CS Professional Corporate Funding and Listing in Stock Exchanges Notes Study Material Important Questions

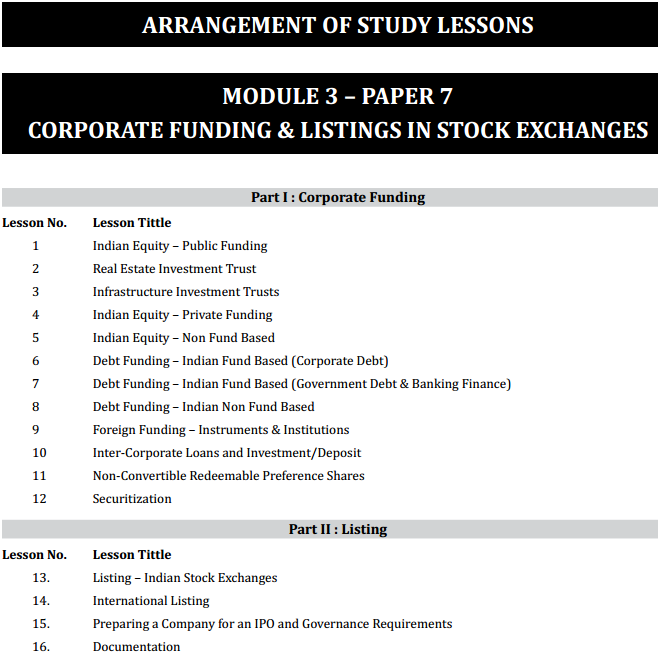

- Chapter 1 Indian Equity-Public Funding

- Chapter 2 Real Estate Investment Trust

- Chapter 3 Infrastructure Investment Trusts

- Chapter 4 Indian Equity-Private Funding

- Chapter 5 Indian Equity-Non Fund Based

- Chapter 6 Debt Funding-Indian Fund Based (Corporate Debt)

- Chapter 7 Debt Funding-Indian Fund Based (Government Debt & Banking Finance)

- Chapter 8 Debt Funding-Indian Non Fund Based

- Chapter 9 Foreign Funding-Instruments & Institutions

- Chapter 10 Inter-Corporate Loans and Investment/Deposit

- Chapter 11 Non-Convertible Redeemable Preference Shares

- Chapter 12 Securitization

- Chapter 13 Listing-Indian Stock Exchanges

- Chapter 14 International Listing

- Chapter 15 Preparing a Company for an IPO and Governance Requirements

- Chapter 16 Documentation

CS Professional Corporate Funding and Listing in Stock Exchanges Syllabus

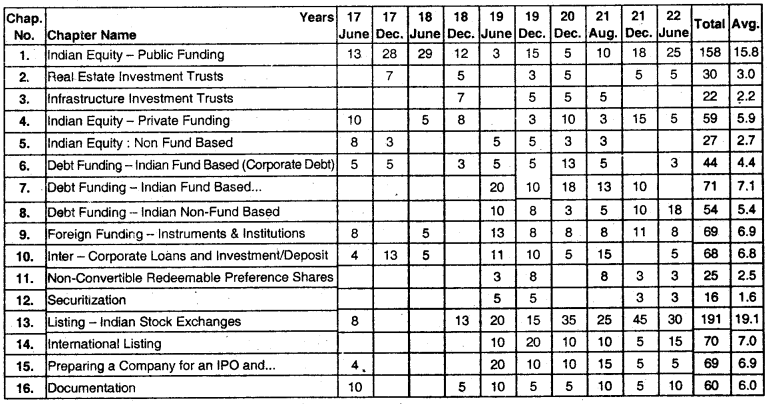

CS Professional Corporate Funding and Listing in Stock Exchanges Chapter Wise Weightage

Professional Programme Module 3

Paper 7 Corporate Funding & Listings in Stock Exchanges (Max. Marks 100)

Syllabus

Objective

Part I: To provide practical knowledge of finance available to corporates at their various stages of the journey, their suitability, pros and cons, process, compliances, etc.

Part II: To acquire knowledge of legal & procedural aspects of various types of listing, eligibility criteria, documentation, compliances, etc.

Detailed Contents

Part I: Corporate Funding (60 Marks)

1. Indian Equity – Public Funding: Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2009; Initial Public Offer (IPO)/ Further Public Offer (FPO); Preferential Allotment; Private Placement; Qualified Institutional Placement; Institutional Private Placement; Rights Issue; Fast Track Issue; Real Estate Investment Trust (REIT); Infrastructure Investment Trust (InvIT).

2. Indian Equity – Private Funding: Venture Capital; Alternative Investment Fund; Angel Funds; Seed Funding; Private Equity.

3. Indian Equity – Non Fund based: Bonus issue; Sweat Equity, ESOP.

4. Debt Funding – Indian Fund Based: Debentures, Bonds; Masala Bonds; Bank Finance; Project Finance including machinery or equipment loan against property, Loan against shares; Working Capital Finance- Overdrafts, Cash Credits, Bill Discounting, Factoring, etc. Islamic Banking.

5. Debt Funding – Indian Non Fund Based: Letter of Credit; Bank Guarantee; Stand by Letter of Credit, etc.

6. Foreign Funding – Instruments & Institutions: External Commercial Borrowing (ECB); American Depository Receipt (ADR)/Global Depository Receipt (GDR); Foreign Currency Convertible Bonds (FCCB); Foreign Currency Exchangeable Bonds (FCEB); International Finance Corporation (IFC), Asian Development Bank (ADB), International Monetary Fund (IMF).

7. Other Borrowings Tools: Inter-corporate Loans; Commercial Paper etc.; Deposits under the Companies Act; Customer Advances/Deposits.

8. Non-Convertible Instruments- Non-Convertible Redeemable Preference Shares (NCRPs) etc.

9. Securitization.

Part II: Listing (40 Marks)

10. Listing–Indian Stock Exchanges: Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015; Equity Listing (SME, ITP, Main); Debt Listing; Post listing disclosures.

11. International Listing: Applicability of Listing Regulations, Singapore Stock Exchange; Luxembourg Stock Exchange; NASDAQ-NGSM, NCM, NGM; London Stock Exchange-Main, AIM; U S Securities and Exchange Commission.

12. Various Procedural requirements for the issue of securities and Listing.

13. Preparing a Company for an IPO and Governance requirements after that, Appraising the Board and other organizational functions regarding the Post IPO/Listing Governance changes.

14. Documentation & Compliances.

Case Studies and Practical Aspects