Accounts from Incomplete Records – CA Inter Accounts Question Bank is designed strictly as per the latest syllabus and exam pattern.

Accounts from Incomplete Records – CA Inter Accounts Question Bank

Question 1.

Answer the following:

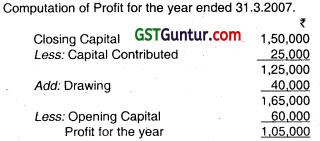

The closing capital of Mr. A on 31.3.2007 was ₹ 1,50,000. On 1.4.2006 his capital was ₹ 60,000. During the year he had, drawn ₹ 40,000 for domestic expenses. He introduced ₹ 25,000 as additional Capital in February 2007. Find out his Not Profit for the year. (Nov 2007, 2 marks)

Answer:

Question 2.

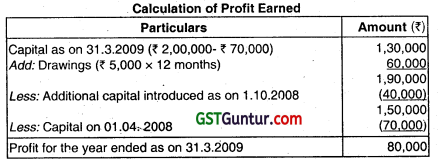

On 1st April 2008. Chhotu started business with an initial Capital of ₹ 70,000. On 1st October 2008, he introduced additional capital of ₹ 40,000. On 7th of every month, he withdraw ₹ 5,000 for household expenses. On 31st March 2009 his Assets and Liabilities were ₹ 2,00,000 and ₹ 70,000 respectively. Ascertain the Profit earned by Chhotu during the year ended 31st March 2009. (Nov 2009, 2 marks)

Answer:

Question 3.

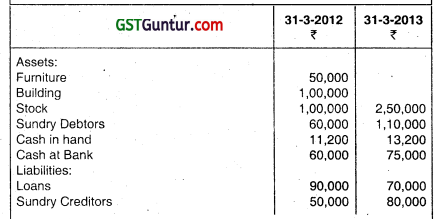

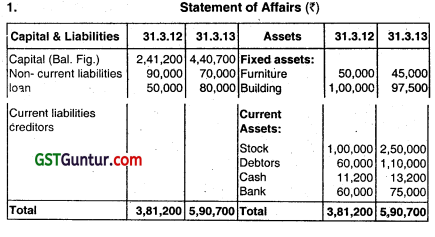

The details of Assets and Liabilities ot Mr. A’ as on 31-3-2012 and 31-3- 2013 are as follows:

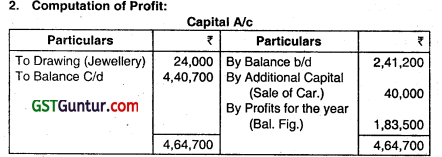

Mr. ‘A’ decided o provide depreciation on building by 2.5% and furniture by 10% for the period ended on 31-3-2013. Mr. A purchased jewellery for ₹ 24,000 for his daughter ¡n December 2012. He sold his car on 30-3-2013 and the amount of ₹ 40,000 is retained in The business.

You are required to:

(i) Prepare statement of affairs as on 31 -3-2012 & 31-3-2013.

(ii) Calculate the profit received by ‘A’ during the year ended 31-3-2013. (Nov 2013, 8 marks)

Answer:

Question 4.

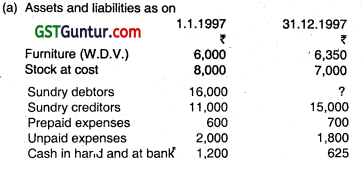

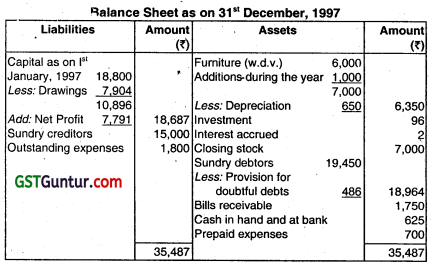

Shri Rashid furnishes you with the following information relating to his business:

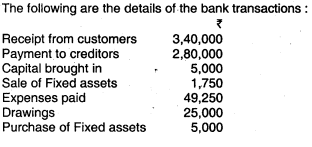

(b) Receipts and payments during 1997:

Collections from debtors, after allowing discount of ₹ 1,500 amounted to ₹ 58,500.

Collections on discounting of bills of exchange, after deduction of discount of ₹ 125 by the bank, totaled to ₹ 6,125.

Creditors of ₹ 40,000 were paid ₹ 39,200 In full settlement of their dues.

Payment for freight inwards ₹ 3,000.

Amounts withdrawn for personal use ₹ 7,000.

Payment for office furniture ₹ 1,000.

Investments carrying annual interest of 4% were purchased at ₹ 96 on 1st July, 1997 end payment made therefor.

Expenses including salaries paid ₹ 14,500.

Miscellaneous receipts ₹ 500.

(c) Bills of exchange drawn on and accepted by customers during the year amounted to ₹ 10,000. Of these, bills of exchange of ₹ 2,000 were endorsed in favour of creditors. An endorsed bill of exchange of ₹ 400 was dishonored,

(d) Goods costing 900 were used as advertising materials.

(e) Goods are invariably sold to show a gross profit of 33 and 1/3% on sales.

(f) Difference in cash book, if any, is to be treated as further drawing or introduction by Shri Rashid.

(g) Provide at 2.5% for doubtful debts on closing debtors. Rastud asks you to prepare Trading and Profit and Loss A/c for the year ended 31st December 1997 and the Balance Sheet as on that date. (May 1998, 20 marks)

Answer:

![]()

Question 5.

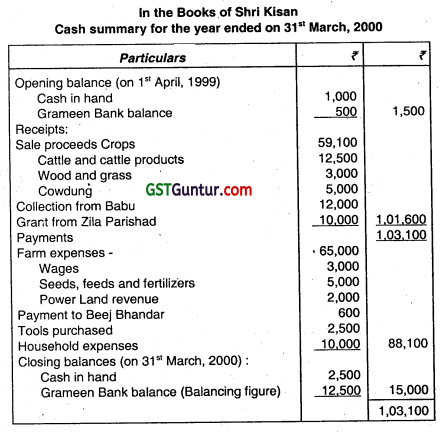

Shri Kisan, a farmer, maintains a cash book, through which he records all receipts and payments and a diary in which he records other relevant information. On 31st March, 1999 he had cash in hand ₹ 1,000 and balance of ₹ 500 with local Grameen Bank. He also owed ₹ 600 to Beej Bhandar for seeds purchased by that date. During the year ended 31st March, 2000, he realised:

Sale proceeds of crops – ₹ 59,100

Sale proceeds of cattle and cattle products – ₹ 12,500

Sale proceeds of wood arid grass – ₹ 3,000

Sale of cow dung – ₹ 5,000

Receipt on account from Babu (a credit customer) – ₹ 12,000

Grant from Zila Parishad for installing tubewell-chegue – ₹ 10,000

During the year ended 31st March, 2000 he paid:

Wages – ₹ 65,000

Beej Bhanciar – ₹ 600

Seeds, feeds and fertilizer – ₹ 3,000

Power – ₹ 5,000

Land revenue – ₹ 2,000

Tools purchased – ₹ 2,500

Household expenses – ₹ 10,000

During the year ended 31st March 2000 his other transactions were:

- Sale of crop to Babu on credit ₹ 20,000

- Purchase on 25th March, 2000 from Beej Bhandar on credit of one-month seeds of ₹ 2,000

- Efforts put in by self and family members on the farm were conservatively valued at ₹ 60,000

- Value of crop used for consumption by:

Self and family ₹ 30,000

Agricultural labourers ₹ 40,000

On 31st March, 2000, his cash in hand was only ₹ 2,500.

The rest was banked. He did not have any stock of seeds.

The tubewell for which the grant cheque was realised in the last week of March, 2000 is to be installed in April, 2000.

Shri Kisan asks you to prepare his cash and income summaries for the year ended 31st March, 2000 and his statement of financial position as on that date. (May 2000, 12 Marks)

Answer:

Question 6.

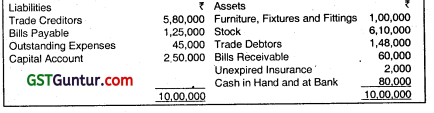

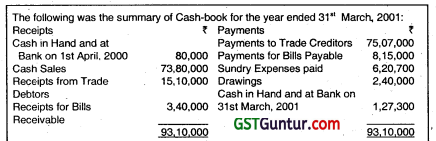

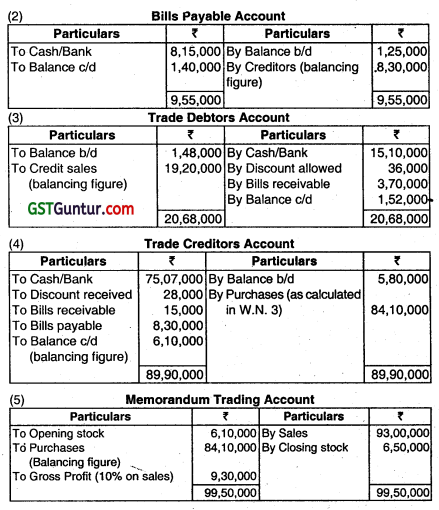

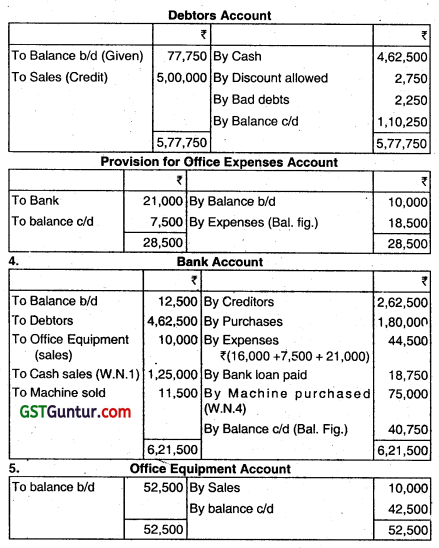

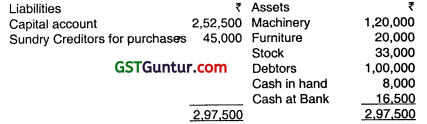

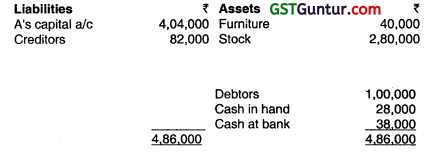

A trader keeps his books of account under single entry system. On 31st March, 2000 his statement of affairs stood as follows:

Discount allowed to trade debtors and received from trade creditors amounted to ₹ 36,000 and ₹ 28,000 respectively. Bills endorsed amounted to ₹ 15,000. Annual Fire Insurance premium of ₹ 6,000 was paid every year on 1st August for the renewal of the policy. Furniture, fixtures and

fittings were subject to depreciation @ 15% per annum on diminishing

balances method.

You are also informed about the following balances as on 31st ‘ March, 2001:

Stock – ₹ 6,50,000

Trade Debtors – ₹ 1,52,000

Bills Receivable – ₹ 75,000

Bills Payable – ₹ 1,40,000

Outstanding Expenses – ₹ 5,000

The trader maintains a steady gross profit ratio of 10% on sales.

Prepare Trading and Profit and Loss Account for the year ended 31st March 2001 and Balance Sheet as at that date. (May 2001, 16 marks)

Answer:

Question 7.

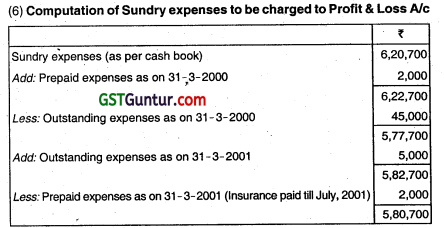

The following is the Balance Sheet of a concern on 31st March. 2000:

The time lag for payment to Trade Creditors for purchase and receipt from Sales is one month. The business earns a gross profit of 30% on turnover. The expenses against gross profit amount to 10% of the turnover. The amount of depreciation is not Included in these expenses.

