Double Taxation Relief – CA Final DT Question Bank is designed strictly as per the latest syllabus and exam pattern.

Double Taxation Relief – CA Final DT Question Bank

Question 1.

Mr. X aged 65 years and resident in India, received a dividend of ₹ 4,00,000 from shares held in a company situated in Hong Kong. His other incomes in India was ₹ 24,00,000. The company in Hong Kong deducted tax at source and no further tax is payable in respect of dividend income in Hong Kong. The Assessing Officer wants to tax the dividend income in India since Mr. X is a resident in India. Examine. [CA Final May 2010] [4 Marks]

Answer:

If there is a Double Taxation Avoidance Agreement (DTAA) between two countries, then taxability of income shall be governed by such DTAA.

As per the DTAA:

- Income is taxed in one of the countries

- If income is taxed in both the countries, then the tax paid in one country is allowed as deduction from the tax payable in other country.

Therefore, as per DTAA between India and Hong Kong, dividend will be taxed in either India or Hong Kong. Since it has been taxed in Hong Kong it shall not be taxable in India.

If DTAA provides that dividend is taxable in India as well as Hong Kong, then the tax deducted at source in Hong Kong will be allowed as deduction from tax payable in India.

If there is no DTAA between India and Hong Kong, then relief for double taxation can be claimed u/s 91.

![]()

Question 2.

Explain the context of provisions of the Act:

(i) The underlying idea behind DTAA

(ii) Rate of tax in other country [CA Final May 2011] [4 Marks)

Answer:

(i) The underlying idea behind DTAA entered between two countries is to promote mutual economic relations by relieving the taxpayers from the burden of paying tax twice on the same income in two different countries.

(ii) Rate of tax in the other country means income tax and super tax actually paid in that country in accordance with the corresponding laws in force in that country after deduction of all relief due, but before deduction of any relief due in the said country on account of double taxation, divided by the whole amount of income assessed in that country.

Question 3.

Nandita, an individual resident retired employee of the Prasar Bharti aged, 60 years, is a well-known dramatist deriving income of ₹ 1,10,000 from theatrical works played abroad. Tax of ₹ 11,000 was deducted in the country where the plays were performed. India does not have any DTAA u/s 90 with that country. Her income in India amounted to ₹ 6,15,000. In view of tax planning, she has deposited ₹ 70,000 in PPF and paid contribution to approved pension fund of LIC ₹ 32,000. She also contributed ₹ 18,000 to Central Government Health Scheme during the previous year and gave payment of medical insurance premium of ₹ 21,000 to insure the health of his father, a non-resident aged 76 years, who is not dependent on her. Compute tax liability of Nandita for the A.Y. 2021-22. [CA Final May 2011] [8 Marks]

Answer:

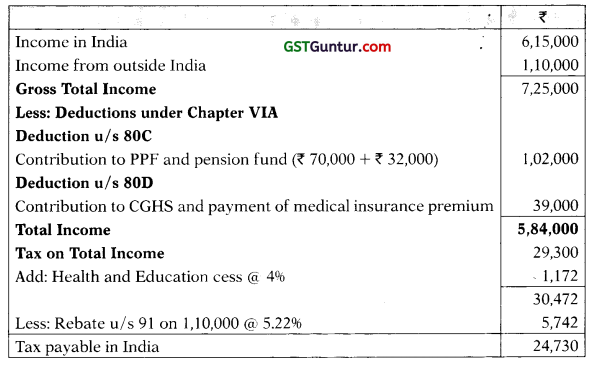

Computation of Total Income and Tax Payable by Nandita for A.Y. 2021-22 If she does not opt for Sec. 115BAC

Note: Relief u/s 91 is allowed on doubly taxed income at lower of the following:

![]()

Average rate of tax in foreign Country:

\(\frac{\text { Foreign Income Tax }}{\text { Foreign Total Income }}\) × 100 = ₹ \(\frac{11,000}{1,10,000}\) × 100 = 10%

Average rate of tax in India:

\(\frac{\text { Tax payable in India }}{\text { Total Income }}\) × 100 = ₹ \(\frac{30,472}{5,84,000}\) × 100 = 5.22%

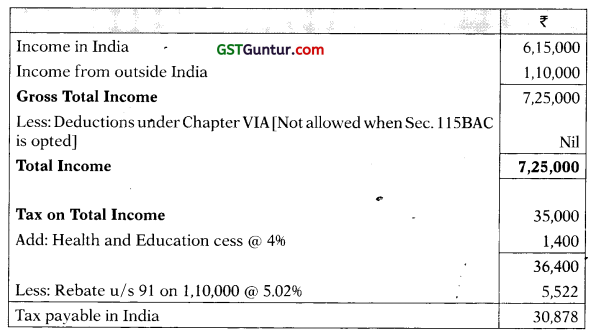

Computation of Total Income and Tax Payable by Nandita for AY. 2021-22 If she opts for Sec. 11 5BAC

Note: Relief u/s 91 is allowed on doubly taxed income at lower of the following:

Average rate of tax in foreign Country:

\(\frac{\text { Foreign Income Tax }}{\text { Foreign Total Income }}\) × 100 = ₹ \(\frac{11,000}{1,10,000}\) × 100 = 10%

Average rate of tax in India:

\(\frac{\text { Tax payable in India }}{\text { Total Income }}\) × 100 = ₹ \(\frac{36,400}{7,25,000}\) × 100 = 5.02%

Tax liability is lower when Nandita does not opt for Sec. 115BAC.

