Taxation of Firms, LLP and AOP/BOI – CA Final DT Question Bank is designed strictly as per the latest syllabus and exam pattern.

Taxation of Firms, LLP and AOP/BOI – CA Final DT Question Bank

Question 1.

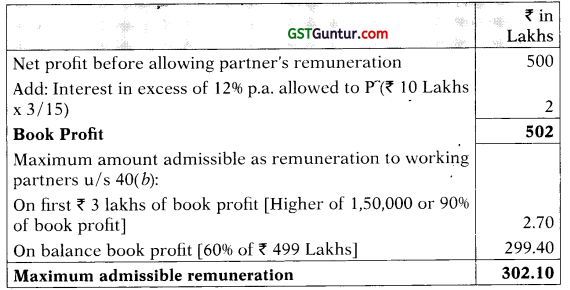

PQR LLP has a profit of ₹ 500 Lakhs after charging interest on capital of one of its partners ‘P’ amounting to ₹ 10 Lakhs calculated at 15% p.a. as per the agreement, but before considering remuneration to partners. What is the maximum admissible amount of remuneration to partners assuming all the partners are working partners and remuneration is authorised by the LLP instrument? [CA Final Nov. 2010] [2 Marks]

Answer:

Maximum admissible remuneration allowable to working partners

![]()

Question 2.

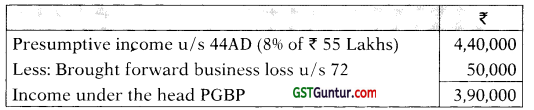

A partnership firm consisting of three partners X, Y and Z is engaged in the business of selling toys.

Turnover of the business for the year ended 31.03.2021 amounts to ₹ 55 Lakhs. Bad Debts written off in the books are ₹ 75,000. Interest at 12% is provided to partner Z on his capital of ₹ 6 Lakhs as authorised by the partnership deed.

The firm had business loss of ₹ 50,000 and unabsorbed depreciation of ₹ 1,50,000 carried forward from A. Y. 2020-21. The firm opts for presumptive taxation u/s 44AD for A.Y. 2021-22.

(i) Compute the income of the firm chargeable under the head “Profits and Gains of Business or Profession”

(ii) What would be the liability for interest u/ss 234B and 234C, if the firm has not paid any advance tax? [CA Final Nov. 2011] [4 Marks]

Answer:

(i) Computation of income of the firm under the head ‘Profits and Gains of business or profession’

Note: As per section 44AD, all deductions allowable u/ss 30 to 38 shall be deemed to have been allowed in full and no further deduction shall be allowed. Therefore, no deduction shall be allowed for bad debts since the same is deductible u/s 36( 1)( vii) and unabsorbed depreciation since the same is deductible u/s 32(2), ‘

Further, deduction for payment of remuneration and interest to partners u/s 40(h) shall NOT be allowed from the presumptive income

u/s44AD.

(ii) Advance tax is payable even on incomes covered under the presumption income scheme. However, in such case, the advance tax is not to be paid in instalment but in one go, i.e. the whole advance tax related to such business is to be paid on or before 15lh March of the relevant Financial year.

![]()

Question 3.

The partnership deed of a firm does not specify the remuneration payable to each individual working partner but lays down the manner of fixing the remuneration as follows:

In case the book profits of the firm are up to ₹ 3 lakhs, then the partners would be entitled to remuneration up to ₹ 1.50 lakhs or 90% of book profits, whichever is more. In respect of balance book profits, it is 60%’. “Book profits” shall be computed as defined in section 40(h) of the Income-tax Act, 1961. In case there is a loss in a particular year, the partners shall not be entitled to any remuneration. Remuneration payable to the working partners should be credited to the respective accounts at the time of closing of the accounting year and the working partners shall be entitled to equal remuneration.

Can the firm claim deduction in respect of remuneration paid to the working partners? [CA Final May 2013] [4 Marks]

Answer:

The issue under consideration is whether, in a case where the partnership deed does not specify the amount of remuneration payable to each partner, but lays down the manner of fixing the remuneration, can payment of such remuneration be allowed as deduction.

