Chapter 4 Search and Status Report – Secretarial Audit Compliance Management and Due Diligence ICSI Study Material is designed strictly as per the latest syllabus and exam pattern.

Search and Status Report – Secretarial Audit, Compliance Management and Due Diligence Study Material

Question 1.

short note on the following:

Importance of search/status report. (Dec 2016, 3 marks)

Answer:

Importance of Search/Status Report

The scope of a search report depends upon the requirements of the Bank or Financial Institution concerned. A search report enables the Bank/Financial Institution to evaluate the extent up to which the company has already borrowed money and created charges on the security of its movable and/or (immovable properties. This information is vital for considering the company’s request for grant of loans and other credit facilities. The Bank/Financial I Institution, while assessing the company’s need for funds, can take a conscious decision regarding the quantum of loan/credit facility to be , sanctioned, sufficiency of security required and its nature, as also other terms and conditions to be stipulated. The search report, thus, acts as an important source of information enabling the lending Bank/Institution to take an informed and speedy decision, and it also assures about the credit-worthiness or otherwise of the borrowing company.

![]()

Question 2.

Write short note on the following:

Charges requiring Registration (June 2018, 3 marks)

Answer:

The followings are the list of charges which is required to be registered with the Registrar of Companies:

- A charge for the purpose of securing any issue of debentures;

- A charge on uncalled share capital of the company;

- A charge on any immovable property, wherever situated, or any interest therein;

- A charge on any book debts of the company;

- A charge, not being a pledge, on any movable property of the company;

- A floating charge on the undertaking or any property of the company including stock-in-trade;

- A charge on calls made but not paid;

- A charge on a ship or any share in ship;

- A charge on goodwill, or on a patent or a license under a patent, or on A trade-mark, or on a copyright, or a license under a copyright;

- Charges on properties acquired subject to any charge thereon.

Question 3.

Write short notes on the following:

Time limit for filing the forms for charges requiring registration with the Registrar of Companies. (Dec 2018, 3 marks)

Answer:

Event:

Creation of charge or modification of charge or acquisition of property which is subject to charge

Time limit:

Section 77(1)

It shall be the duty of every company creating a charge within or outside India, on its property or assets or any of its undertakings, whethertangible or otherwise, and situated in or outside India, to register the particulars of the charge signed by the company and the charge-holder together with the instruments, if any, creating such The date when the event takes place is also included while calculating the limit. With the additional fees and an application supported by. a declaration from charge in such form, on payment of such fees and in such manner as may be prescribed, with the Registrar within thirty days of its creation.

Provided that the Registrar may, on an application by the company, allow such registration to be made

(a) in case of charges created before the commencement of the Companies (Amendment) Ordinance, 2018, within a period of three hundred days of such creation; or

(b) in case of charges created on or after the commencement of the Companies (Amendment) Ordinance, 2019, within a period of sixty days of such creation, on payment of such additional fees as may be prescribed:

Rule 3

1. For registration of charge as provided in sub-section (1) of section 77, section 78 and section 79, the particulars of the charge together with a copy of the instrument, if any, creating or modifying the charge in Form No. CHG-1 (for other than Debentures) or Form No. CHG-9 (for debentures including rectification), as the case may be, duly signed by the company and the charge holder shall be filed with the Registrar within a period of thirty days of the date of creation or modification of charge along with the fee.

2. If the particulars of a charge are not filed in accordance with sub-rule (1), such creation or modification shall be filed in Form No. CHG-1 or Form No. CHG- 9 within the period as specified in section 77 on payment of additional fee or advalorem fee as prescribed in the Companies (Registration Offices and Fees) Rules, 2014.

3. Where the company fails to register the charge in accordance with sub-rule. (1) and the registration is effected on the application of the charge-holder, such charge-holder shall be entitled to recover from the company the amount of any fees or additional fees or advalorem fees paid by him ‘to the Registrar for the purpose of registration of charge.

Effect:

The date when the event takes place is also included while calculating the limit. With the additional fees and an application supported by. a declaration from the company signed by its company secretary or a director that such belated filling shall not adversely affect the rights of any other inter-vening creditors of the company, filled to Registar.

![]()

Question 4.

