Chapter 3 Class Action Suits – Resolution of Corporate Disputes Non Compliances & Remedies Notes is designed strictly as per the latest syllabus and exam pattern.

Class Action Suits – Resolution of Corporate Disputes Non Compliances & Remedies Study Material

Question 1.

Write short note on:

Rule of Opt-out. (June 2022, 4 marks)

Question 2.

What do you mean by Class Action Suit? Discuss with reference to eligibility criteria for class action, nature of relief and effect of Tribunal’s order. (Dec 2017, 4 marks)

Answer:

Section 245 of the Companies Act, 2013 makes provision for class action by investors. The term ‘investors’ include shareholders, deposit holders and any class of security holders of the company.

Section 245 permits a representative of any class of investors to file a suit before the National Company Law Tribunal for relief.

In terms of Section 245 (1), Such number of member or members, depositor or depositors or any class of them, as the case may be, as are indicated in sub-section (2) of the section may, if they are of the opinion that the management or conduct of the affairs of the company are being conducted in a manner prejudicial to the interests of the company or its members or depositors, file an application before the Tribunal on behalf of the members or depositors for seeking all or any of the relief specified.

Eligibility criteria for class action

Sub-section (3) (i) of Section 245 of the Companies Act, 2013 provides the requisite number of members provided in Sub-Section (1) shall be as under:

(a) in the case of a company having a share capital, not less than one hundred members of the company or not less than such percentage of the total number of its members as may be prescribed, whichever is less, or any member or members holding not less than such percentage of the issued share capital of the company as may be prescribed, subject to the condition that the applicant or applicants has or have paid all calls and other sums due on his or their shares;

(b) in the case of a company not having a share capital, not less than one-fifth of the total number of its members.

The requisite number of depositors provided in sub-section (1) shall not be less than one hundred depositors or not less than such percentage of the total number of depositors as may be prescribed, whichever is less, or any depositor or depositors to whom the company owes such percentage of total deposits of the company as may be prescribed.

Nature of Relief

The order by Tribunal may relate:

(a) to restrain the company from committing an act which is ultra vires the articles or memorandum of the company;

(b) to restrain the company from committing breach of any provision of the company’s memorandum or articles;

(c) to declare a resolution altering the memorandum or articles of the company as void if the resolution was passed by suppression of material facts or obtained by mis-statement to the members or depositors;

(d) to restrain the company and its directors from acting on such resolution;

(e) to restrain the company from doing an act which is contrary to the provisions of this Act or any other law for the time being in force;

(f) to restrain the company from taking action contrary to any resolution passed by the members;

(g) to claim damages or compensation or demand any other suitable action from or against:

(i) the company or its directors for any fraudulent, unlawful or wrongful act or omission or conduct or any likely act or omission or conduct on its or their part;

(ii) the auditor including audit firm of the company for any improper or misleading statement of particulars made in his audit report or for any fraudulent, unlawful or wrongful act or conduct; or

(iii) any expert or advisor or consultant or any other person for any incorrect or misleading statement made to the company or for any fraudulent, unlawful or wrongful act or conduct or any likely act or conduct on his part;

(h) to seek any other remedy as the Tribunal may deem fit.

Effect:

Any order passed by NCLT shall be binding on the company and all its members, depositors, auditors, consultants and advisors or any other person associated with the company. Non-compliance of the order by the company shall be punishable with fine which shall not be less than ₹ 5 Lakhs but which may extend to ₹ 25 Lakhs and every officer of the company who is in default shall be punishable with imprisonment for a term upto 3 years and with fine ranging from ₹ 25,000 to ₹ 1 lakh.

![]()

Question 3.

What do you understand by ‘class action suit’ as introduced by the Companies Act, 2013? Explain the objective behind introducing this provision in the Companies. Act and the persons who can initiate such class action suit. (Dec 2017, 4 marks)

Answer:

A class action suit is a lawsuit where a group of people representing a common interest may approach the Tribunal to sue or be sued. It is a procedural instrument that enables one or more plaintiffs to file and prosecute litigation on behalf of a larger group or class having common rights and grievances.

