Alternate Minimum Tax (AMT) – CA Final DT Question Bank is designed strictly as per the latest syllabus and exam pattern.

Alternate Minimum Tax (AMT) – CA Final DT Question Bank

Question 1.

ABC LLP, a Limited Liability Partnership in India is engaged in development of Software and providing IT enabled services through two units, one of which is located in a notified SEZ in Chennai. The particulars relating to previous year 2020-21 furnished by the assessee are as follows:

Total Turnover : SEZ Unit ₹ 120 Lakhs and the other unit ₹ 100 Lakhs

Export Turnover : SEZ Unit ₹ 100 Lakhs and the other unit ₹ 60 Lakhs

Total Profit : SEZ Unit ₹ 50 Lakhs and the other unit ₹ 40 Lakhs The assessee has no other income during the year.

(i) Compute tax payable by ABC LLP for the A.Y. 2021-22

(ii) Will the amount of tax payable change, if ABC LLP is an overseas entity? [CA Final Nov. 2012] [4 Marks]

Answer:

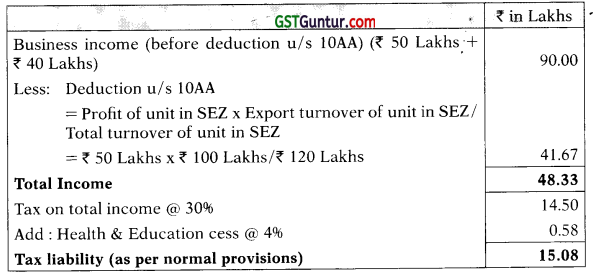

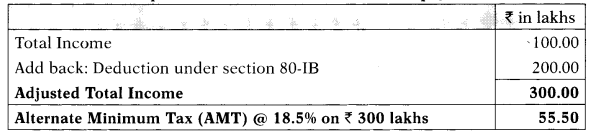

(i) Computation of total income and tax liability of ABC LLP as per normal provisions of the Act for A.Y. 2021 -22

Computation of Adjusted total income and AMT of ABC LLP as per the provisions of section 115JC for A.Y. 2021-22

Since, the tax payable as per the normal provisions of the Act is less than the AMT payable, the adjusted total income shall be deemed to be the total income of ABC LLP and the tax payable for A.Y. 2021-22 shall be ₹ 17.32 Lakhs.

(ii) The provisions of AMT are also applicable to an overseas LLP. So there will be no change in above tax calculations.

Note: While computing the deduction u/s 10AA, it has been assumed that A.Y.2021-22 falls within first five year period commencing from the year of provision of services by the Unit in SEZ of ABC LLP and therefore, deduction @ 100% of the profit derived from export of such services has been provided.

![]()

Question 2.

Victory Polyfibres, a partnership firm, has earned a gross total income of ₹ 300 lakhs for the year ended 31-3-2021. There are no international transactions.

The above includes a profit of ₹ 220 lakhs from an industrial undertaking having a turnover of ₹ 80 crores. This is the fifth year and deduction under section 80-IB of the Income-tax Act is available to the extent of ₹ 200 lakhs.

There are some grey areas in the taxation workings and hence, the assessee is contemplating to file the return of income on 7.11.2021, after seeking clarifications from tax experts.

Advise the assessee-firm by working out the total income and tax pay able, where the return is filed on 31.10.2021 and when the same is filed on 07.11.2021.

What is the practical solution as regards obtaining clarifications, which might or might not have an impact on the total income?

Will it make any difference if the firm has entered into specified domestic transactions where aggregate of such transactions entered into by the firm in the previous year exceeds ₹ 20 crores and the firm file its return on 7.11.2021. [C4 Final May 2014] [10 Marks]

Answer:

As per sec. 80AC, while computing the total income of an assessee, if any deduction is admissible under Chapter VI-A under the heading “C”, no such deduction shall be allowed to him unless he furnishes a return of his income for such assessment year on or before the due date specified under section 139(1).

In the given question, since the turnover of the partnership firm has exceeded ₹ 100 lakhs in the previous year 2020-21, it would be subject to audit under section 44AB, in which case the due date of filing its return of income for A.Y. 2021-22 would be 31st October, 2021, as per section 139(1).

If the firm hires its return on 7-11-2021, it would be a belated return u/s 139(4). Consequently, as per section 80AC, deduction u/s 80-IB would not be available.

In such circumstances, ₹ 300 lakhs will be the total income of the firm.

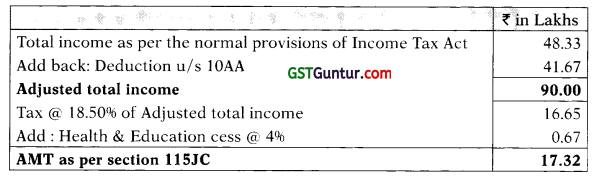

The tax liability would be:

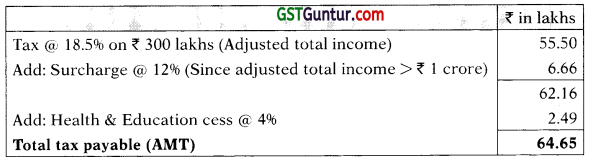

Computation of tax liability of the firm had it filed its return on or before the due date 31.10.2021

Computation of Alternate Minimum Tax payable

Since the regular income-tax payable by the firm is less than the alternate minimum tax payable, the adjusted total income” shall be deemed to be the total income of the firm for the P.Y. 2020-21 and it shall be liable to pay income-tax on such total income 18.5% Sec. II5JC(1)]. Therefore, the tax payable for A.Y. 202 1-22 would be:

Tax Credit for Alternate Minimum Tax [Section 115JD]

Practical solution regarding obtaining clarifications

The practical solution regarding obtaining clarifications would be to hie the return of income under section 139(1) on or before the due date 31.10.2021 and claim deduction under section 80-IB. In such a case, the firm can claim deduction of ₹ 200 lakhs under section 8Q IB.

Thereafter, consequent to the clarifications obtained, if any change is required, it can file a revised return under section 139(5) within 31.3.2022 (i.e., before the end of relevant assessment year) which would replace the original return filed under section 139(1).

If it is assumed that the firm has entered into specified domestic transactions and aggregate of such transactions entered into by the firm in the previous year exceeds ₹ 20 crores, then, the firm would have to hie a report under section 92E, in which case, the due date of filing of return would be 30.11.2021.

In such a case, the return hied on 07.11.2021 would be a return hied before the due date. If such an assumption is made, the computation j of tax liability as given in the Working Note above would form the first part of the answer vis-a-vis computation of tax liability had the return been hied on 7.11.2021

![]()

Question 3.

PQR LLP, a limited liability partnership set up a unit in Special Economic Zone (SEZ) in the financial year 2015-16 for production of washing machines. The unit fulfils all the conditions of Sec. 10AA. During the F.Y. 2018-19, it has also set up a warehousing facility in a district of Tamil Nadu for storage of agricultural produce. It fulfils all the conditions j of Sec. 35AD. Capital expenditure in respect of warehouse amounted to ₹ 75 lakhs (including cost of land ₹ 10 lakhs), the payment of which has been made by an account payee hank draft. The warehouse became operational with effect from 1st April, 2020 and the expenditure of ₹ 75 lakhs was capitalized in the books on that date. Relevant details for the F.Y. 2020-21 are as follows:

| ₹ | |

| Profit of unit located in SEZ

Export sales of above unit Domestic sales of above unit Profit from operation of warehousing facility (before considering deduction u/s 35AD) |

40,00, 000

80,00,000 20,00,000 1,05,00,000 |

Compute income tax (including AMT u/s 115JC) payable by PQR LLP for A.Y. 2021-22. [CA Final Nov. 2015] [10 Marks]

Answer:

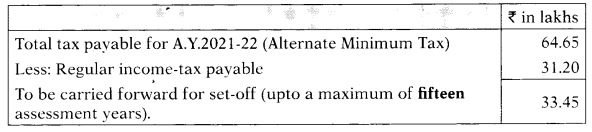

Sec. 115JC provides that, notwithstanding anything contained in this % Act, where the regular income-tax payable by a person, other than company, is less than the alternate minimum tax (AMT) payable for the previous year, the adjusted total income shall be deemed to be the total income of that person for such previous year and he shall be liable to pay income tax I on the adjusted total income at the rate of 18.5%.

Computation of Tax of PQR LLP for A.Y. 2021-22

Since the tax payable under normal provisions of the Act is less that the AMT payable, the adjusted total income shall be deemed to be the total income of POR LLP and the tax payable for AY. 2021-22 shall be ₹ 29,84,510.

![]()

Notes :

1. As per Sec. 35AD, any assessee, carrying on a ‘Specified business’ which includes, inter alia, setting up and operating a warehousing facility for storage of agricultural produce, may at his option claim 100% deduction of capital expenditure (other than land) incurred for such business by an account payee cheque drawn on bank or an account payee bank draft or use of ECS through a bank account.

In this case, the payment for capital expenditure has been made by an account payee bank draft and therefore, deduction u/s 35AD shall be available. Also, where capital expenditure is incurred before commencement of the business, deduction shall be allowed to the extent it has been capitalised in the books of account on date of commencement by the assessee.

2. “Adjusted total income” shall be the total income as computed under the normal provisions of this Act as increased by:

- deductions claimed under heading “C” in Chapter VI-A i.e. u/ss j 80-IA to 80RRB (other than sec. 80P); and

- deduction claimed u/s 10AA (relating to unit in SEZ), if any; and

- deduction claimed for specified business, if any, u/s 35AD as reduced by the amount of depreciation allowable u/s 32 as if no j deduction u/s 35AD was allowed on such assets.

Question 4.

M/s. ABC LLP is engaged in export of computer software from a Special Economic Zone. The net profit of the firm as per its Profit & Loss Account for the year ended 31.3.2021 was ₹ 250 lakhs after debit/credit of the following items:

- Depreciation ₹ 20 lakhs

- Remuneration to its working partners ₹ 200 lakhs

- Interest provided on the current account balance of the partners @ 15% p.a. ₹ 15 lakhs

- Advertisement in a souvenir published by a political party ₹ 2 lakhs

Additional Information:

- The firm commenced business on 1.4.2018

- Depreciation allowable as per Income Tax Rules is ₹ 25 lakhs

- Payment of remuneration to working partners is authorized by the Partnership Deed

- Brought forward business loss and depreciation from Asst. Year 2019 20 was ₹ 50 lakhs and ₹ 30 lakhs respectively.

- The total export turnover of the firm was ₹ 25 crores. Amount of export turnover realized within six months was ₹ 15 crores.

Compute the tax payable by the firm u/s 115JC and the amount of tax credit allowed to be carried forward. Give working notes for your answer. [CA Final Nov. 2019 (Old Syllabus)] [8 Marks]

Answer:

Sec. 115JC provides that, notwithstanding anything contained in this 5 Act, where the regular income-tax payable by a person, other than company, is less than the alternate minimum tax (AMT) payable for the previous year, the adjusted total income shall be deemed to be the total income of that person for such previous year and he shall be liable to pay income tax on the adjusted total income at the rate of 18.5%.

