Modern Business Environment – CA Final SCMPE Study Material is designed strictly as per the latest syllabus and exam pattern.

Modern Business Environment – CA Final SCMPE Study Material

Question 1.

(Components of Cost of Equity)

Classify the following items under appropriate categories of quality costs, viz., Prevention Costs (PC), Appraisal Costs (AC), Internal Failure Costs (IFC) and External Failure Costs (EFC):

(i) Unplanned replacement to customers

(ii) Correction of a bank statement

(iii) Design review

(iv) Equipment accuracy check

(v) Staff training

(vi) Reprocessing of a loan operation

(vii) Product liability warranty

(viii) Product acceptance

(ix) Wastage of material

(x) Planned maintenance of equipment

(You may opt for the following format and fill in the appropriate Roman numerals under each column):

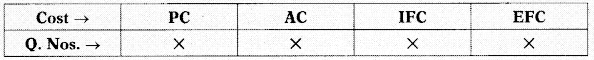

Answer:

Appropriate Categories of Quality Costs

Question 2.

(Cost of Quality) RAX is a market manufacturing organization produces and sells a single product. The cost data per unit for the year 2021 is predicted as below:

| ₹ per unit | |

| Direct Material | 35 |

| Direct Labour | 25 |

| Variable Overheads | 15 |

| Selling Price | 90 |

RAX has forecast that demand for the product during the year 2021 will be 28,000 units. However, to satisfy this level of demand, production quantity will be increased?

There are no opening stock and closing stock of the product.

The stock level of material remains unchanged throughout the period.

The following additional information regarding costs and revenue are given:

- 12.5% of the items delivered to customers will be rejected due to specification failure and will require free replacement. The cost of delivering the replacement item is ₹ 5 per unit.

- 20% of the items produced will be discovered faulty at the inspection stage before they are delivered to customers.

- 10% of the direct material will be scrapped due to damage while in storage. Due to above, total quality costs for the year is expected to be ₹ 10,75,556.

The company is now considering the following proposal:

1. To introduce training programs for the workers which, the management of the company believes, will reduce the level of faulty production to 10%, This training program will cost ₹ 4,50,000 per annum.

2. To avail the services of quality control consultant at an annual charges of ₹ 50,000 which would reduce the percentage of faulty items delivered to customers to 9.5%.

Required

(i) PREPARE a statement of expected quality costs the company would incur if it accepts the proposal. Costs are to be calculated using the four recognised quality costs heads.

(ii) Would you RECOMMEND the proposal? Give financial and non-financial reasons. [MTP Oct. 2018/RTPNov. 2021]

Answer:

(i) Statement of‘Expected Quality Costs’

| Particulars | Current Situation (₹) | Proposed Situation (₹) |

| Prevention Costs | — | 4,50,000 |

| Appraisal Costs | — | 50,000 |

| External Failure Costs | 3,20,000 | 2,35,120 |

| Internal Failure Costs | 7,55,556 | 3,91,538 |

| Total Quality Costs | 10,75,556 | 11,26,658 |

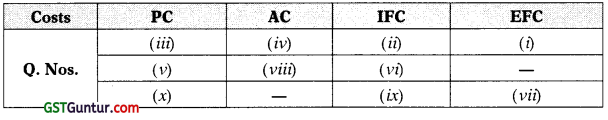

Workings

External Failure Cost

Internal Failure Cost

(ii) Recommendation

On purely financial grounds RAX should not accept the proposal because there is an increase of ₹ 51,102 in quality costs. However there may be other factors to consider as the company may enhance its reputation as a company that cares about quality products and this may increase the company’s market share. On balance RAX should accept the proposal to improve its long-term performance.

![]()

Question 3.

(Optimal Cost of Quality)

Gaur Hari Ltd. produces and sells a single product. Presently the company is having its quality control system in a small way at an annual external failure and internal failure costs of ₹ 4,40,000 and ₹ 8,50,000 respectively. As the company is not able to ensure supply of good quality products upto the expectations of its customers and wants to manage competition to retain market share considers an alternative quality control system. It is expected that the implementation of the system annually will lead to a prevention cost of ₹ 5,60,000 and an appraisal cost of ₹ 70,000. The external and internal failure costs will reduce by ₹ 1,00,000 and ₹ 4,10,000 respectively in the new system. All other activities and costs will remain unchanged.

Required

(i) EXAMINE the new quality control proposal and recommend the acceptance or otherwise of the proposal both from financial and non-financial perspectives.

(ii) What is your ADVICE to the company, if the company wants to achieve zero defect through a continuous quality improvement, program?

(iii) SUGGEST a suitable quality control level at a minimum cost. [May 2018](I0 Marks)

Answer:

(i) Implementation of new system will reduce costs of the non-conformance (internal and external failure) by ₹ 5,10,000 (-40%). However, this will also increase costs of conformance by ₹ 6,30,000. There is inverse relationship between the costs of the conformance and the costs of non-conformance. Gaur Hari Ltd. should try to avoid costs of non- conformance because both internal and external failure affect customer’s satisfaction and organisations profitability. The company should focus on preventing the error such that it ensures that product is of good quality when it reaches the customer at the very first instance. This enhances the customer experience and therefore eliminating the scope for external failures like sales returns and warranty claims. Better quality can yield further sales. Therefore, an increase in spending on quality measures is justified since it not only yields significant improvements to quality but also brings in more sales orders.

Accordingly, from the financial perspective point of view the new proposal for quality control should not be accepted as it will lead to an additional cost of ₹ 1,20,000 (₹ 6,30,000 – ₹ 5,10,000). However, from non-financial perspective point of view as stated above the company should accept the new proposal.

(ii) It is possible to increase quality while at the same time reducing both conformance and non-conformance costs if a programme of aiming for zero defect/and or continuous improvement is followed. Zero defect advocates continuous improvement. To implement this elimination of all forms of waste, including reworks, yield losses, unproductive time, over-design, inventory, idle facilities, safety accidents, etc. is necessary.

(iii) To achieve 0% defects, costs of conformance must be high. As a greater proportion of defects are accepted, however, these costs can be reduced. At a level of 0% defects, cost of non-conformance should be nil but these will increase as the accepted level of defects rises. There should therefore be an acceptable level of defects at which the total costs of quality are at a minimum

Question 4.

(Cost of Quality; SIT) A manufacturing organization Brain Grain is producing a single product RAXY which require three component.

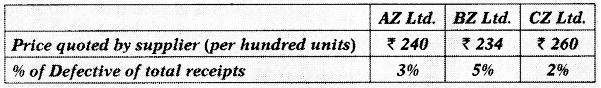

Brain Grain purchases each of these component from three suppliers AZ Ltd, BZ Ltd and CZ Ltd. The following information are available;

If the defectives are not detected they are utilized in production earning a damage of ₹ 200per 100 units of the component. Total requirements is 12,000 units of the components,

The company intends to introduce a system of inspection for the components on receipt. The inspection cost is estimated at ₹ 26 per 100 units of the components. Such as inspection will be able to detect only 90% of the defective components received. No payment will be made for components found to be defective in inspection,

Required

(i) ADVICE whether inspection at the point of receipt is justified

(ii) Which of the three suppliers should be asked to supply? [Nov. 2018](10Marks)

Answer:

(i) A. Statement Showing Effective Cost before Inspection

| Particulars | AZ Ltd. | BZ Ltd. | CZ Ltd. |

| Units Supplies (Nos.) Defectives Expected (Nos.) | 12,000

360 |

12,000

600 |

12,000

240 |

| Costs: Purchase of Components Add: Production Damage on Defective Components (@₹ 200 per 100 components) |

28,800 720 |

28,080 1,200 |

31,200 480 |

| Total | 29,520 | 29,280 | 31,680 |

| Good Components (Nos.) Cost per 100 Good Components |

11,640

253.61 |

11,400

256.84 |

11,760

269.39 |

B. Statement Showing Effective Cost after Inspection

| Particulars | AZ Ltd. | BZ Ltd. | CZ Ltd. |

| Units Supplies (No.s) Defects Not Expected (No.s) Defectives Expected (No.s) Components Paid For |

12,000 36 324 11,676 |

12,000 60 540 11,460 |

12,000 24 216 11,784 |

| Costs: Purchase of Components Add- Inspection Cost |

28,022.40 3,120.00 |

26,816.40 3,120.00 |

30,638.40 3,120.00 |

| Add: Production Damage on Defective Components (@₹ 200 per 100 components) | 72.00 | 120.00 | 48.00 |

| Total | 31,214.40 | 30,056.40 | 33,806.40 |

| Good Components (Nos.) Cost per 100 Good Components |

11,640 268.16 |

11,400 263.65 |

11,760 287.47 |

ADVICE Whether Inspection at the Point of Receipt is Justified

On comparing the cost under situation, A and B shown above, we find that it will not be economical to install a system of inspection.