![]()

Question 4.

Explain the term “Bilateral Relief” in the context of Double Taxation Avoidance Agreement. [CA Final Nov. 2011] [4 Marks]

Answer:

Where a taxpayer is resident in one country but has a source of income in another country, it gives rise to possible double taxation. The Governments of two countries may enter into DTAA to provide relief to the taxpayers from the burden of paying tax twice on the same income by devising mechanism to grant relief as per mutual agreement. This is called bilateral relief.

Bilateral Relief may be granted by way of the following methods:

(a) Exemption method: Under this method, the incomes which are likely to be taxed in both the countries are taxed only in one of the two countries and the other country provides complete exemption from tax on such incomes.

(b) Tax credit method: Under this method, the assessee is liable to have his income taxed in both the countries. The home country calculates tax after including the income earned in source country. Thereafter, the home country allows deduction of the tax paid in source country from the tax payable in its country.

Note: In India, double taxation relief is provided for in sections 90 and 90A, either by way of granting relief in respect of income-tax paid in India and the other country or specified territory or by way of avoidance of double taxation of income in India and the other country or specified territory.

![]()

Question 5.

“The existence of a website on Indian Soil constitutes a permanent establishment”. Is this statement correct? Examine. [CA Final May 2012] [4 Marks]

Answer:

As per section 92F(iiia), “permanent establishment” includes a fixed place of business through which the business of the enterprise is wholly or partly carried on.

It includes (a) a place of management (b) a branch, (c) an office, (d) a factory, (e) a workshop, (f) mines, (g) warehouse, etc.

A website is a set of web documents belonging to a particular organization. It consists of data and programs in digital form, from which it is stored in a server which is accessible through internet.

A website does not normally imply “a fixed place of business”, even though in case of some entities, some business could be transacted through a website. Thus, the mere presence of a website in Indian soil, without anything more, will not amount to a permanent establishment.

If the website contains merely information about the concern, the website cannot be regarded as a permanent establishment. Where the website is being using as a virtual office for transacting orders of purchases or sales or for rendering services on a more than casual basis, then it could be regarded as a permanent establishment.

![]()

Question 6.

Z, a resident Indian aged 21 years, earned a sum of ₹ 10 lakhs during the previous year 2020-21 from playing badminton matches in a country with which India does not have DTAA. Tax of ₹ 2 lakhs was levied on such income in the source country. In India he earned ₹ 15 lakhs during the P.Y. 2020-21 from playing badminton matches. He has deposited ₹ 1 lakh in PPF during the year. Compute his income tax liability for A.Y. 2021-22 by assuming Z has not opted for Sec. 115BAC. [CA Final May 2013] [8 Marks]

Answer:

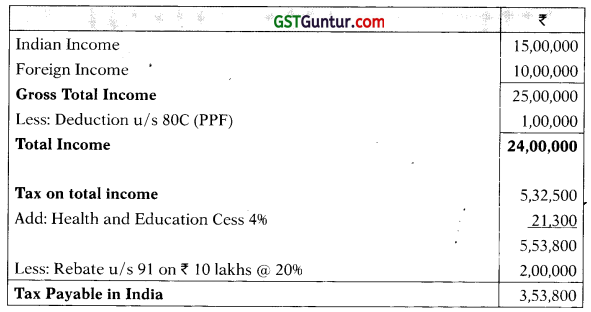

Computation of Income Tax Liability of Z for A.Y. 2021-22

Note:

Relief u/s 91 is allowed on doubly taxed income at lower of the following:

Average rate of tax in foreign Country:

\(\frac{\text { Foreign Income Tax }}{\text { Foreign Total Income }}\) × 100 = ₹ \(\frac{2,00,000}{10,00,000}\) × 100 = 20%

Average rate of tax in India:

\(\frac{\text { Tax payable in India }}{\text { Total Income }}\) × 100 = ₹ \(\frac{5,53,800}{24,00,000}\) × 100 = 23.07%

![]()

Question 7.

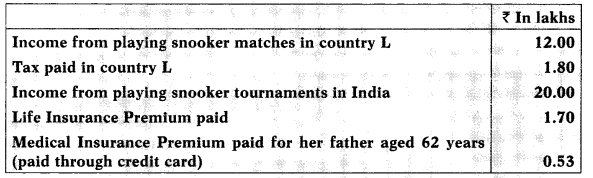

Following are the particulars of income earned by Miss Vivitha, a resident Indian aged 25, for the A.Y. 2021-22:

Compute her total income and tax payable by her for the assessment year 2021-22. There is no Double Taxation Avoidance Agreement between India and country L. [CA Final May 2014, May 2013] [8 Marks]

Answer:

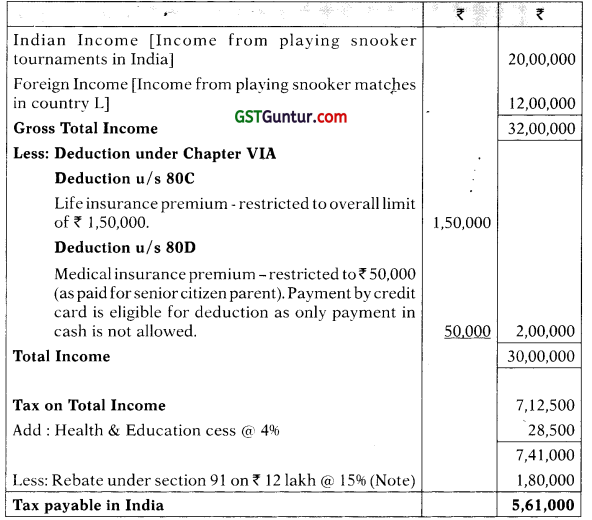

Computation of total income and tax liability of Miss Vivitha for A.Y. 2021-22 when she does not opt for Sec. 115BAC