Draft a Balance Sheet as at 31st March 2001 assuming that creditors are all Trade Creditors for purchases and debtors for sales and there is no other item of current assets and liabilities apart from stock and cash and bank balances. (Nov 2001, 8 marks)

Answer:

Note: In this question, all sales and purchase are considered on the basis of credit.

![]()

Question 8.

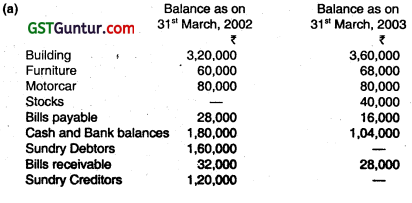

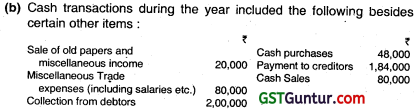

The following information relates to the business of Mr. Shiv Kumar, who requests you to prepare a Trading and Profit & Loss Account for the year ended 31st March 2003 and a Balance Sheet as on that date:

(c) Other information:

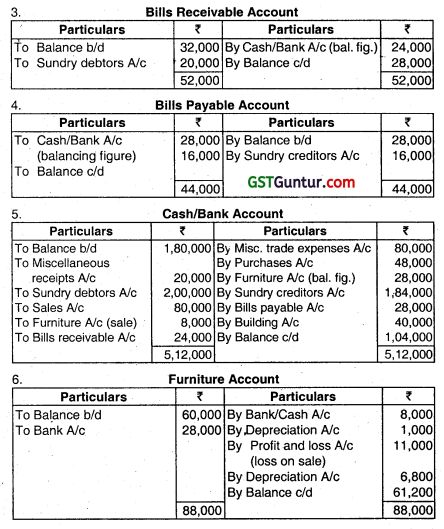

(i) Bills receivable drawn during the year amount to ₹ 20,000 and Bilis payable accepted ₹ 16,000.

(ii) Some items of old furniture, whose written down value on 31st March 2002 was ₹ 20,000 was sold on 30” September 2002 for 8,000. Depreciation is to be provided on Building and Furniture @ 10% p.a. and ón Motorcar 0 20% p.a. Depreciation on sale of furniture to be provided for 6 months and for additions to Building for whole year.

(iii) Of the Debtors, a sum of ₹ 8,000 should be written off as Bad Debt and a reserve for doubtful debts Is to be provided @ 2%.

(iv) Mr. Shivkumar has been maintaining a steady gross profit rate of 30% on turnover.

(v) Outstanding salary on 31st March, 2002 was ₹ 8,000 and on 31st ssMarch, 2003 was ₹ 10,000 on 31st March, 2002. Profit & Loss Account had a credit balance of ₹ 40,000.

(vi) 20% of total Saies arid total purchases are to be treated as for cash.

(vii) Additions in Furniture Account took palce in the beginning of the year and there was no opening provision for doubtful debts. (Nov 2003, 20 marks)

Answer:

Question 9.

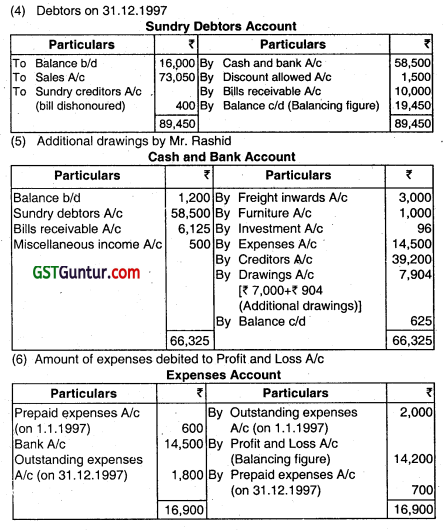

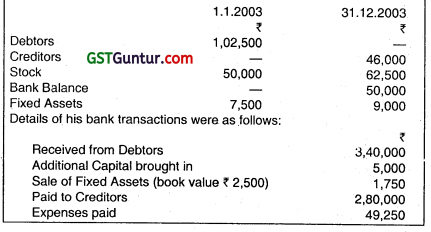

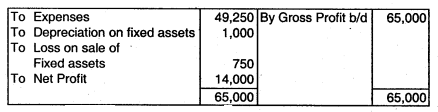

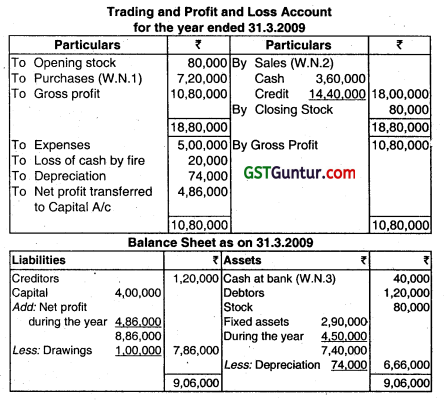

Lucky does not maintain proper books of accounts. However, he maintains a record of his bank transactions and also is able to give the following information, from which you are requested to prepare his final accounts for the year 2003:

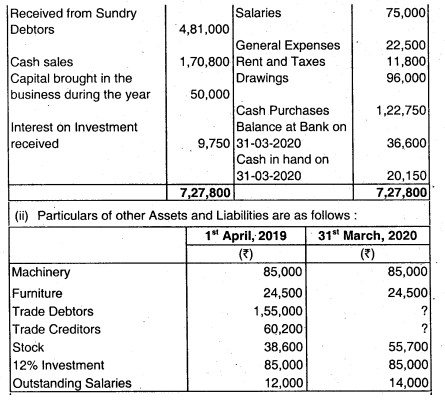

![]()

No cash transactions took place during the year. Goods are sold at cost plus 25%. Cost of goods sold was ₹ 2,60,000. (Nov 2004, 16 marks)

Answer:

Question 10.

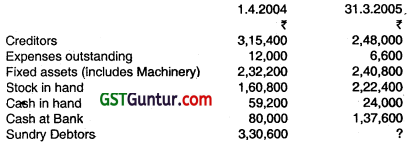

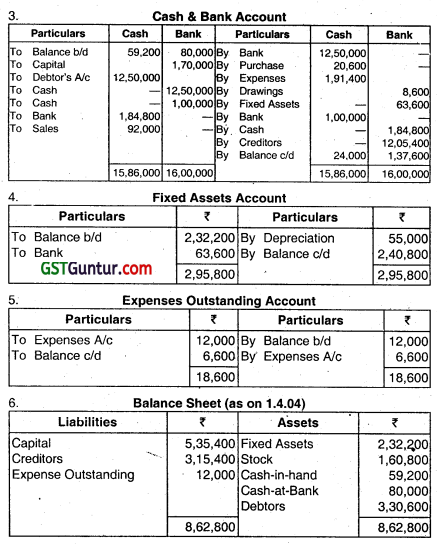

From the following furnished by Shri Ramji, prepare Trading and Profit and Loss account for the year ended 31.3.2005. Also, draft his Balance Sheet as at 31.3.2005:

Details of the year’s transactions are as follows:

| Cash and discounts credited to debtors | 12,80,000 |

| Returns from Debtors | 29,000 |

| Bad Debts | 8,400 |

| Sales (Both Cash and Credit) | 14,36,200 |

| Discounts allowed by creditors | 14,000 |

| Returns to creditors | 8,000 |

| Capital introduced by Cheque | 1,70,000 |

| Collection from debtors (Deposited Intó Bank after receiving cash) | 12,50,000 |

| Cash purchases | 20,600 |

| Expenses paid by cash | 1,91,400 |

| Drawings by Cheque | 8,600 |

| Machinery acquired by Cheque | 63,600 |

| Cash deposited into Bank | 1,00,000 |

| Cash withdrawn from Bank | 1,84,800 |

| Cash Sales | 92,000 |

| Payment to creditors by Cheque | 12,05,400 |

Note: Ramji has not sold any Fixed Asset during the year. (Nov 2005, 16 marks)

Answer:

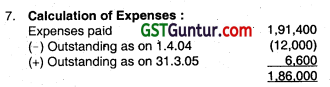

Question 11.

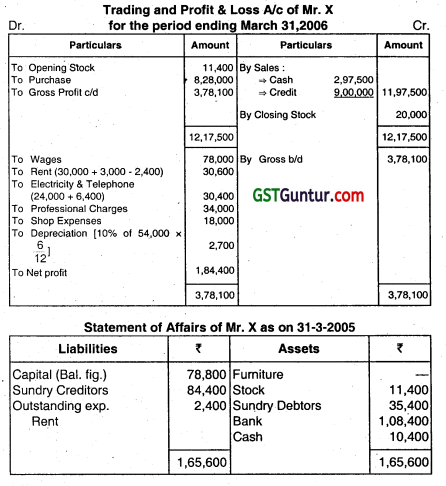

Mr. X runs a retail business. Suddenly he finds on 31.3.2006 that his Cash and Bank balances have reduced considerably. He provides you the following information:

(ii) Bank Pass-book reveals the following:

Total Deposits 10,34,000

Withdrawals:

Creditors 8,90,000

Professional charges 34,000

Furniture & Fixtures (acquired on 1.10.05) 54,000

Proprietor’s drawings 1,61.900

(iii) Rent has been increased from January 2006.

(iv) Mr. X deposited all cash sales and collections from debtors after meeting wages, shop expenses, rent, electricity, and telephone charges.

(v) Mr. X made all purchases on credit.

(vi) His credit sales during the year amounts to ₹ 9,00,000.

(vii) He incurred ₹ 6,500 per month towards wages.

(viii) He incurred following expenses:

(a) Electricity and telephone charges ₹ 24.000 (paid)

(b) Shop expenses ₹ 18,000 (paid).

(ix) Charge depreciation on furniture and fixtures ©10% p.a. Finalise the accounts of Mr. X and compute his profit for the year ended 31.3.2006, Prepare his statement of affairs, and reconcile the profit and capital balance. (May 2006, 20 marks)

Answer:

![]()

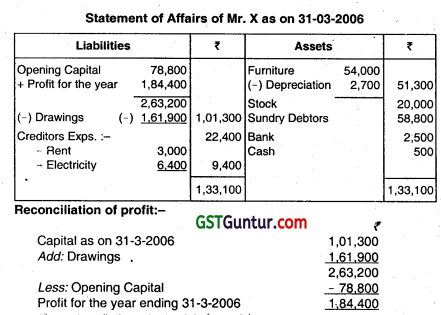

Question 12.

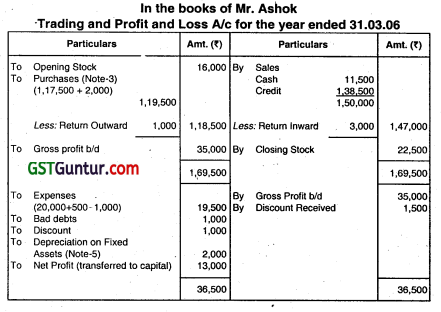

Mr. Ashok keeps his books in Single Entry system. From the following information, prepare Trading and Profit & Loss Account for the year ended 31st March. 2006 and the Balance Sheet as on that date:

(Nov 2006,16 Marks)

Answer:

Question 13.