The High Court, in CITv. Anil Hardware Store (2010) (HP), held that where the manner of fixing the remuneration of the working partners has been ) specified in the partnership deed, the assessee-firm would be entitled to deduct the remuneration paid to such partners, subject to the limits specified under section 40(h)(v).

Therefore, in this case, since the partnership deed lays down the manner of quantifying the remuneration payable to working partners, the firm is entitled to claim deduction of remuneration paid to working partners, subject to the limits specified in section 40(b)(v).

![]()

Question 4.

A partnership firm consisting of three partners R, O, S, was engaged in the business of civil construction and received the following amount by way of contract receipts during the financial year 2020-21:

| ₹ | |

| Contract work for supply of labour

Value of material supplied by the Government |

35,00,000

9,00,000 |

| 44,00,000 |

Each partner of the firm was entitled to draw ₹ 3,000 per month by way of salary as authorized by the partnership deed. Interest of ₹ 1,50,000 was also paid to partner ‘R’ on the capital of ₹ 6,00,000 contributed by him. The profit as per books of account before deduction of salary to partners and interest to partner ‘R’ is ₹ 3,00,000.

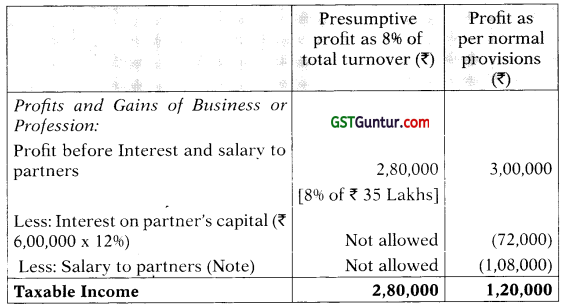

Compute the total income of the firm, applying the provisions of section 44AD, for assessment year 2021-22. Ignore the provision of AMT. [CA Final Nov. 2014] [8 Marfcs]

Answer:

As per Supreme Court in the case of Brij Bhusan Lai Parduman Kumar, materials supplied by contractee at a fixed cost to the Civil Construction Contractor shall not be included in the Gross Receipts or Turnover u/s 44AD of the Contractor for calculating the presumptive income @ 8%.

But the gross Receipts for Turnover purposes for applicability of section 44AD shall include even the value of material supplied by Contractee at a fixed cost to the Civil Construction Contractor.

Computation of Total Income

It is to be noted that in section 44AD, no deduction for interest and salaries 7 paid to partner as per section 40( b) shall be allowed from the presumptive 1 profit of 8%.

Note: As per sec. 40(b), Salary to partner is deductible as lower of the following:

(i) 90% of the first ₹ 3,00,000 of Book profit = 90% of (₹ 3,00,000 – ₹ 72,000 interest to partners) = 90% of ₹ 2,28,000 = ₹ 2,05,200; or

(ii) Remuneration actually paid (₹ 3,000 × 3 partners × 12 months) = ₹ 1,08,000

Thus, the assessee should not opt for section 44AD and declare his income as ₹ 1,20,000.

![]()

Question 5.

X & Co. a partnership firm consisting of three partners enhanced working partner salary from ₹ 25,000 per month for each partner to ₹ 50,000 per month for each partner. The increase in working partner salary was authorised by the deed of partnership.

The Assessing Officer during the course of assessment contended that remuneration paid to working partners @ ₹ 50,000 per month for each partner as excessive and applied Sec. 40A(2)(a) though the payment was within the statutory limit prescribed u/s 40(b)(v). Decide the correctness of action of the Assessing Officer. [CA Final Nov. 2015] [4 Marks]

Answer:

The issue under consideration is whether remun eration paid to working partners as per the partnership deed can be considered as unreasonable and excessive for attracting disallowance u/s 40A(2)(a) even though the same is within the limit prescribed u/s 40(b)(v).

The facts of the case are similar to the facts in CITv. Great City Manufacturing Co. (2013), where the Allahabad High Court observed that section 40( b) (v) prescribes the limit of remuneration to working partners, and deduction is allowable up to such limit while computing the business income. If the remuneration paid is within the ceiling limit provided u/s 40(b)(v), then, recourse to provisions of section 40A(2)(a) cannot be taken.

