Chapter 13 Listing-Indian Stock Exchanges – Corporate Funding and Listing in Stock Exchange ICSI Study Material is designed strictly as per the latest syllabus and exam pattern.

Listing-Indian Stock Exchanges – Corporate Funding & Listing in Stock Exchange Study Material

Question 1.

Write notes on the following.

Compliance officer (June 2013, 3 marks)

Answer:

Compilance Officer: Regulation 6, SEBI (LODR) Regulations, 2015 requires mandatory appointment of Compliance officer who will be a qualified company secretary in every listed entity and his/her obligations are as below:

The compliance officer of the listed entity shall be responsible for:

(a) Ensuring conformity with the regulatory provisions applicable to the listed entity in letter and spirit.

(b) co-ordination with and reporting to the Board, recognized stock exchange(s) and depositories with respect to compliance with rules, regulations and other directives of these authorities in manner as specified from time to time.

(c) Ensuring that the correct procedures have been followed that would result in the correctness, authenticity and comprehensiveness of the information, statements and reports filed by the listed entity under these regulations.

(d) monitoring email àddress of grievance redressal division as designated by the listed entity for the purpose of registering complaints by investors.

Provide that the requirements of this regulation shall not be applicable in the case of units issued by mutual funds which are listed on recognised stock exchange(s) but shall be governed by the provisions of the SEBI India (Mutual Funds) Regulations, 1996.

Question 2.

Write notes on the following:

(ii) Corporate governance compliance certificate

(v) Whistle blower policy. (June 2015, 4 marks each)

Answer:

(ii)

(a) SEBI (LODR) Regulations, 2015 deals with compliance certificate on Corporate Governance,

(b) The practicing Company Secretaries have also been recognised to issue Certificate of Compliance of Conditions of Corporate Governance. The clause provides that the company shall obtain a certificate from either the auditors or practicing company secretaries regarding compliance of conditions of corporate governance as stipulated in this clause and annex the certificate with the directors’ report, which is sent annually to all the shareholders of the company.

(c) The same certificate shall also be sent to the Stock Exchanges along with the annual report filed by the company.

(v) Regulation 22 of SEBI LODR Regulations, 2015 following are the requirements for the ‘Whistle Blower Policy’ in a listed entity:

1. The listed entity shall establish a vigil mechanism/whistle blower policy for directors and employees to report concerns about unethical behaviour, actual or suspected fraud or violation of the company’s code of conduct or ethics policy.

2. This mechanism should also provide for adequate safeguards against victimization of director(s) / employee(s) who avail of the mechanism and also provide for direct access to the Chairman of the Audit Committee in exceptional cases.

3. The details of establishment of such mechanism/whistle blower policy shall be disclosed by the listed entity on its website and in the Board’s report.

![]()

Question 3.

Write a note on the following:

Whistle-blower policy. (June 2016, 4 marks)

Question 4.

Sate any six important Regulations of SEBI (LODR) Regulations 2015. (June 2012, 6 marks)

Answer:

Following are six important Regulations of SEBI (Listing obligations and Disclosure Requirements) Regulations, 2015:

| (i) Regulation 6 | Compliance officer and his obligations |

| (ii) Regulation 17 | Board of Directors, its composition, meeting etc. |

| (iii) Regulation 18 | Audit committee |

| (iv) Regulation 19 | Nomination and remuneration committee |

| (v) Regulation 20 | Stakeholders relationship committee |

| (vi) Regulation 21 | Risk Management Committee |

| (vii) Regulation 22 | Vigil mechanism |

| (viii) Regulation 23 | Related party transactions |

Question 5.

Discuss briefly the composition of ‘audit committee’ in terms of SEBI (LOOR) Regulations, 2015 and enumerate its role and responsibilities. (June 2013, 9 marks)

Answer:

(i) Composition and related matters [Regulation 18(1)]:

Every listed entity shall constitute a qualified and independent audit committee in accordance with the terms of refereñce, subject to the following:

(a) Minimum Number of Directors: The Audit Committee shall have minimum 3 directors as members.

(b) Number of Independent Directors: At least 2/3rd of the members of audit committee shall be independent directors.

(c) Financially literate: All members of audit committee shall be financially literate and at least one member shall have accounting or related financial management expertise.

(d) Chairperson: The Chairperson of the audit committee shall be an independent director and he/she shall be present at AGM to answer shareholders queries.

(e) Secretary: The Company Secretary shall act as the Secretary to the audit committee.

(f) Invitation to the finance director: The audit committee at its discretion shall invite the finance director or head of the finance function, head of internal audit and a representative of the statutory auditor and any other such executives to be present at the meetings of the committee.

(ii) Meeting of the audit committee: The listed entity shall conduct the meeting of audit committee in the following manner:

(a) Minimum Number of Meeting: The audit committee shall meet at least 4 times in a year and not more than 120 days shall elapse between two meetings.

(b) Quorum: Thé quorum for audit committee meeting shall either be:

- 2 members or

- 1/3rd of the members of the audit committee, whichever is greater. with at least 2 independent directors.

(iii) Role of the audit committee: Following are the role of audit committee:

1. Oversight of the listed entity’s financial reporting process and the disclosure of its financial information to ensure that financial statement is correct, sufficient and credible;

2. Recommendation for.

- appointment of auditors and

- remuneration and terms of appointment of auditors of the listed entity;

3. Approval of payment to statutory auditors for any other services rendered by the statutory auditor

4. Reviewing, with the management, the annual financial statements before submission to the board for approval with particular reference to:

(a) Matters required to be included in the Director’s Responsibility Statement to be included in the Board’s report in terms of Clause (c) of Section 134 of the Companies Act, 2013.

(b) Changes, if any, in accounting policies and practices and reasons for the judgment by management.

(c) Major accounting entries involving estimates based on the exercise of judgment by management.

(d) Significant adjustment made in the financial statements arising out of audit findings.

(e) Compliance with listing and other legal requirements relating to financial statements.

(f) Disclosure of any related party transactions

(g) Qualifications in the draft audit report.

5. Reviewing, with the management, the quarterly financial statements before submission to the board for approval.

6. Reviewing, with the management, the ‘statement of uses/application of funds raised through an issue (public issue, rights issue, preferential Issue, etc.), the document/prospectus/notice and the report submitted by the monitoring agency monitoring the utilization of proceeds of a public or rights issue, and making appropriate recommendations to the Board to take up steps in this matter.

7. Reviewing, with the management, performance of statutory and internal auditors, and adequacy of the internal control systems.

8. Review and monitor the auditor’s independence and performance and effectiveness of audit process.

9. Approval of any subsequent modifications of transactions of the company with related parties.

10. Scrutiny of inter-corporate loans and investment.

11. Valuation of undertaking or assets of the company, wherever it is necessary.

12. Evaluation of internal financial control and risk management systems.

13. Reviewing the adequacy of internal audit function, if any, including the structure of the internal audit department, staffing and seniority of the official heading the department, reporting structure coverage and frequency of Internal audit.

14. Discussion with internal auditors any significant findings and follow up there on:

15. Réviewing the findings of any internal investigations by the internal auditors into matters where there is suspected fraud or irregularity or a failure of internal control systems of a material nature and reporting the matter to the board.

16. Discussion with statutory auditors before the audit commences, about the nature and scope of audit as well as post-audit discussion to ascertain any area of concern.

17. To look into the reasons for substantial defaults in the payment to the depositors, debenture holders, shareholders (in case of non payment of declared dividends) and creditors.

18. To review the functioning of the Whistle Blower mechanism, in case the same is existing.

19. Approval of appointment of CFO (i.e., the whole time Finance Director or any other person heading the finance function or discharging that function) after assessing the qualification. experience and background, etc, of the candidate.

20. Carrying out any other function as is mentioned in the terms of reference of the Audit Committee.

21. Reviewing the utilisation of loans and/or advances from investment by the holding company in the subsidiary exceeding 100 crore or 10% of the asset size of the subsidiary, whichever is lower.

![]()

Question 6.