Note: Relief u/s 91 is allowed on doubly taxed income at lower of the following:

Average rate of tax in foreign Country:

\(\frac{\text { Foreign Income Tax }}{\text { Foreign Total Income }}\) × 100 = ₹ \(\frac{1,80,000}{12,00,000}\) × 100 = 15%

Average rate of tax in India:

\(\frac{\text { Tax payable in India }}{\text { Total Income }}\) × 100 = ₹ \(\frac{7,41,000}{30,00,000}\) × 100 = 24.70%

Computation of total income and tax liability of Miss Vivitha for A.Y. 2021-22 when she opts for Sec. 115BAC

Note: Relief u/s 91 is allowed on doubly taxed income at lower of the following:

Average rate of tax in foreign Country:

\(\frac{\text { Foreign Income Tax }}{\text { Foreign Total Income }}\) × 100 = ₹ \(\frac{1,80,000}{12,00,000}\) × 100 = 15%

Average rate of tax in India:

\(\frac{\text { Tax payable in India }}{\text { Total Income }}\) × 100 = ₹ \(\frac{7,25,400}{32,00,000}\) × 100 = 22.67%

Tax liability is lower when Miss Vivitha opts for Sec. 115BAC.

![]()

Question 8.

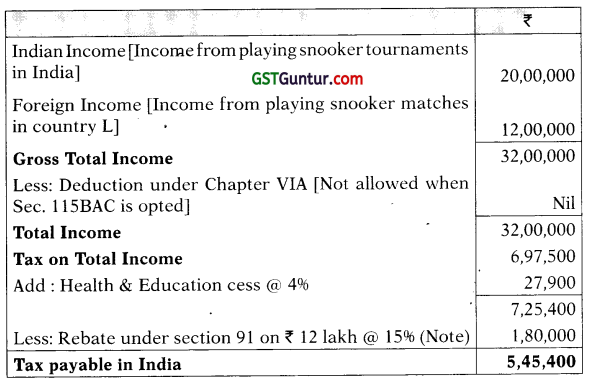

Mr. Kamesh, a resident in India, furnishes the following particulars of income earned in India, Country “X” and Çountry “Y” for P.Y. 2020-21. India has not entered into DTAA with these two countries.

Business Loss in Country “Y” not eligible for set off against other incomes as per law of that country. The rates of tax in Country “X” and Country “Y” are 10% and 25% respectIvely. Compute total income and tax payable by Mr. Kamesh in India for AY. 2021-22. Ignore Sec. 11 5BAC. [CA Final Nov. 2015] [7Marks]

Answer:

Note: Relief u/s 91:

Average rate of tax in India:

\(\frac{\text { Tax payable in India }}{\text { Total Income }}\) × 100 = ₹ \(\frac{2,09,352}{12,96,000}\) × 100 = 16.15%

Average Rate of Tax in Country “X” and Country “Y” is already given as 10% and 25% respectively.

As per the case of CIT v. Bombay Burmah Trading Corporation Ltd. [2003] (Mum.), the relief u/s 91 shall be calculated on the income country-wise and not on the basis of aggregation of income from all foreign sources. Thus, in case of Country “X” relief will be given at the rate of 1096 and in case of Country “Y” relief will be given at the rate of 16.15%.

![]()

Question 9.

Ravinder, a non-resident, had maintained his permanent house both in U.A.E. and in India during the previous year ended on 31.3.2021 but was having his habitual abode in U.A.E. because of employment. He had income in India from dividend, interest and capital gains during the previous year ended on 31.3.2021 which are not subject to tax under any law in force in U.A.E. There exists a DTAA between India and U.A.E. Ravinder claims that none of the income earned by him in India shall be subject to tax ih India because of the benefits available to him under DTAA.

Is the contention of Ravinder correct? [CA Final May 2016] [4 Marks]

Answer:

Section 90(2) provides that where the Central Government has entered into an agreement with the Government of any other country for granting tax relief or for avoidance of double taxation, then, in relation to the assessee to whom such agreement applies, the provisions of Income-tax Act shall apply to the extent they are more beneficial to the assessee.

Since, Mr. Ravinder has a permanent home in UAE and he also has a habitual abode in that country due to his employment in UAE, he shall be deemed to be resident of UAE for A.Y. 2021-22

However, in order to claim relief under the Double Taxation Avoidance Agreement (DTAA), Mr. Ravinder has to obtain a Tax Residency Certificate (TRC) declaring his residence of UAE from the Government of that country. Further, he also has to provide such other documents and information, as may be prescribed.

As regards, dividend income (taxable in the hands of shareholders after amendment by Finance Act, 2020), interest income and capital gains, if a concessional rate of tax is provided under the DTAA with UK, such income would be subject to tax at such concessional rate in the hands of Mr. Madhvesh. If the concessional rates provided under the Income-tax Act in respect of dividend, interest and capital gains are more beneficial, then the I income would be subject to tax at such concessional rates in India.

Therefore, the contention of Mr. Ravinder is not entirely correct, since the DTAA does not provide for exemption from income-tax in India, of all such a income earned in India, in totality.

![]()

Question 10.

