Cash Flow Statement – CA Inter Accounts Question Bank is designed strictly as per the latest syllabus and exam pattern.

Cash Flow Statement – CA Inter Accounts Question Bank

Question 1.

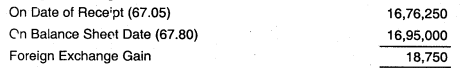

Explain the meaning of the terms ‘cash’ and ‘cash equivalent’ for the purpose of Cash Flow Statement as per AS-3. Ruby Exports had a bank balance of USD 25,000, stated in books at ₹ 16.76.250 using the rate of exchange ₹ 67.05 per USO prevailing on the date of receipt of dollars. However, on the balance sheet date, the closing rate of exchange was ₹ 67.80 and the bank balance had to be restated at ₹ 16,95,000. Comment on the effect of change in bank balance due to exchange rate fluctuation and also discuss how It will be disposed in Cash Flow Statement of Ruby Exports with reference to AS 3. (May 2017, 5 marks)

Answer:

Cash: Cash in hand and deposits repayable on demand with any bank or other financial institutions.

Cash equivalent: Are short-term, highly liquid Investments that are readily convertible into known amounts of cash and are subject to insignificant risk or change in value.

Foreign Exchange Fluctuation:

The Foreign currency monetary assets (e.g. balance with bank, debtors etc.) and liabilities (e.g. creditors) are initially recognised by translating them into reporting currency by the rate of exchange transaction date. On the balance sheet date, these are restated using the rate of exchange on the balance sheet date. The difference in value is exchange gain/loss. The exchange gain and losses are recognised in the statement of profit and loss as per AS

The exchange gains losses in respect of cash and cash equivalents in foreign currency. (e.g. balance in foreign currency bank account) are recognised by the principle aforesaid, and these balances are restated in the balance sheet in reporting currency at the rate of exchange on balance sheet date. The change in cash or cash equivalents due to exchange gains and losses are however not cash flows. This being so, the net increases/decreases In cash or cash equivalents in the cash flow statements are stated exclusive of exchange gains arid losses. The resultant difference between cash and cash equivalents as per the cash flow statement and that recognised in the balance sheet is reconciled in the rote on cash flow statement as per AS-3, “Cash Flow Statement.”

Question 2.

Answer the following:

Intelligent Ltd., a non-financial company has the following entries in its Bank Account, It has sought your advice on the treatment of the same for preparing Cash Flow Statement.

(i) Loans and Advances given to the following and Interest earned on them:

- to suppliers

- to employees

- to its subsidiaries’ companies

(ii) Investment made in subsidiary Smart Ltd. and dividend received

(iii) Dividend paid for the year

(iv) TOS on interest income earned on investments made

(v) TOS on interest earned on advance given to suppliers

(vi) Insurance daim received against loss of PPE by fire Discuss in the

context of AS 3 Cash Flow Statement. (May 2014, 4 marks)

Answer:

Treatment of the given transaction:

As per AS – 3 Cash Flow Statement, the given transaction should be treated as follows:

1. Loans and Advances given to suppliers and to employees and interest received thereon should be reported as operating activity whereas any. investment or loans & Advances related to its subsidiary company should be reported as Investing Activity.

2. Investment made In subsidiary Smart Ltd. and dividend received from It, is required only reporting of dividend received i.e. InvestIng cash flow.

3. Dividends paid is always classified as cash outflow from financing activities.

4. TDS on interest income earned on investments made should be treated as Investing Cash Out Flow.

5. TOS on interest earned on advance given to suppliers is treated operating cash outflow.

6. Insurance claims received against loss of PPE by fire should be treated as extraordinary items and hence, reported separately.

![]()

Question 3.

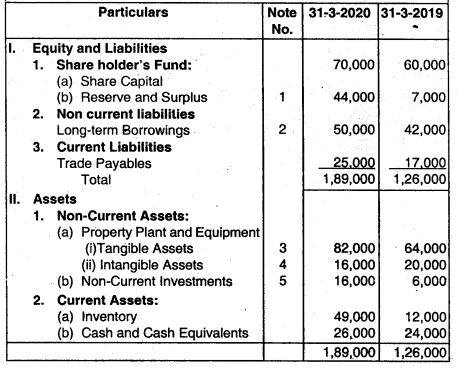

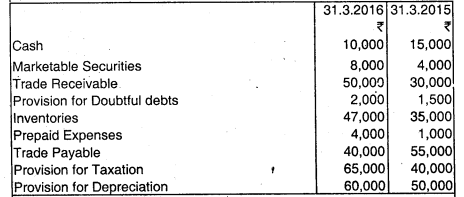

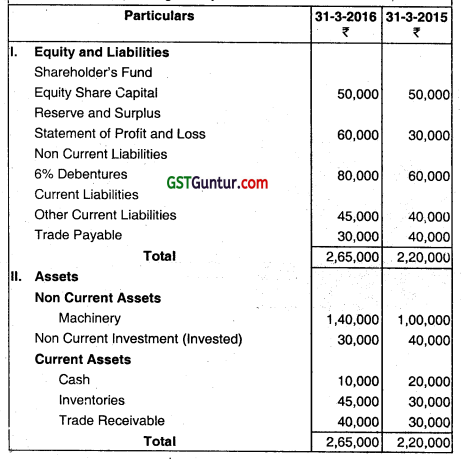

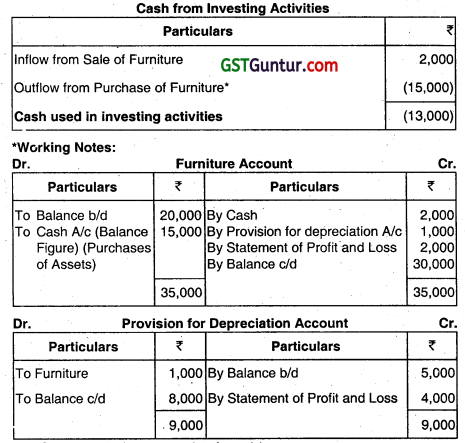

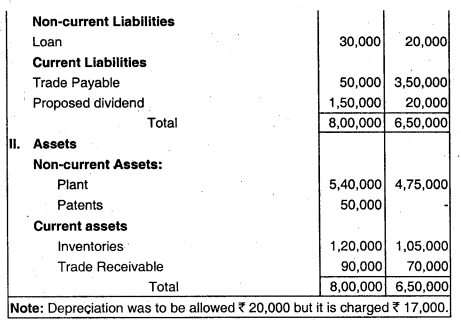

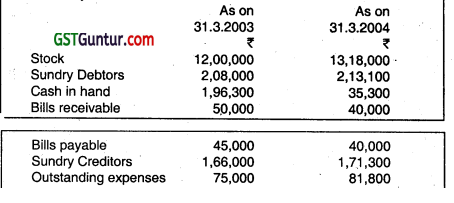

From the following balance sheets of ABC Ltd. find out cash from operating activities only:

Answer:

Question 4.

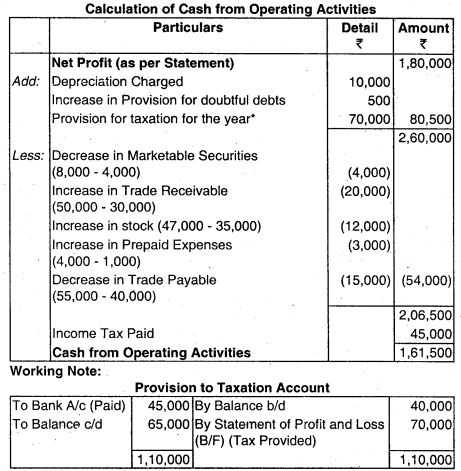

From the following information calculate cash from operating activities.

Operating Profit after tax for the year 2015-16 but before interest received ( 5,000) and claim received for disputed land (‘₹ 10,000) was ₹ 1,80,000. Tax paid during the year amounted to ₹ 45,000.

Answer:

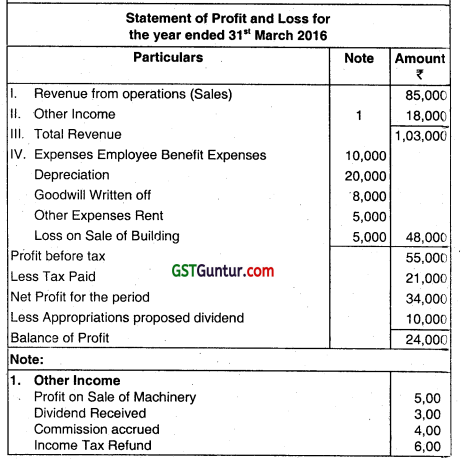

Question 5.

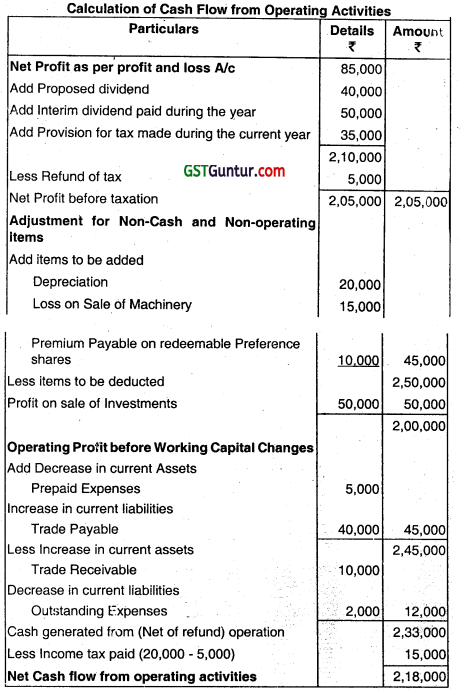

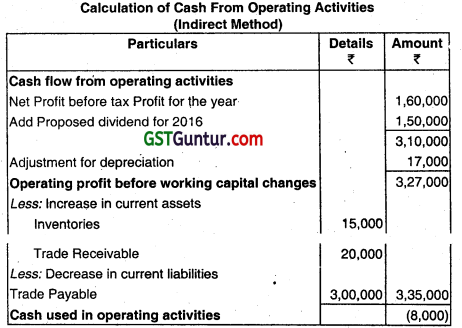

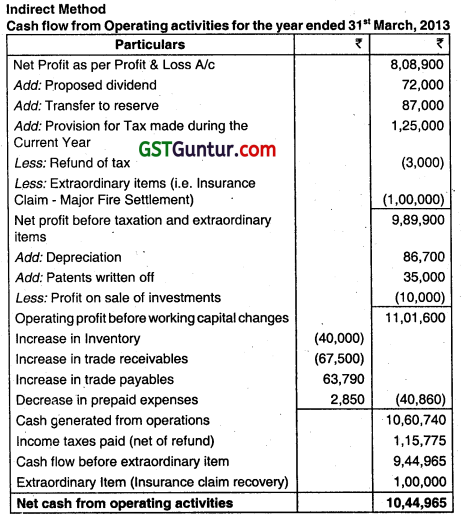

From the following Statement. Calculate the Cash Flow From Operating Activities.

