Deduction, Collection and Recovery of Tax – CA Final DT Question Bank is designed strictly as per the latest syllabus and exam pattern.

Deduction, Collection and Recovery of Tax – CA Final DT Question Bank

Tax Deduction and Collection at Source

Question 1.

Explain the applicability of the provision relating to the deduction of tax at source in the following transactions:

(i) Max Limited pays ₹ 1.20 lakhs to Mini Limited, a resident contractor who, under the contract dated 15th October, 2020, manufactures a product according to specification of Max Limited by using materials purchased from Max Limited.

(ii) A company operating a television channel makes payment of ₹ 5 lakhs to a former cricketer for making running commentary of a one-day cricket match.

(iii) EL Ltd., a foreign company, pays outside India, salary to its employee, Mr. Raghavan, a foreign national and a non-resident, for services rendered in India. [CA Final May 2010] [6 Marks]

Answer:

(i) The definition of “work” u/s 194C includes manufacturing or supplying product as per the requirement or specification of a customer by using material purchased from such customer or its associate. In the instant case, Mini Limited manufactures the product as per the specification given by Max Limited by using the raw materials purchased from Max Limited.

Therefore, it falls within the definition of “work” u/s 194C. Consequently, tax is to be deducted on the invoice value excluding the value of material purchased from such customer if such value is mentioned separately in the invoice. If the material component is not mentioned separately in the invoice, tax is to be deducted on the whole of the invoice value.

![]()

(ii) Provisions for deduction of tax at source u/s 194J are attracted in respect of payment of fees for professional services, if the amount of such fees exceeds ₹ 30,000 in the relevant financial year. The service rendered by a commentator in relation to sports activities has been notified by the CBDT as professional service for the purpose of section194J vide its Notification No. 88 dated 21st August, 2008. Therefore, tax is required to be deducted @ 10% from the fee of ₹ 5 lakhs payable to the former cricketer.

(iii) Section 195 requires deduction of tax at source by any person responsible for making payment to a non-resident, any interest or any other sum chargeable under the provisions of the Income-tax Act, 1961 (other than income chargeable under the head “Salaries”).

Section 192(1) requires “any person” responsible for paying income under the head “Salaries” to deduct tax at source. Therefore, even if the payer is a foreign company, section 192 would be applicable.

TDS provisions u/s 192 are attracted, if the salary payable to a non-resident is chargeable to tax in India. U/s 9(1)(ii), income which falls under the head “Salaries” shall be deemed to accrue or arise in India, if it is earned in India. Salary payable for service rendered in India shall be regarded as income earned in India.

Therefore, salary paid to Mr. Raghavan, a non-resident, attracts tax liability in India, as he has rendered services in India and the salary is attributable to such services. The Supreme Court in the case of CIT v. Eli Lilly & Co. (India) P. Ltd. has expressed the same view.

Therefore, the foreign company, EL Ltd., is liable to deduct TDS u/s 192 from the salary of Mr. Raghavan.

![]()

Question 2.

Bharathi Cements Ltd., the assessee, purchases jute bags from Raj Kumar & Co. The latter has to supply the jute bags with the logo and address of the assessee, printed on it. From 01.09.2020 to 20.03.2021, the value of jute bags supplied is ₹ 8,00,000, for which the invoice has been raised on 20.03.2021. While effecting the payment for the same, is the assessee bound to deduct tax at source, assuming that the value of the printing component involved is ₹ 60,000. The assessee has not sold any material to Raj Kumar & Co. and the latter has to manufacture the jute bags in its plant using raw materials purchased from outsiders. [CA Final May 2010] [2 Marks]

Answer:

As per the definition u/s 194C “work” shall not include manufacturing or supplying a product according to the requirement or specification of a customer by using raw material purchased from a person, other than such customer or its associate, i.e. such a contract would be in the nature of contract for ‘sale’.

The problem clearly states that Raj Kumar & Co. have to manufacture the jute bags using raw materials purchased from outsiders and that the assessee has not sold any material to them. Therefore, in this case, it is a contract for sale. Hence, the provisions of section 194C would not be attracted and no liability to deduct tax at source would arise.

![]()

Question 3.

R Limited transferred a building worth ₹ 25 lakhs to the Chief Executive Officer, Mr. Mohan Lai, a resident individual on his retirement under an agreement for not carrying on any activity related to its business ; for a period of five years. In course of assessment u/s 143(3), the A.O. found that no tax had been deducted at source by R Limited and on that ground, he disallowed 30% of the expenditure by invoking the provision of section 40(a)(ia). Examine the correctness of the action of the Assessing Officer. [CA Final Nov. 2010] [6 Marks]

Answer:

As per section 194J, any person, who is responsible for paying to a resident, any sum by way of fees for professional services, or fees for technical services or royalty or non-compete fees referred to in section 28{va) is required to deduct tax at source.

As per section 28(va), any sum received or receivable in cash or in kind under an agreement for not carrying out any activity in relation to any business is chargeable to tax under the head “Profits and gains of business or profession”.

Therefore, the obligation to deduct tax u/s 194J arises even if the non-compete fee is payable in kind. It is the responsibility of the payer to recover the amount of tax deductible from the recipient of the non-compete fee in kind.

As per Sec. 40(a)(ia), 30% of any sum payable to a resident on which tax is deductible at source shall not be allowed as a deduction on which tax has not been deducted or after deduction has not been paid to the credit of Central Government in due time. Therefore, the action of the Assessing Officer to disallow 30% of expenditure is correct.

![]()

Question 4.

Maya Bank credited ₹ 73,50,000 towards interest on the deposits in a separate account for macro-monitoring only by using Core-branch Banking Solutions (CBS) software. No tax was deducted at source in respect of interest on deposits so credited even where the interest in respect of some deposits exceeded the limit of ₹ 40,000. The Assessing Officer disallowed the entire interest expenditure where the interest on time deposits credited exceeded the limit of ₹ 40,000 and also levied penalty under section 271C.

Decide the correctness of action of the Assessing Officer. [CA Final May 2011] [4 Marks]

Answer:

Explanation to Section 194A provides that where any interest income (other than interest on securities) is credited to any account, whether called ‘Interest payable account’ or ‘Suspense account’ or by any othername, in the books of account of the person liable to pay such income, such crediting shall be deemed to be credit of such income to the account of the payee and provisions of section 194A shall apply accordingly.

However, CBDT vide Circular No. 3/2010 dated 02.03.2010 has clarified that Explanation to section 194A will not apply in cases of banks where credit is made to provisioning account on daily/monthly basis for the purpose of macro monitoring only by the use of CBS software, since no constructive credit to the depositor’s/payee’s account takes place while calculating interest on daily/monthly basis in the CBS software used by banks.

In such cases, tax shall be deducted at source on accrual of interest at the end of the financial year or at periodic intervals as per practice of the bank or as per the depositor’s or payee’s requirement or on maturity or on encashment of time deposit, whichever event takes place earlier.

In view of above, the action of the A.O. in disallowing the interest expenditure credited in a separate account for macro monitoring purpose is not valid and consequent penalty proceedings are also not tenable in law.

![]()

Question 5.

What are the consequences of not collecting tax at source (TCS) in respect of sale of scrap by a manufacturing company? State the circumstances under which the TCS provisions are not applicable in the above case. [CA Final May 2012] [5 Marks]

Answer:

As per section O6C, every person being a seller of, inter alia, scrap, shall, at the time of debiting of the amount payable by the buyer to the account of the buyer or at the lime of receipt of such amount from the buyer, whichever is earlier, collect tax @ source Çoe 1% of the said amount from the buyer. If the seller does not collect tax at source on sale of scrap, then, the following would be the consequences:

- He shall be deemed to be an assessee in default in respect of the tax not collected.

- He shall be liable to pay the tax, which he ought to have collected, to the credit of the Central Government, even if he has not actually collected the tax.

- He shall be liable to pay simple interest @ 1% per month or part thereof on the amount of such tax from the date on which such tax was collectible till the date on which the tax was actually paid. Such interest shall be paid before furnishing the quarterly statement for each quarter.

- Penalty equal to the amount of tax which is not collected can be levied u/s 271CA.

However, the seller, who does not collect tax at source, shall not be deemed to be an assessee in default in respect of such tax if the buyer:

- has furnished his return of income u/s 139; and

- has taken into account such sum for computing income in such return of income; and

- has paid the tax due on the income declared by him in such return of I income; and

- the payer furnishes a certificate to this effect from an accountant in such form as may be prescribed.

![]()

In such cases, the seller shall be liable to pay interest from the date on which such tax was collectible to the date of furnishing of return of income by such buyer. :

The seller, however, would not be liable to collect tax at source in the following cases:

(i) If the buyer is a resident and he furnishes to the person responsible for collecting tax, a declaration’in the prescribed form to the effect that scrap is to be utilized for the purpose of manufacturing, processing , or producing articles or things or for the purposes of generation of power and not for trading purposes.

(ii) If scrap is sold to a public sector company, the Central Government, a State Government, an embassy, a high commission, legation, commission, consulate and the trade representation of a foreign State or a club.