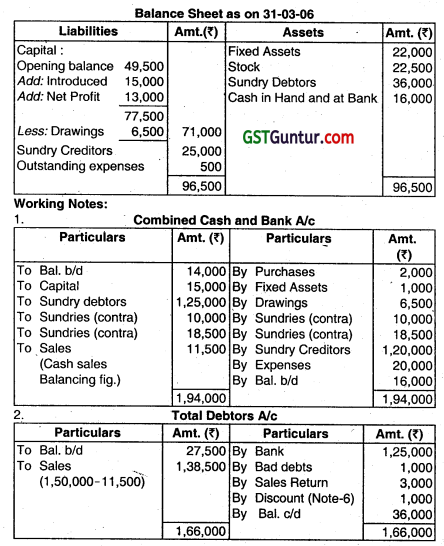

Mr. Y keeps his books under single entry system. On 31st March. 2006 his Balance Sheet was as follows:

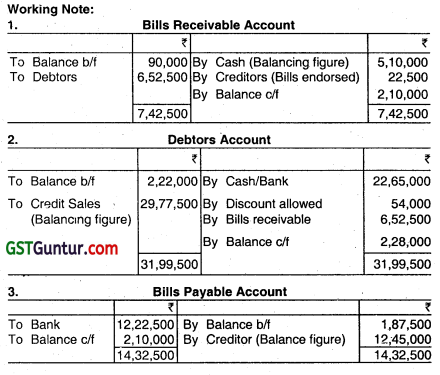

(i) Following are the summary of cash and bank transactions for the year ended 31st March, 2007:

| ₹ | |

| Cash sales | 1,10,70,000 |

| Collection from debtors | 22,65,000 |

| Payments to creditors | 1,12,60,500 |

| Paid for bills payable | 12,22,500 |

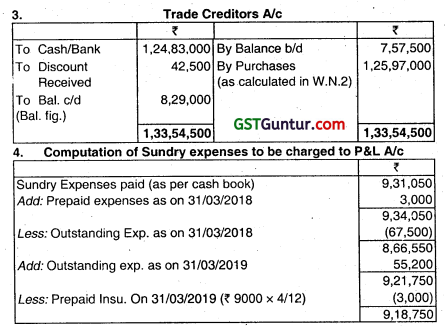

| Sundry expenses paid | 9,31,050 |

| Drawings for domestic expenses by Mr. Y | 3,60,000 |

| Cash and bank balance as on 31.3.2007 | 1,90,950 |

(ii) Following further details are furnished:

Gross profit on sales @ 10%

Bills receivable from debtors during the year 6,52,500

Discount allowed to debtors 54000

Discount received from creditors 42,000

Bills receivable endorsed to creditors 22,500

Annual fire insurance premium paid 63,800

(This is paid on 1st August every year 9,000

Depreciate fixed assets @ 10%

(iii) Balances as on 31.3.2007 are given below:

Stock in hand – ₹ 9,75,000

Debtors – ₹ 2,28,000

Bills receivable – ₹ 2,10,000

Bills payable – ₹ 2,10,000

Outstanding expenses – ₹ 7,500

Prepare Trading, Profit and Loss Account for the year ended 31st March, 2007 and Balance Sheet on that date. (May 2007, 16 marks)

Answer:

Question 14.

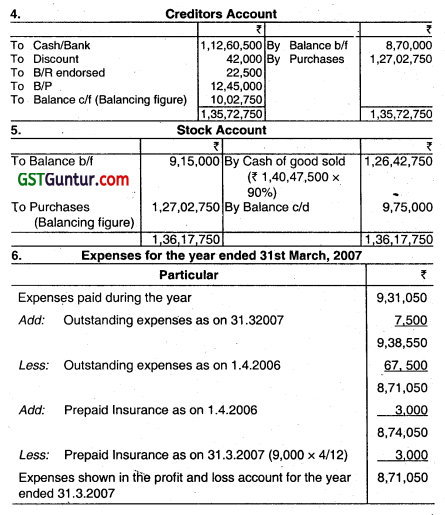

Answer the following:

A company sold 25% of the goods on cash basis and the balance on credit basis. Debtors are allowed 2 months cred and their balance as on 31.3.2008 is 1.40,000. Assume that the sale is uniform through out the year. Calculate the total sales of the company for the year ended 31.3.2008. (May 2008, 2 marks)

Answer:

Question 15.

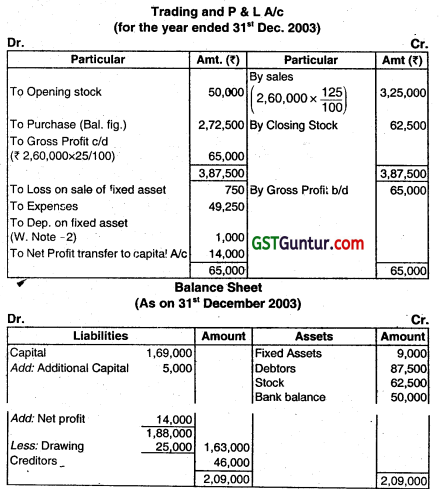

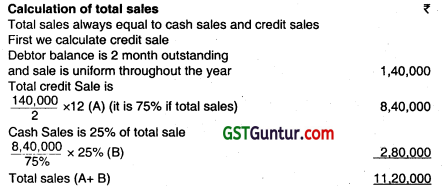

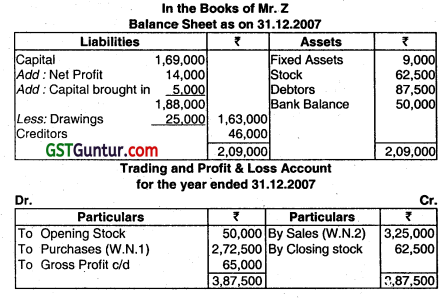

The books of Mr. Z showed the following information:

Other informations:

(i) Cost of goods sold 2,60.000

(ii) Gross profit 25% on cost of goods sold –

(iii) Book value of Assets sold 2,500

Prepare Trading, Profit & Loss account for the year ended 31.12.2007 and Balance Sheet as at 31.12.2007. (Nov 2008, 8 marks)

Answer:

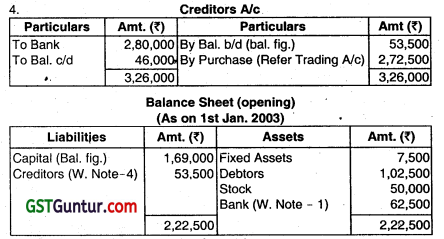

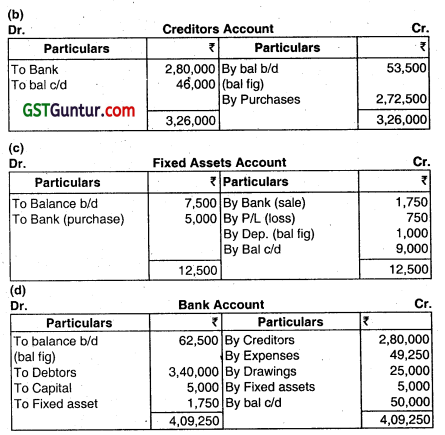

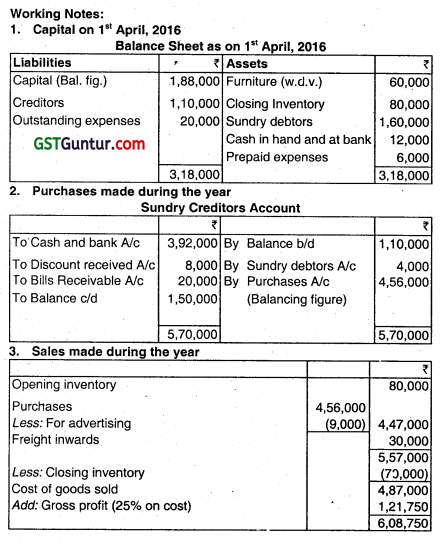

Working Notes:

1. Opening stock + Purchases- Closing stock = Cost of goods sold 50,000 + Purchases- 62,500 = ₹ 2,60,000

Purchases = ₹ 2,72,500/-

It has been assumed that all purchases are on credit.

2. Sales Cost of goods sold + Gross profit

= 2,60,000 + (25% of 2,60,000)

= 3,25,000

It has been assumed that all sales are on credit.

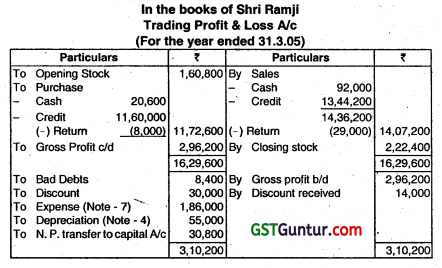

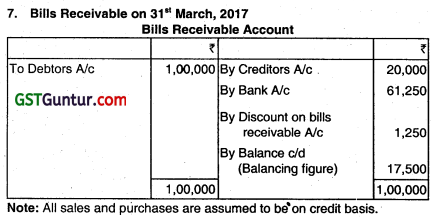

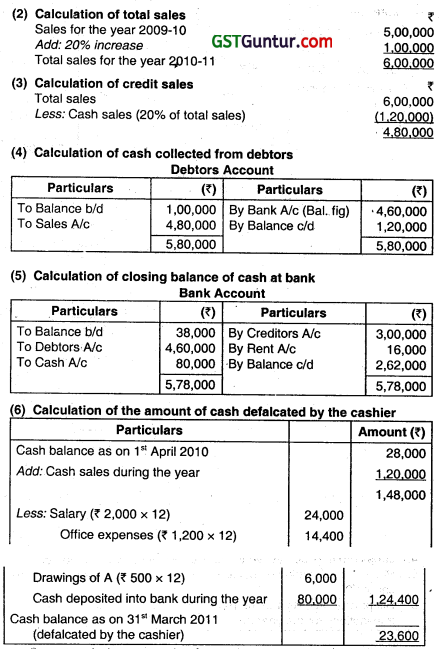

Question 16.

Following is the Balance Sheet of Mr. Ram, a small trader, as on 31st March 2008:

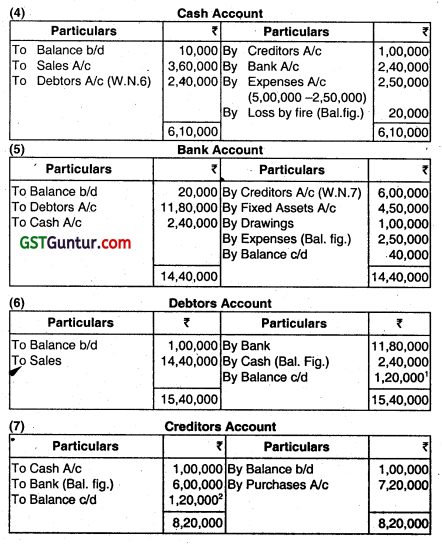

A fire occurred on the night of 31st March 2009, destroying the accounting records as well as the closing cash of the trader. However, the following information was available:

(i) Debtors and creditors as on 31st March 2009 showed an increase of 20% as compared to 31st March 2008.

(ii) Credit period:

Debtors: 1 month

Creditors: 2 months

(iii) Stock was maintained at tile same level throughout the year.

(iv) Cash sales constituted at 20% of the total sales.

(v) All purchases were on credit basis only.

(vi) Current ratio on 31st March 2009 was exactly 2.

(vii) Total expenses excluding depreciation for the year amounted to ₹5,00,000.

(viii) Depreciation was provided @ 10% on the closing book value of fixed assets.

(ix) Bank and cash transáctions for the financial year 2008-09 were as under:

(a) Payment to creditors included ₹ 1,00,000 by cash.

(b) Received debtors Included ₹ 11,80,000 by way of cheques.

(C) Cash deposited into the Bank ₹ 2,40,000.

(d) Personal drawings from Bank ₹ 1,00,000.

(e) Fixed assets purchased and paid by cheques ₹ 4,50,000.

(f) Assume that cash destroyed by fire is written off in the Profit and Loss account. You are required to prepare:

(i) Trading and Profit and Loss account of Shri Ram for the year ended 31st March. 2009.

