Transfer Pricing – CA Final DT Question Bank is designed strictly as per the latest syllabus and exam pattern.

Transfer Pricing – CA Final DT Question Bank

Question 1.

RV Ltd., an Indian company, exports grapes to DK Inc for an amount of ₹ 30 Lakhs. DK Inc is located in a Notified Jurisdictional Area (NJA).

RV Ltd. charges ₹ 38 lakhs and ₹ 40 lakhs for sale of similar goods to CC Inc and MM Inc, respectively, which are not located in NJA and both of them are not associated enterprises of RV Ltd.

Assuming that permissible variation notified by Central Government for such class of international transactions is 6% of the transaction price, state the tax implications u/s 94A in respect of the above transaction by RV Ltd, to DK Inc. [CA Final May 2012] [4 Marks]

Answer:

As per section 94A, in case an assessee enters into any transaction where one of the parties thereto is located in the Notified Jurisdictional Area (NJA) then the parties to the transaction shall be treated as associated enterprises and the transaction shall be deemed to be an international transaction. The transfer pricing provisions would, therefore, be attracted in such a case. However, the benefit of permissible variation between the transfer price and the arm’s length price, as notified by the Central Government, shall not be available in such a case.

Since DKInc. is located in a NJA, the transaction of export of grapes by the Indian company, RV Ltd., would be deemed to be an international transaction and DK Inc. and RV Ltd. would be deemed to be associated enterprises. Therefore, the provisions of transfer pricing would be attracted in this case.

The prices of ₹ 38 lakhs and ₹ 40 lakhs charged for sale of similar goods to CC Inc. and MM Inc., respectively, being independent entities located in a non-NJA country, can be taken into consideration for determining the arm’s length price (ALP) under Comparable Uncontrolled Price (CUP) Method.

Since more than one price is determined by the CUP Method, the ALP would be the arithmetical mean of such prices.

Therefore, ALP = ₹ 39,00,000 i.e., [(₹ 38,00,000 + ₹ 40,00,000)/2]

Transfer Price = ₹ 30,00,000

Since the ALP is more than the transfer price, the ALP of ₹ 39 lakhs would be considered for computing the income (rom the international transaction between RV Ltd. and DK Inc.

![]()

Question 2.

What are the “specified domestic transactions” which are subject to transfer pricing provisions? [CA Final May 2013] [6 Marks]

Answer:

The specified domestic transactions, which are subject to transfer pricing provisions, means any of the following transactions, not being an international transaction, namely-

(i) any transaction referred to in section 80A i.e. transfer of goods or services from any unit, undertaking, enterprise or eligible business to any other business or vice versa, both businesses owned by the same assessee;

(ii) any transfer of goods or services referred to in section 80-IA(8) i.e. transfer of goods or sendees from an eligible business to non-eligible business or vice versa, both businesses owned by the same assessee;

(iii) any business transacted between the assessee and other person as referred to in section 80-1 A( 10) i.e. transfer of goods or services from an eligible business to non-eligible business or vice versa, both businesses owned by the different assessee, but the transaction is so arranged that it produces more than ordinary profit to the eligible business;

(iv) any transaction, referred to in any other section under Chapter VI-A or section 10AA, to which provisions of sub-section (8) or sub-section (10) of section 80-IA are applicable i.e. it will be applicable in case of sections 80-IAB, 80-IAC, 80-IB, 80-IC, 80-ID, 80-IE and 10AA;

(v) any business transacted between the persons referred to in Sec. 115BAB(4); or

(vi) am other transaction as may be prescribed, and where the aggregate of such transactions entered into by the assessee in the previous year exceeds a sum of ₹ 20 crore.

![]()

Question 3.

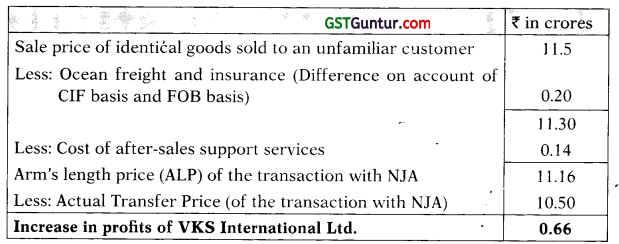

VKS Internationals Ltd., the assessee, has sold goods on 12.1.2021 to L Ltd., located in a notified jurisdictional area (NJA), for ₹ 10.5 crores. The sale price of identical goods sold to an unfamiliar customer in New York during the year was ₹ 11.5 crores. While the second sale was on GIF basis, the sale to L Ltd. was on F.O.B. basis. Ocean freight and insurance amount to ₹ 20 lakhs. India has a DTAA with U.S.A.

The assessee has a policy of providing after-sales support services to the tune of ₹ 14 lakhs to all customers except L Ltd. The ALP worked out as per Cost plus method for identical goods is ₹ 12.1 crores.

You are required to compute the ALP for the sales made to L Ltd., and the amount of consequent increase, if any, in profits of the assessee company. [CA Final May 2014] [8 Marks]

Answer:

If an assessee enters into a transaction, where one of the parties to the transaction is a person located in a notified jurisdictional area, the transaction shall be deemed to be an international transaction and accordingly, transfer pricing regulations shall apply to such transactions.

Also, the transaction of sale to L Ltd., located in a NJA, is an international transaction as per section 92B since it has a bearing on income or assets of the assessee. The ALP has to be computed as per the most appropriate method.

In the given question, the facts suggest that the most appropriate method of computing ALP would be Comparable Uncontrolled Price (CUP) method.

Assuming that CUP method is the most appropriate method, the ALP would be computed as under:

Thus as per the CUP method, the ALP would be ₹ 11.16 crores and the increase in profits of VKS International Ltd. would be ₹ 66 lakhs.

Notes: From the facts of the question, it is assumed that CPM method is not the most appropriate method. Also as per the Guidance Note on Report u/s 92E, issued by ICAI, CUP Method may be adopted as the most appropriate method in respect of a transaction involving sale of goods.

Whereas, CPM is normally used only where raw materials or semi-finished goods are sold or where joint facility agreements or long-term buy and- supply arrangements, or provision of services are involved. Hence, CUP has been assumed to be the most appropriate method. It is also assumed That the goods mentioned in the question are finished goods.