(iii) If the buyer, in the retail sale of scrap, has purchased the scrap for his personal consumption.

![]()

Question 6.

B. Airways Ltd. sold tickets to the travel agents in India at a minimum fixed commercial price. The agents were permitted to sell the tickets at a higher price, however, up to a maximum of published price. Commission at the rate of 9% of published price was payable to the agents of the airlines company, on which tax was deducted under section 194H by the company. The Assessing Officer raised the issue of further liability of tax deduction at source on the amount of difference between the actual sales price and the minimum fixed commercial price by treating it as “additional special commission” in the hands of the agents. Whether the contention raised by the Assessing Officer is tenable in law? Critically examine. [CA Final May 2012] [4 Marks]

Answer:

The facts of the case are similar to the facts in CIT v. Qatar Airways (2011) where the Bombay High Court held that the difference between the published price and the minimum fixed commercial price cannot be treated as additional special commission in the hands of the agents of an airline company to attract TDS provisions u/s 194H as the airline company has no information about the exact rate at which tickets are ultimately sold by the agents.

In order to deduct tax at source, the exact income in the hands of the agents must necessarily be ascertainable by the airline company. Further, it would be impracticable and unreasonable to expect the airline company to get a feedback from its numerous agents in respect of each ticket sold.

Applying the rationale of the above case, B. Airways Ltd. is not liable to deduct tax at source u/s 194H on the difference between the actual sale price and the minimum fixed commercial price, even though the amount earned by the agent over and above minimum fixed commercial price would be taxable as income in the hands of the agent.

Therefore, the contention raised by the Assessing Officer is not tenable in law.

![]()

Question 7.

Amisha Hotels and Resorts Ltd. is engaged in business of owning, operating and managing hotels. The tips are paid by the guests by way of charge to the credit cards in the bills. The company disburses the same to the employees at periodic intervals. Explain with reasons whether the company is responsible for deducting tax at source from disbursement of tips to its employees. [CA Final Nov. 2012] [4 Marks]

Answer:

The liability to deduct tax at source will arise only if the impugned payments disbursed to the employees by the assessee-company are regarded as “Salaries” under section 192.

The facts of this case are similar to the facts of CIIXTDS) v. ITC Ltd [2011] in which the Delhi High Court observed that the tips charged from the customers by the employer creates an obligation on the part of the employer to disburse them to the employees and by virtue of employer-employee relationship, the employees also have a right to claim such tips. Therefore, the tips constitute an additional income for the employees and thus, would be taxable under the head “Salaries” and the company was liable to deduct tax at source from such payments u/s 192.

However, the liability to deduct tax will arise only if the amount of salaries after considering the permissible deductions exceeds the basic exemption limit in the hands of the recipient of such tips.

![]()

Question 8.

Discuss the liability for deduction of tax at source In the following cases:

(i) Mr. A has been running a sole proprietary business having total turn over of ₹ 1.5 crore in the immediately preceding financial year. He pays a monthly rent of ₹ 15,000 for the office premises to Mr. X, the landlord besides, he also pays service charge of ₹ 10,000 per month to Mr. X towards the use of furniture and fixtures.

(ii) By virtue of an agreement with a nationalized bank, a catering organization receives ₹ 50,000 per month towards supply of food, snacks, etc. during the office hours to the employees of the bank.

(iii) A notified infrastructure debt fund eligible for exemption u/s 10(47) of the Income-tax Act, 1961 pays interest of ₹ 5 lakhs to a company incorporated in USA. The US Company incurred expenditure of ₹ 12,000 for earning such interest. The fund also pays interest of ₹ 3 lakhs to Mr. X, who is a resident of a notified jurisdictional area. Discuss the liability for deduction of tax at source. [CA Final May 2013] [8 Marks]

Answer:

(i) Where an individual or HUF, whose total turnover exceeds ₹ 1 crore in the immediately preceding financial year, pays rent exceeding ₹ 2,40,000, liability to deduct tax 10% u/s 194-1 shall arise. Therefore, Mr. A, being an individual, having total turnover of ₹ 1.5 crore in the immediately preceding financial year shall be liable to deduct tax at source u/s 194-I in respect of rental payments made during the current financial year.

As per Explanation to section 194-I, rent includes any payment, by whatever name called, for the use of land, building, furniture, fittings, etc. Therefore, in the given case, along with the rent of 15,000 p.m. for office premises the service charges of 10,000 p.m. for use of furniture and fixtures would also attract TDS u/s 194-I.

![]()

Further, since the aggregate rental payments (for both premises and furniture/fittings) made to Mr. X during the financial year 2020-21 exceeds ₹ 2,40,000, tax has to be deducted on ₹ 3 lakhs @ 10%. The tax to be deducted u/s 194-I would, therefore, be ₹ 30,000.

(ii) Under section 194C, the definition of ‘work’ includes catering services also and therefore, TDS 2% under section 194C will get attracted in respect of payments to the catering organization. As the payment exceeds ₹ 1,00,000, the nationalized bank is required to deduct tax @ 2% on payment made to the catering organisation, thereby, tax to be deducted would be ₹ 12,000 (i.e., 2% of ₹ 6,00,000).

If the catering organization is owned by an individual or HUF, tax is to be deducted 1% under section 194C.

(iii) As per section 194LB, tax would be deductible 5% on gross inter est paid/credited by a notified infrastruclure debt fund, eligible for exemption u/s 10(47), to a foreign company.

In the first case, since the payment is made to a foreign company, health & education cess @ 4% have to be added to the applicable rate of TDS. Therefore, the tax deductible u/s 194LB would be ₹ 26,000 (i.e., 5.20% of ₹ 5 lakhs).

However, in case the notified infrastructure debt fund pays interest to a person who is a resident of a notified jurisdictional area, section 94A will apply. Accordingly, tax would be deductible @30% (plus health & education cess @ 4%) u/s 94A, even though section 194LB provides for deduction of tax at a concessional rate of 5%. Therefore, the tax deductible in respect of payment of ₹ 3 lakh to Mr. X, who is a resident of a notified jurisdictional area, would be ₹ 93,600, being 31.2% of ₹ 3,00,000.

![]()

Question 9.

Explain in the context of provisions contained in Chapter XVII of the Act and also work out the amount of tax to be deducted by the payer of income in the following cases:

(i) Payment of ₹ 5 lakhs made by JCP & Co. to Pingu Events Co. Ltd. for organization of a debate competition on the subject “Preservation of Rural Heritage of Rajasthan”.

(ii) “Profit Commission” of ₹ 1 lakh paid by a re-insurance company to the insurer company after the expiry of the term of insurance where there was no claim during the treaty.

(iii) KD, a part time director of DAF Pvt. Ltd. faas paid an amount of ₹ 2,25,000 as fees which was actually in the nature of commission on sales for the period 01.07.2020 to 30.09.2020. [CA Final Nov. 2013] [6 Marks]

Answer:

(i) For the purpose of section 194J, CBDT has notified the services of ‘Event Managers in relation to Sports activities’ alone as “professional services”. However, in the given case, payment has been made to an event management company for organising a debate competition. Hence, the TDS provisions u/s 194J would not be attracted in this case.

However, TDS provisions u/s 194C, relating to payment to contractors, would be attracted and consequently tax has to be deducted @ 2% under section 194C which will be 10,000, being 2% of ₹ 5 lakhs.

(ii) As per section 194D, tax shall be deductible at source 5% on insurance commission. But re-insurance differs from insurance since there is no direct contractual relationship between the person insured and the re-insurer.

Section 194D shall be levied on the commission or any other payment, which is given as a remuneration or reward for soliciting or procuring the insurance business. However, the insurance companies do not procure business for the reinsurance company nor does the reinsurer pay- commission for soliciting the business from the insurance companies; therefore, section 194D has no application.

Therefore, when profit commission is paid by a reinsurance company to insurance company, after the expiry of the term of insurance, in respect of such cases where there is no claim during the operation of the reinsurance treaty, TDS under section 194D is not attracted.

(iii) Section 194J provides for deduction of tax at source @ 10% on any remuneration or fees or commission, by whatever name called, paid to a director, which is not in the nature of salary on which tax is deductible at source u/s 192. Section 197B provides that where the requirement of deduction of tax falls during the period 14.05.2020 to 31.03.2021, then tax shall be deducted at A of the rate specified in the section.

Therefore, in this case, since the payment is made during the period 14.05.2020 to 31.03.2021, tax is to be deducted @ 7.5 (3/4th of 10%) by DAF Pvt. Ltd. on the commission of ₹ 3,75,000 paid to KD, a part time director.

![]()

Question 10.

Discuss whether tax has to be deducted under the provisions of the Income-tax Act, 1961 in the following situations? .

(i) M/s. Shiva & Co., partnership firm, pays a sum of ₹ 43,000 as interest on loan borrowed from Indian branch of a foreign bank.