(ii) A Balance Sheet as at that date. (May 2009, 8 marks)

Answer:

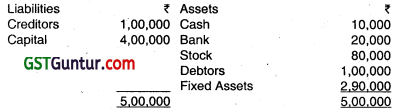

Working Notes:

(1) Calculation of creditors as on 31.3.2009 and credit purchase for 2008-2009

Creditors = Previous year creditors + 20% increase

= 1,00,000+20,000

= ₹ 1,20,000

Credit purchases = Creditors at the end × \(\frac{12}{2}\)

= 1,20,000 x \(\frac{12}{2}\) = ₹ 7,20,000

(2) Calculation of Debtors as 31.3.2009 and Cash and Credit Sales for 2008-2009

Debtors on 31.3.2009 = Debtors on 31.3.2008 + 20% Increase

= 1,00,000 + 20,000

= ₹ 1,20.000

Credit sales for 2008-2009 = Debtors at the end (i.e. one month credit) x 12

= ₹ 1,20,000 x 12 = ₹ 14,40,000

Total sales = ₹ 14,40,000 = ₹ 18,00,000

Cash sales = Total sales – Credit sales

₹ 18,00,000 – ₹ 14,40.000

= ₹ 3,60,000

(3) Cash and Bank Balance as on 31 .3.2009

Current ratio = 2

Current ratio = \(\frac{\text { Current assets }}{\text { Current liabilities }}=\frac{2}{1}\)

Current assets = Current abilities x 2

Current assets = 120,000 x 2 = 2,40,000

Cash and bank balance = Current assets – (Debtors + Stock)

Cash and bank balance = 2,40,000 – (1,20,000 + 80,000)

Cash and bank balance = 2,40,000 – 2,00,000 = ₹ 40,000

1. Debtors on 31.3.2009 = Debtors on 31.3.2008 × 120% I.e. 1,00,000 × 120%=1,20,000 .

2. Creditors on 31.3.2009 = Creditors on 31.3.2008 × 120% i.e. 1,00,000 × 120% = 1,20,000.

![]()

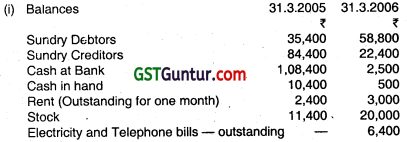

Question 17.

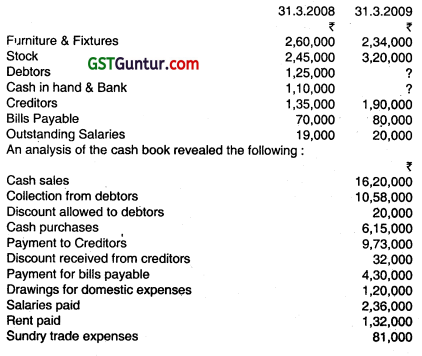

The books of account of Ruk Ruk Maan of Mumbai showed the following figures:

Depreciation is provided on furniture & fixtures 0 10% p.a. on diminishing balance method. Ruk Ruk Maan maintains a steady gross profit rate of 25% on sales. You are required to prepare trading and profit and loss account for the year ended 31st March, 2009 and Balance Sheet as on that date. (May 2010, 16 marks)

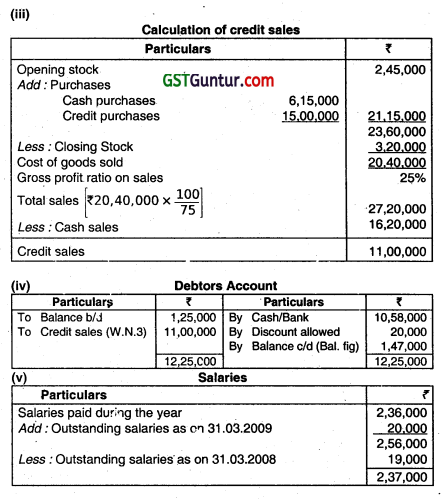

Answer:

Question 18.

M/s. Ice Limited gives you the following information to find out Total Sales and Total Purchases:

| Particulars | Amount (₹) |

| Debtors as on 01.04.2011 | 70,000 |

| Creditors as on 01 .04.2011 | 1,81,000 |

| Bills Receivables received during the year | 47,000 |

| Bills Payable issued during the year | 53,000 |

| Cash received from customers | 1,56,000 |

| Cash paid to suppliers | 1,72,000 |

| Bad Debts recovered | 16,000 |

| Bills Receivables endorsed to creditors | 27,000 |

| Bills Receivables dishonored by customers | 5,000 |

| Discount allowed by suppliers | 7,000 |

| Discount allowed to customers | 9,000 |

| Endorsed Bills Receivables dishonored | 3,000 |

| Sales Return | 11,000 |

| Bills Receivable discounted | 8,000 |

| Discounted Bills Receivable dishonored | 2,000 |

| Cash Sales | 1,68,500 |

| Cash Purchases | 1,97,800 |

| Debtors as on 31.03.2012 | 82,000 |

| Creditors as on 31.03.2012 | 95,000 |

(May 2012, 8 marks)

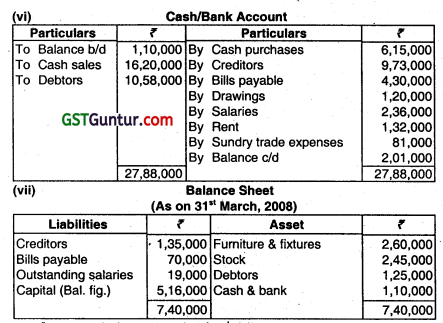

Answer:

(a) 1. Total Sales = Cash sales + Credit sales

= ₹ 1,68,500+ ₹ 2,25,000 (Refer W.N.1) = ₹ 3,93,500

2. Purchases = Cash Purcases + Credit Purchases

= ₹ 1,97,800 + ₹ 2,70,000 (Refer W.N2) = ₹ 4,67,600

Question 19.

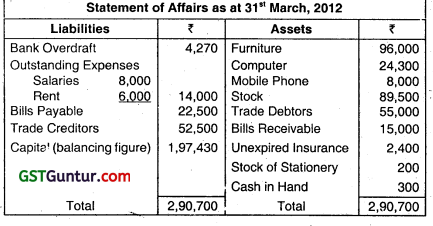

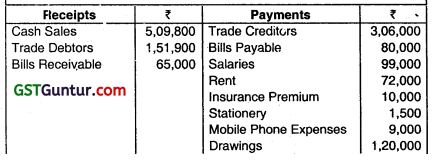

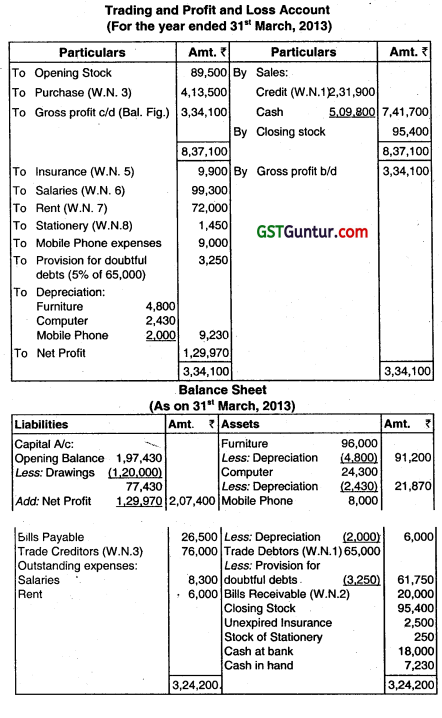

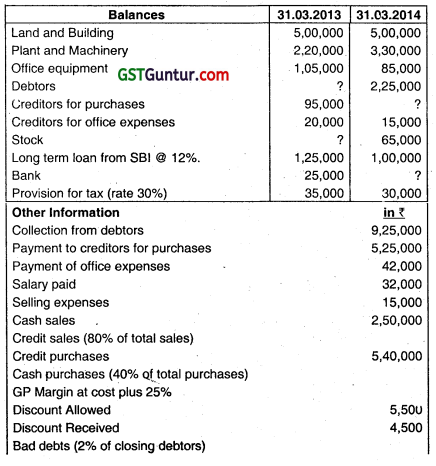

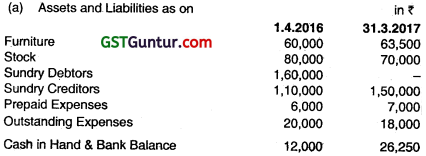

A sole trader requests you to prepare his Trading and Profit & Loss Account for the year ended 31st March, 2013 and Balance Sheet as at that date. He provides you the following information:

He informs you that there has been no addition to or sale of Furniture. Computer and Mobile Phone during the accounting year 2012-1 3. The other assets and liabilities on 31st March, 2013 are as follows:

Stock – ₹ 95,400

Trade Debtors – ₹ 65,000

Bills Receivable – ₹ 20,000

Unexpired Insurance – ₹ 2,500

Stock of Stationery – ₹ 250

Cash at Bank – ₹ 18,000

Cash at Hand – ₹ 7,230

Salaries Outstanding – ₹ 8,300

Rent Outstanding – ₹ 6,000

Bills Payable – ₹ 26,500

Trade Creditors – ₹ 76,000

He also provides to you the following summary of his cash transactions:

It is found prudent to depreciate Furniture @ 5%, Computers 10%, and Mobile Phone 25%. A provision for bad debts @ 5% on Trade Debtos is also considered desirable. (May 2013, 16 marks)

Answer:

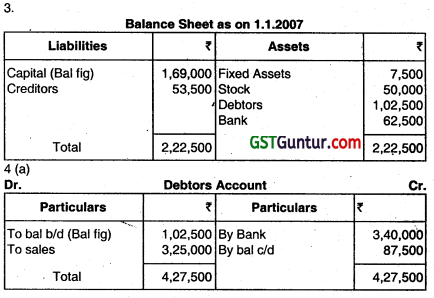

Question 20.

Answer the following questions (give workings):

(viii) Calculate the average collection period from the following details by adopting 360 days an year.

Average Inventory – ₹ 10,80,000 Gross Profit Ratio – 10%

Debtors – ₹ 6,90,000 Credit sales to total sales – 20%

Inventory Turnover ratio – 6 Times 1 year – 360 days. (June 2014, 2 marks)

Answer:

Inventory turn over ratio = \(\frac{\text { Cost of goods sold }}{\text { Average Inventory }}\)

6 = \(\frac{\text { COGS }}{10,80,000}\)

GP = 64,80,000

GP ratio =10%

Hence, Sates = \(\operatorname{COGS} \times \frac{100}{90}\)

= 64,80,000 × \(\frac{100}{90}\) = 72,00,000

Credit sales = 72,00,000 x 20% = 14,40,000

Average collection Period = \(\frac{\text { Average Debtors }}{\text { Credit Sales }} \times 360\)

= \(\frac{6,90,000}{14,40,000} \times 360\) = 172.5 days

![]()

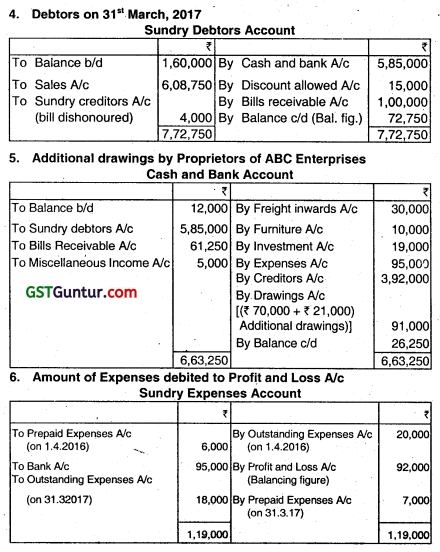

Question 21.