Critically examine and comment on the following:

The scope of a search report depends upon the requirements of the bank or financial institution concerned. (June 2012, 5 marks)

Answer:

The scope of a search report depends upon the requirements of the Bank or Financial Institution concerned. A search report prepared by the company secretary in practice enables the Bank Financial Institution to evaluate the extent upto which the company has already borrowed moneys and created charges on the security of its movable and / or immovable properties. The search report acts as an important source of information enabling the Lending Bank / Institution to take an informed and speedy decision, and also assure it about the credit – worthiness or otherwise of the borrowing company.

Question 5.

Swift Ltd. is seeking your advice as to how the registration of charges (created/modified) with the Registrar of Companies as required under sections 77 to 87 of the Companies Act, 2013 will be made. Advise. (Dec 2012, 5 marks)

Answer:

Registration of Creation/ Modification/ Satisfaction of Charge

- The prescribed particulars of the charge requiring registration were filed with the ROC in e-form CHG-1 digitally signed by the company as well as the charge holder and along with the original/ certified copy of the instrument, if any, within 30 days after the date of its creation or within the time permitted by the ROC under proviso to Section 77 of the Companies Act.

- The e-form CHG-1 was pre-certified by a Practising Company Secretary or Chartered accountant or Cost accountant.

- In case of issue of debentures of a series, if there has been any charge to the benefit of debenture holders of that series, the required particulars have been filed with the Registrar in Form No. CHG-9 (Form CHG-9 should also have been precertified as above) within 30 days from the date of execution of the debentures of the series.

- The documents were duly registered by the ROC or a charge identification number was allotted.

- Abstract of registration is duly endorsed on every debenture or certificate of debenture stock issued, the payment of which is secured by the charge registered.

- Particulars of modification of charges were filed in e-form No. CHG-1 duly signed with the ROC within 30 days of the modification or within the extended period.

- A copy of the instrument creating, modifying charge/ a copy of debenture of the series, if any, required to be registered was kept at the registered office.

- Where payment or satisfaction of charge registered has been effected in full intimation thereof has been sent to the ROC in e- form No. CHG-4 by the company as well as the charge holder within 30 days from the date of such payment or satisfaction (Section 82).

- The satisfaction of charge has been registered by the ROC.

Question 6.

Critically examine and comment of the following:

The scope of a search report depends upon the requirement of the bank or financial institution concerned. (Dec 2018, 4 marks)

![]()

Question 7.

Examine and comment on the following:

The search and status report informs the lenders about the status of charges held by them vis-a-vis held by others. This becomes a part of due diligence before making any further lendings. (Dec 2013, 4 marks)

Answer:

The statement “The search and status report informs the lenders about the status of charges held by them vis-a-vis held by others. This become a part of due diligence before making any further lending” is correct.

Bank and Financial Institutions, while granting loans to companies, invariably obtain a search/status report on the position of borrowings made by the company and the particulars of charges created by the company on its assets. This is a part of the security aspect of the amount proposed to be lent.

Search/status reports refers to report which give* the position of borrowing and particulars of charges created by the company on its assets. Search report may also include information like charges pending registration. Search report is related and restricted to only those documents which are filed in documents file.

Question 8.

Critically examine and comment on the following:

The scope of a search report depends upon the requirements of the lender who advances funds to the company. (Dec 2014, 4 marks)

Answer:

The scope of a Search report depends upon the requirements of the lender who advances funds to the Company.

A Search report prepared enables the Bank/Financial Institution to evaluate the extent up to which the company has already borrowed money and created charges on the security of its movable and/or immovable properties. This information is very vital for considering the company’s request for grant of loans and other credit facilities. The Bank/Financial Institution, while assessing the company’s needs for funds, can take a conscious decision regarding the quantum of loan/credit facility to be sanctioned, sufficiency of security required and its nature, as also other terms and conditions to be stipulated. The Search report, thus, acts as an important source of information enabling the lending Bank/Institution to take an informed and speedy decision and also assures it about the credit-worthiness or otherwise of the borrowing company.

Question 9.

What is the Search and Status Report. What are the points to be considered while finalizing the Search and Status Report? (Dec 2017, 5 marks)

Answer:

A Search and Status Report as is apparent from, its name contains two aspects. The first being ‘search’ which involves physical inspection of documents and the second activity ‘status’ which comprises of reporting of the information as made available by the search.

Thus, a search and status report de facto acts as a ‘Progress Report’ on the legal aspects and also a ready reckoner of the exact position.