(ii) Above firm has paid ₹ 14,000 as interest on capital to partner Mr. Vishnu, a resident in India and ₹ 22,000 as interest’ on capital to partner Mr. Brahma, a non-resident.

(iii) Above firm has paid ₹ 45,000 being share of profit of partner Mr. Brahma, a non-resident. [CA Final May 2014] [6 Marks]

Answer:

(i) As per Sec. 195, any person responsible for paying to a non-resident or a foreign company, any interest (other than interest n/s 194LB or 194LC or 194LD) or any other sum chargeable under this Act (other than salary) shall, at the time of credit or payment whichever is earlier, deduct income tax thereon at the rates in force. In the given case, the payment of interest on loan has been made to a branch of a foreign bank. The branch of the foreign bank would be considered as foreign company in India, assuming that its place of effective management is not in India. Hence M/s. Shiva & Co. needs to deduct tax u/s 195 in case of payment of ₹ 43,000 as interest on loan borrowed from Indian branch of a foreign bank.

However, the foreign banking company may make an application in Form No. 15C to the A.O. for grant of a certificate authorising him to receive such sum without TDS. Such certificate shall be granted by the A.O. subject to the conditions prescribed in rule 29B. So, if the foreign banking company has been granted a certificate of non-deduction of tax by the A.O. then no tax shall be deducted.

AUTHOR S NOTE:

A different view has been expressed in the suggested solution published for CA Final May, 2014 as under –

Section 194A deals with deduction of tax at source on interest, other than interest on securities, subject to the provisions of this section. Section 194A further provides that tax is not required to be deducted from interest credited or paid to any banking company to which the Banking Regulation Act, 1949 applies. A foreign bank operating in India is governed by the Banking Regulation Act. Therefore, M / s Shiva & Co. is not required to deduct tax from interest on loan payable to Indian Branch.

The author does not agree to the view expressed above since the branch of a foreign company is not a resident in India and hence Sec. 194A would not be applicable to it.

![]()

(ii) Section 194A also provides that tax is not to be deducted from interest paid or payable by a partnership firm to its partner resident in India. Hence, the firm need not deduct tax at source from payment of interest to its partner, Mr. Vishnu.

However, interest paid by the firm to its non-resident partner shall be governed by section 195 which requires deduction of tax at source from interest paid or payable to any non-resident. Therefore, the ex-elusion from TDS provisions of section 194A will not be applicable on interest paid to Mr. Brahma, a non-resident and tax has to be deducted at rates in force u/s 195 on the amount of ₹ 22,000.

(iii) As per section 10(2A), share of profit received by a partner from the firm is exempt from tax. Therefore, the share of profit paid to nonresident partner is not liable for TDS.

However, as per section 195(6) the person responsible for paying any sum to a non-corporate non-resident or to a foreign company, shall be required to furnish the information relating to payment of such sum in the prescribed form and manner, whether or not chargeable to tax.

![]()

Question 11.

A foreign company seconded some employees to the assessee, an Indian collaborator. The assessee had not deducted tax on the home salary/special allowance or allowances (education allowance or retention allowance) payments made by foreign company/HO to its employees (expatriated to India) outside India in foreign currency. The Revenue authorities, holding the assessee as an ‘assessee-in-default’ u/s 201 of the Income-tax Act, 1961, levied interest and penalty on it. Is the same justified? [CA Final May 2014] [4 Marks]

Answer:

On facts similar to the given problem, the question which arose before the Supreme Court in the case of CIT v. Eli Lilly & Co.(India) (P.) Ltd. was that whether the Indian assessee was required to deduct tax u/s 192 on the home salary and special allowances paid by the foreign company abroad for rendering services in India.

The Supreme Court held that if the home salary and special allowance payment made by the foreign company abroad is for rendition of services in India and if no work is found to have been performed for foreign company, then such payment would certainly come u/s 192( 1) of the Income-tax Act.

The Supreme Court held that it was duty bound to deduct tax at source u/s 192(1) from the home salary/special allowance(s) paid abroad by the foreign company, particularly when no work stood performed for the foreign company and the total remuneration stood paid only on account of services rendered in India during the period in question. In this case, A.O. is therefore justified in levying penalty and interest u’/s 201(1).

However, as per Sec. 273B, if the Indian collaborator was under the genuine and bona fide belief that it was not under any obligation to deduct tax at source from the special allowance paid by the foreign company, no penalty u/s 271C would be attracted.

![]()

Question 12.

Discuss and compute the liability for deduction of tax at source, if any, in the cases stated hereunder, for the financial year ended 31st , March, 2021.

(i) Mr. X, a resident, acquired a house property at Mumbai from Mr. Y for a consideration of ₹ 90 lakhs, on 20.6.2020. On the same day, Mr. : X made two separate transactions, thereby acquiring an urban plot in Kolkata from Mr. C for a sum of ₹ 49,50,000 and rural agricultural ; land from Mr. D for a consideration of ₹ 60 lakhs.

(ii) A commission of ₹ 50,000 was retained by the consignee ‘ABC Packaging Ltd.’ and not remitted to the consignor ‘XYZ Developers’, while remitting the sale consideration. Examine the obligation of the consignor to deduct tax at source.

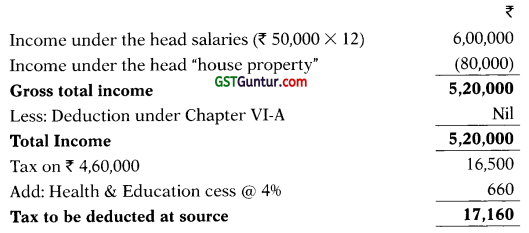

(iii) Raj is working with AB Ltd. He is entitled to a salary of ₹ 50,000 per month w.e.f. 1.4.2018. He has a house property which is self- occupied. He paid an interest of ₹ 80,000 on loan, during the previous year 2020-21. The loan was taken for construction of house. He has notified his employer AB Ltd. that there will be a loss of ₹ 80,000 in respect of this house property for financial year ended 31.3.2021. [CA Final Nov. 2014] [6 Marks]

Answer:

(i) Since, the consideration for transfer House Property at Mumbai, exceeds ₹ 50 lakhs, Mr. X, being the transferee, is required to deduct tax 1% of ₹ 90 lakhs u/s 194-IA.

As per Sec. 197B, as inserted by the Taxation and Other Laws (Relaxations and Amendment of Certain Provisions) Act, 2020, where the requirement of deduction of tax at source falls during the period 14.05.2020 to 31.03.2021, the rate of deduction shall he 3/4th of rate prescribed in the section. Therefore, in this case, since the tax is required to be deducted at source on 20.06.2020, the raie of deduction shall be 0.75% (3’/4th of 1 %) and the amount of TDS would he ₹ 67,500.

Mr. X is not required to deduct tax at source u/s 194-IA from the consideration of ₹ 49,50,000 paid to Mr. C for transfer of urban plot, since the consideration is less than ₹ 50,00,000.

Mr. X is also not required to deduct tax at source u/s 194-IA from the consideration of ₹ 60 lakhs paid to Mi’. D for transfer of rural agricultural land, since the same is specifically excluded from the scope of immovable property for the purpose of tax deduction u/s 194-IA.

![]()

(ii) As per Sec. 194H, tax has to be deducted 5% on commission or brokerage paid to residents. However, no TDS if the amount of commission or brokerage does not exceed ₹ 15,000 in a financial year.

In the given case, ABC Packaging Ltd., the consignee, has not remitted the full sale consideration to the consignor but retained its commission of ₹ 50,000 and then remitted balance amount to the consignor. Such retention of commission by the consignee amounts to constructive payment of the same by the consignor and would not obviate the consignor from liability to deduct tax [CBDT Circular No. 619 dated 4-12-19911. Hence, XYZ Developers, being the consignor, has to deduct tax @ 5% (3/4th ii requirement of deduction of tax Falls during the period 14.05.2020 to 3 1.03.2021) on ₹ 50,000 u/s 194H. Thus, the amount of TDS would be ₹ 2,500.

(iii) AB Ltd. is required to deduct tax at source on the salary of ₹ 50,000 p.m. paid to Mr. Raj as under:

Question 13.

Examine the taxability and applicability of TDS provisions in the following cases:

(i) Miss Sony, a resident, received ₹ 4,60,000 on 01.04.2020 on maturity of her life insurance policy taken on 01.04.2011. The policy sum assured is ₹ 2,00,000 and the annual premium being ₹ 45,000.

(ii) Miss Puja, a resident, received ₹ 1,20,000 on 01.04.2020 on maturity of her life insurance policy taken on 01.04.2017. The policy sum assured is ₹ 1,00,000 and the annual premium being ₹ 8,000. [CA Final May 2015] [4 Marks]

Answer:

(i) In the first case, since the policy has been taken before 01.04.2012, the annual premium should not exceed 20% of the sum assured. Thus, the annual premium should not exceed ₹ 40,000 being 20% of ₹ 2,00,000. Since, the annual premium is ₹ 45,000 which exceeds ₹ 40,000 and the payment is made on or after 1.10.2014, maturity proceeds of ₹ 4,60,000 arc not exempt u/s 10(10D) in the hands of Miss Sony. Therefore, tax is required to be deducted @ 5% u/s 194DA on the amount of income comprised therein i.e. on ₹ 55,000 (₹ 4,60,000, being maturity proceeds – ₹ 4,05,000, being the entire amount of insurance premium paid).

