How to Get Information about EPF Balance, Annual Statement, SMS, E-Passbook: EPF, which stands for Employee Provident Fund, serves as a saving tool for the employees. The employer and employee contributions for savings can be obtained after switching jobs or retirement. Access to EPF annual statement helps employees to plan their expenses, check the status of PF balance, and ail a loan again their EPF balance. Being a member or an employee of the EPFO, one does not have to wait for others to share the EPF balance statement at the end of the year.

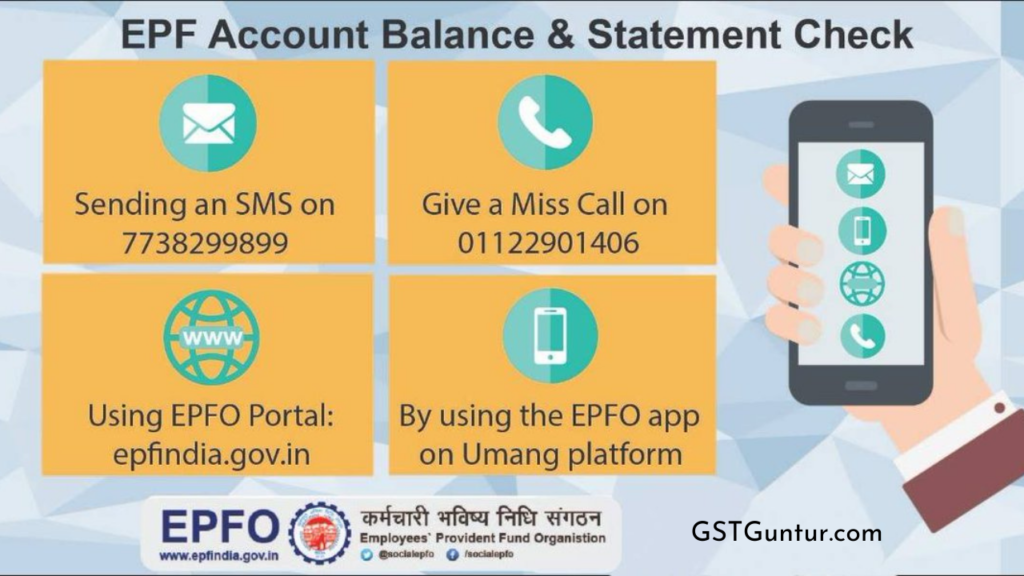

There are four ways to check Employee Provident Fund annual statement if UAN is registered and EPF is unexempted. These facilities involve UMANG App, SMS, EPFO Member, and Missed Call. However, if EPF is managed by any exempted establishment, then one has to follow a different method to check EPF annual statement.

What is EPF Balance?

Employee Provident Fund is a national scheme practised in India. The state as well as national government activists for all employees to pay their EPF. It occurs at the onset of employment where the employee and employer gave a certain amount. Some amount of money is saved at the employee EPF to provide for retirement.

Employee Provident Fund Organization (EPFO) pools together all the funds to help to maintain the accounts of the employee. These funds support the family members even after the employee is dead. From the 12% of the salary, family members can get insurance, medical services, and housing services. The salary PF deduction gets split where 8.33% of employees’ share goes to Employees Pension Scheme. EPS offers pensions for nominees, widow pension, or pension on disablement. The remaining 3.67% goes to the Employees Deposit Linked Insurance Scheme. It provides life insurance cover to the EPF member. The records of the account remain active even if the employee moves to a different job. However, it leads to the loss of some funds. The introduction of the UAN number solved this problem.

What is the UAN Number Associated with EPF?

UAN, which stands for Universal Account Number, is a 12-digit number allotted to all EPFO employees to help track their PF balance. This number helps employers in knowing the contributions made. Employees can follow up on their previous accounts to know EPF balance. The PF is linked to this number where the employee offers the number to new employers for contribution. UAN is useful to make withdrawals for the PF accounts. Apart from it, employees can enjoy several benefits such as check their statements, balance, and contribution.

How to Check PF Annual Statement for Unexempted Establishments?

EPF Passbook: EPF UAN passbook is accessible at the EPF website run by the EPFO. Visit the site, go to Settings, then For Employees section, and then Member Passbook. Here one can enter their Universal Account Number and password. Select the Member ID and see details related to opening balance, EPS Pension contribution by the employer in the passbook. Apart from it, there are details related to transfers and withdrawals made to or from the EPF account.