Points to be considered while finalizing the Search and Status Report

- Examination of documents and registration.

- Inspection of register of Charges

- Verification of Documents relating to Charges

- The Search and Status Report should give exact details of particulars of charges / modifications / satisfactions as effected, filed and registered from time to time.

- Identify those charges and modification of charges, which have been created in favour of a particular lender.

- Take the particulars of the documents creating the charge as specified in CHG-1 and CHG-9

- Ascertain as to whether the amount secured by the charge as per the documents executed has been duly mentioned.

- Ascertain as to whether ‘properties’ offered as security are mentioned as per the documents creating the charge and attached with the Forms and verify whether they are as per the terms of Sanction.

- Check whether the terms and conditions governing the charge have been mentioned.

- Ascertain whether the name of the lender is properly mentioned.

- In case of modification of charge ascertain whether the names of documents effecting the modification are mentioned and whether the particulars of modification are clearly mentioned.

- In case of charge, the particulars of documents attached with forms, amount secured by the charge as per the documents and/or sanction ticket, the properties/assets secured by the charge, the terms and conditions governing the charge and the name of the lender is properly mentioned in the relevant columns of Form CHG-1.

![]()

Question 10

The process of preparing search/status report enables determination out of total borrowing power, the extent upto which the company has already borrowed money or created charges on its movable and immovable properties and also the balance limit to borrow. However, there are certain exceptions to the term ‘borrowing of money’. Enumerate those exceptions i.e., the borrowings which are not included in determining the limit on borrowings. (Dec 2018, 5 marks)

Answer:

The term borrowing of money includes all type of borrowings whether secured or unsecured, loan in the nature of debentures or otherwise etc. However, the following are exceptions to it as enumerated under Section 1 80(1 )(c) of the Companies Act, 2013:

1. Temporary loans obtained from the company’s bankers in the ordinary course of business:

The expression “temporary loans” means loans repayable on demand or within six months from the date of the loan such as short-term, cash credit arrangements, the discounting , of bills and the issue of other short-term loans of a seasonal character, but does not include loans raised for the purpose of financial expenditure of a capital nature;

2. Acceptance by a banking company: In the ordinary course of its business, of deposits of money from the public, repayable on demand or otherwise, and withdrawable by cheque, draft, order or otherwise, shall not be deemed to be a borrowing of monies by the banking company within the meaning of Section 180(1 )(c) of the Companies Act, 2013.

3. Contingent liability like amount outstanding on deferred payment agreement or under guarantees issued by bank or in respect of letter of Credit.

Question 11.

Explain the procedure for search Report under IPR Laws. (June 2019, 5 marks)

Answer:

Procedure for Search Report under IPR Laws

- Preparing checklist:

- Segregating the IP assets relevant for the transaction from irrelevant ones:

- Analysing all documents carefully:

- Verifying facts and confirm that the information is correct:

- Analyzing protected and protectable IP rights:

- Drafting of status and search report:

The IPR Search Report should also contain all the associated risks and liabilities along with strategies to deal with such issues which will help the prospective buyer/ investor understand the pros and cons of the transaction.

Question 12.

While preparing the Search and Status Report, it is important for professionals to conduct due diligence of the intellectual property rights, as tremendous worth is associated with the intangible assets of the business. List the key areas to be analyzed while preparing such Search Report. (Dec 2020, 5 marks)

Answer:

While preparing the Search and Status Report, it is important for professionals to conduct due diligence of the intellectual property rights, as tremendous worth is associated with the intangible assets of the business.

Key areas to be analysed while preparing the search and status report relating to IPR:

- What domestic and foreign patents (and patents pending) does the company have?

- Has the company taken appropriate steps to protect its intellectual property (including confidentiality and invention assignment agreements with current and former employees and consultants)?

- Are there any material exceptions from such assignments (rights preserved by employees and consultants)?

- What registered and common law trademarks and service marks does the company have?

- What copyrighted products and materials are used, controlled, or owned by the company?

- Does the company’s business depend on the maintenance of any trade secrets, and if so what steps has the company taken to preserve their secrecy?

- Is the company infringing on (or has the company infringed on) the intellectual property rights of any third party, and are any third parties infringing on (or have third parties infringed on) the company’s intellectual property rights?

