Standard Costing – CA Inter Costing Question Bank is designed strictly as per the latest syllabus and exam pattern.

Standard Costing – CA Inter Costing Question Bank

Question 1.

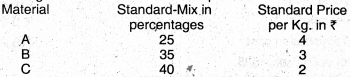

A company produces a finished product by using three basic raw materials. The following standards have been set-up for raw materials:

The standard loss in process is 20% of input. During a particular month, the Company produced 2,400 Kgs. of finished product. The details of stock and purchases for the month are as under:

The opening stock is valued at standard cost. Compute:

(i) Material price and Material cost variances, when:

(a) Variance is calculated at the point of issue of ‘First-in-First-out’ basis.

(b) Variance is calculated at the point of issue on ‘Last-in-First-out’ basis.

(ii) Material Usage variance,

(iii) Material Mix variance, and

(iv) Material Yield variance. (Nov 2000, 12 marks)

Answer:

M1- Actual material used:

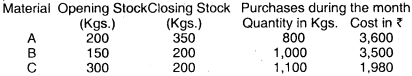

(i)

(ii) Based on LIFO Method

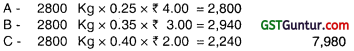

M2– Standard cost of material used

![]()

M3 – Standard Cost of Material if it had been used in standard proportion

M4 – Standard material cast of output

(It is given that output was 2,400 kg. Standard loss in process i$ 20% of Input

Input for an output of 2,400 kg = (2400 ÷ 80) × 100 = 3,000 kg.

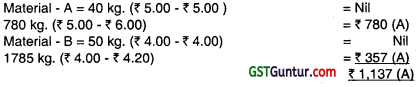

Variance:

(i) Material price and cost variance when variance is calculated at the point of issue on “first in first out” basis –

(a) Material Price Variance = M1 – M2 = 8,295 – 7,850 = 445 (A)

(b) Material cost Variance = M1 – M4 = 8,295 – 8,550 = 255 (F)

(ii) Material price and cost variance when variance is calculated at the point of issue on “Last in first out” basis –

(a) Material price variance = M1 – M2 = 8,430 – 7,850 = 580 (A)

(b) Material cost variance = M1 – M4 = 8,430 – 8,550 = 120 (F)

(iii) Material Mix variance = M2 – M3 = 7,850 – 7,980 = 130 (F)

(iv) Material yield variance = M3 – M4 = 7,980 – 8,550 = 570 (F)

(v) Material usage variance = M2 – M4 = 7,850 – 8550 = 700 (F)

Question 2.

Answer the following :

UV Ltd. presents the following information for November, 2008 :

Budgeted production of product P = 200 units.

Standard consumption of Raw materials = 2 kg per unit of p.

Standard price of material A = ₹ 6 per kg.

Actually, 250 units of P were produced and material A was purchased at ₹ 8 per kg. and consumed at 1.8 kg. per unit of P. Calculate the material cost variances. (Nov 2008, 3 marks)

Answer:

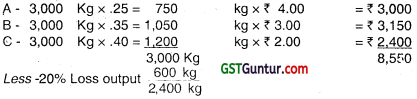

250 units of P were produced from material A.

For one units of P = 1.8 kg of material A is required, so for 250 units of P = 250 × 1.8 = 450 kg of material A is required.

Total Actual cost of output P produced 250 units Actual cost = 250 × 1.8 × 8 = ₹ 3,600

Standard cost = For Actual output produced i.e.; 250 units of P, raw material A will be required as in standard consumption ratio of 2 kg. per unit of P. So for 250 units, standard raw material A required = 250 × 2 = 500 kg. Standard cost per unit of X = ₹ 6 per kg.

So that standard cost = 500 × 6 = ₹ 3,000

Material Cost Variance = Standard cost – Actual cost

= 3000 – 3600 = 600(A)

Material Price Variance = 2700 – 3600 = 900(A)

Material Mix Variance = Nil

Material Yield Variance = 3000 – 2700 = 300(F)

Material Usage Variance = 3000 – 2700 = 300(F)

![]()

Question 3.

Answer the following :

Following details relating to product X during the month of April, 2009 are available :

Standard cost per unit of X :

Materials : 50 kg @ ₹ 40/kg

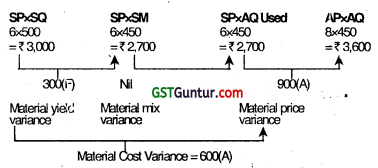

Actual production : 100 units

Actual material cost: ₹ 42/kg

Material price variance : ₹ 9,800 (Adverse)

Material usage variance : ₹ 4,000 (Favourable)

Calculate the actual quantity of material used during the month April, 2009. (May 2009, 2 marks)

Answer:

Material price variance

Actual quantity of material used during the month of April = 4,900 kg.

Question 4.

Answer the following:

Following are the details of the product Phornex for the month of April 2013:

Standard quantity of material required per unit 5 kg

Actual output 1000 units

Actual cost of materials used ₹ 7,14,000

Material price variance ₹ 51,000 (Fav)

Actual price per kg of material is found to be less than standard price per kg of material bÿ ₹ 10.

You are required to calculate:

(i) Actual quantity and Actual price of materials used.

(ii) Material Usage Variance

(iii) Material Cost Variance (5 marks)

Answer:

(i) Actual Quantity and Actual Price of Material used:

Material Price Variance = Actual Quantity (Std. Price – Actual Price)

= ₹ 51,000

Or, AQ (SP – AP) = ₹ 51,000

Or, 10AQ = ₹ 51,000

Or, AQ = 5,100 Kgs.

Actual cost of material used is given i.e.

AQ × AP = ₹ 7,14,000

or, 5,100 × AP = ₹ 7,14,000

∴ AP = ₹ 140

∴ Actual price is less by ₹ 10

So, Standard price = ₹ 140 + ₹ 10 = ₹ 150 per kg

Actual Quantity = 5,100 kgs

Actual Price = ₹ 140/kg

(ii) Material Usage Variance:

Std. Price (Std. Quantity-Actual Quantity)

Or, SP (SQ – AQ)

= ₹ 150 (1,000 units × 5 kg – 5,100 kg) = ₹ 15,000 (A)

(iii) Material Cost Variance:

Std. Cost – Actual Cost

= (SP × SO) – (AP × AQ)

= ₹ 150 × 5,000 – ₹ 140 × 5,100

= ₹ 7,50,000 – ₹ 7,14,000 = ₹ 36,000 (F)

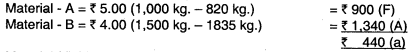

Question 5.

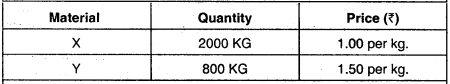

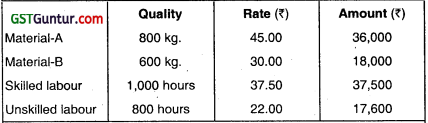

XYZ Limited produces an article and uses a mixture of material X and Y. The standard quantity and price of materials for one unit of output is as under:

During a period, 1500 units were produced. The actual consumption of materials and prsces are given below:

Calculate:

(i) Standard cost for actual output

(ii) Material cost variance

(iii) Material Price variance

(iv) Material usage variance (Nov 2017, 8 marks)

Answer:

Basic Calculations:

Standard quantity for Actual output 1000kg.

(i) Total standard cost for actual output = ₹ 48,00,000.

(ii) Material Cost Variance = Skd. cost for actual – Actual cost

MCV = ₹ 48,00,000 – 54,10,000

= ₹ 6.10,000 (A)

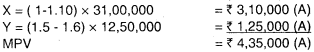

(iii) Material Price Variance = (SP – AP) × AQ

(iv) Material Usage Variance

Check

MCV = MPV + MUV

6,10,000 (A) = 4,35,000 (A) + 1,75,000(A)

![]()

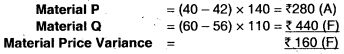

Question 6.

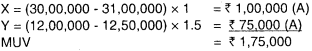

Beta Ltd. is manufacturing Product N. This is manufactured by mixing two materials namely Material P and Material Q. The Standard Cost of Mixture is as under:

Material P 150 ltrs. @ ₹ 40 per ltr.

Material Q 100 ltrs. @ ₹ 60 per ltr.

Standard loss @ 20% of total input is expected during production.

The cost records for the period exhibit following consumption:

Material P 140 ltrs @ ₹ 42 per ltr.

Material Q 110 ltrs. @ ₹ 56 per ltr.

Quantity produced was 195 ltrs.

Calculate:

(i) Material Cost Variance

(ii) Material Usage Variance

(iii) Material Price Variance (May 2018, 5 marks)

Answer:

Material – N is moving faster than Material – M

Calculation

Standard cost of actual output = ₹ 12,000 × \(\frac{195}{200}\) = ₹ 11,700

Caculation of variance

(i) Material Cost Variance = (Standard Cost of Actual Output – Actual Cost)

= (₹ 11,700 – ₹ 12,040)

= ₹ 340 (A)

(ii) Material Usage Variance = (Standard Quantity for actual output – Actual Quantity) × Std. Price

(iii) Material Price Variance = (SP – AP) × AQ

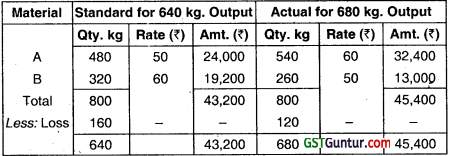

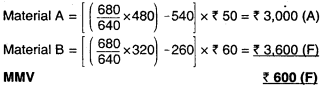

Question 7.