Answer:

Question 6.

From the following summarized BaIa ce sheet Ola company calculates the Cash Flow from Operating activity.

Answer:

Question 7.

From the following particulars, calculate Cash Flows from Operating activities:

Answer:

Question 8.

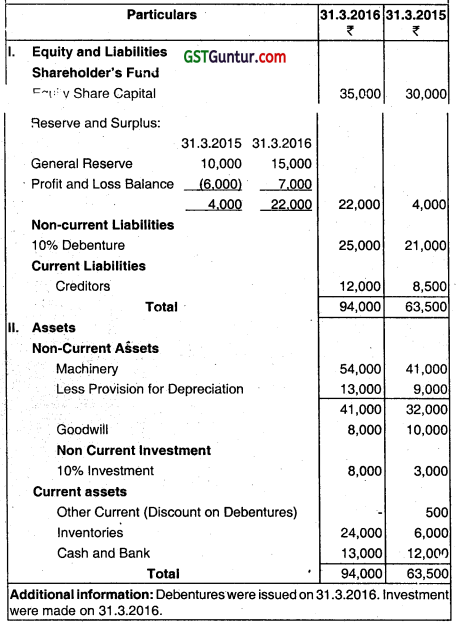

From the following balance sheet of ABC Ltd. find out Cash from operating activities.

Answer:

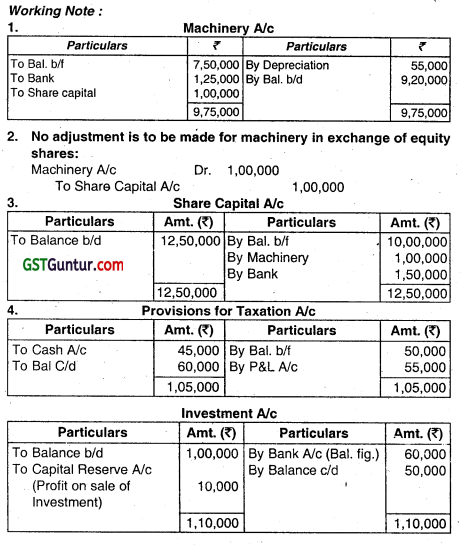

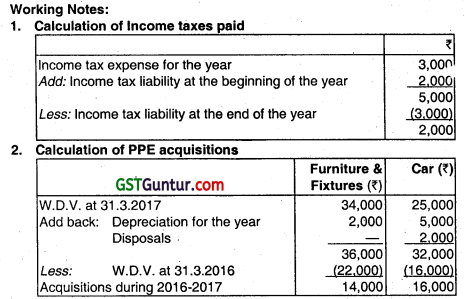

Working Note:

Profit/Loss Debit Balance ₹ 6,000 (Loss)

(Assets side of previous year’s balance sheet) In current year

Profit/Loss Credit Balance ₹ 7,000 (Profit)

(Liabilities side of Balance Sheet current year)

After covering the loss of 6,000 the Profit and Loss Credit balance shows ₹ 7,000

it means Net Profit for current year ₹ 7,000 + ₹ 6,000 = ₹ 13,000

![]()

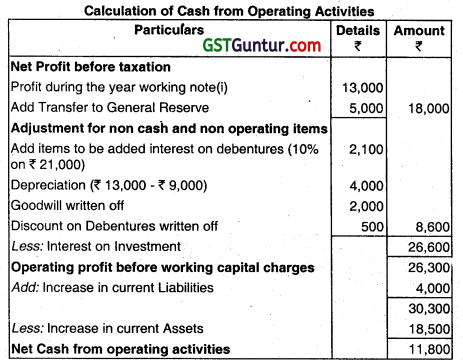

Question 9.

With the help of the following statement of Profit and Loss for the year ended 31.3-2016 and Balance sheets as on 31.3.2015 and 31.3.2014 of ABC Ltd. calculate Cash flows from operating activities.

Answer:

Note: Depreciation ₹ 17,000 will be added back, not ₹ 10000 as ₹ 17,000 was deducted to find out profit.

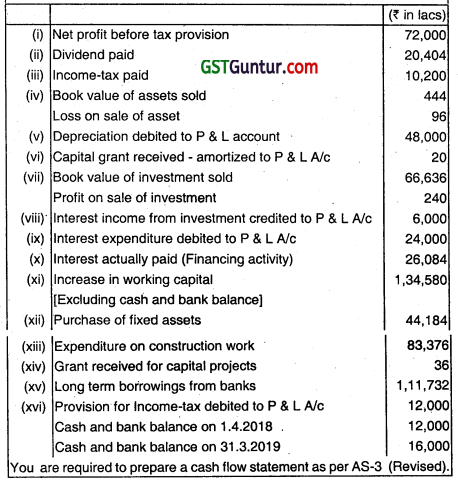

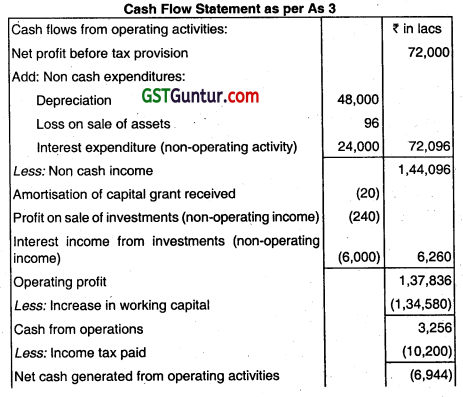

Question 10.

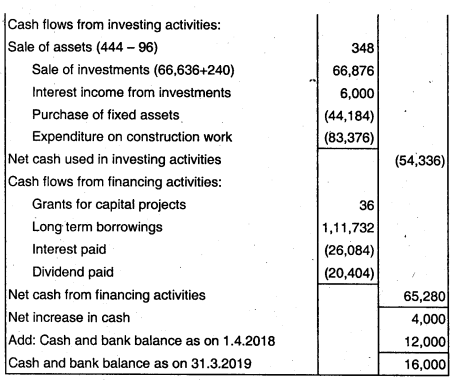

Preet Ltd. presents you the following information for the year ended 31st March 2019:

Answer:

Question 11.

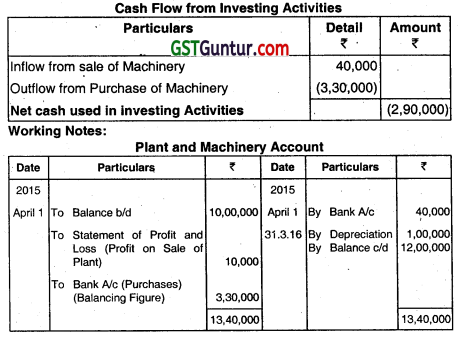

ABC Ltd. has plant and machinery whose W.D.V. on 1st April 2015 was ₹10,00,000 and on 31st March, 2016 was ₹ 12,00,000. Depreciation for the year was ₹ 1,00,000. At the beginning of the year, a piece of Plant was sold for ₹40,000 WhiCh had a W.D.V. of ₹ 30,000. Calculate cash flow from Investing Activities.

Answer:

Question 12.

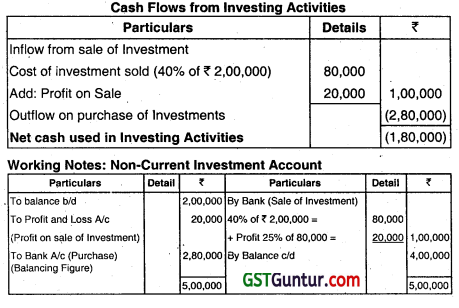

Calculate cash from investing activities.

Answer:

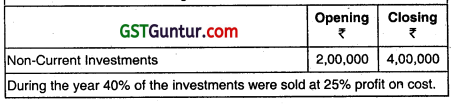

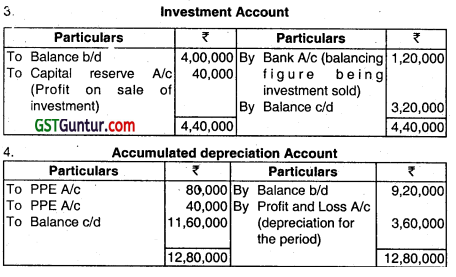

Question 13.

From the following information calculate cash flow from investing activities.

Answer:

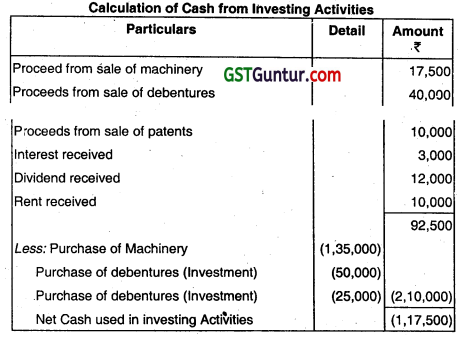

Question 14.

| Assets | 2017 ₹ | 2018 ₹ |

| Investment in land | 1,00,000 | 1,00,000 |

| Shares In Reliance Industries Ltd. | 75,000 | 75,000 |

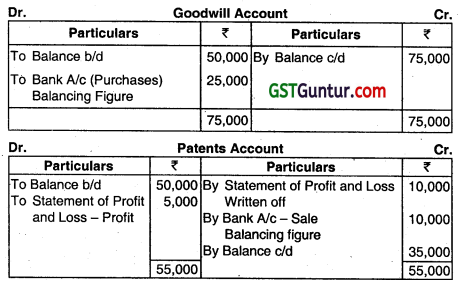

| Goodwill | 50,000 | 75,000 |

| 12% Debentures (Investment) | 25,000 | 40,000 |

| Patents | 50,000 | 35,000 |

| Plant and Machinery | 3,00,000 | 3,75,000 |

Answer:

Question 15.