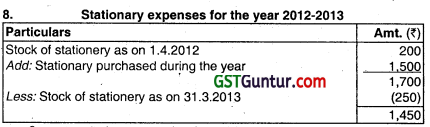

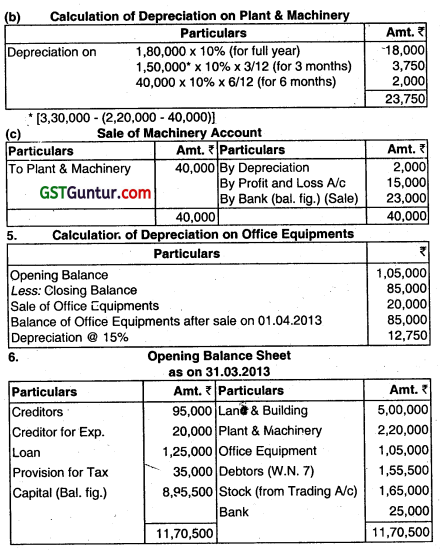

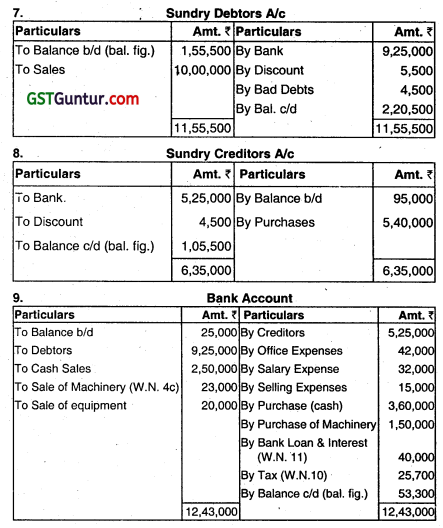

Following are the Incomplete information of Moonlight Traders:

The following balances are available as on 31.032013 and 31.03.2014. (Fig. in ₹ )

Depreciation to be provided as follows

Land and Building 5%

Plant and Machinery 10%

Office Equipment 15%

Other adjustments:

(i) On 01.10.13 they sold machine having Book Value ₹ 40,000 (as on 31.03.2013) at a loss of ₹ 15,000. New machine was purchased on 01.01.2014.

(ii) Office equipment was sold at its book value on 01.04.2013.

(iii) Loan was partly repaid on 31.03.14 together with interest for the year.

Prepare Trading P & L A/c. and Balance Sheet as on 31.03.2014. (May 2014, 16 marks)

Answer:

Note:

The aforesaid solution has been worked out on the basis of the following assumptions:

- Tax profits are the same as accounting profits.

- The figure of ₹ 2,25,000, being the closing balance of Sundry Debtors as given in the question is before providing for bad debts. Accordingly, the closing balance has been reduced by the amount of bad debts.

Question 22.

Answer the question:

(b) Prepare Total Creditors Account for the year ended on 31.03.2013 from the data given below:

| ₹ | |

| Creditors Balance on 01 .04.2012 | 38,000 |

| Credit Purchases during the year | 2,67,000 |

| Bills payable accepted | 62,000 |

| Cash paid to Creditors | 1,37,000 |

| B/R endorsed to creditors | 16,000 |

| Endorsed B/R dishonoured | 3,000 |

| B/P dishonored | 2,000 |

| Purchase returns | 11,000 |

| Discount received | 6,000 |

| Transfer from Debtors’ ledger | 7,000 |

(Dec 2014, 4 marks)

Answer:

Question 23.

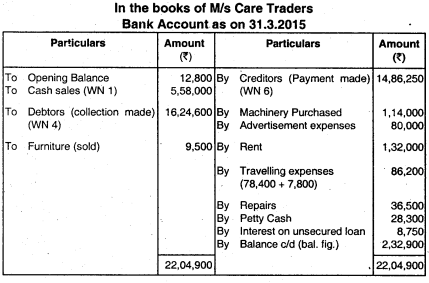

The following is the Balance Sheet of M/s. Care Traders as on 1-4-2014:

A fire broke out the premlses on 31-3-2015 and destroyed the books of account. The accountant could however provide the following information:

(1) Sales for the year ended 31 -3-2014 was ₹ 18,60,000. Sales for the current year was 20% higher than the last year.

(2) 25% sales were made in cash and the balance was on credit.

(3) Gross profit on sales is 30%.

(4) Terms of Credit

Debtors: 2 months

Creditors: 1 month

All creditors are paid by cheque and all credit sales are collected In cheque.

(5) The Bank Pass Book has the following details (other than payment to creditors and collection from debtors)

Machinery purchased – ₹ 1,14,000

Rent paid – ₹ 1,32,000

Advertisement expenses – ₹ 80,000

Travelling expenses – ₹ 78,400

Repairs – ₹ 36,500

Sales of furniture – ₹ 9,500

Cash withdrawn for petty expenses – ₹ 28,300

Interest paid on unsecured loan – ₹ 8,750

(6) Machinery was purchased on 1.10.201 4.

(7) Rent was paid for 11 months only and 25% of the advertisement expenses relates to the next year.

(8) Travelling expenses of 7.800 for which cheques were issued but

not presented in bank.

(9) Furniture was sold on 1-4-2014 at a loss of 2,900 on book value.

(10) Physical verification as on 31-3-2015 ascertained the stock position at 1,81,000 and petty cash balance at nil.

(11) There was no change for unsecured loan during the year.

(12) Depreciation is to be provided at 10% on machinery and 20% on furniture.

Prepare Bank Account, Trading, and Profit and loss Account for the year ended 31-3-2015 In the books of MIs. Care Traders and a Balance Sheet as on that date. Make necessary assumptions wherever necessary. (May 2015, 16 marks)

Answer:

Question 24.

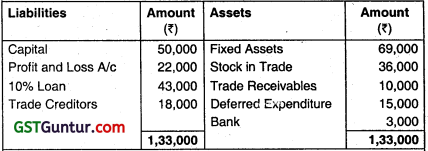

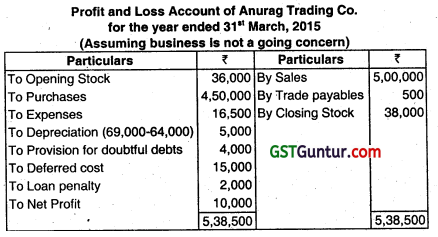

Balance Sheet of Anurag Trading Co. on 31 March, 2014 is given below:

Additional Information:

(i) Remaining lite of fixed assets is 5 years with even use. The net realizable value of fixed assets as on 31st March, 2015 was ₹ 64,000.

(ii) Firm’s sales and purchases for the year 201 4-15 amounted to ₹ 5 lacs and ₹ 4.50 lacs respectively.

(iii) The cost and net realizable value of the stock were ₹ 34,000 and ₹ 38,000 respectively.

(iv) General Expenses for the year 2014-15 were ₹ 16,500.

(v) Deferred Expenditure Is normally amortized equally over 4 years starting from F.Y. 2013-14 i.e. ₹ 5,000 per year.

(vi) Out of debtors worth ₹ 10,000, collection of ₹ 4,000 depends on successful re-design of certain products already supplied to the customer.

(vii) Closing trade payable is ₹ 10,000. Which is likely to be settled at 95%.

(viii) There Is pre-payment penalty of ₹ 2,000 for Bank loan outstanding. Prepare Profil & Loss Account for the year ended 31st March, 2015 by assuming is not a Going Concern. (Nov 2015, 5 marks)

Answer:

Question 25.

Attempt the following:

A company sold 20% of the goods on cash basis and the balance on credit basis. Debtors are allowed 1½ month’s credit and their balance as on 31.03.2015 is ₹ 125,000. Assume that the sale is uniform throughout the year. Calculate the credit sales and total sales of the company for the year ended 31.03.2015. (Nov 2015, 4 marks)

Answer:

Calculation of Credit sales:

Debtor x \(\frac{12}{1.5}\) =1,25,000 × \(\frac{12}{1.5}\) = 10,00,000

Calculation of Total sales:

Credit sale × \(\frac{100 \%}{80 \%}\)

= 10,00,000 × \(\frac{100 \%}{80 \%}\) = 12,50,000.

Question 26.

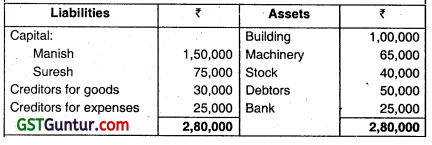

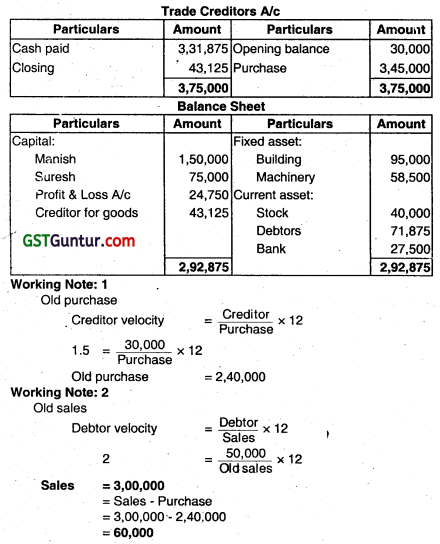

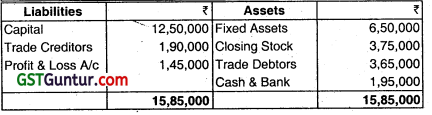

The following is the Balance Sheet of Manish and Suresh as on 1st April 2015:

They give you the following additional information:

(i) Crecditors’ Velocity 1.5 months & Debtos’ Velocity 2 months.

(ii) Stock level Is maintained uniformly in value throughout all over the year.

(iii) Depreciation on machinery is charged @10%, Depreciation on building @ 5% in the current year.

(iv) Cost price will go up 15% as compared to last year and also sales in the current year will increase by 25% in volume.

(v) Rate of gross profit remains the same.

(vi) Business Expenditures are ₹ 50,000 for the year. All expenditures are paid off ¡n cash.

(vii) Closing stock is to be valued on LIFO Basis.

Prepare Trading, Profit, and Loss Account, Trade Debtors A/c, and Trade Creditors A/c for the year ending 31.03.2016. (May 2016, 8 marks)

Answer:

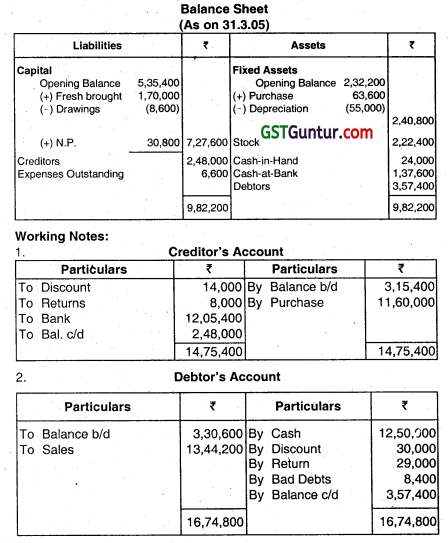

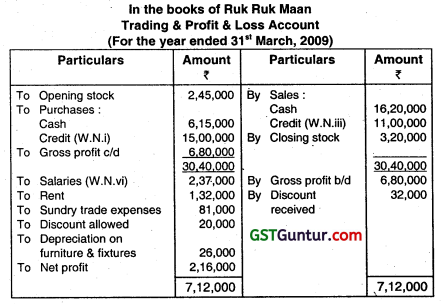

Question 27.

