Schedule III to The Companies Act, 2013 – CA Final Audit Question Bank is designed strictly as per the latest syllabus and exam pattern.

Schedule III to The Companies Act, 2013 – CA Final Audit Question Bank

Question 1.

Write short note on: Divisions of Schedule III to the Companies Act, 2013 w.r.t. AS and hid AS.

Answer:

Divisions of Schedule III:

The Schedule Ill to the Companies Act, 2013 has been divided into three divisions vide notification dated 11.10.2018.

Division I

Division I deals with F.S. for a company whose ES. are required to comply with the Companies (AS) Rules, 2006 Division I has been divided as follows:

- Part I contains the form in which the Balance Sheet of a company should be drawn up, and states the general instructions as regard to presentation of different assets and liabilities.

- Part Il contains the form and states the general instructions as regard to preparation and presentation of information in the Statement of Profit and Loss.

- General instructions for preparation of Consolidated Financial Statements have also been provided in Schedule Ill where a company is required to prepare Consolidated Financial Statements. The company shall mutatis mutandis follow the requirements of this Schedule as applicable to a company in the preparation of balance sheet and statement of profit and loss.

Division II

Division II deals with ES. for a company whose F.S. are drawn up in compliance of the Companies (Ind AS) Rules, 2015. Division II has been divided as follows:

- Part I contains the form in which the Balance Sheet of a company required to comply with Ind AS and states the general instructions as regard to preparation of Balance Sheet.

- Part II contains the form and states the general instructions as regard to preparation of Statement of Profit and Loss.

- PART III contains general instructions for preparation of Consolidated F.S.

Division III

Division III deals with RS. for a Non-Banking Financial Company (NBFC) whose F.S. are drawn up in compliance of the Companies [Ind AS) Rules, 2015. Division III has been divided as follows:

- Part I contains the form in which the Balance Sheet of a company required to comply with Ind AS and states the general instructions as regard to preparation of Balance Sheet.

- Part II contains the form and states the general instructions as regard to preparation of Statement of Profit and Loss.

- PART III contains general instructions for preparation of Consolidated F.S.

Question 2.

Z Ltd. has flexi deposit linked current account with various banks. Cheques are issued from the cur-rent account and as per the requirements of funds, the flexi deposits are encashed and transferred to current accounts. As of 31st March, 2020, certain cheques issued to vendors are not presented for payment resulting in the credit balance in the books of the company. The management wants to present the hook overdraft under current liabilities and flexi deposits under cash & bank balances. Comment. [May 11 (8 Marks)]

Answer:

Presentation of Book Overdraft:

As per instruction given in Schedule III to the Companies Act, 2013, the “cash and cash equivalents” should be classified as:

- Balances with banks;

- Cheques, drafts on hand;

- Cash on hand;

- Others (specifý nature).

The following shall be shown separately:

(a) Earmarked balances with banks

(b) Balances with banks held as margin money or security against the borrowings, guarantees, other commitments.

(c) Repatriation restrictions, if any, in respect of cash and bank balances.

(d) Bank deposits with more than 12 months maturity.

In the present case, it appears that in substance the position is that the composite bank balance including the balance in flexi deposit accounts are positive, even though physical set-off has not been made as on the balance sheet date. Further the bank has got the right to set off the flexi deposits against the cheques issued and hence it would be more informative and useful to the readers of the financial statements to disclose the book credit balance as a set-off from the flexi deposit accounts.

Conclusion: The disclosure of the said book credit balance as book overdraft under the head current liabilities as proposed by the management is not correct.

![]()

Question 3.

Comment on the following: X Ltd., paid 25 lakhs as advance to Y Ltd. towards the purchase of a printing machinery on 15.01.20 with delivéry instructions to deliver the same in the last week of June, 20. Further on 02.02.20 X Ltd. purchased two diesel generator sets from Y Ltd. for ₹ 30 lakhs on 90 days Credit term. In the accounts for 2019-20, X Ltd. intends to adjust the advance paid against Credit purchase and show the net amount of 5 lakhs as due from them. As the statutory auditor, how would you deal with this? [Nov. 08(5 Marks)]

Answer:

Adjustment of Advances:

- Advance payment by X Ltd. to the supplier of machinery (Y Ltd.) should be grouped under the head ‘Capital Work in Progress’. This is as per requirement of Schedule III to the Companies Act, 2013 and the existing accounting practice.

- Purchase of two diesel generator sets from Y Ltd. on credit term should be disclosed separately as current liabilities.