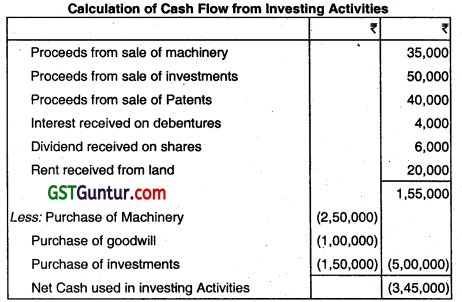

Calculate Cash Flow from Investing Activities from the following information:

| Purchase of machinery ₹ 2,50,000; Sale of Machinery | ₹ 35,000 |

| Dividend received on shares held as investment | ₹ 6,000 |

| Goodwill purchased ₹ 1,00,000: investments sold | ₹ 50,000 |

| Interest received on debentures held as investment | ₹ 4,000 |

| Investments purchased ₹ 1,50,000; Patents sold | ₹ 40,000 |

A pie of sand was purchased as Investment out of surplus, It was let out for commercial use and rent received (₹) 20,000.

Answer:

Question 16.

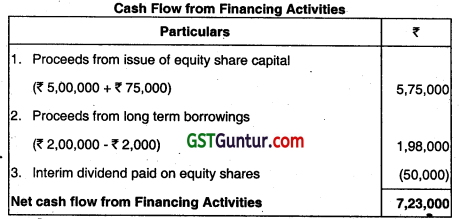

From the following particulars calculate cash flow from financing activities.

1. Issue of equity share capital ₹ 5,00,000 at a premium of 15%.

2. 10% Debenture issued ₹ 2,00,000 at 1% discount.

3. Interim dividend paid on equity share ₹ 50,000.

Answer:

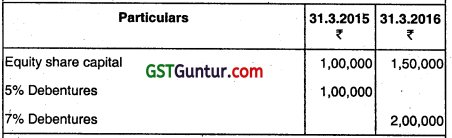

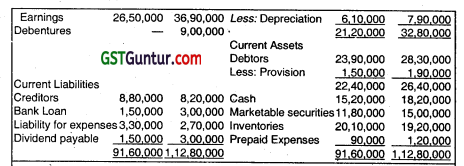

Question 17.

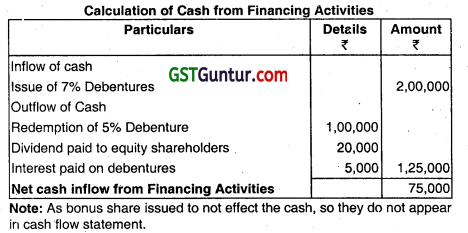

From the following Information calculate cash flow from financing activities.

Addtionel Information:

1. A Bonus issue was made during the year 2015-16 in the ratio of 2:1 by capitalizing the reserves.

2. Dividend paid In equity shares was ₹ 20,000

3. Interest on debentures paid was ₹ 5,000

Answer:

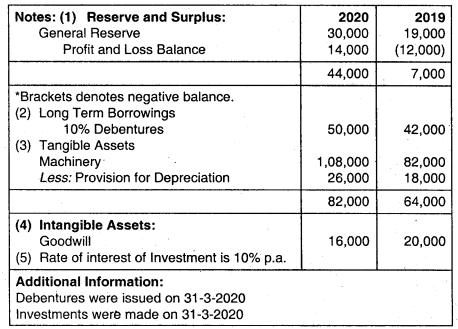

![]()

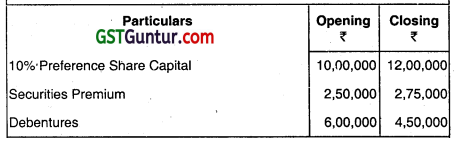

Question 18.

From the following information taken from the books of Mahajan Ltd. calculate cash from financial activities.

Answer:

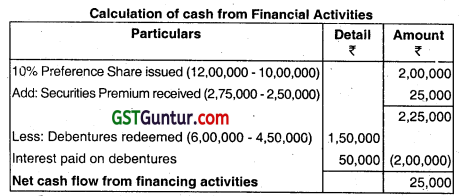

Question 19.

From the following activities, calculate cash flows from financing activities:

Additional Information:

(i) Equity shares were issued at a premium of 15%

(ii) 12% preference shares were redeemed at a premium of 15%.

(iii) 14% debentures were issued at a discount of 1%.

(iv) Interim dividend paid on equity shares ₹ 22,500.

(y) Dividend paid on old preference shares ₹ 6,000.

(vi) Interest paid on debentures ₹ 3,500.

(vii) Underwriting commission of Equity Shares ₹ 2,500.

Answer:

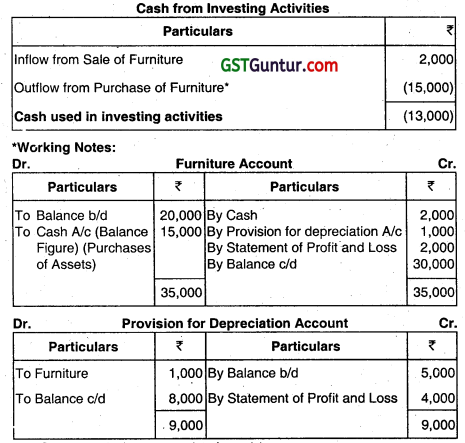

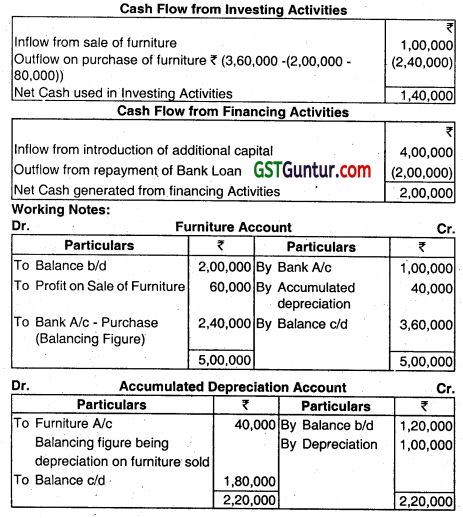

Question 20.

From the following information find out cash flow from investing activities and financing activities:

During the year furniture costing ₹ 80,000 was sold at a profit of ₹ 60,000.

Depreciation on furniture charged during the year amounted to ₹ 1,00,000.

Answer:

Proceeds from sale of the furniture:

= Cost – Accumulated depreciation + Protit on Sale

= 80,000-40,000+60,000= ₹ 1,00,000.

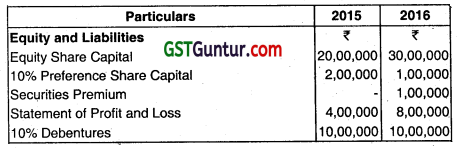

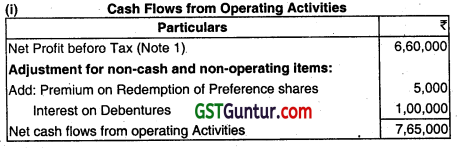

Question 21.

From the following extracts taken from the Balance Sheets of M/s Khanduja Ltd.. on 31st March and the additional information provided, you are required to calculate:

(i) Cash Flows from Operating Activities

(ii) Cash Flows from Financing Activities

Additional Information:

Preference shares were redeemed on 31st March 2016 at premium of 5%. Dividend on equity shares was paid @8%. Fresh issue of Equity shares was done on 1st April 2015.

Answer:

Question 22.

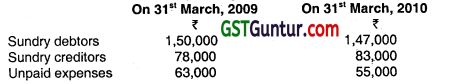

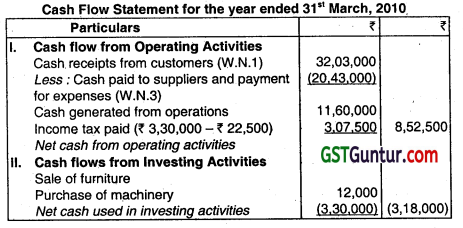

The following particulars relate to Bee Ltd. for the year ended 31st, March 2010:

(i) Furniture of book value of 15,500 was disposed off for ₹ 12,000.

(ii) Machinery costing 3,10,000 was purchased and 20,000 were spent on its erection.

(iii) Fully paid 8% preference shares of the face value of ₹ 10,00,000 were redeemed at a premium of 3%. In this connection, 60,000 equity shares of ₹ 10 each were issued at a premium of ₹ 2 per share. The entire money being received with applications.

(iv) Dividend was paid as follows:

On 8% preference shares ₹ 40,000

On equity shares for the year 2009- 10 ₹ 1,10,000

(y) Total sales were ₹ 32,00,000 out of which cash sales were ₹ 11,50,000.

(vi) Total purchases were ₹ 8,00,000 including cash purchase of ₹ 60,000.

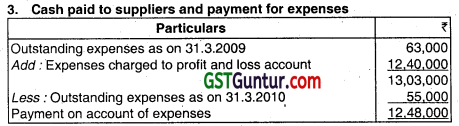

(vii) Total expenses were ₹ 12,40,000.

(viii) Taxes paid includIng dividend tax of ₹ 22,500 were ₹ 3,30,000.

(lx) Cash and cash equivalents as on 31st March 2010 were ₹ 1,25,000.

You are requested to prepare Cash Flow Statement as per AS-3 for the year ended 31st March, 2010 after taking into consideration the following also:

(May 2010, 8 marks)

Answer:

Working Notes:

1. Cash receipt from customers:

Credit sales = Total sales ₹ 32,00,000 – Cash sales ₹ 11,50,000

= ₹ 20,50,000

Total of payment to supphers and payment for expenses = ₹ 7,95,000 + ₹12,48,000 = ₹ 20,43,000

Question 23.