Further we also need to consider that presently many organizations are undergoing Just in Time (JIT) implementation. JIT aims to find a way of working and managing to eliminate wastes in a process. Achievement of this is ensured through eliminating the need to perform incoming inspection. Inspection does not reduce the number of defects, it does not help in improving quality. In general inspection, does not add value to the product. It simply serves as a means of identifying defects the supplier has failed to recognize subsequent to the manufacturing of the product.

As a matter of fact, organizations implementing JIT are seeking eventually to eliminate the need for performing incoming inspection activities through a combination of reducing the supplier base, selection through qualification and vendor development. Vendor development and its proper management seeks to assist the supplier who maintains an interest in striving to provide 10096 defect-free materials and parts.

So, to decision whether inspection at the point of receipt is justified or not will also depend on Qualitative factors as well.

(ii) On comparing the buying cost of components under different situations, as analysed and advised above, if company decides not to install a system of inspection, supplier AZ would be cheaper otherwise supplier BZ would be cheaper and company may choose supplier accordingly.

Note:

This question can also be solved by assuming receipt of good components as requirement ie. 12,000 units.

Question 5.

(Cost of Quality) Olive Ware Private Ltd. manufactures electronic components for cars. Car manufacturers are the primary customers of these products. Raw material components are bought, assembled and the electronic car components are sold to the customers.

| Selling price | ₹ 2,500 per unit |

| Raw material cost | ₹ 900 per unit |

| Assembly & machine cost | ₹ 500 per unit |

| Delivery cost | ₹ 100 per unit |

| Contribution | ₹1,000 per unit |

The customers due to defects in the product return 5,000 units each year. They are replaced free of charge by Olive Ware. The replaced components cannot be repaired and do not have any scrap value. If these defective components had not been supplied, that is had the sale returns due to defective units been nil, customers’ perception about the quality of the product would improve. This could yield 10% increase in market share for Olive ware that is demand for its products could increase to 150,000 units per annum.

Required

(i) ANALYZE, the cost of poor quality per annum due to supply of defective items to the customers.

(ii) The company management is considering a proposal to implement an inspection process immediately before delivery of products to the customers. This would ensure nil sales returns. The cost of having such a facility would be ₹ 2 crores per annum, this would include materials and equipment for quality check, overheads and utilities, salaries to quality control inspectors etc. ANALYZE the net benefit, if any, to the company if it implements this proposal.

(iii) Quality control investigations reveal that‘defective production is entirely on account of inferior quality raw material components procured from a large base of 30 suppliers. Currently there is no inspection at the procurement stage to check the quality of these materials. The management has a proposal to have inspectors check the quality control at the procurement stage itself. Any defective raw material component will be replaced free of cost by the supplier. This will ensure that no product produced by Olive Ware is defective. The cost of inspection for quality control (materials, equipment, salaries of inspectors etc.) would be ? 4 crore per annum. ANALYZE the net benefit to the company if it implements this proposal? Please note that scenarios in questions (ii) and (iii) are independent and not related to each other.

(iv) Between inspection at the end of the process and inspection at the raw material procurement stage, ADVISE a better proposal to implement (a) in terms of profitability and (b) in terms of long term business strategy? [RTP May 2019](20 Marks)

Answer:

(i) Customer demand for Olive Ware’s products is 1,00,000 units per annum. However, 5,000 defective units supplied are to be replaced free of charge by the company. Therefore, the total number of items supplied to customers per annum = 1,00,000 + 5,000 units = 1,05,000 units. The cost of replacement would include raw material cost, assembly & machining cost and delivery cost of 5,000 units = 5,000 units X j (900+500+100) per unit = 5,000 units × ₹ 1,500 per unit = ₹ 75,00,000 per annum.

Further, had the sale returns not happened, market share would have increased by 50,000 units. Contribution is ₹ 1,000 per unit, for 50,000 units contribution would be ₹ 5,00,00,000. Therefore, the ) cost of poor quality per annum = cost of replacement + contribution from lost sales = ₹ 75,00,000 + ₹ 5,00,00,000 = ₹ 5,75,00,000 per annum.

(ii) Inspection at the end of the process would detect defects before delivery to the customers. This would ensure that the sale returns would be nil. Given in the problem, 5,000 units supplied are defective and would ig need to be replaced, in other words, they need to be manufactured again. In other words, inspection after production, before delivery to customers would not prevent production of defective units. However, compared to the current scenario, since these defective units have not yet been delivered to the customer, the cost for additional delivery of replaced products would be saved. This savings in the extra delivery cost = 5,000 units × ₹ 100 per unit = ₹ 5,00,000 per annum. Further, had the sale returns not happened, market share would have increased by 50,000 units. Contribution is ₹ 1,000 per unit, for 50,000 units it would be ₹ 5,00,00,000 per annum. However, additional failure cost for 2,500 units due to increase in sales from 1,00,000 to 1,50,000 units would be incurred. Since these defective units have not yet been delivered to the customer, this cost would be net of delivery cost. This additional failure cost = 2,500 units × ₹ 1,400 per unit = ₹ 35,00,000 per annum. Therefore, the total benefit from the inspection process before delivery to customers = savings on delivery costs + contribution from incremental sales – additional failure cost = ₹ 5,00,000 + ₹ 5,00,00,000 – ₹ 35,00,000 = ₹ 4,70,00,000 per annum. The cost to the company to maintain good quality of its products through inspection = ₹ 2,00,00,000 per annum. Therefore, the net benefit to the company would be ₹ 2,70,00,000 per annum.

His question can also be solved by taking 7,895 defectives on 1,50,000 good units. For 95,000 good units, gross production is 1,00,000 units. For, 1,50,000 good units, gross production would be 1,57,895 units (1,00,000/95,000 × 150,000). Therefore total defective units will be 7,895.

(iii) Inspection of raw material at the procurement stage could entirely eliminate defective production. The benefit would be two-fold, the current replacement cost for 5,000 units will no longer be incurred. Secondly, due to better customer perception, market share would increase, resulting in an increased contribution/revenue to the company. In other words, the cost of poor quality will be nil.

As explained in solution (i), the cost of poor quality per annum = cost of replacement + contribution from lost sales = ₹ 75,00,000 + ₹ 5,00,00,000 = ₹ 5,75,00,000 per annum. This would be the benefit by implementing the proposal.

Olive Ware has to incur an inspection cost to ensure this highest standard of quality (0% defects) which would cost ₹ 4,00,00,000 per annum. Therefore, the net benefit to the company would be ₹ 1,75,00,000 per annum.

(iv) (a) The proposal to implement inspection immediately before delivering goods to the customers results in a net benefit of ₹ 2,70,00,000 per annum. Alternately, the proposal to implement inspection at the raw material procurement stage results in a net benefit of ₹ 1,75,00,000 per annum. Therefore, from a profitability point of view, inspection immediately before delivery of goods to the customer would the preferred option.

(b) The drawback of inspection at the end of the production process is that (1) it cannot prevent production of defective goods and (2) information regarding the root cause of defective production, in this case, supply of defective raw materials will not get tracked. Therefore, inspection at the end of production does not contribute to resolving the root cause of defective production. On the other hand, inspection at the procurement stage can eliminate production of defective goods. This will ensure a much higher quality of production, better utilization of resources and production capacity. Therefore, from a long-term strategy point of view, inspection at the raw material procurement stage will be very beneficial. Currently the cost of ensuring this highest quality of production (0% defects) is ₹ 4 crores per annum. The cost of ensuring 100% quality is quite high, such that the net benefit to the company is lesser than the other proposal. However, due to its long-term benefit, Olive Ware may consider some minimum essential quality control checks at the procurement stage. Although j selective quality check might not ensure complete elimination of defective production, it can contribute towards reducing it. At the same time cost of selective quality check would not be so high as to override its benefits. To determine the extent of quality control inspection, Olive Ware should determine its tolerance limit for defective production and do an analysis of the quality cost trade-off.

![]()

Question 6.

