Students should practice Valuation, Principles & Framework – Corporate and Management Accounting CS Executive MCQ Questions with Answers based on the latest syllabus.

Valuation, Principles & Framework – Corporate and Management Accounting MCQ

Question 1.

Discounted cash flow valuation is based upon__

(A) Expected future discount that is likely to be earned.

(B) Real worth of the business

(C) Expected future cash flows and discount rates.

(D) Earning capacity of the company

Answer:

(C) Expected future cash flows and discount rates.

Question 2.

Net Realizable Value means___

(A) Price the buyer is ready to pay.

(B) Same value as the present value.

(C) Value net of expenses.

(D) Higher of the net selling price and value in use.

Answer:

(C) Value net of expenses.

Question 3.

Statement I:

Net Asset Method can be fairly used to value shares when the firm is liquidated.

Statement 11:

This method does not give any weight to earning capacity of the company.

Select the correct answer from the options given below:

(A) Statement I is correct but Statement II is incorrect

(B) Statement I is incorrect but Statement II is correct

(C) Both Statement I and Statement II are incorrect

(D) Both Statement I and Statement II are correct

Answer:

(D) Both Statement I and Statement II are correct

Question 4.

Which of the following is normally used as discounting factor under the discounted cash flow valuation?

(A) Cost of equity

(B) Cost of debt

(C) Annuity factor

(D) Overall cost of capital

Answer:

(D) Overall cost of capital

Question 5.

Present value means –

(A) Value in use

(B) Value of future cash flows

(C) Value calculated using IRR

(D) Present value that buyer is ready to pay

Answer:

(B) Value of future cash flows

Question 6.

Which of the following is required to be taken into consideration while valuing equity shares of the company?

(A) Size of the block of shares

(B) Restricted transferability aspect

(C) Dividends

(D) All of the above

Answer:

(D) All of the above

Question 7.

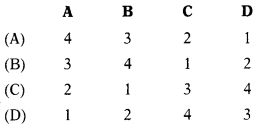

Match the following:

| List-I | List-II |

| A. Present Value | Lower the replacement value & recoverable value |

| B. Liquidation value | Higher of the net selling price and value in use |

| C. Deprival Value | Value of the future net cash inflows |

| D. Recoverable Value | Value net of expenses |

Select the correct answer from the options given below:

Answer:

(B)

Question 8.

Which of the following is the correct formula for the Capitalization of Earning Method?

(A) ‘Net Operating Income divided by ‘Capitalization Rate’

(B) ‘Net Profit’ divided by ‘Discount Rate’

(C) ‘Net Operating Income divided by ‘Growth Rate’

(D) ‘Dividend Per Share’ divided by ‘Annuity Rate’ multiplied by the total number of shares

Answer:

(A) ‘Net Operating Income divided by ‘Capitalization Rate’

Question 9.

In which of the following cases valuation is essential?

(A) Conversion of debt instruments into shares.

(B) On directions of Tribunal or Authority or Arbitration Tribunals.

(C) When issuing shares to the public either through an Initial Public Offer or by the offer for sale.

(D) All of the above

Answer:

(D) All of the above

Question 10.

Which of the following is another name for the required return, on a stock?

(A) Discount rate

(B) Dividend payout ratio

(C) Retention ratio

(D) Value

Answer:

(A) Discount rate

Question 11.

Which of the following is not a general principle involved in a business valuation?

(A) Value is determined at a specific point in time.

(B) Value is prospective.

(C) Value is influenced by liquidity.

(D) Valuation always depends on the fact that who is valuing what.

Answer:

(D) Valuation always depends on the fact that who is valuing what.

Question 12.

Which of the following is equal to the present value of all cash proceeds received by a stock investor?

(A) Value

(B) Retention ratio

(C) Dividend payout ratio

(D) Discount rate.

Answer:

(A) Value

Question 13.

Which of the following do financial analysts consider least important when assessing the long-run economic and financial outlook of a company?

