Cost of Capital – CA Inter FM Question Bank is designed strictly as per the latest syllabus and exam pattern.

Cost of Capital – CA Inter FM Question Bank

Question 1.

Explain the significance of Cost of Capital. (Nov 2019, 4 marks)

Answer

The cost of capital is important to arrive at correct amount and helps the management or an investor to take an appropriate decision. The correct cost of capital helps in the following decision-making:

| 1. Evaluation of Investment options | The estimated benefits (Future cash flows)from available investment opportunities (business or project) are converted into the present value of benefits by discounting them with the relevant cost of capital. Here it is pertinent to mention that every investment option may have different cost of capital hence it is very important to use the cost of capital which is relevant to the options available. Here Internal rate of return (IRR) is treated as cost of capital for evaluation of two options (projects). |

| 2. Performance Appraisal | Cost of capital is used to appraise the performance of a particulars project or business. The performance of a project or business in compared against the cost of capital which is known here as cut-off rate or hurdle rate. |

| 3. Designing of optimum credit policy | While appraising the credit period to be allowed to the customers, the cost of allowing credit period is compared against the benefit/profit earned by providing credit to customer of segment of customers. Here cost of capital is used to arrive to the present value of cost and benefits received. |

Question 2.

A Company issues ₹ 10,00,000 12% debentures of ₹ 100 each. The debentures are redeemable after the expiry of fixed period of 7 years. The Company is in 35% tax bracket.

Required:

(i) Calculate the cost of debt after tax, if debentures are issued at

(a) Par

(b) 10% Discount

(c) 10% Premium. (5 marks)

(ii) If brokerage is paid at 2%, what will be the cost of debentures, if issue is at par? (May 2006, 1 mark)

Answer:

(i) Cost of debenture after tax when debenture are issued:

(a) At par :-

Kd = \(\frac{1(1-t)+(R V-N P) / n}{(R V – N P) / 2} \)

= \(\frac{12(.65)+(100-100) / 7}{(100+100) / 2} \)

= 7.81%

(b) At 10% discount:-

= \(\frac{12(.65)+(100-90) / 7}{(100+90) / 2}\)

= 9.71%

(c) At 10% premium:-

= \(\frac{12(.65)+(100-110) / 7}{(100+110) / 2} \)

= 6.07%

(ii) Cost of debenture when brokerage paid @ 2% issued at par:

Kd = \(\frac{12(.65)+(100-98) / 7}{(100+98) / 2} \)

= \(\frac{7.8+29}{99}\)

= 8.17%.

Question 3.

Answer the following:

A company issues 25,000, 14% debentures of ₹ 1,000 each. The debentures are redeemable after the expiry period of 5 years. Tax rate applicable to the company ¡s 35% (including surcharge and education cess). Calculate the cost of debt after tax if debentures are issued at 5% discount with 2% flotation cost. (Nov 2015, 5 marks)

Answer:

Calculation of Cost of Debt after Tax:

Cost of Debt (Kd)

= \(\frac{\frac{1(1-t)+\left[\frac{R V-N P}{n}\right]}{R V+N P}}{2}\)

Where, I = Interest payment i.e. 14% of ₹ 1,000 = 140

t = Tax rate applicable to the company i.e. 35%

RV = Redeemable value of debentures i.e. ₹ 1,000

NP = Net proceeds per debentures

= ₹ 1,000 × (1 – (0.05 + 0.02))

= ₹ 1,000 × 0.93= 930

n = Redemption period of debentures i.e 5 years

Therefore, Kd = \(=\frac{₹ 140(1-0.35)+\left[\frac{₹ 1,000-₹ 930}{5 \text { year }}\right]}{\left[\frac{₹ 1,000+₹ 930}{2}\right]} \times 100\)

= \(\frac{₹ 91+₹ 14}{₹ 965} \times 100\) = 10.88 %

The Cost of Debt can also be calculated usinç the formula, where first Cost of Debt before tax is calculated and then tax adjustment is made.

Accordingly:

Cost of Debt = \(\frac{1+\left[\frac{R V-N P}{N}\right]}{\left[\frac{R V-N P}{2}\right]} \times(1-t) \times 100 \)

= \(\frac{₹ 140+14}{₹ 965}(1-0.35) \times 100\) = 10.37%.

![]()

Question 4.

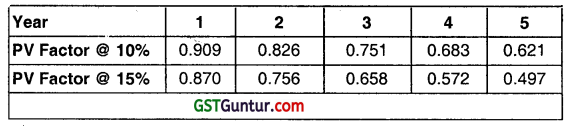

TT Ltd. issued 20,000, 10% convertible debentures of ₹ 1oo each with a maturity period of 5 years. At maturity, the debenture holders will have the option to convert debentures into equity shares of the company in ratio of 1: 5 (5 shares for each debenture). The current market price of the equity share is ₹ 20 each and historically the growth rate of the share is 4% per annum. Assuming tax rate is 25%. Compute the cost of 10% convertible debenture using Approximation Method and internal Rate of Return Method. PV Factors are as under:

(Nov 2020, 5 Marks)

Question 5.

Answer the following:

A company issued 40,000, 12% Redeemable Preference Shares of ₹ 100 each at a premium of ₹ 5 each, redeemable after 10 years at a premium of 10 each.

The floatation cost of each share is 2.

You are required to calculate cost of preference share capital ignoring dividend tax. (May 2013, 5 marks)

Answer:

Computation of Cost of Preference Shares (Kp)

Preference Dividend (PD) = 0.12 × 40,000 × 1oo = 4,80,000

Floatation Cost = 40,000 × 2 = 80,000

Net Proceeds (NP) = 42,00,000 – 80,000 =41 ,20,000

Redemption Value (RV) = 40,000 × 110= 44,00,000

Cost of Redeemable Preference Shares = \(\frac{\frac{P D+(R V-N P) / N}{R V+N P}}{2} \)

Kp = \(\frac{\frac{4,80,000+(44,00,000-41,20,000) / 10}{44,00,000+41,20,000}}{2}\)

= \(\frac{4,80,000+(2,80,000) / 10}{85,20,000 / 2}\)

= \(\frac{4,80,000+28,000}{42,60,000} \) = \(\frac{5,08,000}{42,60,000} \)

= 0.1192

Kp= 11.92%

Alternative Treatment:

Kp may be computed alternatively by taking the RV and NP for one unit of preferred e-shares. Final figure would remain unchanged.

Question 5.

Discuss the dividend-price approach, and earnings-price approach to estimate cost of Equity Capital. (Nov 2006, 2 marks)

Answer:

Dividend price approach: This approach emphasizes on dividend expected by an investor from a particular share to determines its cost. Cost of ordinary share is calculated on the basis of the present values of the expected future stream of dividend; whereas Earning price approach: Under this approach cost of ordinary share capital would be based on expected ratio of earnings of a company. This approach is similar to dividend price approach, only it seeks to nullify the effect of changes in dividend policy.

Question 6.

Distinguish between Unsystematic Risk and systematic Risk. (Nov 2020, 2 marks)

Question 7.

Piyush Loonker and Associates presently pay a dividend of ₹ 1.00 per share and has a share price of ₹ 20.00.

(i) If this dividend were expected to grow at a rate of 12% per annum forever, what is the firm’s expected or required return on equity using a dividend-discount model approach?

(ii) Instead of this situation in part (i), suppose that the dividends were expected to grow at a rate of 20% per annum for 5 years and 10% per year thereafter. Now what is the firm’s expected, or required, return on equity? (May 2001, 8 marks)

Answer:

(i) Firm’s expected or required return on equity (using a dividend discount model approach):

According to dividend discount model approach, the firm’s expected or required return on equity share capital is computed as follows:

ke= \(\frac{D_1}{P_0}+g \)

Where,

ke =Cost of equity share capital

D1 =Expected dividend at the end of year 1

P0 =Current market price of the share

g =Expected growth rate of dividend.