The Assessing Officer is only required to ensure that the remuneration is paid to the working partners mentioned in the partnership deed, the terms and conditions of the partnership deed provide for payment of such remuneration to the working partners and the remuneration is within the limits prescribed u/s’40(b)(v). If these conditions are complied with, then the Assessing Officer cannot disallow any part of the remuneration on the I ground that it is excessive.

Hence, applying the rationale of the Allahabad High Court ruling in this case, the increased remuneration which is authorized by the partnership ” deed and is within the limits specified u/s 40(b)(v) and paid to working . partners, cannot be disallowed by invoking the provisions of section 40A(2) (a). Therefore, the action of the A.O. is not correct.

![]()

Question 6.

Two brothers say, A and B inherited lands equally consequent to demise of their father. Subsequently, those lands were compulsorily acquired by d the State Government. Both A and B received compensation, enhanced compensation and interest on enhanced compensation. They admitted , these as income in their individual status. Now the A.O. wants to assess i income from compulsory acquisition of lands in the status of Association of Persons (AOP). Is the action of A.O. justified in law? [CA Final Nov. 2015] [4 Marks]

Answer:

The issue under consideration is whether in a case where land inherited by two brothers is compulsorily acquired by the State Government, the resultant capital gain would be assessed in the status of “Association of Persons” (AOP) or in their individual status.

The facts of the case are similar to the facts in CITv. Govindbhai Mamaiya (2014), where the Supreme Court held that the compensation received by co-owners on compulsory acquisition of land inherited by them will be i assessable in their respective hands and cannot be collectively assessed treating the said co-owners as Association of persons.

Thus, applying the above rationale, the income from compulsory acquisition of land inherited by the legal heirs, A & B, is taxable in their individual hands and not in the status of AOP. The proposed action of the Assessing Officer to assess such income in the status of AOP is, therefore, not justified in law.

![]()

Question 7.

ABC Private Ltd. was converted into a limited liability partnership (LLP) called ABC LLP on 01.07.2020. You are provided with the following particulars of ABC Private Limited as on 31.03.2021:

(i) Unabsorbed depreciation ₹ 13 lakhs.

(ii) Business loss ₹ 10 lakhs (relating to previous year 2013-14).

(iii) Unadjusted MAT credit under section 115JAA ₹ 8 lakhs.

(iv) Written down value of the assets as per section 43(6) of the Income-tax Act.

Plant and Machinery (15%) ₹ 10 lakhs (market value ₹ 15 lakhs)

Plant and machinery ₹ 50 lakhs (Cost) – deduction claimed under section 35AD

Building (10%) ₹ 20 lakhs (market value ₹ 30 lakhs)

(v) Cost of land (acquired in year 2004) ₹ 50 lakhs (market value ₹ 100 lakhs)

(vi) Expenditure on voluntary retirement incurred by the company during the previous year 2018-19 is ₹ 25 lakhs. The company has been allowed deduction of ₹ 5 lakhs each year for the previous year 2018-19 and previous year 2019-20 under section 35DDA.

Explain the tax treatment of each item stated above in the hands of LLP, assuming that the conversion satisfies all the conditions laid down in section 47(xiiib). [CA Final Nov. 2016] [5 Marks]

Answer:

Tax implications on conversion of company into LLP:

(i) As per section 72A(6A), ABC LLP would be able to carry forward the unabsorbed depreciation of ABC Pvt. Ltd. as on 31.3.2020 indefinitely for set-off against its income.

(ii) As per section 72A(6A), ABC LLP would be able to carry forward the business loss of ABC Pvt. Ltd. as on 31.3.2020 and set off against business income of the LLP for fresh period of 8 years.

(iii) As per section 115JAA, the credit for the MAT paid by ABC Pvt. Ltd. cannot be availed by the successor ABC LLP.