What do you mean by SME Exchange? Discuss the role of Company Secretary in the model SEBI (LODR) Regulations, 2015 laid down by SEBI for SMEs for the purpose of listing. (Dec 2013, 5 marks)

Answer:

(i) Meaning of SME Exchange: It means a trading platform of a recognized stock exchange having nationwide trading terminals permitted by SEBI to list the specified securities issued in accordance with SEBI(ICDR) Regulation. It also includes a stock exchange granted recognition for this purpose but does not include the ‘Main Board’.

Here ‘Main Board’ means a recognized stock exchange having nationwide trading terminals, other than SME exchange.

(ii) Example: BSE and NSE have started their SME listing platforms in India.

(iii) Role of Company Secretary: The roles of CS are as:

(a) All listed SMEs on SME platform are required to appoint the Company Secretary of the Issuer as Compliance Officer who will be responsible for monitoring the share transfer process and report to the Issuer board in each meeting.

(b) The ‘Compliance Officer’ will directly liaise with the authorities such as SEBI, Stock Exchange, ROC etc., and investors with respect to implementation of various clause, rules, regulations and other directives of such authorities and investors service and complaints related matter.

(c) Further “Registrar and Transfer Agent” of a listed SMEs are required to produce a certificate from a practicing company secretary that all the transfers have been completed within the stipulated time and certification regarding compliance of conditions of Corporate Governance.

Question 7.

Comment on the following:

Corporate governance is looked upon as a distinctive brand and benchmark in the profile of corporate excellence. (June 2018, 4 marks)

Answer:

Good Governance in capital market has always been high on the agenda of ‘ SEBI. Corporate Governance is looked upon as a distinctive brand and r benchmark in the profile of Corporate Excellence. This is evident from the continuous updation of guidelines, rules and regulations by SEBI for ensuring transparency and accountability.

In this process, SEBI had constituted a Committee on Corporate Governance under the Chairmanship of Shri Kumar Mangalam Birla. The Committee in its report observed that “the strong Corporate Governance is indispensable to resilient and vibrant capital markets and is an important instrument of investor protection. It is the blood that fills the veins of transparent corporate disclosure and high quality accounting practices. It is the muscle that moves a viable and accessible financial reporting structure.”

Based on the recommendations of the Committee, the SEBI had specified principles of Corporate Governance and introduced a new Clause 49 in the Listing Agreement of the Stock Exchanges in the year 2000. Presently Clause 49 has been replace by Regulations 16, 17, 18 etc. of SEBI (LODR) Regulations, 2015.

Question 8.

Answer the following:

What are the policies required to be framed under SEBI (LODR) ’ Regulations 2015? (June 2017, 4 marks)

Answer:

Following policies required to be framed under SEBI (LODR) Regulations, 2015:

- Risk policy [Regulation 4(2)(f)]

- Policy for Preservation of Documents [Regulation 9]

- Policy on Board diversity [Part-D, Schedule II (3)]

- Policy on materiality of related party transactions [Regulation 23(1)]

- Policy on dealing with related Party Transactions [Regulation 23(1)]

- Whistle Blower Policy [Regulation 23(1)]

- Policy, relating to the remuneration of the directors, key managerial personnel and other employees [Part-D, Schedule II (1)]

Question 9.

Comment on the following statement:

“Listing of securities with stock exchanges is a matter of great importance for companies and investors.” (June 2017, 4 marks)

Answer:

The given statement “Listing of securities with stock exchange is a matter of great importance for companies and investors” is correct. The benefits of listing can be summarized as;

(I) Benefits to the Company:

(a) Increase in Goodwill: A listed company gets much importance, in the eyes of general public, because its shares are quoted.

(b) Easy availability of loan: A listed company gets easily loan from Bank & Financial Institution.

(c) No Threat of Takeover: Since in a listed company, shares are widely distributed, which reduces the fears of easy takeover of the organizations by others.

(II) Benefits to the Investors:

(a) Liquidity in Investment: When securities are listed, the investor can change their hands without any hassle, so their investment remains liquid.

(b) Tracking Price-Trend: The trading prices of listed securities are published in the news paper, from which investor can check the progress of their investment and keep eye on trading price-trend.

(c) Availability of Sufficient information: SEBI (LODR) Regulations, 2015 requires a company to publish its quarterly financial-position, give notice of Board Meetings etc. in the newspaper, so investors get proper information.

![]()

Question 10.

For ensuring independence in the spirit of Independent Directors and their active participation in functioning of the company, SEBI has accepted many recommendations of Committee setup under the Chairmanship of Shri Uday Kotak and made amendments in the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015. Explain any four amended provisions related to Independent Directors. (Dec 2018, 4 marks)

Answer:

Based on the recommendations of Kotak Committee, the amenoments made in the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 with respect to Independent Directors are as follows:

(i) The Board of Directors of the top 500 listed entities shall have at least one independent woman director by April 1, 2019 and the Board of Directors of the top 1000 listed entities shall have at least one independent woman Director By April 1,2020.

(ii) The quorum for every meeting of the Board of Directors of the top 1000 listed entities with effect from April 1, 2019 and the top 2000 listed entities with effect from April 1, 2020 shall be one-third of its total strength or three Directors, whichever is higher, including at least one independent director.

(iii) A person shall not serve as an independent director in more than seven listed entities. However, any person who is serving as a whole time director/managing director in any listed entity shall serve as an independent director in not more than three listed entities.

(iv) The evaluation of independent director shall be done by the entire Board of Directors which shall include:

(a) performance of the director; and

(b) fulfilment of the Independence criteria as specified in SEBI Listing Regulations and their Independence from the management.

However in the above evaluation, directors who are subject to evaluations shall not participate.

(v) the quorum for a meeting of the nomination and remuneration committee shall be either two members or one-third of the members of the committee whichever is greater, including at least one independent director in attendance.

(vi) At least one independent director on the Board of Directors of the listed entities shall be a director on the Board of Directors of an unlisted material subsidiary, whether incorporated in India or not.

(vii) No person shall be appointed or continue as an alternate director for an independent director of a listed entity with effect from October 1, 2018.

(viii) Detailed reasons for the resignation of an independent director who resigns before the expiry of his tenure along with a confirmation by such director that there are no other material reasons other than those provided.

(ix) At least one independent director on the Board of Directors of the listed entity shall be a director on the Board of Directors of an unlisted material subsidiary, whether incorporated in India or not.

(x) Every independent director shall, at the first meeting of the Board in which he participates as a director and thereafter at the first meeting of the board in every financial year or whenever there is any change in the circumstances which may affect his status as an independent director, submit a declaration that he meets the criteria of independence as provided in clause (b) of sub-regulation (1) of regulation 16 of SEBI Listing Regulations and that he is not aware of any circumstance or situation, which exist or may be reasonably anticipated, that could impair or impact his ability to discharge his duties with an objective independent judgement and without any external influence.

Question 11.

