CS Professional Resolution of Corporate Disputes Non Compliances & Remedies Notes Study Material Important Questions

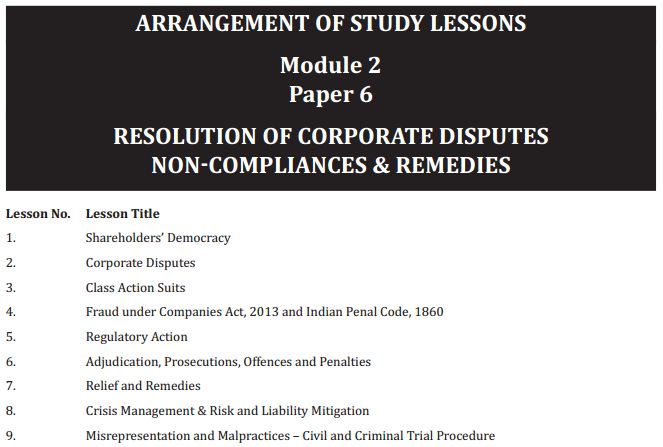

- Chapter 1 Shareholders’ Democracy

- Chapter 2 Corporate Disputes

- Chapter 3 Class Action Suits

- Chapter 4 Fraud under Companies Act, 2013 and Indian Penal Code, 1860

- Chapter 5 Regulatory Action

- Chapter 6 Adjudication, Prosecutions, Offences and Penalties

- Chapter 7 Relief and Remedies

- Chapter 8 Crisis Management & Risk and Liability Mitigation

- Chapter 9 Misrepresentation and Malpractices-Civil and Criminal Trial Procedure

CS Professional Resolution of Corporate Disputes Non Compliances & Remedies Syllabus

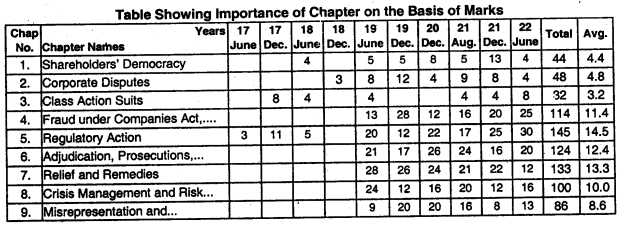

CS Professional Resolution of Corporate Disputes Non Compliances & Remedies Chapter Wise Weightage

Professional Programme Module 2 Paper 6

Resolution of Corporate Disputes, Non-Compliances & Remedies (100 Marks)

Syllabus

Objective

To acquire knowledge of various kinds of corporate disputes and non-compliances under various laws and their resolution and management.

Detailed Contents

1. Shareholders’ Democracy & Rights: Law relating to Majority Powers and Minority Protection; Class action suits.

2. Corporate Disputes: Oppression & Mismanagement – Law & Practice; Refusal of registration of transfer of securities & appeal against refusal; Wrongful withholding of property of company; corporate criminal liability.

3. Fraud under Companies Act and IPC.

4. Misrepresentation & Malpractices: Companies Act, 2013, RBI Act, SEBI Act, FEMA, COFEPOSA, Labour Laws; Prevention of Money Laundering Act; Malpractices under various other laws.

5. Regulatory Action: Enquiries; Inspection; Investigation; Search and Seizure; Arrest; Bail (ROC, RD, SFIO, Stock Exchange, SEBI, RBI, CCI, Labour Law Authorities, Income Tax Authorities, ED, CBI, Economic Offences Wing).

6. Defaults, Adjudication, prosecutions and penalties under the Companies Act, Securities Laws, FEMA, COFEPOSA, Money Laundering, Competition Act, Labour Laws & Tax Laws.

7. Fines, Penalties and Punishments under various laws.

8. Civil and Criminal Trial Procedure and Process.

9. Relief and Remedies: Compounding of offences under Companies Act, SEBI & FEMA; Mediation and Conciliation; Settlement and Proceeding (Consent order under SEBI law); Appeal against the order of Adjudicating officer, SAT, NCLT, NCLAT, Enforcement Directorate, IT Commissioner, GST Commissioner; Revision of order; Appearance before Quasi-judicial and other bodies- NCLT, NCLAT, SAT, SEBI, RD, ROC, RBI, CCI.

10. Crisis management, Professional Liability, D&O Policy & other Risk and liability mitigation approaches.

Case Laws, Case Studies and Practical aspects