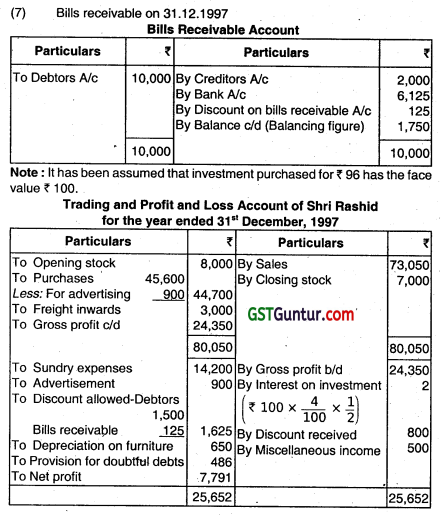

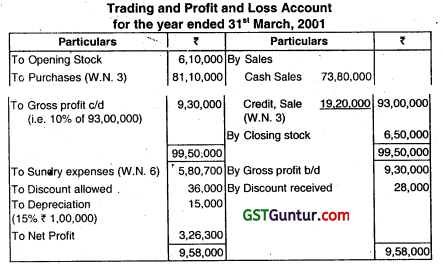

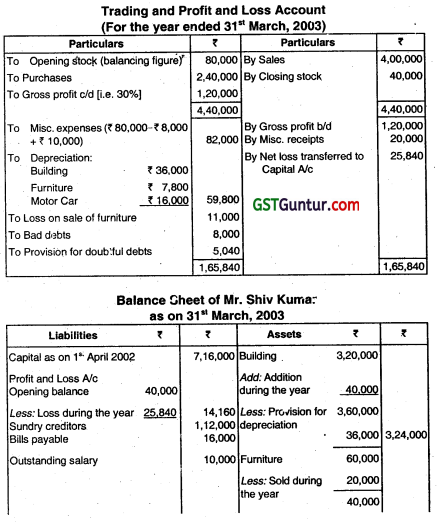

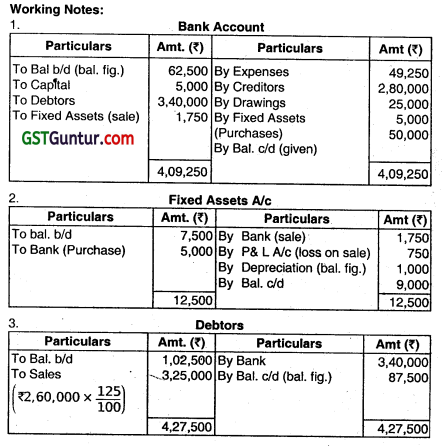

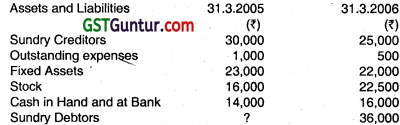

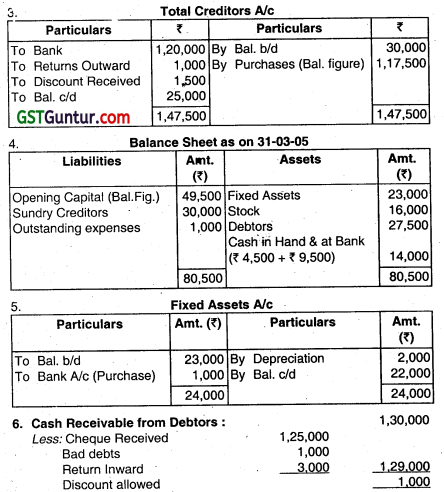

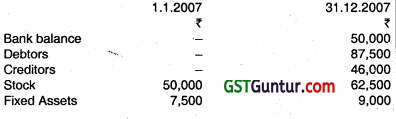

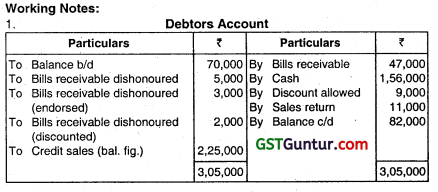

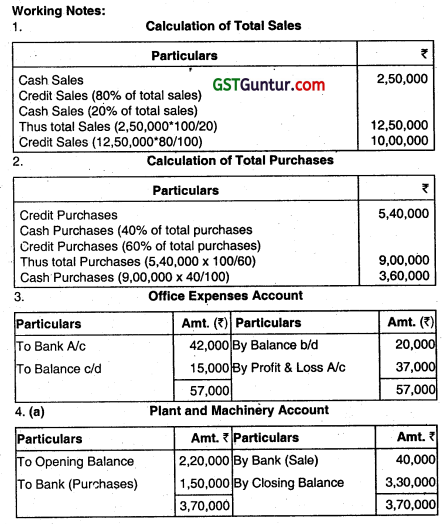

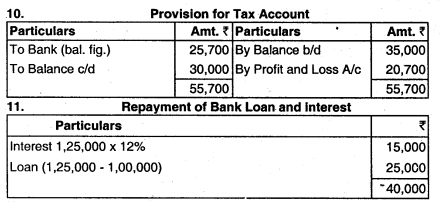

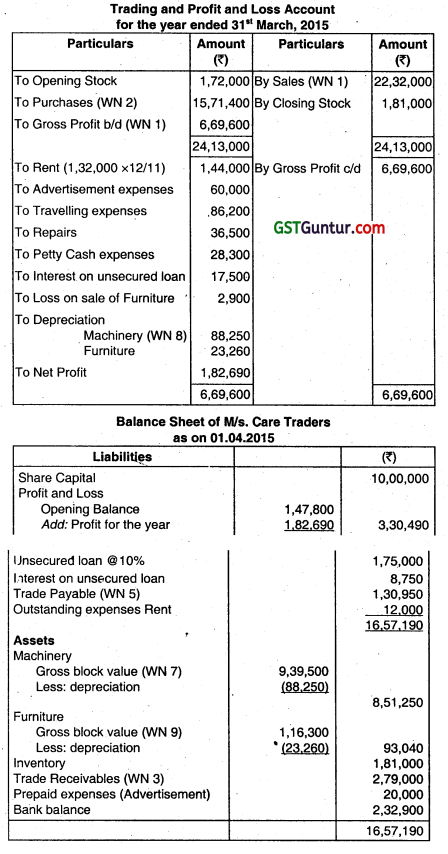

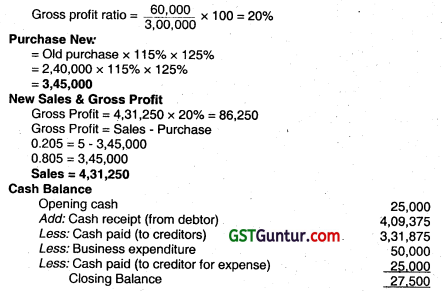

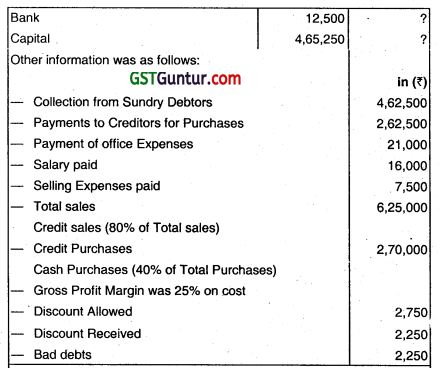

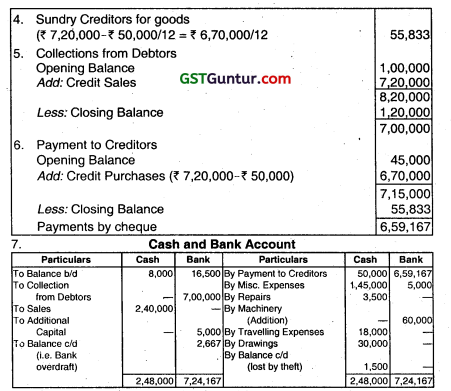

The following information relates to the business of ABC Enterprises, who requests you to prepare a Trading and Profit & Loss A/C for the year ended 31st March, 2017 and a Balance Sheet as on that date.

Cash transactions during the year:

(i) Collection from Debtors, after allowing discount of ₹ 15,000 amounted to ₹ 5,85,000.

(ii) Collection on discounting of Bills of Exchange. after deduction of discount of 1,250 by bank, totalled to ₹ 61,250.

(iii) Creditors of ₹ 4,00,000 were paid ₹ 3,92,000 in full settlement of their dues.

(iv) Payment of Freight inward 01 ₹ 30,000.

(v) Amount withdrawn for personal use ₹ 70,000.

(vi) Payment for office furniture ₹ 10,000.

(vii) Investment carrying annual interest of 6% were purchased at ₹ 95,200 shares, face value 100 each) on 1st October, 2016 and payment made thereof.

(viii) Expenses including saLaries paid ₹ 95,000.

(ix) Miscellaneous receipt of ₹ 5,000.

(c) Bills of exchange drawn on and accepted by customers during the year amounted to ₹ 1,00,000. Of those, bills of exchange of ₹ 20,000 were endorsed in favour of creditors. An endorsed bill of exchange of 4,000 was dishonoured.

(d) Goods costing ₹ 9,000 were used as advertising material.

(e) Goods are invariably sold to show a gross profit of 20% on sales.

(f) Difference in cash book, if any, is to be treated as further drawing or introduction of capital by proprietor of ABC enterprises.

(g) Provide at 2% for doubtful debts on closing debtors. (May 2017,16 marks)

Answer:

![]()

Question 28.

The following balances appeared in the books of Ws Sunshine Traders:

Depreciation to be provided as follows;

Land and Machinery 5% per annum

Plant and Machinery 10% per annum

Office Equipment 15% per annum

On 01.10.2018 the firm sold machine having Book Value 0.000 (as on 31.03.2018) at aïoss of 7,500. New machine was purchased on 01.01.2019.

Office equipment was sold at its book value on 01.04.2018.

Loan was partly repaid on 31.03.2019 together with interest for the year.

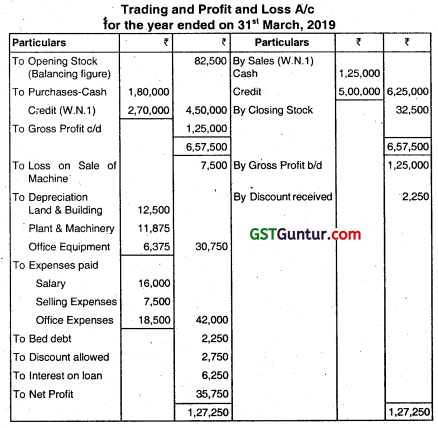

You are required to prepare:

(i) Trading and Profit & Loss account for the year ended 31st March. 2019.

(ii) Balance Sheet as of 31st March, 2019. (May 2019, 12 marks)

Answer:

Working Notes:

1. Calculation of Sales and Purchases:

Total Sales = ₹ 6,25,000

Cash Sales = 20% of total sales = (625,000) = ₹ 1,25,000

Credit Sales = 80% of total sales = (6,25,000) = ₹ 5,00,000

Gross Profit 25% on cost = 6,25,000 x \(\frac{25}{125}\) = ₹ 1,25,000

Credit Purchases = ₹ 2,70,000

Credit Purchases = 60% of total purchases

Credit Purchases = 40% of total purchases

Total Purchases = \(\frac{2,70,000}{60} \times 100 \)

Cash Purchases = ₹ 4,50,000 – ₹ 2,70,000 = ₹ 1,80,000

Question 29.

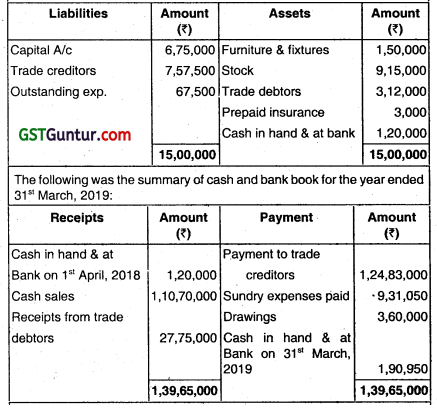

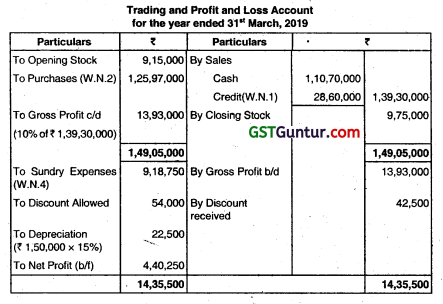

Archana Enterprises maintain their books of accounts under &ngle entry system. The Balance Sheet abon 31st March. 2018 was as follows:

Additional Information:

(i) Discount a flowed to trade debtors and received from trade creditors amounted to ₹ 54,000 and ₹ 42,500 respectively. (for the year ended 31st March 2019)

(ii) Annual fire insurance premium of ₹ 9,000 was paid every year on 1st August for the renewal of the policy.