(Cost of Quality; TPM; TQM) Star Automobile Group is among top 20 business houses in India. It has been founded in the year 1940, at the height of India’s movement for independence from the British, the 1 group has an illustrious history. Star’s footprint stretches over a wide range of industries, spanning automobiles (two wheelers manufacturer and three wheelers manufacturer). Star’s headquarter is located at Hyderabad. Bike Production is one of segment of Star Group. Management of Star wants to analyse the following actual information for the April:

| Cost Data | |

| Customer Complaints Centre Cost | 35 per hr. |

| Equipment Testing Cost | 18 per hr. |

| Warranty Repair Cost | 1,560 per bike |

| Manufacturing Rework Cost | 228 per bike |

Volume and Activity Data:

| Bikes Requiring Manufacturing Rework | 3,200 bikes |

| Bikes Requiring Warranty Repair | 2,600 bikes |

| Production Line Equipment Testing Time . | 1,600 hrs. |

| Customer Complaints Centre Time | 2,000 hrs. |

Additional Information

Due to the quality issues in the month, the bike production line experienced unproductive ‘down time’ which cost ₹ 7,70,000. Star carried out a quality review of its existing suppliers to enhance quality levels during the month at a cost of ₹ 1,25,000.

Required

(i) PREPARE a statement showing ‘Total Quality Costs’.

(ii) ADVISE any TWO measures to reduce the non- conformance cost. [RTP Nov. 2019][Afov. 2021]

Answer:

(i) Statement Showing ‘Total Quality Costs’

| Particulars of Costs | ₹ |

| Prevention Costs | |

| Supplier Review | 1,25,000 |

| Appraisal Costs | |

| Equipment Testing (₹ 18 × 1,600 hrs.) | 28,800 |

| Internal Failure Costs | |

| Down Time | 7,70,000 |

| Manufacturing Rework (₹ 228 × 3,200 bikes) | 7,29,600 |

| External Failure Costs | |

| Customer Complaints (₹ 35 × 2,000 hrs.) | 70,000 |

| Warranty Repair (₹ 1,560 × 2,600 bikes) | 40,56,000 |

| Total Quality Costs | 57,79,400 |

(ii) The reporting of quality costs highlights the cost of quality activities at Star. The total quality costs statement clearly displays the relationship between conformance costs (prevention and appraisal costs) and non-conformance costs (internal failure and external failure costs) and the drivers of a reduction in the overall spending on quality. Statement indicates that only 2.16% of the total quality cost is the cost of preventing quality problems while 0.50% is the cost of appraisal activities. Thus, prevention and appraisal costs make up only 2.66% of total quality costs. In contrast, 97.34% of quality control costs are incurred for internal and external failure costs. Following two measures can be used to reduce non-conformance cost:

Total Productive Maintenance (TPM) is a system of maintaining and improving the integrity of production and quality system through keeping all equipment in top working condition so as to avoid breakdowns and delays in manufacturing processes. It involves identifying machines in every division (including planning, manufacturing, maintenance) and then planning & executing a maintenance programme covering their entire useful life.

In this scenario, TPM will help in reducing internal failure cost (i.e., downtime and manufacturing rework cost), which constitutes 25.95% of total quality cost, by keeping all equipment in good working conditions so that there is no downtime or machine breakdown and ensuring that all equipment run smoothly. If machines work properly, the chances of rework will reduce, ultimately will also reduce chances of warranty repair and cus-tomer complaints (comprising 71.39% of total quality cost which is major part of total quality cost).

Total Quality Management (TQM) aims at improving the quality of organisational output, including goods and services, through continual improvement of internal practices. Its objective is to eradicate waste and increase efficiency without compromising with the quality. It requires that company maintain this quality standards in all aspects of business by ensuring that things are done right the first time so that defects and waste are eliminated from operation.

It appears that Star is not a TQM company at present due to huge disparity between conformance costs and non-conformance costs. In order to make Star to be successful, all staff at Star must be engaged in the improvement process and share in the continuous improvement ethos. In order to establish a reputation as a high-quality bike manufacturer Star must ensure staff are focused on quality and attitudes changed toward the importance of conformance activities, for instance, Star can conduct third party inspection of raw material at supplier’s workplace leading to maintenances of quality standards.

Overall, while applying above two measures, in the Star, consid-eration must therefore be given to the optimum balance between the costs of conformance and the costs of non-conformance.

Question 7.

FIZI is a new banking company which is about to open its first branch in INDIA. FIZI believes that in order to win customers from the market, it needs to offer potential customers a new banking experience. Other banking companies are focusing on interest rates and bank charges, whereas FIZI believes that quality and timely availability of service is an important factor to attract customers.

Required

EXPLAIN how Total Quality Management would enable FIZI to gain competitive advantage in the banking sector. [RTP May 2018]

Answer:

- Total Quality Management is a management philosophy.

- It concerns itself with managing processes and people to make sure that the customer is satisfied at each and every stage.

- This means making the needs of the customer the priority, expanding the relationship beyond traditional services and incorporating the customer’s needs in the company’s business plan and corporate strategy.

- In TQM, the concept of “quality” is perceived exclusively from the frame of reference of the customer.

- These customers can be internal, such as, those working in another department and there can be external customers who are the end recipients of the product or services.

- The organisation should attempt for continuous improvement in the quality that it delivers with the ultimate aim of achieving zero defects in this quality.

TQM should be view as an investment rather than as a cost that should be minimised. There are many ways in which investment can be made in TQM.:

- fine-tuning the product mix,

- fine-tuning of the processes of ensuring quality,

- introducing employee development programmes with the nature of an academic course,

- empowering the employees professionally and personally,

- improving the top management commitment to quality,

- monitoring of the performances and proper rewarding based on achievements,

- ensuring the customer satisfaction etc.

FIZI could provide its employees with training in the technical aspects of banking practice as well as in customer care.

- Customers would thus get a better service not only technically but also from a customer care perspective.

- This should lead to smaller customer complaints and greater customer satisfaction.

- It could also motivate customers to recommend others to use , this bank.

- TQM also requires FIZI to respond to its customer’s requirements immediately for example by providing more staff to reduce the lengths of queues in festive/seasonal/busy time.

- If Bank could also be opened for longer hours to allow customers to complete their bank related requirements and have meetings with bank employees at a time that is more convenient for the customer, this would lead to more satisfaction to customers.

- In long run, if bank continue to follow TQM, the bank would I have higher profits and competitive advantage in banking sector despite incurring additional expenditure to improve quality.

Financial perspective – Required Cost

Non-Financial Perspective – Long term, its Good

![]()

Question 8.

(Total Quality Management) Kasan Ltd. is a manufacturing company, which is engaged in production of wide range of consumer products for home consumption. Among its all product CFL lamp are its most efficient and environmental friendly product. Kasan has a quality control department that monitor the quality of the products produce by company.

As per the recent cost of poor quality report, the current rejection rate for CFL lamps is 5% of units input. 5,000 units of input go through the process each day. Each unit that is rejected results in a ₹ 200 loss to the Kasan Ltd. company. The quality control department has proposed few changes to the inspection process that would enable early detection of defects. This would reduce the overall rejection rate from 5% to 3% of units input. The improved inspection process would cost the company ₹ 15,000 each day.

Required

(i) ANALYSE the proposal and suggest if it would be beneficial for the Kasan to implement it.

(ii) After implementation, ANALYSE the maximum rejection rate beyond which the proposal ceases to be beneficial? [MTP Oct. 2020; MTP April 2019]

Answer:

(i) Analysis of the proposal to make changes to the inspection process: The Kasan company wants to reduce the cost of poor quality on account of rejected items from the process. The current rejection rate is 5% that is proposed to be improved to 3% of units input.

The expected benefit to the company can be worked out as follows: The units of input each day = 5,000. At the current rate of 5%, 250 units of input are rejected each day. It is proposed to reduce rejection rate to 3%, that is 150 units of input rejected each day. Therefore, improvements to the inspection process would reduce the number of units rej ected by 100 units each day. The resultant cost of poor quality would reduce by ₹ 20,000 each day (100 units of input × ₹ 200 cost of one rejected unit).

The cost of implementing these additional controls to the inspection process would be ₹ 15,000 each day.

The net benefit to the company on implementing the proposal would be ₹ 5,000 each day. Therefore, the Kasan company should implement the proposal.

(ii) Analysis of maximum rejection rate beyond which the proposal ceases to be beneficial

The cost of improving controls to the inspection process is ₹ 15,000 each day. The number of units of input processed each day is 5,000. The cost of rejection is ₹ 200 per unit.

It makes sense to implement the improvements to controls only if the benefit is greater than the cost involved. To find out the point where the benefits equal the cost, solve the following equation.

Let the number of reduction in rejections each day due to improved controls be R. At ₹ 200 per unit, benefits from reduction in rejection would be ₹ 200 × R.