The major objective behind the provision of class action suits is to safeguard the interests of the minority shareholders. So, class action suits are expected to play an important role to address numerous prejudicial and abusive acts committed by the Board of Directors and other managerial personnel.

Person to initiate Class Action Suit:

(A) Members:

The requisite number of members provided in sub-section (1) shall be as under:-

(a) in the case of a company having a share capital, not less than one hundred members of the company or not less than such percentage of the total number of its members as may be prescribed, whichever is less, or any member or members holding not less than such percentage of the issued share capital of the company as may be prescribed, subject to the condition that the applicant or applicants has or have paid all calls and other sums due on his or their shares;

(b) in the case of a company not having a share capital, not less than one-fifth of the total number of its members.

(B) Depositors:

According to Section 245(3)(ii) the requisite number of depositors provided in Section 245(1) shall not be less than one hundred depositors or not less than such percentage of the total number of depositors as may be prescribed, whichever is less, or any depositor or depositors to whom the company owes such percentage of total deposits of the company as may be prescribed.

Question 4.

In a scheme of amalgamation, it was proposed that name of the transferor company shall be deemed to be name of transferee company. The Regional Director (RD), Ministry of Company Affairs, objected to the same on the ground that proposed name is undesirable if it is identical with or too nearly resembling name of an existing company. Decide if the stand taken by the RD is valid under the Companies Act, 2013. Reference may be made of decided case laws. (June 2018, 4 marks)

Answer:

It has been held in earlier judgement PMP Auto Industries Ltd. that- in case of amalgamation Chapter XV of the Companies Act, 2013 is a complete code in the nature of a “single window clearance” system, the object of which is to eliminate frequent applications being made to the Court in order effectively to-implement a scheme of amalgamation which the Court sanctions in exercise of its powers. Further in case, Michelin India Private Limited High Court held that a complete code by itself pr\ the subject of arrangement/compromise and reconstruction comprehensive enough to include a change in the name consequent on the amalgamation or arrangement.

Thus, Considering the above, in present case tne objection of RD is invalid.

Question 5.

“Class action suit is a new mechanism in India to claim the loss caused to the specified stakeholders of the Company not only from the Company but also from other entities”. Analyse the statement in brief. (June 2019, 4 marks)

Answer:

A class action suit is a new mechanism to claim the loss caused to the specified stakeholders of the company not only from the company but also from other entities. Various persons/ entities against whom such actions can be taken are:

- A company or its directors for any fraudulent, unlawful or wrongful act or omission.

- An auditor including audit firm of a company for any improper or misleading statement of particulars made in the audit report or for any unlawful or fraudulent conduct.

- An expert or advisor or consultant for an incorrect or misleading statement made to the company.

It is pertinent to note that the definition of the expert is wide under the Companies Act, 2013 which includes an engineer, a valuer, a chartered accountant, a company secretary, a cost accountant and any other person who has the power or authority to issue a certificate in pursuance of any law for the time being in force. However the advisors or consultants are not provided, thus the definitions of the same will be derived from judicial precedence and use of the same in common parlance.

![]()

Question 6.

Class Action suit can be filed by the Members only; this right is not available to the depositors of the company. Do you agree with the statement? Discuss the relevant provisions under the Companies Act, 2013. (Aug 2021, 4 marks)

Answer:

No,” we do not accept with the statement provided in the question. In fact, the class action suit can be filed by the members as well as by the depositors. The important provisions are as under:

1. Class Action Suit by Members under Section 245(3)(i) of Companies Act, 2013

- A company having a share capital: not less than one hundred members of the company or not less than such percentage of the total number of its members as may be prescribed, whichever is less, or any member or members holding not less than such percentage of the issued share capital of the company as may be prescribed, subject to the condition that the applicant or applicants has or have paid all calls and other sums due on his or their shares;

- A company not having share capital: more than one-fifth of the total number of its members.