(iii) Furniture & fixtures were subjecf to depreciation @ 15% p.a. on diminishing balance method.

(iv) The following are the balances as on 31st March 2019:

Stock ₹ 9,75,000

Trade debtors ₹ 3,43,000

Outstanding expenses ₹ 55,200

(v) Gross profit ratio of 10% on sales in maintained throughout the year. You are required to prepare Trading and Profit & Loss account for the year ended 31st March, 2019. and Balance Shout as on that date. (Nov 2019, 10 marks)

Answer:

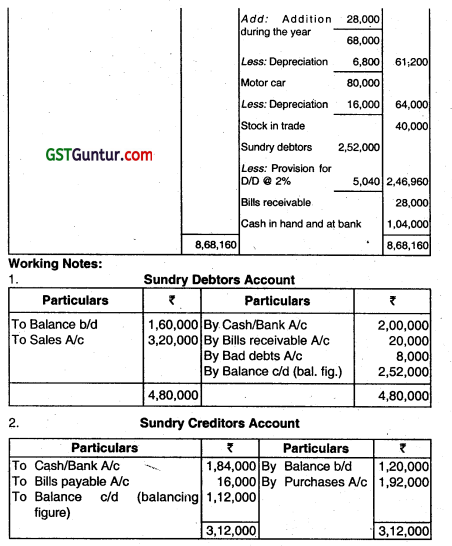

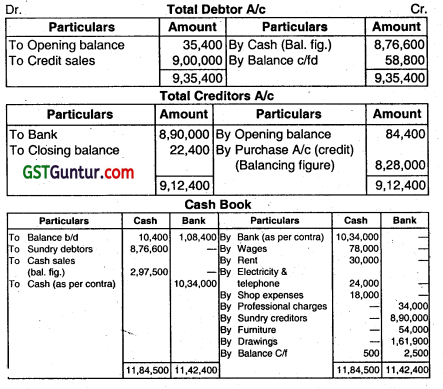

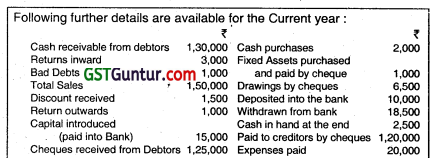

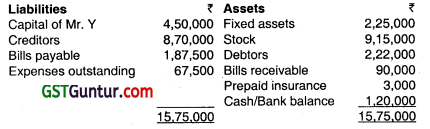

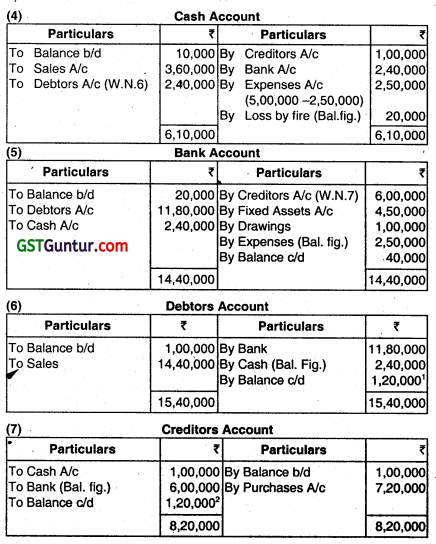

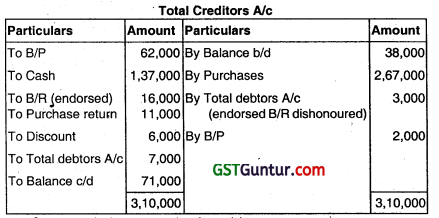

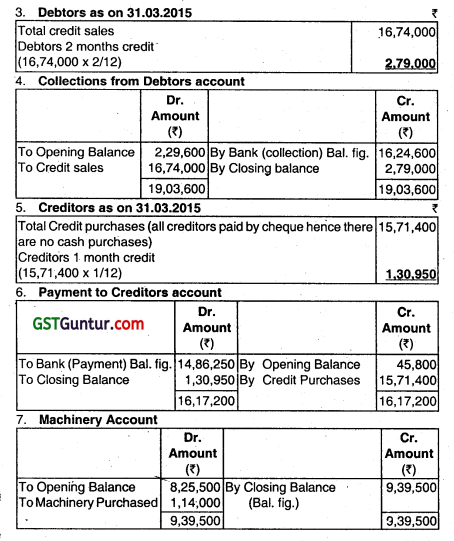

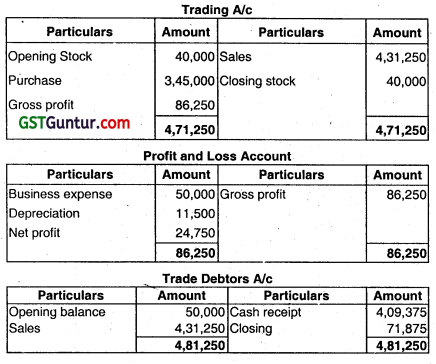

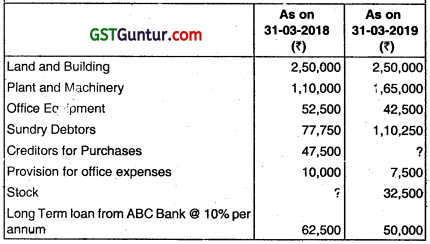

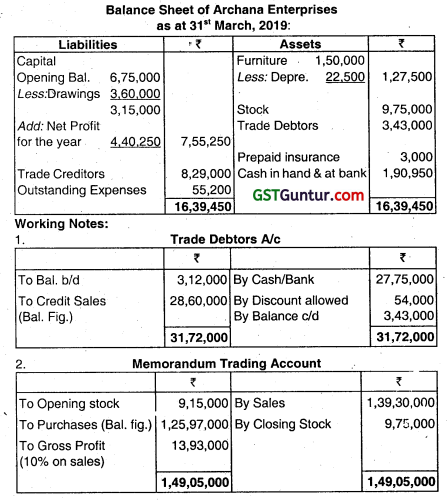

Question 30.

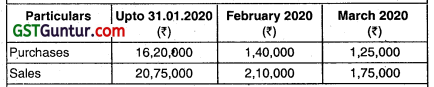

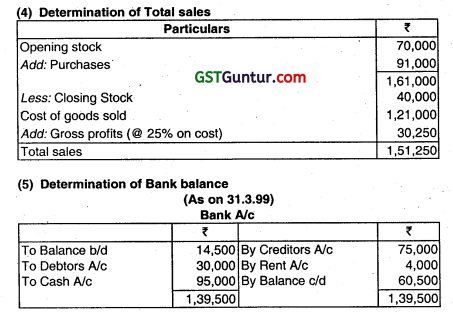

M/s Rohan & Sons runs a business of Electrical goods on wholesale basis. The books of accounts are closed on 31 Mardi every year. The Balance Sheet as on 31st March. 2019 is as follows:

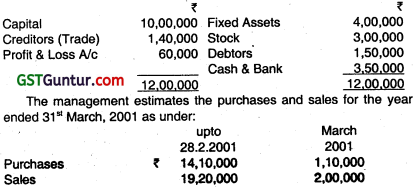

The management estimates the purchase & sales for the year ended 31st March, 2020 as under:

All Sales and Purchases are on credit basis. It was decided to invest ₹ 1,50,000 in purchase of Fixed assets, which are depreciated @ 10% on book value. A Fixed Asset of book value as on 01.04.2019, ₹ 60,000 was sold for ₹ 56,000 on 31st March, 2020.

The time lag for payment to Trade Creditors for purchases is one month and receipt from Trade debtors for sales is two months. The business earns a gross profit of 25% on turnover. The expenses against gross profit amounts to 15% of the turnover. The amount of depreciation is not included in these expenses. Prepare Trading & Protit & Loss Account for the year ending 31st March 2020 and draft a Balance Sheet as at 31st March 2020 assuming that creditors are all Trade creditors for purchases and debtors are all Trade debtors for sales and there is no other current assets and liabilities apart from stock and cash and bank balances. Also, prepare Cash & Bank account and Fixed Assets account for the year ending 31st March, 2020. (Nov 2020, 10 marks)

![]()

Question 31

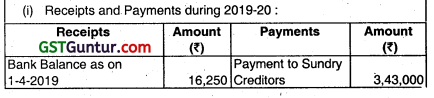

Mr. Prakash furnishes following information for his ready-made garments business:

(i) Receipts and Payments during 2019-20:

Additional information:

(1) 20% of Total sales and 20% of total purchases are in cash.

(2) 0f the Debtors, a sum of 7200 should be written off as Bad debt and further a reserve for doubtful debts is to be provided @2%.

(3) Provide depreciation @ 10% p.a. on Machinery and Furniture. You are required to prepare Trading and Profit & Loss account for the year ended 31st March, 2020, and Balance Sheet as on that date. (Jan 2021, 10 marks)

Question 32

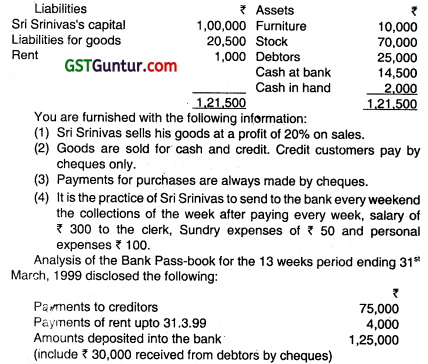

The following is Itie’s Balance Sheet of the retail business of Sn Srinivas as at 31st December, 1998:

On the evening of 31st March, 1999 the Cashier absconded with the available cash in the cash box. There was no cash deposit in the week ended on that date. You are required to prepare a statement showing the amount of cash defalcated by the Cashier and also a Prof it and Loss Account for the period ended 31st March, 1999 and a Balance Sheet as on that date. (May 1999, 12 marks)

Answer:

Notes:

1. AIl purchases are taken as credit purchases.

2. In the absence of information about the depredation rate, no depreciation has been charged on furniture.

3. The amount defalcated by the cashier may be treated as recoverable from him. In that situation, ₹ 17,400 may be treated as sundry advances and shown on assets side In the Balance Sheet and net profit for 13 week period ending 31st March, 1999 would amount ₹ 22,700.

Question 33.

The following is the Balance Sheet of Sri Agni 0ev as on 31st March, 2001:

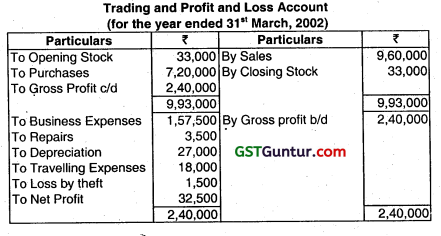

Riots occurred and tire broke out on the evening of 31st March, 2002, destroying the books of account and Furniture. The cashier was grievously hurt and the cash available In the cash box was stolen. The trader gives you the following information:

(i) Sales are effected as 25% for cash and the balance on credit. His total sales for the year ended 31st March, 2002 were 20% higher than the previous year. All the sales and purchases of goods were evenly spread throughout the year (as also in the last year).

(ii) Terms of credit

Debtors 2 Months

Creditors 1 Month

(iii) Stock level was maintained at 33000 all throughout the year.

(iv) A steady Gross Profit rate of 25% on the turnover was maintained throughout. Creditors are paid by cheque onu, except for cash purchase of ₹ 50,000.