Conclusion: Proposal of X Ltd., to show the net balance in the personal account of Y Ltd. is not correct. Such proposal will conceal the two material items in the balance sheet – one, expenditure towards capital asset and the other current liability for purchase of the generator set. Hence, the auditor should advise X Ltd. to show these two items separately. If X Ltd. does not accept the advice, the auditor should qualify his report with suitable quantification of amount involved.

Question 4.

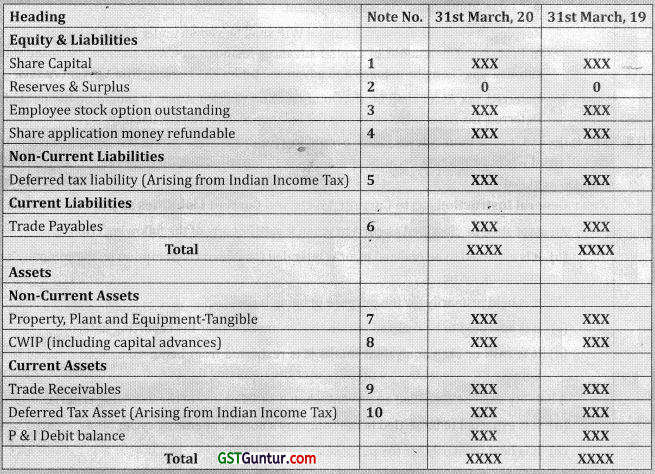

The Balance Sheet of G Ltd as at 31 st March 20 under. Comment on the presentation in terms of Schedule III and Accounting Standards issued by NACAS.

[May 13 (5 Marks), RTP-May 20]

Answer:

Errors in presentation as per Schedule III:

1. Share Capital & Reserve & Surplus are to be reflected under the heading “Shareholders’ funds”, which is not shown while preparing the balance sheet. Although it is a part of Equity and Liabilities yet it must be shown under head “shareholders’ funds”. The heading “Shareholders’ funds” is missing in the balance sheet given in the question.

2. Reserve & Surplus is showing zero balance, which is not correct in the given case. Debit balance of statement of profit & Loss should be shown as a negative figure under the head ‘Surplus The balance of ‘Reserves and Surp1us after adjusting negative balance of surplus shall be shown under the head ‘Reserves and Surplus’ even if the resulting figure is in the negative.

3. Schedule III requires that Employee Stock Option outstanding should be disclosed under the heading “Reserves and Surplus”.

4. Share application money refundable shall be shown under the sub-heading “Other Current Liabilities”. As this is refundable and not pending for allotment, hence it is not a part of equity.

5. Deferred Tax Liability has been correctly shown under Non-Current Liabilities. But Deferred tax assets and deferred tax liabilities, both, cannot be shown in balance sheet because only the net balance of Deferred Tax Liability or Asset is to be shown.

6. Under the main heading of Non-Current Assets, Property, Plant and Equipment are further classified as under:

- Tangible assets

- Intangible assets

- Capital work in Progress

- Intangible assets under development.

Keeping in view the above, the Capital WIP shall be shown under Fixed Assets as Capital Work in Progress. The amount of Capital advances included in CWIP shall be disclosed under the sub-heading “Long term loans and advances” under the heading Non-Current Assets. ‘

7. Deferred Tax Asset shall be shown under Non-Current Asset. It should be the net balance of Deferred Tax Asset after adjusting the balance of deferred tax liability.

![]()

Question 5.

MG & Co. Ltd. seeks your advice while preparing financial statements the general instructions to be followed while preparing balance sheet under Companies Act, 2013 in respect of current assets and current liabilities. [May 15 (4 Marks)]

Answer:

General Instructions as to Current Assets and Current Liabilities-as per Schedule III:

An asset shall be classified as current when it satisfies any of the following criteria:

(a) it is expected to be realized in, or is intended for sale or consumption in, the company’s normal operating cycle;

(b) it is held primarily for the purpose of being traded;

(c) it is expected to be realized within twelve months after the reporting date; or

(d) it is cash or cash equivalent unless it is restricted from being exchanged or used to settle a liability for at least twelve months after the reporting date.

A liability shall be classified as current when it satisfies any of the following criteria:

(a) it is expected to be settled in the company’s normal operating cycle;

(b) it is held primarily for the purpose of being traded;

(c) it is due to be settled within twelve months after the reporting date; or

(d) the company does not have an unconditional right to defer settlement of the liability for at least twelve months after the reporting date. Terms of a liability that could at the option of the counterparty, result in its settlement by the issue of equity instruments do not affect its classification.

Question 6.