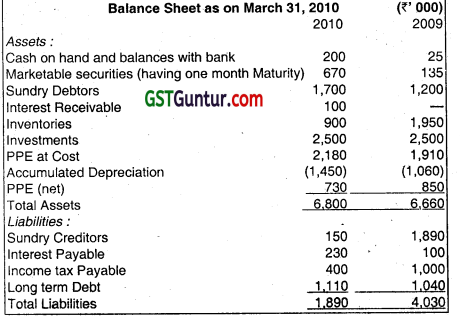

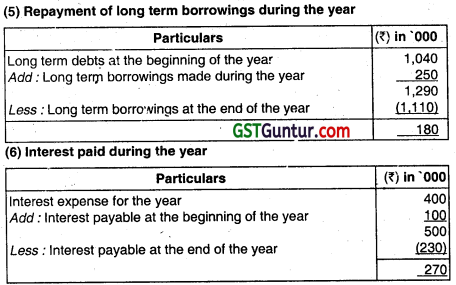

From the following information, prepare a Cash Flow Statement as per AS-3 for Banjara Ltd.. using direct method:

Additional information:

(i) An amount of ₹ 250 was raised from the issue of share capital and a further ₹ 250 was raised from long-term borrowings.

(ii) Interest expense was ₹ 400 of which ₹ 170 was paid during the period ₹ 1oo relating to interest expense of the prior period was also paid during the period.

(iii) Dividends paid were ₹ 1200.

(iv) Tax deducted at source on dividends received (Included In the tax expense of ₹ 300 for the year ) amounted to ₹ 40.

(v) During the period the enterprise acquired PPE for ₹ 350. The payment was made in cash.

(vi) Plant with original cost of ₹ 80 and accumulated Depreciation of ₹ 60 was sold for ₹ 20.

(vii) Sundry debtors and Sundry creditors include amounts relating to credit sales and credit purchases only. (Nov 2010, 16 marks)

Answer:

Working Notes:

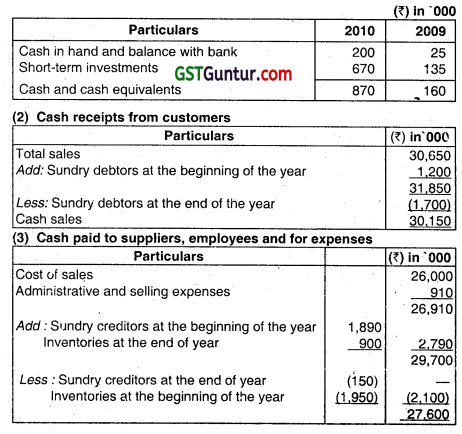

(1) Cash and cash equivalents

Cash and cash equivalents includes cash in hand and balances with banks and investments in money market instruments for short periods.

Note: Out of ₹ 900 thousands, tax deducted at source on dividends received (amounting to ₹ 40 thousands) is included ¡n cash flows from investing activities and the balance of ₹ 860 thousands is included in cash flows from operating activities.

Question 24.

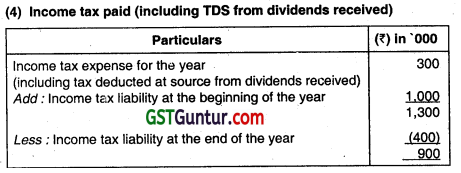

On the basis of the following information prepare a Cash Flow Statement for the year ended 31st March 2013:

(i) Total sales for the year were 199 crore out of which cash sales amounted to ₹ 131 crore.

(ii) Cash collections from credit customers during the year totaled ₹ 67 crores.

(iii) Cash paid to suppliers of goods and services and to the employees of the enterprise amounted to ₹ 159 crore.

(iv) Fully paid preference shares of the face value of ₹ 16 crore were redeemed and equity shares of the face value of ₹ 16 crore were allotted as fully paid up at a premium of 25%.

(v) ₹ 13 crore were paid by way of income tax.

(vi) Machine of the book value of ₹ 21 crore was sold at a loss of ₹ 30 lakhs and a new machine was installed at a total cost of ₹ 40 crore.

(vii) Debenture interest amounting ₹ 1 crore was paid.

viii) Dividends totaling ₹ 10 crores was paid on equity and preference shares. Corporate dividend tax @ 17.647% was also paid.

(ix) On 31st March 2012 balance with bank and cash on hand totaled ₹ 9 crore. (May 2013, 8 marks)

Answer:

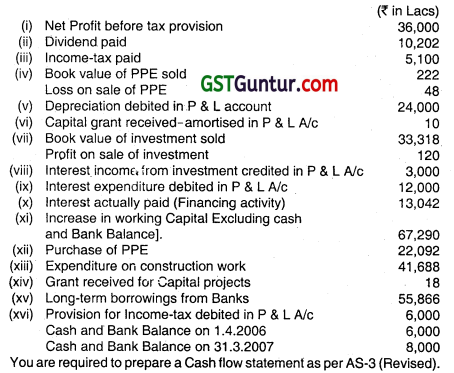

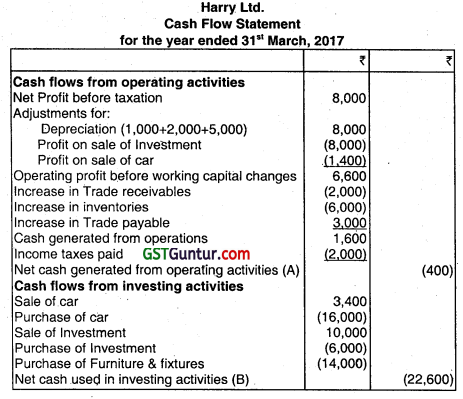

Question 25.

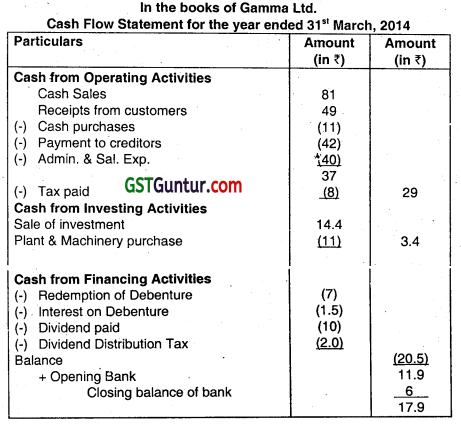

Prepare Cash flow for Gamma Ltd., for the year ending 31.3.2014 from the following information:

1. Sales for the year amounted to ₹ 135 crores out of which 60% was cash sales.

2. Purchases for the year amounted to ₹ 55 crores out of which credit purchase was 80%.

3. Administrative and selling expenses amounted to ₹ 18 crores and salary paid amounted to ₹ 22 crores.

4. The Company redeemed debentures of ₹ 20 crores at a premium of 10%. Debenture holders were issued equity shares of ₹ 15 crores towards redemption and the balance was paid in cash. Debenture interest paid during the year was ₹ 1.5 crores.

5. Dividends paid during the year amounted to ₹ 10 crores. Dividend distribution tax @ 20% (assumed) was also paid.

6. Investments costing ₹ 12 crores were sold at a profit of ₹ 2.4 crores.

7. ₹ 8 crores was paid towards income tax during the year.

8. A new plant costing ₹ 21 crores was purchased In part exchange of an old plant. The book value of the old plant was ₹ 12 crores but the vendor took over the old plant at a value of ₹ 10 crores only. The balance was paid in cash to the vendor.

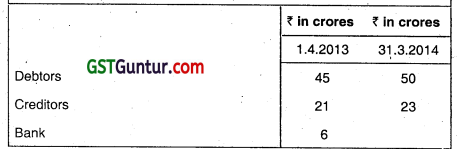

9. The following balances are also provided

(Nov 2014,6 marks)

Answer:

![]()

Question 26.

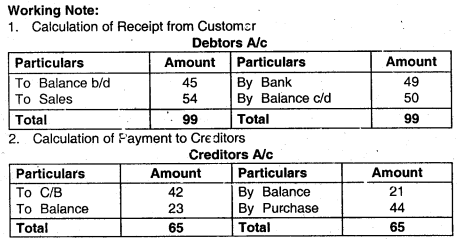

Prepare cash flow statement of M/s MNT Ltd. for the year ended 31st March, 2015 with the help of the following information:

1. Company sold goods for cash only.

2. Gross Profit Ratio was 30% for the year, gross profit amounts to ₹ 3,82,500.

3. Opening inventory was lesser than closing inventory by ₹ 35,000.

4. Wages paid during the year ₹ 4,92.500.

5. Office and selling expenses paid during the year ₹ 75,000.

6. Dividend paid during the year ₹ 30,000 (including dividend distribution tax.)

7. Bank loan repaid during the year ₹ 2,15,000 (induced interest ₹ 15,000)

8. Trade payables on 31st March 2014 exceed the balance on 31st March 2015 by ₹ 25,000.

9. Amount paid to trade payables during the year ₹ 4,60,000.

10. Tax paid during the year amounts to ₹ 65,000 (Provision for taxation as on 31.03.2015 ₹ 45,000).

11. Investments of ₹ 7,00,000 sold during the year at a profit of ₹ 20,000.

12. Depreciation on PPE amounts to ₹ 85,000.

13. Plant and machinery purchased on 15th November, 2014 for ₹ 2,50,000.

14. Cash and Cash Equivalents on 31st March 2014 ₹ 2,00,000.

15. Cash and Cash Equivalents on 31st March 2015 ₹ 6,07,500.

(Nov 2015, 8 marks)

Answer:

Working Notes:

1. Calculation of Cash Sales:

GP Ratio = 30%

Gross Profit = 3,82,500

Sales:

30% → 3,82,500 = \(\frac{100 \times 3,82,500}{30} \)

100% → 9

Cash Sales = ₹ 12,75,000

2. Adjustment for opening and dosing inventory is not done in direct method as there is no movement of cash.

3. Adjustment of trade payable is not done in direct method as there is no movement of cash.

4. Depreciation is a non-cash item, hence it is not considered.

Question 27.