The standard cost of a chemical mixture is as follows:

60% of Material A @ ₹ 50 per kg

40% Material B @ ₹ 60 per kg

A standard loss of 25% on output is expected in production. The cost

records for a period has shown the following usage.

540 kg of Material A @ ₹ 60 per kg

260 kg of Material B @ ₹ 50 per kg

The quantity processed was 680 kilograms of good product.

From the above given information

Calculate:

(i) Material Cost Variance

(ii) Material Price Variance

(iii) Material Usage Variance

(iv) Material Mix Variance

(v) Material Yield Variance (Nov 2019, 10 marks)

Answer:

Basic Calculation

Standard Cost of actual output = ₹ 43,200 × \(\frac{680}{640}\)

= ₹ 45,900

(i) Material Cost Variance = (Std. Cost of Actual Output – Actual Cost)

= (₹ 45,900 – ₹ 45,400)

= ₹ 500 (F)

(ii) Material Price Variance = (SP – AP) × AQ

(iii) Material Usage Variance = (Std. Quantity for Actual Output – Actual Quantity) × Std. Price,

(iv) Material Mix Variance = (Revised Std. Qty. – Actual Qty.) × Std. Price

(v) Material Yield Variance = (AY — SY) × 50P

or

= (SQ – RSQ) × SP

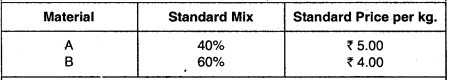

Question 8.

J&J Ltd. produces an article by blending two basic raw materials. The following standards have been set up for raw materials:

The standard loss in processing islO%. During March, 2013, the company produced 2,250 kg. of finished output.

The position of stock and purchases for the month of March, 2013 is as under:

Calculate the following variances:

(i) Material price variance

(ii) Material usage variance

(iii) Materials yield variance

(iv) Materials mix variance

(v) Material cost Variance

Assume FIFO method for issue of material. The opening stock is to be valued at standard price.

Answer:

Working Notes:

(i) Material Price Variance = Actual Quantity (Std. Rate — Actual Rate)

(ii) Material Usage Variance = Std. Rate (Standard Quantity – Actual Quantity)

(iii) Material Yield Variance = Std. Rate (Std. Quantity — Revised Std. Quantity)

(iv) Material mix variance = Std. Rate (Revised Std. Quantity – Actual Quantity)

(v) Material cost variance

= Std. Cost — Actual Cost

= 11,000 – 12,577

= ₹ 1,577 (A)

Question 9.

Mention the causes that give rise to labour rate variance. (Nov 1999, 5 marks)

Answer:

Labour variance arises due to the difference between standard Labour hour rate specified and the actual Labour, hour rate, paid. It is computed by multiplying the actual hours taken by workers on a job by the difference

between the standard and actual wage rate per hour.

Main causes which constitute for the occurrence of Labour rate variance are as below:

- Increase in actual wage rate per hour paid to workers.

- Payment of special increments or allowances to workers.

- Resorting to excessive overtime.

- Using a gang or mix different from that used for setting labour standard.

- Use of wrong type of labour i.e. for a job requiring the use of non-skilled labour uses skilled labour. Since the wages of skilled labour are more than that of non-skilled labour, therefore this increased wage rate per hour of skilled labour force accounts for the occurrence of labour rate variance.

- Non-anticipated wage increase at the time of setting standards.

![]()

Question 10.

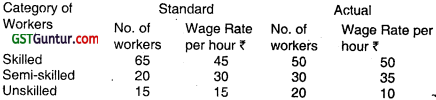

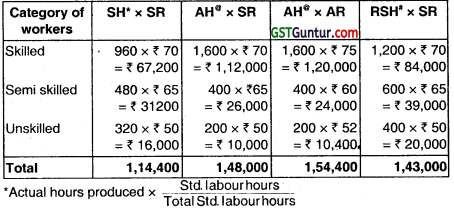

The standard labour employment and the actual labour engaged in a 40 hours week for a job are as under:

Actual output: 1,800 units Abnormal Idle time 2 hours in the week Calculate:

(i) Labour Cost Variance

(ii) Labour Efficieñcy Variance

(iii) Labour Idle Time Variance. (Nov 2012, 6 marks)

Answer:

Working Note: Table Showing Standard & Actual Cost

Calculation of Variances:

(i) Labour Cost Variance = Standard Cost for Actual Output-

Actual Cost

(a) Skilled worker = ₹ 1,05,300 – ₹ 1,00,000

= ₹ 5,300 (F)

(b) Semi-skilled worker = ₹ 21,600 – ₹ 42,000

= ₹ 20,400 (A)

(c) Unskilled Worker = ₹ 8,100 – ₹ 8,000

= ₹ 100 (F)

Total = ₹ 5,300 (F) + ₹ 20,400 (A) + ₹ 100 (F)

= ₹ 15,000 (A)

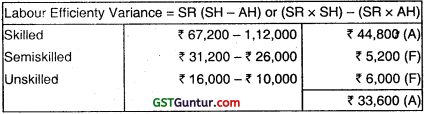

(ii) Labour Efficiency Variance = Std. Rate × (Standard hours – Actual hours worked)

(a) Skilled worker = 45 × (2,340 hrs. – 1,900 hrs.)

= ₹ 19,800(F)

(b) Semi-skifled worker = ₹ 30 × (720 hrs. – 1,140 hrs.)

= ₹ 12,600 (A)

(c) Unskilled Worker = ₹ 15 × (540 hrs. – 760 hrs.)

= ₹ 3,300(A)

Total = ₹ 19,800 (F) + ₹ 12,600(A) + ₹ 3,300 (A)

= ₹ 3,900 (F)

(iii) Labour Idle Time Variance =Std. Rate × Idle Time (Hrs.)

(a) Skilled worker = ₹ 45 × 100

= ₹ 4,500 (A)

(b) Semi-skilled worker = ₹ 30 × 60 hrs.

= ₹ 1,800(A)

(c) Unskilled worker = ₹ 15 × 40 hrs.

= ₹ 600(A)

Total = ₹ 4,500 (A) + ₹ 1,800 (A) + ₹ 600 (A)

= ₹ 6,900(A)

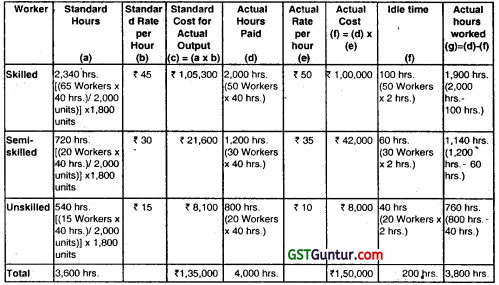

Question 11.

A gang of workers normally consists of 30 skilled workers, 15 semi-skilled workers and 10 unskilled workers. They are paid at standard rate per hour as under:

| Skilled | ₹ 70 |

| Semi-skilled | ₹ 65 |

| Unskilled | ₹ 50 |

In a normal working week of 40 hours, the gang is expected to produce 2000 units of output. During the week ended 31st March, 2019, the gang consisted of 40 skilled, 10 semi-skilled and 5 unskilled workers. The actual wages paid were at the rate of ₹ 75, ₹ 60 and ₹ 52 per hour respectively. Four hours were lost due to machine breakdown and 1600 units were produced.

Calculate the following variances showing clearly adverse (A) or favourable (F)

(i) Labour Cost Variance

(ii) Labour Rate Variance

(iii) Labour Efficiency Variance

(iv) Labour Mix Variance

(v) Labour Idle Time Variance (May 2019, 10 marks)

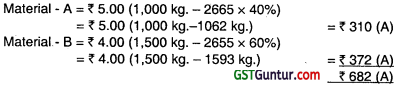

Answer:

Std. hrs for actual output are calculated as follows:

Skilled = \(\frac{1,600}{2,000}\) × 1,200 = 960 hours

Semi skilled = \(\frac{1,600}{2,000}\) × 400 = 480 hours

Unskilled = \(\frac{1,600}{2,000}\) × 400 = 320 hours

@ Actual No. of workers × 40 hours

# St Actual hrs worked ![]()

(i) Labour Cost Variance = (SH × SR) – (AH × AR)

= (1,14,400 – 1,54,400)

= ₹ 40,000 (A)

(ii)

(iii)

(iv) Labour Mix Variance

= Total Actual Time Worked (hours) × (Average Standard Rate per hour of Standard Gang Less Average Standard Rate per hour of Actual Gang) on the basis of hours worked

= 1,980 × \(\left(\frac{₹ 1,44,400}{1,760 \text { hrs. }} \frac{1,440 \mathrm{hrs} . \times ₹ 70+360 \mathrm{hrs} . \times ₹ 65+180 \mathrm{hrs} . \times ₹50}{1,980 \mathrm{hrs} .}\right)\)

= ₹ 4,500(A)

(v)

Question 12.

The following information has been provided by a company:

Number of units produced and sold : 6,000

Standard labour rate per hour : ₹ 8

Standard hours required for 6,000 units : —

Actual hours required : 17,094 hours

Labour efficiency : 105.3%

Labour rate variance : ₹ 68,376 (A)

You are required to calculate:

(i) Actual labour rate per hour

(ii) Standard hours required for 6,000 units

(iii) Labour Efficiency variance.

