CS Professional Secretarial Audit, Compliance Management and Due Diligence Notes Study Material Important Questions

- Chapter 1 Compliance Framework

- Chapter 2 Compliances

- Chapter 3 Documentation & Maintenance of Records

- Chapter 4 Search and Status Report

- Chapter 5 Know Your Customers (KYC)

- Chapter 6 Signing and Certification

- Chapter 7 Segment-wise Role of Company Secretaries

- Chapter 8 Audits

- Chapter 9 Secretarial Audit

- Chapter 10 Internal Audit and Performance Audit

- Chapter 11 Concepts and Principles of Other Audits

- Chapter 12 Audit Engagement

- Chapter 13 Audit Principles and Techniques

- Chapter 14 Audit Process and Documentation

- Chapter 15 Forming an Opinion & Reporting

- Chapter 16 Secretarial Audit-Fraud Detection and Reporting

- Chapter 17 Quality Review

- Chapter 18 Values, Ethics and Professional Conduct

- Chapter 19 Due Diligence-I

- Chapter 20 Due Diligence-II Non Compliances, Penalties and Adjudications

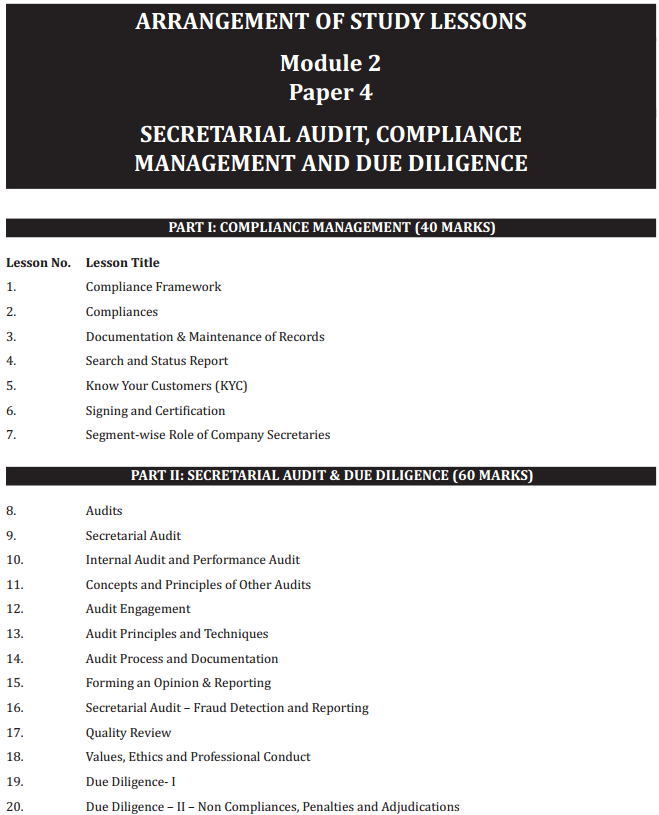

CS Professional Secretarial Audit, Compliance Management and Due Diligence Syllabus

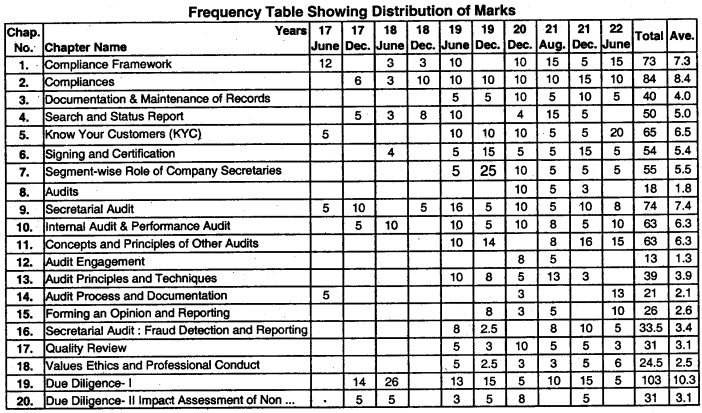

CS Professional Secretarial Audit Compliance Management and Due Diligence Chapter Wise Weightage

PROFESSIONAL PROGRAMME Module 2 Paper 4

SECRETARIAL AUDIT, COMPLIANCE MANAGEMENT AND DUE DILIGENCE (100 Marks)

SYLLABUS

Objective

Part I: To develop expertise in Compliance management, Internal control systems, and preparation of various search and status reports.

Part II: To develop expertise in Secretarial Audits and other Audits and to impart knowledge on the process for conducting Due Diligence of various business transactions.

Detailed Contents

Part I: Compliance Management (40 Marks)

1. Compliance Framework: Identification of applicable laws, rules, and regulations; Risk Assessment; Responsibility center mapping/allocation; Escalation & reporting; Creation of Compliance framework and reporting system; Review & Updation; Training &Implementation.