At what point, would this be equal to the cost of control of ₹ 15,000 per day?

Solving ₹ 200 × R = ₹ 15,000; R = 75 units. That is if the improvements to inspection process control reduces the number of rejections by 75 units each day, the benefit to the Kasan company would be ₹ 15,000 each day.

That is if the rejection rate improves by 1.5% (75 units/5,000 units) then the benefits accruing to the company will equal the cost incurred.

In other words, when the rejection rate is 3.5% (current rate 5% – improvement of 1.5% to the rate) or below, the proposal will be beneficial. In this range, the savings to the cost of poor quality will be more than the cost involved. For example, as explained above, when the improved rejection rate is 3%, the net benefit to the company is ₹ 5,000 each day.

Beyond 3.5% rejection rate, the proposal will result in savings to the cost of poor quality that is less than the cost involved of ₹ 15,000 each day.

Question 9.

Delicious Box Ltd. is a manufacturer and supplier of android set up boxes for various DTH operators. This is very popular with the operators as it converts normal TV to a smart TV. To ensure supply of good quality products to meet the expectations of the viewers, it has set up quality control department that regularly conducts quality inspection and submits its report to the management on weekly basis.

As per the latest quality inspection report submitted by the department, it reflects that the current rejection rate is 7% of units input into the manufacturing system due to poor quality. 3,000 units of input go through the process every day. As per analysis, for each rejection, there is loss of ₹ 150 to the company. The management is very much worried due to high rate of rejection of input units.

The management has asked for suggestions from the quality control department in this regard. The department has suggested implementation of new system for inspection for early detection of defective units. This change would result in drop of rejection rate to 4% from earlier 7%. The cost of new system will be ₹ 12,000 per day.

Required

(i) ANALYSE the Proposed new system for inspection and suggest if it would be beneficial for the company.

(ii) Also CALCULATE the minimum reduction in number of rejections each day upto which the proposed system will be beneficial. [Nov. 2020](5 Marks)

Answer:

(i) Analysis of the Proposal

DTH Box Ltd. wants to reduce the cost of poor quality on account of rejected items from the manufacturing system. The current rejection rate is 7% that is proposed to be improved to 4% of units input.

The expected benefit to the company can be worked out as follows: The units of input each day = 3,000. At the current rate of 7%, 210 units of input are rejected each day. It is proposed to reduce rejection rate to 4%, that is 120 units of input rejected each day. Therefore, new system would reduce the number of units rejected by 90 units each day. The resultant cost of poor quality would reduce by 1 13,500 each day (90 units of input X ₹ 150 cost of one rejected unit).

The cost of implementation of the new system on the inspection pro-cess would be ₹ 12,000 each day.

The net benefit to the DTH Box Ltd on implementing the proposal would be ₹ 1,500 each day. Therefore, the company should implement the proposal.

(ii) Let the number of reductions in reactions each day due to proposed system be X. At ₹ 150 per unit, benefits from reduction in rejection would be ₹ 150 × X.

Point, at which this will be equal to the cost of new system of 12,000 per day: Solving ₹ 150 × X = ₹ 12,000; X = 80 units

Therefore, minimum reduction in number of rejections each day up to which the proposed system will be beneficial is 80 units.

.

Question 10.

(Cost of Quality, TQM)

ORG is a Smart TV manufacturer. Smart TV is a technological convergence of computers, television sets and set-top boxes provided through traditional broadcasting media. It is relatively a new company in the market and the directors are keen to establish a reputation of high quality.

The CEO of the company has heard that “There is no better cost to eliminate than the cost of poor quality”

The board of directors decided in the board meeting to establish a culture of Total Quality Management at the company. For this purpose they have collected the following actual information for the most recent quarter of the current year:

| Cost data | $ |

| Customer support centre cost per hour | 116 |

| Equipment testing cost per hour | 60 |

| Manufacturing rework cost per TV | 760 |

| Warranty repair cost per TV | 5,200 |

| Volume and activity data | |

| TVs requiring manufacturing rework | 800 TVs |

| TVs requiring warranty repair | 650 TVs |

| Customer support centre time | 500 hours |

| Production line equipment testing time | 400 hours |

Additional information

ORG during the quarter, undertook a quality review of its existing suppliers at a cost of $1,20,000.

The TV production line experienced periods of unproductive ‘down time’ due to the quality issues in the quarter which cost $750,000.

Required;

(a) PREPARE a Cost of Quality report using four recognized quality cost headings for ORG.

(b) Explain how a Cost of Quality report would support the development of a TQM culture at ORG.

Answer:

(a) Cost of Quality Report

| Volume | Rate $ | Cost $ | |

| Prevention costs | |||

| Supplier review | 120,000 | ||

| Appraisal costs | |||

| Equipment testing | 400 | 60 | 24,000 |

| Internal failure costs | |||

| Down time | 750,000 | ||

| Manufacturing rework | 800 | 760 | 608,000 |

| Total internal failure costs | 1,358,000 | ||

| External failure costs | |||

| Customer support | 500 | 116 | 58,000 |

| Warranty repair | 650 | 5,200 | 3,380,000 |

| Total external failure costs | 3,438,000 | ||

| Total quality costs | 4,940,000 |

(b) A Total Quality Management (TQM) culture is one where all depart-ments and staff are committed to a process of continuous improve-ment. The aim of the organization is to achieve a zero defect position where products are produced on a consistently high quality basis and the focus of the organisation is on improving processes to attain this state.

The quality costs report highlights the cost of quality activities at ORG. Highlighting the quality activities and reporting on money spent on quality failures helps to strengthen the TQM.

Quality is concerned with conformance to specification; ability to satisfy customer expectations and value for money. Recognizing the importance of cost of quality is important in terms of continuous improvement. The quality cost report display the relationship between conformance costs (prevention and appraisal costs) and non-confor-mance costs (internal failure and external failure costs) and the drivers of a reduction in the overall spending on quality.

![]()

Question 11.

(Total Quality Management)

PRADO is a chocolates manufacturing company however due to some quality reason company has incurred huge losses and fall in market reputation. For the purpose of improvement of profitability the financial manager of PRADO has advise the company to implement TQM.

The company has provided the following information to the board of director in Extraordinary general meeting. This information contain list of performance measurement before the implementation of a Total Quality Management Programme (Pre-TQM) and after its implementation (Post-TQM).

| Pre-TQM performance % | Post-TQM performance % | |

| Returns by customers due to packaging defects | 5 | 2 |

| Rejections on final inspection | 6 | 4 |

| Losses in production | 3 | 1 |

Required

(i) CALCULATE how many units must be input to the process to achieve final sales of 2,000 units:

(a) before the TQM programme

(b) after the TQM programme

(ii) COMMENT on the implementation of TQM in PRADO Company.

Answer:

(i) Calculation of input to the process to achieve final sales of 1,000 units before and after TQM programme.

| Performance | ||

| Pre-TQM Units | Post-TQM Units | |

| Sales Packaging Failures | 2,000,100 | 2,000,40 |

| Rejected Units | 2,100,134 | 2,040,86 |

| Process losses | 2,234,70 | 2,126,22 |

| Units to be input | 2,304 | 2,148 |

(ii) Comment: The TQM improvements have led to a reduction of about 796 (156/2,304) in the quantity of units that need to be input to produce 2,000 units of output.

TQM is “integrated and comprehensive system of planning and controlling all business functions so that products or services are produced which meet or exceed customer expectations. TQM is philosophy of business behaviour, embracing principles such as employee involvement, continuous improvement at all levels and customer focus, as well as being a collection of related techniques aimed at improving quality”.

TQM requires ensuring that things are done right the first time and that defects and waste are eliminated from operations.

Question 12.

(Cost of Quality; TPM; TQM; JIT)

Mega Bike (MB) is large national bike manufacturing organisation established in the year 2003. Mega Bike has a strong position in the market and has also traditionally achieved a good market share however facing tough competition. The Board of Mega Bike recognises that it needs to make fundamental changes to its production approach in order to combat increased competition from foreign manufacturers. Mega Bike is now being seen as non-lucrative, pollutive and with less safety features in comparison to the foreign bikes. The Board plans to address this by improving the quality of its bikes as well as financial performance.

The components are sourced directly by Mega Bike. Suppliers are located worldwide. Suppliers are evaluated on an ongoing basis, including an assessment of whether to utilise new or alternative suppliers to improve capacity and performance. The company is having lot of components piled up in stock and few of them are becoming obsolete. There is lots of reworking as both internal and external failure are more, so the wastage of resources in reworking needs to be controlled. The Board is convinced S that Lean Manufacturing is the best approach to be adopted.