You are the Company Secretary of Sunglow Ltd., which being listed on the Stock Exchange after an IPO is made by the company. The Managing Director desires to know about quarterly compliance requirements under listing agreement. Prepare a list of quarterly compliances as per the listing regulations. (Dec 2018, 4 marks)

Answer:

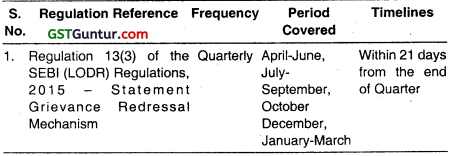

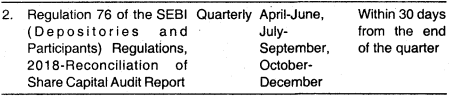

| Title with Regulation | Particulars | Time Limits |

| Investor complaints Statement [Reg. 13(3)] | The listed entity shall file with the recognised Stock Exchange, a statement giving the number of investor complaints pending at the beginning of the quarter, those received during the quarter, disposed of during the quarter and those remaining unresolved at the end of the quarter. | Within 21 days from end of quarter. |

| Quarterly Compliance report [Reg. 27(2)] | The listed entity shall submit a quarterly compliance report on corporate governance in the format as specified by SEBI from time to time to the recognised Stock Exchange(s) | Within 21 days from the end of each quarter |

| Shareholding pattern [Reg. 31(1)(b)] | The listed entity shall submit to the stock exchange(s) a statement showing holding of securities and shareholding pattern separately for each class of securities, in the format specified by SEBI from time to time | Within 21 days from the end of each quarter |

| Statement of deviation(s) or Variation(s) [Regulation 32(1)] | The listed entity shall submit to the stock exchange a statement of deviation or variation (for public issue, rights issue, preferential issue etc.) | Quarterly Basis till such time the issue proceeds have been fully utilized or the purpose for which these proceeds were raised has been achieved. |

| Monitoring Agency Report [Regulation 32(6)] | Where the listed entity has appointed a monitoring agency to monitor utilisation of proceeds of a public or rights issue, the listed entity shall submit to the stock exchange(s) any comments or report received from the monitoring agency | Within 45 days from the end of each quarter. |

| Financial results [Regu. 33(3)] | The listed entity shall submit quarterly and year-to-date standalone financial results to the stock exchange. In case the listed entity has subsidiaries, the listed entity shall also submit quarterly/ year- to date consolidated financial results |

Within 45 days of end of each quarter, other than the last quarter |

| Advertisements in Newspapers [Regu. 47] | Financial results, along-with the modified opinion(s) or reservation^), if any, expressed by the auditor | Within 48 hours of conclusion of the meeting of board of directors at which the financial results were approved. |

Question 12.

Startups companies have now come up with an Initial Public Offer with relaxation of many conditions applicable for Initial Public Offer. In this context, briefly, explain about the innovators Growth Platform (IGP)” and eligibility for listing. (Dec 2018, 5 marks)

Answer:

SEBI has notified new norms for listing of Small and Medium Enterprises (SMEs) including the startup companies in Innovators Growth Platform (IGP) on stock exchanges without an initial public offering.

As per SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018, Innovators Growth Platform (IGP’) means the growth platform for listing and trading of specified securities of issuer that comply with the eligibility criteria specified in regulation 288.

SEBI has come up with a chapter X of SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 with a new set of regulations laying down the terms and conditions for entities desirous of listing on IGP.

Eligibility

The following entitles shall be eligible for listing on the IGP:

(i) an issuer which is intensive in the use of technology, information technology, intellectual property, data Analytics, biotechnology or nanotechnology to provide products, services or business platforms with substantial value áddition shall be eligible for listing on the innovators growth platform, provided that as on the date of filing of draft information document of draft offer document with the Board, as the case may be, 25% of pre-issue capital of the issuer company for at least 1 year should have been held by:

(i) QIBS

(ii) Innovators Growth Platform Investors

(iii) The following regulated entities:

(a) Foreign Portfolio Investors

(b) Other Entity Meeting the Criteria.

(iv) Any other class of investors as specified by SEBI from time to time

![]()

Question 13.

Explain the Regulation 39 of Issuance of Certificates or Receipts for securities and dealing with unclaimed securities under SEBI Listing Regulations, 2015. (June 2019, 5 marks)

Answer:

Regulation 39 of the SEBI (Listing Obligations and Disclosure Requirements)

Regulations, 2015 provides that:

1. The listed entity shall comply with Rule 19(3) of Securities Contract (Regulations) Rules, 1957 in respect of Letter/Advices of Allotment, Acceptance or Rights, transfers, subdivision, consolidation, renewal, exchanges, issuance of duplicates thereof or any other purpose.

2. The listed entity shall issue certificates or receipts or advices, as applicable, of subdivision, split, consolidation, renewal, exchanges, endorsements, issuance of duplicates thereof or issuance of new certificates or receipts or advices, as applicable, in cases of loss or old decrepit or worn out certificates or receipts or advices, as applicable, within a period of thirty days from the date of such lodgement.

3. The listed entity shall submit information regarding loss of share certificates and issue of the duplicate certificates, to the stock exchange within two days of its getting information.

4. The listed entity shall comply with the procedural requirements specified in Schedule VI to these regulations while dealing with securities issued pursuant to the public issue or any other issue, physical or otherwise, which remain unclaimed and/or are lying in the escrow account, as applicable.

Question 14.

List out the Half Yearly Compliance Calender for listed entity for SME (Small and Medium Enterprise) as per SEBI Listing Regulations, 2015. (June 2019, 5 marks)

Answer:

Half Yearly Compliance Calendar for listed entity for SME (Small and Medium Enterprise) as per SEBI Listing Regulations, 2015

| Regulation Reference |

Frequency | Period Covered |

Date by which to be filed |

| 1. 31(1) – Shareholding Pattern | Half Yearly | April September October |

21st October and 21st April |

| 2. 32(8) – Statement of deviation or variation | Half Yearly | April September October |

– |

| 3. 33(5) – Financial Results | Half Yearly | April September October |

14th November and 30th May |

| 4. 7(3) – Compliance Certificate f to the exchange | Half Yearly | April September October |

31st October and 30tt’ April |

| 5. 40(10) – Compliance Certificate’ w.r.t Transfer Or?transmission or transposition of securities within 30 days | Half Yearly | April September October March |

31st October and 30th April |

Question 15.

The provisions SEBI Listing Regulations, 2015, shall not be applicable to “perpetual debt instrument” and “perpetual non-cumulative preference shares” listed by Banks. Comment. (June 2019, 5 marks)

Answer:

The statement is wrong. Chapter V of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 provides for obligations of listed entity which has listed its non-convertible debt securities or non-convertible redeemable preference shares or both. The provisions of this chapter shall also be applicable to “perpetual debt instrument” and “Perpetual non- cumulative preference share” listed by banks.

Further, Chapter V of these regulations deals with the provisions which are applicable to perpetual debt instrument” and “perpetual non-cumulative preference share” listed by banks relating to the following:

- Intimation to stock exchange(s),

- Disclosure of information having bearing on performance/operation of listed entity and/or price sensitive information

- Financial Results

- Annual Report

- Asset Cover

- Documents and Intimation to Debenture Trustees

- Other submissions to stock exchange(s)

- Documents and information to holders of non-convertible debt securities and inconvertible preference shares

- Structure of non-convertible debt securities and non-convertible redeemable preference shares

- Record Date

- Terms- of non-convertible debt securities and non-convertible redeemable preference shares

- Website etc.

Question 16.

Enumerate the principles governing disclosures for the listed companies (June 2019, 5 marks)

Answer:

As per Regulation 4 (1) of SEBI Listing Regulation, 2015, the listed entity shall abide by the following principles, while making disclosures to the stock exchanges or its website or through any other medium:

- Information shall be prepared and disclosed in accordance with applicable standards of accounting and financial disclosure.

- The listed entity shall implement the prescribed accounting standards in letter and spirit in the preparation of financial statements taking into consideration the interest of all stakeholders and shall also ensure that the annual audit is conducted by an independent, competent and qualified auditor.

- The listed entity shall refrain from misrepresentation and ensure that the information provided to recognised stock exchange and investors is not misleading.

- The listed entity shall provide adequate and timely information to recognised stock exchange and investors.

- The listed entity shall ensure that disseminations made under provisions of these regulations and circulars made thereunder, are adequate, accurate, explicit, timely and presented in a simple language.

- Channels for disseminating information shall provide for equal, timely and cost efficient access to relevant information by investors.

- The listed entity shall abide by all the provisions of the applicable laws including the securities laws and also such other guidelines as may be issued from time to time by all the SEBI and the recognised stock exchange(s) in this regard and as may be applicable.

- The listed entity shall make the specified disclosures and follow its obligations in letter and spirit taking into consideration the interest of all stakeholders.

- Filings, reports, statements, documents and information which are event based or are filed periodically shall contain relevant information.

- Periodic filings, reports, statements, documents and information reports shall contain information that shall enable investors to track the performance of a listed entity over regular intervals of time and shall provide sufficient information to enable investors to assess the current status of a listed entity.

![]()

Question 17.

Explain the relevant SEBI Regulation regarding prior intimations to Stock Exchanges, which are required for Board Meetings, where certain proposals, e.g. financial results and fund raising, are to be considered. (Dec 2019, 5 marks)

Answer:

Provisions related to prior intimation of Board Meeting where any of the following proposals is to be considered are included in Regulation 29 of SEBI (LODR) Regulations, 2015 are:

(i) At least 5 clear Days (excluding the date of the intimation and date of the meeting)

(a) financial results viz. quarterly, half yearly, or annual, (Intimation with Date of Board Meeting)

(ii) At least 2 clear Working Days excluding the date of the intimation and date of the meeting):

(a) proposal for buyback of securities

(b) proposal for voluntary delisting

(c) fund raising by way of –

- Further public offer

- Rights Issue

- American Depository Receipts

- Global Depository Receipts

- Foreign Currency Convertible Bonds

- Qualified institutions placement

- Debt issue

- Preferential issue and

- Determination of issue price.

(d) Any AGM or EGM or Postal Ballot proposed to be held for obtaining shareholder approval for further fund raising indicating type of issuance.

(e) Declaration/recommendation of dividend, issue of convertible securities including convertible debentures or of debentures carrying a right to subscribe to equity shares or the passing over of dividend.

(iii) At least 11 Working Days before:

(a) Any alteration in the form or nature of any of its securities or in the rights or privileges of the holders thereof.

(b) Any alteration in the date on which, the interest on debentures or bonds, or the redemption amount of redeemable shares or of debentures or bonds, shall be payable.

Question 18.

Explain the manner in which a listed entity, before issuing securities, shall obtain an ‘in-principle’ approval from recognised stock exchange(s). (Dec 2019, 5 marks)

Answer:

As per Regulation 28 of the Listing Obligation and Disclosure Requirements, 2015 issued by Securities and Exchange Board of India, the listed entity, before issuing securities, shall obtain an ‘in-principle’ approval from recognised stock exchange(s) in the following manner:

Where the securities are listed only on recognized stock Exchange having nationwide trading terminals from all such stock exchanges.

Where the securities are not listed on any recognised stock exchange having nationwide trading terminals, from all the stock exchange(s) in which the securities of the issuer are proposed to be listed.

Where the securities are listed on recognised stock exchange(s) having nationwide trading terminals as well as on the recognised stock exchange(s) not having nationwide trading terminals, from all recognised stock exchange(s) having nationwide trading terminals.

The requirement of obtaining in-principle approval from recognised stock exchange(s), shall not be applicable for securities issued pursuant to the scheme of arrangement for which the listed entity has already obtained No-Objection Letter from recognised stock exchange(s) in accordance with regulation 37 of the Listing Obligation and Disclosure Requirements, 2015 issued by Securities and Exchange Board of India.

Question 19.

Give the list of documents and information required to be submitted to holders of Non-Convertible Preference Shares. (Dec 2019, 5 marks)

Answer:

As per Regulation 58 of the Listing Obligations and Disclosure Requirements, Regulations, 2015 issued by SEBI following are the list of documents and informations required to be submitted to holders of Non-Convertible Preference Shares:

(a) Soft copies of full annual reports to all the holders of Non-Convertible Preference Shares who have registered their email address(es) for the purpose;

(b) Hard copy of statement containing the salient features of all the ‘documents, as specified in Section 136 of Companies Act, 2013 and rules made there under to those holders of Non-Convertible Preference Shares who have not so registered;

(c) Hard copies of full annual reports to those holders of Non Convertible Debt Securities and Non-Convertible Preference Shares, who request for the same.

(d) Half yearly communication, to holders of Non Convertible Debt Securities and Non-Convertible Preference Shares.

To send the notice of all meetings of holders of Non Convertible Debt Securities and Non-Convertible Preference Shares specifically stating that the provisions for appointment of proxy as mentioned in Section 105 of the Companies Act, 2013, shall be applicable for such meeting.

To send proxy forms to holders of Non Convertible Debt Securities and Non-Convertible Preference Shares which shall be worded in such a manner that holders of these securities may vote either for or against each resolution.

![]()

Question 20.

Explain the grievance redressal mechanism under Regulation 13 of SEBI (LODR) Regulations, 2015 for listed entities. (Dec 2020, 5 marks)

Answer:

Grievance Redressal Mechanism:

As per Regulation 13 of SEBI (LODR) Regulations, 2015 the Listed entity shall ensure that:

1. Adequate steps are taken for expeditious redressal of investors complaints.

2. It is registered with SCORES platform or any other platform of SEBI for resolving investors complaint electronically as specified by SEBI.

3. Submission of Statement of Investors compliant.

(a) Submit statement to stock exchange within 21 days from the end of quarter.

(b) Statement should include the following:

- number of complaints pending at the beginning of the quarter

- received during the quarter

- resolved / disposed of during quarter and

- remaining unsolved at the end of the quarter.

Note: The statement of investor’s complaints shall be placed before the Board of Directors of the listed entity on quarterly basis.

Question 21.

Explain ‘Designated Securities’ as per the SEBI Listing Regulation 2015. (Dec 2020, 5 marks)

Answer:

Definition of designated securities is given under clause h) of sub-regulation 1 of Regulations 2 of SEBI (LODR) Regulations, 2015.

Designated securities” means specified securities, non-convertible debt securities, non-convertible redeemable preference shares, perpetual debt instrument, perpetual non-cumulative preference shares, Indian depository receipts, securitised debt instruments, security receipts, units issued by mutual funds and any other securities as may be specified by the Board.

Question 22.

State the principles governing Corporate Governance in protecting the interest of Minority Shareholders. (Dec 2020, 5 marks)

Answer:

A listed entity having listed its specified securities shall comply with the corporate governance principles as specified in Chapter IV, which shall be implemented in a manner so as to achieve the objectives of the principles as included under Chapter II of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 and mentioned below:

(1) The rights of shareholders:

The listed entity shall seek to protect and facilitate the exercise of the following rights of shareholders:

- Right to participate in and to be sufficiently informed of, decisions concerning fundamental corporate changes.

- Opportunity to participate effectively and vote in general shareholder meetings.

- Being informed of the rules, including voting procedures that govern the general shareholder meetings.

- Opportunity to ask questions to the board of directors to place items on the agenda of general meetings, and to propose resolutions, subject to reasonable limitations.

- Effective shareholder participation in key corporate governance decisions, such as the nomination and election of members of board of directors.

- Exercise of ownership rights by all shareholders, including institutional investors.

- Adequate mechanism rights by all shareholders, including institutional investors.

- Protection of minority shareholders from abusive action by, or in the interest of, controlling shareholders acting either directly or indirectly, and effective means of redress.

(2) Timely information:

The listed entity shall provide adequate and timely information to shareholders, including but not limited to the following:

- Sufficient and timely information concerning the date, location and agenda of general meetings.

- Capital structure and arrangements that enable certain shareholders to obtain a degree of control disproportionate to their equity ownership.

- Rights attached to all series and classes of shares, which shall be disclosed to investors before they acquire shares.

(3) Equitable treatment:

The listed entity shall ensure equitable treatment of all shareholders, including minority and foreign shareholders, in the following manner:

- All shareholders of the same series of a class shall be treated equally.

- Effective shareholder participation in key corporate governance decisions, such as the nomination and election of members of board of directors, shall be facilitated.

- Exercise of voting rights by foreign shareholders shall be facilitated.

![]()

Question 23.

List out the event based compliance calendar under Regulation 29 as per SEBI Listing Regulations, 2015. (Dec 2020, 5 marks)

Answer:

| Regulation Reference | Frequency | Date by which to be filed |

| 29(1)(a) – Prior intimations of Board Meeting for financial result | Event based | At least 5 clear days in advance |

| 29(1)(b), 29(1)(c), 29(1)(a), 29(1)e and 29(1)f – Prior intimation of Board Meeting for, fund raising, declaration / recommendation of dividend, the proposal for declaration of bonus securities, buyback, voluntary delisting etc | Event based | At least 2 clear working days in advance |

| 29(3)- Prior intimations of Board Meeting for alteration in nature of securities. | Event based | At least 11 clear working days in advance. |

Question 24.