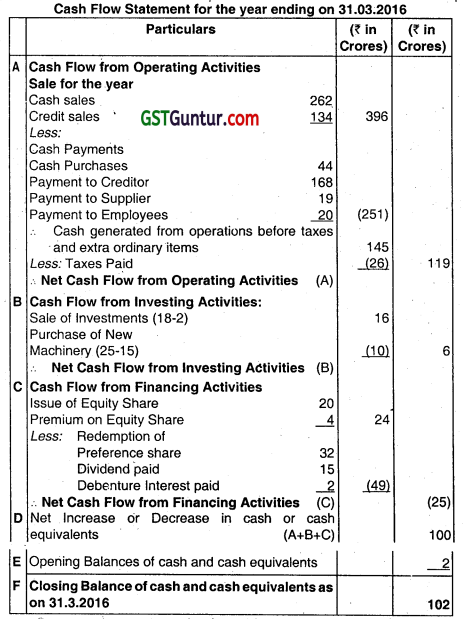

On the basis of the following information prepare a Cash Flow Statement for the year ended 31st March 2016 (Using the direct method):

(i) Total sales for the year were ₹ 398 crores out of which cash sales amounted to ₹ 262 crores,

(ii) Receipts from credit customers during the year, totaled ₹ 134 crores.

(iii) Purchases for the year amounted to ₹ 220 crores out of which credit purchase was 80%.

Balance ¡n creditors as on

1.4.2015 ₹ 8.4 crores

31.3.2016 ₹ 92 croies

(iv) Suppliers of other consumables and services were paid ₹ 19 crores in cash.

(v) Employees of the enterprises were paid ₹ 20 crores In cash.

(vi) Fully paid preference share of the face value of ₹ 32 crores- were redeemed. Equity shares of the face value of ₹ 20 crores were allotted as fully paid up at premium of 20%.

(vii) Debentures of ₹ 20 croies at a premium of 10% were redeemed. Debenture holders were issued equity shares In lieu of their debentures.

(viii) ₹ 26 crores were paid by way of income tax.

(ix) A new machinery costing ₹ 25 crores was purchased in part exchange of an old machinery. The book value of the old machinery was ₹ 13 crores. Through the negotiations, the vendor agreed to take over the old machinery at a higher value of. ₹ 15 crores. The balance was paid in cash to the vendor.

(x) Investment costing ₹ 18 crores were sold at a loss of ₹ 2 crores.

(xi) Dividends totally ₹ 15 ciares (including dividend distribution tax of ₹ 2.7 crores) was also paid.

(xii) Debenture interest amounting ₹ 2 crores was paid.

(xiii) On 31st March 2015, Balance with Bank and Cash on hand totaled ₹ 2 crores. ( Nov 2016, 8 marks)

Answer:

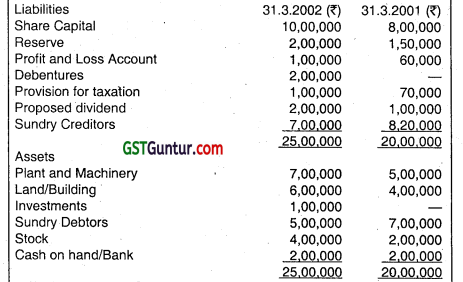

Question 28.

From the following details relating to the Accounts of Grow More prepare Cash Flow Statement:

(i) Depreciation @ 25% was charged on the opening value of Plant and Machinery.

(ii) During the year one old machine costing 50,000 (WDV 20,000) was sold for ₹ 35,000.

(iii) ₹ 50,000 was paid towards Income tax during the year.

(iv) Building under construction was not subject to any depreciation. Prepare Cash Flow Statement. (Nov 2002, 16 marks)

Answer:

Question 29.

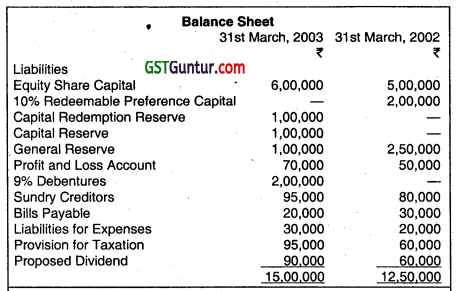

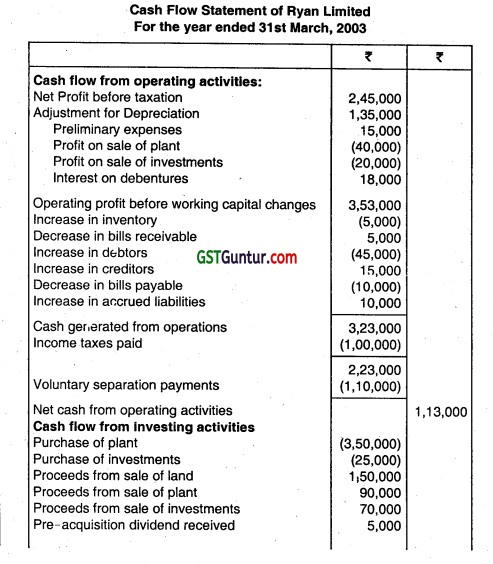

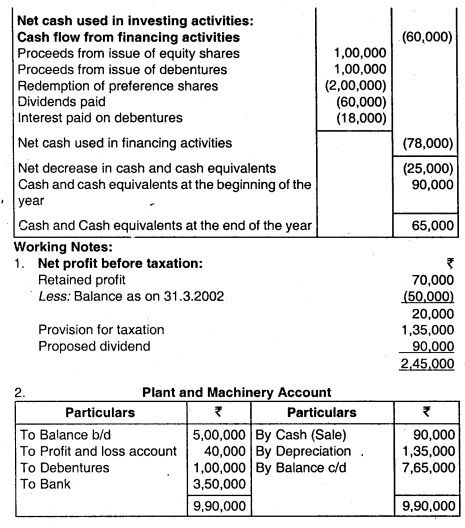

From the following Balance Sheet and information, prepare Cash Flow Statement of Ryan Ltd. for the year ended 31st March 2003:

Additional Information:

(i) A pike of land has been sold out for ₹ 1,50,000 (Cost – ₹ 1,20,000) and the balance land was revalued. Capital Reserve consisted of Profit on sale and profit on revaluation.

(ii) On 1st April, 2002 a plant was sold for 90,000 (Original Cost – ₹ 70,000 and W.D.V. – ₹ 50,000), and Debentures worth 1 lakh was issued at par as part consideration for Plant of 4.5 lakh acquired.

(iii) Part of the investments (Cost – ₹ 50,000) was sold for ₹ 70,000.

(iv) Pre.acqulsition dividend received ₹ 5,000 was adjusted against cost of investment.

(v) Directors have proposed 15% dividend for the current year.

(vi) Voluntary separation cost 0f ₹ 50,000 was adjusted against General Reserve.

(vii) income-tax liability for the current year was estimated at ₹ 1,35,000.

(viii) Depreciation @ 15% has been written off from Plant account but no depreciation has been charged on Land and Building. (May 2003, 20 marks)

Answer:

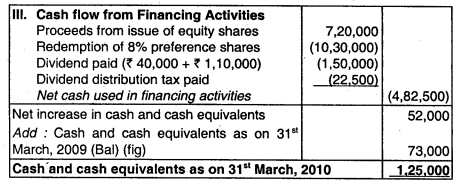

Question 30.

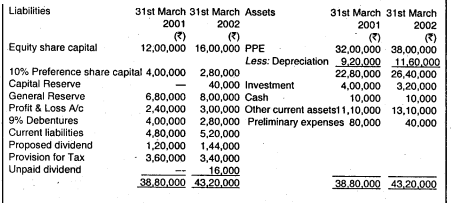

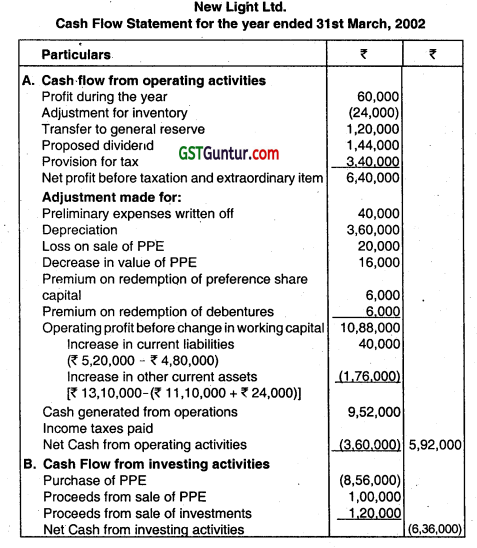

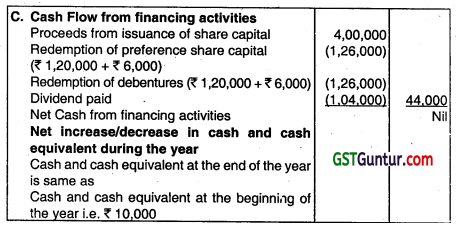

The Balance Sheet of New Light Ltd. for the years ended 31 March, 2001 and 2002 are as follows:

Additional information:

(i) The company sold one fixed asset for ₹ 1,00,000, the cost of which was ₹ 2,00,000 and the depreciation provided on it was ₹ 80,000.

(ii) The company also decided to write off another PPE costing ₹ 56,000 on which depreciation amounting to ₹ 40,000 has been provided.

(iii) Depreciation on PPE provided ₹ 3,60,000.

(iv) Company sold some investments at a profit of ₹ 40,000, which was credited to capital reserve.

(v) Debentures and preference share capital redeemed at 5% premium.

(vi) Company decided to value stock at cost, whereas previously the practice was to value stock at cost less 10%. The stock according to books on 31-3-2001 was ₹ 2,16,000. The stock on 31-3-2002 was correctly valued at ₹ 3,00,000.

Prepare Cash Flow Statement as per revised Accounting Standard-3 by indirect method. (Nov 2003, 16 marks)

Answer:

Working Notes:

1. Revaluation of stock increases the opening stock by ₹ 24,000.

\(\left[\frac{₹ 2,16,000}{90} \times 10=₹ 24,000\right] \times 10 \) = ₹ 24,000

Hence, opening balance of other current assets will be as follows:

₹ 11,10,000 + ₹ 24,000 = ₹ 11,34,000

Due to undervaluation of stock, the opening balance of profit and loss account be increased by ₹ 24,000.

Opening balance of profit and loss account after revaluation of stock will be ₹ 2,40,000 + ₹ 24,000 = ₹ 2,64,000

5. Unpaid dividend is taken as non-current item and dividend paid is shown at (₹’ 1,20,000 — ₹ 16,000) ₹ 1,04,000.

Alternatively: Unpaid demand can be considered as current liability and there fore dividend paid can be shown at ₹ 1,20,000, due to this assumption cash flow from operating activities will get affected. The cash flow from operating activities will increase by ₹ 16,000 to ₹ 6,08,000 and cash flow from financing activities will get reduced by ₹’ 16,000 to ₹’ 28,000 i.e. ₹’ 12,000.