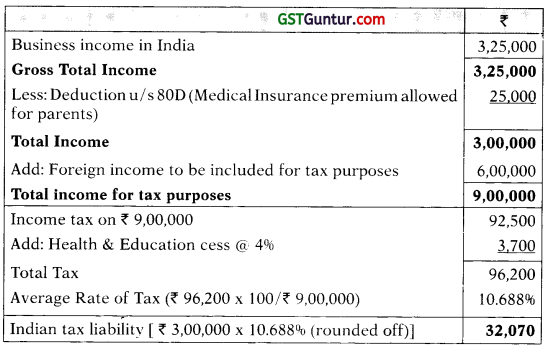

During the previous year 2020-21, Ms. Indu, a citizen of India is a § resident of both India and a foreign country with which India has a Double Tax Avoidance Agreement (DTAA), which provides that “the income would be taxable in country where it is earned and not in other country, but would be included for computation of tax rate in such other country”. Her income is ₹ 3,25,000 from business in India and ₹ 6,00,000 from business in foreign country. In foreign country the rate of tax is 20%. During the year she paid a premium of ₹ 32,000 to insure the health of-her mother, a non-resident, aged 82 years, not dependent on her, through her credit card.

(i) Compute the tax payable by Ms. Indu in India for the A.Y. 2021-22

(ii) Also, show the tax payable by Ms. Indu in India, had there been no DTAA with such foreign country.

Assume Ms. Indu has not opted for Sec. 115BAC. [CA Final Nov. 2016] [6 Marks]

Answer:

Tax payable by Ms. Indu in India for A.Y. 2021-22, where there is DTAA with the foreign country.

Note: Deduction under section 80D shall be available for only ₹ 25,000 as the premium paid by Ms. Indu is on the health of her mother who will not be considered as Senior Citizen, being a non-resident.

(ii) Tax payable by Ms. Indu for A.Y. 2021-22, where there is no DTAA with the foreign country

Note: Relief u/s 91 is allowed on doubly taxed income at lower of the following:

Average rate of tax in foreign Country:

\(\frac{\text { Foreign Income Tax }}{\text { Foreign Total Income }}\) × 100 = ₹ \(\frac{1,20,000}{6,00,000}\) × 100 = 20%

Average rate of tax in India:

\(\frac{\text { Tax payable in India }}{\text { Total Income }}\) × 100 = ₹ \(\frac{96,200}{9,00,000}\) × 100 = 10.688%

![]()

Question 11.

The concept of Permanent Establishment is one of the most important concepts in determining the tax implications of cross border transactions. Explain the significance thereof, when such transactions are governed by Double Taxation Avoidance Agreements (DTAA). [CA Final Nov. 2017, Nov. 2014] [4 Marks]

Answer:

Double Taxation Avoidance Agreements (DTAAs) generally contain an Article providing that business income is taxable in the country of residence, unless the enterprise has a permanent establishment in the country of source, and such income can be attributed to the permanent establishment.

As per section 92F(iiia), the term “Permanent Establishment” includes a fixed place of business through which the business of an enterprise is wholly or partly carried on.

Sec. 9(1)(i) requires existence of business connection for deeming business income to accrue or arise in India. DTAAs however provide that business income is taxable only if there is a permanent establishment in India.

Therefore, in cases covered by DTAAs, where there is no permanent establishment in India, business income cannot be brought to tax due to existence of business connection as per section 9(1)(i).

However, in cases not covered by DTAAs, business income attributable to business connection is taxable.

![]()

Question 12.

Mr. A Is taxable In case of certain income as per the Income-tax Act, 1961. The DTAA, which is applicable to him, excludes the income earned by him from the purview of tax. Is Mr. A liable to pay tax on the income earned by him under Income Tax Act, 1961? [CA Final May 2018 (Old Syllabus)] [4 Marks]

Answer:

As per Sec. 90(2), where the Central Government has entered into an agreement with the Government of a foreign country or specified territory outside India to provide relief from double taxation or for avoidance of double taxation, the provisions of Income-tax Act will not apply to the assessees who are covered by such Double Taxation Avoidance Treaty.

However, if the provisions of the Income-tax Act are more beneficial to assessee, such beneficial provisions will supersede the provisions of Double Taxation Avoidance Treaty.

In this case, DTAA is applicable to Mr. A which excludes the income earned by him from the purview of tax whereas the Income-tax Act taxed the same income in the hands of Mr. A. Since, the provisions of Income-tax Act are not beneficial to Mr. A, the provisions of DTAA will be applicable to him and therefore, Mr. A is not liable to pay the tax on the income earned by him under the Income-tax Act, 1961.

![]()

Question 13.

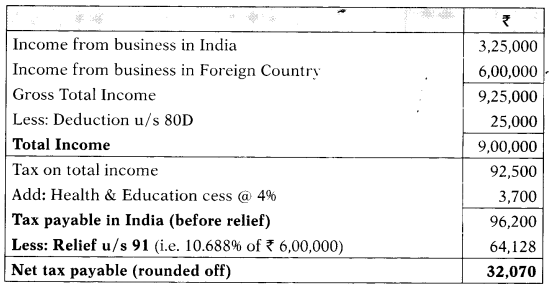

Smt. Laxmi (age 70), resIdent Individual furnishes you the following particulars for the P.Y. 2020-21:

| ₹ | |

| Income from Business in India (computed) | 6,00,000 |

| Loss from let out property at Chennai | 4,40,000 |

| Dividend received from a domestic company | 12,00,000 |

| Business income in country “B” (tax paid thereon at 20%) | 4,00,000 |

| Rental income from property at Mumbai (computed) | 1,80,000 |

Note: Assume that there is no DTAA between India and country “B”.