- Is the company Involved in any intellectual property litigation or other disputes (patent litigation can be very expensive), or received any offers to license or demand letters from third parties?

![]()

Question 13.

Some financial institutions require a Report by the Company Secretary in practice on certain additional points relevant and important for them for cross verification of documents from the MCA records. Prepare a table for such items normally covered under the said report. (Aug 2021, 5 marks)

Answer:

Cross Verification of Documents from the MCA Records

Some financial institutions require a report by Company Secretaries in Practice, on certain additional points relevant and important for them. A separate report can be given after inspecting or verifying the documents and records available with the Registrar and/ or the company. The points normally covered under such Report are:

| Item | Records to be verified |

| 1. Name of the Company | Memorandum of Association, Certificate of Incorporation or Fresh Certificate of Incorporation/Change of Name. |

| 2. Date of Incorporation | Certificate of Incorporation |

| 3. Company Number/ Corporate Identity Number | Certificate of Incorporation/Fresh Certificate upon change of name / Certificate of registration of Tribunal Order for shifting registered office to another State |

| 4. Address of Registered Office | INC-22, MGT-14 Resolution(s) of Board / General Body, INC-28 with copy of NCLT Order. |

| 5. Name and address of present directors (with their date of joining) | Articles of Association, DIR-12, Register of Directors |

| 6. Authorized Share Capital of the company divided into ____________ Shares of ₹ ___________ each | Memorandum of Association, SH-7, MGT-14 |

| 7. Paid-up Capital of the company divided into ______________ Shares of ₹ _____________ each | MGT-14, PAS-3, Register of Members, Annual Return |

| 8. List of Members with details as to shares held by each of them. The names of directors to be specifically mentioned in such list of shareholders (List of members holding shares of a specified monetary threshold is also asked for in some cases). | PAS-3, Annual Return, Register of Members, Register of Directors. |

| 9. Provision in the Articles of Association as to affixation of common seal of the company. (Particulars as to the persons in whose presence the seal of the company can be affixed to any deed). | Articles of Association. If there is no specific cause and the Articles have adopted Table F, Clause 79 of Table F of Schedule-I of Companies Act, 2013 may be referred. |

| 10. Main Objects of the company. | Memorandum of Association |

| 11. Whether the Articles of the company contains provisions for nomination by the corporation a director on the board of the company. | Articles of Association of the company |

![]()

Question 14.

Shekh & Co. LLP, a Company Secretaries firm provides various secretarial and related consulting services. Arun has recently started a private equity fund and was looking for targets for investment. Arun requested Shekh & Co. LLP to examine documents of Jim Ltd”, filed with Ministry of Corporate Affairs (MCA). Explain in brief the process of examination of documents registered on MCA 21 portal. (Aug 2021, 5 marks)

Answer:

The Ministry of Corporate Affairs (MCA) website provides many information relating to the company. Some information are available without payment of fees like Name of the Company, CIN, Authorised and paid up capital, Name and address of the Directors etc. The website also provides for the viewing of document by public on payment of requisite fee. Public documents include the following:

- Incorporation documents

- Certificates, including Incorporation certificate and Charge creation, modification and satisfaction certificates

- Charge documents

- Annual Returns and Balance Sheet

- Change in directors and other e-forms

MCA website offers the facility to view documents and also search and other facilities of public documents. This facility is handy for users and banks and financial institutions while sanctioning loans. This facility enables viewing of public documents of companies for which payment has been made by user. The document can be accessed at any time within 7 days after the payment has been confirmed. However, once the user has started viewing the first document of the company after the payment, the access to the documents will be available for only 3 hours, unless the document:’, are downloaded ) within those 3 hours. Documents once downloaded and saved by the user on his computer/ cloud will be permanently available for future access.

- User has to access My MCA portal (www.mca.gov.in) and register to the portal by creating a User ID and password

- login to the MCA portal through the link available on the home page.

- After logging in, click on the ‘MCA Services”1 tab and in the drop down menu on it, click the “View Public Documents” button appearing under the “Document Related Services” segment.

- On the next page fill the necessary details of your company (for which the search is to be made) and proceed to make the payment for the online search.

- Once the Payment is made, go to “My Services” Tab. On this page, at the bottom, under the heading “Documents”, the List of company names will be displayed, for which user have already paid for public viewing. It also displays

- Date of request i.e., the date, when user made the request to view the company document and the expiry date & time upto which the access is available to the user for the documents.