(ii) In the second case, since the policy has been taken after 01.04.2012, the annual premium should not exceed 10% of the sum assured. Thus, the annual premium should not exceed ₹ 10,000 being 10% of ₹ 1,00,000. Since, the annual premium is ₹ 8,000 which does not exceed ₹ 10,000, the maturity proceeds of ₹ 1,20,000 would be exempt u/s 10(10D) in the hands of Miss Puja. Thus, TDS provisions u/s 194DA wòuld not be attracted and no tax is required to be deducted.

![]()

Question 14.

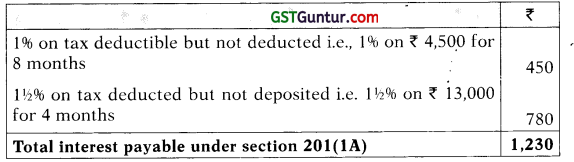

A sum of ₹ 60,000 was paid to Mr. Dastur, an advocate, on 1st July, 2020 towards fees for his professional services without deducting tax 1 at source. Later on, a further sum of ₹ 70,000 was due to him on 27th February, 2021 from which tax of ₹ 13,000 was deducted at source. The tax so deducted was deposited on 25th June, 2021. Compute the interest payable by the deductor u/s 201(1A). [CA Final May 2015, Nov. 2011] [4 Marks]

Answer:

In this case, tax is deductible @ 7.5% (3/4th of 10% as per Sec. 197B) u/s 194J in respect of fees for professional services. Since, there has been a delay in deduction and deposit of tax, interest u/s 201(1 A) is attracted.

As per the provisions of section 201(1 A), if a person who is liable to deduct tax at source fails to deduct tax at source or after deducting such tax, fails to pay the tax as required, then he is liable to pay interest as follows:

- 1% for every month or part of month on the amount of such tax from the date on which such tax was deductible to the date on which such tax is actually deducted.

- 1 1/2% for every month or part of month on the amount of such tax from the date on which such tax was deducted to the date on which tax is actually paid.

Therefore, in the given case, interest under section 201(1 A) would be computed as follows:

Question 15.

Smt. Vijaya, proprietor of Lakshmi Enterprises, made turnover exceeding ₹ 100 lakhs during the P.Y. 2019-20. Her turnover for the year ended 31.03.2021 was t 90 lakhs.

Decide whether provisions relating to deduction of tax at source are attracted for the following payments made during the F.Y. 2020-21:

(i) Purchase commission paid to one agent ₹ 25,000 towards purchases made during the year.

(ii) Payments to Civil engineer of ₹ 5,00,000 for construction of residential house for self use. [CA Final Nov. 2015] [4 Marks]

Answer:

(i) An individual or HUFshall be liable to deduct tax u/s 194H on payments made by way of commission or brokerage to a resident, only if the I total sales, gross receipts or turnover from the business or profession ; carried on by him exceed ₹ 1 crore in case of business or ₹ 50 lakhs in case of profession in the immediately preceding financial year in which such commission or brokerage is credited or paid by him. The rate of TDS u/s 194H is 5%.

In the given case, Smt. Vijava will be liable to deduct tax u/s 194H @ 5% for the purchase commission of ₹ 25,000 paid to one agent because the turnover of Smt. Vijava during the preceding financial year exceeds ₹ 1 crore. The fact that the turnover of the current year is ₹ 90 lakhs is not relevant. Also, the amount of commission exceeds the threshold limit of ₹ 15,000.

Note: It is assuified that the agent receiving commission is a person resident in India.

![]()

(ii) Since, payment to civil engineer is made for construction of residential house for self use, sec. 194J or Sec. 194C shall not be applicable. However, as per Sec. 194M, an individual, who is not required to deduct tax at source u/s 194C, 194H or 194J, shall be liable to deduct tax at source u/s 194M in respect of any payment made for carrying out any work in pursuance of a contract or for fees for professional services where the aggregate payments exceed ₹ 50 lakhs during the financial ear. In this case, since the payment does not exceed ₹ 50 lakhs, not s tax shall be deducted at source by Smt. Vijava from payment made to civil engineer for construction of residential house for self use.

Question 16.

State with reasons whether Chapter XVII-B are attracted in the following case and what is the net amount receivable by the payee. Mr. Sharma is an employee of M/s. ABC Ltd. since 01-04-2017. He has resigned on 31.03.2021 and has withdrawn the amount of ₹ 50,000 being the balance in his EPF account. [CA Final May 2016] [2 Marks]

Answer:

Sec. 192 A provides for TDS @ 10% (If PAN provided otherwise at MMR) on pre-mature withdrawal made by the employee, before the continuous service of 5 years, from the accumulated fund of EPF (except in cases of termination due to ill health, contraction or discontinuance of business, cessation of employment or any cause beyond the control of employee) and does not opt for transfer of accumulated balance to new employer.

Here, in this case, the provisions of sec. 192A shall be applicable and tax will be deducted @ 10% on ₹ 50,000 as Mr. Sharma had withdrawn amount before the continuous service of 5 years. The net amount receivable to the payee Le. Mr. Sharma shall be ₹ 45,000 (₹ 50,000 – 10%). It is assumed that Mr. Sharma had furnishes his PAN.

![]()

Question 17.

‘X’ while making payment “net of tax” to a non-resident for providing technical services on a world bank aided project had deducted tax out of such payments as per rates prescribed but says that the payee is not entitled for the TDS certificate. Examine. [CA Final May 2016] [3 Marks]

Answer:

As per section 198, any sum deducted in accordance with the provisions of Chapter XVII-B of the Income-tax Act, 1961 is deemed to be income received while computing the income of the payee. As per section 203, every person deducting tax at source shall furnish to the payee a certificate in the prescribed form within the prescribed time.

As per Circular No. 785, even if the tax has been borne by the payer of in-come still the payer shall be required to issue a TDS certificate to the payee.

Therefore, in this case, ‘X’ has to issue TDS Certificate to the payee even if the payment is made “Net of Tax”.

![]()

Question 18.

State the rate at which the tax either is to be deducted or collected under the provisions of the Act in the following cases:

(i) A partnership firm making sales of the timber which was procured and obtained under a forest lease.

(ii) Payment of income on investments in the securities to the Foreign Institutional Investor.

(iii) A nationalized bank receiving professional services from a registered society made provision of an amount of ₹ 25 lakhs against the service charges bills to be received.

(iv) Payment of ₹ 5 lakhs made to Mr. Phelps who is an athlete by a manufacturer of a swim wear for brand ambassador. [CA Final May 2016] [4 Marks]

Answer:

Applicable Rate of TDS/TCS

| Situation | TCS/TDS | Rate | Note |

| (i) Partnership firm selling timber obtained under forest lease | TCS | 2.5% | 1 |

| (ii) Payment of income on investments in the securities to the Foreign Institutional Investors In case the securities are Government securities |

TDS | 20.8%

5.20% |

2 |

| (iii) Professional services rendered by a registered society to a nationalised bank | TDS | 10% | 3 |

| (iv) Payment by a manufacturer of swim wear to its brand ambassador Mr. Phelps, an athlete

If Mr. Phelps is a resident If Mr. Phelps is a non-resident |

TDS |

10% 20.80% |

4 |

Notes:

(1) As per section 206C(1), tax has to be collected at source @ 2 1/2 % by the partnership firm, being a seller, at the time of debiting of the amount payable by the buyer to the account of the buyer or at the time of receipt of such amount, whichever is earlier.

(2) As per section 196D, tax has to be deducted at source (a 20.80% (20% plus cess @ 4%) by any person who is responsible for paying to a Foreign Institutional Investor, any income by way of interest on securities ; at the time of credit of such income to the account of the payee or at : the time of payment of such income, whichever is earlier

Alternatively, if the said securities are assumed to be government i securities, tax is deductible @ 5.20% (i.e., 5% plus cess @ 3%) under section 194LD.

(3) Tax has to be deducted at source @10% under section 194J, by the nationalized bank at the time of credit of fees for professional services

to the account of the registered society (i.e., on 31.3.2020), even though 1 payment is to be made after that date.

(4) Tax has to be deducted at source @ 10% under section 194J in respect of income of ₹ 5 lakhs paid to Mr. Phelps, athlete, for, advertisement, on the inherent presumption that Mr. Phelps is a resident.

Alternatively, if Mr. Phelps is assumed to be a non-resident, who is not a citizen of India, tax has to be deducted at source @ 20.8% (20% plus cess 4%) under section 194E in respect of income of ₹ 5 lakhs paid to Mr. Phelps, an athlete, for advertisement referred under section 115BBA.

![]()

Question 19.

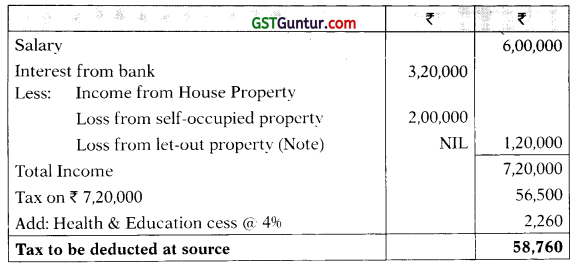

Examine the applicability of provisions relating to deduction of tax at source and compute the liability, if any, for deduction of tax at source In the following cases for the financial year ended 31-03-202 1:

(i) ₹ 80,000 towards Interest on compensation credited to the account of the payee by Motor Accidents Claim Tribunal on 30-11-2020.

(ii) ₹ 2,50,000 paid on 30.09.2020 as consideration to Mr. B, a resident in India, on account of compulsory acquisition of his residential building acquired for laying railway tracks.

(iii) Ravi Kumar aged 67 years derived ₹ 6,00,000 as salary from his employer, XYZ Ltd. for the year ended 31.03.2021. The following details are provided by him to the employer:

| Particulars | ₹ |

| Loss from self-occupied house property at Mumbai | 2,00,000 |

| Net loss from let-out property | 2,00,000 |

| Net loss from business activity | 1,00,000 |

| Interest income from bank | 3,20,000 |

[CA Final Nov. 2016] [6 Marks]

Answer:

(i) As per Sec. 194A, income paid by way of interest on compensation amount awarded by Motor Accident Claim Tribunal is liable for tax deduction @ 10%, where the aggregate amount of such income paid during the financial year does not exceed ₹ 50,000. In the given question, amount of ₹ 80,000 towards interest on compensation is only credited to the account of payee by Motor Accident Claim Tribunal and not paid. So no tax is to be deducted at source.

![]()

(ii) As per section 194LA, any person responsible for paying to a resident of any consideration on account of compulsory acquisition of immovable property other than the agricultural land, shall at the time of payment of such consideration, deduct tax @ 10% on such consideration. However, no tax shall be deducted if the amount of consideration does not exceed ₹ 2,50,000 during a financial year. In this case, the amount paid to Mr. B does not exceed ₹ 2,50,000 and therefore, the payer is not liable to deduct tax on such consideration.

(iii) As per section 192(2B), the employer shall deduct tax considering the other incomes of the employee under the different heads, where an employee has furnished statement of such other incomes also. However, for determining the estimated income of an employee, losses other than the loss under the head ‘Income from House Property’ shall not be considered.

XYZ Ltd. is required to deduct tax at source on the salary of ₹ 6,00,000 paid to Ravi Kumar as under:

As per Sec. 7 1(3A), loss from house property can be set-off against other income, only to the extent of ₹ 2,00,000 for any assessment year.

![]()

Question 20.

Discuss the liability for tax deduction at source in the following cases:

(i) Wings Ltd. has paid amount of ₹ 15 lakhs to Airports Authority of India towards landing and parking charges. [CA Final May 2016, May 2014, Nov. 2011] [4 Marks]

(ii) Omega Ltd., an event management company, organized a concert of international artists in India. In this connection, it engaged the services of an overseas agent Mr. John from UK to bring artists to India. He contacted the artists and negotiated with them for performance in India in terms of the authority given by the company. He did not take part in event organized in India. The company made the payment of commission of ₹ 1 lakh to the overseas agent. [CA Final May 2017, May 2016] [3 Marks]

(iii) Ramesh gave a building on sub-lease to Mac Ltd. with effect from 01.07.2020 on a rent of ₹ 20,000 per month. The company also took on hire machinery from Ramesh with effect from 01.11.2020 on hire charges of ₹ 15,000 per month. The rent of building and hire charges of machinery for the year 2020-21 were credited by the company to the account of Ramesh in its books of account on 31.03.2021. [CA Final May 2017, May 2016] [3 Marks]

(iv) ₹ 1,95,000 paid to Mr. X on 01.02.2021 by Karnataka State Government on compulsory acquisition of his urban land. What would be your answer if the land is agriculture land? [CA Final May 2016] [2 Marks]

Answer:

(i) TDS on landing and parking charges: The Supreme Court in the case of Japan Airlines Co. Ltd. y. CIT and CIT y. Singapore Airlines Ltd. (2015) observed that the landing and parking charges which are fixed by the Airports Authority of India are not merely for the ‘use of the land’. These charges are also for services and facilities offered in connection with the aircraft operation at the airport which include providing of air traffic services, ground safety services, aeronautical communication facilities, installation and maintenance of navigational aids and meteorological services at the airport.

Thus, tax is not deductible u/s 194-1 which provides deduction of tax for payment in the nature of rent. Hence, tax is deductible @ 2% u/s 194C by the i airline company, Wings Ltd., on payment of ₹ 15 lakhs made towards landing and parking charges to the Airports Authority of India for P.Y. 2020.21.

![]()

(ii) TDS on services of overseas agent outside India: An overseas agent of an Indian company operates in his own country and no part of his income accrues or arises in India. His commission is usually remitted directly to him and is, therefore, not received by him or on his behalf in India. The commission paid to the non-resident agent for services rendered outside India is, thus, not chargeable to tax in India [DIT (International Taxation) v. Wizcraft International Entertainment (P.) Ltd. (2014) (Bom.)].

Since commission income for contacting and negotiating with artists by Mr. John, a non-resident, who remains outside India is not subject to tax in India, consequently, there is no liability for TDS. It is assumed that the commission of ₹ 1 lakh was remitted to Mr. John outside India.

(iii) TDS on rent for building and machinery: Tax is deductible on rent under section 194-1, if the aggregate amount of rental income paid or credited to a person exceeds ₹ 2,40,000. Rent includes payment for use of, inter alia, building and machinery. The aggregate payment made by Mac Ltd. to Ramesh towards rent in P.Y. 2020-21 is ₹ 2;55,000 (i.e., ₹ 1,80,000 for building and ₹ 75,000 for machinery).

Hence, Mac Ltd. has to deduct tax @ 10% on rent paid for building and tax @ 296 on rent paid for machinery. However, since the requirement of deduction of tax at source falls during the period 14.05.2020 to 31.03.2021, tax shall be deducted at 3/4th of these rates i.e. 75% on rent paid for building and 1.5% on rent paid for machinery.

(iv) TDS on compensation for compulsory acquisition: Tax is deductible at source @10% under section 194LA, where payment is made to a resident as compensation or enhanced compensation on compulsory acquisition of any immovable property (other than agricultural land).

However, no tax deduction is required if the aggregate payments in a year does not exceed ₹ 2 lakh. Therefore, no tax is required to be deducted at source on payment of ₹ 1,95,000 to Mr. X, since the aggregate payment does not exceed ₹ 2.5 lakh. Since the definition of immovable property specifically excludes agricultural land, no tax is deductible at source on compensation paid for compulsory acquisition of agricultural land.

![]()

Question 21.

M/s Avtar Limited entered into an agreement for the warehousing of its products with ABC Warehousing and deducted tax at source as per provisions of section 194C out of warehousing charges paid during the year ended on 31.03.2021. The Assessing Officer, while completing the assessment for A.Y. 2021-22 of Avtar Limited asked the company by treating the warehousing charges as rent as defined in section 194-1 and asked the company to make payment of difference amount of TDS with interest. It was submitted by the company that the recipient had already paid tax on the entire amount of warehousing charges and therefore, now the difference amount of TDS cannot be recovered. However, it will make the payment of due interest on the difference amount of TDS. Examine critically the correctness of the action or the treatment given. [CA Final May 2017] [3 Marks]

Answer:

Section 201 provides that the payer (including the principal officer of the company) who fails to deduct the whole or any part of the tax on the amount credited or payment made to a payee shall not be deemed to be an assessee-in-default in respect of such tax if such payee –

- has furnished his return of income under section 139;

- has taken into account such sum for computing income in such return of income; and

- has paid the tax due on the income declared by him in such return of income,

and the payer furnishes a certificate to this effect from an accountant in such form as may be prescribed.

However, where the payer fails to deduct the whole or any part of the tax on the amount credited or payment made to a payee and is not deemed to be an assessee-in-default under section 201 (1) as mentioned above, interest under section 201(1 A)(i) i.e., @1% p.m. or part of month, shall be payable by the payer from the date on which such tax was deductible to the date of furnishing of return of income by such payee.

Therefore, M/s Avtar Limited shall not be required to pay the difference tax in case the above mentioned conditions are fulfilled. However, the assessee shall be liable to make payment of interest from the date on which such tax was deductible to the date of furnishing of return of income by ABC Warehousing.

Therefore, the submission of the assessee company, in this case, is correct.

![]()

Question 22.

Jashan Hotels Pvt. Ltd., engaged in the business of owning, operating and managing hotels, allowed its employees to receive tips from the customers, by the virtue of their employment. The tips were also collected directly by the hotel-company from the customers, when payment was made by them through credit cards. The hotel-company thereafter disbursed the tips to the employees. The Assessing Officer treated the receipt of the tips as income under the head “salary” in the hands of the various employees and held that the company was liable to deduct tax at source from such payments under section 192. Since the company had not deducted tax at sources on such payments, the Assessing Officer treated the company as an assessee-in-default under section 201 (1) of the Act. Discuss the correctness of the action of the Assessing Officer. [CA Final Nov 2017] [4 Marks]

Answer:

Issue involved: The issue under consideration is whether tips received by the hotel from customers who made payment through credit card and distributed to employees would constitute as salary to attract the provisions for TDS u/s 192.

Provisions applicable: Section 192 provides obligation to deduct tax at source only to person responsible for paying any income under the head “salaries” and such person is only the employer. Further as per sec. 201, if any person who is liable to deduct TDS does not deduct the whole or any part of the tax or after deducting fails to pay the fax, he shall, be deemed to be an assessee in default.

Analysis: The facts of the case are similar to the facts in ITC Ltd. v. CIT [2016] 384 ITR 14, wherein the above issue came up before, the Supreme Court. The Apex Court observed that the person who is responsible for I paying the employee is not the employer at all, but a third party, namely, the customer. Thus, income from tips would be chargeable in the hands of employees as “Income from Other Sources” and therefore, section 192 would not get attracted.

The Supreme Court further observed that the tips paid by the employer to the employees had no reference to the contract of employment at all as they were received by the employer in a fiduciary capacity as trustee for payments which is later on disbursed to the employees for service rendered to the customer. So there was no reference to the contract of employment when these amounts were paid by the employer to the employee.

The Supreme Court, therefore, held that there is no liability on the assessee company to deduct tax at source u/s 192 and hence, it cannot be treated as an assessee in default for non-deduction of tax at source from the amount of tips collected and distributed to its employees.

Conclusion: Thus, applying the rationale of the Supreme Court ruling to the present case, there is a no liability to the Jashan Hotels Pvt. Ltd to deduct ; tax at source u/s 192 on the payment of tips which is received from the customer and passed on to the employee. Further assessee company shall not be treated as assessee in default u/s 201(1). Therefore action taken by the Assessing Officer is not correct in the eyes of law.

![]()

Question 23.

Discuss the TDS/TCS applicability in context of A.Y. 2021-22 in the following cases and state the amount of the TDS/TCS as per Income-tax Act, 1961. (AH issues as under are independent)

(i) Mr. Shan, an individual, whose turnover from the business carried on by him during the financial year immediately preceding the financial year exceed ₹ 100 lakh, paid fee to an architect of ₹ 50,000 for furnishing his residential house.

(ii) Mr. Shyam purchased a house in Mumbai for consideration of ₹ 90 lakh by cheque from the builder for the use of his residence.

(iii) Mr. Soham purchased licensed copy of computer software from the software vendor (resident of India) along with all right to use it for ₹ 50,000 to be used for business purposes (not in respect of cinematographic films). [CA Final Nov. 2017] [6 Marks]

Answer:

(i) As per Sec. 194J, an individual whose total turnover from business exceeds ₹ 1 crore in the immediately preceding financial year shall be liable to deduct tax at source u/s 194J @ 10% in respect of fees for professional services exceeding ₹ 30,000 paid to a resident during any financial year. However, Sec. 194J would not be attracted, if the fee is paid exclusively for personal purposes.

However, the Finance (No. 2) Act, 2019 has inserted Sec. 194M which provides that an individual who is not required to deduct tax at source u/s 194J in respect of payment of fees for professional services shall be ; required to deduct tax at source u/s 194M @ 5% where the aggregate payment during the financial year exceeds ₹ 50,00,000.

In this case, the fee paid by Mr. Shan is for furnishing of his residential house which is a personal purpose and therefore Sec. 194J shall not be applicable. Further, the fees paid does not exceed ₹ 50,00,000 and therefore, Mr. Shan shall not be liable to deduct tax u/s 194M also.

(ii) As per section 194-IA, tax is required to be deducted at source @1% on the amount of consideration paid for purchase of a residential house, being an immovable property, if the amount of consideration is ₹ 50 lakhs or more.

Therefore, Mr. Shyam is required to deduct tax at source of ₹ 90,000 (1 % of ₹ 90,00,000) from the amount of consideration paid for purchase of a residential house in Mumbai.

(iii) As per Explanation 4 to section 9(1)(vi), consideration for transfer of all or any right to use of computer software (including granting of a licence) would fall within the meaning of “royalty”.

As per Sec. 194J, an individual whose total, turnover from business exceeds ₹ 1 crore in the immediately preceding financial year shall be liable to deduct tax at source u/s 194J @ 10% in respect of payment of royalty exceeding ₹ 30,000 paid to a resident during any financial year.

In this case, by assuming that the turnover of Mr. Soham exceeds ₹ 1 crore in the preceding financial year, he shall be liable to deduct tax at source @ 10% u/s 194J on ₹ 50,000 paid for purchasing license copy of computer software. Therefore. Mr. Soham shall deduct ₹ 5,000 (10% of ₹ 50,000) from the amount paid to software vendor.

![]()

Question 24.

Syed & Co., a dealer in motor cycles conducted motor cycle race on k the occasion of its 25th year anniversary. The prize was given to first 3 winners by way of a luxury motor cycle which was worth ₹ 2,00,000 each. The assessee did not deduct tax at source on the prize given to the winners. S The Assessing Officer treated the assessee as an assessee in default and passed order under section 201(1) and 201(1A). The assessee seeks your advise on the validity of the order and other legal consequences. Advise. [CA Final May 2018 (OM Syllabus)] [4 Marks]

Answer:

Issue involved: The issue under consideration is whether the assessee can be treated as an assessee in default u/s 201 where he fails to deduct tax at source in respect of winnings which are wholly in kind u/s 194B.

Provisions applicable: As per Sec. 194B, the person responsible for paying any income by way of winnings which are wholly in kind shall, before releasing the winnings, ensure that the tax has been paid in respect of said winnings. Also, Sec. 201 provides that where any person is liable to deduct to tax at source does not deduct the whole or any part of the tax or after deducting fails to pay to tax, he shall, be deemed to be an assessee default.

Analysis: The facts of the case are similar to the case of CIT v. Hindustan Lever Ltd. (2014), where the Karnataka High Court observed that Sec. 194B read with Sec. 201 do not cast any duty to deduct tax at source where the winnings are wholly in kind. If the winnings are wholly in kind, as a matter of fact, there cannot be any deduction of tax at source.

The word “deduction” in this provision postulates a reduction or subtraction of an amount from a gross sum to be paid and payment of the net amount thereafter. Where the winnings are wholly in kind the question of deduction of any sum therefrom does not arise and in that evenluality, the only responsibility, as cast u/s 194B, is to ensure that tax is paid by the winner of the prize before the prize or winnings are released in his favour. Therefore, the High Court , held that proceedings u/s 201 cannot be initiated against the assessee.

The High Court, therefore, held that proceedings u/s 201 cannot be initiated against the assessee.

Conclusion: By applying the above rationale, the action of the A.O. to treat the assessee as assessee in default on the ground that the assessee did not deduct tax at source on the prize given to the winners is not correct. However, instead of treating an assessee as assessee in default, there may be other legal consequences.

The other legal consequences may be that the assessee may be subjected to penalty equal to the amount of tax not paid u/s 271C by the Joint Commissioner and may also be subjected to rigorous imprisonment u/s 276B for a term which shall not be less than 3 months but which may extend to 7 years and with fine.

![]()

Question 25.

Amin Co. (P) Ltd. is a dealer of motor cars manufactured by Zeet Ltd. Amin Co. (P) Ltd. paid through banking channel ₹ 110 lakhs to Zeet Ltd. for purchase of cars in January 2021. Of the total motor cars so purchased, 4 motor cars cost ₹ 11 lakhs each and 7 motorcars are for the balance % amount. Decide whether any TDS/TCS provisions will apply. Will your answer be different if Amin Co. (P) Ltd. is not a dealer of motor cars and had acquired the same for the purpose of plying cars on hire? [CA Final May 2018 (Old Syllabus)] [3 Marks] )

Answer:

If Amin Co. (P.) Ltd. is a dealer:

As per Sec. 206C(1F), every person who receives any amount from sale of a motor vehicle exceeding ₹ 10,00,000 shall at the time of receipt of such income, collect from the buyer 1 % of such amount as income tax. However, there is no requirement to collect tax at source on sale of motor vehicles by manufacturers to dealers/distributors.

Here, the seller i.e. Zeet Ltd. is a manufacturer and the buyer ie. Amin Co. (P.) Ltd. is a dealer and therefore, no tax is required to be collected at source, since the provisions of TCS are not applicable on sale of motor vehicles by manufacturer to dealers.