(iv) As per Explanation 2Cto section 43(6), the actual cost of the block of assets in the case of ABC LLP would be the written down value of the block of assets of ABC Pvt. Ltd. on the date of conversion. The aggregate depreciation allowable to ABC Pvt. Ltd. and ABC LLP in the P.Y. 2020-21 cannot exceed the depreciation calculated at the prescribed rates as if the conversion had not taken place [Sixth proviso to section

32(1)(ii)].

![]()

The aggregate depreciation for the P.Y. 2020-21 shall be calculated as follows:

Plant & Machinery ₹ 1.50 lakh (15% of ₹ 10 lakh)

Building ₹ 2.00 lakh (10% of ₹ 20 lakh)

In this case, since the conversion took place on 1.7.2020, the depreciation has to be apportioned between the company and the LLP in proportion to the number of days the assets were used by them. In such a case, the depreciation allowable in the hands of ABC Pvt. Ltd. and ABC LLP would be calculated as given below:

| Asset | In the hands of ABC Pvt. Ltd. (for 91 days) | In the hands of LLP (for 275 days) |

| Plant & machinery | 1,50,000 × 91/365 = ₹ 37,397 | 1,50,000 × 274/365 = ₹ 1,12,603 |

| Building | 2,00,000 × 91/365 = ₹ 49,863 | 2,00,000 × 274/365 = ₹ 1,50,137 |

The written down value of assets as on 1.7.2020

| Asset | WDV as on 1.7.2020 |

| Plant and machinery

Building |

₹ 10,00,000 – ₹ 37,397 = ₹ 9,62,603

₹ 20,00,000 – ₹ 49,863 = ₹ 19,50,137 |

In the hands of ABC LLP, the actual cost of plant and machinery in respect of which deduction has been claimed under section 35AD by ABC Pvt. Ltd., would be Nil [Explanation 13 to section 43(1)].

(v) The cost of acquisition of a non-depreciable asset, being land, in the hands of ABC LLP would be the cost for which ABC Pvt. Ltd. acquired it, ie., ₹ 50 lakh [Section 49(1)]

(vi) ABC LLP would be eligible for deduction of ₹ 5 lakh each for the remaining three years i.e., P.Y. 2020-21, P.Y. 2021-22 and RY 2022-23 as per section 35DDA(4A).

![]()

Question 8.

Ram, Rahim & Robert are equal partners of SSK & Co., which was formed w.e.f. 01.06.2020. The firm is an authorized dealer of watches manufactured by a reputed company. It reported Net Profit as per profit and loss account of ₹ 2,50,000 after debit/credit of the following items:

(i) Depreciation on generator and computers ₹ 1,10,000.

(ii) Working partners’ salary ₹ 30,000 p.m. for each partner. All the partners are working partners and the salary paid is authorized by the deed of partnership.

(iii) Interest on capital to partners @ 18% per annum. The total interest on capital of the firm debited to profit and loss account being ₹ 3,60,000.

(iv) Donation to registered political parties ₹ 80,000 by cash and ₹ 70,000 by electronic transfer.

(v) Monthly rent paid to partner Ram for use of his premises as godown ₹ 30,000 and it is occupied from 01.10.2020. The market rent for the premises is ascertained at ₹ 15,000 p.m. No tax was deducted at source on the rent paid.

(vi) Sponsorship fee for local Cricket tournament ₹ 4,00,000.

(vii) The firm incurred ₹ 5,00,000 by way of expenditure towards the cost of gold coins awarded to customers on the first day of their showroom inauguration. The cost of each gold coin was less than ₹ 10,000 and one coin was given for each of the buyers on that day selected through lucky dip. No tax was deducted at source on such gold coins given to the customers.

Additional information:

(i) Depreciation on tangible assets allowable u/s 32 is ₹ 2,37,500.

(ii) One registered trademark was acquired on 10.07.2020 for ₹ 3,00,000. The firm used the trademark w.e.f. 01.12.2020 since there was some dispute in title of the previous owner and was cleared through court decree only in November 2020.

(iii) The total turnover for the firm for the year ended 31.03.2021 was ₹ 80,00,000. Amount realized by cash ₹ 20,00,000 and the balance of sale proceeds were received through credit card/RTGS/NEFT before 31.03.2021.