(A) Expected return on equity

(B) Prospects of the relevant industry

(C) Expected changes in EPS

(D) General economic conditions

Answer:

(D) General economic conditions

Question 14.

Provisions relating to ‘valuation by registered valuers’ are contained in –

(A) Section 247 of the Companies Act, 2013

(B) Section 242A of the Income-tax Act, 1961

(C) Section 347 of the Companies Act, 2013

(D) Section 240AB of the Income-tax Act, 1961

Answer:

(A) Section 247 of the Companies Act, 2013

Question 15.

Which of the following is NOT a method of a business valuation?

(A) Asset based

(B) Earnings based

(C) Market based

(D) Equity-based

Answer:

(D) Equity-based

Question 16.

Analysts commonly consider all of the following to be indicators that the market is overvalued except.

(A) High average P/E ratio

(B) High average price-to-book ratio

(C) High average dividend yield

(D) All of the above

Answer:

(C) High average dividend yield

Question 17.

Which of the following best describes the replacement value of a business?

(A) Value if sold off piece-meal

(B) Value to replace assets with new

(C) Cost of setting up an equivalent venture

(D) Net present value of current operations

Answer:

(B) Value to replace assets with new

Question 18.

As per Section 247 of the Companies Act, 2013, where a valuation is required to be made in respect of any property, stocks, shares, debentures, securities or goodwill or any other assets or net worth of a company or its liabilities, it shall be valued by a person having such qualifications and experience and registered as a valuer in such manner, on such terms and conditions as may be prescribed and appointed by the –

(A) Audit committee

(B) Board of Directors of the company.

(C) Board of Directors on the recommendation of the audit committee.

(D) Audit committee or in its absence by the Board of Directors of that company.

Answer:

(D) Audit committee or in its absence by the Board of Directors of that company.

Question 19.

Which of the following best defines the market capitalization for a company’s shares?

(A) When a company is listed L e. goes ‘public’

(B) When a company issues new shares and thus increases its capital

(C) Current share price

(D) Share price × number of shares in issue

Answer:

(D) Share price × number of shares in issue

Question 20.

Value of perpetual bond is calculated by:

(A) Interest divided by rate of cost of equity

(B) Fixed income on security divided by the required rate of return

(C) Fixed income on security divided by growth rate

(D) Interest divided by rate of growth

Answer:

(B) Fixed income on security divided by the required rate of return

Question 21.

From the following details calculate the net asset value:

Fixed assets 1,000 lakh (1,215 lakh)

Cash in hand 35 lakh

Current assets 440 lakh (470 lakh)

Current liabilities 55 lakh

Dividend payable 6 lakh

Figures in the bracket indicate market prices of the assets/liabilities.

(A) 1,665 lakh

(B) 1,629 lakh

(C) 1,420 lakh

(D) 1,720 lakh

Hint:

1,215 4 – 35 + 470 – 55 = 1,665

Answer:

(A) 1,665 lakh

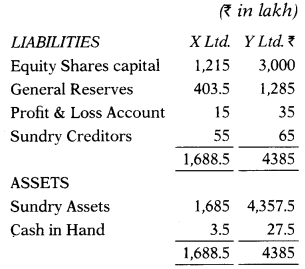

Question 22.

Following details are available for two companies:

X Ltd. has 9 lakh Equity Shares of ₹ 150 each, ₹ 135 paid-up.

Y Ltd. has 40 lakh Equity Shares of ₹ 75 paid-up.

What is the intrinsic value per share for these companies?