State the principles Governing Disclosures under the Listing Obligations and Disclosure Requirements, 2015. (Dec 2020, 5 marks)

Answer:

Principles governing disclosures are included under Regulation 4 under Chapter II of SEBI (Listing obligations and Disclosure Requirements) Regulations, 2015.

These principles includes following:

- Accounting Standard: Information shall be prepared and disclosed in accordance with applicable standards of accounting and financial disclosure.

- Refrain from Misrepresentation: The listed entity shall refrain from misrepresentation and ensure that the information provided to recognised stock exchange (s) and investor is not misleading.

- Advantage Information: The listed entity shall provide adequate and timely information to recognised stock exchanges and investors.

- Simple Language: The listed company shall ensure that dissemination made under provisions of these regulations and circulars made thereunder, are adequate, accurate, explicit, timely and presented in simple language.

- Disseminating Information: Channels for disseminating information shall provide for equal, timely and cost efficient access to relevant information by investors.

- Applicable Laws: The listed entity shall abide by all the provisions of the applicable laws including the securities laws and also such other guidelines as may be issued from time to time by the Board and the recognised stock exchange(s) in this regard and as may be applicable, (h)

- Obligation: The listed entity shall make the specified disclosures and follow its obligations in letter and spirit taking into consideration the interest of all stakeholders.

- Filed Periodically: Filings, reports, statements, documents and information which are event based or are filed periodically shall contain relevant information.

Question 25.

Explain the following:

Advertisement in Newspapers by a listed company in terms of Regulation 47 under SEBI (LODR) Regulations, 2015. (Dec 2020, 5 marks)

Answer:

To publish the following information in the newspapers in terms of Regulation 47 of SEBI (LODR) Regulations, 2015:

(a) Notice of meeting of the board of directors where financial results shall be discussed.

(b) Financial results, along with the modified opinion (s)/reservation (s), if any, expressed by the auditor.

(c) Submission of standalone and consolidated financial results.

(d) Statements of deviation(s) or variation(s) as specified in sub-regulation (1) of regulation 32 on quarterly basis, after review by audit committee and its explanation in directors report in annual report.

(e) Notices given to shareholders by advertisement.

Note: Financial results shall be published within 48 hours of conclusion of the Board Meeting.

The information shall be published in at least one English language national daily another shall be newspaper circulation in the whole of India and published in the language of the region, where the registered office of the listed entity is situated.

Question 26.

Explain the following:

Regulation 43A regarding Dividend Distribution Policy. (Dec 2020, 5 marks)

Answer:

Dividend Distribution Policy (Regulation 43A):

Top 1000 listed entities based on market capitalisation shall formulate a dividend distribution policy.

Dividend distribution policy shall be disclosed in their annual reports, and on their websites.

The dividend distribution policy shall include the following parameters:

(a) The circumstances under which the shareholders of listed entities may or may not expect dividend.

(b) The financial framework that shall be considered while declaring dividend.

(c) Internal and external factors that shall be considered while declaring dividend.

(d) Policy as to how the retained earnings shall be utilized; and

(e) Parameters that shall be adopted with regard to various classes of shares.

(f) Listed entities other than top 500 may disclose their dividend distribution policies on a voluntary basis in their annual reports and on their websites.

![]()

Question 27.

Discuss the procedural requirements which a listed entity needs to delegate to a Share Transfer Agent to deal with unclaimed shares. (Aug 2021, 5 marks)

Answer:

The listed entity may delegate the following procedural requirements to a share transfer agent so as to deal with unclaimed shares:

(i) Reminders to be sent

(1) The listed entity shall send at least three reminders at the address registered as per the following criteria:

(a) For shares in physical form, reminders shall be sent to the address given in the application form as well as last available address as per listed entity’s record.

(b) For shares in demat form, reminders shall be sent to the address captured in depository’s database or address given in the application form, in case of application made in physical form.

(ii) Procedure in case of non-receipt of response to reminders

(1) For shares in demat form, the unclaimed shares shall be credited to a Demat Suspense Account’ with one of the Depository Participants, opened by the listed entity for this purpose.

(2) For shares in physical form, the listed entity shall transfer all the shares into one folio in the name of “Unclaimed Suspense Account and shall dematerialise the shares held in the Unclaimed Suspense Account with one of the Depository Participants (DP).

(3) The listed entity shall maintain details of shareholding of each individual allottee whose shares are credited to such demat suspense account or unclaimed suspense account, as applicable.

(4) The demat suspense account or unclaimed suspense account, as applicable shall be held by the listed entity purely on behalf of the allottees who are entitled to the shares and the shares held in such suspense account shall not be transferred in any manner whatsoever except for the purpose of allotting the shares to the allottee as and when he/she approaches the listed entity.

(iii) Procedure in case of claim by allottee

As and when the allottee approaches the listed entity, the listed entity shall, after proper verification of the identity of the allottee either credit the shares lying in the Unclaimed Suspense Account or demat suspense account, as applicable, to the demat account of the allottee to the extent of the allottee’s entitlement, or deliver the physical certificates after re-materialising the same, depending on what has been opted for by the allottee, Provided that the rematerialising of the physical certificates shall be done only in case where the shares were originally issued in physical form.

Question 28.

Explain the conditions and procedure to be adopted by a listed company to change its name as per Regulation 45 of SEBI (LODR) Regulations 2015. (Aug 2021, 5 marks)

Answer:

Listed Entity is allowed to change its name, subject to compliance with the following conditions as prescribed in the SEBI (Listing Obligations Disclosure Requirements) Regulations, 2015:

- at least 1 year has elapsed from the last Name change;

- at least 50% of the Total Revenue in the preceding 1 year period has been accounted for by the new activity suggested by the new name; or

- the amount invested in the new activity project is at least 50% of the Assets of the listed entity.

If any listed entity has changed its activities which are not reflected in its name, it shall change its name in line with its activities within a period of six months from the change of activities in compliance of provisions as applicable to change of name prescribed under Companies Act, 2013.

On receipt of availability confirmation and, before filing the request for change with the Registrar of Companies (ROC), the company shall seek approval from Stock Exchange (SE) before making final application to ROC for name change.

The company shall submit a certificate from Chartered Accountant stating compliance with conditions as mentioned above.

Question 29.

SEBI has given a good recognition to the Company Secretaries. Discuss this statement in light of SEBI Regulations 2015. (Aug 2021, 5 marks)

Answer:

The SEBI has recognized the significant role played by a Company Secretary as a Governance Professional under the SEBI (LODR) Regulations, 2015 and recognized the role to be played by a Company Secretary under various provisions of such Regulations, which are mentioned below:

1. Regulation 6 states that every listed entity shall appoint a qualified company secretary as the compliance officer.

2. Regulation 7 (3) provides that the listed entity shall submit a compliance certificate duly signed by Company Secretary and authorised representative of the share transfer agent certifying that all activities in relation to physical and electronic share transfers facility are maintained either in house or by Registrar to an issue and share transfer agent registered with the SEBI.

3. Recognition as Senior Management under Regulation 16.

4. Company Secretary is treated as Key Managerial Personnel under Regulation 2(1 )(o).

5. Regulation 24A require that every listed entity and its material unlisted subsidiaries incorporated in India shall undertake Secretarial Audit and shall annex with its Annual Report, a Secretarial Audit Report, given by a Company Secretary in Practice.

6. Regulation 40 (9) provides that the share transfer agent and/ or the in-house share transfer facility, as the case may be, produces a certificate from a practising Company Secretary within one month of the end of each hah of the financial year, certifying that all certificates have been issued within thirty days of the date of lodgement for transfer, sub-division, consolidation, renewal, exchange or endorsement of calls/allotment monies.