![]()

You are required to compute the total income of the firm applying regular provisions and presumptive provisions contained in section 44AD of the Income-tax Act, 1961. Advise the procedural requirement on opting any of the provisions for the purpose of the Act. [CA Final May 2018 (Old Syllabus)] [70 Marks]

Answer:

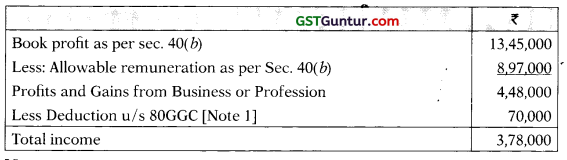

Computation of Book Profit of SSK & Co. for Section 40(b)

| ₹ | |

| Net Profit as per P&L A/c

Add: Depreciation as per books Remuneration to working partners (₹ 30,000 × 10 months × 3 partners) |

2,50,000

1,10,000 9,00,000 |

| Interest to partners (in excess of allowed limit i.e. 12%) | 1,20,000 |

| Donation to political parties [Note 1] | 1,50,000 |

| Rent disallowed u/s 40A(2) [₹ 15,000 (₹ 30,000 – ₹ 15,000) × 6 months] [Note 2] | 90,000 |

| Sponsorship fee for local cricket tournament [Note 3] | NIL |

| Less: Depreciation as per IT Act | (2,37,500) |

| Depreciation on registered trademark [₹ 3,00,000 × 25% × 50%] [Note 5] | (37,500) |

| Book Profit for Section 40( h) | 13,45,000 |

![]()

Maximum remuneration allowable u/s 40(b)

| ₹ | |

| On first ₹ 3,00,000 of book profits @ 90% | 2,70,000 |

| On balance ₹ 10,45,000 of book profit @ 60% | 6,27,000 |

| Total | 8,97,000 |

Actual remuneration to Working partners = ₹ 9,00,000 (₹ 30,000 × 3 partners) × 10 months

Therefore, the maximum remuneration deductible shall be ₹ 8,97,000.

Computation of Total Income of SSK & Co. as per regular provisions

Notes:

1. Donation made to registered political parties shall be disallowed u/s 37(2B) while computing business income. Therefore, ₹ 1,50,000 shall be added back while computing the income under the head “Profits and Gains from Business or Profession”. However, the said donation made by any mode other than cash shall be allowed as deduction from gross total income u/s 80GGC and ₹ 70,000, being the donation made by way of electronic transfer shall be allowed as deduction u/s 80GGC from gross total income.

![]()

2. As per section 40A(2), where the assessee incurs any expenditure for which the payment is made or is to be made to any specified person and the A.O is of the opinion that such expenditure is excessive or unreasonable having regard to the fair market value of the goods, services or facilities, then the A.O. shall disallow such expenditure to the extent he considers excessive or unreasonable.

Therefore, ₹ 90,000 (₹ 15,000 × 6), being the excess rent paid over the market value to the partner shall be disallowed. In respect of non-deduction of tax at source on the amount of rent paid to the partner Ram, section 194-1 provides that no tax is required to be deducted at source where the amount of rent paid does not exceed ₹ 2,40,000 during the financial year. Here, the amount of rent paid by SSK & Co. to partner Ram does not exceed ₹ 2,40,000 and therefore, there is no need to deduct tax at source and there will be no disallowance for non-deduction of tax at source.

3. Sponsorship fee paid for local cricket tournament shall be allowed as a deduction since the same was incurred for the promotion of the business of the firm and was incurred out of business expediency and therefore, is an allowable expenditure u/s 37.

4. Expenditure incurred towards the cost of gold coins awarded to the customers on the first day of showroom inauguration shall be allow ed as deduction, since the same has been incurred for the purposes of business. As per sec. 194B, the person responsible for paying the winnings which are wholly in kind, shall before releasing the winnings ensure that the tax has been paid in respect of the winnings. However, no tax shall have to be deducted in case where the amount of winnings does not exceed ₹ 10,000. Here, the cost of each gold coin does not exceed ₹ 10,000 and therefore, SSK & Co. is not required to deduct tax at source. Since, no tax is required to be deducted, disallowance u/s 40(ia) shall not be attracted.