Alternatively, since the exact nature of goods transferred is not given, the question may be solved by assuming CPM as the most appropriate method.

![]()

Question 4.

State with reasons the validity of the following statement:

Before completing the assessment of any foreign company, the Assessing I Officer has to forward a draft of the proposed order of assessment to the assessee. [CA Final Nov. 2015] [2 Marks]

Answer:

The statement is valid.

1 As per section 144C, the Assessing Officer, in the first instance, has to forward a draft of the proposed order of assessment to the eligible assessee (a foreign company, in this case) if he proposes to make any variation in the income or loss returned which is prejudicial to the interest of such assessee, so as to enable the foreign company to file its objections, if any, to such variation with the Dispute Resolution Panel and the Assessing Officer.

Even if such variation does not arise as a consequence of the order of the Transfer Pricing Officer, such draft assessment order has to be served on the foreign company.

Question 5.

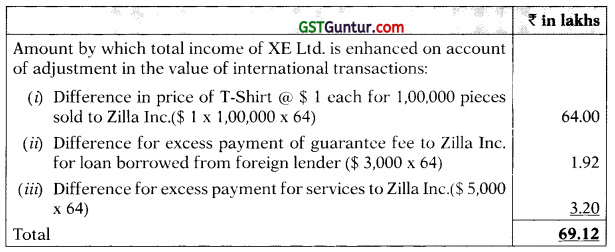

XE Ltd. is an Indian Company in which Zilla Inc., a US company, has 28% shareholding and voting power. Following transactions were effected between these two companies during the financial year 2020-21.

(i) XE Ltd. sold 1,00,000 pieces of T-shirts at $ 2 per T-Shirt to Zilla Inc. The identical T-Shirts were sold to unrelated party namely Kennedy Inc., at $ 3 per T-Shirt.

(ii) XE Ltd. borrowed $ 2,00,000 from a foreign lender based on the guarantee of Zilla Inc. For this, XE Ltd. paid $ 10,000 as guarantee fee to Zilla Inc. To an unrelated party for the same amount of loan, Zilla Inc. collected $ 7,000 as guarantee fee.

(iii) XE Ltd. paid $15,000 to Zilla Inc. for getting various potential customers details to improve its business. Zilla Inc. provided the same service to unrelated parties for $ 10,000.

Assume the rate of exchange as 1 $ = ? 64

XE Ltd. is located in a Special Economic (SEZ) and its income before i transfer pricing adjustments for the year ended 31st March, 2021 was ₹ 1,200 lakhs.

Compute the adjustments to be made to the total income of XE Ltd. State whether it can claim deduction u/s 10AA for the income enhanced by applying transfer pricing provisions. [CA Final Nov. 2015] [6 Marks]

Answer:

XE Ltd, the Indian company and Zilla Inc., the US company are deemed to be associated enterprises as per section 92A(2)(a), since Zilla Inc. holds shares carrying not less than 26% of the voting power in XE Ltd. Therefore, transfer pricing provisions shall be applicable and arm’s length price shall be determined taking the comparable uncontrolled price method to be the most appropriate method.

First proviso to Sec. 92C(4) provides that deduction under Chapter VI-A and Sec. 10AA shall not be available in respect of income enhanced due to transfer pricing provisions. Therefore, XE Ltd. cannot claim deduction u/s 1OAA in respect of ₹ 69.12 lakhs, being the amount of income by which the total income is enhanced.

![]()

Question 6.

In the context of provisions contained in the Income-tax Act, 1961 examine the correctness of the following:

(i) Transfer pricing rules shall have no implication where income is computed on the basis of book profits.

(ii) Assessing Officer can complete the assessment of income from international transaction in disregard of the order passed by the Transfer Pricing Officer by accepting the contention of assessee. [CA Final May 2016] [5 Marks]

Answer:

(i) The statement is correct.

For computing book profit for levying MAT, the net profit as per the profit & loss account can be adjusted only for the adjustments allowed as per explanation 1 to Sec. 115 JB.

No other adjustments shall be made in computing book profit for levy of MAT, except where:

- it is discovered that the profit and loss account is not drawn up in accordance with the relevant Schedule of the Companies Act;

- incorrect accounting policies and/or accounting standards have been adopted for preparing such accounts; and

- the method and rate of depreciation adopted is not correct.

Therefore, transfer pricing adjustments cannot be made while computing book profit for levy of MAT as it is not specified under Explanation 1 to section 115JB.

(ii) The statement is not correct.

As per sec. 92CA, where the A.O. has referred the computation of Arm’s Length Price (ALP) in relation to international transaction or specified domestic transaction to the Transfer Pricing Officer (TPO), the A.O. shall proceed to compute the total income of the assessee only in conformity with the ALP determined by the TPO. The order of the TPO is binding on the A.O.

Therefore, in this case, the A.O. cannot complete the assessment of income from international transaction without considering the order passed by the TPO and by accepting the contention of assessee.

![]()

Question 7.

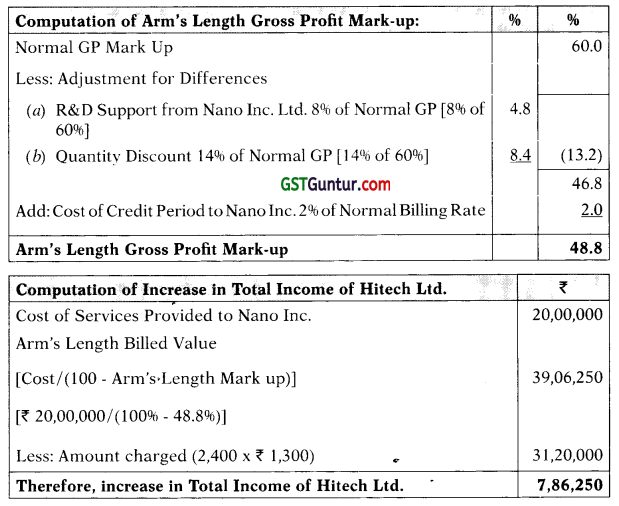

NANO Inc., a German Company holds 45% of equity in Hitech Ltd., an Indian Company. Hitech Ltd. is engaged in development of software and maintenance of the same for customers across the globe. Its clientele includes NANO Incv During the financial year 2020-21 Hitech Ltd. had spent 2,400 man hours for developing and maintaining software for NANO Inc. with each hour being billed at ₹ 1,300. Cost incurred by Hitech Ltd for executing work for NANO Inc. amounts to ₹ 20 lakhs.