Send SMS: By sending an SMS to 7738299899, one can get the details of EPF balance and latest contribution. It is possible only if Universal Account Number is registered with the Employees’ Provident Fund Organization. One should send SMS EPFOHO UAN ENG on the number mentioned. Here ENG refers to the first three characters of the language preferred. It is available in different languages such as Punjabi, Hindi, Gujarati, Tamil, Marathi, Bengali, Malayalam, and English (default).

So, if one wants to receive a message in Punjabi, then they can type EPFOHO UAN PUN. The SMS received involves the information about UAN, Name, Aadhaar, DOB, Bank details, PAN, EPF balance, and last contribution made.

UMANG App: UMANG, which stands for Unified Mobile Application, is an evolving platform to avail central, regional, or state government services. It involves PAN, Indane Gas, EPFO, GST, HP Gas, NPS, DigiLocker, Bharat Gas, and more. The citizens of India can work seamlessly with the government. The passbook accessible at this app is similar to that on the EPF site. To get started, one has to go through a one-time registration process using a registered phone number. The app is not only useful to view the EPF passbook, but also to raise a claim, and track a claim.

- Download the UMANG app on Windows, Android, or iOS

- Select EPFO and there will be three types of services namely- General Services, Employee Centric, and Employer Centric Services

- By selecting Employee Centric Services, one can see view passbook, raise or track claim

- Click on the View Passbook to see EPF annual statement

Missed Call: Give a missed call on 011-22901406 from the mobile number registered on the UAN portal. One will receive an SMS that gives name, Universal account number, DOB, bank details, Aadhaar, PF balance statement, and the last contribution made.

How to Download the EPF e-passbook Online?

The EPFO does not provide any hard copy of the PF statement. EPF contributors can download their e-passbook or statement multiple times in a month. By using the e-passbook facility available on the EPFO website, one can download EPF annual statement. It is essential to first register with EPFO and enter information:

- Name

- Date of Birth

- Mobile Number

- Email ID

Any of the KYC documents among Voter ID Card, PAN Card, Driving License, Passport, or other, and the number appearing on it

After registering, active EPF funders can view plus download their PF balance statements. However, PF statements e-passbooks are not available for Private Trusts or exempted companies. It cannot be availed for settled or inoperative EPF accounts or a negative balance. To generate an e-passbook, one has to follow steps as mentioned below:

- Login to the EPFO website and register by giving above mentioned details

- Click on the label ‘Get PIN’

- Enter the PIN sent via message to the mentioned mobile number

- Click on the option ‘Download e-passbook’

- Select PF office state from the list mentioned

- Enter the company PF code

- Give PF account number and name mentioned in office records

- Click on the Get PIN tab and update the PIN sent

- After three working days, one can get their e-passbook online

How to Check the PF Balance of Exempted Companies?

There are more than Private Trusts in the country. Many large companies such as Wipro, Infosys, Sail, Nestle, TCS, Accenture, HDFC, and more, which have their own PF Trusts. Such private companies are discharged to contribute their EPF corpus with EPFO. These companies manage money with their trusts and have to give the same or higher return compared to EPFO managed funds. An employee of such exempted establishment cannot use the same methods of PF balance check as for an unexempted establishment. Some of the ways to check PF balance of exempted company:

Check out Salary Slip:

Most professional establishments give salary slips to their staff through internal mails. In these slips, one can find other enrolments apart from the details of salary. Along with it, some companies also issue the PF statement. Employees can find their EPF annual statement and monthly aids in that slip.

Log in to Company Site:

Many big companies maintain an employee portal in which one can find the EPF section. By going through the PF account details, one can see the EPF balance. TCS and Wipro are some companies that offer an online facility to check PF balance statements.

Consult HR Department:

In case, if one is not able to find EPF statement by the above-mentioned methods, then they can consult a senior in their office. Anyone, generally a professional HR department who deals with the EPF, can provide all the details.

Final Thoughts on EPF Balance, Account Statement

One can download PF annual statements for unexempted establishments by visiting the UMANG website, sending an SMS, e-passbook, or giving a missed call. For exempted companies, getting a PF statement is quite complicated and can be achieved by direct login on the company website or contact the HR department.