5. Since, the registered trademark has been put to use for less than 182 days during the previous year, only 50% of the normal depreciation shall be allowed as deduction.

![]()

Computation of Total Income of SSK & Co. as per presumptive income i.e. Sec. 44AD

Since, the turnover of SSK & Co. for the RY. 2020-21 is ₹ 80 lakhs, which does not exceed ₹ 2 crore, the firm is eligible to opt for presumptive tax scheme u/s 44AD

| ₹ | |

| Presumptive income u/s 44AD (₹ 60,00,000 × 6% + ₹ 20,00,000 x 8%)

Less: Deduction u/s 80GGC |

5,20,000

70,000 |

| Total Income | 4,50,000 |

As per Sec. 44AD, all deductions allowable u/s 30 to 38 shall be deemed to have been allowed in full and no further deduction shall be allowed. Also, no deduction shall be allowed in respect of interest on capital and 1 remuneration to partners.

Further, the presumptive income shall be computed @ 696 instead of 896 where the amount of total turnover or gross receipts is received by an account payee cheque or account payee bank draft or use of electronic clearing system through a bank account during the previous year or before the due date specified u/s 139(1). Therefore, presumptive income in respect ₹ 60,00,000 of the sale proceeds received through credit card/RTGS/NEFT before 31.03.2021 shall be computed @ 696 and remaining ₹ 20,00,000 shall i be computed @ 8%.

If the firm wants to declare income of ₹ 3,78,000 as per the books of account, advance tax has to be paid in four instalments, in the absence of which interest liability-u/s 234C would be attracted in case of shortfall in each of the four instalments. However, if the firm declares the income of ₹ 4,50,000 on the basis of presumptive tax scheme u/s 44AD, advance tax has to be paid in one instalment in March, 2021 in the absence of which interest u/s 234C would be attracted only for one month.

![]()

Question 9.

Ram Manufactures LLP., engaged in manufacturing activity which is 2 liable for GST @ 18%. The firm consists of 4 equal partners who contributed ₹ 15 lakhs each as capital. The partnership deed authorises interest on capital @ 9% per annum besides working partner salary of ₹ 25,000 per month to each partner, as all of them are working partners.

A survey u/s 133A was conducted in the premises of the firm on 23.01.2021 and during the course of survey (a) bills and vouchers (each below ₹ 10,000 aggregating to ₹ 2,50,000 were found in the premises which were not recorded in the books of account; and (b) unaccounted stock of ₹ 10,50,000 was found in the premises on 23.01.2021.

Note: No effect was given in the books of account of the firm for the above said items even after the conclusion of survey.

The following issues are presented to you:

(i) Depreciation debited in the profit and loss account includes ₹ 3,00,000 representing depreciation on non-compete fee of ₹ 30,00,000 being the amount paid to a retired partner on 30.4.2018.

(ii) The firm allowed ₹ 4,00,000 as discount on goods sold to A & Co, a proprietary concern owned by one of the partners.

(iii) Depreciation debited to profit and loss account does not include depredation on the following:

(a) Plant & Machinery (new) acquired in November, 2020 and used during the year cost ₹ 23,60,000 (including GST @ 18%),

(b) Construction of one factory building was completed on 31st December, 2020 and it was put to use w.e.f. 01.01.2021. The cost of construction admitted in the books was ₹ 40,90,000.

The firm availed loan from a bank for construction of the above said factory building on 20th October, 2019. Interest payable details are as under:

| Period | ₹ |

| From 20-10-2019 to 31-03-2020

From 01-04-2020 to 31-12-2021 From 01-01-2021 to 31-03-2021 |

2,00,000

7,00,000 4,20,000 |

No amount by way of loan interest was paid till ‘due date’ of filing the return of income prescribed u/s 139(1). The loan interest is not debited to profit and loss account and also not included in the cost of construction of the factory building.

![]()

The net profit of the firm for the year ended 31.03.2021 was ₹ 17,21,375 after deducting interest on capital and working partner salary.