If Amin Co. (P) Ltd. has acquired the motor cars for plying them on hire:

If the motor vehicles are purchased by Amin Co. (P.) Ltd. for the purpose ; of plying them on hire, then the position would be different. The total cars purchased are 11 out of which 4 motor cars cost ₹ 11 lakhs each and remaining 7 costs total of ₹ 66 lakhs ie. less than ₹ 10 lakhs each. Therefore, the TCS provisions shall be applicable only in respect of 4 motor cars, since it cost exceed ₹ 10 lakhs and no tax is required to be collected in respect of balance 7 cars.

![]()

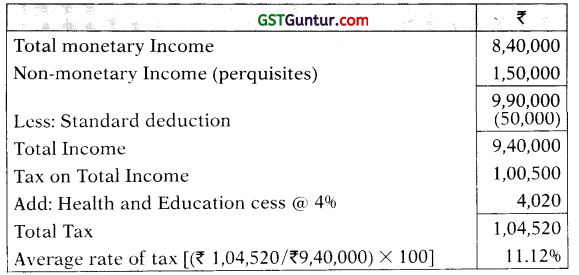

Question 26.

Mr. Ramesh is employed in Raghu Ltd. as senior executive. He availed leave travel assistance (LTA) of ₹ 60,000 in January 2021. He did not produce any evidence for the expenditure incurred. His salary income (computed) before allowing exemption for LTA is ₹ 12,50,000. Mr. Ramesh claimed interest on moneys borrowed for acquisition of his residential house of ₹ 96,000 but did not produce the name, address and PAN of the lender. As employer, how will you treat the claim of exemption of LTA and deduction of housing loan interest claimed by Mr. Ramesh? [CA Final May 2018 (Old Syllabus)] [3 Marks]

Answer:

As per Sec. 192, the employer shall, for the purposes of estimating income of the assessee or computing tax deductible, obtain from the assessee the evidence or proof of particulars of prescribed claims (including claim for set-off of loss) under the provisions of the Act in such form and z manner as may be prescribed.

Rule 26C provides for the evidence or particulars which the employee is g required to furnish to the employer in respect of claims made by him for the purpose of estimating his income or computing the amount of tax deduction at source. Where the employee makes a claim in respect of Leave Travel Concession, he is required to produce evidence of expenditure incurred to the employer. In respect of claim made for deduction of interest under the head “Income from House Property”, the employee is required produce the particulars of name, address and PAN of the lender.

However, in this case, the employee Mr, Ramesh did not produce any evidence for expenditure incurred in respect of claim of Leave Travel Concession. Also, he did not produce the particulars the name, address and PAN of the lender in respect of claim made for deduction of interest under the head “Income from House Property”. Therefore, the employer may do not consider such claims of Mr. Ramesh.

![]()

Question 27.

Discuss the TDS/TCS implications if any, for the following transactions. What is the amount payable to the payee:

(i) X is a bookmaker and Mr. Y is a punter. On 22.01.2021, B has won ₹ 50,000 in Horse Race 1 and suffered a loss of ₹ 20,000 in Horse Race 2.

(ii) Mr. Santosh has let out his house property on a monthly rent of ₹ 60,000 from 15.01.2021 to Mrs. Preeti.

(iii) H Ltd., a manufacturer of luxury cars sold 50 cars on 01.09.2020 to NMP Ltd. its dealer, each car cost ₹ 20 Lakhs.

(iv) AKL Ltd., a third party administrator on behalf of an Insurance Company has settled medical bills of ₹ 5,00,000 submitted by Kay Hospitals Ltd. from a patient under a cashless scheme. [CA Final May 2018 (New Syllabus)] [6 Marks]

Answer:

(i) As per Sec. 1 94BB, any person, being a bookmaker or a holder of license for the horse racing, who is responsible for paving lo any person an income by way of winnings from horse race in amount exceeding ₹ 10,000 shall, at the time of payment thereof, deduct tax at source @ 30%.

Here, B has won ₹ 50,000 in Horse race I and therefore, X being a bookmaker is required to deduct tax at source @ 30go on ₹ 50,000. However, B has suffered a loss of ₹ 20,000 in Horse race 2 and there fore, no tax is required to be deducted at source in respect of such loss. Therefore, Mr. X is liable to deduct tax of ₹ 15,000 (₹ 50,000 × 30%) from winrings of ₹ 50,000 and the net amount payable to B shall be ₹ 15,000 (₹ 50,000 – ₹ 15,000 – ₹ 20,000).

(ii) As per Sec. 194-I, any person, not being an individual or HUF whose total sales or gross receipts from business/profession does not exceed ₹ 1 crore in case of business or ₹ 50 lakhs in cast of profession in the immediately preceding financial year, making payment to a resident any income by way of rent, shall at the time of credit or payment, whichever is earlier, deduct tax thereon 10% for th use of, inter alio., land or building or land appurtenant to the building. However, no deduction shall be made where the amount of rent does not exceed ₹ 2,40,000 during a financial year.

![]()

In this case, if it is assumed that the total sales or gross receipts of Mrs. Preeti exceeds the limits prescribed in the immediately preceding financial year, then she will be made liable For deduction of tax at source u/s 194-I in respect of rent paid to Mr, Santosh. But since, the total amount of rent paid does not exceed ₹ 2,40,000 during the F.Y. 2020-2 1, she is not liable for deduction of tax at source u/s 194-I.

Alternative:

As per Sec. 194-IB, any individual or HUF other than those whose total sales or gross receipts from the business/profession exceed 1 crore in case of business or ₹ 50 lakhs in case of profession in the immediately preceding financial year, making payment to a resident any income by way of rent exceeding ₹ 50,000 for a month or part of the month during the previous year, shall deduct tax thereon @ 5%.

The tax shall be deducted at the time of credit of rent for the last month of the previous year or the last month of tenancy (if the property is vacated during the year) or at the time of payment thereof, whichever is earlier.

In this case, if it assumed that the total sales or gross receipts of Mrs. Preeti does not exceed the limits prescribed in the immediately preceding financial year, then she will be liable for deduction of tax at source @ 5% on 1,50,000 (₹ 60,000 + ₹ 60,000 + ₹ 30,000) in respect of amount of rent paid or payable to Mr. Santosh in the month of March i.e. last month of the previous year or at the time of payment, whichever is earlier.

However, since such requirement of deduction of tax at source falls during the period 14.05.2020 to 31.03.2021, tax shall be deducted @ 3.75% (3/4th of 5%) and the net amount payable to Mr. Santosh shall be ₹ 1,44,375 (₹ 1,50,000 × 96.25%).

(iii) As per Sec. 206C( IF), every person who receives any amount from sale of a motor vehicle exceeding ₹ 10,00,000 shall at the time of receipt of such income, collect from the buyer 1% of such amount as income tax. However, no tax is required to collected tax at source on sale of motor vehicles by manufacturers to dealers. In this case, H Ltd., a manufacturer of luxury cars sold 50 cars costing ₹ 20 lakhs each to NMP Ltd., its dealer. Since, H Ltd. has sold the cars to its dealers, no tax is required to be collected at source by H Ltd. Therefore, NMP Ltd. is required to pay only ₹ 20,00,000 to H Ltd.

(iv) As per Circular No. 8/2009, Third Party Administrators (TPAs) who are making payment on behalf of insurance companies to hospital for settlement of medical/insurance claims, etc., under various schemes including cashless schemes, are liable to deduct tax at source u/s 194J @ 10%.

Therefore, AKL Ltd. is required to deduct tax at source @ 10% in respect of settlement of medical bills of ₹ 5,00,000 submitted by Kay Hospitals Ltd. from a patient under a cashless scheme. Therefore, net amount payable to Kay Hospitals Ltd. shall be ₹ 4,50,000 (₹ 5,00,000

× 90%).

![]()

Question 28.

Examine the applicability of provisions relating to deduction/collection of tax at source and compute the liability, if any, for deduction/ collection of tax at source in the following cases for financial year ended 31st March, 2021 as per provisions contained under the Income-tax Act, 1961:

(i) In terms of agreement between A (the Owner of land) and B (Developer and Builder) the Developer, B agrees to allot 5 apartments to the owner in part consideration for providing his land and also agreed to pay a sum of ₹ 25,00,000. In terms of the agreement, Mr. B issued a cheque for ₹ 15,00,000 towards part of consideration on 30.03.2021.

(ii) (1) Rent of ₹ 60,000 per month deposited by Mr. Shrikanth, software employee on 1st of every month in advance, in the account of Mr. Ashok, who does not provide his PAN. The house was taken on rent with effect from 01.07.2020 and he vacated the house on 28.02.2021.

(2) Would there be any change in TDS, if Mr. Ashok furnished his PAN to the tenant?

(iii) ₹ 19,50,000 credited to the account of Digitec Studios (a partnership firm) on 31.03.2021 by B-TV, Television channel, towards part consideration for shooting of Tele Episode for 10 weeks as per the storyline, contents and specifications of B-TV channel. [CA Final Nov 2018 (Old Syllabus)] [6 Marks]

Answer:

(i) Since the agreement between the owner of land, A, and the develop er and builder, B, is in the nature of specified agreement u/s 45(5A), which involves cash consideration as well, TDS @ 7.5% (3/4th of 10% as per Sec. 1978) on ₹ 25,00,000, being the cash component payable to A, is deductible u/s 194-IC. Assuming that only ₹ 15,00,000, being the amount paid to A on 30.3.2021, has actually been credited to the account of A in the books of B in the P.Y.020-21, the TDS liability would be ₹ 1,12,500, being 7.5% of ₹ 15,00,000.