2. Compliances: (a) Entity wise: Public, Private, Listed, Government, Small Companies, OPC, Section 8 Company, LLP – Annual and Event-based compliances. (b) Activity wise: Compliances related to specific activities undertaken. (c) Sector-wise: Service Sector, Manufacturing, Trading, E-commerce, Mining, Infrastructure. (d) Industry Specific: Compliances with Industry Specific Laws applicable to the company such as Tourism, Pharmaceutical, FMCG, Hospitality, Information Technology, etc. (e) State and Local applicable laws

3. Documentation & Maintenance of Records: Electronic versus Physical repository; General principles of good documentation, coding, storage, preservation, safety & retrieval; Privacy & Control.

4. Search and Status Report: Type of Searches, Purpose, and Objective of Search Reports, Search under Companies Act, IPR Laws, Property Title Search, Compilation & verification of data published by MCA 21, SEBI, RBI, Stock Exchanges, other regulators/ authorities (national/international), Web-sites and other sources.

5. KYC: Carrying out KYC with respect to directors, promoters, and clients, Compliance with the applicable ICSI Guidelines.

6. Signing and Certification: Various Certification(s) by Company Secretary in practice; Pre-certification of Forms; Signing & certification of Annual Return; Corporate Governance Certification; Obligations and Penal provisions.

7. Segment-wise Role of Company Secretaries: Knowledge about the segment(s) in which the company is operating, Industry trends, and national and international developments. Segment-wise Compliances.

Part II: Secretarial Audit & Due Diligence (60 Marks)

8. Audits: Overview and Introduction of Various Audits; ICSI Auditing Standards.

9. Secretarial Audit:

(i) Overview & introduction: Concept; advantages; legal provisions; risk of Secretarial Auditor; code of conduct. (ii) Scope of Secretarial Audit: (a) Corporate, Securities and Foreign Exchange Laws and Rules and Regulations made there under. (b) Other Laws applicable to the Company. (c) Board Processes, Adequacy of Systems and Processes, Compliance with Secretarial Standards and applicable Accounting Standards and Reporting of Major Events. (d) Corporate conduct & practices.

10. Internal Audit & Performance Audit: Objective & Scope; Internal Audit Techniques; Appraisal of Management Decisions; Performance Assessment, Internal Control Mechanism.

11. Concepts and Principles of Other Audits: (a) Corporate Governance Audit, (b) CSR Audit, (c) Takeover Audit, (d) Insider Trading Audit, (e) Industrial and Labour Laws Audit, (f) Cyber Audit, (g) Environment Audit (h) Systems Audit (i) Forensic Audit (j) Social Audit.

12. Audit Engagement: Audit engagement; Appointing authority; communication to previous Auditor; Terms & conditions; Audit fees & expenses; Independence & conflict of interest; confidentiality; Auditing standard on Audit engagement.

13. Audit Principles and Techniques: Audit Planning; Risk Assessment; Collection of information/Records of Audit, Audit Checklist; Audit Techniques, Examination & its process; Enquiry; Confirmation; Sampling; Compliance Test of Internal Control System; Substantive Checking; Dependence on other Expert, Verification of documents/records; Collection of audit evidences; Creation of Audit trails; Analysis of Audit findings; Documentation; materiality; record keeping;

14. Audit Process and Documentation: Preliminary Preparations; Questionnaire; Interaction; Audit program; Identification of applicable laws; creation of master checklist; Maintenance of Work-sheet, working papers and audit trails; Identification of events/ corporate actions; Verification; Board composition; Board process; systems and process; identification of events having bearing on affairs of the Company, Auditing standard on Audit process & documentation.

15. Forming an Opinion & Reporting: Process of forming an opinion; materiality; forming an opinion on report of third party/expert; modified/unmodified opinion/qualifications; Management Representation Letter, Opinion obtained by Management, Discussion with Management, Evaluating Audit Evidence and forming Opinion, Audit report and drafting of qualifications; Sharing Draft Report with Management with Category of Risk involved with each Remark and Qualification, Signing of Audit reports and its Submission, Auditing standards on forming of an Opinion.

16. Secretarial Audit: Fraud detection & Reporting: Duty to report fraud; Reporting of Fraud by Secretarial Auditor; Fraud vs. Non-compliance; speculation; suspicion; Reason to believe; knowledge; Reporting; Professional Responsibilities and Penalties; Record keeping; Reporting of fraud in Secretarial Audit Report.

17. Quality Review: Peer Review; Monitoring of Certification and Audit Work by Quality Review Board.

18. Values Ethics and Professional Conduct: Case Studies & Practical Aspects.

19. Due Diligence-I: Overview and Introduction; Types of Due Diligence; Financial Due Diligence; Tax Diligence; Legal Due Diligence; Commercial or Business Diligence – including operations, IT systems, IPRs; Human Resources Due Diligence; Due Diligence for Merger; Amalgamation; Slump Sale; Takeover; Issue of Securities; Depository Receipts; Competition Law Due Diligence; Labour Laws Due Diligence; Due Diligence Report for Bank; FEMA Due Diligence; FCRA Due Diligence; Techniques of Due Diligence and Risk Assessment; Non-Disclosure Agreement.

20. Due Diligence – II – Non Compliances, Penalties and Adjudications: Impact Assessment of Non Compliances and Reporting thereof.

Case Laws, Case Studies & Practical Aspects.