- Status of the request i.e., whether viewed or to view.

- Click on the view link under status field.

- The documents are grouped under five categories i.e., user has to click on the desired category under which the document falls.

- If more than one document is listed, the user can arrange them name wise or date wise.

- On clicking the document name, the document shall be displayed for viewing. The User can save the document on his computer hard drive/ cloud for future use.

- The public documents under this facility are available for viewing by public on payment of requisite fee.

Question 15.

A charge in favour of a public financial institution to secure a sum of ₹ 300 crore was not created by Dream House Construction Ltd. within the statutory period and the Company Law Board/Tribunal on an application made by the company, did not grant the extension of time. Is it possible to revive the said charge? (June 2014, 5 marks)

Answer:

Section 77 (3) provides for certain charges to be void against liquidator appointed under this Act or the insolvency and Bankruptcy Code, 2016 as the case may be or creditor unless registered. Section 77 requires a company to file, within 30 days after the date of the creation of a charge, with the Registrar, complete particulars together with the instrument, if any, creating, evidencing or modifying the charge, or a copy thereof verified in the prescribed manner for registration; otherwise the charge shall be void against the liquidator and creditors and on the charge becoming void, the money thereby shall immediately become payable.

![]()

Question 16.

The balance sheet of Neeraj Fertilizer Ltd. as at 31st March, 2015 disclosed the following details:

| (₹ in crore) | |

| Authorised shares capital (equity shares) | 500 |

| Paid-up share capital | 200 |

| Statement of profit and loss (Cr.) | 30 |

| General reserve | 70 |

| Debenture redemption reserve | 50 |

| Loan (long term) | 50 |

| Temporary loan payable on demand | 20 |

| Short-term loan | 15 |

Board of directors of the company wishes to borrow an additional sum of ₹ 300 crore from the company’s financial institution. The borrowing was duly approved at a Board meeting. One of the directors had raised objection for such borrowing and argued that said borrowing was beyond the powers of the Board of directors. The Board of directors seeks your advice, being a company’s advisor, about the borrowing limits and compliances required with the provisions of the Companies Act, 2013. Advise the company. (June 2015, 5 marks)

Answer:

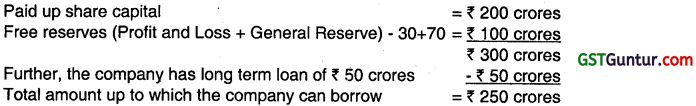

Section 180(1)(c) of the Companies Act, 2013 prohibits the Board of Directors of a company from borrowing a sum which together with the monies already borrowed exceeds the aggregate of the paid-up share capital free reserves and securities premium apart from temporary loans obtained from the company’s bankers in the ordinary course of business unless they have received the prior sanction of the company by a special resolution in general meeting.

Explanation to Section 180(1) (c) provides that the expression “temporary loans” means loans repayable on demand or within six months from the date of the loan such as short-term, cash credit arrangements, the discounting of bills and the issue of other short-term loans of a seasonal character, but does not include loans raised for the purpose of financial expenditure of a capital nature.

According to the above provisions, the Board of Directors of Neeraj Fertilizer Ltd. can borrow without the approval of the shareholders in the general meeting, up to an amount calculated as follows:

So, in the given case, the Board of Directors of Neeraj Fertilizer Ltd. wishes to borrow an additional sum of ₹ 300 crores from the company’s financial institution. Thus, the objection of one of director is correct and the said borrowing will be beyond the powers of the Board of Directors.

So, in order to borrow the said amount the company has to comply with the following requirements:

- Hold the Board Meeting and issue the notice of general meeting.

- Hold general meeting and pass the special resolution for transacting the matter stated above.

- File Form No. MGT -14 with the fee or additional fee as provided in the Companies (Registration of Offices and Fees) Rules, 2014 with the ROC within 30 days of passing the special resolution.

![]()

Question 17.

Excel Ltd. has borrowed a sum of ₹ 10 crore by mortgaging its fixed assets. As a Company Secretary, indicate the steps you would take to get the charge registered with the Registrar of Companies. State the consequences if the charge is not registered. (Dec 2015, 5 marks)

Answer:

Duty to Register Charges, etc.

Notified Date of Section: 01/04/2014 .

1. It shall be the duty of every company creating a charge within or outside India, on its property or assets or any of its undertakings, whether tangible or otherwise, and situated in or outside India, to register the particulars of the charge signed by the company and the charge-holder together with the instruments, if any, creating such charge in such form, on payment of such fees and in such manner as may be prescribed, with the Registrar within thirty days of its creation:

Provided that the Registrar may, on an application by the company, allow such registration to be made

(a) in case of charges created before the commencement of the Companies (Amendment) Act, 2019, within a period of three hundred days of such creation; or

(b) in case of charges created on or after the commencement of the Companies (Amendment) Act, 2019, within a period of sixty days of such creation, on payment of such additional fees as may be prescribed:

Provided further that if the registration is not made within the period specified

(a) in clause (a) to the first proviso, the registration of the charge shall be made within six months from the date of commencement of the Companies (Amendment) Act, 2019, on payment of such additional fees as may be prescribed and different fees may be prescribed for different classes of companies;

(b) in clause (b) to the first proviso, the Registrar may, on an application, allow such registration to be made within a further period of sixty days after payment of such advalorem fees as may be prescribed.

Provided also that any subsequent registration of a charge shall not prejudice any right acquired in respect of any property before the charge is actually registered.

[Provided also that this section shall not apply to such charges as may be prescribed in consultation with the Reserve Bank of India.]

2. Where a charge is registered with the Registrar under sub-section (1), he shall issue a certificate of registration of such charge in such form and in such manner as may be prescribed to the company and, as the case may be, to the person in whose favor the charge is created.

3. Not with standing anything contained in any other law for the time being in force, no charge created by a company shall be taken into account by the liquidator [“appointed under this Act or the Insolvency and Bankruptcy Code, 2016, as the case may be,] or any other creditor unless it is duly registered under sub-section (1) and a certificate of registration of such charge is given by the Registrar under sub-section (2).

4. Nothing in sub-section (3) shall prejudice any contract or obligation for the repayment of the money secured by a charge.

Question 18.

XYZ Bank Ltd. has sanctioned a term loan for ₹ 5,000 crore to CXT Ltd. The purpose of the loan is to develop the townships in 5 Smart Cities including Mumbai. The 30% of the loan amount is to be used for Mumbai only. However, during the verification of the records of the company, it was found that certain land area in Mumbai is a disputed area where the Hon’ble High Court has granted stay till next hearing. You are appointed by the Bank as Secretarial Auditor for making a search report. What are the documents to be inspected by the Secretarial Auditor in the instant case? (June 2019, 5 marks)

Answer:

In the instant case, it is necessary to inspect and retrieve the history of a property right from the original owner of the property to the current owner over a period of time. It provides documents which help determine relevant interests in property of the owner and other individuals, if any, along with the title certificate, ‘agreement to sell’ with the intended purchaser containing details of the existing mortgage, litigation, condition or claim, which are likely to affect the project.

In case of the property title Search report, the following documents are considered:

- Ownership: Status of ownership- sole or joint and the documents stating the same.

- Deed Copy: Recent deeds in respect to the property.

- Legal Description: Description of the property in legal parlance.

- Chain documents: Previous owner of the property.

- Possession: Actual Possession of the property.

- Right of way: Easementary Right – the Right of way given to the owner.

- Leases: Leases on the property which can affect the property status.

- Mortgage: Whether the property has been mortgaged or not?

- Tax Payment: Details of tax payment in relation to the property.

- Bankruptcy Search: Report of bankruptcy of the owner of the property.

- Municipal Service Lien : Report of unpaid municipal dues like water, sewer, trash etc.

- Property Restriction : Restriction on sale of property like sale in case of unsound owner.

- Plot Map : Official copy of Map of the plot.

- Property Zoning: Property lying under which zone like Ecological Zone, Flood Zone, Earthquake Zone etc.

- Civil Court Record : Any order of the Civil Court against the property and other things like Spousal Support Lien Search, Child Support Lien search, Power of Attorney, Special Assessment etc.

In case of Company Search report, the professional should go through the various documents maintained by the company which are required for the purpose of the report, some the documents which may require are as under:

- Various clauses of Memorandum and Articles of Association

- Forms filed with the Registrar of Companies with receipts.

- All statutory registers.

- Verification of financial statement along with notes to accounts and Auditor Report.