In Mega Bike, production process is grouped by function and production teams comprised a number of permanent members, who had acquired their positions through seniority and a few newly selected specialist staff who had yet to discuss their position in any team.

The process of making a bike can be roughly divided into stamping, welding, painting, assembly and inspections, which takes about 11-12 hours in total. The standard time to manufacture a similar bike in industry is 8-9 hours. The nature of end product demand is unstable due to economic factors. However, Mega Bike forecasts demand based on its internal policies and historical trends. Mega Bike sells its bikes in retail stores located in over 10 metro cities. It focuses on building close relationships with retailers, working with them to sell its bikes in a compelling manner.

Enclosed Annexure

Required:

You are newly appointed to Management Accounting Department of MB, Chief Management Accountant asked you to draft a report for CEO, containing-

(i) ANALYSIS of quality costs and ADVISE on two measures to reduce the non-conformance cost,

(ii) ADVISE on implementation of just-in-time purchasing and production

Annexure

Statement Showing ‘Total Quality Costs

| Particulars of Costs | ₹ |

| Prevention Costs Supplier Review | 2,50,000 |

| Appraisal Costs Equipment Testing (₹ 36 × 1,600 hrs.) |

57,600 |

| Internal Failure Costs Down Time Manufacturing Rework (₹ 456 × 3,200 bikes) |

15.40,000 14,59,200 |

| External Failure Costs Customer Complaints (₹ 70 × 2,000 hrs.) Warranty Repair (₹ 3,120 × 2,600 bikes) |

1,40,000 81,12,000 |

| Total Quality Costs | 1,15,58,800 |

Answer:

Addressed to: Office of CEO, Mega Bikes

Dated -6th May, 2020

Report

Analysis of Quality Costs

The reporting of quality costs highlights the cost of quality activities at MB, The total quality costs statement clearly displays the relationship between conformance costs (prevention and appraisal costs) and non-conformance costs (internal failure and external failure costs) and the drivers of a reduction j in the overall spending on quality. Statement indicates that only 2.16% of the total quality cost is the cost of preventing quality problems while 0.50% is the cost of appraisal activities. Thus, prevention and appraisal costs make up only 2.66% of total quality costs. In contrast, 97.34% of quality control costs are incurred for internal and external failure costs.

Two measures to reduce non-conformance cost

Total Productive Maintenance (TPM) is a system of maintaining and improving the integrity of production and quality system through keeping all equipment in top working condition so as to avoid breakdowns and delays in manufacturing processes. It involves identifying machines in every division (including planning, manufacturing, maintenance) and then planning & executing a maintenance programme covering their entire useful life.

In this case, TPM will help in reducing internal failure cost (Le., downtime and manufacturing rework cost), which constitutes 25.95% of total quality cost, by keeping all equipment in good working conditions so that there is no downtime or machine breakdown and ensuring that all equipment run smoothly. If machines work properly, the chances of rework will reduce, ultimately will also reduce chances of warranty repair and customer complaints (comprising 71.39% of total quality cost which is a major part of total quality cost).

Total Quality Management (TQM) aims at improving the quality of organsational output, including goods and services, through continual improve-ment of internal practices. Its objective is to eradicate waste and increase efficiency without compromising with the quality. It requires maintaining quality standards in all aspects of business by ensuring that things are done right the first time so that defects and waste are eliminated from operations.

It appears that MB is not a TQM company at present, due to huge disparity between conformance costs and non-conformance costs. In order to make MB to be successful, all staff at MB must be engaged in the improvement process and share in the continuous improvement ethos. In order to establish a reputation as a high- quality bike manufacturer MB must ensure, staff is having attitude towards the importance of conformance activities, for f instance, MB can conduct third party inspection of components at supplier’s j workplace leading to maintenances of quality standards.

Overall, while applying above two measures, in the MB, consideration must therefore be given to the optimum balance between the costs of conformance and the costs of non-conformance.

Implementation of Just in Time

Just in time purchasing and production technique will put an end to the harrowing task of inventory management. In this form of pull system, purchasing of components and production of bikes will be based on customer demands and MB will have to accordingly coordinate with its suppliers to supply the right quantity of components required at the right time. JIT inventory management calls for having the inventory as and when needed also taking care of massive holding cost suffered related to large build ups. In this environment, MB will also be able to reduce the manufacturing time around 3 hours by streamlining the flow of information in entire supply chain.

Mega is assessing alternative suppliers on continuous basis to improve capacity and performance. It means it is changing sources of material regularly

or using multi-suppliers. In contrast, JIT is based on reduced number of supplier and move towards single sourcing. It is easier to develop long term cooperative relationships with a smaller number of suppliers. The quality of internal services and an organisation’s ability to provide quality products or services to its customers depends upon this relationship. However, this relationship is obviously missing in MB.

MB has close relationship with the retailers but relationship with suppliers is equally important.

It appears that firm is also importing its requirements from abroad. In JIT environment, it is important that suppliers are, to the extent practical, located in close proximity to the manufacturing plant. Carefully selected suppliers are capable of delivering high quality materials in a timely manner, directly at the shopfloor, reducing the material receipt time. Therefore, selection of right supplier located in close proximity to the manufacturing plant is vital for the proper implementation of JIT.

It is also important to note that every supplier is different, but the MB has to be able to view each as one of its part only. The supplier’s network must be able to call up and communicate directly with the MB’s network, obtaining manufacturing schedules and product specification in real time. ERP and other sources of electronic data interchange between supplier and MB will act as backbone in supporting the JIT activity.

On the whole, MB’s management has to treat suppliers as partners with significant influence on the success of the organization.

The functional division is less appropriate in JIT environment. JIT produc-tion requires multi- skilled teams. In MB, teams need to be formed to work by product ie., type of bike rather than by the type of work performed. In addition, staff will need training to work in the new teams, measures surrounding the amount and effectiveness of training will be required. A JIT system works best when employees pitch in with suggestions for improvements. The performance can be measured by computing the number of ideas per worker, the number of ideas suggested in total, the number of ideas implemented, or the proportion of ideas suggested that are implemented.

MB forecasts demand based on its internal policies and historical trends. Today demand in every sector of the market changes by leaps and bounds, so using historical data is not at all recommended. Demand forecasts should be pulled by current market trends and prediction of future market sentiments. However, in case of MB, demand is unstable. In this case, in order to prevent stock-outs, inventory managers can only increase the Kanban numbers of each product; the greater are the variations, the greater is the need of Kanban cards and, thus, the higher is stock level and need more working capital per rupee of sales.

Conclusion

The Board desires to improve the quality as well as financial position which can be achieved through successfully implementation of quality control and lean system. However, the factors discussed above should be taken care of. It is worthwhile to note that any return on investment in proposed system must be viewed long term rather than short term since optimum results may not be realized until the system has been in place for some time.

Further details can be tabled on requisition basis. Closure of Report

Chief Management Accountant

(For Management Accounting Department)

Mega Bikes

![]()

Question 13.

(The Business Excellence Model)

As a guest lecturer at a symposium for Business Excellence where you are giving a lecture on “Sustaining Business Excellence”. A manufacturer of a fashion clothing line is one of the participants at the symposium. He has the following query:

“We are an apparel company that manufacture and sell our fashion clothing and accessories directly through 30 stores spread across India. Shortly we are planning to establish similar outlets overseas. Our business is under constant change due to changing customer trends. At the same time, we are the largest company in our industry segment in India, both in terms of market share and profits. We have a satisfied base of customers who are loyal to our brand. Shareholders are also satisfied stakeholders due to good returns provided on their investments. What would be the relevance of Business Excellence model to our company?

Thank you!”

You are required to frame an appropriate response to this query. Required

(i) EXPLAIN the importance of business excellence to an organization,

(ii) LIST the tool available to achieve and sustain excellence.

(iii) APPLY the fundamentals of EFQM model on the apparel company.

(iv) EXPLAIN the relationship between various criteria of the model in general terms. [RTP May 2019]

Answer:

(i) Business Excellence is a philosophy for developing and strengthening the management systems and processes of an organization to improve performance and create value for stakeholders. Stakeholders in an organization are not limited to shareholders (business) alone. They include also customers, employees (people) and society. What an organization does impact all the stakeholders in different ways, yet they are all interlinked to each other. Customers’ needs are of paramount importance to companies. Yet given uncertain conditions, shareholders demand challenging return on their investments. Employees need more from their company than just their pay-check. They want the company to enable to grow their knowledge and experience that can improve their career growth. Society expects companies to operate ethically and for the overall betterment of the society and environment.