Given,

D1 =D0(1 +g) or ₹ 1(1 +0.12) = 1.12; P0 = ₹ 2 & g=12%

∴ Ke = \(\frac{1.12}{20}\) + 0.12 = 0.176 = 17.6 %

(ii) Firms expected or required return on equity:

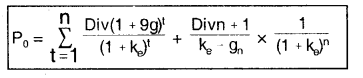

(If dividends were expected to grow at a rate ot 20% p.a. for 5 years & 10% p.a. thereafter): Since in this situation if dividends are expected to grow at a supernormal growth rate gs, for n years & thereafter, at a normal, perpetual growth rate of gn beginning in the year n+l then the cost of equity can be determined by using the following formula:

Where,

gs =Rate of growth in earlier years

gn =Rate of constant growth in later years

P0 =Discounted value of dividend stream

ke =Firm’s expected required return on equity

gs =20% for 5 years, gn = 10%

By trial & error, we are required to find out ke

Now, assume ke = 18%, then we will have:

P0 = 1.20 (0.8475) + ₹ 1.44 (0.7182) + ₹ 1.73 (0.6086) + ₹ 2.07

(0.51589) + ₹ 2.49 (0.43710) + ₹ 2.74 (0.4371) × \(\frac{1}{0.18-0.10}\)

=₹ 1.017+ ₹ 1.034+ ₹ 1.052+ ₹ 1.067+ ₹ 1.09+ ₹ 14.97 = ₹ 20.23

Since The Present Value of dividend stream is more than required it indicates that ke is greater than 18%.

Now, assume ke = 19% we will have:

P0 = ₹ 1.20 (0.8403) + ₹ 1.44 (0.7061) +₹ 1.73 (0.5934) + ₹ 2.07

(0.4986) + ₹ 2.49 (0.4190) + ₹ 2.74 (0.4190) × \(\frac{1}{0.19-0.10}\)

= ₹ 1.008 + ₹ 1.016 + ₹ 1.026 + ₹ 1.032 + ₹ 1.043 + ₹ 12.76 = ₹ 17.89

Since the market price of share (expected value of dividend stream) is ₹ 20. Therefore, the discount rate is closer to 18% than it is to 19%, we can get the exact rate by using the interpolation formula:

Ke = \(\frac{r-\left(P V_s-P V_D\right)}{\Delta P V} \times \Delta r \)

Where,

r =Either of two interest rates

PV =Present value of share

PVD =Present value of dividend stream

Δr =Difference in value of dividend stream

ΔPV = Difference in calculated P.V. of dividend stream

∴ Ke = \(\frac{18 \%-(₹ 20-₹ 20.23)}{₹ 20.23-₹ 1,789} \times 0.01 \)

= \(\frac{18 \%-(₹ 0.23)}{₹ 2.34} \times 0.01 \)

= \(\frac{18 \%+0.23}{2.34} \times 0.01 \)

= 18% + 0.10 = 18.10%

Therefore, the firm’s expected, or required, return on equity is 18.1 0%. At this rate, the present discounted value of dividend stream is equal to the market value of the shares.

Question 8.

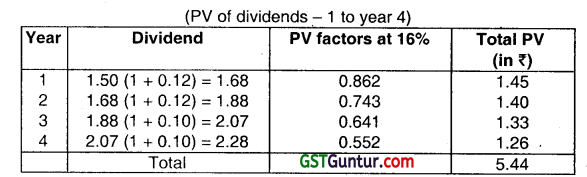

D Ltd. is foreseeing a growth rate of 12% per annum in the next two years. The growth rate is likely to be 10% for the third and fourth years. After that, the growth rate is expected to stabilize at 8% per annum. If the last dividend was ₹ 1.50 per share and the investor’s required rate of return is 16%, determine the current value of the equity share of the company.

The P.V. factors at 16%

| Year | 1 | 2 | 3 | 4 |

| P.V. factor | .862 | .743 | .641 | .552 |

(May 2005, 6 marks)

Answer:

The current value of the equity share of D Ltd. is a sum of the following:

(a) Present value (PV) of dividends payments during 1- 4 years; and

(b) Present value (PV) of expected market price at the end of the fourth year based on a constant growth rate of 8 percent.

Present value of the market price (P4) at the end of the 4th year

P4 = D5(Ke – g) = 2.28 (1.08)/(16% – 8%) = ₹ 30.78

PV of ₹ 30.78 = 30.78 × 0.552 = ₹ 16.99

Therefore Value of equity shares ₹ 5.44 +₹ 16.99 = ₹ 22.43

Question 9.

Answer the following:

Z Ltd.’s operating income (before interest and tax) is ₹ 9,00,000. The firm’s cost of debts ¡s lo per cent and currently firm employs ₹ 30,00,000 of debts. K0 is 12 percent.

Required:

Calculate the cost of equity. (Nov 2007, 3 marks)

Answer:

Total Value of firm = \(\frac{₹ 9,00,000}{12}\)

= 75,00,000

Debt capital: 30,00,000

Equity capital 45,00,000

12 = 10 \(\left(\frac{30,00,000}{75,00,000}\right)+K_e\left(\frac{45,00,000}{75,00,000}\right) \)

12 = 10(4)+Ke(6)

12 = 04+Ke. 6

08 = Ke.6

Ke = \(\frac{.08}{.6}]\)

= 0.1333

= 13.33%

Question 10.

Answer the following:

ABC Company’s equity share is quoted in the market at ₹ 25 per share currently. The company pays a divided of ₹ 2 per share and the investor’s market expects a growth rate of 6% per year.

You are required to:

(i) Calculate the company’s cost of equity capital.

(ii) If the anticipated growth rate is 8% per annum, calculate the indicated market price per share.

(iii) If the company issues 10% debentures of face value of ₹ 1oo each and realises ₹ 96 per debenture white the debentures are redeemable after 12 years at a premium of 12%, what will be the cost of debenture? Assume Tax Rate to be 50%. (Nov 2016, 5 marks)

Answer:

(i) Calculation of Cost of Equity Capital:

Ke = \(\frac{\mathrm{D}_1}{\mathrm{P}_0}+g\)

= \(\frac{2 \times 1.06}{25}\) + 0.06

= 0.0848 + 0.06

= 0.1448

= 14.48%.

![]()

(ii) Calculation the indicated Market price per share:

Ke = \(\frac{D_1}{P_0}+g\)

∴ 0.14 = \(\frac{2}{x}\) + 0.08

∴ 0.14- 0.08 = \(\frac{2}{x}\)

∴ x(0.06) = 2

∴ x = 33.33

Hence, the market price will be ₹ 33.33.

(iii) Calculation of Cost of Debenture:

Kd = \(\frac{I(1-t)+\left(\frac{R V-N P}{N}\right)}{\frac{R V+N P}{2}}\)

= \(\frac{10(1-0.50)+\left(\frac{112-96}{12}\right)}{\frac{112+96}{2}} \)

= \(\frac{5+1.33}{104} \)

= \(\frac{6.33}{104}\)

= 0.0608

= 6.08%.

Question 11.

Answer the following:

Y Ltd. retains ₹ 7,50,000 out of its current earnings. The expected rate of return to the shareholders If they had invested the funds elsewhere is 10%. The brokerage is 3% and the shareholders came in 30% tax bracket. Calculate the cost of retained earnings. (Nov 2009, 2 marks)

Answer:

Computation of Cost of Retained Earnings (Kr)

Kr = K (1 -Tp) – Brokerage

Kr = 0.10(1-0.30) 0.03

= 0.04 or 4%

Cost of Retained Earnings = 6.79%

Question 12.

Answer the following:

What do you understand by Weighted Average Cost of Capital? (Nov 2009, 3 marks)

Answer:

Computation of overall cost of capital of a firm involves:

1. Computation of weighted average cost of capital

2. Computation of cost of specific source of finance.

1. Computation of Weighted Average Cost of Capital (WACC): Weighted average cost of capital is the average cost of the costs of various sources of financing. Weighted average cost of capital is also known as composite cost of capital, overall cost of capital or average cost of capital. Once the specific cost of individual sources of finance is determined, we can compute the weighted average cost of capital by putting weights to the specific costs of capital in proportion to the various sources of firm to the total. The weights may be given either by using the book value of the sources or market value of the sources.