(iv) Standard labour cost per unit

(v) Actual labour cost per unit

Answer:

SR — Standard labour Rate per Hour

AR — Actual labour rate per hour

SH — Standard Hours

AH – Actual hours

(i) Actual labour rate per hour:

Labour rate Variance = AH (SR — AR)

= 17,094 (₹ 8 – AR) = 68,376 (A) = – 68,376

= ₹ 8 – AR = -4

Or, AR = ₹ 12

(ii) Standard hour required for 6,000 units:

Labour Efficiency = \(\frac{\mathrm{SH}}{\mathrm{AH}}\) × 100 = 105.3

= SH \(=\frac{\mathrm{AH} \times 105.3}{100}\) \(=\frac{17094 \text { hours } \times 105.3}{100}\)

= 17,999.982 or, SH = 18,000 hours

(iii) Labour Efficiency Variance = SR (SH — AH)

= ₹ 8 (18,000 – 17,094)

= 8 × 906 = ₹ 7,248 (F)

(iv) Standard Labour Cost per Unit \(=\frac{18,000 \text { hours } \times ₹ 8}{6,000 \text { unit }}\) = ₹ 24

(v) Actual Labour cost per unit \(=\frac{17,094 \text { hours } \times 12}{6,000 \text { unit }}\) = ₹ 34.19

![]()

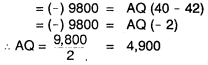

Computation of variances : Overhead Variance

Question 13.

The activity ratio of a concern is 95.6% whereas the capacity ratio is 105%. What is the efficiency ratio? (May 2000, 2 marks)

Answer:

Activity ratio \(=\frac{\text { Standard hours required for actual production }}{\text { Budgeted hours }}\) × 100

= 95.6%

Capacity ratio \(=\frac{\text { Actual hours worked }}{\text { Budgeted hours }}\) × 100 = 105%

Efficiency ratio \(=\frac{\text { Standard hours required for actual production }}{\text { Actual hours worked }}\) × 100

= \(\frac{95.6}{105}\) × 100 = 91.047%

Question 14.

A company has normal capacity of 100 machines working 8 hours per day of 25 days in a month. The budgeted fixed overheads of a month are ₹ 1,50,000. The standard time required to manufacture one unit of product is 4 hours. In a particular month the Company worked for 24 days of 750 machine hours per day and produced 4,500 units of the product. The actual fixed overheads incurred were ₹ 1,45,000 Compute:

(a) Efficiency variance.

(b) Capacity variance

(c) Calendar variance

(d) Expenditure variance

(e) Volume variance

(f) Total fixed overhead variance (May 2001, 10 marks)

Answer:

\(\mathrm{Fo}_1\) – Actual fixed overhead : 1,45,000

\(\mathrm{Fo}_2\) – Budgeted fixed overhead for the period or Standard fixed overhead : 1,50,000

\(\mathrm{Fo}_3\) – Fixed overhead for days/hours available of Standard rate during the year (₹ 150,000 ÷ 25 days) × 24 days : 1,44,000

\(\mathrm{Fo}_4\) – Fixed overhead for actual hour worked during

The year

(8,000 hours × ₹ 7.50) : 1,35,000

\(\mathrm{Fo}_5\) – Standard fixed overhead for actual production 4500 × ₹ 30 : 1,35,000

Variance:

(1) Fixed overhead expenditure variance = \(\mathrm{Fo}_1\) – \(\mathrm{Fo}_2\)

= 1,45,000 – 1,50,000 = 5,000 (F)

(2) Fixed overhead calender variance = \(\mathrm{Fo}_2\) – \(\mathrm{Fo}_3\)

= 1,50,000 – 1,44,000 = 6,000 (A)

(3) Fixed overhead capacity variance = \(\mathrm{Fo}_3\) – \(\mathrm{Fo}_4\)

= 1,44,000 – 1,35,000 = 9,000 (A)

(4) Fixed overhead efficiency variance = \(\mathrm{Fo}_4\) – \(\mathrm{Fo}_5\)

= 1,35,000 – 1,35,000 = Nil

(5) Fixed overhead variance = \(\mathrm{Fo}_1\) – \(\mathrm{Fo}_5\)

= 1,45,000 – 1,35,000 = 10,000 (A)

(6) Fixed overhead volume variance = \(\mathrm{Fo}_2\) – \(\mathrm{Fo}_5\)

= 1,50,000 – 1,35,000 = 15,000 (A)

Question 15.

Overhead variances should be viewed as interdependent rather than independent. Explain. (May 2006, 4 marks)

Answer

Overhead variances occur due to the difference between actual overheads and absorbed overheads. Therefore, if we have to calculate an overhead variance, we have to know the amount of the actual overheads and that of absorbed overheads.

The actual overheads can be known only at the end of the accounting peñod when the expense accounts are finalized.

The absorbed overheads are the overheads charged to each unit of production on the basis of a predetermined overhead rate.

Such pre-determined rate is also known as standard overhead recovery rate, or standard overhead absorption rate or standard burden rate.

To calculate the standard overhead recovery rate, we have to first make an estimate of the likely overhead expenses for each department for the next year.

The estimate of budget of the overheads is to be divided into fixed and variable elements.

An estimate of the level of normal capacity utilization is then made either in terms of production or machine hours or direct labour hours.

The estimated overheads are divided by the estimated capacity level to calculate the pro-determined. Overhead absorption rate as shown below:

Std. Fixed Overhead Rate \(=\frac{\text { Budgeted fixed overheads }}{\text { Normal volume }}\)

Std. Variable Overhead Rate \(=\frac{\text { Budgeted variable overheads }}{\text { Normal volume }}\)

Question 16.

SJ Ltd. has furnished the following information :

Standard overhead absorption rate per unit : ₹ 20

Standard rate per hour : ₹ 4

Budgeted production : 15,000 units

Actual production : 15,560 units

Actual overheads were ₹ 2,95,000 out of which ₹ 62,500 fixed.

Actual hours : 74,000

Overheads are based on the following flexible budget.

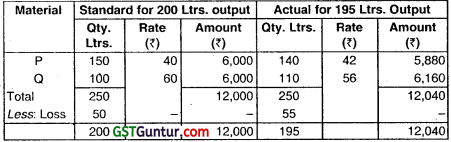

![]()

You are required to calculate the following overhead variances (on hour’s basis) with appropriate workings:

(i) Variable overhead efficiency and expenditure variance.

(ii) Fixed overhead efficiency and capacity variance. (May 2012, 8 marks)

Answer:

Workings:

(a) Variable overhead rate per unit

= Difference in total overheads at two levels/Difference in out-put at two level

= (2,70,000 – 2,10,000) /(14,000 – 10,000) = 60,000/ 4,000 = ₹ 15 per unit

(b) Fixed overhead = 2,70,000 – (14,000 × 15) = ₹ 60,000

(c) Standard Fixed Overhead Rate Per Hour = 4 – 3 = 1

(d) Standard Hour Per Unit = Standard OH rate per unit/standard overhead rate per hour = 20/4 = 5 hours

(e) Actual Variable Overhead = 2,95,000 – 62,500 = 2,32,500

(f) Actual Variable Overhead Per Hour = 2,32,500/74,000 = 3.1419

(g) Budgeted hours = 15,000 × 5 = 75,000 hours

(h) Standard variable overhead rate per hour

= Variable overheads/budgeted hours = 15,000 × 15/75,000 = ₹ 3.00 per hour

(i) Standard Hour’s for Actual Production = 15,560 × 5 = 77,800 hours

(i) Variable Overhead efficiency and expenditure Variance:

Variable overhead efficiency variance

= Standard Rate Per hour (Std. Hours – Actual Hours)

= 3 (77,800 – 74,000) = 11,400(F)

Variable overhead expenditure variance

= Actual Hours (Std. Rate Per Hour- Actual Rate Per Hour)

= 74,000 (3 – 3.1419) = 10,500 (A)

(ii) Fixed overhead efficiency and expenditure variance:

Fixed overhead efficiency Variance = Std. Rate per Hour (Std. Hours-Actual Hours)

= ₹ 1 (77,800 – 74,000) = 3,800 (F)

Fixed overheads Capacity variance = Std. Rate Per Hour(Actual Hours – Budgeted Hours)

= 1 (74,000 – 75,000)

= 74,000 – 75,000 = 1,000 (A)

Standard Fixed overhead rate per hour is calculated with the help of budgeted hours and the Fixed overhead efficiency and expenditure variance is calculated as follows:

Standard fixed overhead rate per hour

= Fixed overheads/budgeted hours = 60,000/75,000 = ₹ 0.80 per hour

(ii) Fixed overhead efficiency and capacity variance:

Fixed overhead efficiency Variance

= Std. Rate per hour (Std. hours – Actual hours)

= ₹ 0.80 (15.560 × 5 – 74,000)

= ₹ 3.040(F)

Fixed overhead capacity variance

= Std. Rate per hour (Actual hours – Budgeted hours)

= ₹ 0.80 (74,000 – 15,000 × 5)

= ₹ 800 (A)

![]()

Question 17.

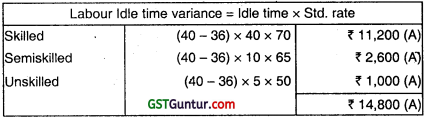

XYZ Co. Ltd. provides the following information:

You are required to calculate following overhead variances:

(a) Variable Overhead Variance

(b) Fixed Overhead Variance

(i) Expenditure Variance

(ii) Volume Variance (May 2014, 8 marks)

Answer:

(a) Calculation of Variable Overhead Variance:

(i) Variable overhead cost variance:

= (Std. hrs. for Actual prod.” × Std. OHS rate) – Actual overhead cost.