(A) ₹ 185.10 & ₹ 180 per share

(B) ₹ 118.50 & ₹ 102 per share

(C) ₹ 181.50 & ₹ 108 per share

(D) ₹ 185.10 & ₹ 102 per share

Hint:

Answer:

(C) ₹ 181.50 & ₹ 108 per share

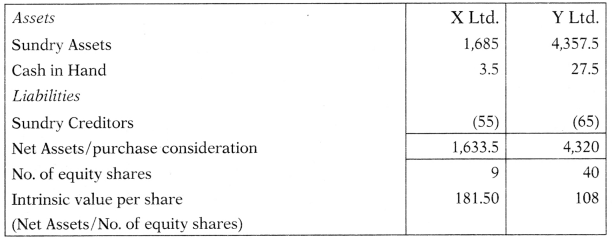

Question 23.

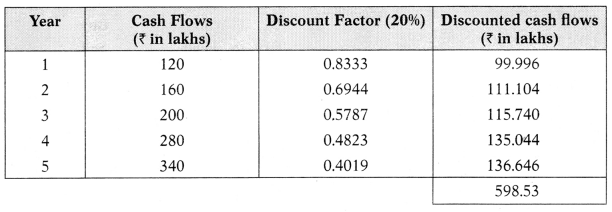

Ramola Ltd. gives the following cash flows estimate:

2015: ₹ 2,000 lakhs

2016 to 2018: Compound growth rate 6.5%

2019 to 2022: Compound growth rate 9.5%

Apply 2096 risk-adjusted discount rate and determine the value of the business.

(A) ₹ 9,530.07 lakh

(B) ₹ 9,053.70 lakh

(C) ₹ 9,750.03 lakh

(D) ₹ 9,350.07 lakh

Hint:

Answer:

(D) ₹ 9,350.07 lakh

Question 24.

If the business is likely to generate cash flow as given below in the next 5 years then what is the value of the business as per discounted cash flow method.

Year 1: 120 lakh

Year 2: 160 lakh

Year 3:200 lakh

Year 4: 280 lakh

Year 5: 340 lakh

Use 20% discount factor.

(A) ₹ 598.53 lakh

(B) ₹ 589.53 lakh

(C) ₹ 578.35 lakh

(D) ₹ 553.98 lakh

Hint:

Answer:

(A) ₹ 598.53 lakh

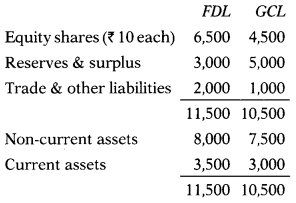

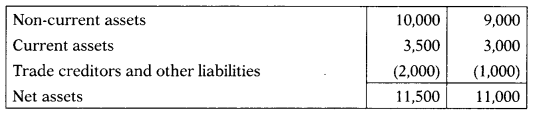

Question 25.

Balance sheets of FDL Ltd. and GCL Ltd. are as follows:

Both companies were amalgamated and a new company WWL Ltd. was formed.

Fixed assets of FDL were valued at ₹ 10,000 and that of GCL was valued at 19,000. WWL would issue the requisite number of equity shares of ₹ 10 each at a 50% premium to discharge the claim of equity shareholders of FDL and GCL.

How many shares of WWL should be issued to take over the business of the two merging companies?

(A) 1,200 shares

(B) 1,500 shares

(C) 1,334 shares

(D) 1,800 shares

Hint:

Total shares to be issued = 766.67 + 733.33 = 1,500

Answer:

(B) 1,500 shares

Question 26.

The Wind Urja Ltd. (WUL) is a closely held unlisted company with financial details as under:

| Market Value on 31.3.2019 (₹ in lakh) | |

| Land and building | 6,500 |

| Plant and machinery | 2,000 |

| Furniture and fixtures | 20 |

| Trade receivables | 1,000 |

| Cash & cash equivalents | 30 |

| Spares | 10 |

| Trade payables | 20 |

| Long-term loans | 2,000 |

| Outstanding expenses | 5 |

Worldwide Wind Energy Ltd. is ready to take over WUL by paying a 35% premium over the market value of assets and liabilities as goodwill. Calculate the price which WWEL is ready to pay to shareholders of WUL.