(v) His private records and the Bank Pass-book disclosed the following transaction for the year:

(iii) Addition to Machinery ₹ 60,000 (paid by cheque)

(iv) Private drawings ₹ 30,000 (paid by cash)

(v) Travelling expenses ₹ 18,000 (paid by cash)

(vi) Introduction of Additional

Capital by depositing into the Bank. ₹ 5,000

(vi) Collection from debtors were all through cheques.

(vii) Depreciation on Machinery is to be provided @ 15% on the Closing Book Value.

(viii) The cash stolen is to be charged to the Profit and Loss Account.

(ix) Loss of furniture is to be adjusted from the Capital Account.

Prepare Trading, Profit, and Loss Account for the year ended 31st March, 2002 and a Balance Sheet as on that date, Make appropriate assumptions wherever necessary. All workings should form part of your answer. (Nov 2002, 20 marks)

Answer:

Question 34.

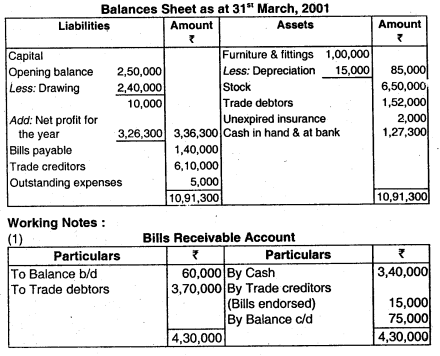

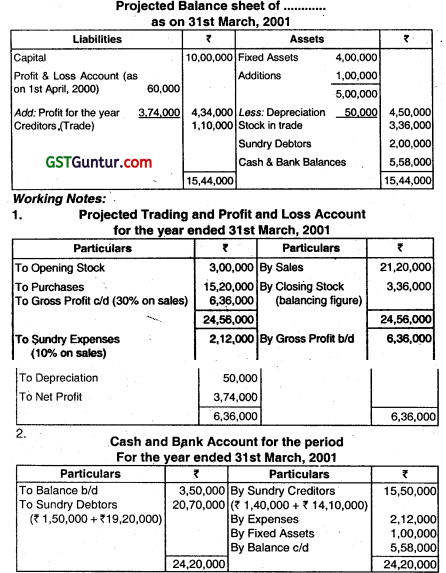

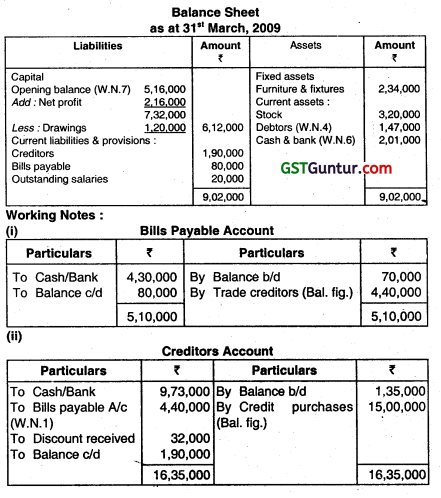

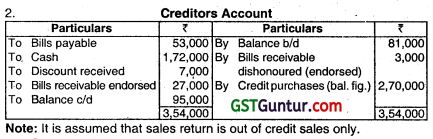

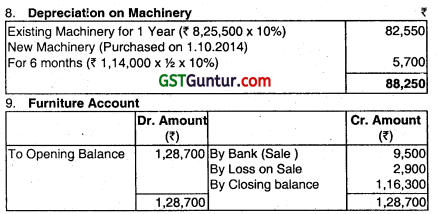

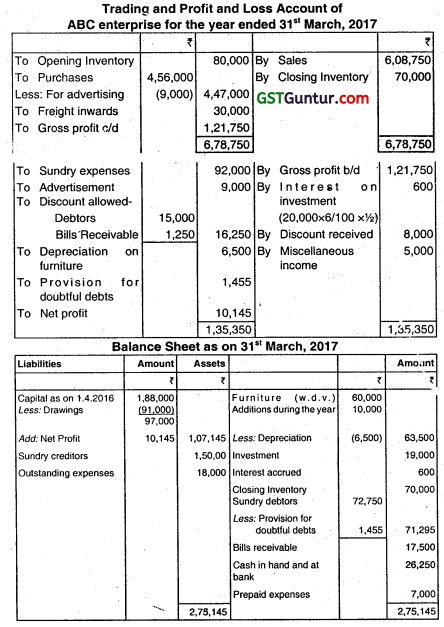

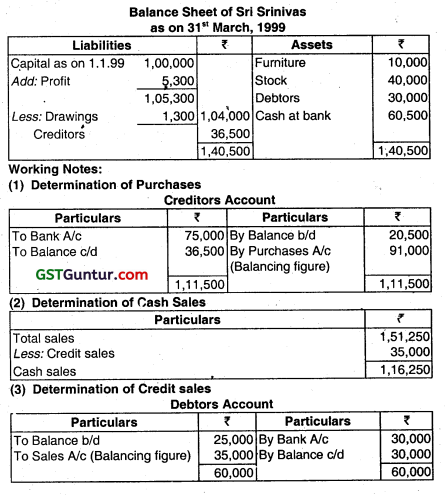

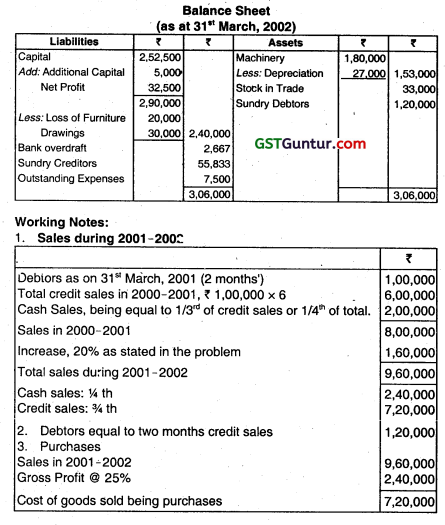

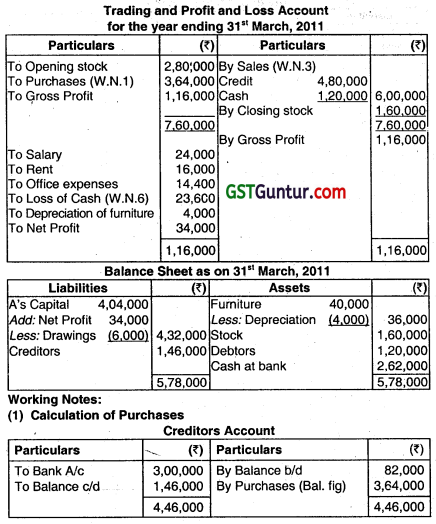

Mr. A. runs a business of readymade garments. He closes the books of accounts on 31st March 2010. The Balance Sheet on 31st March, 2010 was as follows:

You are furnished with the following information:

1. His sales, for the year ended 31st March, 2011 were 20% higher than the sales of previous year, out of which 20% sales was cash sales. Total sales during the year 2009-10 were ₹ 5,00,000.

2. Payments for all the purchases were made by cheques only.

3 Goods were sold for cash and credit both. Credit customers pay by cheques only.

4. Depreciation on furniture is to be charged 10% p.a.

5. Mr. A sent to the bank the collection of the month at the last date of each month after pay ng salary of ₹ 2,000 to the cleric, office expenses ₹ 1,200, and personal expenses ₹ 500.

Analysis of bank passbook for the year ending 31st March, 2011 disclosed the following:

Payment to creditors – ₹ 3,00.000

Payment of rent up to 31st March, 2011 – ₹ 16,000

Cash deposited Into the bank during the year -₹ 80,000

The following are the balances on 31st March, 2011

Stock – ₹1,60,000

Debtors – ₹ 1,20,000

Creditors for goods – ₹1,46,000

On the evening of 31 March, 2011 the cashier absconded with the available cash in the cash book.

You are required to prepare Trading and Profit and Loss A/c for the ended 31st March, 2011 and Balance Sheet as on that date. All the workings should form part of the answer. (May 2011, 16 marks)

Answer:

![]()

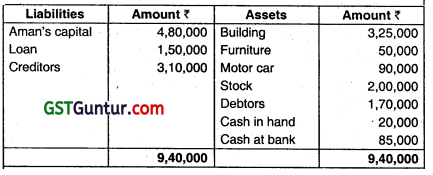

Question 35.

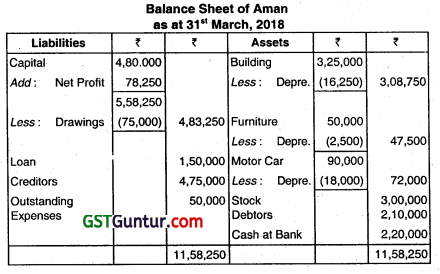

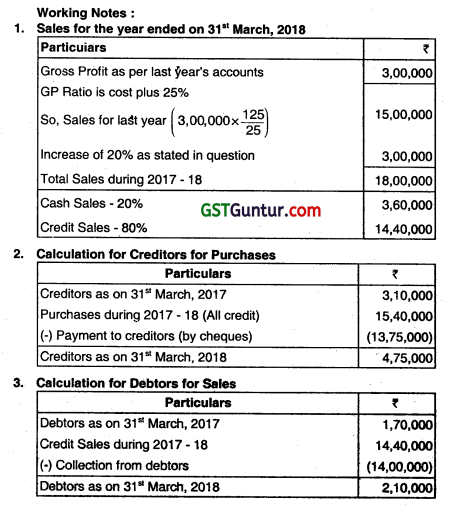

Amans, a readymade garment trader, keeps his books of account under single entry system. On the closing on 31st March, 2017 his statement of affairs stood as follows:

Riots occurred and a fire broke out on the evening of 31st March, 2018, destroying the books of accounts. On that day, the cashier had absconded with the available cash. You are furnished with the following information:

1. Sales for the year ended 31 March, 2018 were 20% higher than the previous year’s sales, out of which, 20% sales were for cash. He always sells his goods at cost plus 25%. There were no cash purchases.

2. Collection from debtors amounted to ₹ 14,00,000, out of which ₹3,50,000 was received in cash.

3. Business expenses amounted to ₹ 2,00,000, of which ₹ 50,000 were outstanding on 31st March, 2018 and ₹ 60,000 paid by cheques.

4. Gross profit as per last year’s audited accounts was ₹ 3,00000.

5. Provide depreciation on building and furniture at 5% each and motor car at 20%.

6. His private records and the Bank Pass Book disclosed the following transactions for the year 2017-18:

Payment to creditors (paid by cheques) – ₹ 13,75,000

Personal drawings (paid by cheques) – ₹ 75,000

Repairs (paid by cash) – ₹ 10,000

Traveling expenses (paid by cash) – ₹ 15,000

Cash deposited in bank – ₹ 7,15,000

Cash withdrawn from bank – ₹ 1,20,000

7. Stock level was maintained at ₹ 3,00,000 all throughout the year.

8. The amount defalcated by the cashier is to be written off to the Profit and Loss Account.

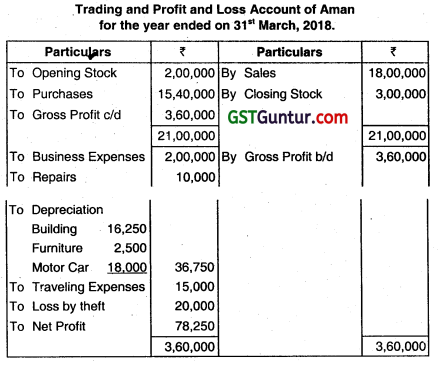

You are required to prepare Trading and Profit and Loss A/c for the year ended 31st March, 2018 and Balance Sheet as on that date of Aman. All the workings should form part of the answer. (Nov 2018, 15 marks)

Answer: