% of the eligible ITC, the details of which are uploaded by the suppliers. In bther words, taxpayer may avail full ITC in respect of a tax period, as and when the invoices are uploaded by the suppliers to the extent eligible [ITC/1.1].

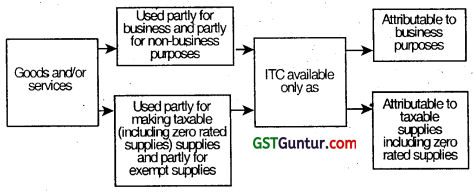

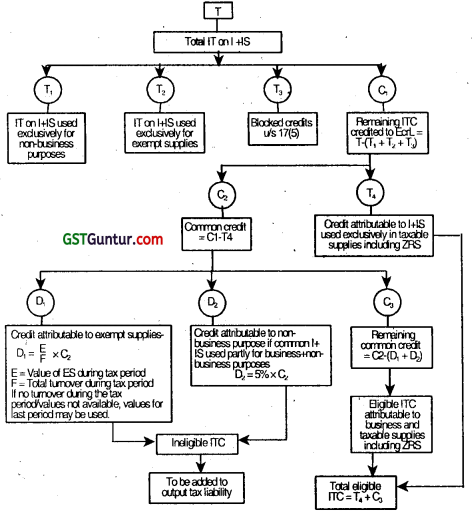

III. The provisions of SectIon 17 relating to apportionment of credit and blocked credits read with relevant rules are summarized as under:

![]()

A. Apportionment of credit

Exempt supplies include supplies charged to tax under reverse charge, transactions in securities, sale of land and sale of building when entire consideration is received post completion certificate/first occupation, whichever is earlier.

B. Special provisions for banking companies and NBFCs

C. Apportionment of common credit in case of inputs and input services

C3 will be computed separately for ITO of CGSTSGST/UTGST and IGST.

Σ (D1 + D2) will be computed for the whole financial year, by taking exempted turnover and aggregate turnover for the whole financial year.

If this amount is more than the amount already added to output tax liability every month, the differential amount will be added to the output tax liability in any of the month till September of succeeding year along with interest @ 18% from 1st April of succeeding year till the date of payment.

![]()

If this amount is less than the amount added to output tax liability every month, the additional amount paid has to be claimed back as credit in the return of any month till September of the succeeding year.

Exempt supplies include reverse charge supplies, transactions in securities, sale of land and sale of building when entire consideration is received after completion certificate/first occupation, whichever is earlier.

Exempt supplies exclude value of services having place of supply in Nepal/Bhutan against payment in Indian rupees, services of accepting deposits, extending loans) advances where the consideration is interest/discount and the same are provided by persons other than banking company/financial institution including NBFC, and outbound (overseas) transportation of goods by a vessel.

Aggregate value of exempt supplies and total turnover exclude the central excise duty, state excise duty and VAT.

Value of exempt supply in respect of land and building is the stamp duty value and for security is 1 % of the sale value of such security.

IT = Input tax

I = Inputs

IS = Input services

Ecrl = Electronic Credit Ledger

ZRS = Zero rated supply

ES = Exempt supplies

![]()

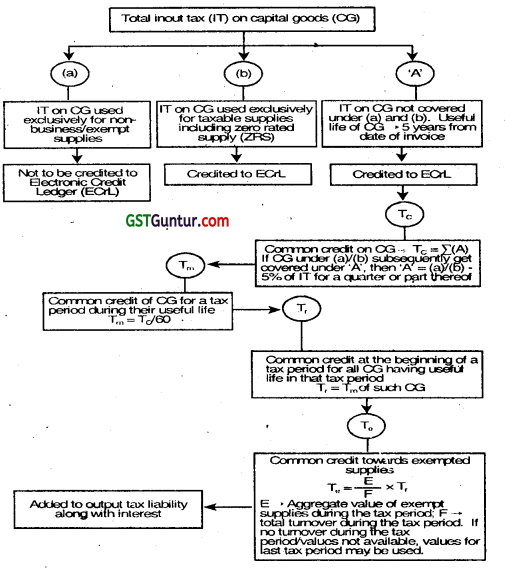

D. Apportionment of common credit on capital

To will be computed separately for ITC to CGST, SGST/UTGST and IGST.