Director (Finance) of Beta Ltd. is of the opinion that total trade payables mentioned in the financial statement is sufficient disclosure in the Balance Sheet as per Part I of Schedule III to the Companies Act, 2013. They did not mention details regarding Micro, small and Medium Enterprises (MSME). Give your view as statutory auditor of die Company and state the details required to be disclosed in notes regarding MSME. [May 18 – Old Syllabus (4 Marks), MTP-April 19]

Answer:

Disclosure regarding Micro, Small and Medium Enterprises:

Schedule III of Companies Act, 2013 requires that trade payables shall be classified as:

(A) total outstanding dues of micro enterprises and small enterprises; and

(B) total outstanding dues of creditors other than micro enterprises and small enterprises.”

The following details relating to Micro, Small and Medium Enterprises shall be disclosed in the notes:

(a) the principal amount and the interest due thereon (to be shown separately) remaining unpaid to any supplier at the end of each accounting year;

(b) the amount of interest paid by the buyer in terms of section 16 of the MSME Development Act, 2006, along with the amount of the payment made to the supplier beyond the appointed day during each accounting year;

(c) the amount of interest due and payable for the period of delay in making payment (which have been paid but beyond the appointed day during the year) but without adding the interest specified under the MSME Development Act, 2006;

(d) the amount of interest accrued and remaining unpaid at the end of each accounting year; and

(e) the amount of further interest remaining due and payable even in the succeeding years, until such date when the interest dues above are actually paid to the small enterprise, for the purpose of disallowance of a deductible expenditure u/s 23 of the MSME Act, 2006.

![]()

Question 7.

Comment on the following with reference to Schedule III to the Companies Act, 2013:

(a) A company has disclosed performance guarantee and counter guarantees as Contingent Liabilities

(b) A company has clubbed all other expenses under the head “Other Expense? on the basis of 1% of total revenue or Rs.5,000 whichever is higher.

(c) A company has shown Deferred Tax Uabllhty under Non-Current Liabilities and Deferred tax asšets under Non-Current Asset In balance sheet. [MTP-Aug 18, May 20]

Answer:

Appropriateness of Disclosures as per Schedule III

(a) Performance guarantee and counter guarantee are not in nature of contingent liabilities, hence disclosures are not appropriate.

(b) Treatment is not proper as Schedule Ill requires that any item of expenditure which exceeds 1% of revenue from operations or Rs. 1 Lac whichever is higher, needs to be disclosed separately.

(c) Treatment is not proper as Schedule Ill requires only net balance of deferred tax liability or asset.

Question 8.

Comment on the following with reference to Schedule III to the Companies Act, 201.3

(a) A company has disclosed performance guaranteé and counter guarantees as Contingent Liabilities.

(b) The parent company has recognized In the current year’s financial statement, dividend declared by its subsidiary after the balance sheet date. [RTP-Nov. 18]

Answer:

Appropriateness of Disclosures as per Schedule III

(a) Performance guarantee and counter guarantee are not in nature of contingent liabilities, hence disclosures are not appropriate.

(b) Dividend is to be recognized as income in the year in which right to receive dividend is established. Hence, recognition of dividend declared after balance sheet date is not proper.

Question 9.

The financial statements of MP Ltd. as on March 31, 2020 are to be prepared under Division II of Schedule III to the Companies Act, 2013. Comment on the disclosure compliances for MP Ltd. from the following information in the financial statements which are required to be drawn up in compliance with Ind AS.

- Property, Plant and Equipment include Rs. 2.50 crore for a boiler plant under construction.

- Cash and cash equivalents include Rs. 1.25 crore deposited with a nationalized bank on 31st March, 2020 for 18 months. It is shown under current assets.

- Non-current assets include under caption “Biological assets other than bearer Plants” a sum of Rs. 1.50 crore being cost of cultivation for bringing to yield level, the cashewnut trees whose yield period, according to estimate shall not be less than 10 Years.

- In the Statements of Profit and Loss, the charge due to re-measurement of defined benefit plans of employees is shown in Employee benefit Expenses.

- In the Statement of Profit and Loss, proposed dividend is shown under finance cost. [May 18-Old Syllabus (5 Marks)]

Answer:

Appropriateness of Disclosures as per Schedule III:

- Disclosure is not appropriate. Boiler plant under construction should be reflected separately as Capital Work in progress under the heading of non-current Asset.

- Disclosure is not appropriate. Amount deposited with the bank is non-current in nature being deposit period exceed 12 months.

- Disclosure is not appropriate. Cultivation expenses cannot be capitalized under the heading Biological assets other than bearer Plants.

- Disclosure is not appropriate. As per Ind-AS 19, charge due to re-measurement of defined benefit plans of employees should be transferred to OCI.

- Disclosure is not appropriate. As per Ind-AS 10 it cannot be shown in books of account. It is reflected in notes of accounts.