2. Class Action Suit by depositors under Section 245(3)(ii) Of Companies Act, 2013

- The number of depositors required to file class action are more than 100 in number or more than such percentage of the total number of depositors as may be specifying, whichever is less, or any depositor or depositors to whom the company owes such percentage of total deposits of the company as may be prescribed.

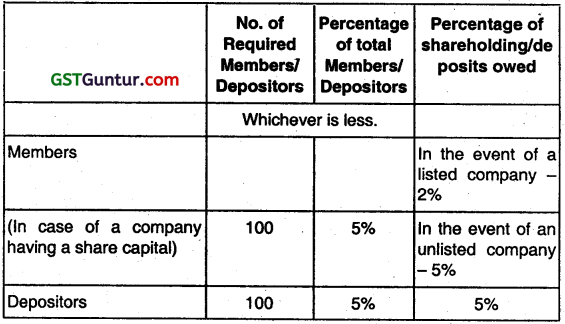

- Thresholds are specified under Rule 84 of National Company Law Tribunal (NCLT) Rules, 2016 (amended on May 08, 2019) relating to class action suits under Section 245. The limits are as under:

In case of a company having a share capital, the requisite number of member or members to file said application shall be:

(i) (a) at least five per cent, of the total number of members of the company; or

(b) one hundred members of the company, whichever is less; or

(ii) (a) member or members holding not less than five per cent, of the issued share capital of the company, in case of an unlisted company

(b) member or members holding not less than two per cent, of the issued share capital of the company, in case of a listed company.

The requisite number of depositor or depositors to file said application shall be:

(i) (a) at least five per cent, of the total number of depositors of the company; or

(b) one hundred depositors of the company, whichever is less; or;

(ii) depositor or depositors to whom the company owes five per cent, of total deposits of the company.

![]()

Question 7.

‘Unlike the Consumer Protection Act, 1986 which permitted a class to initiate a case before a consumer commission in cases of mis-selling, the Consumer Protection Act, 2019 provides for different solution’. Explain whether the new mechanism provided under the Consumer Protection Act, 2019 will strengthen the class action or will dilute the class action suits. (Dec 2021, 4 marks)

Answer:

India enacted a new consumer protection law in 2019. Unlike the erstwhile law which permitted a class to initiate a case before a consumer commission in cases of misselling, the 2019 law establishes a new regulator in the regime of consumer protection i.e. the Central Consumer Protection Authority.

The CCPA is tasked with protecting and enforcing the rights of consumers as a class. As per section 17 of the new Act, a complaint relating to violations of consumer rights prejudicial to the interests of consumers as a class is to be forwarded to the Central Consumer Protection Authority.

It would then conduct a preliminary inquiry as to whether there exists a prima facie case of violation of consumer rights and instruct for an investigation to be conducted.

This has taken away the power to initiate class actions from individuals and vested them into the hands of the regulator.

Unlike earlier, where a class of consumers could approach consumer commissions with their common grievance, they are now required to meet the subjective satisfaction of the Cental Consumer Protection Authority.

This is then meant to result in an investigation, and consequent orders, if any.

The difficulties of public management now impact the enforcement process in consumer grievances.

Persons who have suffered harm are now supplicants before the regulator, requesting it to enforce consumer law. Several steps have been added in the process, which could lead to a lesser filing of class action suits.

Question 8.

“For conducting a Class Action Suit, publication of notice is a sine qua non.” Explain the procedure of ‘publication of notice’ provided under the National Company Law Tribunal Rules, 2016. (June 2022, 4 marks)

Question 9.

Write short notes on Class Action Suits.

Answer:

A class action suit is a lawsuit where a group of people representing a common interest may approach the Tribunal to sue or be sued. It is a procedural instrument that enables one or more plaintiffs to file and prosecute litigation on behalf of a larger group or class having common rights and grievances.