= (19 × 600) – 12,000 = 600 (A)

(ii) Variable efficiency variance:

= (Std. hrs. for actual prod.” – Actual hours) × Std. overhead rate.

= (19 – 21) × 600

= 1,200 (A)

(iii) Variable overhead Expenditure variance:

= (Actual hours × Std. variable overhead fate) – Actual overhead cost

= (21 × 600) – 12,000

= 12,600 – 12,000 ‘

= 600(F)

*Verification

Variable cost variance:

= V.O. exp. variance × V.O. efficiency variance

= 600 F – 1,200 (A)

= 600(A)

(b) Calculation of Fixed Overhead Variance:

(i) Fixed overhead expenditure variance:

= (Std. hours × Std. rate) – Actual overhead.

= (20 × 2,000) – 39,000

= 40,000 – 39,000

= 1,000 (F)

(ii) Fixed overhead volume variance:

= (Std. hours for actual output – Std. hours) × Std. fixed overhead rate

= (19 – 20) × 2,000

= 2,000 (A).

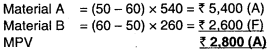

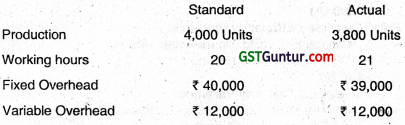

Question 18.

QS Limited has furnished the following information:

Standard overhead absorption rate per unit : ₹ 20

Standard rate per hour : ₹ 4

Budgeted production : 12000 units

Actual production : 15560 units

Actual working hours : 74000

Actual overheads amounted to ₹ 2,95,000, out of which ₹ 62,500 are fixed. Overheads are based on the following flexible budget:

Calculate following overhead variances on the basis of hours:

(i) Variable overhead efficiency variance.

(ii) Variable overhead expenditure variance.

(iii) Fixed overhead efficiency variance. (May 2015, 8 marks)

Answer:

Workings:

(a) Variable Overhead rate per unit

\(=\frac{\text { Difference of Overhead at two level }}{\text { Difference in Production units }}\)

\(=\frac{₹ 2,10,000-₹ 1,80,000}{10,000 \text { units }-8,000 \text { units }}\) = ₹ 15

(b) Fixed Overhead = ₹ 1,80,000 – (8,000 units × ₹ 15) = ₹ 60,000

(c) Standard hours per unit of production

\(=\frac{\text { Std. Overhead Absorption Rate }}{\text { Std. Rate per hour }}\) \(=\frac{₹ 20}{₹ 4}\) = 5 hours

(d) Standard Variable Overhead Rate per hour

\(=\frac{\text { Variable Overhead per unit }}{\text { Std. hour per unit }}\) \(=\frac{₹ 15}{5 \text { hours }}\) = ₹ 3

(e) Standard Fixed Overhead Rate per hour = ₹ 4 – ₹ 3 = ₹ 1

(f) Actual Variable Overhead = ₹ 2,95,000 – ₹ 62,500 = ₹ 2,32,500

(g) Actual Variable Overhead Rate per Hour \(=\frac{₹ 2,32,500}{74,000 \text { hours }}\)

= ₹ 3.1419

(h) Budgeted hours = 12,000 units × 5 hours = 60,000 hours

(i) Standard Hours for Actual Production = 15,560 units × 5 hours

= 77,800 hours

(i) Variable Overhead Efficiency Variance:

= Std. Rate per hour (Std. Hours – Actual Hours)

= ₹ 3 (77,800 hours – 74,000 hours)

= ₹ 11,400(F)

(ii) Variable Overhead Expenditure Variance:

= Actual Hours (Std. Rate – Actual Rate)

= 74,000 hours (₹ 3 – ₹ 3.1419)

= ₹ 10,500(A)

(iii) Fixed Overhead Efficiency Variance:

= Std. Rate per Hour (Std. Hours-Actual Hours)

= ₹ 1 (77,800 hours – 74,000 hours)

= ₹ 3.800(F)

(iv) Fixed Overhead Capacity Variance:

= Std. Rate per Hour (Actual Hours – Budgeted Hours)

= ₹ 1 (74,000 hours – 60,000 hours)

= ₹ 74,000 – ₹ 60,000 = ₹ 14,000(F)

Question 19.

Answer the following:

AB Ltd. has furnished the following

Budgeted fixed overhead rate is ₹ 1.00 per hour. In July 2016, the actual hours worked were 31,500. In relation to fixed overheads, calculate:

(i) Efficiency Variance

(ii) Capacity Variance

(iii) Calendar Variance

(iv) Volume Variance

(v) Expenditure Variance

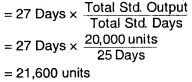

Answer:

Calculation of Fixed Overheads Variances

Output Absorbed = Actual Production × Budgeted Fixed O.H. p/unit

OH (F1) = 22,000 × ₹ 1.50 p/unit

= 33,000

Input Absorbed = Actual hrs. × Budgeted Fixed O.H. p/hour

OH(F2) = 31,500hrs. × ₹ 1

= 31,500

Possible OH (F3) = Possible Production × Budgeted Fixed O.H.

= (per/unit)

= 21,600 units × ₹ 1.50 p/unit

= ₹ 32,400

Budgeted OH (F4) = ₹ 30,000

Actual OH (F5) = ₹ 31,000

Budgeted FOH per unit \(=\frac{\text { Budgeted OHCost }}{\text { Budgeted output }}\) \(=\frac{₹ 30,000}{20,000 \text { units }}\) = ₹ 1.50 per unit

Possible Production = Actual Days × Std. Production in 1 day

Calculation of FOH Variances

- F.OH Efficiency Variance = F1 – F2 = 33000 – 31500 = 1500(F)

- F.OH Capacity Variance = F2 – F3 = 31500 – 32400 = 900(A)

- F.OH Calendar Variance = F3 – F4 = 32400 – 30000 = 2400(F)

- F.OH Volume Variance = F1 – F4 = 33000 – 30000 = 3000(F)

- F.OH Expenditure Variance = F4 – F5 = 30000 – 31000 = 1000(A)

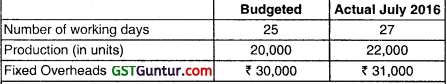

Question 20.

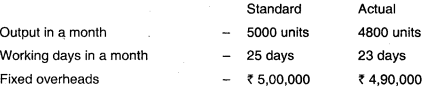

A manufacturing concern has provided following information related to fixed overheads:

Compute:

(i) Fixed overhead variance

(ii) Fixed overhead expenditure variance

(iii) Fixed overhead volume variance

(iv) Fixed overhead efficiency variance (Nov 2018, 5 marks)

Answer:

Standard Fixed Overhead Rate per unit \(=\frac{₹ 5,00,000}{5000 \text { units }}\) = ₹ 100

(i) Fixed Overhead Variance:

– (Absorbed Fixed Overhead – Actual Fixed Overhead)

= 1(4800 units × ₹ 100) – ₹ 4,90,000]

= ₹ 10,000 (Adverse)

(ii) Fixed Overhead Expenditure Variance:

= Budgeted Overhead – Actual Overhead

= (₹ 5,00,000 – ₹ 4,90,000)

= ₹ 10,000 (Favourable)

(iii) Fixed Overhead Volume Variance:

Recovered Overhead – Budgeted Overhead

= [(4800 units × ₹ 100) – ₹ 5,00,000)

= ₹ 20,000 (Adverse)

(iv) Fixed Overhead Efficiency Variance:

Std Fixed OH — Budgeted Fixed OH for Actual days

= 4,80000 — ((5,00,000 ÷ 25) × 23] = 20,000 (F)

Question 21.

ABC Ltd. has furnished the following information regarding the overheads for the month of June 2020 :

(i) Fixed Overhead Cost Variance : ₹ 2,800(Adverse)

(ii) Fixed Overhead Volume Variance : ₹ 2,000(Adverse)

(iii) Budgeted Hours for June, 2020 : 2,400 hours

(iv) Budgeted Overheads for June, 2020 : ₹ 12,000

(v) Actual rate of recovery of overheads : ₹ 8 Per Hour

From the above given information

Calculate :

(1) Fixed Overhead Expenditure Variance

(2) Actual Overheads Incurred

(3) Actual Hours for Actual Production

(4) Fixed Overhead Capacity Variance

(5) Standard Houis for Actual Production

(6) Fixed Overhead Efficiency Variance (Nov 2020, 10 marks)

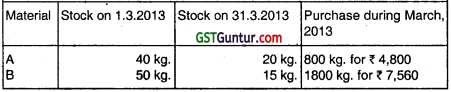

Question 22.

Premier Industries has a small factory where 52 workers are employed on an average for 25 days a month and they work 8 hours per day. The normal down time is 15%. The firm has introduced standard costing for cost control. Its monthly budget for November; 2020 shows that the budgeted variable and fixed overhead are ₹ 1,06,080 and ₹ 2,21,000 respectively. The firm reports the following details of actual performance for November, 2020, after the end of the month:

Actual hours worked : 8,100 hrs.

Actual production expressed in standard hours : 8,800 hrs.

Actual Variable Overheads : ₹ 1,02,000

Actual Fixed Overheads : ₹ 2,00,000

You are required to calculate:

(i) Variable Overhead Variances :

(a) Variable overhead expenditure variance.

(b) Variable overhead efficiency variance.

(ii) Fixed Overhead Variances :

(a) Fixed overhead budget variance.