Hitech Ltd. had also undertaken developing software for Modi Industries, for which Hitech Ltd. had billed at ₹ 2,700 per man-hour. The persons working for Modi Industries and NANO Inc. were part of the same team and were of matching credentials and calibre. Hitech Ltd. rnade a gross profit of 60% on Modi Industries’ work. Hitech Ltd.’s transactions with NANO Inc. are comparable to the transactions with Modi Industries, subject to the following differences:

(i) NANO Inc. gives technical knowhow support to Hitech Ltd., which can be valued at 8% of the normal gross profit. Modi Industries does not provide any such support.

(ii) Since the work for NANO Inc. involved huge number of man hours, a quantity discount of 14% of normal gross profits was given.

(iii) Hitech Ltd. had offered 90 days credit to NANO Inc., the cost of which is measured at 2% of the normal billing rate. No such discount was offered to Modi Industries.

Compute arm’s length price as per cost plus method and the amount of increase in total income of Hitech Ltd. [CA Final Nov. 2016] [6 Marks]

Answer:

![]()

Question 8.

Rk Limited, an Indian company, is engaged in manufacturing electronic components. 74% of shares of the company are held by Rk Inc., incorporated in USA. Rk Limited has borrowed funds from Rk Inc. at LIBOR plus 150 points. The LIBOR prevalent at the time of borrowing is 4% for US $. The borrowings allowed under the External Commercial Borrowings guidelines issued under Foreign Exchange Management Act are LIBOR plus 200 basis points. Discuss whether the borrowing made by Rk Limited is at arm’s length (‘LIBOR’ means London Inter-Bank Offer Rate). [CA Final May 2017] [3 Marks]

Answer:

Rk Inc., USA and Rk Limited, the Indian company are associated enterprises since the former holds 74% shares in the latter.

The arm’s length rate of interest can be determined by using CUP method having regard to the rate of interest on external commercial borrowing permissible as per guidelines issued under Foreign Exchange Management Act. The interest rate permissible is LIBOR plus 200 basis points i.e., 4% + 2% = 6%, which can be taken as the arm’s length rate.

The interest rate applicable on the borrowing by Rk Limited, India from Rk Inc., USA, is LIBOR plus 150 basis points i.e., 4% + 1.5% = 5.5%. Since the rate of interest, i.e. 5.5% is less than the arm’s length rate of 6%, the borrowing made by the Rk Ltd. is not at arm’s length.

However, in this case, the taxable income of Rk Ltd., India, would be lower if the arm’s length rate is applied. Hence, no adjustment is required since the law of transfer pricing will not apply if there is a negative impact on the existing profits.

![]()

Question 9.

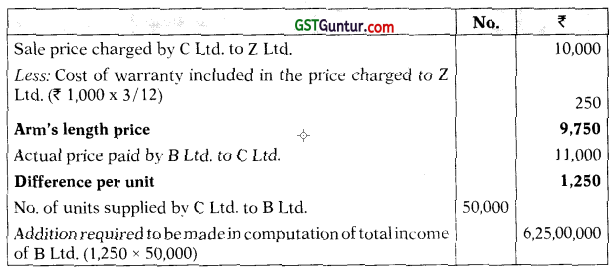

C Ltd., a US company has a subsidiary, B Ltd. in India. C Ltd. sells computer monitors to B Ltd. for resale in India. C Ltd. also sells computer monitors to Z Ltd., another computer reseller. It sells 50,000 computer monitors to B Ltd. at ₹ 11,000 per unit. The price fixed for Z Ltd. is ₹ 10,000 per unit. The warranty in case of sale of monitors by B Ltd. is handled by B Ltd. However, for sale of monitors by Z Ltd., C Ltd. is responsible for the warranty for 3 months. Both C Ltd. and B Ltd. offer extended warranty at a standard rate of ₹ 1,000 per annum. On these facts determine the ALP and the effect on the net profit/income of the assessee-company. [CA Final May 2017] [3 Marks]

Answer:

C Ltd., the foreign company and B Ltd., the Indian company are associated enterprises since C Ltd. is the holding company of B Ltd. C Ltd. sells computer monitors to B Ltd. for resale in India. C Ltd. also sells identical computer monitors to Z Ltd., which is not an associated enterprise. The price charged by C Ltd. for a similar product transferred in- comparable uncontrolled transaction is, therefore, identifiable. Therefore, Comparable Uncontrolled Price (CUP) method for determining arm’s length price can be applied.

While applying CUP method, the price in comparable uncontrolled transaction needs to be adjusted to account for difference, if any, between the international transaction (i.e. transaction between C Ltd. and B Ltd.) and uncontrolled transaction (i.e. transaction between C Ltd. and Z Ltd.) and the price so adjusted shall be the arm’s length price for the international transaction.

For sale of monitors by Z Ltd., C Ltd. is responsible for warranty for 3 months. The price charged by C Ltd. to Z Ltd. includes the charge for warranty for 3 months. Hence arm’s length price for computer monitors being sold by C Ltd. to B Ltd. would be:

No deduction under chapter VI-A would be allowable in respect of the enhanced Income of ₹ 6.25 crores.

Note: It is assumed that B Ltd. has not entered into an advance pricing agreement or opted to be subject to Safe Harbour Rules.

![]()

Question 10.

Examine in the context of provisions contained under the Income-Tax Act and Rules thereunder whether the Transfer Pricing relating to the International Transactions declared by the assessee who have exercised a valid option for application of safe harbour rules can be accepted by the I.T. Authorities for the A.Y. 2021-22 in the following cases:

(i) Bhisma Ltd., is an Indian company providing services of data processing with the use of Information Technology to YOK Inc. of U.S.A. a foreign subsidiary of the Indian company. Aggregate of the transactions value of services by Bhisma Ltd. to YOK Inc. during the previous year 2020-21 is of ₹ 200 crores having operating margin of ₹ 29 crores and operating expenses of ₹ 150 crores.