- Report of Internal Auditor.

- Copies of contracts made between the company and any of the related parties

- Transfer and Transmission of Share.

- Instruments creating, modifying or satisfying charges.

- Various Disclosures Tram Directors.

- Related Party Transactions.

- Corporate Social Responsibility (CSR)

- Directors and Key Managerial Personnel (KMP)

![]()

Question 19.

Axe Ltd, a company providing information technology and enabled services, had raised ₹ 1,200 crore through public issue of its equity shares and was listed on BSE and NSE. The company has also taken a loan of ₹ 500 crore from a consortium, of bankers. As part of its due diligence process, the consortium has appointed you as a Practicing Company Secretary to prepare a search report relating to stock exchange compliances. Explain the procedure for such search report including the key documents to be analysed. (Aug 2021, 5 marks)

Answer:

While preparing the Search and Status Report regarding Stock Exchanges, it is important for the professionals to conduct due diligence of the documents available in public domain on the NSE and BSE website in relation to the listed companies.

Procedure:

- Preparing checklist: The checklist should contain list of information required to understand the company’s business, listing details, board meetings, results calendar, corporate actions, financial results, shareholding data, pledge data, scheme of arrangement etc.

- Analysing all documents carefully: This activity is important as it helps to analyse the nature of documents which are available on public domain with respect to listing details, corporate actions, public notices, financial resultants, XBRL, sustainability reports, disclosures, offer document etc.

- Verifying facts and confirm that the information is correct: This activity is important to verify the legality of documents or information.

- Drafting of status and search report: The final report should contain all observations based on the information available, before the prospective buyer / investor. It should also contain all associated risks

and liabilities along with strategies to deal with such issues which would help the prospective buyer / investor understand the pros and cons of the transaction.

Key documents to be analysed while preparing the search and status report on information/ documents available on NSE and BSE website:

- Corporate Announcements

- Corporate Actions

- Financial Results

- Board Meetings

- Shareholders Meetings

- Voting Results

- Results Calendar

- Shareholding Patterns

- Corporate Governance

- Disclosures

- Offer Documents

- Information Memorandum

- QIP

- Scheme of Arrangement

- Companies listed under Direct Listing

- Revocation

- Pledge Data

- Sustainability Reports

- Buyback / Redemption

- Public Notice – Compulsory Delisting.

Question 20.

TYRE India Ltd. proposed to buy a piece of land on the outskirts of a city to put up their factory. You are appointed as a PCS to prepare a search report for the said property. What are the factors to be considered in the search report? (Dec 2021, 5 marks)

Answer:

A Property Title Search is the process of retrieving the history of a property right from the original owner of the property to the current owner over a period of time. It provides documents which help determine relevant interests in property of the owner and other individuals, if any.

It is mandatory for a developer to annex a copy of the report in the ‘agreement to sell’ with the intended purchaser. This document will state if there is any existing mortgage, litigation, condition or claim, which is likely to affect the title of the buyer adversely.

Property Title Search includes:

- Ownership: Status of ownership- sole or joint and the documents stating the same.

- Deed Copy: Recent deeds in respect to the property.

- Legal Description: Description of the property in legal parlance.

- Chain documents: Previous owner of the property.

- Possession: Actual Possession of the property.

- Right of way: Easementary Right – the Right of way given to the owner.

- Leases: Leases on the property which can affect the property status,

- Mortgage: Whether the property has been mortgaged or not.

- Tax Payment: Details of tax payment in relation to the property.

- Bankruptcy Search: Report of bankruptcy of the owner of the property.

- Municipal Service Lien: Report of unpaid municipal dues like water, sewer, trash etc.

- Property Restriction: Restriction on sale of property like sale in case of unsound owner.

- Plot Map: Official copy of Map of the plot.

- Property Zoning: Property lying underwhich zone like Ecological Zone, Flood Zone, Earthquake Zone etc.

- Civil Court Record: Any order of the Civil Court against the property, and other things like espousal Support Lien Search, Child Support Lien search, Power of Attorney, Special Assessment etc.

![]()

Question 21.

Write a short note on “Compilation and Preparation of Search Report”

Answer:

Compilation and Preparation of Search Report

Search Report compiled on the basis of the scrutiny of the above documents is, therefore, related and restricted to only those documents which are available for the inspection on the date(s) when the search is carried out.