However, if it is assumed that ₹ 25,00,000 has been credited to the account of A in the P.Y. 2020-21, even though only ₹ 15,00,000 has been actually paid in that year, then, tax has to be deducted @ 7.5% on ₹ 25,00,000, being the amount credited to the account of A and TDS liability would be ₹ 1,87,500, being 10% of ₹ 25,00,000.

![]()

(ii) (1)Since Mr. Shrikanth pays rent exceeding ₹ 50,000 per month in the F.Y. 2020-21, he is liable to deduct tax at source @ 3.75 (3/4th of 5%

as per Sec. 197B) u/s 194-IB on such rent for F.Y. 2020-21.

However, since Mr. Ashok does not provide his PAN to Mr. Shrikanth, tax would be deductible 20%, instead of 3.75%.

Tax has to be deducted from rent payable for the last month of the P.Y. 2020-21. However, since he vacated the premises in February, 2021, tax has to be deducted from rent paid on 1.2.2021 for the month of February, 2021. Tax of ₹ 96,000 [₹ 60,000 × 20% × 8] has to be deducted but the same has to be restricted to ₹ 60,000, being rent For February, 2021.

(2) If Mr. Ashok furnished his PAN to Shrikanth, tax would be deductible @ 3.75%.

Tax of ₹ 18,000 (₹ 60,000 × 8 × 3.75%) has to be deducted from rent paid on 01.02.2021 for the month of February, 2021.

(iii) Shooting of Tele Episode for B-TV as per the storyline, contents and specifications of B-TV falls within the scope of “work” u/s 194C. Since, the amount credited exceeds the specified limit of ₹ 30,000, TDS @ 1.5 (3/4th of 2% as per Sec. 197B) u/s 194C is attracted on ₹ 19,50,000 credited to the account of Digitec Studios, a partnership firm. TDS liability would be ₹ 29,250 [being 1.5% of ₹ 19,50,000]

![]()

Question 29.

Tulsi Pvt. Ltd., a company engaged in ship breaking activity, sold some old and used plates, wood, etc., in respect of which it did not collect tax from the buyer. The company claimed that such items are usable as such. Hence these are not ‘scrap’ to attract the provisions for collection of tax at source. The Assessing Officer treated such items in the nature of ‘scrap’ and raised a demand u/s 201(1) and interest u/s 201(1A).

Is the action of the Assessing Officer in treating such items as ‘scrap’ ten-able in law? Discuss. [CA Final Nov 2018 (New Syllabus)] [4 Marks]

Answer:

As per Sec. 206C(1), every person, being a seller shall, at the time of debiting the amount payable by the buyer or at the time of receipt, which-ever is earlier, collect 1% as TCS from buyer on sale, of scrap to the buyer.

The issue under consideration is whether items of finished products from ship breaking activity which are usable as such be treated as “Scrap” to attract provisions for tax collection at source u/s 206C?

The facts of the case are similar to the facts in CIT v. Priya Blue Industries (P) Ltd (2016), where the Gujarat High Court observed that where the assessee is engaged in ship breaking activity, the products obtained from the activity were finished products which are usable as such and hence, are not ‘waste and scrap’ though commercially known as scrap. Accordingly, the High Court held that any material which is usable as such would not fall within the ambit of the expression ‘scrap’ as defined in clause (b) of the Explanation to section 206C.

Accordingly, action of the Assessing Officer in treating such items as ‘scrap’ is not tenable in law.

![]()

Question 30.

Discuss whether liability to deduct tax at source arises in the under-mentioned (Independent) situations in respect of following payments

made by residents in India:

(i) Dindayal & Co., a partnership firm, has credited a sum of ₹ 67,000 and ₹ 4,000 respectively, as interest to partners L (Resident in India) and M (non-resident) respectively. [4 Marks]

(ii) Payment of ₹ 5 lakhs made by Shiv & Company (partnership firm) to Jyoti & Company Ltd. for organising debate competition on the subject ‘Rural Heritage of Rajasthan’. [2 Marks] [CA Final Nov 2018 (New Syllabus)]

Answer:

(i) As per Sec. 194A, any person other than an Individual/HUF whose sales or gross receipts from his business or profession does not exceed ₹ 1 crore in case of business or ₹ 50 lakhs in case of profession in the immediately preceding financial year, making payment of interest other than interest on securities to any resident, shall at the time of credit or payment, whichever is earlier, required to deduct tax at source on such interest @ 10%.

However, no tax is required to deduct in case of any interest credited or paid by a firm to its partner. Therefore, no tax is required to be deducted at source u/s 194A on interest on capital of ₹ 67,000 paid, by the firm to L, a resident partner.

As per Sec. 195, any person responsible for paying to a non-resident or a foreign company, any interest or any other sum chargeable under this Act, shall, at the time of credit or payment, whichever is earlier, deduct income tax thereon at the rates in force. Also, this section does not provide for any exclusion in respect of payment of interest by a firm to its non-resident partner. Therefore, tax has to be deducted u/s 195 at the rates in force in respect of interest on capital of ₹ 4,000 paid to partner M, a non-resident partner.

(ii) The services of Event Managers in relation to sports activities alone have been notified by the CBDT as “professional services” for the purpose of section 194J. In this case, payment of ₹ 5 lakhs was made to an event management company for organization of a debate competition. Hence, the provisions of section 194J are not attracted. However, TDS provisions under section 194C relating to contract payments would be attracted and consequently, tax has to be deducted @ 2% under section 194C. The tax deductible under section 194C would be ₹ 10,000, being 2% of ₹ 5 lacs.

![]()

Question 31.

Discuss the liability of TDS provisions in the following independent cases:

(i) X Ltd. is a producer of natural gas. During the year, it sold natural gas worth ₹ 20,50,000 to M/ s Hawa Co., a partnership firm. It also incurred ₹ 2,00,000 as freight for the transportation of gas. It raised the invoice and clearly bifurcated the value of gas as well as the transportation charges.

(ii) Beta Ltd., gave a contract to Alpha Ltd. for the supply of 2,000 pens on which the logo of Beta Ltd. was printed. The raw materials were purchased by Alpha Ltd. from C Ltd., which is not related to Beta Ltd. The consideration paid for the pens was ₹ 1,50,000.

(iii) M/s. Taba Ltd. enters into a contract with Mr. Babu for the transportation of its products from its plant to warehouses. It pays a lump-sum

amount of ₹ 2,50,000 to Mr. Babu for the year at the year end. Mr. Babu is engaged in the business of plying goods carriages on hire. Mr. Babu is not an assessee under Income-tax Act and thus did not provide PAN to Taba Ltd.

(iv) M/s. Sunivesh Investors is engaged in the business of stock broking, depositories, mobilisation of deposits and marketing of public issues. It is a registered member of Bombay Stock Exchange. Every year it makes payment amounting to ₹ 10 lakhs, to the Stock Exchange by way of transaction charges in respect of fully automated online trading facility. This service is available to all members of the stock exchange in respect of every transaction that is entered into. Would it be liable for tax deduction u/s 194J? [CA Final May 2019 (Op Syllabus)] [8 Marks]

Answer:

(i) TDS u / s 194C is attracted on any sum payable to a resident contractor for carrying out any work. Since X Ltd., the producer of natural gas sells as well as transports the gas to the purchaser, M/s. Hawa Co., a partnership firm, till the point of delivery, where the ownership of gas is simultaneously transferred, the manner of raising the sale bill (whether the transportation charges are embedded in the cost of gas or shown separately) does not alter the basic nature of such contract which remains essentially a ‘contract for sale’ and not a ‘works contract’ as envisaged in section 194C.

Therefore, in such circumstances, TDS provisions u/s 194C are not applicable on the component of Gas Transportation Charges payable by M/s. Hawa Co. to X Ltd. Consequently, there is no liability to deduct tax at source u/s 194C in this case.

![]()

(ii) TDS u/s 194C is attracted on any sum payable to a resident contractor for carrying out any work. However, “work” shall not include manufacturing or supplying a product according to the requirement or specification of a customer by using raw material purchased from a person, other than such customer or its associate, as such a contract is a ‘contract for sale’.

In this case, since Alpha Ltd. has to supply pens to Beta Ltd. by using materials purchased from C Ltd. who is not related to Beta Ltd., the contract for supply of pens is a ‘contract for sale’ and not a works contract. Consequently, there is no liability to deduct tax at source u/s 194C in this case.

(iii) No tax is required to be deducted at source u/s 194C from the sum credited or paid to the account of a contractor, during the course of the business of plying, hiring or leasing goods carriages, if he furnishes his PAN to the deductor.