Exempt supplies include reverse charge supplies, transactions in securities, sale of land and sale of building when entire consideration is received after completion certificate/first occupation, whichever is earlier.

Exempt supplies exclude value of services having place of supply in Nepal/Bhutan against payment in Indian rupees, services of accepting deposits, extending loans/advances where the consideration is interest/discount and the same are provided by persons other than banking company/financial institution including NBFC, and outbound (overseas) transportation of goods by a vessel.

Aggregate value of exempt supplies and total turnover excludes the. central excise duty, State excise duty and VAT.

Value of exempt supply in respect of land and building is the stamp duty value and for security is 1 % of the sale value of such security.

![]()

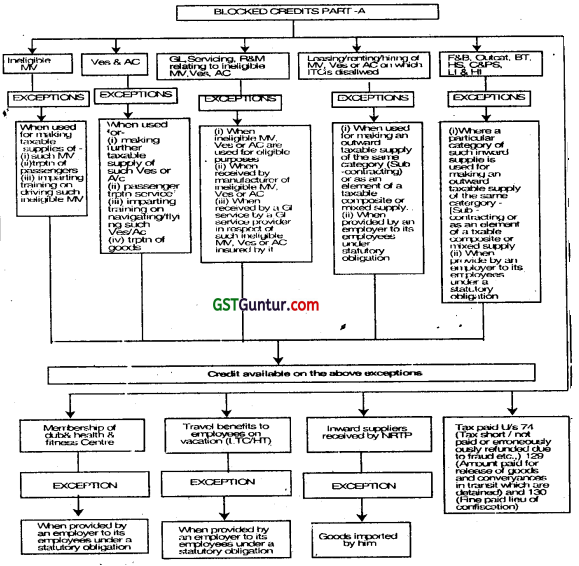

Statutory Provisions- Effective from 1st February 2019 vide The Central Goods & Services Tax Amendment Act,2018

Input tax credit shall not be available in respect of the following namely:

(c) Motor vehicles for transportation of persons having approved seating capacity of not more than thirteen persons (including the driver), except when they are used for making the following taxable supplies, namely:

(A) further supply of such motor vehicles: or

(B) transportation of passengers; or

(C) imparting training on driving such motor vehicles;

(aa) vessels and aircraft except whfen they are used-

- for making the following taxable supplies, namely:-

(A) further supply of such vessels or aircraft; or

(B) transportation of passengers; or

(C) imparting training on navigating such vessels; or

(D) Imparting training on flying such aircraft; - for transportation of goods;

(ab) services of general insurance, servicing, repair and maintenance in so far as they relate to motor vehicles, vessels or aircraft referred to in clause (a) or clause (aa):

Provided that the input tax credit in respect of such services shall be available –

- where the motor vehicles, vessels or aircraft referred to in clause (a) or clause (aa) are used for the purposes specified therein;

- where received by a taxable person engaged-

- in the manufacture of such motor vehicles, vessels or aircraft; or

- in the supply of general insurance services in respect of such motor vehicles, vessels or arcraft insured by him;

![]()

(D) the following supply of goods or services or both –

(i) food and beverages, outdoor catering, beauty treatment, health services, cosmetic and plastic surgery, leasing, renting or hiring of motor vehicles, vessels or aircraft referred to in clause (a) or clause (aa) except when used for the purposes specified therein, life insurance and health insurance:

Provided that the input tax credit in respect of such goods or services or both shall be available where an inward supply of such goods or services or both is used by a registered person for making an outward taxable supply of the same category of goods or services or both or as an element of a taxable composite or mixed supply;

(ii) membership of a club, health and fitness centre; and

(iii) travel benefits extended to employees on vacation such as leave or home travel concession.

Provided that the input tax credit in respect of such goods or services or both shall be available, where it is obligatory for an employer to provide to its employees under any law for the time being in force.