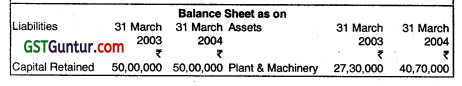

Question 31.

ABC Ltd. gives you the following informations. You are required to prepare Cash Flow Statement by using indirect methods as per AS-3 for the year ended 31.03.2004:

Additional Information:

(i) Net profit for the year ended 31st March, 2004, after charging depreciation 1,80,000 is 22,40,000.

(ii) Debtors of 2,30,000 were determined to be worthless and were written oil against the provisions for doubtful debts account during the year.

(iii) ABC Ltd. declared dividend of 12,00,000 for the year 2003-2004. (May 2004, 16 marks)

Answer:

Alternatively: The adjustment of writing off bad debts can be ignored and the solution can be given on the basis of figures of debtors and provision for doubtful debts as appearing in the balance sheet on 31.3.2004. In this question, bad debts of ₹ 2,30,000 were written off against the provision for doubtful debts A/c during the year. So, in this question, bad debts have been added back m the closing balance of provision for bad and doubtful debts account.

![]()

Question 32.

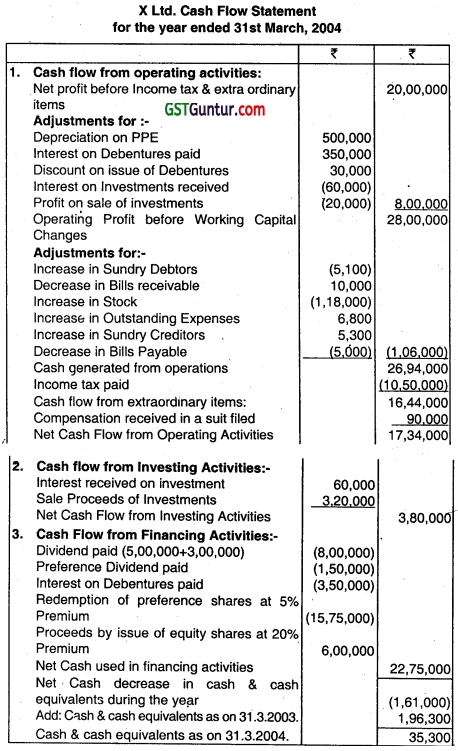

The following figures have been extracted from the Books of X Limited for the year ended on 31.3.2004. You are required to prepare a cash flow statement.

(i) Net profit before taking into account Income Tax and Income from lawsuits but after taking into Account the following items was ₹ 20 lakhs:

(a) Depreciation on PPE ₹ 5 Iakhs.

(b) Discount on issue of Debentures written off ₹ 30,000.

(c) Interest on Debentures paid ₹ 3,50,000.

(ci) Books value of investments ₹ 3 lakhs (Sale of Investments for ₹ 3,20,000).

(e) Interest received on Investments ₹ 60,000.

(f) Compensation received 90,000 by the company in a suit filed.

(ii) Income tax paid during the year ₹ 10,50,000.

(iii) 15,000, 10% preference shares of ₹ 100 each were redeemed on 31.3.2004 at a premium of 5%. Further, the company issued ₹ 50,000 equity shares of ₹ 10 each at a premium of 20% on 2.4.2003. Dividends on preference shares were paid at the time of redemption.

(iv) Dividends paid for the year 2002-2003 ₹ 5 lakhs and Interim dividend paid ₹ 3 Lakhs for the year 2003-04.

(v) Land was purchased on 2.4.2003 for ₹ 2,40,000 for which the company issued ₹ 20,000 equity shares of ₹ 10 each at a premium of 20% to the land owner as consideration.

(vi) Current assets and Current liabilities At the beginning and at the end of the years were as detailed below:

(May 2005, 16 marks)

Answer:

Note: Since purchase of land in exchange of equity shares (issued at 20% Premium) does not involve any cash transaction so it has not been taken in the cash flow statement.

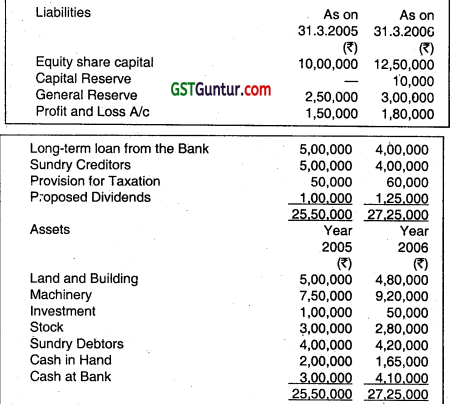

Question 33.

The following are the summarised Balance Sheets of ‘X’ Ltd. as on March 31, 2005, and 2006:

Additional Information:

(i) Dividend of ₹ 1,00,000 was paid during the year ended March 31, 2006.

(ii) Machinery during the year purchased for ₹ 1,25,000.

(iii) Machinery of another company was purchased for a consideration of 1,00,000 payable in equity shares.

(iv) Income tax provided during the year ₹ 55,000.

(v) Company sold some investments at a profit of ₹ 10,000, which was credited to Capital reserve.

(vi) There was no sale of machinery during the year.

(vii) Depreciation written off on Land and Building ₹ 20,000. From the above particulars, prepare a cash flow statement for the year ended March 2006 as per AS-3 (Indirect method). (Nov 2006, 16 marks)

Answer:

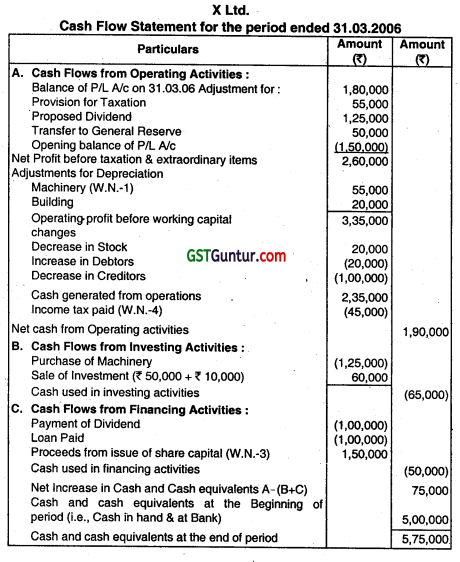

Question 34.

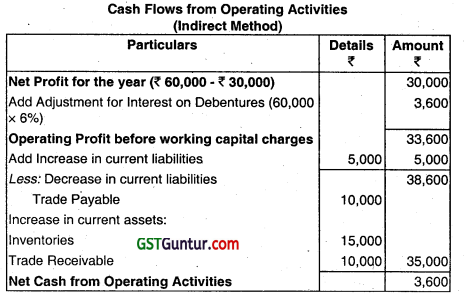

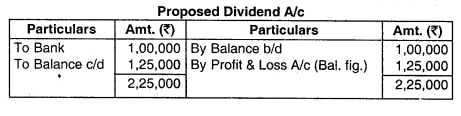

J Ltd. presents you the following information for the year ended 31st March 2007:

(Nov 2007,16 Marks)

Answer:

![]()

Question 35.

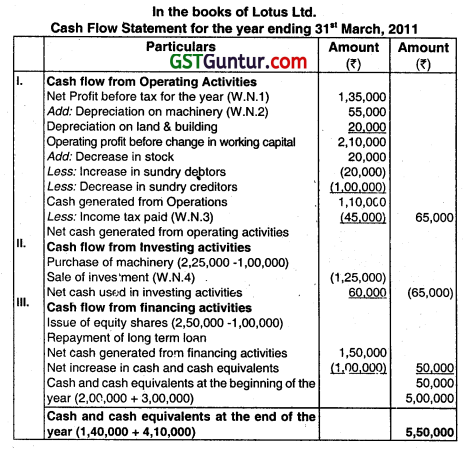

The following are the summarized Balance Sheets of Lotus Ltd. as on 31st March. 2010 and 2011.

Additional information:

1. Depreciation written off on land and building ₹ 20,000.

2. The company sold some Investments at a profit of ₹ 10,000, whIch was credited of Capital Reserve.

3. Income tax provided during the year ₹ 55,000.

4. During the year, the company purchased a machinery for ₹ 2,25,000.

They paid ₹ 1,25,000 in cash and issued 10000 equity shares of ₹ 10 each at par.

You are required to prepare a cash flow statement for the year ended 31st March, 2011 as per AS-3, by using indirect method. (May 2011, 16 marks)

Answer:

Question 36.

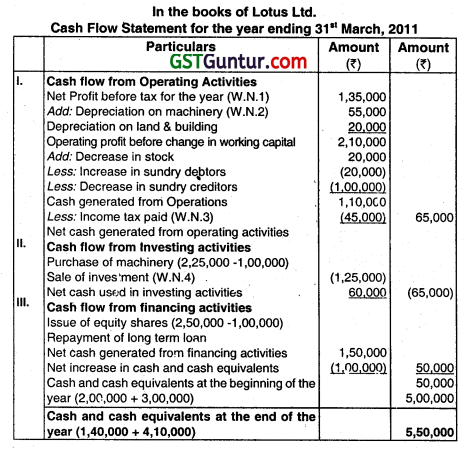

Surya Ltd. has provided you the following particulars. Prepare Cash Flow from Operating Activities by Indirect Method In accordance with AS 3:

(Nov 2013, 8 Marks)

Answer:

Question 37.

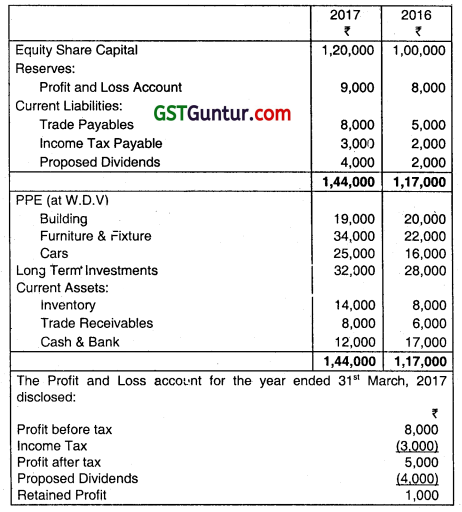

The Balance Sheet of Harry Ltd. for the year ending 31st March, 2017 and 31st March, 2016 were summarised as:

Further Information is available:

1. Depreciation on Building ₹ 1,000

2. Depreciation on Furniture & Fixtures for the year ₹ 2,000

3. Depreciation on Cars for the year ₹ 5,000. One car was disposed during the year for ₹ 3,400 whose written down value was ₹ 2000.