(b) Fixed overhead capacity variance.

(c) Fixed overhead efficiency variance.

(iii) Control Ratios:

(a) Capacity ratio.

(b) Efficiency ratio.

(c) Activity ratio. (Jan 2021, 10 marks)

![]()

Question 23.

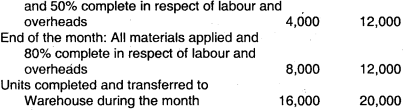

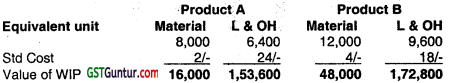

A Company manufacturing two products uses standard costing system. The following data relating to April, 2000 have been furnished to you:

Units processed/in Process

Beginning of the month: All materials applied

You may use average cost method to analyse.

The following were the actual costs recorded during the month:

Direct materials purchased at standard price amount to ₹ 2,00,000 and actual cost of which is ₹ 2,20,000. Direct materials used for consumption at standard price amount to ₹ 1,75,000.

Direct wages for actual hours worked at standard wages rates were ₹ 4,20,000 and at actual wage rates were ₹ 4,12,000.

Fixed overheads budgeted were ₹ 8,25,000 and actual fixed overheads incurred were ₹ 8,50,000.

Required:

(i) Direct material price variance at the point of consumption and at the point of purchase.

(ii) Direct material usage variance.

(iii) Direct wage rate and efficiency variance.

(iv) Fixed overheads volume and expenditure variance.

(v) Standard cost of WIP at the end of the month. (May 2000, 12 marks)

Answer:

(i) Direct material price variance at the point of consumption.

M1 = Actual Quantity × Actual Price.

= 1,75,000 × \(\frac{2,20,000}{2,00,000}\)

= ₹ 1,92,500

M2 = Actual quantity × std price = ₹ 1,75,000

Material price variance = M1 – M2 = 1,92,500 – 1,75,000

= 17,500(A)

Direct material price variance (at the point of purchase)

M1 = Actual quantity of material purchased × Actual Price = ₹ 2,20,000 (given)

M2 = Actual quantity of material purchased × Std price = ₹ 2,00,000 (given)

MPV = M1 – M2

= ₹ 2,20,000 – ₹ 2,00,000

= ₹ 20,000 (A)

(ii) Material usage variance = M2 – M4

M2 = AQ × S P

= ₹ 1,75,000 given

![]()

Direct material usage variance = ₹ 1,76,000 – ₹ 1,75,000 = ₹ 1,000(F)

(iii) Direct wage rate and efficiency variance : wage rate variance = L1 – L2

L1 = Actual labour hour × actual rate = ₹ 4,12,000 (given)

L2 = Actual labour hour × std rate

= ₹ 4,20,000 (given)

Wage rate variance = L1 – L2 = ₹ 4,12,000 – ₹ 4,20,000 = ₹ 8,000 (F)

Efficiency variance = L2 – L5

L2 = ₹ 4,20,000

L5 = Std labour hour × std rate

Efficiency variance = L2 – L5

= ₹ 4,20,000 – ₹ 3,56,800

= ₹ 63,200 (A)

(iv) Fixed over head volume and expenditure variance

F1 = Actual fixed overhead

= ₹ 8,50,000

F2 = Budgeted fixed overhead

F2 = ₹ 8,25,000

l5 = Std fixed overhead for production

Fixed overhead expenditure variance

= F1 – F2

= ₹ 8 50,000 – ₹ 8,25,000

= ₹ 25000 (A)

Volume variance = F2 – F5

= ₹ 8,25,000 – ₹,13,600 = ₹ 1,11,400 (A)

(v) Std Cost of WIP

Product A = ₹ 1,69,600

Product B = ₹ 2,20,800

Working Notes :

Equivalent Production Statement Using average cost method

Material Labour & overhead

Question 24.

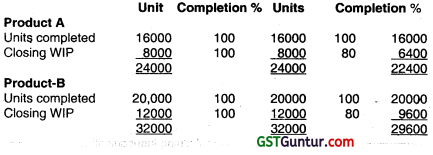

A single product company has prepared the following cost sheet based on 8,000 units of output per month:

?

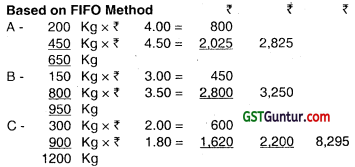

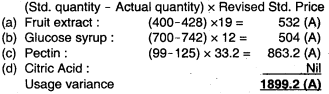

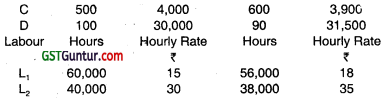

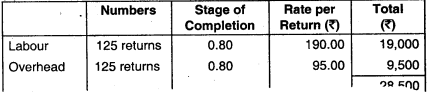

The flexible budget for factory overheads is as under:

![]()

The actual results for the month of October, 2002 are given below:

- Direct Materials purchased and consumed were 11,224 kg at ₹ 2,66,570.

- Direct Labour hours worked were 22,400 and Direct Wages paid amounted to ₹ 96,320.

- Factory overheads incurred amounted to ₹ 96,440 out of which the variable overhead is ₹ 2.60 per Direct Labour hour worked.

- Actual output is 7.620 units.

- Work-in-process:

Opening WIP: 300 units:

Materials 100% complete

Labour and Overheads 60% complete

Closing WIP : 200 units:

Materials 50% complete

Labour and Overheads 40% complete

You are required to analyse the variances. (Nov 2002, 12 marks)

Answer:

Material Variances:

M1 = Actual cost of actual material used

= AQ × AP

= 11,224 × 2375

= 2,66.570

M2 = Std. cost of actual material used

= AQ × SP

= 11,224 × 24

= 2,69,376

M4 = Std. cost of Std. Material used.

= SQ × SP

= 7,420 × 1.5 × 24 (refer working notes for Std. quantity)

= 2,67,120

Material Price variance = M1 – M2

= 2,66,570 – 2,69,376

= 2,806(F)

Material usage variance = M2 – M4

= 2,69,376 – 2,67,1 20

= 2,256 (A)

Material cost variance = M1 – M4

= 2,66,570 – 2,67,120

= 550(F)

Labour Variances:-

L1 = AHA × AR

= 22400 hours × ₹ 4.30 = ₹ 96,320

L2 = AHA × SR

= 22400 hours × ₹ 4 = ₹ 89,600

L5 = SH × SR

= 7520** × 3 × 4 (refer working notes for Std hours)

= ₹ 90,240

Labour cost variance = L1 – L5

= ₹ 96,320 – ₹ 90,240

= ₹ 6,080 (A)

Labour rate variance = L1 – L2

= ₹ 96,320 – 89,600

= ₹ 6,720(A)

Labour efficiency variance = L2 – L1

= 89,600 – 90,240

= ₹ 640(F)

Variable Overhead Variance

V1 = Actual variable overhead

= 22,400 × 2.60 = ₹ 58,240

V2 = Std. variable overhead for actual Hours.

AHA × SR

= 22,400 × 2.40*

= ₹ 53,760

V3 = AY × SR/unit = 7,520 × ₹ 7.20**

= ₹ 54,144

Variable overhead expenditure variance = V1 – V2

= ₹ 58,240 – ₹ 53,760

= ₹ 4,480 (A)

VOH efficiency variance = V2 – V3

= ₹ 53,760 – ₹ 54,144

= ₹ 384(F)

VOH cost variance = V1 – V3

= ₹ 58,240 – ₹ 54,144

= ₹ 4,096 (A)

*Standard Rate \(=\frac{\text { Budgeted variable overhead }}{\text { Budgeted hours. }}\)

= \(\frac{96,000-38,200}{8,000 \times 3}\)

= \(\frac{57,800}{24,000}\)

= ₹ 2.40/hour

Fixed overhead variance:

F1 = Actual fixed overhead

= 96,440 – 58,240

= 38,200

F2 = Budgeted fixed overhead

= 96,000 – 57,600

= 38,400

F3 = SR × ADA

= Not applicable

F4 = AHW × SR*

= 22,400 × 1.60

= 35,840

F5 = AY × SR / unit **

= 7,520 × ₹ 4.80

= ₹ 36,096

Fixed overhead cost variance = F1 – F5

= ₹ 38,200 – ₹ 36,096

= ₹ 2,104 (A)

Fixed overhead expenditure variance = F4 – F2

= ₹ 38,200 – ₹ 38,400

= ₹ 200 (F)

Fixed overhead capacity variance = F2 – F4

= ₹ 38,400 – ₹ 35,840 = ₹ 2,560 (A)

Fixed overhead efficiency variance = F4 – F5

= ₹ 35,840 – ₹ 36,096

= ₹ 256(F)

Fixed overhead volume variance = F2 – F5

= ₹ 38,400 – ₹ 36,096 = ₹ 2,304

* SR / hour \(=\frac{\text { Budgeted fixed overhead }}{\text { Budgeted hours worked }}\)

= \(\frac{38,400}{24,000}\)

= ₹ 1.60/hour

** SR / unit \(=\frac{\text { Budgeted fixed overhead }}{\text { Budgeted output }}\)

= \(\frac{38,400}{8,000}\)

= 4.80 / unit

Working Notes:

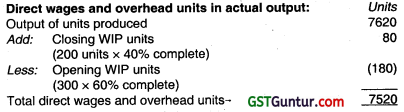

(1) Direct Material units in actual output:

(2)

Question 25.