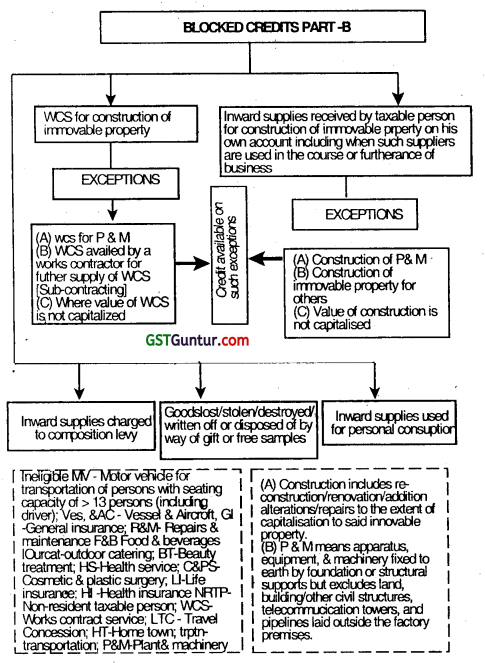

Works contract services when supplied for construction of immovable property, (other than plant and machinery), except where it is an input service for further supply of works contract service;

(d) goods or services or both received by a taxable person for construction of an immovable property (other than plant and machinery) on his.own account, including when such goods or services or both are used in the course or furtherance of business; Explanation: For the purpose of clause (c) and (d), the expression “construction” includes re-construction, renovation, additions or alterations or repairs, to the extent of capitalization, to the said immovable property.

(e) goods or services or both on which tax has been paid under section 10;

(f) goods or services or both received by a non-resident taxable person except on goods imported by him;

(g) goods or services or both used for personal consumption;

(h) goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples; and

(i) any tax paid in accordance with the provisions of sections 74,129 and 130.

![]()

(6) The Government may prescribe the manner in which the credit referred to in. subsections (1) and (2) may be attributed.

Explanation: For the purposes of this Chapter and Chapter VI, the expression ‘plant and machinery’ means apparatus, equipment and machinery fixed to.earth by foundation or structural support that are used for making outward supply of goods or services or both and includes such foundation and structural supports but excludes

- land, building or any other civil structures,

- telecommunication towers; and

- pipelines laid outside the factory premises

![]()

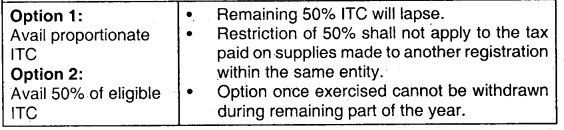

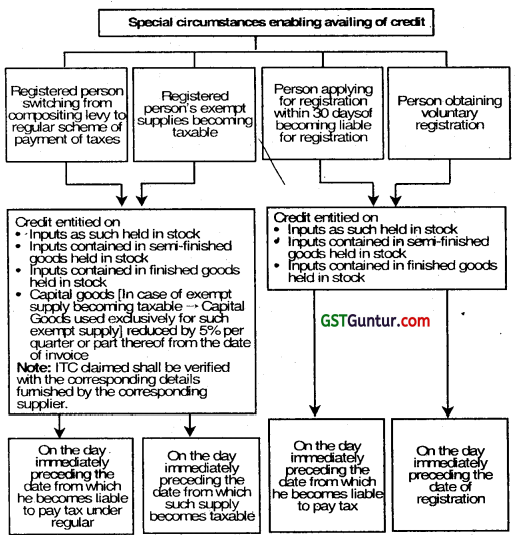

III. The provisions of Section 18 read with relevant rules have been summarized as under:

A. Special circumstances enabling availing of credit

ITC, in all the above cases, is to be a1ailed within 1 year from the date of issue of invoice by the supplier.

![]()

Condition for availing above credit

(i) Filing of electronic declaration giving details of inputs held in stock/contained in semi-finished goods and finished goods held in stock and capital goods on the days immediately preceding the day on which credit becomes eligible.

(ii) Declaration has to be filed within 30 days from becoming eligible to avail credit.

(iii) Details in (i) above to be certified by a CA/Cost Accountant if aggregate claim of CGST, SGST/IGST credit is more than ₹ 2,00,000.