(A) ₹ 7,535 lakhs

(B) ₹ 10,725 lakhs

(C) ₹ 10,172.25 lakhs

(D) ₹ 12,217.52 lakhs

Answer:

(C) ₹ 10,172.25 lakhs

Question 27.

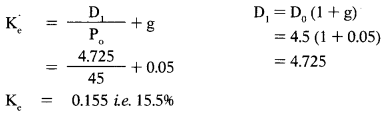

The shares of the company are selling at ₹ 45 per share. The firm had paid dividends @ ₹ 4.5 per share last year. The estimated growth of the company is approximately 5% per year. Determine the cost of equity of the company.

(A) 15.5%

(B) 12.3%

(C) 11.4%

(D) 16.8%

Hint:

Answer:

(A) 15.5%

Question 28.

The shares of the company are selling at ₹ 20 per share. The firm had paid dividends @ ₹ 2 per share last year. The estimated growth of the company is approximately 8% per year. The required rate of return is 15.5%. The market value of equity shares as per the dividend growth model will be:

(A) ₹ 32.4 per share

(B) ₹ 28.8 per share

(C) ₹ 25.5 per share

(D) ₹ 29.1 per share

Hint:

D1 = D0(1 + g)

= 2(1 + 0.08)

= 2.16

P0 = \(\frac{\mathrm{D}_{1}}{\mathrm{~K}_{\mathrm{e}}-\mathrm{g}}=\frac{2.16}{0.155 \cdot 0.08}=\frac{2.16}{0.075}\) = 28.8

Answer:

(B) ₹ 28.8 per share

Question 29.

ZPA Ltd. is foreseeing a growth rate of 12% p.a. in the next two years. The growth rate is likely to fall to 10% for the third year and fourth year. After that growth rate is expected to stabilize at 8% p.a. If the last dividend (D0) paid was ₹ 1.5 per share and the investor’s required rate of return is 16%, find out the intrinsic value per share of ZPA Ltd. as of date.

![]()

(A) ₹ 22.33 per share

(B) ₹ 23.32 per share

(C) ₹ 33.22 per share

(D) ₹ 23.23 per share

Answer:

(A) ₹ 22.33 per share

Question 30.

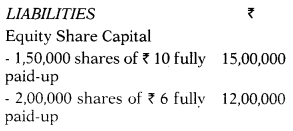

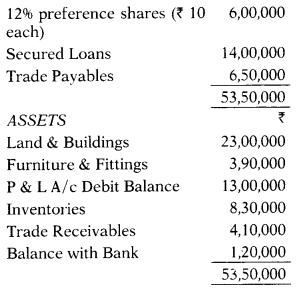

Balance Sheet of Smileheavy Ltd. as of 31.3.2019 reveals as under:

Current value of Land & Buildings is ₹ 30,00,000, Furniture, Fixture & Fittings is ₹ 2,50,000. Inventory is valued at ₹ 9,11,000. Debtors are expected to realize 90% of their book value. You are informed that the preference dividend has not been paid for the last 5 years. Calculate the intrinsic value of per equity shares having face value of ₹ 6 each fully paid-up by Net Assets Method.

(A) ₹ 9.037 per share

(B) ₹ 5.037 per share

(C) ₹ 6.42 per share

(D) ₹ 5.42 per share

Hint:

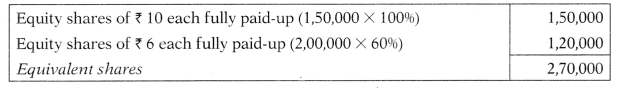

Calculation of equivalent shares:

Value of ₹10 paid-up share = \(\frac{\text { Net Assets }}{\text { Equivalent Shares }}=\frac{24,40,000}{2,70,000}\) = 9.037 per share

Value of ₹ 6 paid-up share = 9.037 × \(\frac{6}{10}\) = 5.42 per share

Answer:

(D) ₹ 5.42 per share

Question 31.

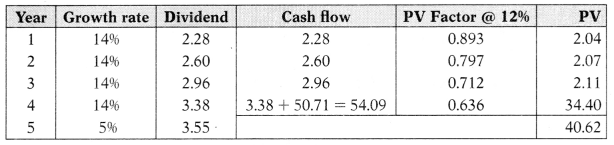

A large chemical company has been expected to grow at 14% per year for the next 4 years and then to grow indefinitely at the same rate as the national economy i.e. 5%. The required rate of return on equity share is 12%. Assume that company paid a dividend of ₹ 2 per share last year (D0 = 2). Determine the market price of the shares today.

(A) ₹ 42.60 per share

(B) ₹ 46.20 per share

(C) ₹ 40.62 per share

(D) ₹ 45.46 per share

Hint:

P4 = \(\frac{\mathrm{D}_{5}}{\mathrm{~K}_{\mathrm{e}}-\mathrm{g}}=\frac{3.55}{0.12-0.05}=\frac{3.55}{0.07}\) = 50.71

The intrinsic value of the chemical company is Rs. 40.62.

Answer:

(C) ₹ 40.62 per share

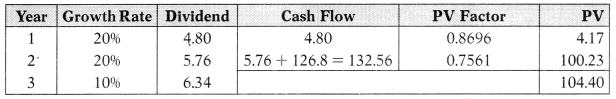

Question 32.

The required rate of return of investors is 15%. ABC Ltd. declared and paid an annual dividend of ₹ 4 per share. It is expected to grow @ 20% for the next 2 years and 10% thereafter. Compute the price at which the shares should sell.

PVFactors: @ 15% for Year 1 = 0.8696 and Year 2=0.7561.

(A) ₹ 108.80 per share

(B) ₹ 104.40 per share

(C) ₹ 110.10 per share

(D) ₹ 105.25 per share

Hint:

P2 = \(\frac{\mathrm{D}_{3}}{\mathrm{~K}_{\mathrm{e}}-\mathrm{g}}=\frac{6.34}{0.15-0.10}=\frac{6.34}{0.05}\)

The intrinsic value of ABC Ltd. is ₹ 104.40.

Answer:

(B) ₹ 104.40 per share

Question 33.

Anurag has invested in a share whose dividend is expected to grow @ 15% for 5 years and thereafter @ 5% till the life of the company. Find out the value of the share, if the current dividend is ? 4 per share and investors required rate of return is 6%.

(A) ₹ 656.93 per share

(B) ₹ 665.39 per share

(C) ₹ 666.99 per share

(D) ₹ 693.56 per share

Answer:

(A) ₹ 656.93 per share

Question 34.

A bond has a face value of ₹ 1,000 and the coupon rate is 8%. Interest on bonds is payable annually. Find the value of the bond if the required rate of return is 6% and the bond is a perpetual bond.

(A) ₹ 1,333

(B) ₹ 1,667

(C) ₹ 1,445

(D) ₹ 1,222

Hint:

Value of perpetual bond = \(\frac{\text { Interest }}{\text { Discount rate }}\)

\(\frac{80}{0.06}\) = 1,333

Answer:

(A) ₹ 1,333

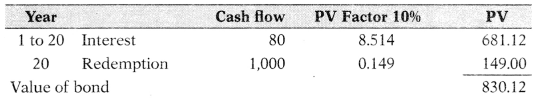

Question 35.

A bond has a face value of ₹ 1,000 and the coupon rate is 8%. Interest on bonds is payable annually. Find the value of the bond if the required rate of return is 10% and the bond has a maturity of 20 years.

(A) ₹ 681.12

(B) ₹ 849.21

(C) ₹ 830.12

(D) ₹ 765.48

Hint:

Answer:

(C) ₹ 830.12

Question 36.