An index of the charges is prepared at the website of MCA. This index provides, charge ID, the date of filing of the document charge amount secured, name of charge holder and its address. In order to view index of charges, it is primarily necessary to quote CIN/FCRN of the company. This number will primarily be available at the website of the ministry.

It is advisable to note down from the index, the short particulars of all Form CHG-1, 4, 9 for the purpose of cross-checking and ensuring that no document is missed in the Search Report.

Also, it would be advisable to mention in the Search Report by way of a footnote as to what was the last document which was available for inspection when the scrutiny was taken/completed. This information can be helpful in identifying the forms and based on which the Search Report is given.

Question 22.

Explain the transactions which require charge registration.

Answer:

Every company creating a charge has to register the particulars of the charge signed by the company and the charge-holder together with the instrument, when:

- the company is acquiring any property or assets whether tangible or not, which are subject to any charge;

- a charge is created within or outside India, any of its undertakings;

- there is any modification in the terms or conditions or the extent or operation of any charge already registered;

- there are charges on properties which are created or acquired by any foreign company.

Every company has to keep at its registered office a register of charges in form CHG-7, which shall include therein all charges and floating charges affecting any property or assets of the company or any of its undertakings.

Question 23.

What are the key areas to be analysed while preparing the search and status report relating to IPR?

Answer:

Key areas to be analysed while preparing the search and status report relating to IPR:

- What domestic and foreign patents (and patents pending) does the company have?

- Has the company taken appropriate steps to protect its intellectual property (including confidentiality and invention assignment agreements with current and former employees and consultants)?

- Are there any material exceptions from such assignments (rights preserved by employees and consultants)?

- What registered and common law trademarks and sen/ice marks does the company have?

- What copyrighted products and materials are used, controlled, or owned by the company?

- Does the company’s business depend on the maintenance of any trade secrets, and if so what steps has the company taken to preserve their secrecy?

- Is the company infringing on (or has the company infringed on) the intellectual property rights of any third party, and are any third parties infringing on (or have third parties infringed on) the company’s intellectual property rights?

Search and Status Report Notes

Search and Status Report

The Search and Status Report is not merely verbatim reporting of the information as made available but also, supplemented by observations/comments by the Company Secretary or such other professional who furnishes the Report. It has two facets. The first being ‘search’ involving physical inspection of documents and the second activity ‘status’ which comprises of reporting of the information as made available by the search. Thus, it acts as a ‘Progress Report’ of the company and gives ready reference to the exact situation.

![]()

Procedure for Search Report under IPR Laws:

- Preparing checklist

- Segregating the IP assets relevant for the transaction from irrelevant ones

- Analysing all documents carefully

- Verifying facts and confirm that the information is correct

- Analyzing protected and protectable IP rights

- Drafting of status and search report

Property Title Search includes:

- Ownership

- Deed Copy

- Legal Description

- Chain documents

- Possession

- Right of way

- Leases

- Mortgage

- Tax Payment

- Corporate Announcements

- Corporate Actions

- Financial Results

- Board Meetings

- Shareholders Meetings

- Voting Results

- Results Calendar

- Shareholding Patterns

- Plot Map

- Property Zoning

- Civil Court Record

- Power of Attorney

- Special Assessment

‘Offer document’:

‘Offer document’ is a document which contains all relevant information about the company, promoters, projects, financial details, objects of raising the money, forms of the issue etc. used for inviting subscription to the issue being made by the issuer. Offer document is called ‘Prospectus’ in case of a public issue and letter of offer in case of rights issue.

‘Red Herring Prospectus’:

‘Red Herring Prospectus’ is a prospectus, which does not have details of either price or number of shares being offered, or the amount of issue. This means that in case price is not disclosed, the number of shares and the upper and lower price bands are disclosed.

Key documents to be analysed while preparing the search and status report on information/ documents available on NSE and BSE website

- Corporate Announcements

- Corporate Actions

- Financial Results

- Board Meetings

- Shareholders Meetings

- Voting Results

- Results Calendar

- Shareholding Patterns

- Corporate Governance

- Disclosures

- Offer Documents

- Information Memorandum

- QIP

- Scheme of Arrangement

- Companies listed under Direct Listing

- Revocation.

- Pledge Data

- Sustainability Reports

- Buyback / Redemption

- Public Notice – Compulsory Delisting