C Preserves produces Jams, Marmalade and Preserves. All the products are produced in a similar fashion; the fruits are cooked at low temperature in a vacuum process and then blended with glucose syrup with added citric acid and pectin to help setting.

Margins are tight and the firm operates, a system of standard costing for each batch of Jam.

The standard cost data for a batch of raspberry jam are.

Fruits extract 400 kgs @ ₹ 16 per kg.

Glucose syrup 700 kgs @ ₹ 10 per kg.

Pectin 99 kgs @ ₹ 33.2 per kg.

Citricacid 1 kg at ₹ 200 per kg.

Labour 18 hours @ ₹ 32.50 per hour.

Standard processing loss 3%.

The climate conditions proved disastrous for the raspberry crop. As a consequence, normal prices in the trade were ₹ 19 per kg for fruits abstract although good buying could achieve some savings. The impact of exchange rates for imported sugar plus the minimum price fixed for sugarcane. caused the price of syrup to increase by 20%. The retail results for the batch were-

Fruit extract 428 kgs at ₹ 18 per kg.

Glucose syrup 742 kgs at ₹ 12 per kg.

Pectin 125 kgs at ₹ 32.8 per kg.

Citric acid 1 kgs at ₹ 95 per kg.

Labour 20 hrs. at ₹ 30 per hour.

Actual output was 1,164 kgs of raspberry jam.

You are required to:

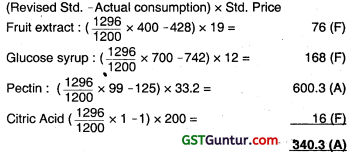

(i) Calculate the ingredients planning variances that are deemed uncontrollable.

(ii) Calculate the Ingredients operating variances that are deemed controllable.

(iii) Calculate the mixture and yield variances.

(iv) Calculate the total variances for the batch. (May 2005, 11 marks)

Answer:

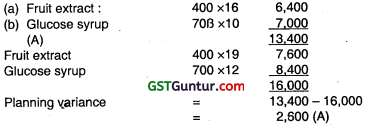

(i) Ingredient Planning Variance:

Standard quantity × Std. Price –

Std. quantity × revised Ski. Price

(ii) Operating variance:

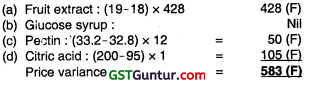

(A) Price variance:

Revised Material Price -Actual Material Price × Actual Quantity consumed

(B) Usage variance:

(C) Mix variance:

(iii) Mixture & Yield variance:

(Actual yield – Std. yield for actual output × Std. cost per unit.)

(1,164 – 1,257.12) × \(\frac{19,486.8}{1,164}\)

= 1,158.9 (A)

(v) Labour Operating variance:

Std. Labour cost – Actual Labour cost

= 18 × 32.50 – 20 × 30

= 585 – 600 = 15(A)

(iv) Total variance:

Planning variance + usage variance + price variance + labour operating variance

= 2600 (A) + 1899.2 (A) + 583(F) + 15(A) = 3931.2 (A)

![]()

Question 26.

The following information is available from the cost records of Vatika & Co.

For the month of August, 2009:

Material purchased 24,000 kg ₹ 1,05,600

Material consumed 22,800 kg

Actual wages paid for 5,940 hours ₹ 29,700

Unit produced 2160 units

Standard rates and prices are:

Direct material rate is ₹ 4.00 per kg

Direct labour rate is ₹ 4.00 per hour

Standard input is 10 kg. for one unit

Standard requirement is 2.5 hours per unit

Calculate all material and labour variances for the month of August, 2009. (Nov 2009, 8 marks)

Answer:

(i) Material variances

(i) Material Cost Variance

= (Standard Quantity × Standard Price) – (Actual Quantity × Actual Price)

= (2,160 × 4 × 10) – (22,800 × 4.40)

= ₹ 86,400 – ₹ 1,00,320

= 13,920(A)

(ii) Material Price Variance

= Actual Quantity (Standard Price – Actual Price)

= 2,800 Kg (4 – 4.40)

= 9,120(A)

(iii) Material Usage Variance

Standard Price (Standard Quantity – Actual Quantity)

= 4 (21,600 – 22,800

= 4,800 (A)

Note: unit basis for direct material has been taken as kg. hence, direct material rate is ₹ 4 per kg.

Verification

MCV = MPV + MUV

13,920 (A) = 9,120 (Adverse) + 4,800 (A)

Labour Variances

(i) Labour Cost Variance

= (Standard Hour × Standard Rate) – (Actual Hour × Actual Rate)

= (2.160 × 2.50 × 4) – (29,700)

= 21,600 – 29,700 = 8,100(a)

(ii) Labour Rate Variance

= Actual Hour (Standard Rato – Actual Rate)

= 5,940 (4 – 5) = 5,940 (A)

(iii) Labour Efficiency Variance

= Standard Rate (Standard Hour – Actual Hour)

= 4(5,400 – 5,940) = 2,160 (A)

Verification:

LCV = LRV + LEV

8,100 (A) = 5,940 (A) + 2,160 (A)

Standard Hour = 2,160 Units × 2.50 Hours = 5,400 Hrs.

= 4(5,400 – 5,940) = 2,160 (A)

Verification:

LCV = LRV + LEV

8,100 (A) = 5,940 (A) + 2,160 (A)

Standard Hour = 2.160 Units × 2.50 Hours = 5,400 Hrs.

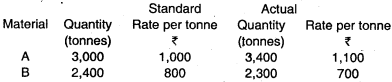

Question 27.

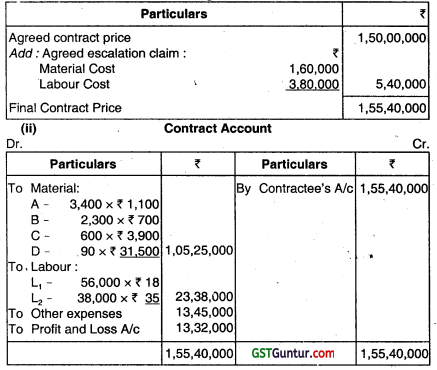

SB Constructions Limited has entered into a big contract at an agreed price of ₹ 1,50,00,000 subject to an escalation clause for material and labour as spent out on the contract and corresponding actuals are as follows:

You are required to:

(i) Give your analysis of admissible escalation daim and determine the final contract price payable. (May 2010, 4 marks)

(ii) Prepare the contract account, if all the expenses other than material and labour related to the contract are ₹ 13,45,000. (May 2010, 3 marks)

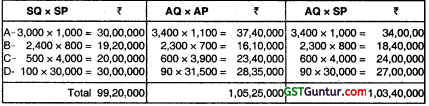

(iii) Calculate the following variances and verify them:

(a) Material cost variance

(b) Material price variance

(c) Material usage variance

(d) Labour cost variance

(e) Labour rate variance

(f) Labour efficiency variance. (May 2010, 8 marks)

Answer:

(i) Statement showing additional claim due to escalation clause.

Statement showing Final Contract Price

(iii)

Material Cost Variance (MCV) = (SQ × SP) – (AQ × AP)

= ₹ 99,20,000 – ₹ 1,05,25,000

= ₹ 6,05,000(A)

Material Price Variance (MPV) = AQ (SP – AP) or (AQ × SP) – (AQ × AP)

= 1,03,40,000 – ₹ 1,05,25,000

= ₹ 1,85,000 (A)

Material Usage Variance (MUV) = (SQ × SP) – (AQ × SP)

= ₹ 99,20,000 – ₹ 1,03,40,000

= ₹ 4,20,000(A)

Verification = MCV = MPV + MUV

Or ₹ 6,05,000 (A) = ₹ 1,85,000(A) + ₹ 4,20,000(A)

Or ₹ 6,05,000 (A) = ₹ 6,05,000(A)

Labour Cost Variance (LCV) = (SH × SR) – (AH × AR)

= ₹ 21,00,000 – 23,38,000

= ₹ 2,38,000(A)

Labour Rate Variance (LRV) = (AH × SR) – (AH × AR)

= ₹ 19,80,000 – ₹ 23,38,000

= ₹ 3,58,000(A)

Labour Efficiency Variance (LEV) = (SH × SP) – (AH × SP)

= 21,00,000 – 19,80,000

= ₹ 1,20,000(F)

Verification – LCV = LRV + LEV

2,38,000(A) = ₹ 3,58,000(A) + ₹ 1,20,000(F)

Or ₹ 2,38,000(A) = ₹ 2,38,000(A)

Question 28.

Gama Ltd. has furnished the following standard cost data per unit of production:

- Material 10kg @ ₹ 10 per kg.

- Labour 6 hours @ ₹ 5.50 per hour.

- Variable overhead 6 hours @ ₹ 10 per hour.

- Fixed overhead ₹ 4,50,000 per month (Based on a normal volume of 30,000 labour hours). The actual cost data for the month of August 2011 are as follows:

- Material used 50,000 kg at a cost of ₹ 5,25,000.

- Labour paid ₹ 1,55,000 for 31,000 hours worked.

- Variable overheads ₹ 2,93,000.

- Fixed overheads ₹ 4,70,000.

- Actual production 4,800 units.

Calculate:

(i) Material cost variance

(ii) Labour cost variance.