(ii) Dhanush Ltd., an Indian company providing services relating to Contract of R & D of the Generic Pharmaceutical Drugs to ABC Inc. of UK a foreign company, which has guaranteed 15% of the total borrowings of the Indian company. Aggregate of the transactions value of services by Dhanush Ltd. to ABC Inc. during the previous year 2020-21 is of ₹ 100 crores having operating margin of ₹ 18 crores and operating expenses of ₹ 60 crores. [CA Final Nov. 2017] [6 Marks]

Answer:

(i) YOK Inc., a foreign company, is a subsidiary of Bhisma Ltd., an Indian company. Hence, YOKInc. and Bhisma Ltd. are associated enterprises. Therefore, provision of data processing services by Bhisma Ltd., an Indian company, to YOK Inc., a foreign company, is an international transaction between associated enterprises, and consequently, the provisions of transfer pricing are attracted in this case.

Data processing services with the use of information technology falls within the definition of “information technology enabled services”, and is hence, an eligible international transaction. Since B Ltd. is providing data processing services to a non-resident associated enterprise and has exercised a valid option for safe harbour rules, it is an eligible assessee.

![]()

Since, the aggregate value of transactions entered into in the P.Y. 202021 does not exceed ₹ 200 crore, Bhisma Ltd. should have declared an operating profit margin of not less than 18ao in relation to operating expense, to be covered within the scope of safe harbour rules. In this case, since Bhisma Ltd. has declared an operating profit margin of 19.33% (i.e. 29/150 × 100) and the same is in accordance with the circumstance mentioned in Rule 10TD. Hence, the income-tax authorities shall accept the transfer price declared by Bhisma Ltd. in respect of such international transaction.

(ii) ABC Inc., a foreign company, guarantees 15% of the total borrowings of Dhanush Ltd., an Indian company. Since ABC Inc. guarantees not less than 10% of the total borrowings of Dhanush Ltd., ABC Inc. and D Ltd. are deemed to be associated enterprises. Therefore, provision of contract R & D services relating to generic pharmaceutical drug by D Ltd., an Indian company, to ABC Inc., a foreign company, is an international transaction between associated enterprises, and consequently, the provisions of transfer pricing are attracted in this case.

Provision of contract R & D services in relation to generic pharmaceutical drug is an eligible international transaction. Since Dhanush Ltd. is providing such services to a non resident associated enterprise and has exercised a valid option for safe harbour rules, it is an eligible assessee.

Since, the aggregate value of transactions entered into in the P.Y. 202021 does not exceed ₹ 200 crore, Dhanush Ltd. should have declared an operating profit margin of not less than 24% in relation to operating expense, to be covered within the scope of safe harbour rules.

In this case, since Dhanush Ltd. has declared an operating profit margin of 30% (i.e. 18/60 × 100), the same is in accordance with the circumstance mentioned in Rule 10TD. Hence, the income-tax authorities shall accept the transfer price declared by D Ltd in respect of such international transaction.

![]()

Question 11.

“Rule 10MA(2)(iv) of Income-tax Rules requires that the application for rollback provision, in respect of an international transaction, has to be made by the applicant for all the rollback years in which the said international transaction has been undertaken by the applicant.

You are required in this context to explain whether the rollback has to be requested for all the four years or applicant can choose the years out of the block of four years. [CA Final Nov. 2017] [4 Marks]

Answer:

As per Circular No.10/2015 dated 10.06.2015 issued by the CBDT, the applicant does not have the option to choose the years for which it wants to apply for rollback in application filed under rule 10MA(2)(iv) of Income-tax Rules, 1962.

The applicant has to either apply for all the four years or not apply at all.

However, if the covered international transaction(s) did not exist in a rollback year or there is some disqualification in a rollback year, then, the applicant can apply for rollback for less than four years.

Accordingly, if the covered international transaction(.s) were not in existence during any of the rollback years, the applicant can apply for rollback for the remaining years.

Similarly, if in any of the rollback years for the covered international transaction(s), the applicant fails the test of the rollback conditions contained in various provisions, then, it would be denied the benefit of rollback for that rollback year.

However, for other rollback years, it can still apply for rollback.

![]()

Question 12.

Answer the following in the context of international transactions:

(i) Company X and Company Y who have entered into Advance Pricing Agreements (APA) and eligible for rollback provisions merged to form Company XY. Is the Company XY eligible for rollback provisions as it was formed on merger of Company X and Company Y?

(ii) Proceedings before the TPO were stayed by court order and it was subsequently lifted. The time limit for completion of assessment after excluding the period of stay due to court order is only 30 days. Within how many more days, the TPO has to pass his order?

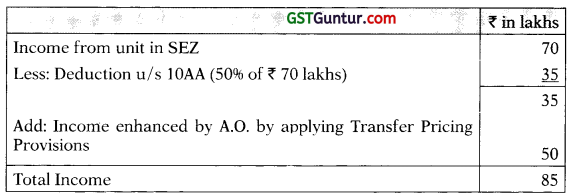

(iii) The gross total income of Sachin Co. Ltd., Pune was ₹ 70 lakhs which is wholly attributable to a unit located in SEZ since April, 2011. Adjustments to total income made by the A.O. by applying the transfer pricing provisions, enhanced the total income by ₹ 50 lakhs. What is the total income of the assessee chargeable to tax and explain why? [CA Final May 2018 (Old Syllabus)] [6 Marks]

Answer:

(i) Where there is merger of companies, only the company who makes an application for advance pricing agreement (APA) would only be entitled to enter into the agreement and be entitled for the rollback provisions in respect of international transactions undertaken by it in rollback years.

The other companies who have merged with the company would not be eligible to rollback years. In this case, company X and company Y who had entered into APA and eligible for rollback provisions, merged to form company XY. Since, the company XY has not applied for the APA, it will not be eligible for the rollback provisions.

(ii) As per Sec. 92CA, where a reference is made to TPO, an order by the TPO may be made at any time before 60 days prior to the date on which the period of limitation referred to in section 153 or section 153B for making the order of assessment or reassessment or re-computation or fresh assessment expires.