WACC = (Proportion of Equity x Cost of Equity) + (Proportion of Preference x Cost of Preference) + (Proportion of Debt x Cost of Debt) For the above formula, we consider some assumptions in order to simplify and make it calculative. These are:

(i) We consider only three types of capital: Equity, non-convertible & non-cancellable preference shares and non-convertible & non-cancellable debts so, we have to ignore other forms of capital. because cost of these forms of capital is very difficult to calculate due to its complexities. Generally, such types of financing covers a minor part only, so it should be excluded as it cannot make any material difference.

(ii) Debts Include: Long-term debts as well as short-term debts (i.e. working capital loan, commercial papers etc.)

(iii) Non-interest: Bearing liabilities such as trade creditors are not included in the calculation of WACC. This is done to ensure the consistency in reality. Such types of securities have costs but such costs are indirectly reflected in the price paid by the co. at the time of getting the goods & services.

Question 13.

XYZ Ltd. has the following book value capital structure:

Equity Capital (in shares of ₹ 1o each, fully paid up – at par) ₹ 15 crores

11 % Preference Capital (in shares of ₹ 1oo each, fully paid up – at par) ₹ 1 crore

Retained Earnings ₹ 20 crores

13.5% Debentures (of ₹ 100 each) ₹ 10 crores

15% Term Loans ₹ 12.5 crores.

The next expected dividend on equity shares per share is 3.60; the

dividend per share is expected to grow at the rate of 7%. The market price per share is 40.

Preference stock, redeemabe after ten years, is currently selling at 75 per share.

Debentures, redeemable after six years, are selling at 80 per debenture.

The Income-tax rate for the company is 40%.

(i) Required:

Calculate the weighted average cost of capital using:

(a) book value proportions; and

(b) market value proportions. (Nov 2000, 6 marks)

Answer:

Note: Since Retained earnings are treated as equity capital for purposes of calculation of the cost of specific sources of finance, the market value of the ordinary shows may be taken to represent the combined market value of equity shares & retained earnings. The separate market values of retained earnings & ordinary shares may also be worked out by allocating to each of these a percentage of total market value equal to their percentage share of the total based on book values.

Question 14.

JKL Ltd. has the following book-value capital structure as on March 31, 2003.

Equity share capital (2,00,000 shares) ₹ 40,00,000

11.5% preference shares 10,00,000

![]()

The equity share of the company sells for ₹ 20. It is expected that the company will pay next year a dividend of ₹ 2 per equity share, which is expected to grow at 5% p.a. forever. Assume a 35% corporate tax rate.

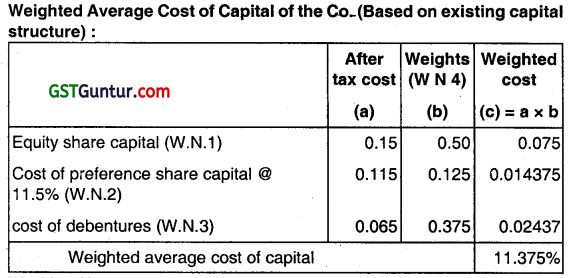

Required:

(i) Compute weighted average cost of capital (WACC) of the company based on the existing capital structure.

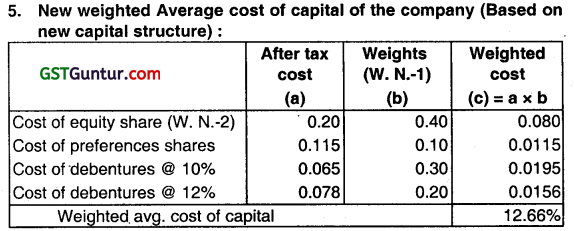

(ii) Compute the new WACC, if the company raises an additional ₹ 20 lakhs debt by issuing 12% debentures. This would result in increasing the expected equity dividend to ₹ 2.40 and leave the growth rate unchanged, but the price of equity shares will fall to ₹ 16 per share.

(iii) Comment on the use of weights in the computation of weighted average cost of capital. (May 2003, 3+3+2 = 8 marks)

Answer:

Working Notes:

1. Cost of equity capital:

Ke = \(\frac{\text { Dividend }}{\text { Current W.P. }}\) + g

= \(\frac{2}{20}\) + 5 % = 0.15

2. Cost of preference share capital:

![]()

= \(\frac{1,15,000}{10,00,000}\) = 0.115

3. Cost of debentures:

\(\frac{1}{\text { Net Proceeds }}\) (Interest Tax) .

= \(\frac{1}{30,00,000}\) (3,00,000 – 1,05,000) = 0.065

4. Weights of equity share capital, preference share capital & debentures in total investment of ₹ 80,00,000:

Weight of equity share capital = \(\frac{\text { Total equity }}{\text { Total Investment }}=\frac{40,00,000}{80,00,000}\) = 0.50

Weight of Preference share capital = \(\frac{\text { Total Preference share }}{\text { Total Investment }} \)

= \(\frac{10,00,000}{80,00,000}\) = 0.15

Weight of debenture = \(\frac{\text { Total debentures }}{\text { Total Investments }}=\frac{30,00,000}{80,00,000}\) = 0.375

Working Notes:

1. Weights of equity, preference & debentures in total Investment of ₹ 1,00,00,000:

Weight of equity hare = \(\frac{40,00,000}{1,00,00,000}\) = 0.4

Weight of Preference share = \(\frac{10,00,000}{1,00,00,000}\) = 0.10

Weight of debenture @ 10% = \(\frac{30,00,000}{1,00,00,000}\) = 0.30

Weight of debenture @ 12% = \(\frac{20,00,000}{1,00,00,000} \) = 0.20

2. Cost of equity capital: ‘

ke= +g

= \(\frac{2.40}{16}\) + 5 % = 20%

3. Comment:

On the computation of weighted average cost of capital weights are preferred to Book value. e.g. weights representing the capital structure under a corporate financing situation, its cash flows are preferred to earnings & market. Balance sheet is preferred to book value Balance sheet.

![]()

Question 15.

ABC Limited has the following book value capital structure:

Equity Share Capital (150 million shares, ₹ 10 par) ₹ 1,500 million

Reserves and Surplus ₹ 2,250 million

10.5% Preference Share Capital

(1 million shares, ₹ 100 par) ₹ 1oo million

9.5% Debentures (1.5 million debentures, ₹ 1000 par) ₹ 1,500 million

8.5% Term Loans from Financial Institutions 500 million

The debentures of ABC Limited are redeemable after three years and are quoting at 981.05 per debenture. The applicable income tax rate for the company is 35%.

The current market price per equity share is ₹ 60. The prevailing default risk-free interest rate on 10-year GOI Treasury Bonds is 5.5%. The average market risk premium is 8%. The beta of the company is 1.1875. The preferred stock of the company is redeemable after 5 years is currently selling at ₹ 98.15 per preference share.

Required:

(i) Calculate weighted average cost of capital of the company using market value weights.

(ii) Define the marginal cost of capital schedule for the firm if it raises ₹ 750 million for a new project. The firm plans to have a target debt-to-value ratio of 20%. The beta of new project is 1.4375. The debt capital will be raised through term loans, It will carry interest rate of 9.5% for the first 100 million and 10% for the next ₹ 50 million. (May 2004, 6 + 3 = 9 marks)

Answer:

Working Notes:

1. Computation of cost of debentures (kd):

981.05 = \(\frac{95}{(1+\mathrm{YTM})^1}+\frac{95}{(1+\mathrm{YTM})^2}+\frac{1,095}{(1+\mathrm{YTM})^3} \) (yield to maturity (ytm)

= 10% appx.)

kd = YTM × (1-Tc)

=10% × (1-0.35)

=6.5%

2. Computation of cost of term loans (kt):

=i × (1 – Te)

= 8.5% (1 – 0.35)

= 5.525%

3. Computation of cost of Preference capital (kp):

98.5 = \(\frac{10.5}{(1+Y T M)^1}+\frac{10.5}{(1+Y T M)^2}+\frac{10.5}{(1+Y T M)^3}+\frac{10.5}{(1+Y T M)^4}+\frac{10.5}{(1+Y T M)^5}\)

YTM= 11%App.

