CA Final Audit Question Bank: Students who have cleared their CA Intermediate Level Exams provided by ICAI can now focus on their next level of examinations ie., CA Final. In ICAI CA Final Examination, there is a subject called Advanced Auditing and Professional Ethics which is very important. To learn and get complete knowledge of it, we have created a valid resource ie., ICAI CA Final Advanced Auditing and Professional Ethics Study Material.

Simply go through this CA Final Audit Question Bank Notes Pdf and start learning the core concepts clearly & easily from the CA Final Audit MCQ Practice Manual, CA Final Audit Book Chapter Wise Important Questions and Answers. Also from this guide, you can directly attain the information regarding the revised new syllabus of Advanced Auditing and Professional Ethics along with CA Final Audit Chapterwise Weightage Details. Just dive in!

- CA Final Audit Question Bank Notes Study Material

- CA Final Audit Chapter Wise Weightage

- Audit CA Final Practice Manual

- CA Final Audit Syllabus

- CA Final AAPE Books

- FAQs on CA Final AAPE Question Bank

CA Final Audit Question Bank Notes Study Material – CA Final Advanced Auditing and Professional Ethics Study Material Notes

One of the comprehensively hand-written notes for the CA Final Audit is here with additional exam resources that boost your confidence and the knowledge same way. Here are the direct links to download or view the CA Final Advanced Auditing and Professional Ethics Question Bank chapter-wise or unit-wise in pdf format.

This sort of neatly explained study notes or question bank by subject experts can be found rarely so grab the opportunity and start preparing for your upcoming CA Final May 2023 examinations.

- Auditing Standards, Statements, and Guidance Notes-An Overview

- Audit Planning, Strategy, and Execution

- Risk Assessment and Internal Control

- Special Aspects of Auditing in an Automated Environment

- Professional Ethics

- Company Audit

- Audit Reports

- CARO, 2020

- Audit of Consolidated Financial Statements

- Audit of Dividend

- Audit Committee and Corporate Governance

- Liabilities of Auditors

- Internal Audit

- Management and Operational Audit

- Audit under Fiscal Laws

- Due Diligence, Investigation, and Forensic Audit

- Peer Review and Quality Review

- Audit of Banks

- Audit of Non-Banking Financial Companies

- Audit of Insurance Companies

- Audit of Public Sector Undertakings

- Accounting Standards

- Schedule III to The Companies Act, 2013

- CA Final Audit Paper Nov 2020

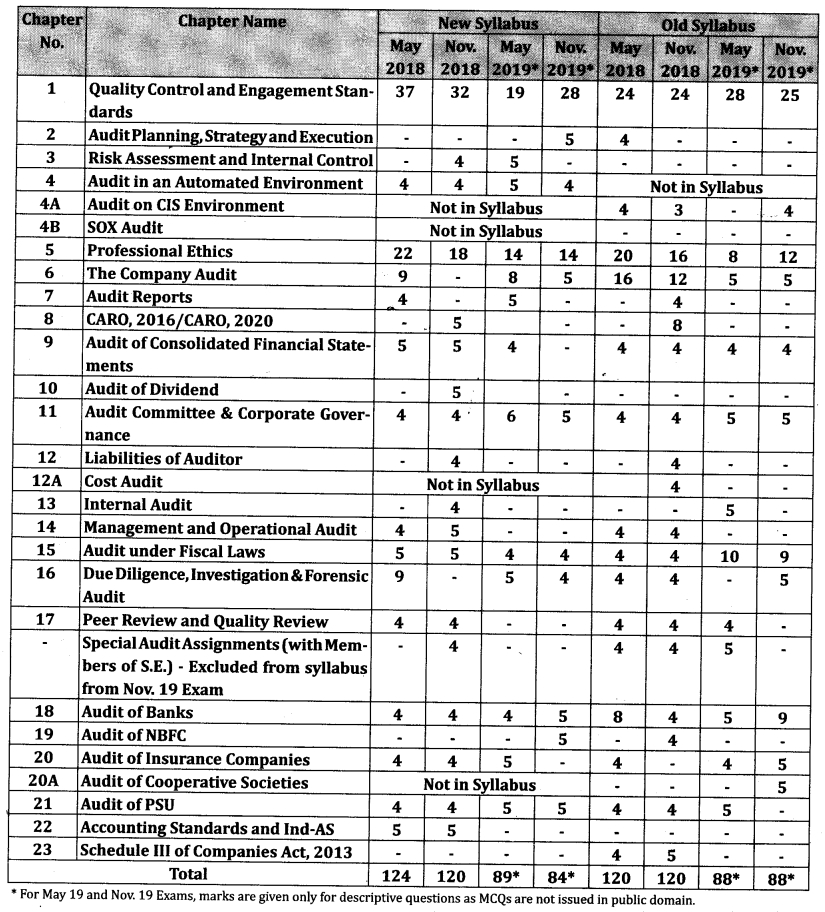

CA Final Audit Chapter Wise Weightage

The following section will help you understand how marks got distributed for the chapters. You can even know the weightage for each and every chapter in terms of the new syllabus and old syllabus. According to the previous year’s weightage, you can estimate and start learning the highest weightage core concepts for your CA Final Audit paper and score high.

Here is the image of the CA Final Auditing Chapter Wise Weightage:

Audit CA Final Practice Manual

One more worthy and helpful exam resource in any exam preparation is the practice manual. This practice manual can easily test your knowledge and help you fill the knowledge gap. If you are looking for the CA final Audit practice manual pdf then this is the best stop.

Below are the pdf formatted practice manuals for the CA final Advanced Auditing and Professional Ethics paper. Make use of them one by one while practicing and screen yourself before the actual exams.

CA Final Auditing Practice Manual – Advanced Auditing and Professional Ethics Practice Manual

Module 1

- Initial Pages

- Chapter 1: Auditing Standards, Statements, and Guidance Notes – An Overview

- Chapter-2: Audit Planning, Strategy, and Execution

- Chapter 3: Risk Assessment and Internal Control

- Chapter 4: Special Aspects of Auditing in an Automated Environment

- Chapter 5: Company Audit

- Annexure: Schedule III to The Companies Act, 2013

- Chapter 6: Audit Reports

Module 2

- Initial Pages

- Chapter 7: Audit Committee and Corporate Governance

- Chapter 8: Audit of Consolidated Financial Statements

- Chapter 9: Audit of Banks

- Chapter 10: Audit of Insurance Company

- Chapter 11: Audit of Non-Banking Financial Companies

- Chapter 12: Audit under Fiscal Laws

Module 3

- Initial Pages

- Chapter 13: Audit of Public Sector Undertakings

- Chapter 14: Liabilities of Auditor

- Chapter 15: Internal Audit, Management and Operational Audit

- Chapter 16: Due Diligence, Investigation and Forensic Audit

- Chapter 17: Peer Review and Quality Review

- Chapter 18: Professional Ethics

Auditing Pronouncements

- Initial Pages

- Part I: Auditing and Assurance Standards

- Part II: Statements

- Relevant Amendments for May, 2023 examination

- Study Materials

- MCQs and Case Scenarios Booklet

- MCQs and Case Scenarios Booklet – Hindi Medium

- Revision Test Papers

- Suggested Answers

- Mock Test Papers

- Question Papers

- Referencer for Quick Revision

CA Final Audit Syllabus

Knowing the new syllabus of paper 3 CA Final can be easy now as we have given it in a detailed way below. Check the following stuff to collect the revised CA Final Auditing Syllabus for May 2023 as it provided topics and sub-topics clearly for every chapter in it. Also, it helps you create a study plan according to your capability and can cover all the core concepts without fail.

CA Final Advanced Auditing and Professional Ethics New Syllabus

Paper 3: Advanced Auditing and Professional Ethics

(One paper – Three hours – 100 marks)

Objective:

(a) To acquire the ability to analyse current auditing practices and procedures and apply them in auditing engagements.

(b) To acquire the ability to solve cases relating to audit engagements.

Contents:

1. Auditing Standards, Statements, and Guidance Notes: Engagement & Quality Control Standards, Statements, and Guidance Notes on Auditing issued by the ICAI; Elements of the system of quality control, leadership responsibilities for quality within the firm, Acceptance, and Continuance of clients relationships and specific engagements, Engagement Performances, etc. (SQC 1 Quality Control for Firms that Perform Audits and Reviews of Historical Financial Information and Other Assurance and Related Services Engagements).

2. Audit Planning, Strategy, and Execution: Planning the flow of audit work; audit strategy, audit plan, audit programme and importance of supervision; principal’s ultimate responsibility; extent of delegation; control over the quality of audit work; Analytical Procedures prior to audit as well as towards finalization; Concept of Principal Auditor and Other Auditor, Acceptance as Principal Auditor, Procedures to be performed by Principal Auditor, Co-ordination between Principal Auditor and Other Auditor (SA 600 Using the Work of Another Auditor); Concept of Internal Audit Functions and its evaluation, Using the work of the internal audit function, Using internal auditors to provide direct assistance (SA 610 Using the Work of Internal Auditors); Auditor’s Expert – Meaning, Need for an Auditor’s Expert, Understanding the Auditor’s Expert, Agreement with the Auditor’s Expert, Adequacy of the Auditor’s Expert’s Work (SA 620 Using the Work of an Auditor’s Expert).

3. Risk Assessment and Internal Control: Evaluation of internal control procedures; Components of internal controls; Internal control and risk assessment; Risk-based audit – audit risk analysis, general steps; Internal audit; Reporting on internal control weaknesses (SA 265 Communicating Deficiencies in Internal Control to Those Charged With Governance and Management); Framework on Reporting of Internal Controls.

4. Special aspects of Auditing in an Automated Environment: Key features of an automated environment, related risks and controls, Standards, Guidelines and procedures, using relevant frameworks and best practices, understanding and documenting automated environment, Enterprise Risk management overview, assessing IT-related risks and controls, evaluating risks and controls at entity level and process level, Considerations of the automated environment at each phase of the audit cycle, using relevant analytical procedures and tests using data analytics, key concepts of auditing in real-time automated environments such as E-Commerce, ERP, Core Banking, etc.

5. Audit of Limited Companies: Application of Relevant Provisions under the Companies Act, 2013 relating to Audit and Auditors and Rules made thereunder; Powers/rights, duties of auditors; Branch Audit; the significance of true and fair view; Dividends and divisible profits- financial, legal, and policy considerations; depreciation; Special features of audit of Limited Liability Partnerships (LLPs)- Eligibility for audit, the appointment of an auditor, remuneration, etc. Audit report under the Companies Act, 2013; Reporting under CARO.

6. Audit Reports: Basic elements of auditor’s report; Types of opinion; Notes on accounts; Distinction between notes and qualifications; Distinction between audit reports and certificates; Communication to Management and those charged with Governance; Self Review threats; Drafting of different types of Audit Reports.

7. Audit Committee and Corporate Governance: Audit committee; Role of auditor in Audit Committee and Certification of Compliance of Corporate Governance; Compliances with Laws and Regulations (SA 250 Consideration of Laws and Regulations in an Audit of Financial Statements); Disclosure requirements including those of SEBI; Regulatory requirements of Corporate Governance, Report on Corporate Governance.

8. Audit of Consolidated Financial Statements: Provisions under the Companies Act, 2013 in respect of Accounts of Companies and Rules made thereunder; Audit of Consolidated Financial Statements- the responsibility of parent company, auditor of the consolidated financial statements; audit considerations- permanent consolidation, current period consolidation; reporting.