However, where assessment proceeding is stayed by an order or injunction of any court and the period of limitation available to the TPO for making an order is less than 60 days, such remaining period shall be extended to 60 days and the aforesaid period of limitation shall be deemed to have been extended accordingly.

![]()

Here, the time limit for completion of assessment after excluding the period of stay due to court order is only 30 days and therefore, the same will be extended by 30 days and TPO can make an order within 60 days. Also, as per 2nd Proviso to Explanation, where the period available to TPO is extended to 60 days u/s 92CA and the period of limitation for completion of assessment by the A.O. is less .than 60 days, such remaining period shall be extended to 60 days and the period of limitation shall be deemed to be extended accordingly. Therefore, the TPO has 60 more days to make an order.

(iii) As per the proviso to Sec. 92C(4), where the A.O. has computed the total income of the assessee having regard to the Arm’s length Price by applying the transfer pricing provisions, no deduction u/s 10AA shall be allowed from the income so enhanced by the A.O.

If we assume that the entire turnover of Sachin Co. Ltd. represents the export turnover, the entire profit of ₹ 70 lakhs is eligible for deduction u/s 10AA and the total income shall be computed as follows:

Since, the unit located in SEZ is in 7th year of operations, it will be eligible for deduction of 50% of profits derived from export turnover.

![]()

Question 13.

X Ltd., a resident Indian Company, on 01.04.2019 has borrowed ₹ 100 crores from M/s. A Ine. a Company incorporated in US, at an interest rate of 9% p.a. The said loan is repayable over a period of 10 years. Further loan is guaranteed by M/s B Inc incorporated in US. M/s. K Inc a non-resident, holds shares carrying 30% of voting power both in M/s X Ltd. and M/s B. Inc. M/s. K Inc has also deposited ₹ 100 crores with M/s. A Inc.

Other information:

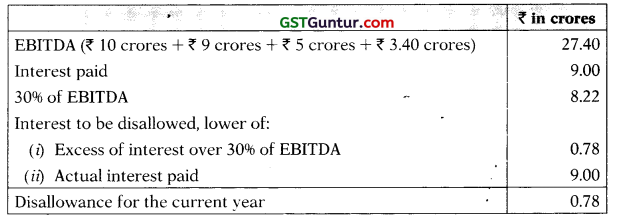

Net profit of M/s X Ltd. was 110 crores after debiting the above Interest, depreciation of ₹ 5 crores and Income Tax of ₹ 3.40 crores. Calculate the amount of interest to be disallowed under the head Profits and Gains of Business or profession in the computation of M/s. X Ltd.

Substantiate your answer with reasons. [CA Final May 2018 (New Syllabus)] [6 Marks]

Answer:

As per Sec. 94B, where an Indian company or a PE of a foreign company in India, being the borrower, incurs any expenditure by way of interest or of similar nature exceeding ₹ 1 crore which is deductible under the head PGBP in respect of any debt issued by a non-resident, being an associated enterprise of such borrower, the interest shall not be deductible in computation of income under the said head to the extent that it arises from excess interest.

Provided that where the debt is issued by a lender which is not associated but an associated enterprise either provides an implicit or explicit guarantee to such lender or deposits a corresponding and matching amount of funds with the lender, such debt shall be deemed to have been issued by an associated enterprise.

In this case, X Ltd., a resident Indian Company, has borrowed ₹ 100 crores from M/s. A Inc, a company incorporated in US at an interest rate of 9% p.a. The loan is guaranteed by M/s. B Inc incorporated in US. M/s. K Inc, a non-resident holds shares carrying 30% of voting power both in M/s. X Ltd. and M/s. B. M/s. K Inc has also deposited ₹ 100 crores with M/s. A Inc.

Since, M/s. K holds more than 26% shares in M/s X Ltd. and M/s. B, M/s. X Ltd. and M/s. B shall be deemed to be an associated enterprises as per Sec. 92A(2). Therefore, the provisions of Sec. 94B shall be applicable, since the amount borrowed by M/s. X Ltd is guaranteed by its associated i enterprise M/s. B and also the amount of interest exceeds ₹ 1 crore.

As per Sec. 94B, the amount of excess interest shall be disallowed. Excess interest shall mean an amount of:

- total interest paid or payable in excess of 30% of earnings before interest, taxes, depreciation and amortization (EBITDA) of the borrower in the previous year, or

- interest paid or payable to associated enterprises for that previous year, whichever is less.

Computation of disallowance of interest u/s 94B for the current year

Therefore, ₹ 78,00,000 shall be disallowed for the current year in computing the income under the head “Profits and Gains from Business or Profession” of M/s. X Ltd. Such interest disallowed shall be carried forward to the following assessment years and allowed as a deduction against the profits and gains of any business or profession carried on by it and assessable for that assessment year to the extent of maximum allowable interest as per this section.

![]()

Question 14.

Konark Digital Solutions Ltd. is an Indian Company in which Yo- kohoma Inc., a Singapore based company holds 30% shareholding and voting power. During the previous year 2019-20, the Indian company supplied laptops to the Singapore based company @ $ 800 per piece. The price of laptop supplied to other unrelated parties in Singapore is @ $ 1200 per piece. During the course of assessment proceedings, the A.O. carried out primary adjustments and added a sum of ₹ 130 lakhs, being the difference between actual price of laptop and arm’s length price for 500 pieces and it was duly accepted by the assessee. On account of this adjustment, the excess money of ₹ 130 lakhs is available with Yokohoma Inc., Singapore. In this context, you are requested to briefly explain the relevant provisions of Income-tax Act, 1961 and suggest suitable solution for the following issues:

(i) What is the effect of this transaction on the taxable income of Konark Digital Solutions Ltd. for the assessment year 2021-22 on the basis that it declared an income of ₹ 250 lakhs and the excess money is still lying with Yokohoma Inc. till today?

Assume the rate of exchange as 1 $ = ₹ 65 and the marginal cost of lending rate of SBI as on 01.04.2020 at 10.75%.

(ii) Would taxable income of Konark Digital Solutions Ltd. undergo any change, if the above adjustment carried out resulted in addition of ₹ 90 lakhs as against ₹ 130 lakhs?

(iii) What is the impact of this adjustment on taxable income of Konark Digital Solutions Ltd. for assessment year 2021 -22, if such adjustment 4 pertains to the previous year 2016-17 as against 2019-20? [CA Final Nov. 2018 (Old Syllabus)] [6 Marks]

Answer:

(i) On account of the primary adjustment of ₹130 lakhs made by A.O., the total income of Konark Digital Solutions Ltd. for A.Y.2020-21 would increase by ₹ 130 lakhs. In this case, secondary adjustment has to be made since

- The company has accepted the primary adjustment made by the Assessing Officer;

- The primary adjustment is in respect of A.Y. 2020-21; and

- The primary adjustment exceeds ₹ 100 lakhs.

![]()

Accordingly, the excess money (i.e., ₹ 130 lakhs) available with the associated enterprise (i.e., Yokohoma Inc., Singapore) not repatriated to India within 90 days of the date of the order of the Assessing Officer would be deemed as an advance made by the Konark Digital Solutions Ltd. to its associated enterprise, Yokohoma Inc.

Interest would be calculated on such advance at the rate of six month LIBOR as on 30th September + 3%, since the international transaction is denominated ‘ in $. Such interest, if any, for the RY 2020-21 would be added to his total income of ₹ 250 lakhs for A.Y. 2021-22.

In order to avoid this tax implication, the excess money (i.e., ₹ 130 lakhs) available with the associated enterprise (i.e., Yokohoma Inc., Singapore) must be repatriated to India within 90 days of the date of the order of the Assessing Officer.

(ii) Since, secondary adjustment in the books of account is not required if the primary adjustment does not exceed ₹ 100 lakhs, no secondary adjustment needs to be made in the books of account if the primary adjustment for A.Y. 2020-21 is only ₹ 90 lakhs. The total income for A.Y. 2021-22 would, therefore, be only ₹ 250 lakhs.

(iii) Secondary adjustment in the books of account is not required where the primary adjustment is made in respect of A.Y. 2017-18 (relevant to P.Y. 2016-17) or any earlier assessment year. Therefore, there would be no impact of this adjustment on the taxable income of the company if primary adjustment pertains to P.Y. 2016-17. The taxable income would remain at ₹ 250 lakhs.

![]()

Question 15.

State with reasons, whether Netlon LLC., (Incorporated in Singapore) and Briggs Ltd., a domestic company, are/can be deemed to be associated enterprises for the transfer pricing regulations (Each situation is independent) of the others:

(i) Netlon LLC. has advanced a loan of ₹ 53 crores to Briggs Ltd. on 12.01.2021. The total book value of assets of Briggs Ltd. Is ₹ 100 crores. The market value of the assets, however, is ₹ 150 crores. Briggs Ltd. repaid ₹ 10 crores before 31.03.2021.

(ii) Netlon LLC. has the power to appoint 2 directors of Briggs Ltd. whose total number of directors in the Board is 4.

(iii) Total value of raw materials and consumables of Briggs Ltd. is ₹ 900 crores. Of this, Netlon LLC. supplies to the tune of ₹ 820 crores, at prices mutually agreed upon once in 6 months and depending upon the market conditions. [CA Final Nov. 2018 (New Syllabus)] [6 Marks]

Answer:

(i) As per section 92A two enterprises are deemed to be associated enter-prises if, at any time during the previous year, a loan advanced by one to other constitutes 51% or more of book value of total assets of other. In this case, Netlon LLC. has advanced a loan of ₹ 53 crores to Briggs Ltd. which constitutes 53% of the total book value of assets of Briggs Ltd. Therefore Netlon LLC., (Incorporated in Singapore) and Briggs Ltd., a domestic company, are deemed to be associated enterprises. Repayment of loan is irrelevant.

(ii) As per section 92A two enterprises are deemed to be associated enter-prises if, at any time during the previous year, any person appoint more than half of board of directors or one or more executives directors of other. In this case, Netlon LLC. has the power to appoint 2 of the directors of Briggs Ltd. whose total number of directors in the Board is 4. Since, Netlon LLC. does not have the power to appoint more than half of board of directors of Briggs Ltd., they are not deemed to be associated enterprises. To become deemed associated enterprises, Netlon LLC should have the power to appoint 3 directors out of 4 directors of Briggs Ltd.

(iii) As per section 92A two enterprises are deemed to be associated enterprises if, at any time during the previous year, 90% or more of raw materials required by one are supplied by the others and prices and other conditions relating thereto are influence by other enterprise.

In this case, Netlon LLC. supplies ₹ 820 crores of raw materials and consumables out of the total requirement of ₹ 900 crores of Briggs Ltd which constitutes more than 90% (i.e. 91% [820 4- 900]) of the requirement of Briggs Ltd. But, since, here it is given that the supplies are made depending upon the market conditions and are not influence by other enterprise, Netlon LLC. and Briggs Ltd. shall not be deemed to be associated enterprises.

![]()

Question 16.

Muskaan Ltd. (MK India) is an Indian company that manufactures cricket kits in India. MK India is eligible for deduction u/s 10AA of the Income-tax Act, 1961. For its UK sales, MK India has entered into a marketing arrangement with Kits Sports (KS UK), a UK incorporated firm. MK India uses the patented design provided by KS UK for manufacturing of cricket kits by it. MK India supplied 30,000 sports kits to KS UK for ₹ 5,000 per kit. In the assessment, the A.O., increased the price charged by MK India from KS UK to ₹ 6,000 per kit. MK India accepts such transfer price adjustment adopted by the Assessing officer. As a result, there is an increase in the income of MK India. You are required to answer the following questions in this respect:

(1) Would MK India and KS UK be treated as associate enterprises for the purposes of transfer pricing adjustment adopted by the A.O.?

(2) What is the liability of KS UK in respect of the change in Arm’s Length Price (ALP) in respect of purchases made by it from MK India?

(3) MK India contends that since the income is increased because of the arm’s length price adopted by the A.O., the deduction claimed by it u/s 10AA should also be increased accordingly, since the amount of deduction is based upon the amount of the export sale. Discuss whether the contention of MK India is valid. [CA Final May 2019 (Old Syllabus)] [6 Marks]

Answer:

(1) Manufacturing of cricket kits by MK India is wholly dependent on the use of patented design provided by KS UK and therefore MK India and KS UK are deemed to be associated enterprises as per section 92A(2).