Kp = 11%

4. Computation of cost of equity (ke):

= rf + Avg. market risk premium x I3eta

= 5.5% + 8% × 1.175

= 15%

5. Computation of proportion of equity capital, preference share, debenture & term loans In the market value of capital structure:

(i) Weighted Average Cost of capital (WACC):

Using market value weights:

WACC = \(\left(k_d \times \frac{D}{V}\right)+\left(k_T \times \frac{T}{V}\right)+\left(k_p \times \frac{P}{V}\right)+\left(k_\sigma \times \frac{E}{V}\right) \)

= (6.5% × 0.1329)+ (5.25% × 0.04517)+(11% × 0.0089)+ (15% × 0.813)

= 0.008638 + 0.002495 + 0.00097 + 0.121 95 = 13.41%

For the values of kd, kt,kp, & ke & weights refer to W. N. I to 5 respectively.

(ii) Marginal cost of capital (MCC) schedule:

ke (New project) = 5.5% +8% x 1.4375= 17%

kd= 9.5% × (1-0.35) = 6.175%

= 10% × (1-0.35)= 6.5%

MCC = 17% × 0.80 + 6.175% × \(\frac{100}{750} \) +6.5% × \(\frac{50}{750} \)

= 14.86% (appx.)

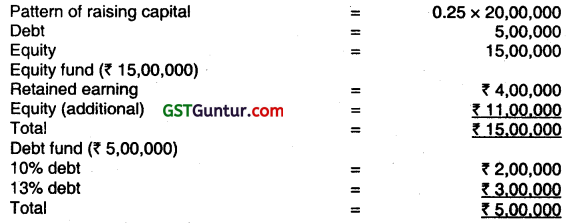

Question 16.

ABC Ltd. wishes to raise additional finance of ₹ 20 Iakhs for meeting its investment plans. The company has ₹ 4,00,000 in the form of retained earnings available for investment purposes. The following are the further details:

Debt-equity ratio 25: 75.

Cost of debt at the rate of 10 percent (before tax) up to ₹ 2,00,000 and 13% (before tax) beyond that.

Earning per share, ₹ 12.

Dividend payout 50% of earnings.

Expected growth rate in dividends 10%.

Current market price per share, ₹ 60.

Company’s tax rate is 30% and shareholder’s personal tax rate is 20%.

Required:

(i) Calculate the post-tax average cost of additional debt.

(ii) Calculate the cost of retained earnings and cost of equity.

(iii) Calculate the overall weighted average (after tax) cost of additional finance. (May 2008, 2+3+3 = 8 marks)

Answer:

(i) Kd = Total Interest (1 – t) /₹ 5,00,000

= [20,000 + 39,000] (1 -0.3)/5,00,000 or (41,300/5,00,000) × 100

= 8.26 %

(ii) Ke = EPS × payout/mp +g= 12 (50%) /60 × 100+ 10% 10% + 10% = 20%

Kr = Ke (1 -tp) = 20(1 -0.2) = 16%

Ko = (3,25,300/20,00,000) × 100 = 16.27%

Question 17.

The capital structure of MNP Ltd. is as under:

Additional information:

(i) ₹ 100 per debenture redeemable at par has 2% floatation cost and 10 years of maturity. The market price per debenture is ₹ 105.

(ii) ₹ 1oo per preference share redeemable at par has 3% floatation cost and 10 years of maturity. The market price per preference share is ₹ 106.

(iii) Equity share has ₹ 4 floatation cost and market price per share of ₹ 24. The next year expected dividend is ₹ 2 per share with annual growth of 5%. The firm has a practice of paying all earnings in the form of dividends.

(vi) Corporate Income- tax rate is 35 %.

Required:

Calculate Weighted Average Cost of Capital (WACC) using market value weights. (May 2009, 9 marks)

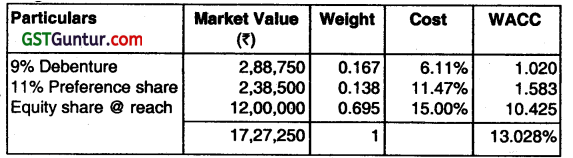

Answer:

Calculation of Weighted Average Cost of Capital by using market value weights:

WACC using market value weight = 13.02%

Working Notes:

Calculation of cost of Redeemable debenture:

Kd = \(=\frac{\text { Interest }(1-\text { taxrate })+\left[\frac{\text { Redeemablevalue }- \text { Issueprice }}{\text { No. of years }}\right]}{\left[\frac{\text { Redeemablevalue }+ \text { IssuePrice }}{2}\right]} \times 100\)

OR

kd = \(\frac{(1-t)+(R V-N P) / N}{(R V+N P) / 2}\)

kd = \(\frac{9(1-.35)+\left[\frac{100-98}{10}\right]}{\left[\frac{100+98}{2}\right]} \times 100 \)

kd = 6.11 %

Kp = \(\frac{\text { Preference dividend }+\left[\frac{\text { Redeemablevalue }- \text { Issueprice }}{\text { No. of years }}\right]}{\left[\frac{\text { Redeemablevalue }+ \text { IssuePrice }}{2}\right]} \times 100 \)

Or

Kp = \(\frac{P D+(R V-N P) / N}{(R V+N P) 2} \times 100\)

Kp = \(\frac{11+\frac{(100-97)}{10}}{\frac{100+97}{2}} \times 100\)

Kp = 11.47%

Cost of equity:

Ke = \(\frac{D_1}{P_0}+g \)

Ke = \(\frac{2}{(24-4)}\) + 0.05 = 15%

Ke = \(\frac{\text { Expected Dividend }}{\text { Current market price }} \) + Growth rate

Question 18.

Answer the following:

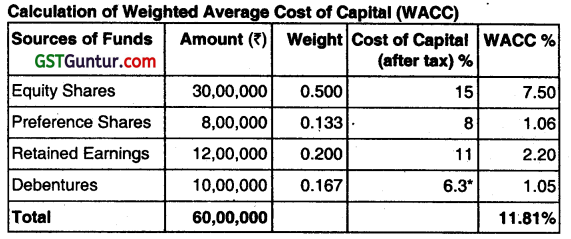

(i) SK Limited has obtained funds from the following sources, the specific cost are also given against them:

Source of funds Amount ₹ Cost of Capital

Equity shares 30,00,000 15 percent

Preference shares 8,00,000 8 percent

Retained earnings 12,00,000 11 percent

Debentures 10,00,000 9 percent (before tax)

You are required to calculate weighted average cost of capital. Assume that Corporate tax rate is 30 percent. (May 2010, 3 marks)

Answer:

Cost of Debentures (Kd) (after tax) = Kd (before tax) × (1 – T)

=9%(1 – 0.3) = 6.3%

Weighted Average Cost of Capital = 11.81 %

Question 19.

Answer the following:

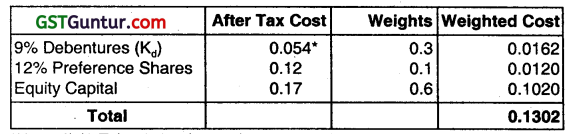

PQR Ltd. has the following capital structure on October 31, 2010:

Equity Share Capital ₹ 20,00,000

(2,00,000 Shares of ₹ 10 each)

The market price of equity share is ₹ 30. It is expected that the company will pay next year a dividend of ₹3 per share, which will grow at 7% forever.

Assume 40% income tax rate.

You are required to compute weighted average cost of capital using market value weights. (Nov 2010, 5 marks)

Answer:

Computation of Weighted Average Cost of Capital (WACC): Existing Capital Structure

Calculation of Cost of Equity

Cost of Equity = \(\frac{D_1}{P_0}\) + g

= \(\frac{₹ 3}{₹ 30} \) + 0.07 = 0.1 + 0.07 = 0.17 = 17%

Kd = rd (1-Tc) = 9% × (1 -0.4) = 5.4% or 0.054

Weighted Average Cost of Capital =0.1302 or 13.02%

Question 20.

Answer the following:

Beeta Ltd. has furnished the following information:

Earning per share (EPS) ₹ 4

Dividend payout ratio 25%

Market price per share ₹ 40

Rate of Tax 30%

Growth rate of dividend 8%

The company wants to raise additional capital of ₹ 10 lakhs including debt of ₹ 4 lakhs. The cost of debt (before tax) is 10% up to ₹ 2 lakhs and 15% beyond that. Compute the after-tax cost of equity and debt and the weighted average cost of capital. (Nov 2011, 5 marks)

Answer:

Cost of Equity Share Capital (Ke)

Ke (after tax) = \(\left(\frac{\mathrm{DPS}}{\mathrm{MPS}} \times 100\right) \) + G

DPS= 25% of ₹ 4 = ₹ 1.00

Ke = (\(\frac{1}{40}\) × 100) +8

Ke = 10.5%

(ii) Cost of Debt (Kd)

Kd = \(\frac{\text { Interest }}{\text { Net Proceeds }} \times 100 \times(1-\mathrm{T}) \)

Kd = \(\frac{50,000}{4,00,000}\) × 100 × (1 – 0.3) = 8.75 %

Question 21.

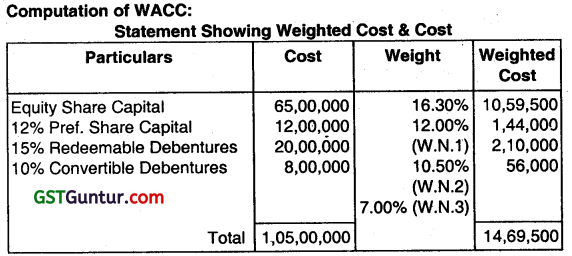

The following details are provided by the GPS Limited:

Equity Share Capital ₹ 65,00,000

12% Preference Share Capital ₹ 12,00,000

15% Redeemable Debentures ₹ 20,00,000

10% Convertible Debentures ₹ 8,00,000

The cost of equity capital for the company is 16.30% and the Income Tax rate for the company is 30%. You are required to calculate the Weighted Average Cost of Capital (WACC) of the company. (May 2014, 5 marks)

Answer:

Weighted Average Cost of Capital = \(\frac{\text { Weighted Cost }}{\text { Total Cost }} \)

= \(\frac{14,69,500}{1,05,00,000} \)

= 0.1399 or

= 13.99%

Working Notes:

1. Calculation of Cost of Preference Shares:

Kp = \(\frac{D_p}{N P}=\frac{1,44,000}{12,00,000}\) 1,44,000 = 0.12 = 12%

2. Calculation of Cost of 15% Redeemable Debentures:

Kd = \(\frac{I(1-t)}{N P}=\frac{3,00,000(1-0.30)}{20,00,000} \) = 0.105 = 10.5%

3. Calculation of Cost of 10% Convertible Debentures:

Kd = \(\frac{I(1-t)}{N P}=\frac{80,000(1-0.30)}{8,00,000}\) = 0.07 = 7%

![]()

Question 22.

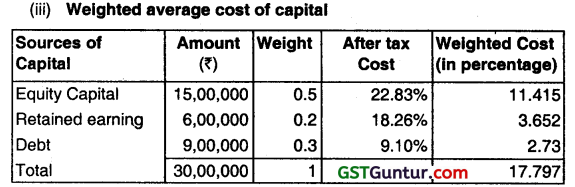

A Ltd. wishes to raise additional finance of ₹ 30 lakhs for meeting its investment plans. The company has ₹ 6,00,000 in the form of retained earnings available for Investment purposes.

The following are the further details:

Debt-equity ratio – 30:70

Cost of debt at the rate of 11 % (before tax) upto ₹ 3,00,000 and 14% (before tax) beyond that.

Earnings per share – 15.

Dividend payout – 70% of earnings.

Expected growth rate in dividend – 10%.

Current market price per share – ₹ 90.

Company’s tax rate is 30% and shareholder’s Personal tax rate is 20%.

You are required to:

(i) Calculate the post-tax average cost of additional debt.

(ii) Calculate the cost of retained earnings and cost of equity.

(iii) Calculate the overall weighted average (after tax) cost of additional finance. (May 2015, 8 marks)

Answer:

Pattern of raising capital = 0.30 x 30,00,000

Debt = 9,00,000

Equity = 21,00,000

(i) Kd = \(\frac{\text { Total Interest }(1-t)}{₹ 9,00,000} \times 100\)

\(\frac{₹ 33,000+₹ 84,000(1-0.3)}{₹ 9,00,000} \times 100\)

Or = \(\frac{₹ 81,900}{₹ 9,00,000} \times 100\) = 9.10%

(ii) Ke = \(\left[\frac{(\text { EPS } \times \text { Payout })(1+g)}{M P} \times 100\right] \) + g

= \(\left[\frac{(₹ 15 \times 0.7) \times 1.1}{₹ 90} \times 100\right]\) + 10%

= \(\left[\frac{₹ 11.55}{₹ 90} \times 100\right] \) + 10% = 22.83%

Kr = Ke (1 – tp) = 22.83%(1 -0.2) = 18.26%

Ke is calculated based on dividend growth model

Kd = Cost of capital; Ke = Cost of equity; Kr = Cost of retained earnings;

Mp = Market price; g = growth; tp = Shareholder’s personal tax;

K0 = Cost of overall capital

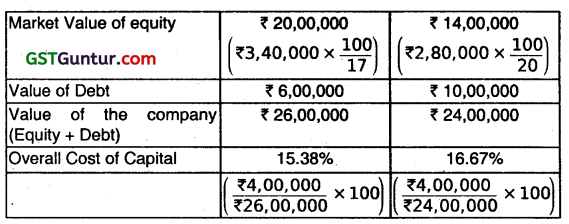

Question 23.

RST Ltd. is expecting an EBIT of ₹ 4 lakhs for F.Y. 2015-16. Presently the company is financed entirely by equity share capital of ₹ 20 lakhs with equity capitalization rate of 16%. The company rs contemplating to redeem part of the capital by introducing debt financing. The company has two options to raise debt to the extent of 30% or 50% of the total fund. It is expected that for debt financing upto 30%, the rate of interest will be 10% and equity capitalization rate will increase to 17%. If the company opts for 50% debt, then the interest rate will be 12% and equity capitalization rate will be 20%. You are required to compute value of the company; its overall cost of capital under different options and also state which is the best option. (Nov 2015, 8 marks)

Answer:

Working Note:

1. Calculation of Market Value of Equity:

Equity Capital Rate = \(\frac{\text { EBIT }}{\text { Market Value }} \)

16% = \(\frac{4,00,000}{\text { Market Value }} \)

Market Value = 25,00,000

Computation of Value of the Company and Overall Cost of Capital under the two options:

| Particulars | Option I | Option II |

| Debt | 30% | 50% |

| Equity (existing) | ₹ 20,00,000 | ₹ 20,00,000 |

| Debt | ₹ 6,00,000 | ₹ 10,00,000 |

| Equity capitalization rate | 17% | 20% |

| Interest on Debt | 10% | 12% |

| EBIT | ₹ 4,00,000 | ₹ 4,00,000 |

| Less: Interest on Debt | ₹ 60,000 | ₹ 1,20,000 |

| Earnings to equity shareholders | ₹ 3,40,000 | ₹ 2,80,000 |

Since, in Option I value of the Company is more and overall cost of Capital is less compared to Option II, hence Option I is better.

Question 24.

Following is the capital structure of RBT Limited as on 31st March 2016:

| Particulars | Book Value (₹) | Market Value (₹) |

| Equity Shares of ₹ 10 each | 50,00,000 | 1,05,00,000 |

| Retained earnings | 13,00,000 | – |

| 11% Preference shares of ₹ 100 each | 7,00,000 | 9,00,000 |

| 14% debentures of ₹ 100 each | 30,00,000 | 36,00,000 |

Market price of equity shares is ₹ 40 per share and it is expected that a dividend of ₹ 4 per share would be declared. The dividend per share is expected to grow at the rate of 8% every year. Income tax rate applicable to the company is 40% and shareholder’s personal income tax rate is 20%.

You are required to calculate:

(i) Cost of capital for each source of capital,

(ii) Weighted average cost of capital on the basis of book value weights,

(iii) Weighted average cost of capital on the basis of market value weights. (Nov 2016, 8 marks)

Answer:

(I) Cost of Capital:

(a) Cost of Equity Share Capital (Ke)

Ke = \(\frac{D_0(1+g)}{P_0}+g\)

= \(\frac{4(1+0.08)}{40}\) +0.08

= \(\frac{4.32}{40} \) +0.08

= 0.188 or 18.8%

(b) Cost of Retained earnings (Ks)

Ks = Ke (1 – tp) = 18.8 (1 .0.2) = 15.04%.

(c) Cost of Preference share (Kp)

Kp = 11%

(d) Cost of debentures (Kd)

Kd = r(1 -t)

=14% (1 -0.4)=0.084 = 8.4%

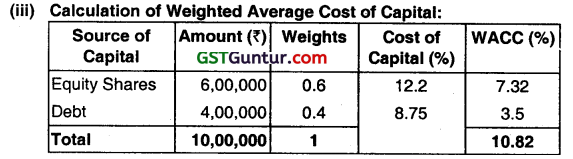

Question 25.

Alpha Ltd. has furnished the following information:

Earning Per Share (EPS) ₹ 4

Dividend payout ratio 25%

Market price per share 50

Rate of tax 30%

Growth rate of dividend 10%

The company wants to raise additional capital of ₹ 10 lakhs including debt of ₹ 4 lakhs. The cost of debt (before tax) is 10% up to ₹ 2 lakhs and 15% beyond that. Compute the after-tax cost of equity and debt and also weighted average cost of capital. (May 2019, 5 marks)

Answer:

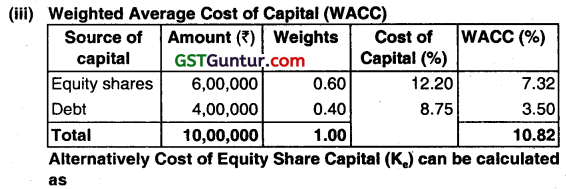

(i) Cost of Equity Share Capital (Ke):

Ke = \(\frac{D_0(1+g)}{P_0}+g \)

= \(\frac{25 \% \text { of } ₹ 4(1+0.1)}{₹ 50}+0.10\)

= \(\frac{₹ 1.10}{₹ 50}+0.10 \)

Ke = 0.122 i.e. 12.20%

(ii) Cost of debt (kd):

Kd = \(\frac{\text { Interest }}{\text { NetProceeds }} \times 100 \times(1-t) \)

Interest on First ₹ 2,00,000 @ 10% = ₹ 20,000

Interest on next ₹ 2,00,000 @ 15% = ₹ 30,000

Kd = \(\frac{₹ 50,000}{₹ 4,00,000} \times(1-0.3) \)

Kd = 0.0875 i.e. 8.75%

Alternate Solution:

(i) Cost of Equity Share Capital (Ke)

Ke = \(\frac{D_0(1+g)}{P_0}+g=\frac{25 \% \text { of } ₹ 4(1+0.10)}{₹ 50}+0.10 \)

= \(\frac{₹ 1.10}{₹ 50}+0.10 \) = 0.122 or 12.2%

(ii) Cost of Debt (Kd)

Kd = \(\frac{\text { Interest }}{\text { Net Proceeds }} \times 100 \times(1-t) \)

Interest on First ₹ 2,00,000 @ 10% = ₹ 20,000

Interest on next ₹ 2,00,000 @ 15% = ₹ 30,000

Kd = \(\frac{50,000}{4,00,000} \) × (1 – 0.3) = 0.0875 or 8.75%

Ke = \(\frac{\mathrm{D}}{\mathrm{P}_0} \) + g = \(\frac{25 \% \text { of } ₹ 4}{₹ 50}+0.10 \) = \(\frac{₹ 1.00}{₹ 50}+0.10\) = 0.120 or 12.00%

Accordingly Weighted Average Cost of Capital (WACC)

Question 26.

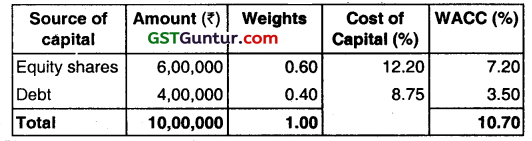

A Company wants to raise additional finance of ₹ 5 crore in the next year.

The company expects to retain ₹ 1 crore earning next year. Further details are as follows:

(i) The amount will be raised by equity and debt in the ratio of 3:1.

(ii) The additional issue of equity shares will result in price per share being fixed at ₹ 25.

(iii) The debt capital raised by way of term loan will cost 10% for the first ₹ 75 lakh and 12% for the next ₹ 50 lakh.

(iv) The net expected dividend on equity shares is ₹ 2.00 per share. The dividend is expected to grow at the rate of 5%.

(v) Income tax rate is 25%.

You are required:

(a) To determine the amount of equity and debt for raising additional finance.

(b) To determine the post-tax average cost of additional debt.

(c) To determine the cost of retained earnings and cost of equity.

(d) To compute the overall weighted average cost of additional finance after tax. (Nov 2019, 10 marks)

Answer:

(a) The amount of equity and debt for raising additional Finance:

Equity = ₹ 5Cr. × \(\frac{3}{4} \) = ₹ 3.75Cr.

Debt = ₹ 5 Cr. × \(\frac{1}{4} \) = ₹ 1.25 Cr.

(b) Determination of post-tax average cost of additional debt:

Kd = I (1-t)

Where, I = Interest Rate

t = Corporate tax rate

on ₹ 0.75 Cr. = 10% (1- 0.25) = 7.5% or 0.075

on ₹ 0.50 Cr. = 12% (1 – 0.25) = 9% or 0.09

The average cost of debt

= \(\frac{(₹ 0.75 \mathrm{Cr} . \times 0.075)+(0.50 \times 0.09)}{₹ 1.25 \mathrm{Cr} .} \times 100\)

Kd = 8.1%.

(c) Determination of cost of retained earnings and cost of equity applying dividend growth model.

Ke = \(\frac{D_1}{P_0} \) +9

Where, Ke = Cost of equity

D1 = D0 (1+9)

D0 = Dividend paid (i.e. 2)

g = Growth rate

P0 = Current market price per share

Then,

Ke = \(\frac{₹ 2(1.05)}{₹ 25} \) + 005

= 0.084 + 0.05

=0.134

= 13.4%

Question 27.

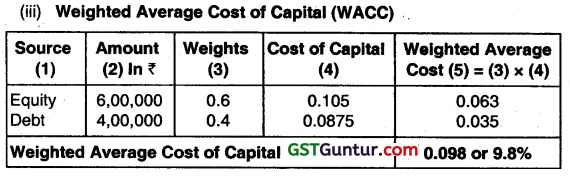

The Capital structure of PQR Ltd. is as follows:

| ₹ | |

| 10% Debenture | 3,00,000 |

| 12% Preference Shares | 2,50,000 |

| Equity Share (face value ₹ 10 per share) | 5,00,000 |

| 10,50,000 |

Additional Information:

(i) ₹ 1oo per debenture redeemable at par has 2% floatation cost & 10 years of maturity. The market price per debenture is ₹ 110.

(ii) ₹ 100 per preference share redeemable at par has 3% floatation cost & 10 years of maturity. The market price per preference share is ₹ 108.

(iii) Equity share has ₹ 4 floatation cost and market price per share of ₹ 25. The next year expected dividend is ₹ 2 per share with annual growth of 5%. The firm has a practice of paying all earnings in the form of dividends.

(iv) Corporate Income Tax rate is 30%.

Required:

Calculate Weighted Average Cost of Capital (WACC) using market value weights. (Jan 2021, 10 marks)

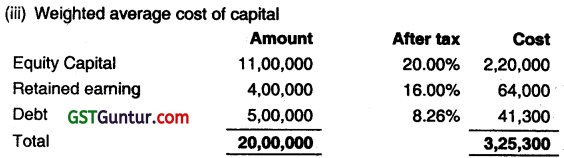

Question 28.

Navya Limited to wishes to raise additional capital of ₹ 10 lakhs for meeting its modernization plan. it has ₹ 3,00,000 in the form of retained earnings available for investments purposes. The following are the further details:

Debt equity mix 40%/60%

Cost of debt (before tax)

Upto ₹1,80,000 10%

Beyond ₹ 1,80,000 16%

Earnings per share ₹ 4

Dividend payout ₹ 2

Expected growth rate in dividend 10%

Current market price per share ₹ 44

Tax rate 50%

Required:

(i) To determine the pattern for raising the additional finance.

(ii) To calculate the post-tax average cost of additional debt.

(iii) To calculate the cost of retained earning and cost of equity, and

(iv) To determine the overall weighted average cost of capital (after tax).

Answer:

(i) Pattern of Raising Additional Finance

Equity = 10,00,000 × 60/100 = ₹ 600000

Debt = 10,00,000 × 40/100 = ₹ 4,00,000

Capital structure after Raising Additional Finance

| Sources of fund | Amount (₹) |

| Shareholder’s funds | |

| Equity capital (6,00,000 – 3,00,000) | 3,00,000 |

| Retained earnings | 3,00,000 |

| Debt at 10% p.a. | 1,80,000 |

| Debt at 16% p.a. (4,00,000 – 1,80,000) | 2,20,000 |

| Total funds | 10,00,000 |

(ii) Post-tax Average Cost of Additional Debt

Kd = I (1- t), where ‘Kd’ is cost of debt, ‘I’ is interest, and ‘t’ tax rate.

On ₹ 1,80,000 = 10% (1- 0.5) = 5% or 0.05

On ₹ 2,20,000 = 16% (1 – 0.5) =8% or 0.08

Average Cost of Debt (Post tax) i.e.

Kd = \(\frac{(1,80,000 \times 0.05)+(2,20,000 \times 0.08)}{4,00,000} \) = 100 = 6.65%

(iii) Cost of Retained Earnings and Cost of equity Applying Dividend Growth Model

Ke \(\frac{1.3865}{20} \) + g Or \(\frac{D_0(1+g)}{P_0}\) + g

Then, Ke = \(\frac{2 .(1.1)}{44}+0.10=\frac{2.2}{44}+0.010\) = 0.15 or 15 %

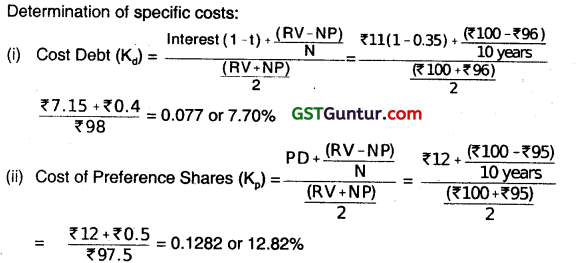

(iv) Overall Weighted Average Cost of Capital (WACC) (After Tax)

| Particular | Amount (₹) | Weights | Cost of Capital | WACC |

| Equity (including retained earnings) | 6,00,000 | 0.6 | 15% | 9 |

| Debt | 4,00,000 | 0.4 | 6.65 | 2.66 |

| Total | 10,00,000 | 1 | 11.66 |

![]()

Question 29.

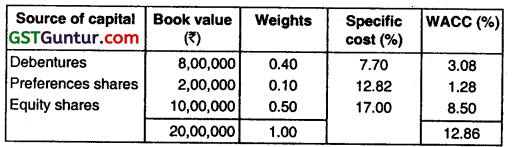

As a financial analyst of a large electronics company, you are required to DETERMINE the weighted average cost of capital of the company using (a) book value weights and (b) market value weights. The following information is available for your perusal.

The Company’s present book value capital structure is:

Debentures (₹ 100 per debenture) ₹ 8,00,000

Preference shares (₹ 100 per share) ₹ 2,00,000

![]()

All these securities are traded in the capital markets. Recent prices are:

Debentures, ₹ 110 per debenture, Preference shares, ₹ 120 per share, and Equity shares, ₹ 22 per share.

Anticipated external financing opportunities are:

(i) ₹ 100 per debenture redeemable at par; 10-year maturity, 11 percent coupon rate, 4 percent flotation costs, sale price, ₹ 100

(ii) ₹ 100 preference share redeemable at par; 10-year maturity, 12 percent dividend rate, 5 percent flotation costs, sale price, ₹ 100.

(iii) Equity shares: 2 per share flotation costs, sale price = ₹ 22.

In addition, the dividend expected on the equity share at the end of the year is ₹ 2 per share, the anticipated growth rate in dividends is 7 percent and the firm has the practice of paying all its earnings in the form of dividends. The corporate tax rate is 35 percent.

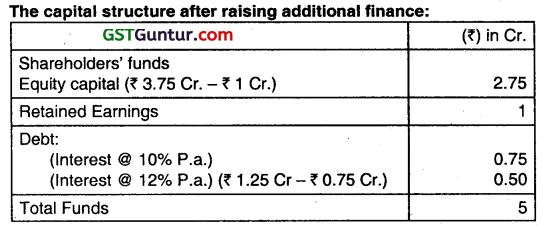

Answer:

(iii) Cost of Equity shares (Ke) = \(\frac{D_1}{P_0}+G=\frac{₹ 2}{₹ 22-₹ 2}+0.07 \) = 0.07 = 0.17 or 17%

I – Interest, t – Tax, RV- Redeemable value, NP- Net proceeds, N- No. of years, PD- Preference dividend, D1 – Expected Dividend, Po- Price of share (net) Using these specific costs we can calculate WACC on the basis of book value and market value weights as follows:

(a) Weighted Average Cost of Capital (K0) based on Book value weights

(b) Weighted Average Cost of Capital (KO) based on market value weights:

Question 30.

Define the weighted marginal cost of capital schedule for the company, if it raises ₹ 10 crores next year, given the following information:

(a) The amount will be raised by equity and debt in equal proportions;

(b) the company expects to retain ₹ 1.5 crores earnings next year;

(c) The additional issue of equity shares results in the net price per share being fixed at ₹ 32;

(d) The debt capital raised by way of term loans will cost 15% for the first ₹ 2.5 crores and 16% for the next ₹ 2.5 crores. (Nov 2000, 12 marks)

Answer:

Statement showing weighted marginal cost of capital schedule for the company, if it raises ₹ 10 crores next year given the following Information:

Working Notes:

1. Cost of equity capital & retained earnings (ke):

k = \(\frac{\mathrm{D} 1}{\mathrm{P}_0}\) +g

Where;

ke = Cost of equity capital

D1 = Expected dividend at the end of year 1

P0 = Current market price of equity shares

g = Growth rate of dividend

Given,

D1; = ₹ 360

P0 = ₹ 40

g = 7%

∴ ke = \(\frac{₹ 3.60}{₹ 40}+0.07 \) = ke = 16%

2. Cost of Preference capital (Kp):

kp = \(\frac{D+\left(\frac{F-P}{n}\right)}{\left(\frac{F+P}{2}\right)} \)

Where,

D = Preference dividend

F = Faæ value of fernce aves

P = Current market price of Preren shares

n = Redemption Period of Preference shares.

Given, D= 11%, F= ₹100, P= ₹ 75 & n= 10 years.

∴ Kp = \(\frac{11+\left(\frac{100-75}{10}\right)}{\left(\frac{100+75}{2}\right)} \times 100 \) = 15.43%

3. Cost of Debentures (kd):

Kd = \(=\frac{r(1-t)\left(\frac{F-P}{n}\right)}{\left(\frac{F+P}{2}\right)} \)

Where, r = Interest on debentures

t = Tax rate applicable to the co.

F = Face value of debentures

P = Current Market Price of debentures

n = Redemption Period of debentures.

Given,

r= 13.5%,t=40%, F= ₹ 100, P= ₹ 80 & n=6 years.

Kd= \(\frac{13.5(1-0.40)+\left(\frac{100-80}{6}\right)}{\frac{100+80}{2}} \times 100 \)

= 12.70%

4. Cost of term loans (kt):

kt = r(1-t)

Where,

r = Rate of Interest on term loans

t =Tax rate applicable to the co.

Given,

r = 15% & t = 40%

∴ kt =15% (1- 0.40) = 9%

5. Cost of fresh equity share (ke):

Ke = \(\frac{D_1}{P}\) + g

Give

D1 = ₹ 3.60,P= ₹ 32 & g = 7%

∴ ke = \(\frac{3.60}{32}\) + 0.07 = 18.25%

6. Cost of debt (Kd):

kd = r(1-t)

(for first ₹ 2.5 crores)

r= 15% & t = 40%

∴ (for the next ₹ 2.5 crores)

r = 16% & t+ 14%

₹ kd = 16% (1- 0.40) = 9.6%

Question 31.