Application of Class Action and Reliefs [Section 245(1)]

Sub-section (1) of Section 245 states that such number of members, depositor or any class of them, as the case may be, may, file an application before the Tribunal for seeking all or any of the following orders, namely:

(a) to restrain the company from committing an act which is ultra vires the articles or memorandum of the company;

(b) to restrain the company from committing breach of any provision of the company’s memorandum or articles;

(c) to declare a resolution altering the memorandum or articles of thq company as void if the resolution was passed by suppression of material facts or obtained by mis-statement to the members or depositors;

(d) to restrain the company and its directors from acting on such resolution;

(e) to restrain the company from doing an act which is contrary to the provisions of this Act or any other law for the time being in force;

(f) to restrain the company from taking action contrary to any resolution passed by the members;

(g) to claim damages or compensation or demand any other suitable action from or against-

(i) the company or its directors for any fraudulent, unlawful or wrongful act or omission or conduct or any likely act or omission or conduct on its or their part;

(ii) the auditor including audit firm of the company for any improper or misleading statement of particulars made in his audit report or for any fraudulent, unlawful or wrongful act or conduct; or

(iii) any expert or advisor or consultant or any other person for any incorrect or misleading statement made to the company or for any fraudulent, unlawful or wrongful act or conduct or any likely act or conduct on his part;

(h) to seek any other remedy as the Tribunal may deem fit.

Question 10.

Write short notes on Effect of Order.

Answer:

Order shall be binding: Any order passed by the Tribunal shall be binding on the company and all its members, depositors and auditor including audit firm or expert or consultant or advisor or any other person associated with the company. [Section 245(6)]

Punishment for non-compliance: Any company which fails to comply with an order passed by the Tribunal under this section shall be punishable with fine which shall not be less than five lakh rupees but which may extend to twenty-five lakh rupees and every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to three years and with fine which shall not be less than twenty- five thousand rupees but which may extend to one lakh rupees. [Section 245(7)]

![]()

Question 11.

Who can file class action suits?

Answer:

There are following set of classes recognized under the Act to file class action suits – (i) members (ii) depositors and (iii) any class of them. The Companies Act, 2013 just like its predecessor recognizes the following persons as members of a company:

- The subscriber to the memorandum of the company who shall be deemed to have agreed to become member of the company, and on its registration, shall be entered as member in its register of members;

- Every other person who agrees in writing to become a member of the company and whose name is entered in the register of members of the company;

- Every person holding shares of the company and whose name is entered as a beneficial owner in the records of a depository.

In simple words:

- subscriber to the memorandum of the company;

- persons who give consent to become shareholder of the company, in form of allotment letter or request for transfer, as the case may be and his name appears in the register of members;

- in listed entity a person whose name appears in the records of the depository as beneficial owner.

The other class which is allowed to file class action suit is depositors, which is defined under the Companies (Acceptance of Deposits) Rules, 2014 (in short “Deposit Rules”) as under:- any member of the company who has made a deposit with the company in accordance with the provisions of sub-section (2) of Section 73 of the Act, or

- any person who has made a deposit with a public company in accordance with the provisions of Section 76 of the Act.

Question 12.

What reliefs can be sought from tribunal?

Answer:

Any member or depositor who files the Class Action Suits can seek all or any of the following reliefs from NCLT:

(a) To restrain the company from:

- Doing an act which is contrary to the provisions of this Act or any other law for the time being in force;

- Taking action contrary to any resolution passed by the members;

- Committing an act which is ultra vires the articles or memorandum of the company;

- Committing breach of any provision of the company’s memorandum or articles;

(b) To declare a resolution altering the memorandum or articles of the company as void if the resolution was passed by suppression of material facts or obtained by misstatement to the members or depositors;

- To restrain the company and its directors from acting on such resolution;

(c) To claim damages or compensation or demand any other suitable action from or against-

- the company or its directors for any fraudulent, unlawful or wrongful act or omission or conduct or any likely act or omission or conduct on its or their part;

- the auditor including audit firm of the company for any improper or misleading statement of particulars made in his audit report or for any fraudulent, unlawful or wrongful act or conduct; or

- any expert or advisor or consultant or any other person for any incorrect or misleading statement made to the company or for any fraudulent, unlawful or wrongful act or conduct or any likely act or conduct on his part.