9. Special features of audit of Banks, Insurance & Non-Banking Financial Companies.

10. Audit under Fiscal Laws: Audit under Fiscal Laws, viz, Direct and Indirect Tax Laws including documentation for Form 3CD, etc.

11. Audit of Public Sector Undertakings: Special features, Directions of Comptroller and Auditor General of India; Concept of propriety audit; Performance audit; Comprehensive audit.

12. Liabilities of Auditors: Professional negligence; Civil liabilities; Criminal liabilities; Liabilities under different statutes – for example, the Income Tax Act, and the Companies Act.

13. Internal Audit, Management, and Operational Audit: Provisions of internal audit as per Companies Act, 2013; Scope of internal auditing; Relationship between internal and external auditor; Basics of Internal Audit Standards issued by the ICAI; Drafting of Internal Audit Report; Management audit and Operational audit.

14. Due Diligence, Investigation and Forensic Audit: Due Diligence Review; Audit versus Investigation; Steps for investigation; Types of investigation; procedure, powers, etc. of the investigator; Types of Fraud, indicators of fraud, follow-up thereof; Forensic audit¬meaning, the difference between statutory audit and forensic audit, forensic audit techniques, forensic audit report, etc.

15. Peer Review and Quality Review

16. Professional Ethics: Code of Ethics with special reference to the relevant provisions of the Chartered Accountants Act, 1949, and the Regulations thereunder.

Note:

(i) The specific inclusions/exclusions, in any topic covered in the syllabus, will be effected every year by way of Study Guidelines.

(ii) The provisions of the Companies Act, 1956 which are still in force would form part of the syllabus till the time their corresponding or new provisions of the Companies Act, 2013 are enforced.

(iii) If new legislations/ Engagement and Quality Control Standards/Guidance Notes/Statements are enacted in place of the existing legislation, the syllabus would include the corresponding provisions of such new legislation with effect from a date notified by the Institute. The changes in this regard would also form part of the Study Guidelines.

CA Final AAPE Books – Whose Book is Best for CA Final Audit?

Not only Auditing Question banks of May/Nov 2023 but studying or learning the core subjects from the recommended experts’ books are also very important as it covers all the required stuff in an easy manner with their experiences and best guidance at the end of every chapter. So, don’t miss to try getting knowledge from these CA final paper 3 Audit suggested books. Check them below:

- Approach to Advanced Auditing and Professional Ethics book written by Vikash Oswal

- CA Kamal Garg Old and New Syllabus Both

- CA Kamal Garg Class Notes New Syllabus book

- Surbhi Bansal (old & new syllabus)

- CA Pankaj Garg Old Syllabus

- CA Pankaj Garg New Syllabus

- ICAI Supplementary Study Material

- CA Abhishek Bansal Handbook (Click Here to Buy Online)

- CA Dilip Gupta (Best for Hindi Medium Students) Jaipur Base Faculty (Click here to buy Online Book)

FAQs on CA Final AAPE Question Bank – Study Notes PDF

1. Is CA final audit easy?

Understanding the concepts of CA Final Audit is super easy among all other subjects but at the same time, it is a little hard to score good grades in that subject. So try to learn as much as possible while preparing and give your best shot to score the highest mark in the audit paper.

2. How to score 60 in the audit CA final?

Make a note of all important keys and formulae, and regularly revise them until you give your paper. Also, learn how to strategy and learn giving the answer for each kind of question in the Audit paper and impress the paper evaluator. Cover every concept and every small and long type question while preparation. These types of small preparations before the exam will help you score 60 and above marks in the CA Final Auditing Paper.

3. What is the good percentage in CA?

The good percentage in Chartered Accountancy is a minimum of 40% in individual paper and 50% marks as an aggregate in each group.

Final Outcomes

We hope the given CA Final Audit Question Bank Notes PDF with pdf direct links as per the new syllabus will help all the students to study and give their best in the CA Final May 2023 Exams. If you want to check other papers’ study notes like CA Final AAPE Study Material then simply click on the below link. For more stay connected with us at gstguntur.com daily.