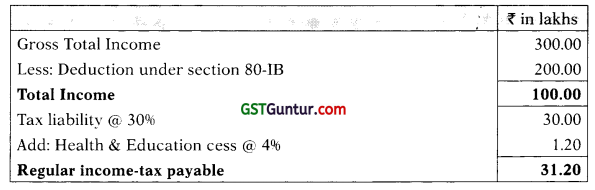

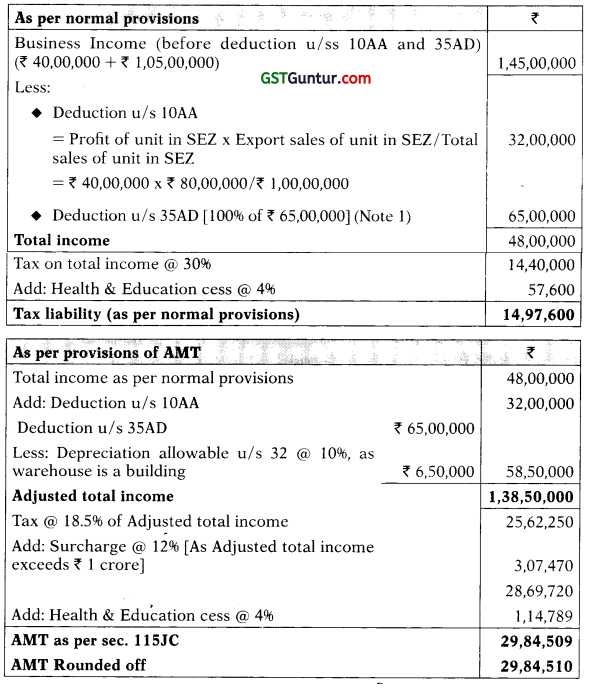

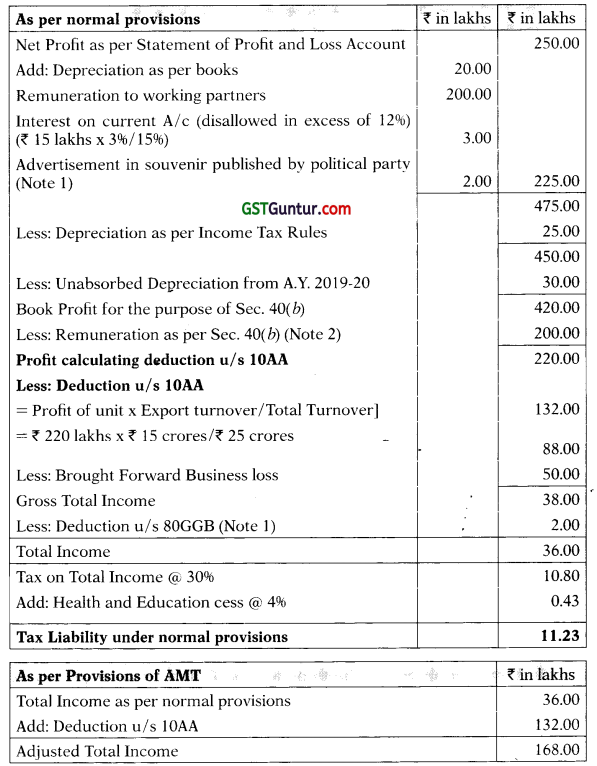

Computation of Tax of M/s. ABC LLP for A.Y. 2021-22

![]()

Since, the tax payable under normal provisions of the Act is less than the AMT payable, the adjusted total income shall be deemed to be the total income of M/s ABC LLP and the tax payable shall for A.Y. 2021-22 shall be ₹ 36.20 lakhs.

Tax Credit for Alternate Minimum Tax [Section 15JD]

| ₹ in lakhs | |

| Total tax payable for A.Y. 2021-22

Less: Regular income-tax payable |

36.20

11.23 |

| To be carried forward for set-off (upto a maximum of 15 assessment years * | 24.97 |

Notes:

1. Expenditure incurred on advertisement published in the souvenir of registered political party shall be disallowed u/s 37(2B). However, it shall be allowed as a deduction from the gross total income of the assessee u/s 80GGC for the amount contributed by any mode other than cash. Therefore, deduction shall be available to the M/s. ABC ‘ LLP in respect of expenditure incurred on advertisement published j in the souvenir of registered political party u/s 80GGC.

2. Maximum remuneration allowable u/s 40(b).

| ?₹ in lakhs | |

| On First ₹ 3 lakhs of book profits @ 90%

On balance ₹ 417 lakhs of book profits @ 60% |

2.70

250.20 |

| Total | 252.90 |

![]()

Actual remuneration is ₹ 200 lakhs. Therefore, remuneration deductible shall be ₹ 200 Lakhs as it does not exceed the maximum limit u/s 40(b)