Compute the total income and tax payable by Smt. Laxml for the AY. 2021-22 under the normal provisions (i.e. without Sec. 115BAC). [CA Final May 2018 (Old Syllabus)] [6 Marks]

Answer:

Computation of Total Income and the tax payable of Smt. Laxmi for , the A.Y. 2021-22

Notes:

1. Relief u/s 91 is allowed on doubly taxed income at lower of the following:

Average rate of tax in foreign Country:

\(\frac{\text { Foreign Income Tax }}{\text { Foreign Total Income }}\) × 100 = ₹ \(\frac{80,000}{4,00,000}\) × 100 = 20%

Average rate of tax in India:

\(\frac{\text { Tax payable in India }}{\text { Total Income }}\) × 100 = ₹ \(\frac{1,76,800}{20,00,000}\) × 100 = 8.84%

2. As per Sec. 71(3A), where there is loss under the head ‘Income from . House Property’ and the assessee has income assessable under any other head of income, then the assessee shall not be entitled to set-off such loss exceeding ₹ 2,00,000 against income under the other head for any assessment year.

Such unabsorbed loss exceeding ₹ 2,00,000 which could not be set-off shall be allowed to be carried forward to subsequent years for set-off as per the normal provisions. Therefore, the unabsorbed loss of ₹ 60,000 (₹ 4,40,000 – ₹ 1,80,000 – ₹ 2,00,000) shall be carried forward for subsequent years.

![]()

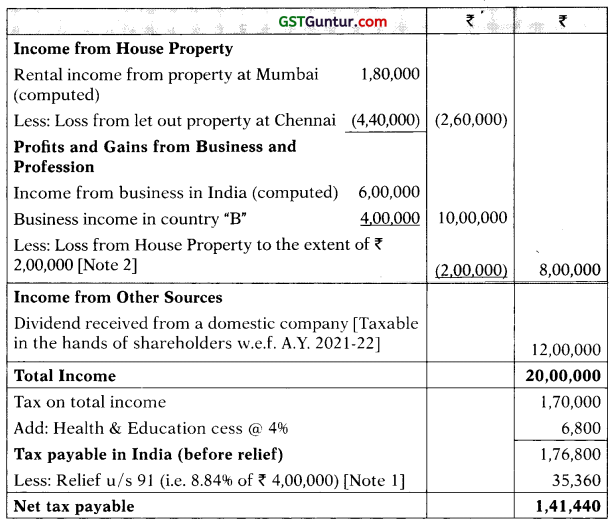

Question 14.

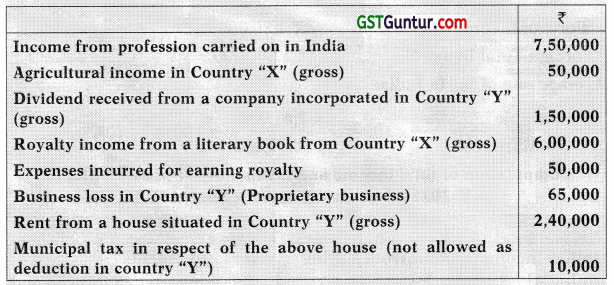

Amrutha is resident Individual. She has Income from the following sources:

(i) Taxable Income from a Sole-Proprietary concern in Kochi ₹ 50 lakhs.

(ii) Share of Profit from a Partnership firm in Chennal ₹ 30 Lakhs.

(iii) Agricultural Income from rubber estate in Country A which has no DTAA with India, USD 70,000. Withholding Tax on the above Income USD 10,500 (Assume 1 USD = 64).

(iv) Brought forward Business Loss in Country A was USD 10,000 which is not permitted to be set off against other income as per the laws of that country.

Compute taxable income and tax payable by Amrutha for the Assessment Year 2021-22. Ignore Sec. 115BAC. [CA Final May 2018 (.New Syllabus)] [6 Marks]

Answer:

Computation of Taxable income and tax payable by Amrutha for A.Y. 2021 -22

Notes:

1. Relief u/s 91 is allowed on doubly taxed income at lower of the following:

Average rate of tax in foreign Country:

\(\frac{\text { Foreign Income Tax }}{\text { Foreign Total Income }}\) × 100 = \(\frac{\$ 10,500}{\$ 70,000}\) × 100 = 15%

Average rate of tax in India:

\(\frac{\text { Tax payable in India }}{\text { Total Income }}\) × 100 = ₹ \(\frac{28,19,388}{88,40,000}\) × 100 = 31.89%

2. Share of profit of ₹ 30 lakhs from a partnership firm in Chennai shall be exempt u/s 10(2A).

3. It is assumed that the agricultural income of USD 70,000 is the gross amount i.e. including withholding tax.

![]()

Question 15.

Discuss the correctness or otherwise of the following with reference to the provisions of Income-tax Act, 1961:

The double taxation avoidance treaties entered into by the Government of India override the domestic law. [CA Final Nov. 2018 (Old Syllabus), May 2016] [2 Marks]

Answer:

The statement is correct.

Section 90(2) provides that where a DTAA is entered into bylbeTjovernment, the provisions of the Income-tax Act, 1961 would apply to the extent they are more beneficial to the assessee.