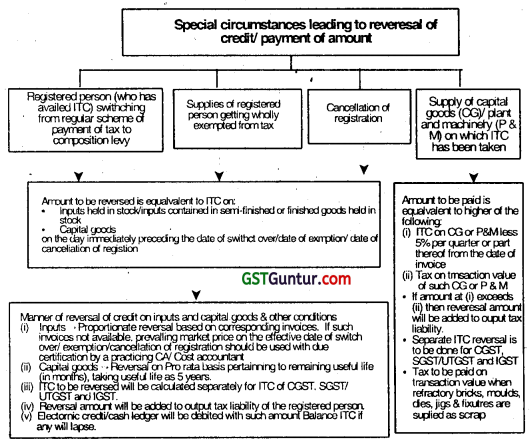

B. Special circumstances leading to reversal of credit/payment of amount

| Transfer of unutilised ITC on account of Change in constitution of registered person | In case of sale, merger, amalgamation, lease or transfer of business, unutilised ITC can be transferred to the new entity if there is a specific provision for transfer of liabilities to the new entity. The inputs and capital goods so transferred shall be duly accounted for by the transferee in his books of accounts. |

| In case of demerger, ITC will be apportioned in the ratio of value of assets of new unit as per the demerger scheme. | |

| Details of change in constitution will have to be furnished on common portal along with request to transfer unutilised ITC, CA/Cost Accountant certificate will have to be submitted certifying that change in constitution has been done with specific provision for transfer of liabilities. | |

| Upon acceptance of such details by the transferee on the common portal, the unutilized ITC will be credited to his Electronic Credit Ledger. |

![]()

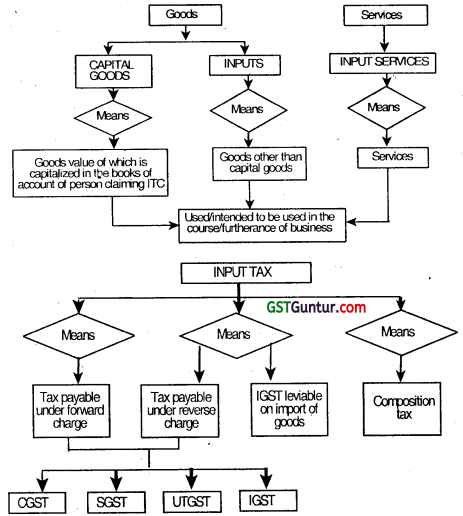

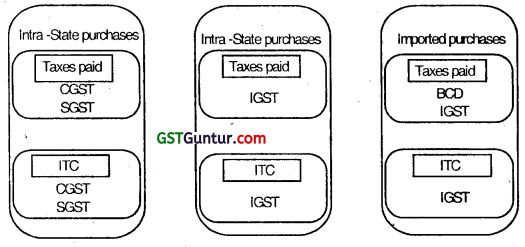

IV. Provisions relating to utilization of ITC are summarized as under:

A registered person is entitled to credits as under:

| Transaction | Credit | ||

| Intra-State supply | CGST & SGST/UTGST | ||

| Inter-State-supply | IGST | ||

| Imports of goods and services | IGST | ||

| The protocol to utilize the credit of CGST, SGST/UTGST and IGST is as follows: | |||

| Credit of | To be utilized first for payment of | May be utilized further for payment of | |

| CGST | CGST . | IGST | |

| SGST/UTGST | SGST/UTGST | IGST | |

| IGST | IGST | CGST, SGST/UTGST in any order | |

![]()

Credit of CGST cannot be used for payment of SGST/UTGST and credit of SGST/UTGST cannot be utilized for payment of CGST.

Analysis:

ITC is credited to a registered person’s electronic credit ledger. A taxable person is entitled for ITC of CGST, SGSTIUTGST and IGST depending upon the nature of supplies received by him.

To illustrate, a supplier making intra-State. inter-State and imported purchases is eligIe for ITC as under:

The person may use the ITC to pay his output tax liability. Since the GST law comprises of multiple taxes viz., CGST, SGST/UTGST and IGST, one may wonder if ITC of one tax can be used to pay any kind of output tax, i.e., if ITC of CGST can be used to pay IGST liability and vice versa or ITC of CGST can be used to pay SGST liability and vice versa. One needs to read the provisions of Section 49(5), Section 49A,. Section 49B, rule 88A and Circular No. 98/17/2019 GST dated 23.4.2019, to find the answer to such questions.