4. Purchase investments for ₹ 6,000.

5. Sold investments for? 10,000, these investments cost ₹ 2,000.

Prepare Cash Flow Statements as per AS-3 (revised) using Indirect method. (Nov 2017, 12 marks)

Answer:

Dividend proposed for the year ended 31st March, 2016 amounting ₹ 2,000 must have been declared and paid in the year 2016-17. Hence, it has been considered as cash outflow for preparation of cash flow statement of 2016-17.

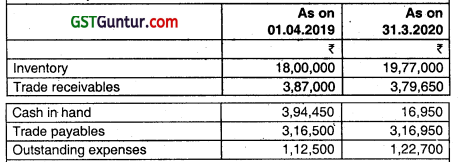

Question 38.

The following figures have been extracted from the books of Manan Limited for the year ended on 31.3.2020. You are required to prepare the Cash Flow Statement as per AS 3 using indirect method.

(i) Net profit before taking into account income tax and income from law Suits but after taking into account the following items was ₹ 30 lakhs:

(a) Depreciation on Property, Plant & Equipment ₹ 7.50 lakhs.

(b) Discount on issue of Debentures written off ₹ 45.000.

(c) Interest on Debentures paid ₹ 5,25,000

(d) Book value of Investments ₹ 4.50 Iakhs (Sale of Investments for ₹ 4,80,000).

(e) Interest received on investments ₹ 90,000.

(ii) Compensation received ₹ 1,35,000 by the company in a suit filed.

(iii) Income tax paid during the year ₹ 15,75,000.

(iv) 22,500, 10% preference shares of ₹ 100 each were redeemed on 02-04-2019 at a premium of 5%.

(v) Further the company issued ₹ 75,000 equity shares of ₹ 10 each at a premium of 20% on 30.3.2020 (Out of ₹ 75,000 equity shares, ₹ 25,000 equity shares were issued to a supplier of machinery)

(vi) Dividends for FY 2018-19 on preference shares were paid at the time of redemption.

(vii) Dividend on Equity shares paid on 31.01.2020 for the year 2018- 2019 ₹ 7.50 lakhs (including dividend distribution tax) and interim dividend paid ₹ 2.50 lakhs for the year 2019-2020.

(viii) Land was purchased on 02.4.2019 for ₹ 3,00,000 for which the company issued ₹ 22,000 equity shares of 10 each at a premium of 20% to the land owner and balance is cash as consideration.

(ix) Current assets and current liabilities in the beginning and at the end of the years were as detailed below:

(Nov 2020, 8 Marks)

Question 39.

Following information was extracted from the books of S Ltd. for the year ended 31st March, 2020:

(1) Net profit before taking into account income tax and after taking into account the following items was ₹ 30 lakhs;

(i) Depreciation on Property, Plant & Equipment ₹ 7,00,000.

(ii) Discount on issue of debentures written off ₹ 45,000.

(iii) Interest on debentures paid ₹ 4,35,000.

(lv) Investment of Book value ₹ 3,50,000 sold for ₹ 3,75,000.

(y) Interest received on Investments ₹ 70,000.

(2) Income tax paid during the year ₹ 12,80,000

(3) Company issued 60,000 Equity Shares of ₹ 10 each at a premium of 20% on 101h April, 2019.

(4) ₹ 20,000. 9% Preference Shares of ₹ 100 each were redeemed on 31st March, 2020 at a premium of 5%

(5) Dividend paid during the year amounted to ₹ 11 Lakhs (including dividend distribution tax)

(6) A new Plant costing ₹ 7 Lakhs was purchased in part exchange of an old plant on 1st January, 2020. The book value of the old plant was ₹ 8 Lakhs but the vendor took over the old plant at a value of ₹ 6 Lakhs only. The balance amount was paid to vendor through cheque on March, 2020.

(7) Company decided to value inventory at cost, whereas previously the practice was to value inventory at cost less 10%. The inventory according to books on 31.03.2020 was ₹ 14,76,000. The inventory on 31.03.2019 was correctly valued at ₹ 1,350,000.

(8) Current Assets and Current Liabilities in the beginning and at the end of year 2019-2020 were as:

You are required to prepare a Cash Flow Statement for the year ended 31st March, 2020 as per AS 3 (revised) using the indirect method. (Jan 2021, 12 marks)

Question 40.

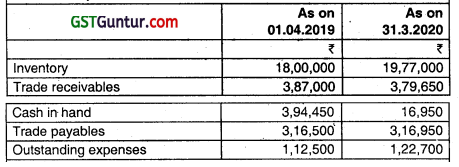

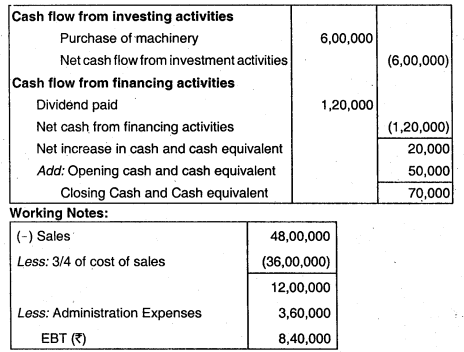

Raj Ltd. gives you the following information for the year ended 31st March, 2006:

(i) Sales for the year ₹ 48,00,000. The Company sold goods for cash only.

(ii) Cost of goods sold was 75% of sales.

(iii) Closing inventory was higher than Opening inventory by ₹ 50,000.

(iv) Trade creditors on 31.3.2006 exceed the outstanding on 31.3.2005 by ₹ 1,00,000.

(y) Tax paid during the year amounts to ₹ 1,50,000.

(vi) Amounts paid to Trade Creditors during the year ₹ 35,50,000.

(vii) Administrative and Selling Expenses paid ₹ 3,60,000.

(viii) One new machinery was acquired in December 2005 for ₹ 6,00,000.

(ix) Dividend paid during the year ₹ 1,20,000.

(x) Cash in hand and at Bank on 31.3.2006 ₹ 70,000.

(xi) Cash in hand and at Bank on 1.4.2005 ₹ 50,000.

Prepare Cash Flow Statement for the year ended 31.3.2006 as per the prescribed Accounting Standard. (May 2006, 12 marks)

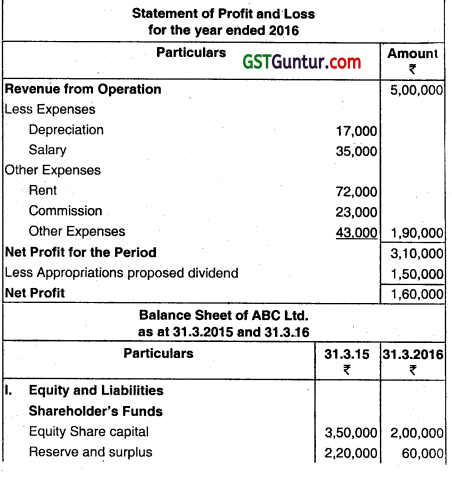

Answer:

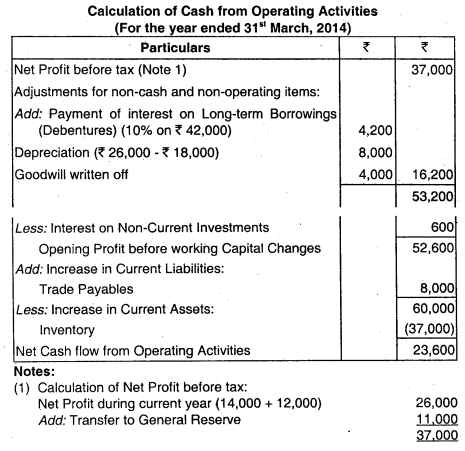

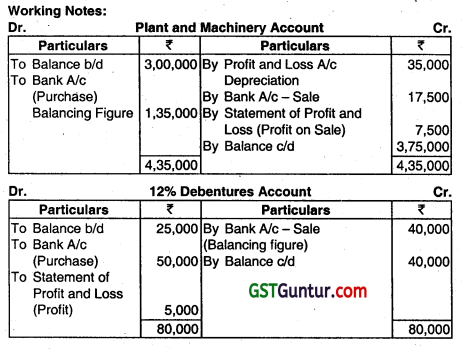

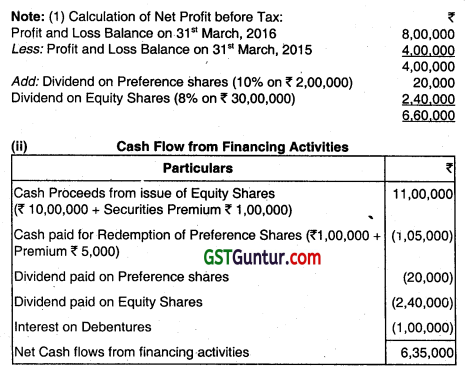

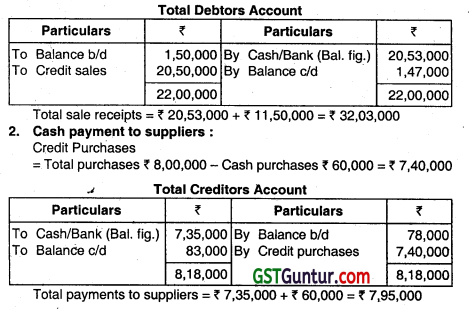

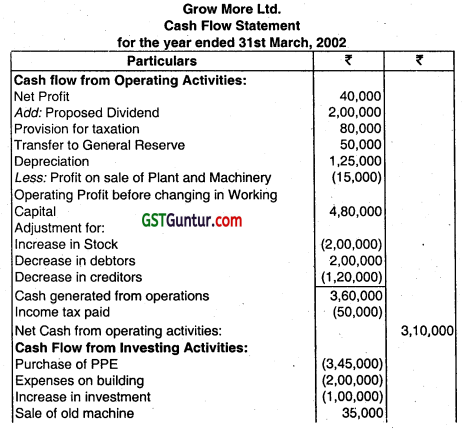

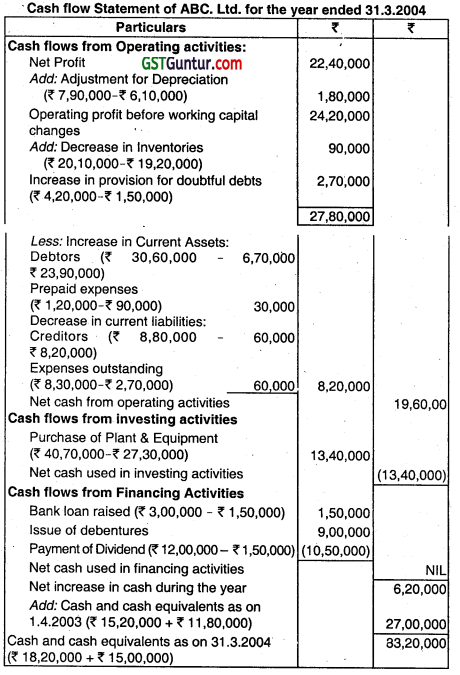

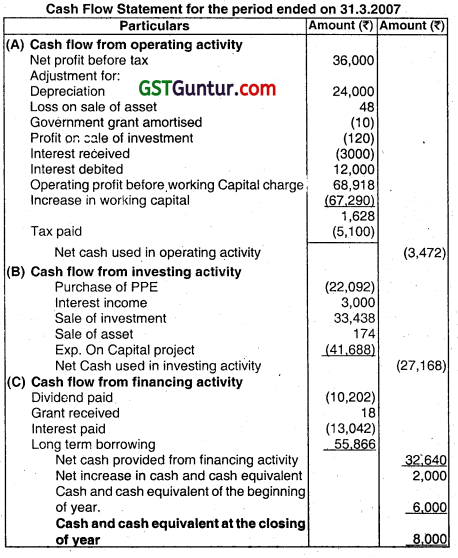

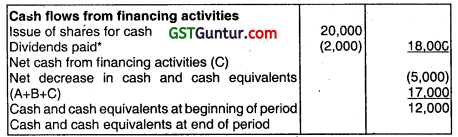

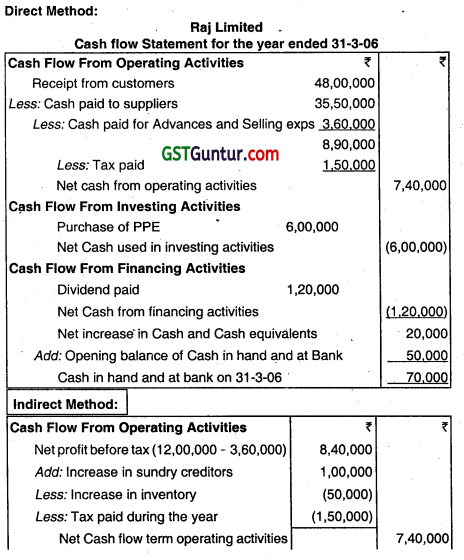

Question 41.

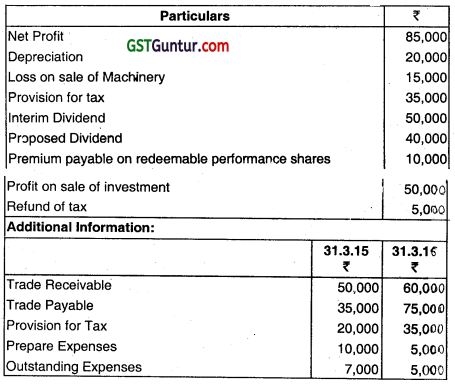

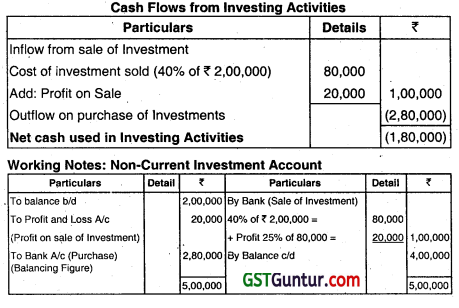

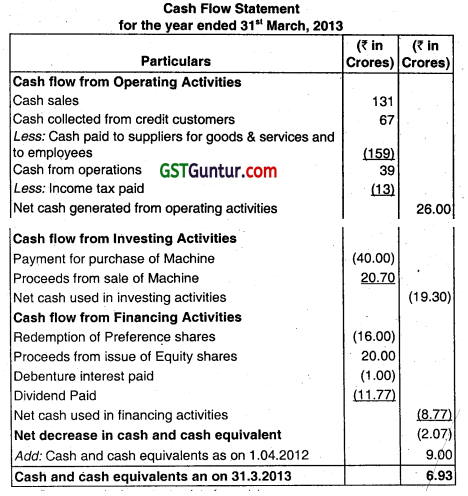

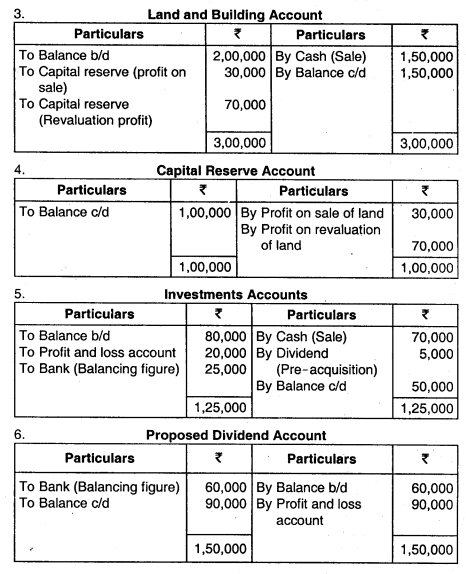

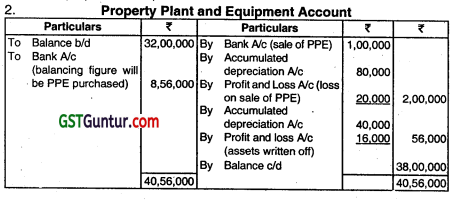

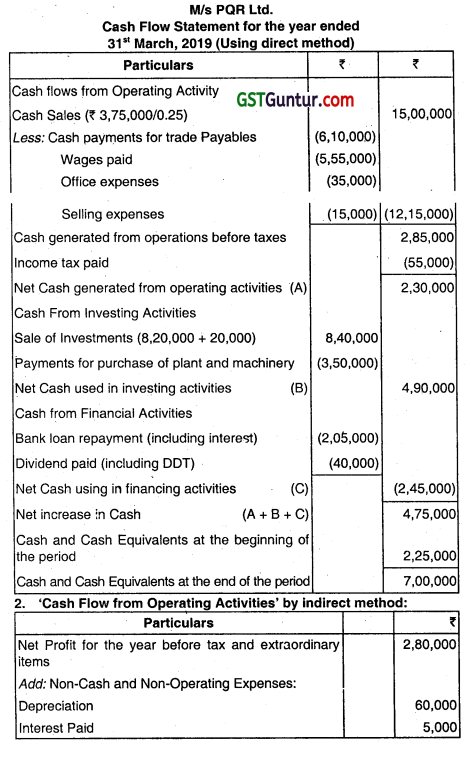

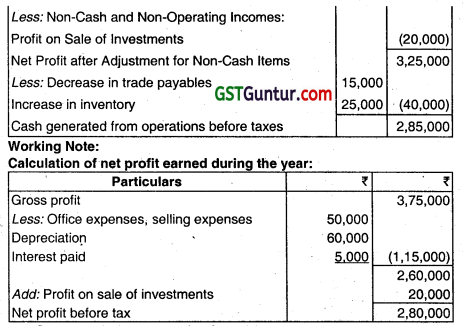

The following information was provided by M/s POR Ltd. for the year ended 31st March, 2019:

1. Gross Profit Ratio was 25% for the year, it amounts to ₹ 3,75,000.

2. Company sold goods for cash only.

3. Opening inventory was lesser than closing inventory by ₹ 25,000.

4. Wages paid during the year ₹ 5,55,000.

5. Office expenses paid during the year ₹ 35,000.

6. Selling expenses paid during the year ₹ 15,000.

7. Dividend paid during the year ₹ 40,000 (including dividend distribution tax).

8. Bank Loan repaid during the year ₹ 2,05,000 (included interest ₹ 5,000)

9. Trade Payables on 31st March, 2018 were ₹ 50,000 and on 31st March, 2019 were ₹ 35,000.

10. Amount paid to Trade payables during the year ₹ 6,10,000.

11. Income Tax paid during the year amounts to ₹ 55,000. (Provision for taxation as on 31st March, 2019 ₹ 30,000.)

12. Investments of ₹ 8,20,000 sold during the year at a profit of ₹ 20,000.

13. Depreciation on furniture amounts to ₹ 40,000.

14. Depreciation on other tangible assets amounts to ₹ 20,000.

15. Plant and Machinery purchased on 15 November 2018 for ₹ 3,50,000. On 31st March, 2019 ₹ 2,00,000,7% Debentures issued at face value in an exchange for a plant.

Cash and Cash equivalents on 31 March, 2018 ₹ 2,25,000.

Prepare cash flow statement for the year ended 31st March, 2019, using direct method.

Calculate cash flow from operating activities, using indirect method. (May 2019,10 marks)

Answer:

![]()

Question 42.

What are the differences between Cash Flow Statement and Fund Flow Statement? ( May 2006, 4 marks)

Answer:

| Basis | Cash Flow Statement | Fund Flow Statement |

| 1. Deals with | Cash flow statement deals with the changes in cash. | Fund flow statement deals with the changes in working capital position between two points of time. |

| 2. Methods | Cash flow statement can be prepared by direct or indirect method. | There is no such type of direct or indirect method for preparation of fund flow statement. |

| 3. Records | Cash flow statement records only inflow and outflow of cash. | Fund flow statement records sources and application of funds. |

| 4. Balances | Cash flow statement contains opening as well as closing balances of cash and cash equivalents. | Fund Flow Statement does not contain such balances. |

| 5. Statement of change | Not in Cash flow statement. | A statement of change In working capital is prepared in fund flow. |