7. Regulation 40(2) require that a listed entity may delegate the power of transfer of securities to a committee or to compliance officer or to the registrar to an issue and/or share transfer agent(s).

8. Schedule V of the Regulation provides that compliance certificate from either the auditors or practising Company Secretaries regarding compliance of conditions of corporate governance to be annexed with the directors’ report.

9. As per Schedule V of the Regulation, a certificate from a Company Secretary in practice that none of the directors on the board of the company have been debarred or disqualified from being appointed or continuing as Directors of Companies by SEBI/ Ministry of Corporate Affairs or any such Statutory Authority.

Question 30.

Regulatory Authorities require that the company must maintain the Asset Cover in respect of Debentures issued. Discuss this statement in context of provisions of SEBI (LODR) Regulations 2015. (Aug 2021, 5 marks)

Answer:

Regulation 54 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 deals with Asset Cover for Non-convertible Debt securities which provides that the listed entity shall maintain 100% asset cover or asset cover as per the terms of offer document/information Memorandum and/or Debenture Trust Deed, sufficient to discharge the principal amount at all times for the non-convertible debt securities issued.

Such entities are also required to disclose to the stock exchange in quarterly, halfyearly, year-to-date and annual financial statements, as applicable, the extent and nature of security created and maintained with respect to its secured listed Non-convertible Debt securities.

![]()

Question 31.

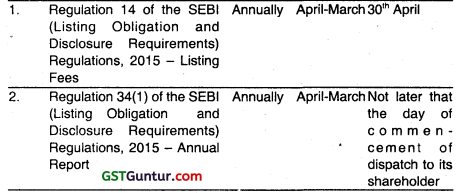

Prepare quarterly and annually compliance calendars for listed SMEs. (Aug 2021, 5marks)

Answer:

Quarterly Compliances

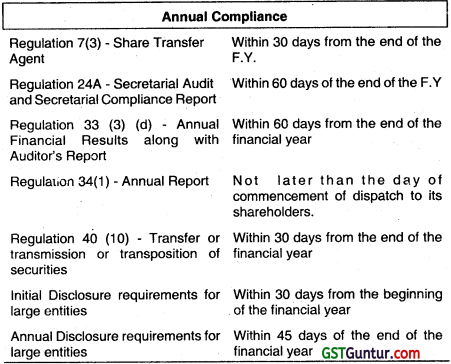

Annual Compliances

Question 32.

(a) The SEBI (LODR) Regulation, 2015 is applicable on which type of securities? (Dec 2021, 5 marks)

(b) List out the points of ‘Common Obligations for a Listed Entity’ prescribed under the SEBI (LODR) Regulations, 2015. (Dec 2021, 5 marks)

(c) Atindra Financial Institutions Group started a new Company for Mutual Fund business. It has sought all the requisite approvals from various regulators. Few of the senior staff were moved from existing group companies to new Mutual Fund Company. The CFO of the new Company is of the view that they also need to appoint a Company Secretary as Compliance Officer. Explain the role of Compliance Officer. (Dec 2021, 5 marks)

(d) Discuss the provisions contained in the SEBI (LODR) Regulations, 2015 relating to dissemination of information to Stock Exchanges on the matter of ‘Corporate Insolvency Resolution Process (CIRP)’ of a listed company which has become corporate debtor under the Insolvency and Bankruptcy Code, 2016. (Dec 2021, 5 marks)

Answer:

(a) Applicability of the SEBI (LODR) Regulations, 2015 [Regulation 3]

These regulations shall apply to a listed entity which has listed any of the following designated securities on recognised stock exchange(s):

(a) specified securities listed on main board or SME Exchange or Innovators Growth Platform; Specified securities means ‘equity shares’ and ‘convertible securities as defined under the SEBI (ICDR) Regulations, 2018.

(b) non-convertible debt securities, non-convertible redeemable preference shares, perpetual debt instrument, perpetual non-cumulative preference shares;

(c) Indian depository receipts (IDR);

(d) securitised debt instruments;

(e) units issued by mutual funds;

(f) any other securities as may be specified by the SEBI.

(b) Chapter III of the SEBI (LODR) Regulations, 2015 deals with the Common Obligations for a Listed Entity.

The Listing Regulations has specified the generic obligations or common obligations of listed entity with respect to filing of information, responsibilities of compliance officer, fees etc. and these requirements are applicable to all types of listed securities. The Common Obligations mainly includes: –

1. General Obligations of Compliance:

The listed entity shall ensure that key managerial personnel, directors, promoters or any other person dealing with the listed entity, complies with responsibilities or obligations, if any, assigned to them under these regulations. (Regulation 5)

2. Appointment of Compliance Officer and his/her Obligations: The listed entity shall appoint a qualified Company Secretary as the Compliance Officer. The Compliance Officer is made responsible for certain things. (Regulation 6 )

3. Appointment of Share Transfer Agent (STA):

The listed entity shall appoint a share transfer agent or mange the share transfer facility in house.(Regulation 7 )

4. Co-operation with intermediaries registered with SEBI:

It shall co-operate with and submit correct and adequate information to the intermediaries registered with SEBI such as credit rating agencies, registrar to an issue and share transfer agents, debenture trustees etc. within timelines and procedures specified under the Act, respective regulations and circulars issued under the Act.(Regulation 8)

5. Preservation of Documents:

The listed entity shall have a policy.

- The policy shall be approved by its Board of Directors.

- The documents may be kept in electronic mode.

Preservation: at least 2 categories of documents as follows:

- Documents permanent in nature

- Documents with preservation > or equal to 8 years after completion of transaction. (Regulation 9)

6. E-Filing of Information:

The listed entity shall file all reports, statements, documents and other information with the recognized stock exchange(s) on the electronic platform as specified by SEBI or the recognized stock exchange(s). (Regulation 10)

And put necessary infrastructure in place to comply with this requirement.

7. Scheme of Arrangement:

The listed entity shall ensure that any scheme of arrangement/ amalgamation/ merger /reconstruction /reduction of capital etc. to be presented to any Court or Tribunal does not in any way violate, override or limit the provisions of securities laws or requirements of the stock exchange(s). (Regulation 11)

8. Payment of dividend of interest or redemption or repayment:

the listed entity shall use Payment facility in electronic mode for payment of dividend, interest, redemption or repayment of amounts, which is approved by the Reserve Bank of India.

If electronic mode is not possible to be used, then

- Issue “Payable at Par” warrants or cheques.

- Speed post to be used for “Payable at Par” cheques for more than ₹ 1,500/-. (Regulation 12)

9. Grievance Redressal Mechanism:

The listed entity shall ensure that adequate steps are taken for expeditious redressal of investors complaints. It shall ensure that it is registered with SEBI Complaints Redress System (SCORES) platform or any other platform of SEBI for handing investors complaints electronically as specified by SEBI.

It shall submit the statement on Investor complaints.

- Submit statement to stock Exchange within 21 days from the end of quarter.

- The Statement should contain the following:

- number of complaints pending at the beginning of the quarter; received during the quarter;

- resolved/ disposed of during the quarter; and

- remaining unsolved at the end of the quarter.

- To be placed before the Board of Directors on quarterly basis. (Regulation 10)

(c) Compliance Officer and his Obligations (Regulation 6) as per Regulation 6 of the SEBI (LODR) Regulations, 2015 which deals with Compliance Officer and his Obligations, every listed company shall appoint a qualified Company Secretary as the Compliance Officer, who is responsible for:

- Ensuring conformity with the regulatory provisions in letter and spirit.

- Co-ordination with and reporting to SEBI, recognized stock exchange(s) and depositories.

- Monitoring email address of grievance redressal division for the purpose of registering complaint by investors.

- Ensuring correctness, authenticity and comprehensiveness of the information, statements and reports filed by listed entities.

This regulation is not applicable to listing of units of mutual funds.

Note : Great responsibility has been cast on the Company Secretary holding the position of Compliance officer in a listed entity.