For several years businesses have been operating under challenging circumstances. For example, landline phones have been entirely replaced by mobile phones. Television programs can be watched seamlessly on internet enabled mobile phones. Not just this, today’s smartphones have computing capability much more than the computers that were used in Apollo Mission to send the first man to moon! The proliferation of mobile phones has changed not just the telecom industry but also others like communication, banking, e-commerce etc. The pace of change is both exhilarating and challenging.

To manage this complex scenario, a company cannot focus on only one aspect of their operations. Optimize processes, delivery quality to customers, manage employee talents, earn required return on investment while managing to be a socially responsible organization. In short, the company should achieve excellence in all aspects of its operations. This is business excellence. Business excellence principles emerged because of development of quality drive into traditional business management. It is imperative not just to achieve excellence but also to sustain it.

Business excellence models are holistic tools that help companies develop stakeholder focused strategy. Each operation within a company enables a corresponding result. Business models present a formal, standardized cause effect relationship between different operations (enablers) and their resultant consequences. If the company want to achieve a different result, it has to do things differently. This can be better analysed through these models. Continuous improvement on various operations will ultimately lead to excellence. More importantly, these models need to be used to sustain and maintain excellence to retain their competitive advantage. They are not to be taken as one time exercise by the company. Assessments using this model have to be made periodically so that timely action can be taken to achieve the desired result.

(ii) Some of the popular business excellence models are

(i) the European Foundation Quality Management (EFQM) model

(ii) Baldrige Criteria for Performance Excellence

(in) Singapore BE Framework

(iv) Japan Quality Award Model and

(iv) Australian Business Excellence Frame-work.

(iii) The apparel company is a well-established player in the industry. It is a growing company that is looking to expand its operations overseas.

To achieve business excellence in this environment, the company could adopt the EFQM model, which is a popular model.

The EFQM model was developed by the European Foundation for Quality Management. The model provides an all-round view of the organization and it can be used to determine how different methods fit together and complement each other. It can help the company understand the cause and effect relationships between what their wl organization does and the results it achieves. Creating an EFQM Management Document gives the organization a holistic overview of its g* strategic goals, the key approaches it has adopted and the key results § it has achieved.

The fundamental concepts for excellence are the basic principles that describe the essential foundation for any organization to achieve sus-tainable excellence. With respect to the company they can be detailed as below:

(a) Adding value to customers: Companies need to understand their customers, their needs, anticipate their needs and make use of opportunities to fulfil their expectations. In the current case, fashion apparel business is ever changing and dynamic due to the changing trends in customer’s tastes. This could differ across locations within India and abroad. In the era of e-commerce, competition would be cut-throat. Before going to “how” it can meet customer’s needs, the company should be clear on “what” need of the customer it can satisfy. For example, should the company cater to Indian apparel market, western apparel market, men or women or children apparel market etc. Once the “what” is clear, the company should have mechanisms in place to find out and anticipate customer tastes. Accordingly, it should structure its operations to add value to the customers in terms of quality, availability, support, and experience.

(b) Creating a sustainable future: Society and environment (People and Planet of Triple Bottomline concept) play a major role in ensuring the sustainability of business. A company should have as much positive impact on its surroundings and try to minimize any negative impact on the same. Here, the company should assess the environmental impact of its operations, measures to minimize adverse impacts, business impact on the society etc. For example, leather is contended to be harmful to the environment since it requires the skin of animals specially cattle hide, needs huge amount of energy and chemicals to process it. This has a negative environmental impact. As regards societal impact, suppliers of cloth to the apparel company should not indulge in labor malpractice like child labor and should adhere to safety standards within its factories. The company should procure cloth only from suppliers who adhere to such standards.

(c) Developing Organizational Capability: Companies need to man age change within the organization and beyond. The company should identify “what it is capable of being great at?” in order to differentiate it from its competitors. For example, the apparel company may have the capability of tracking its inventory at the stores on real time basis. As soon as the inventory falls below a certain level, the stores issues fresh products to stock up. This ensures that there are no stock outs at the retail outlet. This ability to track inventory real time and ability to stock up quickly may be unique to the company that gives it a competitive edge. Another can be the ability to quickly change the apparel production to meet changing trends. Likewise, the company should identify and develop unique capabilities to have a competitive edge in the market.

(d) Harnessing creativity and innovation: Continuous improvement and innovation brings value to the company. The company should promote a working environment that enables and appreciates creativity and innovation. For example, new apparel designs can be promoted to test the market. If found feasible, the company can go for mass production of the same.

(e) Leading with vision, inspiration, and integrity: The tone at the top defines the rest of the company. The leaders and management of the company should have a clear vision of what the company wants to achieve, develop strategy to achieve it, work with integrity and ethics. Leaders shape the future of the organization.

(f) Managing with agility: Agility would be the capability to identify and effectively respond to opportunities and threats. For example, although the apparel company is in an expansionary phase, it should consider the threat, yet opportunity of using e-commerce as a platform to reach out to customers directly. Brick and mortar stores are becoming largely redundant due to online platforms, a threat the company should recognize and act upon.

(g) Succeeding through the talent of people: An organization is only as good as the people who work in it. There should be an atmosphere of teamwork that enable achievement of organizational and personal goals. Performance evaluation, reward and recognition programs, training and talent network are ways to cultivate talent within the organization.

(h) Sustaining outstanding results: Use of EFQM model is not a onetime exercise. Constant and periodic evaluation is required to keep up and sustain excellence.

(iv) The criteria of the model are comprised of 5 enablers and 4 results. Enablers covers what an organization does (its objective) and how it does it (strategy, use of resources to achieve it).

(a) Leadership: A leader defines the organization’s culture. They enable the organization to achieve its goals by taking the correct decisions at the correct time. To do this they should have sufficient skill, work as per the company’s code of conduct and should be ethical in their dealings.

(b) Strategy: Operations should be planned and directed as per a clearly defined strategy. The company’s vision and mission statement with respect to its various stakeholders are the goals that the organization wishes to achieve. Strategy (plan) enables the company to achieve these goals.

(c) People: Excellence is possible only if the people working in the company wish to achieve it. They must be motivated, recognized, and managed to enable them to work towards the company’s vision and mission. The work culture should be that this opens up opportunities for personal development as well. This would cultivate a bond with the organization, which enables people working within to strive for excellence.

(d) Partnerships and resources: Effective management of partnerships that the company has with other organizations is critical to success. Partners could be external vendors, suppliers, and service providers. The services of partners enable business to operate smoothly. Resources, both tangible and intangible should be managed optimally. Tangible resources can be financial (cash, bank accounts) and physical assets (machinery, building, land etc.). Intangible resources would be intellectual property rights, information technology, licenses etc. Proper management of resources enables optimal results.

(e) Processes, Products, and Services: A company exists because of its processes, products, and services. They should be managed and continuously improved to create value to the stakeholders.

Results are what the organization achieves following its operations and decisions. As explained before, the stakeholders of the company are investors (business), people (employees), customers and society. In order to track performance, the company has to develop Key Performance Indicators (KPI)s for each of the stakeholder groups. Results should be tracked periodically. Changes to targets and benchmarks should be continuously made to reflect the current objectives that the company wants to achieve. Some of the results that the company can look at are:

(a) Customer results: Are the customers of the company satisfied with the products and service? How does the company fare in terms of brand loyalty? Is the customer base growing to indicate increasing market share?

(b) People results: Does the company have skilled and motivated employees? What is the employee turnover with reasons for the same? Does the company have proper access to hire required talent? Are the employees motivated, trained, recognized, and rewarded for their performance? What is performance measurement system, is it robust and accurate to measure performance?

(c) Society results: Is the company a good corporate citizen. Are the objectives of corporate social responsibility being met? If the organization is a not for profit organization, is it meeting its objectives and goals?

(d) Business results: Is a for profit organization achieving the required return on investment, profitability that the shareholders and other investor demand? Has the company been able to manage financial and other risks properly?

Enablers enable achievement of results. EFQM model documents this flow and symbiosis in a structured way. It highlights the strength and weakness of the enablers. With this information, the company can alter its operations and strategy to achieve desired results. On assessment, there is a flow from results to enablers. If the results have been achieved, enablers continue to operate status quo. If the results fall short of targets, changes have to be made to enablers to improve performance.

Therefore, it can be concluded the EFQM model encourages constant self- assessment to achieve excellence.

When a company wins an excellence award based on a business excellence model, it gains in stature within the industry. This recognition could work to its advantage financially and otherwise.

![]()

Question 14.