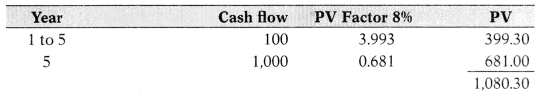

ZPA Ltd. issued ₹ 1,000 optionally convertible debentures at a coupon rate of 10%. These debentures are convertible to 50 equity shares today. The shares are quoting ₹ 25 in the stock market. The investor expects an 8% return on his investment. Debentures are redeemable after 5 years. Will you suggest conversion?

(A) No, as the fair value of debenture is ₹ 1,080.30 which is more than the fair market value of shares

(B) No, as the fair value of debenture is ₹ 1,170.60 which is less than the fair market value of a share

(C) Yes, as the fair value of debenture is ₹ 1,080.30 which is less than the fair market value of shares

(D) Yes, as the fair value of debenture is ₹ 1,238.30 which is more than the fair market value of shares

Hint:

Market value of shares = 50 × 25 = 1,250

Analysis: Since the market value of shares is more than the fair value of debenture, an investor is advised to convert debentures into equity shares.

Answer:

(C) Yes, as the fair value of debenture is ₹ 1,080.30 which is less than the fair market value of shares

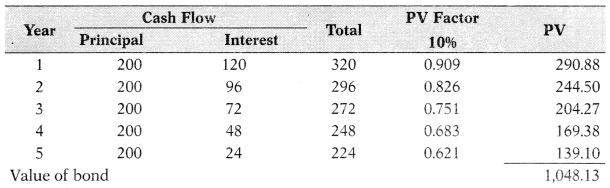

Question 37.

Zensar Ltd. issued 5 years 12% Bond. The face value of the bond is ₹ 1,000 which is redeemable in 5 equal installments. What would be the current price of the bond if the YTM is 10%?

(A) ₹ 1,170.60

(B) ₹ 1,080.30

(C) ₹ 1,048.13

(D) ₹ 1,238.30

Hint:

Answer:

(C) ₹ 1,048.13

Question 38.

What is the value of deep discount bond issued by IDBI for a maturity period of 15 years and having a par value of ₹ 1,00,000 if the required rate of return is 12%?

(A) ₹ 12,000

(B) ₹ 15,400

(C) ₹ 22,600

(D) ₹ 18,300

Hint:

The value of deep discount bond is the present value of ₹ 1,00,000 for 15 years discounted at 12%. The value of deep discount bond = 1,00,000 × 0.183 = 18,300

Answer:

(D) ₹ 18,300

Question 39.

A Zero Coupon Bond (ZCB) was issued at a face value of ₹ 2,50,000 and has maturity of 5 years. Its YTM is 8%. What would be fair price of bond today?

(A) ₹ 1,70,250

(B) ₹ 1,80,520

(C) ₹ 1,60,750

(D) ₹ 1,90,140

Hint:

The value of a zero-coupon bond is the present value of ₹ 2,50,000 for 5 years discounted at 8%.

The value of zero coupon bond = 2,50,000 × 0.681 = ₹ 1,70,250

Answer:

(A) ₹ 1,70,250

Question 40.

A Zero Coupon Bond (ZCB) was issued at a face value of ₹ 2,50,000 and has maturity of 5 years. Its YTM is 8%.

Whether investor should buy, hold or sell the ZCB if the current market price is -(a) ₹ 1,85,000 (&) ₹ 1,65,000

Select the correct answer from the options given below.

(A) Hold Buy

(B) Buy Sell

(C) Sell Buy

(D) Hold Sell

Hint:

The value of a zero-coupon bond is the present value of ₹ 2,50,000 for 5 years discounted at 8%.

The value of zero coupon bond = 2,50,000 × 0.681 = ₹ 1,70,250

Investment Decisions:

(a) If the current market price of ZCB is ₹ 1,85,000, an investor should sell the bond as the market price is more than the fair market value of the bond.

(b) If the current market price of ZCB is ₹ 1,65,000, an investor should buy the bond as the market price is less than the fair market value of the bond.

Answer:

(C) Sell Buy