In Terms of Regulation 18(d) of the SEBI (Mutual Funds) Regulations, 1996, the rights and obligations of the trustees of Mutual Fund includes appointment of Compliance Officer who shall be responsible for monitoring the compliance of the Act, rules and regulations, notifications, guidelines, instructions, etc., issued by the SEBI or the Central Government and for redressal of investors grievances.

As mentioned above the Mutual Fund Company though is not need to appoint a Company Secretary as Compliance Officer. However, to ensure compliances, they shall appoint a Compliance officer.

Conclusion:- Hence on voluntary basis Mutual Fund can appoint Company Secretary as Compliance Officer considering the role and responsibilities.

(d) Para A.16 of Part A of Schedule III of the SEBI (LODR) Regulations, 2015 deals with the disclosures relating to Corporate Insolvency Resolution Process matter, are given below:

The different events in relation to the Corporate Insolvency Resolution Process of a listed corporate debtor under the Insolvency Code shall be disclosed to the Stock Exchanges as a part of material event / information:

- Filing of application by the corporate applicant for initiation of CIRP, also specifying the amount of default;

- Filing of application by financial creditors for initiation of CIRP against the corporate debtor, also specifying the amount of default;

- Admission of application by the Tribunal, along with amount of default or rejection or withdrawal, as applicable;

- Public announcement made pursuant to order passed by the Tribunal under section 13 of Insolvency Code;

- List of creditors as required to be displayed by the corporate debtor under regulation 13(2)(C) of the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations, 2016;

- Appointment/ Replacement of the Resolution Professional;

- Prior or post-facto intimation of the meetings of Committee of Creditors;

- Number of resolution plans received by Resolution Professional;

- Filing of resolution plan with the Tribunal;

- Approval of resolution plan by the Tribunal or rejection, if applicable;

- Specific features and details of the resolution plan as approved by the Adjudicating Authority under the Insolvency Code, not involving commercial secrets;

- Any other material information not involving commercial secrets;

- Proposed steps to be taken by the incoming investor/acquirer for achieving the Minimum Public Shareholding;

- Quarterly disclosure of the status of achieving the MPS;

- The details as to the delisting plans, if any approved in the resolution plan.

![]()

Question 33.

Mr. Jayesh has been recently appointed as Company Secretary of Mahalingam Limited, a company listed on Bombay Stock Exchange (BSE). He wants to draft a dividend distribution policy for the Company. Advise Mr. Jayesh. (Dec 2021, 5 marks)

Answer:

As per Regulation 43A of the SEBI (LODR) Regulations, 2015 prescribes the criteria for Dividend Distribution Policy:

(i) Top 1000 Listed entities based on market capitalization shall formulate a dividend distribution policy.

(ii) Dividend Distribution Policy shall be disclosed on the website of the listed entity and a web-link shall also be provided in their annual reports.

(iii) The dividend distribution policy shall include the following parameters:

(a) the circumstances under which the shareholders of the listed entities may or may not expect dividend;

(b) the financial parameters that shall be considered while declaring dividend;

(c) internal and external factors that shall be considered for declaration of dividend;

(d) policy as to how the retained earnings shall be utilized; and

(e) parameters that shall be adopted with regard to various classes of shares.

Although, If the listed entity proposes to declare dividend on the basis of parameters or proposes to change such additional parameters or the dividend distribution policy contained in any of the parameters, it shall disclose such changes along with the rationale for the same in its annual report and on its website.

Listed entities other than top 1000 may disclose their dividend distribution policies on a voluntary basis on their websites and provide a web-link in their annual reports.

Conclusion:- Mr. Jayesh hence, would be required to comply with the above mentioned provisions to frame Dividend Distribution Policy.

Question 34.

Outline the provisions of Regulation 30 of SEBI (LODR) Regulations, 2015 regarding the criteria for determination of materiality of events and information. (Dec 2021, 5 marks)

Answer:

As per Regulation 30 (4) of the SEBI (LODR) Regulations, 2015 prescribes the criteria for determination of materiality of events / information. Listed entity shall consider the following criteria for determination of materiality of events / information:

- the omission of an event or information, which is likely to result in discontinuity or alteration of event or. information already available publicly; or

- the omission of an event or information is likely to result in significant market reaction if the said omission came to light at a later date;

- an event / information may be treated as being material if in the opinion of the Board of Directors of listed entity, the event information is considered material. The listed entity shall frame a Policy for determination of materiality:

- based on criteria specified in this regulation; r duly approved by its Board of Directors;

- shall be disclosed on its website.

Regulation 30 (5) of the SEBI (LODR) Regulations, 2015, provides that the board of directors of the listed entity shall authorize one or more Key Managerial Personnel (KMP) for the purpose of determining materiality of an event or information and for the purpose of making disclosures to stock exchange(s) and the contact details of such personnel shall be also disclosed to the stock exchange(s) and as well as on the listed entity’s website.

In case where an event occurs or an information is available with the listed entity, which has not been indicated in Para A or B of Part A of Schedule III of the SEBI (LODR), Regulations, 2015, but which may have material effect on it, the listed entity is required to make adequate disclosures in regard thereof.

Question 35.

Write a note explaining the provisions contained in SEBI (LODR) Regulations, 2015 in relation to ‘Holding of Specified Securities and Shareholding Pattern’. (Dec 2021, 5 marks)

Answer:

As per Regulation 31 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 deals with the ‘Holding of Specified Securities and Shareholding Pattern’. It states that-

(1) The listed entity shall submit to the stock exchange(s) a statement showing holding of securities and shareholding pattern separately for each class of securities, in the format specified by the Board from time to time within the following timelines –

(a) one day prior to listing of its securities on the stock exchange(s);

(b) on a quarterly basis, within twenty-one days from the end of each quarter;

(c) within ten days of any capital restructuring of the listed entity resulting in a change exceeding two percent of the total paid-up share capital: Although, in case of listed entities which have listed their specified securities on SME Exchange, the above statements shall be submitted on a half yearly basis within twenty-one days from the end of each half year.

(2) The listed entity shall ensure that 100% of shareholding of promoter(s) and promoter group is in dematerialized form and the same is maintained on a continuous basis in the manner as specified by the Board.

(3) The listed entity shall comply with circulars or directions issued by the Board from time to time with respect to maintenance of shareholding in dematerialized form.

(4) All entities falling under promoter and promoter group shall be disclosed separately in the shareholding pattern appearing on the website of all stock exchanges having nationwide trading terminals where the specified securities of the entity are listed, in accordance with the formats specified by the Board.

![]()

Question 36.

Write a note on the periodical compliance calendar (not event based) under SEBI Listing Regulations, 2015. (Dec 2021, 5 marks)

Answer:

The listed entity shall comply the following periodical compliances under the SEBI (LODR) Regulations 2015, other than event based compliances:

|

Half year Compliance |

|

| Regulation 23 (9) – Disclosures of Related Party Transactions | Within 30 days from the date of publication of its standalone and consolidated financial results |

Question 37.

Briefly discuss Legal Compliance in relation to the Risk Management Committee as per SEBI (LODR) (Second Amendment) Regulations, 2021. (June 2022, 5 marks)

Question 38.

Briefly describe the provisions of Meetings of shareholders and voting under Regulation 44 as per SEBI (LODR) Regulations 2015. (June 2022, 5 marks)

Question 39.

“Great responsibility has been given to the Company Secretary holding the position of Compliance officer in a listed entity”. Explain the obligations of the Company Secretary in brief in light of SEBI Regulations, 2015. (June 2022, 5 marks)

Question 40.

The listed entity shall frame policy for determination of materiality and Criteria for determination of materiality of events/ information. Enumerate in brief with reference to SEBI Regulations, 2015. (June 2022, 5 marks)

Question 41.