(Theory of Constraint)

R Plus Security (RPS) manufactures surveillance camera equipment that are sold to various office establishments. The firm also installs the equipment at the client’s place to ensure that it works properly. Each camera is sold for ₹ 2,500. Direct material cost of ₹ 1,000 for each camera is the only variable cost. All other costs are fixed. Below is the information for manufacturing and installation of this equipment:

| Particulars | Manufacture | Installation |

| Annual Capacity (camera units) | 750 | 500 |

| Actual Yearly Production and Installation (camera units) | 500 | 500 |

Required

The questions below are separate scenarios and are not related to each other.

(i) IDENTIFY the bottleneck in the operation cycle that RPS should focus on improving. Give reasoning for your answer.

(ii) An improvement in the installation technique could increase the number of installations to 550 camera units. This would involve total additional expenditure of ₹ 40,000. ADVISE RPS whether they should implement this technique?

(iii) Engineers have identified ways to improve manufacturing technique that would increase production by 150 camera units. This would in* volve a cost ₹ 100 per earner a unit due to necessary changes to made in direct materials. ADVISE RPS whether they should implement this new technique. [RTP May 2018/2020]

Answer:

The feedback of information relates to the reporting of things that have happened in the past. For example,

(i) Identification of Bottleneck: Installation of cameras is the bottleneck in the operation cycle. The annual capacity for manufacturing and installation are given to be 750 camera units and 500 camera units respectively. Actual capacity utilization is 500 camera units, which is the maximum capacity for the installation process. Although, RPS can additionally manufacture 250 camera units, it is constrained by the maximum units that can be installed. Therefore, the number of units manufactured is limited to 500 camera units, subordinating to the bottleneck installation operation. Therefore, RPS should focus on improving the installation process.

(ii) Improving Capacity of Installation Technique: Every camera sold increases the through put contribution by ₹ 1,500 per camera unit (sale price ₹ 2,500 per camera unit less direct material cost ₹ 1,000 per camera unit). By improving the current installation technique an additional 50 camera units can be sold and installed. This would involve total additional expenditure of ₹ 40,000. Hence, the incremental benefit would be:

| Particulars | Amount (₹) |

| Increase in throughput contribution (additional 50 camera units ₹ 1,500 per camera unit) | 75,000 |

| Less: Increase in total expenditure | 40,000 |

| Incremental benefit | 35,000 |

Since the annual incremental benefit is ₹ 35,000 per annum, RPS should implement this improvement to installation technique, the current bottleneck operation.

(iii) Improving Manufacturing Capacity: Every camera sold increases the throughput contribution by ₹ 1,500 per camera unit (sale price ₹ 2,500 per camera unit less direct material cost ₹ 1,000 per camera unit). By improving the current manufacturing technique an additional 150 camera units can produced. This would involve a cost ₹ 100 per camera unit due to necessary changes to made in direct materials. Therefore, number of units manufactured can increase to 650 camera units. However, production of 150 camera units will not translate into additional sales, because each sale also requires installation by RPS. In a year only 500 camera installations can be made, leading to an inventory pile up of 150 camera units. This is detrimental to RPS, since it does not earn any contribution by holding inventory. Therefore, RPS should not go ahead with the proposal to improve the manufacturing technique.

Question 15.

(Theory of Constraints)

Shrya Steel Company produces three grades of steel – Class i, Class ii and Class iii grade. Each of these products (Grades) has high demand in the market and company is able to sell as much as it can produce these products.

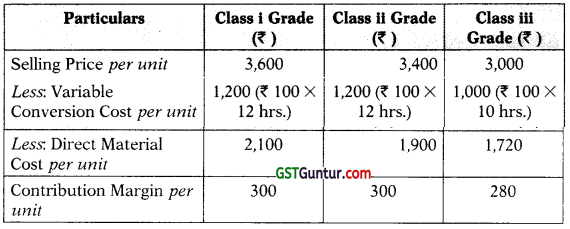

The furnace operation is a bottle-neck in the process. The company is running at 100% of capacity. The company wants to improve its profitability. The variable conversion cost is ₹ 100 per process hour. The fixed cost is ₹ 48,00,000. In addition, the Cost Accountant was able to determine the following information about the three products (grades):

| Class i Grade | Class ii Grade | Class iii Grade | |

| Budgeted Units Produced | 6,000 | 6,000 | 6,000 |

| Total process hours per unit | 12 | 12 | 10 |

| Furnace hours per unit | 6 | 5 | 4 |

| Unit Selling Price | ₹ 3,600 | ₹ 3,400 | ₹ 3,000 |

| Direct Material cost per unit | ₹ 2,100 | ₹ 1,900 | ₹ 1,720 |

The furnace operation is part of the total process for each of these three products. Thus furnace hours are the part of process hours.

Required

(i) DETERMINE the unit contribution margin for each product.

(ii) Give an ANALYSIS to determine the relative product profitability, assuming that the furnace is a bottleneck.

(iii) Managements wishes to improve profitability by increasing prices on selected products. At what price would Class i and Class ii grades need to be offered in order to produce the same relative profitability as Class iii grade steel? [May 2018](20 Marks)

Answer:

(i) Contribution Margin per unit

(ii) The contribution margin per unit may give false signals when an organization has production bottlenecks. Instead, Company should use the contribution margin per bottleneck hour to determine relative product profitability, as follows:

| Particulars | Class i | Class ii | Class iii |

| Grade | Grade | Grade | |

| Contribution Margin per unit (₹) | 300 | 300 | 280 |

| Furnace Bottleneck hrs. per unit | 6 | 5 | 4 |

| Contribution Margin per furnace hour | 50 | 60 | 70 |

Analysis

The Class i and Class ii Grade steel have the highest contribution margin per unit (₹ 300); however, the Class iii grade has the highest contribution margin per furnace hour (₹ 70).

Thus, using production bottleneck analysis indicates that the Class iii Grade is actually more profitable at a ₹ 70 contribution margin per furnace hour than Class i Grade’s ₹ 50 or Class ii Grade’s ₹ 60 contribution margin per furnace hour.

Therefore, the company would want to sell product in the following preference order:

I. Class iii Grade

II. Class ii Grad

III. Class i Grade

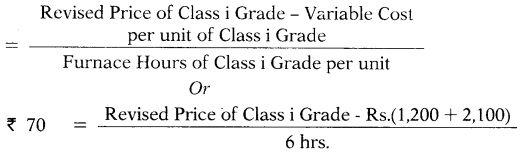

(iii) One way is to revise the pricing would be to increase the price to the point where all three products produce profitability equal to the highest profit product. This would be determined as follows:

Contribution Margin per furnace hour for Class iii Grade

Or, ₹ 420 = Revised Price of Class i Grade – ₹ 3,300

Class i grade steel would require a revised price of ₹ 3,720 in order to deliver the same contribution margin per bottleneck hour as does Class iii Grade steel.

Contribution Margin per furnace hour for Class iii Grade

Class ii grade steel would require a revised price of ₹ 3,450 in order to deliver the same contribution margin per bottleneck hour as does Class iii Grade steel

Question 16.

(Throughput Accounting)

Naya company produces three products Le, Mi and Ne. The capacity of Naya’s plant is restricted by process in machine M2. Process in Machine M2 is expected to be operational for eight hours per day and can produce 1,200 units of Le per hour, 1500 units of Mi per hour, and 600 units of Ne per hour.

The Selling prices and material costs for each product are as follows:

| Product | Selling price $ per unit | Material cost $ per unit | Throughput $ per unit |

| Le | 75 | 40 | 35 |

| Mi | 65 | 20 | 45 |

| Ne | 150 | 50 | 100 |

Operating costs are $360,000 per day.

Required

(a) Calculate the profit per day if daily output achieved is 6,000 units of Le, 4,500 units of Mi and 1,200 units of Ne.

(b) Calculate the Throughput Accounting ratio for each of the product. :

(c) In the absence of demand restrictions for the three products, advise Naya management on the optimal production plan.

Answer:

(a) Calculation of profit per day if daily output achieved is 6,000 units of Le, 4,500 units of Mi and 1,200 units of Ne.

= Throughput contribution – Operating costs

= [($35 × 6,000) + ($40 × 4,500) + ($100 × 1,200)] – $360,000

= $150,000 (Profit per day)

(b) Calculation of TA ratio for each of the product.