In case of any conflict between the provisions of the DTAA and the Income- tax Act, 1961, the provisions of the DTAA would prevail over the Act in view of the provisions of section 90(2), to the extent they are more beneficial to the assessee [CIT v. P.V.A.L. Kulandagan Chettiar (2004) 267ITR 654 (SC)].

Question 16.

Discuss the correctness or otherwise of the following with reference to the provisions of Income-tax Act, 1961:

Rakesh is resident in India during the previous year ended 31.03.2021 and had agricultural income of ₹ 20 lakhs from the lands located in Pakistan. He had paid tax on such agricultural income in Pakistan for which he is not entitled for a deduction from the tax payable in India. [CA Final Nov. 2018 (Old Syllabus)] [2 Marks]

Answer:

The statement is not correct.

Agricultural income from lands located outside India would not be exempt u/s 10(1) in India in the hands of a resident but would be chargeable to tax in his hands in India.

However, while computing Rakesh’s income-tax liability in India, he would be entitled for a deduction in respect of tax paid on agricultural income in Pakistan under any law for the time being in force in that country from the tax payable by him in India.

![]()

Question 17.

Mr. Manav, a resident, has derived certain income from a nation Q with which no DTAA exists. In Q, any Income chargeable to tax is charged at a flat rate of 18%.

Mr. Manav has derived the following income from Q:

(i) Agricultural income from lands in Q ₹ 14 lakhs

(ii) Share income from a partnership firm in Q ₹ 18 lakhs In nation Q, agricultural income is exempt and does not form part of total income. State with reasons, whether, Mr. Manav (assessee) can claim ; double taxation relief in respect of the above two items of income and also ! determine the quantum of double taxation relief available. The “Indian rate of tax” may be taken as 20%. [CA Final Nov. 2018 (New Syllabus)] [6 Marks]

Answer:

Where there is no agreement to avoid double taxation or provide relief I against double taxation with a foreign country, the Indian Government provides unilateral relief on doubly taxed income against income tax payable in India provided the following conditions are satisfied:

(a) The assessee is resident in India during the relevant previous year.

(b) The foreign income, taxable in India, accrues or arises outside India during that previous year.

(c) Such income is not deemed to accrue or arise in India during the previous year.

(d) The assessee has paid tax on such foreign income outside India either by way of deduction of tax at source or otherwise.

Since all the conditions mentioned above are fulfilled, Mr. Manav is eligible for deduction under section 91 in respect of double taxed income.

Agricultural income from lands located outside India would not be exempt from income tax in India under section 10(1) in the hands of a resident. The said income would be chargeable to tax in his hands in India.

Share income from a partnership firm in County Q would not be exempt from income-tax in India under section 10(2A) in the hands of a partner. The same would be chargeable to tax in his hands in India.

Thus, both the above items of income are chargeable to tax in India in the hands of Mr. Manav.

However, he would not be eligible for deduction under section 91 in respect of agricultural income from lands in Country Q since such income is exempt in Country Q and consequently, is not a doubly taxed income.

In case of unilateral relief, the assessee shall be entitled to relief on the amount of doubly taxed income either at the average rate of Indian Income Tax or at the average rate of Foreign Income Tax, whichever is lower.

Therefore, Mr. Manav is entitled for deduction under section 91 @ 18% i.e. rate of tax in Country Q since it is lower than Indian rate of tax. Accordingly, deduction under section 91 available to Mr. Manav would be ₹ 3,24,000, being 18% of ₹ 18,00,000.

![]()

Question 18.

T Inc., a non-resident entity incorporated in Mauritius, has permanent Establishment (PE) in India. The PE filed its return of income for the assessment year 2021-22 disclosing income ₹ 100 lakhs and paid tax at the rate applicable to the domestic company i.e. 30% plus applicable surcharge and cess on the basis of paragraph 2 of Article 24 of Double Tax Avoidance Agreement (non-discrimination) between India and Mauritius, which reads as follows:

“The taxation on PE which is an enterprise of a contracting state has in the other contracting state shall not be less favorably levied in that other state than the taxation levied on enterprise of that other state carrying on the same activities in the same circumstances.”

However, the Assessing Officer computed the Tax on the PE at the rate applicable to a foreign company (40%). Is the action of A.O. in accordance with law? [CA Final Nov. 2018 {New Syllabus), May 2010] [4 Marks]

Answer:

As per section 90(2), where the Central Government has entered into an agreement for avoidance of double taxation with a Foreign Government then, in relation to the assessee to whom such agreement applies, the provisions of the Income-tax Act, 1961 shall apply to .the extent they are more beneficial to the assessee.

Thus, in view of paragraph 2 of the Article 24 (Non-Discrimination) of the DTAA, it appears that the PE of T Inc., incorporated in Mauritius, is liable to tax in India at the rate applicable to domestic company (30%), which is lower than the rate of tax applicable to a foreign company (40%).

However, Explanation 1 to section 90 clarifies that the charge of tax in respect of a foreign company at a rate higher than the rate at which a domestic company is chargeable, shall not be regarded as less favorable charge or levy of tax in respect of such foreign company.

Therefore, in view of this Explanation, the action of the Assessing Officer in levying tax @ 40% on the PE of T, Inc., is in accordance with law.

![]()

Question 19.

Alpha Inc., a non-resident company has an IT enabled business process outsourcing Unit in India (BPO) and it provides certain outsourcing services to a resident Indian entity.