Nikhil Ltd., a listed company is confused about the composition of Board of Directors, seeks your advice regarding the composition of Board of Directors as per Regulation 17(1) of the SEBI (LOOR) Regulation. 2015. As a Company Secretary of Nikhil Ltd., offer your suggestions by highlighting the regulation. (Dec 2015, 6 marks)

Answer:

Regulation 17(1)

Composition of Board of Directors: The Composition of Board of directors of the listed entity shall be as follows:

Executive/Non Executive: Board of Directors shall have an optimum combination of executive and non executive directors:

- With at least one Women Director

- At least 50% of Board of Directors shall comprise of Non-Executive Director.

- Provided that the BOD of the top 500 listed entities shall have at least 1 (one) independent woman director by 01-04-2019 and the Board of Directors of the 1000 listed entities shall have at least 1(one) independent woman director by 01-04-2020.

Independent Director:

- If Chairman of the Board is Non-Executive Director;

- at least (1/3) one-third of the Board of Directors shall comprise of Independent Directors;

- where the listed entity does not have a regular non-executive chairperson;

- Where the listed company has outstanding SR equity shares, at least 1/2 of the BoD shall comprise of “Independent Directors”.

Minimum No. of Directors:

- The BoD of the top 1000 listed entities (w.e.f. 01 -04-2019), and the top 2000 listed entities (w.e.f. 01-04-2020) shall have at least 6 directors.

- at least (1/2) half of the Board of Directors shall comprise of Independent Directors;

- where the regular non-executive chairperson is a promoter of the listed entity; or is related to any promoter; or is related to person occupying management positions at the level of Board of Director; or at one level below the Board of Directors;

- at least (1/2) half of the Board of Directors of the listed entity shall consist of Independent Directors.

Question 42.

MCS Ltd. is a listed company with Bombay Stock Exchange Ltd. The Company enters into related party transactions frequently with MAP Ltd. in which one of director of MCS Ltd. holds 3% paid up capital of MAP Ltd. MCS Ltd. feels that getting the approval of Audit Committee for each transaction is time-consuming and delaying the operational plan. You, being a Company Secretary of MCS Ltd., advise the management with reference to SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 for approval of the related party transactions from the Audit Committee for next one year. Will your answer be different if MAP Ltd. is wholly owned subsidiary of MCS Ltd.? (Dec 2018, 5 marks)

Answer:

According to Regulation 23(2) of the SEBI (Listing obligations and Disclosure Requirements) Regulations, 2015, all related party transactions shall require prior approval of the Audit Committee.

The Audit Committee may grant omnibus approval for related party transactions proposed to be entered into by the listed entity subject to the following conditions:

(i) The audit committee shall lay down the criteria for granting the omnibus approval in line with the policy on related party transactions of the listed entity and such approval shall be applicable in respect of transactions which are repetitive in nature;

(ii) The audit committee shall satisfy itself regarding the need for such omnibus approval and that such approval is in the interest of the listed entity;

(iii) The omnibus approval shall specify;

A. The name(s) of the related party, nature of transaction, period of transaction, maximum amount of transactions that shall be entered into.

B. The indicated base price/current contracted price and the formula for variation in the price if any; and

C. Such other conditions as the audit committee may deem fit. However, where the need for related party transaction cannot be foreseen and aforesaid details are not available, audit committee may grant omnibus approval for such transactions subject to their value not exceeding rupees one crore per transaction.

(iv) The audit committee shall review, at least on a quarterly basis, the details of related party transactions entered into by the listed entity pursuant to each of the omnibus approval is given.

(v) Such omnibus approval shall be valid for a period not exceeding one year and shall require fresh approvals after the expiry of one year.

However, provisions related to the prior approval of audit committee shall not apply, in case the transactions are entered between a holding company and its wholly owned subsidiary whose accounts are consolidated with such holding company and placed before the shareholders at the general meeting for approval. Therefore, in the case of MAP Ltd. which is a wholly owned subsidiary of MCS Ltd., the approval of audit committee is not required.

![]()

Question 43.

ARY & Co. LLP, were the statutory auditors of Ambeaon Limited (a listed company), appointed for period of 5 years. After completion of two years, the auditors resigned as statutory auditors. Soon within a couple of days of auditor’s resignation, two independent directors also resigned from the Board. What would be the disclosure obligations on the Company? (Dec 2021, 5 marks)

Answer:

In case of resignation of the auditor of the listed entity, detailed reasons for resignation of auditor, as given by the said auditor, shall be disclosed by the listed entities to the stock exchanges as soon as possible but not later than twenty four hours of receipt of such reasons from the auditor.

Hence, for resignation of ARY & Co., LLP, the Company would be required to make r above disclosures. In case of resignation of an independent director of the listed entity, within 7 days from the date of resignation, the different disclosures shall be made to the stock exchanges by the listed entities:

(a) Detailed reasons for the resignation of independent directors as given by the said director shall be disclosed by the listed entities to the stock exchanges.

(b) The independent director shall, along with the detailed reasons, also provide a confirmation that there is no other material reasons other than those provided.

(c) The confirmation as provided by the independent director above shall also be disclosed by the listed entities to the stock exchanges along with the detailed reasons.

Question 44.

Smart Care Infra Ltd. has availed credit facilities from Banks, Financial institutions and issued bonds. One of the conditions of bond issued was to obtain credit rating from any two credit rating agencies. However, Smart Care Infra Ltd. refused to co-operate with credit rating agencies and does not provide information for rating the credit facilities. Explain the above situation with reference to SEBI guidelines on “Norms for rating agencies on non-cooperative firms” (June 2022, 5 marks)

Question 45.

A listed company can apply to stock exchange for re-classification of the Promoter’s holdings as public shareholders under SEBI regulations. Whether the following promoters can apply for re-classification, with reference to SEBI Regulations, 2015?

(i) Promoter is declared as fugitive economic offender.

(ii) Promoter is holding 18% of total voting rights in the listed entity.

(iii) Promoter is acting as Chief Financial Officer of the listed entity.

(iv) The Promoter Company has outstanding listing fees only for one year.

(v) Trading of its shares suspended by the stock exchanges. (June 2022, 5 marks)

Question 46.

Write short notes on “Secretarial Audit Report” as per SEBI (LODR) Regulations, 2015.

Answer:

Regulation 24A mandates that every listed entity and its material unlisted subsidiaries incorporated in India shall undertake Secretarial Audit and shall annex a secretarial audit report given by a Company Secretary in Practice, in such form as may be specified with the annual report at the listed entity.

Question 47.

What are the compliance requirements under the SEBI (LODR) Regulations,2015, relating to “ Related Party Transactions” ?

Answer:

(i) Policy Formulation [ Reg. 23(1)]: The listed entity shall formulate a policy on materiality of related party transactions and on dealing with related party transactions including clear threshold limits duly approved by the BOD and such policy shall be reviewed by the BOD at least once every 3 years and updated accordingly.

Explanation.- A transaction with a related party shall be considered material if the transaction(s) to be entered into individually or taken together with previous transactions during a financial year, exceeds 10% of the annual consolidated turnover of the listed entity as per the last audited financial statements of the listed entity. Again a transaction involving payments made to a related party with respect to brand usage or royalty shall be considered material if the transaction (s) be entered along with previous transaction during a financial year, exceed 2% of annual consolidated turnover of the listed entity as per the last audited F.S. [Reg. 23(1 A)]

(ii) Prior approval of Audit Committee [Reg. 23(2)]: All related party transactions and subsequent material modifications shall require prior approval of the audit committee.

(iii) Omnibus Approval Audit Committee [Reg.23(3)]: The “Audit Committee” may grant omnibus approval for related party transactions proposed to be entered into by the listed entity subject to the following conditions, namely-

(a) the audit committee shall lay down the criteria for granting the omnibus approval in line with the policy on related party transactions of the listed entity and such approval shall be applicable in respect of transactions which are repetitive in nature;

(b) The audit committee shall satisfy itself regarding the need for such omnibus approval and that such approval is in the interest of the listed entity;

(c) The omnibus approval shall specify:

(i) The name(s) of the related party, nature of transaction, period of transaction, maximum amount of transactions that shall be entered into,

(ii) The indicative base price / current contracted price and the formula for variation in the price if any; and