Supply of cricket kits by MK India, a resident, to KS UK, a non-resident, would be an international transaction between associated enterprises, and hence, transfer pricing provisions would be attracted in this case.

(2) The increased amount of ₹ 3 crore shall be treated as an advance given by M.K. India to KS UK which is required to be repatriated by KS UK within 90 days from the date of order.

(3) As per the first proviso to section 92C(4), in respect of the increased income of ₹ 3 crores, no deduction under section 10 AA shall be allowed to MK India.

Hence, the contention of MK India that deduction under section 10AA should be increased is not valid.

![]()

Question 17.

Beta Inc.. having its business In Singapore has advanced a loan of SD 1 ,60,000 to Beta Ltd., Mumbai. Book value of total assets of Beta Ltd was 125 lakhs. Beta Ltd provides software backup support to Beta Inc. Beta Ltd has spent 50,000 man hour during the financial year 2020-21 for the services rendered to Beta Inc. The cost for Beta Ltd. is SD 75/man hour. Beta Ltd has billed Beta Inc. at SD 90.75/man hour.:Note: SD = Singapore Dollars .

Gama Ltd. In Mumbal which has a similar business model, provides soft ware backup support to Olive Inc. in Penang, Malaysia. Gama Ltd’s cost and operating profits are as hereunder:

Particulars – INR in lakhs

Direct costs – 600

Indirect costs – 200

Operating profits – 200

(1) Calculate Arm’s Length Price for the transaction between Beta Ltd and Beta Inc. based on the above data of Gama Ltd using the Trans actional Net Margin Method. Assume 1 SD = ₹ 45.

(2) Explain, If there is any adjustment to be made to the total income of Beta Ltd. [cA Final May 2019 (New Svflabus)] [6 Marks]

Answer:

Beta Inc. and Beta Ltd. are deemed to be associated enterprises since a loan of ₹ 72,00,000 (SD 1,60,000 × 45) constitutes 57.60% (₹ 72,00,000/₹ 1,25,00,000) of the book value of assets of Beta Ltd. which is more than 51%.

(1) Under the Transactional Net Margin Method, net profit margin from similar uncontrolled transaction is computed and adjustments for differences in controlled transactions are made to net profit margin.

Net profit margin from uncontrolled transaction (i.e. transaction between Gama Ltd. = ₹ 200 lakhs ÷ ₹ 800 lakhs and Olive Inc.)

= 25%

Therefore, Arm’s Length Price will be SD 93.75 (SD 75 /man hour + 25%)

(2) Adjustment required to be made to total income of Beta Ltd.

= SD 93.75 – SD 90.75 × 50,000 man hours × ₹ 45 per SD = ₹ 67,50,000

![]()

Question 18.

ABC & Co, an Indian LLP is solely engaged in the manufacture and export of engine, engine parts including cooling systems and engine valves. It had supplied auto components worth ₹ 72 crores during financial year 2020-21 to XYZ LLP, a foreign LLP located in Germany, controlled by A & B the partners of Indian LLP along with their relatives. Against the aggregate value of transactions entered into as mentioned above, the Indian LLP incurred an operating expenditure of ₹ 60 crores leaving an operating profit of ₹ 4.50 crores.

(i) Compute the primary adjustment required be made in A.Y. 2021-22, if any, assuming that the Indian LLP exercised a valid option for application of safe harbour rules prescribed under Rule 10TD read with section 92 CB of Income Tax Act.

(ii) Examine the applicability of safe harbour rules, if the Foreign LLP is located in Notified Jurisdictional Area. [CA Final May 2019 (New Syllabus)] [6 Marks]

Answer:

Ans. ABC & Co, an Indian LLP and XYZ LLP, a foreign LLP are associated enterprises since, XYZ LLP is controlled by A & B the partners of Indian LLP along the relatives.

As per Sec. 92 income arising from international transaction shall be computed having regards to the arm’s length price.

As per rule 10TD, where an eligible assessee has entered into an eligible international transaction and the option of safe harbour exercised by the said assessee is not held to he invalid under Rule 10TE, the transfer price declared by the assessee in respect of such transaction shall he accepted by the income-tax authorities, if the eligible international transaction is manufacturing and export of core auto components and the assessee has declared not less than 12% operating profit margin from such transaction. Core auto components includes engine and engine parts.

In this case, ABC & Co, has declared an operating profit margin of 7.5% (₹ 4.5 crores ₹ 60 crores × 100) which is less than the prescribed percentage under Rule 10TD and the Income Tax authorities shall not accept the transfer price declared by ABC & Co.

(i) Primary adjustment required to be made in A.Y. 2021-22: .

ABC & Co. has declared ₹ 4.5 crores and operating expenditure incurred is ₹ 60 crores. The operating profit margin acceptable as per safe harbour rules is 7.2 crores (12% of ₹ 60 crores).

Therefore primary adjustment required to made is ₹ 2.7 crores (₹ 7.2 crores – ₹ 4.5 crores).

Primary adjustment means the determination of transfer price in accordance with the ALP principle resulting in the total income or reduction in the loss of assessee.

(ii) The safe harbour rules shall not apply in respect of eligible international transactions entered into with an associated enterprise located in a notified jurisdictional area. Therefore, if the foreign entity is located in NJA, the safe harbour rules shall not be applicable, irrespective of the operating profit declared by the assessee.

![]()

Question 19.

(1) Explain with reasoning that the following statement is correct or not. Your answer should be based on the provisions of the In,come-tax Act, 1961.

Whether Assessing Officer can complete the assessment of income from international transaction in disregard of the order passed by the Transfer Pricing Officer (TPO) by accepting the contention of assessee?