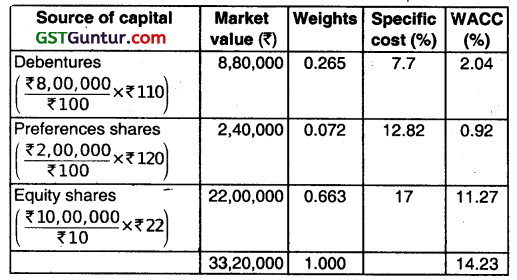

The R & G Company has following capital structure at 31 March, 2004, which is considered to be optimum:

13% debenture 3,60,000

11 % preference share capital 1,20,000

Equity share capital (2,00,000 shares)19,20,000

The company’s share has a current market price of ₹ 27.75 per share. The expected dividend per share in next year is 50 percent of the 2004 EPS. The EPS of last 10 years is as follows. The past trends are expected to continue:

| Year | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 |

| EPS (₹) | 1.00 | 1.120 | 1.254 | 1.405 | 1.574 | 1.762 | 1.974 | 2.211 | 2.476 | 2.773 |

The company can issue 14 percent new debenture. The company’s debenture is currently selling at ₹ 98. The new preference issue can be sold at a net price of ₹ 9.80, paying a dividend of ₹ 1.20 per share. The company’s marginal tax rate is 50%.

(i) Calculate the after-tax cost (a) of a new debts and new preference share capital, (b) of ordinary equity, assuming new equity comes from retained earnings.

(ii) Calculate the marginal cost of capital.

(iii) How much can be spent for capital investment before now ordinary share must be sold? Assuming that retained earnings available for next year’s investment are 50% of 2004 earnings.

(iv) What will be marginal cost of capital (cost of funds raised in excess of the amount calculated In part (iii)) if the company can sell new ordinary shares to net ₹ 20 per share? The cost of debt and of preference capital is constant. (May 2005, 2 + 1 + 2 + 2 =7 marks)

Answer:

Assumption: The present capital structure is assumed to be optimum

Existing Capital Structure Analysis

| Type of capital | Amount (₹) | Ratio |

| 13% debentures | 3,60,000 | 0.15 |

| 11% Preference | 1,20,000 | 0.05 |

| Equity | 19,20,000 | 0.80 |

| 24,00,000 | 1.00 |

(i) (a) After tax cost of debt = Kd = \(\frac{14}{98}\) × (1 – 0.5) = 0.071 43

After-tax cost of preference capital (new)

Kp = \(\frac{1.20}{9.80}\) = 0.122449

(b) After-tax cost of retained earnings

= g = 0.05 + 12=0.17 (where g is the growth rate)

= 0.05 + 0.12 = 0.17

(ii)

(iii) The company can pay the following amount without increasing its Marginal cost of capital without selling the new shares.

Retained earnings = 1.3865 × 2,00,000 = 2,77,300

The ordinary equity (retained earnings in this case) is 80% of the total capital.

Therefore, investment before issuing equity (\(\frac{2,77,300}{80} \times 100 \)) = ₹ 3,46,625

(iv) It the company pay more than ₹ 3,46,625, it will have to issue new shares. The cost of new issue of ordinary share is:

Ke = \(\frac{1.3865}{20}\) + 0.12 = 0.1893

The marginal cost of capital of ₹ 3,46,625

Question 32.

The X Company has following capital structure at 31st March 2015 which is considered to be optimum.

14% Debentures ₹ 3,00,000

11 % Preference Shares ₹ 1,00,000

Equity (100000 shares) ₹ 16.00.000

₹ 20,00,000

The company’s share has a current market price of ₹ 23.60 per share. The expected dividend per share next year is 50% of 2015 EPS. The following are the earning per share figure for the company during preceding ten years. The past trends are expected to continue.

Year EPS (₹) Year EPS (₹)

2006 1.00 2011 1.61

2007 1.10 2012 1.82

2008 1.21 2013 1.95

2009 1.33 2014 2.15

2010 1.46 2015 2.36

The company issued new debentures carrying 16% rate of interest and the current market price of debenture is ₹ 96.

Preference share ₹ 9.20 (with dividend of 1.1 per share) were also issued. The company is in 50% tax bracket.

(i) Calculate after-tax cost of

(a) New debt (b) New Preference share (c) New equity share

(consuming new equity from retained earnings)

(ii) Calculate marginal cost of capital when no new shares was issued.

(iii) How much can be spent for capital investment before new ordinary shares must be sold? Assuming the retained earnings for next year’s investment are 50% of 2015.

(iv) What will be the flarginal cost of capital when the funds exceed the amount calculated in (iii) assuming new equity is Issued at ₹ 20 per share? (May 2016, 8 marks)

Answer:

(i) Calculation of after-tax cost of the followings:

(a) New Debentures (Kd) = \(\frac{I(1-t)}{N P}=\frac{₹ 16(1-0.5)}{₹ 96} \times 100\) = 8.33%

New Preference Shares (Kp) = \(\frac{\text { Preference Dividend }}{\text { Net Proceed }} \)

= \(\frac{₹ 1.10}{₹ 9.20} \times 100 \) = 11.96%

(b) Equity Shares (Consuming New Equity from Retained Earnings) (Ke) .

= \(\frac{\text { Expected dividend }\left(D_1\right)}{\text { Current market price }\left(P_\nu\right)} \) + Growth rate (G)

= \(\frac{50 \% \text { of } ₹ 2.36}{₹ 23.60} \times 100+10 \%=5 \%+10 \%\) = 15%

Growth rate (on the basis of EPS) is calculated as below:

\(\frac{\text { EPSin current year – EPSin previousyear }}{\text { EPSin previous year }} \)

= \(\frac{₹ 2.36-₹ 2.15}{₹ 2.15} \times 100 \) = 10% (Approximate 10% figure ¡s taken because of decimal figures)

[Alternative calculation of Growth rate: Growth rate is calculated on basis average growth of EPS i.e. 10 + 10 + 9.92 + 9.77 + 10.27 + 13.04 + 7.14 + 10.25 + 9.76 = 90.15/9 = 10.01 or 10%.

Or,

The EPS for 2006 is given ₹ 1 and whereas for 2015 is given at ₹ 2.36. This has resulted in increase of ₹ 1.36 over a period of 9 years.

The growth rate can be calculated by using formula:

Et = E0(1 +g)t

2.36 = 1 (1 + g)9 using the CVF table, ₹ 1 becomes ₹ 2.36 at the end of 9th year at the compound interest rate of 10%. Therefore, the growth rate is taken at 10%.]

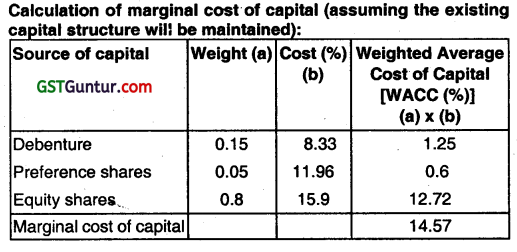

(ii) Marginal Cost of Capital at Existing Capital Structure:

(iii) Company can spend the following amount without increasing its NCC and without selling the new share

Retained earning = 1.18 × 1,00,000 = 1,18,000

The ordinary equity is 80% of total capital. Thus, investment before issuing equity

\(\frac{1,18,000}{80}\) × 100 = 1,47,500

(iv) If the company spends more than ₹ 1,47,500 as calculated in part (iii) above, it will have to issue new shares at ₹ 20 per share.

The cost of new issue of equity shares will be:

Ke = \(\frac{\text { Expected dividend }\left(\mathrm{D}_1\right)}{\text {Current market price }\left(\mathrm{P}_{\mathrm{N}}\right)}+\text { Growth rate }(\mathrm{g})=\frac{50 \% \text { of } ₹ 2.36}{₹ 20} \times 100 \) + 10%

= 5.9% + 10% = 15.9%.