You are requested to compute the total income of the firm by giving brief reasons for each of the item given above. [CA Final Nov. 2019 (New Syllabus)] [8 Marks]

Answer:

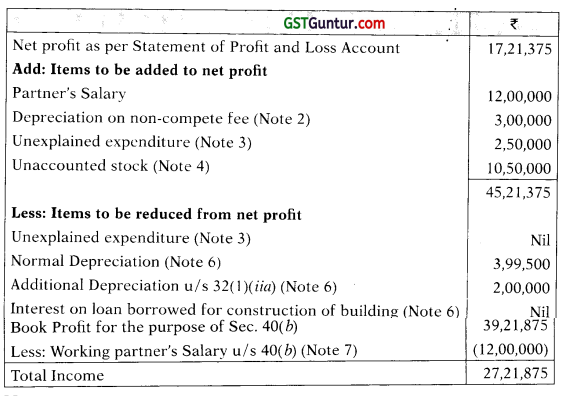

Computation of Total Income of Ram Manufactures LLP for the A. Y. 2021-22

Notes:

1. Since, interest on partner’s capital does not exceed 996, no disallowance shall be attracted u/s 40(h).

2. On payment of ₹ 30,00,000 as non-compete fee to a retired partner, no new asset is created and also the expenditure does not result in enduring benefit in the capital field, and therefore it is not capital in nature. Hence, depreciation is not allowable on such expenditure.

Alternatively: Non-compete fee would be treated as intangible asset and is eligible for depreciation as follows:

Since depreciation of ₹ 3,00,000 is already debited to profit and loss account, the difference of ₹ 1,21,875 (₹ 4,21,875 – ₹ 3,00,000) is to be deducted from business income.

3. Expenditure not recorded in the books of account to be treated as unexplained expenditure and would be deemed to be the income of Ram Manufactures LLP as per section 69C. It would be taxable @ 6096 plus surcharge @ 2596 plus health and education cess @ 496. Also, such unexplained expenditure would not be allowed as deduction under any head of income.

![]()

4. The unaccounted stock found during the survey in the premises shall be added to the net profits since, it will increase the profits.

5. No disallowance u/s 40A(2) shall be attracted in respect of discount allowed on goods sold to A & Co., a proprietary concern owned by one of the partners, since sec. 40A(2) shall be attracted only in cases where payment is made excessive or unreasonable. Here, no payment has been made but instead goods have been sold.

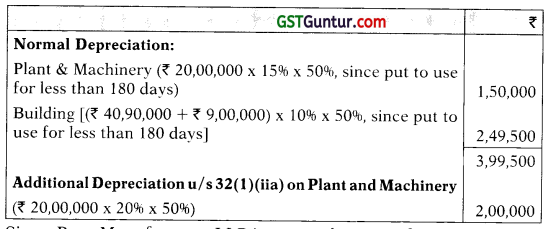

6. Calculation on Depreciation

Since, Ram Manufactures LLP is engaged in manufacturing activity which is liable for GST @ 18%, it is assumed that it will claimed input tax credit in respect of GST paid on plant and machinery acquired and therefore, depreciation shall not be allowed on GST component.

ICDSIX provides that the borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying asset shall be capitalized as part of the cost of that asset. Capitalization shall be commenced from the date on which funds were borrowed to the date when such asset is first put to use. Therefore, interest for the period 20.10.2019 to 31.12.2021 shall be capitalized to the cost of the factory.

Also, interest after the asset is first put to use shall not be allowed as deduction, since the same has not been paid till the due date of filing ROI u/s 139(1). Therefore, ₹ 4,20,000 shall not be allowed as deduction.

![]()

7. Maximum partner’s salary allowable u/s 40(b).

| ₹ | |

| On First ₹ 3,00,000 of book profits @ 90%

On balance ₹ 24,16,875 of book profits @ 60% |

2,70,000

14,50,125 |

| Total | 17,20,125 |

Actual partner’s salary ₹ 12,00,000. Therefore, partner’s salary deductible shall be ₹ 12,00,000 as it does not exceed the maximum limit u/s 40(b).