(iii) Fixed overhead cost variance

(iv) Variable overhead cost variance (Nov 2011, 8 marks)

Answer:

Budgeted Production 30,000/5,000 units

Budgeted Fixed Overhead Rate = 4,50,000/5,000

= ₹ 90 per unit

1. Material Cost Variance = Total Standard Cost for Actual Output – Total Actual Cost

= 4,800 × 10 × 10 × 5,25,000

= 4,80,000 – 5,25,000

= 45,000(A)

2. Labour Cost Variance = Total Standard Cost of labour for Actual Output – Total Actual Cost of labour

= 4,800 × 6.0 × 5.50 – 1,55,000

= 1,58,400 – 1,55,000

= 3,400 (F)

3. Fixed OH Cost Variance = Recovered Fixed overhead – Actual Fixed overhead

= 90 × 4,800 – 4,70,000

= 38,000 (A)

4. Variable OH Cost Variance = Recovered Variable overheads – Actual Variables overheads

= 4,800 × 6 × 10

= 2,88,000 – 2,93,000

= 5,000(A)

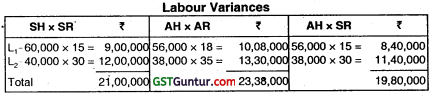

Question 29.

SP Limited produces a product ‘Tempex’ which is sold in a 10 Kg. packet. The standard cost card per packet of ‘Tempex’ are as follows:

Budgeted output for the third quarter of a year was 10,000 Kg. Actual output is 9,000 Kg.

Actual cost for this quarter are as follows:

Direct Materials 8,900 Kg @ ₹ 46 per Kg. : ₹ 4,09,400

Direct Labour 7,000 hours @ ₹ 52 per hour : ₹ 3,64,0001

Variable Overhead incurred : 72,500

Fixed Overhead incurred : ₹ 1,92,000

You are required to calculate:

- Material Usage Variance

- Material Price Variance

- Material Cost Variance

- Labour Efficiency Variance

- Labour Rate Variance

- Labour Cost Variance

- Variable Overhead Cost Variance

- Fixed Overhead Cost Variance (Nov 2013, 8 marks)

Answer:

Budgeted Production 30,000/6 = 5,000 units

Budgeted Fìxed Overhead Rato = 4,50,000/5,000

= ₹ 90 per unit

1. Máterial Cost Variance = Total Standard Cost for Actual Output – Total Actual Cost

= 4,800 × 10 × 10 – 5,25,000

= 4,80,000 – 5,25,000

= 45,000 (A)

2. Labour Cost Variance = Total Standard Cost of labour for Actual Output – Total Actual Cost of labour

= 4,800 × 6.0 × 5.50 – 1,55,000

= 1,58,400 – 1,55,000

= 3,400(F)

3. Fixed OH Cost Variance = Recovered Fixed overhead – Actual Fixed overhead

= 90 × 4,800 – 4,70,000

= 38,000(A)

4. Variable OH Cost Variance Recovered Variable overheads – Actual Variables overheads

= 4,800 × 6 × 10

= 2,88,000 – 2,93,000

= 5,000(A)

Question 30.

SP Limited produces a product ‘Tempex’ which is sold in a 10 Kg. packet. The standard cast card per packet of ‘Tempex’ are as follows:

Budgeted output for the third quarter of a year was 10,000 Kg. Actual output is 9,000 Kg.

Actual cost for this quarter are as follows:

Direct Materials 8,900 Kg @ ₹ 46 per Kg. : ₹ 4,09,400

Direct Labour 7,000 hours @ ₹ 52 per hour : ₹ 3,64,00Œ

Variable Overhead incurred : ₹ 72,500

Fixed Overhead incurred : ₹ 1,92,000

You are required to calculate:

(i) Material Usage Variance

(ii) Material Price Varlarce

(iii) Material Cost Variance

(iv) Labour Efficiency Variance

(v) Labour Rato Variance

(vi) Labour Cost Variance

(vii) Variable Overhead Cost Variance

(viii) Fixed Overhead Cost Variance (Nov 2013, 8 marks)

Answer:

(i) Material Usage Variance

= Standard price (Standard quantity – Actual quantity)

= ₹ 45 (9,000 – 8,900)

= ₹ 4,500(F)

(ii) Material Price Variance

= Actual quantity (Standard price – Actual price)

= 8,900(45-46)

= 8,900 (A)

(iii) Material Cost Variance

= Standard cost – Actual cost

= (9,000 × 45) – (8,900 × 46)

= 4,05,000 – 4,09,400

= 4,400 (A)

(iv) Labour Efficiency Variance

= Standard rate (standard hours for actual output – actual hours)

50 (9,000 × \(\frac{8}{10}\) – 7,000)

= 10,000 (F)

(v) Labour Rate Variance

= Actual time (std. rate – actual rate)

= 7,000 (50 – 52)

= 14,000 (A)

(vi) Labour Cost Variance

= Labour efficiency variance + Labour rate variance

= 10,000 + (-14,000)

= 4,000 (A)

(vii) Variable Overhead Cost Variance

= (Standard hours × Standard rate) – Absorbed variable overhead.

= (9,000 × \(\frac{8}{10}\) × 10) – 72,500 = 500(A)

(viii) Fixed Overhead Cost Variance

= (actual output × std. hours) – Absorbed fixed OH

= (9.000 × \(\frac{200}{10}\)) – 1,92,000 = 12,000 (A)

![]()

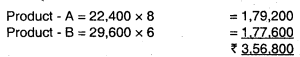

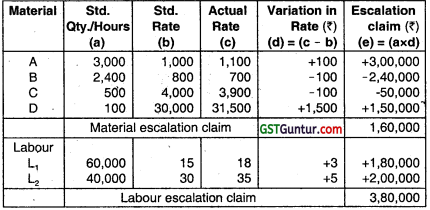

Question 31.

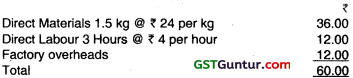

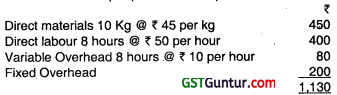

X Associates undertake to prepare income tax returns for individuals for a fee. They use the weighted average method and actual costs for the financial reporting purposes. However, for internal reporting, they use a standard cost system. The standards, based on equivalent performance, have been established as follows:

Labour per return 5 hrs @ ₹ 40 per hour

Overhead per return 5 hrs @ ₹ 20 per hour

For March 2015 performance, budgeted overhead is ₹ 98,000 for standard labour hours allowed. The following additional information pertains to the month of March 2015:

You are required to compute:

(a) For each element, equivalent units of performance and the actual cost per equivalent unit.

(b) Actual cost of return-in-process on March 31.

(c) The standard cost per return.

(d) The labour rate and labour efficiency variance as well as overhead volume and overhead expenditure variance. (May 2016, 8 marks)

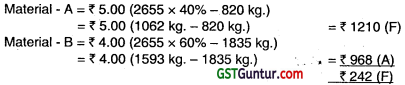

Answer:

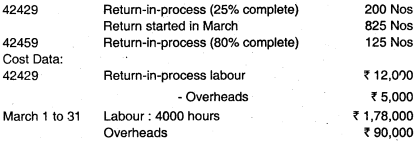

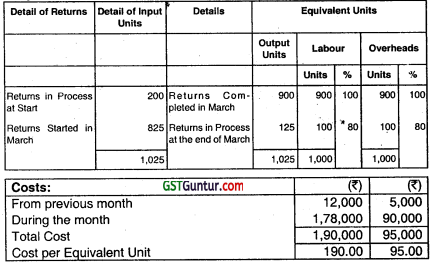

(a) Statement Showing Cost Elements Equivalent. Units of performance and the Actual Cost per Equivalent Unit:

(b) Actual cost of returns in process on March 31:

(c) Standard Cost Per Return

![]()

Budgeted volume for March = 98,000 / 1.000 = 980

Returns

Actual labour rate = ₹ 1,78,000/4,000 = ₹ 44.50

(d) Computation of Variances:

Variance Analysis:

Labour Rate Variance

= Actual Time × (Standard Rate – Actual Rate)

= Standard Rate × Actual Time – Actual Rate × Actual Time

= ₹ 40 × 4,000 hrs. – ₹ 1,78,000 = ₹ 18,000 (A)

Labour Efficiency Variance = Standard Rate × (Standard Time – Actual Time)

= Standard Rate × Standard Time – Standard Rate × Actual Time

= ₹ 40 × (950 units × 5 hrs.) – ₹ 40 × 4,000 hrs.

= 1,90,000 – 1,60,000 = ₹ 30,000 (F)

Overhead Expenditure or Budgeted Variance

= Budgeted Overhead – Actual Overhead

= ₹ 98,000 – ₹ 90,000

= ₹ 8,000 (F)

Overhead Volume Variance

= Recovered/ Absorbed Overhead – Budgeted Overhead

= 950 Units × 5 hrs. × ₹ 20 – ₹ 98,000 = ₹ 3,000 (A)

Question 32.

The following information is available from the cost records of a Company for the month of July. 2016:

- Material purchased 22000 pieces ₹ 90,000

- Material consumed 21000 pieces

- Actual wages paid for 5150 hours ₹ 25,750

- Fixed Factory overhead incurred ₹ 46,000

- Fixed Factory overhead budgeted ₹ 42,000

- Units produced 1900*

- Standard rates and prices are:

Direct material ₹ 4.50 per piece

Standard input 10 pieces per unit

Direct labour rate ₹ 6 per hour

Standard requirement 2.5 hours per unit

Overheads ₹ 8 per labour hour

You are required to calculate the following variances:

- Material price variance

- Material usage variance

- Labour rate variance

- Labour efficiency variance

- Fixed overhead expenditure variance

- Fixed overhead efficiency variance

- Fixed overhead capacity variance. (Nov 2016, 8 marks)

Answer:

Calculation of:

1. Material Price Variance:

MPV = (Standard Price – Actual Price) × Actual Quantity = (4.50 – 4.09) × 21,000 = 8,610 (Favourable)

2. Material Usage Variance:

MUV = (Standard Quantity – Actual Quantity) × Standard Price = (19,000 – 21,000) × 4.50 = 9,000(Adverse)

3. Labour Rate Variance:

LRV = (Standard rate – Actual rate) x Actual hours.