![]()

A combined reading of the above shows that the order of utilization of ITC Is as per the order (of numerals) given below:

| ITC of | Output IGST liability | Output CGST liability | Output SGST/UTGST liability |

| IGST | (I) | (II) In any order or in any propotion | |

(III) ITC of IGST to be completely exhausted mandatorily

| CGST | (V) | (IV) | Not permitted |

| SGST/UTGST | (VII) Only after the ITC of CGST has been utilized fully | Not permitted | (VI) |

The numerals given in the above table can be further explained In the following manner:

- IGST credit should first be utilized towards payment of IGST.

- Remaining IGST credit, if any, can be utilized towards payment of CGST and SGST/UTGST in any order and in any proportion, i.e., remaining ITC of IGST can be utilized –

- first towards payment of CGST and then towards payment of SGST; or

- first towards payment of SGST and then towards payment of CGST; or

- towards payment of CGST and SGST simultaneously in any proportion e.g. 50:50, 30:70, 40:60 and so on.

- Entire ITCof IGST should be fully utilized before utilizing the ITC of CGST or SGST/UTGST.

- & (V) ITC of CGST should be utilized for payment of CGST and IGST in that order. ITC of CGST cannot be utilized for payment SGST/UTGST

- & (VII) ITC of SGST/UTGST should be utilized for payment of SGST.UTGST and IGST in that order.

However, ITC of SGST/UTGST should be utilized for payment of IGST, only after ITC of CGST has been utilized fully. ITC of SGST/UTGST cannot be utilized for payment of CGST.

![]()

Hence cross-utilization of credit is available only between CGST – IGST and SGST/UTGST – IGST. The main restriction is that the CGST credit cannot be utilized .for payment of SGST/UTGST credit cannot be utilized for payment of CGST. Further, ITC of IGST need to be exhausted fully before proceeding to utilize the ITC of CGST and SGST in that order.

Amount of ITC available and output tax liability under different tax heads:

| Head | Output tax liability | ITC |

| IGST | 1000 | 1300 |

| CGST | 300 | 200 |

| SGST/UTGST | 300 | 200 |

| Total | 1600 | 1700 |

![]()

Option : 1

| ITCof | Discharge of output IGST liability | Discharge of output CGST liabililty | Discharge of output SOST/ UTGST liability | Balance of ITC |

| IGST | 1000 | 200 | 100 | 0 |

| ITC of IGST has been completely exhausted | ||||

| CGST | 0 | 100 | – | 100 |

| SGST/U TGST ‘ | 0 | – | 200 | 0 |

| Total | 1000 | 300 | 300 | 100 |

Option : 2

| ITCof | Discharge of output IGST liability | Discharge of output CGST liabililty | Discharge of output SOST/ UTGST liability | Balance of ITC |

| IGST | 1000 | 100 | 200 | 0 |

| ITC of IGST has been completely exhausted | ||||

| CGST | 0 | 200 | – | 0 |

| SGST/U TGST ‘ | 0 | – | 100 | 100 |

| Total | 1000 | 300 | 300 | 100 |

There can be other options also for utilization of ITC of IGST against CGST and SGST liabilities. In this example, two options for utilizing ITC of IGST against CGST and SGST liabilities are shown.

![]()

Restrictions on utilisation of ITC [Rule 86A

The Commissioner? an officer (not below the rank of an Assistant Commissioner) authorised by him is empowered to impose restrictions on utilization of ITC available in the electronic credit ledger if he has reasons to believe that such ITC has been fraudulently availed or is ineligible.

The restrictions can be imposed in the following circumstances:

- ITC has been availed on the basis of tax invoices/valid documents –

- issued by a non-existent supplier or by a person not conducting any business from the registered place of business; or without receipt 6f goods or services or both; or

- the tax in relation to which has not been paid to the Government

- the registered person availing ITC has been found non-existent or not to be conducting any business from the registered place of business; or

- the registered person availing ITC is not in possession of tax invoice/valid document.

If the ITC is so availed, the restrictions can be imposed by not allowing such ITC to be used for discharging any liability under section 49 or not allowing refund of any unutilised amount of such ITC. Such restrictions can be imposed for a period up to 1 year from the date of imposing such restrictions. However, the Commissioner/officer authorised by him, can withdraw such restriction if he is satisfied that conditions for imposing the restrictions no longer exist.