Discuss, the tax implications, in the hand of Alpha Inc. due to presence of BPO unit in India. [CA Final Nov. 2018 {New Syllabus)] [3 Marks]

Answer:

If there is no business connection between Alpha Inc. and resident Indian entity, the resident entity may not be a Permanent Establishment (PE) of Alpha Inc., and the resident entity would have to be assessed to income-tax as a separate entity. In such a case, the Alpha Inc. will not be liable under the Income-tax Act, 1961.

However, if Alpha Inc. is having business connection with the resident Indian entity, then resident Indian entity could be treated as the PE of Alpha Inc.

Alpha Inc. will be liable to tax in India only if the IT enabled BPO in India I constitutes its PE. Alpha Inc. is treated as having a PE in India if its carries on business in India through a branch, sales office etc. or through an agent (other than an independent agent) who habitually exercises an authority to conclude contracts or regularly delivers goods or merchandise or habitually secures orders on behalf of the non-resident principal.

Therefore, if the presence of BPO unit in India constitutes PE of Alpha Inc., Alpha Inc. will be liable to tax in India in respect of the profits attributed to the PE in India as if it were a distinct and separate enterprise.

![]()

Question 20.

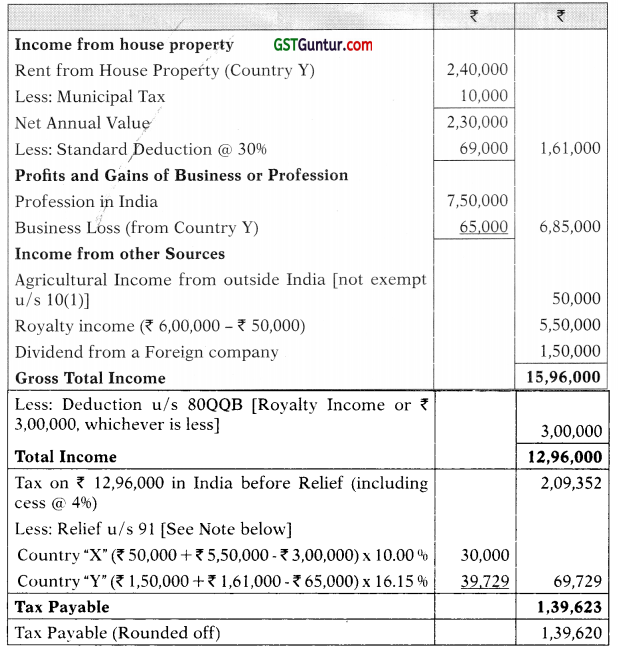

Mr. Kalpesh, aged 56 years, a resident individual furnishes the following particulars of income earned by him in India and country “T” for the P.Y. 2020-21. India has not entered into DTAA with country “T”.

| ₹ | |

| Income from profession carried on in India | 6,00,000 |

| Agricultural income in Country “T” | 75,000 |

| Dividend from a company incorporated in Country “T” | 1,20,000 |

| Royalty income from a literary book from Country “T” , | 4,00,000 |

| Expenses incurred for earning royalty | 60,000 |

| Business loss in Country “T” | 75,000 |

As per income tax law of Country “T” Business loss is not eligible for set off against any other income. The rate of income tax in country “T” is 20%.

Compute total income and tax payable by Mr. Kalpesh in India for A.Y. 2021-22 assuming that he satisfies all conditions for the purpose of section 91. [CA Final May 2019 (Old Syllabus)] [6 Marks]

Answer:

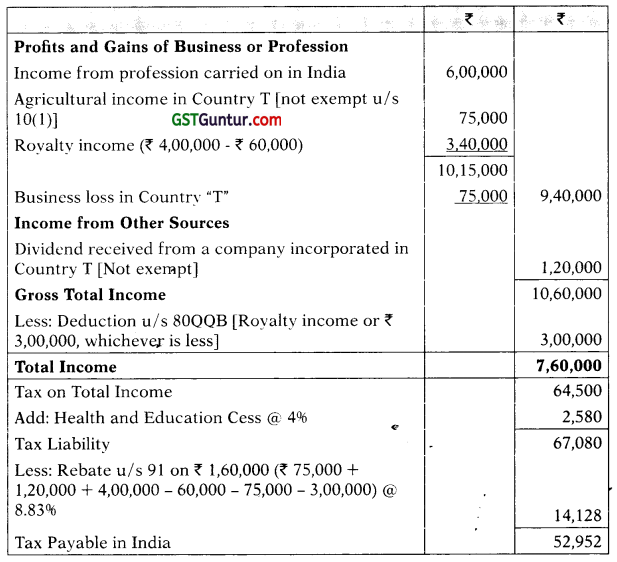

Computation of Total Income of Mr. Kalpesh for A.Y. 2021-22

Notes:

Relief u/s 91 is allowed on doubly taxed income at lower of the following:

Average rate of tax in foreign Country: 20%

Average rate of tax in India:

\(\frac{\text { Tax payable in India }}{\text { Total Income }}\) × 100 = ₹ \(\frac{67,080}{7,60,000}\) × 100 = 8.83%

![]()

Question 21.

Mr. S is a performing musician, resident of India. He has the following income for the year ended 31.03.2021.

(1) Income from music performances in India ₹ 5,00,000.

(2) Income from Country A with which India does not have any DTAA ₹ 5,00,000. Tax deducted from this income was at 20%.

(3) Income from Country B during January 2020 ₹ 1,00,000, July 2020 ₹ 1,00,000 and January 2021 ? 3,00,000. Tax withheld by Country B is at 10%.

Country B follows Calendar year for its tax purposes. India has entered into a DTAA with Country B.