= (6 – 5) × 5,150 = 5,150 (Favourable)

4. Labour Efficiency Variance:

LEV = (Standard hours – Actual hours) × Standard rate

= (4,750 -5,150) × 6 = 2,400 (Adverse)

5. Fixed overhead expenditure variance:

FOH exp. variance = Budgeted exp. – Actual exp.

= ₹ 42,00046,000

= ₹ 4,000 (Adverse)

6. Fixed overhead efficiency variance:

FOH efficiency variance = SR × (SH – AH)

= 8 × (4,750-5,150)

= 3,200 (Adverse)

7. Fixed overhead capacity variance:

FOH capacity variance = SR × (AH – Budgeted Hour)

= 8 × (5,150 – 5,250)

= 800 (Adverse)

Budgeted Hour = \(\frac{42,000}{8}\) = 5,250

Question 33.

ABC Ltd. had prepared the following estimation for the month of April:

Normal loss was expected to be 10% of total input materials and an idle labour time of 5% of expected labour hours was also estimated.

At the end of the month the following information has been collected from the cost accounting department:

The company has produced 1,480 kg. finished product by using the followings:

You are required to CALCULATE:

(a) Material Cost Variance;

(b) Material Price Variance;

(C) Material Mix Variance;

(d) Material Yield Variance;

(e) Labour Cost Variance;

(f) Labour Efficiency Variance and

(g) Labour Yield Variance.

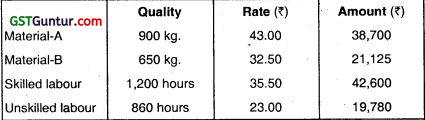

Answer:

Material Variances:

WN-1: Standard Quantity (SQ):

Material – A – (\(\frac{800 \mathrm{~kg} .}{0.9 \times 1,400 \mathrm{~kg}}\) × 1,480 kg) = 939.68 or 940 kg.

Material – B – (\(\frac{600 \mathrm{~kg} .}{0.9 \times 1,400 \mathrm{~kg}}\) × 1,480 kg) = 704.76 or 705 kg.

WN- 2: Revised Standard Quantity (RSQ):

Material A- (\(\frac{800 \mathrm{~kg} .}{0.9 \times 1,400 \mathrm{~kg}}\) × 1,550 kg.] = 885.71 or 886 kg.

Material B – (\(\frac{600 \mathrm{~kg}}{0.9 \times 1,400 \mathrm{~kg}}\) × 1,550 kg.] = 664.28 or 664 kg.

(a) Material Cost Variance (A + B) = {(SQ × SP) – (AQ × AP)}

= {63,450 – 59,825} = 3,625 (F)

(b) Material Price Variance (A + B) = {(AQ × SP) – (AQ × AP)

= {60,000 – 59,825} = 175(F)

(c) Material Mix Variance (A + B) = {(RSQ × SP) – (AQ × SP)}

= {59,790 – 60,000} =210 (A)

(d) Material Yield Variance (A + B) = {(SQ × SP) – (RSQ × SP)}

= {63,450 – 59,790} = 3,660 (F)

Labour Variances:

WN- 3: Standard Hours (SH):

Skilled labour = (\(\frac{0.95 \times 1,000 \mathrm{hrs}}{0.90 \times 1,400 \mathrm{~kg}}\) × 1,480 kg.) = 1,115.87 or 1,116 hrs.

Unskilled labour = ((\(\frac{0.95 \times 800 \mathrm{hrs}}{0.90 \times 1,400 \mathrm{~kg}}\)) × 1,480 kg.) = 892,69 or 893 hrs.

WN- 4: Revised Standard Hours (RSH):

Skilled labour = (\(\frac{1,000 \mathrm{hr}}{1,800 \mathrm{hr}}\) × 2,060 hr.s.) = 1,144.44 or 1,144 hrs.

Unskilled labour = (\(\frac{800 \mathrm{hr}}{1,800 \mathrm{hr}}\) × 2,060 hr.s.) = 915.56 or 916 hrs.

(e) Labour Cost Variance

(Skilled +Unskilled) = {(SH × SR) – (AH × AR)}

= {61,496 – 62,380} = 884 (A)

(f) Labour Efficiency Variance

(Skilled+Unskilled) = {(SH × SR) – (AH × SR)}

= {61,496 – 63,920} = 2,424 (A)

(g) Labour Yield Variance

(Skilled + Unskilled) = {(SH × SR) – (RSH × SR)}

Miscellaneous

Question 34.

Describe three distinct group of variances that arise in standard costing. (May 2000, 6 marks)

Answer:

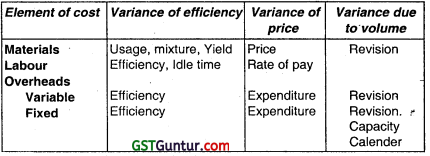

The three distinct groups of variances that arise in standard costing are :

- Variances of efficiency : These are the variances, which arise due to efficiency or inefficiency in use of material, labour etc.

- Variances of prices and rates : These are the variances, which arise due to changes in procurement, price and standard price.

- Variances due to volume : These represent, the effect of difference between actual activity and standard level of activity.

The above can be summarised as follows:-

Question 35.

State the features of Partial Plan of Standards Cost Accounting procedure. (May 2001, 4 marks)

Answer:

Features of Partial Plan of Standard Cost Accounting procedure : Standard cost operations can be recorded in the books of account by using partial plan.

Features of partial plan are as follows :-

- Partial plan system uses current standards in which the inventory will be valued at current standard cost figure.

- The analysis of variance is done after the end of the month.

- The closing balance of WIP is also shown at standard cost. The balance – after making the credit entries represent the variance from standard for the month.

- Under this method, WIP account is charged at the actual cost of production for the month and is credited with the standard cost of the month’s production of finished product.

![]()

Question 36.

“Standard costing system is not compatible with Activity Based Costing System.” Do you agree with this statement? Explain your answer. (May 2002, 3 marks)

Answer:

It is not correct to say that standard Costing system is not compatible with Activity Based Costing System. Standard costing system is a tool for cost control. In this, standards are established for each cost element. Variances between standard cost and actual costs are reported periodically to managers, who use the information of remedial measures or for revision of standards.

Under ‘Activity Based Costing System’ costs are collected around activity pools and are assigned to products and services using appropriate cost drivers. Standards can be established for costs for carrying out each type of activity.

Question 37.

How the opportunity cost for inefficient use of scarce resources be presented in variance reports under a standard costing system? (May 2002, 4 marks)

Answer:

Opportunity cost arises from failure to use scarce resources efficiently, such as :

1. Inefficient capacity utilisation results in loss of production and consequently loss of contribution.

2. Inefficient use of scarce material results in lower production and loss of contribution. So, it is appropriate to include contribution loss in reporting material usage variance or labour efficiency variance, in case the material is scarce or labour hours is scarce. As a general rule, loss of contribution should be included in the variance report and should be assigned to the manager, whose below standard performance has caused the loss.

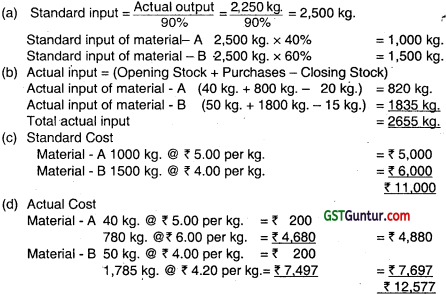

Question 38.

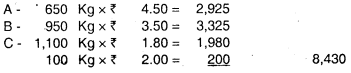

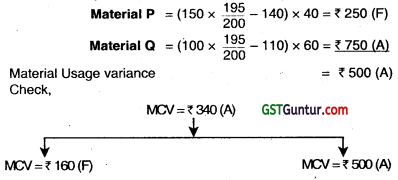

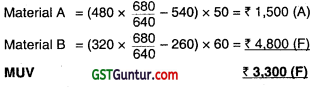

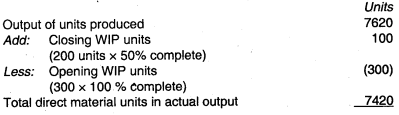

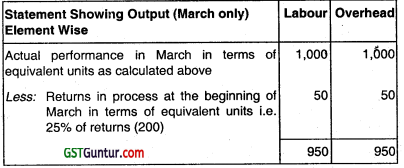

Under the single plan, record the journal entries giving appropriate narration, with indication of amounts of debits or credits alongside the entries, for the following transactions using the respective control A/c.

(i) Material price variance (on purchase of materials)

(ii) Material usage variance (on consumption)

(iii) Labour rate variance. (Nov 2006, 6 marks)

Answer:

Under the single plan, Journal entries are :

(i) Material price variance (on purchase of materials)

![]()

(ii) Material usages variance (on consumption)

![]()

(Being recording of usage variance at Standard cost of over/under utilised quantity).

(iii) Labour Rate Variance :-

![]()

(Being entry to record wages at standard rate)