![]()

Question 13.

Discuss the penalty for non-compliance of order passed by Tribunal.

Answer:

Any company which fails to comply with an order passed by the Tribunal under Section 245 of the Act, shall be punishable with fine which shall not be less than ₹ 5 Lakh but which may extend to ₹ 25 Lakh and every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to 3 years and with fine which shall not be less than ₹ 25,000/- but which may extend to ₹ 1,00,000/-.

Under Section 425 of the Companies Act, 2013 the Tribunal has also been conferred the same jurisdiction, powers and authority in respect of contempt of its orders as conferred on High Court under the Contempt of Courts Act, 1971.

Question 6.

Discuss the impacts of Class Action Suits.

Answer:

Class action suits is an invention of equity to enable it to proceed to a decree in suits where the number of those interested in the subject of the litigation is so great that their joinder as parties in conformity to the usual rules of procedure is impracticable. Thus the said curative measures, viz. class action suit is evolved to overcome such drawbacks and allow a set of persons to represent all other members of said class who are scattered in different jurisdictions.

Class action suits would allow individuals to hold some of the world’s most powerful companies and organizations accountable for their actions. These lawsuits will cover a wide range of issues including the mismanagement of monies invested with a company, securities law related fraud, malfunctioning of accounts, restraining company to act ultra vires or in breach of the articles of association of the Company, etc. The new mechanism will not only protect the interest of investors but will also deter the promoters to enrich themselves at the cost of small shareholders. Class action suits will be taken as a lesson to wrong doers which will deter them as well as others to take such actions. Same has been witnessed in the counterparts, specifically in USA where behavior of doctors changed and they were encouraged to report suspected child abuses after a landmark case. Otherwise they would have faced the threat of civil action for damages in tort proximately if owing from the failure to report the suspected injuries.

Class Action Suits Notes

What is a class action suit?

- A class action suit is a lawsuit where a group of people representing a common interest may approach the Tribunal to sue or be sued.

- It is a procedural instrument that enables one or more plaintiffs to file and prosecute litigation on behalf of a larger group or class having common rights and grievances.

Impacts of class action suits

- • Class action suits is an invention of equity to enable it to proceed to a decree in suits where the number of those interested in the subject of the litigation is so great that their joinder as parties in conformity to the usual rules of procedure is impracticable.

- Thus, the said curative measures, viz. class action suit is evolved to overcome such drawbacks and allow a set of persons to represent all other members of said class who are scattered in different jurisdictions.

Clubbing of similar application and bar on future litigation:

When the facts are similar in suits filed in different dominions by the members of the same class, standing against the same or similar defendants, it makes sense to combine them all and adjudicate it under one roof. Clubbing of similar claims/suits would also result in efficiency of judiciary, as the same would save precious time of judiciary from adjudicating the similar dispute numerous times.

![]()

Compensation in case security fraud:

As stated earlier, representative suits are not naive in India, instead there are three sets of remedies available. In case of civil court, it is settled position of law that in case of securities related fraud, no court of law hold jurisdiction and Securities and Exchange Board of India (SEBI) holds exclusive jurisdiction in such matter.

Who can file class action suits?

There are following set of classes recognized under the Act to file class action suits – (i) members (ii) depositors and (iii) any class of them. The Companies Act, 2013 just like its predecessor recognizes the following persons as members of a company:

(i) The subscriber to the memorandum of the company who shall be deemed to have agreed to become member of the company, and on its registration, shall be entered as member in its register of members;

(ii) Every other person who agrees in writing to become a member of the company and whose name is entered in the register of members of the company;

(iii) Every person holding shares of the company and whose name is entered as a beneficial owner in the records of a depository.

The requirement of members/depositors for filling of class action suit is as under:

Against whom class action suit can be filed:

A class action suit is a new mechanism to claim the loss caused to the specified stakeholders (as discussed herein before) of the company not only from the company but also from other entities.