TA Ratio = \(\frac{\text { Throughput per factory hour }}{\text { Operating costs per factory hour }}\)

| Product | Throughput per factory hour | Operating Cost per factory hour | TA Ratio |

| Le | ₹ 35 × 1,200 = $ 42,000 | ₹ 45,000 | 0.93 |

| Mi | ₹ 45 × 1,500 = $ 67,500 | ₹ 45,000 | 1.50 |

| Ne | ₹ 100 × 600 = $ 60,000 | ₹ 45,000 | 1.33 |

= Operating costs per factory hour = $360,000/8 = $45,000

Note

(c) If it is not possible to increase the number of factory hours available, priority should be given to making and selling Product Mi, since it has the highest TA ratio. If only Product Mi is made and sold (since there is no restriction on sales demand), total output per day would be (1,500 × 8 hours) = 12,000 units of Product Mi. Total throughput would be $540,000 (= 12,000 units × $45) per day. Total profit per day would be $540,000 – $360,000 = $180,000.

This is $30,000 more per day than the profit from the production mix in the answer to part (a).

![]()

Question 17.

(Throughput Accounting Ratio)

Oppi Popcorn Manufactures readymade popcorn packets that has a selling price of ₹ 40. The material costs are ₹ 16 per unit of readymade popcorn packets. Total operating expenses each month are ₹ 240,000

Machine capacity is the key constraint on production. There are only 1200 machine hours available each month, and it takes six minutes of machine time to manufacture each unit of Readymade popcorn packets.

Required

(a) Calculate the throughput accounting ratio for oppi.

(b) List how this ratio might be increased?

Answer:

(a) Throughput per unit of Packet of Popcorn = ₹ 40 – ₹ 16 = ₹ 24.

Machine time per unit of Packet of Popcorn = 6 minutes = 0.10 hours.

Throughput per machine hour = ₹ 24/0.10 = ₹ 240.

Operating expenses per machine hour = ₹ 2,40,000/1200 Hours = ₹ 200

TA ratio for Oppi = ₹ 240/₹ 200 = 1.20

(b) In the following cases it might be possible for Oppi to increase the Throughput Accounting ratio

(i) Raise the selling price for readymade popcorn packet for each unit sold, to increase the throughput per packet.

(ii) Improve the efficiency of machine time used, and so manufacture Popcorn packet in less than six minutes.

(iii) In order to reduce the operating expenses per machine hour, find ways of reducing total operating

Question 18.

RIYAN. Ltd. manufactures three products. The material cost, selling price and bottleneck resource details per unit are as follows:

| Particulars | Product A | Product B | Product C |

| Selling Price (₹) | 66 | 75 | 90 |

| Material and Other Variable Cost (₹) | 24 | 30 | 40 |

| Bottleneck Resource Time (Minutes) | 15 | 15 | 20 |

Budgeted factory costs for the period are ₹ 2,21,600. The bottleneck resources time available is 75,120 minutes per period.

Required

(i) Company adopted throughput accounting and products are ranked according to ‘product return per minute’. Select the highest rank product.

(ii) CALCULATE throughput accounting ratio and COMMENT on it.

Answer:

(i) Calculation of Rank According to ‘Product Return per minute’

| Particulars | A | B | C |

| Selling Price | 66 | 75 | 90 |

| Variable Cost | 24 | 30 | 40 |

| Throughput Contribution | 42 | 45 | 50 |

| Minutes per unit | 15 | 15 | 20 |

| Contribution per minute | 2.8 | 3 | 2.5 |

| Ranking | II | I | III |

(ii) Ranking Based on ‘TA Ratio’

| Contribution per minute | 2.80 | 3.00 | 2.50 |

| Factory Cost per minute(2,21,600/75,120) | 2.95 | 2.95 | 2.95 |

| TA Ratio (Cont. per minute/Cost per minute) | 0.95 | 1.02 | 0.85 |

| Ranking Based on TA Ratio | II | I | III |

Comment

Product B yields more contribution compared to average factory” contribution per minute, whereas A and C yield less.

Question 19.

Shooter Limited produces three products S, 0 and L which use the same resources but in varying quantities. Product S uses one unit of component P which is purchased from outside suppliers at, ₹ 120 per unit. Details of the three products are as follows :

| S | Q | L | |

| Annual Demand (units) | 9,000 | 5,700 | 7,800 |

| Per unit ₹ | Per unit ₹ | Per unit ₹ | |

| Selling Price | 310 | 275 | 224 |

| Component P | 120 | – | – |

| Direct materials (₹ 8per kg.) | 24 | 32 | 24 |

| Skilled labour (₹ 40 per hour) | 20 | 60 | 40 |

| Unskilled labour (₹ 24per hour) | 18 | 24 | 36 |

| Variable Overhead (₹ 6 per machine hour) | 18 | 24 | 24 |

| Annual fixed costs are 115,00,000 | |||

Maximum availability of skilled labour is 16,200 hours. Other resources are sufficient to meet the annual demand/sales.

Engineering division of the company came forward with a proposal to make the component ‘P’ in house with the following costs break up :

| Direct materials (₹ 8 per kg.) | ₹ 24 |

| Skilled labour (₹ 40 per hour) | ₹ 40 |

| Unskilled labour (₹ 24 per hour) | ₹ 8 |

| Variable Overhead (₹ 6 per machine hour) | ₹ 18 |

| ₹ 90 |

For in-house making of the component ‘P’ there will not be any change in the annual fixed costs of the company. The company can either buy | the component ‘P’ or make it in house.

Required

RECOMMEND the optimum production plan and profit for the year. Show calculation in support of your answer [Nov. 2019] (10 Marks)

Answer:

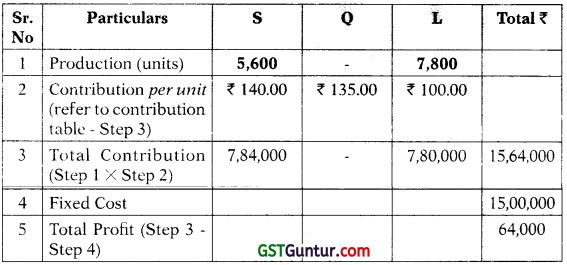

(a) Option-1

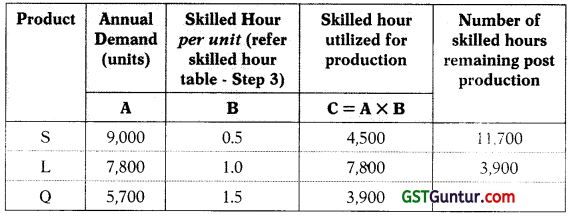

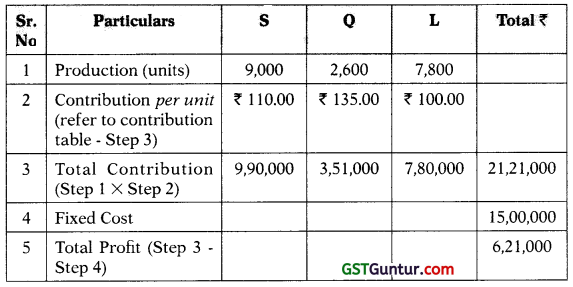

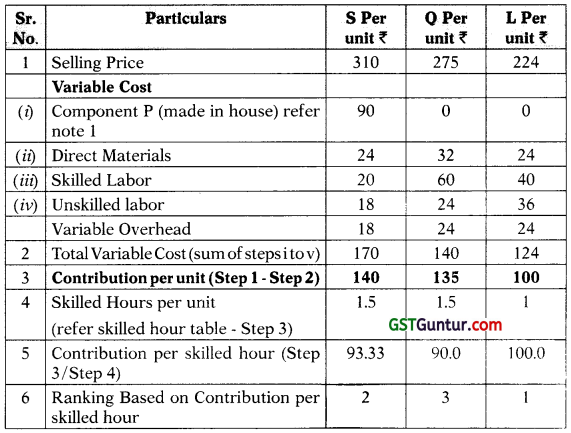

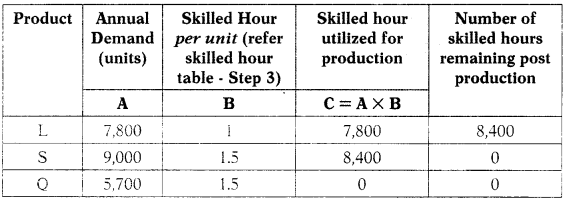

Shooter Ltd. produces 3 products Product S, Product Q and Product L. Each unit of Product S requires one unit of component P, which is currently procured from the external market at ₹ 120 per unit. There is a constraint in terms of skilled hours available for production, the maximum available is 16,200 hours. Given this constraint, the production plan should be based on the contribution derived per skilled labor hour spent on each product.