(2) An advance pricing agreement once entered by the tax payer with the Income Tax authorities cannot be modified or revised. [CA Final Nov. 2019 (Old Syllabus)] [6 Marks]

Answer:

(1) As per Sec. 92CA, where a case in respect of international transaction has been referred to TPO, the TPO will determine the arm’s length price and send a copy of his order to the A.O. and the assessee. On receipt of the order, the A.O. shall proceed to compute the total income of the assessee u/s 92C in conformity with the arm’s length price as so determined by the TPO. Therefore, the A.O. has to compulsorily complete the assessment in conformity of the ALP determined by the TPO. Thus, it is clear that A.O. cannot complete assessment of income in disregard to the order passed by TPO by accepting contention of assessee.

(2) The statement is not correct.

As per Rule 10Q, an agreement, after being entered, may be revised by the board either suo moto or on the request of the assessee or the competent authority in India or the Director General oi Income-tax (International Taxation), if:

- there is a change in critical assumptions or failure to meet a condition subject to which the agreement has been entered into;

- there is a change in law that modifies any matter covered by the agreement but is not of the nature which renders the agreement to be non-binding ; or

- there is a request from competent authority in the other country requesting-revision of agreement, in case of bilateral or multilateral agreement.

![]()

Question 20.

Akanksha Ltd, an Indian Company, is engaged in the provision of Contract R & D services relating to generic pharmaceutical drug, to Palak Inc., a foreign company which guarantees 18% of the total borrowings of Akanksha Ltd. Palak Inc. is non-resident in India for P.Y. 2020-21. Akanksha Ltd assumes insignificant risk.

The aggregate value of transactions entered into by Akanksha Ltd. with Palak Inc., in the P.Y. 2020-21 is 75 crores. The declared Operating profit margin of Akanksha Ltd. is 7,50 crores and the Operating Expenses is 34 crores.

In the light of the above facts, please discuss whether the transfer price declared by the Akanksha Ltd., who have exercised a valid option for application of safe harbour rules, will be acceptable to the Income Tax Authorities. [CA Final Nov. 2019 (Old Syllabus] [6 Marks]

Answer:

Two enterprises are deemed to be associated enterprises if, at any time during the previous year, one enterprise guarantees 10% or more of the total borrowings of the other enterprise. Since, Palak Inc., a foreign company, guarantees 18% of the total borrowings of Akanksha-Ltd., an Indian company, they shall be deemed as associated enterprises.

Therefore, provision of contract R & D services relating to generic pharmaceutical drug by Akanksha Ltd., an Indian company, to Palak Inc., a foreign company, is an international transaction between the associated enterprises, and consequently, the provisions of transfer pricing shall be attracted.

In this case, Akanksha Ltd. has exercised a valid option for application of safe harbour rules. As per Safe Harbour Rules, where the eligible international transaction is in respect of provision of contract R&D services wholly or partly relating to generic pharmaceutical drugs, the operating profit margin declared by the assessee in relation to operating expense incurred shall not be less than 24% and the aggregate value of the transactions entered into during the previous year shall not exceed ₹ 200 crores.

Since the aggregate value of transactions entered into in the RY. 2020-21 does not exceed ₹ 200 crore, Akanksha Ltd., should have declared an operating profit margin of not less than 24% in relation to operating expense, to be covered within the scope of safe harbour rules.

In this case, Akanksha Ltd. has declared an operating profit margin of 22.06% (i.e. 7.5/34 × 100) which is not in accordance of safe harbour rules and therefore, the income tax authorities shall not accept the transfer price declared by Akanksha Ltd. in respect of such international transaction.

![]()

Question 21.

DIY Ltd. a cofnpany registered in India and subsidiary of CD Inc., a company registered in Austria. DIY Ltd. engaged in the manufacturing of fabric. To arrive at the arm’s length price applicable to its transactions with CD Inc., DIY Ltd. enters into an advance pricing agreement with the Board on 25th November, 2020. Accordingly, there will be a substantial change in the income of DIY Ltd. Also, DIY Ltd. wishes to apply for roll back provisions to P.Ys. 2016-17,2017-18,2018-19 and 2019-20. The A.O. wants to apply such transfer pricing provisions from the year in which DIY Ltd. became the subsidiary of CD Inc. i.e., A.Y. 2014-15 onwards.

DIY Ltd. had filed its return of income for the A.Y. 2020-21 on 26th Au-gust, 2020 and for A.Y. 2021-22, on 31st August, 2021. The assessment for A.Y. 2021-22 is pending on the date of entering into APA.

You are required to answer the following questions:

(i) Whether the A.O. is correct to apply the transfer pricing provisions from A.Y. 2014-15 onwards?

(ii) In respect of A.Y. 2018-19, the transfer price arrived at by the Board is resulting in reduction in income of the assessee. Discuss whether the roll back provisions can be applied for that assessment year as well.

(iii) What will happen to completed as well as pending assessments? [CA Final Nov. 2019 (New Syllabus)] [6 Marks]

Answer:

(i) As per section 92CC, the advance pricing agreement may provide for determining the Arm’s length price or specify the manner of in which Arm’s length price shall be determined in relation to International transaction entered into by a person during the Rollback years.

Rollback year means any previous year falling within the period not exceeding for previous years, preceding the first of the five consecutive previous years referred to in sec. 92CC(4)

In this case, DIY Ltd. has entered into advance pricing agreement on 25th November, 2020 Le. for the RY. 2020-21 and thus, Roll back provisions shall be applicable for preceding 4 years of P.Y. 2020-21 i.e. 2016-17 to 2019-20

Thus, the contention of A.O. to apply transfer pricing provision from A.Y. 2014-15 is not valid.

(ii) Roll back provision shall not be applicable in respect of an International transaction for a roll back year if the application of roll back provision has the effect of reducing the total income or increasing the loss, as the case may, be, of the applicant as declared in the ROI of the said year.

Since, in this case, the transfer price arrived at by the Board results into reduction in income of the assessee for A.Y. 2018-18 and therefore, roll back provisions shall not be applicable for A.Y. 2018-19.

![]()

(iii) The A.O. shall, in respect of completed assessments, proceed to assess or re-assess or re-compute the total income of the relevant assessment year in accordance with the agreement and such order shall be passed within 1 year from the end of the financial year in which the modified return is furnished.

In respect of pending assessments, the A.O. shall proceed to complete the assessment or reassessment proceedings in accordance with the agreement taking into consideration the modified return so furnished.