Various persons/ entities against whom such actions can be taken are:

- A company or its directors for any fraudulent, unlawful or wrongful act or omission;

- An auditor including audit frm of a company for any improper or misleading statement of particulars made in the audit report or for any unlawful or fraudulent conduct.

- An expert or advisor or consultant for an incorrect or misleading statement made to the company.

Orders that may be sought from the National Company Law Tribunal [Section 245(1)]:

Section 245(1) provides that such number of member or members, depositor or depositors or any class of them, as the case may be, as are indicated in sub-section (3) may, if they are of the opinion that the management or conduct of the affairs of the company are being conducted in a manner prejudicial to the interests of the company or its members or depositors, file an application before the Tribunal on behalf of the members or depositors for seeking all or any of the following orders, namely:

(a) to restrain the company from committing an act which is ultra vires the articles or memorandum of the company;

(b) to restrain the company from committing breach of any provision of the company’s memorandum or articles;

(c) to restrain the company and its directors from acting on such resolution;

(d) to restrain the company from doing an act which is contrary to the provisions of this Act or any other law for the time being in force;

(e) to restrain the company from taking action contrary to any resolution passed by the members;

Application under Section 245:

Section 245(4) provides that in considering an application under sub-section (1), the Tribunal shall take into account, in particular

(a) Whether the member or depositor is acting in good faith in making the application for seeking an order;

(b) any evidence before it as to the involvement of any person other than directors or officers of the company on any of the matters provided in clauses (a) to (f) of sub-section (1);

(c) whether the cause of action is one which the member or depositor could pursue in his own right rather than through an order under this section;

(d) any evidence before it as to the views of the members or depositors of the company who have no personal interest, direct or indirect, in the matter being proceeded under this section;

(e) where the cause of action is an act or omission that is yet to occur, whether the act or omission could be, and in the circumstances would be likely to be

(a) authorised by the company before it occurs; or

(b) ratified by the company after it occurs;

(f) where the cause of action is an act or omission that has already occurred, whether the act or omission could be, and in the circumstances would be likely to be, ratified by the company.

![]()

In case of admission of Application:

Section 245(5) provides that if an application filed under sub-section (1) is admitted, then the Tribunal shall have regard to the following, namely:

(a) public notice shall be served on admission of the application to all the members or depositors of the class in such manner as may be prescribed;

(b) all similar applications prevalent in any jurisdiction should be consolidated into a single application and the class members or depositors should be allowed to choose the lead applicant and in the event the members or depositors of the class are unable to come to

a consensus, the Tribunal shall have the power to appoint a lead applicant, who shall be in charge of the proceedings from the applicant’s side;

(c) two class action applications for the same cause of action shall not be allowed;

Order shall be Binding:

Section 245(6) provides that any order passed by the Tribunal shall be binding on the company and all its members, depositors and auditor including audit firm or expert or consultant or advisor or any other person associated with the company.

Punishment for Non-Compliance:

According to Section 245(7) any company which fails to comply with an order passed by the Tribunal under this section shall be punishable with one which shall not be less than five lakh rupees but which may extend to twenty-five lakh rupees and every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to three years and with fine which shall not be less than twenty-five thousand rupees but which may extend to one lakh rupees.

Application filed is Frivolous/Vexatious:

Section 245(8) states that where any application fled before the Tribunal is found to be frivolous or vexatious, it shall, for reasons to be recorded in writing, reject the application and make an order that the applicant shall pay to the opposite party such cost, not exceeding one lakh rupees, as may be specified in the order.

Exemption from Application of Section:

According to Section 245(9), nothing contained in this section shall apply to a banking company.

Application may be fled on behalf of Affected persons:

Section 245(10) provides that subject to the compliance of Section 245, an application may be fled or any other action may be taken under this section by any person, group of persons or any association of persons representing the persons affected by any act or omission, specified in sub-section (1) of 245.