(4) Rent received from his property at Chennai ₹ 30,000 per month.

(5) Contribution to PPF is ₹ 1,50,000.

Compute tax payable by Mr. S for A.Y. 2021-22. Give necessary working notes for your answer. [CA Final Nov. 2019 (Old Syllabus)] [6 Marks]

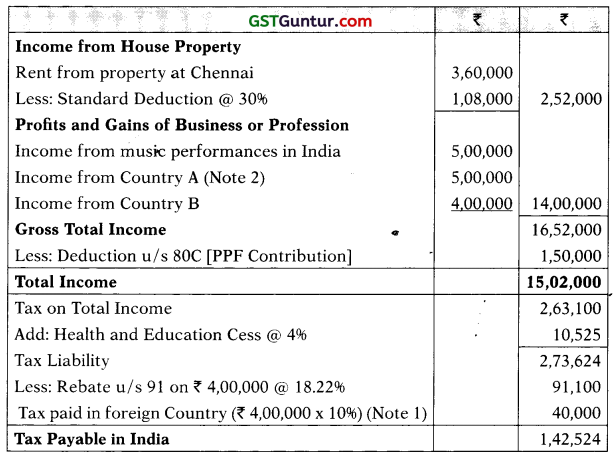

Answer:

Notes:

1. Since, nothing has been given in the question in respect of treatment related to income from Country with which India has entered into DTAA, it is assumed that relief shall be available under tax credit method.

2. Income from Country B during January, 2020 had already been taxed in the P.Y. 2019-20 and therefore, income received in July, 2020 and January, 2021 shall only be taxable in the P.Y. 2020-21 in India.

3. Relief u/s 91 is allowed on doubly taxed income at lower of the following:

Average rate of tax in India:

\(\frac{\text { Tax payable in India }}{\text { Total Income }}\) × 100 = ₹ \(\frac{2,73,624}{15,02,000}\) × 100 = 18.22%

Average rate of tax in foreign country is 20% (given). Therefore, relief u/s 91 shall be available @ 18.22%

![]()

Question 22.

Miss Sapna, a resident of India and a salaried employee employed with a private co., aged 30 years, received the following sums during the P.Y. 2020-21.

| Basic Salary | ₹ 45,000 p.m. |

| DA | 10% of basic salary |

| Transport Allowance | ₹ 8,000 p.m. |

| Medical Allowance | ₹ 3,500 p.m. |

She contributed ₹ 25,000 to approved Pension fund of LIC. She also paid ₹ 1,75,000 by account payee cheque for Mediclaim premium to insure the health of her father, aged 65 years, who is not dependent on her as a lump 5 sum payment for 5 years including the current previous year.

‘Y Apart from this, she also provided guest lecture to a foreign university ; during the year. She received ₹ 7,92,000 from such uriiversity after deduction of tax of ₹ 1,08,000 in the country in which such university is located. India does not have any DTAA u/s 90 with that country. Compute the tax liability of Ms. Sapna for the A.Y. 2021-22 [CA Final Nov. 2019 (New Syllabus)] [6 Marks]

Answer:

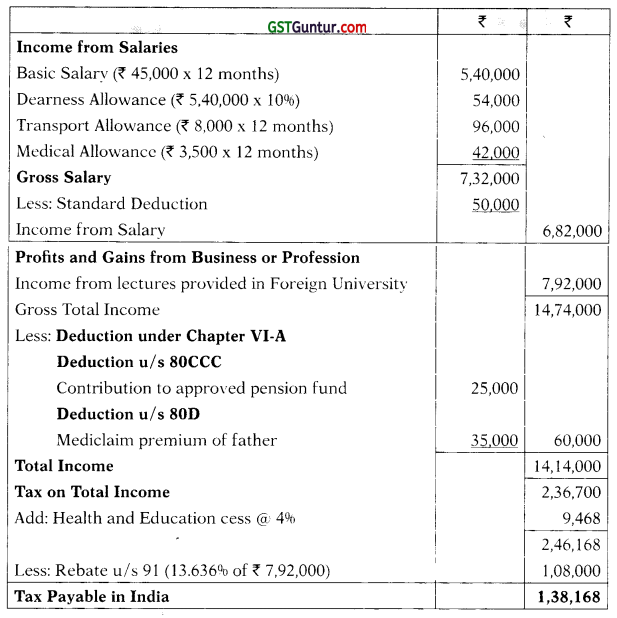

Computation of Taxable Income and Tax Payable by Miss Sapna for A.Y. 2021-22

![]()

Notes:

1. As per the Amendment made by the Finance Act, 2018 in Sec. 80D,

where the lump sum amount is paid in respect of insurance on the health of any person for more than a year, then deduction shall be allowed for each of the relevant previous year equal to the appropriate I fraction of the amount. Therefore, out of the total premium paid of ₹ 1,75,000, ₹ 35,000 (₹ 1,75,000/5) shall be allowed as deduction in the A.Y. 2021-22.

2. Relief u/s 91 is allowed on doubly taxed income at lower of the following:

Average rate of tax in foreign Country:

\(\frac{\text { Foreign Income Tax }}{\text { Foreign Total Income }}\) × 100 = ₹ \(\frac{1,08,000}{7,92,000}\) × 100 = 13.63%

Average rate of tax in India:

\(\frac{\text { Tax payable in India }}{\text { Total Income }}\) × 100 = ₹ \(\frac{2,46,168}{14,14,000}\) × 100 = 17.409%